Cautionary Statement Regarding Forward-Looking Statements Certain statements are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statement that does not directly relate to any historical or current fact and include, but are not limited to (1) goals, guidance and expectations, including statements regarding expected operating margins, comparable sales, effective tax rates, interest expense, net income, diluted earnings per share, profitability, free cash flow, cost and expense savings, merchandise margin, gross margin, SG&A, inflation rates, and capital expenditures, (2) statements regarding expected store openings, store closures, store conversions, and gross square footage, and (3) statements regarding the Company's strategy, plans, and initiatives, including, but not limited to, results expected from such strategy, plans, and initiatives. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. In addition, information with respect to future financial performance, including, but not limited to, fiscal year 2022 cash flows, cost reductions, operating margins and EBITDA, represents the Company’s long-term goals and is not intended as guidance. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict, and significant contingencies, many of which are beyond the Company's control. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are (1) consumer spending and general economic conditions; (2) our ability to identify and respond to new and changing fashion trends, customer preferences, and other related factors; (3) fluctuations in our sales, results of operations, and cash levels on a seasonal basis and due to a variety of other factors, including our product offerings relative to customer demand, the mix of merchandise we sell, promotions, and inventory levels; (4) customer traffic at malls, shopping centers, and at our stores; (5) competition from other retailers; (6) our dependence on a strong brand image; (7) our ability to adapt to changing consumer behavior and develop and maintain a relevant and reliable omni-channel experience for our customers; (8) the failure or breach of information systems upon which we rely; (9) our ability to protect customer data from fraud and theft; (10) our dependence upon third parties to manufacture all of our merchandise; (11) changes in the cost of raw materials, labor, and freight; (12) supply chain or other business disruption; (13) our dependence upon key executive management; (14) our ability to execute our growth strategy, including improving profitability, providing an exceptional brand and customer experience, transforming and leveraging our systems and processes, and cultivating a strong company culture, and achieving our strategic objectives, including delivering compelling merchandise at an attractive value, investing in growing brand awareness and retaining and acquiring new customers to the Express brand, growing e-commerce sales and expanding our omni-channel capabilities, optimizing our store footprint, and managing our overall cost structure; (15) our substantial lease obligations; (16) our reliance on third parties to provide us with certain key services for our business; (17) impairment charges on long-lived assets; (18) claims made against us resulting in litigation or changes in laws and regulations applicable to our business; (19) our inability to protect our trademarks or other intellectual property rights which may preclude the use of our trademarks or other intellectual property around the world; (20) restrictions imposed on us under the terms of our asset-based loan facility, including restrictions on the ability to effect share repurchases; (21) changes in tax requirements, results of tax audits, and other factors that may cause fluctuations in our effective tax rate; (22) changes in tariff rates; and (23) natural disasters, acts of terrorism, or war. Additional information concerning these and other factors can be found in Express, Inc.'s filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law. 2

AGENDA 8:30 Welcome � Corporate Strategy - The EXPRESSway Forward Tim Baxter Matt Moellering Financial Perry Pericleous Closing Comments Tim Baxter Q&A Tim Baxter Matt Moellering Malissa Akay Sara Tervo Perry Pericleous 10:30 Event Concludes 3

TIM BAXTER Chief Executive Officer 4

5

ENGAGE our customers and acquire new ones X-ECUTE with precision to accelerate sales and profitability PRODUCT first REINVIGORATE our brand 6

REINVIGORATE our brand 7

EXPRESS BRAND PURPOSE CREATE CONFIDENCE. INSPIRE SELF-EXPRESSION. 8

EXPRESS BRAND PROMISE We edit the best of NOW for real-life VERSATILITY. 9 9

DREAM BIG. DRESS ACCORDINGLY. 10

#EXPRESSYOU A collaborative community that influences and inspires one another. 11 11

PRODUCT first 12

EVERY DAY IS AN OCCASION DRESSDRESS FORFOR ITIT 13 13

THE EXPRESS EDIT Mix & Match Versatility New & Now Modern Tailored Denim Everywhere Best of Black ENDURING STYLE CODES ENDURING STYLE CODES 14

ENGAGE our customers and acquire new ones 15

DOERS. MAKERS. MOVERS. SHAKERS. 16

EXISTING & NEW CUSTOMER STRATEGIES Improve retention & frequency. Bring in more new customers. • Relaunch loyalty program and � • Digital media reissue credit card (Fall 2020) • First 90 days contact strategy • Optimize digital media • New loyalty program entry point • Optimize CRM • Brand Ambassador program 17

MATT MOELLERING President and Chief Operating Officer 18

X-ECUTE with precision to accelerate sales and profitability 19

FOCUS AREAS • Go-to-Market transformation • Inventory productivity • Improved customer experience • Operational efficiency through fleet rationalization and cost reduction 20

GO-TO-MARKET TRANSFORMATION BRAND BRAND UNIFY Channel/Gender Express Our re-engineered GTM process � will enable more relevant product and TIME INCREASE SPEED TIME Too long Improve by 20-25% marketing stories, greater speed to CALENDAR SIMPLIFY CALENDAR market, more effective and efficient Multiple 1 Master calendar cross-functional workflow. SEASONAL MILESTONES STREAMLINE SEASONAL MILESTONES 18-24 Touchpoints 12 Touchpoints MARKETING INTEGRATION MARKETING INTEGRATION INTEGRATE 0 Touchpoints 4 Touchpoints 21

SYSTEM IMPLEMENTATION Centralized Order Assortment � STREAMLINED Management Planning ACTIVITIES ACROSS Real-time visibility� + Granular sales & unit level = APPLICATIONS to information inventory data Direct Impacts Sourcing & Production Suppliers Merchandising Planning & Allocation 22

INVENTORY OPTIMIZATION • Optimize assortment architecture • Reduce choice counts to drive clarity • Optimize size offerings • Move to targeted monthly redlines • System implementation Takeaway: Driving Margin Expansion & Improved Inventory turns 23

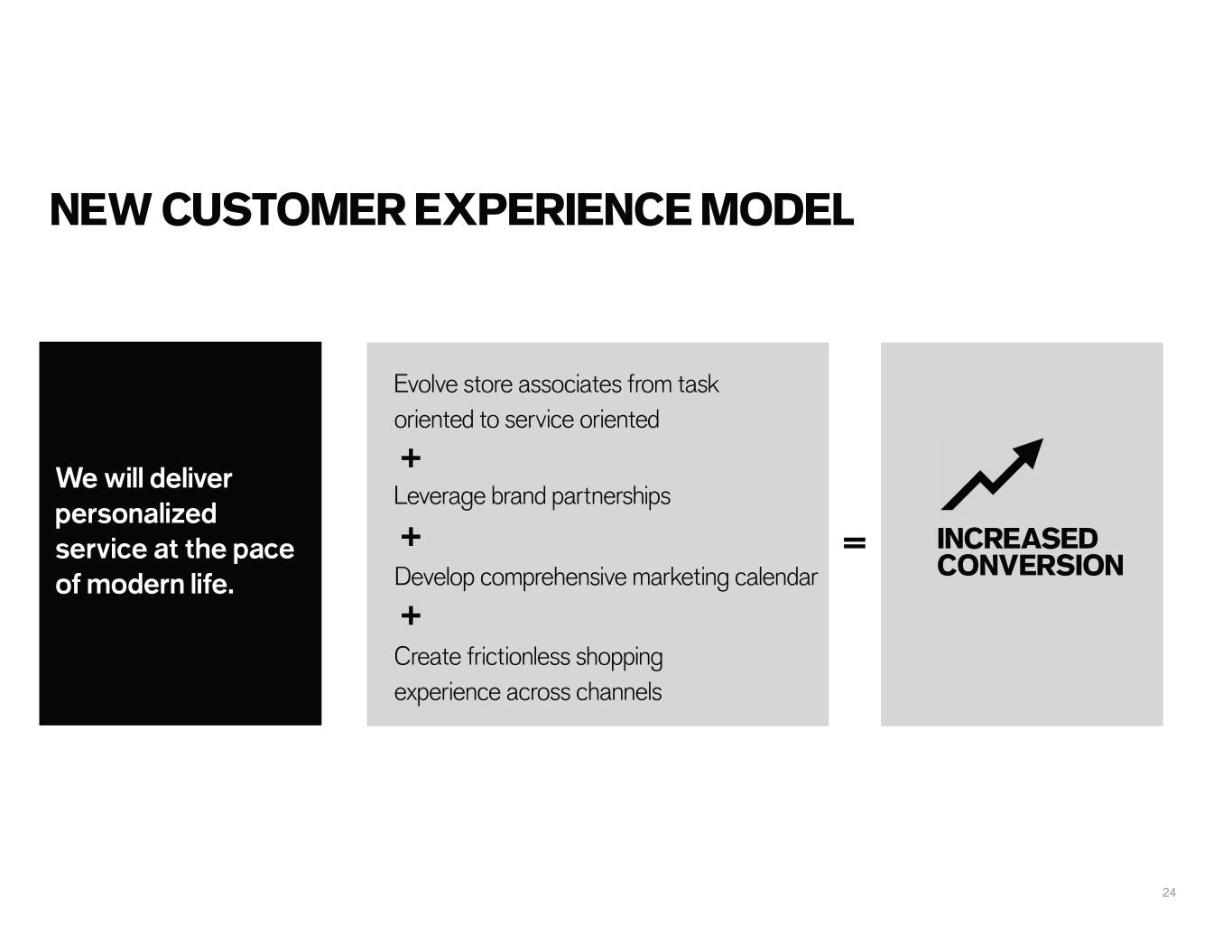

NEW CUSTOMER EXPERIENCE MODEL Evolve store associates from task oriented to service oriented + We will deliver Leverage brand partnerships personalized service at the pace + = INCREASED CONVERSION of modern life. Develop comprehensive marketing calendar + Create frictionless shopping experience across channels 24

OPERATING EFFICIENCY GOALS FLEET RATIONALIZATION COST REDUCTION ANNUALIZED IMPACT BY END OF 2022* Closed Stores Transfer Volume Net Impact # of Stores ~100 + Annualized Cost Reductions Sales ($125M) ~$35M ($90M) $80M Transfer % ~30% EBITDA Inc/(Dec) ~$15M *FY22E information on this slide represents the Company's long-term goals, and is not intended as guidance. See slide two "Cautionary Statements Regarding Forward-Looking Statements." 25

PERRY PERICLEOUS Senior Vice President, Chief Financial Officer 26

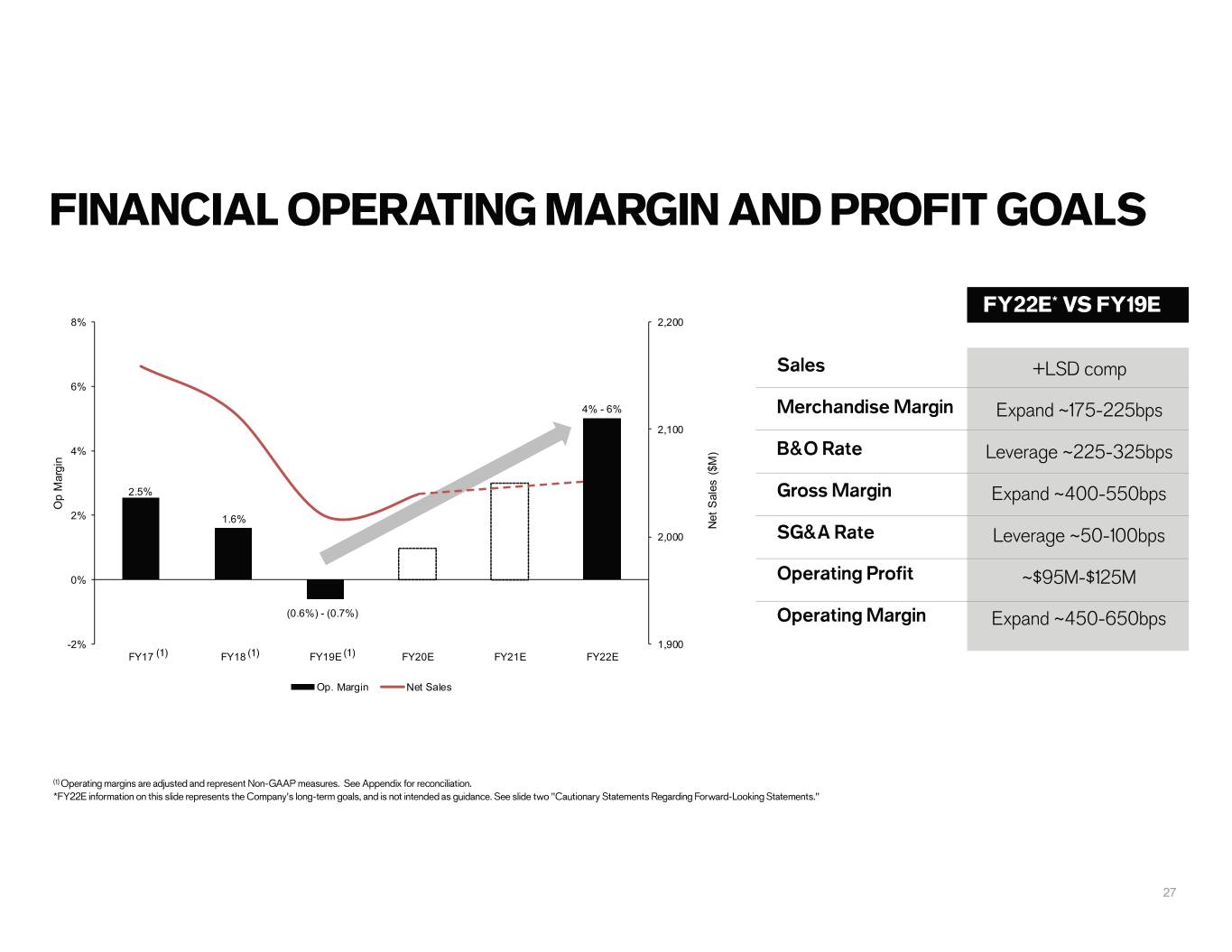

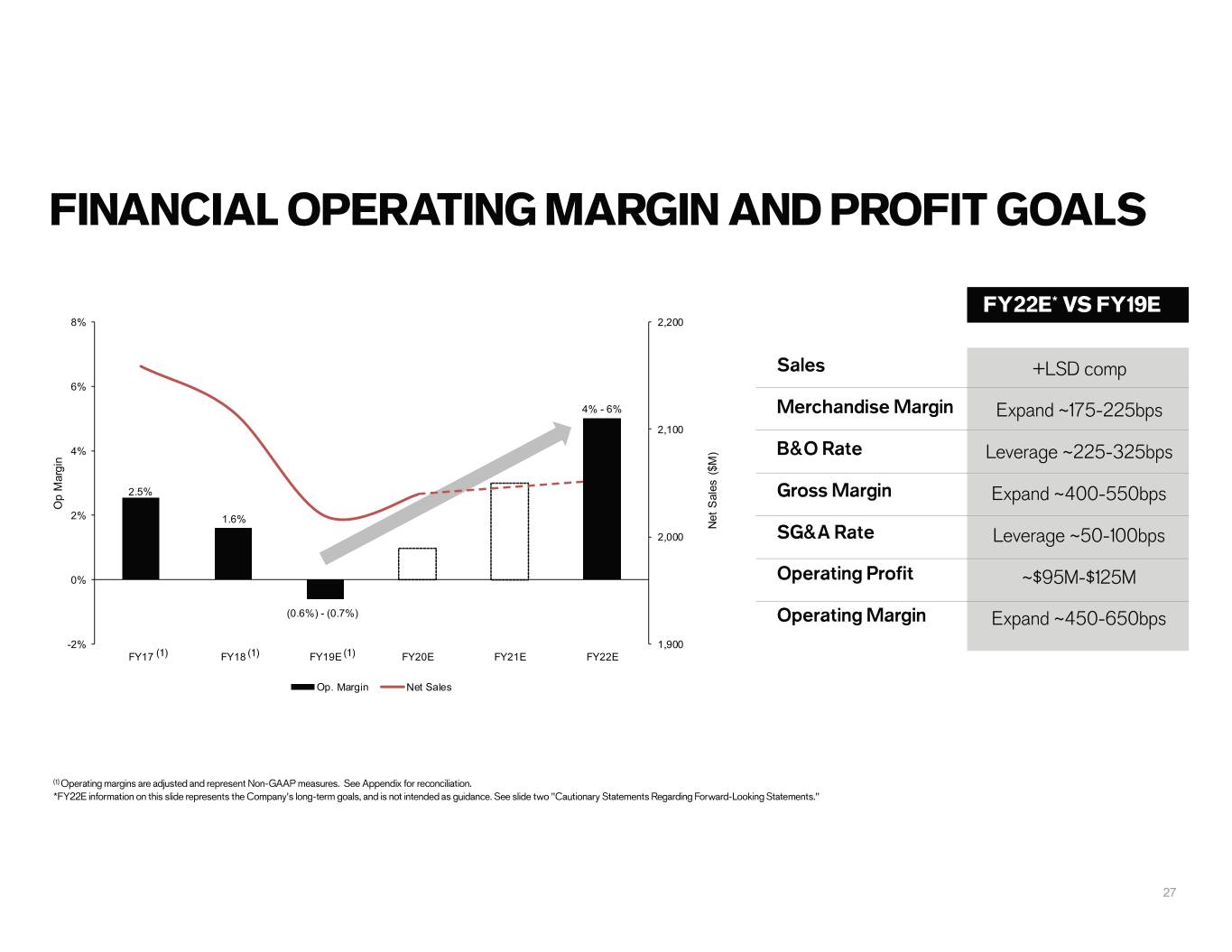

Operating Margin FINANCIAL OPERATING MARGIN AND PROFIT GOALS FY22E* VS FY19E 8% 2,200 COST REDUCTIONS OF $80M Sales +LSD comp 6% 4% - 6% Merchandise Margin Expand ~175-225bps 2,100 4% ) n B&O Rate M i Leverage ~225-325bps $ g ( r a s M e l 2.5% a p Gross Margin S O Expand ~400-550bps t 2% 1.6% e N 2,000 SG&A Rate Leverage ~50-100bps 0% Operating Profit ~$95M-$125M (0.6%(0) .-6(%0.)7%) Operating Margin Expand ~450-650bps -2% 1,900 FY17 (1) FY18 (1) FY19E (1) FY20E FY21E FY22E Op. Margin Net Sales (1) Operating margins are adjusted and represent Non-GAAP measures. See Appendix for reconciliation. *FY22E information on this slide represents the Company's long-term goals, and is not intended as guidance. See slide two "Cautionary Statements Regarding Forward-Looking Statements." 27

OPERATING MARGIN GOALS FY19E(1) PROFIT IMPROVEMENTS HEADWINDS FY22E* Low Single Digit Comp Growth Wage Inflation Operating Operating GTM Transformation/Inventory Turn Regulatory Costs - Min Wage Margin + ~625bps - ~175bps = Margin Expense Savings 825bps - Technology Investments (0.6%)-(0.7%) ~4%-6% Fleet Rationalization Incentive Compensation (ST/LT) (1) Operating margins are adjusted and represent Non-GAAP measures. See Appendix for reconciliation. *FY22E information on this slide represents the Company's long-term goals, and is not intended as guidance. See slide two "Cautionary Statements Regarding Forward-Looking Statements." 28

SALES GROWTH GOALS FY19E SALES DRIVERS FLEET RATIONALIZATION FY22E* Product Net Sales Net Sales Brand LSD Annual Closed Store Sales ~$125M + Comp Growth ~$90M = ~$2.0B Customer - Transfer Volume (~$35M) ~$2.0B-$2.1B Execution *FY22E information on this slide represents the Company's long-term goals, and is not intended as guidance. See slide two "Cautionary Statements Regarding Forward-Looking Statements." 29

COST REDUCTIONS & HEADWIND IMPACT� COST REDUCTIONS OF ~$80M HEADWIND IMPACT OF (~$38M) GTM Transformation ~$25M Wage Inflation Expense Savings: Regulatory Costs - Min Wage Corporate Office Restructuring Technology Investments Store Operations Efficiencies Incentive Compensation (ST/LT) Lease Renewals ~$55M Marketing Optimization Other Corporate 30

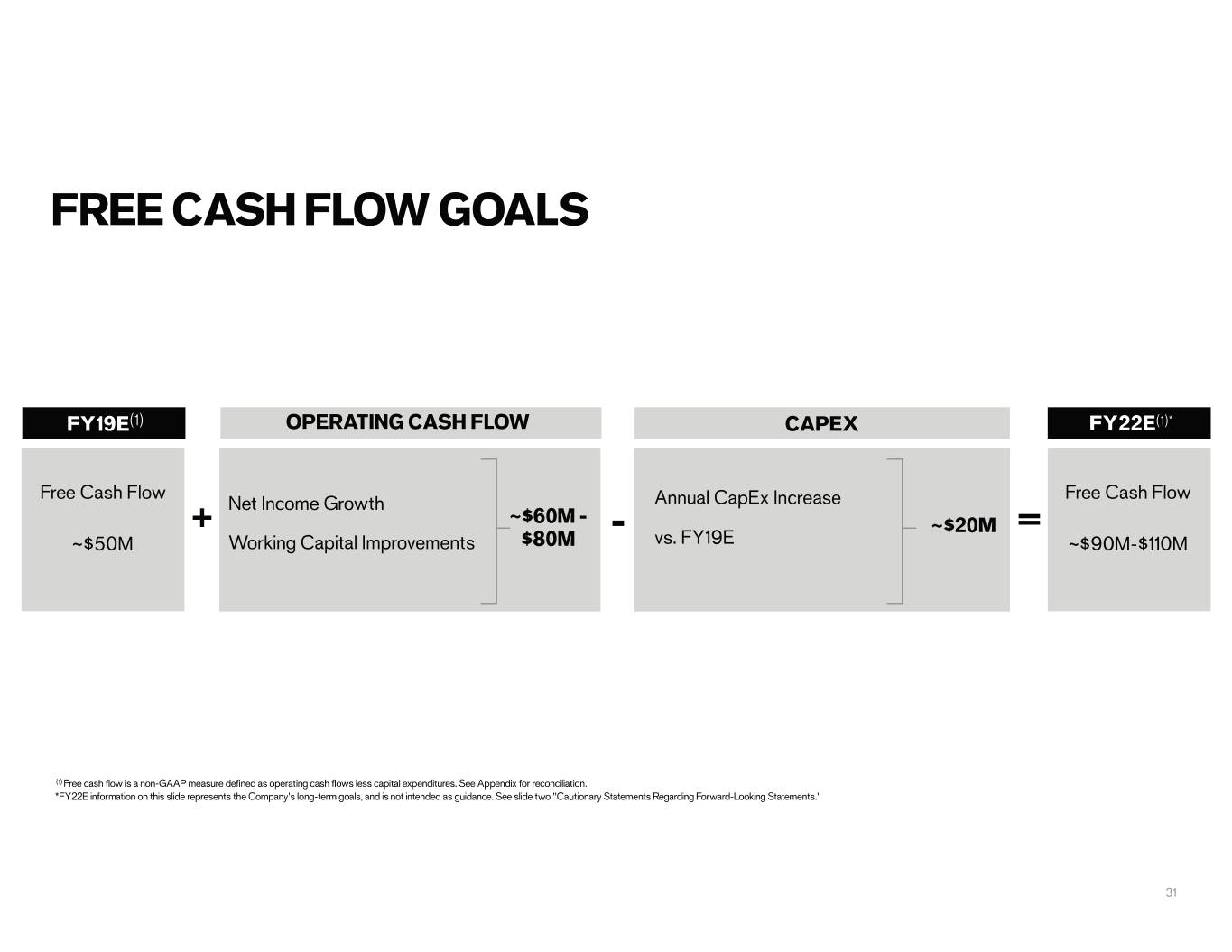

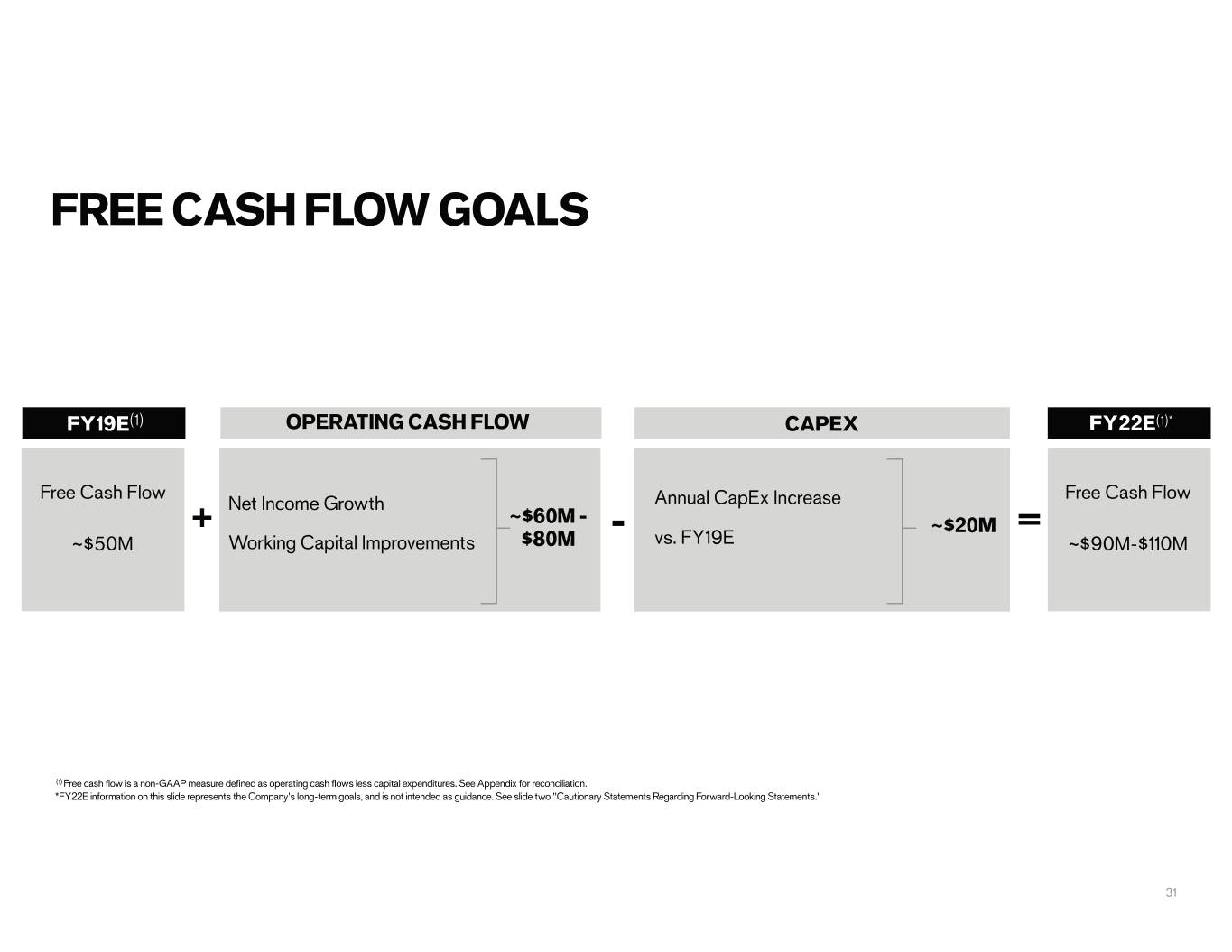

FREE CASH FLOW GOALS FY19E(1) OPERATING CASH FLOW CAPEX FY22E(1)* Free Cash Flow Free Cash Flow Net Income Growth Annual CapEx Increase + ~$60M - ~$20M = ~$50M Working Capital Improvements $80M - vs. FY19E ~$90M-$110M (1) Free cash flow is a non-GAAP measure defined as operating cash flows less capital expenditures. See Appendix for reconciliation. *FY22E information on this slide represents the Company's long-term goals, and is not intended as guidance. See slide two "Cautionary Statements Regarding Forward-Looking Statements." 31

FINANCIAL GOALS FY19E FY22E* VS FY19E Sales ~$2,020M +LSD comp Merchandise Margin Expand ~175-225bps B&O Rate Leverage ~225-325bps Gross Margin Expand ~400-550bps SG&A Rate Leverage ~50-100bps Operating Profit ($11M)-($13M)(1) ~$95M-$125M Operating Margin (0.6%)-(0.7%)(1) Expand ~450-650bps (1) Amount is adjusted and represents a Non-GAAP measure. See Appendix for reconciliation. * FY22E information on this slide represents the Company's long-term goals, and is not intended as guidance. See slide two "Cautionary Statements Regarding Forward-Looking Statements." 32

TIM BAXTER Chief Executive Officer 33

ENGAGE our customers and acquire new ones X-ECUTE with precision to accelerate sales and profitability PRODUCT first REINVIGORATE our brand 34

EXPRESS IS A COMPELLING INVESTMENT • Clear, straightforward & achievable long-term strategy driven by management-controlled initiatives� • $80M in cost reduction opportunities� • Fleet rationalization plan to close ~100 stores� • Strong balance sheet – zero debt, ample liquidity & free cash flow generation� • Disciplined capital allocation philosophy • Early results are resonating with customers with 3 consecutive quarters of comp sales trend improvement� • Results oriented executive leadership team with tremendous experience, skill & diverse viewpoints� 35

36

Appendix 37

Executive Bios 38

TIM BAXTER Chief Executive Officer Tim Baxter has served as our Chief Executive Officer since June 2019. Prior to joining Express, Mr. Baxter was Chief Executive Officer of Delta Galil Premium Brands, a group of specialty retail apparel brands including 7 For All Mankind and Splendid. Prior to that, he held numerous leadership positions at Macy’s from 2006 to 2017 including Chief Merchandising Officer from 2015 to 2017 and Executive Vice President, General Merchandise Manager from 2013 for 2015. Mr. Baxter started his career with Famous-Barr and May Department Stores, where he held positions of increasing responsibility from 1992 to 2006. 39

MATT MOELLERING President and Chief Operating Officer Matt Moellering has served as President and Chief Operating Officer since September 2019. He also served as Interim President and Interim Chief Executive Officer of Express from January 2019 to June 2019. Prior to his current role, he was Executive Vice President and Chief Operating Officer from 2011 to 2019; Executive Vice President, Chief Administrative Officer, Chief Financial Officer, Treasurer and Secretary from 2009 to 2011; Senior Vice President, Chief Financial Officer, Treasurer and Secretary from 2007 to 2009; and Vice President of Finance from 2006 to 2007. Before joining Express, he served in various roles with Limited Brands from 2003 to 2006, including Vice President of Financial Planning. Mr. Moellering also served in various roles with Procter & Gamble where he was employed from 1995 until 2003, and prior to that was an officer in the United States Army. Mr. Moellering serves on the board of directors of L.L.Bean, Inc. which is a privately held company. 40

MALISSA AKAY Executive Vice President and Chief Merchandising Officer Malissa Akay has served as Executive Vice President and Chief Merchandising Officer since September 2019. She joined Express from Lane Bryant where she was Executive Vice President and General Merchandise Manager from 2016 to 2019. Previously, she was with Ralph Lauren from 2012 to 2016 where she held global roles including Chief Merchandising Officer, Polo Accessories, and Senior Vice President, Merchandising, Planning & Allocation and Visual Merchandising. Prior to that, she spent 13 years with DFS Group where she held merchandising leadership positions across multiple categories. 41

SARA TERVO Executive Vice President and Chief Marketing Officer Sara Tervo has served as Executive Vice President and Chief Marketing Officer since September 2019. She joined Express from Justice where she was Executive Vice President and Chief Marketing Officer from 2016 to 2019. From 1998 to 2016, she held multiple leadership positions at L Brands across marketing, creative services and public relations, including Executive Vice President, Marketing for Victoria’s Secret and Senior Vice President, Marketing for PINK. 42

PERRY PERICLEOUS Senior Vice President, Chief Financial Officer Perry Pericleous has served as our Senior Vice President, Chief Financial Officer since July 2015. Immediately prior to that appointment, Mr. Pericleous served as Vice President of Finance at Express, a position he assumed in 2010. He has held a number of other leadership positions within the company including Director of Financial Planning and Analysis, Director of Store Finance, and Manager of Financial Planning and Analysis. Between 2004 and 2005, Mr. Pericleous served as Manager of Store Finance for Limited Brands. Mr. Pericleous initially joined Express in 1999 and assumed increasing responsibility working in financial reporting and store finance until 2004. Mr. Pericleous began his accounting career in 1996, serving in various accounting roles at Drug Emporium and then Value City Department Stores. He is also a Certified Public Accountant. 43

Non-GAAP Reconciliations 44

CAUTIONARY STATEMENT REGARDING NON-GAAP FINANCIAL MEASURES slide 46 45

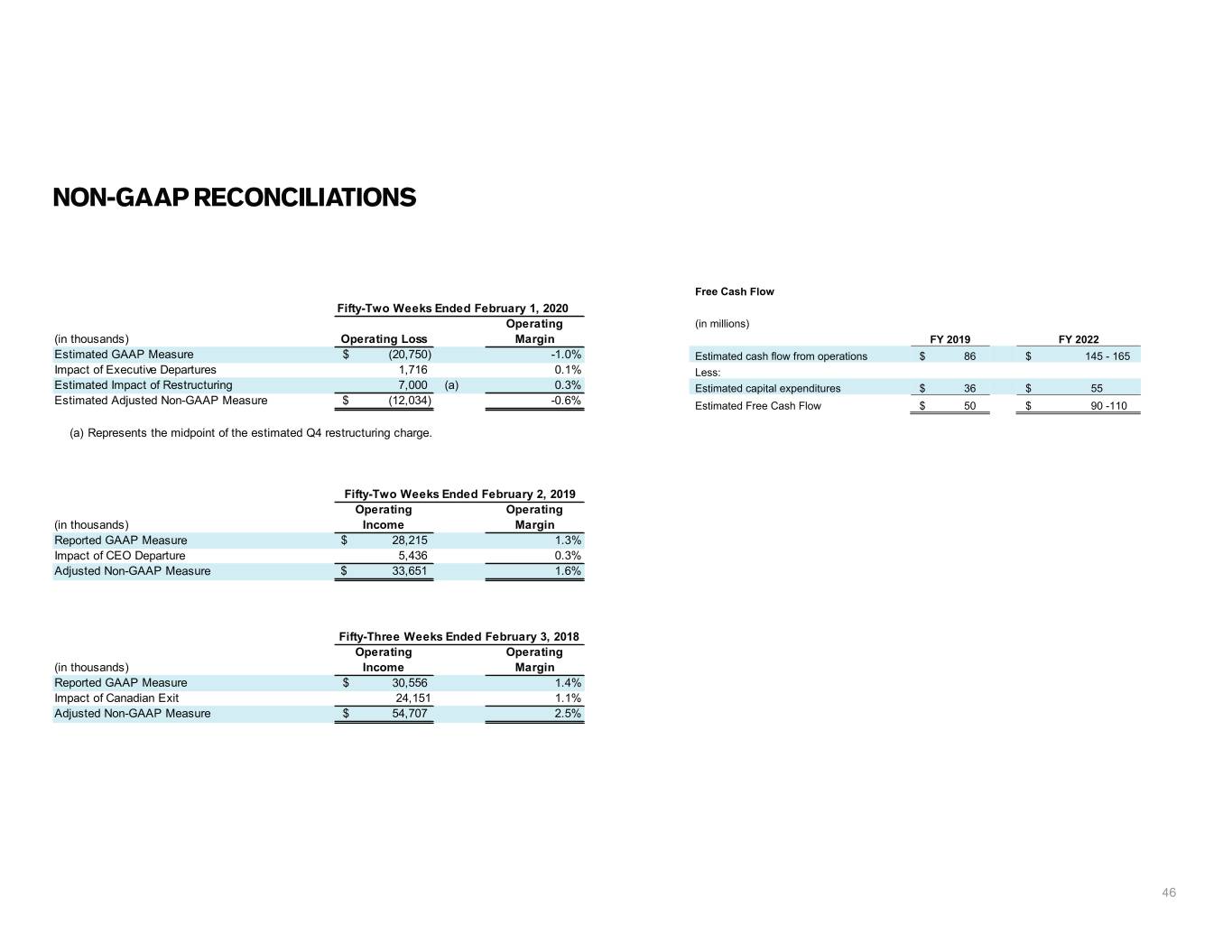

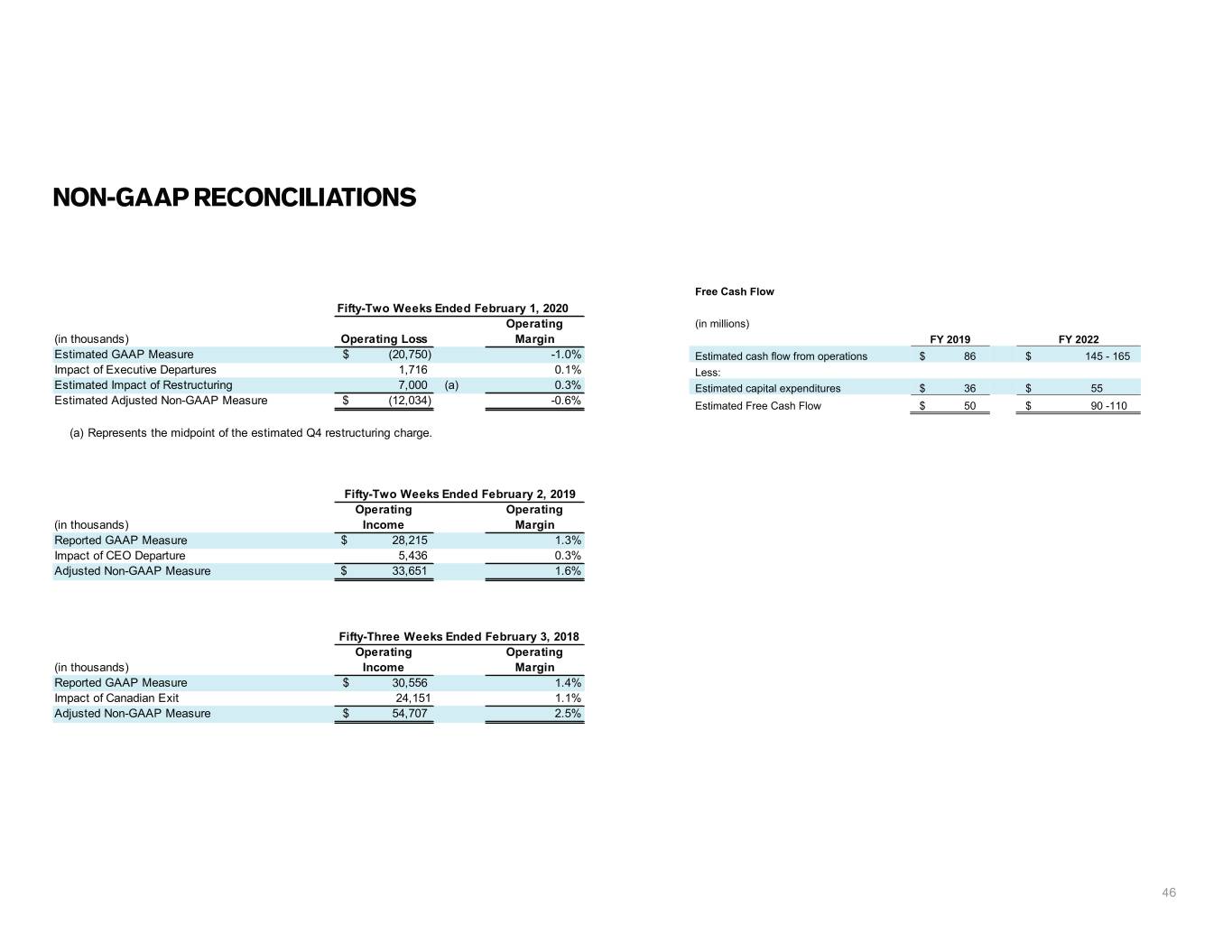

NON-GAAP RECONCILIATIONS ������ � ��������������� Fifty-Two Weeks Ended February 1, 2020 � � � � Operating �������������� � � � (in thousands) Operating Loss Margin � �������� � �������� Estimated GAAP Measure $ ( 20,750) -1.0% ������������������������������������ ������������������� �� ������������������������������ Impact of Executive Departures 1 ,716 0.1% ������ � � � Estimated Impact of Restructuring 7 ,000 (a) 0.3% ������������������������������� ������������������� �� ������������������������� Estimated Adjusted Non-GAAP Measure $ ( 12,034) -0.6% ������������������������� ������������������� � ������������������������������� � (a) Represents the midpoint of the estimated Q4 restructuring charge. Fifty-Two Weeks Ended February 2, 2019 Operating Operating (in thousands) Income Margin Reported GAAP Measure $ 28,215 1.3% Impact of CEO Departure 5 ,436 0.3% Adjusted Non-GAAP Measure $ 33,651 1.6% Fifty-Three Weeks Ended February 3, 2018 Operating Operating (in thousands) Income Margin Reported GAAP Measure $ 3 0,556 1.4% Impact of Canadian Exit 24,151 1.1% Adjusted Non-GAAP Measure $ 5 4,707 2.5% 46