UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

J.P. Morgan Investment Management Inc.

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

With copies to:

| | |

Elizabeth A. Davin, Esq. JPMorgan Chase & Co. 1111 Polaris Parkway Columbus, OH 43240 | | Jon S. Rand, Esq. Dechert LLP 1095 Avenue of the Americas New York, NY 10036 |

Registrant’s telephone number, including area code: 1-844-457-6383

Date of fiscal year end: October 31

Date of reporting period: November 1, 2021 through October 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Reports. Not Applicable. Notices do not incorporate disclosures from the shareholder report.

Annual Report

J.P. Morgan Exchange-Traded Funds

October 31, 2022

| | |

JPMorgan ActiveBuilders Emerging Markets Equity ETF | | |

JPMorgan ActiveBuilders International Equity ETF | | |

JPMorgan BetaBuilders Canada ETF | | |

JPMorgan BetaBuilders Developed Asia Pacific ex-Japan ETF (formerly known as JPMorgan BetaBuilders Developed Asia ex-Japan ETF) | | |

JPMorgan BetaBuilders Europe ETF | | |

JPMorgan BetaBuilders International Equity ETF | | |

JPMorgan BetaBuilders Japan ETF | | |

JPMorgan BetaBuilders U.S. Equity ETF | | |

JPMorgan BetaBuilders U.S. Mid Cap Equity ETF | | |

JPMorgan BetaBuilders U.S. Small Cap Equity ETF | | |

JPMorgan Carbon Transition U.S. Equity ETF | | |

JPMorgan Climate Change Solutions ETF | | |

JPMorgan Diversified Return Emerging Markets Equity ETF | | |

JPMorgan Diversified Return International Equity ETF | | |

JPMorgan Diversified Return U.S. Equity ETF | | |

JPMorgan Diversified Return U.S. Mid Cap Equity ETF | | |

JPMorgan Diversified Return U.S. Small Cap Equity ETF | | |

JPMorgan International Growth ETF | | |

JPMorgan U.S. Momentum Factor ETF | | |

JPMorgan U.S. Quality Factor ETF | | |

JPMorgan U.S. Value Factor ETF | | |

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not at net asset value) through a brokerage account, and are not individually subscribed and redeemed from a Fund. Shares may only be subscribed and redeemed directly from a Fund by Authorized Participants, in large creation/redemption units. Brokerage commissions will reduce returns.

President's Letter

December 15, 2022 (Unaudited)

Dear Shareholder,

Global financial markets reflected turmoil in the global economy in 2022, stirred by sharply higher inflation, rising interest rates, sporadic pandemic disruptions and the widening impact of the Russia-Ukraine conflict. Prices for both equities and bonds tumbled during the first half of the year and remained under pressure through the end of October.

|

“While investors seek to adapt to the current market environment, we believe a well-diversified portfolio and a patient outlook remain crucial components of a successful invest- ment approach.” — Brian S. Shlissel

|

Emerging market equities underperformed both the U.S. and other developed equity markets amid economic weakness in China and slowing global demand during the period. Across Europe, the war in Ukraine set off an energy crisis as a result of reduced imports of natural gas from Russia. U.S. equity markets also fell in 2022, but surprisingly strong corporate earnings and consumer spending helped leading U.S. indexes to rebound from their lowest levels. For the twelve month period ended October 31, 2022, the MSCI Emerging Markets Index returned -31.0%, the MSCI EAFE Index returned -23.0% and the S&P 500 Index returned -14.6%.

Notably, some recent U.S. inflationary data has indicated signs of easing price pressures and U.S. economic output as measured by gross domestic product turned positive in the third quarter of 2022, following two consecutive quarters of negative growth. Though the U.S. economy has lost momentum in 2022, it has not yet fallen into recession. Meanwhile, as the potential for a rapid resolution to the war in Ukraine appears to have faded, the European Union and its largest constituent

nations have moved to secure sufficient winter energy supplies while decreasing their dependence on imports of natural gas from Russia. In the U.K., a year-long political crisis was resolved with the accession of Rishi Sunak to prime minister in October 2022, which helped shore up the value of British pound and stabilize U.K. financial markets. China has eased some of the social restrictions under its “Zero Covid” policy and domestic equity indexes recently rose amid investor expectations that China’s economy may fully reopen in the coming months.

As 2022 comes to a close, financial markets are likely to remain volatile due to investor uncertainty regarding the outlook for inflation, interest rates and economic momentum. Increased geo-political tensions between Russia and Ukraine’s Western allies also remains a headwind for global financial markets.

Investors this year have confronted economic and financial market conditions not experienced in many years. While investors seek to adapt to the current market environment, we believe a well-diversified portfolio and a patient outlook remain crucial components of a successful investment approach. Our broad array of investment solutions seeks to provide investors with ability to build durable portfolios that can help them meet their financial goals.

Sincerely,

Brian S. Shlissel

President, J.P. Morgan Funds

J.P. Morgan Asset Management

1-844-457-6383 or www.jpmorganfunds.com for more information

| J.P. Morgan Exchange-Traded Funds | |

J.P. Morgan Exchange-Traded Funds

MARKET OVERVIEW

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

While developed market equities largely ended 2021 with positive returns, global prices for equities and bonds plummeted in 2022 amid accelerating inflation, rising interest rates, pandemic disruptions in China and the outbreak of conflict in Ukraine. Returns for both equity and bond markets broadly declined during the first half of 2022 and remained in negative territory through the end of October. Notably, global energy prices rose sharply in the first half of 2022 before receding somewhat in the third quarter.

In the EU, the war in Ukraine remained the focus of investors’ attention as energy supplies from Russia were constrained and the potential for a rapid resolution to the conflict receded. Both the EU and its individual constituent nations moved to build up reserves of natural gas and petroleum ahead of the winter months. By the end of October 2022, several European governments had sought to confront soaring inflation with spending plans to help households manage rising food and energy costs. The European Central Bank responded to the highest inflation rates in 40 years by sharply raising its policy interest rates in September 2022 and again in October. During the twelve month period, equity markets in Europe largely outperformed emerging markets equities but underperformed U.S. equity markets.

Political turmoil in the U.K. added to a weakening economic outlook that rattled financial markets and pushed the British pound to a 37-year low against the U.S. dollar. By late October 2022, the accession of Rishi Sunak to prime minister provided some support for both the pound and U.K. financial markets. The Bank of England was among the earliest developed market central banks to move to curb inflationary pressures, with an initial interest rate increase in December 2021, and seven more increases during the period.

Developed markets in the Asia-Pacific region also slumped during the period amid rising inflation, particularly soaring energy prices, and broad weakness in the semiconductors sector. Despite inflationary pressures, the Bank of Japan maintained its ultra-low interest rate policy. Meanwhile, equities in Hong Kong and Singapore largely underperformed other developed markets.

In the U.S., investors largely kept their focus on inflation data as indicators of short-term policy of the U.S. Federal Reserve. In mid-March 2022, the central bank initiated its first interest rate increase since late 2018, and then followed with four more rate raises by the end of September 2022. U.S. gross domestic product fell by 1.6% in the first quarter of 2022 and dropped 0.6% in the second quarter before rebounding to a 2.6% increase in the third quarter. Consumer spending declined but remained somewhat better than investors expected. By the end of June 2022, U.S. equity prices had tumbled more than 20% from the start of the year, which is generally considered a bear market. However, prices rebounded somewhat by the end of October 2022.

Meanwhile, emerging markets equities and bonds slumped throughout the twelve months ended in October 2022. China was among the worst performers as the government’s “zero covid” policy led to strict lockdowns in several large cities, which weighed on the services sector in particular and on economic growth in general. China’s technology sector remained under pressure amid increased scrutiny of large technology companies by government regulators. Across emerging markets rising interest rates weighed on government spending and higher energy prices hurt markets of regions dependent on petroleum imports.

For the twelve months ended October 31, 2022, the S&P 500 Index returned -14.6%, the MSCI EAFE Index returned -23.0% and the MSCI Emerging Markets Index returned -31.0%.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan ActiveBuilders Emerging Markets Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

MSCI Emerging Markets Index (net total return) | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan ActiveBuilders Emerging Markets Equity ETF (the “Fund”) seeks to provide long term capital appreciation.

INVESTMENT APPROACH

The Fund invests primarily in equity securities and equity-related instruments that are tied economically to emerging markets and seeks to construct a portfolio of holdings that will outperform the MSCI Emerging Markets Index (the “Benchmark”) over time while maintaining similar risk characteristics. The Fund allocates investments to the adviser’s actively managed emerging market equity strategies across countries, regions and style strategies and may invest across all market capitalizations.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute return and underperformed the Benchmark.

Relative to the Benchmark, the Fund’s security selection in the financials and materials sectors was a leading detractor from performance, while the Fund’s security selection in the consumer discretionary sector and its underweight position in the communication services sector were leading contributors to relative performance.

By country, the Fund’s security selections in India and Taiwan were leading detractors from performance relative to the Benchmark, while the Fund’s overweight positions in Mexico and Indonesia were leading contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Sberbank and China

Merchants Bank Co., and its out-of-Benchmark position in Sea Ltd. Shares of Sberbank, a Russian financial services provider no longer held by the Fund, fell after the imposition of multilateral economic sanctions in response to Russia’s invasion of Ukraine in late February 2022. At the end of the period, the Fund’s exposure to Russia was less than 0.01% of the portfolio. Shares of China Merchants Bank, a financial services provider based in Shenzhen, China, fell amid overall weakness in investor demand for Chinese equities. Shares of Sea, a Singapore-based internet and mobile platform provider, fell after Tencent Holdings Ltd. reduced its stake in the company.

Leading individual contributors to relative performance included the Fund’s overweight position in Wal-Mart de Mexico SAB and its underweight positions in Alibaba Group Holding Ltd. and Tencent Holdings Ltd. Shares of Wal-Mart de Mexico, a discount retailer, rose amid robust consumer demand supported by higher remittances from expatriates abroad. Shares of Alibaba, a China-based online retail market platform operator, fell amid tighter regulations on Chinese technology companies and slower growth in China’s economy.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s largest overweight allocations relative to the Benchmark were to the information technology and consumer staples sectors and its largest underweight allocations were to the materials and communication services sectors. By country, the Fund’s largest overweight allocations were to Mexico and Taiwan and its

largest underweight positions were in Saudi Arabia and India.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan ActiveBuilders Emerging Markets Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited) (continued)

*

The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $31.07 as of October 31, 2022.

**

Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return was the closing price on the Cboe BZX Exchange, Inc. As of October 31, 2022, the closing price was $31.15.

***

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan) | |

| Samsung Electronics Co. Ltd. (South Korea) | |

| Tencent Holdings Ltd. (China) | |

| | |

| Housing Development Finance Corp. Ltd. (India) | |

| Wal-Mart de Mexico SAB de CV (Mexico) | |

| Alibaba Group Holding Ltd. (China) | |

| HDFC Bank Ltd., ADR (India) | |

| Grupo Financiero Banorte SAB de CV, Class O (Mexico) | |

| SK Hynix, Inc. (South Korea) | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

| J.P. Morgan Exchange-Traded Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF October 31, 2022 (Unaudited)

| | | |

JPMorgan ActiveBuilders Emerging Markets Equity ETF | | | |

| | | |

| | | |

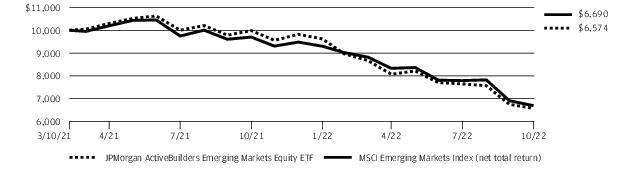

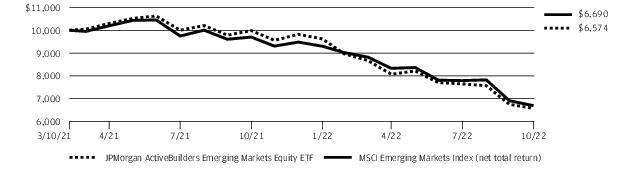

LIFE OF FUND PERFORMANCE (3/10/21 TO 10/31/22)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-844-457-6383.

Fund commenced operations on March 10, 2021.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan ActiveBuilders Emerging Markets Equity ETF and MSCI Emerging Markets Index (net total return) from March 10, 2021 to October 31, 2022. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the MSCI Emerging Markets Index (net total return) does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. MSCI Emerging Markets Index (net total return) is a free float-adjusted market

capitalization-weighted index that is designed to measure the performance of large- and mid-cap stocks in emerging markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan ActiveBuilders International Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

MSCI EAFE Index (net total return) | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan ActiveBuilders International Equity ETF (the “Fund”) seeks to provide long term capital appreciation.

INVESTMENT APPROACH

The Fund invests primarily in equity securities and equity-related instruments of foreign companies across various market capitalizations and seeks to outperform the MSCI EAFE Index (the “Benchmark”) over time while maintaining similar risk characteristics. The Fund allocates investments in the adviser’s actively managed international equity strategies, including country, region and styles strategies.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute return and outperformed the Benchmark.

Relative to the Benchmark, the Fund’s overweight positions in the energy and financials sectors were leading contributors to performance, while the Fund’s security selection in the consumer discretionary and communication services sectors was a leading detractor from relative performance.

By country, the Fund’s security selection in Sweden and Denmark was a leading contributor to performance relative to the Benchmark. The Fund’s security selection in the U.K. and its out-of-Benchmark position in China were leading detractors from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in TotalEnergies SE, DBS Group Holdings Ltd. and Novo Nordisk A/S. Shares of

TotalEnergies, a French integrated petroleum and natural gas company, rose amid higher global energy prices during the period. Shares of DBS Group Holdings, a Singapore financial services provider, rose after the company reported earnings and revenue growth during the period. Shares of Novo Nordisk, a Danish pharmaceuticals and health care products company, rose after legislative efforts to cap insulin prices failed in the U.S. Congress.

Leading individual detractors from relative performance included the Fund’s overweight positions in Adidas, Sea Ltd. and Adyen NV. Shares of Adidas, a German maker of footwear and sports apparel, fell amid supply-chain constraints and consumer backlash to the company’s former partnership with Kanye West. Shares of Sea, a Singapore-based internet and mobile platform provider, fell after Tencent Holdings Ltd. reduced its stake in the company. Shares of Adyen, a Dutch payments and e-commerce company, fell amid a broad sell-off in the information technology sector in the first quarter of 2022 and after the company reported lower-than-expected results for the first half of 2022.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund’s largest overweight allocations relative to the Benchmark were to the financials and energy sectors and its largest underweight allocations were to the real estate and industrials sectors. By country, the Fund’s largest overweight allocations were to Denmark and France and its largest underweight positions were in Australia and Japan.

| J.P. Morgan Exchange-Traded Funds | |

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| | |

| Novo Nordisk A/S, Class B (Denmark) | |

| | |

| LVMH Moet Hennessy Louis Vuitton SE (France) | |

| TotalEnergies SE (France) | |

| ASML Holding NV (Netherlands) | |

| BHP Group Ltd. (Australia) | |

| Diageo plc (United Kingdom) | |

| Novartis AG (Registered) (Switzerland) | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PORTFOLIO COMPOSITION BY COUNTRY AS OF October 31, 2022 | PERCENT OF TOTAL INVESTMENTS |

| |

Others (each less than 1.0%) | |

| |

*

The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $37.38 as of October 31, 2022.

**

Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return was the closing price on the NYSE Arca. As of October 31, 2022, the closing price was $37.36.

***

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan ActiveBuilders International Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF October 31, 2022 (Unaudited)

| | | |

JPMorgan ActiveBuilders International Equity ETF | | | |

| | | |

| | | |

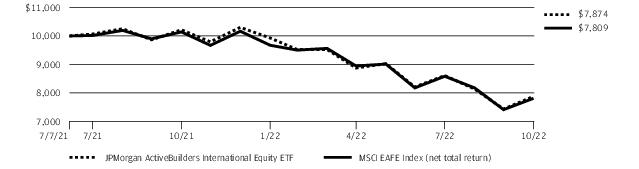

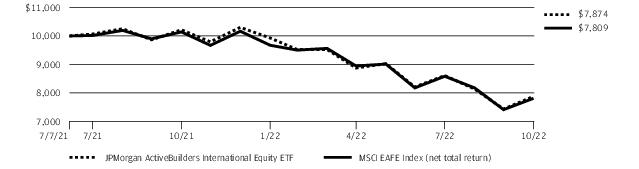

LIFE OF FUND PERFORMANCE (7/7/21 TO 10/31/22)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-844-457-6383.

Fund commenced operations on July 7, 2021.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan ActiveBuilders International Equity ETF and MSCI EAFE Index (net total return) from July 7, 2021 to October 31, 2022. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the MSCI EAFE Index (net total return) does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. MSCI EAFE Index (net total return) is a free float-adjusted market capitalization-weighted index that is designed to measure

the performance of large- and mid-cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders Canada ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

Morningstar® Canada Target Market Exposure IndexSM (net total return) | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders Canada ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® Canada Target Market Exposure IndexSM (the "Underlying Index").

INVESTMENT APPROACH

The Underlying Index is a free float adjusted, market capitalization weighted index, which consists of stocks traded primarily on the Toronto Stock Exchange. Using a "passive" investment approach, the Fund attempts to replicate the constituent securities of the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute return and performed in line with the Underlying Index, before considering the effects of differences in the timing of foreign exchange rate calculations, operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the information technology and financials sectors were leading detractors from absolute performance, while their exposures to the energy and consumer staples sectors were leading contributors to absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were to the financials and energy sectors and their smallest allocations were to the health care and real estate sectors.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| Royal Bank of Canada (Canada) | |

| Toronto-Dominion Bank (The) (Canada) | |

| | |

| Canadian National Railway Co. (Canada) | |

| Canadian Pacific Railway Ltd. (Canada) | |

| Canadian Natural Resources Ltd. (Canada) | |

| Bank of Montreal (Canada) | |

| Bank of Nova Scotia (The) (Canada) | |

| Brookfield Asset Management, Inc., Class A (Canada) | |

| Suncor Energy, Inc. (Canada) | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

*

The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $57.30 as of October 31, 2022.

**

Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders Canada ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited) (continued)

the last day of the period. The price used to calculate the market price return was the closing price on the Cboe BZX Exchange, Inc. As of October 31, 2022, the closing price was $57.35.

***

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Exchange-Traded Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF October 31, 2022 (Unaudited)

| | | |

JPMorgan BetaBuilders Canada ETF | | | |

| | | |

| | | |

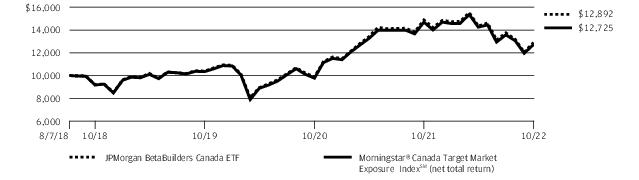

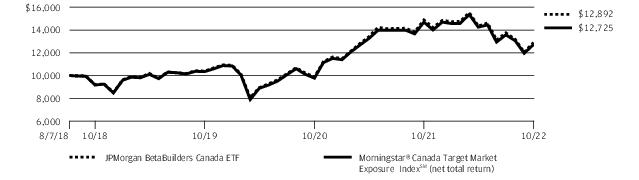

LIFE OF FUND PERFORMANCE (8/7/18 TO 10/31/22)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-844-457-6383.

Fund commenced operations on August 7, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders Canada ETF and Morningstar® Canada Target Market Exposure IndexSM (net total return) from August 7, 2018 to October 31, 2022. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® Canada Target Market Exposure IndexSM (net total return) does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Morningstar® Canada Target Market Exposure IndexSM (net total return) is a rules-based, float-adjusted market capitalization-weighted index designed to cover 85% of the equity float-adjusted market capitalization of the

Canada equity markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

For periods presented prior to November 1, 2019, the date on which a unitary fee structure was adopted, Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders Developed Asia Pacific ex-Japan ETF

(formerly known as JPMorgan BetaBuilders Developed Asia ex-Japan ETF)

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure IndexSM (net total return) | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders Developed Asia Pacific ex-Japan ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure IndexSM (the "Underlying Index").

INVESTMENT APPROACH

The Underlying Index is a free float adjusted, market capitalization weighted index that consists of equity securities from developed Asia-Pacific countries or regions other than Japan, including: Australia, Hong Kong, New Zealand and Singapore. Using a "passive" investment approach, the Fund attempts to replicate the constituent securities of the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute return and performed in line with the Underlying Index, before considering the effects of differences in the Fund’s net asset value calculations versus the Underlying Index’s valuation calculations, differences in the timing of foreign exchange rate calculations, as well as operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the financials and health care sectors were leading detractors from absolute performance, while their exposures to the energy sector was the sole sector contributor to absolute performance.

By country or region, the Fund’s and the Underlying Index’s exposures to Australia and Hong Kong were leading detractors from absolute performance, while their exposures to Singapore and New Zealand were the smallest detractors from absolute performance and no country exposure made a positive contribution to absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were to the financials and materials

sectors and their smallest allocations were to the information technology and communication services sectors. The Fund and the Underlying Index’s largest allocations by country or region were to Australia and Hong Kong and the smallest allocations were to New Zealand and Singapore.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| BHP Group Ltd. (Australia) | |

| Commonwealth Bank of Australia (Australia) | |

| AIA Group Ltd. (Hong Kong) | |

| | |

| National Australia Bank Ltd. (Australia) | |

| Westpac Banking Corp. (Australia) | |

| Australia & New Zealand Banking Group Ltd. (Australia) | |

| DBS Group Holdings Ltd. (Singapore) | |

| Woodside Energy Group Ltd. (Australia) | |

| Macquarie Group Ltd. (Australia) | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

*

The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $42.76 as of October 31, 2022.

**

Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions

| J.P. Morgan Exchange-Traded Funds | |

at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return was the closing price on the Cboe BZX Exchange, Inc. As of October 31, 2022, the closing price was $42.79.

***

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| Amount rounds to less than 0.1%. |

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders Developed Asia Pacific ex-Japan ETF

(formerly known as JPMorgan BetaBuilders Developed Asia ex-Japan ETF)

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF October 31, 2022 (Unaudited)

| | | |

JPMorgan BetaBuilders Developed Asia Pacific ex-Japan ETF (formerly known as JPMorgan BetaBuilders Developed Asia ex-Japan ETF) | | | |

| | | |

| | | |

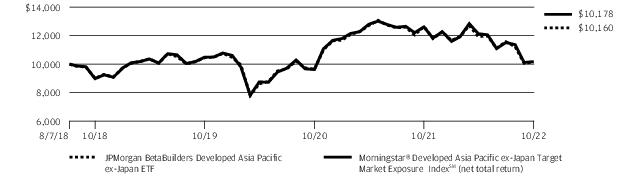

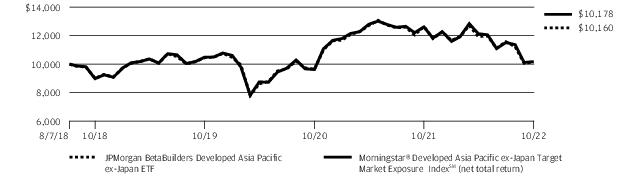

LIFE OF FUND PERFORMANCE (8/7/18 TO 10/31/22)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-844-457-6383.

Fund commenced operations on August 7, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders Developed Asia Pacific ex-Japan ETF and Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure IndexSM (net total return) from August 7, 2018 to October 31, 2022. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure IndexSM (net total return) does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Morningstar® Developed Asia Pacific ex-Japan Target Market Exposure IndexSM (net total return) is a rules-based, float-adjusted market capitalization-weighted index designed to cover 85% of the equity float-adjusted market capitalization of the Developed Asia Pacific ex-Japan

equity markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

For periods presented prior to November 1, 2019, the date on which a unitary fee structure was adopted, Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders Europe ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

Morningstar® Developed Europe Target Market Exposure IndexSM (net total return) | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders Europe ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® Developed Europe Target Market Exposure IndexSM (the "Underlying Index").

INVESTMENT APPROACH

The Underlying Index is a free-float adjusted market capitalization weighted index consisting of equity securities from developed European countries or regions, including Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, the Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland and the U.K. Using a "passive" investment approach, the Fund attempts to replicate the constituent securities of the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute performance and performed in line with the Underlying Index, before considering the effects of differences in the Fund’s net asset value calculations versus the Underlying Index’s valuation calculations, differences in the timing of foreign exchange rate calculations, as well as operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the financials and consumer discretionary sectors were leading detractors from absolute performance, while their exposure to the energy sector was the sole sector contributor to absolute performance.

By country, the Fund’s and the Underlying Index’s exposures to Germany and the U.K. were leading detractors from absolute performance, while their exposures to Portugal and Austria were the smallest detractors. No countries contributed to absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were to the financials and health

care sectors and their smallest allocations were to the communication services and real estate sectors. The Fund’s and the Underlying Index’s largest country allocations were to the U.K. and France and their smallest allocations were to Portugal

and Austria.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| | |

| | |

| Novartis AG (Registered) (Switzerland) | |

| ASML Holding NV (Netherlands) | |

| AstraZeneca plc (United Kingdom) | |

| Novo Nordisk A/S, Class B (Denmark) | |

| LVMH Moet Hennessy Louis Vuitton SE (France) | |

| TotalEnergies SE (France) | |

| Unilever plc (United Kingdom) | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders Europe ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited) (continued)

*

The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $43.61 as of October 31, 2022.

**

Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return was the closing price on the Cboe BZX Exchange, Inc. As of October 31, 2022, the closing price was $43.62.

***

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Exchange-Traded Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF October 31, 2022 (Unaudited)

| | | |

JPMorgan BetaBuilders Europe ETF | | | |

| | | |

| | | |

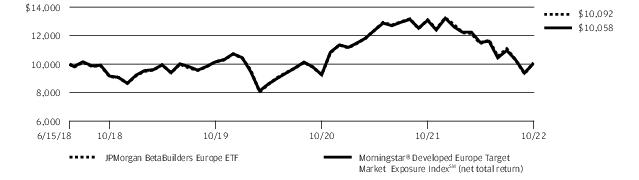

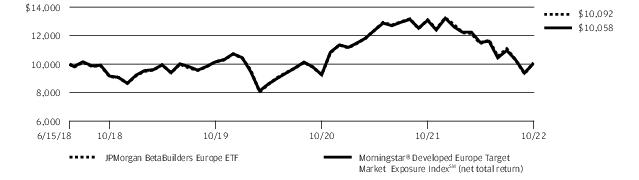

LIFE OF FUND PERFORMANCE (6/15/18 TO 10/31/22)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-844-457-6383.

Fund commenced operations on June 15, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders Europe ETF and Morningstar® Developed Europe Target Market Exposure IndexSM (net total return) from June 15, 2018 to October 31, 2022. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® Developed Europe Target Market Exposure IndexSM (net total return) does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. Morningstar® Developed Europe Target Market Exposure IndexSM (net total return) is a rules-based, float-adjusted market capitalization-weighted index designed to cover 85% of the equity float-adjusted market capitalization of the Developed Europe equity

markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

For periods presented prior to November 1, 2019, the date on which a unitary fee structure was adopted, Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders International Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM (net total return) | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders International Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM (the "Underlying Index").

INVESTMENT APPROACH

The Underlying Index is a free float adjusted, market capitalization weighted index, which consists of equity securities from developed countries or regions outside the U.S. and Canada. Using a "passive" investment approach, the Fund attempts to replicate the constituent securities of the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute return and performed in line with the Underlying Index, before considering the effects of differences in the Fund’s net asset value calculations versus the Underlying Index’s valuation calculations, differences in the timing of foreign exchange rate calculations, as well as operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the consumer discretionary and industrials sectors were leading detractors from absolute performance, while their exposures to the energy sector was the sole sector contributor to absolute performance.

By country or region, the Fund’s and the Underlying Index’s exposures to Japan and Germany were leading detractors from absolute performance, while their exposures to Singapore and Israel were leading contributors to absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest sector allocations were to the financials and industrials sectors, while their smallest allocations were to the real estate and utilities sectors. The Fund’s and the Underlying Index’s largest country or region allocations were to Japan and the U.K. and their smallest allocations were to New Zealand and

Portugal.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| | |

| | |

| Novartis AG (Registered) (Switzerland) | |

| ASML Holding NV (Netherlands) | |

| AstraZeneca plc (United Kingdom) | |

| Novo Nordisk A/S, Class B (Denmark) | |

| Toyota Motor Corp. (Japan) | |

| LVMH Moet Hennessy Louis Vuitton SE (France) | |

| TotalEnergies SE (France) | |

PORTFOLIO COMPOSITION BY COUNTRY

AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

*

The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects

| J.P. Morgan Exchange-Traded Funds | |

adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $44.72 as of October 31, 2022.

**

Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return was the closing price on the Cboe BZX Exchange, Inc. As of October 31, 2022, the closing price was $44.75.

***

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders International Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF October 31, 2022 (Unaudited)

| | | |

JPMorgan BetaBuilders International Equity ETF | | | |

| | | |

| | | |

LIFE OF FUND PERFORMANCE (12/3/19 TO 10/31/22)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-844-457-6383.

Fund commenced operations on December 3, 2019.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders International Equity ETF and Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM (net total return) from December 3, 2019 to October 31, 2022. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM (net total return) does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM (net total return) is a rules-based,

float-adjusted market capitalization-weighted index designed to cover 85% of the equity float-adjusted market capitalization of the Developed Markets ex-North America equity markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some foreign markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders Japan ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

Morningstar® Japan Target Market Exposure IndexSM (net total return) | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders Japan ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® Japan Target Market Exposure IndexSM (the "Underlying Index").

INVESTMENT APPROACH

The Underlying Index is a free float adjusted market-capitalization weighted index, which consists stocks traded primarily on the Tokyo Stock Exchange or the Nagoya Stock Exchange. Using a "passive" investment approach, the Fund attempts to replicate the constituent securities of the Underlying Index as closely as possible, before considering fees and expenses, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute return and performed in line with the Underlying Index, before considering the effects of differences in the Fund’s net asset value calculations versus the Underlying Index’s valuation calculations, differences in the timing of foreign exchange rate calculations, as well as operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the industrials and consumer discretionary sectors were leading detractors from absolute performance, while their exposures to the energy and utilities sectors were the smallest detractors from absolute performance and no sector contributed to absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were to the industrials and consumer discretionary sectors and their smallest allocations were to the energy and utilities sectors.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| Toyota Motor Corp. (Japan) | |

| | |

| | |

| Daiichi Sankyo Co. Ltd. (Japan) | |

| Mitsubishi UFJ Financial Group, Inc. (Japan) | |

| Recruit Holdings Co. Ltd. (Japan) | |

| SoftBank Group Corp. (Japan) | |

| Nintendo Co. Ltd. (Japan) | |

| | |

| | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Others (each less than 1.0%) | |

| |

*

The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $41.69 as of October 31, 2022.

**

Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders Japan ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited) (continued)

the last day of the period. The price used to calculate the market price return was the closing price on the Cboe BZX Exchange, Inc. As of October 31, 2022, the closing price was $41.73.

***

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Exchange-Traded Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF October 31, 2022 (Unaudited)

| | | |

JPMorgan BetaBuilders Japan ETF | | | |

| | | |

| | | |

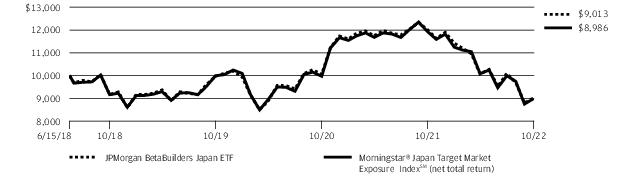

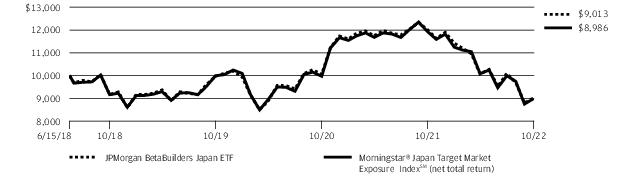

LIFE OF FUND PERFORMANCE (6/15/18 TO 10/31/22)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-844-457-6383.

Fund commenced operations on June 15, 2018.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders Japan ETF and Morningstar® Japan Target Market Exposure IndexSM (net total return) from June 15, 2018 to October 31, 2022. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® Japan Target Market Exposure IndexSM (net total return) does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. Morningstar® Japan Target Market Exposure IndexSM (net total return) is a rule based, float-adjusted market capitalization-weighted index designed to cover 85% of the equity float-adjusted market capitalization of the Japan equity markets. Net total return figures assume the reinvestment of

dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

For periods presented prior to November 1, 2019, the date on which a unitary fee structure was adopted, Fund performance reflects the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the United States can raise or lower returns. Also, some overseas markets may not be as politically and economically stable as the United States and other nations.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders U.S. Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

Morningstar® US Target Market Exposure IndexSM | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders U.S. Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® US Target Market Exposure IndexSM (the "Underlying Index").

INVESTMENT APPROACH

The Underlying Index is a free float adjusted market capitalization weighted index consisting of equity securities traded primarily in the U.S. It targets 85% of those stocks by market capitalization and primarily includes large- and mid-cap companies. Using a "passive" investment approach, the Fund attempts to closely correspond to the performance of the Underlying Index and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute return and performed in line with the Underlying Index, before considering the effects of operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the information technology and communication services sectors were leading detractors from absolute performance, while their exposures to the energy and consumer staples sectors were leading contributors to absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were to the information technology and health care sectors, while their smallest allocations were to

the materials and utilities sectors.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| | |

| | |

| | |

| | |

| Berkshire Hathaway, Inc., Class B | |

| | |

| | |

| | |

| | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

*

The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $69.38 as of October 31, 2022.

**

Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on

| J.P. Morgan Exchange-Traded Funds | |

the last day of the period. The price used to calculate the market price return was the closing price on the Cboe BZX Exchange, Inc. As of October 31, 2022, the closing price was $69.42.

***

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders U.S. Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF October 31, 2022 (Unaudited)

| | | |

JPMorgan BetaBuilders U.S. Equity ETF | | | |

| | | |

| | | |

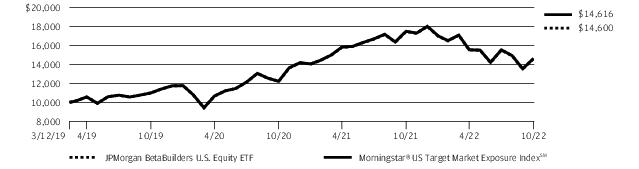

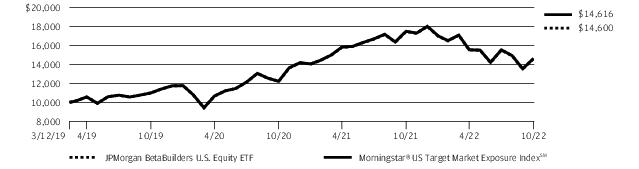

LIFE OF FUND PERFORMANCE (3/12/19 TO 10/31/22)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-844-457-6383.

Fund commenced operations on March 12, 2019.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders U.S. Equity ETF and the Morningstar® US Target Market Exposure IndexSM from March 12, 2019 to October 31, 2022. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® US Target Market Exposure IndexSM does not

reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. Morningstar® US Target Market Exposure IndexSM is a free float-adjusted market capitalization-weighted index which consists of stocks traded primarily on the U.S. stock exchanges. Investors cannot invest directly in an index.

Performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders U.S. Mid Cap Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

Morningstar® US Mid Cap Target Market Exposure Extended IndexSM | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders U.S. Mid Cap Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® US Mid Cap Target Market Exposure Extended IndexSM (the "Underlying Index").

INVESTMENT APPROACH

The Underlying Index consists of mid-cap equity securities traded in the U.S. It targets those securities that fall between the 85th and 95th percentiles in market capitalization of the free-float adjusted investable universe. Using a "passive" investment approach, the Fund attempts to closely correspond to the performance of the Underlying Index, and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute return and performed in line with the Underlying Index, before considering the effects of operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the information technology and health care sectors were leading detractors from absolute performance, while their exposures to the energy and utilities sectors were leading contributors to absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were to the industrials and information technology sectors, while their smallest allocations

were to the utilities and communication services sectors.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| LPL Financial Holdings, Inc. | |

| | |

| | |

| | |

| Booz Allen Hamilton Holding Corp. | |

| | |

| | |

| Gaming and Leisure Properties, Inc. | |

| Darling Ingredients, Inc. | |

| | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF October 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

*

The return shown is based on net asset value and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $74.06 as of October 31, 2022.

**

Market price return was calculated assuming an initial investment made at the market price at the beginning of the reporting period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders U.S. Mid Cap Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited) (continued)

day of the period. The price used to calculate the market price return was the closing price on the NYSE Arca. As of October 31, 2022, the closing price was $73.92.

***

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Exchange-Traded Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF October 31, 2022 (Unaudited)

| | | |

JPMorgan BetaBuilders U.S. Mid Cap Equity ETF | | | |

| | | |

| | | |

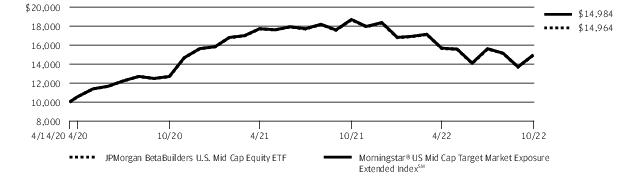

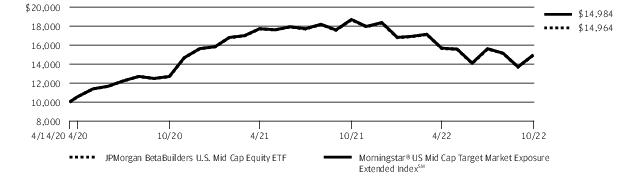

LIFE OF FUND PERFORMANCE (4/14/20 TO 10/31/22)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information, please call 1-844-457-6383.

Fund commenced operations on April 14, 2020.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan BetaBuilders U.S. Mid Cap Equity ETF and Morningstar® US Mid Cap Target Market Exposure Extended IndexSM from April 14, 2020 to October 31, 2022. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Morningstar® US Mid Cap Target Market Exposure

Extended IndexSM does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The Morningstar® US Mid Cap Target Market Exposure Extended IndexSM is a free float adjusted market capitalization weighted index that consists of mid cap U.S. equity securities. Investors cannot invest directly in an index.

Performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on gains resulting from redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Exchange-Traded Funds | |

JPMorgan BetaBuilders U.S. Small Cap Equity ETF

FUND COMMENTARY

TWELVE MONTHS ENDED October 31, 2022 (Unaudited)

| |

| |

| |

Morningstar® US Small Cap Target Market Exposure Extended IndexSM | |

Net Assets as of 10/31/2022 | |

| |

INVESTMENT OBJECTIVE***

The JPMorgan BetaBuilders U.S. Small Cap Equity ETF (the “Fund”) seeks investment results that closely correspond, before fees and expenses, to the performance of the Morningstar® US Small Cap Target Market Exposure Extended IndexSM (the "Underlying Index").

INVESTMENT APPROACH

The Underlying Index primarily consists of small-cap equity securities traded in the U.S. It targets those securities that fall between the 95th and 99th percentiles in market capitalization of free float adjusted investable universe. Using a "passive" investment approach, the Fund attempts to closely correspond to the performance of the Underlying Index and invests in substantially all of the securities in the Underlying Index in approximately the same proportions as the Underlying Index.

HOW DID THE FUND PERFORM?

For the twelve months ended October 31, 2022, the Fund had a negative absolute return and performed in line with the Underlying Index, before considering the effects of operating expenses, fees and tax management of the Fund’s portfolio.

The Fund’s and the Underlying Index’s exposures to the health care and information technology sectors were leading detractors from absolute performance, while their exposures to the energy and consumer staples sectors were leading contributors to absolute performance.

HOW WAS THE FUND POSITIONED?

During the reporting period, the Fund’s and the Underlying Index’s largest allocations were to the financials and industrials sectors and their smallest allocations were to the utilities and

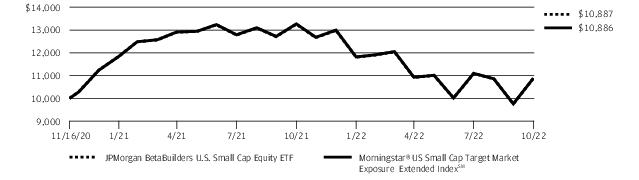

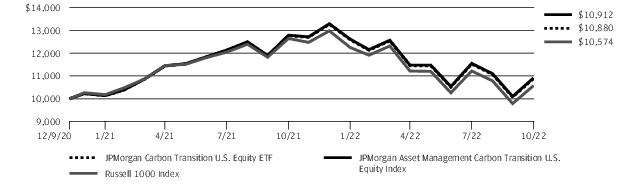

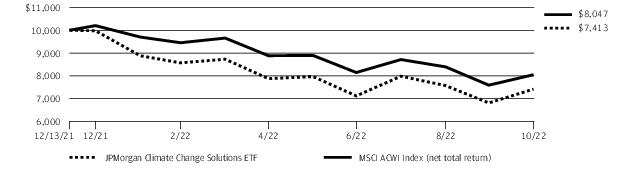

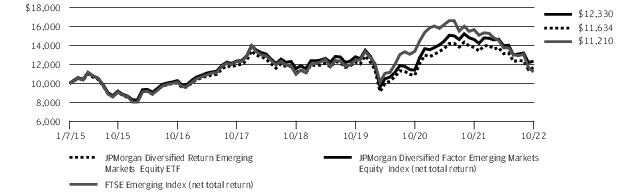

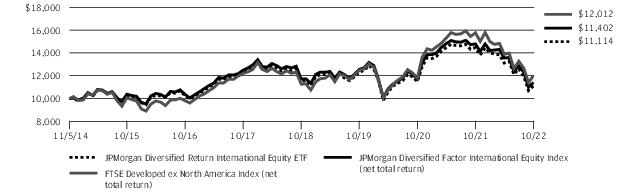

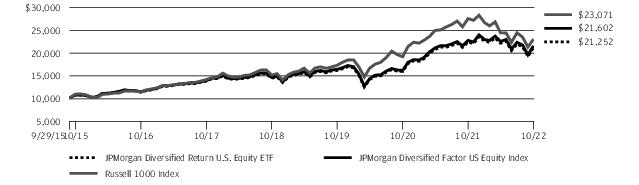

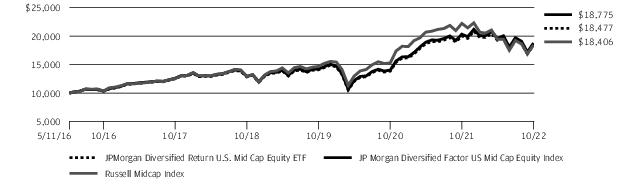

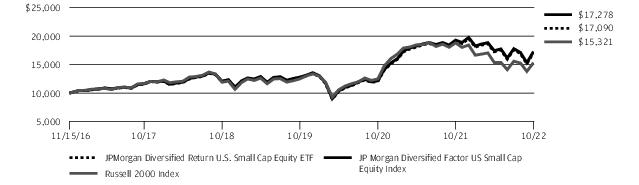

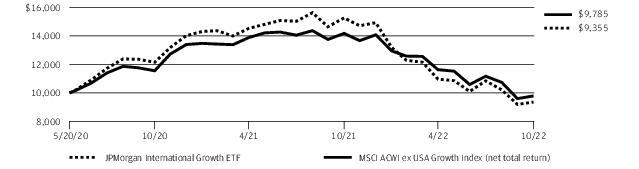

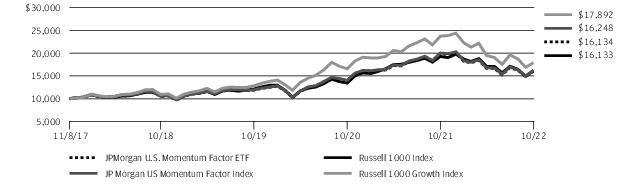

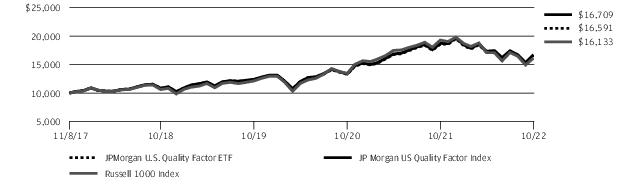

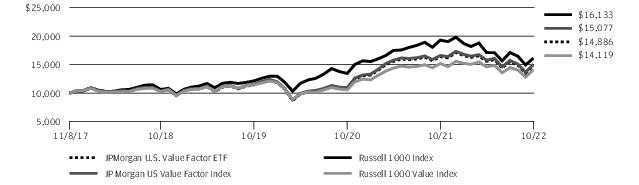

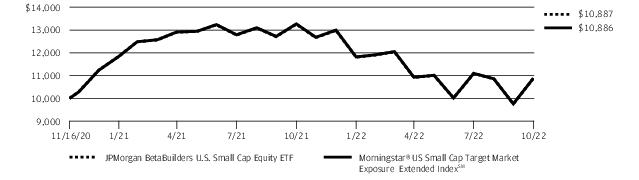

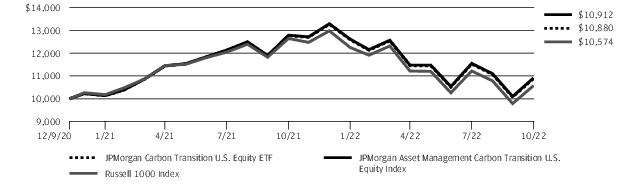

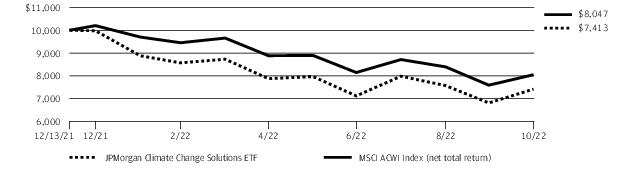

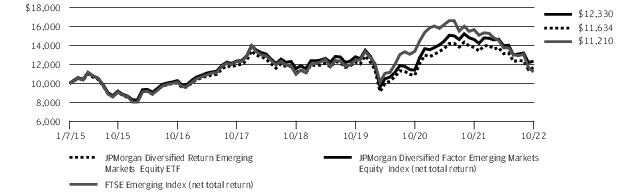

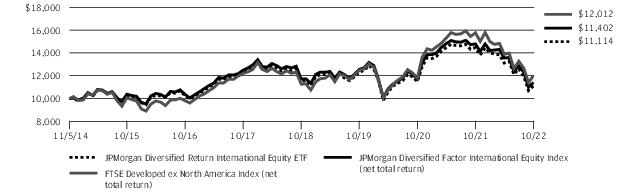

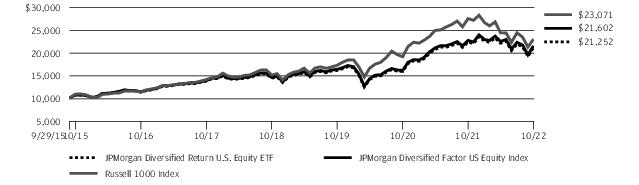

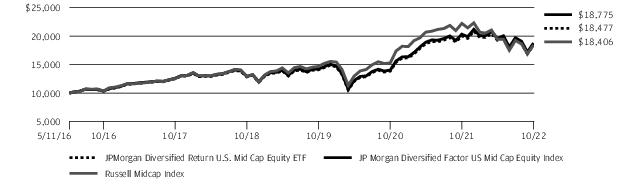

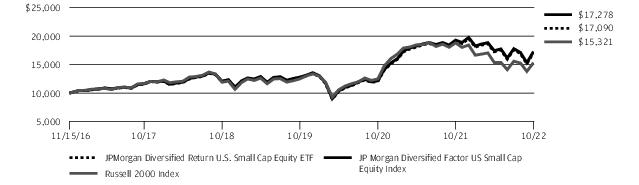

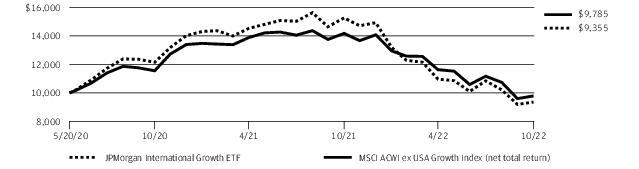

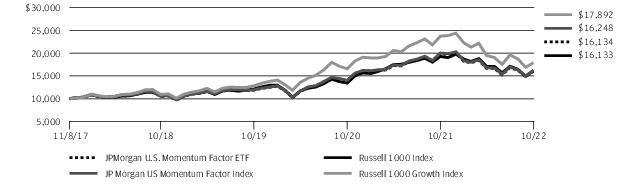

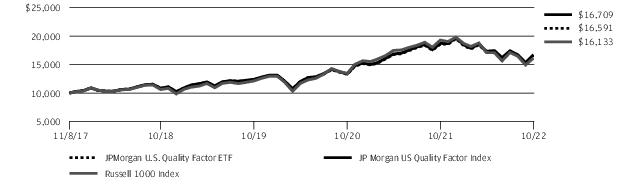

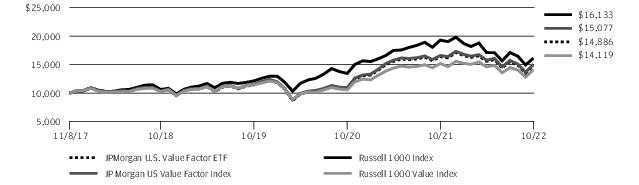

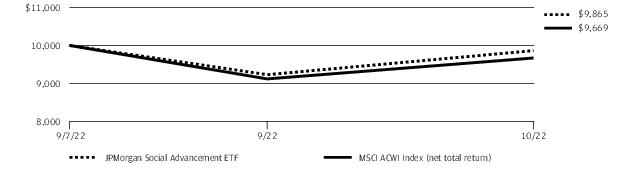

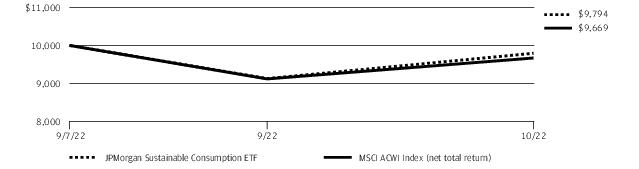

communication services sectors.