EXPRESS Fourth Quarter & Full Year 2021 Earnings Presentation

2 FO U R TH Q U A R TE R & FY 2021 E A R N IN G S Cautionary Statement REGARDING FORWARD-LOOKING STATEMENTS Certain statements are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward- looking statements include any statement that does not directly relate to any historical or current fact and include, but are not limited to (1) guidance and expectations, including statements regarding expected operating margins, comparable sales, effective tax rates, interest income, net income, diluted earnings per share, cash tax refunds, liquidity, EBITDA, free cash flow, eCommerce demand, and capital expenditures, (2) statements regarding expected store openings, store closures, store conversions, and gross square footage, and (3) statements regarding the Company's strategy, plans, and initiatives, including, but not limited to, results expected from such strategy, plans, and initiatives. You can identify these forward-looking statements by the use of words in the future tense and statements accompanied by words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “scheduled,” “estimates,” “anticipates,” “opportunity,” “leads” or the negative version of these words or other comparable words. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict, and significant contingencies, many of which are beyond the Company's control. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are (1) changes in consumer spending and general economic conditions; (2) the COVID-19 pandemic and its continued impact on our business operations, store traffic, employee availability, financial condition, liquidity and cash flow; (3) our ability to operate our business efficiently, manage capital expenditures and costs, and obtain financing when required; (4) our ability to identify and respond to new and changing fashion trends, customer preferences, and other related factors; (5) fluctuations in our sales, results of operations, and cash levels on a seasonal basis and due to a variety of other factors, including our product offerings relative to customer demand, the mix of merchandise we sell, promotions, and inventory levels; (6) customer traffic at malls, shopping centers, and at our stores; (7) competition from other retailers; (8) our dependence on a strong brand image; (9) our ability to adapt to changing consumer behavior and develop and maintain a relevant and reliable omni-channel experience for our customers; (10) the failure or breach of information systems upon which we rely; (11) our ability to protect customer data from fraud and theft; (12) our dependence upon third parties to manufacture all of our merchandise; (13) changes in the cost of raw materials, labor, and freight; (14) supply chain or other business disruption, including as a result of the coronavirus; (15) our dependence upon key executive management; (16) our ability to execute our growth strategy, EXPRESSway Forward, including engaging our customers and acquiring new ones, executing with precision to accelerate sales and profitability, creating great product and reinvigorating our brand; (17) our substantial lease obligations; (18) our reliance on third parties to provide us with certain key services for our business; (19) impairment charges on long-lived assets; (20) claims made against us resulting in litigation or changes in laws and regulations applicable to our business; (21) our inability to protect our trademarks or other intellectual property rights which may preclude the use of our trademarks or other intellectual property around the world; (22) restrictions imposed on us under the terms of our asset-based loan facility, including restrictions on the ability to effect share repurchases; (23) changes in tax requirements, results of tax audits, and other factors that may cause fluctuations in our effective tax rate; (24) changes in tariff rates; and (25) natural disasters, extreme weather, public health issues, including pandemics, fire, acts of terrorism or war and other events that cause business interruption. These factors should not be construed as exhaustive and should be read in conjunction with the additional information concerning these and other factors in Express, Inc.'s filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law.

3 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S Sales Profile 1 For the fifty-two weeks ended January 29, 2022 2 Excludes “other revenue” of $49.4 million ABOUT EXPRESS Grounded in versatility and powered by a styling community, Express is a modern, multichannel apparel and accessories brand whose purpose is to Create Confidence & Inspire Self-Expression. Launched in 1980 with the idea that style, quality and value should all be found in one place, Express has been a part of some of the most important and culture-defining fashion trends. The Express Edit design philosophy ensures that the brand is always ‘of the now’ so people can get dressed for every day and any occasion knowing that Express can help them look the way they want to look and feel the way they want to feel. Express operates over 550 retail and outlet stores in the United States and Puerto Rico, the express.com online store and the Express mobile app. Express, Inc. is comprised of the brands Express and UpWest, and is traded on the NYSE under the symbol EXPR. 57% WOMEN 43% MEN 1,2

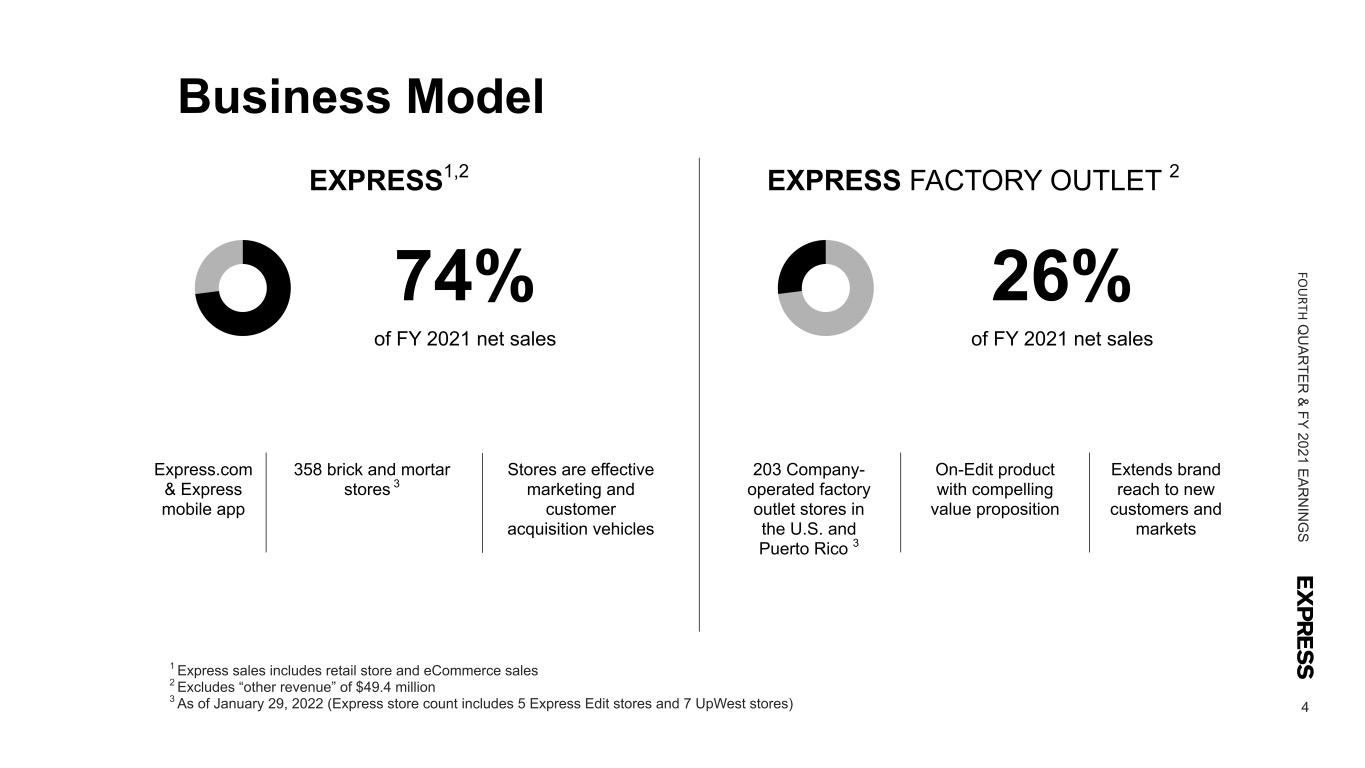

4 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S Business Model Express.com & Express mobile app 358 brick and mortar stores 3 Stores are effective marketing and customer acquisition vehicles On-Edit product with compelling value proposition Extends brand reach to new customers and markets 203 Company- operated factory outlet stores in the U.S. and Puerto Rico 3 1 Express sales includes retail store and eCommerce sales 2 Excludes “other revenue” of $49.4 million 3 As of January 29, 2022 (Express store count includes 5 Express Edit stores and 7 UpWest stores) 26% of FY 2021 net sales 74% of FY 2021 net sales EXPRESS FACTORY OUTLET 2EXPRESS1,2

RESULTS FOURTH QUARTER & FULL YEAR 2021

6 FO U R TH Q U A R TE R & FY 2021 E A R N IN G S Delivered profitable growth in the second, third, and fourth quarters. Comparable sales accelerated each quarter compared to 2019. Delivered positive operating income and free cash flow for the year. • Fourth quarter net sales increased 38% compared to 2020. Consolidated comparable sales increased 43% compared to 2020 and 4% compared to 2019 • Strong growth in fourth quarter eCommerce demand of 33% versus 2020 and 21% versus 2019 • Generated positive full year operating income driven by operating income of $10 million in the fourth quarter • Generated full year EBITDA1 of $65 million and operating cash flow of $89 million • For Q2, Q3 and Q4 combined: Sales grew 53% versus 2020. Comparable sales improved sequentially throughout the period, and gross margin improved 420 bps, versus 2019. Generated $41 million operating income, $89 million EBITDA1, $60 million free cash flow1 • Highest number of active loyalty members in Company's history • Activated our Styling Community, kicked-off innovative Express Community Commerce program • UpWest brand sales grew 41% versus 2020 • On track to achieve stated goals of $1.0 billion in eCommerce demand and over $100 million in operating profit by 2024 1. EBITDA and free cash flow are non-GAAP financial measures. Refer to pages 14-19 for information about non-GAAP financial measures and reconciliations of GAAP to non-GAAP financial measures.

7 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S Q4 2021 Financial Performance 1. EBITDA is a non-GAAP financial measure. Refer to pages 14-19 for information about non-GAAP financial measures and reconciliations of GAAP to non-GAAP financial measures. $595M Net Sales 38% Increase vs 2020 +4% Comp vs 2019 $10M Operating Income $73M increase vs 2020 $26M EBITDA1 $71M increase vs 2020 Net Sales (In Millions) $607 $430 $595 Q4 2019 Q4 2020 Q4 2021 Operating Income/(Loss) (In Millions) $10 Q4 2019 Q4 2020 Q4 2021 EBITDA (In Millions) $(45) $26 Q4 2019 Q4 2020 Q4 2021 $(63) $(190) $(169) 1

8 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S Full Year 2021 Financial Performance 1. EBITDA is a non-GAAP financial measure. Refer to pages 14-19 for information about non-GAAP financial measures and reconciliations of GAAP to non-GAAP financial measures. $1.9B Net Sales 55% increase vs 2020 -2% Comp vs 2019 $1M Operating Income $456M increase vs 2020 $65M EBITDA1 $450M increase vs 2020 Net Sales (In Millions) $2,019 $1,208 $1,870 FY 2019 FY 2020 FY 2021 Operating Income/(Loss) (In Millions) FY 2019 FY 2020 FY 2021 EBITDA (In Millions) $65 FY 2019 FY 2020 FY 2021 $(218) $(455) $(133) $(385) 1 $1

9 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S Balance Sheet and Cash Flow Up 36% to 2020 $89 million Inventory (In Millions) $220 $264 $359 FY 2019 FY 2020 FY 2021 Operating Cash Flow (In Millions) $91 $(324) $89 FY 2019 FY 2020 FY 2021 Inventory Operating Cash Flow * Inventory up 36% to 2020 driven primarily by actions taken to mitigate supply chain challenges to include increasing in transit times and holding late holiday deliveries for Fall 2022. * *

2022 OUTLOOK

11 FO U R TH Q U A R TE R & FY 2021 E A R N IN G S 2022 Outlook This outlook is based on our strong 2021 performance and the power of our product, brand, and customer strategies balanced against the ongoing supply chain constraints, tight labor market and other inflationary pressures. 2022 outlook as compared to 2021. First Quarter • Comparable sales to increase 25% - 30% • Gross Margin rate to increase approximately 550 basis points, including approximately $7 million of expenses related to mitigating supply chain challenges • SG&A expenses as a percent of sales to leverage approximately 250 basis points • Net interest expense of $4 million • Effective Tax rate of approximately 50% Full Year • Comparable sales to increase 7% - 9% • Gross Margin rate to increase approximately 100 basis points • SG&A expenses as a percent of sales approximately flat, including incremental investments in technology, higher labor expenses and general inflationary pressures • Net interest expense of $13 million • Capital expenditures of $50 - $55 million • Inventory elevated in the first half of the year and closer to parity with sales growth in the back half of the year Assumptions in the Company outlook may be affected by the continued uncertainty of the pandemic and its impacts throughout the supply chain.

12 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S Projected 2022 Real Estate Activity First Quarter 2022 - Projected April 30, 2022 - Projected Company-Operated Stores Opened Closed Store Count Gross Square Footage Retail Stores — (2) 344 Outlet Stores — (1) 202 Express Edit Stores 1 (1) 5 UpWest Stores 5 — 12 TOTAL 6 (4) 563 4.7 million Full Year 2022 - Projected January 28, 2023 - Projected Company-Operated Stores Opened Closed Store Count Gross Square Footage Retail Stores — (8) 338 Outlet Stores — (2) 201 Express Edit Stores 5 (1) 9 UpWest Stores 9 (1) 15 TOTAL 14 (12) 563 4.6 million

NON-GAAP RECONCILIATIONS FOURTH QUARTER & FULL YEAR 2021

14 FO U R TH Q U A R TE R & FY 2021 E A R N IN G S Cautionary Statement REGARDING NON-GAAP FINANCIAL MEASURES This presentation contains references to Adjusted Diluted Earnings per Share (EPS), Earnings before interest, taxes, and depreciation and amortization (EBITDA), and Free Cash Flow, which are non-GAAP financial measures. These measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles (GAAP) included in Express, Inc.’s filings with the Securities and Exchange Commission and may differ from similarly titled measures used by others. Please refer to slide 15-17 in this presentation for additional information and reconciliation of Adjusted Diluted EPS to the most directly comparable financial measure calculated in accordance with GAAP, slide 18 for additional information and reconciliation of EBITDA to the most directly comparable financial measure calculated in accordance with GAAP, and slide 19 for additional information and reconciliation of Free Cash Flow to the most directly comparable financial measure calculated in accordance with GAAP. Management believes that Adjusted Diluted EPS provides useful information because it excludes items that may not be indicative of or are unrelated to our underlying business results, and may provide a better baseline for analyzing trends in our underlying business. In addition, Adjusted Diluted EPS and EBITDA are used as a performance measures in our long-term executive compensation program for purposes of determining the number of equity awards that are ultimately earned. EBITDA is also a metric used in our short- term cash incentive compensation plan. Management believes that free cash flow provides useful information regarding liquidity as it shows our operating cash flows less cash reinvested in the business (capital expenditures). These non-GAAP financial measures reflect an additional way of viewing the Company's operations that, when viewed with the GAAP results and the following reconciliations to the corresponding GAAP financial measures, provide a more complete understanding of our business. Management strongly encourages investors and stockholders to review our financial statements and publicly- filed reports in their entirety and not to rely on any single financial measure.

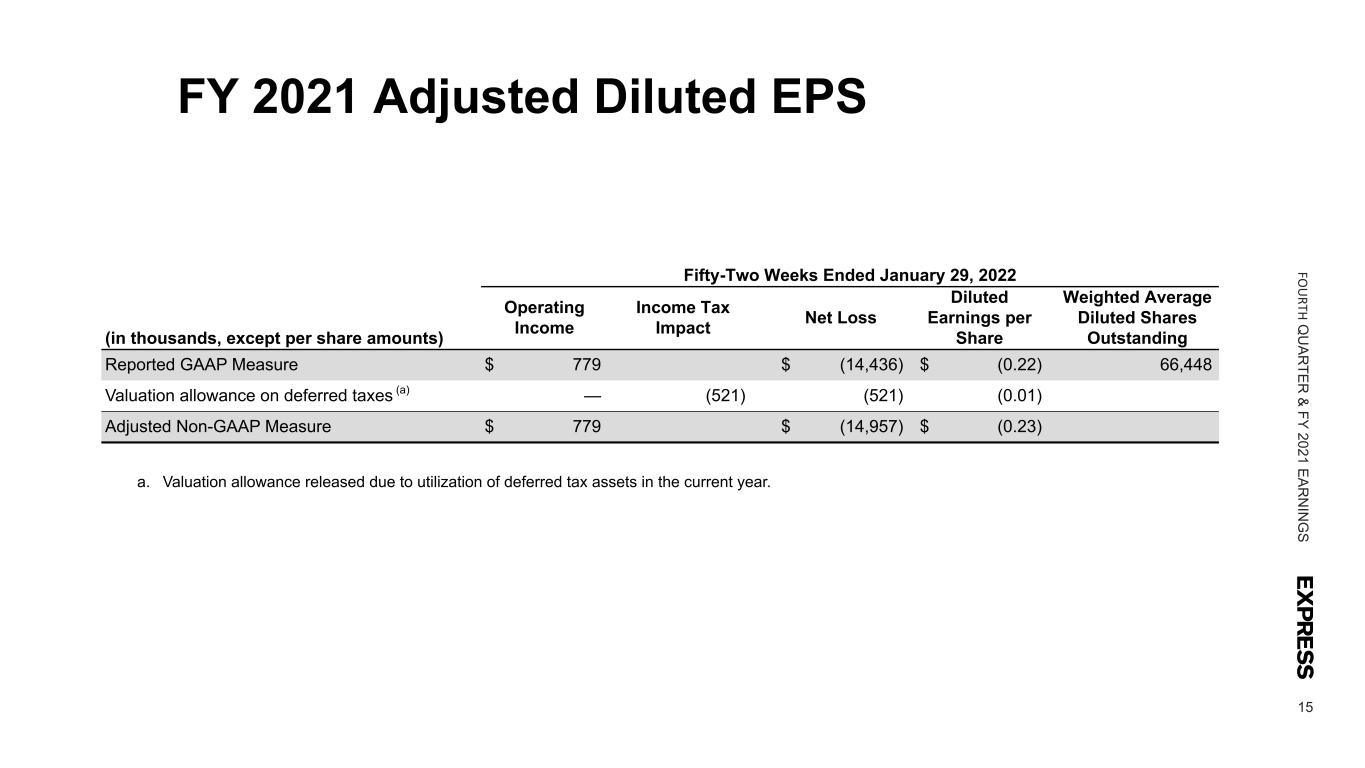

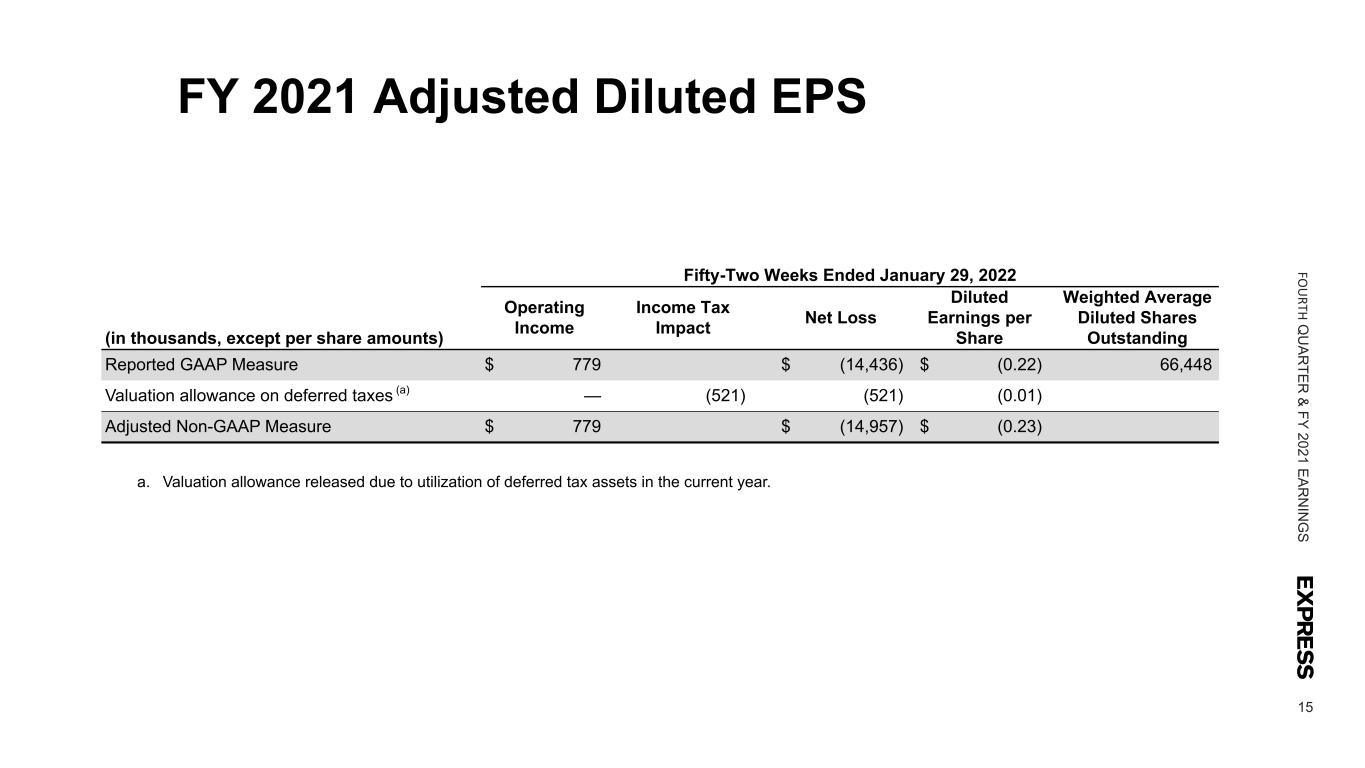

15 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S FY 2021 Adjusted Diluted EPS a. Valuation allowance released due to utilization of deferred tax assets in the current year. Fifty-Two Weeks Ended January 29, 2022 (in thousands, except per share amounts) Operating Income Income Tax Impact Net Loss Diluted Earnings per Share Weighted Average Diluted Shares Outstanding Reported GAAP Measure $ 779 $ (14,436) $ (0.22) 66,448 Valuation allowance on deferred taxes (a) — (521) (521) (0.01) Adjusted Non-GAAP Measure $ 779 $ (14,957) $ (0.23)

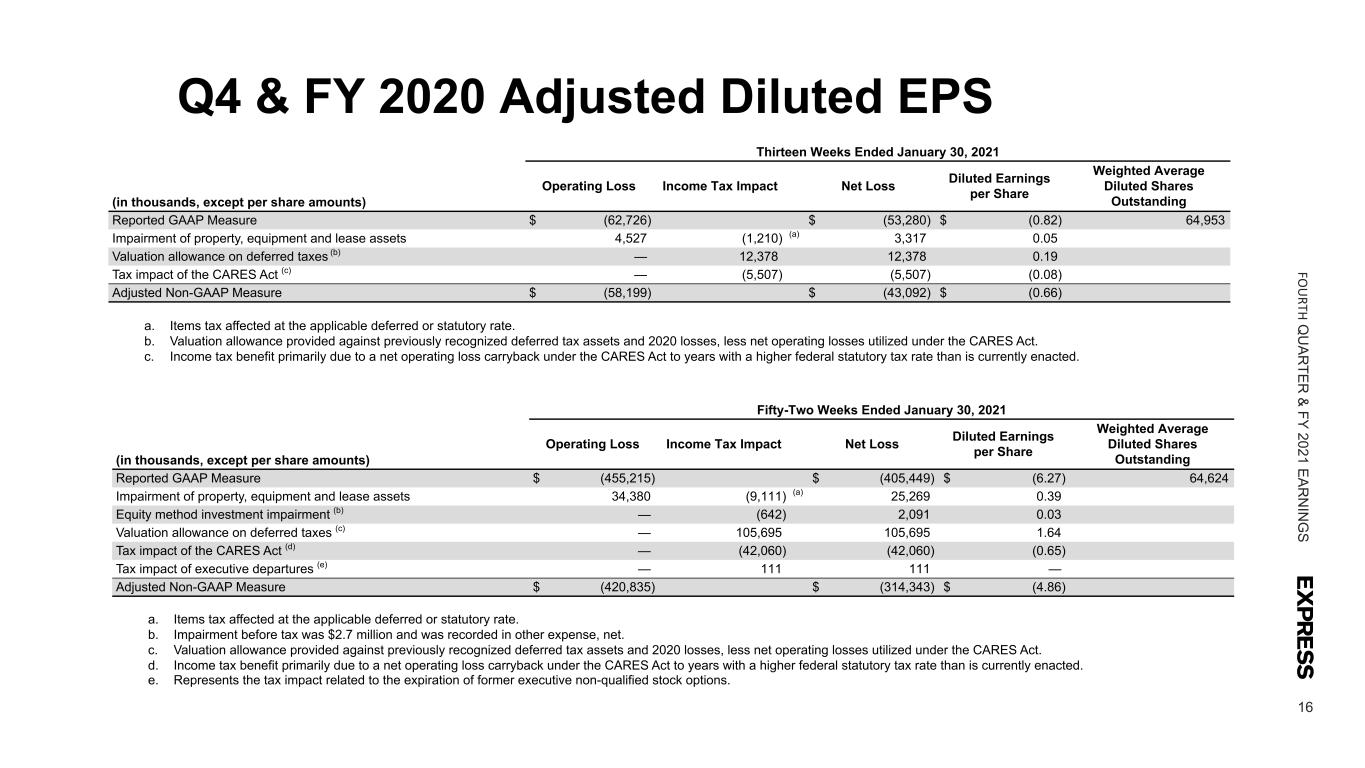

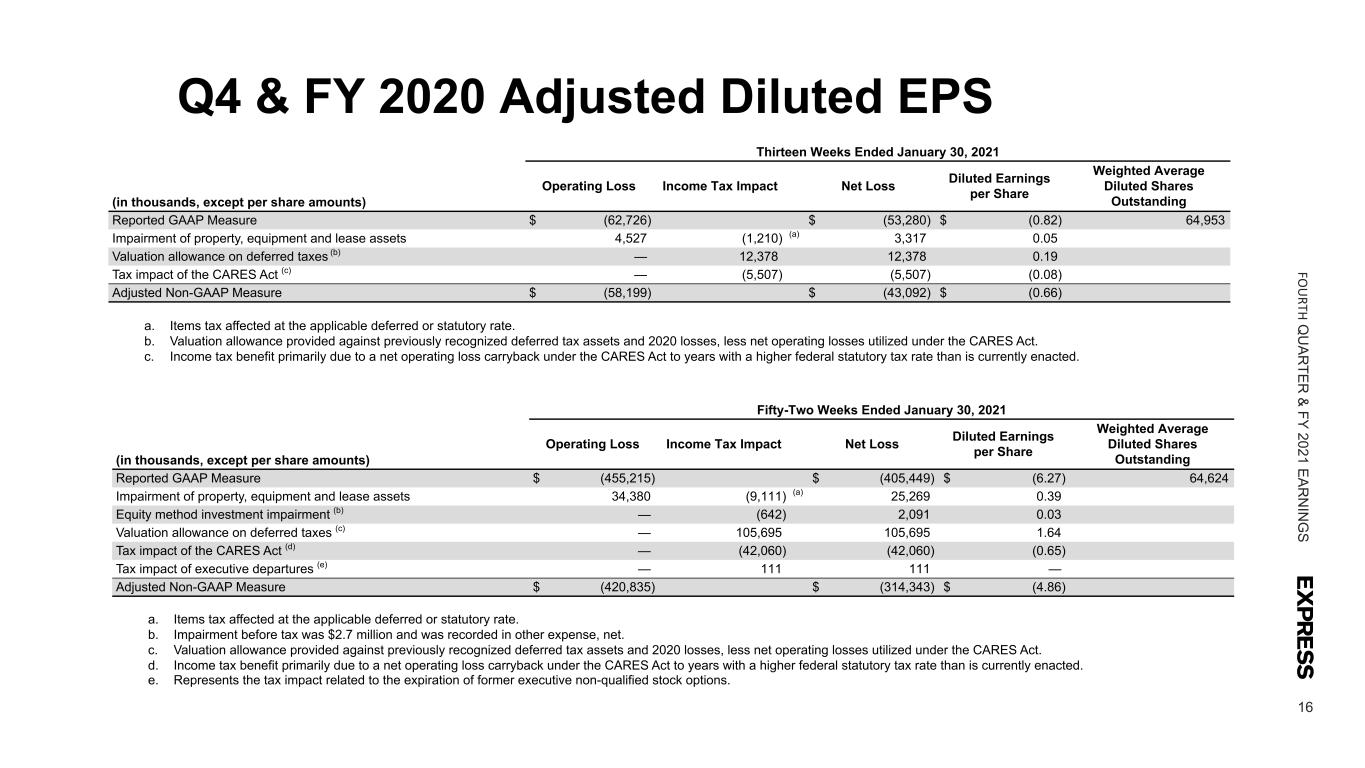

16 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S Q4 & FY 2020 Adjusted Diluted EPS a. Items tax affected at the applicable deferred or statutory rate. b. Valuation allowance provided against previously recognized deferred tax assets and 2020 losses, less net operating losses utilized under the CARES Act. c. Income tax benefit primarily due to a net operating loss carryback under the CARES Act to years with a higher federal statutory tax rate than is currently enacted. Thirteen Weeks Ended January 30, 2021 (in thousands, except per share amounts) Operating Loss Income Tax Impact Net Loss Diluted Earnings per Share Weighted Average Diluted Shares Outstanding Reported GAAP Measure $ (62,726) $ (53,280) $ (0.82) 64,953 Impairment of property, equipment and lease assets 4,527 (1,210) (a) 3,317 0.05 Valuation allowance on deferred taxes (b) — 12,378 12,378 0.19 Tax impact of the CARES Act (c) — (5,507) (5,507) (0.08) Adjusted Non-GAAP Measure $ (58,199) $ (43,092) $ (0.66) a. Items tax affected at the applicable deferred or statutory rate. b. Impairment before tax was $2.7 million and was recorded in other expense, net. c. Valuation allowance provided against previously recognized deferred tax assets and 2020 losses, less net operating losses utilized under the CARES Act. d. Income tax benefit primarily due to a net operating loss carryback under the CARES Act to years with a higher federal statutory tax rate than is currently enacted. e. Represents the tax impact related to the expiration of former executive non-qualified stock options. Fifty-Two Weeks Ended January 30, 2021 (in thousands, except per share amounts) Operating Loss Income Tax Impact Net Loss Diluted Earnings per Share Weighted Average Diluted Shares Outstanding Reported GAAP Measure $ (455,215) $ (405,449) $ (6.27) 64,624 Impairment of property, equipment and lease assets 34,380 (9,111) (a) 25,269 0.39 Equity method investment impairment (b) — (642) 2,091 0.03 Valuation allowance on deferred taxes (c) — 105,695 105,695 1.64 Tax impact of the CARES Act (d) — (42,060) (42,060) (0.65) Tax impact of executive departures (e) — 111 111 — Adjusted Non-GAAP Measure $ (420,835) $ (314,343) $ (4.86)

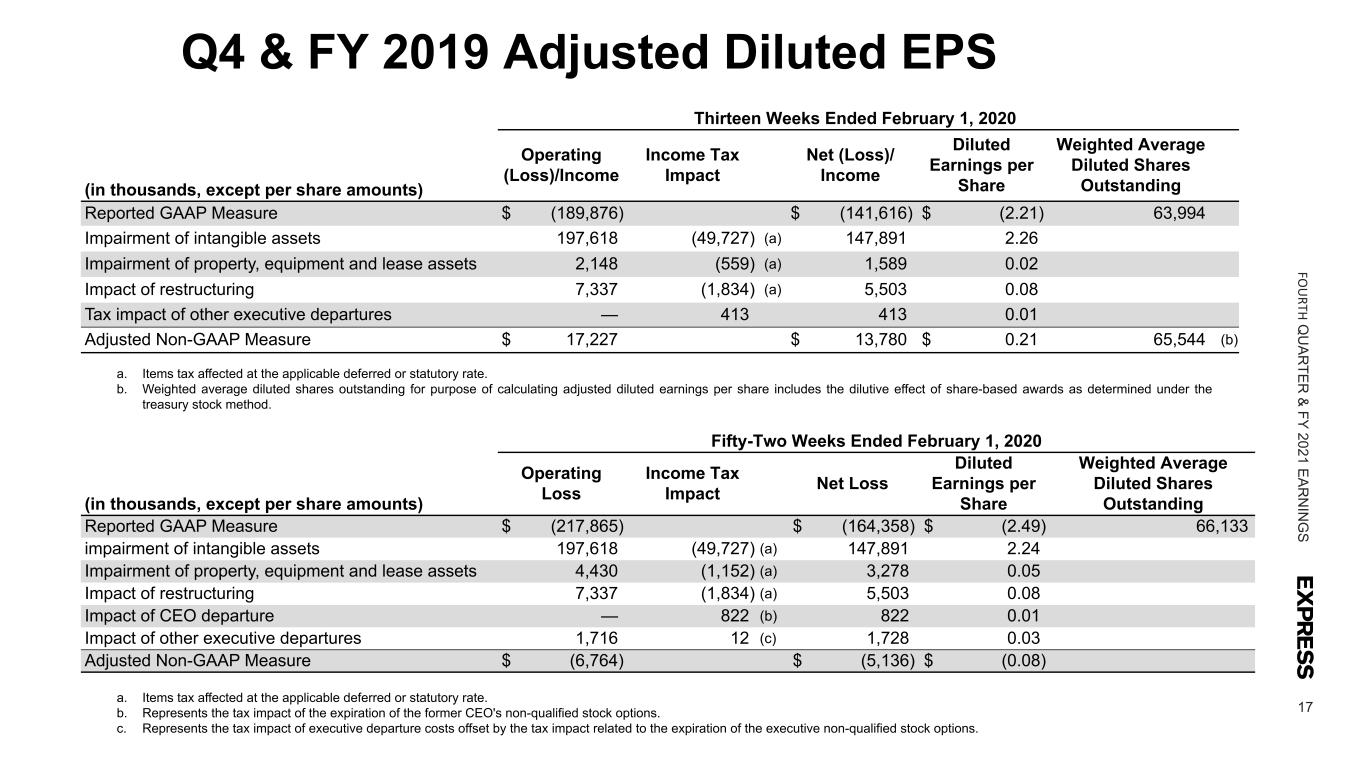

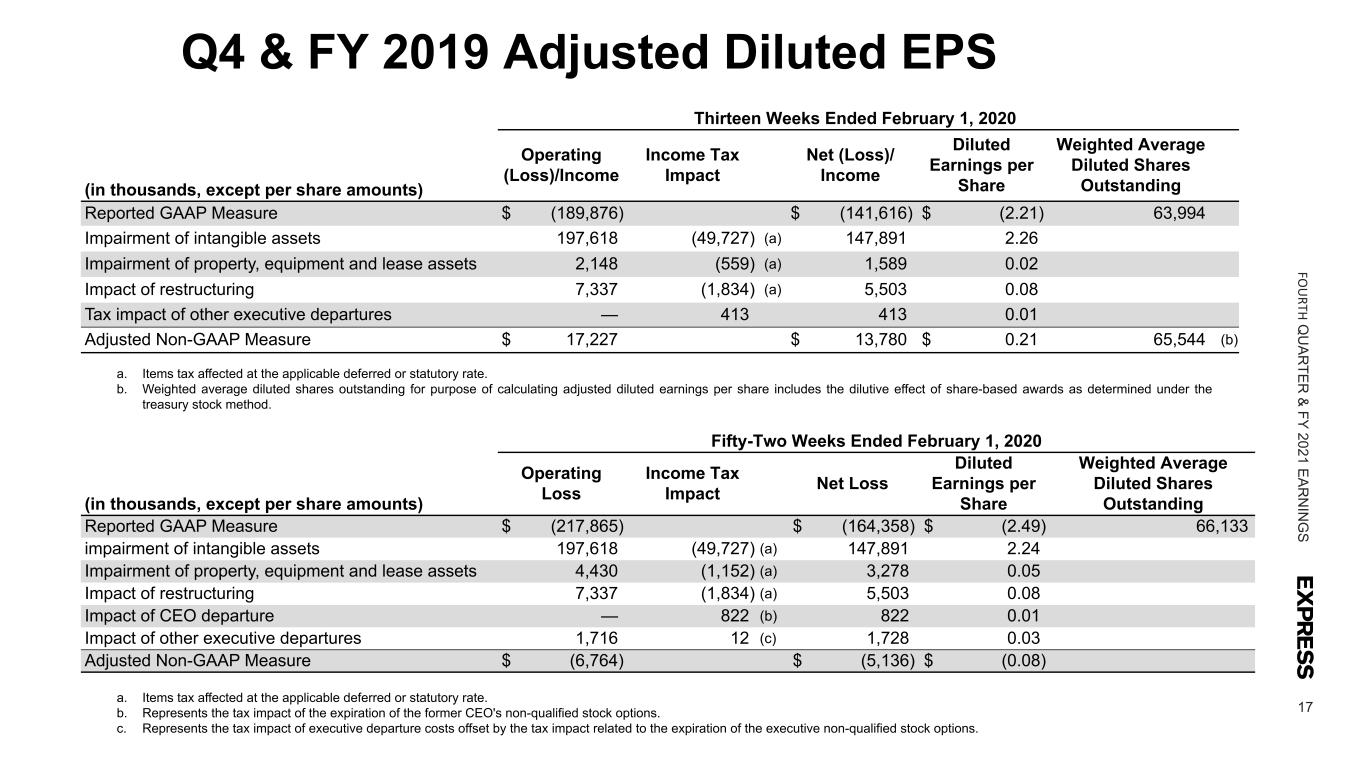

17 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S Q4 & FY 2019 Adjusted Diluted EPS Thirteen Weeks Ended February 1, 2020 (in thousands, except per share amounts) Operating (Loss)/Income Income Tax Impact Net (Loss)/ Income Diluted Earnings per Share Weighted Average Diluted Shares Outstanding Reported GAAP Measure $ (189,876) $ (141,616) $ (2.21) 63,994 Impairment of intangible assets 197,618 (49,727) (a) 147,891 2.26 Impairment of property, equipment and lease assets 2,148 (559) (a) 1,589 0.02 Impact of restructuring 7,337 (1,834) (a) 5,503 0.08 Tax impact of other executive departures — 413 413 0.01 Adjusted Non-GAAP Measure $ 17,227 $ 13,780 $ 0.21 65,544 (b) a. Items tax affected at the applicable deferred or statutory rate. b. Represents the tax impact of the expiration of the former CEO's non-qualified stock options. c. Represents the tax impact of executive departure costs offset by the tax impact related to the expiration of the executive non-qualified stock options. Fifty-Two Weeks Ended February 1, 2020 (in thousands, except per share amounts) Operating Loss Income Tax Impact Net Loss Diluted Earnings per Share Weighted Average Diluted Shares Outstanding Reported GAAP Measure $ (217,865) $ (164,358) $ (2.49) 66,133 impairment of intangible assets 197,618 (49,727) (a) 147,891 2.24 Impairment of property, equipment and lease assets 4,430 (1,152) (a) 3,278 0.05 Impact of restructuring 7,337 (1,834) (a) 5,503 0.08 Impact of CEO departure — 822 (b) 822 0.01 Impact of other executive departures 1,716 12 (c) 1,728 0.03 Adjusted Non-GAAP Measure $ (6,764) $ (5,136) $ (0.08) a. Items tax affected at the applicable deferred or statutory rate. b. Weighted average diluted shares outstanding for purpose of calculating adjusted diluted earnings per share includes the dilutive effect of share-based awards as determined under the treasury stock method.

18 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S Q4 & FY 2021, 2020 & 2019 EBITDA Thirteen Weeks Ended Fifty-Two Weeks Ended (in thousands) January 29, 2022 January 30, 2021 February 1, 2020 January 29, 2022 January 30, 2021 February 1, 2020 Net income/(loss) $ 7,563 $ (53,280) $ (141,616) $ (14,436) $ (405,449) $ (164,358) Interest expense/(income), net 2,952 1,386 (796) 15,198 3,401 (2,981) Income tax expense/(benefit) 88 (10,832) (47,464) 315 (55,900) (50,526) Depreciation and amortization 15,222 17,740 21,201 63,640 73,259 85,099 EBITDA (Non-GAAP Measure) $ 25,825 $ (44,986) $ (168,675) $ 64,717 $ (384,689) $ (132,766)

19 FO U RTH Q U A R TE R & FY 2021 E A R N IN G S FY 2021, 2020 & 2019 Free Cash Flow Fifty-Two Weeks Ended (in thousands) January 29, 2022 January 30, 2021 February 1, 2020 Net cash provided by (used in) operating activities $ 89,380 $ (323,626) $ 90,710 Less: Capital expenditures (34,771) (16,854) (37,039) Free Cash Flow (Non-GAAP Measure) $ 54,609 $ (340,480) $ 53,671

Greg Johnson VP, Investor Relations (614) 474-4890 INVESTOR CONTACT