UNITED STATESSECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No._____)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under Sec. 240.14a-12

| Red Mountain Resources, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| | |

| (5) | Total fee paid: |

| | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| | |

| (3) | Filing Party: |

| | |

| | |

| (4) | Date Filed: |

| | |

RED MOUNTAIN RESOURCES, INC.

2515 McKinney Avenue, Suite 900

Dallas, Texas 75201

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 16, 2013

To the Shareholders of Red Mountain Resources, Inc.:

NOTICE IS HEREBY GIVEN, that the Annual Meeting of Shareholders of Red Mountain Resources, Inc., a Florida corporation (the “Company”), will be held at the Company’s offices located at 2515 McKinney Avenue, Suite 900, Dallas, TX 75201 on December 16, 2013, at 10:00 a.m., local time, for the following purposes:

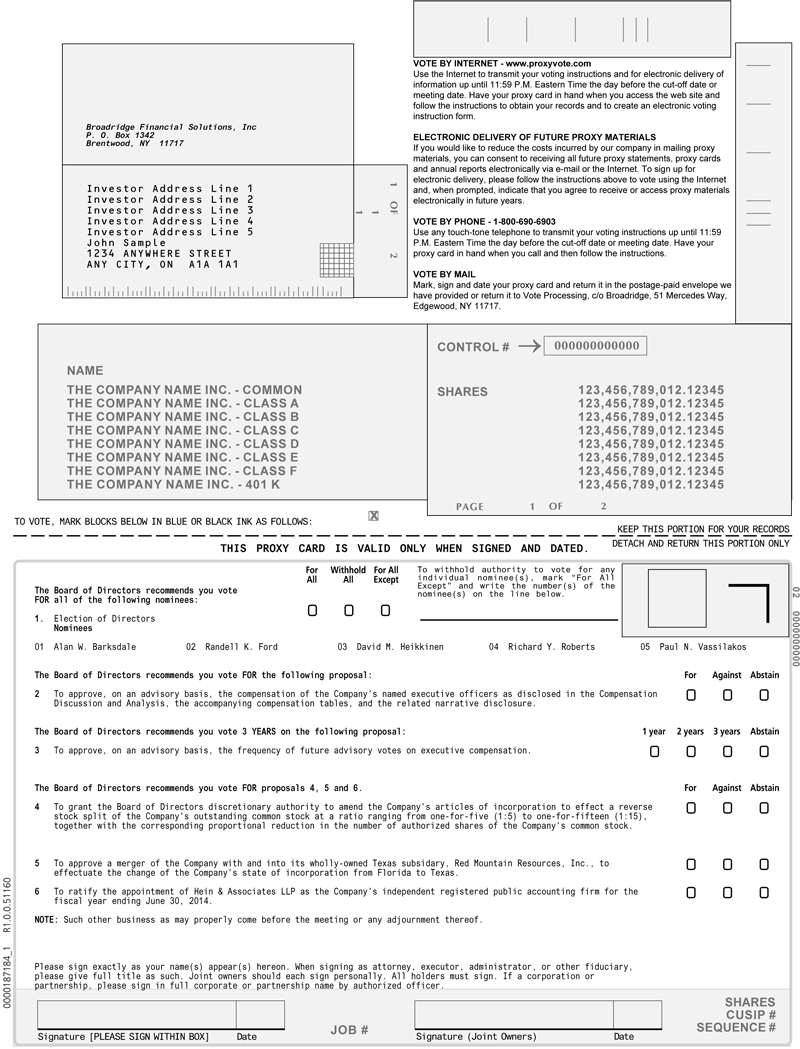

| (1) | To elect five directors to serve until the next annual meeting of shareholders and until their successors are elected and qualified. |

| (2) | To approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the attached proxy statement. |

| (3) | To approve, on an advisory basis, the frequency of future advisory votes on executive compensation. |

| (4) | To grant the board of directors discretionary authority to amend the Company’s articles of incorporation to effect a reverse stock split of the Company’s outstanding common stock at a ratio ranging from one-for-five (1:5) to one-for-fifteen (1:15), together with the corresponding proportional reduction in the number of authorized shares of the Company’s common stock. |

| (5) | To approve a merger of the Company with and into its wholly-owned Texas subsidiary, Red Mountain Resources, Inc., to effectuate the change of the Company’s state of incorporation from Florida to Texas (“Merger”). |

| (6) | To ratify the appointment of Hein & Associates LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2014. |

| (7) | To transact such other business as may properly come before the meeting and any and all postponements or adjournments thereof. |

If Proposal 5 above is approved and the Merger is consummated, holders of shares of the Company’s common stock will receive appraisal rights in strict compliance with Sections 607.1301 ─ 607.1333 of the Florida Business Corporation Act (“Appraisal Provisions”). A copy of the Appraisal Provisions is attached as Annex E to the accompanying Proxy Statement.

The Company’s board of directors has fixed the close of business on October 25, 2013 as the record date for the determination of the shareholders entitled to notice of and to vote at the annual meeting and any postponements or adjournments thereof.

You are encouraged to attend the annual meeting. Whether or not you expect to attend, we urge you to vote by proxy pursuant to the instructions set forth herein as soon as possible. If you are the beneficial owner of shares held in street name in an account at a brokerage firm, bank or other nominee holder, you should follow the directions provided by that organization regarding how to instruct the organization to vote your shares. If your shares are held in street name and you wish to vote your shares in person at the annual meeting, you must obtain a valid legal proxy from your broker, bank or other nominee holder.

| | | By Order of the Board of Directors | |

| | | | |

| | | Alan W. Barksdale | |

| | | Chairman of the Board | |

Dallas, Texas

November 8 , 2013

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held December 16, 2013: This notice, the proxy statement, a proxy card and the Company’s annual report on Form 10-K for the fiscal year ended May 31, 2013 are available at www.proxyvote.com.

TABLE OF CONTENTS

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS | 1 |

PROPOSAL 1 – ELECTION OF DIRECTORS | 7 |

| | COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS | 12 |

| | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 18 |

| RELATED PARTY TRANSACTIONS | 19 |

| PROPOSAL 2 – ADVISORY VOTE ON EXECUTIVE COMPENSATION | 20 |

| PROPOSAL 3 – ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE COMPENSATION | 21 |

| PROPOSAL 4 – GRANT THE BOARD OF DIRECTORS DISCRETIONARY AUTHORITY TO APPROVE AN AMENDMENT TO OUR ARTICLES OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT | 22 |

| PROPOSAL 5 –REINCORPORATION OF THE COMPANY FROM FLORIDA TO TEXAS | 28 |

| PROPOSAL 6 – APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 43 |

| SOLICITATION OF PROXIES | 45 |

| SHAREHOLDERS SHARING AN ADDRESS | 45 |

| SHAREHOLDER PROPOSALS FOR 2014 ANNUAL MEETING | 45 |

| OTHER MATTERS | 46 |

RED MOUNTAIN RESOURCES, INC.

2515 McKinney Avenue, Suite 900

Dallas, Texas 75201

PROXY STATEMENT

___________________________

This proxy statement is being furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of Red Mountain Resources, Inc., a Florida corporation (the “Company,” “Red Mountain,” “we,” “us” or “our”), from the holders of outstanding shares of our common stock for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on December 16, 2013, at 10:00 a.m., local time, at the Company’s principal executive offices located at 2515 McKinney Avenue, Suite 900, Dallas, TX 75201, and any adjournments or postponements thereof. When we refer to Red Mountain’s fiscal year, we mean the twelve-month period ending May 31 of the stated year (for example, fiscal 2013 is June 1, 2012 through May 31, 2013). In July 2013, the Board approved a change in the Company’s fiscal year end from May 31 to June 30, effective June 30, 2013. As a result of the change, the Company will have a June 2013 fiscal month transition period.

This proxy statement along with the accompanying notice of annual meeting, our annual report on Form 10-K for the fiscal year ended May 31, 2013 and a form of proxy card are being mailed on or about November 8, 2013 to shareholders of record on October 25, 2013 (the “Record Date”). We are bearing all costs of this solicitation.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

The following are some of the questions you, as a shareholder, may have about these proxy materials and answers to those questions. The following is not meant to be a substitute for the information contained in the remainder of this proxy statement, and the information contained below is qualified by the more detailed descriptions and explanations contained elsewhere in this proxy statement. We urge you to carefully read this entire proxy statement prior to making any decision on whether to grant, withhold or revoke any proxy.

Why am I receiving these proxy materials?

We have made these materials available to our shareholders of common stock of record on the Record Date in connection with the Board’s solicitation of proxies for use at the Annual Meeting to be held on December 16, 2013. Our records indicate that you were a shareholder of record of common stock on the Record Date.

What is included in the proxy materials?

These materials include:

| · | This proxy statement along with the accompanying notice of annual meeting; |

| · | The Company’s annual report on Form 10-K for the fiscal year ended May 31, 2013, as filed with the Securities and Exchange Commission (the “SEC”) on September 13, 2013; and |

| · | A proxy card with voting instructions for the Annual Meeting. |

What items will be voted on at the Annual Meeting?

The following proposals will be presented for shareholder consideration and voting at the Annual Meeting:

| (1) | To elect five directors to serve until the next annual meeting of shareholders and until their successors are elected and qualified. |

| (2) | To approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in this proxy statement. |

| (3) | To approve, on an advisory basis, the frequency of future advisory votes on executive compensation. |

| (4) | To grant the board of directors discretionary authority to amend the Company’s articles of incorporation to effect a reverse stock split (the “Reverse Stock Split”) of the Company’s outstanding common stock at a ratio ranging from one-for-five (“1:5”) to one-for-fifteen (“1:15”), together with the corresponding proportional reduction in the number of authorized shares of the Company’s common stock (the “Authorized Share Reduction”). |

| (5) | To approve a merger of the Company with and into its wholly-owned Texas subsidiary, Red Mountain Resources, Inc., to effectuate the change of the Company’s state of incorporation from Florida to Texas (the “Merger”). |

| (6) | To ratify the appointment of Hein & Associates LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2014. |

| (7) | To transact such other business as may properly come before the meeting and any and all postponements or adjournments thereof. |

What are the Board’s voting recommendations?

The Board recommends that you vote your shares:

| (1) | FOR the election of each nominee for director. |

| (2) | FOR the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in the compensation discussion and analysis, the accompanying compensation tables and the related narrative disclosure. |

| (3) | For the option of 3 YEARS for future advisory votes on executive compensation. |

| (4) | FOR granting the Board discretionary authority to amend our articles of incorporation to effect the Reverse Stock Split and Authorized Share Reduction. |

| (5) | FOR the approval of the Merger. |

| (6) | FOR the appointment of Hein & Associates LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2014. |

What is the effect of giving a proxy?

Proxies in the form enclosed are solicited by and on behalf of our Board. The persons named in the proxy have been designated as proxies by our Board. If you sign and return the proxy in accordance with the procedures set forth in this proxy statement, the persons designated as proxies by our Board will vote your shares at the meeting as specified in your proxy.

If you sign and return your proxy in accordance with the procedures set forth in this proxy statement but you do not provide any instructions as to how your shares should be voted, your shares will be voted FOR the election of each nominee for director (Proposal 1); FOR the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in the compensation discussion and analysis, the accompanying compensation tables and the related narrative disclosure (Proposal 2); for the option of 3 YEARS for future advisory votes on executive compensation (Proposal 3); FOR granting the Board discretionary authority to amend our articles of incorporation to effect the Reverse Stock Split and Authorized Share Reduction (Proposal 4); FOR the approval of the Merger (Proposal 5); and FOR the appointment of Hein & Associates LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2014 (Proposal 6).

If you give your proxy, your shares also will be voted in the discretion of the proxies named on the proxy card with respect to any other matters properly brought before the meeting and any postponements or adjournments.

Who is entitled to vote at the Annual Meeting?

Only shareholders of record of common stock at the close of business on the Record Date will be entitled to vote by proxy or attend and vote in person at the Annual Meeting and any postponements or adjournments thereof. As of the Record Date, we had issued and outstanding 134,013,103 shares of common stock, our only class of voting securities outstanding. Each holder of our common stock is entitled to one vote for each share held on the Record Date. Holders of our 10% Series A Cumulative Redeemable Preferred Stock (“Series A Preferred Stock”) are not entitled to vote at the Annual Meeting.

What is the difference between a shareholder of record and a beneficial owner of shares held in street name?

Some of our shareholders hold their shares in street name – that is, such shareholders hold their shares through an account at a brokerage firm, bank or other nominee holder, rather than holding shares in their own names. As summarized below, there are some differences in the voting procedures applicable to you if your shares are held in street name.

Shareholder of Record. If on the Record Date, your shares were registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., you are considered a shareholder of record with respect to those shares, and we sent the proxy materials directly to you. As the shareholder of record, you have the right to direct the voting of your shares by voting by proxy. Whether or not you plan to attend the Annual Meeting, please vote by proxy in accordance with the instructions set forth herein to ensure that your vote is counted.

Beneficial Owner of Shares Held in Street Name. If on the Record Date, your shares were held in street name in an account at a brokerage firm, bank or other nominee holder, then you are considered the beneficial owner of the shares and the proxy materials were forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct the organization on how to vote the shares held in your account. However, since you are not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from the organization.

What is a broker non-vote?

Under applicable rules of national securities exchanges, brokers generally may, in the absence of instructions from the beneficial owner, vote shares held in street name as to any “routine” matter. However, in the absence of instructions from the beneficial owners, brokers may not vote on any “non-routine” matters, which results in a “broker non-vote.” Broker non-votes will be counted as present at the Annual Meeting for purposes of determining a quorum, but will not be treated as votes cast in favor of or against any of the proposals.

Your broker has discretionary authority to vote your shares with respect to the ratification of Hein & Associates LLP (Proposal 6). All other proposals discussed in this proxy statement are considered “non-routine” matters. Accordingly, if you do not give your broker, bank or other nominee holder any instructions on how to vote your shares, a “broker non-vote” will result for Proposals 1-5.

How do I vote?

If you are a shareholder of record, there are four ways to vote:

| · | By Internet. You may vote by proxy via the Internet at the website address provided on the enclosed proxy card. |

| · | By telephone. You may vote by proxy by calling the toll-free number provided on the enclosed proxy card. |

| · | By mail. You may vote by proxy by filling out the enclosed proxy card and sending it back in the envelope provided. |

| · | In person. If you are a shareholder of record, you may vote in person at the Annual Meeting. If you desire to vote in person at the Annual Meeting, please request a ballot when you arrive. |

If you are a beneficial owner of shares held in street name, you should follow the directions provided by your broker, bank or other nominee holder regarding how to instruct such organization to vote your shares. If your shares are held in street name, you will not be able to vote in person at the Annual Meeting unless you obtain a valid legal proxy from such organization.

Can I change my vote after I have voted?

If you are a shareholder of record, you may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. Proxies may be revoked by:

| · | delivering a written revocation of the proxy to the Company’s corporate secretary before the Annual Meeting at 2515 McKinney Avenue, Suite 900, Dallas, Texas 75201; |

| · | submitting a later-dated proxy by mail or by voting over the Internet or telephone; or |

| · | appearing at the Annual Meeting and voting in person. |

Attendance at the Annual Meeting will not, in and of itself, constitute revocation of a proxy. You must vote in person in order to revoke your proxy.

If you are a beneficial owner of shares held in street name, you may revoke your voting instructions only by following the directions received from your broker, bank or other nominee holder describing how to change your instructions.

What is a quorum?

A quorum is the minimum number of shares that must be present in order to transact business at the Annual Meeting. A majority of the shares of our common stock entitled to vote, represented in person or by proxy, shall constitute a quorum. Your stock will be counted towards the quorum if you submit a valid proxy (or, if you are the beneficial owner of shares held in street name, a valid proxy is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will also be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

How many votes are required to adopt the Annual Meeting proposals?

If a quorum is present at the meeting as determined in the manner explained above, then the required votes for each proposal are as follows:

| · | For Proposal 1, directors are elected by a plurality of the votes cast by the shares entitled to vote on the election of directors at the Annual Meeting. There are no cumulative voting rights. For purposes of the election of directors, abstentions and broker non-votes, if any, will not count as votes in favor of any nominee. |

| · | Proposals 2 and 3 are advisory votes, the results of which will be taken into account by the Company and the Board but will not be binding on the Company. Proposal 2 will be approved, on an advisory basis, if the number of votes cast in favor of such proposal exceeds the number of votes cast opposing such proposal. For Proposal 3, the number of years (1, 2 or 3) that receives the highest number of votes will be the non-binding selection of the shareholders. Broker non-votes and abstentions, if any, will not count as votes cast in favor of or against such matters and accordingly, will have no effect on the outcome of the vote. |

| · | Proposals 4 and 6 will be approved if the number of votes cast in favor of such proposal exceeds the number of votes cast opposing such proposal. Broker non-votes and abstentions, if any, will not count as votes cast in favor of or against such matters and accordingly, will have no effect on the outcome of the vote. |

| · | Proposal 5 will be approved if a majority of all of our outstanding shares of common stock affirmatively votes in favor of the proposal. Abstentions and broker non-votes will have the same effect as a vote against the Merger proposal. |

What if I oppose any of the proposals presented at the Annual Meeting? Do I have appraisal rights available?

If Proposal 5 is approved and the Merger is consummated, holders of shares of the Company’s common stock will be entitled to assert appraisal rights under, and in strict compliance with, Sections 607.1301 ─ 607.1333 of the Florida Business Corporation Act (“Appraisal Provisions”). A copy of the Appraisal Provisions is attached as Annex E to this proxy statement

The right of any shareholder to exercise any rights to appraisal is contingent upon the consummation of the corporate action for which such appraisal rights are being asserted and strict compliance with the Appraisal Provisions which require, among other things, that the shareholder give the Company notice of such shareholder’s intention to assert such appraisal rights at or prior to the Annual Meeting and he or she must not vote his or her respective shares in favor of the corporate action for which he or she is asserting such appraisal rights. For a summary of the requirements of the Appraisal Provisions, see “Proposal 5 Reincorporation of the Company from Florida to Texas—Statutory Right of Appraisal under Florida Law.”

How can I attend the Annual Meeting?

Only shareholders of record of common stock at the close of business on the Record Date, their proxy holders and our invited guests may attend the Annual Meeting and any adjournments or postponements thereof. If you plan to attend, please mark the appropriate box on your proxy card and return it to us promptly. In order to be admitted to the Annual Meeting, please bring identification and, if you hold shares in street name, your bank or broker statement showing your beneficial ownership of our common stock on the Record Date. If your shares are held in street name and you wish to vote your shares in person at the Annual Meeting, you must obtain a valid legal proxy from your bank, broker or other nominee holder.

Who is bearing the costs of this proxy solicitation?

The Company will bear the costs of soliciting proxies from its shareholders. Directors, officers and other employees of the Company, not specifically employed for this purpose, may solicit proxies, without additional remuneration therefore, by personal interview, mail, telephone or other means of communication. The Company will request brokers and other fiduciaries to forward proxy soliciting material to the beneficial owners of shares of common stock that are held of record by such brokers and fiduciaries and will reimburse such persons for their reasonable out-of-pocket expenses. We also intend to retain a proxy solicitation firm to assist us in the solicitation of proxies. If we retain a proxy solicitation firm, we will name them in our definitive proxy materials. In addition, we have engaged Morrow & Co., LLC, 470 West Ave., Stamford, CT 06902 to assist us in the solicitation of proxies. We expect to pay Morrow & Co., LLC a fee of $12,000, plus reimbursement for disbursements made on our behalf.

Where do I find the voting results of the Annual Meeting?

We will announce voting results at the Annual Meeting in a current report on Form 8-K within four business days after the Annual Meeting.

Who should I call if I have questions about the solicitation?

If you have questions about the Annual Meeting, including questions about the procedures for voting your shares, you should contact:

Red Mountain Resources, Inc.

2515 McKinney Avenue, Suite 900

Dallas, Texas 75201

Attention: Stephen Evans, Corporate Secretary

Telephone: (214) 871-0400 PROPOSAL 1

ELECTION OF DIRECTORS

Our Board is comprised of five directors. Pursuant to our bylaws, our directors serve for one year terms and are subject to annual election by the shareholders. Each director elected at an annual meeting of shareholders holds office until the next annual meeting and until a successor is duly elected and qualified, or until his or her earlier death, resignation or removal.

The Board has nominated Alan W. Barksdale, Randell K. Ford, David M. Heikkinen, Richard Y. Roberts and Paul N. Vassilakos for election at the Annual Meeting. Each of the nominees is currently a member of the Board. The Board expects that each nominee will be able to stand for election and serve on the Board, but should any nominee become unable to serve, or for good cause will not serve, all proxies (except proxies marked to the contrary) will be voted for the election of a substitute candidate nominated by the Board.

Each of the director nominees has provided the Company with the benefit of his experience and service since his appointment to the Board. We believe that the combination of the various qualifications, skills and experiences of our directors contribute to the effectiveness and orderly functioning of our Board and that, individually and as a whole, our directors possess the necessary qualifications to provide effective oversight of our business and quality advice to our management. For more information about the unique qualifications and experience of each nominee, please see the subsection entitled “—Directors and Director Nominees.”

Vote Required

Directors are elected by a plurality of the votes cast by the shares entitled to vote on the election of directors at the Annual Meeting. Broker-non votes and abstentions will not count as votes in favor of or against any nominee and will have no effect on the vote total for the proposal.

Directors and Director Nominees

The following sets forth information about the Company’s directors and director nominees as of November 5, 2013:

| Name | | Age | | Position |

| | | | President, Chief Executive Officer and Chairman of the Board of Directors |

| | | | |

| | | | |

| | | | |

| | | | |

Alan W. Barksdale has been our President, Chief Executive Officer and a director since June 2011 and served as our Interim Acting Chief Financial Officer from June 2011 to August 2011. Mr. Barksdale has also served as President of Black Rock Capital, Inc., our wholly owned subsidiary (“Black Rock”), since its inception. Mr. Barksdale has also been the owner and president of The StoneStreet Group, Inc. (“StoneStreet”) and president and manager of StoneStreet Operating Company, LLC (“StoneStreet Operating”), advisory and management services and merchant banking firms, since 2008. Mr. Barksdale has also been the president of AWB Enterprises, Inc., a holding company that owns a percentage of StoneStreet, since November 2011. From January 2004 to April 2010, Mr. Barksdale served as a director in the Capital Markets Group of Crews & Associates, an investment banking firm. From August 2003 to October 2003, Mr. Barksdale served as an investment banker at Stephens Inc., an investment banking firm. From 2002 to 2003, Mr. Barksdale was an investment banker at Crews & Associates. Mr. Barksdale has served as the Non-Executive Chairman of the Board for Cross Border Resources, Inc. (“Cross Border”), an oil and gas exploration company and majority owned subsidiary of the Company, since May 2012. We believe that Mr. Barksdale’s experience in operating, managing, financing and investing in more than 100 wells in Louisiana, New Mexico and Texas, combined with his over ten years of capital markets experience and contacts and relationships, provides our Board of Directors with management and operational direction.

In 2004, the National Association of Securities Dealers, Inc. (“NASD”) alleged that Mr. Barksdale solicited an attorney to make contributions to officials of an issuer with which Stephens Inc. was engaging in municipal securities business when Mr. Barksdale was employed as an investment banker at Stephens Inc. Without admitting or denying the allegations, Mr. Barksdale entered into an acceptance, waiver and consent decree that provided for a 30-day suspension from associating with any NASD member and a $5,000 fine.

Randell K. Ford has been a director since November 2011. Mr. Ford has worked in the oil and gas industry for over 40 years. Since 1993, Mr. Ford has been the President of R. K. Ford and Associates, Inc., a consulting firm based in the Permian Basin in Midland, Texas that specializes in drilling, engineering and completion of oil and gas wells. Currently, Mr. Ford is a partner in Western Drilling Inc., an onshore drilling services company. While serving as President, Division Drilling Engineer, Principal and various other oilfield service positions, Mr. Ford has drilled, managed, consulted or invested in over 4,000 wells located domestically in 18 states and internationally in 12 countries. Mr. Ford has also served on the Board of Directors of Cross Border since May 2012. Our Board of Directors benefits from Mr. Ford’s operational expertise, stemming from his over 40 years of experience in the oil and natural gas industry.

David M. Heikkinen has been a director since April 2013. Mr. Heikkinen has served as the Chief Executive Officer of Heikkinen Energy Advisors, LLC, an institutional equity research and investment advisory firm, since he founded it in July 2012. From December 2005 to February 2012, Mr. Heikkinen served as Head of Exploration and Production Research for Tudor, Pickering, Holt & Co., an integrated energy investment and merchant bank, providing advice and services to institutional and corporate clients. From February 2000 to December 2005, Mr. Heikkinen served as the Exploration and Production Analyst for Capital One Southcoast, Inc., an energy investment banking boutique. From January 1994 to February 2000, Mr. Heikkinen held various engineering roles with Shell Offshore Inc. and Shell International Exploration and Production. We believe our Board of Directors benefits from Mr. Heikkinen’s extensive capital markets experience in the oil and gas industry.

Richard Y. Roberts has been a director since October 2011. Mr. Roberts co-founded a regulatory and legislative consulting firm, Roberts, Raheb & Gradler LLC, in March 2006. He was a partner with Thelen Reid & Priest LLP, a national law firm, from January 1997 to March 2006. From August 1995 to January 1997, Mr. Roberts was a consultant at Princeton Venture Research, Inc., a private consulting firm. From 1990 to 1995, Mr. Roberts was a commissioner of the SEC. Mr. Roberts is currently a director of Cullen Agricultural Holding Corp. (“CAH”). CAH is a development stage agricultural company which was formed in connection with the business combination between Triplecrown Acquisition Corp. and Cullen Agricultural Technologies, Inc. in October 2009. He was a director of (i) Nyfix, Inc. from September 2005 to December 2009, (ii) Endeavor Acquisition Corp. from July 2005 to December 2007, (iii) Victory Acquisition Corp. from January 2007 to April 2009 and (iv) Triplecrown Acquisition Corp. from June 2007 to October 2009. Mr. Roberts’ experience at the SEC, and his experience as a director of other public companies, as well as his professional contacts and relationships, provides our Board of Directors with necessary insight into the requirements and needs of an emerging public company.

Paul N. Vassilakos has been a director since October 2011. Mr. Vassilakos also previously served as our interim President and Chief Executive Officer from February 2011 to March 2011. From November 2011 through February 2012, Mr. Vassilakos served as Chief Executive Officer, Chief Financial Officer and director of Soton Holdings Group, Inc., a publicly held company now known as Rio Bravo Oil, Inc. Mr. Vassilakos has been the assistant treasurer of CAH since October 2009. In July 2007, Mr. Vassilakos founded Petrina Advisors, Inc., a privately held advisory firm providing investment banking services, and has served as its president since its formation. Mr. Vassilakos also founded and, since December 2006, serves as the vice president of Petrina Properties Ltd., a privately held real estate holding company. From February 2002 through June 2007, Mr. Vassilakos served as vice president of Elmsford Furniture Corp., a privately held furniture retailer in the New York area. Mr. Vassilakos has also served on the Board of Directors of Cross Border since May 2012. Mr. Vassilakos brings extensive public company and capital markets experience, as well as his professional contacts and experience, to our Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” EACH DIRECTOR NOMINEE

FOR ELECTION TO THE BOARD OF DIRECTORS.

Director Independence

The standards relied upon the Board in determining whether a director is “independent” are those set forth in the rules of the NYSE MKT LLC (formerly, NYSE Amex). The NYSE MKT LLC generally defines “independent directors” as a person other than an executive officer or employee of a company, who does not have a relationship with the company that would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Consistent with these standards, our Board of Directors has determined that Messrs. Heikkinen, Roberts and Vassilakos are our independent directors.

Board Committees

We do not have separate standing audit, nomination or compensation committees as we are not required to have such committees at this time. Our Board of Directors performs the functions of our audit, nominating and compensation committees.

Audit Committee Functions

Our independent directors, performing the functions of our audit committee, do not have an audit committee charter. Our Board has not determined that we have an “audit committee financial expert,” as defined in SEC rules, serving on the Board. However, the Board believes that our independent directors have sufficient knowledge in financial and auditing matters to perform the functions of an audit committee. The Board accordingly does not believe it is necessary at this time to recruit a new director in order to name an audit committee financial expert.

Nominating Committee Functions

In the absence of a designated nominating committee, each of our independent directors participates in the consideration of director nominees. In the Board’s view, a standing nominating committee is not necessary since, given the Board’s current size and composition, our independent directors are capable of performing the same functions as necessary.

We will consider candidates for Board membership suggested by the Board members, as well as management and shareholders. We consider, among many factors, leadership experience, financial and accounting expertise, industry expertise and strategic planning expertise in choosing Board members. We also examine the skills, diversity, backgrounds and experience of director nominees. In evaluating and determining whether to recommend a person as a candidate for election as a director, the Board considers the following specific qualifications: relevant management and/or industry experience; high personal and professional ethics; integrity and values; a commitment to representing the long-term interests of our shareholders; independence; and an ability and willingness to devote sufficient time to carrying out their duties and responsibilities as directors.

Compensation Committee Functions

In the absence of a designated compensation committee, our Board of Directors participates in the determination of executive and director compensation. In the Board’s view, a standing compensation committee is not necessary because our independent directors are willing and able to perform the same functions as necessary.

Our policies with respect to the compensation of our executive officers are administered by our Board in consultation with our independent directors. Our compensation policies are intended to provide for compensation that is sufficient to attract, motivate and retain executives of outstanding ability and potential and to establish an appropriate relationship between executive compensation and the creation of shareholder value.

The Board anticipates that performance-based and equity-based compensation will be an important foundation in future executive compensation packages as we believe it is important to maintain a strong link between executive incentives and the creation of shareholder value. We believe that performance and equity-based compensation can be an important component of the total executive compensation package for maximizing shareholder value while, at the same time, attracting, motivating and retaining high-quality executives.

Board and Committee Meetings

The Board met ten times during the fiscal year ended May 31, 2013. During fiscal 2013, each director attended 75% or more of the aggregate number of meetings held by the Board. The Board’s independent directors did not meet separately from the Board meetings that were held during the fiscal year ended May 31, 2013, but performed the necessary functions as audit, nominating and compensation committees during these meetings as necessary.

We do not have a formal policy respecting attendance by our Board of Directors of annual meetings of the shareholders. However, we attempt to schedule our annual meetings so that all of our directors can attend and encourage them to do so. All of the then current members of the Board attended the Company’s 2012 Annual Meeting of Shareholders.

Board Leadership Structure and Role in Risk Oversight

Mr. Barksdale serves both as our Chief Executive Officer and Chairman of the Board. At this time, our Board believes that the Company is best served by having one person serve as both chief executive officer and the chairman because this structure provides unified leadership and direction. Given Mr. Barksdale’s extensive experience in operating, managing, financing and investing in oil and natural gas wells and his capital markets experience, Mr. Barksdale is uniquely situated to provide day-to-day operational guidance, as well as broader strategic and management direction for the Company. His knowledge of the Company’s daily operations as Chief Executive Officer ensures that key business issues are brought to the Board’s attention and prioritized as appropriate for the Company’s success. Our Board has not appointed a lead independent director.

Our Board’s role in the risk oversight process includes receiving regular reports from senior management on areas of material risk, including operational, financial, legal and regulatory and strategic and reputational risks. In connection with its review of the operations of our business and corporate functions, our Board considers and addresses the primary risks associated with those functions. Our Board regularly engages in discussions of the most significant risks that we are facing and how we manage these risks.

Code of Ethics

Our Board of Directors has adopted a code of ethics that applies to our directors, officers, and employees. A copy of our code of ethics is available on our website at www.redmountainresources.com/investor-information under the “Governance” heading. We intend to post any amendments to, or waivers from, our code of ethics that apply to our principal executive officer, principal financial officer, and principal accounting officer on our website at www.redmountainresources.com/investor-information.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires our executive officers and directors, and persons who beneficially own more than 10% of our equity securities, to file reports of ownership and changes in ownership with the SEC. Based solely on our review of Forms 3, 4 and 5 furnished to us as required under the rules of the Exchange Act and representations to us from our executive officers and directors, we have no knowledge of any failure to report on a timely basis any transaction required to be disclosed under Section 16(a) during fiscal 2013.

Shareholder Board Nominee Recommendations and Other Board Communications

Shareholders and other interested parties may send written communications to the Board, or any of the individual directors, c/o Red Mountain Resources, Inc., 2515 McKinney Avenue, Suite 900, Dallas, Texas 75201, attention: Corporate Secretary. All communications will be compiled by our Corporate Secretary and submitted to the Board or the individual directors, as applicable, on a periodic basis. The independent directors will consider all shareholder board nominee recommendations presented to them in writing provided that such nominee recommendations are received by the independent directors no later than the first day of the first quarter of the Company’s fiscal year for consideration for nomination by the independent directors at the following annual shareholders meeting.

Report of the Independent Directors Performing the Functions of the Audit Committee

Our independent directors, performing the functions of our audit committee, have:

| | ● | Reviewed and discussed the audited financial statements with management; |

| | | |

| | ● | Discussed with the independent auditors of the Company the matters requiring discussion by Statement on Auditing Standards (SAS) No. 61, as amended, as adopted by the Public Company Accounting Oversight Board in Rule 3200T; and |

| | | |

| | ● | Received and reviewed written disclosures and letters from the independent auditors required by applicable requirements of the Public Company Accounting Oversight Board, regarding the independent auditor’s communications with the Board concerning independence, and discussions with the auditors regarding their independence. |

Based on the above-mentioned reviews and discussions with management and the independent auditors, the independent directors recommended to the Board that the Company’s audited consolidated financial statements be included in its Annual Report Form 10-K for the fiscal year ended May 31, 2013, for filing with the Securities and Exchange Commission.

| | Independent Directors Performing the Functions of the Audit Committee: |

| | Richard Y. Roberts David M. Heikkinen Paul N. Vassilakos |

Executive Officers

The Company’s executive officers are appointed by the Board of Directors and hold office until their successors are chosen and qualify. The following table and text sets forth certain information with respect to the Company’s executive officers as of November 5, 2013, other than Mr. Barksdale, whose information is set forth above under “—Directors and Director Nominees”:

| Name | | Age | | Position |

| Michael R. Uffman | | 37 | | Chief Financial Officer |

| Hilda D. Kouvelis | | 50 | | Chief Accounting Officer and Executive Vice President |

| Tommy W. Folsom | | 59 | | Executive Vice President and Director of Exploration and Production of RMR Operating, LLC |

Michael R. Uffman has served as our Chief Financial Officer since November 2012. His extensive investment banking background includes years of experience advising companies on equity and debt capital markets, investor relations, and assisting in the acquisition and divestiture of assets, all in the exploration and production space. Throughout his career, Mr. Uffman has assisted clients raise more than $5 billion in the energy space. From January 2012 until December 2012, Mr. Uffman served as a Managing Director of Global Hunter Securities, LLC, a full service, natural resource focused investment banking firm. From July 2010 to December 2011, Mr. Uffman served as Director of Oil and Gas Business Development for Louisiana Economic Development, which is responsible for strengthening Louisiana's business environment and creating a more vibrant economy in the state. From May 2007 to June 2010, Mr. Uffman served as Director of Energy Investment Banking for Dahlman Rose & Company, a research-driven investment bank focused internationally on the commodity supply chain. From 2002 to 2007, Mr. Uffman served as Vice President of Energy Investment Banking at Capital One Southcoast, Inc., an energy investment banking boutique. From 2000 to 2002, Mr. Uffman served in External Audit at KPMG, LLP.

Hilda D. Kouvelis has served as our Chief Accounting Officer since February 2012 and was appointed Executive Vice President in July 2012. Ms. Kouvelis has more than 25 years of industry accounting and finance experience. From January 2005 until June 2011, she was employed with TransAtlantic Petroleum Ltd., an international oil and natural gas company engaged in the acquisition, exploration, development and production of oil and natural gas, serving as its Chief Financial Officer from January 2007 until April 2011 and as its Vice President from May 2007 to April 2011. She also served as its controller from January 2005 to January 2007. Prior to joining TransAtlantic Petroleum, Ms. Kouvelis served as Controller for Ascent Energy, Inc. from 2001 to 2004 and as Financial Controller for the international operations at the headquarters of PetroFina, S.A. in Brussels, Belgium from 1998 through 2000.

Tommy W. Folsom has been Executive Vice President and Director of Exploration and Production of RMR Operating, LLC, our wholly owned subsidiary, since August 2012 and served as our Executive Vice President and Director of Exploration and Production from September 2011 to August 2012. Mr. Folsom is the founder of Enerstar Resources O & G, LLC ("Enerstar"), an oil company involved in the drilling, re-completion, re-entry and acquisition of properties and leases in the United States, and has served as its President since its formation in 1994. From 1996 to August 2011, Mr. Folsom served as the Operations Manager of Murchison Oil and Gas, Inc., a privately-held independent oil and gas company engaged in the acquisition, development and production of oil and gas resources in the United States.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Compensation Discussion and Analysis

This section contains a discussion of the material elements of the Company’s executive compensation for fiscal 2013 for: (i) its President and Chief Executive Officer, Alan W. Barksdale, (ii) its Chief Financial Officer, Michael R. Uffman, and (iii) its two other executive officers as of May 31, 2013, Hilda D. Kouvelis and Tommy W. Folsom (collectively, the “named executive officers”).

Executive Compensation Overview

The Company’s Board of Directors determines executive compensation. The Board does not have a formal, annual compensation review process. Rather, the Board makes compensation decisions on an as needed basis. The Company’s President and Chief Executive Officer has significant influence on compensation decisions for the named executive officers, other than himself.

The Company’s executive compensation decisions are intended to attract, motivate and retain talented executives. At this stage of the Company’s development, executive compensation is not tied to specific financial performance metrics and primarily consists of base salary.

The Board of Directors does not retain a compensation consultant nor prepare a benchmarking report in connection with base salary determinations. Rather, the Board of Directors relies on its experience and business judgment to set base salaries at amounts that it believes are competitive for similarly situated executives in the industry.

Elements of Executive Compensation

Other than a guaranteed bonus awarded to Mr. Folsom, the Company’s fiscal 2013 compensation program consisted entirely of base salary.

Pursuant to Mr. Folsom’s employment agreement, he receives a minimum annual bonus of $250,000 per year, which he can elect to receive in cash, shares of common stock or stock options. In August 2013, Mr. Folsom elected to receive $50,000 of his bonus in stock options. The Company has not issued the stock options. The Company expects to issue the stock options in fiscal 2014. The Company did not change Mr. Folsom’s base salary in fiscal 2013.

Mr. Uffman was hired as the Company’s Chief Financial Officer as of November 30, 2012. The Board set his base salary at $200,000 per year.

Ms. Kouvelis was hired as the Company’s Chief Accounting Officer as of February 7, 2012. On July 25, 2012, the Board appointed Mrs. Kouvelis as Executive Vice President of the Company and its subsidiaries and, on July 27, 2012, her employment agreement was amended to increase to her base salary to $200,000 per year from $170,000 per year.

The Company did not change Mr. Barksdale’s base salary in fiscal 2013.

Other Benefits

The Company provides its named executive officers with customary, broad-based benefits that are provided to all of its employees. The Company pay insurance premiums on behalf of each of its employees, including the named executive officers, for life insurance policies pursuant to which the employee is entitled to life insurance equal to one year’s salary. The Company also provides its named executive officers with certain perquisites that are not a material element of their executive compensation.

Share Ownership

The Company has not adopted formal stock ownership guidelines for its named executive officers, but the Company believes that named executive officers owning shares helps align their interests with those of long-term shareholders. As of May 31, 2013, Mr. Barksdale beneficially owned approximately 8.7% of the Company’s common stock.

Shareholder Advisory Vote

The Company was a smaller reporting company in fiscal 2012. As a result, the Company was not required to conduct an advisory vote on executive compensation in fiscal 2012 and did not voluntarily hold such a vote. Therefore, the Company’s Board of Directors did not consider the result of such voting in determining executive compensation for fiscal 2013.

Compensation Committee Interlocks and Insider Participation

The Board of Directors is primarily responsible for overseeing the Company’s compensation and employee benefit plans and practices. The Company does not have a compensation committee or other Board committee that performs equivalent functions. During fiscal 2013, no officer or employee of the Company (other than its President and Chief Executive Officer who is also a director of the Company), nor any former officer of the Company (other than Mr. Vassilakos, the Company’s former interim President and Chief Executive Officer), participated in deliberations of the Company’s Board of Directors concerning executive compensation.

Compensation Committee Report on Executive Compensation

The Board of Directors has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Board of Directors recommended that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2013.

| | Alan W. Barksdale |

| | Randell K. Ford |

| | David M. Heikkinen |

| | Richard Y. Roberts |

| | Paul N. Vassilakos |

FISCAL 2013, 2012 AND 2011 SUMMARY COMPENSATION TABLE

On June 22, 2011, we changed our fiscal year end from January 31 to May 31. The following table sets forth information concerning compensation of our named executive officers for the period from February 1, 2011 to May 31, 2011 and the fiscal years ended May 31, 2012 and 2013.

The named executive officers are: (i) our President and Chief Executive Officer, (ii) our Executive Vice President and Director of Exploration and Production of our wholly owned subsidiary, RMR Operating, LLC (“RMR Operating”) (iii) our Chief Accounting Officer and Executive Vice President and (iv) our Chief Financial Officer. We do not have any other executive officers.

| Name and Principal Position | Period Ended | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | All Other Compensation ($) | | Total ($) |

Alan W. Barksdale (1) President and Chief Executive

Officer | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Tommy W. Folsom (3) Executive Vice President and

Director of Exploration and

Production of RMR Operating | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Hilda D. Kouvelis (7) Chief Accounting Officer and

Executive Vice President | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Michael R. Uffman (8) Chief Financial Officer | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

______________

| (1) | Mr. Barksdale has served as Chief Executive Officer since June 22, 2011 and as President since July 25, 2012. From June 22, 2011 to August 8, 2011, Mr. Barksdale also served as Interim Acting Chief Financial Officer. |

| (2) | Consists of life insurance premiums and car allowance. |

| (3) | Mr. Folsom served as our Executive Vice President and Director of Exploration and Production from September 30, 2011 until August 1, 2012 and has served as RMR Operating’s Executive Vice President and Director of Exploration and Production since August 1, 2012. |

(4) (5) (6) (7) | This award has not been issued. Consists of allowances for car, cell phone and mobile home parking paid to Enerstar. Includes a $100,000 signing bonus. Ms. Kouvelis has served as our Chief Accounting Officer and Executive Vice President since February 7, 2012. |

| (8) | Mr. Uffman has served as our Chief Financial Officer since November 30, 2012. |

Employment Agreements

Mr. Folsom entered into an employment agreement with us effective September 14, 2011, as amended July 27, 2012. Under the agreement, as amended, Mr. Folsom serves as Executive Vice President and Director of Exploration and Production of RMR Operating. Under the agreement, Mr. Folsom is entitled to a base salary of $20,000 per month and an annual performance bonus. The performance bonus is to be determined based upon objectives determined annually by our Board of Directors, but will not be less than $250,000 per year (pro-rated for any partial year). The performance bonus is payable in cash, shares of the Company’s common stock, stock options or a combination thereof as determined by Mr. Folsom. As of September 27, 2013, the performance objectives for the performance bonus have not been determined.

Pursuant to the employment agreement, Mr. Folsom is entitled to receive additional equity grants in the discretion of our Board of Directors on the same basis as other similarly situated senior executives. We are required to provide Mr. Folsom with disability, accident, medical, life and hospitalization insurance, as well as other benefits provided to similarly situated senior executives. In lieu of these benefits, Mr. Folsom may elect to receive a lump sum payment for such benefits not to exceed 7% of his salary. Mr. Folsom is also entitled to either a vehicle provided by us plus reimbursement for the cost of fuel, maintenance and insurance, or a $1,000 per month vehicle allowance plus reimbursement for the cost of fuel. If Mr. Folsom’s employment is terminated by us without “cause” or by Mr. Folsom for “good reason” (as each term is defined below), he will be entitled to receive a lump sum payment equal to the lesser of three months of his base salary or the base salary for the remainder of the term of the agreement. If the agreement is terminated upon Mr. Folsom’s death or total disability, we are required to pay Mr. Folsom or his estate the greater of any death or long-term disability payment, as applicable, due under any plan or policy, or the amount of the minimum annual performance bonus that would be paid to Mr. Folsom for the remainder of the term of the agreement. Under the agreement, Mr. Folsom is prohibited from disclosing confidential information about us. The agreement expires on December 31, 2016.

Ms. Kouvelis entered into an employment agreement with us effective February 1, 2012. Under the agreement, Ms. Kouvelis serves as our Chief Accounting Officer. The agreement provides for Ms. Kouvelis to receive a base salary of $170,000 per year. On July 25, 2012, the Board appointed Ms. Kouvelis as Executive Vice President of the Company and its subsidiaries and on July 27, 2012, her employment agreement was amended to increase to her base salary to $200,000. Pursuant to the employment agreement, Ms. Kouvelis is entitled to receive an annual performance bonus based on performance objectives and parameters to be determined by the Board of Directors. The performance bonus is payable in cash, shares of our common stock, or a combination thereof as determined by the Board of Directors. Ms. Kouvelis is also entitled to receive an initial stock option grant in an amount to be determined by the Board of Directors with a value of not less than $42,500. As of September 27, 2013, neither the performance objectives and parameters nor the size of the initial stock option grant had been determined. The Company expects to issue the initial stock option grant during fiscal 2014. Pursuant to the employment agreement, Ms. Kouvelis is entitled to receive additional equity grants in the discretion of our Board on the same basis as other similarly situated senior executives. We are required to provide Ms. Kouvelis with disability, accident, medical, life and hospitalization insurance, as well as other benefits provided to similarly situated senior executives. If Ms. Kouvelis is terminated by us without “cause” or by Ms. Kouvelis for “good reason” (as each term is defined below), she will be entitled to receive a lump sum payment equal to the lesser of six months of her base salary or the base salary for the remainder of the term. Under the agreement, Ms. Kouvelis is prohibited from disclosing confidential information about us and she has agreed not to compete with us during the term of her employment and for six months thereafter. The agreement expires on January 31, 2015.

“Cause” in Mr. Folsom and Ms. Kouvelis’ employment agreements is defined as the conviction by the executive of any felony or crime involving moral turpitude, the executive’s willful and intentional failure or refusal to follow instructions of the Board of Directors, a material breach in the performance of the executive’s obligations under the agreement, the executive’s violation of any of our written policies if the executive knows or should know such action constitutes a violation thereof, or the executive’s act of misappropriation, embezzlement, intentional fraud or similar conduct, or other dishonest conduct in his or her relations with us. “Good reason” in each of the employment agreements is defined as a material reduction in the executive’s salary or benefits or duties, authority or responsibilities, the relocation of the executive’s work location to a location more than 50 miles from the executive’s current location, or the failure of a successor to assume and perform under the agreement.

Long-Term Incentive Plan

The Red Mountain Resources, Inc. 2012 Long-Term Incentive Plan (the “Incentive Plan”) provides for the granting of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock, restricted stock units, performance awards, and dividend equivalent rights, which may be granted singly, in combination, or in tandem. The Incentive Plan is intended to enable the Company to remain competitive and innovative in the Company’s ability to attract, motivate, reward, and retain the services of key employees, certain key contractors, and outside directors. As of May 31, 2013, no awards had been issued under the Incentive Plan, and there were 8,200,000 shares of common stock available for issuance under the Incentive Plan.

Potential Payments Upon Termination or Change of Control

Set forth below are the amounts that the named executive officers would have received if specified events had occurred on May 31, 2013.

| Name | | Payment | | Termination Following a Change in Control ($) | | | Termination Without Cause or for Good Reason ($) | | | Death ($) | | | Disability ($) | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

____________

| (1) | This amount is net of Company-paid life insurance proceeds of $240,000. |

Director Compensation

The following is a summary of our director compensation program for the fiscal year ended May 31, 2013:

| · | Each non-employee director receives an annual cash fee of $35,000; |

| · | Each chairman of the audit committee and compensation committee (if any such committees then exist) receives an additional annual cash fee of $10,000 and $5,000, respectively; |

| · | Each non-employee director receives a cash fee of $1,000 and $500 for each in person Board and committee meeting, respectively, such director participates in; and |

| · | Each non-employee director annually receives $50,000 paid in shares of our common stock at a price equal to the last sales price of our common stock on the OTC Bulletin Board (“OTCBB”) on the date of issuance. |

All directors are reimbursed for their costs incurred in attending meetings of the Board of Directors or of the committees on which they serve. All cash compensation is paid quarterly within 30 days of the beginning of each quarter. The stock grant is paid annually on May 31st of each year (or the next business day if May 31st is not a business day) and pro-rated for partial service in any given year. The term of office for each director is one year, or until his or her successor is elected at our annual shareholders meeting and qualified.

DIRECTOR COMPENSATION TABLE

The table below reflects compensation paid to non-employee directors for the fiscal year ended May 31, 2013. Mr. Barksdale serves as a director and our President and Chief Executive Officer. As such, information about his compensation is listed in the Fiscal 2013, 2012 and 2011 Summary Compensation Table above. Mr. Barksdale did not receive any additional compensation for his service as a director.

| Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1)(2) | | | Total ($) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

______

| (1) | Consists of shares of common stock granted to the directors on May 31, 2013 pursuant to our director compensation program. The awards to Messrs. Heikkinen and Rose were pro-rated for partial service during fiscal 2013. |

| (2) | The amounts shown were not actually paid to the directors. Rather, as required by the rules of the SEC, the amounts represent the aggregate grant date fair value of the shares of common stock awarded to each of them in fiscal 2013. These values were determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation—Stock Compensation. |

| (3) | Mr. Heikkinen joined the Board on April 11, 2013. |

| (4) | Mr. Rose resigned from the Board on April 11, 2013. |

Risk Management Relating to Compensation Policies

Due to the limited nature of compensation that we currently pay, particularly performance-based compensation, we do not believe there are any risks arising from our compensation policies and practices that are reasonably likely to have a material adverse effect on us.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of October 25, 2013 by (i) each person known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock; (ii) each of our named executive officers and directors and (iii) all of our executive officers and directors as a group.

Name and Address of Beneficial Owner (1) | | Amount of Beneficial Ownership (2)(3) | | Percentage of Outstanding Common Stock (2)(3) |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

All executive officers and directors as a group (8 persons) | | | | |

| | | | | |

StoneStreet Group, Inc. 2515 McKinney Ave., Suite 900 Dallas, Texas 75201 | | | | |

| | | | | |

Sophia Company Inc. Sterling House, 16 Wesley Street Hamilton, HM 11 Bermuda | | | | |

___________

| * | Less than one percent. |

| (1) | Unless noted otherwise, the address for the above individuals is 2515 McKinney Ave., Suite 900, Dallas, Texas 75201. |

| (2) | Beneficial ownership as reported in the above table has been determined in accordance with Rule 13d-3 under the Exchange Act. Unless otherwise specified, beneficial ownership information is based on the most recent Forms 3, 4 and 5 and Schedule 13D and 13G filings with the SEC and reports made directly to the Company. The number of shares shown as beneficially owned includes shares of common stock that may be acquired upon exercise of warrants within 60 days after October 25, 2013. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. |

| (3) | The percentages indicated are based on 134,013,103 shares of common stock outstanding on October 25, 2013. Shares of common stock that may be acquired upon exercise of warrants within 60 days after October 25, 2013 are deemed outstanding for computing the percentage of the person or entity holding such warrants but are not outstanding for computing the percentage of any other person or entity. |

| (4) | These shares are owned by StoneStreet. Alan Barksdale (our President, Chief Executive Officer and Chairman of the Board) is the sole shareholder and president of StoneStreet and may be deemed to beneficially own these shares. |

| (5) | Based upon Sophia Company Inc.’s participation in our common stock offerings during fiscal 2013 and 2014. Includes 88,889 warrants to acquire 2,222,225 shares of common stock. |

RELATED PARTY TRANSACTIONS

On December 10, 2012, we entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) with Bamco Gas, LLC (“Bamco”). Mr. Barksdale was the receiver for the receivership estate of Bamco. Pursuant to the Asset Purchase Agreement, we agreed to acquire working interests and claims and causes of action in or relating to certain oil and gas exploration projects in Duval, Johnson and Zapata Counties in Texas (the “Bamco Properties”). On December 10, 2012, pursuant to the Asset Purchase Agreement, we issued 2,375,000 shares of our common stock to the indenture trustee of certain debentures of Bamco, and we executed a waiver and release of a claim against the receivership estate of Bamco for a $2.7 million note receivable that we deemed uncollectible in 2011.

We entered into an arrangement with R. K. Ford and Associates and Cabal Energy relating to the operations of the Good Chief State #1 and Big Brave State #1 wells, and a contract for drilling services with Western Drilling Inc. on our Madera 24-2H well. Each of these entities are owned or partially owned by Mr. Ford. During the fiscal year ended May 31, 2013, we paid an aggregate of $0.2 million to these entities for engineering, drilling and completion services. In addition, we are a party to a lease agreement with R. K. Ford and Associates, pursuant to which we lease office space in Midland, Texas. During the fiscal year ended May 31, 2013, we paid $25,200 to R. K. Ford and Associates pursuant to the lease agreement.

PROPOSAL 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Section 14A of the Exchange Act implements requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and enables our shareholders to vote to approve, on an advisory (non-binding) basis, the compensation of our named executive officers (sometimes referred to as "say on pay"). We are asking shareholders to indicate their support for our named executive officers compensation as described in this proxy statement by voting "FOR" the following resolution:

"RESOLVED, that the shareholders approve, on an advisory basis, the compensation of the Company's named executive officers as disclosed in the Compensation Discussion and Analysis, the accompanying compensation tables, and the related narrative disclosure in the Company's proxy statement for the 2013 Annual Meeting."

The advisory vote on the “say on pay” resolution is intended to address the overall compensation of the Company’s named executive officers rather than any specific element or amount of compensation. This vote is advisory, which means that the vote is not binding on the Company or the Board. The Board expects to take into account the outcome of the vote when considering future executive compensation decisions to the extent they can determine the cause or causes of any significant negative voting results.

Vote Required

Proposal 2 will be approved, on an advisory basis, if the number of votes cast in favor of such proposal exceeds the number of votes cast opposing such proposal. Broker-non votes and abstentions will not count as votes in favor of or against the proposal and will have no effect on the vote total for the proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THE COMPENSATION DISCUSSION AND ANALYSIS, THE ACCOMPANYING COMPENSATION TABLES, AND THE RELATED NARRATIVE DISCLOSURE.

PROPOSAL 3

ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE COMPENSATION

Section 14A of the Exchange Act also provides that shareholders must be given the opportunity to vote, on a non-binding, advisory basis, for their preference as to how frequently we should seek future advisory votes on the compensation of our named executive officers. By voting with respect to this proposal, shareholders may indicate whether they would prefer that we conduct future advisory votes on executive compensation once every one, two, or three years. Shareholders also may, if they wish, abstain from casting a vote on this proposal.

The Board believes that a frequency of every “3 years” for the advisory vote on executive compensation is the optimal interval for conducting and responding to a “say on pay” vote. In determining to recommend that shareholders vote for a frequency of once every three years, the Board considered how an advisory vote at this frequency will provide our shareholders with sufficient time to evaluate the effectiveness of our overall compensation philosophy, policies and practices in the context of our long-term business results for the corresponding period, while avoiding over-emphasis on short term variations in compensation and business results. An advisory vote occurring once every three years will also permit our shareholders to observe and evaluate the impact of any changes to our executive compensation policies and practices which have occurred since the last advisory vote on executive compensation, including changes made in response to the outcome of a prior advisory vote on executive compensation. We will continue to engage with our shareholders regarding our executive compensation program during the period between advisory votes on executive compensation. Shareholders who have concerns about executive compensation during the interval between “say on pay” votes are welcome to bring their specific concerns to the attention of the Board. Please refer to “Shareholder Board Nominee Recommendations and Other Board Communications” in this proxy statement for information about communicating with the Board.

The proxy card provides shareholders with the opportunity to choose among four options (holding the vote every 1, 2 or 3 years, or abstaining) and, therefore, shareholders will not be voting to approve or disapprove the Board’s recommendation.

Although this advisory vote on the frequency of the “say on pay” vote is non-binding, the Board will take into account the outcome of the vote when considering the frequency of future advisory votes on executive compensation.

Vote Required

The number of years (one, two or three) that receives the highest number of votes will be the non-binding selection of the shareholders. Broker-non votes and abstentions will not count as votes in favor of or against the proposal and will have no effect on the vote total for the proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE OPTION OF “3 YEARS” FOR FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION.

PROPOSAL 4

GRANT THE BOARD OF DIRECTORS DISCRETIONARY AUTHORITY TO APPROVE AN AMENDMENT TO OUR ARTICLES OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

General

Our Board of Directors has unanimously adopted and is recommending for shareholder approval (i) an amendment to our articles of incorporation to effect a reverse stock split of our outstanding shares of common stock at a ratio ranging from 1:5 to 1:15 and a proportional reduction in our authorized shares of common stock, and (ii) granting discretionary authority to our Board to decide whether and when to effect the Reverse Stock Split and Authorized Share Reduction and to select the specific ratio which shall be included in the amendment to effect the Reverse Stock Split and Authorized Share Reduction.

Under the proposed amendment, between five and fifteen outstanding shares of our common stock would be combined and converted into one share of common stock together with the corresponding proportional reduction in our authorized shares of common stock.

If approved by our shareholders, the Reverse Stock Split and the Authorized Share Reduction will become effective upon (i) the filing of articles of amendment to our articles of incorporation with the State of Florida if consummated prior to the Merger; or (ii) the filing of a certificate of amendment to the certificate of formation with the State of Texas if consummated after the Merger (the “Effective Time”). However, notwithstanding approval of the Reverse Stock Split and Authorized Share Reduction by our shareholders, the Board will have the sole authority to (i) elect whether or not to amend our articles of incorporation to effect the Reverse Stock Split and to effect the Authorized Share Reduction and (ii) select the specific ratio which shall be included in the amendment to effect the Reverse Stock Split and Authorized Share Reduction.

The form of the proposed amendment to our articles of incorporation (or certificate of formation) to effect the Reverse Stock Split and Authorized Share Reduction is attached to this proxy statement as Annex A (the “Amendment”).

Reasons for the Reverse Stock Split

Our primary objective in proposing the Reverse Stock Split is to attempt to raise the per share trading price of our common stock in order to gain listing on the NYSE MKT. Before our common stock may be listed on the NYSE MKT, we must satisfy certain listing requirements. One of these listing requirements is that our common stock must generally have a minimum bid price of $3.00 per share. On October 24, 2013, the closing price of our common stock on the OTCBB was $0.53 per share.

We anticipate that the Reverse Stock Split will increase the per share bid price per share of our common stock above $3.00, and thereby satisfy one of the NYSE MKT’s listing requirements. However, we cannot be certain that the Reverse Stock Split will, initially or in the future, have the intended effect of raising the bid price of our common stock above $3.00 per share. In addition, even if we effect the Reverse Stock Split, there are no assurances that we will be able to satisfy the other requirements to obtain or maintain a listing on the NYSE MKT or other stock exchange.