UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

J.P. Morgan Investment Management Inc.

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

| With copies to: |

Elizabeth A. Davin, Esq.

JPMorgan Chase & Co.

1111 Polaris Parkway

Columbus, OH 43240 | Jon S. Rand, Esq.

Dechert LLP

1905 Avenue of the Americas

New York, NY 10036 |

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan BetaBuilders MSCI US REIT ETF

Ticker: BBRE - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan BetaBuilders MSCI US REIT ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan BetaBuilders MSCI US REIT ETF | $6 | 0.11% |

| * | This charge is annualized. |

| Fund net assets | $871,643,752 | |

| Total number of portfolio holdings | $122 | |

| Portfolio turnover rate | $2 | % |

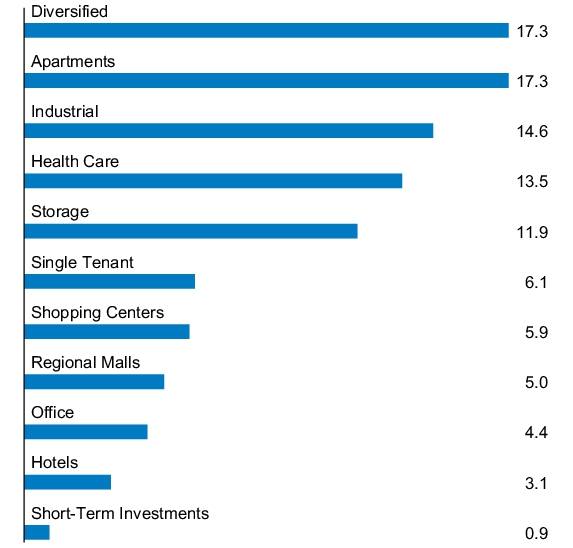

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan Inflation Managed Bond ETF

Ticker: JCPI - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Inflation Managed Bond ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Inflation Managed Bond ETF | $13 | 0.24% |

| * | This charge is annualized. |

| Fund net assets | $669,828,714 | |

| Total number of portfolio holdings | $788 | |

| Portfolio turnover rate | $49 | % |

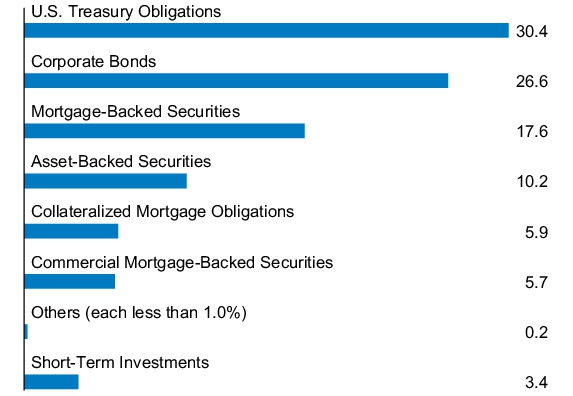

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan Realty Income ETF

Ticker: JPRE - NYSE Arca, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Realty Income ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Realty Income ETF | $27 | 0.50% |

| * | This charge is annualized. |

| Fund net assets | $387,539,138 | |

| Total number of portfolio holdings | $30 | |

| Portfolio turnover rate | $39 | % |

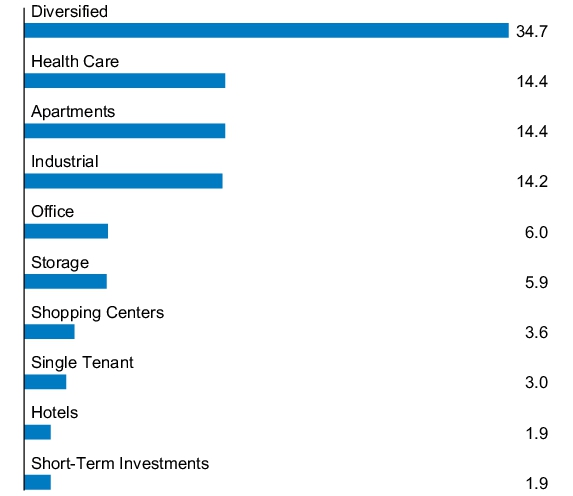

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan High Yield Municipal ETF

Ticker: JMHI - NYSE Arca, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan High Yield Municipal ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan High Yield Municipal ETF | $17 | 0.34% |

| * | This charge is annualized. |

| Fund net assets | $174,334,211 | |

| Total number of portfolio holdings | $138 | |

| Portfolio turnover rate | $45 | % |

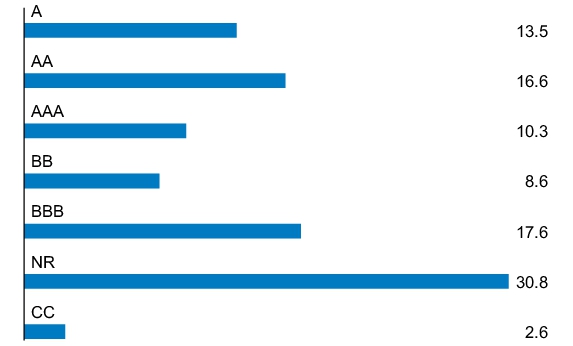

CREDIT QUALITY ALLOCATIONS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan Sustainable Municipal Income ETF

Ticker: JMSI - NYSE Arca, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Sustainable Municipal Income ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Sustainable Municipal Income ETF | $8 | 0.17% |

| * | This charge is annualized. |

| Fund net assets | $218,780,640 | |

| Total number of portfolio holdings | $168 | |

| Portfolio turnover rate | $41 | % |

CREDIT QUALITY ALLOCATIONS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan Limited Duration Bond ETF

Ticker: JPLD - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Limited Duration Bond ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Limited Duration Bond ETF | $12 | 0.23% |

| * | This charge is annualized. |

| Fund net assets | $757,842,643 | |

| Total number of portfolio holdings | $325 | |

| Portfolio turnover rate | $16 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan International Bond Opportunities ETF

Ticker: JPIB - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan International Bond Opportunities ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan International Bond Opportunities ETF | $26 | 0.50% |

| * | This charge is annualized. |

| Fund net assets | $474,891,216 | |

| Total number of portfolio holdings | $825 | |

| Portfolio turnover rate | $25 | % |

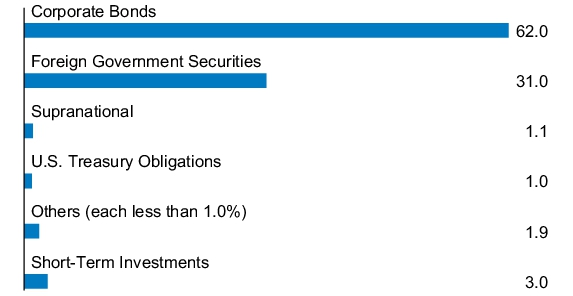

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan Ultra-Short Municipal Income ETF

Ticker: JMST - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Ultra-Short Municipal Income ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Ultra-Short Municipal Income ETF | $9 | 0.17% |

| * | This charge is annualized. |

| Fund net assets | $2,773,935,102 | |

| Total number of portfolio holdings | $2,462 | |

| Portfolio turnover rate | $36 | % |

CREDIT QUALITY ALLOCATIONS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan Core Plus Bond ETF

Ticker: JCPB - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Core Plus Bond ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Core Plus Bond ETF | $20 | 0.38% |

| * | This charge is annualized. |

| Fund net assets | $3,855,288,381 | |

| Total number of portfolio holdings | $2,420 | |

| Portfolio turnover rate | $54 | % |

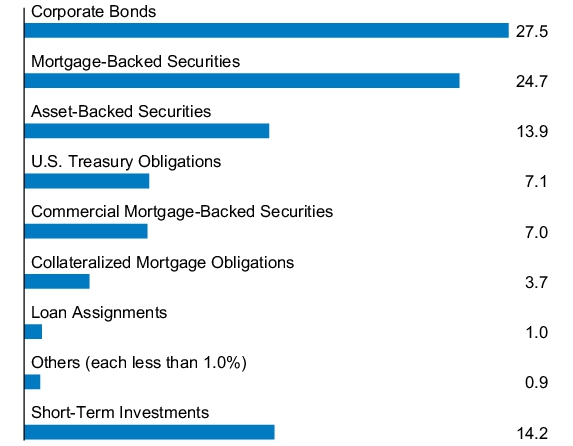

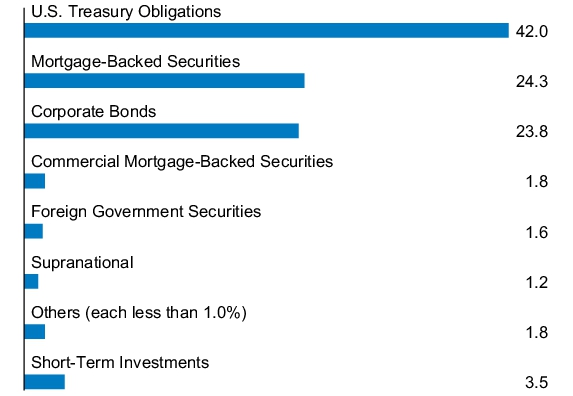

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan Ultra-Short Income ETF

Ticker: JPST - NYSE Arca, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Ultra-Short Income ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Ultra-Short Income ETF | $9 | 0.18% |

| * | This charge is annualized. |

| Fund net assets | $25,376,225,121 | |

| Total number of portfolio holdings | $685 | |

| Portfolio turnover rate | $32 | % |

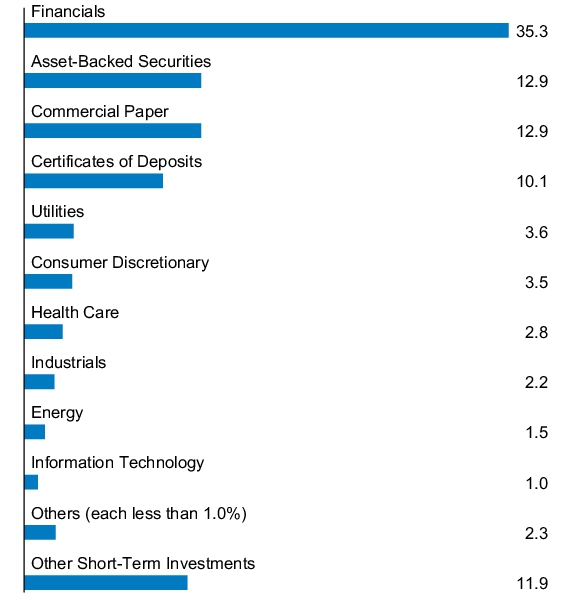

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

Ticker: JMUB - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Municipal ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Municipal ETF | $9 | 0.17% |

| * | This charge is annualized. |

| Fund net assets | $1,677,586,329 | |

| Total number of portfolio holdings | $891 | |

| Portfolio turnover rate | $24 | % |

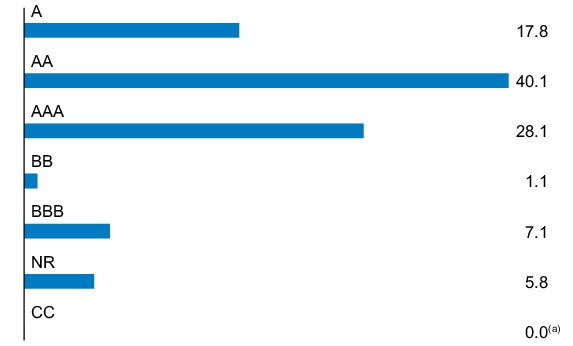

CREDIT QUALITY ALLOCATIONS

(% of Total Investments)

| (a) | Amount rounds to less than 0.1%. |

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan Short Duration Core Plus ETF

Ticker: JSCP - NYSE Arca, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Short Duration Core Plus ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Short Duration Core Plus ETF | $17 | 0.33% |

| * | This charge is annualized. |

| Fund net assets | $443,618,310 | |

| Total number of portfolio holdings | $868 | |

| Portfolio turnover rate | $34 | % |

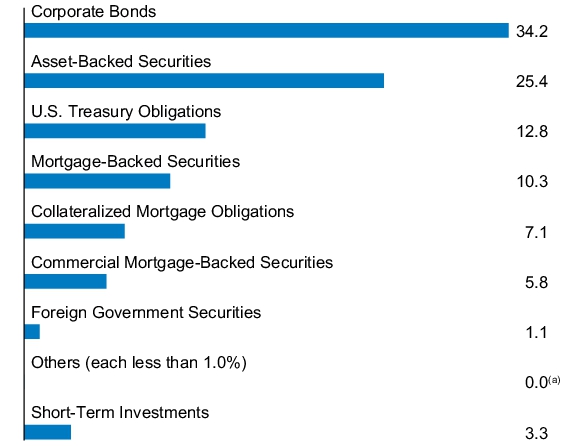

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

| (a) | Amount rounds to less than 0.1%. |

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

Ticker: JPIE - NYSE Arca, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Income ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Income ETF | $20 | 0.39% |

| * | This charge is annualized. |

| Fund net assets | $1,879,997,257 | |

| Total number of portfolio holdings | $1,548 | |

| Portfolio turnover rate | $80 | % |

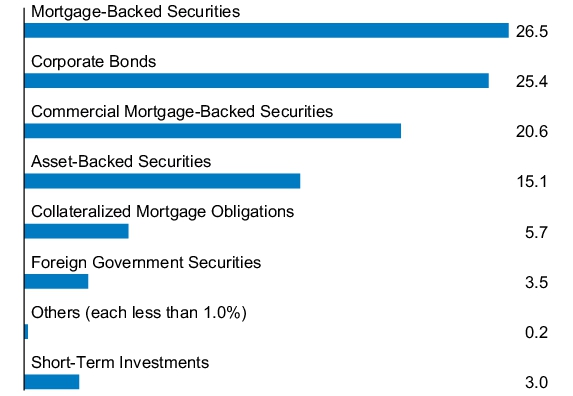

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

Ticker: JBND - New York Stock Exchange LLC

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Active Bond ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan Active Bond ETF | $14 | 0.27% |

| * | This charge is annualized. |

| Fund net assets | $543,392,775 | |

| Total number of portfolio holdings | $776 | |

| Portfolio turnover rate | $52 | % |

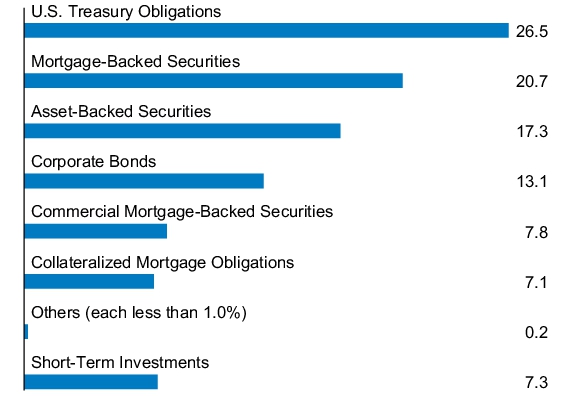

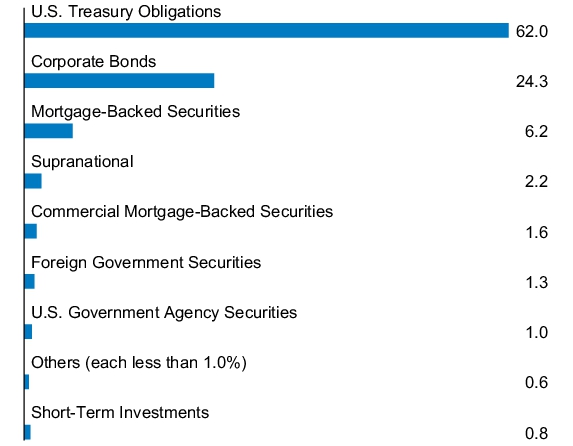

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan BetaBuilders USD Investment Grade Corporate Bond ETF

Ticker: BBCB - NYSE Arca, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan BetaBuilders USD Investment Grade Corporate Bond ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan BetaBuilders USD Investment Grade Corporate Bond ETF | $5 | 0.09% |

| * | This charge is annualized. |

| Fund net assets | $46,286,439 | |

| Total number of portfolio holdings | $987 | |

| Portfolio turnover rate | $7 | % |

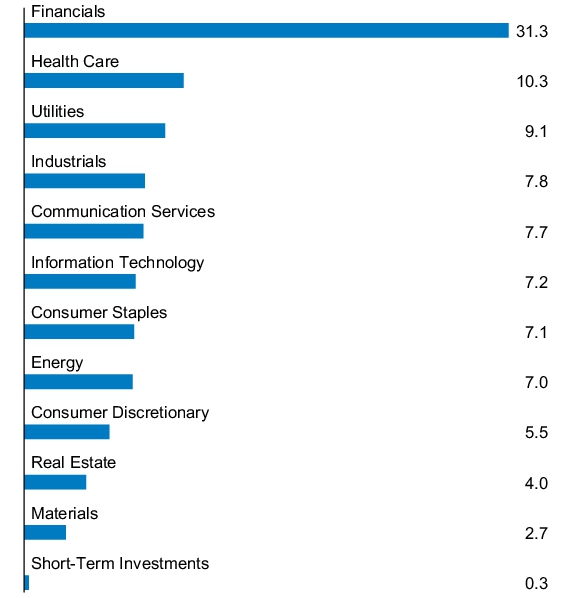

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan BetaBuilders USD High Yield Corporate Bond ETF

Ticker: BBHY - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan BetaBuilders USD High Yield Corporate Bond ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan BetaBuilders USD High Yield Corporate Bond ETF | $8 | 0.15% |

| * | This charge is annualized. |

| Fund net assets | $1,290,922,572 | |

| Total number of portfolio holdings | $1,453 | |

| Portfolio turnover rate | $21 | % |

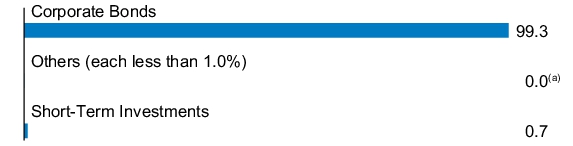

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

| (a) | Amount rounds to less than 0.1%. |

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan USD Emerging Markets Sovereign Bond ETF

Ticker: JPMB - NYSE Arca, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan USD Emerging Markets Sovereign Bond ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan USD Emerging Markets Sovereign Bond ETF | $20 | 0.39% |

| * | This charge is annualized. |

| Fund net assets | $635,948,461 | |

| Total number of portfolio holdings | $422 | |

| Portfolio turnover rate | $11 | % |

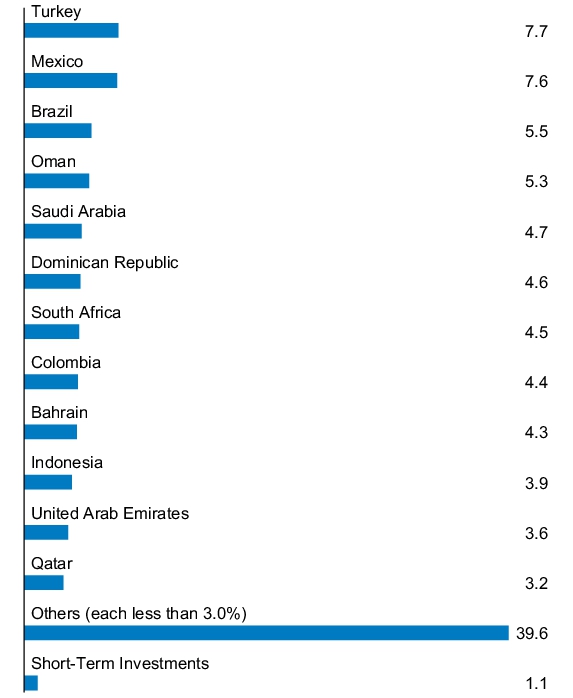

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan BetaBuilders U.S. Aggregate Bond ETF

Ticker: BBAG - NYSE Arca, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan BetaBuilders U.S. Aggregate Bond ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan BetaBuilders U.S. Aggregate Bond ETF | $1 | 0.03% |

| * | This charge is annualized. |

| Fund net assets | $1,421,896,420 | |

| Total number of portfolio holdings | $2,319 | |

| Portfolio turnover rate | $51 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan BetaBuilders 1-5 Year U.S. Aggregate Bond ETF

Ticker: BBSA - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan BetaBuilders 1-5 Year U.S. Aggregate Bond ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan BetaBuilders 1-5 Year U.S. Aggregate Bond ETF | $3 | 0.05% |

| * | This charge is annualized. |

| Fund net assets | $14,522,444 | |

| Total number of portfolio holdings | $410 | |

| Portfolio turnover rate | $23 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan BetaBuilders U.S. Treasury Bond 3-10 Year ETF

Ticker: BBIB - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan BetaBuilders U.S. Treasury Bond 3-10 Year ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan BetaBuilders U.S. Treasury Bond 3-10 Year ETF | $4 | 0.07% |

| * | This charge is annualized. |

| Fund net assets | $6,202,183 | |

| Total number of portfolio holdings | $87 | |

| Portfolio turnover rate | $13 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan BetaBuilders U.S. Treasury Bond 20+ Year ETF

Ticker: BBLB - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan BetaBuilders U.S. Treasury Bond 20+ Year ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan BetaBuilders U.S. Treasury Bond 20+ Year ETF | $4 | 0.07% |

| * | This charge is annualized. |

| Fund net assets | $25,031,494 | |

| Total number of portfolio holdings | $41 | |

| Portfolio turnover rate | $11 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan BetaBuilders U.S. Treasury Bond 1-3 Year ETF

Ticker: BBSB - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan BetaBuilders U.S. Treasury Bond 1-3 Year ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan BetaBuilders U.S. Treasury Bond 1-3 Year ETF | $4 | 0.07% |

| * | This charge is annualized. |

| Fund net assets | $2,973,627 | |

| Total number of portfolio holdings | $84 | |

| Portfolio turnover rate | $31 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

SEMI-ANNUAL SHAREHOLDER REPORT | August 31, 2024 (Unaudited)

JPMorgan BetaBuilders U.S. TIPS 0-5 Year ETF

Ticker: BBIP - Cboe BZX Exchange, Inc.

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan BetaBuilders U.S. TIPS 0-5 Year ETF for the period of March 1, 2024 to August 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-844-457-6383 or by sending an e-mail request to jpm.xf@jpmorgan.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

| JPMorgan BetaBuilders U.S. TIPS 0-5 Year ETF | $4 | 0.07% |

| * | This charge is annualized. |

| Fund net assets | $1,466,751 | |

| Total number of portfolio holdings | $28 | |

| Portfolio turnover rate | $17 | % |

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-844-457-6383.

ITEM 2. CODE OF ETHICS.

Not applicable to a semi-annual report.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable to a semi-annual report.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable to a semi-annual report.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to a semi-annual report.

ITEM 6. INVESTMENTS.

File Schedule I – Investments in securities of unaffiliated issuers as of the close of the reporting period as set forth in Section 210.12-12 of Regulation S-X, unless the schedule is included as part of the report to shareholders filed under Item 1 of this Form.

Included in Item 1.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

Semi-Annual Report

J.P. Morgan Exchange-Traded Funds

August 31, 2024 (Unaudited)

| | |

| | New York Stock Exchange LLC |

JPMorgan Core Plus Bond ETF | | |

| | |

JPMorgan International Bond Opportunities ETF | | |

| | |

JPMorgan Short Duration Core Plus ETF | | |

JPMorgan Ultra-Short Income ETF | | |

JPMorgan Ultra-Short Municipal Income ETF | | |

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not at net asset value) through a brokerage account, and are not individually subscribed and redeemed from a Fund. Shares may only be subscribed and redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF August 31, 2024 (Unaudited)

| | |

U.S. Treasury Obligations — 27.6% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

U.S. Treasury STRIPS Bonds | | |

| | |

| | |

Total U.S. Treasury Obligations

(Cost $146,733,275) | | |

Mortgage-Backed Securities — 21.5% |

FHLMC Gold Pools, Other Pool # RE0003, 4.00%, 7/1/2049 | | |

| | |

Pool # SI2041, 3.00%, 10/1/2049 | | |

Pool # QA9530, 2.50%, 5/1/2050 | | |

Pool # QB3756, 2.50%, 9/1/2050 | | |

Pool # RA3653, 1.50%, 10/1/2050 | | |

| | |

|

Pool # RA3838, 3.00%, 10/1/2050 | | |

Pool # QB4903, 2.50%, 11/1/2050 | | |

Pool # QC2061, 2.00%, 5/1/2051 | | |

Pool # RA5680, 2.00%, 8/1/2051 | | |

Pool # SD0809, 3.00%, 1/1/2052 | | |

Pool # SD8190, 3.00%, 1/1/2052 | | |

Pool # RA6815, 2.50%, 2/1/2052 | | |

Pool # QE0399, 3.00%, 4/1/2052 | | |

Pool # QE1075, 3.00%, 4/1/2052 | | |

Pool # SD1373, 3.00%, 5/1/2052 | | |

Pool # SD5754, 3.50%, 6/1/2052 | | |

Pool # QE8520, 3.50%, 8/1/2052 | | |

Pool # SD2355, 4.50%, 12/1/2052 | | |

FNMA UMBS, 20 Year Pool # BM4920, 4.00%, 10/1/2038 | | |

| | |

Pool # AL9058, 3.50%, 9/1/2046 | | |

Pool # AL9397, 3.00%, 10/1/2046 | | |

Pool # BE9590, 3.50%, 5/1/2047 | | |

Pool # BK2113, 2.50%, 3/1/2050 | | |

Pool # BP8608, 2.50%, 6/1/2050 | | |

Pool # CA8670, 2.50%, 8/1/2050 | | |

Pool # BQ1367, 2.50%, 9/1/2050 | | |

Pool # BQ3137, 2.50%, 10/1/2050 | | |

Pool # FM4947, 2.00%, 12/1/2050 | | |

Pool # BP7667, 2.50%, 12/1/2050 | | |

Pool # CA8021, 2.50%, 12/1/2050 | | |

Pool # CA8044, 2.50%, 12/1/2050 | | |

Pool # CB0458, 2.50%, 5/1/2051 | | |

Pool # FM7293, 2.50%, 5/1/2051 | | |

Pool # CB0397, 3.00%, 5/1/2051 | | |

Pool # FM7346, 3.00%, 5/1/2051 | | |

Pool # FM7531, 3.00%, 5/1/2051 | | |

Pool # BT2415, 2.50%, 7/1/2051 | | |

Pool # FM7910, 2.50%, 7/1/2051 | | |

Pool # FM7957, 2.50%, 7/1/2051 | | |

Pool # CB1406, 3.00%, 8/1/2051 | | |

Pool # FM8479, 3.00%, 8/1/2051 | | |

Pool # FS5389, 2.50%, 11/1/2051 | | |

Pool # BU3608, 3.00%, 11/1/2051 | | |

Pool # FM9776, 3.00%, 11/1/2051 | | |

Pool # BU9885, 2.50%, 1/1/2052 | | |

Pool # FS8807, 3.00%, 1/1/2052 | | |

Pool # CB2855, 2.50%, 2/1/2052 | | |

Pool # FS3381, 2.50%, 2/1/2052 | | |

Pool # FS0488, 3.00%, 2/1/2052 | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF August 31, 2024 (Unaudited) (continued)

| | |

Mortgage-Backed Securities — continued |

Pool # BV4133, 2.50%, 3/1/2052 | | |

Pool # FS8041, 2.50%, 3/1/2052 | | |

Pool # CB3384, 4.00%, 4/1/2052 | | |

Pool # BV5631, 3.00%, 6/1/2052 | | |

Pool # FS8114, 3.50%, 6/1/2052 | | |

Pool # CB3775, 4.00%, 6/1/2052 | | |

Pool # CB4160, 4.50%, 7/1/2052 | | |

Pool # BY9849, 6.00%, 10/1/2053 | | |

| | |

Pool # BS2870, 1.27%, 8/1/2028 | | |

Pool # BL6257, 2.13%, 11/1/2028 | | |

Pool # BS5507, 3.23%, 11/1/2028 | | |

Pool # BS4928, 2.15%, 3/1/2029 | | |

Pool # BL5459, 2.37%, 6/1/2029 | | |

Pool # BS5162, 2.73%, 9/1/2029 | | |

Pool # BZ1679, 4.49%, 9/1/2029 ‡ (b) | | |

Pool # BS7010, 4.81%, 9/1/2029 | | |

Pool # BL4429, 2.25%, 10/1/2029 | | |

Pool # AM6835, 3.58%, 10/1/2029 | | |

Pool # BL4333, 2.52%, 11/1/2029 | | |

Pool # AN8514, 3.27%, 2/1/2030 | | |

Pool # BS6161, 4.47%, 8/1/2030 | | |

Pool # BZ0392, 4.82%, 3/1/2031 | | |

Pool # BZ1791, 4.61%, 8/1/2031 ‡ (b) | | |

Pool # BZ1524, 5.08%, 9/1/2031 ‡ (b) | | |

Pool # BM6857, 1.83%, 12/1/2031 (c) | | |

Pool # BZ1849, 4.74%, 1/1/2032 ‡ (b) | | |

Pool # BS5337, 3.01%, 4/1/2032 | | |

Pool # BZ1869, 4.76%, 4/1/2032 ‡ (b) | | |

Pool # BS5581, 3.46%, 6/1/2032 | | |

Pool # BS5659, 3.66%, 6/1/2032 | | |

Pool # AN5759, 3.29%, 7/1/2032 | | |

Pool # BS5530, 3.30%, 7/1/2032 | | |

Pool # BS6132, 3.86%, 7/1/2032 | | |

Pool # BS6276, 3.97%, 8/1/2032 | | |

Pool # AM0762, 3.29%, 9/1/2032 | | |

Pool # BS5718, 3.46%, 9/1/2032 | | |

Pool # BS6689, 3.83%, 9/1/2032 | | |

Pool # BS6417, 3.83%, 10/1/2032 | | |

Pool # BS6951, 3.90%, 10/1/2032 | | |

Pool # BS6619, 3.91%, 10/1/2032 | | |

Pool # BS6731, 3.78%, 11/1/2032 | | |

Pool # BS5864, 3.75%, 12/1/2032 | | |

Pool # BZ1498, 4.92%, 12/1/2032 | | |

Pool # BZ0159, 4.98%, 1/1/2033 | | |

| | |

|

Pool # BZ1867, 4.74%, 3/1/2033 (b) | | |

Pool # BS1636, 2.25%, 4/1/2033 | | |

Pool # BS1899, 2.17%, 5/1/2033 | | |

Pool # BS9616, 4.79%, 9/1/2033 | | |

Pool # BZ0419, 4.25%, 1/1/2034 | | |

Pool # BZ0430, 4.32%, 2/1/2034 | | |

Pool # BZ0401, 4.52%, 3/1/2034 | | |

Pool # BL2213, 3.34%, 5/1/2034 | | |

Pool # BZ0565, 5.04%, 5/1/2034 | | |

Pool # BL3772, 2.92%, 10/1/2034 | | |

Pool # BL7071, 1.91%, 6/1/2035 | | |

Pool # AN4430, 3.61%, 1/1/2037 | | |

Pool # BS5761, 3.87%, 6/1/2037 | | |

Pool # MA1177, 3.50%, 9/1/2042 | | |

Pool # CA4632, 4.00%, 11/1/2043 | | |

Pool # BF0189, 3.00%, 6/1/2057 | | |

Pool # BF0440, 3.00%, 1/1/2060 | | |

Pool # BF0546, 2.50%, 7/1/2061 | | |

FNMA/FHLMC UMBS, Single Family, 30 Year | | |

TBA, 2.50%, 9/25/2054 (b) | | |

TBA, 3.00%, 9/25/2054 (b) | | |

TBA, 5.00%, 9/25/2054 (b) | | |

TBA, 5.50%, 9/25/2054 (b) | | |

GNMA I, 30 Year Pool # CU0301, 6.50%, 5/15/2053 | | |

GNMA II Pool # CK7234 ARM, 6.67%, 2/20/2072 (c) | | |

| | |

Pool # AQ6679, 3.50%, 10/20/2045 | | |

Pool # AK8802, 3.75%, 3/20/2046 | | |

Pool # 787457, 4.00%, 3/20/2052 | | |

Pool # CO8957, 5.00%, 12/20/2052 | | |

Pool # CX2674, 6.00%, 10/20/2053 | | |

Pool # DD2409, 6.50%, 6/20/2054 | | |

Pool # DD0108, 6.50%, 7/20/2054 | | |

Pool # DD0109, 7.00%, 7/20/2054 | | |

Pool # DD0094, 7.00%, 8/20/2054 | | |

| | |

Pool # AD0019, 3.50%, 2/20/2033 | | |

Pool # 787496, 6.00%, 7/20/2064 | | |

Total Mortgage-Backed Securities

(Cost $113,422,271) | | |

Asset-Backed Securities — 18.1% |

ACM Auto Trust Series 2023-2A, Class A, 7.97%, 6/20/2030 (d) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

| | |

Asset-Backed Securities — continued |

American Credit Acceptance Receivables Trust Series 2023-4, Class C, 6.99%, 9/12/2030 (d) | | |

| | |

Series 2020-SFR2, Class E1, 4.03%, 7/17/2037 (d) | | |

Series 2020-SFR2, Class E2, 4.28%, 7/17/2037 (d) | | |

Series 2020-SFR4, Class D, 2.01%, 11/17/2037 (d) | | |

Series 2021-SFR1, Class D, 2.60%, 6/17/2038 (d) | | |

Series 2021-SFR2, Class A, 1.53%, 8/17/2038 (d) | | |

Series 2021-SFR3, Class C, 1.80%, 10/17/2038 (d) | | |

Series 2021-SFR3, Class E1, 2.33%, 10/17/2038 (d) | | |

Series 2019-SFR1, Class D, 3.25%, 1/19/2039 (d) | | |

Series 2022-SFR3, Class E2, 4.00%, 10/17/2039 (d) | | |

Series 2023-SFR1, Class E1, 4.00%, 4/17/2040 (d) | | |

Series 2023-SFR2, Class E1, 3.95%, 6/17/2040 (d) | | |

| | |

Series 2019-A, Class C, 4.01%, 7/16/2040 (d) | | |

Series 2020-AA, Class C, 3.97%, 7/17/2046 (d) | | |

BG Beta Ltd. (Cayman Islands) | | |

| | |

| | |

| | |

Series 2022-SFR1, Class A, 3.40%, 11/17/2037 (d) | | |

Series 2024-SFR1, Class C, 4.30%, 8/17/2040 (d) | | |

Bridgecrest Lending Auto Securitization Trust | | |

Series 2024-3, Class C, 5.70%, 7/16/2029 | | |

Series 2023-1, Class C, 7.10%, 8/15/2029 | | |

Business Jet Securities LLC | | |

Series 2021-1A, Class A, 2.16%, 4/15/2036 (d) | | |

Series 2021-1A, Class B, 2.92%, 4/15/2036 (d) | | |

Series 2021-1A, Class C, 5.07%, 4/15/2036 (d) | | |

| | |

|

BXG Receivables Note Trust Series 2022-A, Class C, 5.35%, 9/28/2037 (d) | | |

Carvana Auto Receivables Trust | | |

Series 2023-N1, Class B, 5.85%, 11/10/2027 (d) | | |

Series 2021-P4, Class A4, 1.64%, 12/10/2027 | | |

Series 2022-P1, Class A4, 3.52%, 2/10/2028 | | |

Cascade MH Asset Trust Series 2021-MH1, Class M2, 3.69%, 2/25/2046 (d) | | |

CPS Auto Receivables Trust Series 2023-D, Class C, 7.17%, 1/15/2030 (d) | | |

Credit Acceptance Auto Loan Trust | | |

Series 2021-4, Class A, 1.26%, 10/15/2030 (d) | | |

Series 2021-4, Class C, 1.94%, 2/18/2031 (d) | | |

Series 2023-2A, Class A, 5.92%, 5/16/2033 (d) | | |

DP Lion Holdco LLC Series 2023-1A, Class A, 8.24%, 11/30/2043 ‡ | | |

| | |

Series 2022-2A, Class E, 6.45%, 5/15/2029 (d) | | |

Series 2023-1A, Class E, 10.39%, 1/15/2030 (d) | | |

Energy Assets, 8.11%, 8/25/2044 ‡ | | |

| | |

Series 2023-2A, Class B, 7.49%, 11/15/2029 (d) | | |

Series 2024-1A, Class B, 6.26%, 3/15/2030 (d) | | |

First Investors Auto Owner Trust Series 2023-1A, Class C, 6.81%, 12/17/2029 (d) | | |

| | |

Series 2020-SFR1, Class D, 2.24%, 8/17/2037 (d) | | |

Series 2020-SFR1, Class E, 2.79%, 8/17/2037 (d) | | |

Series 2020-SFR2, Class C, 1.67%, 10/19/2037 (d) | | |

Series 2020-SFR2, Class E, 2.67%, 10/19/2037 (d) | | |

Series 2021-SFR1, Class C, 1.89%, 8/17/2038 (d) | | |

Series 2021-SFR1, Class E1, 2.39%, 8/17/2038 (d) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF August 31, 2024 (Unaudited) (continued)

| | |

Asset-Backed Securities — continued |

Series 2021-SFR2, Class C, 1.71%, 9/17/2038 (d) | | |

Series 2022-SFRA, Class A, 3.10%, 3/17/2039 (d) | | |

| | |

Series 2020-GT1, Class A, 4.45%, 1/25/2026 (c) (d) | | |

Series 2021-GT1, Class A, 3.62%, 7/25/2026 (c) (d) | | |

Series 2021-GT1, Class B, 4.36%, 7/25/2026 (c) (d) | | |

Series 2021-GT2, Class A, 3.85%, 10/25/2026 (c) (d) | | |

Series 2022-GT1, Class B, 7.17%, 4/25/2027 (d) | | |

| | |

Series 2020-1A, Class C, 5.75%, 7/16/2040 (d) | | |

Series 2021-1A, Class A, 1.27%, 5/15/2041 (d) | | |

Series 2023-2A, Class D, 9.10%, 6/15/2049 (d) | | |

Series 2024-1A, Class C, 6.53%, 12/15/2049 (d) | | |

FRTKL Series 2021-SFR1, Class D, 2.17%, 9/17/2038 (d) | | |

FW Energy Asset Issuer LLC, 7.15%, 8/25/2044 ‡ | | |

GLS Auto Receivables Issuer Trust | | |

Series 2021-4A, Class D, 2.48%, 10/15/2027 (d) | | |

Series 2024-3A, Class D, 5.53%, 2/18/2031 (d) | | |

GLS Auto Select Receivables Trust | | |

Series 2023-2A, Class A3, 6.38%, 2/15/2029 (d) | | |

Series 2024-1A, Class C, 5.69%, 3/15/2030 (d) | | |

Series 2024-3A, Class B, 5.64%, 8/15/2030 (d) | | |

Series 2024-1A, Class D, 6.43%, 1/15/2031 (d) | | |

Goodgreen (Cayman Islands) Series 2019-1A, Class A, 3.86%, 10/15/2054 ‡ (d) | | |

| | |

Series 2024-1A, Class A, 6.29%, 7/15/2056 ‡ (d) | | |

Series 2024-1A, Class B, 8.12%, 7/15/2056 ‡ (d) | | |

| | |

|

| | |

Series 2016-1A, Class A, 3.23%, 10/15/2052 ‡ (d) | | |

Series 2020-1A, Class A, 2.63%, 4/15/2055 ‡ (d) | | |

Granite Park Equipment Leasing LLC | | |

Series 2023-1A, Class A3, 6.46%, 9/20/2032 (d) | | |

Series 2023-1A, Class D, 7.00%, 8/22/2033 (d) | | |

HERO Funding (Cayman Islands) Series 2017-3A, Class A1, 3.19%, 9/20/2048 ‡ (d) | | |

HERO Funding Trust (Cayman Islands) Series 2020-1A, Class A, 2.59%, 9/20/2057 ‡ (d) | | |

Hilton Grand Vacations Trust | | |

Series 2022-2A, Class B, 4.74%, 1/25/2037 (d) | | |

Series 2024-1B, Class B, 5.99%, 9/15/2039 (d) | | |

HIN Timeshare Trust Series 2020-A, Class A, 1.39%, 10/9/2039 (d) | | |

HINNT LLC Series 2024-A, Class C, 6.32%, 3/15/2043 (d) | | |

Home Partners of America Trust | | |

Series 2021-2, Class D, 2.65%, 12/17/2026 (d) | | |

Series 2021-2, Class E1, 2.85%, 12/17/2026 (d) | | |

Series 2022-1, Class D, 4.73%, 4/17/2039 (d) | | |

Series 2020-2, Class E, 3.08%, 1/17/2041 (d) | | |

| | |

Series 2024-SFR1, Class D, 4.25%, 9/17/2029 (b) (d) | | |

Series 2024-SFR1, Class E, 4.50%, 9/17/2029 (b) (d) | | |

| | |

Series 2021-1A, Class B, 2.47%, 11/20/2031 (d) | | |

Series 2021-2A, Class B, 2.37%, 4/20/2032 (d) | | |

Series 2022-1A, Class E, 7.58%, 7/20/2032 ‡ (d) | | |

Mariner Finance Issuance Trust | | |

Series 2020-AA, Class A, 2.19%, 8/21/2034 (d) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

| | |

Asset-Backed Securities — continued |

Series 2020-AA, Class B, 3.21%, 8/21/2034 (d) | | |

Series 2021-AA, Class B, 2.33%, 3/20/2036 (d) | | |

Series 2021-AA, Class C, 2.96%, 3/20/2036 (d) | | |

Series 2021-AA, Class D, 3.83%, 3/20/2036 (d) | | |

Series 2024-AA, Class D, 6.77%, 9/22/2036 (d) | | |

Series 2021-BA, Class C, 2.66%, 11/20/2036 (d) | | |

Merchants Fleet Funding LLC Series 2023-1A, Class A, 7.21%, 5/20/2036 (d) | | |

Mercury Financial Credit Card Master Trust Series 2024-2A, Class A, 6.56%, 7/20/2029 (d) | | |

MNR ABS Issuer I LLC, 8.95%, 12/15/2038 ‡ | | |

MVW LLC Series 2021-1WA, Class C, 1.94%, 1/22/2041 (d) | | |

New Residential Mortgage Loan Trust Series 2022-SFR1, Class B, 2.85%, 2/17/2039 (d) | | |

NRZ Excess Spread-Collateralized Notes | | |

Series 2021-FNT1, Class A, 2.98%, 3/25/2026 (d) | | |

Series 2021-FHT1, Class A, 3.10%, 7/25/2026 (d) | | |

Series 2021-GNT1, Class A, 3.47%, 11/25/2026 (d) | | |

NRZ FHT Excess LLC Series 2020-FHT1, Class A, 4.21%, 11/25/2025 (d) | | |

OneMain Direct Auto Receivables Trust | | |

Series 2021-1A, Class A, 0.87%, 7/14/2028 (d) | | |

Series 2021-1A, Class B, 1.26%, 7/14/2028 (d) | | |

| | |

Series 2024-1A, Class B, 6.55%, 4/8/2031 (d) | | |

Series 2021-B, Class A, 1.47%, 5/8/2031 (d) | | |

Series 2021-B, Class C, 3.65%, 5/8/2031 (d) | | |

Series 2021-C, Class A, 2.18%, 10/8/2031 (d) | | |

Series 2021-C, Class B, 2.67%, 10/8/2031 (d) | | |

Series 2024-2, Class B, 5.83%, 2/9/2032 (d) | | |

| | |

|

Series 2024-2, Class C, 6.61%, 2/9/2032 (d) | | |

Pagaya AI Technology in Housing Trust | | |

Series 2022-1, Class E2, 4.25%, 8/25/2025 (d) | | |

Series 2023-1, Class A, 3.60%, 10/25/2040 (d) | | |

Series 2023-1, Class E2, 3.60%, 10/25/2040 (d) | | |

PEAC Solutions Receivables LLC Series 2024-1A, Class A3, 5.64%, 11/20/2030 (d) | | |

PRET LLC Series 2022-NPL1, Class A1, 2.98%, 1/25/2052 (d) (e) | | |

PRET Trust Series 2024-RPL2, Class A1, 4.07%, 6/25/2064 ‡ (d) (e) | | |

Pretium Mortgage Credit Partners LLC Series 2021-RN1, Class A1, 4.99%, 2/25/2061 (d) (e) | | |

| | |

Series 2021-SFR3, Class A, 1.64%, 5/17/2026 (d) | | |

Series 2021-SFR1, Class C, 1.56%, 4/17/2038 (d) | | |

Progress Residential Trust | | |

Series 2022-SFR2, Class E1, 4.55%, 4/17/2027 (d) | | |

Series 2021-SFR6, Class A, 1.52%, 7/17/2038 (d) | | |

Series 2021-SFR7, Class A, 1.69%, 8/17/2040 (d) | | |

Series 2023-SFR2, Class D, 4.50%, 10/17/2040 (d) | | |

Series 2021-SFR10, Class E1, 3.57%, 12/17/2040 (d) | | |

Series 2022-SFR1, Class E1, 3.93%, 2/17/2041 (d) | | |

Series 2022-SFR4, Class A, 4.44%, 5/17/2041 (d) | | |

Series 2024-SFR4, Class C, 3.32%, 7/17/2041 (c) (d) | | |

PRPM LLC Series 2021-7, Class A1, 4.87%, 8/25/2026 (d) (e) | | |

Regional Management Issuance Trust Series 2022-1, Class B, 3.71%, 3/15/2032 (d) | | |

| | |

Series 2017-2A, Class A, 3.22%, 9/22/2053 ‡ (d) | | |

Series 2023-1A, Class A, 5.90%, 11/20/2058 ‡ (d) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF August 31, 2024 (Unaudited) (continued)

| | |

Asset-Backed Securities — continued |

Series 2024-1A, Class A, 6.21%, 11/20/2059 ‡ (d) | | |

Republic Finance Issuance Trust | | |

Series 2020-A, Class B, 3.54%, 11/20/2030 (d) | | |

Series 2024-A, Class A, 5.91%, 8/20/2032 (d) | | |

Santander Drive Auto Receivables Trust | | |

Series 2022-4, Class C, 5.00%, 11/15/2029 | | |

Series 2022-5, Class D, 5.67%, 12/16/2030 | | |

Series 2022-6, Class D, 5.69%, 2/18/2031 | | |

SCF Equipment Leasing LLC | | |

Series 2022-2A, Class A3, 6.50%, 10/21/2030 (d) | | |

Series 2023-1A, Class A3, 6.17%, 5/20/2032 (d) | | |

Series 2024-1A, Class C, 5.82%, 9/20/2032 (d) | | |

Series 2022-2A, Class D, 6.50%, 10/20/2032 (d) | | |

Series 2023-1A, Class D, 7.00%, 8/22/2033 (d) | | |

Sierra Timeshare Receivables Funding LLC | | |

Series 2021-2A, Class A, 1.35%, 9/20/2038 (d) | | |

Series 2021-2A, Class C, 1.95%, 9/20/2038 (d) | | |

Series 2023-1A, Class C, 7.00%, 1/20/2040 (d) | | |

Series 2022-2A, Class C, 6.36%, 6/20/2040 (d) | | |

Series 2024-2A, Class C, 5.83%, 6/20/2041 (d) | | |

Stream Innovations Issuer Trust | | |

Series 2024-1A, Class A, 6.27%, 7/15/2044 (d) | | |

Series 2024-1A, Class B, 7.89%, 7/15/2044 (d) | | |

Tricolor Auto Securitization Trust Series 2022-1A, Class D, 5.38%, 1/15/2026 (d) | | |

Tricon American Homes Trust Series 2020-SFR2, Class E1, 2.73%, 11/17/2039 (d) | | |

| | |

Series 2022-SFR1, Class E1, 5.34%, 4/17/2039 (d) | | |

Series 2023-SFR2, Class C, 5.00%, 12/17/2040 (d) | | |

| | |

|

United Airlines Pass-Through Trust Series 2024-1, Class AA, 5.45%, 2/15/2037 | | |

VOLT C LLC Series 2021-NPL9, Class A1, 4.99%, 5/25/2051 (d) (e) | | |

VOLT CII LLC Series 2021-NP11, Class A1, 4.87%, 8/25/2051 (d) (e) | | |

VOLT XCIII LLC Series 2021-NPL2, Class A1, 4.89%, 2/27/2051 (d) (e) | | |

VOLT XCIV LLC Series 2021-NPL3, Class A1, 5.24%, 2/27/2051 (d) (e) | | |

VOLT XCVI LLC Series 2021-NPL5, Class A1, 5.12%, 3/27/2051 (d) (e) | | |

Westgate Resorts LLC Series 2024-1A, Class B, 6.56%, 1/20/2038 (d) | | |

Westlake Automobile Receivables Trust Series 2023-4A, Class D, 7.19%, 7/16/2029 (d) | | |

Wingspire Equipment Finance LLC Series 2024-1A, Class C, 5.28%, 9/20/2032 (d) | | |

Total Asset-Backed Securities

(Cost $95,634,318) | | |

|

Aerospace & Defense — 0.3% |

BAE Systems plc (United Kingdom) 5.80%, 10/11/2041 (d) | | |

|

| | |

| | |

L3Harris Technologies, Inc. |

| | |

| | |

| | |

Northrop Grumman Corp. 5.15%, 5/1/2040 | | |

RTX Corp. 3.03%, 3/15/2052 | | |

| | |

|

General Motors Co. 5.95%, 4/1/2049 | | |

|

ABN AMRO Bank NV (Netherlands) (US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.10%), 2.47%, 12/13/2029 (d) (f) | | |

AIB Group plc (Ireland) (SOFR + 1.91%), 5.87%, 3/28/2035 (d) (f) | | |

Banco Santander SA (Spain) 5.44%, 7/15/2031 | | |

|

(SOFR + 1.06%), 2.09%, 6/14/2029 (f) | | |

(SOFR + 1.21%), 2.57%, 10/20/2032 (f) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

| | |

Corporate Bonds — continued |

|

(SOFR + 1.65%), 5.47%, 1/23/2035 (f) | | |

(SOFR + 1.91%), 5.43%, 8/15/2035 (f) | | |

(SOFR + 1.88%), 2.83%, 10/24/2051 (f) | | |

Bank of Ireland Group plc (Ireland) (SOFR + 1.62%), 5.60%, 3/20/2030 (d) (f) | | |

Banque Federative du Credit Mutuel SA (France) 5.79%, 7/13/2028 (d) | | |

Barclays plc (United Kingdom) |

(SOFR + 2.98%), 6.22%, 5/9/2034 (f) | | |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.30%), 3.33%, 11/24/2042 (f) | | |

(SOFR + 2.42%), 6.04%, 3/12/2055 (f) | | |

|

(SOFR + 1.52%), 5.18%, 1/9/2030 (d) (f) | | |

(SOFR + 1.88%), 5.74%, 2/20/2035 (d) (f) | | |

|

(SOFR + 1.98%), 6.61%, 10/19/2027 (d) (f) | | |

(SOFR + 2.59%), 7.00%, 10/19/2034 (d) (f) | | |

(SOFR + 1.85%), 5.94%, 5/30/2035 (d) (f) | | |

|

(3-MONTH CME TERM SOFR + 1.45%), 4.08%, 4/23/2029 (f) | | |

(SOFR + 1.18%), 2.52%, 11/3/2032 (f) | | |

(SOFR + 1.45%), 5.45%, 6/11/2035 (f) | | |

Credit Agricole SA (France) (SOFR + 1.86%), 6.32%, 10/3/2029 (d) (f) | | |

Danske Bank A/S (Denmark) (US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.40%), 5.71%, 3/1/2030 (d) (f) | | |

HSBC Holdings plc (United Kingdom) |

(SOFR + 1.29%), 2.21%, 8/17/2029 (f) | | |

(SOFR + 1.52%), 5.73%, 5/17/2032 (f) | | |

(SOFR + 2.65%), 6.33%, 3/9/2044 (f) | | |

Lloyds Banking Group plc (United Kingdom) (US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.07%), 5.72%, 6/5/2030 (f) | | |

Mizuho Financial Group, Inc. (Japan) (US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.90%), 5.75%, 7/6/2034 (f) | | |

| | |

|

|

NatWest Group plc (United Kingdom) |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.95%), 5.81%, 9/13/2029 (f) | | |

(3-MONTH SOFR + 1.87%), 4.45%, 5/8/2030 (f) | | |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.22%), 4.96%, 8/15/2030 (f) | | |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.50%), 5.78%, 3/1/2035 (f) | | |

Santander Holdings USA, Inc. (SOFR + 2.14%), 6.34%, 5/31/2035 (f) | | |

Skandinaviska Enskilda Banken AB (Sweden) 5.38%, 3/5/2029 (d) | | |

Societe Generale SA (France) |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.30%), 2.89%, 6/9/2032 (d) (f) | | |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 2.95%), 6.69%, 1/10/2034 (d) (f) | | |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 2.10%), 6.07%, 1/19/2035 (d) (f) | | |

Standard Chartered plc (United Kingdom) |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.05%), 5.69%, 5/14/2028 (d) (f) | | |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.45%), 5.91%, 5/14/2035 (d) (f) | | |

Sumitomo Mitsui Financial Group, Inc. (Japan) 5.42%, 7/9/2031 | | |

Truist Financial Corp. (SOFR + 1.92%), 5.71%, 1/24/2035 (f) | | |

US Bancorp (SOFR + 1.86%), 5.68%, 1/23/2035 (f) | | |

|

(SOFR + 1.79%), 6.30%, 10/23/2029 (f) | | |

(SOFR + 2.06%), 6.49%, 10/23/2034 (f) | | |

(SOFR + 1.78%), 5.50%, 1/23/2035 (f) | | |

(SOFR + 2.13%), 4.61%, 4/25/2053 (f) | | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF August 31, 2024 (Unaudited) (continued)

| | |

Corporate Bonds — continued |

|

Anheuser-Busch InBev Worldwide, Inc. (Belgium) 5.80%, 1/23/2059 | | |

Molson Coors Beverage Co. 4.20%, 7/15/2046 | | |

| | |

|

|

| | |

| | |

| | |

Amgen, Inc. 5.75%, 3/2/2063 | | |

Gilead Sciences, Inc. 2.60%, 10/1/2040 | | |

| | |

Broadline Retail — 0.0% ^ |

Amazon.com, Inc. 3.25%, 5/12/2061 | | |

Building Products — 0.0% ^ |

Masco Corp. 6.50%, 8/15/2032 | | |

|

Bank of New York Mellon Corp. (The) |

(SOFR + 1.60%), 6.32%, 10/25/2029 (f) | | |

(SOFR + 1.85%), 6.47%, 10/25/2034 (f) | | |

Deutsche Bank AG (Germany) |

(SOFR + 1.59%), 5.71%, 2/8/2028 (f) | | |

| | |

(SOFR + 1.72%), 3.04%, 5/28/2032 (f) | | |

Goldman Sachs Group, Inc. (The) |

(SOFR + 1.27%), 5.73%, 4/25/2030 (f) | | |

(SOFR + 1.21%), 5.05%, 7/23/2030 (f) | | |

(SOFR + 1.25%), 2.38%, 7/21/2032 (f) | | |

(SOFR + 1.55%), 5.85%, 4/25/2035 (f) | | |

(SOFR + 1.55%), 5.33%, 7/23/2035 (f) | | |

(3-MONTH CME TERM SOFR + 1.69%), 4.41%, 4/23/2039 (f) | | |

|

(SOFR + 1.59%), 5.16%, 4/20/2029 (f) | | |

(SOFR + 1.22%), 5.04%, 7/19/2030 (f) | | |

(SOFR + 1.87%), 5.25%, 4/21/2034 (f) | | |

(SOFR + 1.73%), 5.47%, 1/18/2035 (f) | | |

(SOFR + 1.56%), 5.32%, 7/19/2035 (f) | | |

Nomura Holdings, Inc. (Japan) 5.78%, 7/3/2034 | | |

UBS Group AG (Switzerland) |

(USD SOFR ICE Swap Rate 1 Year + 1.34%), 5.62%, 9/13/2030 (d) (f) | | |

| | |

|

Capital Markets — continued |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 2.00%), 6.30%, 9/22/2034 (d) (f) | | |

(US Treasury Yield Curve Rate T Note Constant Maturity 1 Year + 1.10%), 3.18%, 2/11/2043 (d) (f) | | |

| | |

|

CF Industries, Inc. 5.15%, 3/15/2034 | | |

DuPont de Nemours, Inc. 5.32%, 11/15/2038 | | |

LYB International Finance III LLC 4.20%, 10/15/2049 | | |

Nutrien Ltd. (Canada) 5.00%, 4/1/2049 | | |

Sherwin-Williams Co. (The) 4.80%, 9/1/2031 | | |

| | |

Commercial Services & Supplies — 0.0% ^ |

Element Fleet Management Corp. (Canada) 6.32%, 12/4/2028 (d) | | |

|

AerCap Ireland Capital DAC (Ireland) |

| | |

| | |

| | |

Avolon Holdings Funding Ltd. (Ireland) |

| | |

| | |

| | |

General Motors Financial Co., Inc. 5.95%, 4/4/2034 | | |

Macquarie Airfinance Holdings Ltd. (United Kingdom) 6.50%, 3/26/2031 (d) | | |

| | |

Consumer Staples Distribution & Retail — 0.1% |

7-Eleven, Inc. 1.80%, 2/10/2031 (d) | | |

Alimentation Couche-Tard, Inc. (Canada) |

| | |

| | |

|

| | |

| | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

| | |

Corporate Bonds — continued |

|

Goodman US Finance Three LLC (Australia) 3.70%, 3/15/2028 (d) | | |

Simon Property Group LP 3.25%, 9/13/2049 | | |

WP Carey, Inc. 2.25%, 4/1/2033 | | |

| | |

Diversified Telecommunication Services — 0.3% |

|

| | |

| | |

| | |

Verizon Communications, Inc. |

| | |

| | |

| | |

| | |

Electric Utilities — 1.5% |

Baltimore Gas and Electric Co. 5.65%, 6/1/2054 | | |

|

Series B, 3.25%, 4/1/2051 | | |

Series B, 3.65%, 3/1/2052 | | |

| | |

|

| | |

| | |

Duquesne Light Holdings, Inc. 2.78%, 1/7/2032 (d) | | |

Electricite de France SA (France) 5.95%, 4/22/2034 (d) | | |

Emera US Finance LP (Canada) 4.75%, 6/15/2046 | | |

Enel Finance International NV (Italy) |

| | |

| | |

Entergy Arkansas LLC 5.75%, 6/1/2054 | | |

Entergy Mississippi LLC 5.85%, 6/1/2054 | | |

|

| | |

| | |

FirstEnergy Transmission LLC 5.45%, 7/15/2044 (d) | | |

Fortis, Inc. (Canada) 3.06%, 10/4/2026 | | |

|

| | |

| | |

|

Electric Utilities — continued |

| | |

Massachusetts Electric Co. 4.00%, 8/15/2046 (d) | | |

Monongahela Power Co. 5.85%, 2/15/2034 (d) | | |

NextEra Energy Capital Holdings, Inc. |

| | |

| | |

Niagara Mohawk Power Corp. 5.66%, 1/17/2054 (d) | | |

Oklahoma Gas and Electric Co. 5.60%, 4/1/2053 | | |

Oncor Electric Delivery Co. LLC 4.95%, 9/15/2052 | | |

Pacific Gas and Electric Co. |

| | |

| | |

| | |

| | |

PG&E Recovery Funding LLC |

Series A-2, 5.23%, 6/1/2042 | | |

Series A-3, 5.53%, 6/1/2049 | | |

PPL Capital Funding, Inc. 5.25%, 9/1/2034 | | |

PPL Electric Utilities Corp. 5.25%, 5/15/2053 | | |

Public Service Co. of Oklahoma |

| | |

Series K, 3.15%, 8/15/2051 | | |

Public Service Electric and Gas Co. 3.00%, 3/1/2051 | | |

Sierra Pacific Power Co. 5.90%, 3/15/2054 | | |

Southern California Edison Co. |

| | |

| | |

| | |

| | |

Union Electric Co. 4.00%, 4/1/2048 | | |

Virginia Electric and Power Co. 5.55%, 8/15/2054 | | |

Vistra Operations Co. LLC 6.00%, 4/15/2034 (d) | | |

Xcel Energy, Inc. 4.80%, 9/15/2041 | | |

| | |

Electronic Equipment, Instruments & Components — 0.0% ^ |

Corning, Inc. 5.35%, 11/15/2048 | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF August 31, 2024 (Unaudited) (continued)

| | |

Corporate Bonds — continued |

|

Take-Two Interactive Software, Inc. 5.60%, 6/12/2034 | | |

Warnermedia Holdings, Inc. 5.14%, 3/15/2052 | | |

| | |

Financial Services — 0.2% |

|

| | |

| | |

|

| | |

| | |

Nationwide Building Society (United Kingdom) (3-MONTH SOFR + 1.45%), 4.30%, 3/8/2029 (d) (f) | | |

NTT Finance Corp. (Japan) 5.14%, 7/2/2031 (d) | | |

| | |

|

Bunge Ltd. Finance Corp. 2.75%, 5/14/2031 | | |

Campbell Soup Co. 3.13%, 4/24/2050 | | |

|

| | |

| | |

|

| | |

| | |

| | |

Kraft Heinz Foods Co. 4.38%, 6/1/2046 | | |

Tyson Foods, Inc. 5.70%, 3/15/2034 | | |

| | |

|

Atmos Energy Corp. 4.13%, 3/15/2049 | | |

Boston Gas Co. 4.49%, 2/15/2042 (d) | | |

Piedmont Natural Gas Co., Inc. 5.05%, 5/15/2052 | | |

Southwest Gas Corp. 3.80%, 9/29/2046 | | |

| | |

Ground Transportation — 0.1% |

Burlington Northern Santa Fe LLC |

| | |

| | |

CSX Corp. 3.35%, 9/15/2049 | | |

| | |

|

Ground Transportation — continued |

Norfolk Southern Corp. 4.05%, 8/15/2052 | | |

Penske Truck Leasing Co. LP 6.05%, 8/1/2028 (d) | | |

Union Pacific Corp. 4.10%, 9/15/2067 | | |

| | |

Health Care Providers & Services — 0.5% |

Aetna, Inc. 4.50%, 5/15/2042 | | |

Cigna Group (The) 3.40%, 3/15/2051 | | |

|

| | |

| | |

Elevance Health, Inc. 4.65%, 1/15/2043 | | |

|

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

|

Alexandria Real Estate Equities, Inc. 5.25%, 5/15/2036 | | |

Healthcare Realty Holdings LP 3.10%, 2/15/2030 | | |

|

| | |

| | |

| | |

Independent Power and Renewable Electricity Producers — 0.2% |

Constellation Energy Generation LLC |

| | |

| | |

| | |

Southern Power Co. 5.15%, 9/15/2041 | | |

| | |

Industrial Conglomerates — 0.0% ^ |

Honeywell International, Inc. 5.25%, 3/1/2054 | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

| | |

Corporate Bonds — continued |

|

|

| | |

| | |

| | |

|

Aon North America, Inc. 5.75%, 3/1/2054 | | |

Arthur J Gallagher & Co. 5.75%, 7/15/2054 | | |

Berkshire Hathaway Finance Corp. 3.85%, 3/15/2052 | | |

CNA Financial Corp. 5.13%, 2/15/2034 | | |

Corebridge Global Funding 5.20%, 6/24/2029 (d) | | |

F&G Annuities & Life, Inc. 6.50%, 6/4/2029 | | |

F&G Global Funding 5.88%, 6/10/2027 (d) | | |

Liberty Mutual Group, Inc. 3.95%, 10/15/2050 (d) | | |

Mutual of Omaha Cos. Global Funding 5.45%, 12/12/2028 (d) | | |

New York Life Insurance Co. 3.75%, 5/15/2050 (d) | | |

Pine Street Trust III 6.22%, 5/15/2054 (d) | | |

Prudential Funding Asia plc (Hong Kong) 3.13%, 4/14/2030 | | |

Teachers Insurance & Annuity Association of America 4.27%, 5/15/2047 (d) | | |

| | |

Interactive Media & Services — 0.1% |

|

| | |

| | |

| | |

|

Charter Communications Operating LLC |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

|

|

Discovery Communications LLC 3.63%, 5/15/2030 | | |

Paramount Global 5.85%, 9/1/2043 | | |

| | |

|

Glencore Funding LLC (Australia) 5.63%, 4/4/2034 (d) | | |

|

| | |

| | |

|

| | |

| | |

| | |

|

Ameren Illinois Co. 5.55%, 7/1/2054 | | |

Consolidated Edison Co. of New York, Inc. 5.70%, 6/15/2040 | | |

Consumers Energy Co. 3.25%, 8/15/2046 | | |

Dominion Energy, Inc. Series C, 4.90%, 8/1/2041 | | |

Puget Energy, Inc. 2.38%, 6/15/2028 | | |

Puget Sound Energy, Inc. 5.69%, 6/15/2054 | | |

San Diego Gas & Electric Co. 3.95%, 11/15/2041 | | |

Southern Co. Gas Capital Corp. |

| | |

Series 21A, 3.15%, 9/30/2051 | | |

| | |

Oil, Gas & Consumable Fuels — 1.1% |

|

| | |

| | |

APA Infrastructure Ltd. (Australia) 4.25%, 7/15/2027 (d) | | |

Cheniere Energy, Inc. 5.65%, 4/15/2034 (d) | | |

Columbia Pipelines Operating Co. LLC 5.93%, 8/15/2030 (d) | | |

ConocoPhillips Co. 5.30%, 5/15/2053 | | |

Devon Energy Corp. 5.75%, 9/15/2054 | | |

Enbridge, Inc. (Canada) 5.63%, 4/5/2034 | | |

|

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF August 31, 2024 (Unaudited) (continued)

| | |

Corporate Bonds — continued |

Oil, Gas & Consumable Fuels — continued |

Enterprise Products Operating LLC 5.55%, 2/16/2055 | | |

|

| | |

| | |

Flex Intermediate Holdco LLC 3.36%, 6/30/2031 (d) | | |

|

| | |

| | |

Marathon Petroleum Corp. 6.50%, 3/1/2041 | | |

| | |

|

| | |

| | |

Northern Natural Gas Co. 5.63%, 2/1/2054 (d) | | |

Occidental Petroleum Corp. |

| | |

| | |

|

| | |

| | |

Phillips 66 Co. 4.90%, 10/1/2046 | | |

Plains All American Pipeline LP 4.90%, 2/15/2045 | | |

Targa Resources Corp. 5.50%, 2/15/2035 | | |

TotalEnergies Capital International SA (France) 3.13%, 5/29/2050 | | |

TransCanada PipeLines Ltd. (Canada) |

| | |

| | |

Williams Cos., Inc. (The) 5.80%, 11/15/2054 | | |

| | |

|

|

| | |

| | |

| | |

Eli Lilly & Co. 5.00%, 2/9/2054 | | |

Merck & Co., Inc. 2.90%, 12/10/2061 | | |

Takeda Pharmaceutical Co. Ltd. (Japan) |

| | |

| | |

| | |

| | |

|

|

|

| | |

| | |

UDR, Inc. 3.10%, 11/1/2034 | | |

| | |

|

|

| | |

| | |

|

| | |

| | |

| | |

Semiconductors & Semiconductor Equipment — 0.3% |

|

| | |

| | |

| | |

Foundry JV Holdco LLC 6.15%, 1/25/2032 (d) | | |

Intel Corp. 5.70%, 2/10/2053 | | |

KLA Corp. 3.30%, 3/1/2050 | | |

|

| | |

| | |

QUALCOMM, Inc. 4.50%, 5/20/2052 | | |

Texas Instruments, Inc. 5.05%, 5/18/2063 | | |

| | |

|

Intuit, Inc. 5.50%, 9/15/2053 | | |

|

| | |

| | |

| | |

| | |

Specialized REITs — 0.0% ^ |

Crown Castle, Inc. 4.00%, 3/1/2027 | | |

Extra Space Storage LP 5.90%, 1/15/2031 | | |

| | |

Technology Hardware, Storage & Peripherals — 0.1% |

Apple, Inc. 4.10%, 8/8/2062 | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

| | |

Corporate Bonds — continued |

|

BAT Capital Corp. (United Kingdom) |

| | |

| | |

| | |

Philip Morris International, Inc. 3.88%, 8/21/2042 | | |

| | |

Trading Companies & Distributors — 0.1% |

Aviation Capital Group LLC 5.38%, 7/15/2029 (d) | | |

|

American Water Capital Corp. 5.45%, 3/1/2054 | | |

Wireless Telecommunication Services — 0.3% |

Rogers Communications, Inc. (Canada) 3.70%, 11/15/2049 | | |

|

| | |

| | |

| | |

Vodafone Group plc (United Kingdom) |

| | |

| | |

| | |

Total Corporate Bonds

(Cost $70,976,359) | | |

Commercial Mortgage-Backed Securities — 8.1% |

BAMLL Re-REMIC Trust Series 2024-FRR3, Class B, 1.50%, 1/27/2050 (c) (d) | | |

Banc of America Re-Remic Trust Series 2024-FRR1, Class B, 0.00%, 4/27/2049 ‡ (d) | | |

BB-UBS Trust Series 2012-SHOW, Class B, 3.88%, 11/5/2036 (d) | | |

| | |

Series 2014-USA, Class A2, 3.95%, 9/15/2037 (d) | | |

Series 2014-USA, Class B, 4.18%, 9/15/2037 (d) | | |

Series 2014-USA, Class C, 4.34%, 9/15/2037 (d) | | |

FHLMC, Multi-Family Structured Pass-Through Certificates | | |

Series KJ36, Class A1, 1.30%, 12/25/2026 | | |

| | |

|

Series KL06, Class XFX, IO, 1.47%, 12/25/2029 (c) | | |

Series KJ40, Class A2, 3.69%, 11/25/2030 (c) | | |

Series K135, Class AM, 1.91%, 10/25/2031 (c) | | |

Series KJ44, Class A2, 4.61%, 2/25/2033 | | |

| | |

Series 2020-M52, Class A1, 0.88%, 10/25/2030 | | |

Series 2022-M2S, Class A1, 3.88%, 5/25/2032 (c) | | |

Series 2020-M53, Class A2, 1.75%, 11/25/2032 (c) | | |

Series 2023-M8, Class A1, 4.62%, 11/25/2032 (c) | | |

Series 2024-M2, Class A1, 4.77%, 4/25/2033 (c) | | |

| | |

Series 2017-K66, Class B, 4.18%, 7/25/2027 (c) (d) | | |

Series 2017-KGX1, Class BFX, 3.71%, 10/25/2027 (c) (d) | | |

Series 2019-KBF3, Class B, 7.97%, 1/25/2029 (c) (d) | | |

Series 2018-K154, Class B, 4.16%, 11/25/2032 (c) (d) | | |

Series 2018-K155, Class B, 4.31%, 4/25/2033 (c) (d) | | |

Series 2015-K46, Class C, 3.82%, 4/25/2048 (c) (d) | | |

Series 2015-K49, Class B, 3.85%, 10/25/2048 (c) (d) | | |

Series 2016-K55, Class C, 4.30%, 4/25/2049 (c) (d) | | |

Series 2016-K58, Class C, 3.87%, 9/25/2049 (c) (d) | | |

Series 2017-K64, Class B, 4.14%, 5/25/2050 (c) (d) | | |

Series 2018-K80, Class B, 4.38%, 8/25/2050 (c) (d) | | |

Series 2017-K71, Class B, 3.88%, 11/25/2050 (c) (d) | | |

Series 2017-K71, Class C, 3.88%, 11/25/2050 (c) (d) | | |

Series 2019-K91, Class C, 4.40%, 4/25/2051 (c) (d) | | |

Series 2018-K79, Class C, 4.35%, 7/25/2051 (c) (d) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Exchange-Traded Funds | |

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF August 31, 2024 (Unaudited) (continued)

| | |

Commercial Mortgage-Backed Securities — continued |

Series 2019-K103, Class B, 3.57%, 12/25/2051 (c) (d) | | |

Series 2019-K102, Class B, 3.65%, 12/25/2051 (c) (d) | | |

Series 2019-K90, Class C, 4.46%, 2/25/2052 (c) (d) | | |

Series 2019-K88, Class C, 4.53%, 2/25/2052 (c) (d) | | |

Series 2019-K94, Class C, 4.10%, 7/25/2052 (c) (d) | | |

Series 2019-K98, Class C, 3.86%, 10/25/2052 (c) (d) | | |

Series 2019-K100, Class C, 3.61%, 11/25/2052 (c) (d) | | |

Series 2020-K737, Class B, 3.42%, 1/25/2053 (c) (d) | | |

Series 2020-K737, Class C, 3.42%, 1/25/2053 (c) (d) | | |

Series 2020-K105, Class C, 3.53%, 3/25/2053 (c) (d) | | |