Exhibit 99.2 February 21, 2024 Strategic Combination with Enerplus 1

Important Disclosures No Offer or Solicitation Communications in this document do not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Additional Information and Where You Can Find It Unless otherwise indicated, all dollar amounts in this presentation are stated in U.S. dollars and all references to $ are to U.S. dollars. This presentation contains references to boe (barrels of oil equivalent) and Mboe (one thousand barrels of oil equivalent). The parties have adopted the standard of six thousand cubic feet of natural gas to one barrel of oil (6 Mcf: 1 bbl) when converting natural gas to boes. The conventions boe and Mboe may be misleading, particularly if used in isolation. The foregoing conversion ratios are based on an energy equivalency conversion method primarily applicable at the burner tip and do not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of oil as compared to natural gas is significantly different from the energy equivalent of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value. All production volumes presented in this presentation are reported on a net basis (a company's working interest share after deduction of royalty obligations, plus the company's royalty interests), which differs from gross basis (a company's working interest before deduction of royalties) for reporting production under National Instrument 51-101 and industry practice in Canada. All references to oil in this presentation include light and tight crude oil. In connection with the proposed transaction, Chord Energy Corporation (“Chord”) and Enerplus Corporation (“Enerplus”) intend to file materials with the Securities and Exchange Commission (“SEC”) and on SEDAR+, as applicable. Chord intends to file a Proxy Statement on Schedule 14A (the Proxy Statement ) with the SEC in connection with the solicitation of proxies to obtain Chord stockholder approval of the proposed transaction, and Enerplus intends to file an information circular (the “Circular”) with the TSX and on SEDAR+ in connection with the solicitation of proxies to obtain Enerplus shareholder approval of the proposed transaction. After the Proxy Statement is cleared by the SEC, Chord intends to mail a definitive Proxy Statement to the shareholders of Chord. This document is not a substitute for the Proxy Statement, the Circular or for any other document that Chord or Enerplus may file with the SEC or on SEDAR+ and/or send to Chord’s shareholders and/or Enerplus’ shareholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF CHORD AND ENERPLUS ARE URGED TO CAREFULLY AND THOROUGHLY READ THE PROXY STATEMENT AND THE CIRCULAR, RESPECTIVELY, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOCUMENTS FILED BY CHORD AND/OR ENERPLUS WITH THE SEC OR ON SEDAR+, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CHORD, ENERPLUS, THE PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS. Shareholders of Chord and Enerplus will be able to obtain free copies of the Proxy Statement and the Circular, as each may be amended from time to time, and other relevant documents filed by Chord and/or Enerplus with the SEC or on SEDAR+ (when they become available) through the website maintained by the SEC at www.sec.gov or at www.sedarplus.ca, as applicable. Copies of documents filed with the SEC by Chord will be available free of charge from Chord’s website at www.chordenergy.com under the “Investors” tab or by contacting Chord’s Investor Relations Department at (281) 404-9600 or ir@chordenergy.com. Copies of documents filed with the SEC or on SEDAR+ by Enerplus will be available free of charge from Enerplus’ website at www.enerplus.com under the “Investors” tab or by contacting Enerplus’ Investor Relations Department at (403) 298-1707. Participants in the Solicitation Chord, Enerplus and their respective directors and certain of their executive officers and other members of management and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from Chord’s shareholders and Enerplus’ shareholders in connection with the transaction. Information regarding the executive officers and directors of Chord is included in its definitive proxy statement for its 2023 annual meeting under the headings “Item 1 – Election of Directors”, “Our Executive Officers”, “Compensation Discussion and Analysis”, “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management”, which was filed with the SEC on March 16, 2023 and is available at https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/1486159/000148615923000007/chrd-20230316.htm. Information regarding the executive officers and directors of Enerplus is included in its information circular and proxy statement for its 2023 annual meeting under the headings “Director Compensation” and “Executive Compensation”, which was filed on SEDAR+ on April 4, 2023 and is available at https://www.sec.gov/Archives/edgar/data/1126874/000110465923041270/tm235372d3_ex99-2.htm. Additional information regarding the persons who may be deemed participants and their direct and indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement, the Circular and other materials when they are filed with the SEC or on SEDAR+ in connection with the transaction. Free copies of these documents may be obtained as described in the paragraphs above. 2

Cautionary Statement Regarding Forward-Looking Statements Forward-Looking Statements Certain statements in this document concerning the proposed transaction, including any statements regarding the expected timetable for completing the proposed transaction, the results, effects, benefits and synergies of the proposed transaction, future opportunities for the combined company, future financial performance and condition, guidance and any other statements regarding Chord’s or Enerplus’ future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements based on assumptions currently believed to be valid. Forward-looking statements are all statements other than statements of historical facts. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “should,” “would,” “potential,” “may,” “might,” “anticipate,” “likely” “plan,” “positioned,” “strategy,” and similar expressions or other words of similar meaning, and the negatives thereof, are intended to identify forward-looking statements. Specific forward-looking statements include, but are not limited to, statements regarding Chord’s or Enerplus’ plans and expectations with respect to the proposed transaction and the anticipated impact of the proposed transaction on the combined company’s results of operations, financial position, growth opportunities, competitive position, and anticipated future performance, including maintaining Chord and Enerplus management, strategies and plans, integration, debt levels and leverage ratio, cash flows, synergies, expected accretion to cash flow per shares, free cash flow per share, net asset value and return of capital. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those anticipated, including, but not limited to, the possibility that shareholders of Chord may not approve the issuance of new shares of Chord common stock in the proposed transaction or that shareholders of Enerplus may not approve the proposed transaction; the risk that any other condition to closing of the proposed transaction may not be satisfied, that either party may terminate the arrangement agreement or that the closing of the proposed transaction might be delayed or not occur at all; the risk that the agreement is terminated and either Chord or Enerplus is required to pay a termination fee to the other party; potential adverse reactions or changes to business or employee relationships of Chord or Enerplus, including those resulting from the announcement or completion of the proposed transaction; the diversion of management time on transaction-related issues; the ultimate timing, outcome and results of integrating the operations of Chord and Enerplus; the ability of Chord and Enerplus to retain customers, retain and hire key personnel and maintain relationship with their suppliers and customers and their impact on Chord's and Enerplus' operating results and businesses generally; the effects of the business combination of Chord and Enerplus, including the combined company’s future financial condition, results of operations, strategy and plans; the ability of the combined company to realize anticipated synergies in the timeframe expected or at all; changes in capital markets and the ability of the combined company to finance operations in the manner expected; regulatory approval of the proposed transaction; the risk of any litigation relating to the proposed transaction; the risk of changes in governmental regulations or enforcement practices;the effects of commodity prices; the risks of oil and gas activities; and the fact that operating costs and business disruption may be greater than expected following the public announcement or consummation of the proposed transaction. Expectations regarding business outlook, including changes in revenue, pricing, capital expenditures, cash flow generation, strategies for the combined company’s operations, oil and natural gas market conditions, legal, economic and regulatory conditions, and environmental matters are only forecasts regarding these matters. Additional factors that could cause results to differ materially from those described above can be found in Chord’s Annual Report on Form 10-K for the year ended December 31, 2022, and subsequent Quarterly Reports on Form 10-Q, which are on file with the SEC and available from Chord’s website at www.chordenergy.com under the “Investors” tab, and in other documents Chord files with the SEC and in Enerplus’ annual information form for the year ended December 31, 2022, which is on file with the SEC and on SEDAR+ and available from Enerplus’ website at www.enerplus.com under the “Investors” tab, and in other documents Enerplus files with the SEC or on SEDAR+. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Chord nor Enerplus assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by applicable securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. Non-GAAP Financial Measures Projected EBITDAX, net debt, and free cash flow are specified financial measures that are not presented in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP measure should not be considered in isolation or as a substitute for net income (loss), operating income (loss), net cash provided by (used in) operating activities, earnings (loss) per share or any other measures prepared under GAAP. Because these non-GAAP measures exclude some but not all items that affect net income (loss) and may vary among companies, the amounts presented may not be comparable to similar metrics of other companies. Cautionary Statement Regarding Oil and Gas Quantities The SEC requires oil and gas companies, in their filings with the SEC, to disclose proved reserves, which are those quantities of oil and gas, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible— from a given date forward, from known reservoirs, and under existing economic conditions (using unweighted average 12-month first day of the month prices), operating methods, and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities of the exploration and development companies may justify revisions of estimates that were made previously. If significant, such revisions could impact Chord’s and Enerplus’ strategy and future prospects. Accordingly, reserve estimates may differ significantly from the quantities of oil and natural gas that are ultimately recovered. The SEC also permits the disclosure of separate estimates of probable or possible reserves that meet SEC definitions for such reserves; however, neither Chord nor Enerplus currently discloses probable or possible reserves in its SEC filings. The production forecasts and expectations of the combined company for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or drilling cost increases. 3

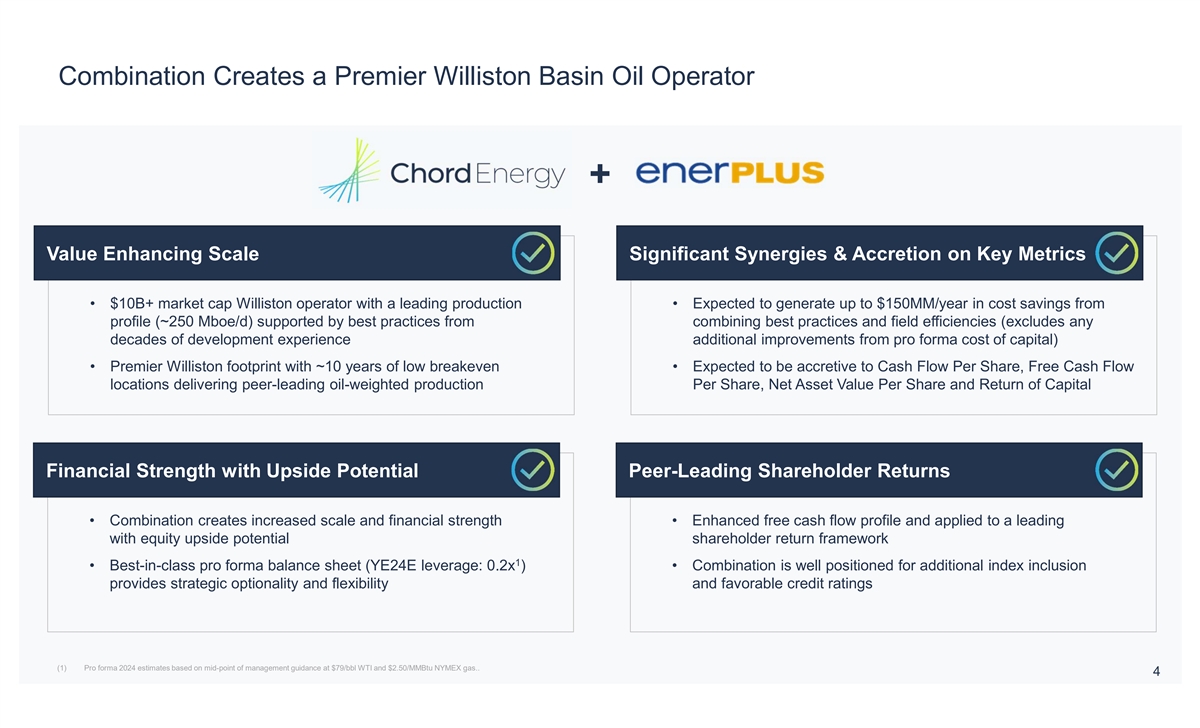

Combination Creates a Premier Williston Basin Oil Operator + Value Enhancing Scale Significant Synergies & Accretion on Key Metrics • $10B+ market cap Williston operator with a leading production • Expected to generate up to $150MM/year in cost savings from profile (~250 Mboe/d) supported by best practices from combining best practices and field efficiencies (excludes any decades of development experience additional improvements from pro forma cost of capital) • Premier Williston footprint with ~10 years of low breakeven • Expected to be accretive to Cash Flow Per Share, Free Cash Flow locations delivering peer-leading oil-weighted production Per Share, Net Asset Value Per Share and Return of Capital Financial Strength with Upside Potential Peer-Leading Shareholder Returns • Combination creates increased scale and financial strength • Enhanced free cash flow profile and applied to a leading with equity upside potential shareholder return framework 1 • Best-in-class pro forma balance sheet (YE24E leverage: 0.2x ) • Combination is well positioned for additional index inclusion provides strategic optionality and flexibility and favorable credit ratings (1) Pro forma 2024 estimates based on mid-point of management guidance at $79/bbl WTI and $2.50/MMBtu NYMEX gas.. 4

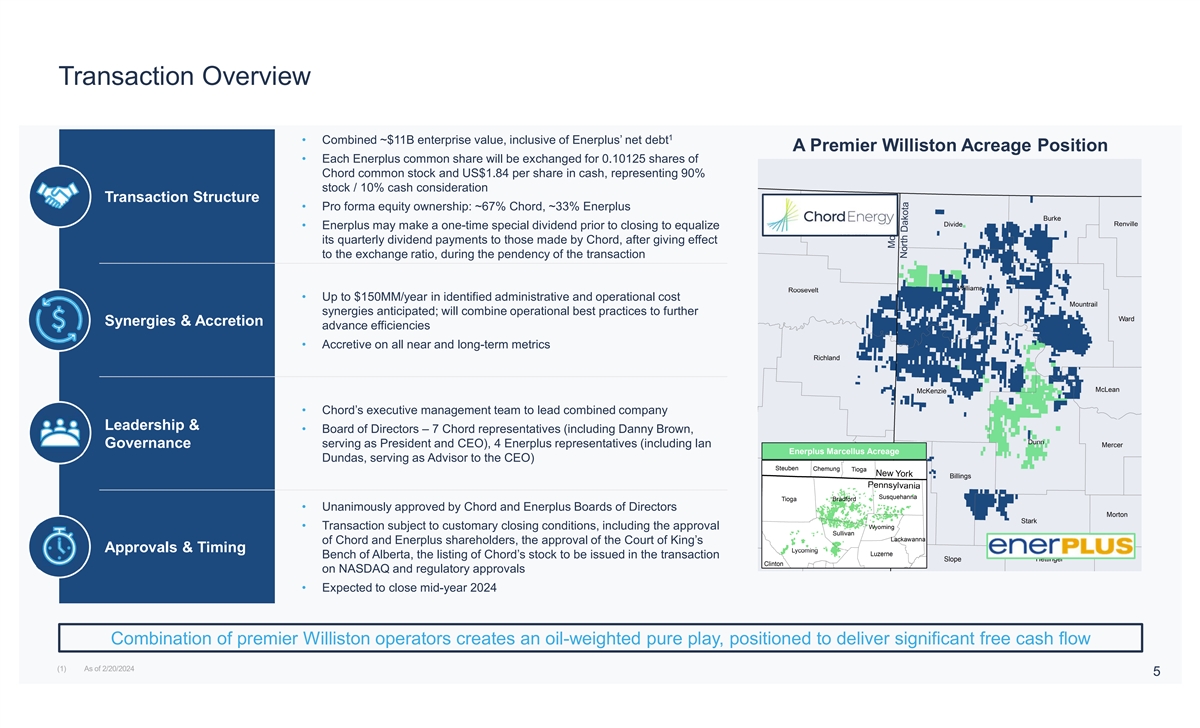

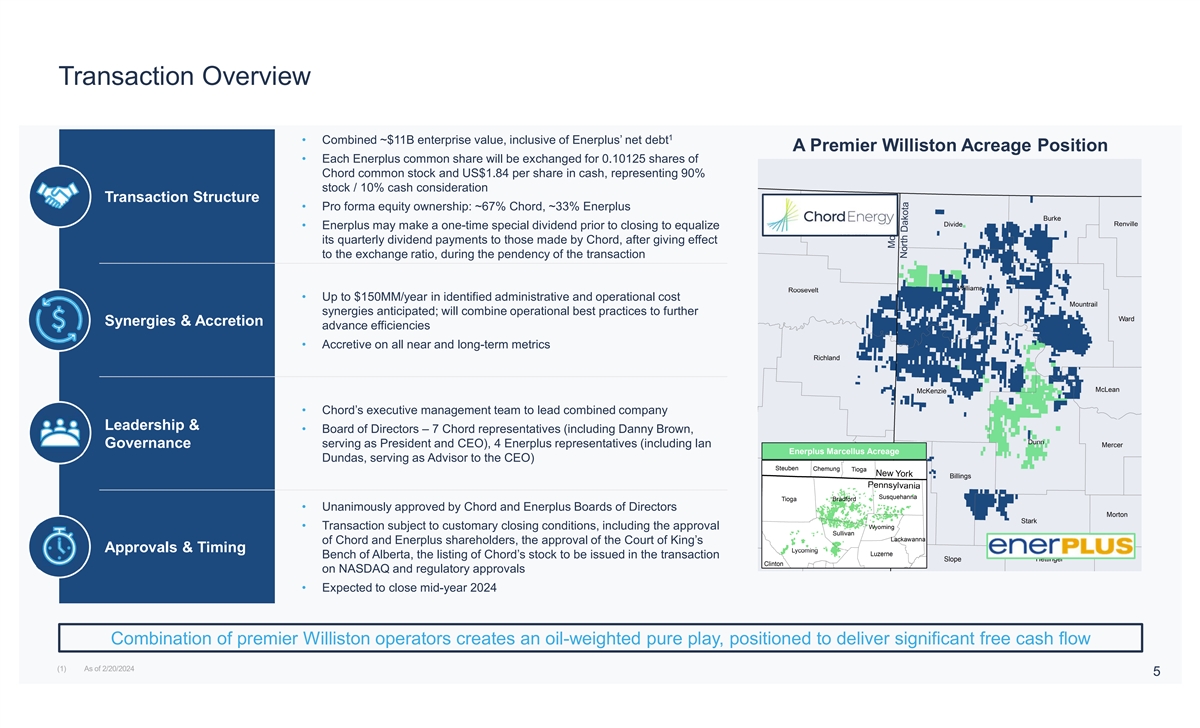

Transaction Overview 1 • Combined ~$11B enterprise value, inclusive of Enerplus’ net debt A Premier Williston Acreage Position • Each Enerplus common share will be exchanged for 0.10125 shares of Chord common stock and US$1.84 per share in cash, representing 90% stock / 10% cash consideration Transaction Structure • Pro forma equity ownership: ~67% Chord, ~33% Enerplus • Enerplus may make a one-time special dividend prior to closing to equalize its quarterly dividend payments to those made by Chord, after giving effect to the exchange ratio, during the pendency of the transaction • Up to $150MM/year in identified administrative and operational cost synergies anticipated; will combine operational best practices to further Synergies & Accretion advance efficiencies • Accretive on all near and long-term metrics • Chord’s executive management team to lead combined company Leadership & • Board of Directors – 7 Chord representatives (including Danny Brown, serving as President and CEO), 4 Enerplus representatives (including Ian Governance Enerplus Marcellus Acreage Dundas, serving as Advisor to the CEO) • Unanimously approved by Chord and Enerplus Boards of Directors • Transaction subject to customary closing conditions, including the approval of Chord and Enerplus shareholders, the approval of the Court of King’s Approvals & Timing Bench of Alberta, the listing of Chord’s stock to be issued in the transaction on NASDAQ and regulatory approvals • Expected to close mid-year 2024 Combination of premier Williston operators creates an oil-weighted pure play, positioned to deliver significant free cash flow (1) As of 2/20/2024 5

Enhanced Scale Delivering Williston Leading Production and Operations Value Enhancing Scale Significant Synergies Financial Strength Shareholder Returns Pro Forma 1 • Combined inventory supports ~10 years of development Market Cap ($B) $7.0 $3.4 $10.4 • Creates a leading Williston operator, combining best practices from decades of in-basin Enterprise Value ($B) $7.1 $3.9 $11.1 development by Chord and Enerplus Production (Mboe/d) 176 103 279 Williston Production (Mboe/d) 176 78 254 • Company positioned to optimize development in Williston and drive value for investors Williston Acreage (‘000) 1,025 236 1,261 2 Williston Net Production by Operator (Mboe/d) 254 214 190 176 121 111 94 78 54 Leading Williston production profile supported by best practices from decades of development experience (1) At 2024E development pace. Economic locations (>10% IRR @ $60/Bbl WTI flat). Source: Management estimates. 6 (2) 3Q23 reported Williston production. Pro forma Q4 2023 Williston production is 262 mboe/d.

Chord Elevates Into Large-Cap Peer Group, with Highest Oil Weighting Value Enhancing Scale Significant Synergies Financial Strength Shareholder Returns 1 New Large-Cap Peers Prior Peers Market Capitalization ($B) $18.7 $13.7 $12.4 $11.5 $10.4 $7.0 $7.0 $6.4 $4.6 $4.5 $3.4 CTRA MRO OVV PR PF CHRD + ERF MTDR CHRD CIVI SM MGY ERF 2 Oil Production (%) 58% 56% 53% 49% 48% 48% 47% 44% 41% 30% 14% CHRD PF CHRD + ERF ERF CIVI MTDR PR MRO SM MGY OVV CTRA ♦ Chord’s single-basin footprint and oil weighting provide a leading platform for scale and returns Note: Pro Forma metrics based on 90% stock / 10% cash transaction with 0.10125 equity exchange ratio and $1.84/share in cash. Metrics based on Wall Street Consensus estimates as of 2/20/2024. 7 (1) APA Corporation would also be in the large-cap peer group, however, excluded from this presentation due to pending merger with Callon. (2) 3Q23 reported production.

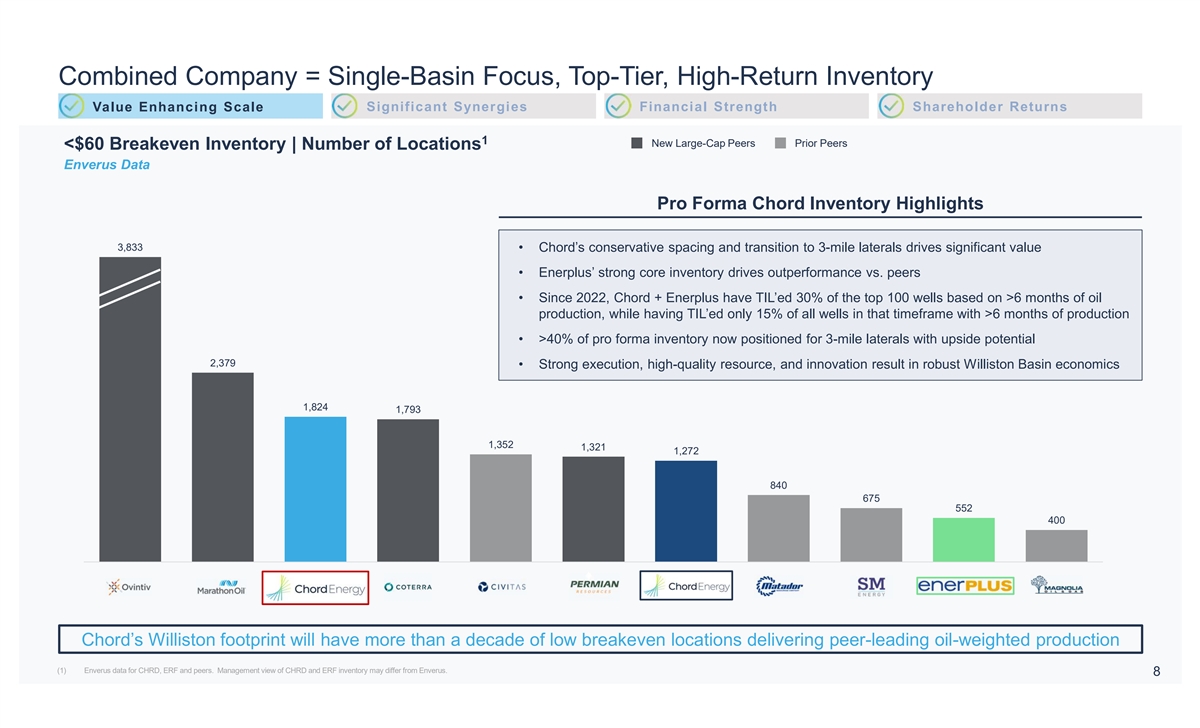

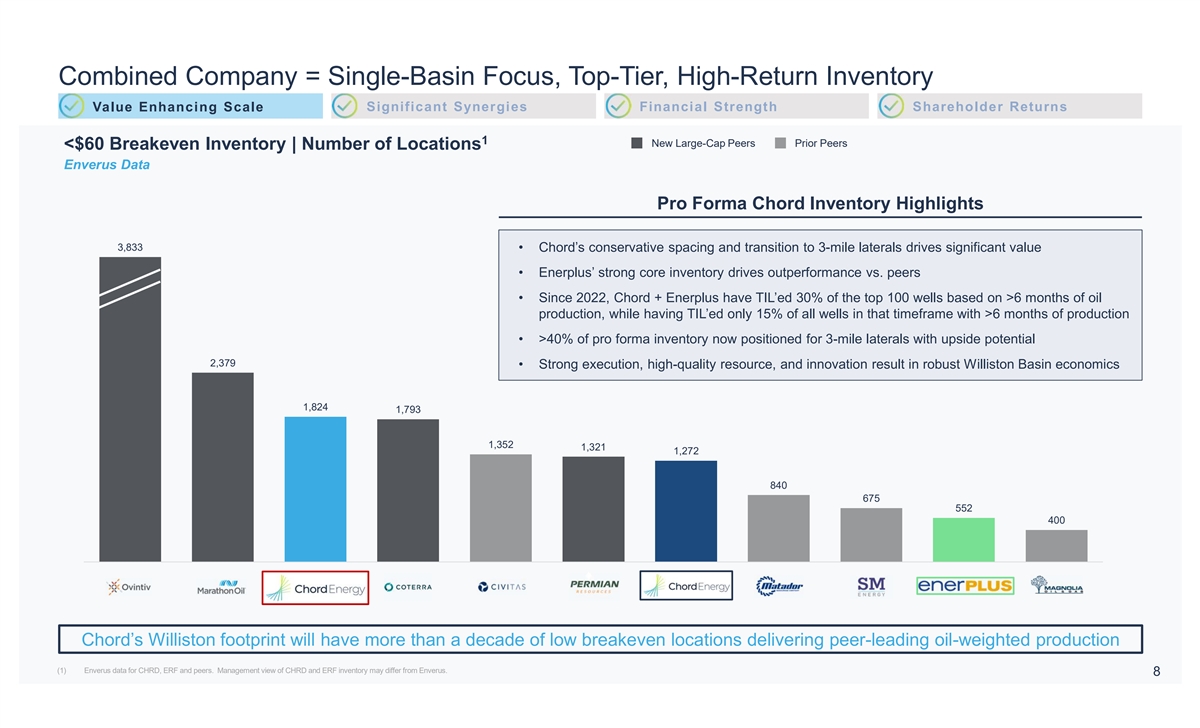

Combined Company = Single-Basin Focus, Top-Tier, High-Return Inventory Value Enhancing Scale Significant Synergies Financial Strength Shareholder Returns 1 New Large-Cap Peers Prior Peers <$60 Breakeven Inventory | Number of Locations Enverus Data Pro Forma Chord Inventory Highlights 3,833 • Chord’s conservative spacing and transition to 3-mile laterals drives significant value • Enerplus’ strong core inventory drives outperformance vs. peers • Since 2022, Chord + Enerplus have TIL’ed 30% of the top 100 wells based on >6 months of oil production, while having TIL’ed only 15% of all wells in that timeframe with >6 months of production • >40% of pro forma inventory now positioned for 3-mile laterals with upside potential 2,379 • Strong execution, high-quality resource, and innovation result in robust Williston Basin economics 1,824 1,793 1,352 1,321 1,272 840 675 552 400 OVV MRO Pro Forma CTRA CIVI PR CHRD MTDR SM ERF MGY ♦ Chord’s Williston footprint will have more than a decade of low breakeven locations delivering peer-leading oil-weighted production (1) Enverus data for CHRD, ERF and peers. Management view of CHRD and ERF inventory may differ from Enverus. 8

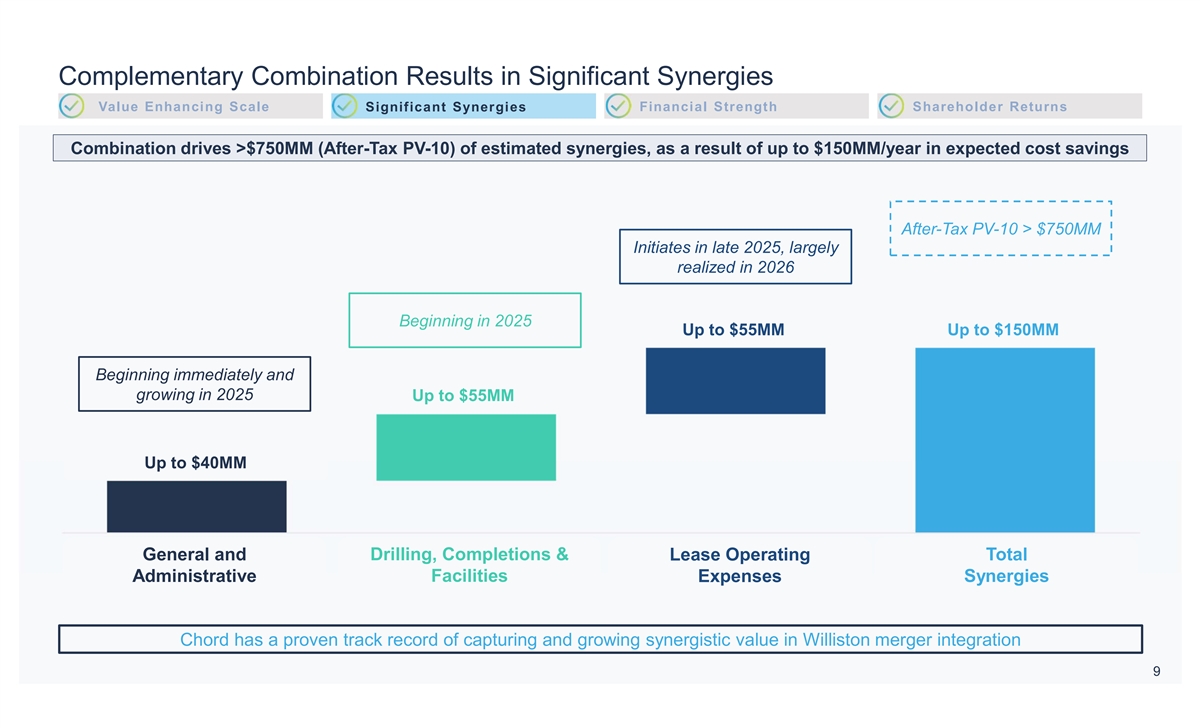

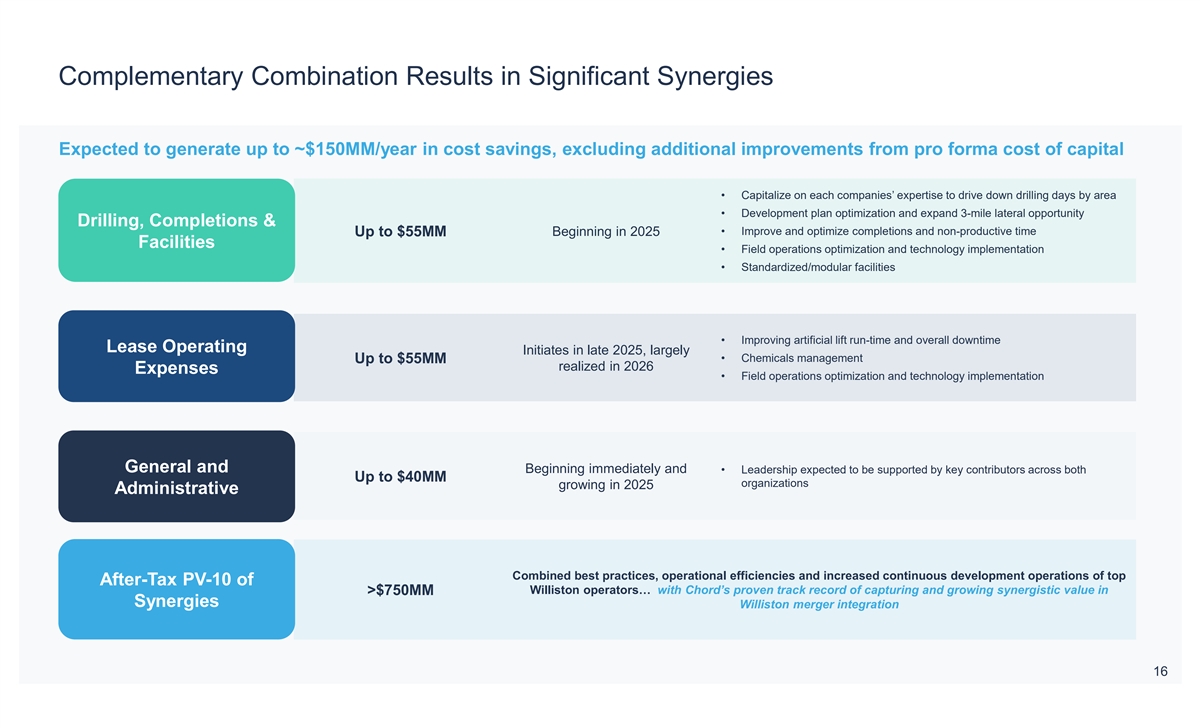

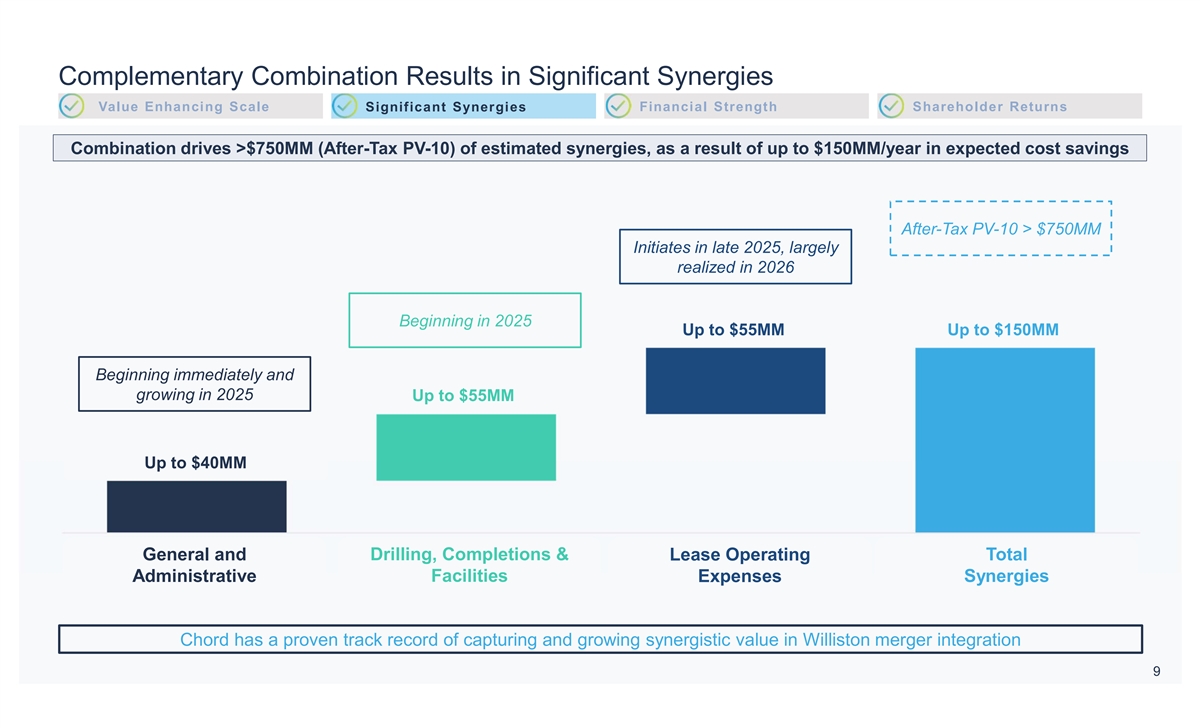

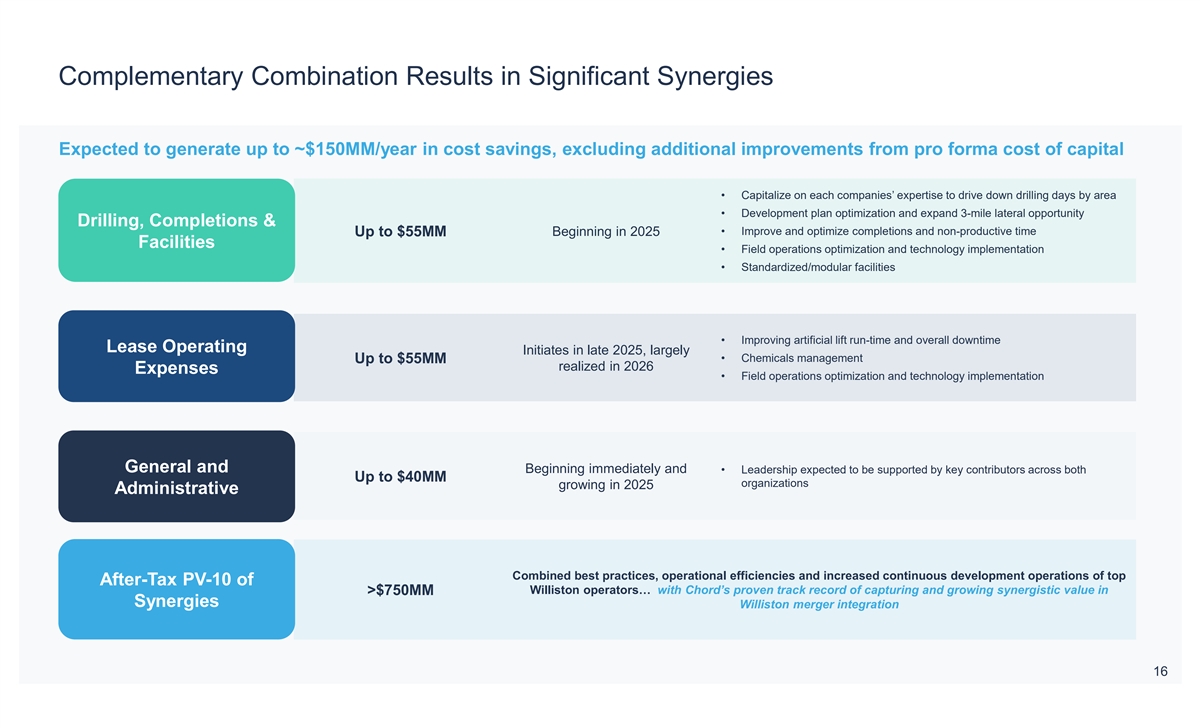

Complementary Combination Results in Significant Synergies Value Enhancing Scale Significant Synergies Financial Strength Shareholder Returns Combination drives >$750MM (After-Tax PV-10) of estimated synergies, as a result of up to $150MM/year in expected cost savings After-Tax PV-10 > $750MM Initiates in late 2025, largely realized in 2026 Beginning in 2025 Up to $55MM Up to $150MM Beginning immediately and growing in 2025 Up to $55MM Up to $40MM General and Drilling, Completions & Lease Operating Total Administrative Facilities Expenses Synergies Chord has a proven track record of capturing and growing synergistic value in Williston merger integration 9

Combination Has Superior Profitability and Best-in-Class Balance Sheet Value Enhancing Scale Significant Synergies Financial Strength Shareholder Returns Superior Profitability Best-in-Class Balance Sheet • Premier, oil-weighted footprint drives superior EBITDA margins • Significant liquidity and minimal near-term maturities • Upside to margins with combined best practices and operational efficiencies • Best-in-class balance sheet provides strategic optionality and flexibility 2024E EBITDA Margins YE 2024E Net Debt / 2024E EBITDA ($/boe vs. Peer Average) (x vs. Peer Average) $29 0.7x $25 0.2x ♦ Chord’s premier, oil-weighted Williston footprint drives superior profitability, complemented by significantly lower leverage Note: Pro Forma metrics based on 90% stock / 10% cash transaction with 0.10125 equity exchange ratio and $1.84/share in cash. Metrics based on Wall Street Consensus Estimates as of 2/20/2024. 10

Chord Delivers for its Shareholders Value Enhancing Scale Significant Synergies Financial Strength Shareholder Returns Combination Supports Chord’s Leading Return Framework Demonstrated History of Returning Capital to Shareholders 1 Free Cash Flow (2024E) Total Shareholder Return Since January 2021 >50% increase in free cash ($B) (%) flow and return of capital 500% ~$1.2 462% 400% ~$0.8 300% New Peer 245% Median 200% Standalone Pro Forma 100% WTI 62% Capital Allocation 32% S&P 500 -- • Maintain program of returning 75%+ of free cash flow to investors • Reaffirm annual $5.00/share base dividend (100%) • Underpinned by share buybacks and supplemented with variable dividends Chord has consistently returned more capital to shareholders than its large-cap peer group Source: FactSet, Company Filings. Market data as of 2/20/2024. 11 Note: Peer set includes CTRA, OVV, MRO and PR. (1) Pro forma 2024 estimates based on mid-point of management guidance at $79/bbl WTI and $2.50/MMBtu NYMEX gas.

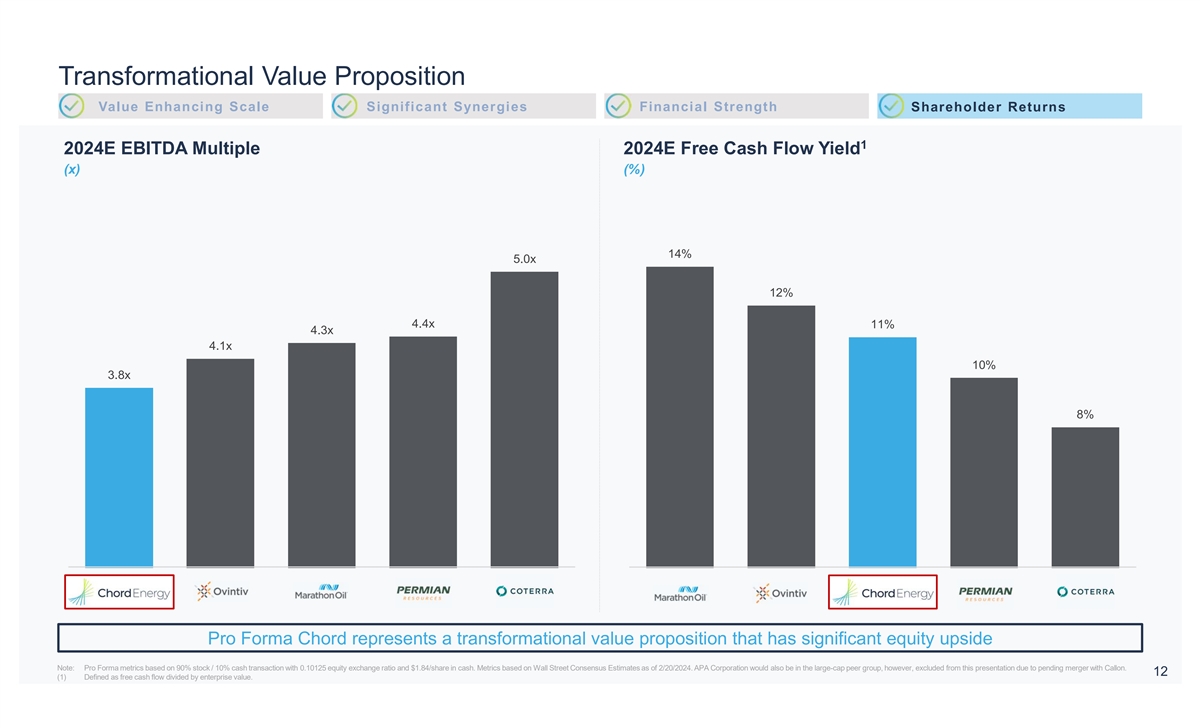

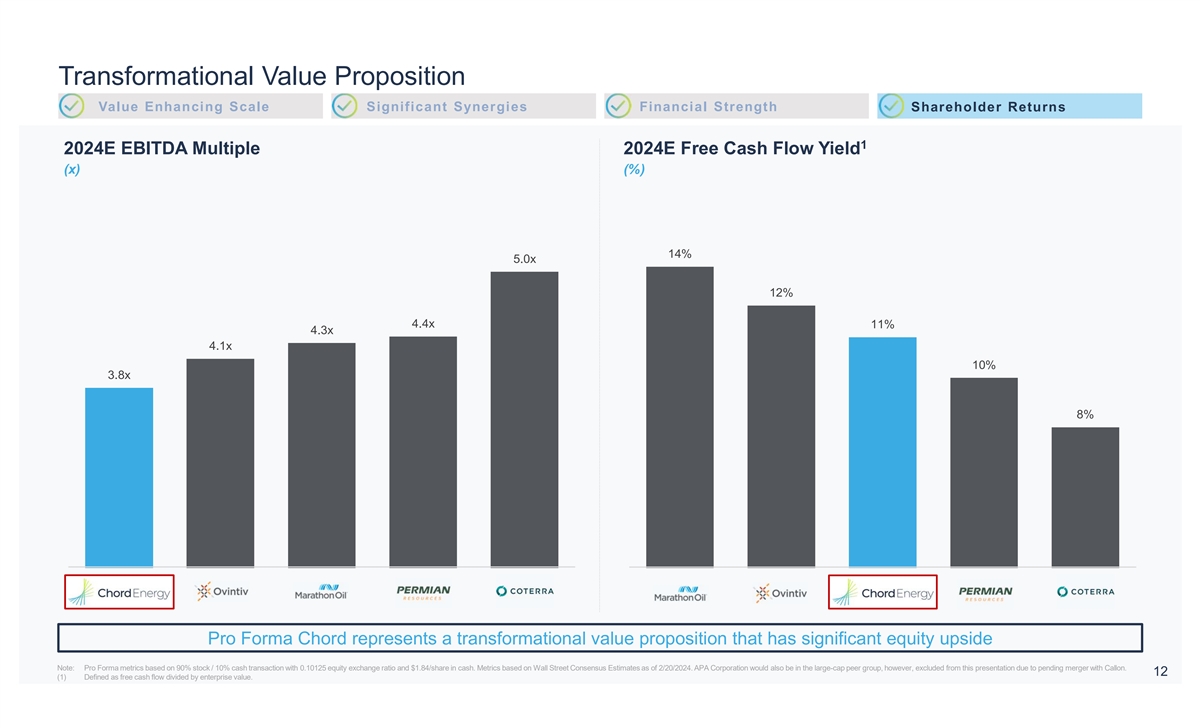

Transformational Value Proposition Value Enhancing Scale Significant Synergies Financial Strength Shareholder Returns 1 2024E EBITDA Multiple 2024E Free Cash Flow Yield (x) (%) 14% 5.0x 12% 4.4x 11% 4.3x 4.1x 10% 3.8x 8% Pro Forma Chord represents a transformational value proposition that has significant equity upside Note: Pro Forma metrics based on 90% stock / 10% cash transaction with 0.10125 equity exchange ratio and $1.84/share in cash. Metrics based on Wall Street Consensus Estimates as of 2/20/2024. APA Corporation would also be in the large-cap peer group, however, excluded from this presentation due to pending merger with Callon. 12 (1) Defined as free cash flow divided by enterprise value.

Combination Creates a Premier Williston Basin Oil Operator Significant and Resilient A Premier Williston Operator Enhances Position as with Top-TierAssets Free Cash Flow Generation Low-Cost Operator Enhances size and scale with high quality assets across ~1.3MM net acres and low Expected to generate up to breakeven inventory pricing ~$150MM/year in identified administrative Expected ~$1.2B of FCF in 2024 with a and operational / capital synergies while 2 combined reinvestment rate of ~51% Commitment to continuous improvement combining operational best practices to across its business, including its further advance efficiencies 1 environmental footprint Compelling Long Term Capital Returns Program to Maintains Best in Class Value Proposition Balance Sheet Deliver Significant Value Attractive valuation vs. new peer set results in compelling investment opportunity 2 Peer leading return-of-capital program YE24E Net Debt / EBITDA of 0.2x through base dividends, share buybacks All shareholders expected to immediately Strong financial capacity and variable dividends benefit from compelling pro forma metrics vs. peers Combination allows for significant shareholder value creation and equity upside (1) Please refer to Chord website (www.chordenergy.com) and Enerplus website (www.enerplus.com) for ESG disclosure and reporting. Enerplus published it latest ESG report in June 2023 13 (2) Pro forma 2024 estimates based on mid-point of management guidance at $79/bbl WTI and $2.50/MMBtu NYMEX gas..

Combination Creates a Premier Williston Basin Oil Operator Significant Synergies & Value Enhancing Scale Accretion on Key Metrics Financial Strength with Peer-Leading Upside Potential Shareholder Returns 14

Appendix

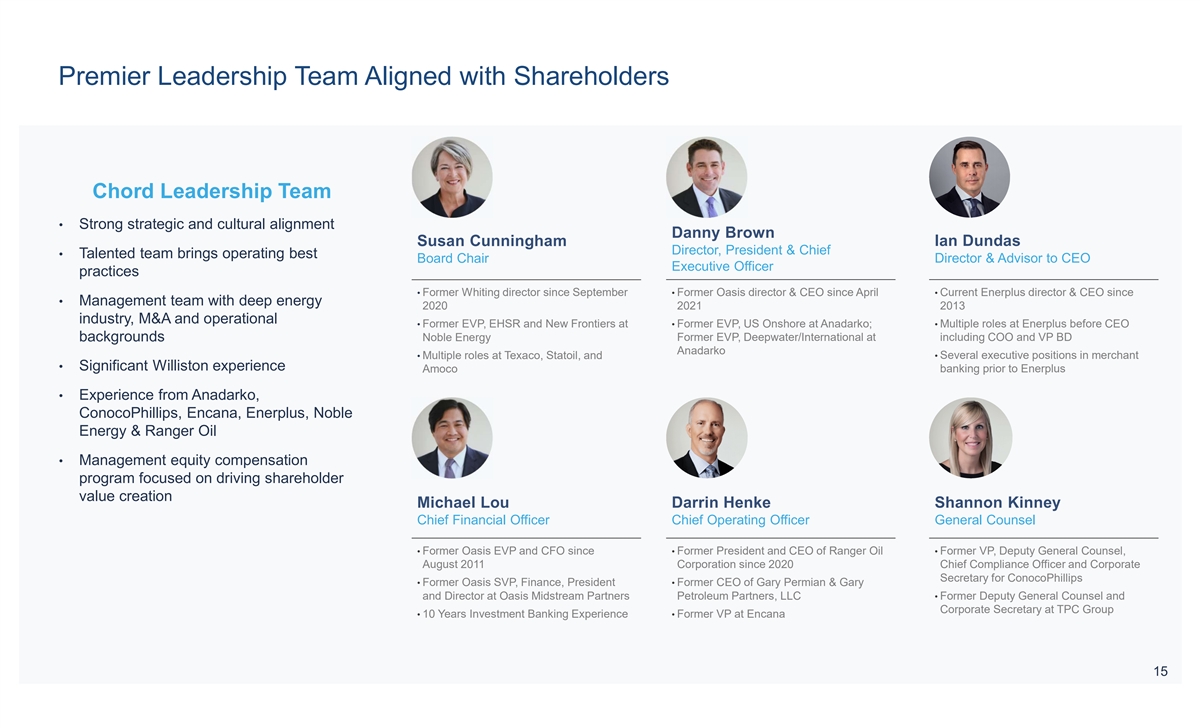

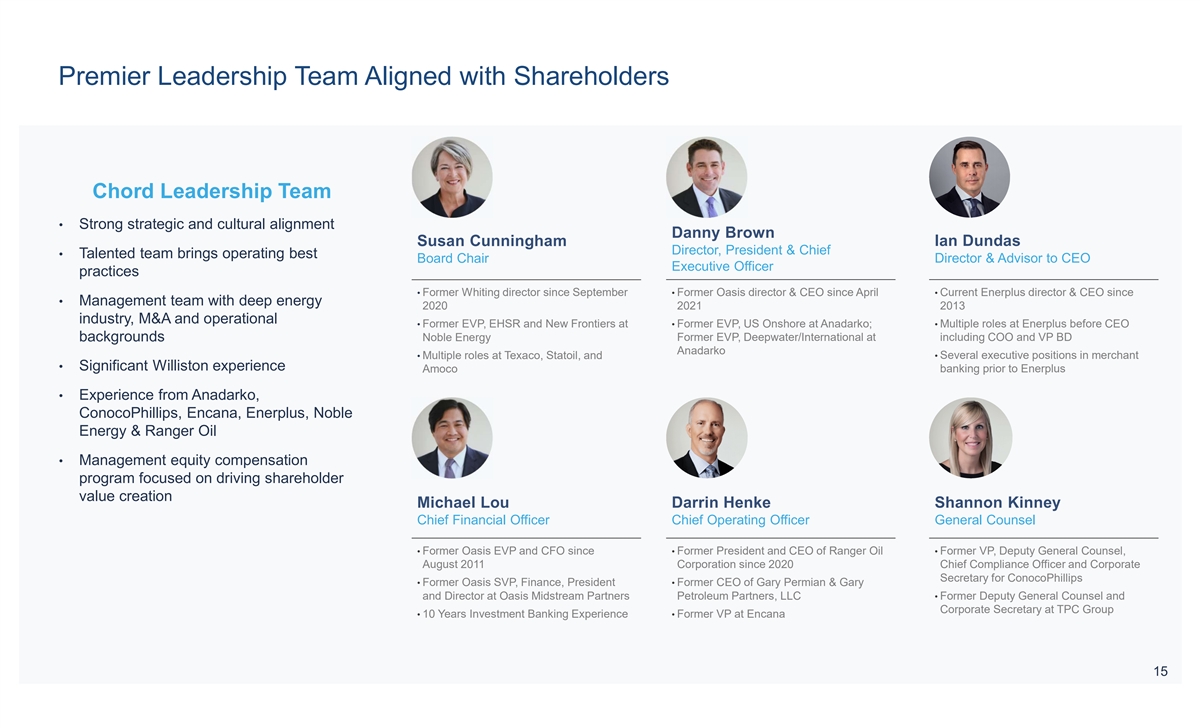

Premier Leadership Team Aligned with Shareholders Chord Leadership Team • Strong strategic and cultural alignment Danny Brown Susan Cunningham Ian Dundas Director, President & Chief • Talented team brings operating best Board Chair Director & Advisor to CEO Executive Officer practices • Former Whiting director since September • Former Oasis director & CEO since April • Current Enerplus director & CEO since • Management team with deep energy 2020 2021 2013 industry, M&A and operational • Former EVP, US Onshore at Anadarko; • Multiple roles at Enerplus before CEO • Former EVP, EHSR and New Frontiers at backgrounds Noble Energy Former EVP, Deepwater/International at including COO and VP BD Anadarko • Multiple roles at Texaco, Statoil, and • Several executive positions in merchant • Significant Williston experience Amoco banking prior to Enerplus • Experience from Anadarko, ConocoPhillips, Encana, Enerplus, Noble Energy & Ranger Oil • Management equity compensation program focused on driving shareholder value creation Michael Lou Darrin Henke Shannon Kinney Chief Financial Officer Chief Operating Officer General Counsel • Former Oasis EVP and CFO since • Former President and CEO of Ranger Oil • Former VP, Deputy General Counsel, August 2011 Corporation since 2020 Chief Compliance Officer and Corporate Secretary for ConocoPhillips • Former Oasis SVP, Finance, President • Former CEO of Gary Permian & Gary and Director at Oasis Midstream Partners Petroleum Partners, LLC • Former Deputy General Counsel and Corporate Secretary at TPC Group • 10 Years Investment Banking Experience • Former VP at Encana 15

Complementary Combination Results in Significant Synergies Expected to generate up to ~$150MM/year in cost savings, excluding additional improvements from pro forma cost of capital • Capitalize on each companies’ expertise to drive down drilling days by area • Development plan optimization and expand 3-mile lateral opportunity Drilling, Completions & Beginning in 2025 • Improve and optimize completions and non-productive time Up to $55MM Facilities • Field operations optimization and technology implementation • Standardized/modular facilities • Improving artificial lift run-time and overall downtime Lease Operating Initiates in late 2025, largely • Chemicals management Up to $55MM realized in 2026 Expenses • Field operations optimization and technology implementation General and Beginning immediately and • Leadership expected to be supported by key contributors across both Up to $40MM organizations growing in 2025 Administrative Combined best practices, operational efficiencies and increased continuous development operations of top After-Tax PV-10 of Williston operators… with Chord’s proven track record of capturing and growing synergistic value in >$750MM Synergies Williston merger integration 16