UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

| |  |

| For the fiscal year ended: | | Commission file number: |

| December 31, 2012 | | 001-34903 |

TOWER INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

| |  |

| Delaware | | 27-3679414 |

| (State of Incorporation) | | (IRS Employer Identification Number) |

| |  |

17672 Laurel Park Drive North, Suite 400 E

Livonia, Michigan | | 48152 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code: (248) 675-6000

Securities registered pursuant to Section 12(b) of the Act:

| |  |

| Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yeso Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15d of the Act.Yeso Nox

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yesx Noo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yesx Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| |  | |  | |  |

| Large accelerated filero | | Accelerated filerx | | Non-accelerated filero | | Smaller reporting companyo |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yeso Nox

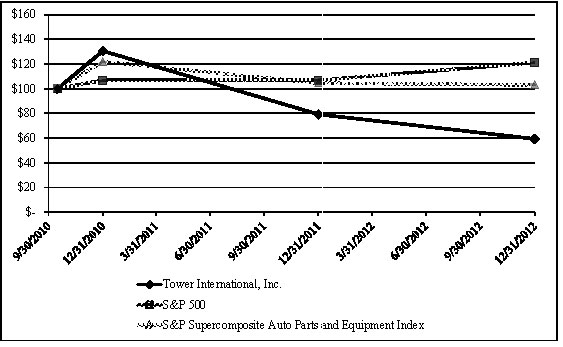

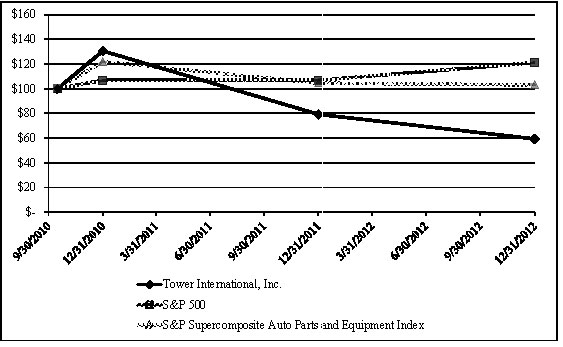

The aggregate market value of the common stock held by non-affiliates of the registrant, computed by reference to the average high and low trading prices of the common stock as of the closing of trading on June 30, 2012, was approximately $71,980,303.

There were 20,247,134 shares of the registrant’s common stock outstanding at February 28, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions, as expressly described in this report, of the Registrant’s Proxy Statement for the 2013 Annual Meeting of the Stockholders are incorporated by reference into Part III.

TABLE OF CONTENTS

TOWER INTERNATIONAL, INC. — FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2012

TABLE OF CONTENTS

| |  |

| | 10-K Pages |

PART I

| | | | |

Item 1. Business | | | 1 | |

Item 1A. Risk Factors | | | 13 | |

Item 1B. Unresolved Staff Comments | | | 23 | |

Item 2. Properties | | | 24 | |

Item 3. Legal Proceedings | | | 25 | |

Item 4. Mine Safety Disclosures | | | 25 | |

PART II

| | | | |

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Repurchases of Equity Securities | | | 26 | |

Item 6. Selected Financial Data | | | 27 | |

Item 7. Management's Discussion and Analysis of Financial Condition and

Results of Operations | | | 29 | |

Item 7A. Quantitative and Qualitative Disclosures about Market Risk | | | 53 | |

Item 8. Financial Statements and Supplementary Data | | | 55 | |

Item 9. Changes in and Disagreements with Accountants on Accounting and

Financial Disclosure | | | 113 | |

Item 9A. Controls and Procedures | | | 113 | |

Item 9B. Other Information | | | 116 | |

PART III

| | | | |

Item 10. Directors, Executive Officers, and Corporate Governance | | | 117 | |

Item 11. Executive Compensation | | | 117 | |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | | 117 | |

Item 13. Certain Relationships and Related Transactions, and Director Independence | | | 117 | |

Item 14. Principal Accountant Fees and Services | | | 118 | |

PART IV

| | | | |

Item 15. Exhibits and Financial Statement Schedules | | | 118 | |

Signatures

| | | | |

Exhibit Index

| | | | |

Exhibits

| | | | |

EX-18

| | | | |

EX-21

| | | | |

EX-23

| | | | |

EX-31.1

| | | | |

EX-31.2

| | | | |

EX-32.1

| | | | |

EX-32.2

| | | | |

EX-101. INS

| | | | |

EX-101. SCH

| | | | |

EX-101. CAL

| | | | |

EX-101. LAB

| | | | |

EX-101. PRE

| |

i

TABLE OF CONTENTS

PART I

Item 1. Business

Our Company

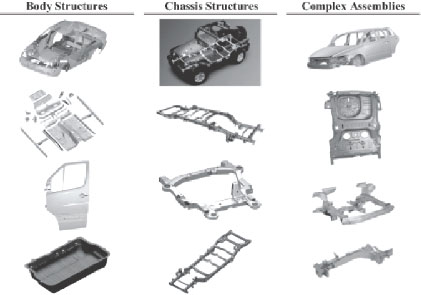

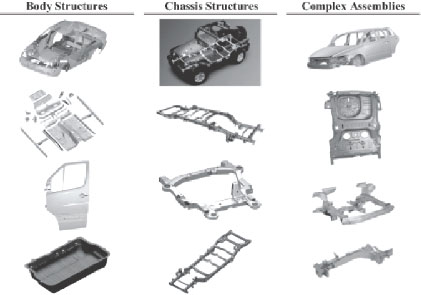

We are a leading integrated global manufacturer of engineered structural metal components and assemblies primarily serving automotive original equipment manufacturers, or OEMs. We offer our automotive customers a broad product portfolio, supplying body-structure stampings, frame and other chassis structures, as well as complex welded assemblies, for small and large cars, crossovers, pickups and sport utility vehicles, or SUVs.

Our products are manufactured at 29 production facilities strategically located near our customers in North America, South America, Europe and Asia. We support our manufacturing operations through eight engineering and sales locations throughout the world. We are a disciplined, process-driven company with an experienced management team that has a history of implementing sustainable operational improvements. For the year ended December 31, 2012, we generated revenues of $2.1 billion and net income attributable to Tower International, Inc. of $18 million. In addition, we had Adjusted EBITDA of $193.7 million and an Adjusted EBITDA margin of 9.3% for the year ended December 31, 2012. (Item 7 of this Annual Report and note 16 to our consolidated financial statements include a discussion of Adjusted EBITDA as a non-GAAP measure).

We believe that our product capabilities, our geographic, customer and product diversification, and our competitive cost position us to benefit from the long-term recovery in North American and European automotive industry production, and we have made recent investments in Brazil and China to expand our footprint in these rapidly growing markets.

Our History and Corporate Structure

Our Corporate History

Tower Automotive, Inc., our predecessor (the “Predecessor Company”), was formed in 1993 to acquire R. J. Tower Corporation. On February 2, 2005, Tower Automotive, Inc. along with 25 of its United States subsidiaries each filed a voluntary petition for relief under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court, Southern District of New York. On July 11, 2007, the Bankruptcy Court confirmed the Chapter 11 Reorganization Plan of the debtors and approved the sale of substantially all of the debtors’ assets to Tower Automotive, LLC, an affiliate of Cerberus Capital Management, L.P. (“CCM”) and funds and accounts affiliated with CCM (collectively, “Cerberus”). The plan became effective on July 31, 2007, and in connection therewith, the debtors completed the sale of substantially all of their assets to Tower Automotive, LLC. As part of the sale, Tower Automotive, LLC also acquired the capital stock of substantially all of the foreign subsidiaries of Tower Automotive, Inc.

Our Corporate Conversion and Initial Public Offering (“IPO”)

On October 14, 2010, (i) all of our equity owners transferred their equity interests in Tower Automotive, LLC to a newly created limited liability company, Tower International Holdings, LLC, a newly formed entity controlled by Cerberus, (ii) Tower Automotive, LLC converted into a Delaware corporation, which was named Tower International, Inc., and (iii) all of the equity interests in Tower Automotive, LLC were converted into common stock of Tower International, Inc. We refer to this transaction as our “Corporate Conversion.”

On October 15, 2010, our common stock began trading on the New York Stock Exchange following our IPO, through which we raised $80.2 million of proceeds in connection with the sale of 6,633,722 shares of common stock.

Divestiture of our South Korean Subsidiary

On December 28, 2012, our subsidiaries Tower Automotive Holdings Asia B.V. and Tower Automotive International Holdings B.V. (together, “Sellers”), entered into a Stock Purchase Agreement (“Agreement”) with SJ Holdings, Inc., a subsidiary of SECO (“Buyer”) and consummated the divestiture of our Korean subsidiary Seojin Industrial Company Ltd. (“Seojin” or “Tower Korea”). Pursuant to the Agreement, the Buyer acquired all of the outstanding capital stock of Seojin for a purchase price of fifty billion Korean Won (approximately $47 million USD) and assumed the outstanding debt of Seojin. Accordingly, Seojin has been presented as a discontinued operation within this Annual Report in accordance with FASB ASC No. 205,Discontinued Operations.

1

TABLE OF CONTENTS

Our Industry

We believe OEMs produce a majority of their structural metal components and assemblies internally. While OEM policies differ and may be especially impacted by their own capacity utilization, the capital expenditures associated with internal production can be substantial. We believe that longer term, OEMs may outsource a greater proportion of their stamping requirements because of this capital and fixed-cost intensity and we may benefit from this shift in our customer preferences. In addition, we believe OEMs will increasingly favor global vehicle platforms supported by larger, more capable and financially strong suppliers. Given our global manufacturing footprint, cost structure and integrated design, engineering and program management capabilities, we are well-positioned to take advantage of these potential opportunities.

Our Strategy

We seek:

| — | To execute a business model that generates sustainable ongoing free cash flow, providing flexibility for capital allocation; |

| — | To reduce debt leverage and interest cost, which we consider integral to a financially strong and capable auto parts supplier; |

| — | To achieve growth at or above industry through strong competitive capabilities in engineering, manufacturing, and program management that contribute to leading positions in cost and quality, plus opportunistic, accretive acquisitions and entering new growth markets; and |

| — | To manage risk through financial discipline and customer and geographic diversification. |

Execute Business Model Focused on Free Cash Flow

Ongoing free cash flow (defined as net cash provided by operating activities less cash disbursed for purchases of property, plant, and equipment, net) is one of our important financial metrics. This focus keeps us disciplined regarding product pricing and margins, as well as determining and prioritizing affordable capital expenditures. To further our alignment, free cash flow is a major component of our annual bonus program for salaried and hourly colleagues. (Item 7 of this Annual Report includes a discussion of free cash flow as a non-GAAP measure).

We estimate that the demonstrated present capability of our business model (at normalized conditions) generates positive free cash flow equal to about 1% of revenues. We see a realistically achievable path to ongoing free cash flow equal to about 3% of revenues by approximately 2015. Adjusted EBITDA less capital expenditures is expected to contribute one percentage point of improvement with industry production at trend in all regions and with recent expansion investments in China and Brazil behind us. Reducing leverage to target at present market interest rate can improve cash flow by about 1% of revenues. Our business model is summarized in the table below (as percent of revenues):

| |  | |  | |  |

| | Present Capability | | Achievable Improvements | | Planned Capability |

| Adjusted EBITDA | | | 9 - 10 | % | | | | | | | | |

| Capital Expenditures (Capex) | | | (4) - (5 | )% | | | | | | | | |

| Adjusted EBITDA Less Capex | | | 5 | % | | | +1 | % | | | 6 | % |

| Interest Expense | | | (2.5 | )% | | | +1 | % | | | (1.5 | )% |

| All Other* | | | (1.5 | )% | | | | | | | (1.5 | )% |

| Free Cash Flow | | | 1 | % | | | +2 | % | | | 3 | % |

| * | Includes cash taxes, pension contributions, working capital, and other |

Reduce Leverage and Interest Expense

Reducing net debt leverage (defined as total debt less cash and cash equivalents divided by Adjusted EBITDA) and interest expense are important business priorities and potential significant opportunities to improve financial results and ongoing financial strength. As of December 31, 2012, our net debt (defined as

2

TABLE OF CONTENTS

total debt less cash and cash equivalents) was $383.1 million, or approximately 2.0 times Adjusted EBITDA for the year ended December 31, 2012. Our long-term target for net debt leverage is 1.0 times. In addition to using free cash flow to reduce leverage, we may pursue additional asset sales, as evidenced by the accretive sale of Tower Korea in December 2012, which reduced net debt by 26%. (Item 7 of this Annual Report includes a discussion of net debt as a non-GAAP measure).

In addition to reducing the amount of net debt leverage, we also will pursue a significantly lower interest rate by re-financing our senior secured notes due 2017 at the earliest opportunity that makes business sense. We had $354.8 million of these notes outstanding at December 31, 2012 at an effective interest rate of 11.25%. The notes have annual call options up to 10% of the original principal at a price of 105, and the notes are callable in total as of September 1, 2014 at a price of 105.313. See note 6 to the consolidated financial statements for additional information on the senior secured notes.

Achieve Growth at or Above Industry

We have demonstrated the ability to win net new business from a combination of new OEM models, share gains from competitors via conquest wins, and some OEM outsourcing. We also are reasonably well-positioned geographically, with about 20% of present revenue in the secular above-average growth markets of China and Brazil. We believe our ability to win business at a return in excess of our cost of capital is a direct reflection of our core engineering strength, competitive cost and quality, and proven ability to manage complex and critical new-model launches for customers. We use processes such as Lean Six Sigma, labor best practices standardization, and advanced product quality planning (APQP) to drive productivity and quality and manage new programs on time and on budget.

We believe there can be meaningful upside growth opportunities in the future from entering additional growth markets like Mexico and India where we do not yet manufacture and from accretive acquisitions as the sector consolidates.

Manage Risk

We consider risk management an important part of operating predictably and successfully in the cyclical and capital-intensive auto parts industry. Foremost in managing risk is financial discipline, beginning during the evaluation and approval of new programs to ensure sound assumptions and projected returns in excess of our cost of capital. During each year, we carefully monitor and manage all elements of cost, with an objective of achieving productivity and other savings that at least offset customer price reductions and labor and overhead inflation. Through our commercial agreements, we are largely shielded from changes in steel prices.

In addition to our financial discipline, customer and geographic diversification can help to minimize overall risk. While there can be no assurance that future results will match past performance, we believe our ability to weather the severely depressed auto industry conditions of 2008 – 2009 without receiving customer pricing assistance or violating any financial covenants is good evidence of the company’s effective risk management.

We supply products to approximately 170 vehicle models globally for 11 of the 12 largest global OEMs. The below charts summarize our diversification by customer, region, and vehicle platform.

3

TABLE OF CONTENTS

Customer Diversification

We have a diversified customer mix as seven different OEMs individually accounted for 5% or more of our revenues in 2012. The below charts summarize our customer mix as a percent of revenues for the year ended December 31, 2012.

| |  |

| Customer | | |

| VW | | | 23 | % |

| Ford | | | 21 | % |

| Chrysler | | | 9 | % |

| Fiat | | | 9 | % |

| Volvo | | | 7 | % |

| Nissan | | | 7 | % |

| Daimler | | | 5 | % |

| Toyota | | | 4 | % |

| BMW | | | 3 | % |

| Honda | | | 2 | % |

| Chery | | | 1 | % |

| PSA | | | 1 | % |

| Geely | | | 1 | % |

| Other | | | 7 | % |

| Total | | | 100 | % |

Geographic Diversification

The below chart summarizes our geographic mix as a percent of revenues for the year ended December 31, 2012.

| |  |

| Region | | |

| North America | | | 44 | % |

| Europe | | | 37 | % |

| Asia | | | 10 | % |

| South America | | | 9 | % |

| Total | | | 100 | % |

Platform Diversification

Our products are offered on a diverse mix of vehicle platforms, reflecting the balanced portfolio approach of our business model and the breadth of our product capabilities. The below chart summarizes our vehicle platform mix as a percent of revenues for the year ended December 31, 2012.

| |  |

| Vehicle Platform | | |

| Small Cars | | | 40 | % |

| Large Cars | | | 19 | % |

| Other – Light Trucks | | | 22 | % |

| North American Framed Vehicles | | | 19 | % |

| Total | | | 100 | % |

The term “small cars” refers to passenger cars that are classified by IHS Automotive®, or IHS, in the smallest three of IHS’s four categories of passenger cars, the term “large cars” refers to the largest category of passenger cars, multi-purpose vehicles and cross-over vehicles that are based on a unibody structure, the term “other – light trucks” refers to SUVs that are based on a unibody structure, minivans, and light trucks in the international regions, and the term “North American framed vehicles” refers to vehicles such as pick-up trucks and SUVs that are built on a full-frame structure.

4

TABLE OF CONTENTS

The reports prepared by IHS referred to in this Annual Report are subscription-based. All references in this report to historical industry production volumes, projections, estimates or other data attributable to IHS are based on data available from the IHS February 2013 forecast.

Our Products

We produce a broad range of structural components and assemblies, many of which are critical to the structural integrity of a vehicle.

Product Offerings

Body structures and assemblies

Body structures and assemblies form the basic upper body structure of the vehicle and include structural metal components such as body pillars, roof rails and side sills. This category also includes Class A surfaces and assemblies, which are the “exterior skin” of the vehicle — body sides, hoods, doors, fenders and pickup truck boxes. These components form the appearance of the vehicle, calling for flawless surface finishes.

Chassis, lower vehicle structures and suspension components

Lower vehicle frames and structures include chassis structures that make up the “skeleton” of a vehicle and which are critical to overall performance, particularly in the areas of noise, vibration and harshness, handling and crash management. These products include pickup truck and SUV full frames, automotive engine and rear suspension cradles, floor pan components, and cross members that form the basic lower body structure of the vehicle. These heavy gauge metal stampings carry the load of the vehicle, provide crash integrity, and are critical to the strength and safety of vehicles. We manufacture a wide variety of stamped, formed and welded suspension components including control arms, suspension links, track bars, spring and shock towers, shackles, twist axles, radius arms, stabilizer bars, trailing axles and brackets.

Complex body-in-white assemblies

Complex body-in-white assemblies are comprised of multiple components and sub-assemblies welded to form major portions of the vehicle’s body structure. We refer to body-in-whites as the manufacturing stage in which the vehicle body sheet metal has been assembled or designed but before the components and trim have been added. Examples of complex assemblies include front and rear floor pan assemblies and door/pillar assemblies.

Other

We also manufacture a variety of other automotive products and defense and aerospace products.

5

TABLE OF CONTENTS

Product Mix

We have a well-diversified product group mix. Our product group mix as a percent of revenues for the year ended December 31, 2012 is shown below:

| |  | |  | |  |

|

| Product Group | | |

| Body structures and assemblies | | | 55 | % |

Chassis, lower vehicle structures and

suspension components | | | 20 | % |

| Complex body-in-white assemblies | | | 24 | % |

| Other | | | 1 | % |

| Total | | | 100 | % |

Overview of Major Vehicle Models

The following table presents an overview of the major vehicle models for which we supply products:

| |  | |  |

| OEM | | Models | | Product Type |

Europe

| | | | |

| Volvo | | S40/V50/C30/C70/V40 | | Complex Assembly |

| VW | | Cayenne/Touareg/Q7 | | Body Structures & Complex Assembly |

| | | Caddy Van | | Body Structures |

| | | Citigo | | Body Structures |

| | | Mii | | Body Structures |

| | | Octavia | | Body Structures |

| | | Up! | | Body Structures |

| BMW | | 1/3 Series | | Body Structures |

| Daimler | | Sprinter/Crafter | | Body Structures & Complex Assembly |

| Fiat | | 500 | | Body Structures |

| | | Ducato | | Body Structures |

| | | Giuletta | | Body Structures |

| | | MiTo | | Body Structures |

| | | Punto | | Body Structures |

| Opel | | Astra | | Body Structures |

North America

| | | | |

| Ford | | Econoline | | Frame Assembly |

| | | Explorer | | Complex Assembly |

| | | Expedition/Navigator | | Body Structures |

| | | F-Series | | Body Structures |

| | | Focus | | Body Structures |

| | | Taurus/MKS | | Complex Assembly |

| | | C-Max | | Body Structures |

6

TABLE OF CONTENTS

| |  | |  |

| OEM | | Models | | Product Type |

| Chrysler | | Grand Caravan/Town & Country | | Body Structures |

| | | Grand Cherokee | | Body Structures |

| | | Wrangler | | Frame Assembly |

| | | Dart | | Body Structures |

| Nissan | | Frontier/Xterra | | Body Structures & Frame Assembly |

| | | NV Series | | Frame Assembly |

| | | Titan/Armada | | Frame Assembly |

| | | Altima | | Body Structures |

| Toyota | | Camry | | Body Structures |

| | | Tacoma | | Frame Assembly |

China

| | | | |

| FAW-VW | | Bora/Golf A4 | | Chassis |

| | | Jetta | | Chassis |

| Chery | | A3 | | Chassis |

| | | Cowin 3 | | Chassis |

| | | Fulwin 2 | | Chassis |

| | | Tiggo | | Chassis |

| SAIC | | Roewe 550 | | Chassis |

| Fiat | | 343c | | Body Structures |

| Geely | | Vision | | Body Structures |

| | | Seaview | | Body Structures |

South America

| | | | |

| VW | | Gol | | Body Structures |

| | | Fox | | Body Structures |

| | | Saveiro | | Body Structures |

| Fiat | | Palio/Doblo | | Body Structures |

| | | Punto | | Body Structures |

| | | Strada | | Body Structures |

| Honda | | Civic | | Body Structures |

| | | Fit | | Body Structures |

| | | City | | Body Structures |

| PSA | | Picasso | | Body Structures |

International Operations

We have significant manufacturing operations outside the United States, and in 2012, approximately 56% of our revenues originated outside the United States. For information regarding potential risks associated with our international operations, see Risk Factors — “We are subject to risks related to our international operations.” See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and note 16 to our consolidated financial statements for further information regarding our international operations.

Manufacturing and Operations

Our manufacturing operations consist primarily of stamping and welding operations, system and modular assembly operations, coating, and other ancillary operations. Stamping involves passing metal through dies in a stamping press to form the metal into three-dimensional parts. We produce stamped parts using precision single-stage, progressive and transfer presses, ranging in size from 150 to 4,500 tons, which perform multiple functions to convert raw material into finished products. We invest in our press technology to increase flexibility, improve safety and minimize die changeover time.

We feed stampings into assembly operations that produce complex assemblies through the combination of multiple parts that are welded or fastened together. Our assembly operations are performed on either dedicated, high-volume welding/fastening machines or on flexible cell-oriented robotic lines. The assembly

7

TABLE OF CONTENTS

machines attach additional parts, fixtures or stampings to the original metal stampings. In addition to standard production capabilities, our assembly machines also are able to perform various statistical control functions and identify improper welds and attachments. We work with manufacturers of fixed/robotic welding systems to develop faster, more flexible machinery.

We require significant quantities of steel in the manufacture of our products. Our products use various grades and thicknesses of steel and aluminum, including high-strength, hot-and cold-rolled, galvanized, organically coated, stainless, and aluminized steel. Although changing steel prices affect our results, we seek to be neutral with respect to steel pricing over time, with the intention of neither making nor losing money as steel prices fluctuate. The pricing of our products includes a component for steel which increases as steel prices increase and decreases as steel prices decrease. For our North American customers and several of our other customers, we purchase steel through our customers’ resale programs, where our customers actually negotiate the cost of steel for us. In other cases, we procure steel directly from the mills, negotiating our own price and seeking to pass through steel price increases and decreases to our customers.

We focus on achieving superior product quality at the lowest operating costs possible and concentrate on improving our manufacturing processes to drive out inefficiencies. We seek to continually improve our processes in efforts to improve our cost competitiveness and to achieve higher quality. We continue to adapt our capacity to customer demand, both by expanding capabilities in growth areas and by reallocating capacity away from demand segments in decline.

We are committed to sustaining Lean Six Sigma principles throughout our manufacturing processes. We utilize Lean Six Sigma principles to increase the efficiency of our operations and to reduce operating costs, thereby improving our cost competitiveness. We have accomplished efficiency improvements while at the same time improving our quality, with customer-reported defects averaging about 29 per million parts delivered in 2012, which we believe is world-class performance.

Supply Base — Manufactured Components and Raw Materials

We purchase various manufactured components and raw materials for use in our manufacturing processes. All of these components and raw materials are available from numerous sources. We employ just-in-time manufacturing and sourcing systems enabling us to meet customer requirements for faster deliveries while minimizing our need to carry significant inventory levels. The primary raw material used to produce the majority of our products is steel. We purchase hot-and cold-rolled, galvanized, organically coated, stainless and aluminized steel from a variety of suppliers. We purchase a portion of our steel from certain of our customers through various OEM resale programs. The remainder of our steel purchasing requirements are met through contracts with steel producers and market purchases. In addition, we procure small-and medium-sized stampings, fasteners, tubing, and rubber products.

Sales, Marketing and Distribution

Our sales and marketing efforts are designed to create awareness of our engineering, program management, manufacturing and assembly expertise, and to translate our leadership position into contract wins. We have developed a sales team that consists of an integrated group of professionals, including skilled engineers and program managers, which we believe provides the appropriate mix of operational and technical expertise needed to interface successfully with OEMs. We sell directly to OEMs through our sales and engineering teams at our technical and customer service centers strategically located around the world. Bidding on automotive OEM platforms typically encompasses many months of engineering and business development activity. We integrate our sales force directly into our operating team and work closely with our customers throughout the process of developing and manufacturing a product. Our proximity to our customer base enables us to enjoy close relationships with our customers and positions us well to seek future business awards.

Customers

We have developed long-standing business relationships with our automotive customers around the world. We work together with our customers in various stages of production, including development, component sourcing, quality assurance, manufacturing and delivery. With a diverse mix of products and facilities in major

8

TABLE OF CONTENTS

markets worldwide, we believe we are well-positioned to meet customer needs. We believe we have a strong, established reputation with customers for providing high-quality products at competitive prices, as well as for timely delivery and customer service. Given that the automotive OEM business involves long-term production contracts awarded on a platform-by-platform basis, we believe we can leverage our strong customer relationships to obtain new platform awards.

Customer Support

We have eight engineering and sales locations throughout the world, including a 24-hour engineering support center in India. We believe that we provide effective customer solutions, products and service to our customers globally. Our customer service group is organized into customer-dedicated teams within regions to provide more focused service to our clients.

Seasonality

Our customers in Europe typically shut down vehicle production during portions of July or August and during one week in December. Our North American customers typically shut down vehicle production for approximately two weeks during July and for one week during December. Our customers in Brazil and China typically shut down vehicle production during certain periods in our first quarter. Our quarterly results of operations, cash flows and liquidity may be impacted by these seasonal practices. For example, working capital is typically a use of cash during the first quarter of the year and a source of cash generation in the fourth quarter. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for further discussion on working capital.

Competition

We principally compete for new business both at the beginning of the development of new models and upon the redesign of existing models. New-model development generally begins two to three years before the marketing of such models to the public. Once a supplier has been designated to supply parts for a new program, an OEM usually will continue to purchase those parts from the designated producer for the life of the program, although not necessarily for a redesign. OEMs typically rigorously evaluate suppliers based on many criteria such as quality, price/cost competitiveness, system and product performance, reliability and timeliness of delivery, new product and technology development capability, excellence and flexibility in operations, degree of global and local presence, effectiveness of customer service and overall management capability.

We believe that we compete effectively with other leading suppliers in our sector. The strength and breadth of our program management and engineering capabilities, as well as our geographic, customer and platform diversification, provide the necessary scale to optimize our cost structure. We follow manufacturing practices designed to improve efficiency and quality, including manpower standardization and global inventory reduction initiatives, which enable us to manage inventory so that we can deliver quality components and systems to our customers in the quantities and at the times ordered.

Our major competitors include: Magna International, Inc. (Cosma division), Gestamp Automocion, Martinrea International, Gruppo Magnetto, and Benteler Automotive. We compete with other competitors with respect to certain of our products and in particular geographic markets. The number of our competitors has decreased in recent years and we believe will continue to decline due to supplier consolidation. We expect that OEMs are increasingly focused on the global capability and financial strength of their supply base. We believe that such scrutiny of suppliers will result in additional contraction in the supply base.

In addition, most of our OEM customers manufacture products that compete with our products. We believe the recent trend has been for OEMs, on average, to increase outsourcing, and we expect that trend to continue.

9

TABLE OF CONTENTS

Joint Ventures

As of December 31, 2012, we had four consolidated joint ventures in China: 1) Tower Automotive (WuHu) Company, Ltd., which we refer to as “WuHu”, 2) Changchun Tower Golden Ring Automotive Products Co., Ltd., which we refer to as “TGR”, 3) (Xiangtan) DIT Automotive Products Co., Ltd., which we refer to as “Xiangtan”, and 4) Tower (Ningbo) DIT Automotive Products Co., Ltd., which we refer to as “Ningbo”.

Our WuHu joint venture, 80% owned by Tower, has plants in WuHu City and Dalian and primarily supplies Chery.

Our TGR joint venture, 60% owned by Tower, has plants in Changchun and Chengdu and primarily supplies FAW-VW and FAW.

Our Xiangtan joint venture, 51% owned by Tower, has two plants in Xiangtan and primarily supplies Geely and Fiat-GAC.

Our Ningbo joint venture, 36% owned by Tower, has two plants in Ningbo with plans to supply Geely.

Employees

As of December 31, 2012, we had approximately 9,000 employees worldwide, of whom approximately 5,800 were covered under collective bargaining agreements that expire at various times.

We are not aware of any work stoppages since the inception of the Predecessor Company in 1993. A strike or slow-down by one of our unions could have a material adverse effect on our business. We believe that our relations with our employees are satisfactory.

Environmental Matters

We are subject to various domestic and foreign federal, state and local laws and regulations governing the protection of the environment and health and safety, including those regulating soil, surface water and groundwater contamination; the generation, storage, handling, use, disposal and transportation of hazardous materials; the emission and discharge of materials, including greenhouse gases, or GHGs, into the environment; and the health and safety of our employees. We are also required to obtain environmental permits from governmental authorities for certain operations. We have taken steps to comply with these numerous and sometimes complex laws, regulations and permits. We have also achieved ISO 14001 registration for substantially all of our facilities. While compliance with environmental requirements has not had a material impact on our capital expenditures, earnings or competitive position, we have made and will continue to make capital and other expenditures pursuant to such requirements and, if we violate or fail to comply with these requirements, could be subject to fines, penalties or litigation.

Environmental laws, regulations and permits, and the enforcement thereof, change frequently and have tended to become more stringent over time. In particular, more rigorous Greenhouse Gas (“GHG”) emission requirements are in various stages of development. For example, the United States Environmental Protection Agency has promulgated: (1) the Greenhouse Gas Reporting Rule, which requires reporting of GHG data and other relevant information from large sources and suppliers in the United States; and (2) the GHG Tailoring Rules, which requires certain facilities with significant GHG emissions to obtain emissions permits under the authority of the Clean Air Act (typically limited to only the largest stationary sources of GHGs). Additionally, the United States Congress has considered imposing additional restrictions on GHG emissions. Any regulation of GHG emissions by either the United States Congress and/or U.S. EPA could include a cap-and-trade system, technology mandate, emissions tax, reporting requirement or other program, could subject us to significant costs, including those relating to emission credits, pollution control equipment, monitoring and reporting, as well as increased energy and raw material prices. In addition, our OEM customers may seek price reductions from us to account for their increased costs resulting from GHG regulations. Further, growing pressure to reduce GHG emissions from mobile sources could reduce automobile sales, thereby reducing demand for our products and ultimately our revenues. Although there is still significant uncertainty surrounding the scope, timing and effect of future GHG regulation, any such regulation could have a material adverse impact on our business, financial condition, results of operations, reputation, product demand and liquidity.

10

TABLE OF CONTENTS

We also could be responsible for costs relating to any contamination at our, or a predecessor entity’s, current or former owned or operated properties or third party waste disposal sites, even if we were not at fault. Some of these locations have been impacted by environmental releases, and soil or groundwater contamination is being addressed at certain of these sites. In addition to potentially significant investigation and remediation costs, contamination can give rise to third party claims for fines or penalties, natural resource damages, personal injury or property damage. Our costs and liabilities associated with environmental contamination could be substantial and may be material to our business, financial condition, results of operations or cash flows.

Segment Overview

See note 16 to our consolidated financial statements for information on our operating and reportable segments.

Public Information

We maintain a website athttp://www.towerinternational.com. We will make available on our website, free of charge, the proxy statements and reports on Forms 8-K, 10-K and 10-Q that we file with the United States Securities and Exchange Commission, or SEC, as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Additionally, we have adopted and posted on our website a Code of Business Conduct and Ethics that applies to, among other people, our principal executive officer, principal financial officer and principal accounting officer. We intend to disclose any waivers of the Code of Business Conduct and Ethics on our website. We will provide, free of charge, a copy of our Code of Business Conduct and Ethics to any person who requests such a copy. All such requests should be directed to our Executive Director, Investor & External Relations, c/o Tower International, Inc., 17672 Laurel Park Drive North, Suite 400 E, Livonia, Michigan 48152. Except as otherwise stated, the information contained on our website or available by hyperlink from our website is not incorporated into this Annual Report on Form 10-K or other documents we file with, or furnish to, the SEC.

Disclosure Regarding Forward-Looking Statements

This Annual Report contains statements which constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties. The forward-looking statements can be identified by the words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “project,” and other similar expressions, as well as by statements regarding our intent, belief, or current plans or expectations. Our forward looking statements also include, without limitation, statements regarding our anticipated future financial condition, operating results, free cash flows, net debt leverage, Adjusted EBITDA and business and financing plans and models. Forward-looking statements are made as of the date of this report and are based upon management’s current expectations and beliefs concerning future developments and their potential effects on us. Such forward-looking statements are not guarantees of future performance. The following important factors, and those important factors described elsewhere in this Annual Report, including the matters set forth under the captions entitled “Risk Factors” and “Quantitative and Qualitative Disclosures About Market Risk” could cause our actual results to differ materially from estimates or expectations reflected in such forward-looking statements:

| • | global automobile production volumes; |

| • | the financial condition of our customers and suppliers; |

| • | our ability to make scheduled payments of principal or interest on our indebtedness and comply with the covenants and restrictions contained in the instruments governing our indebtedness; |

| • | our ability to refinance our indebtedness; |

| • | our ability to generate non-automotive revenues; |

| • | risks associated with non-U.S. operations, including foreign and economic uncertainty in some regions; |

| • | any increase in the expense and funding requirements of our pension and postretirement benefits; |

| • | our customers’ ability to obtain equity and debt financing for their businesses; |

11

TABLE OF CONTENTS

| • | our dependence on our large customers; |

| • | pricing pressure from our customers; |

| • | work stoppages or other labor issues at our facilities or at the facilities of our customers or suppliers; |

| • | our ability to integrate acquired businesses; |

| • | risks associated with business divestitures; and |

| • | costs or liabilities related to environmental and safety regulations. |

Any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

This Annual Report also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the statistical and other industry data generated by independent parties that is contained in this Annual Report and, accordingly, we cannot assure you of its accuracy or completeness. In addition, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree of uncertainty and risk.

12

TABLE OF CONTENTS

Item 1A. Risk Factors

Our business is subject to a number of risks. In addition to the various risks described elsewhere in this Annual Report, the following risk factors should be considered.

Risk Factors Relating to Our Industry and Our Business

A downturn in the global economy could negatively affect demand for automobiles and automobile parts and our business, financial condition, results of operations and cash flows.

Demand for and pricing of our products are subject to economic conditions and other factors present in the various domestic and international markets where our products are sold. The level of demand for our products depends primarily upon the level of consumer demand for new vehicles that are manufactured with our products. The level of new vehicle purchases is cyclical, affected by such factors as general economic conditions, interest rates, consumer confidence, consumer preferences, patterns of consumer spending, fuel costs and the automobile replacement cycle.

The global economic crisis that prevailed throughout 2008 and 2009 resulted in delayed and reduced purchases of durable consumer goods, such as automobiles. If the global economy were to take another significant downturn, depending upon its length, duration and severity, our business, financial condition, results of operations, and cash flow would again be materially adversely affected.

The economic instability in countries in which we operate in Europe could adversely affect our business, financial condition, results of operations and cash flows as well as negatively impact our access to, and cost of, capital.

We have invested substantial resources in markets where we expect growth and we may be unable to timely alter our strategies should such expectations not be realized.

Our future growth is dependent on our making the right investments at the right time to support product development and manufacturing capacity in areas where we can support our customer base. We have identified China and Brazil as markets likely to experience substantial growth, and accordingly have made and expect to continue to make substantial investments, both directly and through participation in various partnerships and joint ventures to support anticipated growth in those regions. If we are unable to deepen existing and develop additional customer relationships in these regions, we may not only fail to realize expected rates of return on our existing investments, but we may incur losses on such investments and be unable to timely redeploy the invested capital to take advantage of other markets, potentially resulting in lost market share to our competitors. Our results will also suffer if these regions do not grow as quickly as we anticipate.

Our operations in China are conducted through joint ventures which have unique risks that could have a material adverse impact on our business and customer relationships.

We have four joint ventures in China. At two of the joint ventures, our joint venture partner is also affiliated with the largest customer of the joint venture. As such, these partners may negotiate on behalf of customers of the joint venture for sales terms that may not be in the best interest of the joint venture.

Additional risks associated with joint ventures include one or more partners failing to satisfy contractual obligations, conflicts arising between us and any of our partners that could have a material adverse impact on customer relationships and business, and a change in ownership of any of our partners. Additionally, our ability to sell our interest in a joint venture may be subject to contractual and other limitations.

13

TABLE OF CONTENTS

Our substantial international operations make us vulnerable to risks associated with doing business in foreign countries.

Our international operations include manufacturing facilities in Europe, China, and Brazil, and we sell our products in each of these areas. For the year ended December 31, 2012, approximately 56% of our revenues were derived from operations outside the United States. International operations are subject to various risks that could have a material adverse effect on those operations and our business as a whole, including:

| • | exposure to local economic conditions; |

| • | exposure to local political conditions, including the risk of seizure of assets by a foreign government; |

| • | exposure to local social unrest, including any resultant acts of war, terrorism or similar events; |

| • | exposure to local public health issues and the resultant impact on economic and political conditions; |

| • | exposure to local tax requirements and obligations; |

| • | foreign currency exchange rate fluctuations; |

| • | hyperinflation in certain foreign countries; |

| • | the risk of government-sponsored competition; |

| • | difficulty of enforcing agreements and collecting receivables through certain foreign legal systems; |

| • | controls on the repatriation of cash, including the imposition or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries; and |

| • | export and import restrictions. |

Foreign exchange rate fluctuations could cause a decline in our financial condition, results of operations and cash flows.

We generate a significant portion of our revenues and incur a significant portion of our expenses in currencies other than the U.S. dollar. As a result, appreciation of the U.S. dollar against these foreign currencies generally will have a negative impact on our reported sales and profits while depreciation of the U.S. dollar against these foreign currencies will generally have a positive effect on reported revenues and profits. As of December 31, 2012, we estimated that a hypothetical change of 100 basis points in the Euro to the U.S. dollar exchange rate would have impacted our stockholders’ equity by approximately $2.9 million.

We may use a combination of natural hedging techniques and financial derivatives to protect against certain foreign currency exchange rate risks. Such hedging activities may be ineffective or may not offset more than a portion of the adverse financial impact resulting from foreign currency variations. Gains or losses associated with hedging activities also may negatively impact operating results.

Any acquisitions or divestitures we make could disrupt our business and materially harm our financial condition, results of operations and cash flows.

We may, from time to time, consider certain acquisitions or divestitures. Acquisitions and divestitures involve numerous risks, including difficulties in the assimilation of the acquired businesses, the diversion of our management’s attention from other business concerns, the assumption of unknown liabilities, undisclosed risks impacting the target, potential adverse effects on existing business relationships with current customers and suppliers, and decreased geographic diversification. For example, the divestiture of Seojin during 2012 has resulted in increased revenue concentration in North America and Europe. We cannot provide assurance that any acquisitions or divestitures will perform as planned or prove to be beneficial to our operations and cash flow or that we will be able to successfully integrate any acquisitions that we undertake. Any such failure could seriously harm our financial condition, results of operations and cash flows.

14

TABLE OF CONTENTS

We may be unable to realize revenues represented by our awarded business, which could materially and adversely impact our business, financial condition, results of operations and cash flows.

The realization of future revenues from awarded business is inherently subject to a number of important risks and uncertainties, including the number of vehicles that our customers will actually produce, the timing of that production and the mix of options that our customers may choose.

In addition to not having a commitment from our customers regarding the minimum number of products they must purchase from us if we obtain awarded business, typically the terms and conditions of the agreements with our customers provide that they have the contractual right to unilaterally terminate our contracts with them with no notice or limited notice. If such contracts are terminated by our customers, our ability to obtain compensation from our customers for such termination is generally limited to the direct out-of-pocket costs that we incurred for raw materials and work-in-progress and in certain instances undepreciated capital expenditures.

We base a substantial part of our planning on the anticipated lifetime revenues of particular products. We calculate the lifetime revenues of a product by multiplying our expected price for a product by forecasted production volume during the length of time we expect the related vehicle to be in production. We use a third-party forecasting service, IHS, to provide long-term forecasts, which allows us to determine how long a vehicle is expected to be in production. If we over-estimate the production units or if a customer reduces its level of anticipated purchases of a particular platform as a result of reduced demand, our actual revenues for that platform may be substantially less than the lifetime revenues we had anticipated for that platform.

Typically, it takes two to three years from the time a manufacturer awards a program until the program is launched and production begins. In many cases, we must commit substantial resources in preparation for production under awarded customer business well in advance of the customer’s production start date. We cannot provide assurance that our results of operations will not be materially adversely impacted in the future if we are unable to recover these types of pre-production costs related to our customers’ cancellation of awarded business.

Deterioration in the United States and world economies could exacerbate the difficulties experienced by our customers and suppliers in obtaining financing, which, in turn, could materially and adversely impact our business, financial condition, results of operations and cash flows.

The capital and credit markets provide companies with liquidity to operate and grow their businesses beyond the liquidity that operating cash flows provide. Disruptions in the capital and credit markets could adversely affect our customers by making it increasingly difficult for them to obtain financing for their businesses and for their customers to obtain financing for automobile purchases. Our OEM customers typically require significant financing for their respective businesses. In addition, our OEM customers typically have related finance companies that provide financing to their dealers and customers. These finance companies have historically been active participants in the securitization markets, which have experienced severe disruptions during the global economic crisis. Our suppliers, as well as the other suppliers to our customers, may face similar difficulties in obtaining financing for their businesses. If capital is not available to our customers and suppliers, or if its cost is prohibitively high, their businesses would be negatively impacted, which could result in their restructuring or even reorganization/liquidation under applicable bankruptcy laws. Any such negative impact, in turn, could materially and negatively affect our Company either through the loss of revenues to any of our customers so affected, or due to our inability to meet our commitments without excess expense resulting from disruptions in supply caused by the suppliers so affected.

Financial difficulties experienced by any major customer could have a material adverse impact on us if such customer were unable to pay for the products we provide or we experienced a loss of, or material reduction in, business from such customer. As a result of such difficulties, we could experience lost revenues, significant write-offs of accounts receivable, significant impairment charges or additional restructurings beyond the steps we have taken to date.

15

TABLE OF CONTENTS

We sponsor a defined benefit pension plan that is underfunded and will require cash payments. If the performance of the assets in our pension plan does not meet our expectations, or if other actuarial assumptions are modified, our required contributions may be higher than we expect.

We sponsor a defined benefit pension plan that is underfunded. Although the Predecessor Company ceased benefit accruals under the plan, the plan will require annual cash payments in order to meet our funding obligations, adversely impacting our cash flow.

Additionally, our earnings may be impacted by the amount of income or expense recorded for our pension plan. Generally accepted accounting principles (“GAAP”) in the United States require that income or expense for pension plans be calculated at the annual measurement date using actuarial assumptions and calculations. These calculations reflect certain assumptions, the most significant of which relate to the capital markets, interest rates and other economic conditions. Changes in key economic indicators can change these assumptions. These assumptions, along with the actual value of assets at the measurement date, will impact the calculation of pension expense for the year. Although GAAP expense and pension contributions are not directly related, the key economic indicators that affect GAAP expense also affect the amount of cash that we would contribute to our pension plan. As a result of current economic instability, the investment portfolio of the pension plan has experienced volatility. Because the values of these pension plan assets have fluctuated and will fluctuate in response to changing market conditions, the amount of gains or losses that will be recognized in subsequent periods, the impact on the funded status of the pension plan and the future minimum required contributions, if any, could have a material adverse effect on our business, financial condition, results of operations and cash flows, but such impact cannot be determined at this time.

The automobile industry is highly cyclical and cyclical downturns in our domestic or international business segments negatively impact our business, financial condition, results of operations and cash flows.

The volume of automotive production in North America, Europe and the rest of the world has fluctuated, sometimes significantly from year-to-year, and such fluctuations give rise to changes in demand for our products. Because we have significant fixed production costs, relatively modest declines in our customers’ production levels can have a significant adverse impact on our results of operations.

The highly cyclical nature of the automotive industry presents a risk that is outside our control and that cannot be accurately predicted. Moreover, a number of factors that we cannot predict can and have impacted cyclicality in the past. Decreases in demand for automobiles generally, or in the demand for our products in particular, could materially and adversely impact our business, financial condition, results of operations and cash flows.

The decreasing number of automotive parts suppliers could make it more difficult for us to compete favorably.

Consolidation and bankruptcies among automotive parts suppliers are resulting in fewer and larger competitors who benefit from purchasing and distribution economies of scale. If we cannot compete favorably in the future with these larger suppliers, our business, financial condition, results of operations and cash flows could be adversely affected due to a reduction of, or inability to increase, revenues.

We may have difficulty competing favorably in the highly competitive automotive parts industry.

The automotive parts industry is highly competitive. Although the overall number of competitors has decreased due to ongoing industry consolidation, we face significant competition within each of our major product areas. The principal competitive factors include price, quality, global presence, service, product performance, design and engineering capabilities, new product innovation and timely delivery. We cannot provide assurance that we will be able to continue to compete favorably in these competitive markets or that increased competition will not have a material adverse effect on our business by reducing our ability to increase or maintain sales and profit margins.

16

TABLE OF CONTENTS

The inability for us, our customers and/or our suppliers to obtain and maintain sufficient capital financing, including working capital lines, and credit insurance may adversely affect our, our customers’ and our suppliers’ liquidity and financial condition.

Our working capital requirements can vary significantly, depending in part on the level, variability and timing of our customers’ worldwide vehicle production and the payment terms with our customers and suppliers. Our liquidity could also be adversely impacted if our suppliers were to suspend normal trade credit terms and require payment in advance or payment on delivery. If our available cash flows from operations are not sufficient to fund our ongoing cash needs, we would be required to look to our cash balances and availability for borrowings under our credit facilities to satisfy those needs, as well as potential sources of additional capital, which may not be available on satisfactory terms and in adequate amounts, if at all.

There can be no assurance that we, our customers and our suppliers will continue to have such ability. This may increase the risk that we cannot produce our products or will have to pay higher prices for our inputs. These higher prices may not be recovered in our selling prices.

Our suppliers often seek to obtain credit insurance based on our financial condition and strength, which may be less robust than our consolidated financial condition. If we were to experience liquidity issues, our suppliers may not be able to obtain credit insurance and in turn would likely not be able to offer us payment terms that we have historically received. Our failure to receive such terms from our suppliers could have a material adverse effect on our liquidity.

We are dependent on large customers for current and future revenues. The loss of any of these customers or the loss of market share by these customers could have a material adverse impact on us.

We depend on major vehicle manufacturers for our revenues. For example, during 2012, our top four customers, Volkswagen, Ford, Chrysler, and Fiat accounted for 23%, 21%, 9%, and 9% of our revenues, respectively. The loss of all or a substantial portion of our sales to any of our large-volume customers could have a material adverse effect on our business, financial condition, results of operations and cash flows by reducing cash flows and by limiting our ability to spread our fixed costs over a larger revenue base. We may make fewer sales to these customers for a variety of reasons, including, but not limited to:

| • | loss of awarded business; |

| • | reduced or delayed customer requirements; |

| • | OEMs’ insourcing business they have traditionally outsourced to us; |

| • | strikes or other work stoppages affecting production by our customers; or |

| • | reduced demand for our customers’ products. |

Disruptions in the automotive supply chain could have a material adverse impact on our business, financial condition, results of operations and cash flows.

The automotive supply chain is subject to disruptions because we, along with our customers and suppliers, attempt to maintain low inventory levels. In addition, our plants are typically located in proximity to our customers.

Disruptions could be caused by a multitude of potential problems, such as closures of one of our or our suppliers’ plants or critical manufacturing lines due to strikes, mechanical breakdowns, electrical outages, fires, explosions or political upheaval, as well as logistical complications due to weather, earthquakes, or other natural or nuclear disasters, mechanical failures, delayed customs processing and more.

Additionally, if we are the cause for a customer being forced to halt production, the customer may seek to recoup all of its losses and expenses from us. Any disruptions affecting us or caused by us could have a material adverse impact on our business, financial condition, results of operations and cash flows.

The volatility of steel prices may adversely affect our results of operations.

We utilize steel and various purchased steel products in virtually all of our products. We refer to the “net steel impact” as the combination of the change in steel prices that are reflected in customer pricing, the change in

17

TABLE OF CONTENTS

the cost to procure steel from the mills, and the change in our recovery of scrap steel, which we refer to as offal. While we strive to achieve a neutral net steel impact over time, we are not always successful in achieving that goal. Changes in steel prices may affect our liquidity because of the time difference between our payment for our steel and our collection of cash from our customers. We tend to pay for replacement materials, which are more expensive when steel prices are rising, over a much shorter period. As a result, rising steel prices may cause us to draw greater than anticipated amounts from our credit lines to cover the cash flow cycle from our steel purchases to cash collection for related accounts receivable. This cash requirement for working capital is higher in periods when we are increasing our inventory quantities.

A by-product of our production process is the generation of scrap, or offal. We typically sell offal in secondary markets, which are similar to the steel markets. We generally share our recoveries from sales of offal with our customers either through scrap sharing agreements, in cases where we are on resale programs, or in the product pricing that is negotiated regarding increases and decreases in the steel price in cases where we purchase steel directly from the mills. In either situation, we may be impacted by the fluctuation in scrap steel prices, either positive or negative, in relation to our various customer agreements. Since scrap steel prices generally increase and decrease as steel prices increase and decrease, our sale of offal may mitigate the severity of steel price increases and limit the benefits we achieve through steel price declines. Any dislocation in offal and steel prices could negatively affect our business, financial condition, results of operations and cash flows.

The seasonality we experience in our business may negatively impact our quarterly results of operations, cash flows and liquidity.

Our customers in Europe typically shut down vehicle production during portions of July or August and during one week in our fourth quarter. Our North American customers typically shut down vehicle production for approximately two weeks during July and for one week during December. Our customers in Brazil and China typically shut down vehicle production during certain periods in our first quarter. Such seasonality may adversely affect our quarterly results of operations, cash flows and liquidity.

We may incur material costs related to plant closings, which could have a material adverse impact on our business, financial condition, results of operations and cash flows.

If we must close manufacturing locations because of loss of business or consolidation of manufacturing facilities, the employee severance, asset retirement and other costs to close these facilities may be significant. In certain locations that are subject to leases, we may continue to incur material costs consistent with the initial lease terms. We continually attempt to align production capacity with demand, but we cannot provide assurance that plants will not have to be closed.

Our business could be adversely affected by labor disruptions.

As of December 31, 2012, we had approximately 9,000 employees, of whom approximately 5,800 were covered under collective bargaining agreements that expire at various times. If major work disruptions involving our employees were to occur, our business could be adversely affected by a variety of factors, including a loss of revenues, increased costs and reduced profitability. We cannot provide assurance that we will not experience a material labor disruption at one or more of our facilities in the future in the course of renegotiation of our labor arrangements or otherwise.

We are subject to environmental requirements and risks as a result of which we may incur significant costs, liabilities and obligations.

We are subject to a variety of environmental and pollution control laws, regulations and permits that govern, among other things, soil, surface water and groundwater contamination; the generation, storage, handling, use, disposal and transportation of hazardous materials; the emission and discharge of materials, including greenhouse gases, or GHGs, into the environment; and health and safety. If we fail to comply with these laws, regulations or permits, we could be fined or otherwise sanctioned by regulators or become subject to litigation. Environmental and pollution control laws, regulations and permits, and the enforcement thereof, change frequently, have tended to become more stringent over time and may necessitate substantial capital expenditures or operating costs.

18

TABLE OF CONTENTS

Under certain environmental requirements, we could be responsible for costs relating to any contamination at our, or a predecessor entity’s, current or former owned or operated properties or third-party waste-disposal sites, even if we were not at fault. Soil and groundwater contamination is being addressed at certain of these locations. In addition to potentially significant investigation and cleanup costs, contamination can give rise to third-party claims for fines or penalties, natural resource damages, personal injury or property damage.

We cannot provide assurance that our costs, liabilities and obligations relating to environmental matters will not have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our ability to utilize our net operating loss carryforwards may be limited and delayed.

As of December 31, 2012, we had U.S. net operating loss carryforwards of $206.2 million. Certain provisions of the United States tax code could limit our annual utilization of the net operating loss carryforwards. There can be no assurance that we will be able to utilize all of our net operating loss carryforwards and any subsequent net operating loss carryforwards in the future. There is a full valuation allowance recorded against the deferred tax asset benefit of this carryforward.

Further, as a result of our IPO, we may have an “ownership change” for purposes of Section 382 of the Internal Revenue Code if, under certain circumstances, our existing stockholders were to sell within a specified period a sufficient amount of our common stock that they then possess to cause an ownership change. If we do experience an ownership change, we may be further limited, pursuant to Section 382 of the Internal Revenue Code, in using our then-current net operating losses to offset taxable income for taxable periods (or portions thereof) beginning after such ownership change. Consequently, in the future we may be required to pay increased cash income taxes because of the Section 382 limitations on our ability to use our net operating loss carryforwards.

In addition, adverse changes in the underlying profitability and financial outlook of our operations in several foreign jurisdictions could lead to changes in our valuation allowances against deferred tax assets and other tax accruals that could adversely affect our financial results.

We have a material amount of goodwill, which, if it becomes impaired, would result in a reduction in our net income and equity.

Goodwill represents the excess of the cost of an acquisition over the fair value of the net assets acquired. GAAP requires that goodwill be periodically evaluated for impairment based on the fair value of the reporting unit. As of December 31, 2012, we had approximately $64.8 million of goodwill on our consolidated balance sheet that could be subject to impairment. Declines in our profitability or the value of comparable companies may impact the fair value of our reporting units, which could result in a write-down of goodwill and a reduction in net income.

We may face risks relating to climate change that could have an adverse impact on our business.

Greenhouse gas emissions have increasingly become the subject of substantial international, national, regional, state and local attention. GHG emission regulations have been promulgated in certain of the jurisdictions in which we operate, and additional GHG requirements are in various stages of development. For example, the United States Congress has considered legislation that would establish a nationwide limit on GHGs. In addition, the EPA has issued regulations limiting GHG emissions from mobile and stationary sources pursuant to the federal Clean Air Act. When effective, such measures could require us to modify existing or obtain new permits, implement additional pollution control technology, curtail operations or increase our operating costs. In addition, our OEM customers may seek price reductions from us to account for their increased costs resulting from GHG regulations. Further, growing pressure to reduce GHG emissions from mobile sources could reduce automobile sales, thereby reducing demand for our products and ultimately our revenues. Thus, any additional regulation of GHG emissions, including through a cap-and-trade system, technology mandate, emissions tax, reporting requirement or other program, could adversely affect our business, results of operations, financial condition, reputation, product demand and liquidity.

19

TABLE OF CONTENTS

Risk Factors Relating to Our Indebtedness

We have a substantial amount of indebtedness, which could have a material adverse effect on our financial health and our ability to fund our operations, to obtain financing in the future and to react to changes in our business, and which could adversely affect the price of our common stock.

As of December 31, 2012, our total debt, including capital lease obligations, was $497 million. That indebtedness could:

| • | adversely affect our stock price; |

| • | make it more difficult for us to satisfy our obligations under our financing documents; |

| • | increase our vulnerability to adverse economic and general industry conditions, including interest rate fluctuations, because a portion of our borrowings are, and will continue to be, at variable rates of interest; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, which would reduce the availability of our cash flow from operations to fund working capital, capital expenditures or other general corporate purposes; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and industry; |

| • | place us at a disadvantage compared to competitors that may have proportionately less debt; |

| • | limit our ability to obtain additional debt or equity financing due to applicable financial and restrictive covenants in our debt agreements; and |

| • | increase our cost of borrowing. |

The borrowings available under our revolving credit facility are subject to the calculation of a borrowing base, which is based upon the value of certain of our assets, including accounts receivable, inventory and property, plant and equipment. The administrative agent for this facility causes a third party to perform an appraisal of the assets included in the calculation of the borrowing base either on an annual basis or, if our availability under the facility is less than $22.5 million during any twelve month period, as frequently as on a semi-annual basis. In addition, if certain material defaults under the facility have occurred and are continuing, the administrative agent has the right to perform any such appraisal as often as it deems necessary in its sole discretion.

We may not be able to refinance any of our debt or we may not be able to refinance our debt on commercially reasonable terms.

We cannot provide assurance that we will be able to refinance, extend the maturity or otherwise amend the terms of our existing indebtedness, or whether any refinancing, extension or amendment will be on commercially reasonable terms. The indebtedness issued in any refinancing of our existing indebtedness could have a significantly higher rate of interest and greater costs than our existing indebtedness. There can be no assurance that the financial terms or covenants of any new credit facility and/or other indebtedness issued to refinance our existing indebtedness will be the same or as favorable as those under our existing indebtedness.