UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| o | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended ______________

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

x | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: July 7, 2010

Commission file number: 000-53914

Ossen Innovation Co. Ltd.

(formerly Ultra Glory International Ltd.)

(Exact name of Registrant as Specified in its Charter)

British Virgin Islands

(Jurisdiction of Incorporation or Organization)

518 Shangcheng Road, Floor 17, Shanghai, 200120, Peoples Republic of China

(Address of Principal Executive Offices)

Tel: +86 (21) 6888-8886 Fax: +86 (21) 6888-8666.

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Name of Each Exchange On Which Registered |

| None | | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Ordinary Shares, par value $0.01 per share

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of July 7, 2010 was: 15,000,000 ordinary shares, par value $0.01 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

Yes o No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

x U.S. GAAP o International Financial Reporting Standards as issued by the International Accounting

Standards Board o Other o

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No o

OSSEN INNOVATION CO. LTD.

(formerly Ultra Glory International Ltd.)

FORM 20-F SHELL COMPANY REPORT

TABLE OF CONTENTS

| | | | | Page |

| |

| PART I |

| Item 1. | | Identity of Directors, Senior Management and Advisors | | 2 |

| Item 2. | | Offer Statistics and Expected Timetable | | 2 |

| Item 3. | | Key Information | | 3 |

| Item 4. | | Information on the Company | | 18 |

| Item 4A. | | Unresolved Staff Comments | | 35 |

| Item 5. | | Operating and Financial Review and Prospects | | 35 |

| Item 6. | | Directors, Senior Management, and Employees | | 48 |

| Item 7. | | Major Shareholders and Related Party Transactions | | 52 |

| Item 8. | | Financial Information | | 53 |

| Item 9. | | The Offer and Listing | | 53 |

| Item 10. | | Additional Information | | 54 |

| Item 11. | | Quantitative and Qualitative Disclosures About Market Risk | | 61 |

| Item 12. | | Description of Securities Other Than Equity Securities | | 62 |

| |

| PART II |

| Item 13. | | Defaults, Dividend Arrearages and Delinquencies | | 62 |

| Item 14. | | Material Modifications to the Rights of Security Holders and Use of Proceeds | | 62 |

| Item 15. | | Controls and Procedures | | 62 |

| Item 16. | | Reserved | | 62 |

| Item 16A. | | Audit Committee Financial Expert | | 62 |

| Item 16B. | | Code of Ethics | | 62 |

| Item 16C. | | Principal Accountiing Fees and Services | | 62 |

| Item 16D. | | Exemptions from the Listing Standards for Audit Committees | | 62 |

| Item 16E. | | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | | 62 |

| Item 16F. | | Change in Registrant's Certifying Accountant | | 63 |

| Item 16G. | | Corporate Governance | | 63 |

| |

| PART III |

| Item 17. | | Financial Statements | | 64 |

| Item 18. | | Financial Statements | | 64 |

| Item 19. | | Exhibits | | 64 |

CERTAIN INFORMATION

In this shell company report on Form 20-F, unless otherwise indicated, “we,” “us,” “our,” the “Company” and “Ossen” refer to Ossen Innovation Co., Ltd., formerly known as Ultra Glory International Ltd., or Ultra Glory, a company organized in the British Virgin Islands, and its subsidiaries, subsequent to the business combination referred to below. Unless the context indicates otherwise, all references to “Ossen Materials” in this shell company report refer to Ossen Innovation Materials Co., Ltd., a subsidiary of Ossen and one of the entities through which the operating business is held, all references to “Ossen Jiujiang” in this shell company report refer to Ossen (Jiujiang) Steel Wire & Cable Co., Ltd., a subsidiary of Ossen Materials and one of the entities through which our operating business is held, and all references to “Ossen Materials Group” refer to Ossen Innovation Materials Group, Co., Ltd., our wholly-owned subsidiary, which is a holding company that indirectly owns Ossen Materials and Ossen Jiujiang. The “business combination” refers to the share exchange between Ultra Glory, the sole shareholder of Ultra Glory, Ossen and the shareholders of Ossen, resulting in the acquisition of all of the outstanding securities of Ossen by Ultra Glory, which was consummated on July 7, 2010.

Unless the context indicates otherwise, all references to “China” refer to the People’s Republic of China. All references to “Renminbi” or “RMB” are to the legal currency of the People’s Republic of China and all references to “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States. This shell company report contains translations of Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. We make no representation that the Renminbi or U.S. dollar amounts referred to in this report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all. On June 28, 2010, the cash buying rate announced by the People’s Bank of China was RMB 6.789 to $1.00.

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, and the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors”, “Operating and Financial Review and Prospects,” and elsewhere in this report.

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

1.A. Directors and Senior Management

The following table lists the members of the Company’s board of directors:

| Name | | Age | | Position(s) |

| Liang Tang | | 42 | | Chairman of the Board |

| Zhiping Gu | | 50 | | Director |

| Wei Hua | | 47 | | Director |

The business address of each of the directors is: c/o Ossen Innovation Materials Co. Ltd., 518 Shangcheng Road, Floor 17, Shanghai, 200120, People’s Republic of China.

The following table lists the senior management of the Company:

| Name | | Age | | Position(s) |

| Wei Hua | | 47 | | Chief Executive Officer |

| Zhiping Gu | | 47 | | Chief Financial Officer |

The business address for each of the members of senior management is: c/o Ossen Innovation Materials Co. Ltd., 518 Shangcheng Road, Floor 17, Shanghai, 200120, Peoples Republic of China.

See Item 6.A. – Directors and Senior Management below for more information about our directors and executive officers.

1.B. Advisors

The Company’s legal advisors in the People’s Republic of China are: Grandall Legal Group, 31/F, Nanzheng Building, 580 Nanjing Road West, Shanghai 200041, People’s Republic of China.

The Company’s legal advisors in the U.S. are: Kramer Levin Naftalis & Frankel LLP, 1177 Avenue of the Americas, New York, NY 10036.

The Company’s legal advisors in the British Virgin Islands are: Withers BVI, 3rd Floor, Little Denmark, Main Street, Road Town, Tortola, BVI.

1.C. Auditors

The Company’s auditors are: Sherb & Co. LLP, 805 Third Avenue, New York, NY 10022. See Item 16.F Change in Registrant’s Certifying Accountant below for information about the change in our auditor following the business comination.

Sherb & Co. LLP has confirmed that it is independent with respect to the Company under the guidelines of the SEC and the Independence Standards Board.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not Applicable.

3.A. Selected Financial Data

The following selected financial information should be read in connection with, and is qualified by reference to, our consolidated financial statements and their related notes and the section entitled “Operating and Financial Review and Prospectus,” each of which is included elsewhere in this report. The consolidated statements of operations and comprehensive income data for the fiscal years ended December 31, 2008 and 2009 and the balance sheets data as of December 31, 2008 and 2009 are derived from the audited consolidated financial statements included elsewhere in this report. The consolidated statements of operations and comprehensive income data for the fiscal years ended December 31, 2005, 2006 and 2007 and the balance sheets data as of December 31, 2005, 2006 and 2007 have been derived from unaudited financial statements that are not included in this prospectus. Our historical results for any of these periods are not necessarily indicative of results to be expected in any future period.

| | | Year Ended December 31, | |

| | | 2009 (Audited) | | | 2008 (Audited) | | | 2007 (Unaudited) | | | 2006 (Unaudited) | | | 2005 (Unaudited) | |

| | | | | | | | | | | | | | | | |

| Revenues | | $ | 101,087,796 | | | $ | 82,742,310 | | | $ | 71,909,873 | | | $ | 59,547,454 | | | $ | 17,195,347 | |

| Cost of goods sold | | | 87,659,925 | | | | 70,532,733 | | | | 63,340,890 | | | | 56,853,946 | | | | 15,216,951 | |

| Gross profit | | | 13,427,871 | | | | 12,209,577 | | | | 8,568,983 | | | | 2,693,508 | | | | 1,978,395 | |

| Selling and distribution expenses | | | 503,724 | | | | 4,326,491 | | | | 3,662,373 | | | | 1,024,209 | | | | 219,650 | |

| General and administrative expenses | | | 1,143,672 | | | | 1,316,606 | | | | 571,498 | | | | 340,847 | | | | 255,270 | |

| Total Operating Expenses | | | 1,647,396 | | | | 5,643,097 | | | | 4,288,796 | | | | 1,410,056 | | | | 501,920 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from operations | | | 11,780,475 | | | | 6,566,480 | | | | 4,280,187 | | | | 1,283,451 | | | | 1,476,475 | |

| Interest expenses, net | | | (1,496,712 | ) | | | (1,891,671 | ) | | | (1,189,027 | ) | | | (359,130 | ) | | | (22,920 | ) |

| Other income, net | | | 183,495 | | | | 380,766 | | | | 278,924 | | | | 211,875 | | | | 56,362 | |

| Income before income taxes | | | 10,467,258 | | | | 5,055,575 | | | | 3,370,084 | | | | 1,136,196 | | | | 1,509,917 | |

| Income taxes | | | (740,053 | ) | | | (291,520 | ) | | | (233,674 | ) | | | - | | | | - | |

| Net income | | | 9,727,205 | | | | 4,764,055 | | | | 3,136,410 | | | | 1,136,196 | | | | 1,509,917 | |

| Less: Net Income Attributable to non-controlling interest | | | 1,714,670 | | | | 809,437 | | | | - | | | | - | | | | - | |

| Net income attributable to controlling interest | | | 8,012,535 | | | | 3,954,618 | | | | 3,136,410 | | | | 1,136,196 | | | | 1,509,917 | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation gain, net of tax | | | 31,146 | | | | 420,883 | | | | 66,913 | | | | 360,384 | | | | 37,135 | |

| Total Other comprehensive income, net of tax | | | 31,146 | | | | 420,883 | | | | 66,913 | | | | 360,384 | | | | 37,135 | |

| Comprehensive Income | | $ | 8,043,681 | | | $ | 4,375,501 | | | | 3,203,323 | | | | 1,496,580 | | | | 1,547,052 | |

| Balance Sheet Data (at end of period) | | December 31, | |

| (in U.S. Dollars) | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | Audited | | | Audited | | | Unaudited | | | Unaudited | | | Unaudited | |

| Cash and cash equivalents | | $ | 8,409,467 | | | $ | 3,761,315 | | | $ | 6,735,616 | | | $ | 7,828,750 | | | $ | 3,120,317 | |

| Total current assets | | | 68,374,508 | | | | 47,316,208 | | | | 35,162,129 | | | | 18,712,764 | | | | 9,901,704 | |

| Total assets | | | 85,717,587 | | | | 65,896,382 | | | | 52,626,708 | | | | 31,436,385 | | | | 19,799,869 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total liabilities | | | 65,538,241 | | | | 55,475,387 | | | | 47,390,651 | | | | 18,297,807 | | | | 8,317,707 | |

| Total shareholders’ equity | | | 20,179,346 | | | | 10,420,995 | | | | 5,236,057 | | | | 13,138,578 | | | | 11,482,162 | |

| Total liabilities and shareholders’ equity | | | 85,717,587 | | | | 65,896,382 | | | | 52,626,708 | | | | 31,436,385 | | | | 19,799,869 | |

3.A.3. Exchange Rates

Not Applicable.

3.B. Capitalization and Indebtedness

The following table sets forth our capitalization and indebtedness as of December 31, 2009 on an actual basis. This information should be read in conjunction with our consolidated financial statements and the notes relating to such statements appearing elsewhere in this report.

| As of December 31, 2009 | | | |

| | | | |

| Cash: | | | |

| Cash and cash equivalents | | $ | 8,409,467 | |

Restricted cash (1) | | | 11,824,214 | |

| | | | | |

| Debt: | | | | |

Notes payable - bank acceptance notes (1) | | | 19,744,925 | |

Short-term bank loans (2) | | | 27,350,377 | |

| | | | | |

| Shareholders’ equity: | | | | |

Common shares, no par value | | | 500 | |

| Accumulated other comprehensive income | | | 543,036 | |

| Statutory Reserve | | | 1,093,331 | |

| Retained earnings | | | 13,069,401 | |

| Non-controlling interest | | | 5,473,078 | |

| Total shareholders’ equity | | $ | 20,179,346 | |

(1) Restricted cash represents amounts held by a bank as security for bank acceptance notes and therefore is not available for the Company’s use until such time as the bank acceptance notes have been fulfilled or expired, normally within a twelve month period. All the notes payable are subject to bank charges of 0.05% of the principal amount as commission on each loan transaction.

(2) Short-term bank loans are obtained from local banks in China. All the short-term bank loans are repayable within one year and are secured by property, plant and equipment and land use rights owned by us, as well as by guarantees made by our affiliates.

3.C. Reasons For The Offer And Use Of Proceeds

Not Applicable.

3.D. Risk Factors

You should carefully consider the risks described below in evaluating our business before investing in our ordinary shares. If any of the following risks were to occur, our business, results of operations and financial condition could be harmed. In that case, the trading price of our ordinary shares could decline and you might lose all or part of your investment in our ordinary shares. You should also refer to the other information set forth in this shell company report, including our consolidated financial statements and the related notes and the section captioned “Operating and Financial Review and Prospects” before deciding whether to invest in our ordinary shares.

Risks Related to Our Business and Our Industry

Our revenues are highly dependent on a limited number of customers and the loss of any one of our major customers could materially and adversely affect our growth and our revenues.

During the years ended December 31, 2008 and 2009, our six largest customers contributed 80.8% and 86.6% of our total sales, respectively. As a result of our reliance on a limited number of customers, we may face pricing and other competitive pressures, which may have a material adverse effect on our profits and our revenues. The volume of products sold for specific customers varies from year to year, especially since we are not the exclusive provider for any customers. In addition, there are a number of factors, other than our performance, that could cause the loss of a customer or a substantial reduction in the products that we provide to any customer and that may not be predictable. For example, our customers may decide to reduce spending on our products or a customer may no longer need our products following the completion of a project. The loss of any one of our major customers, a decrease in the volume of sales to these customers or a decrease in the price at which we sell our products to them could materially adversely affect our profits and our revenues.

In addition, this customer concentration may subject us to perceived or actual leverage that our customers may have in negotiations with us, given their relative size and importance to us. If our customers seek to negotiate their agreements on terms less favorable to us and we accept such unfavorable terms, such unfavorable terms may have a material adverse effect on our business, financial condition and results of operations. Accordingly, unless and until we diversify and expand our customer base, our future success will significantly depend upon the timing and volume of business from our largest customers and the financial and operational success of these customers.

Anti-dumping duties imposed by foreign governments on our products have caused us to cease doing business with some of our international customers.

In 2008, we sold approximately 32% of our products to customers in the United States and Europe. The Crispin Corporation, a US company, and Ibercordones Pretensados S.L., a Spanish Company, were two of our top three customers in 2008.

However, in May 2009, the Council of the European Union imposed an anti-dumping duty on imports of certain prestressed wires and wire strands originating in China. Dumping occurs when a foreign company sells a product at a price that is considered less than fair value in the country into which the product is imported. Following an anti-dumping investigation initiated in February 2008, the Council concluded that imports of these products originating in China caused material injury to the European industry. The rate of the anti-dumping duty applicable to us has been set at 31.1% and the duty applicable to our competitors generally has been set at 46.2%.

On May 17, 2010, the U.S. Department of Commerce announced an affirmative final decision, imposing an anti-dumping rate of 193.55% for imports of certain prestressed concrete steel wire strands, including the plain surface materials we had been selling to our U.S. customers, exported from China to the U.S. The U.S. Customs and Border Protection has been instructed to collect a cash deposit or bond based on this rate.

In anticipation of these rulings, we discontinued sales to these regions at the end of 2008. If these anti-dumping measures remain in place and we are unable to continue increasing our sales to customers in China or other regions in which we sell our products, these measures could have a negative impact on our business and results of operations.

Because we decreased sales to international customers and increased sales to domestic PRC customers in 2009 as a result of the global economic crisis, we have experienced, and will continue to experience, increased needs to finance our working capital requirements, which may materially and adversely affect our financial position and results of operations.

Historically, we sold a significant portion of our products to international customers, who generally pay by letter of credit, enabling us to convert our accounts receivable into cash more quickly, prepay our suppliers and reduce the amount of funds that we needed to finance our working capital requirements. However, at the end of 2008, as a result of the global economic crisis and in anticipation of the anti-dumping measures ultimately imposed by the U.S. and the European Union, we had to exit some of these international markets entirely and turn to the domestic PRC customers, which generally pay approximately 40 days after receiving the materials at the construction site. These longer payment terms have negatively impacted our short-term liquidity. Although we have been able to maintain adequate working capital primarily through short-term borrowing, any failure by our customers to settle outstanding accounts receivable in the future could materially and adversely affect our cash flow, financial condition and results of operations.

Some of the terms of the agreements between Ossen Materials and its affiliates may be less favorable to us than similar agreements negotiated between unaffiliated third parties.

We purchase a significant amount of our raw materials from Shanghai Z.F.X. Steel Co., Ltd., or Shanghai ZFX, an affiliate of ours. Specifically, Ossen Materials acquired 26.4% and 15.0%, and Ossen Jiujiang acquired 25.8% and 4.3%, of their raw materials from Shanghai ZFX in 2008 and 2009, respectively. While we believe we benefit from these agreements, such agreements were negotiated between two affiliated companies, and therefore may not reflect the terms that would have been reached by two unaffiliated parties negotiating at arm’s length. The transactions may be less favorable to us than would be the case if they were negotiated with unaffiliated third parties.

As we expand our operations, we may need to establish a more diverse supplier network for our raw materials. The failure to secure a more diverse and reliable supplier network could have an adverse effect on our financial condition.

We currently purchase almost all of our raw materials from a small number of suppliers. Purchases from our five largest suppliers amounted to 86.5% and 89.5% of our total cost of supplies in 2008 and 2009, respectively. As we increase the scale of our production, we may need to establish a more diverse supplier network, while attempting to continue to leverage our purchasing power to obtain favorable pricing and delivery terms. However, in the event that we need to diversify our supplier network, we may not be able to procure a sufficient supply of raw materials at a competitive price, which could have an adverse effect on our results of operations, financial condition and cash flows.

Furthermore, despite our efforts to control our supply of raw materials and maintain good relationships with our existing suppliers, we could lose one or more of our existing suppliers at any time. The loss of one or more key suppliers could increase our reliance on higher cost or lower quality supplies, which could negatively affect our profitability. Any interruptions to, or decline in, the amount or quality of our raw materials supply could materially disrupt our production and adversely affect our business and financial condition and financial prospects.

Volatile steel prices can cause significant fluctuations in our operating results. Our sales and operating income could decrease if steel prices decline or if we are unable to pass price increases on to our customers.

Our principal raw material is high carbon steel wire rods that we typically purchase from multiple primary steel producers. The steel industry as a whole is cyclical and, at times, pricing and availability of steel can be volatile due to numerous factors beyond our control, including general domestic and international economic conditions, labor costs, sales levels, competition, levels of inventory held by us and other steel service centers, consolidation of steel producers, higher raw material costs for steel producers, import duties and tariffs and currency exchange rates. This volatility can significantly affect the availability and cost of raw materials for us.

We, like many other steel manufacturers, maintain substantial inventories of steel to accommodate the short lead times and just-in-time delivery requirements of our customers. Accordingly, we purchase steel in an effort to maintain our inventory at levels that we believe to be appropriate to satisfy the anticipated needs of our customers based upon historic buying practices, supply agreements with customers and market conditions. Our commitments to purchase steel are generally at prevailing market prices in effect at the time we place our orders. We have no long-term, fixed-price steel purchase contracts. When steel prices increase, as they did in 2008, competitive conditions will influence how much of the price increase we can pass on to our customers. To the extent we are unable to pass on future price increases in our raw materials to our customers, the net sales and profitability of our business could be adversely affected.

When steel prices decline, as they did in the fourth quarter of 2008 and through the first half of 2009, customer demands for lower prices and our competitors' responses to those demands could result in lower sale prices, lower margins and inventory valued at the lower of cost or market adjustments as we use existing steel inventory. Significant or rapid declines in steel prices or reductions in sales volumes could result in us incurring inventory or goodwill impairment charges. Changing steel prices therefore could significantly impact our net sales, gross margins, operating income and net income.

We are subject to various risks and uncertainties that might affect our ability to procure quality raw materials.

Our performance depends on our ability to procure low cost, high quality raw materials on a timely basis from our suppliers. Our supplies are subject to certain risks, including availability of raw materials, labor disputes, inclement weather, natural disasters, and general economic and political conditions, which might limit the ability of our suppliers to provide us with low cost, high quality merchandise on a timely basis. Furthermore, for these or other reasons, one or more of our suppliers might not adhere to our quality control standards, and we might not identify the deficiency. Our suppliers’ failure to supply quality materials at a reasonable cost on a timely basis could reduce our net sales, damage our reputation and have an adverse effect on our financial condition.

Our operations are cash intensive, and our business could be adversely affected if we fail to maintain sufficient levels of liquidity and working capital.

Historically, we have spent a significant amount of cash on our operational activities, principally to procure raw materials for our products. We financed our operations mainly through cash flows from our operations, short-term bank loans and proceeds from bank acceptance notes. If we fail to continue to generate sufficient cash flow from these sources, we may not have sufficient liquidity to fund our operating costs and our business could be adversely affected.

Our short-term loans are from Chinese banks and are generally secured by our fixed assets, receivables and/or guarantees by third parties. The term of almost all such loans is one year or less. Historically, we have rolled over such loans on an annual basis. However, we may not have sufficient funds available to pay all of our borrowings upon maturity in the future. Failure to roll over our short-term borrowings at maturity or to service our debt could result in the imposition of penalties, including increases in interest rates, legal actions against us by our creditors, or even insolvency.

If available liquidity is not sufficient to meet our operating and loan obligations as they come due, our plans include considering pursuing alternative financing arrangements, reducing expenditures as necessary, or limiting our plans for expansion to meet our cash requirements. However, there is no assurance that, if required, we will be able to raise additional capital, reduce discretionary spending or efficiently limit our expansion to provide the required liquidity. Currently, the capital markets for small capitalization companies are extremely difficult and banking institutions have become stringent in their lending requirements. Accordingly, we cannot be sure of the availability or terms of any third party financing. If we are unable to raise additional financing, we may be unable to implement our long-term business plan, develop or enhance our products, take advantage of future opportunities or respond to competitive pressures on a timely basis. In the alternative, if we raise capital by issuing equity or convertible debt securities, such issuances could result in substantial dilution to our shareholders.

Our inability to manage our growth may have a material adverse effect on our business, results of operations and financial condition.

We have experienced significant growth since we began operations in 2004. Our revenues have grown from approximately $17.2 million in 2005 to approximately $101.1 million in 2009.

| | · | recruiting, training and retaining sufficient skilled sales and management personnel; |

| | · | adhering to our high quality and process execution standards; |

| | · | maintaining high levels of customer satisfaction; |

| | · | creating and managing economies of scale; |

| | · | maintaining and managing costs to correspond with timeliness of revenue recognition; and |

| | · | developing and improving our internal administrative infrastructure, including our financial, operational and communication systems, processes and controls. |

Any inability to manage our growth may have a material adverse effect on our business, results of operations and financial condition.

We face intense competition, and if we are unable to compete effectively we may not be able to maintain profitability.

We compete with many other companies located in the PRC and internationally that manufacture materials similar to ours. Many of our competitors are larger companies with greater financial resources than us. In addition, we expect that as demand in the PRC and in other foreign countries for high quality, prestressed materials continues to grow, new competitors will enter the market. Increased competition may adversely affect our future financial performance or reputation. Moreover, increased competition may result in potential or actual litigation between us and our competitors relating to such activities as competitive sales practices, relationships with key suppliers and customers or other matters.

We may lose our competitive advantage, and our operations may suffer, if we fail to prevent the loss or misappropriation of, or disputes over, our intellectual property.

We rely on a combination of patents, trademarks, trade secrets and confidentiality agreements to protect our intellectual property rights. While we are not currently aware of any infringement on our intellectual property rights, our ability to compete successfully and to achieve future revenue growth will depend, in significant part, on our ability to protect our proprietary technology. Despite many laws and regulations promulgated, and other efforts made, by China over the past several years in an attempt to protect intellectual property rights, intellectual property rights are not as certain in China as they would in many Western countries, including the United States. Furthermore, enforcement of such laws and regulations in China has not been fully developed. Neither the administrative agencies nor the court systems in China are equipped as their counterparts in developed countries to deal with violations or handle the nuances and complexities between compliant technological innovation and non-compliant infringement.

Our competitors may independently develop proprietary methodologies similar to ours or duplicate our products or services. Unauthorized parties may infringe upon or misappropriate our services or proprietary information, which could have a material adverse effect on our business, results of operations and financial condition. The misappropriation or duplication of our intellectual property could disrupt our ongoing business, distract our management and employees, reduce our revenues and increase our expenses. We may need to litigate to enforce our intellectual property rights. Any such litigation could be time consuming and costly and the outcome of any such litigation cannot be guaranteed.

Our operating results may vary significantly from quarter to quarter. Therefore, we believe that period-to-period comparisons of our results of operations are not necessarily meaningful and should not be relied upon as an indication of our future performance. It is possible that in the future some of our quarterly results of operations may be below the expectations of market analysts and our investors, which could lead to a significant decline in the trading price of our ordinary shares.

Factors which affect the fluctuation of our revenues, expenses and profits include:

| | · | changes in prices of our raw materials, with higher prices leading to reduced operating income; |

| | · | variations, expected or unexpected, in the duration, size, timing and scope of purchase orders; |

| | · | changes in our pricing policies or those of our competitors; |

| | · | changes in compensation, which may reduce our gross profit for the quarter in which they are effected; |

| | · | our inability to manage costs, including those related to our raw materials, personnel, infrastructure and facilities; |

| | · | exchange rate fluctuations; and |

| | · | general economic conditions. |

A portion of our expenses, particularly those related to personnel and facilities, are generally fixed in advance of any particular quarter. As a result, unanticipated variations in the number and timing of our purchase orders or prices of our raw materials may cause significant variations in our operating results in any particular quarter.

We may undertake strategic acquisitions, joint ventures and alliances, which may prove to be difficult to integrate and manage or may not be successful, and may result in increased expenses or write-offs.

We may over time pursue strategic acquisitions, joint ventures and alliances to enhance our capabilities and expand our industry expertise and geographic coverage. It is possible that we may not identify suitable acquisition candidates, alliances or joint venture partners, or if we do identify suitable candidates or partners, we may not complete those transactions on terms commercially acceptable to us or at all. The inability to identify suitable acquisition targets, joint ventures or alliances, or our inability to complete such transactions on terms commercially acceptable to us or at all, may adversely affect our ability to compete and grow.

These types of transactions involve numerous risks, including:

| | · | difficulties in integrating operations, systems, technologies, accounting methods and personnel; |

| | · | difficulties in supporting and transitioning clients of our acquired companies or strategic partners; |

| | · | disruption of our ongoing business; |

| | · | diversion of financial and management resources from existing operations; |

| | · | risks of entering new markets; |

| | · | potential loss of key employees; and |

| | · | inability to generate sufficient revenue to offset transaction costs and expenses. |

Furthermore, any such transaction that we attempt, whether or not completed, or any media reports or rumors with respect to any such transactions, may materially and adversely affect the value of our ordinary shares.

We may finance future transactions through debt financing or the issuance of our equity securities or a combination of the foregoing. Acquisitions financed with the issuance of our equity securities could be dilutive, which could affect the market price of our ordinary shares. Acquisitions financed with debt could require us to dedicate a substantial portion of our cash flow to principal and interest payments and could subject us to restrictive covenants. Acquisitions also frequently result in the recording of goodwill and other intangible assets that are subject to potential impairments in the future that could harm our financial results. Moreover, if we fail to properly evaluate acquisitions, alliances or investments, we may not achieve the anticipated benefits of those transactions, and we may incur costs in excess of what we had anticipated.

Our success depends in large part upon our senior management and key personnel. Our inability to attract and retain these individuals could materially and adversely affect our business, results of operations and financial condition.

We are highly dependent on our senior management and other key employees, including our Chairman, Dr. Tang, Mr. Hua and Mr. Gu. Our future performance will be dependent upon the continued service of members of our senior management and key employees. We do not maintain key man life insurance for any of the members of our management team or other key personnel. Competition for senior management in our industry is intense, and we may not be able to retain our senior management and key personnel or attract and retain new senior management and key personnel in the future, which could materially and adversely affect our business, results of operations and financial condition.

We are exposed to risks associated with product liability claims in the event that the use of our products results in property damage or personal injury. Since our products are ultimately incorporated into bridges, buildings, railways and other large structures, it is possible that users of these structures or people installing our products could be injured or killed by such structures, whether as a result of defects, improper installation or other causes. Because we continue to expand our customer base, we are unable to predict whether product liability claims will be brought against us in the future or to predict the impact of any resulting adverse publicity on our business. The successful assertion of product liability claims against us could result in potentially significant monetary damages and require us to make significant payments. We do not carry product liability insurance and may not have adequate resources to satisfy a judgment in the event of a successful claim against us. As the insurance industry in China is still in its early stages of development, even the insurance that we currently carry offers limited coverage compared with that offered in many other countries. Any business interruption or natural disaster could result in substantial losses and diversion of our resources and materially and adversely affect our business, financial condition and results of operations.

One shareholder owns a large percentage of our outstanding stock and could significantly influence the outcome of our corporate matters.

Currently, Dr. Tang, our chairman, beneficially owns approximately 79% of our outstanding ordinary shares. As our majority shareholder, Dr. Tang is able to exercise significant influence over all matters that require shareholder approval, including the election of directors to our board and approval of significant corporate transactions that we may consider, such as a merger or other sale of our company or its assets. This concentration of ownership in our shares by Dr. Tang will limit your ability to influence corporate matters and may have the effect of delaying or preventing a third party from acquiring control over us.

If we are unable to maintain appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, and cause investors to lose confidence in our reported financial information.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud.

As a public company, we have significant requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and, for many companies, a report by the independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not in the future identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to comply with Sarbanes-Oxley and meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, and cause investors to lose confidence in our reported financial information.

We will incur increased costs as a result of being a public company.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. We expect the rules and regulations to which public companies are subject, including the Sarbanes-Oxley Act of 2002, to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements.

Risks Related to Doing Business in China

Changes in China’s political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country, but the government could change these economic reforms or any of the legal systems at any time. This could either benefit or damage our operations and profitability. Some of the things that could have this effect are:

| | · | Level of government involvement in the economy; |

| | · | Control of foreign exchange; |

| | · | Methods of allocating resources; |

| | · | Balance of payments position; |

| | · | International trade restrictions; and |

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in many ways. For example, state-owned enterprises still constitute a large portion of the Chinese economy, and weak corporate governance and the lack of a flexible currency exchange policy still prevail in China. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy was similar to those of the OECD member countries.

The PRC government has exercised, and continues to exercise, substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 5.9% and as low as (0.8)%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

You may have difficulty enforcing judgments against us.

Our assets are located, and our operations are conducted, in the PRC. In addition, all of our directors and officers are nationals and residents of the PRC and a substantial portion of their assets is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts because China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security, or the public interest.

Most of our revenues are denominated in Renminbi, which is not freely convertible for capital account transactions and may be subject to exchange rate volatility.

We are exposed to the risks associated with foreign exchange controls and restrictions in China, as our revenues are primarily denominated in Renminbi, which is currently not freely exchangeable. The PRC government imposes control over the convertibility between Renminbi and foreign currencies. Under the PRC foreign exchange regulations, payments for “current account” transactions, including remittance of foreign currencies for payment of dividends, profit distributions, interest and operation-related expenditures, may be made without prior approval but are subject to procedural requirements. Strict foreign exchange control continues to apply to “capital account” transactions, such as direct foreign investment and foreign currency loans. These capital account transactions must be approved by, or registered with, the PRC State Administration of Foreign Exchange, or SAFE. Further, capital contribution by an offshore shareholder to its PRC subsidiaries may require approval by the Ministry of Commerce in China or its local counterparts. We cannot assure you that we are able to meet all of our foreign currency obligations to remit profits out of China or to fund operations in China.

On August 29, 2008, SAFE promulgated the Circular on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises, or Circular 142, to regulate the conversion by foreign invested enterprises, or FIEs, of foreign currency into Renminbi by restricting how the converted Renminbi may be used. Circular 142 requires that Renminbi converted from the foreign currency-dominated capital of a FIE may be used only for purposes within the business scope approved by the applicable government authority and may not be used for equity investments within the PRC unless specifically provided. In addition, SAFE strengthened its oversight over the flow and use of Renminbi funds converted from the foreign currency-dominated capital of a FIE. The use of such Renminbi may not be changed without approval from SAFE, and may not be used to repay Renminbi loans if the proceeds of such loans have not yet been used. Compliance with Circular 142 may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business.

Fluctuation in the value of the Renminbi and of the U.S. dollar may have a material adverse effect on investments in our ordinary shares.

Any significant revaluation of the Renminbi may have a material adverse effect on the U.S. dollar equivalent amount of our revenues and financial condition as well as on the value of, and any dividends payable on, our ordinary shares in foreign currency terms. For instance, a decrease in the value of Renminbi against the U.S. dollar could reduce the U.S. dollar equivalent amounts of our financial results, the value of your investment in our ordinary shares and the dividends we may pay in the future, if any, all of which may have a material adverse effect on the prices of our common shares. A significant portion of our revenues are denominated in Renminbi. Any further appreciation of Renminbi against U.S. dollars may result in significant exchange losses.

Prior to 1994, the Renminbi experienced a significant net devaluation against most major currencies, and there was significant volatility in the exchange rate during certain periods. Upon the execution of the unitary managed floating rate system in 1994, the Renminbi was devalued by 50% against the U.S. dollar. Since 1994, the Renminbi to U.S. dollar exchange rate has largely stabilized. On July 21, 2005, the People’s Bank of China announced that the exchange rate of U.S. dollar to Renminbi would be adjusted from $1 to RMB8.27 to $1 to RMB8.11, and it ceased to peg the Renminbi to the U.S. dollar. Instead, the Renminbi would be pegged to a basket of currencies, whose components would be adjusted based on changes in market supply and demand under a set of systematic principles. On September 23, 2005, the PRC government widened the daily trading band for Renminbi against non-U.S. dollar currencies from 1.5% to 3.0% to improve the flexibility of the new foreign exchange system. Since the adoption of these measures, the value of Renminbi against the U.S. dollar has fluctuated on a daily basis within narrow ranges, but overall has further strengthened against the U.S. dollar. There remains significant international pressure on the PRC government to further liberalize its currency policy, which could result in a further and more significant appreciation in the value of the Renminbi against the U.S. dollar. The Renminbi may be revalued further against the U.S. dollar or other currencies, or may be permitted to enter into a full or limited free float, which may result in an appreciation or depreciation in the value of the Renminbi against the U.S. dollar or other currencies.

China’s legal system is different from those in some other countries.

China is a civil law jurisdiction. Under the civil law system, prior court decisions may be cited as persuasive authority but do not have binding precedential effect. Although progress has been made in the promulgation of laws and regulations dealing with economic matters, such as corporate organization and governance, foreign investment, commerce, taxation and trade, China’s legal system remains less developed than the legal systems in many other countries. Furthermore, because many laws, regulations and legal requirements have been recently adopted, their interpretation and enforcement by the courts and administrative agencies may involve uncertainties. Sometimes, different government departments may have different interpretations. Licenses and permits issued or granted by one government authority may be revoked by a higher government authority at a later time. Government authorities may decline to take action against unlicensed operators which may work to the disadvantage of licensed operators, including us. The PRC legal system is based in part on government policies and internal rules that may have a retroactive effect. We may not be aware of our violation of these policies and rules until some time after the violation. Changes in China’s legal and regulatory framework, the promulgation of new laws and possible conflicts between national and provincial regulations could adversely affect our financial condition and results of operations. In addition, any litigation in China may result in substantial costs and diversion of resources and management attention.

On August 8, 2006, six PRC regulatory agencies promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the 2006 M&A Rule, which became effective on September 8, 2006. According to the 2006 M&A Rule, a “round-trip investment” is defined as having taken place when a PRC business that is owned by PRC individuals is sold to a non-PRC entity that is established or controlled, directly or indirectly, by those same PRC individuals. Under the 2006 M&A Rules, any round-trip investment must be approved by MOFCOM, and any indirect arrangement or series of arrangements which achieves the same end result without the approval of MOFCOM is a violation of PRC law.

The direct shareholders of Ossen Materials, Ossen Asia and Topchina, are British Virgin Islands limited liability companies that were owned by Ossen Materials Group, a British Virgin Islands limited liability company that was controlled by Dr. Tang prior to our business combination. Topchina also holds shares in Ossen Jiujiang. We have been advised that we are not required to obtain MOFCOM approval because the relevant transactions occurred prior to the effectiveness of the 2006 M&A Rule.

However, the PRC regulatory authorities may take the view that the acquisition of shares in our PRC operating subsidiaries by Ossen Asia and Topchina, and the share exchange between Ultra Glory and Ossen Materials Group, are part of an overall series of arrangements which constitute a round-trip investment. If the PRC regulatory authorities take this view, we cannot assure you we may be able to obtain the approval required from MOFCOM. It is also possible that the PRC regulatory authorities could invalidate our acquisition and ownership of our Chinese subsidiaries, and that these transactions require the prior approval of the China Securities Regulatory Commission, or CSRC, before MOFCOM approval is obtained.

If these regulatory actions occur, we cannot assure you that we will be able to re-establish control of our Chinese subsidiaries’ business operations, that any such contractual arrangements will be protected by PRC law, or that we would receive as complete or effective an economic benefit and control of our Chinese subsidiaries’ business as if we had direct ownership of our Chinese subsidiaries.

Under the New Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC shareholders.

China passed a New Enterprise Income Tax Law, or the New EIT Law, which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with de facto management bodies within China is considered a resident enterprise, meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 clarified that dividends and other income paid by such resident enterprises will be considered to be PRC source income, subject to PRC withholding tax, currently at a rate of 10%, when recognized by non-PRC enterprise shareholders. This recent circular also subjects such resident enterprises to various reporting requirements with the PRC tax authorities.

Although substantially all of our management is currently located in the PRC, it remains unclear whether the PRC tax authorities would require or permit our overseas registered entities to be treated as PRC resident enterprises. We do not currently consider our company to be a PRC resident enterprise. However, if the PRC tax authorities determine that we are a resident enterprise for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries would qualify as tax-exempt income, we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new resident enterprise classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC shareholders and with respect to gains derived by our non-PRC shareholders from transferring our shares.

Restrictions under PRC law on our PRC subsidiaries' ability to pay dividends and make other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our business.

Our revenues are generated by our PRC subsidiaries. However, PRC regulations restrict the ability of our PRC subsidiaries to pay dividends and make other payments to their offshore parent company. PRC legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of their registered capital. Allocations to these statutory reserve funds can be used only for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends. Any limitations on the ability of our PRC subsidiaries to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Any failure to comply with PRC environmental laws may require us to incur significant costs.

We carry on our business in an industry that is subject to PRC environmental protection laws and regulations. These laws and regulations require enterprises engaged in manufacturing and construction that may cause environmental waste to adopt effective measures to control such waste. In addition, such enterprises are required to pay fines, or to cease operations entirely under extreme circumstances, should they discharge waste substances. The Chinese government may also change the existing laws or regulations or impose additional or stricter laws or regulations, compliance with which may cause us to incur significant capital expenditures, which we may be unable to pass on to our customers through higher prices for our products.

We must comply with the Foreign Corrupt Practices Act.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from making prohibited payments to foreign officials for the purpose of obtaining or retaining business. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices occur from time to time in mainland China. If any of our non-U.S. listed competitors that are not subject to the Foreign Corrupt Practices Act engage in these practices, they may receive preferential treatment and secure business from government officials in a way that is unavailable to us. Furthermore, although we inform our personnel that such practices are illegal, we cannot assure you that our employees or other agents will not engage in illegal conduct for which we might be held responsible under U.S. law. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties.

Because our funds are held in banks that do not provide insurance, the failure of any bank in which we deposit our funds could affect our ability to continue our business operations.

Banks and other financial institutions in the PRC do not provide insurance for funds held on deposit. As a result, in the event of a bank failure, we may not have access to funds on deposit. Depending upon the amount of money we maintain in a bank that fails, our inability to have access to our cash could impair our operations, and, if we are not able to access funds to pay our suppliers, employees and other creditors, we may be unable to continue our business operations.

If relations between the United States and China worsen, investors may be unwilling to hold or buy our ordinary shares and our share price may decrease.

At various times during recent years, the United States and China have had significant disagreements over political and economic issues. Controversies may arise in the future between these two countries. Any political or trade controversies between the United States and China, whether or not directly related to our business, could reduce the price of our ordinary shares.

Risks Related to Our Ordinary Shares

The market price for our ordinary shares may be volatile.

The market price for our ordinary shares is likely to be highly volatile and subject to wide fluctuations in response to various factors, including the following:

| | · | actual or anticipated fluctuations in our quarterly operating results and revisions to our expected results; |

| | · | changes in financial estimates by securities research analysts; |

| | · | conditions in the markets for our products; |

| | · | changes in the economic performance or market valuations of companies specializing in our industry or our customers or their industries; |

| | · | announcements by us or our competitors of new products, acquisitions, strategic relationships, joint ventures or capital commitments; |

| | · | addition or departure of our senior management and key personnel; |

| | · | fluctuations of exchange rates between the Renminbi and the U.S. dollar; |

| | · | litigation related to our intellectual property; |

| | · | release or expiry of lock-up or other transfer restrictions on our outstanding ordinary shares; and |

| | · | sales or perceived potential sales of our ordinary shares. |

In addition, the securities market has from time to time, and to an even greater degree since the last quarter of 2007, experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also have a material adverse effect on the market price of our ordinary shares. Furthermore, in the past, following periods of volatility in the market price of a public company’s securities, shareholders have frequently instituted securities class action litigation against that company. Litigation of this kind could result in substantial costs and a diversion of our management’s attention and resources.

We may not be able to pay any dividends on our ordinary shares.

Under British Virgin Islands law, we may pay dividends if the directors declare that the company is able to satisfy the provisions of Section 57 of the BVI Companies Act, 2004. Pursuant to this provision, the company, immediately after the distribution must satisfy the solvency test, in so far as its assets exceeds its liabilities, and the company must be able to pay its debts as they become due. Our ability to pay dividends will therefore depend on our ability to generate sufficient profits. We cannot give any assurance that we will declare dividends of any amounts, at any rate or at all in the future. We have not paid any dividends in the past. Future dividends, if any, will be at the discretion of our board of directors, subject to the approval of our shareholders, and will depend upon our results of operations, our cash flows, our financial condition, the payment of our subsidiaries of cash dividends to us, our capital needs, future prospects and other factors that our directors may deem appropriate.

There is no public market for our ordinary shares, and you may not be able to resell our ordinary shares at or above the price you paid, or at all.

There is no public market for our ordinary shares. If an active trading market for our ordinary shares does not develop, the market price and liquidity of our ordinary shares will be materially and adversely affected and you may not be able to resell our ordinary shares at or above the price you paid, or at all. An active trading market for our ordinary shares may not develop in a timely manner or at all.

If equity research analysts do not publish research reports about our company or if they issue unfavorable commentary or downgrade our ordinary shares, the price of our ordinary shares could decline.

The trading market for our ordinary shares will rely in part on the research reports that equity research analysts publish about us and our company. We do not control these analysts. The price of our ordinary shares could decline if one or more equity analysts downgrade our ordinary shares or if they issue other unfavorable commentary, or cease publishing reports, about us or our company.

| ITEM 4. | INFORMATION ON THE COMPANY |

4A. History and Development of the Company

We are a British Virgin Islands limited liability company organized on January 21, 2010 under the BVI Business Companies Act, 2004 under the name Ultra Glory International Ltd., or Ultra Glory, as a blank check company for the purpose of acquiring, through a share exchange, asset acquisition or other similar business combination, an operating business.

Business Combination

On July 7, 2010, Ultra Glory and its sole shareholder entered into a share exchange agreement with Ossen Innovation Group, a British Virgin Islands limited liability company organized on April 30, 2010 under the British Virgin Islands Companies Act (2004) and the shareholders of Ossen Innovation Group. Pursuant to the share exchange agreement, Ultra Glory acquired from the shareholders of Ossen Innovation Group all of the issued and outstanding shares of Ossen Innovation Group, in exchange for an aggregate of 10,000,000 newly issued ordinary shares issued by Ultra Glory to the shareholders of Ossen Innovation Group. In addition, the sole shareholder of Ultra Glory sold all of the 5,000,000 ordinary shares of Ultra Glory that were issued and outstanding prior to the business combination, to the shareholders of Ossen Innovation Group for cash, at a price of $0.03 per share. As a result, the individuals and entities that owned shares of Ossen Innovation Group prior to the business combination acquired 100% of the equity of Ultra Glory, and Ultra Glory acquired 100% of the equity of Ossen Innovation Group. Ossen Innovation Group is now a wholly owned subsidiary of Ultra Glory. In conjunction with the business combination, Ultra Glory filed an amended charter, pursuant to which Ultra Glory changed its name to Ossen Innovation Co., Ltd., changed its fiscal year end to December 31, changed the par value of its ordinary shares to $0.01 per share and increased its authorized shares to 100,000,000. Upon the consummation of the business combination, we ceased to be a shell company.

Our Shareholders

Dr. Tang, our chairman, owns 100% of the shares of Effectual Strength Enterprises Ltd., a British Virgin Islands company, which owned 79% of the shares of Ossen Innovation Group prior to the business combination, and owns 79% of our shares since the business combination. The holders of the remaining 21% of our shares are investors that are residents of the PRC and are unaffiliated with Ossen.

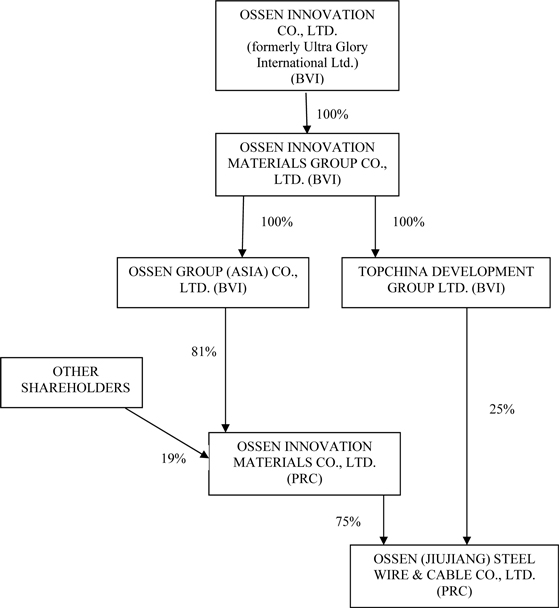

Our Subsidiaries

British Virgin Islands Companies

Ossen Innovation Group, our wholly owned subsidiary, is the sole shareholder of two holding companies organized in the British Virgin Islands: Ossen Group (Asia) Co., Ltd., or Ossen Asia, and Topchina Development Group Ltd., or Topchina. All of the equity of Ossen Asia and Topchina had been held by Dr. Tang since inception. In May 2010, Dr. Tang transferred these shares to Ossen Innovation Group in anticipation of the public listing of our company’s shares in the United States.

Ossen Asia is a British Virgin Islands limited liability company organized on February 7, 2002. Ossen Asia has one direct operating subsidiary in China, Ossen Innovation Materials Co. Ltd., or Ossen Materials. Ossen Asia owns 81% of the equity of Ossen Materials.

Topchina is a British Virgin Islands limited liability company organized on November 3, 2004. Ossen Materials and Topchina directly own an operating subsidiary in China, Ossen (Jiujiang) Steel Wire & Cable Co., Ltd., or Ossen Jiujiang. Ossen Materials owns 75% of the equity of Ossen Jiujiang and Topchina owns 25%.

Ossen Materials

Ossen Materials was formed in China on October 27, 2004 as a Sino-foreign joint venture limited liability company under the name Ossen (Ma’anshan) Steel Wire and Cable Co., Ltd. On May 8, 2008, Ossen Materials was restructured from a Sino-foreign joint venture limited liability company to a corporation. The name of the entity was changed at that time to Ossen Innovation Materials Co., Ltd.

Ossen Asia owns 81% of the equity of Ossen Materials. The remaining 19% is held in the aggregate by four Chinese entities, two of which are controlled by Chinese governmental entities, one of which is controlled by Zhonglu Co. Ltd., a company whose shares are listed on the Shanghai Stock Exchange, and one of which is controlled by Chinese citizens.

Through Ossen Materials, we have manufactured and sold plain surface prestressed concrete (“PC”) strands, galvanized PC steel wires and PC wires in our Maanshan City, PRC, facility since 2004. The primary products manufactured in this facility are our plain surface PC strands. The primary markets for the products manufactured at our Maanshan facility are Anhui Province, Jiangsu Province, Zhejiang Province and Shanghai City, each in the PRC.

Ossen Jiujiang

On April 6, 2005, Ossen Shanghai Investment Co., Ltd., or Ossen Shanghai, acquired a portion of the bankruptcy assets of Jiujiang Tianlong Galvanized Prestressing Steel Strand LLC, including equipment, land use rights and inventory for approximately $3.9 million. Ossen Jiujiang was formed by Ossen Shanghai in the PRC as a Sino-foreign joint venture limited liability company on April 13, 2005. Ossen Shanghai then transferred the newly acquired assets to Ossen Jiujiang. At its inception, Ossen Jiujiang was owned by two entities: 33.3% of its equity was held by Ossen Asia and 66.7% by Ossen Shanghai. Ossen Shanghai is a Chinese company owned by five Chinese individuals, one of whom is a director of our subsidiary, Ossen Materials. In June 2005, Ossen Shanghai transferred its entire interest in Ossen Jiujiang to Topchina in exchange for approximately $2.9 million. In October 2007, Topchina transferred 41.7% of the equity in Ossen Jiujiang to Ossen Asia for no consideration. On December 17, 2007, Ossen Asia transferred all of its shares in Ossen Jiujiang to Ossen Materials for no consideration. Since that date 75% of the equity of Ossen Jiujiang has been held by Ossen Materials and 25% by Topchina.

Through Ossen Jiujiang, we manufacture galvanized PC wires, plain surface PC strands, galvanized PC strands, unbonded PC strands, helical rib PC wires, sleeper PC wires and indented PC wires. The primary products manufactured in this facility are our galvanized PC wires. The primary markets for the PC strands manufactured in our Jiujiang facility are Jiangxi Province, Wuhan Province, Hunan Province, Fujian Province and Sichuan Province, each in the PRC.

Organizational Structure Chart

The following chart reflects our organizational structure since the date of the business combination between Ultra Glory and the shareholders of Ossen Innovation Group:

Capital Expenditures

Our capital expenditures consist primarily of expenditures on property, plant and equipment. Capital expenditures on property, plant and equipment were $2.9 million in 2007, $2.3 million in 2008 and $0.2 million in 2009. We financed our capital expenditure requirements from the cash flows generated by our operating activities and from short-term bank loans. We have no current commitments for capital expenditures.

Registered office

The address of our registered office in the British Virgin Islands is: Akara Building, 24 De Castro Street, Wickhams Cay 1, Road Town, Tortola, British Virgin Islands. The telephone number of the registered office is (284) 494-4840.

4B. Business Overview

General