UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

J.P. Morgan Investment Management Inc.

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

With copies to:

| | |

| Elizabeth A. Davin, Esq. | | Jon S. Rand, Esq. |

| JPMorgan Chase & Co. | | Dechert LLP |

| 1111 Polaris Parkway | | 1095 Avenue of the Americas |

| Columbus, OH 43240 | | New York, NY 10036 |

Registrant’s telephone number, including area code: 1-844-457-6383

Date of fiscal year end: Last day of February

Date of reporting period: March 1, 2019 through August 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1).

Semi-Annual Report

J.P. Morgan Exchange-Traded Funds

August 31, 2019 (Unaudited)

JPMorgan BetaBuilders 1-5 Year U.S. Aggregate Bond ETF

JPMorgan Core Plus Bond ETF

JPMorgan Corporate Bond Research Enhanced ETF

JPMorgan Global Bond Opportunities ETF

JPMorgan High Yield Research Enhanced ETF (formerly known as JPMorgan Disciplined High Yield ETF)

JPMorgan Municipal ETF

JPMorgan U.S. Aggregate Bond ETF

JPMorgan Ultra-Short Income ETF

JPMorgan Ultra-Short Municipal Income ETF

JPMorgan USD Emerging Markets Sovereign Bond ETF

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.jpmorganfunds.com and you will be notified by mail each time a report is posted and provided with a website to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

You may elect to receive shareholder reports and other communications from the Funds’ electronically anytime by contacting your financial intermediary (such as a broker dealer, bank, or retirement plan).

Alternatively, you may elect to receive paper copies of all future reports free of charge by contacting your financial intermediary. Your election to receive paper reports will apply to all funds held within your account(s).

CONTENTS

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Fund.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844)457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not at net asset value) through a brokerage account, and are not individually subscribed and redeemed from a Fund. Shares may only be subscribed and redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

PRESIDENT’S LETTER

October 10, 2019 (Unaudited)

Dear Shareholder,

The upward trajectory of JPMorgan Exchange-Traded Funds’ growth has continued in 2019. So far this year, we’ve increased our assets under management to more than $27 billion; placing J.P. Morgan as a top five provider in ETF flows as of the end of September 2019.1 We continue to offer an expanding suite oflow-cost, liquid and transparent solutions for building well-diversified, well-priced portfolios. J. P. Morgan is proud to provide ETFs that can help each investor to achieve their goals.

| | |

| | “Amid changing market environments, we believe that investors should have all the tools to build a diversified ETF portfolio — J.P. Morgan ETFs span asset classes, management styles and portfolio needs to help investors build portfolios that endure over market cycles.” |

While our ETF business has been progressing, the U.S. economic expansion slowed but remained above global growth trends through the six months ended August 31, 2019. U.S. equity and bond markets provided positive returns amid growth in corporate profits and continued strength in consumer spending. In July, the U.S. Federal Reserve cut interest rates for the first time in more than a decade, which provided further support for both equity and bond prices. However, a slowing global economy and a sharp increase in reciprocal trade tariffs between the U.S. and China led to increased volatility in financial markets and downward pressure on asset prices in August. For the six months, the S&P 500

| 1 | Bloomberg LP, September 30, 2019. |

returned 6.15% and the Bloomberg Barclays U.S. Aggregate Index returned 8.02%.

Amid an uncertain macro backdrop, we believe diversification is key — both across and within asset classes. As interest rate volatility increases, an appropriately diversified fixed income portfolio can help investors generate income and diversify equity volatility. J.P. Morgan’s fixed income ETFs offerlow-cost, research-driven choices to achieve critical objectives and build a diversified bond portfolio. Our full suite of fixed income solutions span across global markets and into factor-based and active strategies with the potential for better performance, lower risk and greater diversification to stocks.

We are proud to bring a range of investment solutions to help you navigate a changing market landscape. We are committed to building solutions that address your needs and help you build stronger portfolios. Thank you for your belief in our Firm and our process.

Sincerely,

Joanna M. Gallegos

President, J.P. Morgan Exchange-Traded Funds

J.P Morgan Asset Management

1-844-4JPM-ETF or jpmorgan.com/etfs for more information

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 1 | |

J.P. Morgan Exchange-Traded Funds

MARKET OVERVIEW

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

Both equity and bond markets in the U.S. provided positive returns for the six month reporting period amid continued U.S. economic growth, buoyant corporate earnings and the U.S. Federal Reserve’s first reduction in benchmark interest rates in more than a decade. Global bond markets generally provided positive returns, particularly in emerging markets and lower-rated corporate bonds, which benefitted from investor demand for higher yielding assets.

While financial markets largely rallied in the first months of the reporting period, investor concerns about slowing global economic growth and an increase in U.S.-China trade tensions drove an increase in market volatility and weighed down asset prices in the final months of the period.

Amid market volatility, investors flocked to longer-dated U.S. Treasury bonds in August, which drove the yields on the30-year U.S. Treasury bonds below 2% for the first time. More notably, yields on10-year U.S. Treasury bonds fell below yields ontwo-year U.S. Treasury bonds for the first time since 2007. Thisso-called yield curve inversion, which has preceded every U.S. economic recession since 1950, put further pressure on financial markets at the end of the reporting period.

For the six months ended August 31, 2019, the Bloomberg Barclays U.S. Aggregate Index returned 8.02% and the Bloomberg Barclays U.S. High Yield Bond Index returned 4.46%.

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

JPMorgan BetaBuilders 1-5 Year U.S. Aggregate Bond ETF

FUND COMMENTARY

PERIOD MARCH 12, 2019 (FUND INCEPTION DATE) THROUGH AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Net Asset Value* | | | 3.56% | |

| Market Price** | | | 3.64% | |

| Bloomberg Barclays Short-Term US Aggregate Bond Index | | | 3.63% | |

| |

| Net Assets as of 8/31/2019 | | $ | 31,990,088 | |

| Duration as of 8/31/2019 | | | 2.6 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders1-5 Year U.S. Aggregate Bond ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Bloomberg Barclays Short-Term US Aggregate Bond Index (the “Underlying Index”),

INVESTMENT APPROACH

The Underlying Index, which includes bonds with remaining effective maturities between one and five years, is a subset of the Bloomberg Barclays US Aggregate Index which consists of U.S. dollar denominated investment-grade taxable bonds. Using a “passive” investment approach, the Fund attempts to replicate the Underlying Index as closely as possible and invests at least 80% of its assets in securities included in the Underlying Index.

HOW DID THE FUND PERFORM?

For the period from inception on March 12, 2019 to August 31, 2019, the Fund performed in line with the Underlying Index, before considering the effects of operating expenses, fees and tax management of the Fund’s portfolio.

The Fund and the Underlying Index’s exposure to U.S. Treasury bonds was a leading contributor to performance during the reporting period. The Fund’s and the Underlying Index’s exposures to U.S. agency mortgage backed securities was a leading detractor from performance.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund’s and the Underlying Index’s largest allocations were in the U.S. Treasury and corporate bond sectors and the smallest allocations were in the securitized debt and government related bond sectors.

| | | | |

PORTFOLIO COMPOSITION**** | |

| U.S. Treasury Obligations | | | 57.9 | % |

| Corporate Bonds | | | 25.1 | |

| Mortgage-Backed Securities | | | 6.7 | |

| Supranational | | | 2.9 | |

| U.S. Government Agency Securities | | | 2.3 | |

| Commercial Mortgage-Backed Securities | | | 1.9 | |

| Foreign Government Securities | | | 1.4 | |

| Asset-Backed Securities | | | 1.1 | |

| Municipal Bonds | | | 0.1 | |

| Short-Term Investments | | | 0.6 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $25.59 as of August 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $25.61 as of August 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of August 31, 2019. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 3 | |

JPMorgan BetaBuilders 1-5 Year U.S. Aggregate Bond ETF

FUND COMMENTARY

PERIOD MARCH 12, 2019 (FUND INCEPTION DATE) THROUGH AUGUST 31, 2019 (Unaudited) (continued)

| | | | | | | | |

TOTAL RETURNSAS OF AUGUST 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | CUMULATIVE

SINCE

INCEPTION | |

JPMorgan Betabuilders1-5 Year U.S. Aggregate Bond ETF | | | | | | | | |

Net Asset Value | | | March 12, 2019 | | | | 3.56 | % |

Market Price | | | | | | | 3.64 | % |

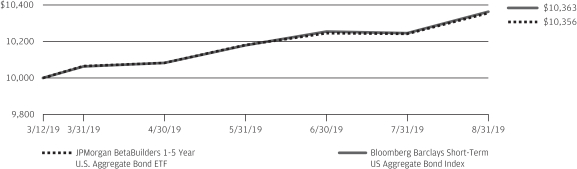

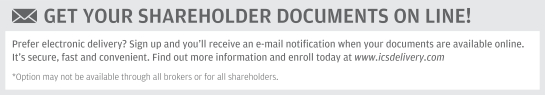

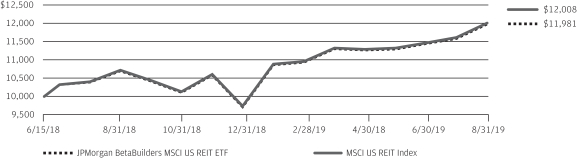

LIFE OF FUND PERFORMANCE(3/12/19 TO 8/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on March 12, 2019.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders 1-5 Year U.S. Aggregate Bond ETF and the Bloomberg Barclays Short-Term US Aggregate Bond Index from March 12, 2019 to August 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays Short-Term US Aggregate Bond Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of

all dividends and capital gain distributions of the securities included in the Index, if applicable. The Bloomberg Barclays Short-Term US Aggregate Bond Index is an unmanaged index that represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

JPMorgan Core Plus Bond ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Net Asset Value* | | | 7.71% | |

| Market Price** | | | 7.68% | |

| Bloomberg Barclays US Aggregate Index | | | 8.02% | |

| |

| Net Assets as of 8/31/2019 | | $ | 32,078,250 | |

| Duration as of 8/31/2019 | | | 6.1 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan Core Plus Bond ETF (the “Fund”) seeks to provide a high level of current income by investing primarily in a diversified portfolio of high, medium andlow-grade debt securities.

INVESTMENT APPROACH

The Fund invests primarily in investment grade bonds, with the flexibility to invest up to 35% in high yield debt (also known as “junk bonds”). Up to 35% of the Fund’s assets may be invested in foreign securities. The portfolio managers allocate the Fund’s assets among a range of sectors based on strategic positioning and other tactical considerations. In buying and selling investments for the Fund, the adviser looks for market sectors and securities that it believes will perform well over time. The adviser selects individual securities after performing a risk/reward analysis that includes an evaluation of interest rate risk, credit risk, currency risk, legal provisions and the structure of the transactions

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2019, the Fund underperformed the Bloomberg Barclays US Aggregate Index (the “Index”).

The Fund’sout-of-Index allocation to high yield corporate bonds was a leading contributor to relative performance. The Fund’s overweight position and security selection in short-dated securitized credit sectors, including asset-backed securities and commercial mortgage-backed securities also contributed to relative performance.

Relative to the Index, the Fund’s underweight position in investment grade credit detracted from performance. Agency mortgage-backed securities had negative performance for the reporting period and the Fund’s overweight position in the sector also detracted from relative performance.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers focused on security selection and relative value, which seeks to take advantage of pricing discrepancies between individual securities or market sectors. The managers employed macro-economic analysis to

determine asset allocations and positioning on the yield curve. The yield curve shows the relationship between yields and maturity dates for a set of similar bonds at a given point in time. The Fund’s portfolio managers usedbottom-up research andtop-down macro perspective to construct a diversified portfolio of fixed income securities. As a result of this process, the Fund’s largest sector allocations at the end of the reporting period were in mortgage-backed securities and U.S. Treasuries and its smallest allocations were in emerging markets debt and commercial mortgage-backed securities.

| | | | |

PORTFOLIO COMPOSITION**** | |

| Corporate Bonds | | | 26.1 | % |

| Mortgage-Backed Securities | | | 17.4 | |

| U.S. Treasury Obligations | | | 14.9 | |

| Asset-Backed Securities | | | 13.0 | |

| Collateralized Mortgage Obligations | | | 6.1 | |

| Commercial Mortgage-Backed Securities | | | 6.1 | |

| Others (each less than 1.0%) | | | 0.0 | (a) |

| Short-Term Investments | | | 16.4 | |

| (a) | | Amount rounds to less than 0.1%. |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $53.46 as of August 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $53.57 as of August 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of August 31, 2019. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 5 | |

JPMorgan Core Plus Bond ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited) (continued)

| | | | | | | | | | | | |

TOTAL RETURNSAS OF AUGUST 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | SIX MONTHS* | | | CUMULATIVE

SINCE

INCEPTION | |

JPMorgan Core Plus Bond ETF | | | | | | | | | | | | |

Net Asset Value | | | January 28, 2019 | | | | 7.71 | % | | | 8.76 | % |

Market Price | | | | | | | 7.68 | % | | | 8.98 | % |

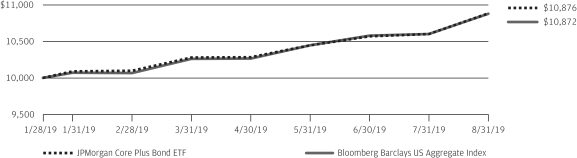

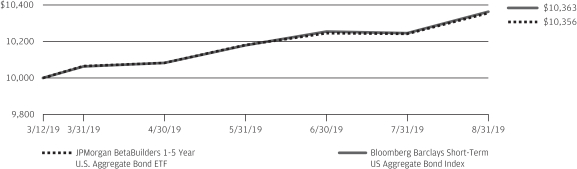

LIFE OF FUND PERFORMANCE(1/28/19 TO 8/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on January 28, 2019.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Core Plus Bond ETF and the Bloomberg Barclays US Aggregate Index from January 28, 2019 to August 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays US Aggregate Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities

included in the Index, if applicable. The Bloomberg Barclays US Aggregate Index is an unmanaged index that represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

JPMorgan Corporate Bond Research Enhanced ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Net Asset Value* | | | 11.26% | |

| Market Price** | | | 11.21% | |

| Bloomberg Barclays U.S. Corporate Bond Index | | | 11.08% | |

| |

| Net Assets as of 8/31/2019 | | $ | 29,344,923 | |

| Duration as of 8/31/2019 | | | 7.9 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan Corporate Bond Research Enhanced ETF (the “Fund”) seeks to provide total return from a portfolio of investment grade corporate bonds.

INVESTMENT APPROACH

The Fund invests primarily in investment grade bonds and uses fundamental credit research for enhanced security selection and sector allocation. The Fund seeks to outperform the Bloomberg Barclays U.S. Corporate Bond Index while maintaining similar risk characteristics.

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2019, the Fund outperformed the Bloomberg Barclays U.S. Corporate Bond Index (the “Index”).

Relative to the Index, the Fund’s security selection within the energy and communications sectors was a leading contributor to performance during the reporting period. The Fund’s overweight position in Anadarko Petroleum Corp. was the largest contributor to performance as the company’s bonds benefitted from the company’s acquisition by Occidental Petroleum Corp.

In the communications sector, the Fund’s positions in Vodafone Group PLC and Verizon Communications Inc. helped relative performance.

The Fund’s underweight position in the technology sector detracted from relative performance as some of the higher quality, large issuers such as Microsoft Corp. and Apple Inc. outperformed during the period. The Fund’s underweight position in the insurance subsector also detracted from performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s portfolio managers sought to invest in companies that they believed were attractive from a fundamental and relative value analysis, while seeking to underweight companies that were unattractive based on their analysis. From a sector perspective, the Fund remained largely in line with the sector weightings in the Index, with its largest underweight allocations in the consumer cyclical and technology sectors, and its largest overweight allocations in the financial and capital goods sectors.

| | | | |

PORTFOLIO COMPOSITION**** | |

| Corporate Bonds | | | 97.7 | % |

| U.S. Treasury Obligations | | | 1.2 | |

| Asset-Backed Securities | | | 0.1 | |

| Short-Term Investments | | | 1.0 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $55.90 as of August 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the NYSE Arca, Inc. The midpoint price was $56.00 as of August 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of August 31, 2019. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 7 | |

JPMorgan Corporate Bond Research Enhanced ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited) (continued)

| | | | | | | | | | | | |

TOTAL RETURNSAS OF AUGUST 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | SIX MONTHS* | | | CUMULATIVE

SINCE

INCEPTION | |

JPMorgan Corporate Bond Research Enhanced ETF | | | | | | | | | | | | |

Net Asset Value | | | December 12, 2018 | | | | 11.26 | % | | | 14.88 | % |

Market Price | | | | | | | 11.21 | % | | | 15.08 | % |

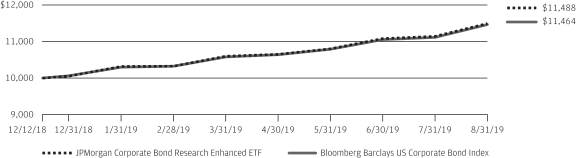

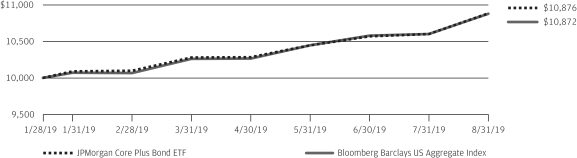

LIFE OF FUND PERFORMANCE(12/12/18 TO 8/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on December 12, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Corporate Bond Research Enhanced ETF and the Bloomberg Barclays US Corporate Bond Index from December 12, 2018 to August 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays US Corporate Bond Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain

distributions of the securities included in the Index, if applicable. The Bloomberg Barclays US Corporate Bond Index broadly measures the investment grade, fixed-rate, taxable, corporate bond market. It includes USD denominated securities publicly issued by U.S. and non-U.S. industrial, utility, and financial issuers that meet specified maturity, liquidity, and quality requirements. Securities in the index roll up to the U.S. Credit and U.S. Aggregate Indices.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

JPMorgan Global Bond Opportunities ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Net Asset Value* | | | 6.18% | |

| Market Price** | | | 6.32% | |

| Bloomberg Barclays Multiverse Index | | | 6.21% | |

| |

| Net Assets as of 8/31/2019 | | $ | 194,475,936 | |

| Duration as of 8/31/2019 | | | 4.2 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan Global Bond Opportunities ETF (the “Fund”) seeks to provide total return.

INVESTMENT APPROACH

The Fund invests across sectors in developed and emerging markets without benchmark constraints. The Fund is flexible and opportunistic and the Fund’s adviser has broad discretion to shift the Fund’s exposures to strategies, sectors, countries or currencies based on changing market conditions and its view of the best mix of investment opportunities.

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2019, the Fund posted a positive return of 6.18%. The Fund is managed with an unconstrained orientation and is not managed relative to a benchmark index. While the Fund is not managed to a benchmark, its return is compared to the Bloomberg Barclays Multiverse Index, which returned 6.21% for the reporting period.

The Fund’s allocations to corporate high yield bonds (also known as “junk bonds”), investment grade bonds, and emerging market debt were leading contributors to absolute performance. High yield bonds benefitted from investors seeking higher yields, positive investor sentiment and low default rates. The Fund’s allocation to securitized debt also contributed to absolute performance. During the reporting period, securitized debt benefitted from lower volatility relative to other bond market sectors and continued economic growth in the U.S.

There were no significant detractors from absolute performance. The Fund’s exposure to foreign currencies was the smallest contributor to absolute performance.

Relative to the Bloomberg Barclays Multiverse Index, the Fund’s shorter overall duration detracted from performance as interest rates fell during the period. Duration measures the price sensitivity of the portfolio of bonds relative to changes in interest rates. Generally, bonds with shorter duration will generally experience smaller price appreciation when interest rates fall, compared with bonds of longer duration.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund invested opportunistically across different markets and sectors. The Fund’s managers applied a flexible investment approach and did not manage to a benchmark. This allowed the Fund to shift its allocations based on changing market conditions. The Fund had exposure to a broad range of asset classes during the reporting period, including high yield and investment grade corporate bonds, agency andnon-agency mortgage-backed securities, asset-backed securities, commercial mortgage-backed securities, emerging markets debt, convertible bonds and foreign government securities. At the end of the reporting period, the Fund’s largest allocations were in U.S. high yield bonds, government bonds and securitized debt. The Fund’s smallest allocations were innon-agency mortgage-backed securities, convertible bonds and collateralized loan obligations.

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 9 | |

JPMorgan Global Bond Opportunities ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited) (continued)

| | | | |

PORTFOLIO COMPOSITION BY COUNTRY**** | |

| United States | | | 46.2 | % |

| Spain | | | 5.0 | |

| Portugal | | | 4.2 | |

| Canada | | | 3.7 | |

| United Kingdom | | | 3.3 | |

| France | | | 2.8 | |

| Italy | | | 2.5 | |

| Indonesia | | | 1.6 | |

| South Africa | | | 1.6 | |

| Mexico | | | 1.6 | |

| Greece | | | 1.5 | |

| Luxembourg | | | 1.2 | |

| Germany | | | 1.2 | |

| Netherlands | | | 1.2 | |

| Switzerland | | | 1.2 | |

| Malaysia | | | 1.0 | |

| Ireland | | | 1.0 | |

| Poland | | | 1.0 | |

| Brazil | | | 1.0 | |

| Others (each less than 1.0%) | | | 13.2 | |

| Short-Term Investments | | | 4.0 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $51.18 as of August 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $51.33 as of August 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of August 31, 2019. The Fund’s composition is subject to change. |

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OF AUGUST 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | SIX MONTHS* | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan Global Bond Opportunities ETF | | | | | | | | | | | | | | | | |

| Net Asset Value | | | April 5, 2017 | | | | 6.18 | % | | | 8.94 | % | | | 5.01 | % |

| Market Price | | | | | | | 6.32 | % | | | 9.27 | % | | | 5.13 | % |

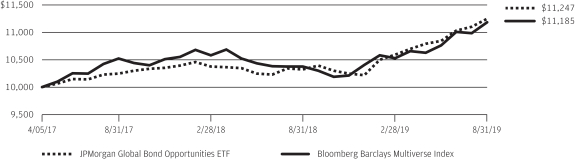

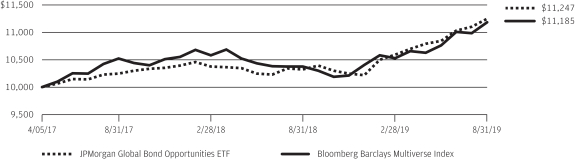

LIFE OF FUND PERFORMANCE(4/5/17 TO 8/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-date,month-end performance information please call1-844-457-6383.

Fund commenced operations on April 5, 2017.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Global Bond Opportunities ETF and the Bloomberg Barclays Multiverse Index from April 5, 2017 to August 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays Multiverse Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable.

The Bloomberg Barclays Multiverse Index is an unmanaged index, which measure the global fixed-income bond market that combines the Bloomberg Barclays Global Aggregate Index and the Bloomberg Barclays Global High Yield Index. The Bloomberg Barclays Global Aggregate Index measures global investment grade debt from twenty-four different local currency markets. The Bloomberg Barclays Global High-Yield Index measures the global high-yield fixed income markets. Investors cannot invest directly in an index.

Fund performance reflects the partial waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 11 | |

JPMorgan High Yield Research Enhanced ETF

(formerly known as JPMorgan Disciplined High Yield ETF)1

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Net Asset Value* | | | 5.46% | |

| Market Price** | | | 5.71% | |

| ICE BofAML US High Yield Index | | | 4.51% | |

| Bloomberg Barclays US Aggregate Index | | | 8.02% | |

| |

| Net Assets as of 8/31/2019 | | $ | 164,107,476 | |

| Duration as of 8/31/2019 | | | 3.1 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan High Yield Research Enhanced ETF (the “Fund”) seeks to provide a high level of income. Capital appreciation is a secondary objective.

INVESTMENT APPROACH

The Fund invests in a diversified portfolio of high-yield securities (also called “junk bonds”). Issuers may be domestic or foreign, but the Fund only invests in U.S. dollar-denominated investments.

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2019, the Fund posted a positive absolute performance and outperformed the ICE BofAML US High Yield Index (the “Benchmark”) and underperformed the Bloomberg Barclays US Aggregate Index.

During the reporting period, bonds rated CCC and lower significantly underperformed bonds rated BB andsingle-B as prices for lower rated bonds generally fell. Relative to the Benchmark, the Fund’s overweight position in bonds rated BB and its lack of holdings in bonds rated CCC helped performance during the reporting period. Bonds issued by publicly traded companies outperformed bonds issued by privately held companies during the reporting period. The Fund did not invest in bonds issued by privately held companies, which helped performance relative to the Benchmark.

To maintain sufficient liquidity, the Fund did not invest in bond issues of less than $500 million or in bond issuers with less than $1 billion in total bonds outstanding, which also contributed to relative performance.

HOW WAS THE FUND POSITIONED?

The Fund’s managers believed that bonds rated CCC generally have materially higher volatility and default risk than bonds rated BB andsingle-B, while providing inadequate incremental return over a market cycle to justify the higher volatility. In addition, the managers believe bonds issued by private companies have had a materially higher probability of default than similarly-rated bonds issued by public companies. As such, the Fund did not invest in bonds rated CCC or bonds issued by private companies. Relative to the Benchmark, the Fund was overweight in bonds rated BB and underweight in bonds rated B and CCC.

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

| | | | |

PORTFOLIO COMPOSITION BY INDUSTRY**** | |

| Oil, Gas & Consumable Fuels | | | 11.3 | % |

| Media | | | 9.9 | |

| Hotels, Restaurants & Leisure | | | 7.7 | |

| Diversified Telecommunication Services | | | 7.0 | |

| Health Care Providers & Services | | | 6.5 | |

| Wireless Telecommunication Services | | | 4.0 | |

| Metals & Mining | | | 3.5 | |

| Equity Real Estate Investment Trusts (REITs) | | | 3.0 | |

| Aerospace & Defense | | | 3.0 | |

| Consumer Finance | | | 2.5 | |

| Containers & Packaging | | | 2.4 | |

| Commercial Services & Supplies | | | 2.2 | |

| Banks | | | 2.0 | |

| Pharmaceuticals | | | 2.0 | |

| Food Products | | | 2.0 | |

| Technology Hardware, Storage & Peripherals | | | 2.0 | |

| Chemicals | | | 2.0 | |

| Communications Equipment | | | 1.8 | |

| Auto Components | | | 1.7 | |

| Trading Companies & Distributors | | | 1.6 | |

| Software | | | 1.5 | |

| Entertainment | | | 1.4 | |

| Capital Markets | | | 1.4 | |

| Energy Equipment & Services | | | 1.4 | |

| Electric Utilities | | | 1.3 | |

| Investment of cash collateral from securities loaned | | | 1.3 | |

| IT Services | | | 1.1 | |

| Independent Power and Renewable Electricity Producers | | | 1.1 | |

| Household Durables | | | 1.0 | |

| Others (each less than 1.0%) | | | 8.5 | |

| Short-Term Investments | | | 1.9 | |

| 1 | | On September 9, 2019, the Fund’s name was changed to JPMorgan High Yield Research Enhanced ETF. The Fund’s investment approach also changed and its primary benchmark was changed to the Bloomberg Barclays US Corporate High Yield – 2% Issuer Capped Index. |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $51.28 as of August 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $51.36 as of August 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of August 31, 2019. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 13 | |

JPMorgan High Yield Research Enhanced ETF

(formerly known as JPMorgan Disciplined High Yield ETF)

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited) (continued)

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OF AUGUST 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | SIX MONTHS* | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan High Yield Research Enhanced ETF | | | | | | | | | | | | | | | | |

| Net Asset Value | | | September 14, 2016 | | | | 5.46 | % | | | 8.36 | % | | | 5.90 | % |

| Market Price | | | | | | | 5.71 | % | | | 8.18 | % | | | 5.94 | % |

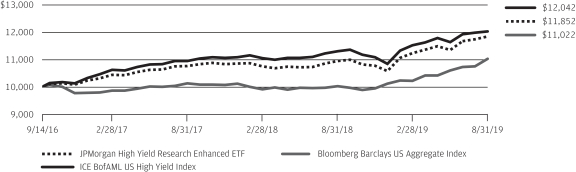

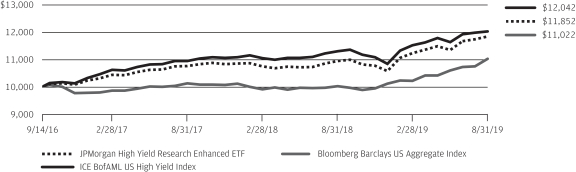

LIFE OF FUND PERFORMANCE(9/14/16 TO 8/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-date,month-end performance information please call1-844-457-6383.

Fund commenced operations on September 14, 2016.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan High Yield Research Enhanced ETF, the ICE BofAML US High Yield Index and the Bloomberg Barclays US Aggregate Index from September 14, 2016 to August 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the ICE BofAML US High Yield Index and the Bloomberg Barclays US Aggregate Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The ICE BofAML US High Yield Index is an unmanaged index, which measures the performance

of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. The Bloomberg Barclays US Aggregate Index is an unmanaged index that represents securities that areSEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Investors cannot invest directly in an index.

Fund performance reflects the partial waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

JPMorgan Municipal ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Net Asset Value* | | | 6.56% | |

| Market Price** | | | 6.42% | |

| Bloomberg Barclays US1-15 Year Blend(1-17) Municipal Bond Index | | | 5.04% | |

| |

| Net Assets as of 8/31/2019 | | $ | 35,531,083 | |

| Duration as of 8/31/2019 | | | 5.7 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan Municipal ETF (the “Fund”) seeks to provide monthly dividends, which are excluded from gross income, and to protect the value of your investment by investing primarily in municipal obligations. For purposes of the Fund’s investment objective, “gross income” means gross income for federal income tax purposes.

INVESTMENT APPROACH

The Fund invests primarily in a diversified portfolio of intermediate-term municipal bonds, the income from which is exempt from federal income tax. The Fund seeks to maintain an average weighted maturity between three and ten years.

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2019, the Fund outperformed to the Bloomberg Barclays US1-15 Year Blend(1-17) Municipal Bond Index (the “Index”). Interest rates fell during the reporting period and lower rated bonds generally outperformed higher rated bonds.

Relative to the Index, the Fund’s longer overall duration was a leading contributor to performance. Duration measures the price sensitivity of a portfolio of bonds relative to changes in interest rates. Generally, a portfolio of bonds with a longer duration will experience a larger increase in price when interest rates fall. The Fund’s overweight allocations to bonds rated BBB and BB and its overweight allocations to local general obligation bonds and the leasing sector also contributed to relative performance.

The Fund’s underweight allocations to the hospital, industrial development revenue/pollution control revenue and transportation sectors were leading detractors from relative performance. The Fund’s allocation to floating rate notes, which were not held in the Index and were used tactically to maintain liquidity and market stability in the portfolio, also detracted from performance. Typically, floating rate notes do not experience price appreciation when interest rates fall. The Fund’s underweight positions in Connecticut and New Jersey bonds and its overweight positions in Texas and Florida bonds also hurt relative performance.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund’s largest allocations were in revenue bonds and general obligation bonds, while its smallest allocation was inpre-refunded bonds. In terms of quality, the Fund’s largest allocations were in bonds rated AA andsingle-A, while its smallest allocations were in unrated bonds and bonds rated BB. The Fund’s overall duration was 5.7 years compared with 4.5 years for the Index.

| | | | |

PORTFOLIO COMPOSITION**** | |

| Municipal Bonds | | | 97.4 | % |

| Short-Term Investments | | | 2.6 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $54.66 as of August 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $54.68 as of August 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of August 31, 2019. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 15 | |

JPMorgan Municipal ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited) (continued)

| | | | | | | | | | | | |

TOTAL RETURNSAS OF AUGUST 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | SIX MONTHS* | | | CUMULATIVE

SINCE

INCEPTION | |

JPMorgan Municipal ETF | | | | | | | | | | | | |

| Net Asset Value | | | October 29, 2018 | | | | 6.56 | % | | | 11.61 | % |

| Market Price | | | | | | | 6.42 | % | | | 11.65 | % |

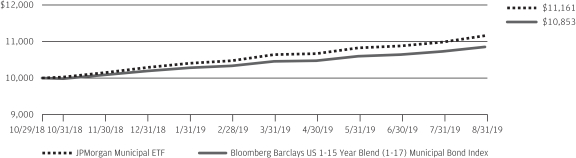

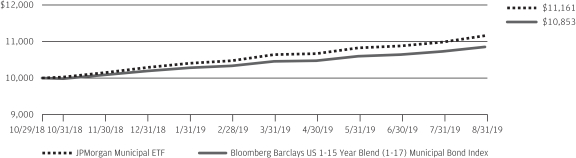

LIFE OF FUND PERFORMANCE(10/29/18 TO 8/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on October 29, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Municipal ETF and the Bloomberg Barclays US 1-15 Year Blend (1-17) Municipal Bond Index from October 29, 2018 to August 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays US 1-15 Year Blend (1-17) Municipal Bond Index does not reflect the deduction of expenses associated with an

exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Bloomberg Barclays US 1-15 Year Blend (1-17) Municipal Bond Index represents the performance of municipal bonds with maturities from 1 to 17 years.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

JPMorgan U.S. Aggregate Bond ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Net Asset Value* | | | 7.88% | |

| Market Price** | | | 8.07% | |

| Bloomberg Barclays US Aggregate Index | | | 8.02% | |

| |

| Net Assets as of 8/31/2019 | | $ | 189,858,909 | |

| Duration as of 8/31/2019 | | | 5.7 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan U.S. Aggregate Bond ETF (the “Fund”) seeks to provide long-term total return.

INVESTMENT APPROACH

The Fund invests in a diversified portfolio of high-quality fixed income securities, including corporate bonds, U.S. Treasury obligations and other U.S. government and agency securities, and asset-backed, mortgage-related and mortgage-backed securities. With respect to corporatesub-sectors, the Fund applies a multi-factor credit screening process that seeks exposure to corporate debt issuers with attractive value, quality and momentum characteristics.

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2019, the Fund underperformed the Bloomberg Barclays US Aggregate Index (the “Index”).

Relative to the Index, the Fund’s security selection within corporate bonds detracted from performance. During the reporting period, interest rates generally declined and lower quality bonds outperformed higher quality bonds.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund applied a multi-factor credit screening process to the corporatesub-sectors of the Index that sought exposure to corporate debt issuers that the Fund’s portfolio managers believed had attractive value, quality and momentum characteristics. The Fund’s and the Index’s largest allocations at the end of the reporting period were in government bonds and corporate bonds and its smallest allocations were in agency debt and municipal bonds.

| | | | |

PORTFOLIO COMPOSITION**** | |

| U.S. Treasury Obligations | | | 39.8 | % |

| Mortgage-Backed Securities | | | 26.8 | |

| Corporate Bonds | | | 25.8 | |

| Commercial Mortgage-Backed Securities | | | 2.0 | |

| Foreign Government Securities | | | 1.6 | |

| Supranational | | | 1.3 | |

| U.S. Government Agency Securities | | | 1.3 | |

| Others (each less than 1.0%) | | | 1.1 | |

| Short-Term Investments | | | 0.3 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $26.93 as of August 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the NYSE Arca, Inc. The midpoint price was $27.00 as of August 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of August 31, 2019. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 17 | |

JPMorgan U.S. Aggregate Bond ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited) (continued)

| | | | | | | | | | | | |

TOTAL RETURNSAS OF AUGUST 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | SIX MONTHS* | | | CUMULATIVE

SINCE

INCEPTION | |

JPMorgan U.S. Aggregate Bond ETF | | | | | | | | | | | | |

| Net Asset Value | | | December 12, 2018 | | | | 7.88 | % | | | 9.92 | % |

| Market Price | | | | | | | 8.07 | % | | | 10.21 | % |

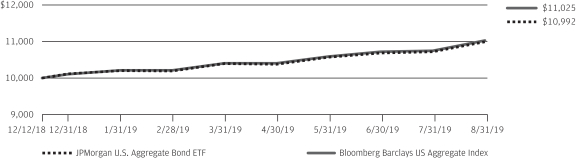

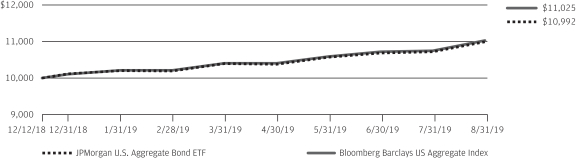

LIFE OF FUND PERFORMANCE(12/12/18 TO 8/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on December 12, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan U.S. Aggregate Bond ETF and the Bloomberg Barclays US Aggregate Index from December 12, 2018 to August 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays US Aggregate Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the secu-

rities included in the Index, if applicable. The Bloomberg Barclays US Aggregate Index is an unmanaged index that represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Investors cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 18 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

JPMorgan Ultra-Short Income ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Net Asset Value* | | | 1.81% | |

| Market Price** | | | 1.81% | |

| ICE BofAML US3-Month Treasury Bill Index | | | 1.25% | |

| |

| Net Assets as of 8/31/2019 | | $ | 8,377,351,630 | |

| Duration as of 8/31/2019 | | | 0.5 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan Ultra-Short Income ETF (the “Fund”) seeks to provide current income while seeking to maintain a low volatility of principal.

INVESTMENT APPROACH

The Fund primarily invests mainly in investment-grade, U.S. dollar-denominated short-term fixed, variable and floating-rate debt. The Fund seeks to maintain a duration of one year or less, although under certain market conditions, the Fund’s duration may be longer than one year. Duration measures the price sensitivity of a portfolio of bonds to relative changes in interest rates. Generally, bonds with longer duration will experience a larger decrease or increase in price as interest rates rise or fall, respectively, versus bonds with shorter duration. The Fund’s adviser has broad discretion to shift the Fund’s exposure to strategies and sectors based on changing market conditions and its view of the best mix of investment opportunities.

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2019, the Fund outperformed the ICE BofAML US3-Month Treasury Bill Index (the “Index”). Interest rates fell during the reporting period and lower rated bonds generally outperformed higher rated bonds.

The Fund’s allocations to investment grade corporate bonds and money market securities were leading contributors to both absolute performance and performance relative to the Index during the reporting period. The Fund’s allocations to collateralized loan obligations, asset backed securities and commercial mortgage backed securities also contributed to absolute and relative performance. The Fund also added exposure to U.S. Treasury bonds which, given the steep decline in bond yields over the period, positively contributed to absolute and relative performance.

There were no significant detractors from absolute or relative performance during the reporting period.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s portfolio management team positioned the Fund according to its belief that interest rates would be moving lower throughout the year and that corporate credit fundamentals would remain favorable, despite

geopolitical risks and the potential impact of protracted trade tensions between the U.S. and China. The team added to its U.S. Treasury bonds allocation in an effort to protect against market volatility from trade uncertainty and benefit from a shift to a declining interest rate environment. In descending order, the Fund’s largest allocations were in corporate bonds, money market securities, collateralized loan obligations, asset backed securities, U.S. Treasury bonds, commercial mortgage backed securities, andnon-corporate credit.

| | | | |

PORTFOLIO COMPOSITION BY SECTOR**** | |

| Financials | | | 45.6 | % |

| Asset-Backed Securities | | | 11.2 | |

| U.S. Treasury Obligations | | | 6.2 | |

| Utilities | | | 2.8 | |

| Energy | | | 2.8 | |

| Consumer Discretionary | | | 2.7 | |

| Industrials | | | 2.5 | |

| Health Care | | | 2.3 | |

| Consumer Staples | | | 2.0 | |

| Communication Services | | | 1.9 | |

| Real Estate | | | 1.1 | |

| Others (each less than 1.0%) | | | 2.0 | |

| Short-Term Investments | | | 16.9 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $50.40 as of August 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $50.43 as of August 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of August 31, 2019. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 19 | |

JPMorgan Ultra-Short Income ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited) (continued)

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNSAS OF AUGUST 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | SIX MONTHS* | | | 1 YEAR | | | SINCE

INCEPTION | |

JPMorgan Ultra-Short Income ETF | | | | | | | | | | | | | | | | |

| Net Asset Value | | | May 17, 2017 | | | | 1.81 | % | | | 3.21 | % | | | 2.51 | % |

| Market Price | | | | | | | 1.81 | % | | | 3.18 | % | | | 2.54 | % |

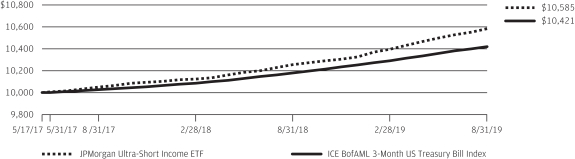

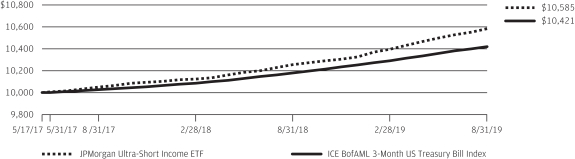

LIFE OF FUND PERFORMANCE(5/17/17 TO 8/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Forup-to-date,month-end performance information please call1-844-457-6383.

Fund commenced operations on May 17, 2017.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Ultra-Short Income ETF and the ICE BofAML 3-Month US Treasury Bill Index from May 17, 2017 to August 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the ICE BofAML 3-Month US Treasury Bill Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the

securities included in the Index, if applicable. The ICE BofAML 3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. The index is rebalanced monthly and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond 3 months from the rebalancing date. Investors cannot invest directly in an index.

Fund performance reflects the partial waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 20 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

JPMorgan Ultra-Short Municipal Income ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Net Asset Value* | | | 1.26% | |

| Market Price** | | | 1.26% | |

| Bloomberg Barclays 1-Year Municipal Bond Index | | | 1.51% | |

| |

| Net Assets as of 8/31/2019 | | $ | 123,669,200 | |

| Duration as of 8/31/2019 | | | 0.7 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan Ultra-Short Municipal Income ETF (the “Fund”) seeks as high a level of current income exempt from federal income tax as is consistent with relative stability of principal.

INVESTMENT APPROACH

The Fund invests primarily in investment grade fixed, variable and floating rate municipal securities, the income from which is exempt from federal income tax. The Fund seeks to maintain an average weighted maturity of two years or less.

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2019, the Fund underperformed the Bloomberg Barclays 1- Year Municipal Bond Index (the “Index”). Interest rates fell during the reporting period and lower rated bonds generally outperformed higher rated bonds.

The Fund’s allocation to variable rate bonds, which are not held in the Index and are used tactically to maintain liquidity and market stability in the portfolio, was a leading detractor from both absolute performance and performance relative to the Index. Typically, variable rate bonds do not experience price appreciation when interest rates fall. The Fund’s underweight allocations to bonds ratedsingle-A and BBB and its overweight allocation to local general obligation bonds also detracted from relative performance.

The Fund’s allocation to bonds with maturities longer than two years, which are not held in the Index, was a leading contributor to both absolute performance and performance relative to the Index during the reporting period. Relative to the Index, the Fund’s overweight allocations to the leasing and industrial development revenue/pollution control revenue sectors, and its

underweight allocation to bonds issued in California also contributed to performance.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund’s overall duration was 0.7 years vs. 1.5 years for the Index. Duration measures the price sensitivity of a portfolio of bonds relative to changes in interest rates. Generally, bonds with shorter duration experience smaller increase in price as interest rates fall, relative to longer duration bonds.

| | | | |

PORTFOLIO COMPOSITION**** | |

| Municipal Bonds | | | 98.6 | % |

| Short-Term Investments | | | 1.4 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $50.48 as of August 31, 2019. |

| ** | | Market price return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Cboe BZX Exchange, Inc. The midpoint price was $50.51 as of August 31, 2019. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of August 31, 2019. The Fund’s composition is subject to change. |

| | | | | | | | |

| | | |

| AUGUST 31, 2019 | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | | | | 21 | |

JPMorgan Ultra-Short Municipal Income ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited) (continued)

| | | | | | | | | | | | |

TOTAL RETURNSAS OF AUGUST 31, 2019 (Unaudited) | |

| | | INCEPTION DATE | | | SIX MONTHS* | | | CUMULATIVE

SINCE

INCEPTION | |

JPMorgan Ultra-Short Municipal Income ETF | | | | | | | | | | | | |

| Net Asset Value | | | October 16, 2018 | | | | 1.26 | % | | | 2.44 | % |

| Market Price | | | | | | | 1.26 | % | | | 2.50 | % |

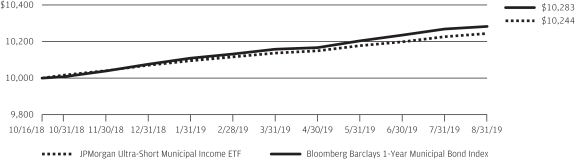

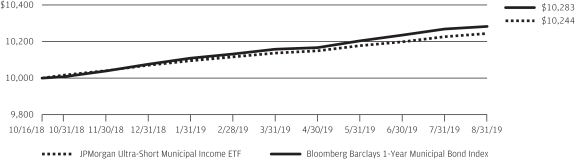

LIFE OF FUND PERFORMANCE(10/16/18 TO 8/31/19)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on October 16, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Ultra-Short Municipal Income ETF and the Bloomberg Barclays1-Year Municipal Bond Index from October 16, 2018 to August 31, 2019. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Barclays 1-Year Municipal Bond Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Bloomberg

Barclays 1 Year Municipal Bond Index is an unmanaged index that includes bonds with a minimum credit rating of BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million, and have maturities of 1 to 2 years. The performance of the index does not reflect the deduction of expenses associated with a mutual fund, such as investment management fees. By contrast, the performance of the Fund reflects the deduction of the mutual fund expenses, including sales charges if applicable. An individual cannot invest directly in an index.

Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 22 | | | | J.P. MORGAN EXCHANGE-TRADED FUNDS | | AUGUST 31, 2019 |

JPMorgan USD Emerging Markets Sovereign Bond ETF

FUND COMMENTARY

SIX MONTHS ENDED AUGUST 31, 2019 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Net Asset Value* | | | 9.62% | |

| Market Price** | | | 9.94% | |

| JPMorgan Emerging Markets Risk-Aware Bond Index | | | 9.88% | |

| |

| Net Assets as of 8/31/2019 | | $ | 66,104,839 | |

| Duration as of 8/31/2019 | | | 7.5 Years | |

INVESTMENT OBJECTIVE***

The JPMorgan USD Emerging Markets Sovereign Bond ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the JPMorgan Emerging Markets Risk-Aware Bond Index (the “Underlying Index”).

INVESTMENT APPROACH

The Fund is passively managed to the Underlying Index, which is comprised of liquid, U.S. dollar-denominated sovereign and quasi-sovereign fixed and floating rate debt securities from emerging markets. The Underlying Index utilizes a rules-based, proprietary methodology that filters for liquidity and country risk and allocates risk across credit ratings. The Underlying Index methodology includes monthly rebalancing within countries and semi-annual rebalancing across countries. The Fund also employs optimization techniques that seek to minimize tracking error to the Underlying Index.

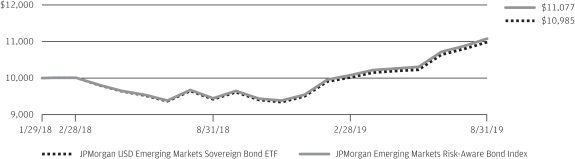

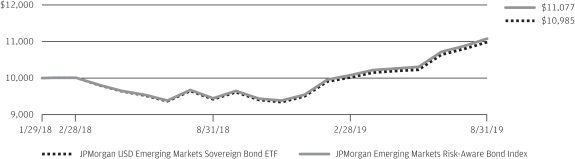

HOW DID THE FUND PERFORM?

For the six months ended August 31, 2019, the Fund performed in line with the Underlying Index. The majority of the Fund’s deviation against the Underlying Index was due to operating expenses, fees and tax management of the Fund’s portfolio.