Suite 1240, 1140 West Pender Street

Vancouver, British Columbia, V6E 4G1

Tel: (604) 681-8030 Fax: (604) 681-8039

_________________________________________________

INFORMATION CIRCULAR

As at June 18, 2014, unless otherwise noted

FOR THE ANNUAL AND SPECIAL MEETING

OF THE SHAREHOLDERS

TO BE HELD ON JULY 29, 2014

SOLICITATION OF PROXIES

This information circular (the “Information Circular”) is furnished in connection with the solicitation of proxies by the management (“Management”) of Alderon Iron Ore Corp. (the “Company” or “Alderon”) for use at the Annual and Special Meeting (the “Meeting”) of the shareholders (the “Shareholders”) of the Company to be held at the time and place and for the purposes set forth in the Notice of Meeting, and at any adjournment thereof.

PERSONS OR COMPANIES MAKING THE SOLICITATION

The enclosed Instrument of Proxy is solicited by Management. Solicitations will be made by mail and may be supplemented by telephone or other personal contact by regular officers and employees of the Company without special compensation. The Company does not reimburse Shareholders’ nominees or agents (including brokers holding shares on behalf of clients) for the cost incurred in obtaining from their principals the authorization to execute the Instrument of Proxy. No solicitation will be made by specifically engaged employees or soliciting agents. The cost of solicitation will be borne by the Company. None of the directors of the Company have advised that they intend to oppose any action intended to be taken by Management as set forth in this Information Circular.

APPOINTMENT AND REVOCATION OF PROXIES

The persons named in the accompanying Instrument of Proxy are directors or officers of the Company and are nominees of Management. A Shareholder has the right to appoint a person to attend and act for him/her on his/her behalf at the Meeting other than the persons named in the enclosed Instrument of Proxy. To exercise this right, a Shareholder should strike out the names of the persons named in the Instrument of Proxy and insert the name of his/her nominee in the blank space provided, or complete another proper form of Instrument of Proxy. The completed Instrument of Proxy should be deposited with the Company’s Registrar and Transfer Agent, Computershare Investor Services Inc., 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, at least 48 hours before the time of the Meeting or any adjournment thereof, excluding Saturdays, Sundays and holidays.

The Instrument of Proxy must be dated and be signed by the Shareholder or by his/her attorney in writing, or, if the Shareholder is a company, it must either be under its common seal or signed by a duly authorized officer.

In addition to revocation in any other manner permitted by law, a Shareholder may revoke an Instrument of Proxy either by (a) signing another proper form of Instrument of Proxy bearing a later date and depositing it at the place and within the time aforesaid, or (b) signing and dating a written notice of revocation (in the same manner as the Instrument of Proxy is required to be executed as set out in the notes to the Instrument of Proxy) and either depositing it at the place and within the time aforesaid or with the Chairman of the Meeting on the day of the Meeting or on the day of any adjournment thereof, or (c) registering with the Scrutineer at the Meeting as a Shareholder present in person, whereupon such Proxy shall be deemed to have been revoked.

NON-REGISTERED HOLDERS OF THE COMPANY’S SHARES

Only Shareholders whose names appear in the Company’s Central Securities Register (the “Registered Shareholders”) or duly appointed proxyholders are permitted to vote at the Meeting. Shareholders who do not hold common shares of the Company (the “Common Shares”) in their own name (“Beneficial Shareholders”) are advised that only proxies from Shareholders of record can be recognized and voted at the Meeting. Beneficial Shareholders who complete and return an Instrument of Proxy must indicate thereon the person (usually a brokerage house) who holds the Common Shares as registered Shareholder. Management of the Company does not intend to pay for intermediaries to forward to objecting beneficial owners under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) the proxy-related materials and Form 54-101F7 – Request for Voting Instructions Made by Intermediary, and in case of an objecting beneficial owner, the objecting beneficial owner will not receive the materials unless the objecting beneficial owner’s intermediary assumes the cost of delivery.

If Common Shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those Common Shares will not be registered in such Shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the name of the Shareholder’s broker or agent of that broker. In Canada, the vast majority of such Common Shares are registered under the name of CDS & Co. (the registration for the Canadian Depository for Securities, which company acts as nominee for many Canadian brokerage firms). Common Shares held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, brokers/nominees are prohibited from voting Common Shares for their clients. The directors and officers of the Company do not know for whose benefit the Common Shares registered in the name of CDS & Co. are held.

In accordance with NI 54-101, the Company has distributed copies of the Notice of Meeting, this Information Circular and the Instrument of Proxy to the clearing agencies and intermediaries for onward distribution. Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of Shareholders’ meetings unless the Beneficial Shareholders have waived the right to receive meeting materials. Every intermediary/broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting. Often the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the Instrument of Proxy provided by the Company to the Registered Shareholders. However, its purpose is limited to instructing the Registered Shareholder how to vote on behalf of the Beneficial Shareholder. Should a Beneficial Shareholder receive such a form and wish to vote at the Meeting, the Beneficial Shareholder should strike out the Management proxyholder’s name in the form and insert the Beneficial Shareholder’s name in the blank space provided. The majority of brokers now delegate the responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically applies a special sticker to the proxy forms, mails those forms to the Beneficial Shareholders and requests Beneficial Shareholders to return the proxy forms to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the

Meeting. A Beneficial Shareholder receiving a form of proxy with a Broadridge sticker on it cannot use that form of proxy to vote Common Shares directly at the Meeting – the form of proxy must be returned to Broadridge well in advance of the Meeting in order to have the Common Shares voted. All references to Shareholders in this Information Circular and the accompanying Instrument of Proxy and Notice of Meeting are to Registered Shareholders unless specifically stated otherwise.

VOTING OF SHARES AND EXERCISE OF DISCRETION OF PROXIES

On any poll, the persons named in the enclosed Instrument of Proxy will vote the Common Shares in respect of which they are appointed and, where directions are given by the Shareholder in respect of voting for or against any resolution, will do so in accordance with such direction.

If no choice is specified on the Instrument of Proxy with respect to a matter to be acted upon, the Instrument of Proxy confers discretionary authority with respect to the matter upon the proxyholder named on the Instrument of Proxy. In the absence of any direction in the Instrument of Proxy, it is intended that the proxyholder named by Management in the Instrument of Proxy will vote the Common Shares represented by the Instrument of Proxy in favour of the motions proposed to be made at the Meeting as stated under the headings in this Information Circular. The Instrument of Proxy enclosed, when properly signed, confers discretionary authority with respect to amendments or variations to any matters which may properly be brought before the Meeting.

At the time of printing of this Information Circular, Management is not aware that any such amendments, variations or other matters are to be presented for action at the Meeting. However, if any other matters which are not now known to Management should properly come before the Meeting, the proxies hereby solicited will be exercised on such matters in accordance with the best judgement of the nominee.

NOTICE TO UNITED STATES SHAREHOLDERS

The solicitation of proxies by the Company is not subject to the requirements of Section 14(a) of the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), by virtue of an exemption applicable to proxy solicitations by “foreign private issuers” as defined in Rule 3b-4 under the U.S. Exchange Act. Accordingly, this Information Circular has been prepared in accordance with the applicable disclosure requirements in Canada. Shareholders in the United States should be aware that such requirements are different than those of the United States applicable to proxy statements under the U.S. Exchange Act.

The Company’s common shares are listed on the NYSE MKT LLC (“NYSE MKT”). Section 110 of the NYSE MKT Company Guide permits the NYSE MKT to consider the laws, customs and practices of foreign issuers in relaxing certain NYSE MKT listing criteria, and to grant exemptions from NYSE MKT listing criteria based on these considerations. For a description of the significant ways in which the Company’s governance practices differ from those followed by domestic companies pursuant to NYSE MKT see “NYSE MKT Corporate Governance” in the Company’s Annual Information Form for the fiscal year ended December 31, 2013 which is filed as Exhibit No. 1.3 to the Company’s Annual Report on Form 40-F which is filed on EDGAR.

Unless stated otherwise, all references to dollar amounts in this Information Circular are references to Canadian dollars.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

At June 18, 2014, the Company had 130,144,167 Common Shares without par value issued and outstanding. All Common Shares are of the same class and each carries the right to one vote. The

quorum for a meeting of Shareholders is two persons who are, or represent by proxy, Shareholders holding, in the aggregate, at least five percent of the issued Common Shares entitled to be voted at the meeting.

June 23, 2014 has been determined as the record date as of which Shareholders are entitled to receive notice of and attend and vote at the Meeting. Shareholders desiring to be represented by proxy at the Meeting must deposit their proxies at the place and within the time set forth in the notes to the Instrument of Proxy in order to entitle the person duly appointed by the proxy to attend and vote thereat.

Other than as set forth below, to the knowledge of the directors and senior officers of the Company, as at June 18, 2014, no Shareholder beneficially owns or controls, directly or indirectly, voting securities carrying more than 10% of the voting rights attached to the Common Shares:

| | · | Altius Resources Inc. (“Altius”) and its parent, Altius Minerals Corporation, collectively, are the beneficial owners of 32,869,006 Common Shares representing approximately 25.26% of the issued and outstanding Common Shares. |

| | · | Liberty Metals & Mining Holdings, LLC (“LMM”) is the beneficial owner of 18,797,454 Common Shares representing approximately 14.44% of the issued and outstanding Common Shares. |

| | · | Hebei Iron & Steel Group Co., Ltd. (“Hebei”), through its wholly-owned subsidiary, HBIS International Holding (Luxembourg) Co S.A.R.L., is the beneficial owner of 25,858,889 Common Shares representing approximately 19.87% of the issued and outstanding Common Shares |

PRESENTATION OF THE FINANCIAL STATEMENTS

The audited financial statements of the Company for the year ended December 31, 2013 will be presented to the Shareholders at the Meeting.

FIXING THE NUMBER OF DIRECTORS AND ELECTION OF DIRECTORS

Fixing the Number of Directors

The persons named in the enclosed Instrument of Proxy intend to vote in favour of the ordinary resolution fixing the number of directors on the board of directors of the Company (the “Board of Directors” or the “Board”) at twelve (12).

Election of Directors

Although Management is nominating twelve (12) individuals to stand for election, the names of further nominees for directors may come from the floor at the Meeting. Each director of the Company is elected annually and holds office until the next annual general meeting of the Shareholders unless that person ceases to be a director before then. Management proposes to nominate the persons herein listed for election as directors of the Company to serve until their successors are elected or appointed. In the absence of instructions to the contrary, the Common Shares represented by proxy will, on a poll, be voted for the nominees herein listed. MANAGEMENT DOES NOT CONTEMPLATE THAT ANY OF THE NOMINEES WILL BE UNABLE TO SERVE AS A DIRECTOR. IN THE EVENT THAT PRIOR TO THE MEETING ANY VACANCIES OCCUR IN THE SLATE OF NOMINEES HEREIN LISTED. IT IS INTENDED THAT DISCRETIONARY AUTHORITY SHALL BE EXERCISED BY MANAGEMENT TO VOTE THE PROXY ON ANY POLL FOR THE ELECTION OF ANY PERSON

OR PERSONS AS DIRECTOR UNLESS THE SHAREHOLDER HAS SPECIFIED OTHERWISE IN THE INSTRUMENT OF PROXY. UNLESS AUTHORITY TO DO SO IS WITHHELD, THE PERSONS NAMED IN THE ACCOMPANYING INSTRUMENT OF PROXY INTEND TO VOTE FOR THE ELECTION OF ALL OF THE NOMINEES.

The Board of Directors of the Company has adopted a policy (“Majority Voting Policy”) stipulating that if the Common Shares voted in favour of the election of a director nominee at a shareholders’ meeting represent less than a majority of the total Common Shares voted for and voted as withheld at the meeting, the director nominee will submit his resignation promptly after such meeting to the Nominating and Corporate Governance Committee’s consideration. After reviewing the matter, the Nominating and Corporate Governance Committee will make a recommendation to the Board, and the Board’s subsequent decision to accept or reject the resignation offer will be publicly disclosed. The director nominee will not participate in any Nominating and Corporate Governance Committee or Board deliberations regarding the resignation offer. The Majority Voting Policy does not apply in circumstances involving contested director elections.

The following table sets out the names of the persons to be nominated for election as directors, the positions and offices which they presently hold with the Company, their respective principal occupations or employment (including during the past five years, if such director nominee is not a presently elected director) and the number of Common Shares which each beneficially owns, directly or indirectly, or over which control or direction is exercised as of the date of this Information Circular:

Name, Province or State and Country of Ordinary Residence of Nominee(1) | Principal Occupation and, if not a Presently Elected Director, Occupation during the last Five Years(1) | Period from which Nominee has been a Director | Number of Common Shares Held(2)(3) |

Mr. Mark J. Morabito(4) BC, Canada | Executive Chairman of the Company; Chief Executive Officer of King & Bay West Management Corp. (formerly Forbes West Management Corp.) | December 15, 2009 | 2,014,353 |

Mr. John A. Baker, Q.C.(5) NL, Canada | Senior Partner of the law firm, McInnes Cooper. | December 10, 2010 | Nil(6) |

Mr. Brian F. Dalton(7) NL, Canada | Co-Founder, Director, President & Chief Executive Officer of Altius Minerals Corporation. | December 10, 2010 | Nil(6) |

Mr. David J. Porter(4)(5)(7)(8) ON, Canada | Senior executive/management consultant. | December 10, 2010 | Nil |

Mr. Tayfun Eldem(4) QC, Canada | President & Chief Executive Officer of the Company. | September 30, 2011 | Nil |

Ms. Diana Walters(5) New York, USA | President and Chief Executive Officer of LMM, a resource investment company, from January 2010 to date; Managing Partner of Eland Capital, LLC from August 2008 to January 2011. | December 10, 2013 | Nil(9) |

Name, Province or State and Country of Ordinary Residence of Nominee(1) | Principal Occupation and, if not a Presently Elected Director, Occupation during the last Five Years(1) | Period from which Nominee has been a Director | Number of Common Shares Held(2)(3) |

Mr. John Vettese(4)(8) ON, Canada | Corporate finance and M&A lawyer and Deputy Managing Partner of Cassels Brock & Blackwell LLP. | March 28, 2012 | 25,000 |

Ms. Zheng Liangjun Beijing, China | Vice President of Hebei Iron & Steel Group International Trade Corp. | September 4, 2012 | Nil(10) |

Mr. Tian Zejun Beijing, China | Director of the Company since September 2012. | September 4, 2012 | Nil(10) |

Mr. Lenard F. Boggio(7)(8) BC, Canada | Retired partner from PricewaterhouseCoopers LLP (“PwC”). | February 20, 2013 | Nil |

Mr. Ian Ashby California, USA | Self-employed adviser from July 2012 to present; President, Iron Ore of BHP Billiton from November 2006 to June 2012. | N/A | Nil |

Mr. Adrian Loader London, United Kingdom | Chairman of Oracle Coalfields plc from July 2011 to present; Chairman of Compton Petroleum Corporation from August 2011 to July 2012; Chairman of Candax Energy Inc. from January 2008 to June 2010. | N/A | 20,000 |

| (1) | The information as to residence and principal occupation, not being within the knowledge of the Company, has been furnished by the respective directors individually. |

| (2) | Common Shares beneficially owned (within the meaning of applicable Canadian securities laws), directly and indirectly, or over which control or direction is exercised, at the date hereof, not being within the knowledge of the Company is based upon the information furnished to the Company by individual directors. Unless otherwise indicated, such Common Shares are held directly. These figures do not include Common Shares that may be acquired on the exercise of any share purchase warrants or stock options held by the respective directors. |

| (3) | The directors and nominees, as a group beneficially own (within the meaning of applicable Canadian securities laws), directly or indirectly, 2,059,353 Common Shares representing 1.6% of the total issued and outstanding Common Shares. |

| (4) | Current member of the Project Finance Committee of the Company. |

| (5) | Current member of the Nominating and Corporate Governance Committee of the Company. |

| (6) | Messrs. Baker and Dalton are directors and officers of Altius Minerals Corporation which beneficially owns, directly or indirectly through its subsidiaries, a total of 32,869,006 Common Shares. Messrs. Baker and Dalton are also nominees of Altius Minerals Corporation which has a contractual right to appoint up to three director nominees to the Board of Directors. While Altius holds Common Shares which exceed 20% of the Common Shares outstanding, it has the right to appoint three director nominees. While Altius holds Common Shares which exceed 10% of the Common Shares outstanding, it has the right to appoint one director nominee. |

(7) Current member of the Audit Committee of the Company.

| (8) | Current member of the Compensation Committee of the Company. |

| (9) | Ms. Walters is the President and Chief Executive Officer of LMM which beneficially owns, directly or indirectly a total of 18,797,454 Common Shares. Ms. Walters is also the nominee of LMM which has a contractual right to appoint one director nominee to the Board of Directors provided that LMM holds at least 7.5% of the Common Shares, on a fully diluted basis but excluding any Common Shares issued after January 11, 2012 pursuant to any equity compensation plan of the Company. |

| (10) | Ms. Zheng is a Vice President of a subsidiary of Hebei. Hebei, through its wholly-owned subsidiary, HBIS International Holding (Luxembourg) Co S.A.R.L., is the beneficial owner of 25,858,889 Common Shares. Ms. Zheng |

| | and Mr. Tian are also nominees of Hebei which has a contractual right to appoint up to two director nominees to the Board of Directors. For so long as Hebei owns directly or indirectly, 17.0% or more of the Common Shares, Hebei shall be entitled to designate two nominees for election or appointment to the Board of Directors and for so long as Hebei owns directly or indirectly, less than 17.0% of the Common Shares but 7.5% or more of the Common Shares, Hebei shall be entitled to designate one nominee for election or appointment to the Board of Directors. |

Penalties and Sanctions

Other than as disclosed below, no proposed director of the Company is, or within the 10 years prior to the date of this Information Circular, has been, a director, chief executive officer or chief financial officer of any company (including the Company) that:

(a) while that person was acting in that capacity, was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or

(b) was the subject of a cease trade or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer, that resulted from an event that occurred while that person was acting in such a capacity.

Other than as disclosed below, no proposed director of the Company is, or within the 10 years prior to the date of this Information Circular, has been, a director or executive officer of any company (including the Company) that while that person was acting in that capacity or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

Other than as disclosed below, no proposed director has individually, within the 10 years prior to this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director, officer or Shareholder.

Other than as disclosed below, no proposed director of the Company has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

Brian Dalton and John A. Baker are directors of Newfoundland and Labrador Refining Corporation (“NLRC”) which, on June 18, 2008, filed a Notice of Intention to Make a Proposal with the Office of the Superintendent of Bankruptcy. On October 17, 2008, NLRC submitted a proposal to its creditors for a maintenance and care plan for up to 36 months. Under the maintenance and care plan, it was proposed that ongoing costs be kept to a minimum and that all refinery permits would be kept in good standing until such time as its refinery project could be sold or financed when economic conditions improved. In addition, it was proposed that all creditors’ claims would be deferred until the end of the maintenance and care period or until the project obtains financing. On November 20, 2009, the Supreme Court of Newfoundland and Labrador accepted the proposal and dismissed all further requests for creditors’ claim adjustments for voting purposes.

STATEMENT OF EXECUTIVE COMPENSATION

Definitions

For the purposes of this Information Circular:

“Chief Executive Officer” or “CEO” of the Company means an individual who served as chief executive officer of the Company or acted in a similar capacity during the most recently completed financial year;

“Chief Financial Officer” or “CFO” of the Company means an individual who served as chief financial officer of the Company or acted in a similar capacity during the most recently completed financial year;

“Executive officer” of the Company for the financial year, means an individual who at any time during the year was:

| (a) | a chair, vice-chair or president of the Company; |

| (a.1) | a chief executive officer or chief financial officer of the Company; |

| (b) | a vice-president of the Company in charge of a principal business unit, division or function including sales, finance or production; or |

| (c) | performing a policy-making function in respect of the Company. |

“equity incentive plan” means an incentive plan, or portion of an incentive plan, under which awards are granted and that falls within the scope of IFRS 2 Share-based Payment;

“incentive plan” means any plan providing compensation that depends on achieving certain performance goals or similar conditions within a specified period;

“incentive plan award” means compensation awarded, earned, paid, or payable under an incentive plan;

“NEO” or “Named Executive Officer” means each of the following individuals:

| (c) | each of the three most highly compensated executive officers of the Company, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000, as determined in accordance with subsection 1.3(6) of Form 51-102F6, for that financial year; and |

| (d) | each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the company, nor acting in a similar capacity, at the end of that financial year; |

For the purposes of this Information Circular, the following executive officers are the Named Executive Officers for the year ended December 31, 2013:

1. Mark J. Morabito, Executive Chairman;

2. Tayfun Eldem, President & Chief Executive Officer;

3. François Laurin, Chief Financial Officer;

4. Keith Santorelli, Former Chief Financial Officer;

5. Brian Penney, Chief Operating Officer; and

6. Bernard Potvin, Executive VP, Project Delivery.

“non-equity incentive plan” means an incentive plan or portion of an incentive plan that is not an equity incentive plan;

“option-based award” means an award under an equity incentive plan of options, including, for greater certainty, share options, share appreciation rights, and similar instruments that have option-like features;

“plan” includes any plan, contract, authorization, or arrangement, whether or not set out in any formal document, where cash, securities, similar instruments or any other property may be received, whether for one or more persons; and

“share-based award” means an award under an equity incentive plan of equity-based instruments that do not have option-like features, including, for greater certainty, common shares, restricted shares, restricted share units, deferred share units, phantom shares, phantom share units, common share equivalent units, and stock.

Compensation Discussion and Analysis

About the Company

The Company is a development stage company focused on the development of the Kami Iron Ore Project (“Kami Project”) located in western Labrador. The Kami Project is owned 75% by the Company and 25% by Hebei. The Kami Project is a development-stage iron ore property on which a feasibility study has recently been completed. The Company’s primary objective is to bring the Kami Project into production. To execute all aspects of its objective, the Company is building a team of mining professionals with experience and technical knowledge in mineral exploration, development, construction, mine operations, environmental compliance, corporate development and financial management.

Compensation Philosophy and Objectives

Effective October 3, 2011, the Company formed the Compensation Committee to oversee matters relating to executive compensation. Accordingly, as of October 3, 2011, the Compensation Committee began recommending to the Board the base salaries, performance bonuses and stock options to be granted to the Named Executive Officers. With reference to the Compensation Committee’s recommendations, the Board is responsible for approving the compensation of the Named Executive Officers.

The Company’s executive officers have significant influence over the Company’s corporate performance and creating value for Shareholders. Over the past decade, the demand for mining executives with requisite experience and skills has significantly increased, due in part to the increasing global demand for commodities, but also due to the fact that the mining industry as a whole is facing a shortage of qualified talent. A declining number of graduates from mining related programs and the decrease of talent and

knowledge as a result of retirement and turn-over have all contributed to the shortage. As a result, the Company operates in a highly competitive market for key executives and the attraction and retention of experienced and talented executives is one of the key objectives of the Company’s executive compensation program.

In order to retain a competent, strong and effective management group focused on the Company’s growth strategy, corporate performance, risk management and the creation of Shareholder value, in a very tight and competitive market, it is important that the Company’s executive compensation program provides executives with the proper incentives and is competitive with compensation paid to executives having comparable responsibilities and experience at other companies engaged in the same or similar lines of business as the Company. The objectives of the Company’s executive compensation program are to recognize the need to attract and retain high caliber executives by providing competitive salaries; reward performance in achieving pre-determined objectives by providing bonus awards; and motivate executives to remain with the Company and enhance Shareholder value through long-term incentives in the form of stock options. In keeping with this philosophy, the main objectives of the executive compensation programs are to:

| | · | pay for performance by rewarding the attainment of goals and objectives; |

| | · | attract and retain motivated and quality executive officers to drive long term Shareholder value; |

| | · | develop a sense of proprietorship; |

| | · | build flexibility in programs to accommodate the cyclical nature of the mining industry; and |

| | · | align programs to business needs, structure and culture. |

In 2011, the Company retained a compensation consultant to review compensation packages provided to executive officers and senior Management of the Company, including the Chief Executive Officer, Chief Financial Officer and Chief Operating Officer (See “Compensation Consultant” below for further details). Based on the review conducted by the compensation consultant and recommendation of the Compensation Committee, the Company implemented a general compensation framework in effect for its December 31, 2012 fiscal year and that the Company continues to follow. The executive compensation framework formulated by the Compensation Committee comprises three components: base salary, annual cash bonus and long-term incentive in the form of stock options. A portion of the annual cash bonus is directly related to the overall performance of the Company.

Compensation Elements

The following summarizes the three aspects of compensation provided to Named Executive Officers:

Base Salary

Base salary or fees are a fixed element of compensation that are payable to each Named Executive Officer for performing his or her position’s specific duties. While base salary or fees are intended to fit into the Company’s overall compensation objectives by serving to attract and retain talented executive officers, the size of the Company and the nature and stage of its business also impacts the level of base salary or fees. In determining the base salary or fees of an executive officer, the Compensation Committee and the Board consider the following factors: the recommendation of the President & Chief Executive Officer of the Company (other than with respect to the compensation of the President & Chief Executive Officer); the particular responsibilities related to the position; the experience level of the executive officer; the

difficulties in recruiting new talent; and competitiveness with base salaries paid for similar positions in the mining industry.

In respect of the base fees paid to the President & Chief Executive Officer, the Board also considered salaries or consulting fees paid to other chief executive officers in the mining industry, the President & Chief Executive Officer’s contribution toward the Company’s achievement of business goals and objectives for the previous financial year.

In respect of the base fees paid to the Executive Chairman, until October, 2012, he received base fees of $16,667 per month. The majority of the Executive Chairman’s compensation came through the grant of discretionary performance bonuses. After October 2012, the base fees received by the Executive Chairman were increased to $41,667 as a result of his increased time commitments to the affairs of the Company, with the intention that the quantum of discretionary performance bonuses would be decreased and based on the fact that the base fees had not changed since his initial engagement by the Company in March 2010.

There is no mandatory framework that determines which of the above-referenced factors may be more or less important and the emphasis placed on any of these factors is at the discretion of the Board and may vary among the executive officers. Details of the base salaries paid to the Named Executive Officers during the years ended December 31, 2013, 2012 and 2011 are listed in the “Summary Compensation Table” below.

The Company makes reference to salary surveys that are published by various organizations that set out a broad comparison of the salary and compensation programs of various companies. When the general compensation framework that the Company follows was implemented for the 2012 fiscal year, the Compensation Committee reviewed the Coopers Consulting Ltd. National Mining Industries Salary Survey dated July 2011 (the “Coopers Survey”). The Coopers Survey provides an analysis of the compensation paid to mining executives in Canada. There were numerous companies surveyed in the Coopers Survey and the Compensation Committee made reference to the results of the Coopers Survey generally without benchmarking to a specific group of companies within the survey.

During fiscal 2013, the Compensation Committee reviewed a survey prepared by Coopers Consulting Ltd. titled Forecast Salary Budget Adjustments 2013 – North American Mining Industry and dated November 12, 2012. This survey was based on responses received from 73 companies in the North American mining industry regarding forecasted salary adjustments. Based on the results of this survey, which are presented on an aggregate basis and not separated by company, the Compensation Committee recommended, and the Board of Directors approved, the following salary increases for fiscal 2013 for the Named Executive Officers:

| Named Executive Officer | 2013 Base Salary/Fees ($)(3) | Increase from 2012

Base Salary |

Executive Chairman(1) | 500,000 | 0.0% |

| President & Chief Executive Officer | 386,250 | 3.0% |

Chief Financial Officer(2) | 243,500 | 3.6% |

| Executive VP, Project Delivery | 255,000 | 6.3% |

| | (1) | The Executive Chairman’s base salary was increased in October 2012. |

| | (2) | This was the salary for Mr. Keith Santorelli, who resigned effective June 17, 2013. He was replaced by Mr. Francois Laurin on June 17, 2013 who received an annualized salary of $290,000. In determining Mr. Laurin’s salary, reference was made to Mr. Santorelli’s salary and the Compensation |

| | Committee determined that Mr. Laurin should receive a higher salary based on his significant experience and also as a result of negotiation with Mr. Laurin regarding the terms of his employment. |

| | (3) | The Chief Operating Officer was appointed on May 1, 2013 with an annualized salary of $275,000. Mr. Penney’s salary was determined based on the fees he received in his prior role as President & Chief Executive Officer of Ridgemont Iron Ore Corp. and through negotiation with Mr. Penney regarding the terms of his employment. |

During the first quarter of 2014, the Compensation Committee reviewed the survey prepared by The Bedford Consulting Group Inc. entitled “Canadian Mining Industry Report” and dated November 2013 (the “Bedford Survey”). This survey contains a summary of the compensation practices of 165 companies in the mining industry, ranging for junior, mid-tier, and major firms that are publically listed in Canada and internationally. These companies range in stage of evolution (exploration, development, production) and commodity focus (gold, silver, copper, etc.). The Compensation Committee made reference to the general results of the Bedford Survey for companies that have corporate assets between $200 million and $500 million, without making reference to any specific companies within that group. The Bedford Survey lists the following companies as having corporate assets between $200 million and $500 million.

| Companies with Assets Between $200 Million and $500 Million |

| Alexco Resource Corporation | Amerigo Resources Ltd. | Augusta Resources Corp. |

| Aura Minerals Inc. | Brigus Gold Corp. | Canada Lithium Corp. |

| Claude Resources Inc. | Colossus Minerals Inc. | Crocodile Gold Corp. |

| Denison Mines Corp. | Endeavour Silver Corp. | Fortuna Silver Mines Inc. |

| General Moly, Inc. | Guyana Goldfields Inc. | Ivernia Inc. |

| Kirkland Lake Gold Inc. | Labrador Iron Mines Holdings Limited | Largo Resources Ltd. |

| Lucara Diamond Corp. | Mawson West Ltd. | MBAC Fertilizer Corp. |

| Mercator Minerals Ltd. | Monument Mining Limited | Nautilus Minerals Inc. |

| North American Palladium Ltd. | Orvana Minerals Corp. | Platinum Group Metals |

| Premier Gold Mines Ltd. | Rio Alto Mining Ltd. | Romarco Minerals Inc. |

| Rubicon Minerals Corp. | Sabina Gold & Silver Corp. | San Gold Corporation |

| Seabridge Gold, Inc. | Stornoway Diamond Corporation | St. Andrew Goldfields Ltd. |

| Trevali Mining Corporation | Veris Gold Corp. | |

Based on this review, the Compensation Committee recommended, and the Board of Directors approved, the following base salaries for the Company’s Named Executive Officers for the fiscal year ending December 31, 2014.

| Named Executive Officer | 2014 Base Salary/Fees ($) | Increase from 2013 Base Salary |

| Executive Chairman | 500,000.00 | 0.0% |

| President & Chief Executive Officer | 397,837.50 | 3.0% |

| Chief Financial Officer | 301,500.00 | 4.0% |

| Chief Operating Officer | 284,750.00 | 3.5% |

| Executive VP, Project Delivery | 262,750.00 | 3.0% |

Based on the results of the Bedford Survey, the salary for the President & Chief Executive Officer is approximately 2% above the median Chief Executive Officer salary for companies with a similar amount of corporate assets as the Company. The salary for the Chief Financial Officer is approximately 7% above the median Chief Financial Officer salary for companies with a similar amount of corporate assets as the Company. The salary for the Chief Operating Officer is approximately 3% below the median Chief Operating Officer salary for companies with a similar amount of corporate assets as the Company. The salary for the Executive VP, Project Delivery is approximately 14% below the median Vice President, Operations salary for companies with a similar amount of corporate assets as the Company. The Bedford Survey does not contain results for the Executive Chairman position; however, when compared to the results for the Chief Executive Officer position, the annual base fees of the Executive Chairman of the Company are approximately 28% above the median Chief Executive Officer salary for companies with a similar amount of corporate assets as the Company.

Bonus Payments

General

The Company’s Named Executive Officers are entitled to participate in an annual cash bonus plan that provides the Named Executive Officer with the opportunity to receive a cash-based performance bonus as a certain percent of his Annual Salary (the “Target Bonus”) based on the Named Executive Officer’s contribution, as determined by the Board, to the achievement of Company goals established by the Board prior to or at the beginning of each calendar year and the Company’s performance and financial condition. The Target Bonus as a percentage of base salary for which each Named Executive Officer was eligible in fiscal 2013 is set forth in the following table. Target Bonus amounts for fiscal 2014 remain the same. The purpose of the Bonus Target is to provide a targeted bonus amount that a Named Executive Officer will receive if he meets all of his goals and objectives for the fiscal year. The actual bonus paid can exceed the Bonus Target if the performance of the Named Executive Officer results in him exceeding his goals and objectives. Bonus Targets are not benchmarked against any comparison group.

| Named Executive Officer | 2013 Bonus Target (% of Base Salary) |

| Executive Chairman | N/A(1) |

| President & Chief Executive Officer | 75% |

| Chief Financial Officer | 50% |

| Chief Operating Officer | 50% |

| Executive VP, Project Delivery | 50% |

| | (1) | Although the Executive Chairman does not have a Target Bonus, he is entitled to a bonus under the annual cash bonus plan in an amount determined by the Compensation Committee. |

Executive Chairman

The Executive Chairman’s performance is evaluated against the matters for which he has primary responsibility as set out in his Position Description and the Company’s Statement of Division of Responsibilities between the Executive Chairman and President & Chief Executive Officer. These matters include the following: (a) aboriginal engagement and consultation, (b) capital markets and equity/debt financing, (c) federal government relations, (d) provincial government relations, (e) Hebei relationship, (f) off-take transactions and financing, and (g) Board leadership. The Company does not currently prescribe a set of formal objective measures for these matters to determine discretionary bonus entitlements. Rather, the Compensation Committee and the Board reviews the Executive Chairman’s actual contributions to each of these matters during the fiscal year and determines his discretionary bonus entitlement on a subjective basis.

President & Chief Executive Officer

The Company has established a formal set of annual objectives and performance plan for the President & Chief Executive Officer. For the year ended December 31, 2013, the objectives for the President & Chief Executive Officer are set forth in the table below:

| Objectives | Weight(1) |

Power: Conclude all steps necessary to secure power for the Kami Project including: (a) confirmation of power availability and delivery by Nalcor; (b) Stage III engineering and cost estimate for the new transmission line; (c) Formal Power Purchase Agreement including mutually acceptable security arrangements; and (d) Public Utilities Board exemption. | 25% |

Environmental Assessment: Achieve release from Provincial and Federal Environmental Assessment while addressing all stakeholder concerns put forward during the process. | 25% |

Financing: Lead or participate in financing efforts including: (a) marketing meetings and presentations at key investment forums/conferences; (b) introduction to and negotiations with strategic partners with emphasis on terms of offtake deal; (c) co-leading debt and equity financing with Executive Chairman; and (d) establishing Kami concentrates value proposition for potential offtake partners and the broader market. | 10% |

Management of Hebei Relationship: Proactively manage the relationship to ensure respective interests/needs are addressed without compromising the overall success of the Kami Project: (a) involve Hebei in procurement of appropriate materials and services from China with the objective of reducing overall project costs; (b) ensure Hebei’s monthly reporting needs are met; (c) present and defend feasibility study results; and (d) create opportunities for Hebei to get involved in engineering and contribute to project development. | 10% |

Project Roll-Out & Cash Management: Advance detailed engineering, construction planning, procurement and team build out while ensuring cash burn aligns with the financing efforts and healthy cash buffer is maintained. | 15% |

Provincial and Municipal Agreements: Conclude agreements with Municipalities and Provincial Government. | 10% |

Rail Negotiations: Advance rail negotiations in sync with the overall project development. | 5% |

| | (1) | Weighting given to each performance factor in determining bonus payments for performance in 2013. |

Other Named Executive Officers

For the Chief Financial Officer, Chief Operating Officer and Executive VP, Project Delivery, the Company does prescribe a set of formal objective measures to determine discretionary bonus entitlements. A summary of the objectives for these Named Executive Officers is set out in the table below.

Named Executive Officer | Summary of Objectives for the year ended December 31, 2013 |

| Chief Financial Officer | -Play a leadership role in preparing and executing a financing strategy for the Kami Project through 2015 and secure approval of the financing strategy from Alderon’s Board of Directors. -Continue ongoing discussions and negotiations with potential providers of leasing solutions for mining equipment and railcars. -Ensure the full transition of Alderon’s IT function (infrastructure / support) and the implementation of a new ERP (accounting / finance modules only). -Review the insurance program and insurance broker relationships and make appropriate recommendations. -Review the banking and cash management relationship and make appropriate recommendations. -Implement a forecast/budgeting plan by month up to the end of 2014 and report actual results against it on a timely basis for Management and Board level. |

| Chief Operating Officer | -Position Alderon to secure rail transportation on the QNS&L & CFA Railways -Deliver Alderon’s power requirements including facilitating negotiations on transmission line construction and a power purchase agreement. -Secure opportunities to defer pre-production capital on infrastructure and equipment through strategic operating contracts with respect to infrastructure, milling equipment and maintenance facilities. -Develop and commence operational readiness plan for mining, identifying timing for key milestones. -Develop protocol and sign off procedure for key decisions during project development, identify opportunities to lower capital and improve schedule, and operate as a liaison with key stakeholders. |

| Executive VP, Project Delivery | -Command and lead the work the project team is carrying out. -Provide guidance and education on project execution to the environmental assessment and finance teams. -Support closing of the transaction with Hebei. -Finalize negotiations for the Engineering Procurement and Construction Management Agreement. -Complete the owner’s team build-up at a level assuring adequate control of all project activities. -Prepare to commence construction as soon as permits are received. |

In addition, each of the Chief Financial Officer, Chief Operating Officer and Executive VP, Project Delivery, are evaluated based on their collaboration and independence & self-motivation. With respect to collaboration each executive is evaluated on his sharing of knowledge regarding industry best practices, building of sustainable relationships both inside and outside of the Company, drawing upon experience of others inside and outside of the Company, acting in the best interests of the Company and recognizing and rewarding collaborative behaviours amongst peers and subordinates. With respect to independence & self-motivation, each executive is evaluated on his taking ownership of his decisions and personal performance, demonstrating tenacity and resilience in overcoming obstacles, seeking opportunities for and accepting feedback and constructive criticism, understanding the impact of his behaviour on others, exhibiting self-confidence, humility, energy and drive and acting decisively when tough decisions are required or a quick response is essential to the best interests of the Company.

Unlike the President & Chief Executive Officer, a weighting system has not been implemented with respect to these objectives and as a result the performance of these Named Executive Officers is evaluated based on their attainment of the individual objectives as a whole. The performance of each of these Named Executive Officers is evaluated on a scale of one to five which is set out below. The Named Executive Officer is given an overall score between one and five and this score is then used to determine the amount of bonus to be received by the Named Executive Officer relative to their Target Bonus. In general, a Named Executive Officer will be awarded his full Target Bonus if he achieves an overall score of four. If a Named Executive Officer receives a score greater than four, generally his bonus will be adjusted above the Target Amount.

| Scale | |

| One: | Performance does not meet the minimum requirements for this role. Requires counselling and coaching with respect to work performance. Consideration must be given to removal from role or termination, as this performance level cannot be accepted. |

| Two: | Performance meets some but not all requirements of the role. Performance in the role may improve with experience and/or further development. |

| Three: | Performance meets expectations and all the requirements of the role. Output is generally reliable and solid. |

| Four: | Performance consistently meets all requirements and frequently exceeds most requirements of the role. |

| Five: | Performance consistently exceeds requirements of the role. Superior contribution of the employee is recognised by peers and other staff throughout the organization. Displays mastery in all aspects of role. Performance is likely to have changed the nature of the job. This is a level of performance seldom obtained. |

2013 Performance Bonuses

The bonuses awarded for performance during the year ended December 31, 2013 are set out in the table below:

| Named Executive Officer | 2013 Bonus Target (% of Base Salary) | Annual Bonus amount paid ($) | Bonus amount as % of annual salary (at December 31, 2013) |

| Executive Chairman | N/A | 324,450 | 65% |

| President & Chief Executive Officer | 75% | 324,450 | 84% |

| Named Executive Officer | 2013 Bonus Target (% of Base Salary) | Annual Bonus amount paid ($) | Bonus amount as % of annual salary (at December 31, 2013) |

| Chief Financial Officer | 50% | 86,350 | 30%(1) |

| Chief Operating Officer | 50% | 96,600 | 35%(2) |

| Executive VP, Project Delivery | 50% | 127,500 | 50% |

| | (1) | The Chief Financial Officer commenced employment with the Company on June 17, 2013 and his annual bonus was pro-rated for the portion of the year that he was employed. On an annualized basis, his annual bonus would represent 55% of his annual salary at December 31, 2013. |

| | (2) | The Chief Operating Officer commenced employment with the Company on May 1, 2013 and his annual bonus was pro-rated for the portion of the year that he was employed. On an annualized basis, his annual bonus would represent 52.5% of his annual salary at December 31, 2013. |

Executive Chairman

As noted above, the Executive Chairman is evaluated with respect to his contributions with respect to the following matters: (a) aboriginal engagement and consultation, (b) capital markets and equity/debt financing, (c) federal government relations, (d) provincial government relations, (e) Hebei relationship, (f) off-take transactions and financing, and (g) Board leadership. In evaluating the performance of the Executive Chairman, the Compensation Committee made reference to a detailed list of accomplishments by the Company in 2013 that the Executive Chairman led or contributed to and evaluated his performance on a subjective basis. As the Executive Chairman and the President & Chief Executive Officer worked closely together on many of the major accomplishments of the Company in 2013, the Compensation Committee determined that it was appropriate that they be paid the same bonus amount.

President & Chief Executive Officer

The 2013 performance bonus for the President & Chief Executive Officer was determined in the First Quarter of 2014, by the Board of Directors following recommendations made by the Compensation Committee. In formulating its recommendations, the Compensation Committee reviewed 2013 corporate performance based on the achievement of the various specific objectives that have been established for the President & Chief Executive Officer. The Board of Directors, taking into consideration the recommendations made by the Compensation Committee, made the final determination with respect to the performance and achievement of the objectives by the President & Chief Executive Officer and the bonus that was payable.

The President & Chief Executive Officer achieved, or exceeded expectations with respect to all of his objectives for 2013. As a result of the President & Chief Executive Officer exceeding expectations with respect to the management of Hebei relationship, project roll-out and cash management and concluding agreements with municipalities and the provincial government, he was awarded a bonus equal to 84% of his annual salary, exceeding his bonus target of 75% of his annual salary. In addition, the President & Chief Executive Officer transitioned from a consultant to become a full-time employee of the Company in 2014 and in consideration was awarded a signing bonus of $80,000 ($40,000 of which was paid in 2013 and $40,000 of which will be paid in 2014).

Other Named Executive Officers

The Compensation Committee, in consultation with the President & Chief Executive Officer, also assessed the performance of the other Named Executive Officers (Chief Financial Officer, Chief

Operating Officer, and Executive VP, Project Delivery) and provided recommendations to the Board of Directors. Bonuses for the other Named Executive Officers were determined based on the evaluation framework disclosed above under “Bonus Payments – General”. The results of the evaluation are set out in the table below:

| Named Executive Officer | Overall Evaluation Score | Bonus amount as a percentage of Target Bonus amount |

| Chief Financial Officer | 4.5 | 110% |

| Chief Operating Officer | 4.2 | 105% |

| Executive VP, Project Delivery | 4.0 | 100% |

In assessing an individual executive’s performance relative to their corporate goals and objectives, each executive’s contribution towards those goals and objectives was reviewed and analyzed in the manner described above. In addition, during the evaluation process it is recognized that executive officers cannot control certain factors, such as the international market for iron ore. When applying the performance criteria, factors over which the executive officers could exercise control are considered such as controlling costs, schedule, safety performance, taking successful advantage of business opportunities and enhancing the competitive and business prospects of the Company.

Completion Bonus Program

The Company is currently undertaking the financing and construction of the Kami Project. This is a significant undertaking and in order for it to be completed successfully, on time and on budget, a strong and experienced management team is required. Alderon already has such a management team in place; however, due to their experience and expertise there are competing iron ore development and production companies that may attempt to solicit them away from the Company. In order to mitigate this risk and incentivize management to exceed development targets, a senior executive completion bonus program (the “Completion Bonus Program”) has been developed by the Compensation Committee and approved by the Board of Directors. The senior officers that the Completion Bonus Program will apply to are set out below:

| | · | Tayfun Eldem, President & Chief Executive Officer |

| | · | Brian Penney, Chief Operating Officer |

| | · | Francois Laurin, Chief Financial Officer |

| | · | Bernard Potvin, Executive VP, Project Delivery |

The actual bonus payout will be on a graduated system and the payout on achievement of each milestone will be determined based on the performance measured against this graduated system. For each of the three milestones there will be a “threshold” level, “target” level and “exceed” level. The bonus payout at each of the three levels will be threshold (80%), target (100%), exceed (120%). If the threshold level is not achieved, no bonus will be payable for that particular milestone.

| Milestone | Exceed (120%) | Target (100%) | Threshold (80%) |

| Construction Completion – Dumping of first train consisting of concentrate produced from the Kami Project at yard in Sept Îles. | Milestone achieved less than 25 months following official Board decision to commence construction at the Kami Project. | Milestone achieved on or after 25 months, but less than 28 months, following official Board decision to commence construction at the Kami Project. | Milestone achieved on or after 28 months, but less than 31 months following official Board decision to commence construction at the Kami Project. |

| Total Installed Cost – Total Capital Cost (Feasibility Study budget and activities including the 15% reserve amount and a 3% escalation factor) to complete the construction of the Kami Project. | Total amount is less than Total Installed Cost estimate range. | Total amount is within the Total Installed Cost estimate range. | Total amount exceeds the Total Installed Cost estimate range by less than 10% |

| Commercial Production – Commercial production is defined a 30 day average production of at least 460,273 tonnes (70% of 8M annual tonnes). | Commercial Production occurs less than 6 months following construction completion. | Commercial Production occurs on or after 6 months, but less than 9 months, following construction completion. | Commercial Production occurs on or after 9 months, but less than 12 months, following construction completion. |

The target level payment amount for each milestone is set out in the table below:

| Completion Bonus Amount |

President & CEO - $500,000 |

Chief Operating Officer - $250,000 |

Chief Financial Officer - $250,000 |

Executive VP, Project Delivery - $250,000 |

If all “Target” payouts are met for each of the three milestones, the total payout would be $3.75 million or less than 0.5% of the current budget for the Kami Project. If all the “Exceed” payouts are met the Kami Project will come in ahead of schedule and the incremental increase in total payout of $750,000, which represents less than 1% of the amount of funds that would be saved. Any bonuses paid pursuant to the Completion Bonus Program will be reported as compensation for the year it is paid.

Long-Term Incentives

The Board believes that granting stock options to key personnel encourages retention and more closely aligns the interests of executive Management with the interests of Shareholders. The inclusion of options

in compensation packages allows the Company to compensate employees while not drawing on limited cash resources. Further, the Board believes that the option component serves to further align the interests of Management with the interests of the Shareholders.

The Compensation Committee recommends stock option awards to the Board of Directors after considering input from Management. The Company does not utilize a set of formal objective measures to determine long-term incentive entitlements, rather, long-term incentive grants, such as stock options to the Named Executive Officers are determined in a discretionary manner on a case by case basis, but giving consideration to the relative contribution and involvement of the individual in question as well as the number of options previously granted. There are no other specific quantitative or qualitative measures associated with option grants and no specific weights are assigned to any criteria individually, rather, the performance of the Company is broadly considered as a whole when determining the number of stock based compensation (if any) to be granted and the Company does not focus on any particular performance metric.

During the year ended December 31, 2013, a total of 350,000 stock options were granted to Named Executive Officers, as follows:

| Name | Title | Date of Grant | No. of Stock Options | Exercise Price | Expiry Date |

| François Laurin | CFO | June 10, 2013 | 350,000 | $1.16 | June 10, 2018 |

Hedging Restrictions

The Company does not have any policies that restrict a NEO or director from purchasing financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director except that NEOs and directors are prohibited from undertaking any of the following activities under the Company’s Insider Trading Policy:

| | · | speculating in securities of the Company, which may include buying with the intention of quickly reselling such securities, or selling securities of the Company with the intention of quickly buying such securities (other than in connection with the acquisition and sale of shares issued under the Company’s stock option plan or any other Company benefit plan or arrangement); |

| | · | buying the Company’s securities on margin; |

| | · | short selling a security of the Company or any other arrangement that results in a gain only if the value of the Company’s securities declines in the future; |

| | · | selling a “call option” giving the holder an option to purchase securities of the Company; and |

| | · | buying a “put option” giving the holder an option to sell securities of the Company. |

Risk Management and Assessment

The Board is aware that compensation practices can have unintended consequences and is continuously looking at ways to improve how it factors risk management into its compensation decisions. In order to assist the Board of Directors in fulfilling its oversight responsibilities with respect to risk management in terms of the Company’s compensation structure, the Compensation Committee annually reviews the Company’s compensation policies and practices. As part of its review process, the Committee endeavours to identify any practice that may encourage an executive or employee to expose the Company to unacceptable risk.

With respect to the management of risk, the Board takes a conservative approach to executive compensation, rewarding individuals with additional performance-based compensation dependent upon the success of the Company and when such success can be demonstrated. Care is taken in measuring this success, while ensuring it is achieved within normal operating procedures and standards, including those related to the environment, health, safety and sustainable development.

The nature of the business and the competitive environment in which the Company operates requires some level of risk-taking to achieve growth and desired results in the best interest of stakeholders. The Company’s executive compensation program seeks to encourage behaviours directed towards increasing long-term value, while limiting incentives that promote excessive risk taking.

In order to mitigate possible risks that may be associated with performance-based compensation, the Company’s performance-based compensation programs generally contain a target for the benefit or payout limit that may be earned by a Named Executive Officer in any given calendar year. These restrictions include a target payout for performance bonuses, expressed as a percentage of annual salary. In addition, generally there is a two year vesting period for stock options which mitigates against inappropriate risk taking for short-term gains.

While the variable compensation components are intended to establish a direct link between senior executive compensation and the Company’s financial and non-financial performance, and to reward individual contributions to achieving the overall corporate objectives of the development of the Kami Project and enhanced Shareholder value, the target amounts for bonuses in any given calendar year are designed to limit the temptation to take on unmanageable risk and unsustainable performance over the long term.

At present, the Compensation Committee is satisfied that the current executive compensation program does not encourage the executives to expose the business to inappropriate risks. Furthermore, the Compensation Committee is satisfied that the Company’s executive compensation programs provide the necessary framework and governance to align the interest of executives and other key employees, the Company and its stakeholders, and discourages excessive risk taking. The following are examples of some of the actions that have been taken to mitigate the Company’s compensation-related risks:

| | · | the establishment of a target for annual bonus payments to each Named Executive Officer (except for the Executive Chairman) in any one calendar year; and |

| | · | the establishment of a stock option plan that generally provides for a vesting period of two (2) years from the date of grant. |

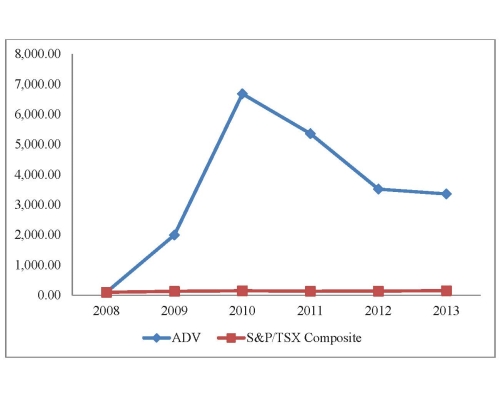

Performance Graph

The following graph depicts the Company’s cumulative total Shareholder returns in the past five years (to December 31, 2013), assuming a $100 investment in Common Shares on December 31, 2008, compared

to an equal investment in the S&P/TSX Composite Index. Alderon does not currently issue dividends. The Common Share performance as set out in the graph does not necessarily indicate future price performance.

As described above, the Compensation Committee considers various factors in determining the compensation of the Named Executive Officers and common share performance is one performance measure that is reviewed and taken into consideration with respect to executive compensation. As an iron ore development company, the Common Share price can be impacted by the market price of iron ore, which can fluctuate widely and be affected by numerous factors that are beyond the Company’s control and difficult to forecast. The Common Share price is also affected by other factors beyond the Company’s control, including general and industry-specific economic and market conditions.

There is no correlation between the trend of Alderon’s stock price and Alderon’s executive compensation. Due to a variety of factors, the Company’s executive compensation has increased over the five year period. Factors contributing to the increase in executive compensation include increased competition for qualified mining executives, the expansion, development and success of the Company over the past five years, and the Company’s need to retain and attract experienced personnel in order to deliver on its long-term strategy to maximize Shareholder value through the responsible growth and development of the Kami Project.

Compensation Governance

Compensation Committee

Members and Independence

The Compensation Committee comprises three directors of the Company, the majority of which are currently independent of the Company for purposes of applicable securities laws and the rules and regulations of the NYSE MKT. On February 19, 2013, Bruce Humphrey resigned as a member of the Board of Directors and Compensation Committee and Lenard F. Boggio was appointed to the Compensation Committee in his place. Accordingly as at the date of this Information Circular, the Compensation Committee is comprised of David Porter, Lenard F. Boggio and John Vettese. Each of

Messrs. Porter and Boggio, are independent directors for the purposes of applicable securities laws and the rules and regulations of the NYSE MKT and Mr. Humphrey was an independent director before he resigned. Mr. Vettese is not an independent director.

Skills and Experience

The Board believes that each current and former member of the Compensation Committee possesses skills and experience relevant to the mandate of the Compensation Committee. In addition, the members of the Compensation Committee each have skills and experience that enable them to make decisions on the suitability of the Company’s compensation policies and practices.

| Committee Member | Relevant Skills and Experience |

| David Porter | David Porter is a seasoned executive who has served as Vice President Human Resources & Organizational Effectiveness for the Iron Ore Company of Canada. He has also been responsible for Operations, Safety, Health, Sustainable Development, Communications and Community Relations across the mining and steel sectors for over 33 years. Based on his human resources background, Mr. Porter has an appropriate skill set to make decisions on the suitability of the Company’s compensation policies and procedures. |

| Lenard F. Boggio | Lenard F. Boggio was a Partner with PwC and its predecessor firm Coopers & Lybrand from 1988 until his retirement from PwC in May 2012. During that time, he was Leader of the B.C. Mining Group of PwC, a senior member of PwC’s Global Mining Industry Practice and an audit practitioner for publicly listed Canadian, U.S. and U.K. mineral resource and energy clients. The scope of his clients’ activities included exploration, development and production stage operations in the Americas, Africa, Europe and Asia. Mr. Boggio has developed significant knowledge with respect to executive compensation policies and procedures. |

| John Vettese | Mr. Vettese is a corporate finance and M&A lawyer and is the Deputy Managing Partner of Cassels Brock & Blackwell LLP. He is also a member of the firm’s Executive Committee. He has acted and continues to act as lead counsel for several companies in the mining sector. Mr. Vettese routinely advises publicly traded mineral resource companies on executive compensation matters and has developed significant knowledge in this area. |

Responsibilities, Powers and Operation

The Compensation Committee’s primary function to assist the Board of Directors in fulfilling its responsibilities by:

| | · | reviewing and approving and then recommending to the Board of Directors salary or consulting fees, bonus, and other benefits, direct or indirect, and any change-of-control packages of the President & Chief Executive Officer and any other Management individual at that level or above; |

| | · | considering and if deemed appropriate approving, with or without revision, the recommendation of the President & Chief Executive Officer on the salary or consulting fees, bonus, and other benefits, direct or indirect, and any change-of-control packages of the Chief Financial Officer, Chief Operating Officer and other officers; |

| | · | reviewing compensation of the Board of Directors on at least an annual basis; |

| | · | administration of the Company’s compensation plans, including stock option plans, outside directors compensation plans, and such other compensation plans or structures as are adopted by the Company from time to time; |

| | · | research and identification of trends in employment benefits; and |

| | · | establishment and periodic review of the Company’s policies in the area of Management benefits and perquisites based on comparable benefits and perquisites in the mining industry. |

Meetings of the Compensation Committee are held from time to time as the Compensation Committee or the Chairman of the Compensation Committee shall determine. The Compensation Committee may ask members of Management or others to attend meetings or to provide information as necessary. The Compensation Committee is permitted to retain and terminate the services of outside compensation specialists and other advisors to the extent required, and has the sole authority to approve their fees and other retention terms.

Compensation Consultant

Identity and Mandate of Compensation Consultant

On October 21, 2011, the Company retained WMH & Associates Consultants Ltd. (“WMH”) to review compensation packages provided to executive officers and senior Management of the Company, including the President & Chief Executive Officer, Chief Financial Officer and Chief Operating Officer. Based on the review conducted by WMH, the Company implemented a general compensation framework in effect for its December 31, 2012 fiscal year and that the Company continues to follow, which is described above. On August 9, 2012, Mr. Bill Heath, the principal of WMH, was retained by the Company to act as Executive VP, Human Resources.

In connection with his engagement as Executive VP, Human Resources, Mr. Heath provides the following services:

| | · | Assisting the Company with the development and implementation of basic policies to govern Human Resources and General Administrative Activities which will form an employment handbook and updating such handbook as required. Such basic policies include, but are not limited to, conducting employment interviews, travel and entertainment, employee relocation, use of outside consultants, office procedures, hours of work and reference checking. |

| | · | In cooperation with the Company’s General Counsel, assisting the Company in the preparation of an employment agreement template. |

| | · | Assisting the Company in the development and implementation of employee salary scales, incentive programs (including the development of guidelines for the granting of incentive stock options), and a comprehensive benefits program. |

| | · | Assisting the Company in the scheduling of employment interviews and the relocation of employees where necessary. |

| | · | Providing such other general human resources, administrative and management consulting services as the Company may request from time to time. |

The Company does not have a requirement that the Compensation Committee or Board of Directors pre-approve the services that a compensation consultant provides to the Company at the request of Management.

Fees Paid to Compensation Consultant

During the two most recently completed financial years, and prior to Mr. Heath’s engagement as Executive VP, Human Resources, the following fees have been billed by WMH to the Company:

| Financial Year | 2013 | 2012 |

| Executive compensation-related fees | Nil | $6,300 |

| All other fees | Nil | $10,250(1) |

| Total fees | Nil | $16,550 |

(1) All other fees includes amounts paid with respect to consulting advice regarding the introduction of an employee benefits program and a the development and introduction of an employee handbook setting out basic policies and procedures.

Summary Compensation Table

The following table contains information about the compensation paid to, or earned by, those who were during the fiscal year ended December 31, 2013 the Company’s Named Executive Officers. The Company had six Named Executive Officers during the fiscal year ended December 31, 2013, namely Mark J. Morabito, Tayfun Eldem, Keith Santorelli, François Laurin, Brian Penney and Bernard Potvin.

| Name and principal position | Year | Salary | Share-based awards | Option-based awards | Non-equity incentive plan compensation | Pension value | All other compensation | Total compen-sation |

| | | ($) | ($) | ($)(7) | Annual incentive plans(8) | Long-term incentive plans | ($) | ($) | ($) |

Mark J. Morabito(1) | 2013 | Nil | Nil | Nil | 324,450 | Nil | Nil | 500,000 | 824,450 |

| Executive Chairman | 2012 | Nil | Nil | Nil | 1,200,000 | Nil | Nil | 275,000 | 1,475,000 |

| | 2011 | Nil | Nil | 964,810 | 350,000 | Nil | Nil | 400,004 | 1,714,814 |

Tayfun Eldem(2) | 2013 | 32,187 | Nil | Nil | 364,450 | Nil | Nil | 354,063 | 750,700 |

| President & CEO | 2012 | Nil | Nil | Nil | 525,000 | Nil | Nil | 356,250 | 881,250 |

| | 2011 | Nil | Nil | 2,083,780 | 50,000 | Nil | Nil | 135,428 | 2,269,208 |

Keith Santorelli(3) | 2013 | 150,063 | Nil | Nil | Nil | Nil | Nil | Nil | 150,063 |

| Former CFO | 2012 | 232,500 | Nil | Nil | 105,750 | Nil | Nil | Nil | 338,250 |

| | 2011 | 33,750 | Nil | 516,874 | Nil | Nil | Nil | Nil | 550,624 |