SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------

FORM F-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ONTARIO SOLAR ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

Province of Ontario, Canada (State or other jurisdiction of incorporation or organization) | 8748 (Primary Standard Industrial Classification Code Number) |

255 Duncan Mill Road, Suite 203

Toronto, Ontario

Canada M3B 3H9

(Address of principal executive offices, including Postal Code)

Registrant's area code and telephone number: (416) 510-2991

The Law Office of Conrad C. Lysiak, P.S.

601 West First Avenue

Suite 903

Spokane, Washington 99201

(509) 624-1475

(Name, address, including zip code, and telephone number, including area code, of agent of service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If delivery of the prospectus is expected to be made pursuant to Rule 434 under the Securities Act of 1933, check the following box. [ ]

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to Be Registered | Amount to Be Registered | Proposed Offering Price per Share [1] | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

| | | | | |

Common stock, without par value, to be sold by Selling Shareholders | 4,041,666 | $ | 0.25 | $ | 1,010,416.50 | $ | 72.04 |

| | | | | | | | |

| Total | 4,041,666 | $ | 0.25 | $ | 1,010,416.50 | $ | 72.04 |

| [1] | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a). |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS

ONTARIO SOLAR ENERGY CORPORATION

4,041,666 SHARES BEING SOLD BY SELLING SHAREHOLDERS

We are registering for sale by selling shareholders 4,041,666 shares of common stock. We will not receive any proceeds from the shares sold by the selling shareholders.

The sales price to the public is fixed at $0.25 per share until such time as the shares of our common stock become traded on the Bulletin Board operated by the Financial Industry Regulatory Authority or another exchange. If our common stock becomes quoted on the Bulletin Board or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale.

Our shares of common stock are not traded anywhere.

Investing in our common stock involves risks. See "Risk Factors" starting at page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. It is illegal to tell you otherwise.

The date of this prospectus is ____________________.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROSPECTUS. WE HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION THAT IS DIFFERENT. THIS PROSPECTUS MAY ONLY BE USED WHERE IT IS LEGAL TO SELL THESE SECURITIES. THE INFORMATION IN THIS PROSPECTUS MAY ONLY BE ACCURATE ON THE DATE OF THIS DOCUMENT.

PROSPECTUS SUMMARY

The following summary highlights, should be read in conjunction with the more detailed information contained elsewhere in this prospectus. You should read carefully the entire document, including our financial statements and related notes, to understand our business, our common shares, and the other considerations that are important to your decision to invest in our common shares. You should pay special attention to the ARisk Factors@ section.

The phrase Afiscal year@ refers to the interim period from inception of September 3, 2009 to December 31 of the relevant year. All references to A$@ or Adollars@ mean United States dollars, unless otherwise indicated. All financial information with respect to us has been prepared in accordance with generally accepted accounting principles in the United States, unless otherwise indicated.

ONTARIO SOLAR ENERGY CORPORATION

We were incorporated pursuant to the Ontario Business Corporations Act on September 3, 2009 in the Province of Ontario, Canada. We are in the business of providing consulting services related to solar energy.

Operations

We have not begun operations. We have completed our business plan and raised $414,049 from the sale of our common stock to our sole officer and director and others.

Our sole officer and director will only spend 15 hours per week on our operations.

Corporate Information

We were incorporated under the laws of the Province of Ontario on September 3, 2009.

We have no subsidiary corporations.

The Offering

Common shares offered | 4,041,696 by selling shareholders |

Common shares to be outstanding after the offering | 11,541,666 shares |

Estimated initial public offering price | $0.25 per share. |

Selected financial data

The following financial information summarizes the more complete historical financial information at the end of this prospectus.

| Inception on September 3, 2009 To December 31, 2009 (Audited) |

Balance Sheet Total Assets Total Liabilities Stockholders Equity | $ $ $ | 314,043 1,052 312,991 |

| | Period from September 3, 2009 (date of inception) to December 31, 2009 (Audited) |

Income Statement Revenue Total Expenses Net Loss | $ $ $ | 0 101,058 (101,058) |

RISK FACTORS

Please consider the following risk factors before deciding to invest in our common stock.

Risks associated with Ontario Solar Energy Corporation:

1. Because our auditors have issued a going concern opinion and because our officer and director will not loan any additional money to us, we have to complete this offering to commence operations. If we do not complete this offering, we will not start our operations.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we will be an ongoing business for the next twelve months. As of the date of this prospectus we have not commenced operations. Because our officer and director is unwilling to loan or advance any additional capital to us, except to prepare and file reports with the SEC, we will have to complete this offering in order to commence operations.

2. We lack an operating history and have losses that we expect to continue into the future. There is no assurance our future operations will result in profitable revenues. If we cannot generate sufficient revenues to operate profitably, we may suspend or cease operations.

We were incorporated on September 3, 2009 and we have not started our proposed business operations or realized any revenues. We have no operating history upon which an evaluation of our future success or failure can be made. Our net loss since inception is $101,058. Our ability to achieve and maintain profitability and positive cash flow is dependent upon:

* * | our ability to attract clients who will buy our services our ability to generate revenues through the sale of our services |

Based upon current plans, we expect to incur operating losses in future periods because we will be incurring expenses and not generating revenues. We cannot guarantee that we will be successful in generating revenues in the future. Failure to generate revenues will cause us to suspend or cease operations.

3. Because our sole officer and director will only be devoting limited time to our operations, our operations may be sporadic which may result in periodic interruptions or suspensions of operations. This activity could prevent us from attracting purveyors and clients and result in a lack of revenues that may cause us to suspend or cease operations.

Our sole officer and director, Oliver Xing, will only be devoting limited time to our operations. Oliver Xing will be devoting approximately 15 hours per week of his time to our operations. Because our sole officer and director will only be devoting limited time to our operations, our operations may be sporadic and occur at times which are convenient to him. As a result, operations may be periodically interrupted or suspended which could result in a lack of revenues and a possible cessation of operations.

4. Because we have only one officer and director who has no formal training in financial accounting and management, who is responsible for our managerial and organizational structure, in the future, there may not be effective disclosure and accounting controls to comply with applicable laws and regulations which could result in fines, penalties and assessments against us.

We have only one officer and director. He has no formal training in financial accounting and management, however, he is responsible for our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes Oxley Act of 2002. While Oliver Xing has no formal training in financial accounting matters, he has been preparing the financial statements that have been audited and reviewed by our auditors and included in this prospectus. When the disclosure and accounting controls referred to above are implemented, he will be responsible for the administration of them. Should he not have sufficient experience, he may be incapable of creating and implementing the controls which may cause us to be subject to sanctions and fines by the SEC which ultimately could cause you to lose your investment. However, because of the small size of our expected operations, we believe that -he will be able to monitor the controls he will have created and will be accurate in assembling and providing information to investors.

5. If Oliver Xing, our sole officer and director, should resign or die, we will not have a chief executive officer which could result in our operations suspending. If that should occur, you could lose your investment.

Oliver Xing is our sole officer and director. We are extremely dependent upon him to conduct our operations. If he should resign or die we will not have a chief executive officer. If that should occur, until we find another person to act as our chief executive officer, our operations could be suspended. In that event it is possible you could lose your entire investment.

Risks associated with this offering:

6. Because Oliver Xing, our sole shareholder will own more than 38.99% of the outstanding shares after this offering, he will retain control of us and be able to decide who will be directors and you may not be able to elect any directors which could decrease the price and marketability of the shares.

Oliver Xing will still own 7,000,000 shares of our common stock and will continue to control us. As a result, after completion of this offering, regardless of the number of shares sold by selling shareholders, Oliver Xing will be able to elect all of our directors and control our operations, which could decrease the price and marketability of the shares.

7. Because there is no public trading market for our common stock, you may not be able to resell your stock.

There is currently no public trading market for our common stock. Therefore there is no central place, such as stock exchange or electronic trading system, to resell your shares. If you do want to resell your shares, you will have to locate a buyer and negotiate your own sale.

8. Because the SEC imposes additional sales practice requirements on brokers who deal in our shares that are penny stocks, some brokers may be unwilling to trade them. This means that you may have difficulty reselling your shares and this may cause the price of the shares to decline.

Our shares would be classified as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934 and the rules promulgated there under which impose additional sales practice requirements on brokers/dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, the broker/dealer must make a special suitability determination and receive from you a written agreement prior to making a sale for you. Because of the imposition of the foregoing additional sales practices, it is possible that brokers will not want to make a market in our shares. This could prevent you from reselling your shares and may cause the price of the shares to decline.

9. Since we are a Canadian company and most of our assets and key personnel are located in Canada, you may not be able to enforce any United States judgment for claims you may bring against us, our assets, our key personnel or the experts named in this prospectus.

We have been organized under the laws of the Province of Ontario, Canada. Many of our assets are located outside the United States. In addition, a majority of the members of our board of directors and our officers and the experts named in this prospectus are residents of countries other than the United States. As a result, it may be impossible for you to affect service of process within the United States upon us or these persons or to enforce against us or these persons any judgments in civil and commercial matters, including judgments under United States federal securities laws. In addition, a Canadian court may not permit you to bring an original action in Canada or to enforce in Canada a judgment of a U.S. court based upon civil liability provisions of U.S. federal securities laws.

10. Forward Looking Statements.

This prospectus contains forward-looking statements. We intend to identify forward-looking statements in this prospectus using words such as Aanticipates,@ Awill,@ Abelieves,@ Aplans,@ Aexpects,@ Afuture,@ Aintends@ or similar expressions. These statements are based on our beliefs as well as assumptions we made using information currently available to us. Because these statements reflect our current views concerning future events, these statements involve risks, uncertainties and assumptions. Actual future results may differ significantly from the results discussed in the forward-looking statements. Some, but not all, of the factors that may cause these differences include those discussed in the Risk Factors section. You should not place undue reliance on these forward-looking statements.

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares by selling shareholders.

DIVIDEND POLICY

We have never declared or paid any dividends on our capital stock. We intend to retain earnings, if any, to fund the operation and growth of our business and do not anticipate paying any cash dividends in the foreseeable future.

CAPITALIZATION

The following table sets forth our capitalization at December 31, 2009, on a historical basis and as adjusted to reflect the sale of the shares. No proceeds from the sale of shares of common stock by Selling Shareholders will be received by us.

This table should be read in conjunction with the section entitled, Management's Discussion and Analysis of Financial Condition and Results of Operations; our Financial Statements and Notes; and other financial and operating data included elsewhere in this prospectus.

| | | As Adjusted After Offering |

| | Actual | 100% |

Common Stock: unlimited authorized shares with no par value, issued and outstanding | | 11,541,666 | | 11,541,666 |

| | | | | |

| TOTAL STOCKHOLDERS' EQUITY | $ | 312,991 | $ | 312,991 |

| | | | | |

DILUTION

There will be no dilution as a result of the sale of shares of common stock by the selling shareholders.

SELECTED FINANCIAL AND OTHER DATA

The following financial information summarizes the more complete historical financial information at the end of this prospectus.

| Inception on September 3, 2009 To December 31, 2009 (Audited) |

Balance Sheet Total Assets Total Liabilities Stockholders Equity | $ $ $ | 314,043 1,052 312,991 |

| | Period from September 3, 2009 (date of inception) to December 31, 2009 (Audited) |

Income Statement Revenue Total Expenses Net Loss | $ $ $ | 0 101,058 (101,058) |

MANAGEMENT=S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

This section of the prospectus includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this prospectus. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

We are a start-up stage corporation and have initiated limited operations, but not generated or realized any revenues from our business operations.

Our auditors have issued a going concern opinion. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues has incurred losses since inception resulting in an accumulated deficit of $101,058 as of December 31, 2009, further losses are anticipated in the development of its business raising substantial doubt about our ability to continue as a going concern. The ability to continue as a going concern is dependent upon us generating profitable operations in the future and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management intends to finance operating costs over the next twelve months with existing cash on hand and loans from director and or private placements of common stock.

Plan of Operation

We have raised the minimum amount in this offering, we believe we can satisfy our cash requirements during the next 12 months. We will not be conducting any product research or development. We do not expect to purchase any significant equipment. Further we do not expect significant changes in the number of employees.

Upon completion of our public offering, our specific goal is to profitably sell our advisory services. We intend to accomplish the foregoing through the following milestones:

| 1. | We will begin to acquire the equipment we need to begin operations. Acquiring the equipment we need will take up to 30 days. The cost of the equipment will be $10,000. We do not intend to hire employees. Our sole officer and director will handle our administrative duties. |

| 2. | After we acquire the equipment we need, we intend to contact companies through our website and by personal contact through Oliver Xing our sole officer and director. We also intend to hire an outside web designer to begin development of the website. As additional relationships are created, we intend to create a data base of clients who we intend to interest in new programs. This promotion will be ongoing through the life of our operations. |

| 3. | In approximately 90 days, we intend to promote our services through traditional sources such as business publications, letters, emails, flyers and mailers. We also intend to attend solar energy conferences. We intend to promote our services to corporations to become users of our advisory services. Initially we will aggressively court contacts provided by our president, Oliver Xing. We believe that it will cost a minimum of $15,000 for our marketing campaign. |

| 4. | Within 90 days from the initial launch of our marketing program, we believe that we will begin generating fees from our advisory services. |

In summary, we should implement our business plan and expect to be engaging clientele within 90 days and we estimate that we will generate revenue 120 to 180 days after beginning operations.

Until our website is fully operational, we do not believe that clients will use our advisory services. We believe, however, that once our website is operational, we will be able to offer advisory services to potential clients. In this regard, we expect that clients will be able to download some of our literature and advice from our website, for a fee, and we will be able to provide real time interactive consultations.

If we are unable to negotiate suitable terms with service providers to enable us to represent their companies, or if we are unable to attract clients to use our advisory services, we may have to suspend or cease operations.

If we cannot generate sufficient revenues to continue operations, we will suspend or cease operations. If we cease operations, we do not know what we will do and we do not have any plans to do anything else.

Limited operating history; need for additional capital

There is no historical financial information about us upon which to base an evaluation of our performance. We are in start-up stage operations and have not generated any revenues. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources and possible cost overruns due to price and cost increases in services and products.

To become profitable and competitive, we have to engage clients and generate revenues from the sale of our advisory services.

We intend to use the funds we acquired in our private placements to conduct our operations. Our current funds will last at least one year.

Results of operations

From Inception on September 3, 2009 to December 31, 2009

Since inception, we incorporated the company, completed our private placement, hired the attorney, and hired the auditor for the preparation of this registration statement. We have prepared an internal business plan. We have reserved the domain name Awww.ontariosolarcorp.com@. Our loss since inception is $101,058, all of which is for the general and administrative expenses. We have started limited operations.

Since inception, we sold 11,541,666 shares of common stock to 23 persons in consideration of $414,049.

Liquidity and capital resources

As of the date of this prospectus, we have yet to generate any revenues from our business operations.

As of December 31, 2009, our total assets were $314,043 and our total liabilities were $1,052. As of December 31, 2009, we had cash of $314,039.

BUSINESS

General

We were incorporated in the Province of Ontario, Canada on September 3, 2009. We have not started operations. We intend to provide consulting services to corporations which will assist them with the development of their solar projects. We have not generated any revenues and the only operation we have engaged in is the development of a business plan. We maintain our statutory registered agent's office and our business office is located at 255 Duncan Mill Road, Suite 203, Toronto, Ontario M3B 3H9. Our telephone number is (416) 510-2991.

We have no plans to change our planned business activities or to combine with another business, and we are not aware of any events or circumstances that might cause these plans to change. We have not begun operations and will not begin operations until we have completed this offering. Our plan of operation is prospective and there is no assurance that we will ever begin operations.

Background

Electric power is used to operate businesses, industries, homes, offices and provides the power for our communications, entertainment, transportation and medical needs. As our energy supply and distribution mix changes, electricity is likely to be used more for local transportation (electric vehicles) and space/water heating needs. According to the Edison Electric Institute, the electric power industry in the U.S. is over $218 billion in size, and will continue to grow with our economy.

According to the U.S. Department of Energy (DOE), electricity is generated from the following: coal - 51%, nuclear -21%, gas - 16%, hydro - 6%, and oil - 3%, with renewable energy contributing 3%. “Renewable Energy” typically refers to non-traditional energy sources, including solar energy. Due to continuously increasing energy demands, we believe the electric power industry faces the following challenges:

| | · | Limited Energy Supplies. The primary fuels that have supplied this industry, fossil fuels in the form of oil, coal and natural gas, are limited. Worldwide demand is increasing at a time that industry experts have concluded that supply is limited. Therefore, the increased demand will probably result in increased prices, making it more likely that long-term average costs for electricity will continue to increase. |

| | · | Generation, Transmission and Distribution Infrastructure Costs. Historically, electricity has been generated in centralized power plants transmitted over high voltage lines, and distributed locally through lower voltage transmission lines and transformer equipment. As electricity needs increase, these systems will need to be expanded. Without further investments in this infrastructure, the likelihood of power shortages (“brownouts” and “blackouts”) may increase. |

| | · | Stability of Suppliers. Since many of the major countries who supply fossil fuel are located in unstable regions of the world, purchasing oil and natural gas from these countries may increase the risk of supply shortages and cost increases. |

| | · | Environmental Concerns and Climate Change. Concerns about global warming and greenhouse gas emissions has resulted in the Kyoto Protocol various states enacting stricter emissions control laws and utilities in several states being required to comply with Renewable Portfolio Standards, which require the purchase of a certain amount of power from renewable sources. |

Solar energy is the underlying energy source for renewable fuel sources, including biomass fuels and hydroelectric energy. By extracting energy directly from the sun and converting it into an immediately usable form, either as heat or electricity, intermediate steps are eliminated. We believe, in this sense, solar energy is one of the most direct and unlimited energy sources.

Solar energy can be converted into usable forms of energy either through the photovoltaic effect (generating electricity from photons) or by generating heat (solar thermal energy). Solar thermal systems include traditional domestic hot water collectors (DHW), swimming pool collectors, and high temperature thermal collectors (used to generate electricity in central generating systems). DHW thermal systems are typically distributed on rooftops so that they generate heat for the building on which they are situated. High temperature thermal collectors typically use concentrating mirror systems and are typically located in remote sites.

According to SolarBuzz, a research and consulting firm, the global solar power market, as defined by solar power system installations, had an estimated $17.2 billion in revenue in 2007. The U.S. solar power installation market comprised approximately 8% of the total global market installations, reaching approximately 220 megawatts installed during 2007. According to Solarbuzz, the residential and small commercial market segments represent approximately 65% of the U.S. market and are expected to continue to do so through 2010.

Anatomy of a Solar Power System

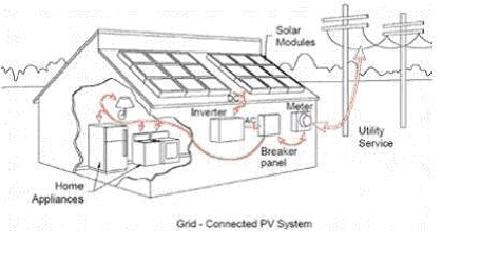

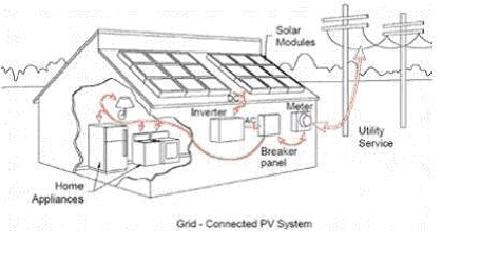

Solar power systems convert the energy in sunlight directly into electrical energy within solar cells based on the photovoltaic effect. Multiple solar cells, which produce DC power, are electrically interconnected into solar panels. A typical 180 watt solar panel may have 72 individual solar cells. Multiple solar panels are electrically wired together. The number of solar panels installed on a building are generally selected to meet that building’s annual electrical usage, or selected to fill available un-shaded roof or ground space. Solar panels are electrically wired to an inverter, which converts the power from DC to AC and interconnects with the utility grid. The following diagram schematically shows a typical solar power system:

Solar Electric Cells. Solar electric cells convert light energy into electricity at the atomic level. The conversion efficiency of a solar electric cell is defined as the ratio of the sunlight energy that hits the cell divided by the electrical energy that is produced by the cell. By improving this efficiency, we believe solar electric energy becomes competitive with fossil fuel sources. The earliest solar electric devices converted about 1%-2% of sunlight energy into electric energy. Current solar electric devices convert 5%-25% of light energy into electric energy (the overall efficiency for solar panels is lower than solar cells because of the panel frame and gaps between solar cells), and current mass produced panel systems are substantially less expensive than earlier systems. Effort is the industry is currently being directed towards the development of new solar cell technology to reduce per watt costs and increase area efficiencies.

Solar Panels. Solar electric panels are composed of multiple solar cells, along with the necessary internal wiring, aluminum and glass framework, and external electrical connections. Although panels are usually installed on top of a roof or on an external structure, certain designs include the solar electric cells as part of traditional building materials, such as shingles and rolled out roofing. Solar electric cells integrated with traditional shingles is usually most compatible with masonry roofs and, while it may offset costs for other building materials and be aesthetically appealing, it is generally more expensive than traditional panels.

Inverters. Inverters convert the DC power from solar panels to the AC power used in buildings. Grid-tie inverters synchronize to utility voltage and frequency and only operate when utility power is stable (in the case of a power failure these grid-tie inverters shut down to safeguard utility personnel from possible harm during repairs). Inverters also operate to maximize the power extracted from the solar panels, regulating the voltage and current output of the solar array based on sun intensity.

Monitoring. There are two basic approaches to access information on the performance of a solar power system. We believe that the most accurate and reliable approach is to collect the solar power performance data locally from the inverter with a hard-wired connection and then transmit that data via the internet to a centralized database. Data on the performance of a system can then be accessed from any device with a web browser, including personal computers and cell phones. As an alternative to web-based remote monitoring, most commercial inverters have a digital display on the inverter itself that shows performance data and can also display this data on a nearby personal computer with a hard-wired or wireless connection.

Net Metering. The owner of a grid-connected solar electric system may not only buy, but may also sell, electricity each month. This is because electricity generated by the solar electric system can be used on-site or fed through a meter into the utility grid. Utilities are required to buy power from owners of solar electric systems (and other independent producers of electricity) under the Public Utilities Regulatory Policy Act of 1978 (PURPA). California’s net metering law provides that all utilities must allow customers with solar electric systems rated up to 1.5 megawatts (“ mW”) to interconnect with the local utility grid and receive retail value for the electricity produced. When a home or business requires more electricity than the solar power array is generating (for example, in the evening), the need is automatically met by power from the utility grid. When a home or business requires less electricity than the solar electric system is generating, the excess is fed (or sold) back to the utility and the electric meter actually spins backwards. Used this way, the utility serves as a backup to the solar electric similar to the way in which batteries serve as a backup in stand-alone systems.

Solar Power Benefits

The direct conversion of light into energy offers the following benefits compared to conventional energy sources:

| | · | Economic — Once a solar power system is installed, the cost of generating electricity is fixed over the lifespan of the system. There are no risks that fuel prices will escalate or fuel shortages will develop. In addition, cash paybacks for systems range from 5 to 25 years, depending on the level of state and federal incentives, electric rates, annualized sun intensity and installation costs. Solar power systems at customer sites generally qualify for net metering to offset a customer’s highest electric rate tiers, at the retail, as opposed to the wholesale, electric rate. |

| | · | Convenience — Solar power systems can be installed on a wide range of sites, including small residential roofs, the ground, covered parking structures and large industrial buildings. Solar power systems also have few, if any, moving parts and are generally guaranteed to operate for 25 years resulting, we believe, in low maintenance and operating costs and reliability compared to other forms of power generation. |

| | · | Environmental — We believe solar power systems are one of the most environmentally friendly way of generating electricity. There are no harmful greenhouse gas emissions, no wasted water, no noise, no waste generation and no particulates. Such benefits continue for the life of the system. |

| | · | Security — Producing solar power improves energy security both on an international level (by reducing fossil energy purchases from hostile countries) and a local level (by reducing power strains on local electrical transmission and distribution systems). |

| | · | Infrastructure — Solar power systems can be installed at the site where the power is to be used, thereby reducing electrical transmission and distribution costs. Solar power systems installed and operating at customer sites may also save the cost of construction of additional energy infrastructure including power plants, transmission lines, distribution systems and operating costs. |

We believe escalating fuel costs, environmental concerns and energy security make it likely that the demand for solar power systems will continue to grow. The federal government, and several states, have put a variety of incentive programs in place that directly spur the installation of grid-tied solar power systems, so that customers will “purchase” their own power generating system rather than “renting” power from a local utility. These programs include:

| | · | Rebates — to customers (or to installers) to reduce the initial cost of the solar power system, generally based on the size of the system. California, New Jersey, New York, Connecticut, Colorado and other states have rebates that can substantially reduce initial costs. |

| | · | Renewable Energy Grants – the federal government will provide grants equal to 30% of the cost of commercial solar power systems placed in service in 2009 and 2010, and solar power systems that are not placed into service prior to December 31, 2010 qualify for the grants so long as construction begins prior to December 31, 2010 and they are placed into service by December 31, 2017. |

| | · | Tax Credits — federal and state income tax offsets directly reducing ordinary income tax. New York and California currently offer state tax credits. There is currently a 30% federal tax credit for residential and commercial solar power systems. Commercial customers can elect either a 30% cash payment from the federal grant program or the traditional tax credit. Effective from the beginning of 2009, the $2,000 cap on the federal tax credit for residential solar power systems has been removed, and that credit is now uncapped. |

| | · | Accelerated Depreciation — solar power systems installed for businesses (including applicable home offices) are generally eligible for accelerated depreciation. |

| | · | Net Metering — provides a full retail credit for energy generated. |

| | · | Feed-in Tariffs — are additional credits to consumers based on how much energy their solar power system generates. Feed-in Tariffs set at appropriate rates have been successfully used in Europe to accelerate growth. |

| | · | Renewable Portfolio Standards — require utilities to deliver a certain percentage of power generated from renewable energy sources. |

| | · | Renewable Energy Credits (RECs) — are additional credits provided to customers based on the amount of renewable energy they produce. |

| | · | Solar Rights Acts — state laws to prevent unreasonable restrictions on solar power systems. California’s Solar Rights Act has been updated several times in past years to make it easier for customers of all types and in all locations to install a solar power system. |

| | · | PPA's — Power Purchase Agreements, or agreements between a solar power system purchaser and an electricity user under which electricity is sold/purchased on a long-term basis. |

According to PV News, California and New Jersey account for approximately 90% of the U.S. residential market. We believe this is largely attributable to the fact that they currently have the most attractive incentive programs. The California Solar Initiative provides $3.2 billion of incentives toward solar development over 11 years. In addition, recently approved regulations in New Jersey require solar photovoltaic power to provide 2% of New Jersey’s electricity needs by 2020, requiring the installation of 1,500 megawatts of solar electric power. According to DSIRE (the Database of State Incentives for Renewable Energy) at least 18 other states also have incentive programs. We expect that such programs, as well as Federal grants, tax rebates and other incentives, will continue to drive growth in the solar power market for the near future.

Challenges Facing the Solar Power Industry

We believe the solar power industry faces three key challenges:

| | · | Improve Customer Economics — In most cases, the cost to customers for electricity produced by a solar power system at the customer’s site is comparable to conventional, utility-generated power. We believe lower equipment (primarily solar panels) and installation costs would reduce the total cost of a system and increase the potential market for solar power. |

| | · | Increase System Performance and Reliability — We believe that a design that incorporates factory assembly of an integrated solar power system versus field assembly provides a more reliable solution. A system with these characteristics will deliver improved system performance and allow the customer to achieve the shortest possible payback. |

| | · | Improve Aesthetics — We believe that customers prefer solar panels that blend into existing roof surfaces with fewer shiny parts, mounted closely to the roof surface and have more of a “skylight” appearance than the traditional rooftop metal framed solar panels raised off the roof. |

Solar energy is an integral aspect of the United Nations Climate Change program with regulatory and voluntary initiatives being implemented by countries, states and corporations across the globe.

Throughout the world massive amounts of energy is consumed and as a result generates emits greenhouse gases which than any other country in the world with the exception of the United States. It is expected that China will surpass the United States in greenhouse gases emissions by 2010. The expansion of China's power plants alone is estimated to include over 500 new coal-fired power plants by 2012. We estimate that the total clean energy market in which we participate is valued at $7.4 billion annually. We define the clean energy sector as being comprised of three segments: Alternative Energy resources, Smart Grid technology, and conservation and efficiency.

Our Strategy

We intend to establish a consulting business to provide advice regarding solar energy, thereby omitting the use of fossil fueled combustion for steam generation. Our consulting services will focus on issues such as skills assessment, clarifying goals and identifying targets, adapting to a specific corporate culture, effectively communicating with employees, reducing and eliminating personality conflict within the organization, and time management. At the outset, Oliver Xing will be responsible for providing these services. Oliver Xing has experience in general business skills provide the basis for successfully implementing our business plan. However, in the event that Oliver Xing does not believe that he is qualified to provide effective consulting services related to one or more issues, we will hire others to provide such services.

As of the date of this report, we do not have any clientele under contract with us nor have we commenced with the provision of any management/consulting services.

Target Market

Initially, Oliver Xing will promote our services, discussing them with companies that are seeking advice about solar energy. We also anticipate utilizing several other marketing activities in our attempt to make our services known to corporations and attract clientele. These marketing activities will be designed to inform potential clients about the benefits of using our services and will include the following: development and distribution of marketing literature, direct mail and email, advertising, promotion of our website, and developing industry analyst relations.

We intend to target companies that are seeking to convert to solar energy as a viable alternative energy source. Worldwide, those companies are readily available as entities seeking Green House Credits since their operations require the acquisition of such credits or mandate a cessation of operations. In addition to our website, we intend to send printed materials to such companies we have identified as possible candidates for our services. We will rely upon Oliver Xing to initiate contacts with companies and attract clientele to us.

The solar energy market is growing at a very fast pace for which we are ideally placed with an integrated portfolio of technology, solutions and services. The growth in the market is providing immediate business opportunities for the early mover companies such as ours. The market requires new generation, innovative and economical technologies and we have developed a portfolio which is attracting considerable interest from international customers who are required to comply with the emissions reduction and renewable energy legislation being imposed or voluntarily being adopted.

Revenue

Initially, we intend to generate revenue from three sources:

1. Term Fee - By charging a fee for given terms;

2. Fixed Fee - By charging a fixed fee;

3. Hourly Fee - By charging an hourly fee for advisory services.

We intend to develop and maintain a database of all our clients so that we can anticipate their various needs and continuously build and expand our advisory services.

There is no assurance that we will be able to interest companies in our services. If we do not, we will not generate revenue from our prospective business model.

Government Regulation

We do not need to pursue or satisfy any special licensing or regulatory requirements before establishing or delivering our intended services other than the requisite business licenses. If new government regulations, laws, or licensing requirements are passed, it could cause us to restrict or eliminate delivery of any of our intended services. New regulations and licensing requirements may adversely affect our business. For example, if we were required to obtain a government issued license for the purpose of providing consulting services, we could not guarantee that we would qualify for such license. If a licensing requirement existed, and we were not able to qualify, our business could suffer. Presently, to our knowledge, no regulations, laws, or licensing requirements exist or are likely to be implemented in the near future that are reasonably expected to have a material impact on our prospective sales, revenues, or income from our business operations.

Competition

We compete with other environmental consulting companies. We will not be differentiating ourselves from them, but merely competing with them. The environmental consulting market is a large, fragmented market and may be difficult to penetrate. Our competitive position within the industry is negligible in light of the fact that we have not started our operations. Older, well-established environmental consulting firms with records of success currently attract customers. Since we have not started operations, we cannot compete with them on the basis of reputation. We expect to compete on the basis of the range of advisory services and the quality of advisory services we intend to provide. At this time, our principal method of competition will be through personal contact with potential clients with whom Oliver Xing has an existing relationship.

Oliver Xing, our president, will be devoting approximately 15 hours a week of his time to our operations. Because Oliver Xing will only be devoting limited time to our operations, our operations may be sporadic and occur at times which are convenient to him. As a result, operations may be periodically interrupted or suspended which could result in a lack of revenues and a cessation of operations.

Insurance

We do not maintain any insurance and do not intend to maintain insurance in the future. Because we do not have any insurance, if we are made a party to a liability action, we may not have sufficient funds to defend the litigation. In that event, a judgment could be rendered against us that could cause us to cease operations.

Employees

We are a development stage company and currently have no employees, other than our sole officer and director. We intend to hire additional employees on an as-needed basis.

Offices

Our administrative offices are currently located at 255 Duncan Mill Road, Suite 203, Toronto, Ontario M3B 3H9. Our telephone number is (416) 510-2991. This is Mr. Xing's personal office. We use approximately50 square feet of space on a rent-free basis.

MANAGEMENT

Officers and Directors

Our sole director will serve until his successor is elected and qualified. Our sole officer is elected by the board of directors to a term of one (1) year and serves until his successor is duly elected and qualified, or until he is removed from office. The board of directors has no nominating, auditing or compensation committees.

The name, address, age and position of our present officers and directors are set forth below:

| Name and Address | Age | Position(s) |

Oliver Xing 255 Duncan Mill Road, Suite 203, Toronto, Ontario M3B 3H9 | 45 | president, principal executive officer, secretary, treasurer, principal financial officer, principal accounting officer and sole member of the board of directors. |

The person named above has held his offices/positions since inception of our company and is expected to hold his offices/positions until the next annual meeting of our stockholders.

Background of officers and directors

Since our inception on September 3, 2009, Oliver Xing has been our president, principal executive officer, secretary, treasurer, principal financial officer, principal accounting officer and sole member of the board of directors. Since March 18, 2005, Mr. Xing has been the managing partner of CRR Capital Markets, Inc. an exempt market dealer located in Ontario, Canada. Further, since 1996, Mr. Xing has been a business consultant to Toronto based corporations.

During the past five years, Oliver Xing has not been the subject of the following events:

1. Any bankruptcy petition filed by or against any business of which Mr. Xing was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time.

2. Any conviction in a criminal proceeding or being subject to a pending criminal proceeding.

3. An order, judgment, or decree, not subsequently reversed, suspended or vacated, or any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting Mr. Xing=s involvement in any type of business, securities or banking activities.

4. Found by a court of competent jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Future Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Audit Committee Financial Expert

We do not have an audit committee financial expert. We do not have an audit committee financial expert because we believe the cost related to retaining a financial expert at this time is prohibitive. Further, because we have no operations, at the present time, we believe the services of a financial expert are not warranted.

Conflicts of Interest

The only conflict that we foresee are that our sole officer and director will devote time to projects that do not involve us.

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid by us since our inception on September 3, 2009 through December 31, 2009 for each of our officers. This information includes the dollar value of base salaries, bonus awards and number of stock options granted, and certain other compensation, if any. The compensation discussed addresses all compensation awarded to, earned by, or paid or named executive officers.

Summary Compensation Table

| | | | | | | Non- | Nonqualified | | |

| | | | | | | Equity | Deferred | All | |

| Name | | | | | | Incentive | Compensa- | Other | |

| and | | | | Stock | Option | Plan | tion | Compen- | |

| Principal | | Salary | Bonus | Awards | Awards | Compensation | Earnings | sation | Total |

| Position | Year | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) |

| Oliver Xing | 2009 | 0 | 0 | 60,000 | 0 | 0 | 0 | 0 | 60,000 |

| President | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| | 2007 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

We have no employment agreements with any of our officers. We do not contemplate entering into any employment agreements until such time as we begin profitable operations.

The compensation discussed herein addresses all compensation awarded to, earned by, or paid to our named executive officers.

There are no other stock option plans, retirement, pension, or profit sharing plans for the benefit of our officers and directors other than as described herein.

Compensation of Directors

The member of our board of directors is not compensated for his services as a director. The board has not implemented a plan to award options to any directors. There are no contractual arrangements with any member of the board of directors. We have no director's service contracts. The following table sets for compensation paid to our directors from inception on September 3, 2009 to our first year end on December 31, 2009.

Director=s Compensation Table

| | Fees | | | | | | |

| | Earned | | | | Nonqualified | | |

| | or | | | Non-Equity | Deferred | | |

| | Paid in | Stock | Option | Incentive Plan | Compensation | All Other | |

| | Cash | Awards | Awards | Compensation | Earnings | Compensation | Total |

| Name | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) | (US$) |

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) |

| Oliver Xing | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Long-Term Incentive Plan Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

Indemnification

Our articles of incorporation do not provide for indemnification. Our by-Law does provide indemnification for our Director and officer of the Corporation.

PRINCIPAL AND SELLING SHAREHOLDERS

The following table sets forth, as of the date of this prospectus, the total number of shares owned beneficially by each of our directors, officers and key employees, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The table also reflects what their ownership will be assuming completion of the sale of all shares in this offering. The stockholders listed below have direct or indirect ownership of their shares and possesses sole voting and dispositive power with respect to the shares.

The percentage of beneficial ownership before the offering is based on 11,541,666 common shares outstanding as of December 31, 2009.

| | Number of | | | |

| Name of owner | Shares | Position | Percent of Class | |

Oliver Xing | 6,000,000 | President, President, Principal | 51.99% | |

| | | Executive Officer, Secretary, | | |

| | | Treasurer, Principal Financial Officer, | | |

| | | Principal Accounting Officer, and | | |

| | | sole director | | |

| | | | | |

| ALL OFFICERS AND | 6,000,000 | | 51.99% | |

| DIRECTORS AS A GROUP | | | | |

| (1 person) | | | | |

| | | | | |

| Early Bird Capital Corporation[1] | 3,000,000 | | 25.99% | |

| | | | | |

| | | | | |

| | | | | |

| 1547698 Ontario Limited[2] | 1,000,000 | | 8.66% | |

| | | | | |

| | | | | |

| [1] | Oliver Xing currently holds 100% of the voting shares of Early Bird Capital Corporation. |

| [2] | He Zheng currently holds 100% of the voting shares of 1547698 Ontario Limited. |

As of December 31, 2009, there were no U.S. holders of our common shares.

There are no options outstanding to purchase our shares of common stock.

Selling Shareholders

The following holders of our common shares will sell their common shares as set forth in the table below. The percentage of beneficial ownership before and after the offering is based on 11,541,666 common shares outstanding as of December 31, 2009. Oliver Xing, our sole officer and director is selling 1,500,000 shares of common stock.

Name and Address of | Number of Shares Beneficially Owned | Number of Shares | Number of Shares Beneficially Owned | Percentage of Shares Beneficially Owned |

| Beneficial Owner | Before Offering | Being Offered | After Offering | Before Offering | After Offering |

| 1547698 Ontario Limited[1] | 1,000,000 | 250,000 | 750,000 | 8.66% | 6.50% |

| Cora Ke Chen | 10,000 | 10,000 | 0 | 0.09% | 0.00% |

| Duncan Ma | 10,000 | 10,000 | 0 | 0.09% | 0.00% |

| Earlybird Capital Corp.[2] | 3,000,000 | 750,000 | 2,250,000 | 25.99% | 19.49% |

| Fang Wang | 50,000 | 50,000 | 0 | 0.43% | 0.00% |

| Ge Wang | 25,000 | 25,000 | 0 | 0.22% | 0.00% |

| Hongcheng Wei | 75,000 | 75,000 | 0 | 0.65% | 0.00% |

| Jian Liu | 13,333 | 13,333 | 0 | 0.12% | 0.00% |

| Kai Liu | 15,000 | 15,000 | 0 | 0.13% | 0.00% |

| Li Yang | 235,000 | 235,000 | 0 | 2.04% | 0.00% |

| Li Ying | 500,000 | 500,000 | 0 | 4.33% | 0.00% |

| Ling Wang | 50,000 | 50,000 | 0 | 0.43% | 0.00% |

| Toronto College of Technology Inc.[3] | 20,000 | 20,000 | 0 | 0.17% | 0.00% |

| Wei Qian | 13,333 | 13,333 | 0 | 0.12% | 0.00% |

| Xing, Oliver[4] | 6,000,000 | 1,500,000 | 4,500,000 | 51.99% | 38.99% |

| Xinyu Liu | 115,000 | 115,000 | 0 | 1.00% | 0.00% |

| Xuelin He | 50,000 | 50,000 | 0 | 0.43% | 0.00% |

| Yan Gao | 20,000 | 20,000 | 0 | 0.17% | 0.00% |

| Yude Ling | 15,000 | 15,000 | 0 | 0.13% | 0.00% |

| Zhaohui Jia | 100,000 | 100,000 | 0 | 0.87% | 0.00% |

| Zhaoyong Cheng | 50,000 | 50,000 | 0 | 0.43% | 0.00% |

| Zhigeng Fu | 150,000 | 150,000 | 0 | 1.30% | 0.00% |

| Zhigang Yang | 25,000 | 25,000 | 0 | 0.22% | 0.00% |

| TOTAL | 11,541,666 | 4,041,666 | 7,500,000 | 100.00% | 64.99% |

[1] 1547698 Ontario Limited is owned and controlled by He Zheng, the wife of Oliver Xing, our president. He Zheng has voting and investment control over the shares held by 1547698 Ontario Limited.

[2] Early Bird Capital Corporation is owned and controlled by Oliver Xing who has voting and investment control over the shares held by Early Bird Capital Corporation.

[3] Toronto College of Technology Inc. is owned and controlled by Paul Pu, who has voting and investment control over the shares held by Toronto College of Technology Inc.

[4] Sales made Oliver Xing, our sole officer and director, are deemed sales by an underwriter.

None of the selling shareholders has, or has had within the past three years, held any position, office, or other material relationship with us or any of our predecessors or affiliates other than Oliver Xing.

None of the selling shareholders is a broker-dealer, an affiliate of a broker dealer.

RELATED PARTY TRANSACTIONS

On September 3, 2009, we issued 6,000,000 restricted shares of common stock to our sole officer and director, Oliver Xing in consideration of $60,000.00.

On September 3, 2009, we issued 1,000,000 restricted shares of common stock to 1547698 Ontario Limited, in consideration of $10,000.00. 1547698 Ontario Limited is owned and controlled by He Zheng, the wife of Oliver Xing, our president. He Zheng has voting and investment control over the shares held by 1547698 Ontario Limited.

On September 3, 2009, we issued 3,000,000 restricted shares of common stocks to EarlyBird Capital Corporation, in consideration of $30,000. EarlyBird Capital Corporation is owned and controlled by Mr. Oliver Xing who has voting and investment control over the shares held by EarlyBird Capital Corporation.

As at December 31, 2009, the President had loaned the Corporation $1,052. The loan is non-interest bearing, due upon demand and unsecured.

Other than as disclosed above, neither our sole officer and director, or any associate or affiliate of the foregoing, has not participated in and have no other interest, direct or indirect, in any material transactions in which we have participated, or in any proposed transaction which has materially affected or will materially affect our company since inception on September 3, 2009 to the present.

There are no additional interests of management in transactions involving our company except as set forth above.

We will determine whether we will enter into a related party transaction on a case-by-case basis. We prohibit loans to our affiliates. Other than the foregoing, we have no policies or procedures for the review, approval or ratification of related party transactions.

DESCRIPTION OF SECURITIES

Common Stock

Our authorized capital stock consists of an unlimited number of shares of common stock, no par value per share. The holders of our common stock:

| * | have equal ratable rights to dividends from funds legally available if and when declared by our Board of Directors; |

| * | are entitled to share ratably in all of our assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of our affairs; |

| * | do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights; and |

| * | are entitled to one non-cumulative vote per share on all matters on which stockholders may vote. |

We refer you to our articles of incorporation, bylaws and the applicable statutes of the Province of Ontario for a more complete description of the rights and liabilities of holders of our securities.

Non-cumulative Voting

Holders of shares of our common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of our directors. After this offering is completed, present stockholders will own approximately -64.98% of our outstanding shares.

Cash Dividends

As of the date of this prospectus, we have not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of our Board of Directors and will depend upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Reports

After we complete this offering, we will not be required to furnish you with an annual report. Further, we will not voluntarily send you an annual report. We will be required to file reports with the SEC. The reports will be filed electronically. The reports we will be required to file are Forms 20-F and 6-K. You may read copies of any materials we file with the SEC at the SECs Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that will contain copies of the reports we file electronically. The address for the Internet site is www.sec.gov.

Stock Transfer Agent

Currently we have not retained a transfer agent. We act as our own stock transfer agent for our securities. We intend to retain Pacific Stock Transfer Company, Las Vegas, Nevada as our transfer agent upon SEC effectiveness of this registration statement.

UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

This description is our counsel=s opinion of the material U.S. federal income tax considerations to investors who hold our common shares as a capital asset. Our counsel is The Law Office of Conrad C. Lysiak, P.S., West First Avenue, Suite 903, Spokane, Washington 99201. This discussion is based upon, as of the date hereof, the applicable provisions of the U.S. Internal Revenue Code of 1986, as amended (the ACode@), Treasury Regulations promulgated or proposed thereunder, and administrative and judicial interpretation thereof, all of which are subject to change either prospectively or retroactively, or are subject to different interpretations. We have not obtained nor do we intend to obtain, a ruling from the Internal Revenue Service as to any United States federal income tax consequences discussed below and there can be no assurances that the Internal Revenue Service will not take contrary positions.

As used herein, the term AU.S. Holder@ means a beneficial owner of common shares that is for United States federal income tax purposes:

| * | a citizen or resident of the United States; |

| * | a corporation, or other entity taxed as a corporation for United States federal income tax purposes, created or organized in or under the laws of the United States or any political subdivision thereof; |

| * | an estate, the income of which is subject to United States federal income taxation regardless of its source; or |

| * | a trust, if both (a) a United States court is able to exercise primary supervision over the administration of the trust, and (b) one or more United States persons have the authority to control all substantial decisions of the trust. The discussion below does not address all of the United States federal income tax consequences that may be relevant to U.S. Holders in light of their particular circumstances, nor does it address the tax consequences to U.S. Holders subject to special treatment under the United States federal income tax laws, such as: |

| * | certain financial institutions; |

| * | insurance companies; |

| * | traders in securities that elect to mark-to-market; |

| * | securities dealers; |

| * | partnerships or other entities classified as partnerships for United States federal income tax purposes; |

| * | tax-exempt organizations; |

| * | persons that hold the common shares as part of an integrated investment (including a straddle); |

| * | persons owning, directly, indirectly or constructively, 10% or more of voting stock of Ontario Solar Energy Corporation; and |

| * | persons whose Afunctional currency@ is not the U.S. dollar. The discussion also does not address the tax consequences arising under the laws of any foreign, state or local jurisdiction. |

General

Distributions

Subject to the discussion under ASpecial Tax Provisions@ below, distributions of cash or property made by Ontario Solar Energy Corporation with respect to the common shares will constitute dividends to U.S. Holders, to the extent that the distributions are made out of current or accumulated earnings and profits of Ontario Solar Energy Corporation (as determined for United States federal income tax purposes). Dividends paid by Ontario Solar Energy Corporation are includable in a U.S. Holder=s gross income and are taxable as ordinary income. If a portion of a distribution made by Ontario Solar Energy Corporation with respect to the common shares exceeds its current and accumulated earnings and profits, that portion will be treated as nontaxable return of capital, which will reduce the U.S. Holder=s adjusted basis in the common shares (but not below zero). To the extent a distribution exceeds the U.S. Holder=s adjusted basis in the common shares; the distribution will constitute capital gain. Dividends received by a corporate U.S. Holder from Ontario Solar Energy Corporation will not be eligible for the dividends received deduction.

For United States foreign tax credit purposes, a distribution treated as a dividend for United States federal income tax purposes will constitute income from sources outside the United States. In the case of U.S. Holders who are not residents of Canada, the Canada-United States Income Tax Convention (1980), as amended (the AConvention@), provides that dividends received in respect of the common shares generally will be subject to a 15% Canadian withholding tax. Subject to limitations set forth in the Code, as modified by the Convention, including certain minimal holding periods, U.S. Holders may elect to claim a foreign tax credit against their U.S. federal income tax liability for Canadian tax withheld from dividends paid in respect of common shares. The limitation on foreign taxes eligible for the foreign tax credit is calculated separately with respect to specific classes of income. For this purpose, dividends paid by Ontario Solar Energy Corporation generally will constitute Apassive income,@ or in the case of certain U.S. Holders, Afinancial services income.@ The rules relating to the United States foreign tax credit are extremely complex and the availability of the foreign tax credit depends on numerous factors. Prospective investors are urged to consult their own tax advisors concerning the application of the United States foreign tax credit rules in light of their particular circumstances.

If a dividend is paid in a currency other than the U.S. dollar, the amount includible in a U.S. Holder=s gross income will be the U.S. dollar value of the dividend, calculated by reference to the exchange rate in effect on the date the U.S. Holder receives the dividend, regardless of whether the payment actually is converted into U.S. dollars. Gain or loss, if any, that a U.S. Holder realizes as a

result of currency exchange fluctuations during the period from the date the U.S. Holder includes the dividend in gross income to the date the U.S. Holder converts the payment into U.S. dollars will be treated as ordinary income or loss for United States federal income tax purposes. This gain or loss will be from sources within the United States for United States foreign tax credit purposes.

Dispositions

Subject to the discussion of ASpecial Tax Provisions@ immediately below, upon a sale or other taxable disposition of the common shares, a U.S. Holder will recognize taxable gain or loss in an amount equal to the difference between the amount of cash and the fair market value of other property that the U.S. Holder receives in the sale or other taxable disposition (the Aamount realized@) and the U.S. Holder=s adjusted tax basis in the common shares. Subject to the passive foreign investment company rules discussed below, the U.S. Holder=s gain or loss will be capital gain or loss. The gain or loss will be long-term capital gain or loss if the common shares were held by the U.S. Holder for more than one year.

Long-term capital gains recognized by certain non-corporate U.S. Holders (including individuals) are eligible for preferential United States federal income taxation rates. Any gain or loss recognized by U.S. Holders on a sale or other taxable disposition of the common shares will be treated as derived from U.S. sources for United States foreign tax credit purposes.

The deduction of capital losses is subject to certain limitations under the Code. A capital loss realized by a non-corporate U.S. Holder is allowable as an offset against capital gain and up to $3,000 of ordinary income. Any capital loss not utilized in any taxable year by a non-corporate U.S. Holder may be carried forward indefinitely and used to offset capital gain and up to $3,000 of ordinary income in any future taxable year of the non-corporate U.S. Holder. A capital loss realized by a corporate U.S. Holder is allowable as an offset only against capital gain. Any capital loss not utilized by a corporate U.S. Holder first must be carried back and applied against capital gain in the three years preceding the year of the sale or other taxable disposition giving rise to the capital loss, and then may be carried forward to the five taxable years subsequent to the year of the sale or other taxable disposition. The amount that a corporate U.S. Holder may carry back is limited, however, to an amount that does not increase or produce a net operating loss in the carry back year.

Backup Withholding and Information Reporting

Backup withholding and information reporting requirements may apply to distributions made by Ontario Solar Energy Corporation to a U.S. Holder with respect to the common shares, or to the proceeds of a sale, redemption or other disposition of the common shares. Under the backup withholding rules, a paying agent may be required to withhold tax from a U.S. Holder=s distributions or proceeds, if the U.S. Holder fails to furnish a correct taxpayer identification number and comply with certain certification procedures, or otherwise fails to comply with the applicable requirements of the backup withholding rules. Some U.S. Holders (including, among others, corporations) are exempt from the backup withholding requirements. Any amounts withheld under the backup withholding rules may be claimed by a U.S. Holder as a credit against the U.S. Holder=s United States federal income tax liability and the U.S. Holder may be entitled to receive a refund, provided that the required information is furnished to the Internal Revenue Service.

Special Tax Provisions

Some provisions of the Code specifically deal with the United States federal income tax treatment of investments by U.S. persons in foreign corporations and may alter the United States federal income tax consequences described above or propose special rules for United States foreign tax credit purposes.

Passive Foreign Investment Company

U.S. persons owning shares of a Apassive foreign investment company@ (APFIC@) are subject to a special United States federal income tax regime with respect to specified distributions received from the PFIC and gain from the sale or disposition of PFIC stock. A foreign corporation will be classified as a PFIC for United States federal income tax purposes in any taxable year in which, after applying relevant look-through rules with respect to the income and assets of subsidiaries, either:

| * | at least 75% of its gross income is Apassive income;@ or |

| * | on average at least 50% of the gross value of its assets is attributable to assets that produce passive income or are held for the production of passive income. |

For this purpose, passive income includes, among other things, dividends, interest, rents, royalties, gains from the disposition of passive assets and gains from commodities transactions, other than gains derived from Aqualified active sales@ of commodities and Aqualified hedging transactions@ involving commodities, within the meaning of applicable Treasury Regulations. Based on certain estimates of the gross income and gross assets of Ontario Solar Energy Corporation, Ontario Solar Energy Corporation does not believe that it currently is a PFIC, nor does Ontario Solar Energy Corporation anticipate becoming a PFIC in the foreseeable future. However, since PFIC status will be determined by Ontario Solar Energy Corporation on an annual basis and PFIC status depends upon the composition of Ontario Solar Energy Corporation= income and assets (including, among others, less than 25% owned equity investments), and the nature of its activities, from time to time, there can be no assurance that Ontario Solar Energy Corporation will not be considered a PFIC for any taxable year. We are unable to obtain an opinion of counsel at this time regarding PFIC status because the opinion of counsel is dependent upon the existing facts at the time the opinion is obtained. Upon filing our audited financial statements for the period ending December 31, 2006, we will file a post-effective amendment to this registration statement should it be determined that ONTARIO SOLAR ENERGY CORPORATION is a PFIC. Further, no ruling will be sought from the Internal Revenue Service, regarding the characterization of Ontario Solar Energy Corporation as a PFIC for United States federal income tax purposes.

If Ontario Solar Energy Corporation is treated as a PFIC for any taxable year during which a U.S. Holder held common shares, some adverse consequences could apply to the U.S. Holder (see discussion below). For this reason, if Ontario Solar Energy Corporation is treated as a PFIC for any taxable year, a U.S. Holder may desire to make an election to treat Ontario Solar Energy Corporation as a Aqualified electing fund@ (a AQEF@) with respect to the electing U.S. Holder. A QEF election should be made on or before the due date for filing the electing U.S. Holder=s United States federal income tax return for the first taxable year in which the common shares are held by the U.S. Holder and Ontario Solar Energy Corporation is treated as a PFIC.

If a timely QEF election is made, whether or not distributed by Ontario Solar Energy Corporation, the electing U.S. Holder will be required to annually include in gross income (a) as ordinary income, a pro-rata share of the ordinary earnings of Ontario Solar Energy Corporation, and (b) as long-term capital gain, a pro-rata share of the net capital gain of Ontario Solar Energy Corporation. An electing corporate U.S. Holder will not be eligible for the dividends received deduction with respect to the income or gain included in gross income under this rule. In addition, in the event that Ontario Solar Energy Corporation incurs a net loss for a taxable year, the loss will not be available as a deduction to an electing U.S. Holder, and may not be carried forward or back in computing the ordinary earnings and net capital gain of Ontario Solar Energy Corporation in other taxable years. In some cases in which a QEF does not distribute all of its earnings in a taxable year, electing U.S. Holders may be permitted to elect to defer the payment of some or all of their United States federal income taxes on the QEF=s undistributed earnings, subject to an interest charge on the deferred tax amount.

If Ontario Solar Energy Corporation is treated as a PFIC for any taxable year during which a U.S. Holder held common shares, Ontario Solar Energy Corporation will provide to a U.S. Holder, upon written request, all information and documentation that the U.S. Holder is required to obtain in connection with making a QEF election for United States federal income tax purposes.

A U.S. Holder fails to make a timely QEF election (or mark-to-market election, see discussion below) for any taxable year that Ontario Solar Energy Corporation is treated as a PFIC, the United States federal income tax consequences to the U.S. Holder will be determined under the so-called Ainterest charge@ method. Under the interest charge regime: