UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission file number: 001-34656

H World Group Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

CAYMAN ISLANDS

(Jurisdiction of incorporation or organization)

No. 1299 Fenghua Road

Jiading District

Shanghai 201803

People’s Republic of China

+86 (21) 6195-2011

(Address of principal executive offices)

Jihong He

Chief Financial Officer

H World Group Limited

11 Penang Lane

Singapore 238485

+65 8655-0278

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Trading Symbol(s) |

| Name of Each Exchange on Which Registered |

| | | | |

Ordinary Shares, par value US$0.00001 per share | | 1179 | | The Stock Exchange of Hong Kong Limited |

American Depositary Shares, each representing ten ordinary shares | | HTHT | | NASDAQ Global Select Market |

| | | | |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 3,112,413,730 Ordinary Shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

☒ U.S. GAAP

☐ International Financial Reporting Standards as issued by the International Accounting Standards Board

☐ Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

TABLE OF CONTENTS

| | | | ||

|

| Page | |||

| 1 | ||||

| 4 | ||||

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | | 4 | |||

| 4 | ||||

| 4 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

| 84 | ||||

| 87 | ||||

| 87 | ||||

| 88 | ||||

| 88 | ||||

| 104 | ||||

| 110 | ||||

| 110 | ||||

| 111 | ||||

| 112 | ||||

| 112 | ||||

| 115 | ||||

| 117 | ||||

| 119 | ||||

| 119 | ||||

6.F. Disclosure of Action to Recover Erroneously Awarded Compensation | | 120 | |||

| 120 | ||||

| 120 | ||||

| 121 | ||||

| 121 | ||||

| 122 | ||||

8.A. Consolidated Statements and Other Financial Information | | 122 | |||

| 123 | ||||

| 123 | ||||

| 123 | ||||

| 123 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| 124 | ||||

| | |

| 124 | |

| 124 | |

| 134 | |

| 134 | |

| 134 | |

| 134 |

i

ii

CERTAIN CONVENTIONS

Unless otherwise indicated, all translations from U.S. dollars to RMB in this annual report were made at a rate of US$1.00 to RMB 6.8972, the exchange rate as set forth in the H.10 statistical release of the U.S. Federal Reserve Board on December 30, 2022. No representation is made that the RMB amounts referred to herein could have been or could be converted into U.S. dollars at any particular rate or at all. On April 21, 2023, the exchange rate was US$1.00 to RMB6.8920. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding.

Unless otherwise indicated, in this annual report,

| ● | “ADRs” are to the American depositary receipts that may evidence our ADSs; |

| ● | “ADSs” are to our American depositary shares, each representing ten ordinary shares; |

| ● | “China” or the “PRC” are to the People’s Republic of China, excluding, for purposes of this annual report, Hong Kong, Macau and Taiwan; |

| ● | “Consolidated Affiliated Entities” are to Tianjin Jizhu Information Technology Co., Ltd. (“Tianjin Jizhu”), Huanmei Information Technology (Shanghai) Co., Ltd. (“Shanghai Huanmei”) and its wholly owned subsidiary Huanmei International Travel Agency (Shanghai) Co., Ltd. (“Huanmei Travel”), and Ningbo Futing Enterprise Management Co., Ltd. (“Ningbo Futing”), each of which is a Consolidated Affiliated Entity; |

| ● | “Consolidated Fund” are to Ningbo Hongting Investment Management Center (LLP) (“Ningbo Hongting”) and its subsidiary; |

| ● | “Deutsche Hospitality” or “legacy DH” refers to Steigenberger Hotels GmbH (formerly known as Steigenberger Hotels Aktiengesellschaft), a subsidiary of our company established under the laws of Germany on September 12, 1985, and its subsidiaries; |

| ● | “EUR” and “Euro” refers to the legal currency of European Union; |

| ● | “HKD” refers to the legal currency of Hong Kong; |

| ● | “Hong Kong” or “HK” refers to the Hong Kong Special Administrative Region of the PRC; |

| ● | “Hong Kong Listing Rules” are to the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited; |

| ● | “Hong Kong Stock Exchange” are to The Stock Exchange of Hong Kong Limited; |

| ● | “Huanmei Travel” are to Huanmei International Travel Agency (Shanghai) Co., Ltd.; |

| ● | “leased hotels” are to leased-and-operated hotels; |

| ● | “legacy Huazhu” refers to our company excluding Deutsche Hospitality; |

| ● | “manachised hotels” are to franchised-and-managed hotels; |

| ● | “Ningbo Futing” are to Ningbo Futing Enterprise Management Co., Ltd.; |

| ● | “Ningbo Hongting” are to Ningbo Hongting Investment Management Center (LLP); |

| ● | “occupancy rate” refers to the number of rooms in use divided by the number of available rooms for a given period; |

1

| ● | “RevPAR” refers to revenue per available room, calculated by room revenue during a period divided by the number of available rooms of such hotel during the same period; |

| ● | “ordinary shares” or “Shares” are to our ordinary shares, par value US$0.00001 per share; |

| ● | “RMB” and “Renminbi” are to the legal currency of China; |

| ● | “Shanghai Huanmei” are to Huanmei Information Technology (Shanghai) Co., Ltd.; |

| ● | “Tianjin Jizhu” are to Tianjin Jizhu Information Technology Co., Ltd. (formerly known as Tianjin Mengguang Information Technology Co., Ltd.); |

| ● | “US$” and “U.S. dollars” are to the legal currency of the United States; |

| ● | “VIEs” are to the Consolidated Affiliated Entities and the Consolidated Fund; and |

| ● | “We,” “us,” “our company,” “our” and “Huazhu” are to H World Group Limited (formerly known as Huazhu Group Limited and China Lodging Group, Limited), a Cayman Islands exempted company with limited liability, its predecessor entities and its subsidiaries and, in the context of describing our operations and consolidated financial information, the VIEs. |

When calculating the number of cities in China with our hotel network coverage in this annual report, we include the number of municipalities, cities and counties with at least one hotel under our operation or under development.

In June 2021, we effected a share split that each issued and unissued ordinary share with a par value of US$0.0001 was sub-divided into ten ordinary shares with a par value of US$0.00001 each (the “Share Subdivision”). Concurrent with the Share Subdivision, the ratio of ADS to ordinary share was adjusted from one (1) ADS representing one (1) ordinary share to one (1) ADS representing ten (10) ordinary shares. Except otherwise stated, the Share Subdivision has been retrospectively applied for all periods presented in this annual report.

2

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this annual report, including those regarding our future financial position, strategies, plans, objectives, goals and targets, future developments in the markets where we participate or are seeking to participate and any statements preceded by, followed by or that include the words “aim,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “going forward,” “intend,” “may,” “ought to,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” “would,” “vision,” “aspire,” “target,” “schedules,” “goal,” “outlook” and the negative of these words and other similar expressions, as they relate to us or our management, are intended to identify forward-looking statements. Such statements reflect the current views of our management with respect to future events, operations, liquidity and capital resources, some of which may not materialize or may change. These statements are subject to certain known and unknown risks, uncertainties and assumptions, including the risk factors as described in this annual report. You are strongly cautioned that reliance on any forward-looking statements involves known and unknown risks and uncertainties. The risks and uncertainties facing us which could affect the accuracy of forward-looking statements include, but are not limited to, the following:

| ● | our anticipated growth strategies, including developing new hotels at desirable locations in a timely and cost-effective manner and launching a new hotel brand; |

| ● | our future business development, results of operations and financial condition; |

| ● | expected changes in our revenues and certain cost or expense items; |

| ● | our ability to attract customers and leverage our brand; |

| ● | trends and competition in the lodging industry; |

| ● | the status of the relevant regulatory and legislative developments in the countries we operate; |

| ● | natural disasters, health epidemics, pandemics and similar outbreaks, including COVID-19; and |

| ● | general economic, business and socio-political conditions globally, including recent Russia-Ukraine war. |

By their nature, certain disclosures relating to these and other risks are only estimates and should one or more of these uncertainties or risks, among others, materialize, actual results may vary materially from those estimated, anticipated or projected, as well as from historical results. Specifically but without limitation, sales could decrease, costs could increase, capital costs could increase, capital investment could be delayed and anticipated improvements in performance might not be fully realized.

We would like to caution you not to place undue reliance on these forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in “Item 3. Key Information—3D. Risk Factors.” Other sections of this annual report include additional factors that could adversely affect our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3

PART I

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3.KEY INFORMATION

H World Group Limited is a holding company incorporated in the Cayman Islands. As a holding company, it has no material operations of its own and conducts substantially all its operations through its subsidiaries. China is one of our major markets and we also have operations in Europe as well as other countries.

Permits and Permission Required from the PRC Authorities for Our Operations

As advised by our PRC counsel, JunHe LLP, as of the date of this annual report, none of our PRC subsidiaries or VIEs are required to obtain any further permission or approval from China Securities Regulatory Commission (the “CSRC”), Cyberspace Administration of China (the “CAC”), or other PRC regulatory authorities to approve our contractual arrangements with the VIEs and their respective shareholders other than the permissions related to certain businesses operated by the Consolidated Affiliated Entities, or the renewal of the permission or approval we have already obtained (if applicable).

JunHe LLP is of the view that:

(a)pursuant to the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) and its relevant notes and five supporting guidelines (each, “Supporting Guideline”), which came into effective on March 31, 2023, PRC-based companies that seek to offer and list securities in overseas markets, either through direct or indirect means, are required to conduct relevant filings with the CSRC.

Furthermore, pursuant to the Circular on the Arrangements for the Filing-based Administration of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures Circular”), companies that have already offered or listed securities overseas prior to the implementation of the Trial Measures be are considered as “Stock Enterprises”, and these Stock Enterprises are not required to apply for filings immediately with CSRC until a re-financing event takes place and then a filing for such re-financing is required.

As our company is considered as a Stock Enterprise, our PRC subsidiaries or the VIEs are not subject to immediate filing requirements under the Trial Measures. However, in the event of our future re-financing in an overseas market (whether on Nasdaq, Hong Kong Stock Exchange or in other overseas market), we will be subject to relevant filing requirements of the CSRC; and

(b)with respect to the regulatory requirements for cyber security and data protection, according to the Cybersecurity Review Measures, which became effective in February 2022, a company is subject to cybersecurity review if it affects or may affect national security and falls under any of the following circumstances: (i) it is a critical information infrastructure operator (“CIIO”), who purchases network products and service, or (ii) it is a network platform operator who carries out data processing activities. In addition, any network platform operator possessing over one million users’ individual information must apply for a cybersecurity review before listing abroad. Relevant PRC regulatory authorities may also initiate cybersecurity review if they determine that certain network products, services, or data processing activities affect or may affect national security.

As of the date of this annual report, none of our company, our subsidiaries or the VIEs has received any notice from the CAC or other PRC regulatory authorities that identifies any of these entities as a CIIO under the Cybersecurity Review Measures, or has been required to go through a cybersecurity review by any PRC authorities. Also, none of our company, our subsidiaries or the VIEs has received any notice from the CAC or other PRC regulatory authorities that investigate our data processing activities or accuses our data processing activities affecting national security.

4

In November 2021, the CAC promulgated the Draft Administrative Regulations on Cyber Data Security, or the Draft Cyber Data Security Regulations, for public comment. These draft regulations set forth different scenarios under which data processors would be required to apply for cybersecurity review, including, among others, (i) merger, reorganization or division of Internet platform operators with significant data resources related to national security, economic development or public interests that affects or may affect national security; (ii) overseas listing of issuers who process over one million users’ personal information; (iii) Hong Kong listing that affects or may affect national security; or (iv) other data processing activities that affect or may affect national security. In addition, data policies and rules and any material amendments thereof of large Internet platform operators with over 100 million daily active users would be evaluated by a third-party organization designated by the CAC and be approved by the respective local branch of cyberspace and telecommunication at the provincial or above level. However, there is no definite timetable as to when these draft regulations will be enacted. As such, none of our company, our PRC subsidiaries or the VIEs is required to obtain approval from CAC.

On July 7, 2022, the CAC issued the Measures for the Security Assessment of Data Cross-border Transfer, or the Security Assessment Measures, which became effective on September 1, 2022. In accordance with the Security Assessment Measures, a data processor should apply to the CAC for a security assessment under certain circumstances, including, among others, (i) where a data processor provides important data abroad; (ii) where a critical information infrastructure operator or a data processor processing personal information of over one million people provides personal information abroad; (iii) where a data processor has provided personal information of 100,000 people or sensitive personal information of 10,000 people in total abroad since January 1 of the previous year; and (iv) other circumstances prescribed by the CAC. Moreover, the Security Assessment Measures provide that for non-compliant cross-border data transfers that had been carried out before this regulation came into effect, rectification must be completed within six months from the effective date of the regulation. The said rectification includes, among others, a self-assessment on the risks of cross-border data transmission. After the completion of rectification, the data processor should file an application with the CAC by submitting materials including, (i) a declaration form; (ii) a self-assessment report on the risks of cross-border data transmission; (iii) the legal documents to be concluded by the data processor and the overseas recipient; and (iv) other materials necessary for security assessment. Since the Security Assessment Measures are relatively new, it remains uncertain whether relevant regulatory authorities will implement this regulation in ways that may negatively affect us.

As of the date of this annual report, we have conducted the self-assessment on the risks of the cross-border data transmission pursuant to the regulation and have filed an assessment filing with the CAC within six months from the effective date of the regulation. As of the date of this annual report, we have received a written confirmation from CAC regarding their receipt of our assessment filing, and we have been informed by the CAC that our filings are conformed to required formalities. However, CAC has not granted us a final written decision on our assessment filing.

On February 22, 2023, the CAC issued the Measures for the Standard Contract for Outbound Transfer of Personal Information, which will become effective on June 1, 2023. Pursuant to PRC law and such regulation, entering into a CAC-formulated Standard Contract with the overseas data recipient is a pre-requisite for a data processor to transfer data abroad, if such data processor meets all the following conditions: (i) it is not a CIIO; (ii) it processes personal information of fewer than one million individuals; (iii) it has cumulatively transferred personal information of fewer than 100,000 individuals abroad since January 1 of the previous year; and (iv) it has cumulatively transferred sensitive personal information of fewer than 10,000 individuals abroad since January 1 of the previous year. Within ten (10) working days after the Standard Contract takes effect, the data processor should file the executed Standard Contract with the CAC. Since such regulation was recently released, it remains uncertain whether relevant regulatory authorities will implement this regulation in ways that may negatively affect us.

There remains uncertainty as to how current or future relevant rules published by the CSRC and the CAC will be interpreted or implemented, and the opinions summarized above are subject to new laws, rules and regulations and/or detailed implementations and interpretations. In addition, PRC laws and regulations governing the conditions and the requirements of such approval are uncertain, and the relevant regulatory authorities have broad discretion in interpreting these laws and regulations. Accordingly, the PRC regulatory authorities may take a different view than what is described above. PRC regulatory authorities that regulate our business and other participants in our industry may not agree that our corporate structure or any of the above contractual arrangements comply with PRC licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future.

5

Furthermore, under current PRC laws, regulations and regulatory rules, our PRC subsidiaries or VIEs may be required to obtain permissions from the CSRC, and may be required to go through cybersecurity review by the CAC, in connection with any offering and listing in an overseas market. If we fail to obtain the relevant approval or complete other review or filing procedures for any future offshore offering or listing, we may face sanctions by the CSRC or other PRC regulatory authorities, which could include fines and penalties on our operations in China, limitations on our operating privileges in China, restrictions on or prohibition of the payments or remittance of dividends by our subsidiaries in China, restrictions on or delays to our financing transactions offshore, or other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ADSs.

The PRC regulators have recently indicated an intent to exert more oversight over offerings that are conducted overseas and/or foreign investment in China-based issuers. For more detailed information, see “—D. Risk Factors—Risks Related to Doing Business in China—Recent regulatory developments in China may subject us to additional regulatory review and disclosure requirements, expose us to government influence, or otherwise restrict or completely hinder our ability to offer securities and raise capital outside China, which could adversely affect our business operations and cause the value of our securities to significantly decline or become worthless.”

Risks and Uncertainties Relating to Doing Business in China

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934 (the “Exchange Act”), and as such we are exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers. Moreover, the information we are required to file with or furnish to the Securities and Exchange Commission (the “SEC”) will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. In addition, as a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the Nasdaq corporate governance standards. These practices may afford less protection to shareholders than they would enjoy if we complied fully with the Nasdaq corporate governance standards.

We face various legal and operational risks and uncertainties as China is one of our major markets. We are subject to risks arising from the uncertainty in the interpretation and the enforcement of the PRC laws and regulations. In addition, rules and regulations in China can change quickly with little advance notice. In recent years, Chinese regulators have announced regulatory actions targeting certain sectors of China’s economy, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, adopting new laws and regulations related to data security, and expanding the efforts in anti-monopoly enforcement. Although the lodging industry does not appear to be the focus of these regulatory actions, we cannot guarantee that the Chinese regulators will not in the future take regulatory actions that materially adversely affect the business environment and financial markets in China as they relate to us, our ability to operate our business, our liquidity and our access to capital.

Our Holding Company Structure and Operations in China

Holders of our ADSs do not hold equity interest in our operating subsidiaries, the Consolidated Affiliated Entities or the Consolidated Fund, but instead hold equity interest in H World Group Limited, a Cayman Islands holding company whose consolidated financial results include those of the Consolidated Affiliated Entities and the Consolidated Fund under U.S. GAAP. Our securities that are listed on the NASDAQ Global Select Market and the Hong Kong Stock Exchange are securities of our Cayman Islands holding company, not of our operating subsidiaries or the VIEs.

H World Group Limited is a Cayman Islands holding company that conducts its business primarily through its subsidiaries, a majority of which are based in China and Europe, and for some businesses (including internet-based and international travel agency businesses), the direct holding of which is restricted by PRC law, through the Consolidated Affiliated Entities. Neither H World Group Limited nor its subsidiaries directly own any equity interest in the Consolidated Affiliated Entities. Instead, H World Group Limited relies on contractual arrangements among one of its PRC subsidiaries, the Consolidated Affiliated Entities and the Consolidated Affiliated Entities’ respective nominee shareholders, which allow H World Group Limited, to the extent permitted by PRC law, to:

| (i) | direct the activities of the Consolidated Affiliated Entities that most significantly impact the Consolidated Affiliated Entities’ economic performance; |

| (ii) | receive substantially all of the economic benefits of the Consolidated Affiliated Entities; and |

6

| (iii) | have an exclusive option to purchase all or part of the equity interests in the Consolidated Affiliated Entities. |

In addition, we serve as the general partner and the fund manager of the Consolidated Fund, which comprises an investment fund and its subsidiary established in the PRC that operate hotel businesses and invest in companies in the hotel industry. While we have a minority equity ownership in the Consolidated Fund, the Consolidated Fund’s partnership arrangement enables us to direct the activities that most significantly affect the economic performance of the entities comprising the Consolidated Fund, as well as receive significant economic benefits of these entities.

As a result of these arrangements, we have control over and are the primary beneficiary of the VIEs (composed of the Consolidated Affiliated Entities and the Consolidated Fund) for accounting purposes and, therefore, we have consolidated the financial results of the VIEs in our consolidated financial statements in accordance with U.S. GAAP. Any references to control or benefits that accrue to us because of the VIEs in this annual report are limited to, and subject to conditions for consolidation of, the VIEs under U.S. GAAP.

The contractual arrangements underlying our VIE model, including our arrangements with the Consolidated Affiliated Entities and Consolidated Fund, have not been tested in court. There is no entry restriction on foreign investment in the business operated by the Consolidated Fund. However, the Special Administrative Measures for Access of Foreign Investment, or the Negative List (2021 Edition) (as issued by the National Development and Reform Commission, or the NDRC, and the Ministry of Commerce, or MOFCOM, and amended from time to time), and other applicable PRC laws and regulations (including the Regulations on Travel Agencies (Revised in 2020)), prohibit direct foreign investment in certain international travel agency businesses and restrict direct foreign investment in certain internet-based businesses. Due to these regulatory restrictions on direct foreign investment, we conduct relevant operations through contractual arrangements with the Consolidated Affiliated Entities, which hold the licenses, permits and approvals that are necessary for operating relevant restricted businesses in the PRC.

The financial impacts of these VIEs were immaterial to our historical consolidated financial statements. The VIEs in aggregate contributed an insignificant portion (less than 1%) of our total revenues and total net profit (loss) in each of the fiscal years ended December 31, 2020, 2021 and 2022 and the impact of the VIEs to our consolidated balance sheets as of December 31, 2020, 2021 and 2022 were also immaterial (in aggregate contributing less than 1% of our total assets as of these respective dates). If the PRC regulatory authorities deem that any of our business operations carried out through the VIEs do not comply with PRC regulatory restrictions, especially the restrictions on foreign investment in the relevant industries, or if the relevant regulations or their interpretation change in the future, the PRC regulatory authorities could disallow this structure, which could result in us being subject to penalties or being forced to relinquish its interests in the affected operations. Additionally, potential future actions by the PRC regulatory authorities could affect the legality and enforceability of the contractual arrangements underlying the VIE model, which, consequently, would affect our ability to consolidate the financial results of the VIEs. If any of these happens, there would likely be changes in our operations and/or changes in the value of the securities of the investors. In the worst circumstances, if the contribution from VIEs becomes significant to our operations and the VIE model does not comply with PRC laws and regulations, such changes could cause the value of our securities to significantly decline or become worthless. For more information, see “—D. Risk Factors—Risks Related to Our Corporate Structure” below in this annual report.

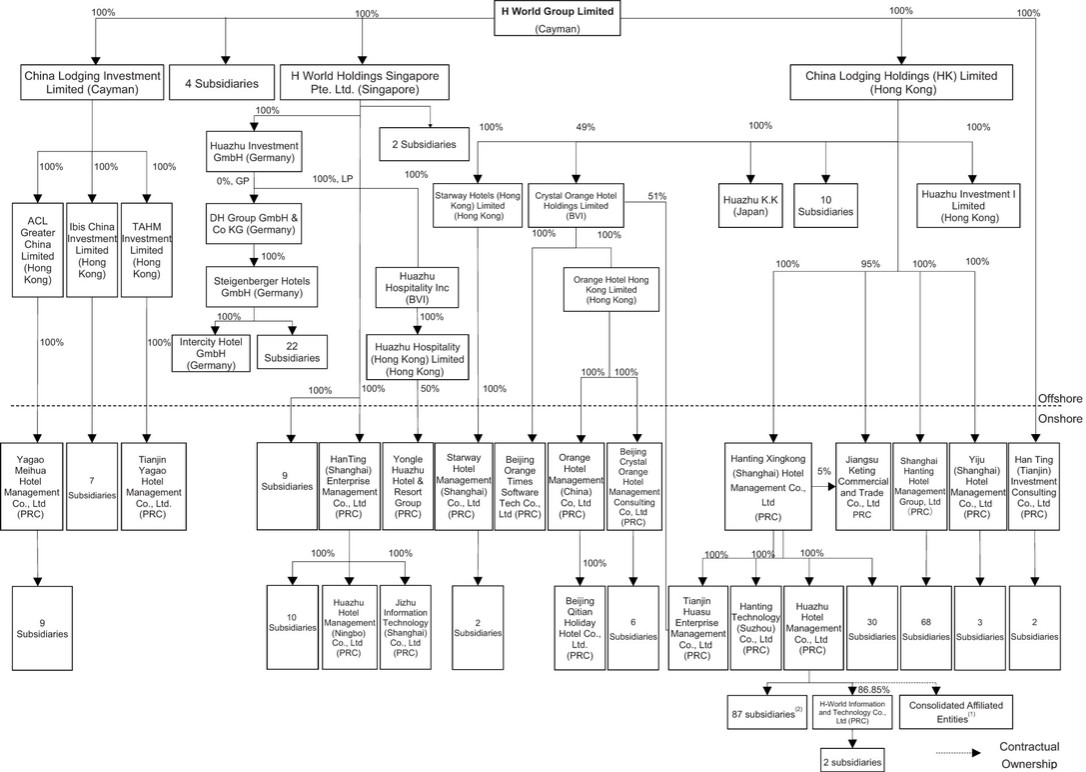

For our corporate structure as of the date of this annual report, including our significant subsidiaries and the VIEs, see “Item 4. Information on the Company—4.C. Organizational Structure” below in this annual report.

7

Recent Regulatory Developments

Cyber Security Review and Data Privacy Regulations

Recently, the PRC regulatory authorities have promulgated, among others, the Personal Information Protection Law of the PRC, the Data Security Law of the PRC and the Draft Amendment to Cyber Security Law of the PRC for public comments to ensure cybersecurity, data and personal information protection. These new laws, as well as other proposed regulations, demonstrate that relevant laws and regulations governing these areas are developing along with the enforced and constantly tightening of relevant regulatory supervision. The State Council of the PRC promulgated the Regulations on the Protection of the Security of Critical Information Infrastructure on July 30, 2021, which took effect on September 1, 2021. This regulation requires, among other things, that certain competent authorities identify and protect critical information infrastructures. In addition, in November 2021, the CAC promulgated the Draft Cyber Data Security Regulations for public comments, which set forth different scenarios where data processors should apply for cybersecurity review. The CAC and a number of other departments under the State Council promulgated the Cybersecurity Review Measures on December 28, 2021, which became effective on February 15, 2022. According to this regulation, critical information infrastructure operators purchasing network products and services and network platform operators carrying out data processing activities, which affect or may affect national security, are required to conduct cybersecurity review. On July 7, 2022, the CAC issued the Security Assessment Measures, which became effective on September 1, 2022 and require a data processor to apply to the CAC for a security assessment under certain circumstances. On February 22, 2023, the CAC issued the Measures for the Standard Contract for Outbound Transfer of Personal Information, which requires a data processor to enter into Standard Contracts under certain circumstances. See “—Permits and Permission Required from the PRC Authorities for Our Operations” above in this annual report for more information.

On September 1, 2021, the Data Security Law of the PRC became effective, which imposes data security and privacy obligations on entities and individuals conducting data-related activities, and introduces a data classification and hierarchical protection system. In addition, the Standing Committee of the National People’s Congress promulgated the Personal Information Protection Law of the PRC (the “PIPL”) on August 20, 2021, and this law took effect on November 1, 2021. The PIPL further emphasizes processors’ obligations and responsibilities for personal information protection and sets out the basic rules for processing personal information and the rules for cross-border provision of personal information. Furthermore, the Standing Committee of the National People’s Congress promulgated the Draft Amendment to Cyber Security Law (the “CSL”) for public comments on September 12, 2022. The proposed amendments of CSL imposed more severe and comprehensive fines and other penalties for offences under CSL, among others, the director, supervisor, or senior executive of a company that is in violation of the CSL would be prohibited from continuing to serve as a director, supervisor, or senior executive of that company. Under the Draft Cyber Data Security Regulations for public comments, critical data processors or foreign-listed data processors are required to carry out annual data security evaluations and submit evaluation reports to the municipal cyberspace administration authority. We have implemented comprehensive cybersecurity and data protection policies, procedures and measures to safeguard personal information and ensure secured storage and transmission of data and prevent unauthorized access or use of data. However, we cannot guarantee that the regulators will agree with us or will not in the future adopt new laws and regulations that restrict our business operations.

There are uncertainties as to the interpretation and application of these cybersecurity and data privacy laws, regulations and standards, and they may be interpreted and applied in a manner that is inconsistent with our current policies and practices or require changes to the features of our data systems. If the CAC or other regulatory agencies later deem us to be a CIIO and require that we obtain their approvals for our future offshore offerings, we may be unable to obtain such approvals in a timely manner, or at all, and such approvals may be rescinded even if obtained. Any such circumstance could significantly limit or completely hinder our ability to continue to offer securities to investors and cause the value of our securities to significantly decline or be worthless. In addition, implementation of industry-wide regulations affecting our business operations could limit our ability to attract new customers and/or users and cause the value of our securities to significantly decline. Therefore, investors of our company and our business face potential uncertainties from actions taken by the PRC regulatory authorities affecting our business.

Potential CSRC Filings on Overseas Listing

On February 17, 2023, the CSRC promulgated the Trial Measures and relevant notes and Supporting Guidelines, which came into effective on March 31, 2023.

8

The Trial Measures seek to regulate all types of overseas offerings and listings by PRC based companies, including: (a) direct overseas listings, i.e. overseas listings by joint-stock companies which are established in PRC (such as H shares, N shares, GDRs); and (b) indirect overseas listings, i.e. overseas listings by PRC based companies in the names of an overseas entity (such as red-chip listings), if such issuers meets both of the following conditions: (i) more than 50% of its audited financial indicators (either operating revenue, profits, total assets or net assets) for the most recent accounting year is accounted for by its PRC-based companies, and (ii) major business activities or operations are conducted within the territory of PRC; main places of business are located within the territory of the PRC; or the majority of senior management staff domicile in the PRC or are Chinese citizens.

The Trial Measures does not only govern initial public offerings (the “IPOs”), but also governs spin-off listings, single or multiple acquisitions of domestic assets, share swaps or transfer of shares, reverse takeovers, SPAC listings, subsequent issuances of securities, secondary listings or dual listing, etc. In addition to offering and listing of shares, offering and listing of depository receipts, corporate bonds convertible to shares, and other equity securities by PRC-based companies shall also be subject to the filing requirements under the Trial Measures.

The Trial Measures and Supporting Guidelines require PRC-based companies that seek overseas offerings and listings to fulfill the filing procedures with and report relevant information to the CSRC, specifically: (a) for an IPO, the filing with CSRC shall be conducted within three (3) working days following the submission of the application; (b) for a subsequent issuance of securities, the filing shall be conducted within three (3) working days following the completion of the offering; (c) for the listings in other stock markets (e.g. secondary listings or dual listings), the same filing timeline applied to an IPO shall apply; (d) for the listing of assets via multiple acquisitions, share swaps, transfers of shares (e.g. reverse takeover), the same filing timeline applied to an IPO shall apply; (e) for the unlisted shares of PRC Companies applying for conversion to listed shares trading on overseas market, the filings shall be conducted pursuant to the other regulations.

Furthermore, an overseas offering and listing would be prohibited under the following circumstances: (a) it is explicitly prohibited under applicable laws and administrative regulations; (b) there exists national security concerns as reviewed and determined by competent authorities under the State Council; (c) a crime has been committed by the issuer’s PRC-based company, its controlling shareholder(s) or actual shareholder(s) in the last three (3) years (e.g. corruption, bribery, embezzlement, misappropriation of property or undermining the market economy orders); (d) the issuer’s PRC-based company is under investigations for criminal acts or major violations of applicable laws and regulations, and no conclusion of the investigation has yet been made; and (e) there exists material ownership disputes over equity interests held by controlling shareholders (or by shareholders who are controlled by the controlling shareholder or actual controllers). If there exists any of the aforementioned circumstances, the overseas offerings and listings shall be postponed or even terminated.

Specifically, if an issuer adopts a VIE structure for the purpose of overseas offering and listing, it shall disclose relevant contractual arrangements to the CSRC through fillings. The Supporting Guidance also provides that PRC counsel needs to verify the following issues, including (i) the participation of foreign investors in the issuer management operation, for example, the appointment of directors; (ii) whether there exist situations where PRC laws and administrative regulations expressly prohibit the use of contractual arrangements to retain business licenses and qualifications, etc.; (iii) whether there exist situations where the PRC operating entity of the issuer falls under the scope of foreign investment security review, or within the restricted or prohibited sectors of foreign investment.

Despite the foregoing, pursuant to the Trial Measures Circular, companies that have already offered shares or been listed overseas prior to the implementation of the Trial Measures will be considered as “Stock Enterprises”. Stock Enterprises are not required to apply for filings until a subsequent re-financing event occurs.

As our company is considered as a Stock Enterprise, our PRC subsidiaries and the VIEs are not subject to the immediate filing requirements under the Trial Measures. However, in the events of any re-financing in the future, such as subsequent share issuance, our company will be subject to the relevant filing requirements pursuant to the Trial Measures.

9

As of the date of this annual report, we have not received any inquiry, notice, warning, sanctions or regulatory objection from the CSRC or the CAC. Because these regulatory actions are relatively new, it is uncertain how soon legislative or regulatory bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operation, our ability to accept foreign investments and listing on a U.S. or other overseas exchanges. PRC laws and their interpretations and enforcement continue to develop and are subject to change, and the PRC regulators may adopt other rules and restrictions in the future. See “—D. Risk Factors—Risks Related to Doing Business in China” below for more details.

The Holding Foreign Companies Accountable Act

Our financial statements contained in this annual report have been audited by Deloitte Touche Tohmatsu Certified Public Accountants LLP, an independent registered public accounting firm that is headquartered in Shanghai, China with offices in other cities in China. It is a firm registered with the U.S. Public Company Accounting Oversight Board, or PCAOB, and is required by the laws of the U.S. to undergo regular inspections by the PCAOB to assess its compliance with the laws of the U.S. and professional standards. According to Article 177 of the PRC Securities Law which became effective in March 2020, the securities regulatory authority of the State Council may establish a regulatory cooperation mechanism with the securities regulatory authorities of another country or region, to implement cross-border supervision and administration, or the Regulatory Cooperation Mechanism; no overseas securities regulator is allowed to directly conduct investigation or evidence collection activities within the territory of the PRC. Accordingly, without a Regulatory Cooperation Mechanism or the consent of the competent PRC securities regulators and relevant authorities, no organization or individual may provide the documents and materials relating to securities business activities to overseas parties.

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. The HFCA Act states if the SEC determines that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit such securities from being traded on a national securities exchange or in the over the counter trading market in the U.S. The SEC has adopted rules to implement the HFCA Act and, pursuant to the HFCA Act, the PCAOB issued a report notifying the SEC of its determinations on December 16, 2021 that it was unable to inspect or investigation completely accounting firms headquartered in mainland China or Hong Kong, including our auditor Deloitte Touche Tohmatsu Certified Public Accountants LLP. We were also conclusively identified as a “Commission-Identified Issuer” under the HFCA Act on May 26, 2022 in respect of our Annual Report for 2021 on Form 20-F filed on April 27, 2022. Further, on December 29, 2022, the Accelerating Holding Foreign Companies Accountable Act, or the AHFCA Act, was signed into law by the U.S. president as part of the fiscal year 2023 omnibus spending legislation, which reduced the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. As a result, the risk has been heightened.

On August 26, 2022, the PCAOB signed a Statement of Protocol with the CSRC and the Ministry of Finance of the PRC, taking a first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in Mainland China and Hong Kong. On December 15, 2022, the PCAOB announced its determination that it has been able to inspect and investigate audit firms in mainland China and Hong Kong completely for purposes of the HFCA Act, and the PCAOB vacated its December 16, 2021 determinations. Based on this announcement, we do not expect to be a Commission-Identified Issuer in respect of this annual report for 2022 on Form 20-F. However, the PCAOB stated that should PRC authorities obstruct the PCAOB’s ability to inspect or investigate completely in any way and at any point in the future, the PCAOB Board will act immediately to consider the need to issue new determinations consistent with the HFCA Act. While we currently do not expect the HFCA Act or the AHFCA Act to prevent us from maintaining the trading of our ADSs in the U.S., uncertainties exist with respect to future determinations of the PCAOB in this respect and any further legislative or regulatory actions to be taken by the U.S. or Chinese regulatory authorities that could affect our listing status in the U.S.

The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. See “—D. Risk Factors—Risks Related to Doing Business in China—If the PCAOB is unable to inspect our auditors as required under the HFCA Act, the SEC will prohibit the trading of our ADSs, which may materially and adversely affect the value of your investment” in this annual report for more details.

3.A. Selected Financial Data

[Reserved]

10

3.B. Capitalization and Indebtedness

Not applicable.

3.C. Reason for the Offer and Use of Proceeds

Not applicable.

3.D. Risk Factors

An investment in our ADSs involves risks. You should carefully consider the risks described below, as well as the other information included or incorporated by reference in this annual report, before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The market or trading price of our ADSs could decline due to any of these risks, and you may lose all or part of your investment. In addition, the risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. Please note that additional risks not presently known to us, that we currently deem immaterial or that we have not anticipated may also impair our business and operations.

Risk Factor Summary

Risks Related to Our Business

| ● | Our operating results are subject to conditions affecting the lodging industry in general; |

| ● | Our business is sensitive to Chinese, European and global economic conditions. A severe or prolonged downturn in the Chinese, European or global economy could materially and adversely affect our revenues and results of operations; |

| ● | The lodging industries in China and Europe are competitive, and if we are unable to compete successfully, our financial condition and results of operations may be harmed; |

| ● | The COVID-19 outbreak has adversely affected, and may continue to adversely affect, our financial and operating performance; |

| ● | Seasonality of our business and national or regional special events may cause fluctuations in our revenues, cause our ADS or ordinary share price to decline, and adversely affect our profitability; |

| ● | We may not be able to manage our planned growth, which could adversely affect our operating results; |

| ● | Failure to comply with data protection laws or maintain the integrity of internal or customer data could result in harm to our reputation or subject us to costs, liabilities, fines or lawsuits; and |

| ● | We, our directors, management and employees may be subject to certain risks related to legal proceedings filed by or against us, and adverse results may harm our business. |

Risks Related to Doing Business in China

| ● | We are subject to many of the economic and political risks associated with emerging markets due to our operations in China; |

| ● | Inflation in China may disrupt our business and have an adverse effect on our financial condition and results of operations; |

| ● | Developments in the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us; |

11

| ● | Recent regulatory developments in China may subject us to additional regulatory review and disclosure requirements, expose us to government influence, or otherwise restrict or completely hinder our ability to offer securities and raise capital outside China, which could adversely affect our business operations and cause the value of our securities to significantly decline or become worthless; |

| ● | If the PCAOB is unable to inspect our auditors as required under the HFCA Act, the SEC will prohibit the trading of our ADSs, which may materially and adversely affect the value of your investment; and |

| ● | Proceedings instituted by the SEC against the Big Four PRC-based accounting firms, including our independent registered public accounting firm, could result in financial statements being determined to not be in compliance with the requirements of the Exchange Act. |

Risks Related to Our Corporate Structure

| ● | H World Group Limited is a Cayman Islands holding company. As a result, you may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management based on foreign laws; |

| ● | Revenue and assets contributions from the Consolidated Affiliated Entities have not been material. Nonetheless, if the PRC regulatory authorities deem that the contractual arrangements in relation to the Consolidated Affiliated Entities do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, our ordinary shares and ADSs may decline in value if we are unable to assert our contractual control rights over the assets of the Consolidated Affiliated Entities; |

| ● | We rely in part on contractual arrangements with each of the Consolidated Affiliated Entities and their respective nominee shareholders to operate certain restricted business. These contractual arrangements may not be as effective as direct ownership in providing operational control and otherwise have a material adverse effect as to our business; |

| ● | If we exercise the option to acquire equity ownership of the Consolidated Affiliated Entities, the ownership transfer may subject us to certain limitations and substantial costs; |

| ● | The nominee shareholders of the Consolidated Affiliated Entities may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition; |

| ● | If the custodians or authorized users of our controlling non-tangible assets, including chops and seals, fail to fulfill their responsibilities, or misappropriate or misuse these assets, our business and operations may be materially and adversely affected; and |

| ● | Uncertainties exist with respect to the interpretation and implementation of the Foreign Investment Law and its implementing rules and how they may impact our business, financial condition and results of operations. |

Risks Related to our ADSs, ordinary shares and Our Trading Market

| ● | The market prices for our ADSs and/or ordinary shares has been and may continue to be volatile; |

| ● | An active trading market for our ordinary shares on the Hong Kong Stock Exchange might not be sustained and trading prices of our ordinary shares might fluctuate significantly; |

| ● | If securities or industry analysts do not continue to publish research or if they publish inaccurate or unfavorable research about our business, the market prices and trading volume for our ADSs and/or ordinary shares could decline; |

| ● | Techniques employed by short sellers may drive down the market prices of the ADSs and/or ordinary shares; |

12

| ● | We may need additional capital, and the sale of additional ADSs, ordinary shares or other equity securities could result in additional dilution to our shareholders and the incurrence of additional indebtedness could increase our debt service obligations; |

| ● | As our founder and co-founders collectively hold a controlling interest in us, they have significant influence over our management and their interests may not be aligned with our interests or the interests of our other shareholders; and |

| ● | There is uncertainty as to whether Hong Kong stamp duty will apply to the trading or conversion of our ADSs. |

Risks Related to Our Business

Our operating results are subject to conditions affecting the lodging industry in general.

Our operating results are subject to conditions typically affecting the lodging industry, which include:

| ● | changes and volatility in national, regional and local economic conditions in China, Europe and other countries and regions where we operate; |

| ● | competition from other hotels, the attractiveness of our hotels to customers, and our ability to maintain and increase sales to existing customers and attract new customers; |

| ● | adverse weather conditions, natural disasters or travelers’ fears of exposure to contagious diseases and social unrest; |

| ● | changes in travel patterns or in the desirability of particular locations; |

| ● | increases in operating costs and expenses due to inflation and other factors; |

| ● | local market conditions such as an oversupply of, or a reduction in demand for, hotel rooms; |

| ● | the quality and performance of managers and other employees of our hotels; |

| ● | the availability and cost of capital to fund construction and renovation of, and make other investments in, our hotels; |

| ● | seasonality of the lodging business and national or regional special events; |

| ● | the possibility that leased properties may be subject to challenges as to their compliance with the relevant government regulations; and |

| ● | maintenance and infringement of our intellectual property. |

Changes in any of these conditions could adversely affect our occupancy rates, average daily room rates and RevPAR, or otherwise adversely affect our results of operations and financial condition.

Our business is sensitive to Chinese, European and global economic conditions. A severe or prolonged downturn in the Chinese, European or global economy could materially and adversely affect our revenues and results of operations.

Our business and operations are primarily based in China as well as in Europe. We depend on domestic business and leisure travel customers in China for a significant majority of our revenues, and we also derive a relatively large portion of our revenues from Europe following our acquisition of Deutsche Hospitality on January 2, 2020. Accordingly, our financial results have been, and we expect will continue to be, affected by developments in the economies and travel industries primarily of China as well as those of Europe.

13

As the travel industry is highly sensitive to business and personal discretionary spending levels, it tends to decline during general economic downturns. A prolonged slowdown in the Chinese economy could erode consumer confidence which could result in changes to consumer spending patterns for travel and lodging-related products and services. The European hotel industry is also significantly affected by European countries’ economic growth. While the European hotel industry demonstrated stable growth from 2015 to 2019, its growth rate slowed down from 2020 to 2021 due to the impact of COVID-19 and gradually recovered since early 2022.

The global financial markets experienced significant disruptions in 2008 and the United States, Europe and other economies went into recession. The recovery from the lows of 2008 and 2009 was uneven and it is facing new challenges, including sanctions against Russia over the Ukraine crisis since 2014, shadows of international terrorism spread by Islamic State of Iraq and al-Sham, which has been particularly intensified since the Paris terror attacks in November 2015, the impact of the election of Donald Trump as former President of the United States and the tax reform that he subsequently signed into law, the trade war between the United States and China and the Syrian airstrike in 2018, the tension between the United States and Iran in 2019, the impact of the United Kingdom leaving the European Union (the “EU”), the outbreak of COVID-19, and the tension between China and the United States over the Taiwan strait due to the U.S House Representative’s visit to Taiwan in August 2022. In addition, conflicts between the United States and China have extended to multiple areas, which could place further pressure on China’s economic growth. For example, the U.S. government imposed economic and trade sanctions directly or indirectly affecting China-based technology companies. Such laws and regulations are likely subject to frequent changes, and their interpretation and enforcement involves substantial uncertainties, which may be heightened by national security concerns or driven by political and/or other factors that are out of our control. In addition, the SEC has issued statements primarily focused on companies with significant China-based operations, such as us. All of these events have introduced uncertainties to the geopolitical situations and the global economic outlook. There is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies that have been adopted by China. On the other hand, after a sustained period of low interest rates, interest rates have risen significantly in the U.S. and Europe since 2022. There are expectations that interest rates will continue to rise in 2023 as the U.S. Federal Reserve seeks to combat inflation. The combination of rising interest rates and inflation has resulted in significant market volatility and economic uncertainty. There have also been concerns over unrest in the Middle East and Africa, which have resulted in significant market volatility, and over the possibility of a war involving Iran or North Korea. Furthermore, eruptions of regional tensions, such as the ongoing military conflict involving Ukraine and Russia, and the related sanctions against Russia have resulted in major economic shocks worldwide and substantial volatility across global financial markets. Moreover, there have been concerns about the economic effect of the earthquake, tsunami and nuclear crisis in Japan and the tensions between Japan and its neighboring countries. Economic conditions in China and Europe are sensitive to global economic conditions.

It is unclear whether the above challenges will be contained or resolved and what effects they may have. Any prolonged slowdown in the Chinese, European or global economy may have a negative impact on our business, results of operations and financial condition, and continued turbulence in the international markets may adversely affect our ability to access the capital markets to meet liquidity needs.

The lodging industries in China and Europe are competitive, and if we are unable to compete successfully, our financial condition and results of operations may be harmed.

The lodging industries in China and Europe are highly fragmented. As a multi-brand hotel group, we believe that we compete primarily based on location, room rates, brand recognition, quality of accommodations, geographic coverage, service quality, range of services, guest amenities and convenience of the central reservation system. We primarily compete with other hotel groups as well as various independent hotels in each of the markets in which we operate, including Chinese hotel groups such as BTG Homeinns and Jinjiang, as well as international hotel groups such as Marriott, Intercontinental, Accor and Hilton. We also face competitions from lodging products offered on platforms such as Airbnb and service apartments. New and existing competitors may offer more competitive rates, greater convenience, services or amenities or superior facilities, which could attract customers away from our hotels and result in a decrease in occupancy rates and average daily room rates of our hotels. Competitors may also outbid us for new leased hotel conversion sites, negotiate better terms for potential manachised or franchised hotels or offer better terms to our existing franchisees in connection with our manachised or franchised hotels, thereby slowing our anticipated pace of expansion. Furthermore, our typical guests may change their travel, spending and consumption patterns and choose to stay in other kinds of hotels, especially given the increase in our hotel room rates to keep pace with inflation. Even if our peers cannot outcompete us, any increasing supply of hospitality assets in the areas we operate could negatively affect our operational and financial results. Any of these factors may have an adverse effect on our competitive position, results of operations and financial condition.

14

The COVID-19 outbreak has adversely affected, and may continue to adversely affect, our financial and operating performance.

In December 2019, COVID-19 was reported to have surfaced in Wuhan, China, which subsequently spread throughout China. On January 31, 2020, the World Health Organization declared COVID-19 as a Public Health Emergency of International Concern. The travel industry has been severely affected by the outbreak of COVID-19 since the beginning of 2020 due to the reduced traveler traffic. During the COVID-19 pandemic, government authorities around the world have imposed widespread lockdowns, closure of workplaces and restrictions on mobility and travel to contain the spread of the virus. These containment measures negatively affected occupancy rates and revenue of our hotels (including both leased and owned hotels and manachised and franchised hotels). Since the outbreak of COVID-19, we have taken various cost and cash flow mitigation measures to counter the negative impact of COVID-19 on our results of operations. Despite these efforts, our business operations and results in 2020, 2021 and 2022 were adversely affected by COVID-19. Due to the impact of COVID-19, we experienced operating losses and closed down certain of our hotels in 2020, 2021 and 2022.

China has significantly eased its COVID-19 control measures. While we believe that these actions have boosted consumers’ willingness to travel and demand for lodging, uncertainties still exist with respect to the effect of these measures on our business and results of operations. In addition, we cannot guarantee that the regulatory authorities in jurisdictions where we operate will not re-adopt control measures, such as travel restrictions and quarantine requirements, to combat the pandemic (including any new variant), which could slow down the recovery of our industry. Any significant decline in revenues for our hotels also increases the probability that franchisees will be unable to fund working capital and to repay or refinance indebtedness, which may cause our franchisees to declare bankruptcy. Such bankruptcies may result in termination of our franchise agreements and eliminate our anticipated income and cash flows. Moreover, bankrupted franchisees may not have sufficient assets to pay termination fees, other unpaid fees, reimbursements or unpaid loans owed to us.

As the COVID-19 pandemic continues to develop worldwide, its overall impact on our business, liquidity and results of operations remains uncertain. Moreover, COVID-19 has not been eliminated and new variants may develop. While vaccines for COVID-19 are being and have been developed, there is no guarantee that vaccines will continue to work as expected or be made available or will be accepted on a significant scale and in a timely manner. Furthermore, future variants of COVID-19 could also prove to be more resistant to vaccines and other mitigation measures. The potential downturn brought by and the duration of the COVID-19 pandemic may be difficult to assess or predict where actual effects will depend on many factors beyond our control. To the extent COVID-19 adversely affects our business, financial condition and results of operations, it may also heighten some of the other risks described under the heading “Risk Factors” in this annual report.

Seasonality of our business and national or regional special events may cause fluctuations in our revenues, cause our ADS or ordinary share price to decline, and adversely affect our profitability

The lodging industry is subject to fluctuations in revenues due to seasonality and national or regional special events. The seasonality of our business may cause fluctuations in our quarterly operating results. Generally, the first quarter, in which both the New Year and Spring Festival holidays fall, accounts for a lower percentage of our annual revenues than other quarters of the year. Our hotels in China typically have a lower RevPAR in the fourth quarter, as compared to the second and third quarters, due to reduced travel activities in winter, though some of our European hotels may recognize higher sales in the fourth quarter as a result of more trade fairs and corporate events. In addition, national or regional special events that attract large numbers of people to travel may also cause fluctuations in our operating results in particular for the hotel locations where those events are held. Therefore, you should not rely on our operating or financial results for prior periods as an indication of our results in any future period. As our revenues may vary from quarter to quarter, our business performance is difficult to predict and our quarterly results could fall below investor expectations, which could cause our ordinary share and/or ADS prices to decline. Furthermore, the ramp-up process of our new hotels can be delayed during the low season, which may negatively affect our revenues and profitability.

Our relatively limited operating history makes it difficult to evaluate our future prospects and results of operations.

Our operations commenced in 2005, when we launched our HanTing Hotel brand. See “Item 4. Information on the Company — A. History and Development of the Company.” Accordingly, you should consider our future prospects in light of the risks and challenges encountered by a company with a relatively limited operating history. These risks and challenges include:

| ● | continuing our growth while trying to achieve and maintain our profitability; |

15

| ● | preserving and enhancing our competitive position in the lodging industry in China, Europe and other countries and regions where we operate; |

| ● | offering innovative products to attract recurring and new customers; |

| ● | implementing our strategy and modifying it from time to time to respond effectively to competition and changes in customer preferences and needs; |

| ● | increasing awareness of our brands and products and continuing to develop customer loyalty; |

| ● | attracting, training, retaining and motivating qualified personnel; |

| ● | renewing leases for our leased hotels on commercially viable terms after the initial lease terms expire; and |

| ● | continuing to attract franchisees to our network. |

If we are unsuccessful in addressing any of these risks or challenges, our business may be materially and adversely affected.

Our new leased and owned hotels typically incur significant pre-opening expenses during their development stages and generate relatively low revenues during their ramp-up stages, which may have a significant negative impact on our financial performance.

The operation of each of our leased and owned hotels goes through three stages: development, ramp-up and mature operations. During the development stage, leased and owned hotels do not generate any revenue, and incur pre-opening expenses generally ranging from approximately RMB1.5 million to RMB20.0 million per hotel. During the ramp-up stage, when the occupancy rate is relatively low, revenues generated by these hotels may be insufficient to cover their operating costs, which are relatively fixed in nature. As a result, these newly opened leased and owned hotels may not achieve profitability during the ramp-up stage. As we continue to expand our leased and owned hotel portfolio, the significant pre-opening expenses incurred during the development stage and the relatively low revenues during the ramp-up stage of our newly opened leased and owned hotels may have a significant negative impact on our financial performance. Moreover, we plan to develop more midscale and upscale leased and owned hotels in the future with relatively higher pre-opening expenses, especially rent, which may lead to a more evident negative impact on our financials. In addition, we must maintain our hotels’ conditions and may upgrade a certain number of our hotels, which requires renovation and other improvements to our hotels from time to time. Hotels under renovation may need to be closed partially or entirely or otherwise be seriously disrupted due to the renovations, which could adversely affect the hotels’ revenues.

A significant portion of our costs and expenses may remain at the same level or increase even if our revenues decline, which would adversely affect our net margins and results of operations.

A significant portion of our operating costs, including rent and depreciation and amortization, is fixed. Accordingly, a decrease in revenues could result in a disproportionately higher decrease in our earnings because our operating costs and expenses are unlikely to decrease proportionately. For example, the New Year and Spring Festival holiday periods generally account for a lower portion of our annual revenues than other periods. However, our expenses do not vary as significantly with changes in occupancy and revenues as we need to continue to pay rent and salary and to make regular repairs, maintenance and renovations and invest in other capital improvements throughout the year to maintain the attractiveness of our hotels. Our property development and renovation costs may increase as a result of increasing costs of materials. However, we may have a limited ability to pass increased costs to customers through room rate increases. Therefore, our costs and expenses may remain constant or increase even if our revenues decline, which would adversely affect our net margins and results of operations.

We may not be able to manage our planned growth, which could adversely affect our operating results.

Our hotel group has been growing rapidly since we commenced our business of operating and managing a multi-brand hotel group.

16

We intend to continue developing and operating additional hotels in different geographic locations in China and overseas. Such expansions have placed, and will continue placing, substantial demands on our managerial, operational, technological and other resources. Our planned expansion will also require us to maintain the consistency of our products and the quality of our services to ensure that our business does not suffer as a result of any deviations, whether actual or perceived, in our quality standards. In order to manage and support our growth, we must continue improving our existing operational, administrative and technological systems and our financial and management controls, and recruit, train and retain qualified hotel management personnel as well as other administrative and sales and marketing personnel, particularly as we expand into new markets. We cannot assure you that we will be able to effectively and efficiently manage the growth of our operations, recruit and retain qualified personnel and integrate new hotels into our operations. Our inability to anticipate the changing demands that expanding operations will impose on our management and information and operational systems, or our failure to quickly adapt our systems and procedures to the new markets, could result in declines of revenues and increases in expenses or otherwise harm our results of operations and financial condition.