SUPPLEMENTAL FINANCIAL INFORMATION FOR Q1 2019 May 8, 2019 BRT APARTMENTS CORP. 60 Cutter Mill Rd., Great Neck, NY 11021

Forward Looking Statements FORWARD LOOKING STATEMENTS The information set forth herein contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provision for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions. Forward- looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words "may", "will", "believe", "expect", "intend", "anticipate”, “estimate", "project", or similar expressions or variations thereof. Forward- looking statements involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could materially affect actual results, performance or achievements. Investors are cautioned not to place undue reliance on any forward-looking statements and are urged to read the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K filed on December 10, 2018 and in reports filed with the SEC thereafter, including our Quarterly Report on Form 10-Q for the period ended March 31, 2019, that we anticipate will be filed shortly after the furnishing of this document. The Company undertakes no obligation to update or revise the information herein, whether as a result of new information, future events or circumstances, or otherwise. Units under rehabilitation for which we have received or accrued rental income from business interruption insurance, while not physically occupied, are treated as leased (i.e., occupied) at rental rates in effect at the time of the casualty.

Table of Contents Table of Contents Page Number Financial Highlights 1 Operating Results 2 Funds From Operations 3 Consolidated Balance Sheets 4 BRT’s Share of the Operating Results 5 BRT’s Share of the Consolidated Balance Sheets 6 Portfolio Data by State 7 Same Store Comparison 8 Multi-Family Acquisitions and Dispositions 9 Value-Add Information and Capital Expenditures 10 Debt Analysis 11 Non-GAAP Financial Measures, Definitions, and 12-13 Reconciliations Portfolio Table 14

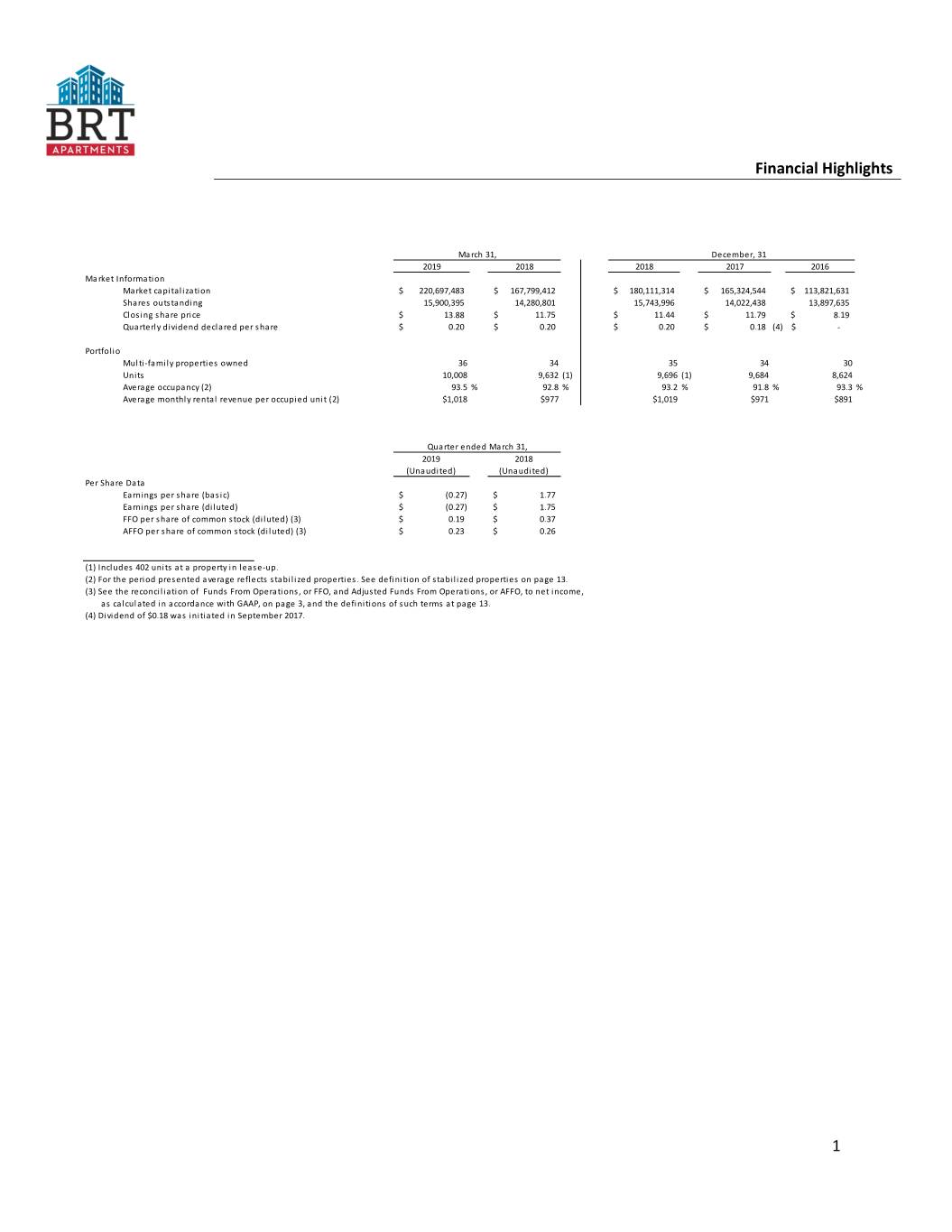

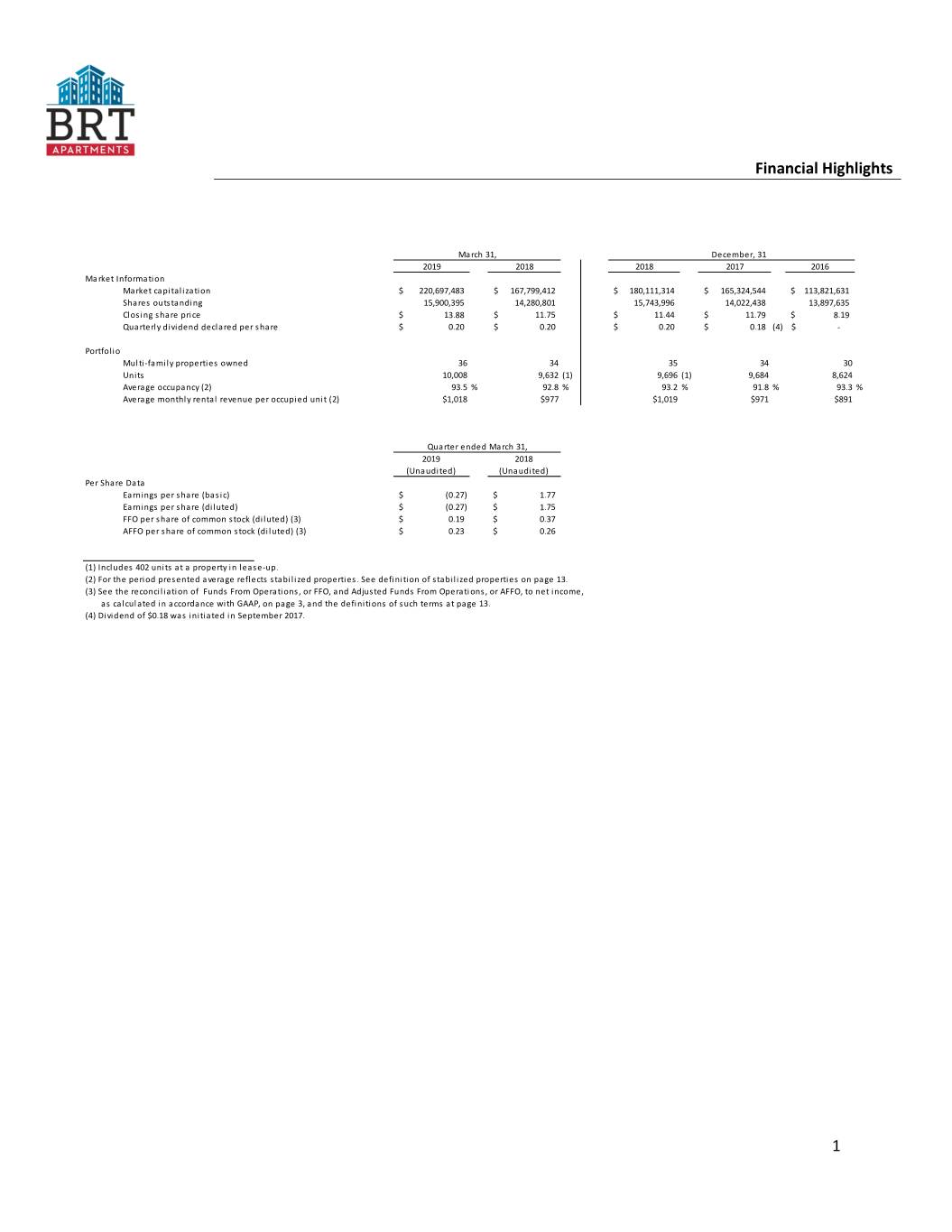

Financial Highlights March 31, December, 31 2019 2018 2018 2017 2016 Market Information Market capitalization $ 220,697,483 $ 167,799,412 $ 180,111,314 $ 165,324,544 $ 113,821,631 Shares outstanding 15,900,395 14,280,801 15,743,996 14,022,438 13,897,635 Closing share price $ 13.88 $ 11.75 $ 11.44 $ 11.79 $ 8.19 Quarterly dividend declared per share $ 0.20 $ 0.20 $ 0.20 $ 0.18 (4) $ - Portfolio Multi-family properties owned 36 34 35 34 30 Units 10,008 9,632 (1) 9,696 (1) 9,684 8,624 Average occupancy (2) 93.5 % 92.8 % 93.2 % 91.8 % 93.3 % Average monthly rental revenue per occupied unit (2) $1,018 $977 $1,019 $971 $891 Quarter ended March 31, 2019 2018 (Unaudited) (Unaudited) Per Share Data Earnings per share (basic) $ (0.27) $ 1.77 Earnings per share (diluted) $ (0.27) $ 1.75 FFO per share of common stock (diluted) (3) $ 0.19 $ 0.37 AFFO per share of common stock (diluted) (3) $ 0.23 $ 0.26 (1) Includes 402 units at a property in lease-up. (2) For the period presented average reflects stabilized properties. See definition of stabilized properties on page 13. (3) See the reconciliation of Funds From Operations, or FFO, and Adjusted Funds From Operations, or AFFO, to net income, as calculated in accordance with GAAP, on page 3, and the definitions of such terms at page 13. (4) Dividend of $0.18 was initiated in September 2017. 1

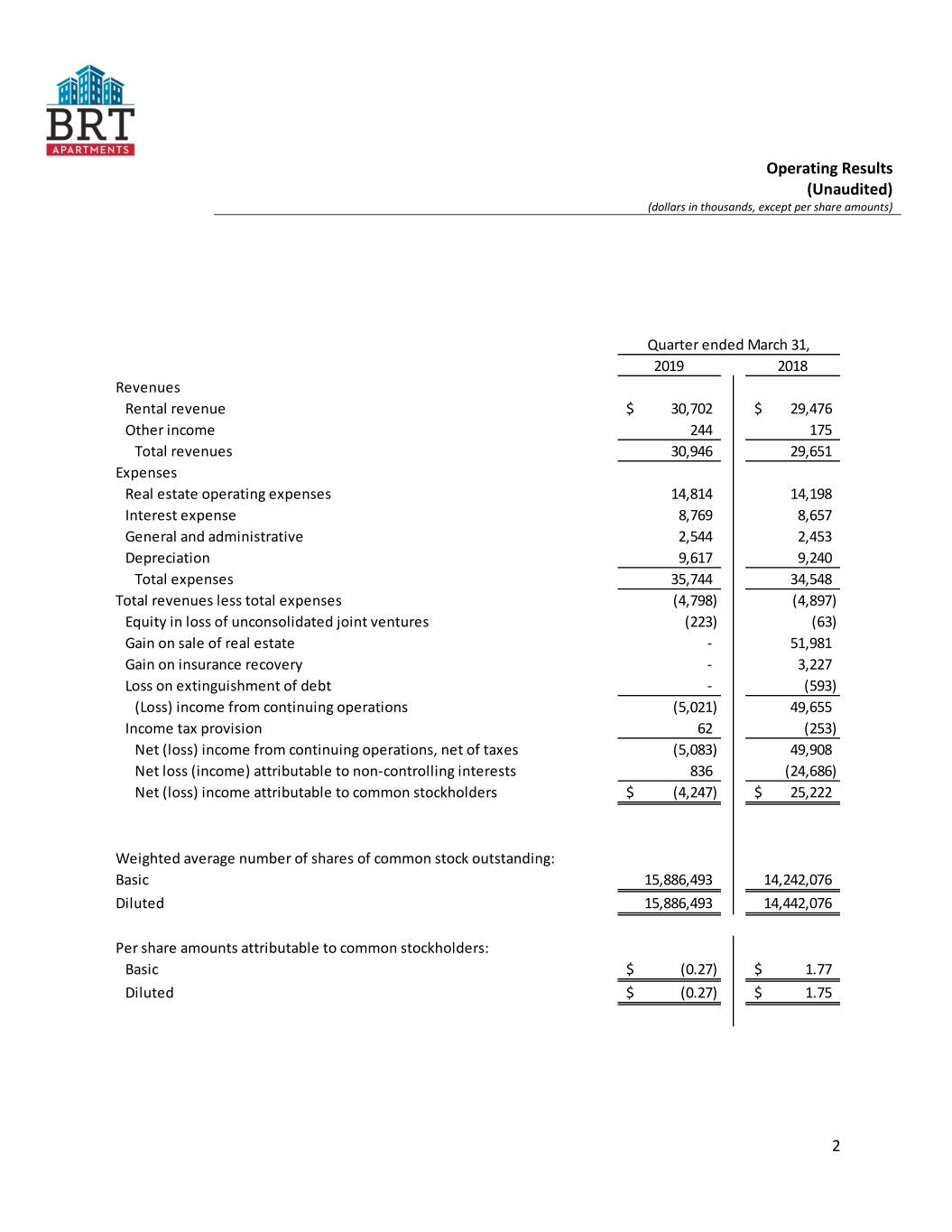

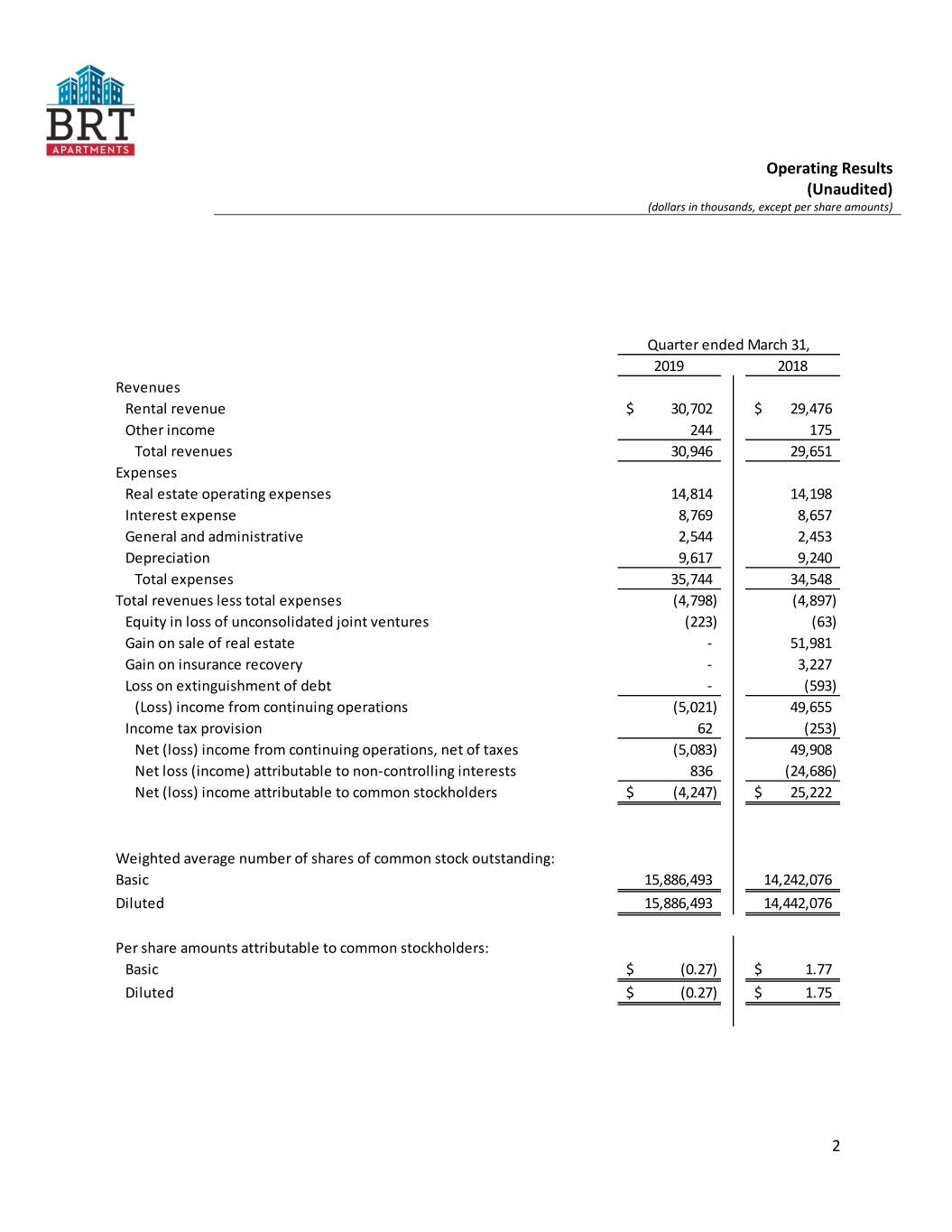

Operating Results (Unaudited) (dollars in thousands, except per share amounts) Quarter ended March 31, 2019 2018 Revenues Rental revenue $ 30,702 $ 29,476 Other income 244 175 Total revenues 30,946 29,651 Expenses Real estate operating expenses 14,814 14,198 Interest expense 8,769 8,657 General and administrative 2,544 2,453 Depreciation 9,617 9,240 Total expenses 35,744 34,548 Total revenues less total expenses (4,798) (4,897) Equity in loss of unconsolidated joint ventures (223) (63) Gain on sale of real estate - 51,981 Gain on insurance recovery - 3,227 Loss on extinguishment of debt - (593) (Loss) income from continuing operations (5,021) 49,655 Income tax provision 62 (253) Net (loss) income from continuing operations, net of taxes (5,083) 49,908 Net loss (income) attributable to non-controlling interests 836 (24,686) Net (loss) income attributable to common stockholders $ (4,247) $ 25,222 Weighted average number of shares of common stock outstanding: Basic 15,886,493 14,242,076 Diluted 15,886,493 14,442,076 Per share amounts attributable to common stockholders: Basic $ (0.27) $ 1.77 Diluted $ (0.27) $ 1.75 2

Funds From Operations (Unaudited) (dollars in thousands, except per share amounts) Quarter ended March 31, 2019 2018 GAAP Net (loss) income attributable to common stockholders $ (4,247) $ 25,222 Add: depreciation of properties 9,617 9,240 Add: our share of depreciation in unconsolidated joint ventures 467 447 Deduct: gain on sales of real estate - (51,981) Adjustment for non-controlling interests (2,775) 22,406 Funds from operations (FFO) attributable to common stockholders 3,062 5,334 Adjust for straight line rent accruals (10) (10) Add: loss on extinguishment of debt - 593 Add: amortization of restricted stock and restricted stock units 365 297 Add: amortization of deferred mortgage costs 379 373 Deduct: gain on insurance recovery - (3,227) Adjustment for non-controlling interests (78) 434 Adjusted funds from operations (AFFO) attributable to common stockholders $ 3,718 $ 3,794 Per share data GAAP Net (loss) income attributable to common stockholders $ (0.27) $ 1.75 Add: depreciation of properties 0.60 0.64 Add: our share of depreciation in unconsolidated joint ventures 0.03 0.03 Deduct: gain on sales of real estate - (3.60) Adjustment for non-controlling interests (0.17) 1.55 Funds from operations (FFO) attributable to common stockholders 0.19 0.37 Add: loss on extinguishment of debt - 0.04 Add: amortization of restricted stock and restricted stock units 0.02 0.01 Add: amortization of deferred mortgage costs 0.02 0.03 Deduct: gain on insurance recovery - (0.22) Adjustment for non-controlling interests - 0.03 Adjusted funds from operations (AFFO) attributable to common stockholders $ 0.23 $ 0.26 3

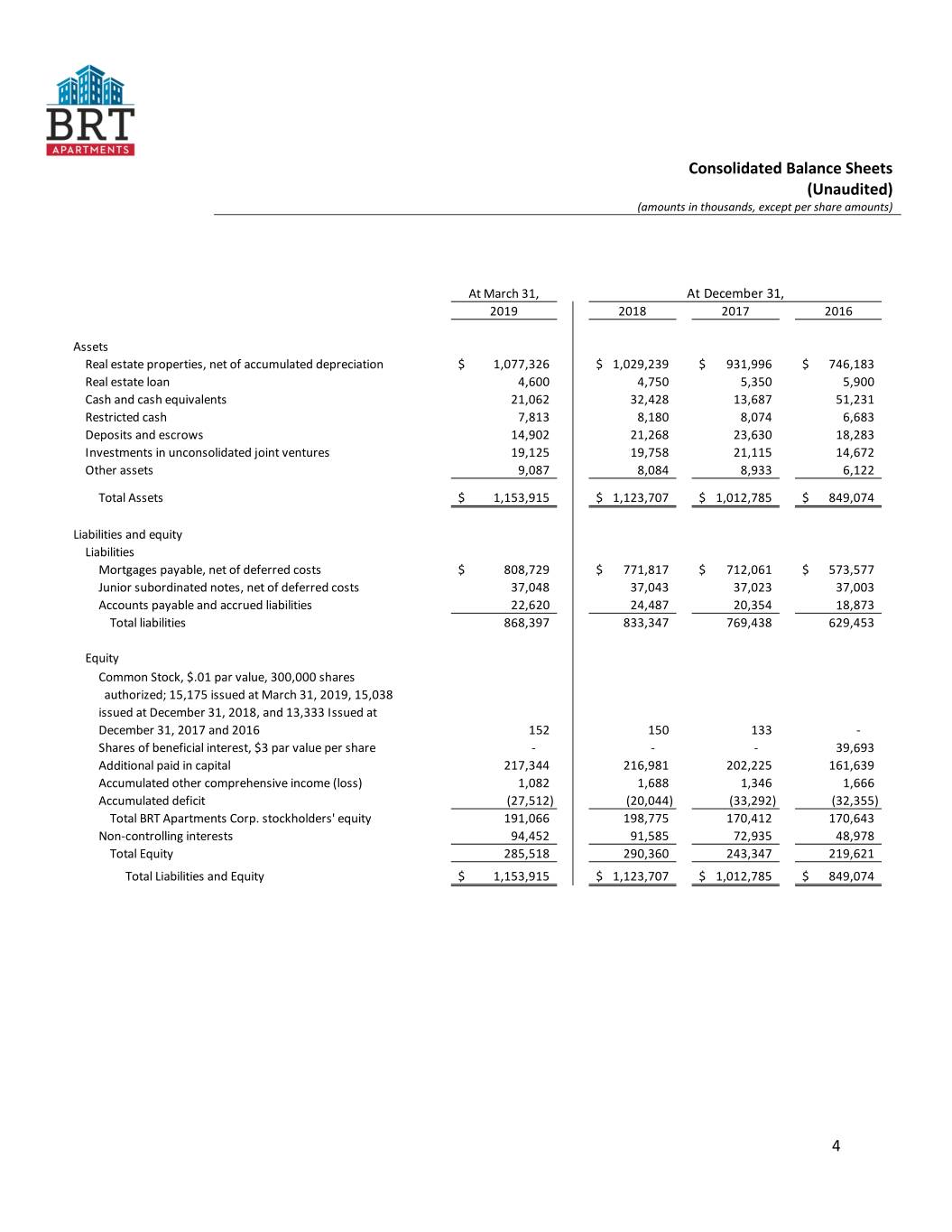

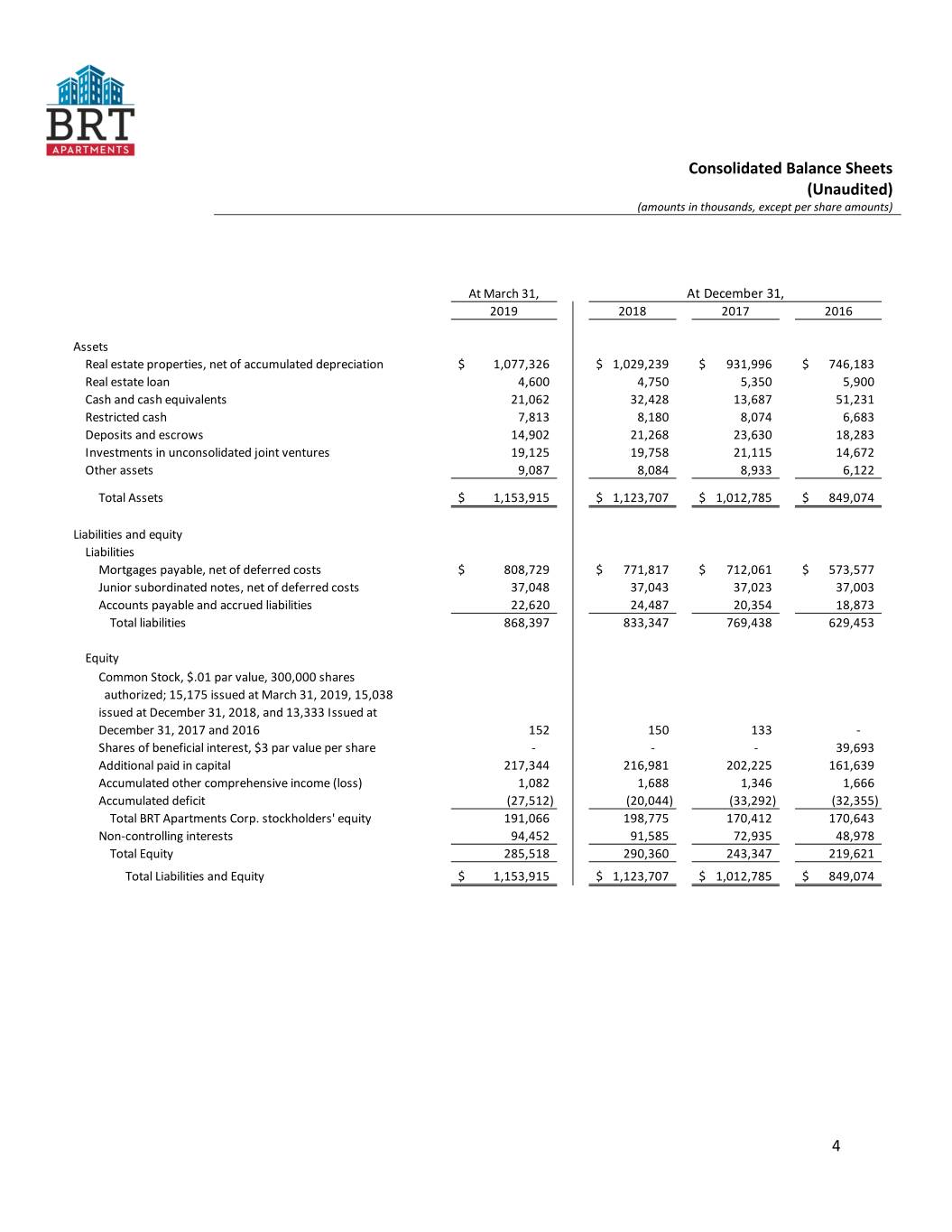

Consolidated Balance Sheets (Unaudited) (amounts in thousands, except per share amounts) At March 31, At December 31, 2019 2018 2017 2016 Assets Real estate properties, net of accumulated depreciation $ 1,077,326 $ 1,029,239 $ 931,996 $ 746,183 Real estate loan 4,600 4,750 5,350 5,900 Cash and cash equivalents 21,062 32,428 13,687 51,231 Restricted cash 7,813 8,180 8,074 6,683 Deposits and escrows 14,902 21,268 23,630 18,283 Investments in unconsolidated joint ventures 19,125 19,758 21,115 14,672 Other assets 9,087 8,084 8,933 6,122 Total Assets $ 1,153,915 $ 1,123,707 $ 1,012,785 $ 849,074 Liabilities and equity Liabilities Mortgages payable, net of deferred costs $ 808,729 $ 771,817 $ 712,061 $ 573,577 Junior subordinated notes, net of deferred costs 37,048 37,043 37,023 37,003 Accounts payable and accrued liabilities 22,620 24,487 20,354 18,873 Total liabilities 868,397 833,347 769,438 629,453 Equity Common Stock, $.01 par value, 300,000 shares authorized; 15,175 issued at March 31, 2019, 15,038 issued at December 31, 2018, and 13,333 Issued at December 31, 2017 and 2016 152 150 133 - Shares of beneficial interest, $3 par value per share - - - 39,693 Additional paid in capital 217,344 216,981 202,225 161,639 Accumulated other comprehensive income (loss) 1,082 1,688 1,346 1,666 Accumulated deficit (27,512) (20,044) (33,292) (32,355) Total BRT Apartments Corp. stockholders' equity 191,066 198,775 170,412 170,643 Non-controlling interests 94,452 91,585 72,935 48,978 Total Equity 285,518 290,360 243,347 219,621 Total Liabilities and Equity $ 1,153,915 $ 1,123,707 $ 1,012,785 $ 849,074 4

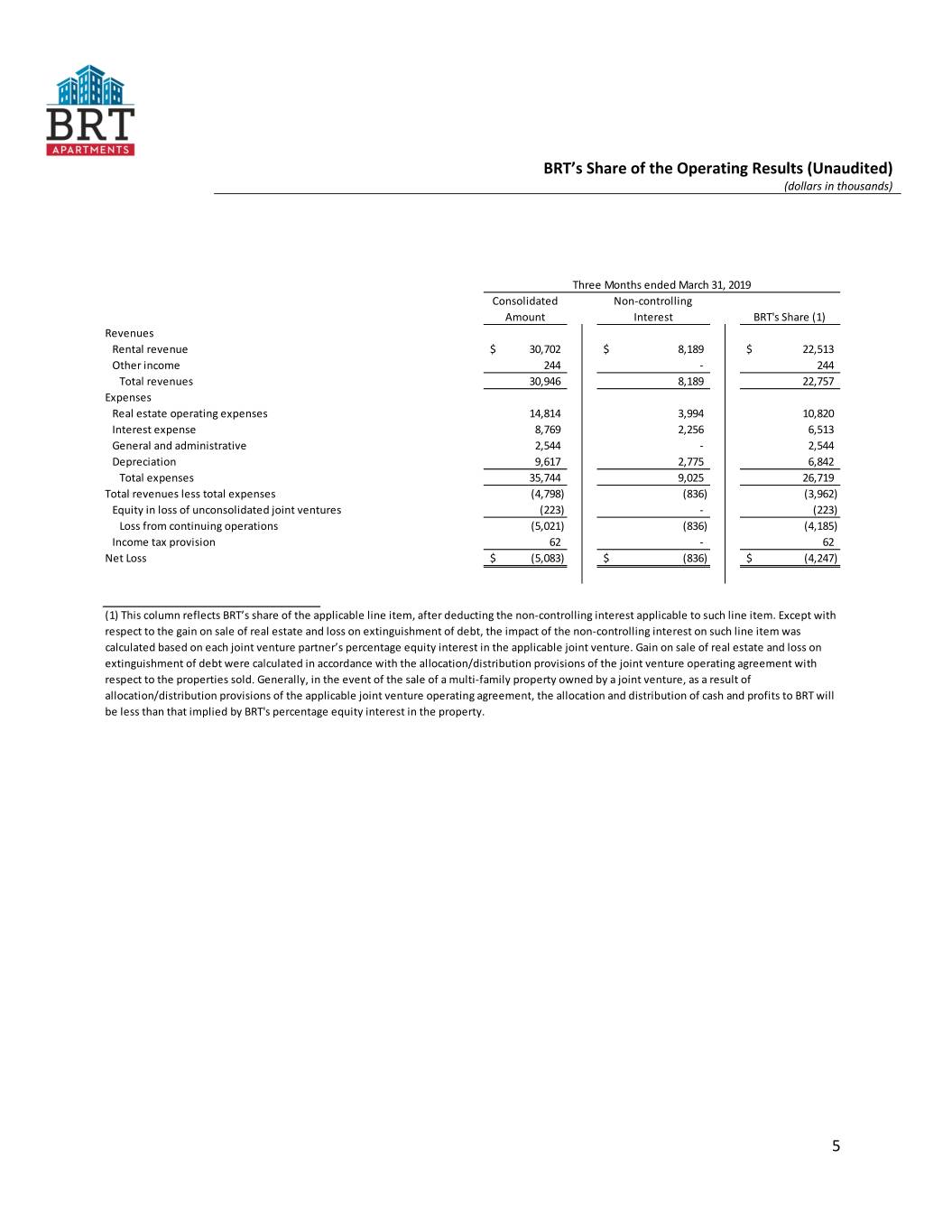

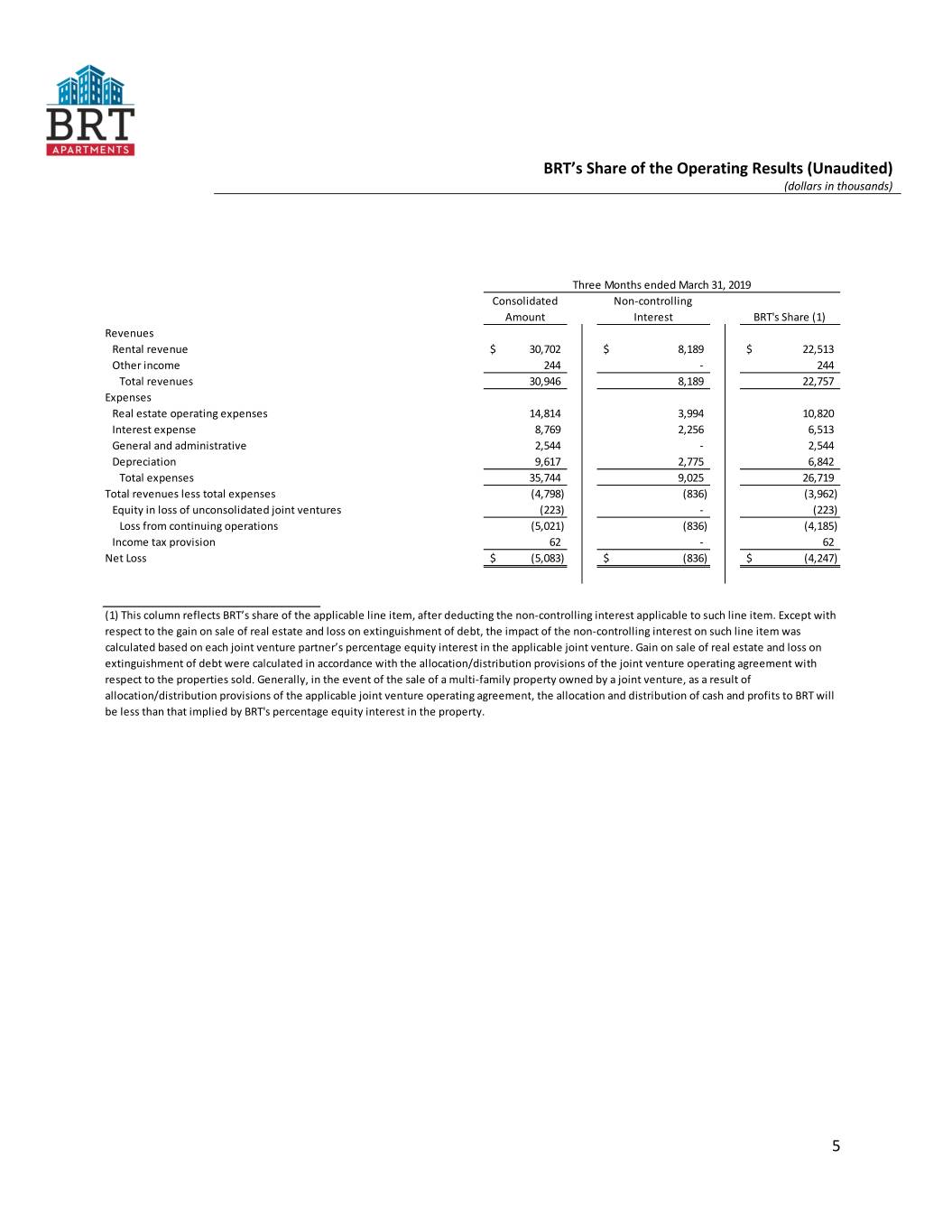

BRT’s Share of the Operating Results (Unaudited) (dollars in thousands) Three Months ended March 31, 2019 Consolidated Non-controlling Amount Interest BRT's Share (1) Revenues Rental revenue $ 30,702 $ 8,189 $ 22,513 Other income 244 - 244 Total revenues 30,946 8,189 22,757 Expenses Real estate operating expenses 14,814 3,994 10,820 Interest expense 8,769 2,256 6,513 General and administrative 2,544 - 2,544 Depreciation 9,617 2,775 6,842 Total expenses 35,744 9,025 26,719 Total revenues less total expenses (4,798) (836) (3,962) Equity in loss of unconsolidated joint ventures (223) - (223) Loss from continuing operations (5,021) (836) (4,185) Income tax provision 62 - 62 Net Loss $ (5,083) $ (836) $ (4,247) (1) This column reflects BRT’s share of the applicable line item, after deducting the non-controlling interest applicable to such line item. Except with respect to the gain on sale of real estate and loss on extinguishment of debt, the impact of the non-controlling interest on such line item was calculated based on each joint venture partner’s percentage equity interest in the applicable joint venture. Gain on sale of real estate and loss on extinguishment of debt were calculated in accordance with the allocation/distribution provisions of the joint venture operating agreement with respect to the properties sold. Generally, in the event of the sale of a multi-family property owned by a joint venture, as a result of allocation/distribution provisions of the applicable joint venture operating agreement, the allocation and distribution of cash and profits to BRT will be less than that implied by BRT's percentage equity interest in the property. 5

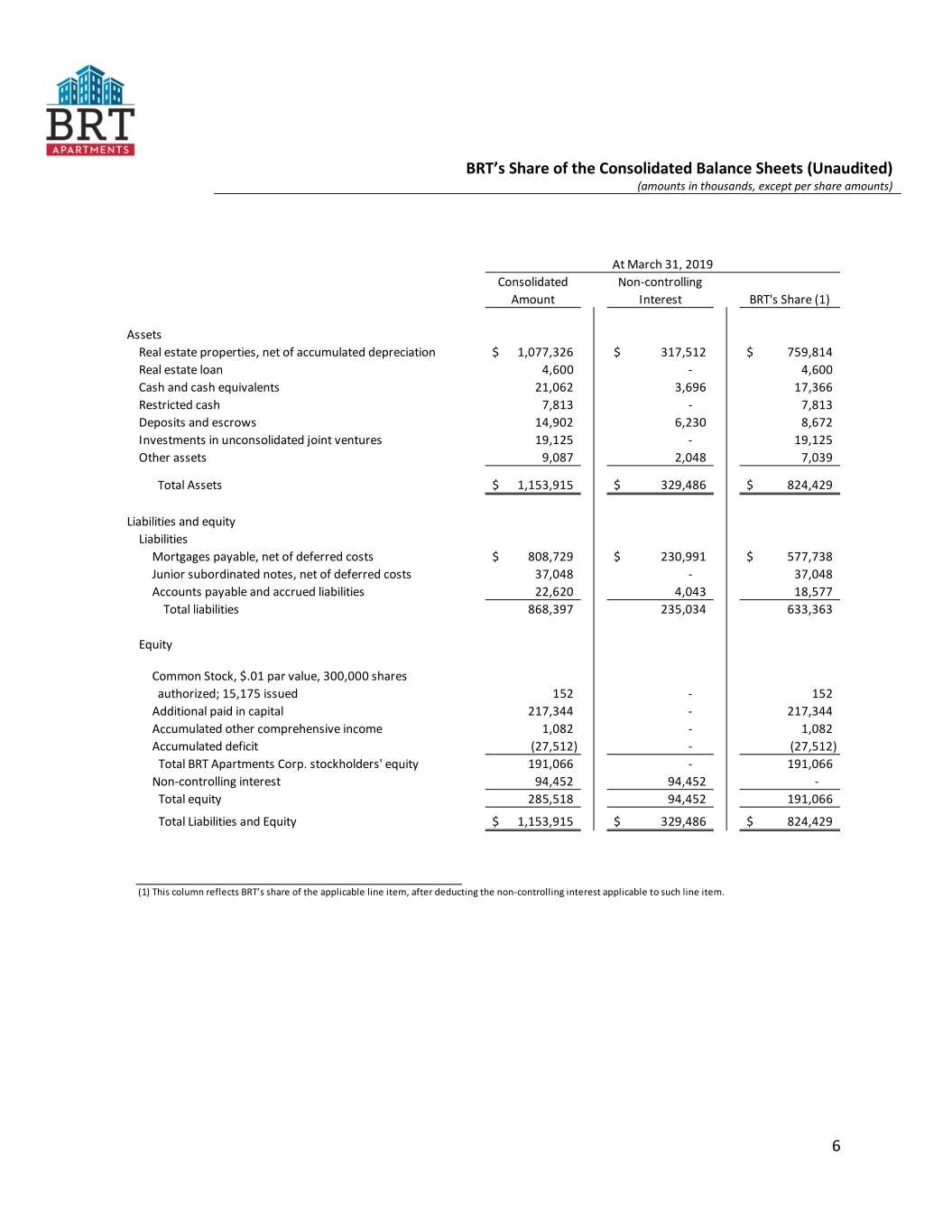

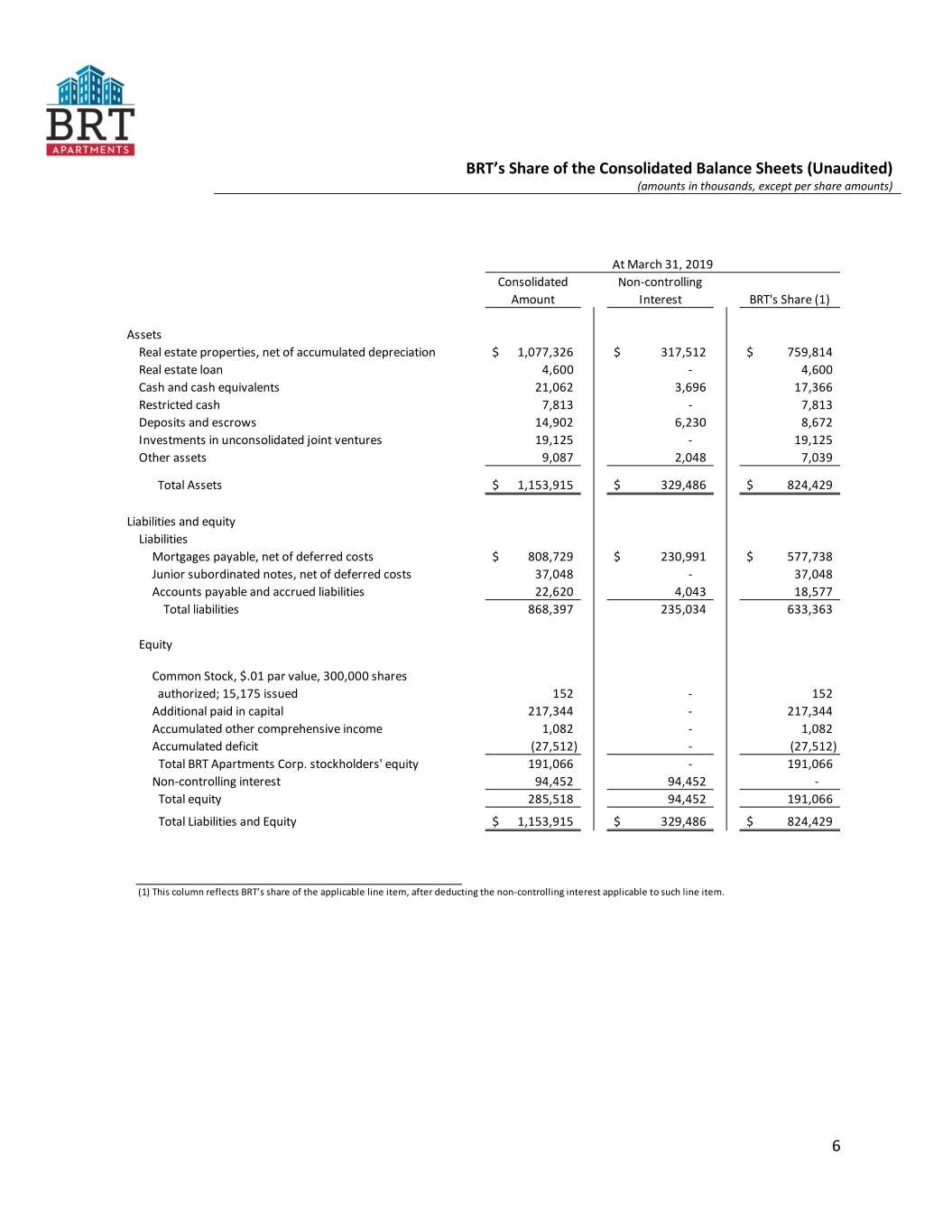

BRT’s Share of the Consolidated Balance Sheets (Unaudited) (amounts in thousands, except per share amounts) At March 31, 2019 Consolidated Non-controlling Amount Interest BRT's Share (1) Assets Real estate properties, net of accumulated depreciation $ 1,077,326 $ 317,512 $ 759,814 Real estate loan 4,600 - 4,600 Cash and cash equivalents 21,062 3,696 17,366 Restricted cash 7,813 - 7,813 Deposits and escrows 14,902 6,230 8,672 Investments in unconsolidated joint ventures 19,125 - 19,125 Other assets 9,087 2,048 7,039 Total Assets $ 1,153,915 $ 329,486 $ 824,429 Liabilities and equity Liabilities Mortgages payable, net of deferred costs $ 808,729 $ 230,991 $ 577,738 Junior subordinated notes, net of deferred costs 37,048 - 37,048 Accounts payable and accrued liabilities 22,620 4,043 18,577 Total liabilities 868,397 235,034 633,363 Equity Common Stock, $.01 par value, 300,000 shares authorized; 15,175 issued 152 - 152 Additional paid in capital 217,344 - 217,344 Accumulated other comprehensive income 1,082 - 1,082 Accumulated deficit (27,512) - (27,512) Total BRT Apartments Corp. stockholders' equity 191,066 - 191,066 Non-controlling interest 94,452 94,452 - Total equity 285,518 94,452 191,066 Total Liabilities and Equity $ 1,153,915 $ 329,486 $ 824,429 (1) This column reflects BRT’s share of the applicable line item, after deducting the non-controlling interest applicable to such line item. 6

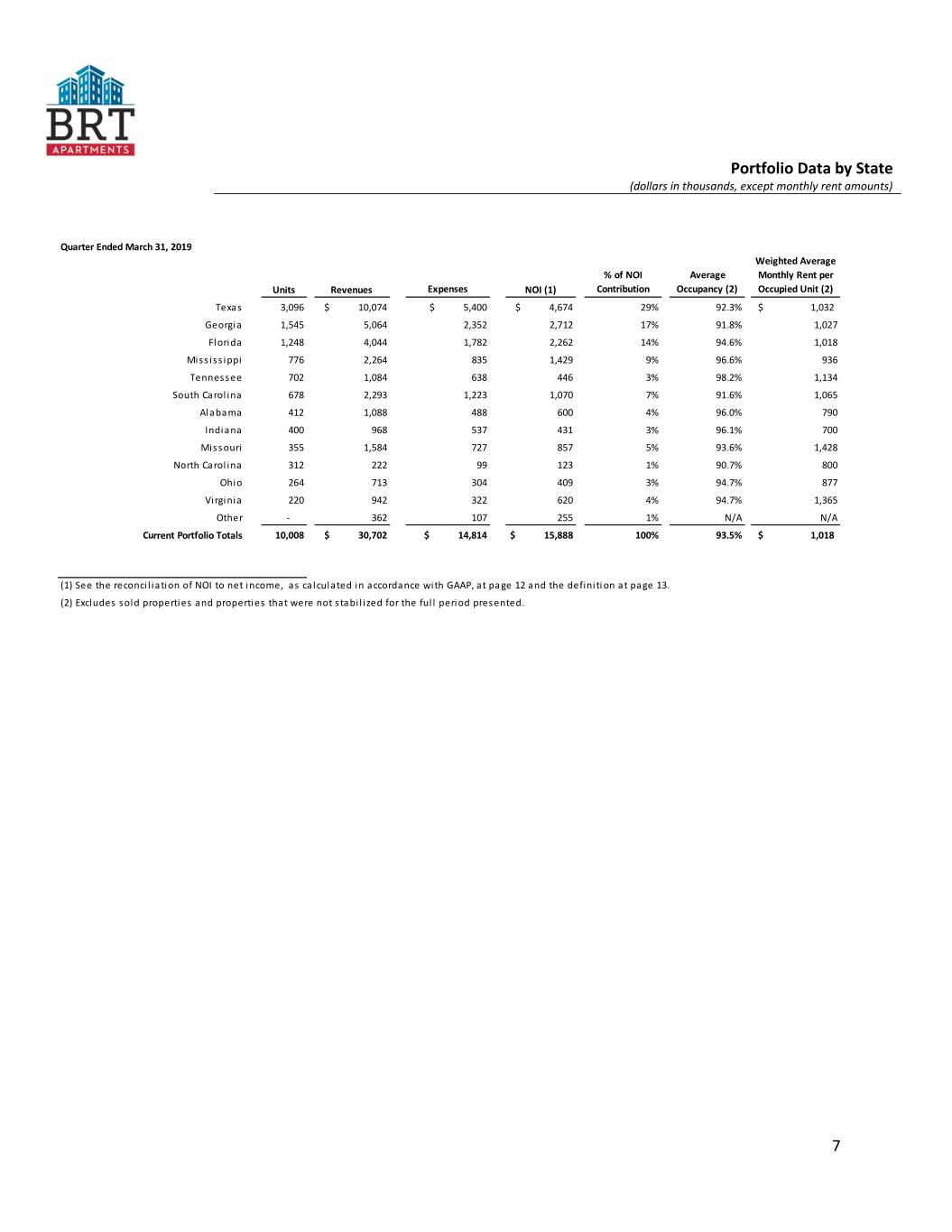

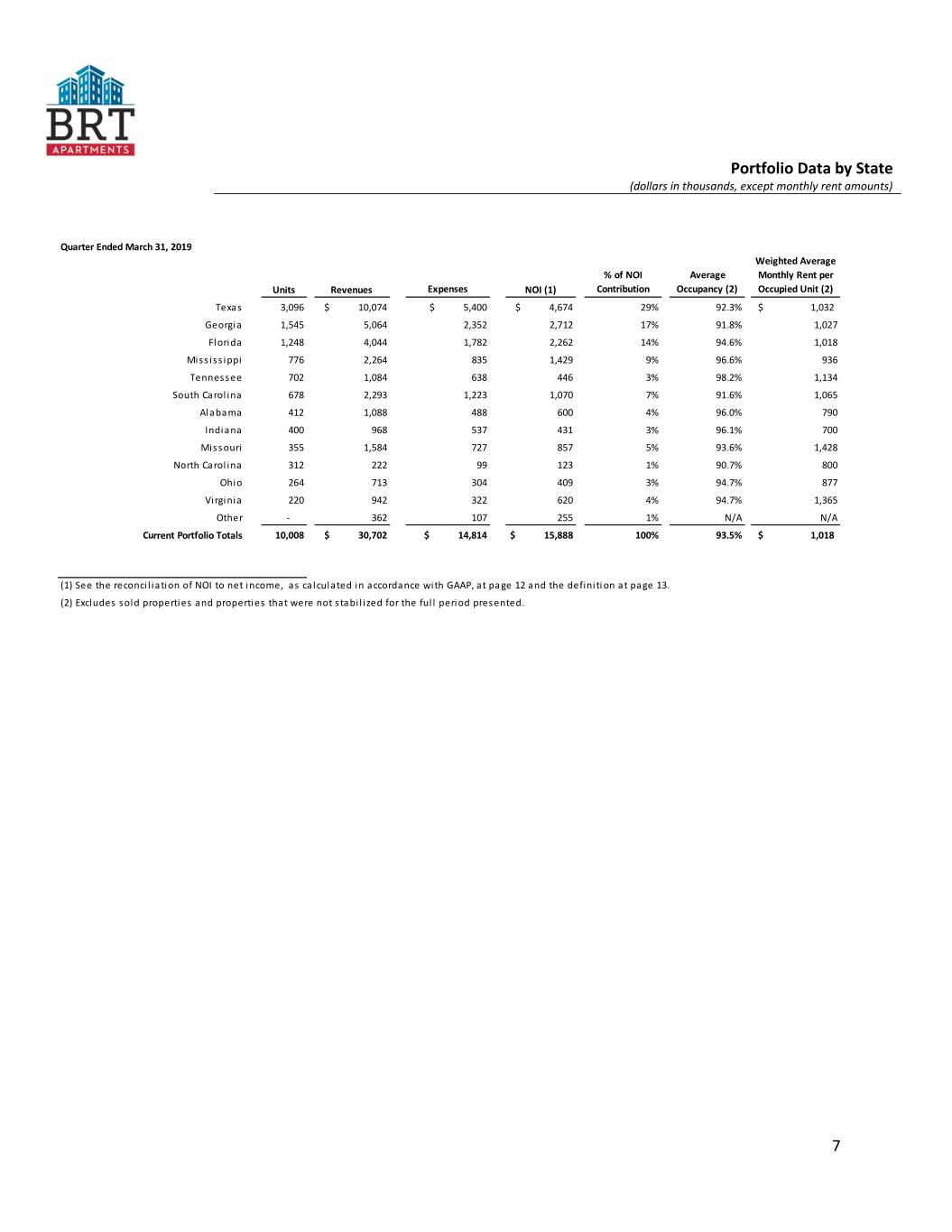

Portfolio Data by State (dollars in thousands, except monthly rent amounts) Quarter Ended March 31, 2019 Weighted Average % of NOI Average Monthly Rent per Units Revenues Expenses NOI (1) Contribution Occupancy (2) Occupied Unit (2) Texas 3,096 $ 10,074 $ 5,400 $ 4,674 29% 92.3% $ 1,032 Georgia 1,545 5,064 2,352 2,712 17% 91.8% 1,027 Florida 1,248 4,044 1,782 2,262 14% 94.6% 1,018 Mississippi 776 2,264 835 1,429 9% 96.6% 936 Tennessee 702 1,084 638 446 3% 98.2% 1,134 South Carolina 678 2,293 1,223 1,070 7% 91.6% 1,065 Alabama 412 1,088 488 600 4% 96.0% 790 Indiana 400 968 537 431 3% 96.1% 700 Missouri 355 1,584 727 857 5% 93.6% 1,428 North Carolina 312 222 99 123 1% 90.7% 800 Ohio 264 713 304 409 3% 94.7% 877 Virginia 220 942 322 620 4% 94.7% 1,365 Other - 362 107 255 1% N/A N/A Current Portfolio Totals 10,008 $ 30,702 $ 14,814 $ 15,888 100% 93.5% $ 1,018 (1) See the reconciliation of NOI to net income, as calculated in accordance with GAAP, at page 12 and the definition at page 13. (2) Excludes sold properties and properties that were not stabilized for the full period presented. 7

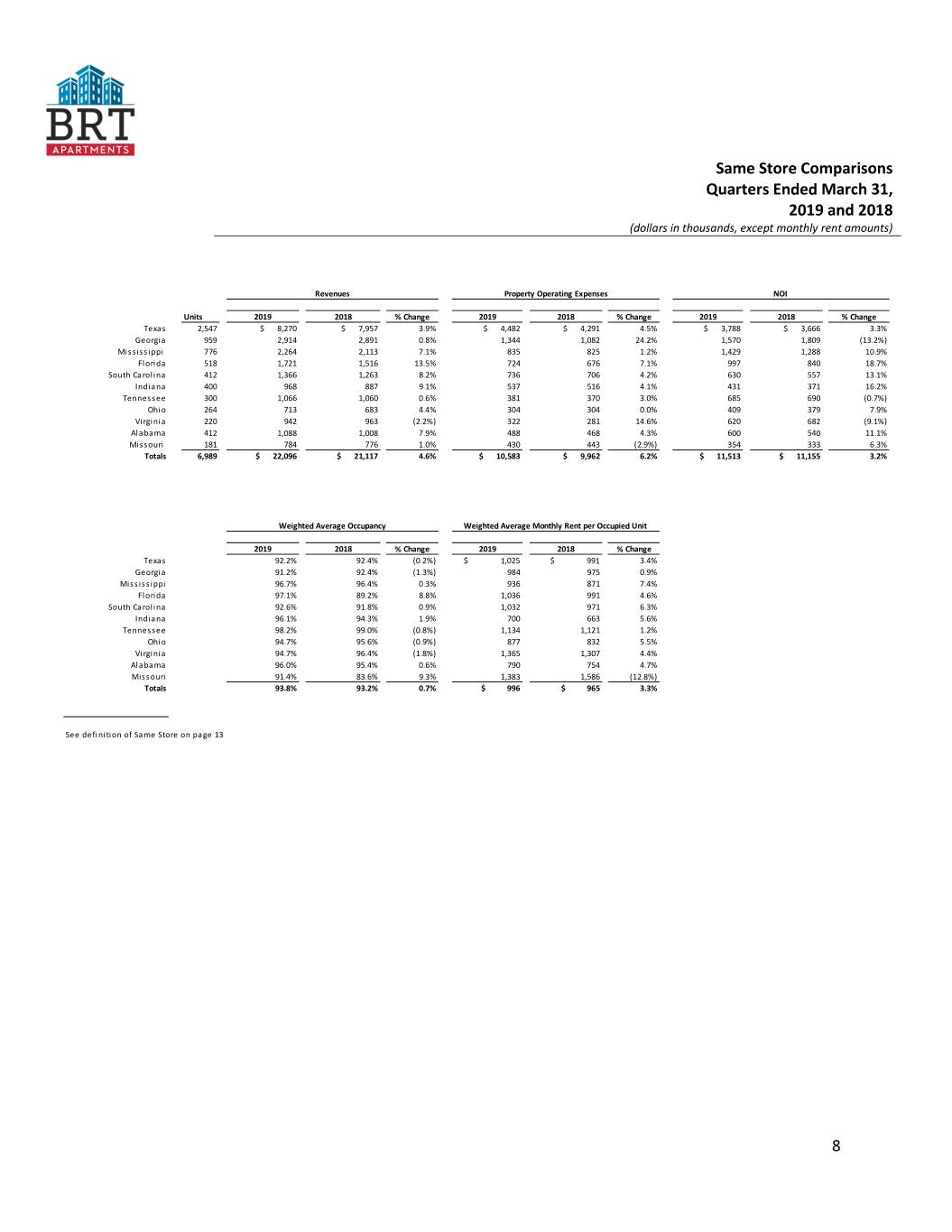

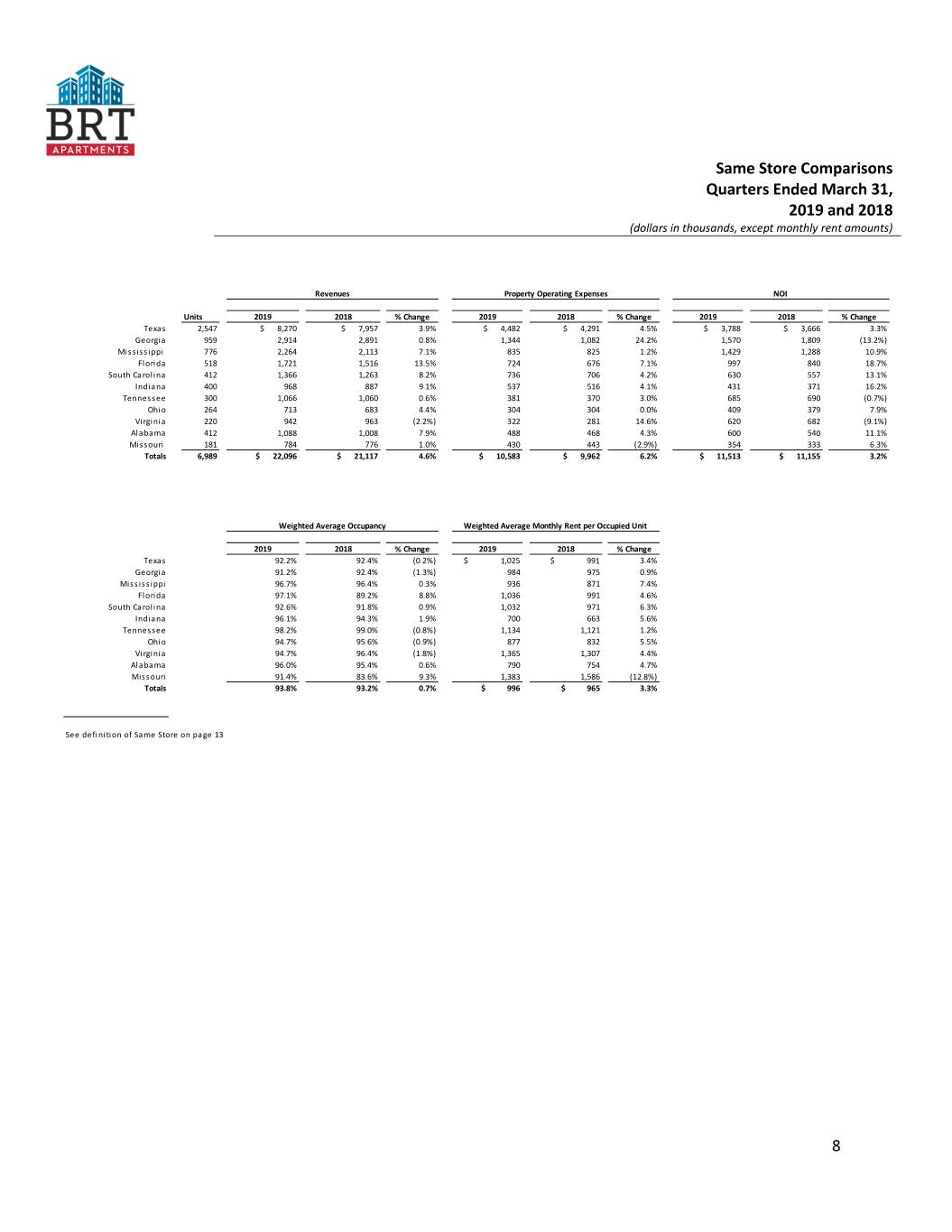

Same Store Comparisons Quarters Ended March 31, 2019 and 2018 (dollars in thousands, except monthly rent amounts) Revenues Property Operating Expenses NOI Units 2019 2018 % Change 2019 2018 % Change 2019 2018 % Change Texas 2,547 $ 8,270 $ 7,957 3.9% $ 4,482 $ 4,291 4.5% $ 3,788 $ 3,666 3.3% Georgia 959 2,914 2,891 0.8% 1,344 1,082 24.2% 1,570 1,809 (13.2%) Mississippi 776 2,264 2,113 7.1% 835 825 1.2% 1,429 1,288 10.9% Florida 518 1,721 1,516 13.5% 724 676 7.1% 997 840 18.7% South Carolina 412 1,366 1,263 8.2% 736 706 4.2% 630 557 13.1% Indiana 400 968 887 9.1% 537 516 4.1% 431 371 16.2% Tennessee 300 1,066 1,060 0.6% 381 370 3.0% 685 690 (0.7%) Ohio 264 713 683 4.4% 304 304 0.0% 409 379 7.9% Virginia 220 942 963 (2.2%) 322 281 14.6% 620 682 (9.1%) Alabama 412 1,088 1,008 7.9% 488 468 4.3% 600 540 11.1% Missouri 181 784 776 1.0% 430 443 (2.9%) 354 333 6.3% Totals 6,989 $ 22,096 $ 21,117 4.6% $ 10,583 $ 9,962 6.2% $ 11,513 $ 11,155 3.2% Weighted Average Occupancy Weighted Average Monthly Rent per Occupied Unit 2019 2018 % Change 2019 2018 % Change Texas 92.2% 92.4% (0.2%) $ 1,025 $ 991 3.4% Georgia 91.2% 92.4% (1.3%) 984 975 0.9% Mississippi 96.7% 96.4% 0.3% 936 871 7.4% Florida 97.1% 89.2% 8.8% 1,036 991 4.6% South Carolina 92.6% 91.8% 0.9% 1,032 971 6.3% Indiana 96.1% 94.3% 1.9% 700 663 5.6% Tennessee 98.2% 99.0% (0.8%) 1,134 1,121 1.2% Ohio 94.7% 95.6% (0.9%) 877 832 5.5% Virginia 94.7% 96.4% (1.8%) 1,365 1,307 4.4% Alabama 96.0% 95.4% 0.6% 790 754 4.7% Missouri 91.4% 83.6% 9.3% 1,383 1,586 (12.8%) Totals 93.8% 93.2% 0.7% $ 996 $ 965 3.3% See definition of Same Store on page 13 8

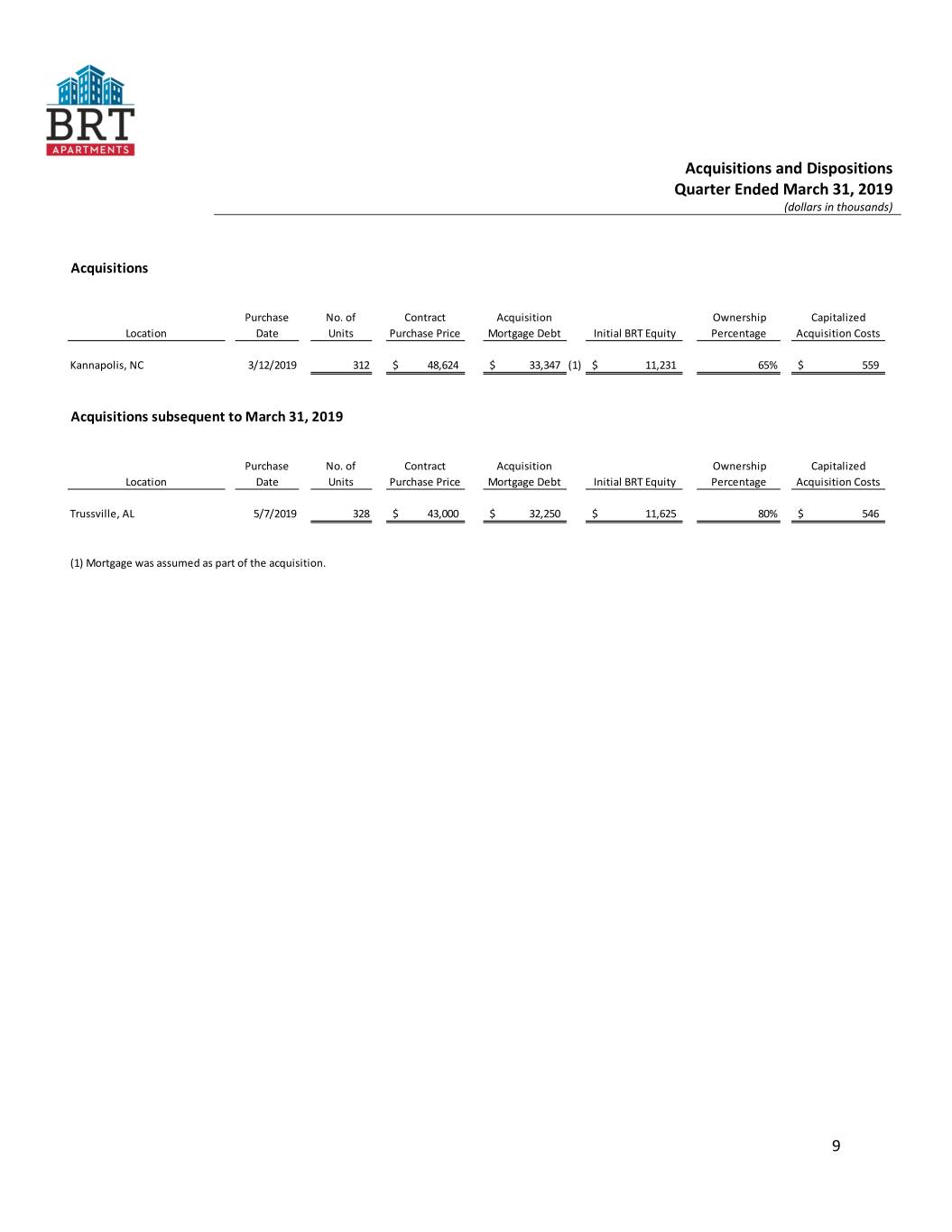

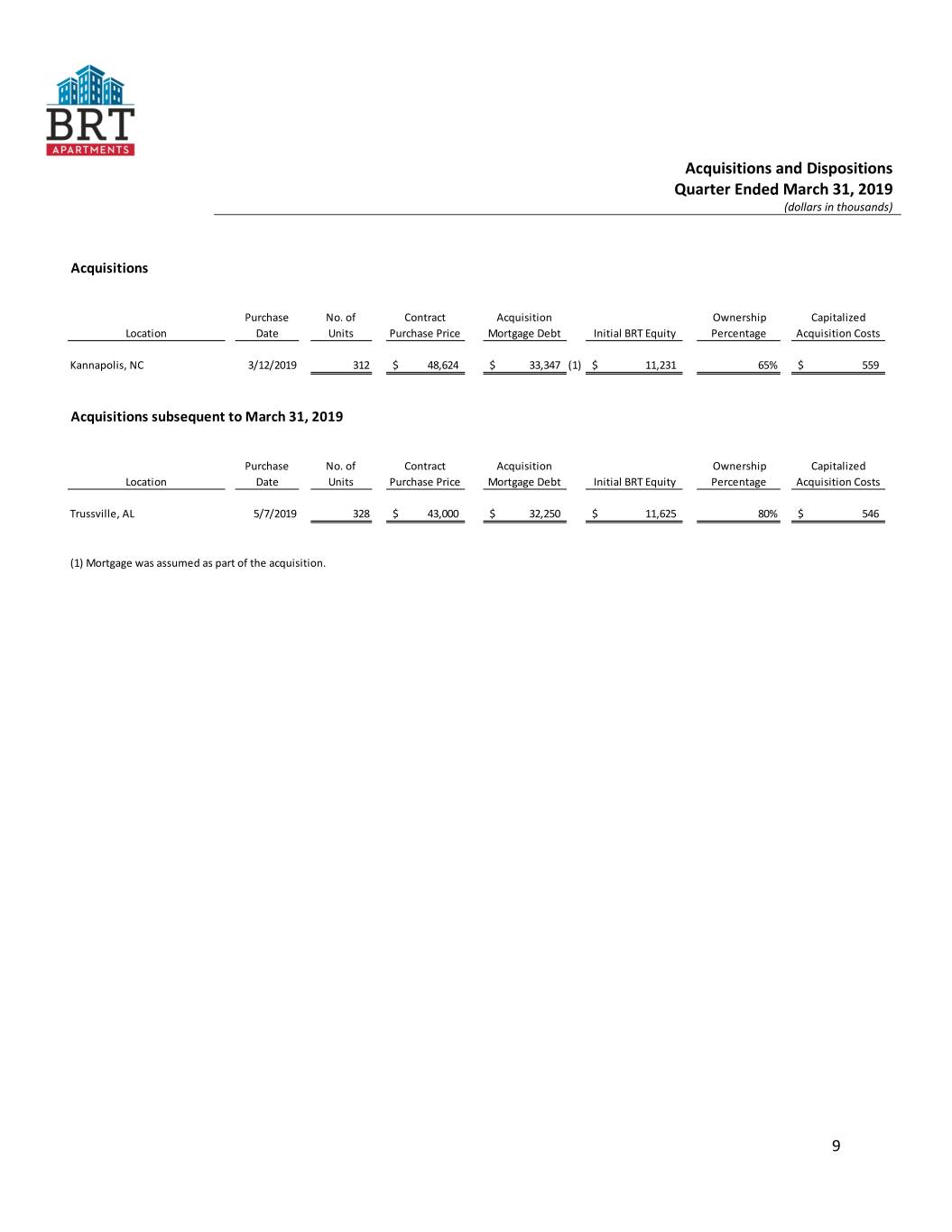

Acquisitions and Dispositions Quarter Ended March 31, 2019 (dollars in thousands) Acquisitions Purchase No. of Contract Acquisition Ownership Capitalized Location Date Units Purchase Price Mortgage Debt Initial BRT Equity Percentage Acquisition Costs Kannapolis, NC 3/12/2019 312 $ 48,624 $ 33,347 (1) $ 11,231 65% $ 559 Acquisitions subsequent to March 31, 2019 Purchase No. of Contract Acquisition Ownership Capitalized Location Date Units Purchase Price Mortgage Debt Initial BRT Equity Percentage Acquisition Costs Trussville, AL 5/7/2019 328 $ 43,000 $ 32,250 $ 11,625 80% $ 546 (1) Mortgage was assumed as part of the acquisition. 9

Value-Add Program and Capital Expenditures Quarter Ended March 31, 2019 Value-Add Program Estimated Estimated Units Rehab Average Estimated Rehabilitated Estimated Rehab Costs Per Monthly Rent Annualized (1) Costs (2) unit Increase (3) ROI (3) 294 $1,248,000 $4,245 $95 27.0% (1) Refers to rehabilitated units at 17 properties with respect to which a new lease or renewal lease was entered into during the period. (2) Reflects rehab costs incurred during the current and prior periods with respect to units completed, in which a new lease or renewal lease was entered into during the current period. (3) These results are not necessarily indicative of the results that would be generated if such improvements were made across our portfolio of properties or at any particular property. Rents at a property may increase for reasons wholly unrelated to property improvements, such as changes in demand for rental units in a particular market or sub-market. Capital Expenditures BRT Share of Recurring Capital Consolidated Amount Non-Controlling Interest Expenditures Estimated Recurring Capital Expenditures (1) $ 262,000 $ 45,000 $ 217,000 Estimated Non-Recurring Capital Expenditures (2) 1,915,000 576,000 1,339,000 Total Capital Expenditures $ 2,177,000 $ 621,000 $ 1,556,000 Replacements (3) $ 606,405 $ 138,050 $ 468,355 Estimated Recurring Capital Expenditures and Replacements per unit (10,008 units ) $ 87 $ 18 $ 69 (1) Recurring capital expenditures represent our estimate of expenditures incurred at the property to maintain the property's existing operations - it excludes revenue enhancing projects. (2) Non-recurring capital expenditures respresent our estimate of significant improvements to the common areas, property exteriors, or interior units of the property, and revenue enhancing upgrades. (3) Replacements are expensed as incurred at the property. 10

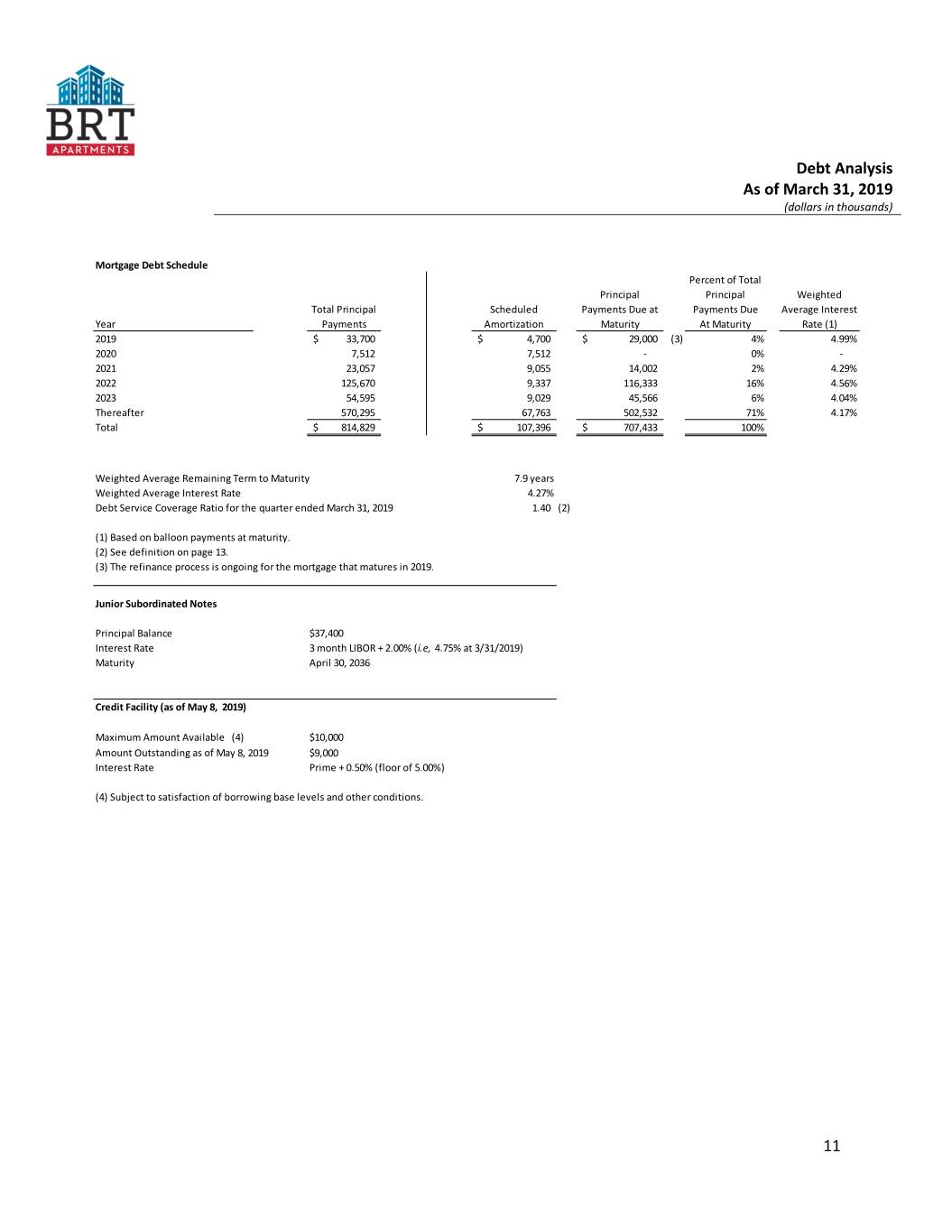

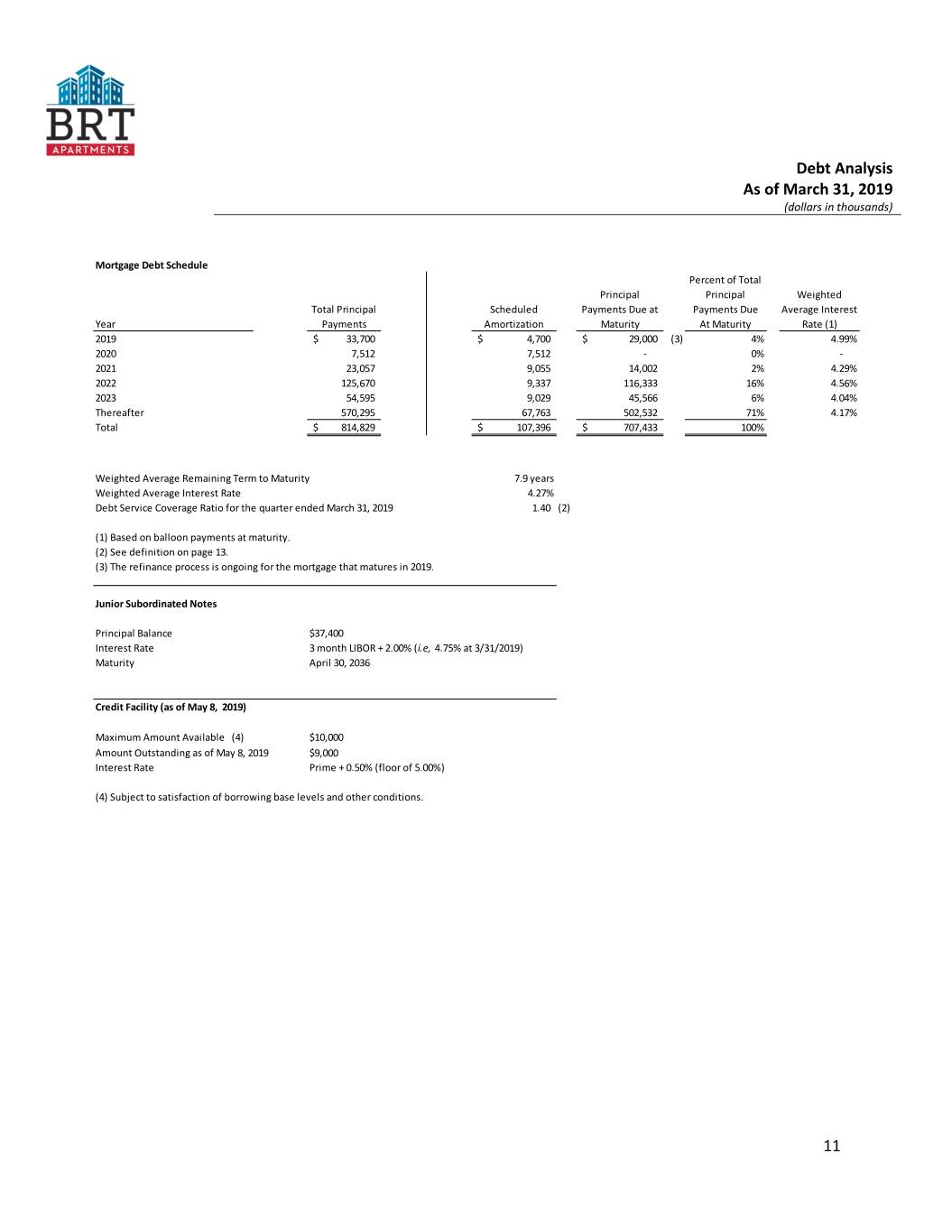

Debt Analysis As of March 31, 2019 (dollars in thousands) Mortgage Debt Schedule Percent of Total Principal Principal Weighted Total Principal Scheduled Payments Due at Payments Due Average Interest Year Payments Amortization Maturity At Maturity Rate (1) 2019 $ 33,700 $ 4,700 $ 29,000 (3) 4% 4.99% 2020 7,512 7,512 - 0% - 2021 23,057 9,055 14,002 2% 4.29% 2022 125,670 9,337 116,333 16% 4.56% 2023 54,595 9,029 45,566 6% 4.04% Thereafter 570,295 67,763 502,532 71% 4.17% Total $ 814,829 $ 107,396 $ 707,433 100% Weighted Average Remaining Term to Maturity 7.9 years Weighted Average Interest Rate 4.27% Debt Service Coverage Ratio for the quarter ended March 31, 2019 1.40 (2) (1) Based on balloon payments at maturity. (2) See definition on page 13. (3) The refinance process is ongoing for the mortgage that matures in 2019. Junior Subordinated Notes Principal Balance $37,400 Interest Rate 3 month LIBOR + 2.00% (i.e, 4.75% at 3/31/2019) Maturity April 30, 2036 Credit Facility (as of May 8, 2019) Maximum Amount Available (4) $10,000 Amount Outstanding as of May 8, 2019 $9,000 Interest Rate Prime + 0.50% (floor of 5.00%) (4) Subject to satisfaction of borrowing base levels and other conditions. 11

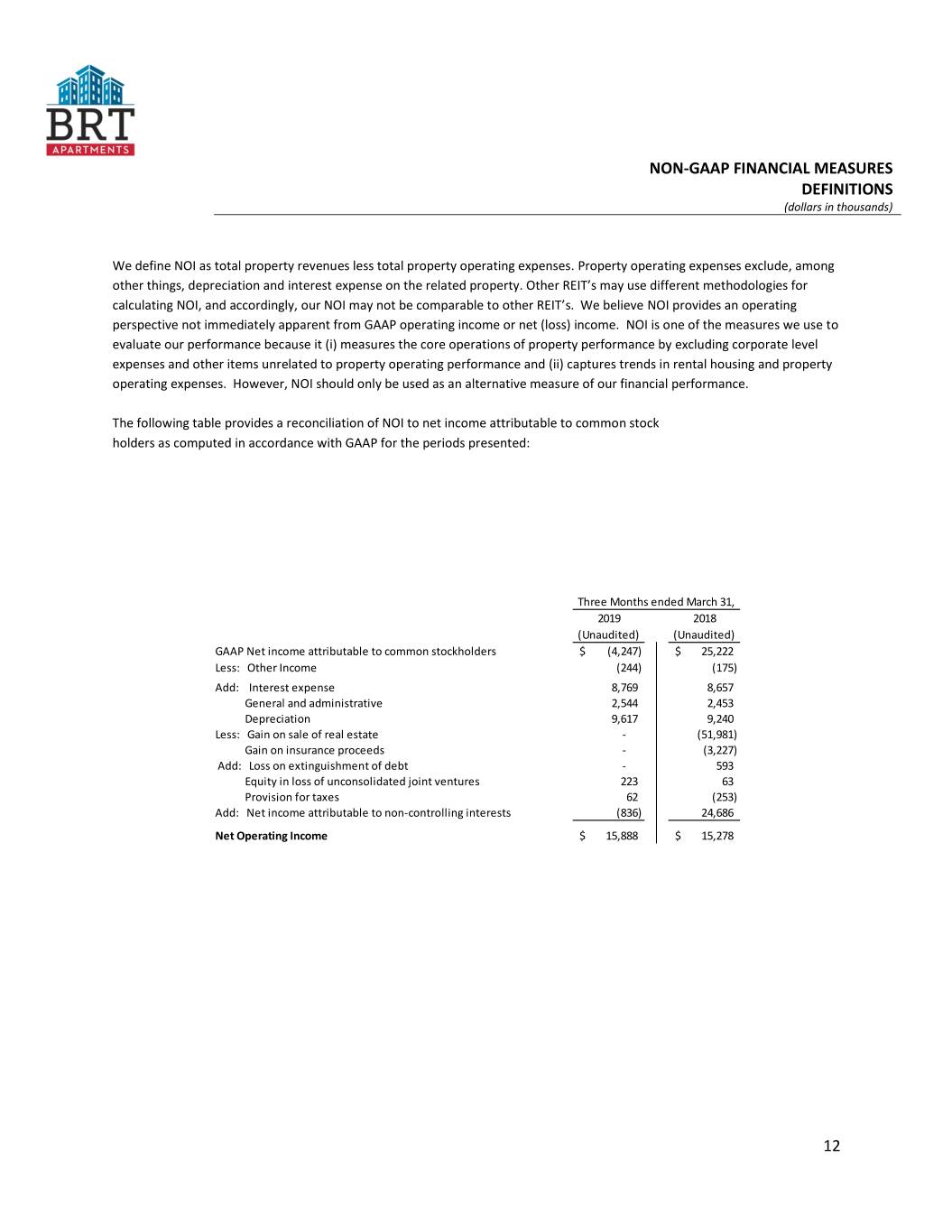

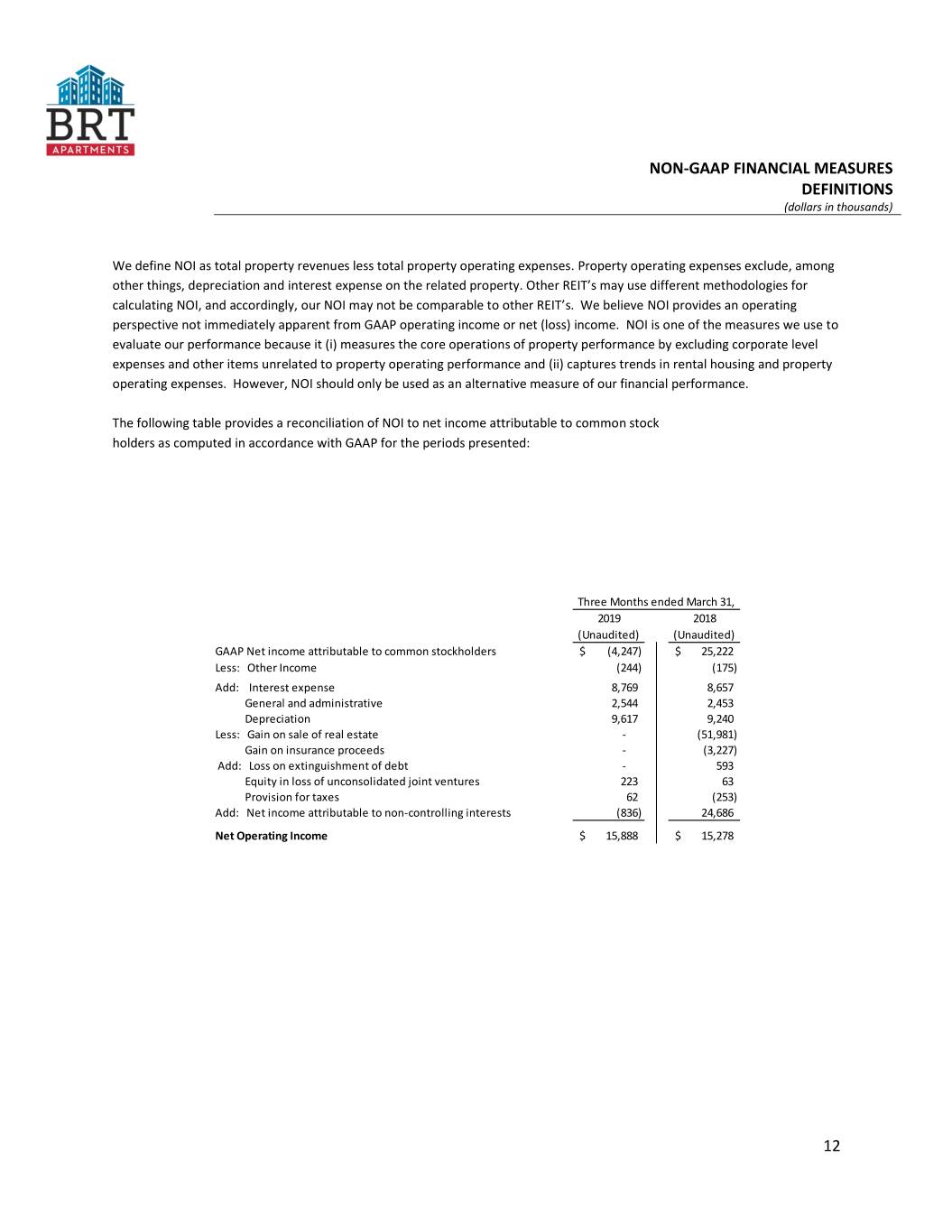

NON-GAAP FINANCIAL MEASURES DEFINITIONS (dollars in thousands) We define NOI as total property revenues less total property operating expenses. Property operating expenses exclude, among other things, depreciation and interest expense on the related property. Other REIT’s may use different methodologies for calculating NOI, and accordingly, our NOI may not be comparable to other REIT’s. We believe NOI provides an operating perspective not immediately apparent from GAAP operating income or net (loss) income. NOI is one of the measures we use to evaluate our performance because it (i) measures the core operations of property performance by excluding corporate level expenses and other items unrelated to property operating performance and (ii) captures trends in rental housing and property operating expenses. However, NOI should only be used as an alternative measure of our financial performance. The following table provides a reconciliation of NOI to net income attributable to common stock holders as computed in accordance with GAAP for the periods presented: Three Months ended March 31, 2019 2018 (Unaudited) (Unaudited) GAAP Net income attributable to common stockholders $ (4,247) $ 25,222 Less: Other Income (244) (175) Add: Interest expense 8,769 8,657 General and administrative 2,544 2,453 Depreciation 9,617 9,240 Less: Gain on sale of real estate - (51,981) Gain on insurance proceeds - (3,227) Add: Loss on extinguishment of debt - 593 Equity in loss of unconsolidated joint ventures 223 63 Provision for taxes 62 (253) Add: Net income attributable to non-controlling interests (836) 24,686 Net Operating Income $ 15,888 $ 15,278 12

NON-GAAP FINANCIAL MEASURES DEFINITIONS (dollars in thousands) Funds from Operations (FFO) FFO is a non-GAAP financial performance measure defined by the National Association of Real Estate Investment Trusts and is widely recognized by investors and analysts as one measure of operating performance of a REIT. The FFO calculation excludes items such as real estate depreciation and amortization, gains and losses on the sale of real estate assets and impairment on depreciable assets. Historical accounting convention used for real estate assets requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, it is management’s view, and we believe the view of many industry investors and analysts, that the presentation of operating results for a REIT using the historical accounting for depreciation is insufficient. FFO excludes gains and losses from the sale of real estate, which we believe provides management and investors with a helpful additional measure of the performance of our real estate portfolio, as it allows for comparisons, year to year, that reflect the impact on operations from trends in items such as occupancy rates, rental rates, operating costs, general, administrative and other expenses, and interest expenses. Adjusted Funds from Operations (AFFO) AFFO, as defined by us, excludes from FFO straight line rent adjustments, loss on extinguishment of debt, amortization of restricted stock and RSU expense, amortization of deferred mortgage costs and gain on insurance recovery. Management believes that excluding acquisition-related expenses from AFFO provides investors with supplemental performance information that is consistent with the performance models and analysis used by management and provides investors a view of the performance of our portfolio over time, including after the time we cease to acquire properties on a frequent and regular basis. We believe that AFFO enables investors to compare the performance of our portfolio with other REITs that have not recently engaged in acquisitions, as well as a comparison of our performance with that of other non-traded REITs, as AFFO, or an equivalent measure is routinely reported by non-traded REITs, and we believe often used by analysts and investors for comparison purposes. Debt Service Coverage Ratio Debt service coverage ratio is net operating income ("NOI") divided by total debt service. Total Debt Service Total debt service is the cash required to cover the repayment of interest and principal on a debt for a particular period. Total debt service is used in the calculation of the debt service coverage ratio which is used to determine the borrower’s ability to make debt service payments. Stabilized Properties For all periods presented, stabilized properties include all our consolidated properties, other than those in lease-up or development. Same Store Same store refers to stabilized properties that we and our consolidated joint ventures owned and operated for the entirety of both periods being compared. 13

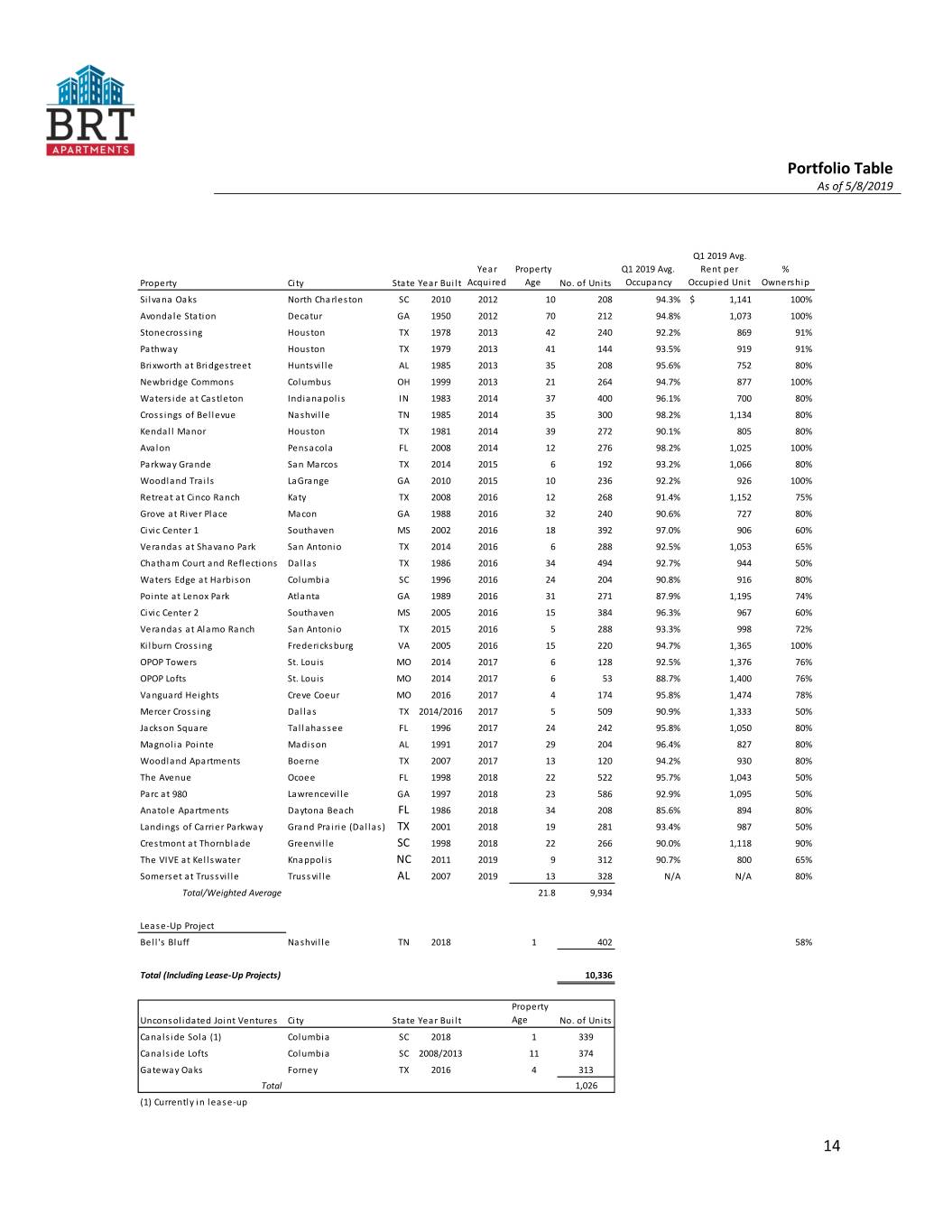

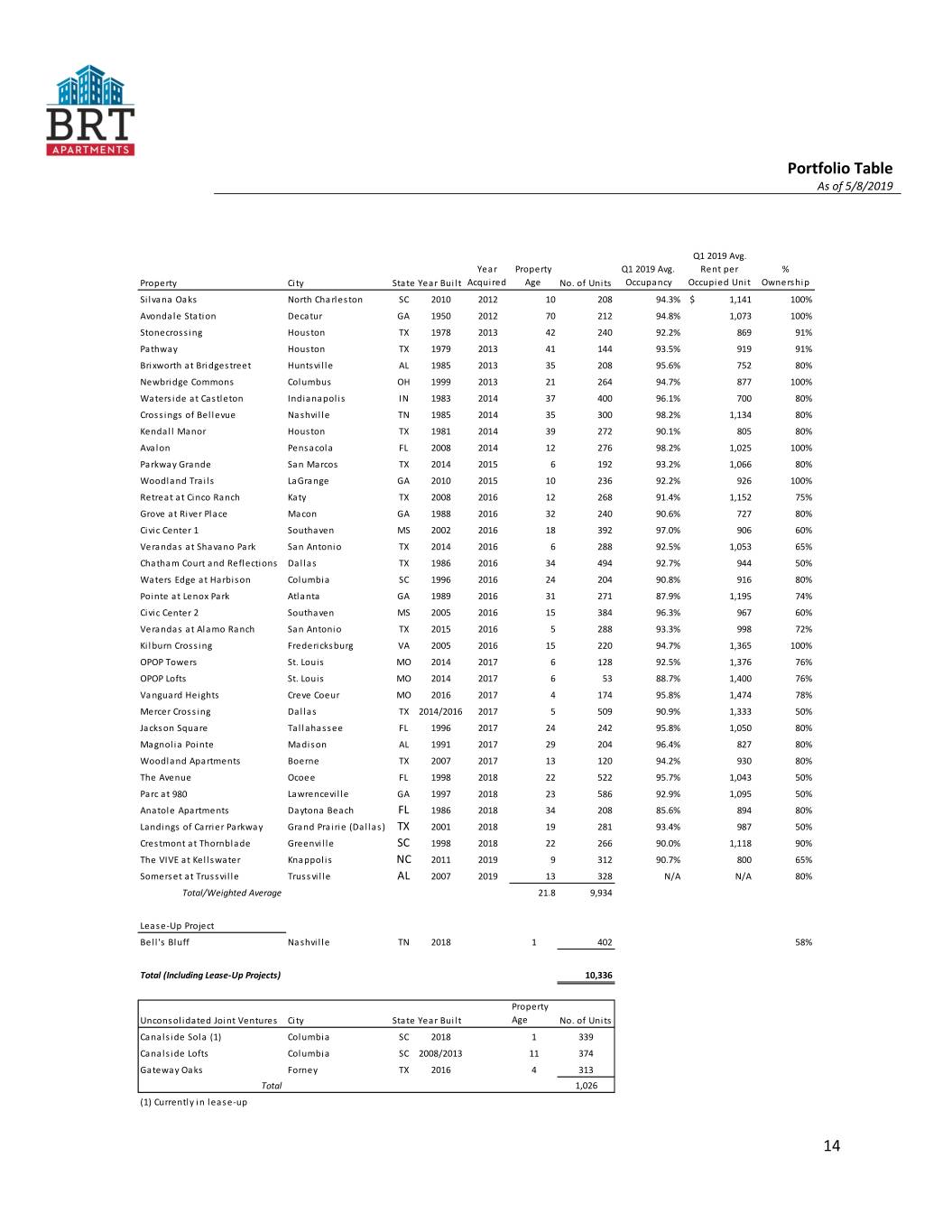

Portfolio Table As of 5/8/2019 Q1 2019 Avg. Year Property Q1 2019 Avg. Rent per % Property City State Year Built Acquired Age No. of Units Occupancy Occupied Unit Ownership Silvana Oaks North Charleston SC 2010 2012 10 208 94.3% $ 1,141 100% Avondale Station Decatur GA 1950 2012 70 212 94.8% 1,073 100% Stonecrossing Houston TX 1978 2013 42 240 92.2% 869 91% Pathway Houston TX 1979 2013 41 144 93.5% 919 91% Brixworth at Bridgestreet Huntsville AL 1985 2013 35 208 95.6% 752 80% Newbridge Commons Columbus OH 1999 2013 21 264 94.7% 877 100% Waterside at Castleton Indianapolis IN 1983 2014 37 400 96.1% 700 80% Crossings of Bellevue Nashville TN 1985 2014 35 300 98.2% 1,134 80% Kendall Manor Houston TX 1981 2014 39 272 90.1% 805 80% Avalon Pensacola FL 2008 2014 12 276 98.2% 1,025 100% Parkway Grande San Marcos TX 2014 2015 6 192 93.2% 1,066 80% Woodland Trails LaGrange GA 2010 2015 10 236 92.2% 926 100% Retreat at Cinco Ranch Katy TX 2008 2016 12 268 91.4% 1,152 75% Grove at River Place Macon GA 1988 2016 32 240 90.6% 727 80% Civic Center 1 Southaven MS 2002 2016 18 392 97.0% 906 60% Verandas at Shavano Park San Antonio TX 2014 2016 6 288 92.5% 1,053 65% Chatham Court and Reflections Dallas TX 1986 2016 34 494 92.7% 944 50% Waters Edge at Harbison Columbia SC 1996 2016 24 204 90.8% 916 80% Pointe at Lenox Park Atlanta GA 1989 2016 31 271 87.9% 1,195 74% Civic Center 2 Southaven MS 2005 2016 15 384 96.3% 967 60% Verandas at Alamo Ranch San Antonio TX 2015 2016 5 288 93.3% 998 72% Kilburn Crossing Fredericksburg VA 2005 2016 15 220 94.7% 1,365 100% OPOP Towers St. Louis MO 2014 2017 6 128 92.5% 1,376 76% OPOP Lofts St. Louis MO 2014 2017 6 53 88.7% 1,400 76% Vanguard Heights Creve Coeur MO 2016 2017 4 174 95.8% 1,474 78% Mercer Crossing Dallas TX 2014/2016 2017 5 509 90.9% 1,333 50% Jackson Square Tallahassee FL 1996 2017 24 242 95.8% 1,050 80% Magnolia Pointe Madison AL 1991 2017 29 204 96.4% 827 80% Woodland Apartments Boerne TX 2007 2017 13 120 94.2% 930 80% The Avenue Ocoee FL 1998 2018 22 522 95.7% 1,043 50% Parc at 980 Lawrenceville GA 1997 2018 23 586 92.9% 1,095 50% Anatole Apartments Daytona Beach FL 1986 2018 34 208 85.6% 894 80% Landings of Carrier Parkway Grand Prairie (Dallas) TX 2001 2018 19 281 93.4% 987 50% Crestmont at Thornblade Greenville SC 1998 2018 22 266 90.0% 1,118 90% The VIVE at Kellswater Knappolis NC 2011 2019 9 312 90.7% 800 65% Somerset at Trussville Trussville AL 2007 2019 13 328 N/A N/A 80% Total/Weighted Average 21.8 9,934 Lease-Up Project Bell's Bluff Nashville TN 2018 1 402 58% Total (Including Lease-Up Projects) 10,336 Property Unconsolidated Joint Ventures City State Year Built Age No. of Units Canalside Sola (1) Columbia SC 2018 1 339 Canalside Lofts Columbia SC 2008/2013 11 374 Gateway Oaks Forney TX 2016 4 313 Total 1,026 (1) Currently in lease-up 14