Exhibit 99.6

IMPORTANT—IMMEDIATE ACTION RECOMMENDED

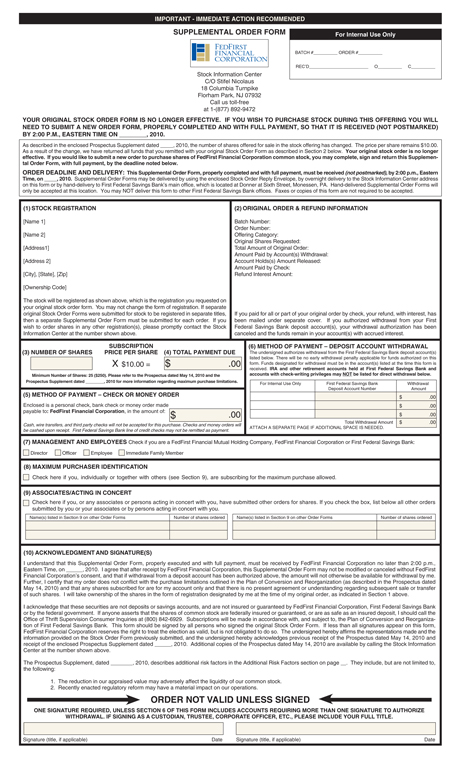

SUPPLEMENTAL ORDER FORM

For Internal Use Only

BATCH # ORDER #

REC’D O C

Stock Information Center

C/O Stifel Nicolaus

18 Columbia Turnpike

Florham Park, NJ 07932

Call us toll-free at 1-(877) 892-9472

YOUR ORIGINAL STOCK ORDER FORM IS NO LONGER EFFECTIVE. IF YOU WISH TO PURCHASE STOCK DURING THIS OFFERING YOU WILL NEED TO SUBMIT A NEW ORDER FORM, PROPERLY COMPLETED AND WITH FULL PAYMENT, SO THAT IT IS RECEIVED (NOT POSTMARKED) BY 2:00 P.M., EASTERN TIME ON , 2010.

As described in the enclosed Prospectus Supplement dated , 2010, the number of shares offered for sale in the stock offering has changed. The price per share remains $10.00.

As a result of the change, we have returned all funds that you remitted with your original Stock Order Form as described in Section 2 below. Your original stock order is no longer effective. If you would like to submit a new order to purchase shares of FedFirst Financial Corporation common stock, you may complete, sign and return this Supplemental Order Form, with full payment, by the deadline noted below.

ORDER DEADLINE AND DELIVERY: This Supplemental

Order Form, properly completed and with full payment, must be received (not postmarked), by 2:00 p.m., Eastern

Time, on , 2010. Supplemental Order Forms may be delivered by using the enclosed Stock Order Reply Envelope, by overnight delivery to the Stock Information Center address

on this form or by hand-delivery to First Federal Savings Bank’s main office, which is located at Donner at Sixth Street, Monessen, PA. Hand-delivered Supplemental Order Forms will only be accepted at this location. You may NOT deliver this form to other First Federal Savings Bank offices. Faxes or copies of this form are not required to be accepted.

[Name 1] [Name 2]

[Address1]

[Address 2] [City],

[State], [Zip]

[Ownership Code]

The stock will be registered as shown above, which is the registration you requested on your original stock order form. You may not change the form of registration. If separate original Stock Order Forms were submitted for stock to be registered in separate titles, then a separate Supplemental Order Form must be submitted for each order. If you wish to order shares in any other registration(s), please promptly contact the Stock Information Center at the number shown above.

(2) | | ORIGINAL ORDER & REFUND INFORMATION |

Batch Number: Order Number: Offering Category: Original Shares Requested: Total Amount of Original Order: Amount Paid by Account(s) Withdrawal: Account Holds(s)

Amount Released: Amount Paid by Check: Refund Interest Amount:

If you paid for all or part of your original order by check, your refund, with interest, has been mailed under separate cover. If you authorized withdrawal from your First Federal Savings Bank deposit account(s), your withdrawal authorization has been canceled and the funds remain in your account(s) with accrued interest.

SUBSCRIPTION PRICE PER SHARE

(6) | | METHOD OF PAYMENT—DEPOSIT ACCOUNT WITHDRAWAL |

The undersigned authorizes withdrawal from the First Federal Savings Bank deposit account(s) listed below. There will be no early withdrawal penalty applicable for funds authorized on this form. Funds designated for withdrawal must be in the account(s) listed at the time this form is received. IRA and other retirement accounts held at First Federal Savings Bank and accounts with check-writing privileges may NOT be listed for direct withdrawal below.

For Internal Use Only First Federal Savings Bank

X $10.00 $.00

Deposit Account Number Amount

$ .00

$ .00

$ .00

Total Withdrawal Amount $ .00

ATTACH A SEPARATE PAGE IF ADDITIONAL SPACE IS NEED

X $10.00 =

$ .00

Minimum Number of Shares: 25 ($250). Please refer to the Prospectus dated May 14, 2010 and the Prospectus Supplement dated , 2010 for more information regarding maximum purchase limitations.

(5) | | METHOD OF PAYMENT—CHECK OR MONEY ORDER |

Enclosed is a personal check, bank check or money order made

payable to: FedFirst Financial Corporation, in the amount of: $ .00

Cash, wire transfers, and third party checks will not be accepted for this purchase. Checks and money orders will be cashed upon receipt. First Federal Savings Bank line of credit checks may not be remitted as payment.

(7) MANAGEMENT AND EMPLOYEES Check if you are a FedFirst Financial Mutual Holding Company, FedFirst Financial Corporation or First Federal Savings Bank: Director Officer Employe Immediate Family Member

(8) | | MAXIMUM PURCHASER IDENTIFICATION |

Check here if you, individually or together with others (see Section 9), are subscribing for the maximum purchase allowed.

(9) | | ASSOCIATES/ACTING IN CONCERT |

Check here if you, or any associates or persons acting in concert with you, have submitted other orders for shares. If you check the box, list below all other orders submitted by you or your associates or by persons acting in concert with you.

Name(s) listed in Section 9 on other Order Forms Number of shares ordered Name(s) listed in Section 9 on other Order Forms Number of shares ordered

(10) | | ACKNOWLEDGMENT AND SIGNATURE(S) |

I understand that this Supplemental Order Form, properly executed and with full payment, must be received by FedFirst Financial Corporation no later than 2:00 p.m., Eastern Time, on , 2010. I agree that after receipt by FedFirst Financial Corporation, this Supplemental Order Form may not be modified or canceled without FedFirst

Financial Corporation’s consent, and that if withdrawal from a deposit account has been authorized above, the amount will not otherwise be available for withdrawal by me. Further, I certify that my order does not conflict with the purchase limitations outlined in the Plan of Conversion and Reorganization (as described in the Prospectus dated May 14, 2010) and that any shares subscribed for are for my account only and that there is no present agreement or understanding regarding subsequent sale or transfer of such shares. I will take ownership of the shares in the form of registration designated by me at the time of my original order, as indicated in Section 1 above.

I acknowledge that these securities are not deposits or savings accounts, and are not insured or guaranteed by FedFirst Financial Corporation, First Federal Savings Bank or by the federal government. If anyone asserts that the shares of common stock are federally insured or guaranteed, or are as safe as an insured deposit, I should call the Office of Thrift Supervision Consumer Inquiries at (800) 842-6929. Subscriptions will be made in accordance with, and subject to, the Plan of Conversion and Reorganization of First Federal Savings Bank. This form should be signed by all persons who signed the original Stock Order Form.

If less than all signatures appear on this form, FedFirst Financial Corporation reserves the right to treat the election as valid, but is not obligated to do so. The undersigned hereby affirms the representations made and the information provided on the Stock Order Form previously submitted, and the undersigned hereby acknowledges previous receipt of the Prospectus dated May 14, 2010 and receipt of the enclosed Prospectus Supplement dated , 2010. Additional copies of the Prospectus dated May 14, 2010 are available by calling the Stock Information

Center at the number shown above.

The Prospectus Supplement, dated , 2010, describes additional risk factors in the Additional Risk Factors section on page .. They include, but are not limited to,

the following:

1. The reduction in our appraised value may adversely affect the liquidity of our common stock.

2. Recently enacted regulatory reform may have a material impact on our operations.

ORDER NOT VALID UNLESS SIGNED

ONE SIGNATURE REQUIRED, UNLESS SECTION 6 OF THIS FORM INCLUDES ACCOUNTS REQUIRING MORE THAN ONE SIGNATURE TO AUTHORIZE WITHDRAWAL. IF SIGNING AS A CUSTODIAN, TRUSTEE, CORPORATE OFFICER, ETC., PLEASE INCLUDE YOUR FULL TITLE.

Signature (title, if applicable)

Date Signature (title, if applicable)

Date

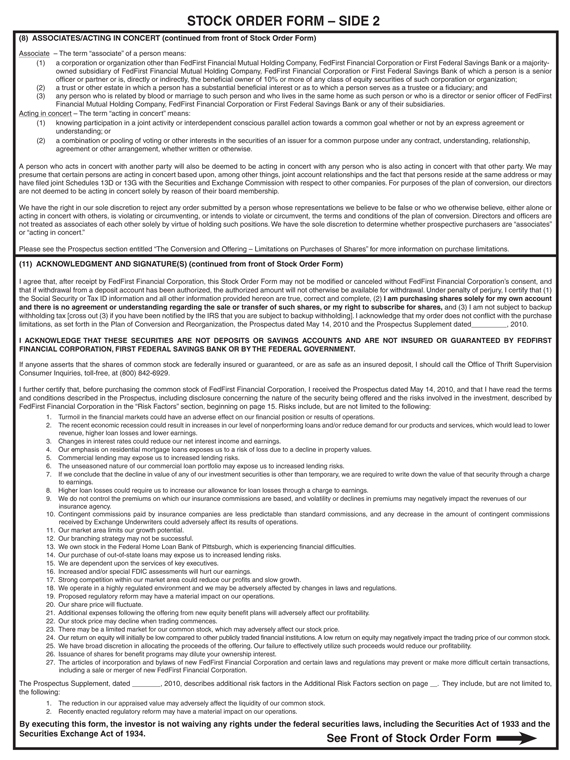

STOCK ORDER FORM – SIDE 2

(8) | | ASSOCIATES/ACTING IN CONCERT (continued from front of Stock Order Form) |

Associate – The term “associate” of a person means:

(1) a corporation or organization other than FedFirst Financial Mutual Holding Company, FedFirst Financial Corporation or First Federal Savings Bank or a majority-owned subsidiary of FedFirst Financial Mutual Holding Company, FedFirst Financial Corporation or First Federal Savings Bank of which a person is a senior officer or partner or is, directly or indirectly, the beneficial owner of 10% or more of any class of equity securities of such corporation or organization;

(2) a trust or other estate in which a person has a substantial beneficial interest or as to which a person serves as a trustee or a fiduciary; and

(3) any person who is related by blood or marriage to such person and who lives in the same home as such person or who is a director or senior officer of FedFirst Financial Mutual Holding Company, FedFirst Financial Corporation or First Federal Savings Bank or any of their subsidiaries.

Acting in concert – The term “acting in concert” means:

(1) knowing participation in a joint activity or interdependent conscious parallel action towards a common goal whether or not by an express agreement or understanding; or

(2) a combination or pooling of voting or other interests in the securities of an issuer for a common purpose under any contract, understanding, relationship, agreement or other arrangement, whether written or otherwise.

A person who acts in concert with another party will also be deemed to be acting in concert with any person who is also acting in concert with that other party. We may presume that certain persons are acting in concert based upon, among other things, joint account relationships and the fact that persons reside at the same address or may have filed joint Schedules 13D or 13G with the Securities and Exchange Commission with respect to other companies. For purposes of the plan of conversion, our directors are not deemed to be acting in concert solely by reason of their board membership.

We have the right in our sole discretion to reject any order submitted by a person whose representations we believe to be false or who we otherwise believe, either alone or acting in concert with others, is violating or circumventing, or intends to violate or circumvent, the terms and conditions of the plan of conversion. Directors and officers are not treated as associates of each other solely by virtue of holding such positions. We have the sole discretion to determine whether prospective purchasers are “associates” or “acting in concert.”

Please see the Prospectus section entitled “The Conversion and Offering – Limitations on Purchases of Shares” for more information on purchase limitations.

(11) | | ACKNOWLEDGMENT AND SIGNATURE(S) (continued from front of Stock Order Form) |

I agree that, after receipt by FedFirst Financial Corporation, this Stock Order Form may not be modified or canceled without FedFirst Financial Corporation’s consent, and that if withdrawal from a deposit account has been authorized, the authorized amount will not otherwise be available for withdrawal. Under penalty of perjury, I certify that (1) the Social Security or Tax ID information and all other information provided hereon are true, correct and complete, (2) I am purchasing shares solely for my own account and there is no agreement or understanding regarding the sale or transfer of such shares, or my right to subscribe for shares, and (3) I am not subject to backup withholding tax [cross out (3) if you have been notified by the IRS that you are subject to backup withholding]. I acknowledge that my order does not conflict with the purchase limitations, as set forth in the Plan of Conversion and Reorganization, the Prospectus dated May 14, 2010 and the Prospectus Supplement dated , 2010.

I ACKNOWLEDGE THAT THESE SECURITIES ARE NOT DEPOSITS OR SAVINGS ACCOUNTS AND ARE NOT INSURED OR GUARANTEED BY FEDFIRST FINANCIAL CORPORATION, FIRST FEDERAL SAVINGS BANK OR BY THE FEDERAL GOVERNMENT.

If anyone asserts that the shares of common stock are federally insured or guaranteed, or are as safe as an insured deposit, I should call the Office of Thrift Supervision Consumer Inquiries, toll-free, at (800) 842-6929.

I further certify that, before purchasing the common stock of FedFirst Financial Corporation, I received the Prospectus dated May 14, 2010, and that I have read the terms and conditions described in the Prospectus, including disclosure concerning the nature of the security being offered and the risks involved in the investment, described by FedFirst Financial Corporation in the “Risk Factors” section, beginning on page 15. Risks include, but are not limited to the following:

1. Turmoil in the financial markets could have an adverse effect on our financial position or results of operations.

2. The recent economic recession could result in increases in our level of nonperforming loans and/or reduce demand for our products and services, which would lead to lower revenue, higher loan losses and lower earnings.

3. Changes in interest rates could reduce our net interest income and earnings.

4. Our emphasis on residential mortgage loans exposes us to a risk of loss due to a decline in property values.

5. Commercial lending may expose us to increased lending risks.

6. The unseasoned nature of our commercial loan portfolio may expose us to increased lending risks.

7. If we conclude that the decline in value of any of our investment securities is other than temporary, we are required to write down the value of that security through a charge to earnings.

8. Higher loan losses could require us to increase our allowance for loan losses through a charge to earnings.

9. We do not control the premiums on which our insurance commissions are based, and volatility or declines in premiums may negatively impact the revenues of our insurance agency.

10. Contingent commissions paid by insurance companies are less predictable than standard commissions, and any decrease in the amount of contingent commissions received by Exchange Underwriters could adversely affect its results of operations.

11. | | Our market area limits our growth potential. |

12. | | Our branching strategy may not be successful. |

13. | | We own stock in the Federal Home Loan Bank of Pittsburgh, which is experiencing financial difficulties. |

14. | | Our purchase of out-of-state loans may expose us to increased lending risks. |

15. | | We are dependent upon the services of key executives. |

16. | | Increased and/or special FDIC assessments will hurt our earnings. |

17. | | Strong competition within our market area could reduce our profits and slow growth. |

18. | | We operate in a highly regulated environment and we may be adversely affected by changes in laws and regulations. |

19. | | Proposed regulatory reform may have a material impact on our operations. |

20. | | Our share price will fluctuate. |

21. | | Additional expenses following the offering from new equity benefit plans will adversely affect our profitability. |

22. | | Our stock price may decline when trading commences. |

23. | | There may be a limited market for our common stock, which may adversely affect our stock price. |

24. Our return on equity will initially be low compared to other publicly traded financial institutions. A low return on equity may negatively impact the trading price of our common stock.

25. We have broad discretion in allocating the proceeds of the offering. Our failure to effectively utilize such proceeds would reduce our profitability.

26. | | Issuance of shares for benefit programs may dilute your ownership interest. |

27. The articles of incorporation and bylaws of new FedFirst Financial Corporation and certain laws and regulations may prevent or make more difficult certain transactions, including a sale or merger of new FedFirst Financial Corporation.

The Prospectus Supplement, dated , 2010, describes additional risk factors in the Additional Risk Factors section on page .. They include, but are not limited to, the following:

1. The reduction in our appraised value may adversely affect the liquidity of our common stock.

2. Recently enacted regulatory reform may have a material impact on our operations.

By executing this form, the investor is not waiving any rights under the federal securities laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934.

See Front of Stock Order Form