As filed with the Securities and Exchange Commission on June 30, 2010

File No. 000-53938

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 1

to

Form 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the

Securities Exchange Act of 1934

Nevada Property 1 LLC

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 27-1695189 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 4285 Polaris Avenue, Las Vegas, Nevada | | 89103 |

| (Address of principal executive office) | | (Zip Code) |

(702) 215-5501

(Registrant’s telephone number, including area code)

Copies of correspondence to:

| | |

Anthony J. Pearl General Counsel The Cosmopolitan of Las Vegas 4285 Polaris Avenue Las Vegas, Nevada 89103 (702) 215-5501 | | David J. Goldschmidt Skadden, Arps, Slate, Meagher & Flom LLP Four Times Square New York, New York 10036 (212) 735-3000 |

Securities to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each class To be so registered | | Name of each exchange on which Each class to be registered |

| NOT APPLICABLE | | NOT APPLICABLE |

Securities to be registered pursuant to Section 12(g) of the Act:

CLASS A MEMBERSHIP INTERESTS

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| | | | | | | | | | |

| | Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x | | Smaller reporting company ¨ | | |

| | | | | | (Do not check if a smaller reporting company) | | | | |

TABLE OF CONTENTS

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to registration statement on Form 10 is being filed voluntarily by Nevada Property 1 LLC in order to register its Class A Membership Interests pursuant to Section 12(g) under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Nevada Property 1 LLC originally filed a registration statement (File No. 000-53938) on April 9, 2010, filed pre-effective Amendment No. 1 to such registration statement on May 25, 2010 and is filing this post-effective amendment to such registration statement in response to comments received from the Securities and Exchange Commission.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document includes various “forward-looking statements,” which represent our expectations or beliefs concerning future events. Statements containing expressions such as “believes,” “anticipates” or “expects” used in this Registration Statement are intended to identify forward-looking statements. All forward-looking statements involve risks and uncertainties. Although we believe our expectations are based upon reasonable assumptions within the bounds of our knowledge of our business and operations, our actual results may materially differ from expected results. We caution that these and similar statements included in this Registration Statement are further qualified by important factors that could cause actual results to differ materially from those in the forward-looking statements. Such factors include, without limitation, the risk factors discussed under “Business—Risk Factors.” Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date thereof. We undertake no obligation to publicly release any revisions to such forward-looking statements to reflect events or circumstances after the date hereof.

THE COMPANY

Nevada Property 1 LLC (the “Company,” “we,” “us” or “our”) is a limited liability company organized in Delaware. The Company owns “The Cosmopolitan of Las Vegas” (“The Cosmopolitan” or “Property”), an integrated resort currently being constructed. The Company’s wholly-owned subsidiaries are Nevada Restaurant Venture 1 LLC (“Nevada Restaurant”), which was formed on November 24, 2009 as a limited liability company in Delaware and Nevada Retail Venture 1 LLC (“Nevada Retail”), which was also formed on November 24, 2009 as a limited liability company in Delaware. Nevada Restaurant master leases the Property’s restaurants and the nightclub from the Company and has and will be entering into management agreements with third party restaurant operators and a nightclub operator to manage and operate their respective establishments at the Property. Nevada Retail master leases the retail spaces at the Property from the Company and will operate certain of the retail spaces within the Property. In addition, Nevada Retail will be entering into lease agreements with third party retail operators to manage and operate their respective retail businesses at the Property. To date these subsidiaries have not had any significant operating activities.

On April 1, 2010, the Company acquired Nevada Employer LLC, a limited liability company formed in Delaware. Nevada Employer LLC employs the development employees of the Company.

The Acquisition of The Cosmopolitan

The entity that previously owned the Property was Cosmo Senior Borrower LLC, a limited liability company organized in Delaware (“CSB”), which acquired the Property from its affiliate, 3700 Associates, LLC, a Delaware limited liability company (the “Previous Owner”), in December 2005. In April 2004, the Previous Owner purchased approximately 8.7 acres of land in Las Vegas, Nevada, in order to develop the Property and to eventually run the business at The Cosmopolitan.

A subsidiary of Deutsche Bank AG made a mortgage loan to CSB on December 30, 2005 (the “Cosmopolitan Mortgage Loan”), encumbering the Property. The Cosmopolitan Mortgage Loan went into default on January 15, 2008 and remedies were exercised against CSB. The Company was formed on July 30, 2008 for the purpose of holding the first lien mortgage loan on the Property and ultimately foreclosing on the Property. On August 29, 2008, the Company, which is an indirect wholly-owned subsidiary of Deutsche Bank AG New York Branch (“Deutsche Bank”), acquired ownership of the Cosmopolitan Mortgage Loan. The Company then acquired the Property at a foreclosure sale for $1 billion on September 3, 2008, and is the current owner of the Property.

1

Corporate Structure

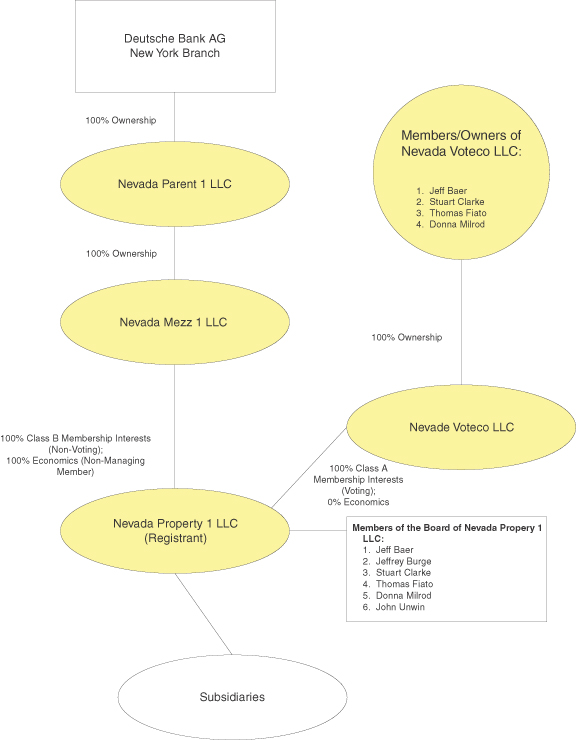

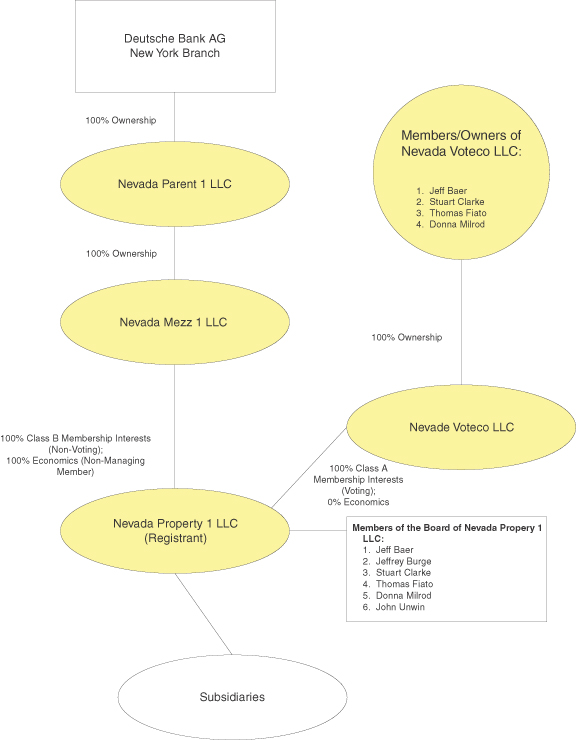

Currently, Nevada Mezz 1 LLC, a limited liability company organized in Delaware (“Nevada Mezz”), is the sole managing member of the Company. Nevada Mezz currently holds 100% of the Company’s Class A Membership Interests, which have voting rights (the “Class A Membership Interests”), and 100% of the Class B Membership Interests, which have all the economic interests in the Company, but do not have any voting rights (the “Class B Membership Interests”). Deutsche Bank, through its wholly-owned subsidiary, Nevada Parent 1 LLC, a limited liability company organized in Delaware (“Nevada Parent”), currently holds all of the voting and economic interests in the Company through Nevada Parent’s ownership of 100% of the membership interests of Nevada Mezz.

In order for the Company to become the owner and operator of the gaming-related activities at The Cosmopolitan, we are required to apply for approval from, and be licensed by, the Nevada Gaming Commission (the “Nevada Commission”), the Nevada State Gaming Control Board (the “Nevada Board”), and the Clark County Liquor and Gaming Licensing Board (the “Clark County Board” and, together with the Nevada Commission and the Nevada Board, the “Nevada Gaming Authorities”). We are prohibited from receiving any gaming-related revenues at The Cosmopolitan until we have obtained the necessary gaming approvals from the Nevada Gaming Authorities. See “Business — Nevada Gaming Regulation and Licensing.”

Immediately prior to the Nevada Commission licensing the operation of the gaming-related activities at The Cosmopolitan and the Nevada Gaming Authorities licensing or finding suitable the individual members of Nevada Voteco LLC, a limited liability company organized in Delaware (“Nevada Voteco” and its members, the “Voteco Members”), the Class A Membership Interests will be transferred to Nevada Voteco from Nevada Mezz. Nevada Voteco, through the exercise of the powers of the Voteco Members, will have voting control over the Company. Deutsche Bank will no longer have voting control over the Company, but will continue to indirectly hold all of the economic interests in the Company through its indirect ownership of the Class B Membership Interests. Nevada Voteco will have no economic interests in the Company. See “Business — Agreements Governing the Operation of The Cosmopolitan.”

2

Post-Opening/Licensing Structure

Immediately prior to and after obtaining our license to operate the gaming-related activities at The Cosmopolitan, our corporate structure will be as follows:

3

FORM 10 REGISTRATION

We are prohibited from receiving any gaming-related revenues at The Cosmopolitan until we have obtained the necessary gaming approvals from the Nevada Gaming Authorities. Once we have satisfied all conditions to obtain the necessary gaming approvals, we anticipate that we will commence gaming operations at The Cosmopolitan. We expect that The Cosmopolitan will open and commence operations in December 2010. We cannot be assured that we will be able to obtain the required licenses on a timely basis or if at all. See “Business—Nevada Gaming Regulation and Licensing.”

Following effectiveness of this Registration Statement, the Company will be required and expected to file annual, quarterly and current reports and other information with the Securities and Exchange Commission (“SEC”). You may read and copy any reports, statements or other information filed by the Company at the SEC’s public reference facilities at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms. The Company’s filings are also available to the public from commercial document retrieval services and at the world wide web site maintained by the SEC at http://www.sec.gov.

OVERVIEW OF THE COSMOPOLITAN

The Company will own and operate The Cosmopolitan, which we believe will be a premier destination as a modern integrated resort. The Cosmopolitan will have over 6.6 million square feet of total space and will be built at an estimated cost of $3.5 billion. The Property will feature the following:

| | • | | an approximately 100,000 square-foot state-of-the art casino with approximately 85 table games and 1,500 slot machines and we expect to utilize the latest system supported gaming software; |

| | • | | an East and West Tower of 50 and 52 stories, respectively. The two towers will be comprised of: |

| | • | | 2,175 condominium-hotel style units with full outdoor terraces, kitchenettes and other modern amenities; |

| | • | | 810 stylishly furnished hotel rooms; and |

| | • | | Ten, 3 story hotel suites directly adjacent to the recreation deck; |

| | • | | an integrated entertainment venue of approximately 50,000 square feet featuring a 25,000 square-foot nightclub, a recreation deck and ultra lounge; |

| | • | | an approximately 185,000 square-foot convention and banquet facility with approximately 150,000 square feet of leasable space; |

| | • | | a series of entertainment establishments on the upper level of the building’s podium, which will include three pool decks, lounges, dining selections and other modern recreational facilities. In addition, the pool area adjacent to the Las Vegas Strip has the capability to transform into a concert venue, with an audience capacity in excess of 2,000 guests; |

| | • | | approximately 130,000 square feet of world-class fine dining featuring more than 10 establishments. The Cosmopolitan will also offer a premier buffet experience in a modern environment; |

| | • | | approximately 50,000 square feet of spa, salon and fitness center facilities; |

| | • | | retail space totaling approximately 62,500 square feet; |

| | • | | a five level parking garage with approximately 3,600 spaces; |

| | • | | 355 feet of Las Vegas Strip frontage; and |

| | • | | an approximately 65,000 square-foot, 1,800 seat showroom. |

Construction on The Cosmopolitan began in October 2005. In connection with the development of The Cosmopolitan, the Company assembled an experienced development team. The Previous Owner had originally engaged Perini Building Company, Inc. (“Perini���) in September 2005 to be the general contractor for the Property. We retained Perini as the general contractor for the construction of the Property when we took ownership of the Property. In 2008, the Company engaged Related Cosmo Developer, LLC, an affiliate of Related Companies, L.P., to manage and supervise the development and construction of the Property.

4

We anticipate that The Cosmopolitan’s grand opening will be in December 2010 with 2,008 hotel and condominium-hotel style units, the casino, the nightclub and ultra lounge, numerous restaurants, full convention and banquet facilities, the spa/salon/fitness centers, pools, parking and a portion of the retail space. Additional amenities of the Property including 968 hotel and condominium-hotel style units located in the West Tower and the remaining retail and restaurant locations will be completed incrementally through July 2011 without disruption to the already existing operations. The showroom and an additional 19 condominium and/or hotel style units will be completed at a later date as management deems appropriate based on various factors, including market conditions.

LOCATION OF THE COSMOPOLITAN

The Cosmopolitan comprises approximately 8.7 acres of land and is located on the Las Vegas Strip directly between Bellagio and MGM’s City Center. The Cosmopolitan is connected to City Center to the south via an elevated pedestrian bridge and to the west side of the Las Vegas Strip via a second pedestrian bridge, as well as ground floor public access between Bellagio to the north and The Cosmopolitan. We believe our location will be an attractive destination for free independent travelers, business travelers, group and convention business and Las Vegas locals due to its proximity to many of the amenities of Las Vegas including:

| | • | | The Las Vegas Convention Center and other large scale convention venues; |

| | • | | A high concentration of Las Vegas restaurants and nightclubs; |

| | • | | Popular entertainment and show venues; |

| | • | | Numerous condominiums and non-gaming hotels; |

| | • | | McCarran International Airport; and |

| | • | | The Las Vegas Motor Speedway – host of various NASCAR events. |

The principal executive offices of The Cosmopolitan of Las Vegas are located at 4285 Polaris Avenue, Las Vegas, Nevada 89103 and the telephone number is (702) 215-5501. The Cosmopolitan internet website is located at www.cosmopolitanlasvegas.com

BUSINESS STRATEGY

We believe that The Cosmopolitan has an opportunity to create a unique destination resort directly on the Las Vegas Strip, in one of the most highly trafficked vacation and business travel destinations in the United States. Our Property will offer distinctly designed physical structures, situated on one of the premiere, center-strip locations in Las Vegas, while also delivering a compelling guest experience created specifically for the needs of our target clientele.

Target Clientele

Our marketing strategy will target numerous segments of the Las Vegas, United States and international leisure and business traveler customer base, as we will deploy a multi-channel distribution strategy to drive visitation from the most valuable segments of the group/convention, casino, and free independent traveler market segments.

We believe our integrated resort, along with our employees and staff who take care of our guests, will be positioned to cater to our target clientele in a way not currently offered by our competitors in the Las Vegas market. The combination of a distinctive hotel and condominium-hotel style unit offering, featuring outdoor terraces in the majority of the rooms, multiple non-gaming amenities, and prime location will provide a compelling package and experience in the minds of our potential customers.

Property Location

Our integrated resort is being developed to include a range of amenities unique to the Las Vegas Strip. The hotel and condominium-hotel style units will offer a broader range of amenities than many of our primary competitors, including condominium-hotel style units with full kitchenettes, cutting edge in-room technology and, for the majority of the units, spacious outdoor terraces. The terraces in particular are a new offering in the Las Vegas market, and given our premier location on the Las Vegas Strip, we believe that the outdoor terrace experience will be an inimitably attractive offering for our guests. Views from the terraces look to the north over the Bellagio Fountains, one of the prime tourist attractions on the Las Vegas Strip, and to the south, over City Center, and the south Las Vegas Strip.

5

Significant Revenues from Non-Gaming Operations

We believe we will derive significant revenues from our non-gaming operations. Our hotel, convention and meeting space, pool decks, restaurant collection, retail, food and beverage, nightclub, spa/salon/fitness centers and other operations will allow us to market the Property as a fully integrated resort. Our diversified revenue base should allow us to be less dependent on the casino as a source of revenue and profits.

Emphasis on Guest Service

One of the cornerstones of our business strategy will be providing our guests with a high level of personal service. Integral to the creation of our brand is a continuous process of embedding the brand values in all aspects of our service delivery, creating a pervasive spirit of personalized guest service throughout all areas of our business. Our management is committed to the implementation and execution of our brand service program, and will fully leverage the opportunity of creating a stand-alone brand experience to embed a dedicated, service focused culture throughout our Property. Our brand is being created by a team with deep experience in branding in the hospitality and resort industry, and will be launched through a variety of marketing initiatives throughout 2010.

THE COSMOPOLITAN

The Hotel/Property

Once complete, The Cosmopolitan will include an East and West Tower of 50 and 52 stories, respectively, with 2,995 stylishly furnished hotel and condominium-hotel style units with modern amenities. 2,175 of the rooms will be condominium-hotel style units, featuring upgraded amenities and finishes, as well as private outdoor terraces. All hotel rooms and condominium-hotel style units will feature cutting edge in-room technology, which will allow our guests the ability to interact with multiple aspects of the integrated resort from their in-room televisions.

The 2,995 rooms will open as follows: 2,008 during the anticipated opening in December 2010, 968 incrementally through July 2011 and the remaining 19 at a later date as management deems appropriate.

The Casino

The approximately 100,000 square-foot casino will feature the latest in gaming technology in a modern, energetic atmosphere. The casino floor will include approximately 1,500 slot machines and 85 table games, with immediate guest access from each of the East and West Towers and accessible just steps from the Las Vegas Strip. The casino level will contain several destination bar/lounge areas, a three story feature attraction using an innovative light and music display, as well as an intimate entertainment lounge that will be used to bring live performances to the gaming floor. The casino will also have a separate area for high limit table games and slots, centrally located but distinct from the main gaming floor, catering specifically to our higher limit clientele.

Restaurant Collection

The Cosmopolitan will offer a collection of distinctive restaurants, managed and operated by experienced world class culinary third-parties new to the Las Vegas market. Each of the restaurants in our collection will individually represent a distinctive offering, and collectively produce what we believe to be the most compelling array of dining options available in the Las Vegas market, which has already itself become known as a dining destination.

Food and Beverage

In addition to our restaurant collection, The Cosmopolitan will offer a number of casual dining options for our guests, including a premiere buffet, a burger bar, a poolside grill, a casual restaurant on the casino level, a pizzeria, and in-room dining options available 24/7. For beverage options, The Cosmopolitan will incorporate a number of bars, lounges, and destination venues which will collectively feature a comprehensive cocktail and wine program, offering our guests a wide range of the finest in beverage options.

Retail

Our retail offering is expected to showcase approximately 2,500 square feet of prime space on the southeast, street level corner of the Property, directly adjacent to the Las Vegas Strip, and will include a collection of retailers on the second level of the podium in approximately 60,000 square feet of contiguous space. We expect that a sizeable amount of foot traffic will naturally flow through our second floor retail space, as this will be the primary pathway for Las Vegas visitors to travel north and south between the City Center project and Bellagio. Our retail operators are being selected to fit with our overall brand image and profile, and will offer guests a range of accessible, distinctive retail options.

6

Nightclub and Recreation Deck

The Cosmopolitan will feature an integrated entertainment venue of approximately 50,000 square feet including a cutting edge, world class nightclub operation. The nightclub complex is approximately 25,000 square feet, and is located at the top of the podium between the two hotel towers. The nightclub will encompass all of the features of a major Las Vegas integrated resort nightclub, including an ultra lounge experience.

Spa/Salon/Fitness Centers

Our integrated resort will offer a 50,000 square-foot spa/salon facility, located at the base of the West Tower and will be easily accessible from any room in The Cosmopolitan. Our spa/salon will be a key element in the overall offerings to our guests, and will offer a level of quality, service, and experience that we believe will compete with the best spa offerings in the Las Vegas market.

Separately, the Property will offer two fitness centers, one in the East Tower and the other in the West Tower, offering our guests 24/7 access to high quality fitness and exercise equipment.

Showroom

We expect to house a 1,800 seat showroom, accessible via the second floor of the podium level. While the completion date of the showroom has not yet been determined, we believe that the space, once complete, will provide The Cosmopolitan with a world class showroom venue, able to accommodate a range of entertainment offerings.

Convention and Banquet Facility

Our approximately 185,000 square-foot convention and banquet facility is located on the second, third and fourth levels of the podium. The space is designed for maximum flexibility, and will be able to accommodate everything from small group meetings to large conferences in the 66,000 square feet of ballroom space. Directly beneath the hotel towers, the location of the ballroom space will be unique to the Las Vegas market, allowing convention attendees immediate access from the hotel towers to the meeting space. The space will feature full high speed Wi-Fi coverage, and have support capabilities to enable all modern meeting technology requirements.

MARKETING

Our marketing efforts are targeted at both the visitor market (tourists and business travelers) as well as local patrons. Our marketing efforts will focus on innovative marketing strategies to promote The Cosmopolitan, building brand recognition and sales momentum for all aspects of our integrated resort. Our hotel sales and marketing teams are deploying an industry leading multi-channel distribution strategy to drive profitable, repeat visitation from valuable customer segments in the group/convention, leisure, and wholesale/aggregator channels. We will also be deploying an industry leading customer relationship management solution to drive in-bound and out-bound marketing campaigns to our casino guests. The Cosmopolitan will be marketed through domestic and international public relations activities, direct mail, internet blasts, social media, print, radio and television advertising.

We are the owner of our name used in our business, and in this connection we own a number of trademark applications and registrations for our name and related names, including THE COSMOPOLITAN OF LAS VEGAS, U.S. Ser. Nos. 77/909,504 and 77/909,506, and THE COSMOPOLITAN RESORT & CASINO, U.S. Reg. No. 3,337,479.

In December 2009, we entered into a co-existence agreement with Hearst Communications, Inc., which resulted in a settlement and dismissal of all trademark infringement claims that were the subject of an ongoing lawsuit between us and Hearst Communications, Inc. The co-existence agreement provides that we may utilize the “Cosmopolitan” name and marks within certain defined parameters. Specifically, the co-existence agreement provides that we should use (i) the word “the” preceding the word “Cosmopolitan” (e.g., “The Cosmopolitan”), or (ii) words identifying physical locations or attractions of our hotel-casino properties preceding or following the word “Cosmopolitan” (e.g., “Cosmopolitan Residences” or “Cosmopolitan Beach Club”), or (iii) “Las Vegas” preceding and/or following the word “Cosmopolitan” (e.g., “Cosmopolitan Las Vegas”, etc.). The co-existence agreement further provides that the use of the “Cosmopolitan” marks be limited to the operation, promotion, marketing, and advertising of hotel-casino properties and related products and services. The co-existence agreement also provides for certain limitations regarding the use of “Cosmopolitan” marks in connection with women’s fashion products and the use of the term “Cosmo.”

The Cosmopolitan will offer a membership program that we believe will generate true loyalty from our guests and be highly differentiated from the players club “discounting” card programs offered by many of our competitors. Our membership program will not be for casino patrons only, but rather we plan to engage, reward, and incentivize our guests in a manner that respects their desire to have fully integrated experiences across all the venues and amenities offered at The Cosmopolitan. Additionally, we will deploy a sophisticated in-house reservation system, and we are in the process of engaging with third parties to supplement our reservation capabilities.

7

LAS VEGAS MARKET

Over the past 20 years, Las Vegas has become one of the fastest growing and largest entertainment markets in the United States. Since 2007, however, the Las Vegas market has generally experienced a decline in growth as the number of visitors and gaming revenues have fallen from prior periods. During 2009, according to the Las Vegas Convention and Visitors Authority (the “LVCVA”), gaming revenues in Clark County reached approximately $8.8 billion. In addition, according to the LVCVA:

| | • | | the number of visitors traveling to Las Vegas was approximately 36.4 million in 2009, representing a compound annual growth rate of approximately 3.5% since 1989’s 18.1 million visitors; and |

| | • | | the number of hotel and motel rooms in Las Vegas was 67,391 in 1989 and 148,941 in 2009, representing a compound annual growth rate of approximately 4.0%. |

The following table sets forth certain statistical information for the Las Vegas market for the years 2004 through 2009, as reported by the LVCVA:

LAS VEGAS MARKET STATISTICS

| | | | | | | | | | | | | | | | | | |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

Visitor Volume (in thousands) | | | 37,389 | | | 38,566 | | | 38,915 | | | 39,197 | | | 37,481 | | | 36,351 |

Clark County Gaming Revenues (in millions) | | $ | 8,711 | | $ | 9,709 | | $ | 10,643 | | $ | 10,868 | | $ | 9,797 | | $ | 8,834 |

Hotel/Motel Rooms Inventory | | | 131,503 | | | 133,186 | | | 132,605 | | | 132,947 | | | 140,529 | | | 148,941 |

Airport Passenger Traffic (in thousands) | | | 41,442 | | | 44,267 | | | 46,193 | | | 47,728 | | | 44,075 | | | 40,469 |

Convention Attendance (in thousands) | | | 5,725 | | | 6,166 | | | 6,308 | | | 6,209 | | | 5,900 | | | 4,492 |

The Las Vegas hotel, resort and casino industry is seasonal in nature. A variety of factors contribute to the seasonality of the Las Vegas market, including the timing of major Las Vegas conventions, major holidays such as New Year’s and Chinese New Year and major sporting events, particularly the Super Bowl and premier boxing events. These factors can drive additional business to the Las Vegas market. Visitor volumes typically are lower during off-peak times, such as mid-week or during traditional slower leisure periods between Thanksgiving and New Year’s.

COMPETITION

The Cosmopolitan is located directly on the Las Vegas Strip and will compete with other high-quality Las Vegas resorts and other Las Vegas hotel casinos, including those located on the Las Vegas Strip, on the basis of overall atmosphere, range of amenities, price, location, entertainment offered, theme and size. Currently, there are numerous upscale luxury gaming properties located on or near the Las Vegas Strip, and additional gaming properties located in other areas of Las Vegas. Many of the competing properties, such as Aria, Bellagio, Encore Las Vegas, Mandalay Bay, The Palazzo Las Vegas, The Venetian and Wynn Las Vegas, have themes and/or attractions which draw a significant number of visitors and directly compete with our operations. Some of these facilities are operated by companies that have more than one operating facility and may have greater name recognition and financial and marketing resources than we do and market to the same target demographic group. Furthermore, additional hotel casinos containing a significant number of hotel rooms may open in Las Vegas within the coming years. Also, visitor volume in Las Vegas has declined since 2007, resulting in lower casino and gaming volumes and reduced hotel occupancy rates. There can be no assurance the Las Vegas market will be able to attract as many visitors as it has in prior periods or hotel casino resorts will continue to be popular, and a continued decline or leveling off of the growth or popularity of such facilities, would adversely affect our financial condition and results of operations.

To a lesser extent, we will also face competition from hotels and hotel casinos that may be established in jurisdictions other than Las Vegas. Our integrated resort will compete with hotel casinos in the Mesquite, Laughlin, Reno and Lake Tahoe areas of Nevada, and in a growing number of other jurisdictions in which gaming is now permitted. The Cosmopolitan will also compete with state-sponsored lotteries, on-and off-track wagering, card parlors, riverboat and Native American gaming ventures, and other forms of legalized gaming in the United States, as well as with gaming on cruise ships, Internet gaming ventures and international gaming operations. See “Risk Factors—Risks Related to Our Business—We face intense competition which could impact our operations and adversely affect our business and results of operations.”

8

EMPLOYEES

As of February 28, 2010, we had 158 employees. Upon the opening and commencement of operations at The Cosmopolitan, we expect to have approximately 3,580 employees. None of our employees are currently members of unions; however, pursuant to the terms of an existing neutrality agreement, we would anticipate that certain of our employees may elect union representation. We may from time to time be approached by other unions to organize future employees and cannot assure that one or more unions will not approach our employees directly.

NEVADA GAMING REGULATION AND LICENSING

Introduction

The gaming industry is highly regulated. Gaming registrations, licenses and approvals, once obtained, can be suspended or revoked for a variety of reasons. We cannot assure you that we will obtain all required registrations, licenses and approvals on a timely basis or at all, or that, once obtained, the registrations, findings of suitability, licenses and approvals will not be suspended, conditioned, limited or revoked. The ownership and operation of casino gaming facilities in the State of Nevada are subject to the Nevada Gaming Control Act and the regulations made under such Act, as well as to various local ordinances. The Cosmopolitan is subject to the licensing and regulatory control of the Nevada Gaming Authorities.

Owner and Operator Licensing Requirements

In order for the Company to become the owner and operator of the gaming-related activities at The Cosmopolitan, it is required to apply for approval from, and be licensed by, the Nevada Gaming Authorities as a nonrestricted licensee. If the Company is issued gaming licenses, it will have to pay periodic fees and taxes. The gaming licenses will not be transferable. The Company is in the process of filing all necessary applications with the Nevada Gaming Authorities. We cannot assure you that the Company will be able to obtain all approvals and licenses from the Nevada Gaming Authorities on a timely basis or at all.

Company Registration Requirements

For purposes of the Nevada Gaming Control Act, and in order to for the Company to be licensed to own and operate the gaming-related activities at The Cosmopolitan, we are registering with the Nevada Commission as a “publicly traded corporation,” or registered company. Further, the individual Voteco Members are required to apply to, and be found suitable by, the Nevada Commission to own our voting securities. We cannot assure you that each of the Voteco Members will be able to obtain all approvals and licenses from the Nevada Gaming Commission prior to the opening of The Cosmopolitan.

Once we have been registered by the Nevada Commission, we will be required to submit detailed financial and operating reports to the Nevada Commission and provide any other information that the Nevada Commission may require. Substantially all of our material loans, leases, sales of securities and similar financing transactions must be reported to, or approved by, the Nevada Commission.

Individual Licensing Requirements

No person may become a stockholder of, or receive any percentage of the profits of, a registered intermediary company or company licensee without first obtaining licenses and approvals from the Nevada Gaming Authorities. The Nevada Gaming Authorities may investigate any individual who has a material relationship to or material involvement with us to determine whether the individual is suitable or should be licensed as a business associate of a gaming licensee. We, the Members of our Board, the individual Voteco Members and certain of our key executives are required to file applications with the Nevada Gaming Authorities and may be required to be licensed or found suitable by the Nevada Gaming Authorities. The Nevada Gaming Authorities may deny an application for licensing for any cause. A finding of suitability is comparable to licensing, and both require submission of detailed personal and financial information followed by a thorough investigation. An applicant for licensing or an applicant for a finding of suitability must pay or must cause to be paid all the costs of the investigation. Changes in licensed positions must be reported to the Nevada Gaming Authorities and, in addition to their authority to deny an application for a finding of suitability or licensing, the Nevada Gaming Authorities have the jurisdiction to disapprove a change in a corporate position.

If the Nevada Gaming Authorities were to find an officer, director or key employee unsuitable for licensing or unsuitable to continue having a relationship with us, we would have to sever all relationships with that person. In addition, the Nevada Commission may require us to terminate the employment of any person who refuses to file appropriate applications. Determinations of suitability or questions pertaining to licensing are not subject to judicial review in Nevada.

9

Consequences of Violating Gaming Laws

If the Nevada Commission determines that we have violated the Nevada Gaming Control Act or any of its regulations, it could limit, condition, suspend or revoke our applications, or registrations and gaming license, once obtained. In addition, we and the persons involved could be subject to substantial fines for each separate violation of the Nevada Gaming Control Act, or of the regulations of the Nevada Commission, at the discretion of the Nevada Commission. Further, the Nevada Commission could appoint a supervisor to operate the gaming-related activities at The Cosmopolitan, and under specified circumstances, earnings generated during the supervisor’s appointment (except for the reasonable rental value of the premises) could be forfeited to the State of Nevada. Limitation, conditioning or suspension of any gaming licenses we may obtain and the appointment of a supervisor could, and revocation of any such gaming license would, have a significant negative effect on our gaming operations.

Requirements for Voting Security Holders

Regardless of the number of shares or other interests held, any beneficial holder of the voting or non-voting securities of a registered company may be required to file an application, be investigated and have that person’s suitability as a beneficial holder of voting or non-voting securities determined if the Nevada Commission has reason to believe that the ownership would otherwise be inconsistent with the declared policies of the State of Nevada. If the beneficial holder of such securities who must be found suitable is a corporation, partnership, limited partnership, limited liability company or trust, it must submit detailed business and financial information including a list of its beneficial owners. The applicant must pay all costs of the investigation incurred by the Nevada Gaming Authorities in conducting any investigation.

The Nevada Act requires any person who acquires more than 5% of the voting securities of a registered company to report the acquisition to the Nevada Commission. The Nevada Act requires beneficial owners of more than 10% of a registered company’s voting securities to apply to the Nevada Commission for a finding of suitability within 30 days after the Chairman of the Nevada Board mails the written notice requiring such filing. However, an “institutional investor,” as defined in the Nevada Act, which beneficially owns more than 10%, but not more than 11%, of the registered company’s voting securities as a result of a stock repurchase by the registered company may not be required to file such an application. Further, an institutional investor which acquires more than 10% but not more than 25% of a registered company’s voting securities may apply to the Nevada Commission for a waiver of a finding of suitability if the institutional investor holds the voting securities for investment purposes only. An institutional investor that has obtained a waiver may own more than 25% but not more than 29% of the voting securities of a registered company and maintain the waiver where the additional ownership results from a stock repurchase by the registered company. An institutional investor will not be deemed to hold voting securities for investment purposes unless the voting securities were acquired and are held in the ordinary course of business as an institutional investor and not for the purpose of causing, directly or indirectly, the election of a majority of the members of the board at directors of the registered company, a change in the corporate charter, bylaws, management, policies or operations of the registered company, or any of its gaming affiliates, or any other action which the Nevada Commission finds to be inconsistent with holding the registered company’s voting securities for investment purposes only. Activities which are not deemed to be inconsistent with holding voting securities for investment purposes only include:

| | • | | voting on all matters voted on by stockholders or interest holders; |

| | • | | making financial and other inquiries of management of the type normally made by securities analysts for informational purposes and not to cause a change in its management, policies or operations; and |

| | • | | other activities that the Nevada Commission may determine to be consistent with such investment intent. |

Consequences of Being Found Unsuitable

Any person who fails or refuses to apply for a finding of suitability or a license within 30 days after being ordered to do so by the Nevada Commission or by the Chairman of the Nevada Board, or who refuses or fails to pay the investigative costs incurred by the Nevada Gaming Authorities in connection with the investigation of its application, may be found unsuitable. The same restrictions apply to a record owner if the record owner, after request, fails to identify the beneficial owner. Any person found unsuitable and who holds, directly or indirectly, any beneficial ownership of any voting security or debt security of a registered company beyond the period of time as may be prescribed by the Nevada Commission may be guilty of a criminal offense. We will be subject to disciplinary action if, after we receive notice that a person is unsuitable to hold an equity interest or to have any other relationship with, we:

| | • | | pay that person any dividend or interest upon any voting securities; |

| | • | | allow that person to exercise, directly or indirectly, any voting right held by that person relating to our Company; |

| | • | | pay remuneration in any form to that person for services rendered or otherwise; or |

10

| | • | | fail to pursue all lawful efforts to require the unsuitable person to relinquish such person’s voting securities including, if necessary, the immediate purchase of the voting securities for cash at fair market value. |

Approval of Public Offerings

A registered company may not make a public offering of its securities without the prior approval of the Nevada Commission if it intends to use the proceeds from the offering to construct, acquire or finance gaming facilities in Nevada, or to retire or extend obligations incurred for those purposes or for similar transactions. Once we become a public company, any approval that we might receive in the future relating to future offerings will not constitute a finding, recommendation or approval by any of the Nevada Board or the Nevada Commission as to the accuracy or adequacy of the offering memorandum or the investment merits of the securities. Any representation to the contrary is unlawful.

The regulations of the Nevada Commission also provide that any entity which is not an “affiliated company,” as that term is defined in the Nevada Act, or which is not otherwise subject to the provisions of the Nevada Act or regulations, such as our Company, that plans to make a public offering of securities intending to use such securities, or the proceeds from the sale thereof, for the construction or operation of gaming facilities in Nevada, or to retire or extend obligations incurred for such purposes, may apply to the Nevada Commission for prior approval of such offering. The Nevada Commission may find an applicant unsuitable based solely on the fact that it did not submit such an application, unless upon a written request for a ruling, referred to as a Ruling Request, the Nevada Board Chairman has ruled that it is not necessary to submit an application.

Approval of Changes in Control

Once we become a registered company, we must obtain prior approval of the Nevada Commission with respect to a change in control through:

| | • | | stock or asset acquisitions; |

| | • | | management or consulting agreements; or |

| | • | | any act or conduct by a person by which the person obtains control of us. |

Entities seeking to acquire control of a registered company must satisfy the Nevada Board and Nevada Commission with respect to a variety of stringent standards before assuming control of the registered company. The Nevada Commission may also require controlling stockholders, officers, directors and other persons having a material relationship or involvement with the entity proposing to acquire control to be investigated and licensed as part of the approval process relating to the transaction.

Approval of Defensive Tactics

The Nevada legislature has declared that some corporate acquisitions opposed by management, repurchases of voting securities and corporate defense tactics affecting Nevada gaming licenses or affecting registered companies that are affiliated with the operations permitted by Nevada gaming licenses may be harmful to stable and productive corporate gaming. The Nevada Commission has established a regulatory scheme to reduce the potentially adverse effects of these business practices upon Nevada’s gaming industry and to further Nevada’s policy to:

| | • | | assure the financial stability of corporate gaming operators and their affiliates; |

| | • | | preserve the beneficial aspects of conducting business in the corporate form; and |

| | • | | promote a neutral environment for the orderly governance of corporate affairs. |

11

Once we become a registered company, approvals may be required from the Nevada Commission before we can make exceptional repurchases of voting securities above their current market price and before a corporate acquisition opposed by management can be consummated. The Nevada Act also requires prior approval of a plan of recapitalization proposed by a registered company’s board of directors in response to a tender offer made directly to its stockholders for the purpose of acquiring control.

Fees and Taxes

License fees and taxes, computed in various ways depending on the type of gaming or activity involved, are payable to the State of Nevada and to the counties and cities in which the licensed subsidiaries respective operations are conducted. Depending upon the particular fee or tax involved, these fees and taxes are payable monthly, quarterly or annually and are based upon:

| | • | | a percentage of the gross gaming revenue received; |

| | • | | the number of gaming devices operated; or |

| | • | | the number of table games operated. |

A live entertainment tax is also payable when entertainment is provided in connection with admission fees, the selling or serving of food or refreshments, or the selling of merchandise.

Foreign Gaming Investigations

Any person who is licensed, required to be licensed, registered, required to be registered, or is under common control with those persons (collectively, “licensees”), and who proposes to become involved in a gaming venture outside of Nevada, is required to deposit with the Nevada Board, and thereafter maintain, a revolving fund in the amount of $10,000 to pay the expenses of investigation of the Nevada Board of the licensee’s or registrant’s participation in such foreign gaming. The revolving fund is subject to increase or decrease at the discretion of the Nevada Commission. Licensees and registrants are required to comply with the reporting requirements imposed by the Nevada Act. A licensee or registrant is also subject to disciplinary action by the Nevada Commission if it:

| | • | | knowingly violates any laws of the foreign jurisdiction pertaining to the foreign gaming operation; |

| | • | | fails to conduct the foreign gaming operation in accordance with the standards of honesty and integrity required of Nevada gaming operations; |

| | • | | engages in any activity or enters into any association that is unsuitable because it poses an unreasonable threat to the control of gaming in Nevada, reflects or tends to reflect, discredit or disrepute upon the State of Nevada or gaming in Nevada, or is contrary to the gaming policies of Nevada; |

| | • | | engages in activities or enters into associations that are harmful to the State of Nevada or its ability to collect gaming taxes and fees; or |

| | • | | employs, contracts with or associates with a person in the foreign operation who has been denied a license or finding of suitability in Nevada on the ground of unsuitability. |

License for Conduct of Gaming and Sale of Alcoholic Beverages

The conduct of gaming activities and the service and sale of alcoholic beverages at The Cosmopolitan are subject to licensing, control and regulation by the Clark County Board. In addition to approving the licensee, the Clark County Board has the authority to approve all persons owning or controlling the stock of any business entity controlling a gaming or liquor license. All licenses are revocable and are not transferable. The Clark County Board has full power to limit, condition, suspend or revoke any license. Any disciplinary action could, and revocation would, have a substantial negative impact upon the operations of The Cosmopolitan.

12

AGREEMENTS GOVERNING THE OPERATION OF THE COSMOPOLITAN

Amended and Restated Limited Liability Company Agreement

Our Amended and Restated Limited Liability Company Agreement governs our relationship with our members.

Classes of Membership Interests. We have two classes of membership interests: Class A Membership Interests and Class B Membership Interests. Holders of Class A Membership Interests are entitled to vote on any matter to be voted upon by our members. Holders of Class B Membership Interests have all the economic interests in the Company and except as provided by law, do not have any right to vote. Prior to the Company being licensed to operate the gaming-related activities at The Cosmopolitan, the Class A Membership Interests will be held by Nevada Mezz. Immediately prior to the Nevada Commission licensing the operation of the gaming-related activities at The Cosmopolitan and the Nevada Gaming Authorities licensing or finding suitable the individual Voteco Members, the Class A Membership Interests will be transferred by Nevada Mezz to Nevada Voteco and Nevada Mezz will continue to hold the Class B Membership Interests. Accordingly, Nevada Mezz currently holds 100% of our Class A Membership Interests and 100% of our Class B Membership Interests.

Additional Capital Contributions. The Amended and Restated Limited Liability Company Agreement provides that no member will be required to make any contribution to the Company’s capital. The board of the Company (the “Board”) may determine from time to time that additional capital is necessary or appropriate to enable the Company to conduct its activities and may seek additional capital contributions from the holders of Class B Membership Interests on such terms as the Board may propose in its sole discretion.

Allocations and Distributions. The Amended and Restated Limited Liability Company Agreement provides that the Company’s net profits or net losses shall be determined on an annual basis in accordance with the manner determined by the Board. All profits and losses shall be allocated entirely to the holders of Class B Membership Interests. Subject to compliance with applicable law, the Amended and Restated Limited Liability Company Agreement provides that the Company shall make distributions of available cash net of reasonable reserves quarterly, or in the sole discretion of the Board, more frequently, to the extent available. Any such distributions and all distributions in liquidation of the Company shall be made entirely to the holders of Class B Membership Interests. Holders of Class A Membership Interests shall not be allocated any profits or losses or be entitled to receive any distributions of the Company.

Board. We are managed by our Board. Under the Amended and Restated Limited Liability Company Agreement, holders of a majority of the then outstanding Class A Membership Interest, which initially shall be Nevada Mezz, shall have the sole power to designate and remove members of the Board (the “Members of the Board”). The Board shall have decision making authority in the management of the Company’s business. The current Members of the Board are Jeff Baer, Jeffrey Burge, Stuart Clarke, Thomas Fiato, Donna Milrod and John Unwin.

Officers. The Board may appoint or remove officers of the Company from time to time. The officers serve at the pleasure of the Board. All appointments of officers shall be subject to the Nevada Act, and if any officer is found to be unsuitable pursuant the Nevada Act, such officer shall be automatically removed from such position.

Restrictions on Transfer. Under the Amended and Restated Limited Liability Company Agreement, members are prohibited from transferring any Membership Interests except in accordance with the Transfer Restriction Agreement.

Dissolution. We may be dissolved upon the decision of a majority of our Board and upon decree of judicial dissolution under the applicable law. In the event of dissolution, the cash proceeds from the liquidation will be distributed in accordance with the Amended and Restated Limited Liability Company Agreement.

13

Operating Agreement of Nevada Voteco LLC

The Operating Agreement of Nevada Voteco will be an agreement, by and among the Voteco Members. The current Voteco Members are Jeff Baer, Stuart Clarke, Thomas Fiato and Donna Milrod.

The Operating Agreement will provide that, to the fullest extent permitted by law, no Voteco Member shall have any liability for obligations or liabilities of Nevada Voteco. Voteco Members may vote, approve a matter or take any action by vote of Voteco Members at a meeting, in person or by proxy, or without a meeting by written consent. The Operating Agreement will provide that the business and affairs of Nevada Voteco shall be managed by the managers of Nevada Voteco (the “Voteco Managers”). The powers of Nevada Voteco shall be exercised by or under the authority of, and the business and affairs of Voteco shall be managed under the direction of, all of the Voteco Managers and all of the Voteco Managers may make all decisions and take all actions for and on behalf of Nevada Voteco. All such decisions and actions for and on behalf of Nevada Voteco must be approved by the Voteco Members holding a majority in interest. Any decisions or actions for or on behalf of Nevada Voteco that are effected without such approval shall be deemed null and void.

Subject to applicable gaming laws, in the event that any Voteco Member shall be unwilling or unable to serve as a Voteco Manager, he or she shall be succeeded by such person or persons as shall be elected by a majority interest. A Voteco Manager may be removed by a majority in interest only in the event that the Voteco Manager is no longer a Voteco Member or a withdrawal event has occurred with respect to such person as set forth in the Operating Agreement. No Voteco Member may transfer all or any part of such Voteco Member’s interest in Nevada Voteco without the prior written consent of the Voteco Managers and only in accordance with the terms of the Transfer Restriction Agreement. In the event of the death of any Voteco Member, the interests in Nevada Voteco held by such Voteco Member shall not transfer to the heirs or become part of the estate thereof, but shall immediately become subject to a 30-day option to purchase in favor of the Voteco Managers at a price equal to the price paid by such Voteco Member. Subject to applicable gaming laws, no assignee of all or any part of an interest of a Voteco Member in Nevada Voteco shall be admitted to Nevada Voteco as an additional member unless and until (a) the Voteco Managers shall have consented in writing to such admission (the granting or denial of which shall be in the Voteco Managers’ sole discretion), (b) the assignee has executed a counterpart of the Operating Agreement and such other instruments as the other Voteco Members may reasonably deem necessary or appropriate to confirm the undertaking of the assignee to be bound by all the terms and provisions of the Operating Agreement and (c) the assignee has paid any expenses incurred by Nevada Voteco in connection with such assignment. Notwithstanding anything to the contrary expressed or implied in the Operating Agreement, the transfer of any interest in the Company is ineffective unless approved in advance by the applicable gaming authorities.

Nevada Voteco shall indemnify any person made, or threatened to be made, a party to any action, suit or proceeding by reason of the fact that he, his testator or intestate, is or was a Voteco Manager, Voteco Member, organizer or officer of Nevada Voteco or of any other company which he or she served as such at the request of Nevada Voteco, against all reasonable expenses, including attorneys’ fees, actually or necessarily incurred by him in connection with the defense of such action, suit or proceeding, or in connection with any appeal therein, and including the cost of court approved settlements, to the fullest extent and in the manner set forth in and permitted by the Delaware Limited Liability Company Act and any other applicable law, as from time to time in effect.

For as long as Nevada Voteco remains subject to regulations under gaming laws, ownership of Nevada Voteco shall be held subject to the applicable provisions of the applicable gaming laws. Voteco Managers will have the power and authority to provide that all certificates issued to represent or evidence a Voteco Member’s interest shall bear legends, including, without limitation, any legends as the Voteco Managers deem appropriate to assure that Nevada Voteco complies with applicable gaming laws and does not become liable for violations of federal or state securities laws or other applicable law.

Transfer Restriction Agreement

The Transfer Restriction Agreement will be an agreement by and among Jeff Baer, Stuart Clarke, Thomas Fiato and Donna Milrod, Nevada Voteco and Nevada Mezz, setting forth certain rights and restrictions relating to the membership interests of the Company. The Transfer Restriction Agreement shall provide that Nevada Voteco agrees not to transfer ownership of any equity interests in the Company, except that if Nevada Mezz proposes to transfer any of its non-voting interests in the Company to an approved purchaser, then Nevada Mezz shall have an option to purchase from Nevada Voteco a corresponding number of Class A Membership Interests in the Company. Each Voteco Member shall also agree not to transfer any of the Nevada Voteco equity interests owned by such Voteco Member except pursuant to the Voteco Operating Agreement or as approved by Nevada Mezz.

14

Letter Agreement

The Letter Agreement, by and among Deutsche Bank and the Voteco Members, shall provide that Deutsche Bank will not take any action to influence the Voteco Members in the exercise of their management or voting rights in respect of the gaming-related activities at The Cosmopolitan, and authorizes the Voteco Members to exercise such rights independently of Deutsche Bank.

Restaurant/Nightclub Management Agreements

We have and will be entering into management agreements with each third party restaurant operator and a nightclub operator that will be managing and operating their respective establishments at The Cosmopolitan. Each of the management agreements contains or will contain customary terms and conditions governing the rights and obligations between the third party operators and the Company.

Retail Lease Agreements

We will be entering into retail lease agreements with each third party retail operator that will be managing and operating their respective retail businesses at The Cosmopolitan. Each of the retail lease agreements will contain customary terms and conditions governing the rights and obligations between the third party retail operator and the Company.

15

Set forth below are risks and uncertainties that we believe are material to the Company. You should consider carefully the following risks and uncertainties, together with the other information contained in and incorporated by reference in this Registration Statement, and the descriptions included in our consolidated financial statements and accompanying notes.

Risks Related to Our Business

The recent downturn in the U.S. economy, the volatility and disruption of the capital and credit markets and adverse changes in the global economy could negatively impact our financial performance.

Due to a number of factors affecting consumers, including a slowdown in global economies, contracting credit markets and reduced consumer spending, the outlook for the gaming, travel, and entertainment industries remains highly uncertain in 2010. Auto traffic into Las Vegas and air travel to McCarran International airport has declined since 2007, resulting in lower casino volumes and reduced hotel occupancy rates. These factors have and could continue to result in fewer customers visiting, or customers spending less, in Las Vegas, as compared to prior periods. Gaming and other leisure activities represent discretionary expenditures and participation in such activities tends to decline during economic downturns, during which consumers generally have less disposable income. Furthermore, during periods of economic contraction such as the current period, revenues may decrease while some of our costs remain fixed or even increase, resulting in decreased earnings. There can be no assurances that government responses to the disruptions in the financial and credit markets will restore consumer confidence. As a result, customer demand for the luxury amenities and leisure activities that we will offer may continue to be depressed or continue to decline for an extended period. The recent severe economic downturn and adverse conditions in the local, regional, national and global markets may negatively affect our operations in the future.

Our business depends on one key market and has a limited base of operations, and accordingly, we could be disproportionately harmed by an economic downturn in this market or a disaster that reduced the willingness or ability of our customers to travel to Las Vegas.

All of our revenues in the future will be generated from a single source, The Cosmopolitan. As a result, the profitability of our operations is linked to local economic conditions in Las Vegas, surrounding areas of Nevada and, indirectly, Southern California, where many of the hotel casino’s targeted customers reside. A continued decline in the local economies of Nevada or Southern California could negatively impact our business and the results of our operations. Examples of events which may impact our results of operations include, increased unemployment in Nevada and California, rising fuel prices in California or a decline in air passenger traffic due to higher ticket prices, reduced flights by airline operators or fears associated with air travel. Furthermore, due to our single location, we are subject to greater risks than a more diversified hotel and casino resort operator, including natural and other disasters and changes in local and state governmental laws and regulations. The combination of the single location and the significant investment associated with the development of the Property, may cause our operating results to fluctuate significantly and may adversely affect our business.

We face intense competition which could impact our operations and adversely affect our business and results of operations.

We will compete mainly in the Las Vegas hotel, resort and casino industry. Specifically, our integrated resort will compete with other high-quality Las Vegas resorts, especially those located on the Las Vegas Strip. Currently, various upscale, luxury and mid-priced gaming properties are located on or near the Las Vegas Strip. Upscale, luxury and mid-priced gaming properties are also located in the downtown Las Vegas area and additional gaming properties are located in other areas of Las Vegas. Many of the competing properties have themes and attractions which draw a significant number of visitors and will directly compete with our operations. Some of these properties are operated by subsidiaries or divisions of large public companies that may have greater name recognition and financial and marketing resources than we do and market to the same demographic group which we plan to target.

16

Additional hotel casinos containing a significant number of rooms may open, renovate or expand in Las Vegas over the next several years, which could also significantly increase competition. We believe that competition in the Las Vegas hotel, resort and casino industry is based on certain property-specific factors, including overall quality of service, types of amenities available to guests, price, location, entertainment attractions, theme and size. Our ability to generate and maintain the appropriate level of market awareness and penetration in relation to these property-specific factors could adversely affect our ability to compete effectively and could potentially impact our business and results of operations.

To a lesser extent, we will also compete with resort, hotels and casinos in other parts of Nevada, Atlantic City, New Jersey and other gambling destinations located elsewhere in the United States. We will also compete with other types of gaming operations such as state-sponsored lotteries, on and off-track wagering, card parlors, riverboat gaming ventures, and other forms of legalized gaming in the United States, as well as with gaming on cruise ships, Internet gaming ventures and international gaming operations. Continued legalization and proliferation of gaming activities could significantly and adversely affect our business and results of operations.

Another area of competition is legalized gaming from casinos located on Native American tribal lands. Native American tribes in California are permitted to operate casinos with video slot machines, black jack and house-banked card games. The governor of California has entered into compacts with numerous tribes in California and has announced the execution of a number of compacts with no limits on the number of gaming machines (which had been limited under the prior compacts). The federal government has approved numerous compacts in California and casino-style gaming is now legal on those tribal lands. While the competitive impact on our operations in Las Vegas from the continued growth of Native American gaming establishments in California remains uncertain, the proliferation of gaming in California and other areas located near The Cosmopolitan could have an adverse effect on the Company’s business and results of operations.

In addition, certain states have legalized, and others may legalize, casino gaming in specific areas, including metropolitan areas from which we traditionally attract customers, such as New York, Philadelphia, Los Angeles, San Francisco and Boston. Additionally, the current global trend toward liberalization of gaming restrictions and resulting proliferation of gaming venues, including those in Macau and Singapore, could also result in a decrease in the number of visitors to The Cosmopolitan by attracting international customers closer to home and away from Las Vegas, which could adversely affect our business and results of operations.

The Las Vegas hotel, resort and casino industry is capital intensive; financing construction and future capital improvements could reduce our cash flow and adversely affect our financial performance.

We expect to open The Cosmopolitan in December 2010. We may not be able to complete construction of the Property on time or within budget. Our inability to complete construction on time or within budget may adversely affect our operating results and financial performance.

Nevertheless, our integrated resort will have an ongoing need for renovations and other capital improvements to remain competitive, including replacement, from time to time, of furniture, fixtures and equipment. We may also need to make capital expenditures to comply with any changes in applicable laws and regulations such as a requirement to install additional surveillance or life safety equipment. Renovations and other capital improvements of hotel casinos require significant capital expenditures. In addition, renovations and capital improvements of hotel casinos usually generate little or no cash flow until the project’s completion. We may not be able to fund such projects solely from cash provided from our operating activities. Consequently, we will rely upon the availability of debt or equity capital to fund renovations and capital improvements and our ability to carry them out will be limited if we cannot obtain satisfactory debt or equity financing, which will depend on, among other things, market conditions. No assurances can be made that we will be able to obtain additional equity or debt financing or that we will be able to obtain such financing on favorable terms.

Renovations and other capital improvements, including the current construction of our Property, may give rise to the following additional risks, among others:

| | • | | construction cost overruns and delays; |

17

| | • | | temporary closures of all or a portion of the integrated resort to customers; |

| | • | | uncertainties as to market demand or a loss of market demand after capital improvements have begun or are completed; |

| | • | | disruption in service and room availability causing reduced demand, occupancy and rates; |

| | • | | disruption in gaming operations; and |

| | • | | possible environmental risks and problems. |

As a result, the current construction of our Property and any other future capital improvement projects may increase our expenses and reduce our cash flows and our revenues. If capital expenditures exceed our expectations, this excess would have an adverse effect on our available cash.

Our business model involves high fixed costs, including property taxes and insurance costs, which we may be unable to adjust in a timely manner in response to a reduction in our revenues.

The costs associated with owning and operating hotel casinos are significant, some of which may not be altered in a timely manner in response to changes in demand for services, and failure to adjust our expenses may adversely affect our business and results of operations. Property taxes and insurance costs are a significant part of our operating expenses. Our real property taxes may increase as property tax rates change and as the values of properties are assessed and reassessed by tax authorities. Our real estate taxes do not depend on our revenues, and generally we could not reduce them other than by disposing of our real estate assets.

Insurance premiums for the Las Vegas hotel, resort and casino industry have not changed significantly in recent years. However, an escalation in rates resulting from events beyond our control may increase insurance costs resulting in our inability to obtain adequate insurance at acceptable premium rates. A continuation of this trend would appreciably increase the operating expenses of our integrated resort. If we do not obtain adequate insurance, to the extent that any of the events not covered by an insurance policy materialize, our financial condition may be materially adversely affected.

In the future, our Property may be subject to increases in real estate and other tax rates, utility costs, certain operating expenses, and insurance costs, which could reduce our cash flow and adversely affect our financial performance. If our revenues decline and we are unable to reduce our expenses in a timely manner, our business and results of operations could be adversely affected.

Our success will depend on the value of our name, image and brand. If demand for, or the value of, our name, image or brand diminishes, our business and results of operations would be adversely affected.

Our success will depend on our ability to shape and stimulate consumer demands by maintaining our name, image and brand. We may not be successful in this regard and we may not be able to anticipate and react to changing consumer tastes and demands in a timely manner.

Furthermore, a high media profile is an integral part of our ability to shape and stimulate demand for our integrated resort with our target customers. A key aspect of our marketing strategy is to focus on attracting media coverage. If we fail to attract that media coverage, we may need to substantially increase our advertising and marketing costs, which would adversely affect our business and results of operations. In addition, other types of marketing tools, such as traditional advertising and marketing, may not be successful in attracting our target customers.

Our business would be adversely affected if our public image or reputation were to be diminished. Our brand names and trademarks are integral to our marketing efforts. If the value of our name, image or brands were diminished, our business and operations would be adversely affected. In December 2009, we entered into a co-existence agreement with Hearst Communications, Inc., which resulted in a settlement and dismissal of all trademark infringement claims that were the subject of an ongoing lawsuit between us and Hearst Communications, Inc. The co-existence agreement provides that we may utilize the “Cosmopolitan” name and marks within certain defined parameters. We may also be subject to litigation if we use our brand name and trademarks in a way that results in a breach of such defined parameters pursuant to the terms of the co-existence agreement.

18

We have substantial debt, and we may incur additional indebtedness, which may negatively affect our business and financial results.

We have substantial debt service obligations. As of December 31, 2009, our total debt was approximately $2.0 billion. Our indebtedness and the covenants applicable to our indebtedness are described under “Financial Information—Liquidity and Capital Resources.”

Our substantial debt may negatively affect our business and operations in several ways, including:

| | • | | requiring us to use a substantial portion of our funds from operations to make required payments on debt, which will reduce funds available for operations and capital expenditures, future business opportunities and other purposes; |

| | • | | making us more vulnerable to economic and industry downturns and reducing our flexibility in responding to changing business and economic conditions; |

| | • | | limiting the Company’s flexibility in planning for, or reacting to, changes in the business and the industry in which the Company operates; |

| | • | | placing the Company at a competitive disadvantage compared to its competitors that have less debt; |

| | • | | limiting our ability to borrow more money for operations over and above the current committed credit facility; |

| | • | | limiting our ability to borrow more money for capital or to finance acquisitions in the future; and |

| | • | | requiring us to dispose of portions of the integrated resort in order to make required debt payments. |

Our working capital and liquidity reserves may not be adequate to cover all of our cash needs and we may have to obtain additional debt financing. Sufficient financing may not be available or, if available, may not be available on terms acceptable to us. Additional borrowings for working capital purposes or needed renovations or capital improvements will increase our interest expense, and, therefore, may harm our business and results of operations.

If we increase our leverage, the resulting increase in debt service could adversely affect our ability to make payments on our indebtedness and harm our business and results of operations. Our primary source of liquidity is a $3.9 billion credit facility with Deutsche Bank AG Cayman Island Branch, $2.0 billion of which was outstanding as of December 31, 2009. The preferential loan interest rates we currently benefit from under the credit facility is because we are an indirect wholly-owned subsidiary of Deutsche Bank. We will continue to benefit from this relationship with Deutsche Bank upon the opening of The Cosmopolitan. However, upon change of control through the sale or other transfer of the Property, we will have to pay interest at market rates, which could have a material adverse effect on our business, financial condition, results of operations and ability to make payments on our indebtedness. Deutsche Bank may or may not participate in the financing of the Company after a change of control.

We anticipate that we will refinance our indebtedness from time to time to repay our debt, and our inability to refinance on favorable terms, or at all, could harm our business and operations.

We believe that our internally generated cash flow may be inadequate to repay our indebtedness prior to maturity; therefore, we expect that we may be required to repay debt from time to time through refinancing of our indebtedness and/or offerings of equity or debt. The amount of our existing indebtedness may harm our ability to repay our debt through refinancing. If we are unable to refinance our indebtedness on acceptable terms, or at all, we might be forced to sell portions of our property on disadvantageous terms, which might result in losses to us. If prevailing interest rates or other factors at the time of any refinancing result in higher interest rates on any refinancing, our interest expense would increase, which would harm our business and results of operations.

19

Our management has limited experience managing a public company.