Strictly Confidential Forward-Looking / Cautionary Statements Forward-Looking Statements Non-GAAP Financial Measures This presentation, including the oral statements made in connection herewith, contains Cash Interest, Adjusted EBITDA, E&P Cash G&A, Free Cash Flow, Adjusted Net Income (Loss) forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 Attributable to Oasis, Adjusted Diluted Earnings (Loss) Attributable to Oasis Per Share and Recycle and Section 21E of the Securities Exchange Act of 1934. All statements, other than Ratio are supplemental financial measures that are not presented in accordance with generally statements of historical facts, included in this presentation that address activities, events or accepted accounting principles in the United States (“GAAP”). These non-GAAP measures should not developments that the Company expects, believes or anticipates will or may occur in the be considered in isolation or as a substitute for interest expense, net income (loss), operating income future are forward-looking statements. Without limiting the generality of the foregoing, (loss), net cash provided by (used in) operating activities, earnings (loss) per share or any other forward-looking statements contained in this presentation specifically include the measures prepared under GAAP. Because Cash Interest, Adjusted EBITDA, Free Cash Flow, expectations of plans, strategies, objectives and anticipated financial and operating results of Adjusted Net Income (Loss) Attributable to Oasis, Adjusted Diluted Earnings (Loss) Attributable to the Company, including the Company's drilling program, production, derivative instruments, Oasis Per Share and Recycle Ratio exclude some but not all items that affect net income (loss) and capital expenditure levels and other guidance included in this presentation. When used in this may vary among companies, the amounts presented may not be comparable to similar metrics of presentation, the words "could," "should," "will,“ "believe," "anticipate," "intend," "estimate," other companies. Reconciliations of these non-GAAP financial measures to their most comparable "expect," "project," the negative of such terms and other similar expressions are intended to GAAP measure can be found in the annual report on Form 10-K, quarterly reports on Form 10-Q and identify forward- looking statements, although not all forward-looking statements contain such on our website at www.oasispetroleum.com. Amounts excluded from these non-GAAP measure in identifying words. These statements are based on certain assumptions made by the future periods could be significant. Company based on management's experience and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. Cautionary Statement Regarding Oil and Gas Quantities Such statements are subject to a number of assumptions, risks and uncertainties, many of The Securities Exchange Commission (the “SEC”) requires oil and gas companies, in their filings with which are beyond the control of the Company, which may cause actual results to differ the SEC, to disclose proved reserves, which are those quantities of oil and gas, which, by analysis of materially from those implied or expressed by the forward-looking statements. When geoscience and engineering data, can be estimated with reasonable certainty to be economically considering forward-looking statements, you should keep in mind the risk factors and other producible—from a given date forward, from known reservoirs, and under existing economic cautionary statements described under the headings “Risk Factors” and “Cautionary conditions (using unweighted average 12-month first day of the month prices), operating methods, Statement Regarding Forward-Looking Statements” included in the Company’s filings with and government regulations—prior to the time at which contracts providing the right to operate expire, the Securities and Exchange Commission. These include, but are not limited to, the unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or Company’s ability to integrate acquisitions into its existing business, changes in oil and probabilistic methods are used for the estimation. The accuracy of any reserve estimate depends on natural gas prices, weather and environmental conditions, the timing of planned capital the quality of available data, the interpretation of such data and price and cost assumptions made by expenditures, availability of acquisitions, uncertainties in estimating proved reserves and reserve engineers. In addition, the results of drilling, testing and production activities of the exploration forecasting production results, operational factors affecting the commencement or and development companies may justify revisions of estimates that were made previously. If maintenance of producing wells, the condition of the capital markets generally, as well as the significant, such revisions could impact the Company’s strategy and future prospects. Accordingly, Company's ability to access them, the proximity to and capacity of transportation facilities, reserve estimates may differ significantly from the quantities of oil and natural gas that are ultimately and uncertainties regarding environmental regulations or litigation and other legal or recovered. The SEC also permits the disclosure of separate estimates of probable or possible regulatory developments affecting the Company's business and other important factors. reserves that meet SEC definitions for such reserves; however, we currently do not disclose probable Should one or more of these risks or uncertainties occur, or should underlying assumptions or possible reserves in our SEC filings. prove incorrect, the Company’s actual results and plans could differ materially from those expressed in any forward-looking statements. Proved reserves at December 31, 2019 are estimated utilizing SEC reserve recognition standards and pricing assumptions based on the trailing 12-month average first-day-of-the-month prices of $55.85 Any forward-looking statement speaks only as of the date on which such statement is made per barrel of oil and $2.62 per MMBtu of natural gas. The reserve estimates for the Company are and the Company undertakes no obligation to correct or update any forward-looking based on reports prepared by DeGolyer and MacNaughton ("D&M"). statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Our production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or drilling cost increases. 2

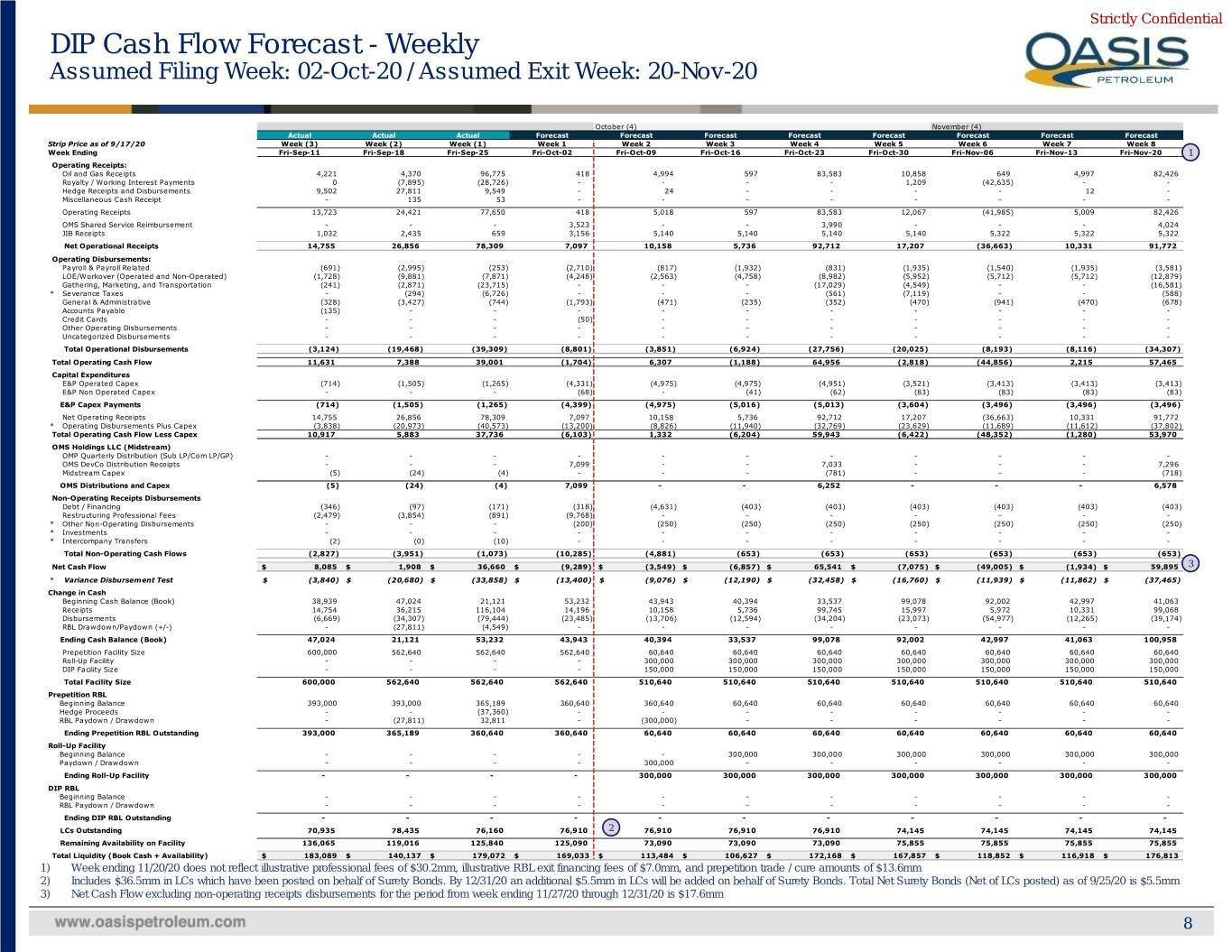

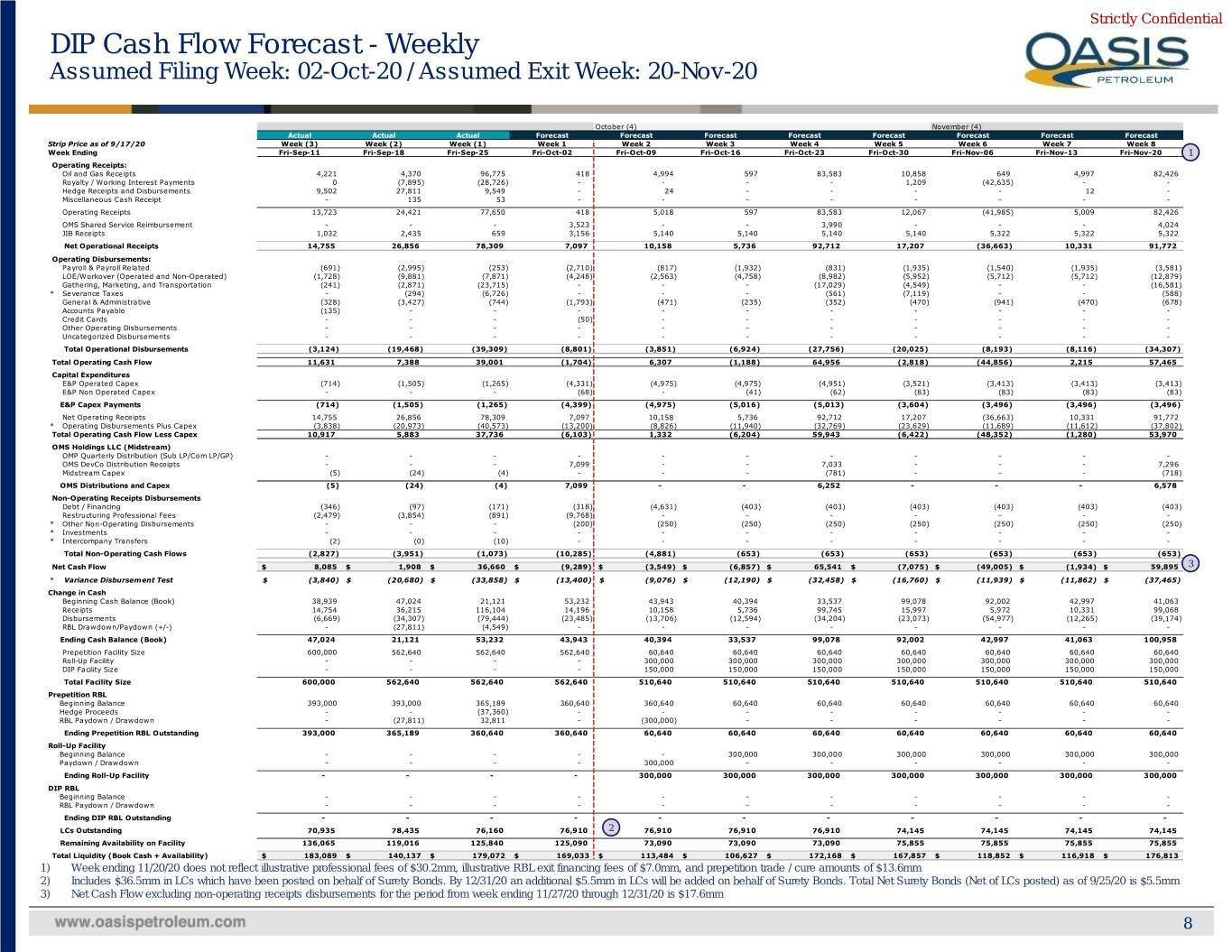

Strictly Confidential DIP Cash Flow Forecast - Weekly Assumed Filing Week: 02-Oct-20 / Assumed Exit Week: 20-Nov-20 October (4) November (4) Actual Actual Actual Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Strip Price as of 9/17/20 Week (3) Week (2) Week (1) Week 1 Week 2 Week 3 Week 4 Week 5 Week 6 Week 7 Week 8 Week Ending Fri-Sep-11 Fri-Sep-18 Fri-Sep-25 Fri-Oct-02 Fri-Oct-09 Fri-Oct-16 Fri-Oct-23 Fri-Oct-30 Fri-Nov-06 Fri-Nov-13 Fri-Nov-20 1 Operating Receipts: Oil and Gas Receipts 4,221 4,370 96,775 418 4,994 597 83,583 10,858 649 4,997 82,426 Royalty / Working Interest Payments 0 (7,895) (28,726) - - - - 1,209 (42,635) - - Hedge Receipts and Disbursements 9,502 27,811 9,549 - 24 - - - - 12 - Miscellaneous Cash Receipt - 135 53 - - - - - - - - Operating Receipts 13,723 24,421 77,650 418 5,018 597 83,583 12,067 (41,985) 5,009 82,426 OMS Shared Service Reimbursement - - - 3,523 - - 3,990 - - - 4,024 JIB Receipts 1,032 2,435 659 3,156 5,140 5,140 5,140 5,140 5,322 5,322 5,322 Net Operational Receipts 14,755 26,856 78,309 7,097 10,158 5,736 92,712 17,207 (36,663) 10,331 91,772 Operating Disbursements: Payroll & Payroll Related (691) (2,995) (253) (2,710) (817) (1,932) (831) (1,935) (1,540) (1,935) (3,581) LOE/Workover (Operated and Non-Operated) (1,728) (9,881) (7,871) (4,248) (2,563) (4,758) (8,982) (5,952) (5,712) (5,712) (12,879) Gathering, Marketing, and Transportation (241) (2,871) (23,715) - - - (17,029) (4,549) - - (16,581) * Severance Taxes - (294) (6,726) - - - (561) (7,119) - - (588) General & Administrative (328) (3,427) (744) (1,793) (471) (235) (352) (470) (941) (470) (678) Accounts Payable (135) - - - - - - - - - - Credit Cards - - - (50) - - - - - - - Other Operating Disbursements - - - - - - - - - - - Uncategorized Disbursements - - - - - - - - - - - Total Operational Disbursements (3,124) (19,468) (39,309) (8,801) (3,851) (6,924) (27,756) (20,025) (8,193) (8,116) (34,307) Total Operating Cash Flow 11,631 7,388 39,001 (1,704) 6,307 (1,188) 64,956 (2,818) (44,856) 2,215 57,465 Capital Expenditures E&P Operated Capex (714) (1,505) (1,265) (4,331) (4,975) (4,975) (4,951) (3,521) (3,413) (3,413) (3,413) E&P Non Operated Capex - - - (68) - (41) (62) (83) (83) (83) (83) E&P Capex Payments (714) (1,505) (1,265) (4,399) (4,975) (5,016) (5,013) (3,604) (3,496) (3,496) (3,496) Net Operating Receipts 14,755 26,856 78,309 7,097 10,158 5,736 92,712 17,207 (36,663) 10,331 91,772 * Operating Disbursements Plus Capex (3,838) (20,973) (40,573) (13,200) (8,826) (11,940) (32,769) (23,629) (11,689) (11,612) (37,802) Total Operating Cash Flow Less Capex 10,917 5,883 37,736 (6,103) 1,332 (6,204) 59,943 (6,422) (48,352) (1,280) 53,970 OMS Holdings LLC (Midstream) OMP Quarterly Distribution (Sub LP/Com LP/GP) - - - - - - - - - - - OMS DevCo Distribution Receipts - - - 7,099 - - 7,033 - - - 7,296 Midstream Capex (5) (24) (4) - - - (781) - - - (718) OMS Distributions and Capex (5) (24) (4) 7,099 - - 6,252 - - - 6,578 Non-Operating Receipts Disbursements Debt / Financing (346) (97) (171) (318) (4,631) (403) (403) (403) (403) (403) (403) Restructuring Professional Fees (2,479) (3,854) (891) (9,768) - - - - - - - * Other Non-Operating Disbursements - - - (200) (250) (250) (250) (250) (250) (250) (250) * Investments - - - - - - - - - - - * Intercompany Transfers (2) (0) (10) - - - - - - - - Total Non-Operating Cash Flows (2,827) (3,951) (1,073) (10,285) (4,881) (653) (653) (653) (653) (653) (653) Net Cash Flow $ 8,085 $ 1,908 $ 36,660 $ (9,289) $ (3,549) $ (6,857) $ 65,541 $ (7,075) $ (49,005) $ (1,934) $ 59,895 3 * Variance Disbursement Test $ (3,840) $ (20,680) $ (33,858) $ (13,400) $ (9,076) $ (12,190) $ (32,458) $ (16,760) $ (11,939) $ (11,862) $ (37,465) Change in Cash Beginning Cash Balance (Book) 38,939 47,024 21,121 53,232 43,943 40,394 33,537 99,078 92,002 42,997 41,063 Receipts 14,754 36,215 116,104 14,196 10,158 5,736 99,745 15,997 5,972 10,331 99,068 Disbursements (6,669) (34,307) (79,444) (23,485) (13,706) (12,594) (34,204) (23,073) (54,977) (12,265) (39,174) RBL Drawdown/Paydown (+/-) - (27,811) (4,549) - - - - - - - - Ending Cash Balance (Book) 47,024 21,121 53,232 43,943 40,394 33,537 99,078 92,002 42,997 41,063 100,958 Prepetition Facility Size 600,000 562,640 562,640 562,640 60,640 60,640 60,640 60,640 60,640 60,640 60,640 Roll-Up Facility - - - - 300,000 300,000 300,000 300,000 300,000 300,000 300,000 DIP Facility Size - - - - 150,000 150,000 150,000 150,000 150,000 150,000 150,000 Total Facility Size 600,000 562,640 562,640 562,640 510,640 510,640 510,640 510,640 510,640 510,640 510,640 Prepetition RBL Beginning Balance 393,000 393,000 365,189 360,640 360,640 60,640 60,640 60,640 60,640 60,640 60,640 Hedge Proceeds - - (37,360) - - - - - - - - RBL Paydown / Drawdown - (27,811) 32,811 - (300,000) - - - - - - Ending Prepetition RBL Outstanding 393,000 365,189 360,640 360,640 60,640 60,640 60,640 60,640 60,640 60,640 60,640 Roll-Up Facility Beginning Balance - - - - - 300,000 300,000 300,000 300,000 300,000 300,000 Paydown / Drawdown - - - - 300,000 - - - - - - Ending Roll-Up Facility - - - - 300,000 300,000 300,000 300,000 300,000 300,000 300,000 DIP RBL Beginning Balance - - - - - - - - - - - RBL Paydown / Drawdown - - - - - - - - - - - Ending DIP RBL Outstanding - - - - - - - - - - - LCs Outstanding 70,935 78,435 76,160 76,910 2 76,910 76,910 76,910 74,145 74,145 74,145 74,145 Remaining Availability on Facility 136,065 119,016 125,840 125,090 73,090 73,090 73,090 75,855 75,855 75,855 75,855 Total Liquidity (Book Cash + Availability) $ 183,089 $ 140,137 $ 179,072 $ 169,033 $ 113,484 $ 106,627 $ 172,168 $ 167,857 $ 118,852 $ 116,918 $ 176,813 1) Week ending 11/20/20 does not reflect illustrative professional fees of $30.2mm, illustrative RBL exit financing fees of $7.0mm, and prepetition trade / cure amounts of $13.6mm 2) Includes $36.5mm in LCs which have been posted on behalf of Surety Bonds. By 12/31/20 an additional $5.5mm in LCs will be added on behalf of Surety Bonds. Total Net Surety Bonds (Net of LCs posted) as of 9/25/20 is $5.5mm 3) Net Cash Flow excluding non-operating receipts disbursements for the period from week ending 11/27/20 through 12/31/20 is $17.6mm 8