UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended ______________

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: September 10, 2010

Commission file number: 000-53940

CC Jewelry Co., Ltd.

(formerly Super Champ Group Limited)

(Exact name of Registrant as Specified in its Charter)

British Virgin Islands

(Jurisdiction of Incorporation or Organization)

186 Pingyang Road, 6th Floor, Taiyuan City, Shanxi, 030006, People’s Republic of China

(Address of Principal Executive Offices)

Xiaolin Mao

Tel: +0351-5602855 Fax: +0351-7323989

186 Pingyang Road, 6th Floor, Taiyuan City, Shanxi, 030006, People’s Republic of China

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Name of Each Exchange On Which Registered |

| None | | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Ordinary Shares, par value $0.01 per share

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of September 10, 2010 was: 12,000,000 ordinary shares par value $0.01 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Yes ¨ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

x U.S. GAAP ¨ International Financial Reporting Standards as issued by the International Accounting

Standards Board ¨ Other ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ¨

CC JEWELRY CO., LTD.

(formerly Super Champ Group Limited)

FORM 20-F SHELL COMPANY REPORT

TABLE OF CONTENTS

| | | Page |

| |

| PART I |

| Item 1. | Identity of Directors, Senior Management and Advisors | 2 |

| Item 2. | Offer Statistics and Expected Timetable | 3 |

| Item 3. | Key Information | 3 |

| Item 4. | Information on the Company | 18 |

| Item 4A. | Unresolved Staff Comments | 33 |

| Item 5. | Operating and Financial Review and Prospects | 34 |

| Item 6. | Directors, Senior Management, and Employees | 48 |

| Item 7. | Major Shareholders and Related Party Transactions | 51 |

| Item 8. | Financial Information | 53 |

| Item 9. | The Offer and Listing | 53 |

| Item 10. | Additional Information | 54 |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 59 |

| Item 12. | Description of Securities Other Than Equity Securities | 60 |

| |

PART II |

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 60 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 61 |

| Item 15. | Controls and Procedures | 61 |

| Item 16. | Reserved | 61 |

| Item 16A. | Audit Committee Financial Expert | 61 |

| Item 16B. | Code of Ethics | 61 |

| Item 16C. | Principal Accountiing Fees and Services | 61 |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 61 |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 61 |

| Item 16F. | Change in Registrant's Certifying Accountant | 61 |

| Item 16G. | Corporate Governance | 62 |

| |

PART III |

| Item 17. | Financial Statements | 63 |

| Item 18. | Financial Statements | 63 |

| Item 19. | Exhibits | 63 |

CERTAIN INFORMATION

In this shell company report on Form 20-F, unless otherwise indicated, “we,” “us,” “our,” the “Company” and “CC Jewelry” refer to CC Jewelry Co., Ltd., formerly known as Super Champ Group Limited, or Super Champ, a company organized in the British Virgin Islands, and its subsidiaries, subsequent to the business combination referred to below. The “business combination” refers to the share exchange between Super Champ and the shareholders of Square. C Commerce Company Ltd., or Square C, resulting in the acquisition of all of the outstanding securities of Square C by Super Champ, which was consummated on September 10, 2010.

Unless the context indicates otherwise, all references to “China” refer to the People’s Republic of China. All references to “Renminbi” or “RMB” are to the legal currency of the People’s Republic of China and all references to “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States. This report contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. We make no representation that the Renminbi or U.S. dollar amounts referred to in this report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On September 7, 2010, the cash buying rate announced by the People’s Bank of China was RMB 6.786 to $1.00.

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, and the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors”, “Operating and Financial Review and Prospects” and elsewhere in this report.

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

1.A. Directors and Senior Management

The following table lists the members of the Company’s board of directors:

| Name | | Age | | Position(s) |

| Quanxiang Chen | | 38 | | Chairman of the Board and Chief Executive Officer |

| Xiaolin Mao | | 43 | | Chief Financial Officer and Director |

| Xiaoguo Cui | | 31 | | Vice President, Human Resources and Director |

The business address for each of our directors is: c/o CC Jewelry Co., Ltd., 186 Pingyang Road, 6th Floor, Taiyuan City, Shanxi, 030006, People’s Republic of China.

The following table lists the senior management of the Company:

| Name | | Age | | Position(s) |

| Quanxiang Chen | | 38 | | Chairman of the Board and Chief Executive Officer |

| Xiaolin Mao | | 43 | | Chief Financial Officer and Director |

| Xiaoguo Cui | | 31 | | Vice President, Human Resources and Director |

| Yingyan Guo | | 33 | | Vice President, Brand Development |

The business address for each of the members of senior management is: c/o CC Jewelry Co., Ltd., 186 Pingyang Road, 6th Floor, Taiyuan City, Shanxi, 030006, People’s Republic of China.

See Item 6.A. – Directors and Senior Management below for more information about our directors and executive officers.

1.B. Advisors

The Company’s legal advisors in the People’s Republic of China are: JunZeJun Law Offices, 6/F, Financial Street Center, No. 9 Financial Street Road, Xicheng District, Beijing 100033 P.R. China.

The Company’s legal advisors in the United States are: Kramer Levin Naftalis & Frankel LLP, 1177 Avenue of the Americas, New York, NY 10036.

The Company’s legal advisors in the British Virgin Islands are: Withers BVI, 3rd Floor, Little Denmark, Main Street, Road Town, Tortola, BVI.

1.C. Auditors

The Company’s auditors are: Sherb & Co., LLP, 805 Third Avenue, New York, NY 10022. See Item 16.F – Change in Registrant’s Certifying Accountant below for information about the change in our auditor following the business combination.

Sherb & Co., LLP has confirmed that it is independent with respect to the Company under the guidelines of the SEC and the Independence Standards Board.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not Applicable.

3.A. Selected Financial Data

The following selected financial information should be read in connection with, and is qualified by reference to, our consolidated financial statements and their related notes and the section entitled “Operating and Financial Review and Prospectus,” each of which is included elsewhere in this report. The consolidated statements of operations and comprehensive income data for the fiscal years ended December 31, 2009 and 2008 and the balance sheets data as of December 31, 2009 and 2008 are derived from the audited consolidated financial statements included elsewhere in this report. The consolidated statements of operations and comprehensive income data for the fiscal years ended December 31, 2007, 2006 and 2005 and the balance sheets data as of December 31, 2007, 2006 and 2005 have been derived from unaudited financial statements that are not included in this report. Our historical results for any of these periods are not necessarily indicative of results to be expected in any future period.

| | | Statement of Income Year Ended December 31, | |

| | | 2009 (Audited) | | | 2008 (Audited) | | | 2007 (Unaudited) | | | 2006 (Unaudited) | | | 2005 (Unaudited) | |

| | | | | | | | | | | | | | | | |

| Revenue, net | | $ | 58,920,419 | | | $ | 59,767,770 | | | $ | 32,435,935 | | | | 18,486,338 | | | | 12,379,178 | |

| Cost of goods sold | | | 41,180,014 | | | | 44,148,820 | | | | 22,354,515 | | | | 12,948,019 | | | | 9,117,960 | |

| Gross profit | | | 17,740,405 | | | | 15,618,950 | | | | 10,081,420 | | | | 5,538,320 | | | | 3,261,219 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | | |

| Selling expenses | | | 5,103,750 | | | | 5,946,222 | | | | 3,893,923 | | | | 2,017,397 | | | | 1,516,743 | |

| Advertising expense | | | 1,216,275 | | | | 1,591,568 | | | | 730,849 | | | | 333,795 | | | | 147,791 | |

| General and administrative expenses | | | 1,979,296 | | | | 2,590,548 | | | | 2,344,795 | | | | 1,260,551 | | | | 666,174 | |

| Total Operating Expenses | | | 8,299,321 | | | | 10,128,388 | | | | 6,969,567 | | | | 3,611,743 | | | | 2,330,708 | |

| Income from operations | | | 9,441,084 | | | | 5,490,612 | | | | 3,111,853 | | | | 1,926,577 | | | | 930,511 | |

| Other income (Loss) | | | | | | | | | | | | | | | | | | | | |

| Interest expenses, net | | | (957,643 | ) | | | (1,051,180 | ) | | | (474,202 | ) | | | (294,649 | ) | | | (232,875 | ) |

| Other expenses, net | | | (85,970 | ) | | | (47,048 | ) | | | 2,351 | | | | 25,858 | | | | 105,131 | |

| Total other expenses | | | (1,043,613 | ) | | | (1,098,228 | ) | | | (471,851 | ) | | | (268,791 | ) | | | (127,744 | ) |

| Income before income taxes | | | 8,397,471 | | | | 4,392,384 | | | | 2,640,002 | | | | 1,657,786 | | | | 802,767 | |

| Income taxes | | | (2,170,785 | ) | | | (1,179,861 | ) | | | (660,000 | ) | | | (414,447 | ) | | | (200,692 | ) |

| Net income | | | 6,226,686 | | | | 3,212,523 | | | | 1,980,001 | | | | 1,243,339 | | | | 602,075 | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | | 55,309 | | | | 1,104,798 | | | | - | | | | - | | | | - | |

| Comprehensive Income | | $ | 6,281,995 | | | $ | 4,317,321 | | | $ | 1,980,001 | | | | 1,243,339 | | | | 602,075 | |

| Balance Sheets Data (at end of period) | | December 31, | |

| (in U.S. Dollars) | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | Audited | | | Audited | | | Unaudited | | | Unaudited | | | Unaudited | |

| Cash and cash equivalents | | $ | 1,540,673 | | | $ | 759,785 | | | $ | 783,825 | | | $ | 958,156 | | | $ | 70,547 | |

| Total current assets | | | 44,142,294 | | | | 35,310,639 | | | | 26,610,366 | | | | 14,566,855 | | | | 8,246,523 | |

| Total noncurrent assets | | | 6,626,162 | | | | 5,529,073 | | | | 4,213,475 | | | | 902,938 | | | | 450,085 | |

| Total assets | | | 50,768,456 | | | | 40,839,712 | | | | 30,823,841 | | | | 15,469,793 | | | | 8,696,609 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total liabilities | | | 23,247,067 | | | | 19,936,729 | | | | 13,863,728 | | | | 251,897 | | | | (2,654,458 | ) |

| Total shareholders’ equity | | | 27,521,389 | | | | 20,902,983 | | | | 16,960,113 | | | | 15,217,896 | | | | 11,351,066 | |

| Total liabilities and shareholders’ equity | | | 50,768,456 | | | | 40,839,712 | | | | 30,823,841 | | | | 15,469,793 | | | | 8,696,609 | |

3.A.3. Exchange Rates

Not Applicable.

3.B. Capitalization and Indebtedness

The following table sets forth our capitalization and indebtedness as of December 31, 2009 on an actual basis. This information should be read in conjunction with our consolidated financial statements and the notes relating to such statements appearing elsewhere in this report.

| As of December 31, 2009 | | | |

| Cash: | | | |

| Cash and cash equivalents | | $ | 1,540,673 | |

| | | | | |

| Debt: | | | | |

Short-term bank loans (1) | | | 8,190,487 | |

| | | | | |

| Shareholders’ equity: | | | | |

| Paid-in capital | | | 3,918,548 | |

| Statutory reserve | | | 3,406,574 | |

| Retained earnings | | | 19,036,160 | |

| Accumulated other comprehensive income | | | 1,160,107 | |

| Total shareholders’ equity | | | 27,521,389 | |

(1) Short-term bank loans are obtained from local banks in China. All the short-term bank loans are repayable within one year. The weighted average annual interest rate of the short-term bank loans was 8.43% as of December 31, 2009. Interest expense related to these loans was $511,361 for the year ended December 31, 2009.

3.C. Reasons For The Offer And Use Of Proceeds

Not Applicable.

3.D. Risk Factors

You should carefully consider the risks described below in evaluating our business before investing in our ordinary shares. If any of the following risks were to occur, our business, results of operations and financial condition could be harmed. In that case, the trading price of our ordinary shares could decline and you might lose all or part of your investment in our ordinary shares. You should also refer to the other information set forth in this report, including our consolidated financial statements and the related notes and the section captioned “Operating and Financial Review and Prospects” before deciding whether to invest in our ordinary shares.

Risks Related to Our Business

Our operations are cash intensive, and our business could be adversely affected if we fail to maintain sufficient levels of liquidity and working capital.

Historically, we have spent a significant amount of cash on our operational activities, principally to maintain the adequate levels of inventory in our boutiques. We finance our operations primarily through cash flows from our operations, short-term loans from local banks in the PRC and interest-free notes from Mr. Chen, our Chairman and Chief Executive Officer. Our financing needs are greatest during the periods immediately prior to holidays and traditional Chinese festivals, as we purchase greater levels of inventory in anticipation of higher levels of sales during these periods. If we fail to continue to generate sufficient cash flow, particularly during the periods preceding holidays and traditional Chinese festivals, we may not have sufficient liquidity to fund our operating costs and our business could be adversely affected.

Our short-term loans are from Chinese banks and are generally secured by our inventories and/or guarantees by third parties. The term of almost all such loans is one year or less. Historically, we have rolled over such loans on an annual basis. However, we may not have sufficient funds available to pay all of our borrowings upon maturity in the future. Failure to roll over our short-term borrowings at maturity or to service our debt could result in the imposition of penalties, including increases in interest rates, legal actions against us by our creditors, or even insolvency.

If available liquidity is not sufficient to meet our operating and loan obligations as they come due, our plans include considering pursuing alternative financing arrangements, reducing expenditures as necessary, or limiting our plans for expansion to meet our cash requirements. However, there is no assurance that, if required, we will be able to raise additional capital, reduce discretionary spending or efficiently limit our expansion to provide the required liquidity. Currently, the capital markets for small capitalization companies are extremely difficult and banking institutions have become stringent in their lending requirements. Accordingly, we cannot be sure of the availability or terms of any third party financing. If we are unable to raise additional financing, we may be unable to implement our long-term business plan, develop or enhance our products, take advantage of future opportunities or respond to competitive pressures on a timely basis. In the alternative, if we raise capital by issuing equity or convertible debt securities, such issuances could result in substantial dilution to our shareholders.

Our ability to maintain or increase our revenue could be harmed if we are unable to strengthen and maintain our brand image.

We believe that some of the primary factors in facilitating customer buying decisions in China’s jewelry sector include price, confidence in the merchandise sold, and the level and quality of customer service. The ability to differentiate our products and service from competitors by our brand-based marketing strategies is a key factor in attracting consumers, and if our strategies and efforts to promote our brand, such as television and magazine advertising, fail to garner brand recognition, our ability to generate revenue may suffer. If we are unable to differentiate our products, our ability to sell our products at anticipated profit levels could be adversely affected. If we fail to identify or react appropriately or timely to customer buying decisions, we could experience reduction in consumer recognition of our products, a diminished brand image, higher markdowns, and costs to recast overstocked jewelry. These factors could result in lowering selling prices and sales volumes for our products, which could adversely affect our financial condition and results of operations.

Our sales and profitability fluctuate on a seasonal basis and are affected by a variety of other factors.

Our business is affected by the seasonal pattern common to most retailers. The primary factors that affect the seasonal changes in our business operations are holidays and traditional Chinese festivals. Historically, the months that generally generate the greatest revenues for us are October through January (approximately 36.4% in 2008 and 36.5% in 2009 of annual revenues), as a result of holidays and festivals that occur during those months. Retailers often experience increased sales due to the week-long public holiday for Chinese National Day, as well as Christmas and New Year’s Day. These months are also a peak season for marriages and the birth of newborns in China, which have historically resulted in higher sales.

Any significant decrease in net sales during the holiday or Chinese festival seasons would have a material adverse effect on our business, our financial condition and our results of operations. In addition, in order to prepare for these seasons, we must order and keep in stock significantly more merchandise than we carry during other periods during the year. This inventory build-up may require us to expend cash faster than we generate by our operations during these periods. Any unanticipated decrease in demand for our merchandise during this peak shopping season could require us to sell excess inventory at a substantial markdown, which could have a material adverse effect on our business and profitability.

Because of the briefness of these selling periods, the opportunity for sales to recover in the event of a disruption or other difficulty is limited, and the impact of disruptions and difficulties can be significant. For instance, adverse weather, a significant interruption in the receipt of products, or a sharp decline in mall traffic occurring during one of these selling periods could materially impact sales for the affected period and, because of the importance of each of these selling periods, commensurately impact overall sales and earnings.

Our retail expansion strategy depends on our ability to open and operate a certain number of new counters and stores each year, which could strain our resources and cause the performance of our existing operations to suffer.

Our retail expansion strategy will largely depend on our ability to successfully find sites for, and to open and operate, new retail locations. Our ability to open and operate new retail locations successfully depends on several factors, including, among others, our ability to:

| | · | identify suitable counter and store locations, the availability of which is outside our control; |

| | · | purchase and negotiate acceptable lease terms; |

| | · | prepare counters and stores for opening within budget; |

| | · | source sufficient levels of inventory at acceptable costs to meet the needs of new counters and stores; |

| | · | hire, train and retain personnel; |

| | · | secure required governmental permits and approvals; |

| | · | successfully integrate new counters and stores into our existing operations; |

| | · | contain payroll costs; and |

| | · | generate sufficient operating cash flows or secure adequate capital on commercially reasonable terms to fund our expansion plans. |

Any failure to successfully open and operate new retail counters and stores could limit our ability to grow our revenues in the manner we desire. In addition, our proposed retail expansion program will place increased demands on our operational, managerial and administrative resources. These increased demands could cause us to operate our business less effectively, which, in turn, could cause deterioration in the financial performance of our overall business.

As we expand our operations, we may need to establish a more diverse supplier network for our materials. The failure to secure a more diverse and reliable supplier network could have an adverse effect on our financial condition.

We currently purchase almost all of our materials from a small number of suppliers. During 2008 and 2009, we purchased approximately 56.3% and 49.6%, respectively, of our finished merchandise, such as gold accessories, from our top five finished product vendors and almost all of our diamonds from our top five diamond suppliers. As we increase the scale of our retail operations, we may need to establish a more diverse supplier network, while attempting to continue to leverage our purchasing power to obtain favorable pricing and delivery terms. However, in the event that we need to diversify our supplier network, we may not be able to procure a sufficient supply of high quality diamonds and fine jewelry at a competitive price, which could have an adverse effect on our results of operations, financial condition and cash flows.

Furthermore, despite our efforts to control our supply of diamonds and fine jewelry and maintain good relationships with our existing suppliers, we could lose one or more of our existing suppliers at any time. The loss of one or more key suppliers could increase our reliance on higher cost or lower quality supplies, which could negatively affect our profitability. Any interruptions to, or decline in, the amount or quality of our diamond and fine jewelry supplies could materially disrupt our production and adversely affect our business, financial condition and financial prospects.

We are subject to various risks and uncertainties that might affect our ability to procure high quality merchandise.

Our performance depends on our ability to procure high quality merchandise on a timely basis from our suppliers. Our supplies are subject to certain risks, including availability of materials, labor disputes, inclement weather, natural disasters, and general economic and political conditions, which might limit the ability of our suppliers to provide us with high quality merchandise on a timely basis. Furthermore, for these or other reasons, one or more of our suppliers might not adhere to our quality control standards, and we might not identify the deficiency. Our suppliers’ failure to supply quality materials at a reasonable cost on a timely basis could reduce our net sales, damage our reputation and have an adverse effect on our financial condition.

Our inability to manage our growth may have a material adverse effect on our business, results of operations and financial condition.

We have experienced significant growth since we began operations in 2002. Our revenues have grown from approximately $12.4 million in 2005 to approximately $58.9 million in 2009.

We expect our growth to continue to place significant demands on both our management and our resources. This requires us to continuously evolve and improve our operational, financial and internal controls across our organization. In particular, continued expansion increases the challenges we face in:

| | · | recruiting, training and retaining sufficient skilled sales and management personnel; |

| | · | adhering to our high quality and process execution standards; |

| | · | maintaining high levels of customer satisfaction; |

| | · | creating and managing economies of scale; |

| | · | maintaining and managing costs to correspond with timeliness of revenue recognition; and |

| | · | developing and improving our internal administrative infrastructure, including our financial, operational and communication systems, processes and controls. |

Any inability to manage our growth may have a material adverse effect on our business, results of operations and financial condition.

Jewelry purchases are discretionary, may be particularly affected by adverse trends in the general economy, and an economic decline may make it more difficult to generate revenue.

The success of our operations depends, to a significant extent, upon a number of factors relating to discretionary consumer spending in China. These factors include economic conditions and perceptions of such conditions by consumers, employment rates, the level of consumers’ disposable income, business conditions, interest rates, consumer debt levels, availability of credit and levels of taxation in the regions in which we sell our products. Consumer spending on jewelry may be adversely affected by changes in general economic conditions in China or by changes in any one of the aforementioned factors, which in turn could harm our financial performance.

Competition in the jewelry industry could cause us to lose market share, thereby materially and adversely affecting our business, results of operations and financial condition.

The jewelry industry in China is highly fragmented and very competitive. We believe that the market may become even more competitive as the jewelry industry in China continues to grow. We compete with local jewelry retailers and large foreign multinational companies that offer products that are similar to ours. Some of these competitors have larger local or regional customer bases, more locations, more brand equity, and substantially greater financial, marketing and other resources than we have. Our inability to maintain or increase our market share in proportion to our competitors could materially and adversely affect our business, results of operations and financial condition.

Our sales are dependent upon mall traffic.

Our boutiques are located primarily in shopping malls and department stores throughout the PRC. Our success is in part dependent upon the continued popularity of malls and department stores, and particularly the malls and department stores in which our boutiques are located, as a shopping destination and the ability of these malls, their tenants and other mall attractions to generate customer traffic. Accordingly, a significant decline in this popularity, especially if it is sustained, would substantially harm our sales and earnings. In addition, even assuming this popularity continues, mall traffic can be negatively impacted by weather, gas prices and similar factors.

Any failure of our pricing and promotional strategies to be as effective as desired will negatively impact our sales and earnings.

We set prices for our products and establish product specific and store-wide promotions in order to generate store traffic and sales. While these decisions are intended to maximize our sales and earnings, in some instances they do not. For instance, promotions, which can require substantial lead time, may not be as effective as desired or may prove unnecessary in certain economic circumstances. If we implement a pricing or promotional strategy that does not work as expected, our sales and earnings will be adversely impacted.

If we are not able to adapt to changing jewelry trends in China, our inventory may be overstocked and we may be forced to reduce the price of our overstocked jewelry.

Our jewelry sales depend on consumer fashions, which can change rapidly. The ability to accurately predict future changes in taste, respond to changes in consumer preferences and carry the inventory demanded by customers at a high quality, all have an important influence on determining sales performance and achieved gross margin. If we fail to anticipate, identify or react appropriately to changes in styles and trends, we could experience excess inventories, higher than normal markdowns or an inability to sell our products.

If our inventory is lost due to theft, our results of operations would be negatively impacted.

We purchase large volumes of precious metals. Although we have security systems in place, we may be subject to losses due to third-party or employee theft. The implementation of security measures beyond those that we already utilize, which include security cameras and alarm systems, would increase our operating costs. Also, any such losses could exceed the limits of, or be subject to an exclusion from, coverage under our insurance policies. Claims filed by us under our insurance policies could lead to increases in the insurance premiums payable by us or the termination of coverage under the relevant policy.

Volatile gold prices can cause significant fluctuations in our operating results. Our revenues and operating income could decrease if gold or precious stone prices decline or if we are unable to pass price increases on to our customers.

Our principal materials are gold, platinum, diamonds and other precious stones. The gold industry as a whole is cyclical and, at times, pricing and availability of gold can be volatile due to numerous factors beyond our control, including general domestic and international economic conditions, industry, demand, inflation and expectations with respect to the rate of inflation, interest rates, gold sales by central banks, changes in investment trends and international monetary systems and the effect of changes in the supply and demand for gold in public and private markets. This volatility can significantly affect the availability and cost of gold materials for us.

When gold prices increase, competitive conditions will influence how much of the price increase we can pass on to our customers. To the extent we are unable to pass on future price increases in our gold materials to our customers, the revenues and profitability of our business could be adversely affected. When gold prices decline, customer demands for lower prices and our competitors' responses to those demands could result in lower sale prices, lower margins and inventory valued at the lower of cost or market adjustments as we use existing inventory. Significant or rapid declines in gold prices or reductions in sales volumes could result in us incurring inventory or goodwill impairment charges. Therefore, changing gold prices could significantly impact our revenues, gross margins, operating income and net income.

Our quarterly results may fluctuate because of many factors and, as a result, investors should not rely on quarterly operating results as indicative of future results.

Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the value of our securities. Quarterly operating results may fluctuate in the future due to a variety of factors that could affect revenues or expenses in any particular quarter. Fluctuations in quarterly operating results could cause the value of our securities to decline. Investors should not rely on quarter-to-quarter comparisons of results of operations as an indication of future performance. As a result of the factors listed below, it is possible that in future periods our results of operation may be below the expectations of public market analysts and investors. Factors that may affect our quarterly results include:

| | · | vulnerability of our business to a general economic downturn in China; |

| | · | fluctuation and unpredictability of costs related to gold, diamonds, platinum and precious metal jewelry; |

| | · | seasonality of our business; |

| | · | changes in the laws of the PRC that affect our operations; |

| | · | competition from our competitors; |

| | · | our ability to obtain all necessary government certifications and/or licenses to conduct our business; and |

| | · | development of a public trading market for our securities. |

Our success depends in large part upon our senior management and key personnel and our inability to attract or retain these individuals could materially and adversely affect our business, results of operations and financial condition.

We are highly dependent on our senior management, including our Chief Executive Officer, Quanxiang Chen, our Chief Financial Officer, Xiaolin Mao, our Vice President, Human Resources, Xiaoguo Cui, and our Vice President, Brand Development, Yingyan Guo. Our future performance will be dependent upon the continued service of members of our senior management. Competition for senior management in our industry is intense, and we may not be able to retain our senior management and key personnel or attract and retain new senior management and key personnel in the future, which could materially and adversely affect our business, results of operations and financial condition.

One shareholder owns a large percentage of our outstanding stock and could significantly influence the outcome of our corporate matters.

Currently, Quanxiang Chen, our Chief Executive Officer, beneficially owns approximately 67.5% of our outstanding ordinary shares. As our majority shareholder, Mr. Chen is able to exercise significant influence over all matters that require shareholder approval, including the election of directors to our board and approval of significant corporate transactions that we may consider, such as a merger or other sale of our company or our assets. This concentration of ownership in our shares by Mr. Chen will limit your ability to influence corporate matters and may have the effect of delaying or preventing a third party from acquiring control over us.

Our business could be materially adversely affected if we cannot protect our intellectual property rights.

We have developed trademarks, know-how, trade names and other intellectual property rights that are of significant value to us. However, the legal regime governing intellectual property in the PRC is still evolving and the level of protection of intellectual property rights in the PRC may differ from those in other jurisdictions. Thus, it may be difficult to enforce our rights relating to our intellectual property. In the event of the occurrence of any unauthorized use of, or other infringement to, our intellectual property, potential sales of our products might be diverted to such unauthorized sellers and could cause potential damage to, or dilute the value of, such rights or our brand.

Any loss or limitations on our right to use intellectual property licensed from third parties could have a material adverse effect on our business, operating results and financial condition.

We have been granted an exclusive license to use two trademarks, both of which are registered trademarks in the PRC. The owner of the trademarks, Man Yu, is the wife of Mr. Chen, our Chairman and Chief Executive Officer. Pursuant to the licensing agreement between Ms. Yu and Chongqing, we have the exclusive right to these trademarks. While we are not aware of any disputes between the trademark owner and us or any third party, the trademark owner may determine not to protect her intellectual property rights that we license from her and we may be unable to defend such intellectual property rights on our own or we may have to undertake costly litigation to defend the intellectual property rights of the trademark owner. Upon the termination of the license agreement for this trademark, we may no longer continue to have proprietary rights to the intellectual property that we license from the trademark owner. Any loss or limitations on our right to use the intellectual property licensed from the trademark owner could have a material adverse effect on our business, operating results and financial condition.

Our inability to maintain appropriate internal financial reporting controls and procedures could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, and cause investors to lose confidence in our reported financial information.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. As a public company, we have significant requirements for enhanced financial reporting and internal controls. We are required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and, for many companies, a report by the independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not in the future identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to comply with Sarbanes-Oxley and meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, and cause investors to lose confidence in our reported financial information.

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. We expect the rules and regulations to which public companies are subject, including Sarbanes-Oxley, to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements.

Risks Related to Our Corporate Structure

The PRC government may determine that our corporate structure is not in compliance with applicable PRC laws, rules and regulations.

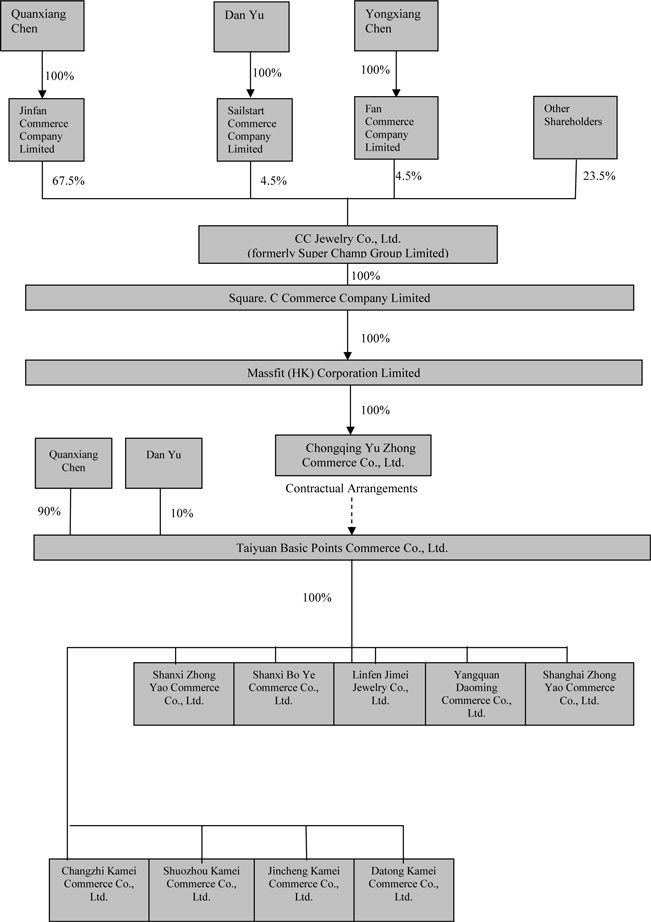

Our wholly owned subsidiary, Chongqing Yu Zhong Commerce Co., Ltd., or Chongqing, manages and operates our fine jewelry business through Taiyuan Basic Points Commerce Co., Ltd., or Taiyuan Basic Points, a PRC company owned by Mr. Chen, our Chairman and Chief Executive Officer, and his brother in-law, Mr. Yu, who is also the general manager of Taiyuan Basic Points. Chongqing operates Taiyuan Basic Points’ business pursuant to contractual arrangements with Taiyuan Basic Points and Messrs. Chen and Yu, which arrangements we also refer to throughout this report as the VIE Agreements. Almost all economic benefits and risks arising from Taiyuan Basic Points’ operations have been transferred to Chongqing under these agreements. Details of the VIE Agreements are set out below in Item 4A – “History and Development of the Company – Contractual Arrangements.”

There are risks involved in the operation of our business in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. If the VIE Agreements were for any reason determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

| | · | imposing economic penalties; |

| | · | discontinuing or restricting the operations of Chongqing or Taiyuan Basic Points; |

| | · | imposing conditions or requirements in respect of the VIE Agreements with which Chongqing may not be able to comply; |

| | · | requiring our company to restructure the relevant ownership structure or operations; |

| | · | taking other regulatory or enforcement actions that could adversely affect our company’s business; and |

| | · | revoking the business licenses and/or the licenses or certificates of Chongqing or Taiyuan Basic Points, and voiding the VIE Agreements. |

Any of these actions could adversely affect our ability to manage, operate and gain the financial benefits of Taiyuan Basic Points, which would have a material adverse impact on our business, financial condition and results of operations.

Our ability to manage and operate Taiyuan Basic Points under the VIE Agreements may not be as effective as direct ownership.

We conduct our jewelry retail businesses in the PRC, and generate all of our revenues, through the VIE Agreements. Our plans for future growth are based on growing the operations of Taiyuan Basic Points. However, the VIE Agreements may not be as effective in providing us with control over Taiyuan Basic Points as direct ownership. Under the current VIE arrangements, as a legal matter, if Taiyuan Basic Points fails to perform its obligations under these contractual arrangements, we may have to (a) incur substantial costs and resources to enforce such arrangements and (b) seek legal remedies under PRC law, which we cannot be sure would be effective. Therefore, if we fail to effectively control Taiyuan Basic Points, such failure would have an adverse effect on our ability to achieve our business objectives and grow our revenues.

The shareholders of Taiyuan Basic Points may breach, or cause Taiyuan Basic Points to breach, the VIE Agreements.

Mr. Chen, the primary shareholder of Taiyuan Basic Points may breach, or cause Taiyuan Basic Points to breach, the VIE Agreements because his equity interests in Taiyuan Basic Points are greater than his equity interests in our company. As a result, Mr. Chen may breach a contract with us if he believes that such breach will lead to greater economic benefit for him. If the shareholders of Taiyuan Basic Points were to breach, or cause Taiyuan Basic Points to breach, the VIE Agreements for this reason or any other reason, we may have to rely on legal or arbitral proceedings to enforce our contractual rights, including specific performance, injunctive relief or claiming damages. Such arbitral and legal proceedings may cost us substantial financial and other resources, and result in disruption of our business, and we cannot assure you that the outcome will be in our favor.

The payment arrangement under the VIE Agreements may be challenged by the PRC tax authorities.

We generate our revenues through payments that we receive from Taiyuan Basic Points pursuant to the VIE Agreements. We could face adverse tax consequences if the PRC tax authorities determine that the VIE Agreements were not entered into based on arm’s length negotiations. For example, PRC tax authorities may adjust our income and expenses for PRC tax purposes which could result in our being subject to higher tax liability.

Risks Related to Doing Business in China

Changes in China’s political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have a negative effect are:

| | · | level of government involvement in the economy; |

| | · | control of foreign exchange; |

| | · | methods of allocating resources; |

| | · | balance of payments position; |

| | · | international trade restrictions; and |

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in a number of ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy, and weak corporate governance and the lack of a flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of OECD member countries.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised, and continues to exercise, substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 5.9% and as low as (0.8)%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

You may have difficulty enforcing judgments against us.

Our assets are located, and our operations are conducted, in the PRC. In addition, all of our directors and officers are nationals and residents of the PRC and a substantial portion of their assets are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts because China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security, or the public interest.

Most of our revenues are denominated in Renminbi, which is not freely convertible for capital account transactions and may be subject to exchange rate volatility.

We are exposed to the risks associated with foreign exchange controls and restrictions in China, as our revenues are primarily denominated in Renminbi, which is currently not freely exchangeable. The PRC government imposes control over the convertibility between Renminbi and foreign currencies. Under the PRC foreign exchange regulations, payments for “current account” transactions, including remittance of foreign currencies for payment of dividends, profit distributions, interest and operation-related expenditures, may be made without prior approval but are subject to procedural requirements. Strict foreign exchange control continues to apply to “capital account” transactions, such as direct foreign investment and foreign currency loans. These capital account transactions must be approved by, or registered with, the PRC State Administration of Foreign Exchange, or SAFE. Further, capital contribution by an offshore shareholder to its PRC subsidiaries may require approval by the Ministry of Commerce in China or its local counterparts. We cannot assure you that we will be able to meet all of our foreign currency obligations to remit profits out of China or to fund operations in China.

On August 29, 2008, SAFE promulgated the Circular on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises, or Circular 142, to regulate the conversion by foreign invested enterprises, or FIEs, of foreign currency into Renminbi by restricting how the converted Renminbi may be used. Circular 142 requires that Renminbi converted from the foreign currency-dominated capital of a FIE may be used only for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC unless specifically provided. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Compliance with Circular 142 may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business.

Fluctuation in the value of the Renminbi and of the U.S. dollar may have a material adverse effect on investments in our ordinary shares.

Any significant revaluation of the Renminbi may have a material adverse effect on the U.S. dollar equivalent amount of our revenues and financial condition as well as on the value of, and any dividends payable on, our ordinary shares in foreign currency terms. For instance, a decrease in the value of Renminbi against the U.S. dollar could reduce the U.S. dollar equivalent amounts of our financial results, the value of your investment in our ordinary shares and the dividends we may pay in the future, if any, all of which may have a material adverse effect on the prices of our common shares. All of our revenues are denominated in Renminbi. Any further appreciation of the Renminbi against the U.S. dollar may result in significant exchange losses.

Prior to 1994, the Renminbi experienced a significant net devaluation against most major currencies, and there was significant volatility in the exchange rate during certain periods. Upon the execution of the unitary managed floating rate system in 1994, the Renminbi was devalued by 50% against the U.S. dollar. Since 1994, the Renminbi to U.S. dollar exchange rate has largely stabilized. On July 21, 2005, the People’s Bank of China announced that the exchange rate of U.S. dollar to Renminbi would be adjusted from $1 to RMB8.27 to $1 to RMB8.11, and it ceased to peg the Renminbi to the U.S. dollar. Instead, the Renminbi would be pegged to a basket of currencies, whose components would be adjusted based on changes in market supply and demand under a set of systematic principles. On September 23, 2005, the PRC government widened the daily trading band for Renminbi against non-U.S. dollar currencies from 1.5% to 3.0% to improve the flexibility of the new foreign exchange system. Since the adoption of these measures, the value of Renminbi against the U.S. dollar has fluctuated on a daily basis within narrow ranges, but overall has further strengthened against the U.S. dollar. In June 2010, the Chinese government announced its intention to allow the Renminbi to fluctuate within the June 2005 parameters. There remains significant international pressure on the PRC government to further liberalize its currency policy, which could result in a further and more significant appreciation in the value of the Renminbi against the U.S. dollar. The Renminbi may be revalued further against the U.S. dollar or other currencies, or may be permitted to enter into a full or limited free float, which may result in an appreciation or depreciation in the value of the Renminbi against the U.S. dollar or other currencies.

China’s legal system is different from those in some other countries.

China is a civil law jurisdiction. Under the civil law system, prior court decisions may be cited as persuasive authority but do not have binding precedential effect. Although progress has been made in the promulgation of laws and regulations dealing with economic matters, such as corporate organization and governance, foreign investment, commerce, taxation and trade, China’s legal system remains less developed than the legal systems in many other countries. Furthermore, because many laws, regulations and legal requirements have been recently adopted, their interpretation and enforcement by the courts and administrative agencies may involve uncertainties. Sometimes, different government departments may have different interpretations. Licenses and permits issued or granted by one government authority may be revoked by a higher government authority at a later time. Government authorities may decline to take action against unlicensed operators which may work to the disadvantage of licensed operators, including us. The PRC legal system is based in part on government policies and internal rules that may have a retroactive effect. We may not be aware of our violation of these policies and rules until some time after the violation. Changes in China’s legal and regulatory framework, the promulgation of new laws and possible conflicts between national and provincial regulations could adversely affect our financial condition and results of operations. In addition, any litigation in China may result in substantial costs and diversion of resources and management attention.

Under the New Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification would likely result in unfavorable tax consequences to us and our non-PRC shareholders.

China passed a New Enterprise Income Tax Law, or the New EIT Law, which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with de facto management bodies within China is considered a resident enterprise, meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 clarified that dividends and other income paid by such resident enterprises will be considered to be PRC source income, subject to PRC withholding tax, currently at a rate of 10%, when recognized by non-PRC enterprise shareholders. This recent circular also subjects such resident enterprises to various reporting requirements with the PRC tax authorities.

Although all of our management is currently located in the PRC, it remains unclear whether the PRC tax authorities would require or permit our overseas registered entities to be treated as PRC resident enterprises. We do not currently consider our company to be a PRC resident enterprise. However, if the PRC tax authorities determine that we are a resident enterprise for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries would qualify as tax-exempt income, we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new resident enterprise classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC shareholders and with respect to gains derived by our non-PRC shareholders from transferring our shares.

Restrictions under PRC law on Chongqing’s ability to pay dividends and make other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our business.

PRC regulations restrict the ability of PRC subsidiaries to pay dividends and make other payments to their offshore parent company. PRC legal restrictions permit payments of dividends by PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of their registered capital. Allocations to these statutory reserve funds can be used only for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends. Any limitations on the ability of Chongqing to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

The scope of our business license in China is limited, and we may not expand or continue our business without government approval.

Chongqing, our wholly owned subsidiary, is a Wholly Foreign Owned Enterprise, commonly known as a WFOE. A WFOE can conduct business only within the approved business scope that appears on the company’s business license. Chongqing’s business license permits it to design, manufacture, sell and market jewelry products to department stores throughout the PRC. Any amendment to the scope of Chongqing’s business requires further application and government approval. In order for Chongqing to expand its business beyond the scope of its license, Chongqing will be required to enter into a negotiation with the authorities for the approval to expand the scope of its business. We cannot assure you that Chongqing will be able to obtain the necessary government approval for any change or expansion of its business.

If the China Securities Regulatory Commission, or CSRC, or another Chinese regulatory agency, determines that CSRC approval is required in connection with our business combination or our contractual arrangement with Chongqing and its shareholders, we may become subject to penalties.

On August 8, 2006, six Chinese regulatory agencies, including the Chinese Securities Regulatory Commission, or CSRC, promulgated the M&A Regulation, which became effective on September 8, 2006 and was subsequently revised on June 22, 2009. This regulation, among other things, has certain provisions that require offshore special purpose vehicles formed for the purpose of acquiring Chinese domestic companies and directly or indirectly established or controlled by Chinese entities or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock market. On September 21, 2006, the CSRC published on its official website a notice specifying the documents and materials that are required to be submitted for obtaining CSRC approval. It is not clear how the provisions in the regulation regarding the offshore listing and trading of the securities of a special purpose vehicle apply to us. We believe, based on the interpretation of the regulation and the practice experience of our Chinese legal counsel, JunZeJun Law Offices, that CSRC approval is not required for the business combination between Super Champ and Square C or our contractual arrangement with Chongqing and its shareholders. There remains some uncertainty as to how this regulation will be interpreted or implemented. If the CSRC or another Chinese regulatory agency subsequently determines that the CSRC’s approval is required for this offering or our contractual arrangement with Chongqing and its shareholders, we may face sanctions by the CSRC or another Chinese regulatory agency. If this happens, these regulatory agencies may impose fines and penalties on our operations in China, limit our operating privileges in China, restrict or prohibit payment or remittance of dividends to us or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from making prohibited payments to foreign officials for the purpose of obtaining or retaining business. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time to time in mainland China. If any of our non-U.S. listed competitors that are not subject to the Foreign Corrupt Practices Act engage in these practices, they may receive preferential treatment and secure business from government officials in a way that is unavailable to us. Furthermore, although we inform our personnel that such practices are illegal, we cannot assure you that our employees or other agents will not engage in illegal conduct for which we might be held responsible under U.S. law. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

Because our funds are held in banks that do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue our business operations.

Banks and other financial institutions in the PRC do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue our business operations.

If relations between the United States and China worsen, investors may be unwilling to hold or buy our ordinary shares and our share price may decrease.

At various times during recent years, the United States and China have had significant disagreements over political and economic issues. Controversies may arise in the future between these two countries. Any political or trade controversies between the United States and China, whether or not directly related to our business, could reduce the price of our ordinary shares.

Risks Related to Our Ordinary Shares.

We may not be able to pay any dividends on our ordinary shares.

Under British Virgin Islands law, we may pay dividends if we are able to satisfy the solvency test laid out in the BVI Business Companies Act, 2004, or the BVI Act, which provides that directors must declare that immediately following the payment of a dividend or distribution the Company would be solvent on both a cash flow and balance sheet basis. Our ability to pay dividends will therefore depend on our ability to generate sufficient profits. We cannot give any assurance that we will declare dividends of any amounts, at any rate or at all in the future. Future dividends, if any, will be at the discretion of our board of directors and will depend upon our results of operations, our cash flows, our financial condition, the payment of our subsidiaries of cash dividends to us, our capital needs, future prospects and other factors that our directors may deem appropriate. We have never declared or paid any dividend on our ordinary shares and we do not anticipate paying any dividends on our ordinary shares in the future.

There is no public market for our ordinary shares, and you may not be able to resell our ordinary shares at or above the price you paid, or at all.

There is no public market for our ordinary shares. If an active trading market for our ordinary shares does not develop, the market price and liquidity of our ordinary shares will be materially and adversely affected and you may not be able to resell our ordinary shares at or above the price you paid, or at all. An active trading market for our ordinary shares may not develop in a timely manner or at all.

If equity research analysts do not publish research reports about our company or if they issue unfavorable commentary or downgrade our ordinary shares, the price of our ordinary shares could decline.

The trading market for our ordinary shares will rely in part on the research reports that equity research analysts publish about us and our company. We do not control these analysts. The price of our ordinary shares could decline if one or more equity analysts downgrade our ordinary shares or if they issue other unfavorable commentary, or cease publishing reports, about us or our company.

| ITEM 4. | INFORMATION ON THE COMPANY |

4A. History and Development of the Company

We are a British Virgin Islands limited liability company organized on January 5, 2010 under the BVI Act under the name Super Champ Group Limited, or Super Champ, as a blank check company for the purpose of acquiring, through a share exchange, asset acquisition or other similar business combination, an operating business.

Business Combination

On September 10, 2010, Super Champ and its sole shareholder entered into a share exchange agreement with Square C, a British Virgin Islands limited liability company organized on April 9, 2010 under the BVI Act, and the shareholders of Square C. Pursuant to the share exchange agreement, Super Champ acquired from the shareholders of Square C all of the issued and outstanding shares of Square C, in exchange for an aggregate of 7,000,000 newly issued ordinary shares issued by Super Champ to the shareholders of Square C. In addition, the sole shareholder of Super Champ sold all of the 5,000,000 ordinary shares of Super Champ that were issued and outstanding prior to the business combination, to the shareholders of Square C for cash, at a price of $0.03 per share. As a result, the individuals and entities that owned shares of Square C prior to the business combination acquired 100% of the equity of Super Champ, and Super Champ acquired 100% of the equity of Square C. Square C is now a wholly owned subsidiary of Super Champ. In conjunction with the business combination, Super Champ filed an amended charter, pursuant to which Super Champ changed its name to CC Jewelry Co., Ltd., changed its fiscal year end to December 31, changed the par value of its ordinary shares to $0.01 per share and increased its authorized shares to 100,000,000. Upon the consummation of the business combination, we ceased to be a shell company.

Our Shareholders

Mr. Chen, our Chairman and Chief Executive Officer, owns 100% of the equity in Jin Fan Commerce Company Limited, a British Virgin Island company, which owned 67.5% of the equity of Square C prior to the business combination, and owns 67.5% of our equity since the business combination. Dan Yu, the brother in-law of Mr. Chen and general manager of Taiyuan Basic Points, owns 100% of the equity in Sail Start Commerce Company Limited, a British Virgin Islands company, which owned 4.5% of the equity of Square C prior to the business combination and owns 4.5% of our equity since the business combination. Yongxiang Chen, the brother of our chairman, Quanxiang Chen, owns 100% of the equity in Zong Fan Commerce Company Limited, a British Virgin Islands company, which owned 4.5% of the equity of Square C prior to the business combination and owns 4.5% of our equity since the business combination.

The holders of the remaining 23.5% of our shares are investors that are residents of the PRC and are unaffiliated with us.

Our Subsidiaries

Offshore Holding Company Subsidiaries

Square C, our wholly owned subsidiary, was incorporated on April 9, 2010 under the laws of the British Virgin Islands. We acquired all of the capital stock of Square C pursuant to the business combination on September 10, 2010. On June 25, 2010, Square C acquired all of the outstanding equity of Massfit Corporation Ltd., or Massfit, a limited liability company formed on March 17, 2010 under the laws of Hong Kong. On June 9, 2010, Massfit established a wholly owned subsidiary, Chongqing Yu Zhong Commerce Co., Ltd., or Chongqing, a wholly foreign owned enterprise formed under the laws of the PRC. Square C, Massfit and Chongqing are holding companies. As a result of these transactions, each of Square C, Massfit and Chongqing is a wholly owned subsidiary of ours. As described below under “Contractual Arrangements,” Chongqing controls Taiyuan Basic Points.

PRC Operating Companies

Taiyuan Basic Points is a PRC company formed on February 28, 2002, formerly known as Taiyuan Kamei Jewelry Trading Co., Ltd. Mr. Chen and Ms. Yu together own 100% of Taiyuan Basic Points, which operates all of our business operations in the PRC along with its subsidiaries. Mr. Chen owns 90% of Taiyuan Basic Points and Mr. Yu owns 10%.

The following table provides a description of each of the subsidiaries of Taiyuan Basic Points:

| Name of Subsidiary | | Operating activities |

| Shanxi Zhong Yao Commerce Co., Ltd. | | Operating Chow Tai Fook brand and managing Chow Tai Fook counters and stores |

| Shanxi Bo Ye Commerce Co., Ltd. | | Operating FENIX brand and managing FENIX counters and stores |

| Linfen Jimei Jewelry Co., Ltd. | | Operating and managing CC counter in Linfen |

| Yangquan Daoming Commerce Co., Ltd. | | Operating and managing CC counter in Yangquan |

| Shanghai Zhong Yao Commerce Co., Ltd. | | Operating FENIX brand and managing FENIX counters and stores |

Changzhi Kamei Commerce Co., Ltd. (1) | | Operating and managing CC and Chow Tai Fook counters in Changzhi |

Shuozhou Kamei Commerce Co., Ltd. (1) | | Operating and managing CC counter in Shuozhou |

Jincheng Kamei Commerce Co., Ltd. (1) | | Operating and managing CC and Chow Tai Fook counters in Jincheng |

Datong Kamei Commerce Co., Ltd. (2) | | Operating and managing CC and Chow Tai Fook counters in Datong |

(1) These subsidiaries were formed subsequent to our fiscal year ended December 31, 2009.

(2) This entity was acquired on April 30, 2010 for approximately $0.8 million.

History of Taiyuan Basic Points

Our business is operated by Taiyuan Basic Points, a PRC company formed on February 28, 2002. Taiyuan Basic Points is a leading jewelry company which designs and retails fine jewelry in China, with headquarters in Taiyuan City, Shanxi Province, PRC.

Mr. Chen, our Chairman and Chief Executive Officer, established the c.comeliness, or CC, brand and began selling CC products in Shanxi Province in 2000. In 2002, Mr. Chen established Taiyuan Basic Points, which acquired all of the CC assets from Mr. Chen.

In order to attract high income consumers, Taiyuan Basic Points created the FENIX brand in 2003. In addition, in 2004, Taiyuan Basic Points began operating as a non-exclusive distributor for Chow Tai Fook jewelry in Shanxi Province through newly opened boutiques. In September 2006, Taiyuan Basic Points began operating as a non-exclusive distributor for Calvin Klein clothing in Chendu.