Q3 2017 Earnings Call

Cautionary Statement Regarding Forward-Looking Statements Forward Looking Statements: Certain statements are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statement that does not directly relate to any historical or current fact and include, but are not limited to, (1) guidance and expectations for the fourth quarter and full year 2017, including statements regarding expected comparable sales, interest expense, effective tax rates, net income, adjusted net income, diluted earnings per share, adjusted diluted earnings per share, and capital expenditures, (2) statements regarding expectations for improving sales and margin performance, (3) statements regarding cash flow generation, (4) statements regarding expected store openings, store closures, store conversions, and gross square footage, (5) expectations regarding the retail environment, including those regarding mall traffic and promotions, (6) statements regarding the Company's strategy, plans, and initiatives, including, but not limited to, results expected from such strategy, plans, and initiatives, and (7) statements regarding the Company’s intention to repurchase shares of its common stock and the funding for such purposes. Forward looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict, and significant contingencies, many of which are beyond the Company's control. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are (1) changes in consumer spending and general economic conditions; (2) our ability to identify and respond to new and changing fashion trends, customer preferences, and other related factors; (3) fluctuations in our sales, results of operations, and cash levels on a seasonal basis and due to a variety of other factors, including our product offerings relative to customer demand, the mix of merchandise we sell, promotions, and inventory levels; (4) competition from other retailers; (5) customer traffic at malls, shopping centers, and at our stores and online; (6) our dependence on a strong brand image; (7) our ability to develop and maintain a relevant and reliable omni-channel experience for our customers; (8) the failure or breach of information systems upon which we rely; (9) our ability to protect customer data from fraud and theft; (10) our dependence upon third parties to manufacture all of our merchandise; (11) changes in the cost of raw materials, labor, and freight; (12) supply chain or other business disruption; (13) our dependence upon key executive management; (14) our ability to achieve our strategic objectives, including improving profitability through a balanced approach to growth, increasing brand awareness and elevating our customer experience, transforming and leveraging information technology systems, and investing in the growth and development of our people; (15) our substantial lease obligations; (16) our reliance on third parties to provide us with certain key services for our business; (17) claims made against us resulting in litigation or changes in laws and regulations applicable to our business; (18) our inability to protect our trademarks or other intellectual property rights which may preclude the use of our trademarks or other intellectual property around the world; (19) restrictions imposed on us under the terms of our asset-based loan facility, including restrictions on the ability to effect share repurchases; (20) impairment charges on long-lived assets; and (21) changes in tax requirements, results of tax audits, and other factors that may cause fluctuations in our effective tax rate. Additional information concerning these and other factors can be found in Express, Inc.'s filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward looking statement as a result of new information, future events, or otherwise, except as required by law. 2

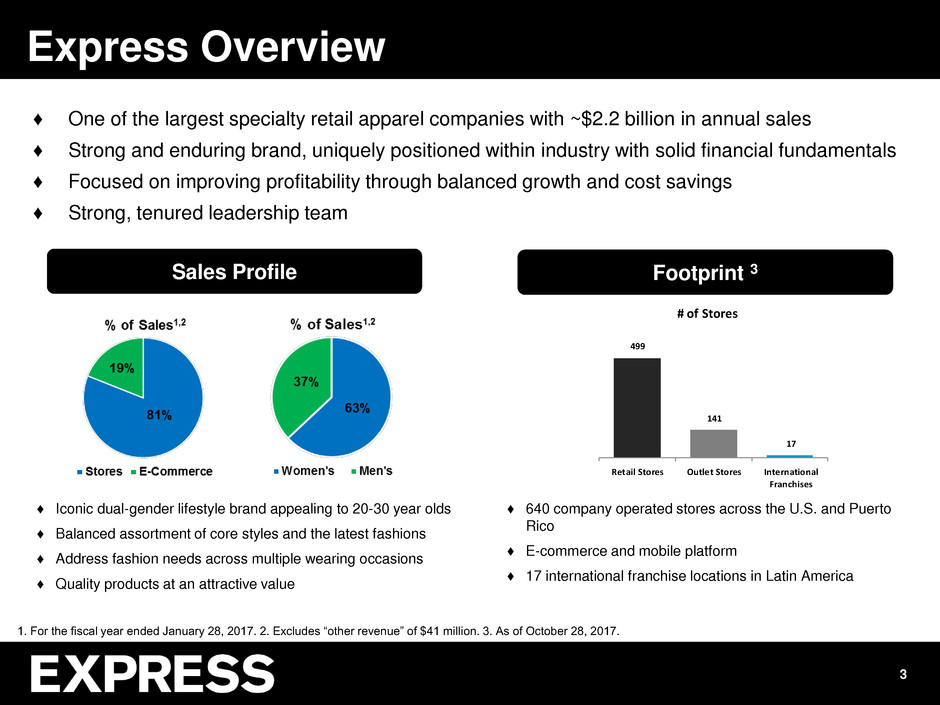

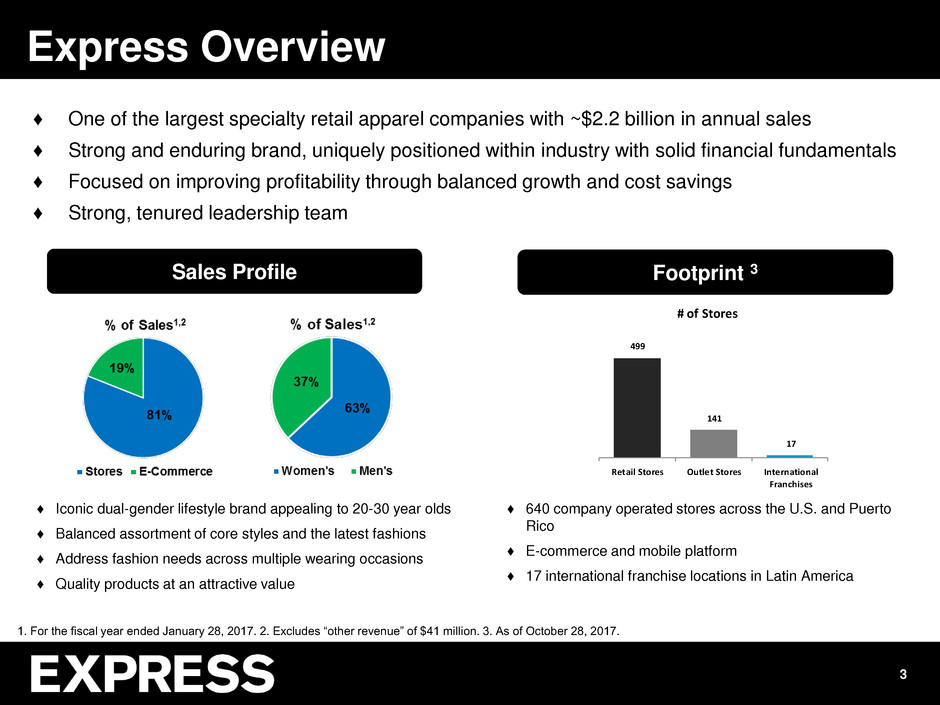

♦ One of the largest specialty retail apparel companies with ~$2.2 billion in annual sales ♦ Strong and enduring brand, uniquely positioned within industry with solid financial fundamentals ♦ Focused on improving profitability through balanced growth and cost savings ♦ Strong, tenured leadership team Sales Profile Footprint 3 ♦ Iconic dual-gender lifestyle brand appealing to 20-30 year olds ♦ Balanced assortment of core styles and the latest fashions ♦ Address fashion needs across multiple wearing occasions ♦ Quality products at an attractive value ♦ 640 company operated stores across the U.S. and Puerto Rico ♦ E-commerce and mobile platform ♦ 17 international franchise locations in Latin America 3 Express Overview 499 141 17 Retail Stores Outlet Stores International Franchises # of Stores 1. For the fiscal year ended January 28, 2017. 2. Excludes “other revenue” of $41 million. 3. As of October 28, 2017.

4 Key Q3 Achievements ♦ Comparable sales were at the top end of our guidance, as were earnings excluding the hurricane impact ♦ Outstanding performance in e-commerce, with sales increasing 23%, on top of 15% growth last year, and accounting for 24% of net sales, up from 19% in the prior year period ♦ Further sequential improvement in our retail stores’ performance, driven by merchandise that resonated with our customers and greater clarity in our fashion message ♦ Significant enrollment growth in our NEXT loyalty program, with customer sign-ups already achieving our 2017 target ♦ Initial success from our expanded omni-channel capabilities, including positive sales contribution from “ship from store” and the pilot launch of “buy online, pick up in store” ♦ Increased marketing effectiveness with new brand platform, focus on digital and social media, and expanded content creation; announced marketing partnership with the NBA ♦ Strong balance sheet maintained, with $198 million in cash, an improved inventory position, and no debt ♦ Remain on track to deliver $20 million in cost savings in 2017 and a total of $44 to $54 million over the 2016 to 2019 period

♦ We are focused on generating long-term value for our stockholders through the following strategic objectives: 1. Improving profitability through a balanced approach to growth 2. Increasing brand awareness and elevating our customer experience 3. Transforming and leveraging information technology systems 4. Investing in the growth and development of our people 5 Strategic Objectives

6 Improving Profitability 1. Increasing the productivity of our existing stores Telling more defined fashion stories Ensuring offerings are clear and cohesive across lifestyles 2. Optimizing our retail store footprint and opening new outlet stores Investing in stores that achieve a strong return on investment Continuing conversion of select mall stores to outlets 3. Growing our e-commerce and omni-channel capabilities Expanding product assortment, further enhancing mobile experience, launching “ship from store,” and piloting “buy online, pick up in store” 4. Significant cost savings initiatives Aggressively managing costs across all areas of the business Taking a more conservative approach to capital spending

Q3 2017 Results

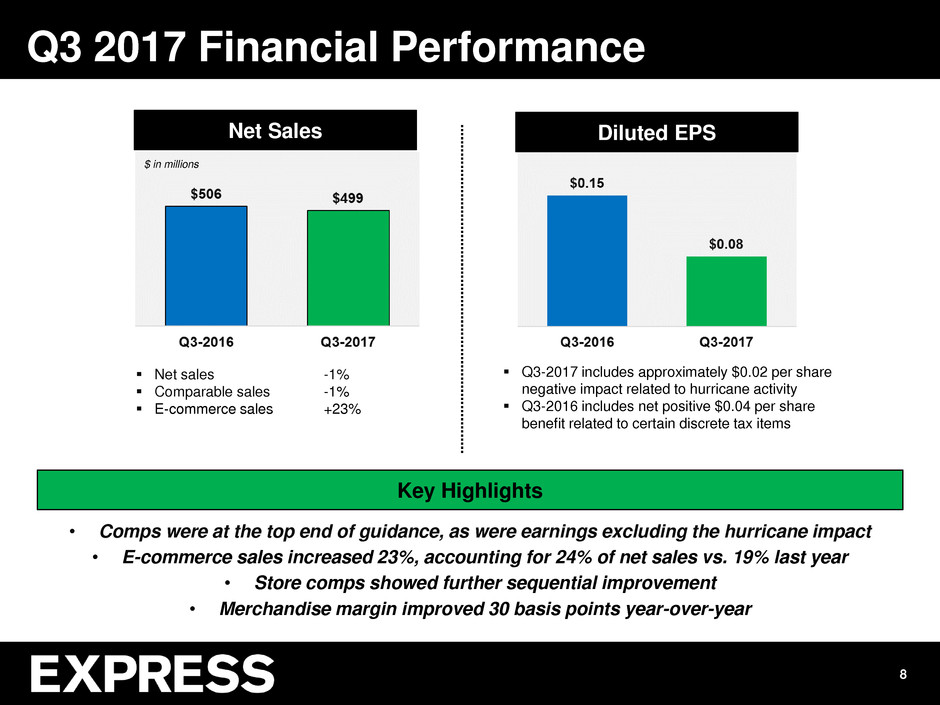

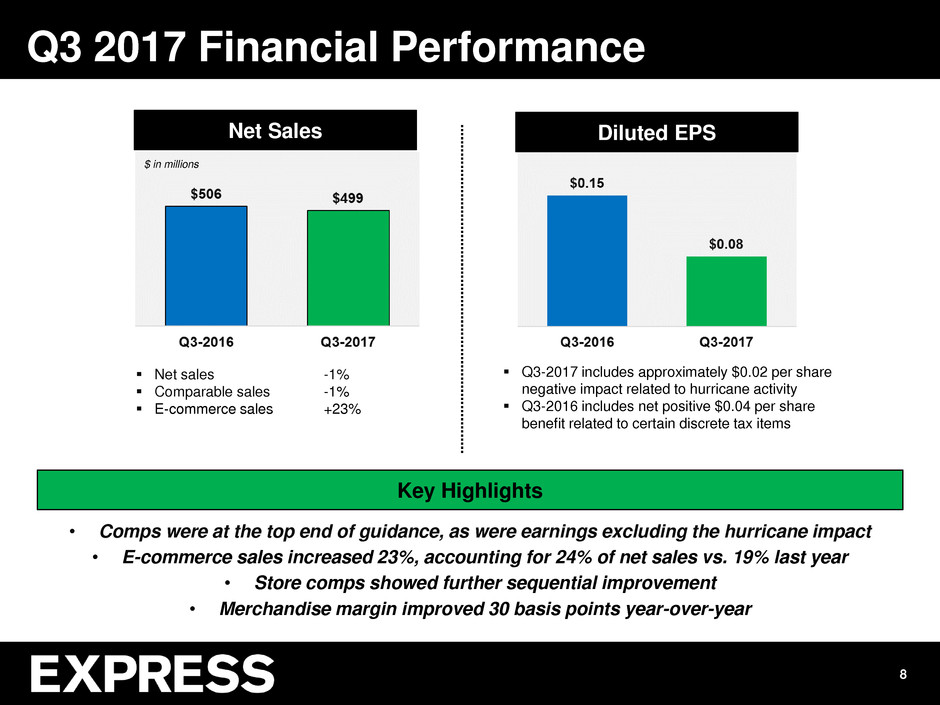

8 Q3 2017 Financial Performance $ in millions Net Sales Diluted EPS Net sales -1% Comparable sales -1% E-commerce sales +23% • Comps were at the top end of guidance, as were earnings excluding the hurricane impact • E-commerce sales increased 23%, accounting for 24% of net sales vs. 19% last year • Store comps showed further sequential improvement • Merchandise margin improved 30 basis points year-over-year Key Highlights Q3-2017 includes approximately $0.02 per share negative impact related to hurricane activity Q3-2016 includes net positive $0.04 per share benefit related to certain discrete tax items

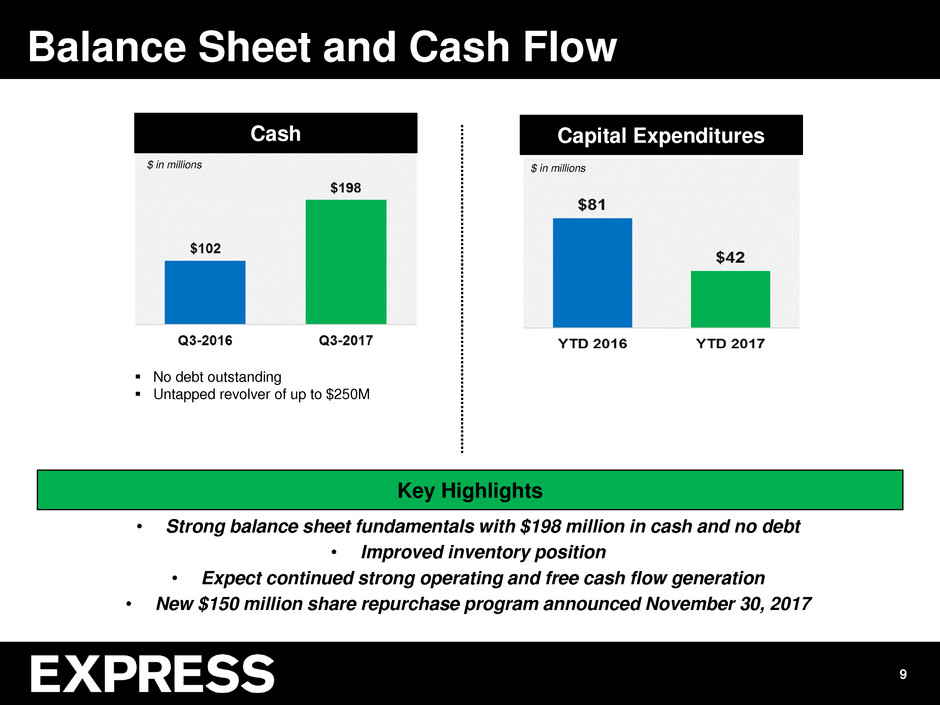

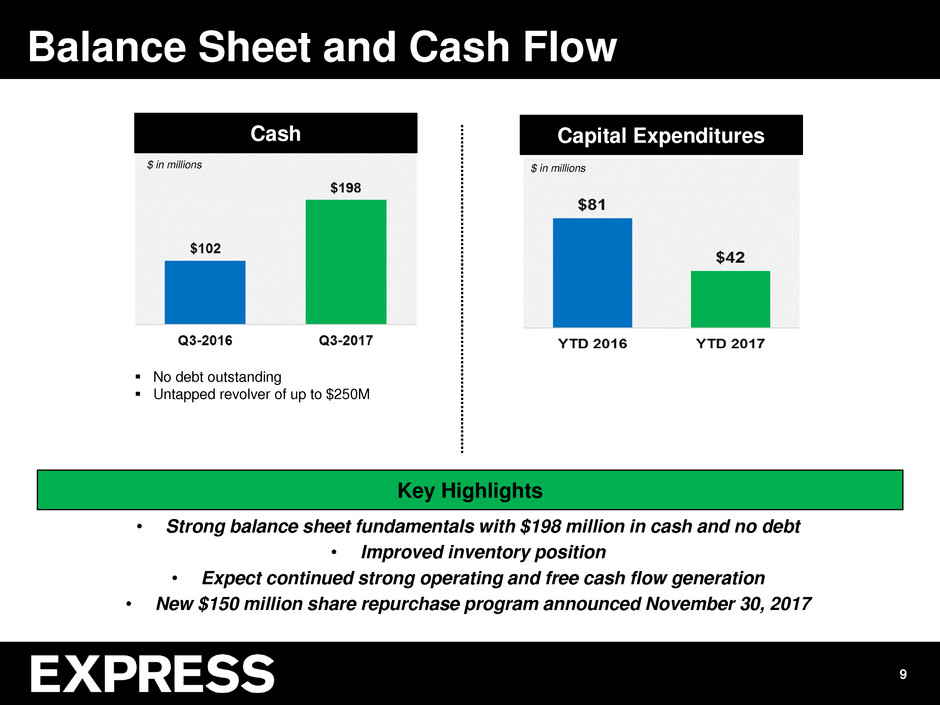

9 Balance Sheet and Cash Flow $ in millions Cash Capital Expenditures No debt outstanding Untapped revolver of up to $250M • Strong balance sheet fundamentals with $198 million in cash and no debt • Improved inventory position • Expect continued strong operating and free cash flow generation • New $150 million share repurchase program announced November 30, 2017 $ in millions Key Highlights

2017 Financial Guidance

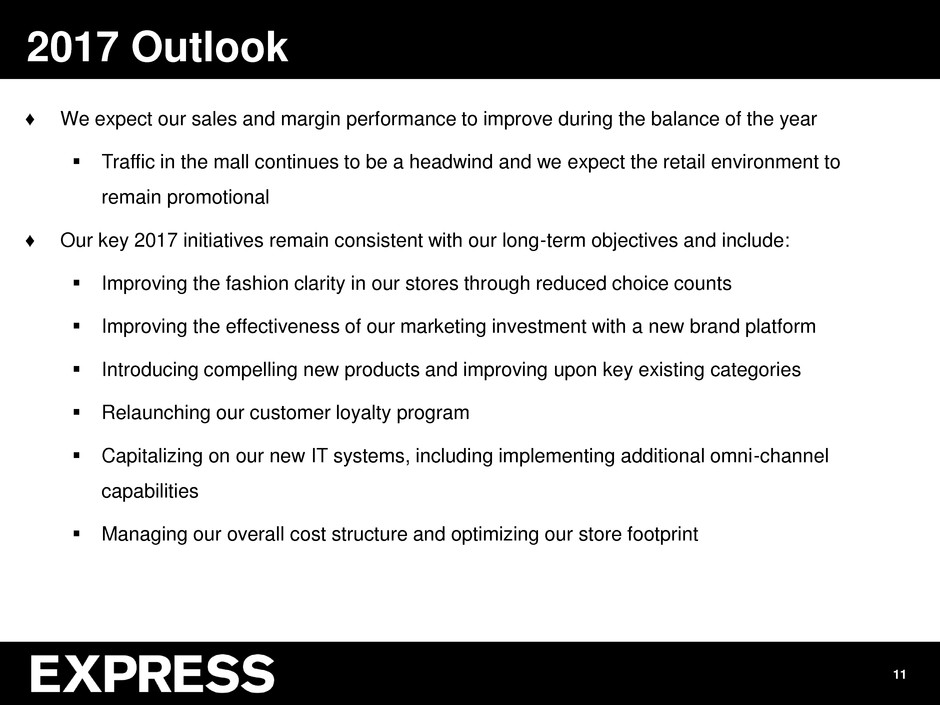

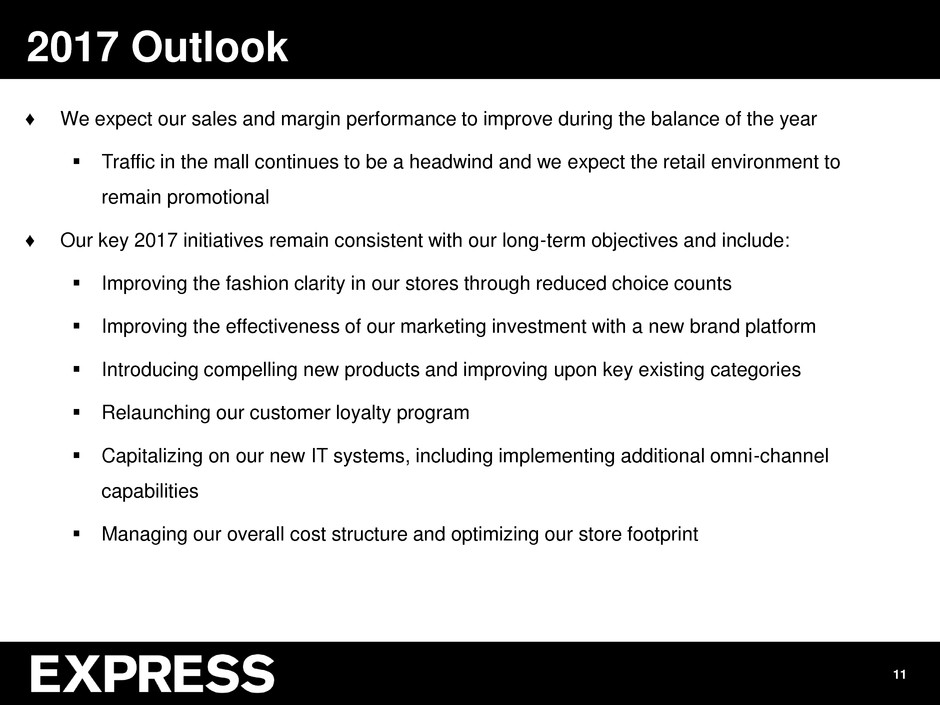

♦ We expect our sales and margin performance to improve during the balance of the year Traffic in the mall continues to be a headwind and we expect the retail environment to remain promotional ♦ Our key 2017 initiatives remain consistent with our long-term objectives and include: Improving the fashion clarity in our stores through reduced choice counts Improving the effectiveness of our marketing investment with a new brand platform Introducing compelling new products and improving upon key existing categories Relaunching our customer loyalty program Capitalizing on our new IT systems, including implementing additional omni-channel capabilities Managing our overall cost structure and optimizing our store footprint 11 2017 Outlook

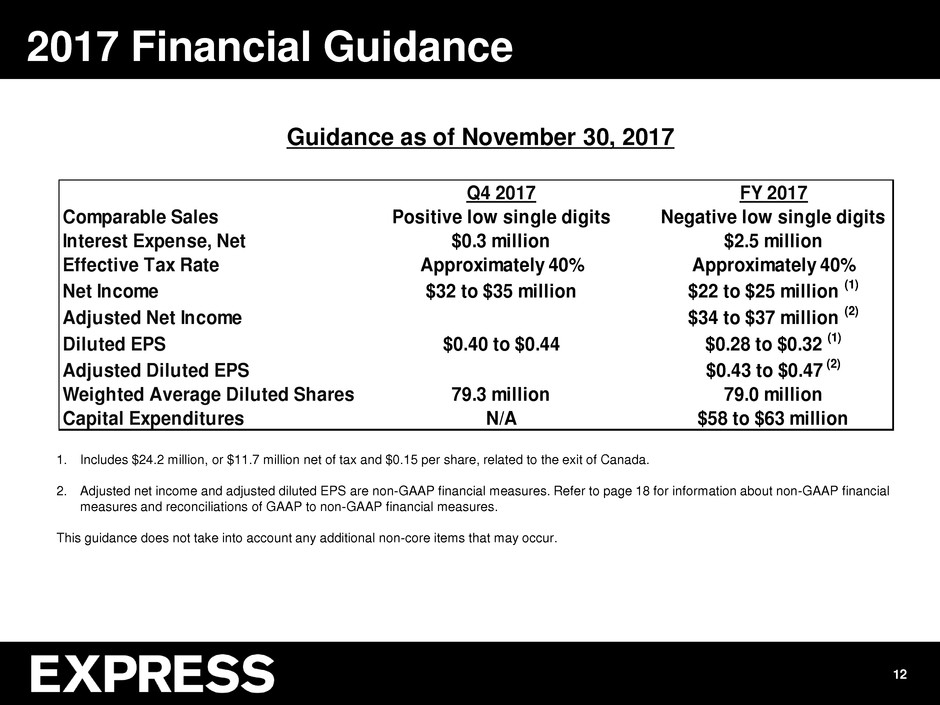

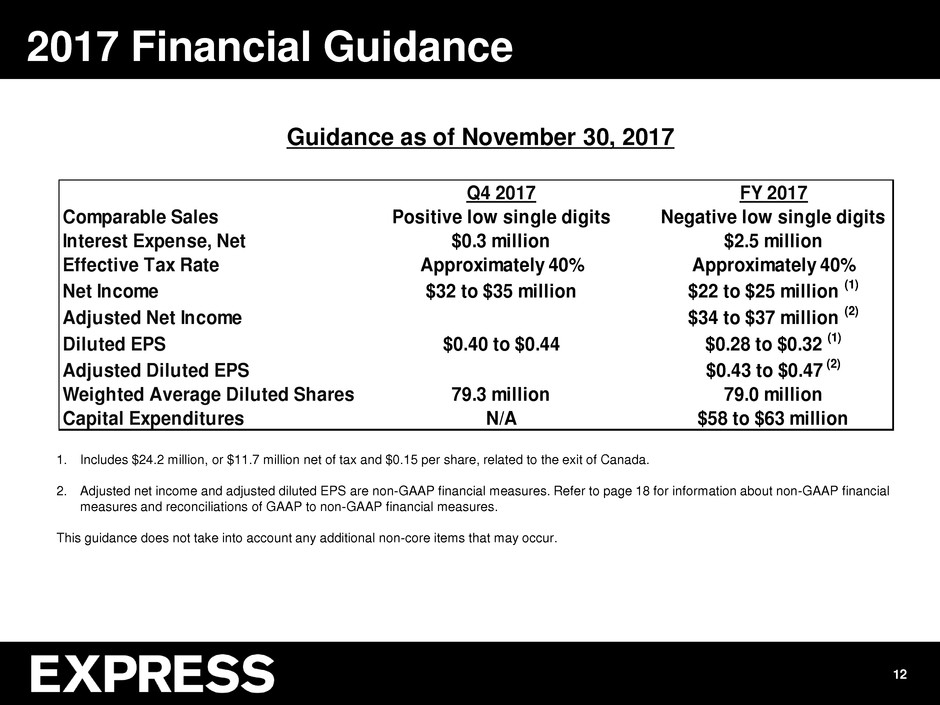

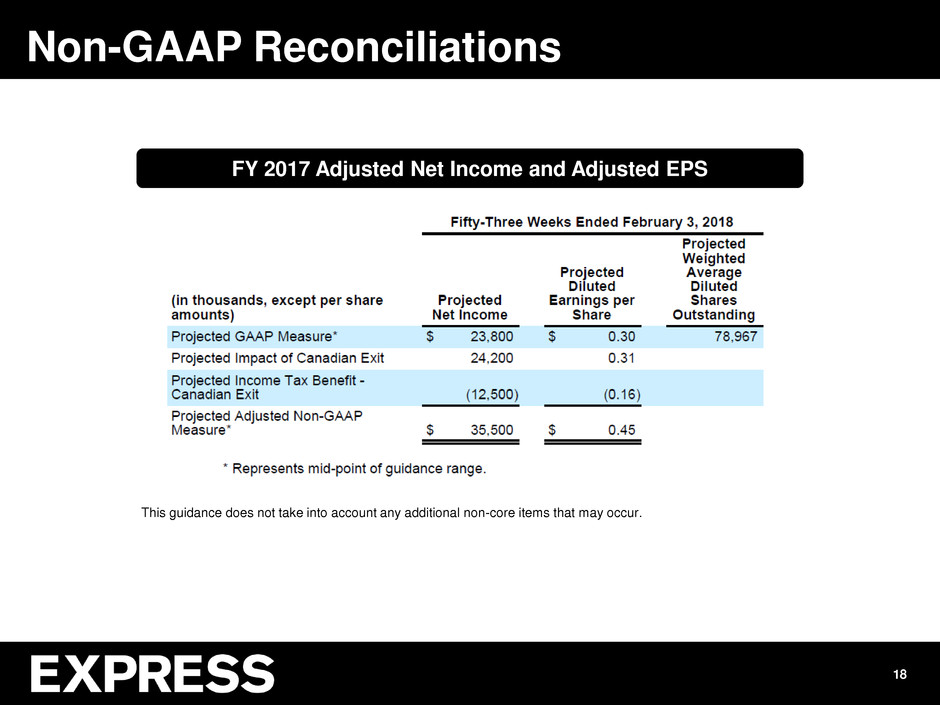

12 2017 Financial Guidance Guidance as of November 30, 2017 Q4 2017 FY 2017 Comparable Sales Positive low single digits Negative low single digits Interest Expense, Net $0.3 million $2.5 million Effective Tax Rate Approximately 40% Approximately 40% Net I come $32 to $35 million $22 to $25 million (1) Adjusted Net Income $34 to $37 million (2) Diluted EPS $0.40 to $0.44 $0.28 to $0.32 (1) Adjusted Diluted EPS $0.43 to $0.47 (2) 79.3 million 79.0 million Capital Expenditures N/A $58 to $63 million Weighted Average Diluted Shares 1. Includes $24.2 million, or $11.7 million net of tax and $0.15 per share, related to the exit of Canada. 2. Adjusted net income and adjusted diluted EPS are non-GAAP financial measures. Refer to page 18 for information about non-GAAP financial measures and reconciliations of GAAP to non-GAAP financial measures. This guidance does not take into account any additional non-core items that may occur.

Appendix

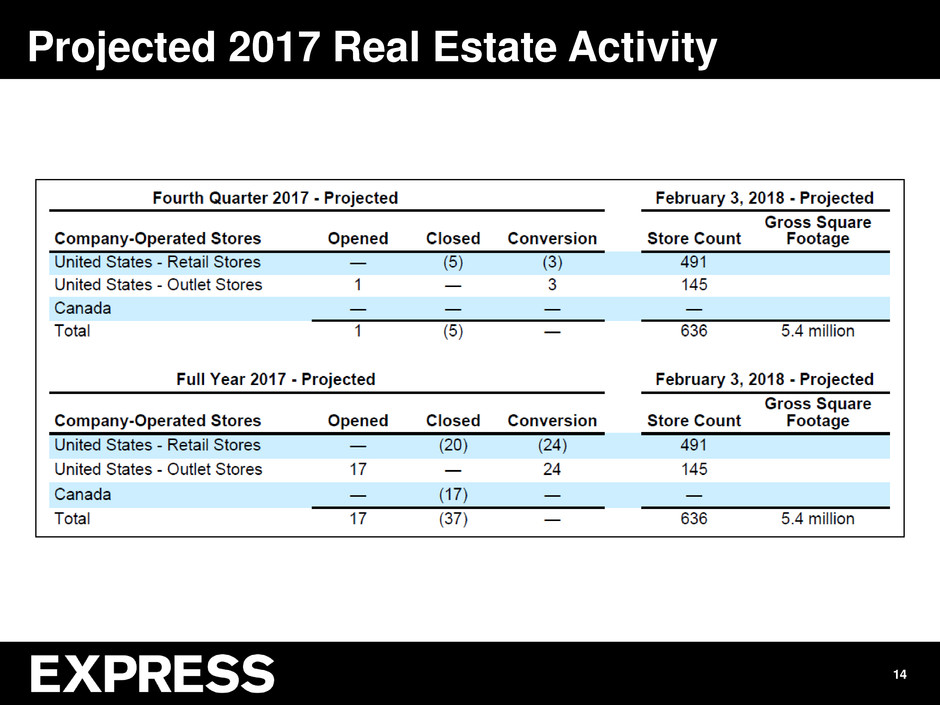

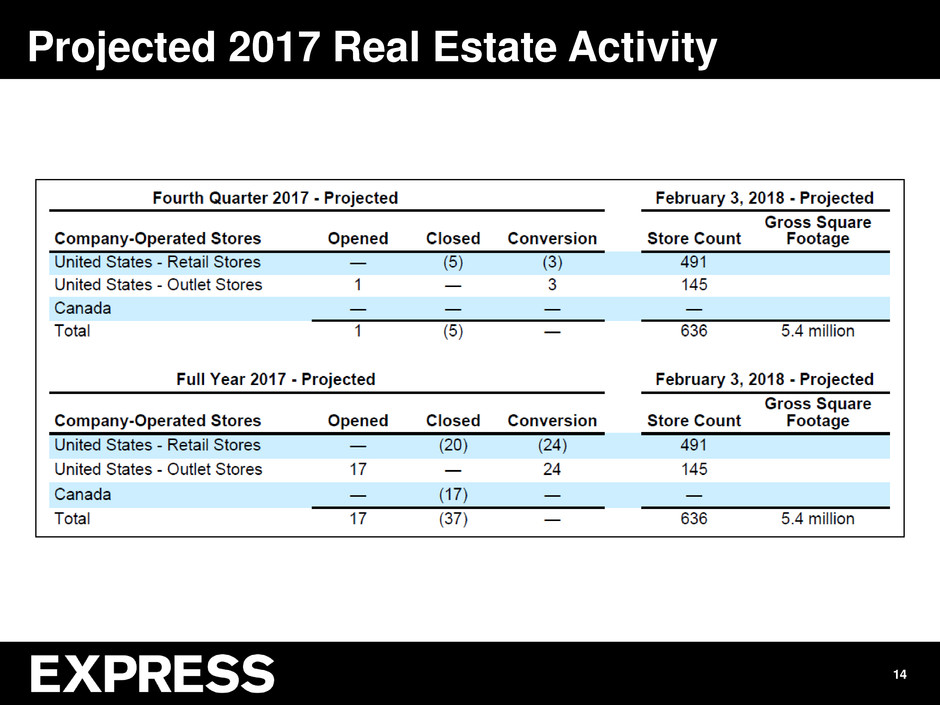

14 Projected 2017 Real Estate Activity

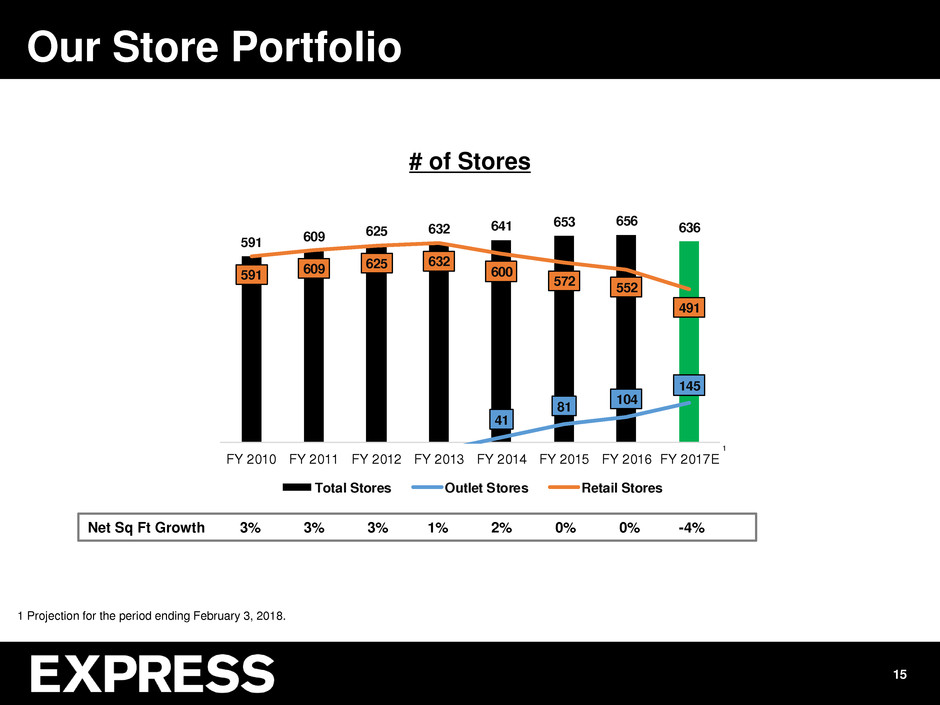

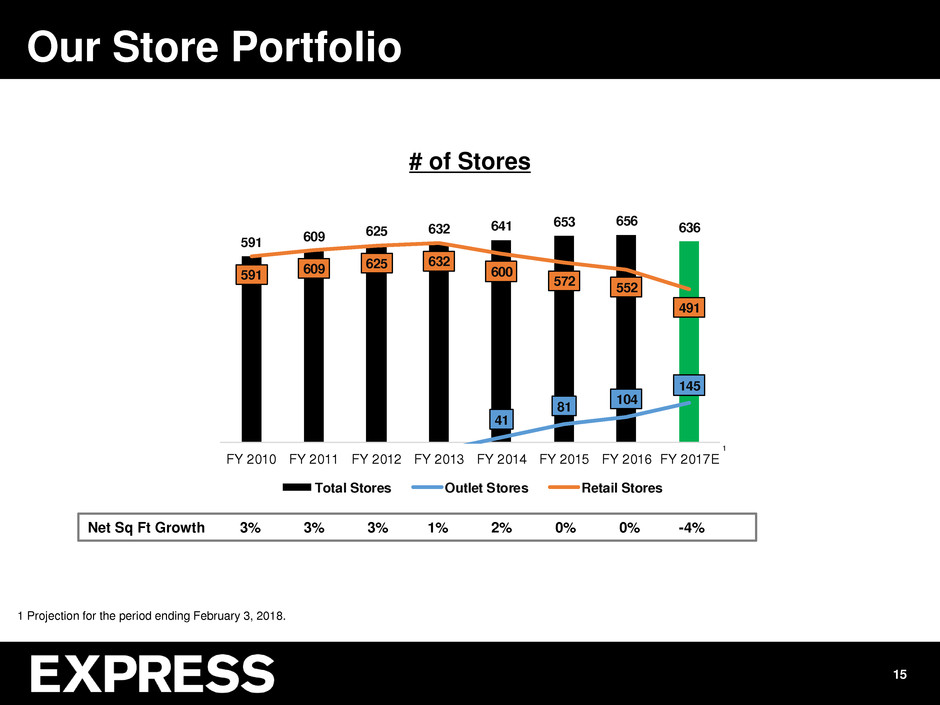

591 609 625 632 641 653 656 636 41 81 104 145 591 609 625 632 600 572 552 491 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017E Total Stores Outlet Stores Retail Stores 15 Our Store Portfolio Net Sq Ft Growth 3% 3% 3% 1% 2% 0% 0% -4% # of Stores 1 Projection for the period ending February 3, 2018. 1

Non-GAAP Reconciliations

Cautionary Statement Regarding Non GAAP Financial Measures Non-GAAP Financial Measures This presentation contains references to adjusted net income and adjusted diluted earnings per share, which are non-GAAP measures. These measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles (GAAP). The Company provides non-GAAP measures when management believes they provide additional useful information to assist stockholders in understanding the Company’s financial results and assessing its prospects for future performance. Management believes adjusted net income and adjusted diluted earnings per share are important indicators of the Company's business performance because they exclude items that may not be indicative of, or are unrelated to, the Company's underlying operating results, and provide a better baseline for analyzing trends in the business. In addition, adjusted diluted earnings per share is used as a performance measure in the Company's executive compensation program for purposes of determining the number of equity awards that are ultimately earned. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies' non-GAAP financial measures having the same or similar names. Please refer to page 18 in this presentation for reconciliations of these non-GAAP measures to the most directly comparable financial measures calculated in accordance with GAAP. 17

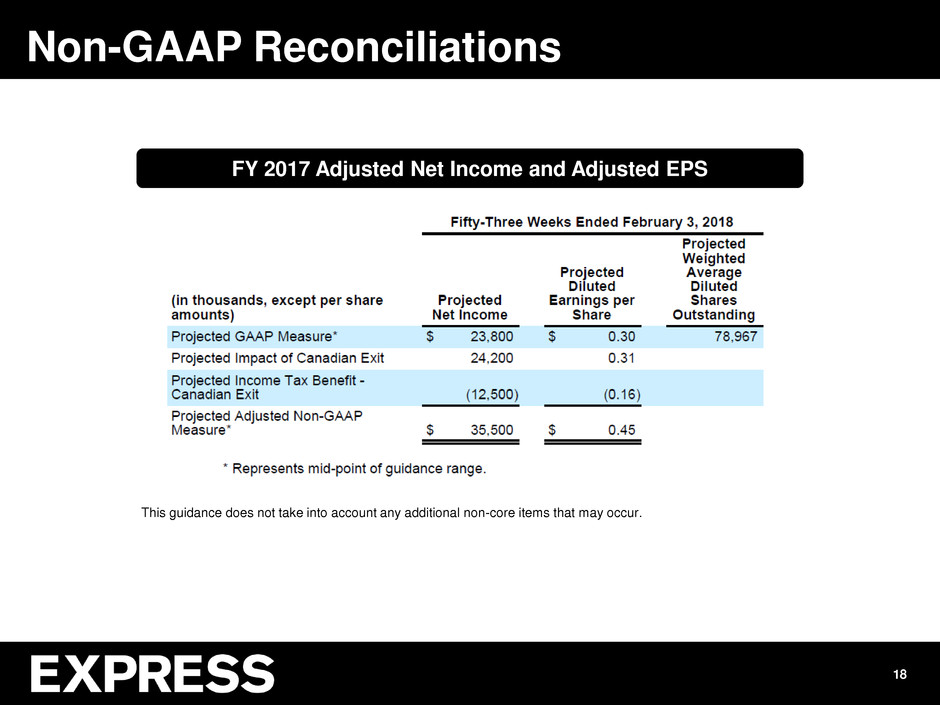

18 Non-GAAP Reconciliations FY 2017 Adjusted Net Income and Adjusted EPS This guidance does not take into account any additional non-core items that may occur.