Exhibit 99.1

929 North Front Street

Wilmington, North Carolina 28401

[ ], 2010

Dear PPD Shareholder:

On October 28, 2009, we announced a plan to spin off our compound partnering business (the “Compound Partnering Business”) into a separate publicly traded U.S. company, Furiex Pharmaceuticals, Inc. (“Furiex”). Pharmaceutical Product Development, Inc. (“PPD”) will continue to own its core drug discovery and development services, or contract research organization, business (the “CRO Business”).

We expect to complete this spin-off on [ ], 2010. We will accomplish the spin-off through a pro rata dividend of the common stock of Furiex to PPD’s shareholders. At the time of the spin-off, you will receive one share of Furiex common stock for every shares of PPD common stock that you hold at 5:00 p.m., Eastern Time, on [ ], 2010, the record date for this dividend. However, if you sell your shares of PPD common stock prior to the ex-dividend date you also will be selling your right to receive shares of Furiex common stock. We will not issue any fractional shares of Furiex, so if you otherwise would have been entitled to a fractional share of Furiex in the spin-off, you would receive the net cash value of such fractional share instead. We have applied to have the common stock of Furiex listed on the Nasdaq Global Market under the symbol “FURX”. Shares of PPD will continue to be listed on the Nasdaq Global Select Market under the symbol “PPDI”.

Our Board of Directors has determined that a strategic separation of the Compound Partnering Business from the CRO Business is in the best interests of each of those businesses and our shareholders. We believe that the separation will enhance value for our shareholders by allowing them to realize the full potential of each company independently. We also expect that the separation of the businesses will allow each business to deploy and raise capital in accordance with the unique needs of its business. Specifically, we believe that the separation of the business will increase our ability to attract and retain employees by providing equity compensation tied directly to our company’s performance, and our research and development efforts in particular. In addition, we anticipate that the separation will permit the management of each business to better focus on its distinct type of operation and to more effectively pursue the strategies necessary to improve its business performance. Finally, we believe that the separation of the two businesses will simplify the profile of each company, allowing investors to more easily evaluate each company.

Enclosed please find an Information Statement that describes the spin-off and the business of Furiex, which we are providing to all PPD shareholders in accordance with U.S. securities laws. The Information Statement describes in detail the distribution of Furiex common stock to holders of PPD common stock and contains important business and financial information about Furiex. We encourage you to read this information carefully. Please note that shareholder approval is not required for this spin-off, so we are not asking you for a proxy. You will not need to take any action to receive Furiex shares and you will not be required to pay anything for the Furiex shares or surrender any of your PPD shares.

If you have any questions regarding the spin-off, please contact our investor relations department by calling (910) 558-7585 or sending a letter to: Investor Relations, Pharmaceutical Product Development, Inc., 929 North Front Street, Wilmington, North Carolina 28401.

|

| Sincerely, |

|

| Fred N. Eshelman |

| Executive Chairman |

This Information Statement is first being mailed to shareholders on or about [ ], 2010. This Information Statement is furnished for informational purposes only.

3900 Paramount Parkway

Suite 150

Morrisville, North Carolina 27560

[ ], 2010

Dear Future Furiex Shareholder:

It is my great pleasure to welcome you as a shareholder of Furiex Pharmeceuticals, Inc. (“Furiex”) and introduce you to our company. We are a drug development collaboration company that will pursue the Compound Partnering Business of our parent company, Pharmaceutical Product Development, Inc. (“PPD”).

We seek to collaborate with pharmaceutical and biotechnology companies to increase the value of their early stage drug candidates by applying our novel approach to drug development that we believe expedites research and development decision-making and can shorten drug development timelines. We share risk with our collaborators by financing the cost of development to the point of mutually agreed upon pre-determined clinical milestones. In exchange, Furiex shares the potential rewards with our collaborators, receiving milestone payments and royalties based on the continued development and commercialization success of the drug candidate. Most of the large pharmaceutical companies with which we collaborate have the option to continue late stage clinical development and commercialization of the drug candidate after it has reached the specified pre-determined milestones. If our collaborator is unable or unwilling to perform late stage development and commercialization, then we have the option to seek out a new development and commercialization partner. Furiex’s team is staffed with the same key PPD team members who demonstrated proven success in the drug development collaboration business while at PPD, as well as highly-qualified new members. Our strategy is to invest in programs that have well defined clinical endpoints, a relatively straightforward path to regulatory approval and a large potential addressable market.

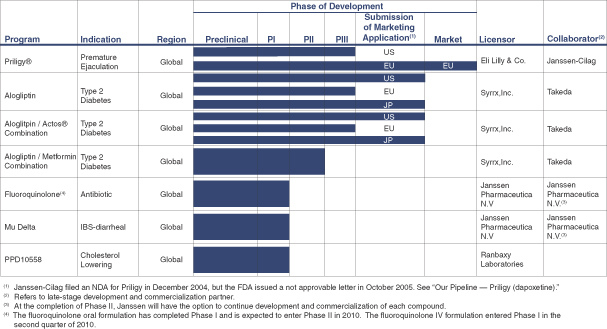

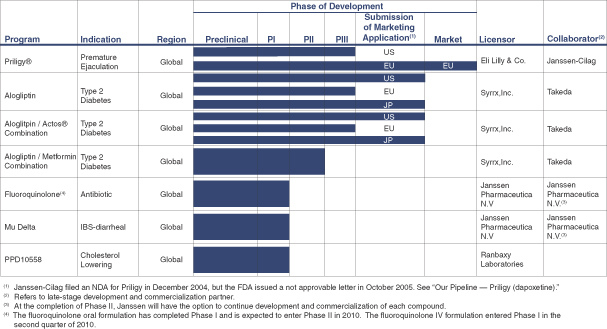

Our current pipeline is comprised of several compounds in various stages of development and commercialization, including:

| | • | | Rights to royalties and sales-based milestones from the collaboration with ALZA Corporation, a Janssen-Cilag affiliate, on Priligy®, the first approved treatment in the world for premature ejaculation. To date, Priligy has been approved for marketing in Austria, Finland, Germany, Italy, Mexico, New Zealand, Portugal, South Korea, Spain and Sweden. |

| | • | | Rights to potential future regulatory milestones and, if approved, royalties and sales-based milestones from Takeda Pharmaceutical Company Limited on alogliptin and alogliptin-containing products. Alogliptin is a dipeptidyl peptidase IV, or DPP4, inhibitor for the treatment of type 2 diabetes. In June and September 2009, the U.S. Food and Drug Administration, or FDA, issued complete response letters to the alogliptin monotherapy and the fixed-dosed combination of alogliptin and Actos® New Drug Applications, requesting an additional cardiovascular safety trial with the alogliptin monotherapy to satisfy the FDA’s December 2008 guidance on anti-diabetic therapies. That trial is presently ongoing. |

| | • | | A fluoroquinolone antibiotic compound we licensed from Janssen Pharmaceutica, N.V., an affiliate of Johnson & Johnson, in November 2009 for the treatment of complicated skin and skin structure infections, such as abscesses that occur deep in the skin layers, and respiratory infections. This antibiotic has a broad spectrum of activity and is able to treat methicillin-resistant staphylococcus aureus, or MRSA, infections. Based on pre-clinical in vitro data, we believe this product may show superior bacteriocidal activity, compared to currently marketed antibiotics, for a number of difficult-to-treat pathogens. We are developing both oral and intravenous, or IV, formulations of this compound to allow doctors and patients to select the appropriate method of delivery under the |

| | circumstances. We have initiated work with the goal of beginning a Phase I study with the IV formulation in the first half of 2010. We are planning to initiate Phase II clinical trials using the oral formulation for complicated skin infections and using both formulations for respiratory infections in 2010. |

| | • | | A compound that is a mu opioid receptor agonist and delta opioid receptor antagonist, which we call mu delta, we licensed from Janssen Pharmaceutica, N.V. in November 2009 for the treatment of diarrhea-predominant irritable bowel syndrome. We have begun work with the goal of initiating Phase II clinical trials during the second quarter of 2010. |

| | • | | A novel statin compound we refer to as PPD 10558 licensed from Ranbaxy Laboratories, Ltd. for the treatment of dyslipidemia, which is an excessive level of blood lipids such as cholesterol. Preclinical data suggests this statin will avoid some of the adverse interactions seen when currently marketed statins are taken with some other drugs by patients with high blood lipid levels. In addition, one of the most common side effects of statin usage is a condition of pain and/or muscle weakness, known as statin-associated myopathy, which is reported to occur in up to 10% of statin-treated patients. Preclinical and Phase I human studies suggest that PPD 10558 has similar cholesterol-lowering properties as a leading marketed statin, and also has pharmacologic properties which suggest that it may have a lower risk of myopathy than currently marketed statins. PPD 10558 may therefore be a useful treatment option for statin-intolerant patients. PPD completed a high-dose comparator study in healthy volunteers that indicated the drug was well-tolerated and suggested it compares favorably to currently marketed statins with respect to lowering lipid levels. |

| | • | | A variety of therapeutic candidates developed by Eli Lilly and Company that we obtained through our acquisition of Magen BioSciences, Inc. in April 2009, including vitamin D receptor modulators. We have tested two of these compounds for various safety and efficacy parameters for topical treatment of dermatology indications in the anti-proliferative and anti-inflammatory areas. We have elected, however, not to pursue the development of these compounds. We also are currently investigating other compounds under material transfer agreements to identify potential drug development candidates for dermatological indications, and are considering other strategic alternatives for our dermatology business. |

As you know, the Board of Directors of PPD has approved a plan to spin off Furiex into a separate publicly traded company. We expect to complete the spin-off on [ ], 2010. We have applied to have our common stock listed on the Nasdaq Global Market under the symbol “FURX”.

With our existing product rights, promising clinical pipeline, experienced management team and strong balance sheet, we believe that we will begin our future as an independent public company from a position of considerable strength. This spin-off should enable us to operate our business with even greater focus and agility. As a Furiex shareholder, you can share in our progress as we strive to continue strengthening and growing our business.

On behalf of the Furiex team, I invite you to learn more about Furiex and our opportunity as a soon-to-be independent publicly traded company by reading the attached Information Statement.

|

| Sincerely, |

|

|

June S. Almenoff, President and |

Chief Medical Officer |

Information contained herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the Securities and Exchange Commission.

Preliminary and Subject to Completion, dated April 29, 2010

Information Statement

Furiex Pharmaceuticals, Inc

(par value $0.001 per share)

We are furnishing this Information Statement to the shareholders of Pharmaceutical Product Development, Inc., or PPD, in connection with PPD’s distribution to holders of its common stock of all outstanding shares of common stock of Furiex Pharmaceuticals, Inc., or Furiex. At this time, Furiex is a wholly owned subsidiary of PPD. After the spin-off is completed, Furiex will be a separate publicly traded company and will own and operate the compound partnering business (the “Compound Partnering Business”) currently owned and operated by PPD. PPD will continue to own its drug discovery and development services, or contract research organization, business (the “CRO Business”).

If you are a holder of record of PPD common stock at 5:00 p.m., Eastern Time, on [ ], 2010, which will be the record date for the distribution, you will be entitled to receive one share of our common stock for every shares of PPD common stock that you hold on the record date. However, if you sell your shares of PPD common stock prior to the ex-dividend date, you also will be selling your right to receive shares of Furiex common stock. Our common stock will be issued in book-entry form only, which means no physical stock certificates will be issued. No fractional shares of Furiex common stock will be issued. If you otherwise would have been entitled to a fractional share of Furiex common stock in the distribution, you will receive the net cash value of such fractional share instead. Immediately after the distribution is completed on the distribution date, we will be an independent publicly traded company. We expect the distribution to occur on [ ], 2010.

No shareholder vote is required for the spin-off to occur. We are not asking you for a proxy, and you are requested not to send us a proxy. No action is necessary for you to receive the shares of our common stock to which you are entitled in the spin-off. This means that you donot need to:

| | • | | pay any consideration to Furiex or to PPD; or |

| | • | | surrender or exchange any shares of PPD common stock to receive your shares of our common stock. |

Currently, there is no public trading market for the common stock of Furiex, although we expect that a “when-issued” trading market will develop on or shortly after the record date for the distribution. We have applied to have our common stock traded on the Nasdaq Global Market under the symbol “FURX”.

As you review this Information Statement, you should carefully consider the matters described in “Risk Factors” beginning on page 11.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Information Statement is truthful or complete. Any representation to the contrary is a criminal offense.

This Information Statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

If you have inquiries related to the distribution, you should contact PPD’s transfer agent, American Stock Transfer & Trust Company, at 59 Maiden Lane, Plaza Level, New York, New York 10038 or (800) 937-5449.

Table of Contents

i

Explanatory Note

Furiex is furnishing this Information Statement to you solely to provide you with information regarding both the spin-off and our company. It is not, and should not be construed as, an inducement or encouragement to buy or sell any securities of Furiex or PPD.

You should rely only on the information contained in this Information Statement. We have not authorized any other person to provide you with information different from that contained in this Information Statement. The information contained in this Information Statement is believed by us to be accurate as of its date. Therefore, you should assume that the information contained in this Information Statement is accurate only as of the date on the front cover of this Information Statement or other dates stated in this Information Statement, regardless of the time of delivery of this Information Statement. Our business, financial condition, results of operations and prospects may have changed since that date, and neither we nor PPD will update the information except in the normal course of our respective public disclosure obligations and practices or as specifically indicated in this Information Statement.

We own or have rights to trademarks, trade names, copyrights and other intellectual property used in our business. All other company names, tradenames and trademarks included in this Information Statement are trademarks, registered trademarks or trade names of their respective owners.

As used in this Information Statement, the terms “we,” “us,” “our,” and the “Company” mean Furiex and its subsidiaries (unless the context indicates a different meaning).

We describe in this Information Statement the Compound Partnering Business transferred to us by PPD in connection with the spin-off as though the Compound Partnering Business were our business for all historical periods described. However, Furiex is a newly-formed entity. Some of the actions necessary to transfer assets and liabilities of PPD to us have not occurred but will occur before the effectiveness of the spin-off. References in this Information Statement to the historical assets, liabilities, products, business or activities of our business are intended to refer to the historical assets, liabilities, products, business or activities of the Compound Partnering Business as those were conducted as part of PPD prior to the transfer and assumption by Furiex and the spin-off.

ii

Summary

The following is a summary of some of the information contained in this Information Statement. We urge you to read this entire document carefully, including the risk factors, our historical combined financial statements and the notes to those financial statements, and our unaudited pro forma condensed combined financial statements.

Our Company

Furiex is a drug development collaboration company that will pursue the Compound Partnering Business of our parent company, PPD. We seek to collaborate with pharmaceutical or biotechnology companies to increase the value of their early stage drug candidates by applying our novel approach to drug development that we believe expedites research and development decision-making and can shorten drug development timelines.

In order to obtain regulatory approval from the FDA to market a drug, certain data about the safety and efficacy of the drug is required by the FDA. To obtain such data, drug developers frequently choose to run studies sequentially. For example, they may run one study, wait to see the results, and then they run the next study. Developers prefer this approach primarily to limit upfront expenditures since the success of any given study is not known and the decision may be made not to move forward due to negative data. This sequential approach slows down the development process. In addition, development is slowed due to time taken at each decision point at the end of each study.

Furiex approaches drug development by minimizing the time it takes to bring products to the market. Furiex’s novel approach manages drug development with parallel processing and efficient decision making. We use our drug development experience to predict possible outcomes of a study and take risks based on those predictions. By assuming in advance success at each critical decision point, as opposed to waiting for results to demonstrate success in order to make a decision, time is reduced. In addition, we seek to mitigate risks by contingency planning for potential problems. As a result, we can accelerate the development process by bridging steps across the developmental program as well as between studies, as was evidenced with alogliptin where it took just five years from the start of our collaboration to the filing of the NDA. Additionally, we focus our efforts on the essential studies necessary for regulatory approval and we do not include extraneous studies. This helps to shorten developmental timelines while still achieving success.

Our approach to drug development poses risks to us. If we miscalculate the assumed safety and efficacy of any drug as well as any assumed decision point in its development, the time to develop could be significantly extended, which would add to the expense of development. In addition, if our assumptions or calculations about any drug are incorrect or we encounter unforeseen difficulties with any drug, we might have invested significant amounts without any return on that investment. Further, the value of the drug candidate might be impaired, and possibly significantly so, which could result in material losses to us if the selected indication or the drug itself is abandoned. For example, we recorded an impairment charge of $10.4 million related to one of our dermatology compounds, MAG-131, due to efficacy data which led us to determine that the asset was impaired.

We share risk with our collaborators by financing the cost of development to the point of mutually agreed upon pre-determined clinical milestones. In exchange, Furiex shares the potential rewards with our collaborators, receiving milestone payments and royalties based on the continued development and commercialization success of the drug candidate. Most of the large pharmaceutical companies with which we collaborate have the option to continue late stage clinical development and commercialization of the drug candidate after it has reached the specified pre-determined milestones. If our collaborator is unable or unwilling to perform late stage development and commercialization, then we have the option to seek out a new development and commercialization partner. Furiex’s team is staffed with the same key PPD team members who demonstrated proven success in the drug

1

development collaboration business while at PPD, as well as highly-qualified new members. Our strategy is to invest in programs that have well defined clinical endpoints, a relatively straightforward path to regulatory approval and a large potential addressable market.

Our current pipeline is comprised of several compounds in various stages of development and commercialization, including:

| | • | | Rights to royalties and sales-based milestones from the collaboration with ALZA Corporation, a Janssen-Cilag affiliate, on Priligy®, the first approved treatment in the world for premature ejaculation. To date, Priligy has been approved for marketing in Austria, Finland, Germany, Italy, Mexico, New Zealand, Portugal, South Korea, Spain and Sweden. |

| | • | | Rights to potential future regulatory milestones and, if approved, royalties and sales-based milestones from Takeda Pharmaceutical Company Limited on alogliptin and alogliptin-containing products. Alogliptin is a dipeptidyl peptidase IV, or DPP4, inhibitor for the treatment of type 2 diabetes. In June and September 2009, the U.S. Food and Drug Administration, or FDA, issued complete response letters to the alogliptin monotherapy New Drug Application, or NDA, and the fixed-dosed combination of alogliptin and Actos® NDA, requesting an additional cardiovascular safety trial with the alogliptin monotherapy to satisfy the FDA’s December 2008 guidance on anti-diabetic therapies. That trial is presently ongoing. |

| | • | | A fluoroquinolone antibiotic compound we licensed from Janssen Pharmaceutica, N.V., an affiliate of Johnson & Johnson, in November 2009 for the treatment of complicated skin and skin structure infections, such as abscesses that occur deep in the skin layers, and respiratory infections. This antibiotic has a broad spectrum of activity and is able to treat methicillin-resistant staphylococcus aureus, or MRSA, infections. Based on pre-clinical in vitro data, we believe this product may show superior bacteriocidal activity, compared to currently marketed antibiotics, for a number of difficult-to-treat pathogens. We are developing both oral and intravenous, or IV, formulations of this compound to allow doctors and patients to select the appropriate method of delivery under the circumstances. We have initiated work with the goal of beginning a Phase I study with the IV formulation in the first half of 2010. We are planning to initiate Phase II clinical trials using the oral formulation for complicated skin infections and using both formulations for respiratory infections in 2010. |

| | • | | A compound that is a mu opioid receptor agonist and delta opioid receptor antagonist, which we call mu delta, we licensed from Janssen Pharmaceutica, N.V. in November 2009 for the treatment of diarrhea-predominant irritable bowel syndrome. We have begun work with the goal of initiating Phase II clinical trials during the second quarter of 2010. |

| | • | | A novel statin compound we refer to as PPD 10558 licensed from Ranbaxy Laboratories, Ltd. for the treatment of dyslipidemia, which is an excessive level of blood lipids such as cholesterol. Preclinical data suggests this statin will avoid some of the adverse interactions seen when currently marketed statins are taken with some other drugs by patients with high blood lipid levels. In addition, one of the most common side effects of statin usage is a condition of pain and/or muscle weakness, known as statin-associated myopathy, which is reported to occur in up to 10% of statin-treated patients. Preclinical and Phase I human studies suggest that PPD 10558 has similar cholesterol-lowering properties as a leading marketed statin, and also has pharmacologic properties which suggest that it may have a lower risk of myopathy than currently marketed statins. PPD 10558 may therefore be a useful treatment option for statin-intolerant patients. PPD completed a high-dose comparator study in healthy volunteers that indicated the drug was well-tolerated and suggested it compares favorably to currently marketed statins with respect to lowering lipid levels. |

2

| | • | | A variety of therapeutic candidates developed by Eli Lilly and Company that we obtained through our acquisition of Magen BioSciences, Inc. in April 2009, including vitamin D receptor modulators. We have tested two of these compounds for various safety and efficacy parameters for topical treatment of dermatology indications in the anti-proliferative and anti-inflammatory areas. We have elected, however, not to pursue the development of these compounds. We also are currently investigating other compounds under material transfer agreements to identify potential drug development candidates for dermatological indications, and are considering other strategic alternatives for our dermatology business. |

At the closing of the spin-off, PPD will capitalize our company with cash and cash equivalents amounting to $100.0 million, and we will assume current accounts payable and other accrued expenses payable to third parties and incurred in the ordinary course of our Compound Partnering Business, which as of December 31, 2009, totaled approximately $4.6 million. We expect that this cash contribution will fund Furiex’s operations and working capital requirements for at least 12 months after the closing of the spin-off, based on current operating plans. In addition to this cash contribution, we expect to receive future payments from our existing collaborations that will provide additional support for our operations and working capital requirements. We might, however, run into unexpected delays or other problems with our drug candidates, which could increase our development costs and deplete our cash resources more rapidly than we anticipate. Further, we might not receive anticipated payments from our collaborators because of failure to meet milestones or other reasons, which would reduce our income. If we are unable to raise additional capital, whether we face any of these development issues or not, we might have to curtail or cease development of one or more of our drug candidates.

We were incorporated in Delaware on October 21, 2009 as PPD Therapeutics, Inc. and changed our name to Furiex Pharmaceuticals, Inc. on February 22, 2010. Our principal executive office is located at 3900 Paramount Parkway, Suite 150, Morrisville, North Carolina 27560 and our telephone number at that location is (919) 380-2000. Our internet address is www.furiex.com. Our website and the information contained on that site, or connected to that site, are not incorporated into this Information Statement or our registration statement on Form 10.

Reasons for the Spin-Off

On October 28, 2009, PPD announced a plan to spin off its Compound Partnering Business into a separate publicly traded company. PPD and we believe that the separation of the Compound Partnering Business from the CRO Business will enhance value for holders of PPD and Furiex stock by creating significant opportunities and benefits, including:

| | • | | Market Recognition: allowing investors to recognize and realize the full potential value of each company independently; |

| | • | | Employee Incentives: increasing our ability to attract and retain employees by providing equity compensation tied directly to our company’s performance, and our research and development efforts in particular; |

| | • | | Improved Capital Flexibility: allowing each company to deploy capital and access additional financing, if appropriate, in accordance with its unique needs and business model; and |

| | • | | Business Focus: allowing each company to focus its efforts on and allocate its resources towards its own business opportunities and challenges. |

As a newly independent company, however, we might not realize any of these benefits for any number of reasons, including lack of market acceptance of the value of our business model or drug pipeline, an inability to attract and retain qualified employees, and the difficulty in managing our business independently, which we have never done.

3

Summary of the Spin-Off

The following is a brief summary of the terms of the spin-off. Please see “The Spin-Off” beginning on page 30 for a more detailed description of the matters described below.

Distributing company | Pharmaceutical Product Development, Inc. |

Distributed company | Furiex Pharmaceuticals, Inc. |

Distribution ratio | Each holder of PPD common stock will receive one share of our common stock for every shares of PPD common stock held on the record date. |

Securities to be distributed | Approximately million shares of our common stock. The shares of our common stock to be distributed will constitute all of the outstanding shares of our common stock immediately after the spin-off. |

Fractional shares | We will not distribute any fractional shares of our common stock. Instead, the distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate net cash proceeds of the sales pro rata to each holder who otherwise would have been entitled to receive a fractional share in the distribution. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payment made in lieu of fractional shares. The receipt of cash in lieu of fractional shares generally will be taxable to the recipient shareholders as described in “The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution” beginning on page 32. |

Distribution agent, transfer agent and registrar for Furiex shares | American Stock Transfer & Trust Company, LLC 59 Maiden Lane, Plaza Level New York, New York 10038 (800) 937-5449 |

Record Date | 5:00 p.m. Eastern Time on [ ], 2010 |

Distribution Date | [ ], 2010 |

Stock exchange listing | Currently there is no public market for our common stock. We have applied to have our common stock listed on the Nasdaq Global Market under the symbol “FURX”. |

U.S. federal income tax consequences | PPD has requested a private letter ruling from the Internal Revenue Service and is expecting an independent tax opinion confirming that the distribution will qualify as a tax-free reorganization for U.S. federal income tax purposes under Sections 368(a)(1)(D) and 355 of the Internal Revenue Code of 1986, as amended, or the Code. Assuming that the distribution is tax-free, for U.S. federal income tax purposes, no taxable gain or loss will be recognized by a shareholder that is subject to U.S. federal income tax, and no amount will be included in the taxable income of a shareholder that is subject to U.S. federal income tax, upon the receipt of our common stock pursuant to |

4

| | the distribution. A shareholder that is subject to U.S. federal income tax generally will recognize taxable gain or loss with respect to any cash received in lieu of a fractional share. See “Risk Factors—Risks Relating to the Spin-off—If the distribution or internal transactions undertaken in anticipation of the separation are determined to be taxable for U.S. federal income tax purposes, we, our shareholders that are subject to U.S. federal income tax and PPD could incur significant U.S. federal income tax liabilities” on page 14 and “The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution” beginning on page 32. |

Purposes of the Distribution | PPD’s Board and management have determined that the spin-off will enhance long-term shareholder value by providing the benefits set forth below under the caption “The Spin-Off—Reasons for the Spin-Off” beginning on page 30. |

Conditions to the distribution | The distribution of our common stock is subject to the satisfaction of the following conditions, among other conditions described in this information statement: |

| | • | | the Securities and Exchange Commission, or SEC, shall have declared effective our registration statement on Form 10, of which this Information Statement is a part, under the Securities Exchange Act of 1934, as amended, or Exchange Act, and no stop order relating to the registration statement is in effect; |

| | • | | all permits, registrations and consents required under the securities or blue sky laws of states or other political subdivisions of the United States or of other foreign jurisdictions in connection with the distribution shall have been received; |

| | • | | the listing of our common stock on the Nasdaq Global Market shall have been approved, subject to official notice of issuance; |

| | • | | the receipt of a favorable private letter ruling from the Internal Revenue Service and an independent tax opinion to the effect that the pro rata dividend distribution of our shares to PPD shareholders will be treated as a tax-free distribution to PPD and its shareholders; |

| | • | | all material government approvals and other consents necessary to consummate the distribution shall have been received; and |

| | • | | no order, injunction or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing consummation of the distribution or any of the transactions related thereto, including the transfers of the assets and liabilities contemplated by the Separation and Distribution Agreement, shall be in effect. |

The fulfillment of these conditions does not create any obligation on PPD to effect the distribution, and the PPD Board has reserved the

5

| | right, in its sole discretion, to amend, modify or abandon the distribution and related transactions at any time prior to the distribution date. PPD has the right not to complete the distribution if, at any time, the PPD Board determines, in its sole discretion, that the distribution is not in the best interests of PPD or its shareholders or that market conditions are such that it is not advisable to separate the Compound Partnering Business from PPD. |

Risks relating to ownership of our common stock and the distribution | Our business is subject to both general and specific risks and uncertainties relating to our business, our relationship with PPD and our being a separate, publicly traded company. Our business is also subject to risks relating to the separation. You should read carefully “Risk Factors” beginning on page 11. |

Agreements with PPD | Before and as a condition to the distribution, we will enter into a Separation and Distribution Agreement, a Master Development Services Agreement, a Transition Services Agreement and other agreements with PPD to effect the separation and distribution and provide a framework for our relationship with PPD after the separation. These agreements will govern the relationships among us and PPD after the completion of the separation plan and provide for the allocation among us and PPD of PPD’s assets, liabilities and obligations (including employee benefits and tax-related assets and liabilities) attributable to periods prior to our separation from PPD. For a discussion of these arrangements, see “Related Person Transactions” beginning on page 88. |

Questions and Answers about the Spin-off

How will the spin-off work? | The spin-off will be accomplished through a series of transactions by which PPD will contribute to us its Compound Partnering Business, which we refer to as the contribution, and PPD will distribute to its shareholders all of the outstanding shares of our common stock on a pro rata basis, which we refer to as the distribution. When we refer to the occurrence of the spin-off, we are referring to the date the spin-off is finalized and our stock is distributed to you. For additional information on the transactions in the spin-off, see “The Spin-Off—Manner of Effecting the Spin-Off” beginning on page 30. |

What will our relationship with PPD be after the spin-off? | PPD and Furiex each will be independent, publicly traded companies. However, we will enter into agreements with PPD or one of its wholly owned subsidiaries that will ease the transition of PPD and Furiex into two independent, publicly traded companies following the spin-off. These agreements will also allocate responsibility for obligations arising before and after the spin-off, including, among others, obligations relating to taxes. We will also enter into an agreement appointing PPD as the preferred provider of CRO services to us. For additional information on our relationship with PPD after the spin-off, see “Our Relationship with PPD after the Spin-Off” beginning on page 66. |

6

When will the spin-off be completed? | PPD expects to complete the spin-off by distributing shares of our common stock on [ ], 2010, to holders of record of PPD common stock on the record date. As discussed under “The Spin-Off—Trading of PPD Common Stock After the Record Date and Prior to the Ex-Dividend Date,” if you sell your shares of PPD common stock in the “regular way” market after the record date and prior to the ex-dividend date, you also will be selling your right to receive shares of our common stock in connection with the spin-off. For additional information on the spin-off, see “The Spin-Off—Results of the Spin-Off” beginning on page 31. |

What do I have to do to participate in the distribution? | Nothing. You are not required to take any action to receive shares of our common stock in the spin-off. No vote of PPD shareholders is required or will be taken to authorize the spin-off. If you own shares of PPD common stock as of the close of business on the record date and do not sell those shares in the “regular way” market prior to the ex-dividend date, a book-entry account statement reflecting your ownership of shares of our common stock will be mailed to you, or your brokerage account will be credited for the shares, on or about [ ], 2010. Do not mail in PPD common stock certificates in connection with the spin-off. |

How many shares of your common stock will I receive? | PPD will distribute one share of our common stock for every shares of PPD common stock you own of record as of the close of business on the record date and do not sell in the “regular way” market prior to the ex-dividend date. Cash will be distributed in lieu of fractional shares, as described below. Based on approximately million shares of PPD common stock that we expect to be outstanding on the record date, PPD will distribute a total of approximately million shares of our common stock. The number of shares of our common stock that PPD will distribute to its shareholders will be reduced to the extent that cash payments are to be made in lieu of the issuance of fractional shares of our common stock and to the extent that shares of our common stock are held back and sold on the market to satisfy backup withholding taxes and non-U.S. holder dividend withholding taxes and brokerage and other costs, and will be increased to the extent, if any, that PPD options are exercised prior to the record date. For additional information on the distribution, see “The Spin-Off—Results of the Spin-Off” beginning on page 31. |

How will PPD distribute fractional shares of Furiex common stock? | PPD will not distribute any fractional shares of our common stock to its shareholders. Instead, the distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate net cash proceeds of the sales pro rata to each holder who otherwise would have been entitled to receive a fractional share in the distribution. Recipients of cash in lieu of fractional shares will not be entitled to any interest on the amounts of payment made in lieu of fractional shares. The receipt of cash in lieu of fractional shares |

7

| | generally will be taxable to the recipient shareholders as described in “The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution” beginning on page 32. |

Can PPD decide to cancel the distribution of Furiex common stock even if all the conditions have been met? | Yes. PPD has the right to terminate the distribution, and the spin-off, even if all of the conditions set forth in the Separation and Distribution Agreement are satisfied, if at any time the Board of PPD determines that the distribution is not in the best interest of PPD and its shareholders or that market conditions are such that it is not advisable to separate the Compound Partnering Business from PPD. |

Will I receive physical certificates representing shares of Furiex common stock following the separation? | No. We will not issue physical stock certificates in the distribution, even if requested. Instead, PPD, with the assistance of American Stock Transfer & Trust Company, the distribution agent, will electronically issue shares of our common stock to you or to your bank or brokerage firm on your behalf by way of direct registration in book-entry form. The book-entry system allows registered shareholders to hold their shares without physical stock certificates. A benefit of issuing stock electronically in book-entry form is that there will be none of the physical handling and safekeeping responsibilities that are inherent in owning physical stock certificates. For additional information, see “The Spin-Off—Manner of Effecting the Spin-Off” beginning on page 30. |

Do you intend to pay dividends on your common stock? | We currently do not intend to pay dividends on our common stock. The declaration and amount of dividends will be determined by our Board and will depend on our financial condition, earnings, capital requirements, legal requirements, regulatory constraints, contractual restrictions, and any other factors that our Board believes are relevant. See “Dividend Policy” on page 38 for additional information on our dividend policy following the spin-off. |

What if I want to sell my PPD common stock or Furiex common stock? | You should consult your financial advisors, such as your stockbroker, bank or tax advisor. Neither PPD nor Furiex makes any recommendation as to the purchase, retention or sale of shares of PPD common stock or the Furiex common stock to be distributed. |

If you decide to sell any shares before the ex-dividend date, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your PPD common stock or the Furiex common stock you will receive in the distribution or both.

Where will I be able to trade shares of Furiex common stock? | There is no current trading market for our common stock. We plan to have our common stock authorized for listing on the Nasdaq Global Market under the symbol “FURX”. We expect that a limited market, commonly known as a “when-issued” trading market, for our common stock will begin on or shortly after [ ], 2010. The term “when-issued” means that shares can be traded prior to the time shares are actually available or issued. We expect that on the distribution date or the first trading day after the distribution date, “when-issued” trading in our common stock will end and “regular |

8

| | way” trading will begin. “Regular way” trading refers to trading after a security has been issued and typically involves a transaction that settles on the third full business day following the date of a trade. Shares of our common stock generally will be freely tradable following the spin-off. For additional information regarding the trading of our common stock, see “The Spin-Off—Market for Our Common Stock; Trading of Our Common Stock in Connection with the Spin-Off” beginning on page 35. |

Will the number of PPD shares I own change as a result of the spin-off? | No. The number of shares of PPD common stock you own will not change as a result of the spin-off. |

What will happen to the listing of PPD common stock? | Nothing. It is expected that after the distribution of Furiex common stock, PPD common stock will continue to be traded on the Nasdaq Global Select Market under the symbol “PPDI”. |

Are there any risks to owning Furiex common stock? | Yes. Our business is subject to both general and specific risks relating to our operations, anticipated net losses, and our operating as a stand-alone company. Our business is also subject to risks relating to the separation. These and other risks are described in “Risk Factors” beginning on page 11. We encourage you to read that section carefully. |

Who do I contact for information regarding Furiex and the spin-off? | Before the spin-off, you should direct inquiries relating to the spin-off to: |

Investor Relations

Pharmaceutical Product Development, Inc.

929 North Front Street

Wilmington, North Carolina 28401

(910) 558-7585

After the spin-off, you should direct inquiries relating to our common stock to:

Investor Relations

Furiex Pharmaceuticals, Inc.

3900 Paramount Parkway, Suite 150

Morrisville, North Carolina 27560

(919) 380-2000

After the spin-off, the transfer agent and registrar for our common stock will be:

American Stock Transfer & Trust Company, LLC

59 Maiden Lane, Plaza Level

New York, New York 10038

(800) 937-5449

9

Summary Historical Combined Financial Information

The tables below set forth selected historical financial data of the combined financial statements of Furiex. This information has been prepared from Furiex’s audited combined financial statements as of December 31, 2009 and 2008 and for each of the three years in the period ended December 31, 2009. Financial information as of December 31, 2007, 2006 and 2005 and for each of the two years in the period ended December 31, 2006 has been prepared from unaudited combined financial statements not included herein. During these periods, Furiex was an integrated business of PPD. The historical financial information is not likely to be indicative of Furiex’s future performance or its future financial position or results of operations, and it does not provide or reflect data as if Furiex had actually operated as a separate, stand-alone entity during the periods covered. Per share data has not been presented as no common shares were outstanding during the periods presented and such information would not be meaningful.

The selected historical financial data should be read in conjunction with the combined financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, included elsewhere in this Information Statement.

Combined Statements of Operations Data (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 (1) | |

Net revenue | | $ | 25,371 | | | $ | 15,857 | | | $ | 560 | | | $ | 18,419 | | | $ | 6,312 | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses | | | 28,029 | | | | 3,604 | | | | 23,316 | | | | 11,645 | | | | 38,131 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from operations(2) | | | (2,658 | ) | | | 12,253 | | | | (22,756 | ) | | | 6,774 | | | | (31,819 | ) |

Other income (expense), net | | | (2 | ) | | | (329 | ) | | | 19 | | | | 14 | | | | (2 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (2,660 | ) | | | 11,924 | | | | (22,737 | ) | | | 6,788 | | | | (31,821 | ) |

Discontinued operations(3) | | | 2,164 | | | | (4,066 | ) | | | (185 | ) | | | (976 | ) | | | 22,890 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (496 | ) | | $ | 7,858 | | | $ | (22,922 | ) | | $ | 5,812 | | | $ | (8,931 | ) |

| | | | | | | | | | | | | | | | | | | | |

Combined Balance Sheet Data (in thousands):

| | | | | | | | | | |

| | | As of December 31, |

| | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

Total assets | | 69,166 | | 63,581 | | 63,265 | | 61,138 | | 55,877 |

PPD net investment(4) | | 62,314 | | 58,895 | | 56,870 | | 55,524 | | 49,270 |

| (1) | We acquired Magen BioSciences, Inc. in 2009. Results of operations for the acquisition are included in our combined results of operations as of and since the effective date of the acquisition. For further details, see Note 2 in the notes to the combined financial statements. |

| (2) | Impairments of intangible assets are included in income (loss) from operations. For 2009, the impairment of intangible asset was related to in-process research and development for the MAG-131 compound obtained through the acquisition of Magen Biosciences. For 2008, the impairment of intangible asset related to the remaining unamortized value of our royalty interest in SinuNase and other Accentia antifungal products. For further details, see Note 5 in the notes to the combined financial statements. |

| (3) | In 2009, we completed dispositions of Piedmont Research Center, LLC and PPD Biomarker Discovery Sciences, LLC. Results of operations for these dispositions are included in discontinued operations, net of provision for income tax of $0. For further details, see Note 2 in the notes to the to the combined financial statements. |

| (4) | The financial statements of the company represent a combination of various components of PPD comprising the Discovery Sciences segment. Because a direct ownership relationship did not exist among all the components comprising the company, PPD’s net investment in the company is shown in lieu of shareholder’s equity in the combined financial statements. The net investment account represents the cumulative investments in, distributions from and earnings (loss) of the company. |

10

Risk Factors

This Information Statement includes forward-looking statements. All statements other than statements of historical facts are forward-looking statements, including any projections of milestones, royalties or other financial items, any statements of the plans and objectives of management for future operations, any statements concerning proposed new products or licensing or collaborative arrangements, any statements regarding future economic conditions or performance, and any statement of assumptions underlying any of the foregoing. In some cases, forward-looking statements can be identified by the use of terminology such as “believes”, “might”, “will”, “expects”, “plans”, “anticipates”, “estimates”, “potential” or “continue”, or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements contained in this Information Statement are reasonable, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to inherent risks and uncertainties, including the risk factors set forth below, and for the reasons described elsewhere in this Information Statement, any of which could significantly adversely impact our business and cause a partial or complete loss of your Furiex stock’s value. All forward-looking statements and reasons why results might differ included in this Information Statement are made as of the date hereof, and we assume no obligation to update these forward-looking statements or reasons why actual results might differ.

Risks Relating to the Spin-Off

We might not realize the potential benefits from the spin-off; PPD shareholders might not realize the potential benefits of the spin-off.

We expect the spin-off to provide us with market recognition of our potential as an independent company and the attendant benefits of being able to incentivize our employees with compensation tied directly to our performance, deploy capital and access financing to meet our specific needs and focus our efforts on our own business opportunities and challenges. However, we might not realize the potential benefits that we expect from our spin-off from PPD. Further, PPD shareholders might not realize the intended benefits of the spin-off. We have described those anticipated benefits in greater detail elsewhere in this Information Statement. See “The Spin-Off—General”. There is a risk, however, that by separating from PPD we might be more susceptible to market fluctuations and other adverse events than we would have been were we still a part of PPD. In addition, we will incur significant costs, which might exceed our estimates, and we will incur some negative effects from our separation from PPD, including the loss of cash flow and revenue derived from PPD’s CRO Business.

Our historical and pro forma financial information is not necessarily indicative of our future financial position, future results of operations or future cash flows and does not reflect what our financial position, results of operations or cash flows would have been as a stand-alone company during the periods presented.

Our historical financial information included in this Information Statement does not necessarily reflect what our financial position, results of operations or cash flows would have been as a stand-alone company during the periods presented. In addition, it is not necessarily indicative of our future financial position, future results of operations or future cash flows. This is primarily a result of the following factors:

| | • | | Prior to our separation, our business was operated by PPD as part of its broader corporate organization and we did not operate as a stand-alone company; |

| | • | | Most general administrative functions were performed by PPD for the combined entity, so although our historical combined financial statements reflect allocations of costs for services shared with PPD, these allocations may differ from the costs we will incur for these services as an independent company; |

11

| | • | | After the completion of our separation, the cost of capital for our business might be higher than PPD’s cost of capital prior to our separation; and |

| | • | | Prior to the separation, our financial statements include revenues and expenses of services that will not be continued by us subsequent to the separation. |

The unaudited pro forma condensed combined balance sheet as of December 31, 2009 assumes the funding by PPD of $100.0 million for a capital contribution based on the anticipated post-separation capital structure as well as the assumption by us of accounts payable to third parties in the ordinary course of our Compound Partnering Business. The pro forma financial position of Furiex as of December 31, 2009 and its results of operations for the years ended December 31, 2008 and 2009 also will differ from the financial position and results of operations of Furiex after the spin-off due to ongoing losses that are expected to continue after December 31, 2009. Please refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Unaudited Pro Forma Condensed Combined Financial Statements” and our historical combined financial statements and the notes to those statements included elsewhere in this Information Statement.

Our separation from PPD might present significant challenges.

There is a significant degree of difficulty and management distraction inherent in the process of our separating from PPD. These difficulties include:

| | • | | the challenge of effecting the separation while carrying on the ongoing operations of each business; |

| | • | | the potential difficulty in retaining key officers and personnel of each company; and |

| | • | | separating corporate infrastructure, including but not limited to systems, insurance, accounting, legal, finance, tax and human resources, for each of the two companies. |

Our separation from PPD might not be completed as successfully and cost-effectively as we anticipate. This could have an adverse effect on our business, financial condition and results of operations.

Our internal systems and resources might not be adequately prepared to meet the financial reporting and other requirements to which we will be subject following the separation.

Our financial results previously were included within the consolidated results of PPD. However, we were not directly subject to the reporting and other requirements of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. As a result of the separation, we will be directly subject to the reporting and other obligations under the Exchange Act immediately after the separation. In addition, we expect to be subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 beginning with our financial statements for the year ending December 31, 2011, which will require annual management assessments of the effectiveness of our internal control over financial reporting and a report by our independent registered public accounting firm addressing the effectiveness of our internal control over financial reporting. These reporting and other obligations will place significant demands on our management and administrative and operational resources, including accounting resources.

To comply with these requirements, we might need to acquire or upgrade our systems, including information technology, implement additional financial and management controls, reporting systems and procedures and hire additional legal, accounting and finance staff. If we are unable to establish our financial and management controls, reporting systems, information technology and procedures in a timely and effective fashion, our ability to comply with our financial reporting requirements and other rules that apply to reporting companies could be impaired. In addition, if we are unable to conclude that our internal control over financial reporting is effective (or if the auditors are unable to express an opinion on the effectiveness of our internal controls), we could lose investor confidence in the accuracy and completeness of our financial reports.

12

Our management will be responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) under the Exchange Act. Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States. Any failure to achieve and maintain effective internal controls could have an adverse effect on our business, financial position and results of operations.

As a stand-alone company, we will not receive any of the revenue or cash flows derived from PPD’s CRO Business.

For fiscal 2009, PPD earned $1.4 billion or approximately 99.6% of its revenue from continuing operations from services revenues derived from PPD’s CRO Business. After the completion of the separation, we will not receive any such revenue. PPD will initially contribute to us cash and cash equivalents of $100.0 million, and we will assume current accounts payable and other accrued expenses payable to third parties and incurred in the ordinary course of our Compound Partnering Business, which as of December 31, 2009, totaled approximately $4.6 million. We expect that this cash contribution will fund Furiex’s operations and working capital requirements for at least 12 months after the closing of the spin-off, based on current operating plans. In addition to this cash contribution, we expect to receive future payments from our existing collaborations that will provide additional support for our operations and working capital requirements. Despite these resources and potential future revenue, we cannot assure you that such funds will meet our working capital and operational needs or that our working capital requirements will not increase beyond our current expectations. We might need to obtain additional financing from banks or other lenders, or through public offerings or private placements of debt or equity securities, strategic relationships or other arrangements to fully execute our business strategy.

Concerns about our prospects as a stand-alone company could affect our ability to retain employees.

The spin-off represents a substantial organizational and operational change and our employees might have concerns about our prospects as a stand-alone company, including our ability to successfully operate the new entity and our ability to maintain our independence after the spin-off. If we are not successful in assuring our employees of our prospects as an independent company, our employees might seek other employment, which could materially adversely affect our business.

We have no history operating as an independent company upon which you can evaluate us.

We do not have an operating history as a stand-alone entity. While our Compound Partnering Business has constituted a part of the historic operations of PPD since 1998, we have not operated as a stand-alone company without the CRO Business. Following the spin-off, as an independent company, our ability to satisfy our obligations and achieve profitability will be solely dependent upon the future performance of our Compound Partnering Business, and we will not be able to rely upon the capital resources and cash flows of the CRO Business remaining with PPD.

We might have received better terms from unaffiliated third parties than the terms we receive in our agreements with PPD.

The agreements we will enter into with PPD in connection with the spin-off, including the Master Development Services Agreement, the sublease, the Employee Matters Agreement and the Transition Services Agreement, were negotiated while we were still part of PPD. The terms of these agreements relate to, among other things, drug development services to be provided to us by PPD, the subleasing of our offices, employee benefit matters and the provision of transition services to us by PPD. The Master Development Services Agreement requires us to use PPD for specified drug development services for three years contingent on PPD’s expertise and capabilities to provide the needed services. While we believe the terms and conditions of these agreements with PPD are reasonable and acceptable to us, they might not reflect the same terms and conditions that we could have obtained had we sought competitive bids from and negotiated with unaffiliated parties. See “Our Relationship with PPD after the Spin-Off”.

13

The ownership by our executive officers and some of our directors of shares of common stock and/or options to purchase shares of common stock of PPD might create, or might create the appearance of, conflicts of interest.

Due to their current or former employment with or service to PPD, several of our executive officers and directors own shares of common stock of PPD and hold options to purchase shares of common stock of PPD. As of March 31, 2010, the following individuals owned the following amounts of common stock and options to purchase common stock of PPD (exercisable within 60 days of March 31, 2010): Fred N. Eshelman, our founding Chairman and a director, 7,669,601 shares and 776,665 options; Stuart Bondurant, a director, 7,160 shares and 35,399 options; Gail McIntyre, our Senior Vice President – Research, 3,220 shares and 121,032 options; and Paul S. Covington, our Senior Vice President – Clinical Operations, 881 shares and 58,334 options. If the options were exercised, Dr. Eshelman would own 7.1% and the other individuals would own less than 1.0% of PPD’s outstanding common stock as of that date. These individual holdings of common stock and/or options to purchase common stock of PPD may be significant compared to the individual’s total assets. This ownership by our directors and officers, after our separation, of common stock and/or options to purchase common stock of PPD creates, or, might create the appearance of, conflicts of interest when these directors and officers are faced with decisions that could have different implications for PPD than for us.

If the distribution or internal transactions undertaken in anticipation of the separation are determined to be taxable for U.S. federal income tax purposes, we, our shareholders that are subject to U.S. federal income tax and PPD could incur significant U.S. federal income tax liabilities.

PPD is seeking a private letter ruling from the Internal Revenue Service regarding the U.S. federal income tax consequences of the distribution of our common stock to the PPD shareholders substantially to the effect that the distribution, except for cash received in lieu of a fractional share of our common stock, will qualify as tax-free under Sections 368(a)(1)(D) and 355 of the Code. The private letter ruling is also expected to provide that any internal transactions undertaken in anticipation of the separation will qualify for favorable treatment under the Code. The private letter ruling relies or will rely on facts and assumptions, and representations and undertakings, from us and PPD regarding the past and future conduct of our respective businesses and other matters. Notwithstanding the private letter ruling, the Internal Revenue Service could determine on audit that the distribution or the internal transactions should be treated as taxable transactions if it determines that any of these facts, assumptions, representations or undertakings is not correct or has been violated, or that the distribution should be taxable for other reasons, including as a result of significant changes in stock or asset ownership after the distribution. If the distribution ultimately is determined to be taxable, the distribution could be treated as a taxable dividend or capital gain to you for U.S. federal income tax purposes, and you could incur significant U.S. federal income tax liabilities. In addition, PPD would recognize taxable gain in an amount equal to the excess, if any, of the fair market value of our common stock distributed to PPD shareholders on the distribution date over PPD’s tax basis in these common shares, if the distribution were held to be taxable.

In addition, under the terms of the Tax Sharing Agreement that we will enter into with PPD, in the event the distribution or the internal transactions were determined to be taxable and such determination was the result of actions taken after the distribution by us or PPD, the party responsible for such actions would be responsible for all resulting taxes imposed on us or PPD. If such determination is not the result of actions taken after the distribution by us or PPD, then PPD would be responsible for any resulting taxes imposed on us or PPD. These taxes could be significant.

We might not be able to engage in desirable strategic transactions and equity issuances following the separation because of restrictions relating to U.S. federal income tax requirements for tax-free distributions.

Our ability to engage in significant equity transactions could be limited or restricted after the distribution in order to preserve for U.S. federal income tax purposes the tax-free nature of the distribution by PPD. In addition, similar limitations and restrictions will apply to PPD. Even if the distribution otherwise qualifies for tax-free

14

treatment under Sections 368(a)(1)(D) and 355 of the Code, it might result in corporate-level taxable gain to PPD under Section 355(e) of the Code if 50% or more, by vote or value, of our shareholder equity or PPD shareholder equity is acquired or issued as part of a plan or series of related transactions that includes the distribution. For this purpose, any acquisitions or issuances of PPD’s shareholder equity within two years before the distribution, and any acquisitions or issuances of our shareholder equity or PPD shareholder equity within two years after the distribution, generally are presumed to be part of such a plan, although we or PPD might be able to rebut that presumption. If an acquisition or issuance of our shareholder equity or PPD shareholder equity triggers the application of Section 355(e) of the Code, PPD would recognize taxable gain as described above, and could incur significant U.S. federal income tax liabilities as a result of the application of Section 355(e) of the Code.

Under the Tax Sharing Agreement, there are restrictions on our ability to take actions that could cause the distribution or internal transactions undertaken in anticipation of the separation to fail to qualify as tax-favored, which could include entering into, approving or allowing any transaction that results in a change in ownership of more than 50% of our common shares, a redemption of equity securities, a sale or other disposition of a substantial portion of our assets, an acquisition of a business or assets with shareholder equity to the extent one or more persons would acquire 50% or more of our shareholder equity, or engaging in certain internal transactions. These restrictions apply at any time after the distribution, unless we obtain a private letter ruling from the Internal Revenue Service or an opinion that such action will not cause the distribution or the internal transactions undertaken in anticipation of the separation to fail to qualify as tax-favored transactions, and such letter ruling or opinion, as the case may be, is acceptable to the parties. PPD is subject to similar restrictions under the Tax Sharing Agreement. Moreover, the Tax Sharing Agreement generally provides that a party thereto is responsible for any taxes imposed on any other party thereto as a result of the failure of the distribution or internal transactions to qualify as a tax-favored transaction under the Code if the failure is attributable to post-distribution actions taken by or in respect of the responsible party or its shareholders, regardless of whether the other parties consent to such actions or such party obtains a favorable letter ruling or opinion as described above. For example, we would be responsible for the acquisition of us by a third party at a time and in a manner that would cause such failure. These restrictions might prevent us from entering into transactions that might be advantageous to our shareholders, or might increase the cost of the transactions.

If PPD waives one or more conditions to the spin-off, it could adversely impact our operations, the tax treatment of the spin-off, the liquidity of our common stock or have other consequences.

PPD can waive certain of the conditions to the spin-off in it sole and absolute discretion. See “The Spin-Off—Distribution Conditions and Termination”. If PPD waived the condition that it receive a private letter ruling and an independent tax opinion to the effect that the distribution will qualify as a tax-free reorganization for U.S. federal income tax purposes, then the distribution might be taxable to you as PPD stockholders. Waivers of other conditions by PPD also could have material adverse consequences. However, PPD cannot waive the condition that the SEC declare our registration statement effective or that our common stock be approved for listing on Nasdaq. While PPD has the ability to waive the condition that there not be an order, injunction or decree that prohibits or prevents the consummation of the spin-off, PPD would not waive this condition because it would be illegal to do so. Further, we are not aware of any material federal or state regulatory requirements that must be complied with or any material permits, registrations or approvals that must be obtained, other than compliance with SEC rules and regulations and the declaration of effectiveness of our registration statement by the SEC, in connection with the distribution. In addition, we have received all necessary third party consents for the transfer of assets from PPD to Furiex as part of the spin-off.

15

Risks Relating to Furiex’s Business

We anticipate that we will incur losses for the foreseeable future. We might never achieve or sustain profitability. If additional capital is not available, we might have to curtail or cease operations.

Our business has experienced significant net losses. We had net losses of $22.9 million in 2007, net income of $5.8 million in 2008 and a net loss of $8.9 million in 2009. The net income for 2008 included aggregate milestone payments of $18.0 million. We expect to continue to incur additional net losses over the next several years as we continue our research and development activities and incur significant preclinical and clinical development costs. Since we or our collaborators or licensees might not successfully develop additional products, obtain required regulatory approvals, manufacture products at an acceptable cost or with appropriate quality, or successfully market products with desired margins, our expenses might continue to exceed any revenues we receive. Our commitment of resources to the continued development of our products might require significant additional funds for development. Our operating expenses also might increase if we:

| | • | | move our earlier stage potential products into later stage clinical development, which is generally a more expensive stage of development; |

| | • | | select additional preclinical product candidates for preclinical development and then clinical development; |

| | • | | pursue clinical development of our potential products in new indications; |

| | • | | increase the number of patents we are prosecuting or otherwise expend additional resources on patent prosecution or defense; |

| | • | | invest in or acquire additional technologies, product candidates or businesses although we have no current agreements to do so; or |

| | • | | impair any of our investments in our product candidates. |

In the absence of substantial licensing, milestone and other revenues from third-party collaborators, royalties on sales of products licensed under our intellectual property rights, future revenues from our products in development or other sources of revenues, we will continue to incur operating losses and might require additional capital to fully execute our business strategy. The likelihood of reaching, and time required to reach, sustained profitability are highly uncertain.

Although we expect that we will have sufficient cash to fund our operations and working capital requirements for at least 12 months after the spin-off based on current operating plans, we might need to raise additional capital in the future to:

| | • | | acquire complementary businesses or technologies; |

| | • | | respond to competitive pressures; |

| | • | | fund our research and development programs; or |

| | • | | commercialize our product candidates. |

Our future capital needs depend on many factors, including:

| | • | | the scope, duration and expenditures associated with our research and development programs; |

| | • | | continued scientific progress in these programs; |

16

| | • | | the outcome of potential licensing transactions, if any; |

| | • | | competing technological developments; |

| | • | | our proprietary patent position, if any, in our product candidates; |

| | • | | the regulatory approval process for our product candidates; and |

| | • | | the cost of attracting and retaining employees. |

We might seek to raise necessary funds through public or private equity offerings, debt financings or additional collaborations and licensing arrangements. We might not be able to obtain additional financing on terms favorable to us, if at all. General market conditions might make it very difficult for us to seek financing from the capital markets. We might have to relinquish rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us, in order to raise additional funds through collaborations or licensing arrangements. If adequate funds are not available, we might have to delay, reduce or eliminate one or more of our research or development programs and reduce overall overhead expenses or cease operations. These actions might reduce the market price of our common stock.

Our near-term success is largely dependent on the success of Priligy and our lead drug candidate, alogliptin, as well as our other drug candidates, and we cannot be certain that we will be able to obtain regulatory approval for or commercialize any of these drug candidates.