FIRST QUARTER 2021 EARNINGS

2 F IR S T Q U A R T E R 2021 E A R N IN G S Cautionary Statement REGARDING FORWARD-LOOKING STATEMENTS Certain statements are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statement that does not directly relate to any historical or current fact and include, but are not limited to (1) guidance and expectations, including statements regarding expected operating margins, comparable sales, effective tax rates, interest income, net income, diluted earnings per share, cash tax refunds, liquidity, EBITDA, and capital expenditures, (2) statements regarding expected store openings, store closures, store conversions, and gross square footage, and (3) statements regarding the Company's strategy, plans, and initiatives, including, but not limited to, results expected from such strategy, plans, and initiatives. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict, and significant contingencies, many of which are beyond the Company's control. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are (1) changes in consumer spending and general economic conditions; (2) the COVID-19 pandemic and its continued impact on our business operations, store traffic, employee availability, financial condition, liquidity and cash flow; (3) our ability to operate our business efficiently, manage capital expenditures and costs, and obtain financing when required; (4) our ability to identify and respond to new and changing fashion trends, customer preferences, and other related factors; (5) fluctuations in our sales, results of operations, and cash levels on a seasonal basis and due to a variety of other factors, including our product offerings relative to customer demand, the mix of merchandise we sell, promotions, and inventory levels; (6) customer traffic at malls, shopping centers, and at our stores; (7) competition from other retailers; (8) our dependence on a strong brand image; (9) our ability to adapt to changing consumer behavior and develop and maintain a relevant and reliable omni-channel experience for our customers; (10) the failure or breach of information systems upon which we rely; (11) our ability to protect customer data from fraud and theft; (12) our dependence upon third parties to manufacture all of our merchandise; (13) changes in the cost of raw materials, labor, and freight; (14) supply chain or other business disruption, including as a result of the coronavirus; (15) our dependence upon key executive management; (16) our ability to execute our growth strategy, EXPRESSway Forward, including engaging our customers and acquiring new ones, executing with precision to accelerate sales and profitability, creating great product and reinvigorating our brand; (17) our substantial lease obligations; (18) our reliance on third parties to provide us with certain key services for our business; (19) impairment charges on long-lived assets; (20) claims made against us resulting in litigation or changes in laws and regulations applicable to our business; (21) our inability to protect our trademarks or other intellectual property rights which may preclude the use of our trademarks or other intellectual property around the world; (22) restrictions imposed on us under the terms of our asset-based loan facility, including restrictions on the ability to effect share repurchases; (23) changes in tax requirements, results of tax audits, and other factors that may cause fluctuations in our effective tax rate; (24) changes in tariff rates; and (25) natural disasters, extreme weather, public health issues, including pandemics, fire, acts of terrorism or war and other events that cause business interruption. Additional information concerning these and other factors can be found in Express, Inc.'s filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law.

3 F IR S T Q U A R T E R 2021 E A R N IN G S ABOUT EXPRESS Express is a modern, versatile, dual gender apparel and accessories brand that helps people get dressed for every day and any occasion. Launched in 1980 with the idea that style, quality and value should all be found in one place, Express has always been a brand of the now, offering some of the most important and enduring fashion trends. Express aims to Create Confidence & Inspire Self-Expression through a design & merchandising view that brings forward The Best of Now for Real Life Versatility. Express operates over 500 retail and factory outlet stores in the United States and Puerto Rico, as well as an online store. Express, Inc. is traded on the NYSE under the symbol EXPR. 40% Men 1 For the fiscal year ended January 30, 2021 2 Excludes “other revenue” of $43 million Sales Profile1,2 Women 60%

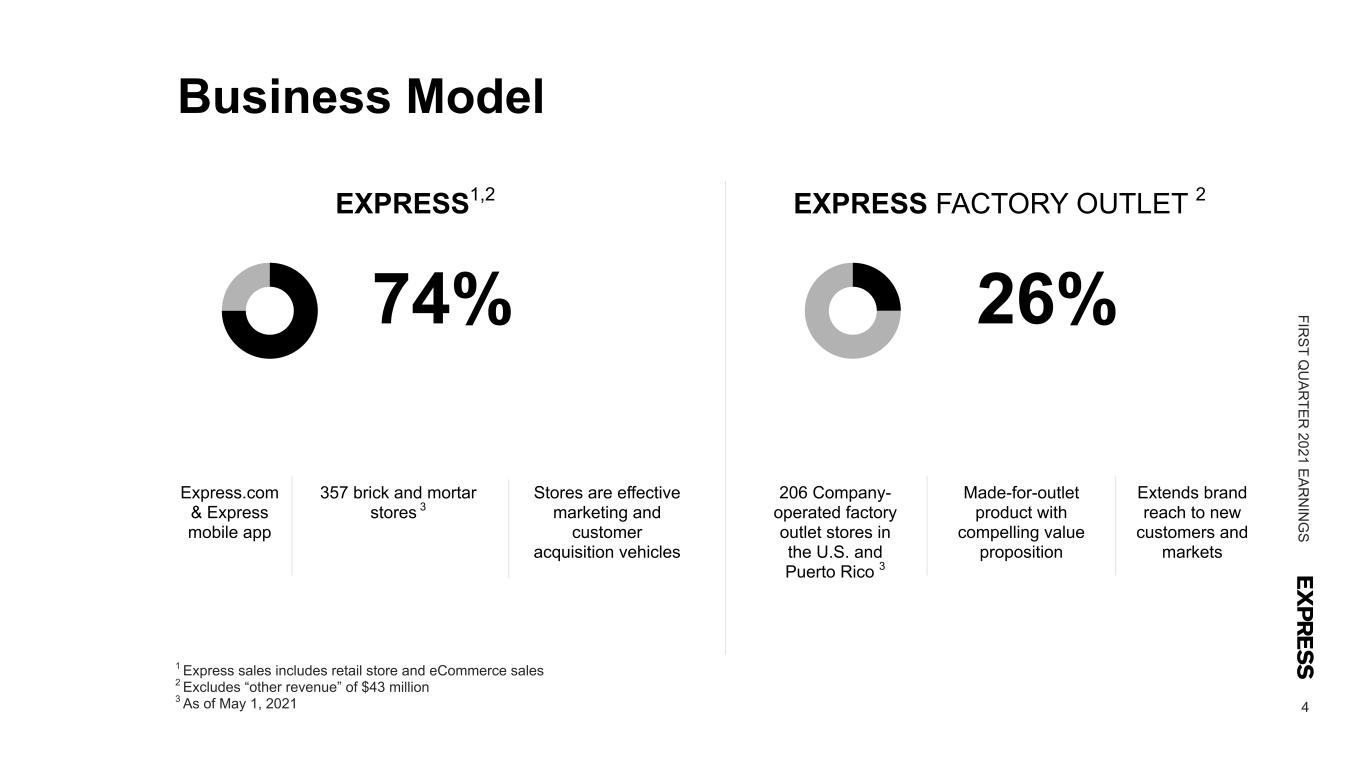

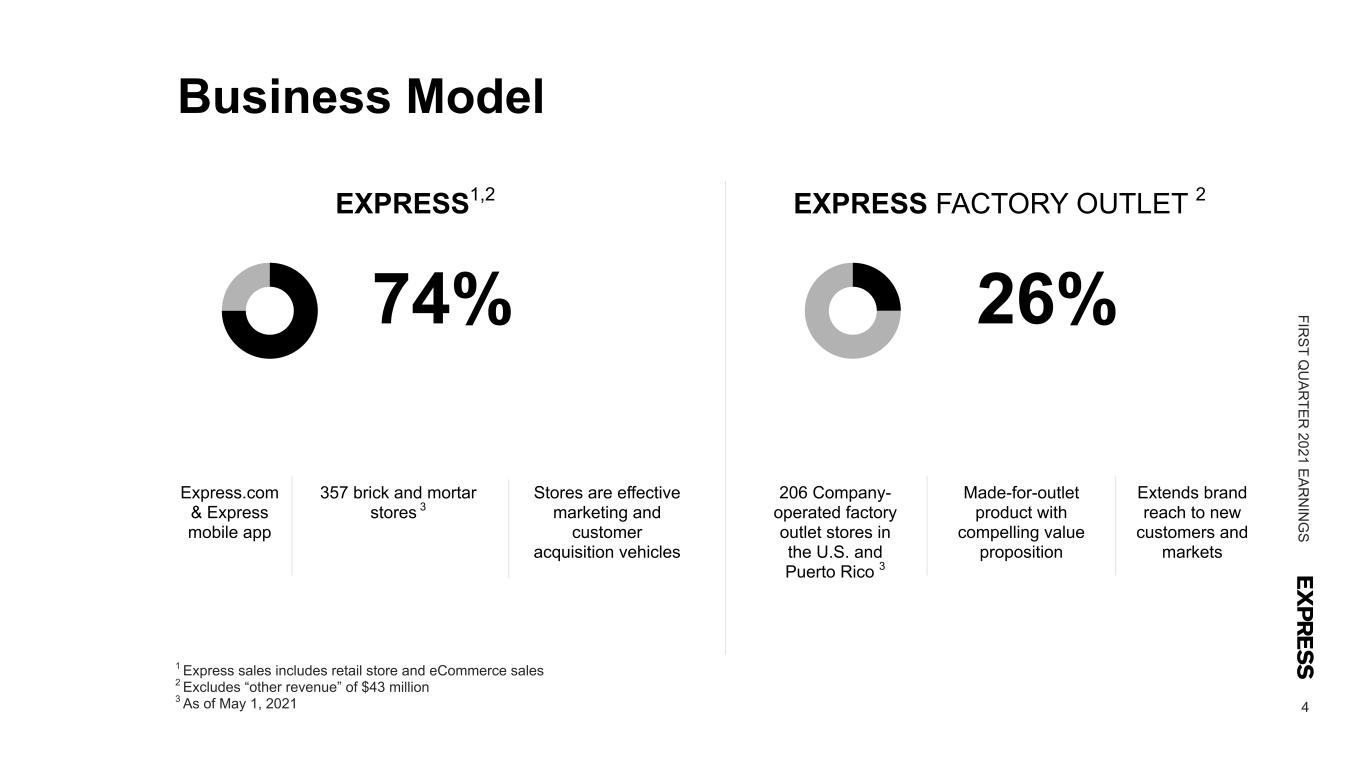

4 F IR S T Q U A R T E R 2021 E A R N IN G S Business Model Express.com & Express mobile app 357 brick and mortar stores 3 Stores are effective marketing and customer acquisition vehicles Made-for-outlet product with compelling value proposition Extends brand reach to new customers and markets 206 Company- operated factory outlet stores in the U.S. and Puerto Rico 3 1 Express sales includes retail store and eCommerce sales 2 Excludes “other revenue” of $43 million 3 As of May 1, 2021 26%74% EXPRESS FACTORY OUTLET 2EXPRESS1,2

RESULTS FIRST QUARTER 2021

6 F IR S T Q U A R T E R 2021 E A R N IN G S Results exceeded Company expectations across all channels and the Company improved its operating cash flow by $130 million during the first quarter. • Store sales plus demand in the second quarter to date are exceeding 2019 levels on a comparable basis • eCommerce drove a 40% increase in transactions, a 19% increase in conversion, and an 18% increase in traffic; resulting in a comp of over 40%, further accelerating to 70% in the second quarter to date • Continued to see strong momentum with fashion deliveries with sell-throughs up double digits versus 2019 • Drove positive comps in both denim and Express Essentials versus 2019 • Exceeded first quarter plans for both acquiring new and retaining existing customers • Continued to drive greater brand awareness through influencer network activations, and demand driven by these channels increased by 30% • Completed the relaunch of the loyalty program and added 7% more new members than in 2019 • Initiated a customer reactivation strategy that has led to a 22% increase in returning lapsed customers compared to 2019 • Expect positive operating cash flow for the year, beginning in the second quarter and positive EBITDA in the third quarter

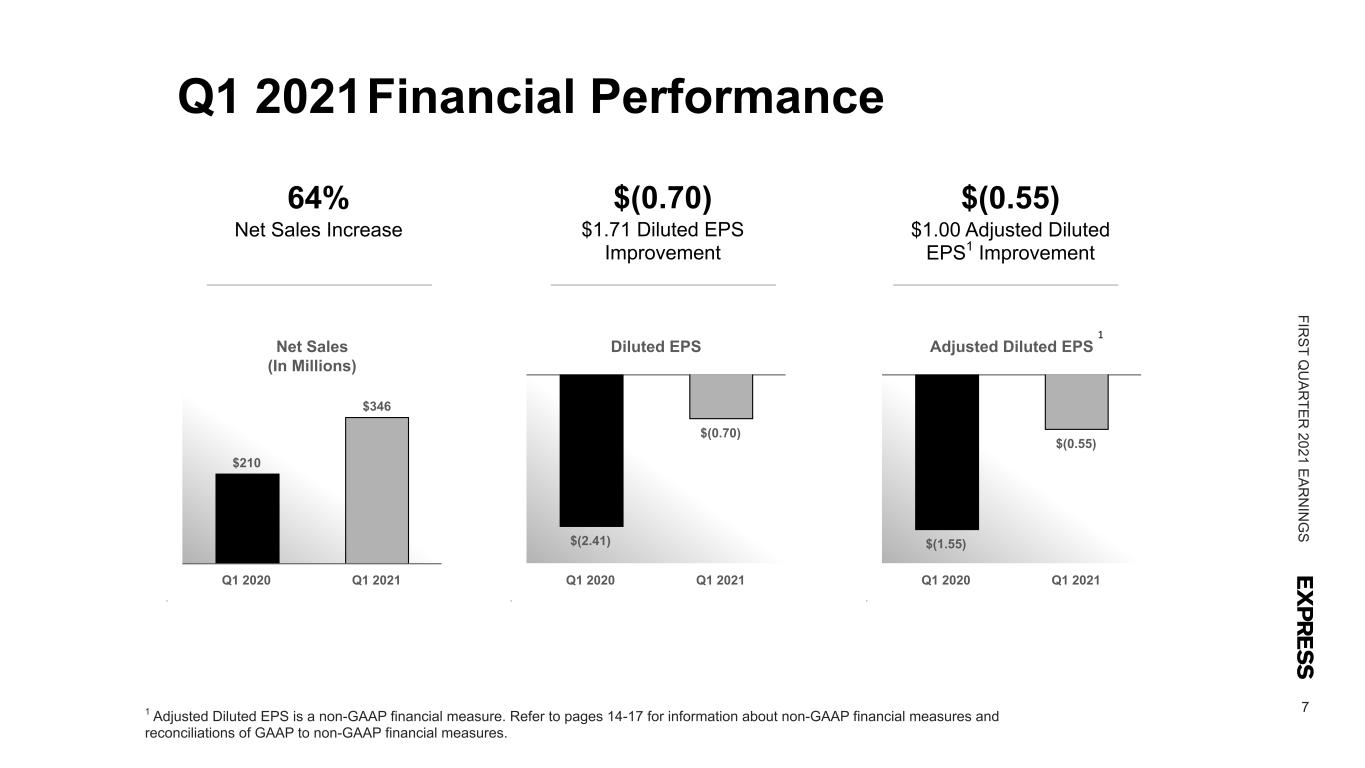

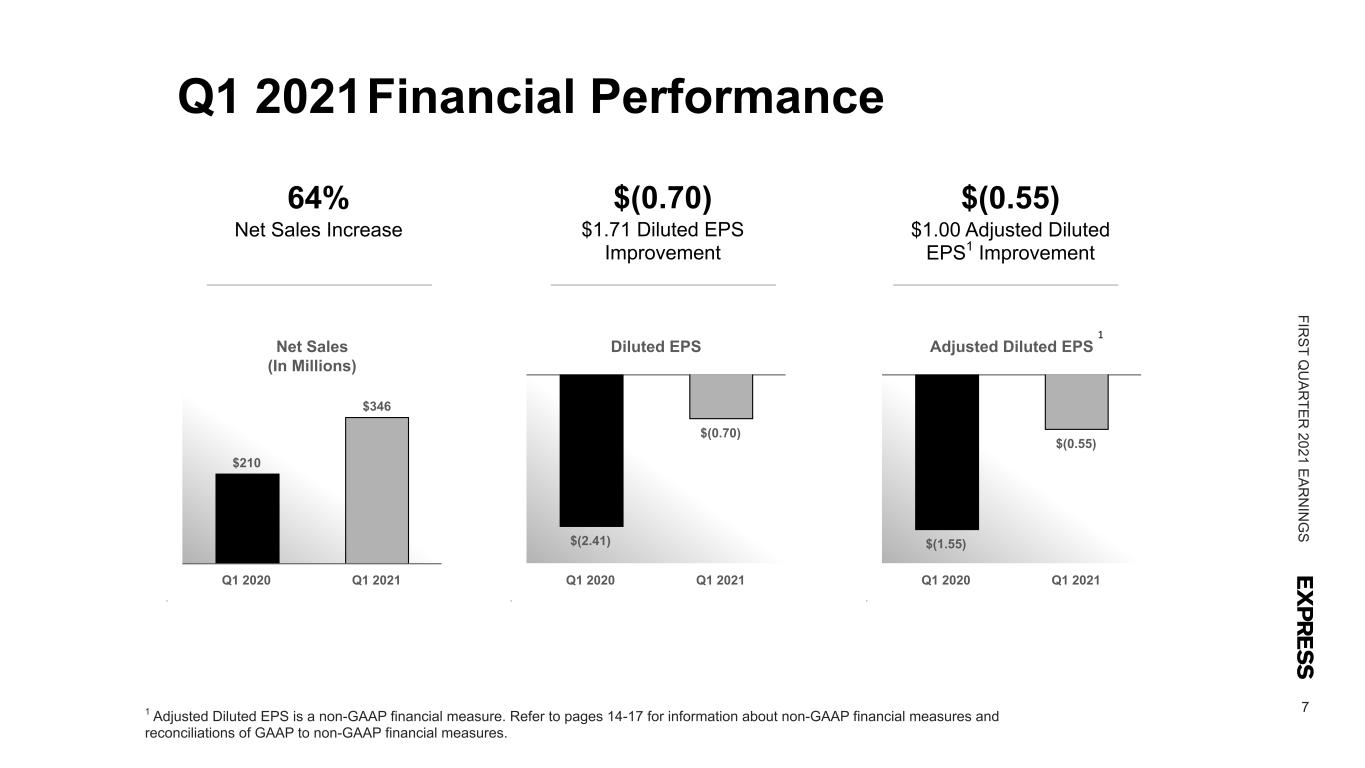

7 F IR S T Q U A R T E R 2021 E A R N IN G S Q1 2021 Financial Performance 1 Adjusted Diluted EPS is a non-GAAP financial measure. Refer to pages 14-17 for information about non-GAAP financial measures and reconciliations of GAAP to non-GAAP financial measures. 64% Net Sales Increase $(0.70) $1.71 Diluted EPS Improvement $(0.55) $1.00 Adjusted Diluted EPS1 Improvement Net Sales (In Millions) $210 $346 Q1 2020 Q1 2021 Diluted EPS $(2.41) $(0.70) Q1 2020 Q1 2021 Adjusted Diluted EPS $(1.55) $(0.55) Q1 2020 Q1 2021 1

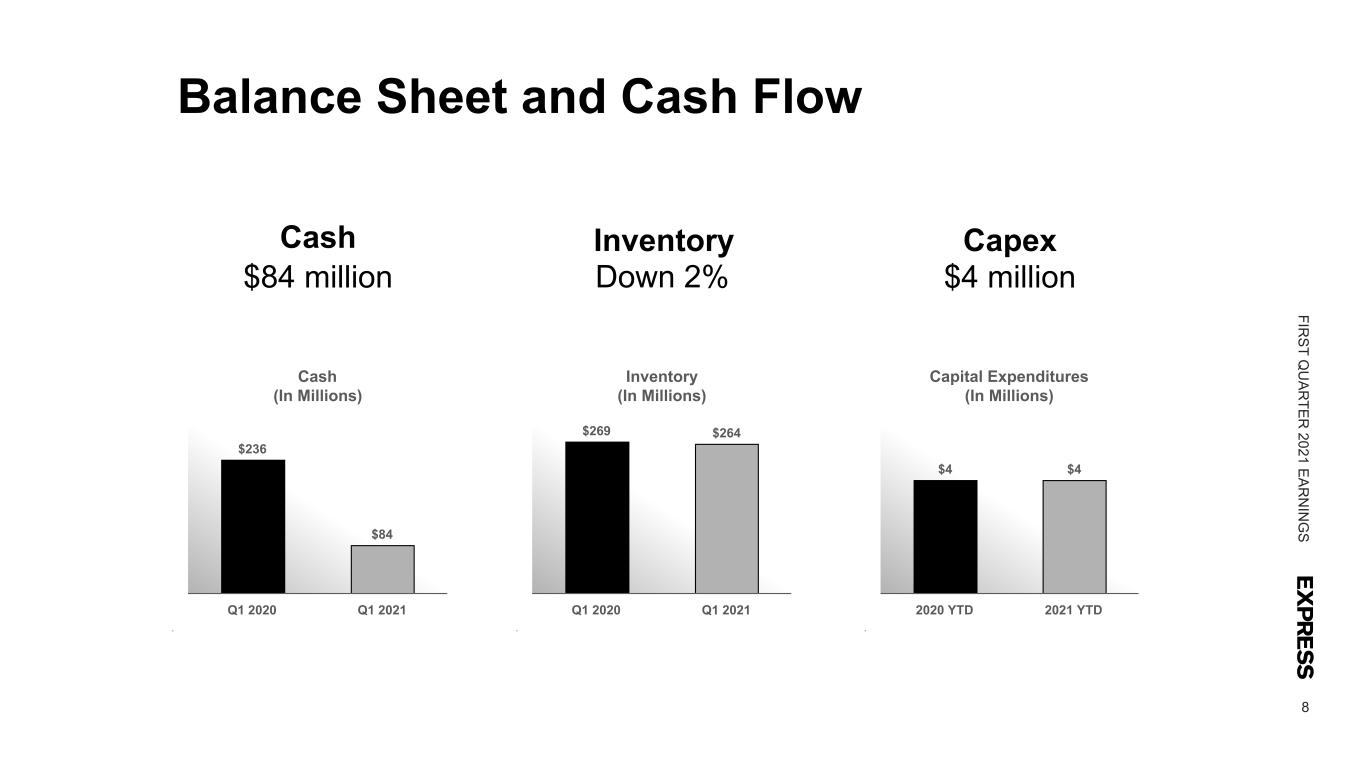

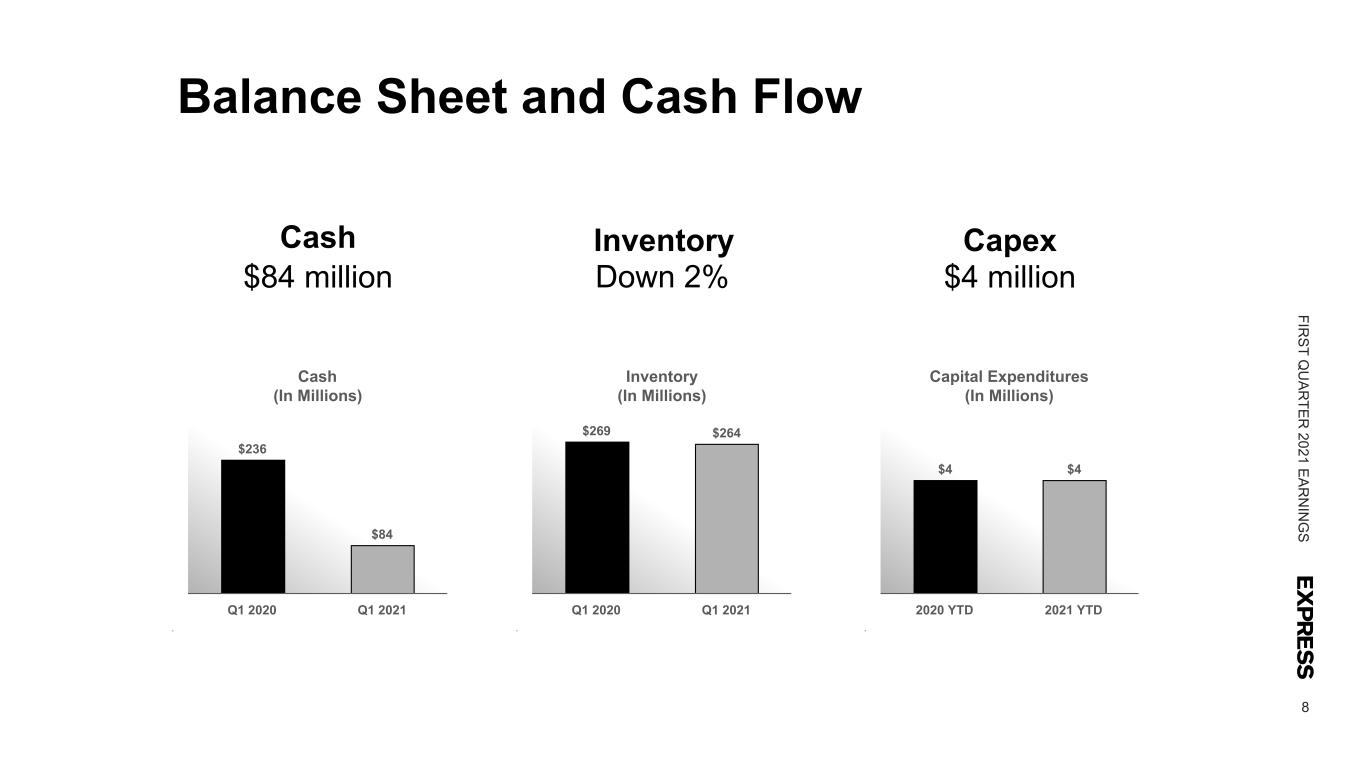

8 F IR S T Q U A R T E R 2021 E A R N IN G S Balance Sheet and Cash Flow $84 million Down 2% $4 million Cash (In Millions) $236 $84 Q1 2020 Q1 2021 Inventory (In Millions) $269 $264 Q1 2020 Q1 2021 Capital Expenditures (In Millions) $4 $4 2020 YTD 2021 YTD Cash Inventory Capex

FINANCIAL GUIDANCE FULL YEAR 2021

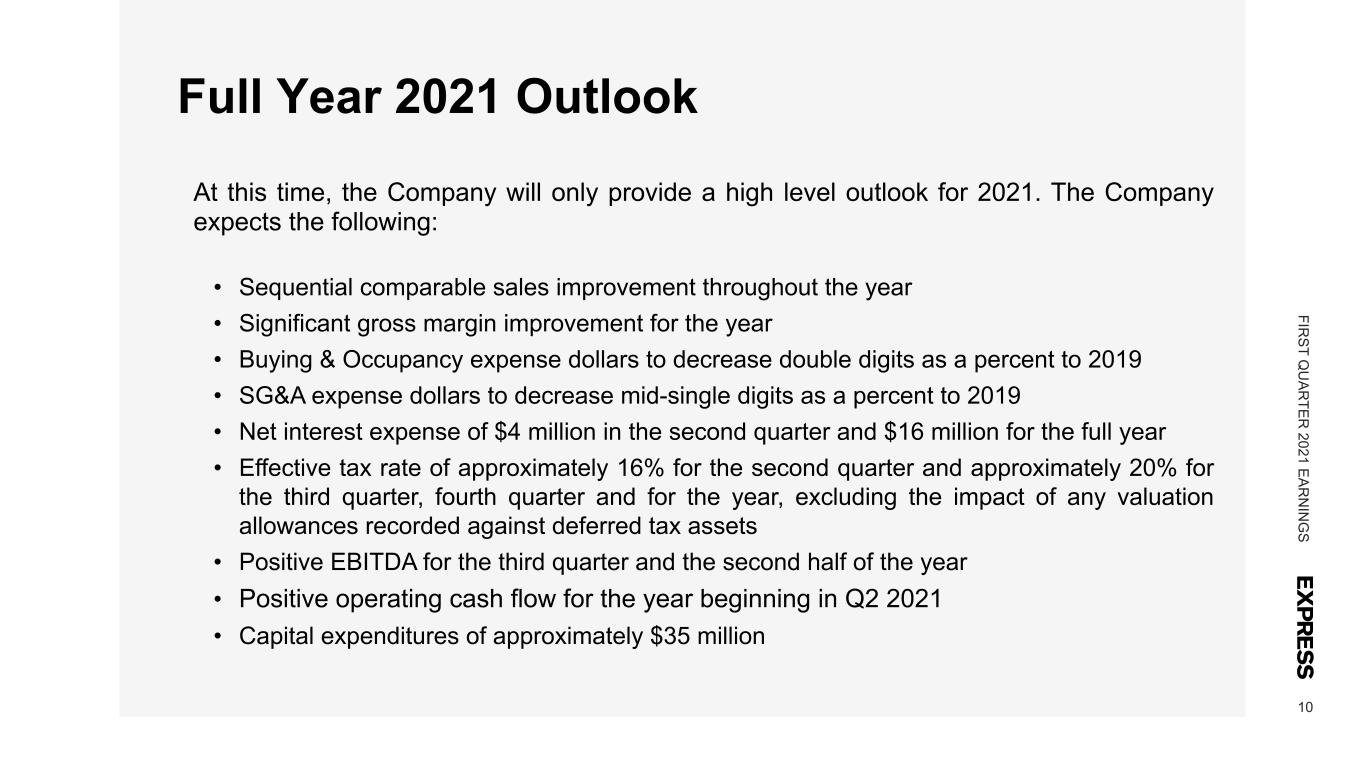

10 F IR S T Q U A R T E R 2021 E A R N IN G S Full Year 2021 Outlook At this time, the Company will only provide a high level outlook for 2021. The Company expects the following: • Sequential comparable sales improvement throughout the year • Significant gross margin improvement for the year • Buying & Occupancy expense dollars to decrease double digits as a percent to 2019 • SG&A expense dollars to decrease mid-single digits as a percent to 2019 • Net interest expense of $4 million in the second quarter and $16 million for the full year • Effective tax rate of approximately 16% for the second quarter and approximately 20% for the third quarter, fourth quarter and for the year, excluding the impact of any valuation allowances recorded against deferred tax assets • Positive EBITDA for the third quarter and the second half of the year • Positive operating cash flow for the year beginning in Q2 2021 • Capital expenditures of approximately $35 million

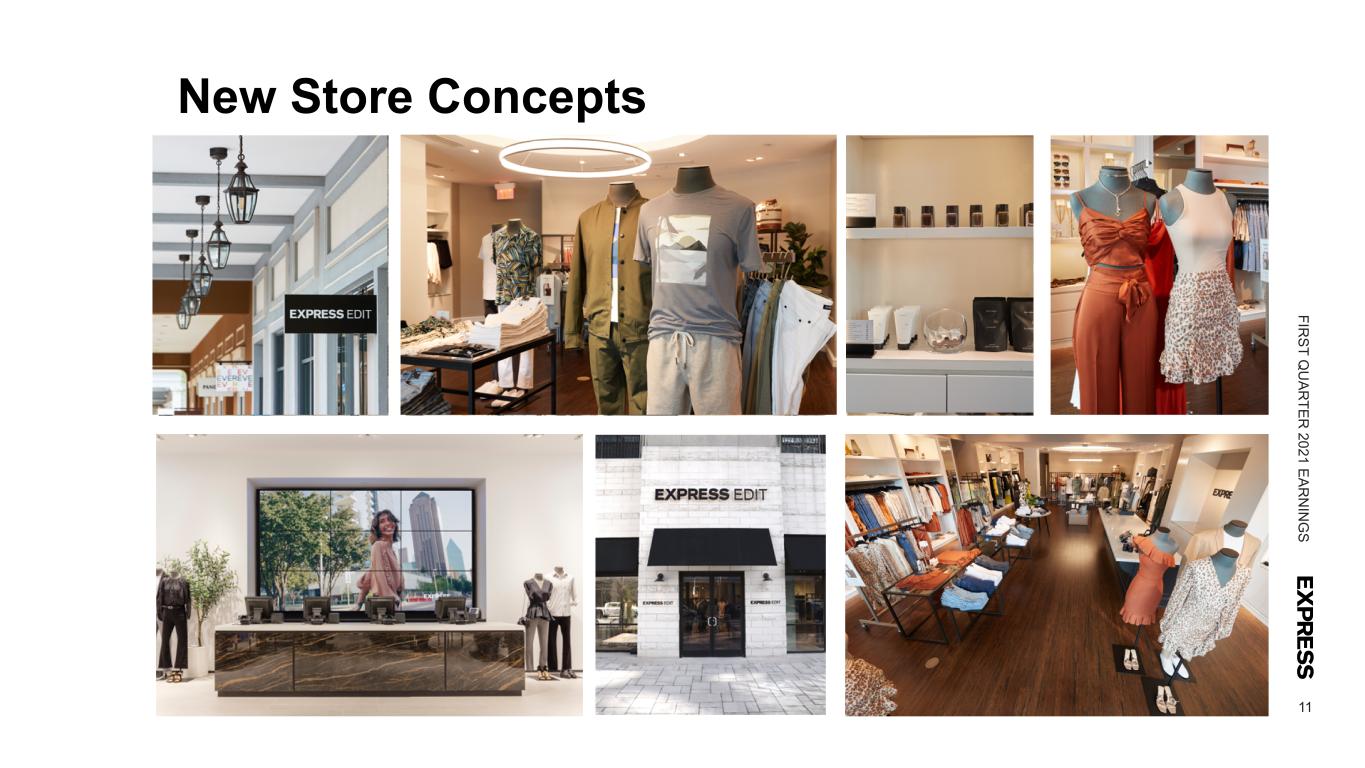

11 F IR S T Q U A R T E R 2021 E A R N IN G S New Store Concepts

12 F IR S T Q U A R T E R 2021 E A R N IN G S Projected 2021 Real Estate Activity First Quarter 2021 - Actual May 1, 2021 - Actual Company-Operated Stores Opened Closed Store Count Gross Square Footage Retail Stores — (5) 354 Outlet Stores — (4) 206 Express Edit Concept Stores1 1 — 2 UpWest Stores 1 — 1 TOTAL 2 (9) 563 4.8 million Second Quarter 2021 - Projected July 31, 2021 - Projected Company-Operated Stores Opened Closed Store Count Gross Square Footage Retail Stores — (2) 352 Outlet Stores — — 206 Express Edit Concept Stores1 4 (1) 5 UpWest Stores 4 — 5 TOTAL 8 (3) 568 4.8 million Full Year 2021 - Projected January 29, 2022 - Projected Company-Operated Stores Opened Closed Store Count Gross Square Footage Retail Stores — (20) 339 Outlet Stores 1 (5) 206 Express Edit Concept Stores1 9 (1) 9 UpWest Stores 5 — 5 TOTAL 15 (26) 559 4.7 million 1. The initial lease terms for Express Edit Concept stores are typically less than 12 months.

NON-GAAP RECONCILIATIONS FIRST QUARTER 2021

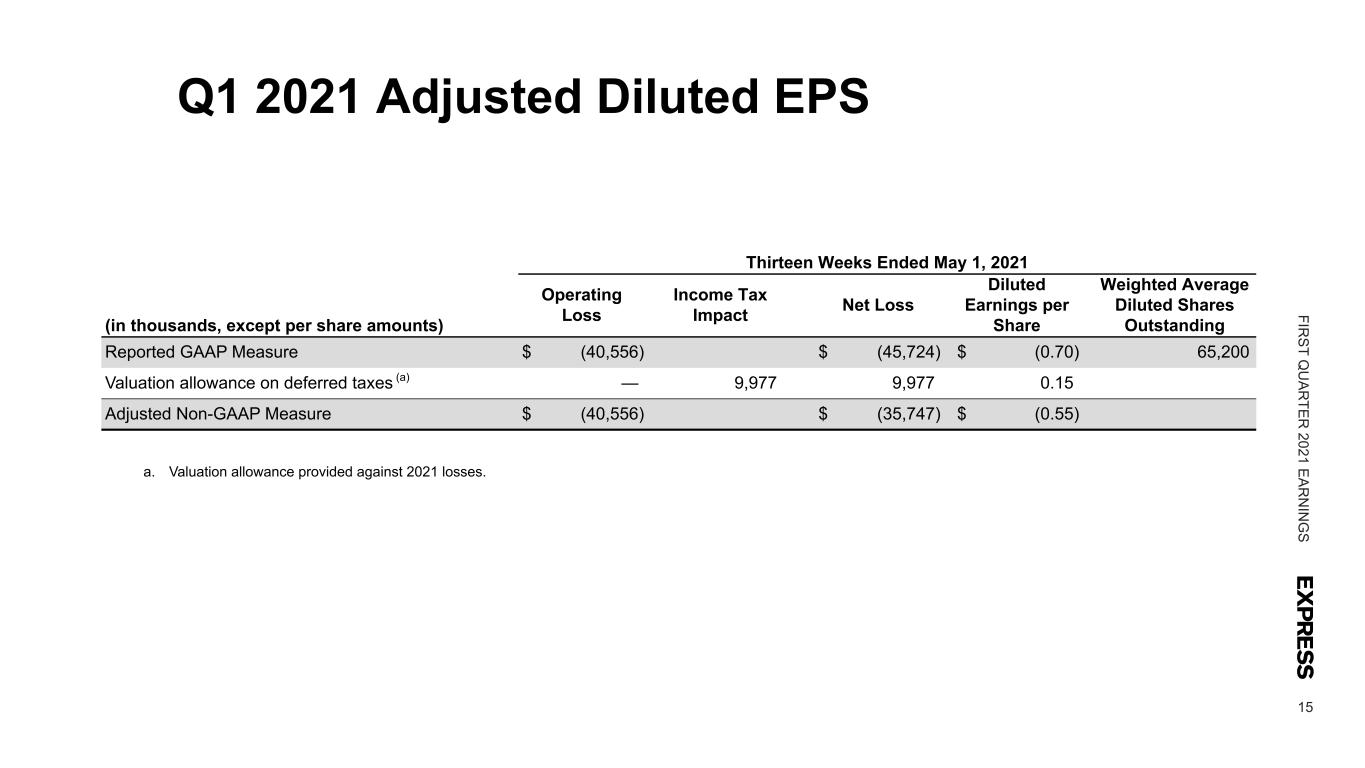

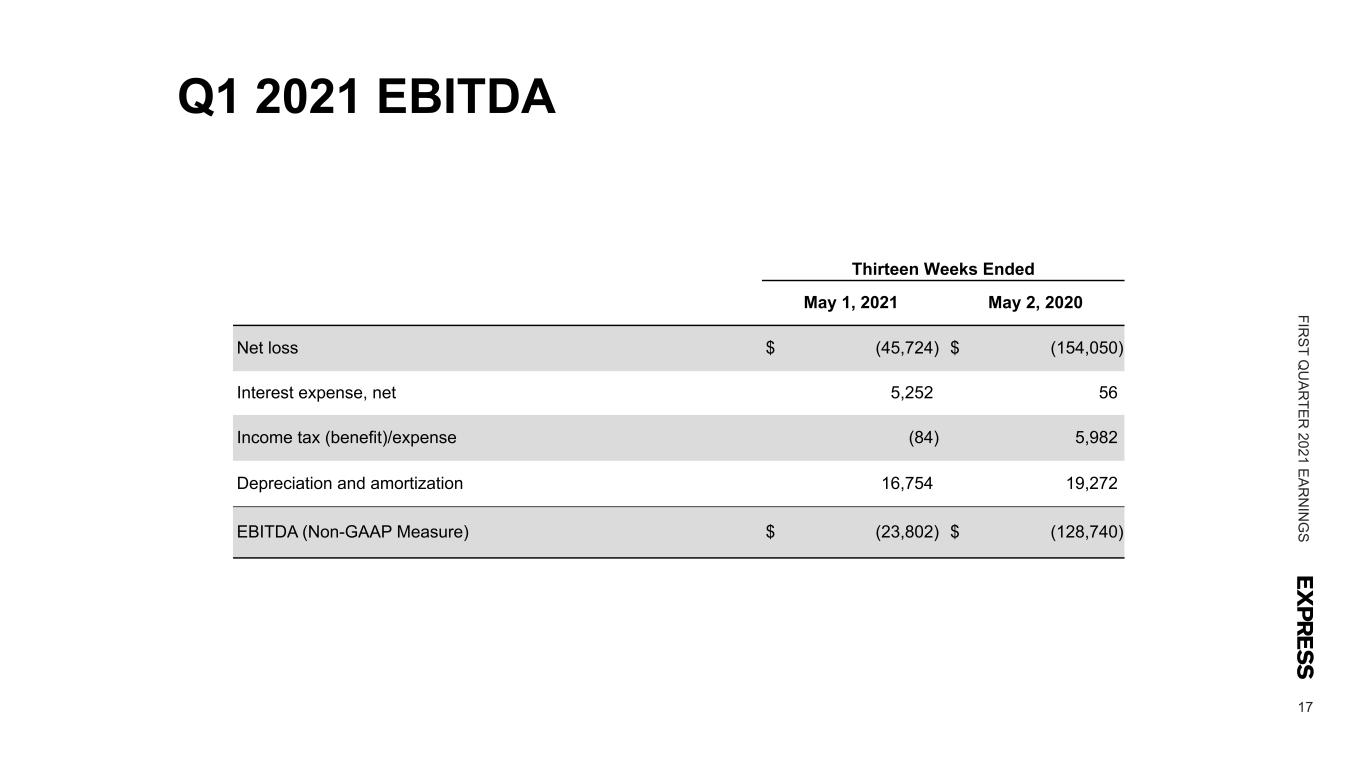

14 F IR S T Q U A R T E R 2021 E A R N IN G S CAUTIONARY STATEMENT REGARDING NON-GAAP FINANCIAL MEASURES This presentation contains references to Adjusted Diluted Earnings per Share (EPS) and Earnings before interest, taxes, and depreciation and amortization (EBITDA) which are non-GAAP financial measures. These measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles (GAAP) included in Express, Inc.’s filings with the Securities and Exchange Commission and may differ from similarly titled measures used by others. Please refer to slide 15-16 in this presentation for additional information and reconciliation of Adjusted Diluted EPS to the most directly comparable financial measures calculated in accordance with GAAP and slide 17 for additional information and reconciliation of EBITDA to the most directly comparable financial measures calculated in accordance with GAAP. Management believes that Adjusted Diluted EPS provides useful information because it excludes items that may not be indicative of or are unrelated to our underlying business results, and may provide a better baseline for analyzing trends in our underlying business. In addition, Adjusted Diluted EPS and EBITDA are used as a performance measures in our long-term executive compensation program for purposes of determining the number of equity awards that are ultimately earned. EBITDA is also a metric used in our short-term cash incentive compensation plan. These non-GAAP financial measures reflect an additional way of viewing the Company's operations that, when viewed with the GAAP results and the following reconciliations to the corresponding GAAP financial measures, provide a more complete understanding of our business. Management strongly encourages investors and stockholders to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure.

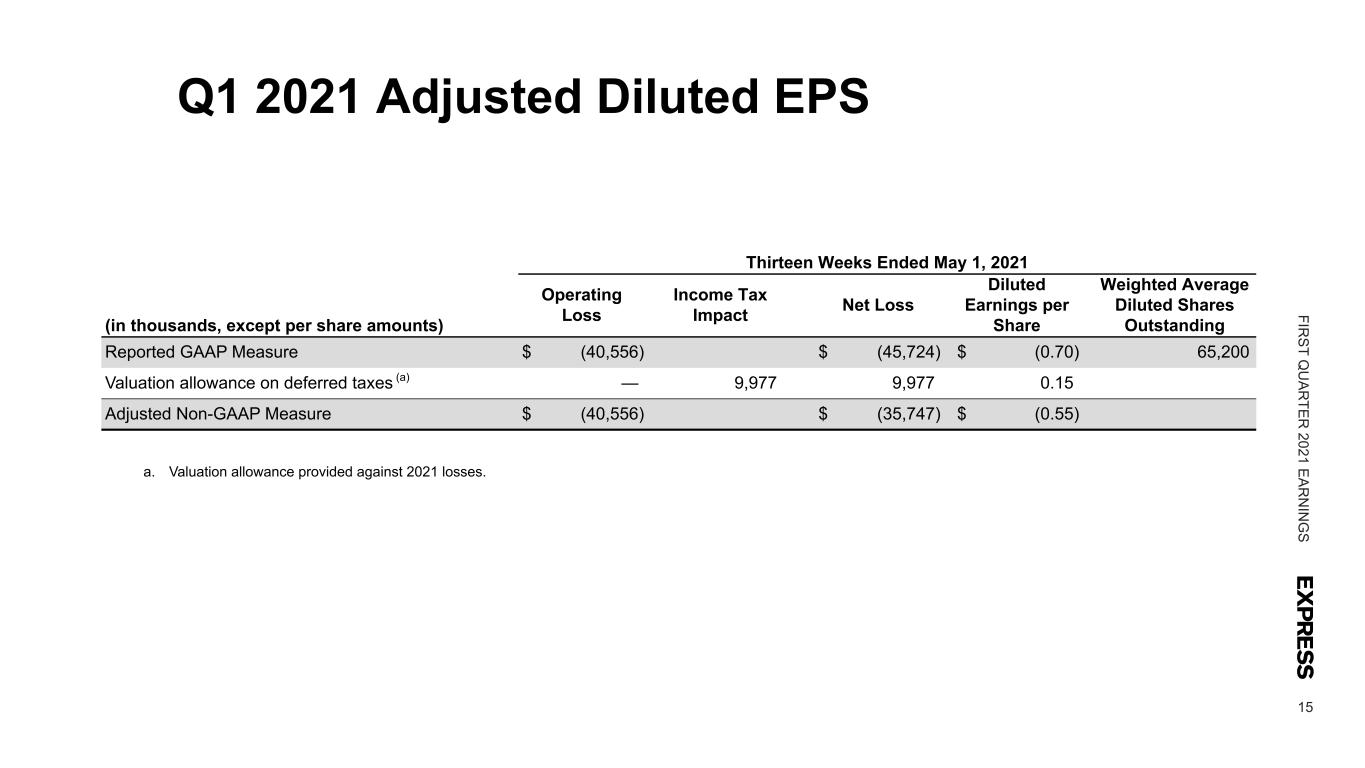

15 F IR S T Q U A R T E R 2021 E A R N IN G S Q1 2021 Adjusted Diluted EPS a. Valuation allowance provided against 2021 losses. Thirteen Weeks Ended May 1, 2021 (in thousands, except per share amounts) Operating Loss Income Tax Impact Net Loss Diluted Earnings per Share Weighted Average Diluted Shares Outstanding Reported GAAP Measure $ (40,556) $ (45,724) $ (0.70) 65,200 Valuation allowance on deferred taxes (a) — 9,977 9,977 0.15 Adjusted Non-GAAP Measure $ (40,556) $ (35,747) $ (0.55)

16 F IR S T Q U A R T E R 2021 E A R N IN G S Q1 2020 Adjusted Diluted EPS a. Items tax affected at the applicable deferred or statutory rate. b. Impairment before tax was $2.7 million and was recorded in other expense, net. c. Valuation allowance provided against previously recognized deferred tax assets and 2020 losses, less net operating losses utilized under the CARES Act. d. Income tax benefit primarily due to a net operating loss carryback under the CARES Act to years with a higher federal statutory tax rate than is currently enacted. e. Represents the tax impact related to the expiration of former executive non-qualified stock options. Thirteen Weeks Ended May 2, 2020 (in thousands, except per share amounts) Operating Loss Income Tax Impact Net Loss Diluted Earnings per Share Weighted Average Diluted Shares Outstanding Reported GAAP Measure $ (145,279) $ (154,050) $ (2.41) 64,030 Impairment of property, equipment and lease assets 14,678 (3,856) (a) 10,822 0.17 Equity method investment impairment (b) — (642) 2,091 0.03 Valuation allowance on deferred taxes (c) — 61,075 61,075 0.95 Tax impact of the CARES Act (d) — (19,473) (19,473) (0.30) Tax impact of executive departures (e) — 111 111 — Adjusted Non-GAAP Measure $ (130,601) $ (99,424) $ (1.55)

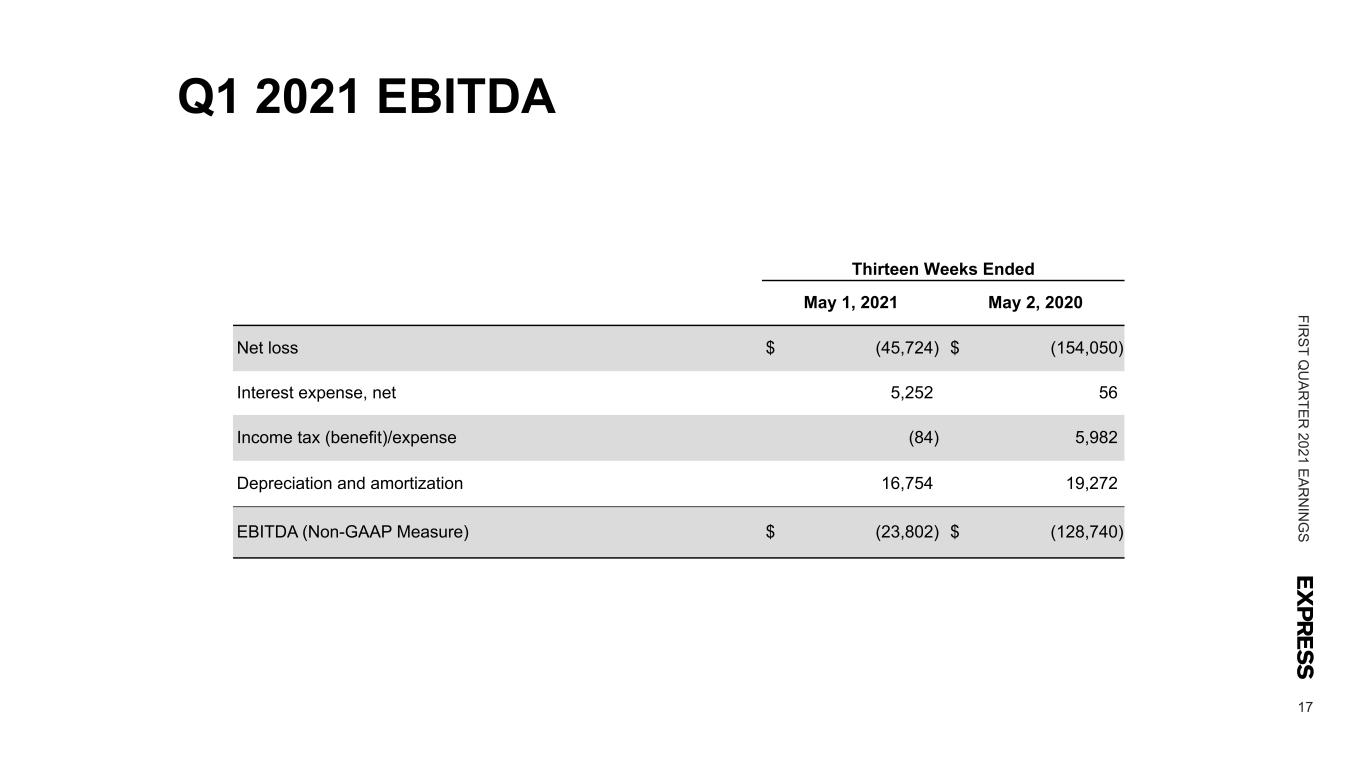

17 F IR S T Q U A R T E R 2021 E A R N IN G S Q1 2021 EBITDA Thirteen Weeks Ended May 1, 2021 May 2, 2020 Net loss $ (45,724) $ (154,050) Interest expense, net 5,252 56 Income tax (benefit)/expense (84) 5,982 Depreciation and amortization 16,754 19,272 EBITDA (Non-GAAP Measure) $ (23,802) $ (128,740)

Dan Aldridge VP, Investor Relations (614) 474-4890 INVESTOR CONTACT