UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Chord Energy Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | |

“The substantial progress made over the past several years has been the result of focusing on robust capital allocation practices and building a corporate culture centered on continuous improvement in all aspects of our business. We believe both of these items are critical to being a competitive company in a dynamic global commodity market.” | Dear Shareholders, Chord Energy enters 2024 on strong footing following a series of achievements made over the past several years. 2023 marked our first full year as an integrated company following the 2022 merger between Oasis and Whiting. Since closing the transaction we have not only increased our organization’s size, but have become a better, more efficient, and more resilient company. Over the course of 2023 we shifted our development program to build on the best practices of both legacy organizations, including delivering more three-mile lateral wells, which increased capital efficiency and lowered Chord’s cost of supply. On February 21 of this year we announced plans to combine with Enerplus Corporation, which will create a combined company with a market capitalization of greater than $10 billion and a premier Williston Basin position with substantial flowing production and significant low-cost inventory. We expect the combination with Enerplus to allow us to build on the improvements made in 2023 and apply our learnings, and new best practices, in the core of the basin. We expect this to once again create a stronger, more efficient, more resilient, and more relevant entity for all our stakeholders. The substantial progress made over the past several years has been the result of focusing on robust capital allocation practices and building a corporate culture centered on continuous improvement in all aspects of our business. We believe both of these items are critical to being a competitive company in a dynamic global commodity market. As a result of our efforts, the organization is delivering strong returns at a low reinvestment rate and significant free cash flow. A core tenant of our capital allocation philosophy is to return a significant portion of this free cash flow to investors, which we accomplish through a mix of a base and variable dividends along with share repurchases. We believe this instills discipline in the business and allows shareholders to benefit from both return on, and return of, their capital investment. Following the pending combination with Enerplus, Chord will have an enviable and durable position within the Williston Basin with meaningful opportunities to improve the company and drive returns even higher. In 2023, approximately 50% of our wells were three-mile laterals, the highest level in our company’s history. Longer laterals are a more efficient way to develop our resource base as they allow for a compelling uplift to reserves per well relative to the incremental capital required. Also, longer laterals have less of an impact to the surrounding landscape, helping to reduce our environmental footprint. |

Along those lines, and in keeping with our focus on continuous improvement, Chord continues to make progress on sustainability and, in 2023, published its inaugural sustainability report following the 2022 merger of Oasis and Whiting. In 2023 we made further progress, particularly in the areas of safety and emissions. We remain committed to delivering affordable and reliable energy in an increasingly sustainable and responsible manner and enhancing disclosure and improving performance in several key areas. Finally, I’d like to thank our employees who have been central in driving our progress and results. I am proud and grateful of all their hard work which has made us a stronger company, benefited stakeholders and increased relevance with investors. As we look forward, Chord will remain committed to its core values which have put the company in a strong position to succeed. We would appreciate your vote in support of the items described in the accompanying proxy statement. Sincerely, Daniel E. Brown President and Chief Executive Officer |

| | | | | |

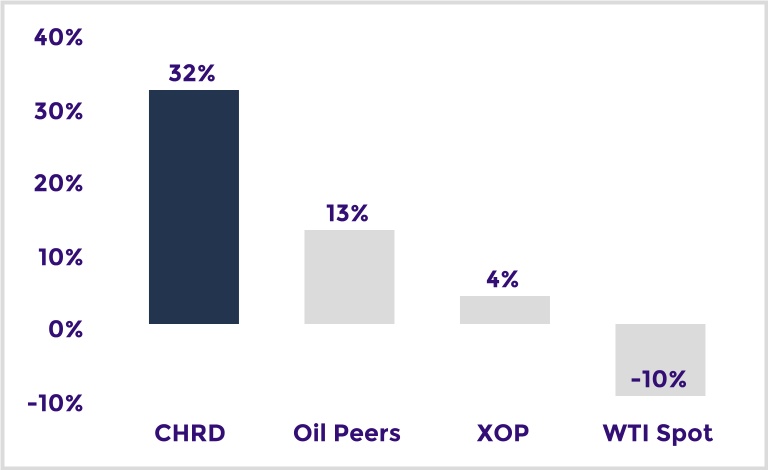

"Strong corporate governance continues to be critical to aligning management and shareholder incentives while achieving strategic goals of the organization. In 2023, our executive compensation program succeeded in rewarding performance which created economic value and drove shareholder returns while benefiting stakeholders." | Dear Shareholders, I was appointed Board Chair of Chord Energy's Board of Directors in January and am honored to have the opportunity to lead the board in building on the Company’s success while delivering value for our stakeholders. The macro environment remains volatile and uncertain, but Chord is strategically positioned to be in a competitive position through a lower cost structure, disciplined investment framework, flexible balance sheet and culture of continuous improvement. The commodity markets have been turbulent in recent years as they evaluate various impacts to supply and demand and pace of the energy transition. There is a growing consensus that oil and natural gas will be essential components of the world energy mix for decades. Chord is prepared to succeed through the energy transition by continuing to prioritize producing cleaner, more efficient and more profitable energy, while working safely and being responsible stewards of our environment. Chord recently announced plans to combine with Enerplus in a strategic transaction the Board believes will add value enhancing scale to the organization, while putting the company in a position to benefit from improving returns, capital efficiency, low-cost inventory and a strong balance sheet. Additionally, I’m happy to report important accomplishments on our sustainability and ESG endeavors in 2023, including the publication of Chord’s inaugural Sustainability Report following the 2022 merger of Oasis Petroleum and Whiting Petroleum, and continued progress in improving safety and emissions. We are fostering diversity at the Board level and across the organization, while having a positive impact on the communities in which we operate. Strong corporate governance continues to be critical to aligning management and shareholder incentives while achieving strategic goals of the organization. In 2023, our executive compensation program succeeded in rewarding performance which created economic value and drove shareholder returns while benefiting stakeholders. Going forward, Chord will remain focused on the things it can control which are likely to drive success through business and commodity cycles. We believe the company is well positioned to create and deliver value for our stakeholders against the backdrop of an evolving energy landscape. We look forward to continued success Sincerely,

Susan M. Cunningham Board Chair |

|

| | | | | |

| Notice of Annual Meeting of Shareholders |

| |

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

| DATE AND TIME Wednesday, May 1, 2024 9:00 AM Central Time | LOCATION 1001 Fannin Street, Suite 1500 Houston, Texas 77002 | RECORD DATE March 7, 2024 | |

| | | | |

Items of Business

| | | | | | | | | | | |

| PROPOSALS | BOARD VOTE

RECOMMENDATION | FOR FURTHER

DETAILS |

| | | |

| 1 | Election of nine Directors to serve until the Company's 2025 Annual Meeting. | “FOR” all nominees | |

| 2 | Advisory vote to approve executive compensation as described in the accompanying proxy statement. | “FOR” | |

| 3 | Ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2024. | “FOR” | |

| | | |

| | | | | | | | | | | |

| We will also transact such other business as may properly come before the Annual Meeting. | | By order of the Board of Directors,

|

Houston, Texas March 19, 2024 | | | Shannon B. Kinney Corporate Secretary |

| | | |

How to Vote

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| | | | |

| ONLINE www.proxyvote.com | BY PHONE 1-800-690-6903 | BY MAIL Sign, date and return your proxy card in the enclosed envelope | |

| | | | |

IMPORTANT NOTICE REGARDING THE ELECTRONIC AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 1, 2024

Chord Energy Corporation (the "Company," "Chord," "we," "us," or "our") has elected to take advantage of the U.S. Securities and Exchange Commission (the “SEC”) rules that allow us to furnish proxy materials to the Company’s shareholders via the internet. These rules allow us to provide information that the Company’s shareholders need while lowering the costs and accelerating the speed of delivery and reducing the environmental impact of the 2024 Annual Meeting of Shareholders (the "Annual Meeting"). The Company is making this proxy statement and its Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”) available to its shareholders at www.proxyvote.com.

At the Annual Meeting, shareholders will not be voting on the recently-announced combination with Enerplus Corporation. Shareholders will receive a separate proxy statement and related materials before the special meeting we intend to hold to seek shareholder approvals as described under the “Recent Developments” section of the accompanying proxy statement.

Company Overview

| | | | | | | | |

| | |

| Chord Energy is an independent U.S. energy company that acquires, explores, develops, and produces crude oil, natural gas, and natural gas liquids to meet domestic and international demand. The Company was created through the joining of Oasis Petroleum and Whiting Petroleum, whose complementary strengths created a more resilient company, better positioned to deliver value creation through the evolving energy landscape. Chord Energy has a premier Williston Basin position, a peer leading balance sheet, significant scale, and enhanced free cash flow generation, all of which enable us to provide value to our Stakeholders: Neighbors, Landowners, Communities, Employees, and Shareholders. We seek to responsibly and reliably deliver affordable energy vital for the prosperity of all. As a proud oil and gas operator, we’re committed to sustainably energizing the world today and tomorrow. | |

| | |

Business Strategy

Our operational and financial strategy is focused on rigorous capital discipline and generating significant, sustainable free cash flow by executing on the following strategic priorities:

| | | | | |

| |

| Maximize Returns. We intend to maximize returns through efficiently executing our development program and optimizing our capital allocation, while evaluating our performance and focusing on continuous improvement. | Financial Strength. Our management team is focused on maintaining a solid risk management process to preserve our strong balance sheet and protect our cash generation capabilities. |

| |

| |

| Commitment to Excellence. We are focused on creating a durable organization that generates strong financial returns and sustainable free cash flow through commodity cycles. | Responsible Stewards. We are committed to our established ESG initiatives and seek to maintain a culture of continuous improvement in ESG practices. |

2023 Operational and Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | 173,425 Boepd AVERAGE PRODUCTION VOLUMES | | $10.41 per Boe LEASE OPERATING EXPENSES ("LOE") |

| | | | | | |

| | | | | | |

| | $922.3MM E&P and OTHER CAPEX | | 636.2 MMBoe NET PROVED RESERVES(1) |

| | | | | | |

| | | | | |

| | 94 gross (69 net) TIL'D OPERATED WELLS | | 3-mile laterals 50% 2023 WELLS |

| | | | | | |

| | (1)Estimated as of December 31, 2023, with a Standardized Measure of $7.0 billion and PV-10 of $8.5 billion. |

| | | | | | |

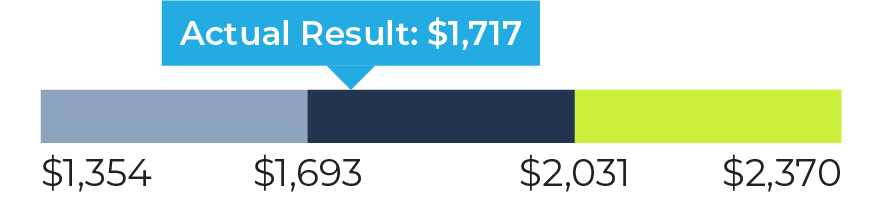

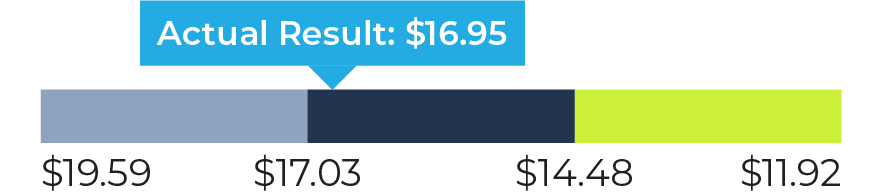

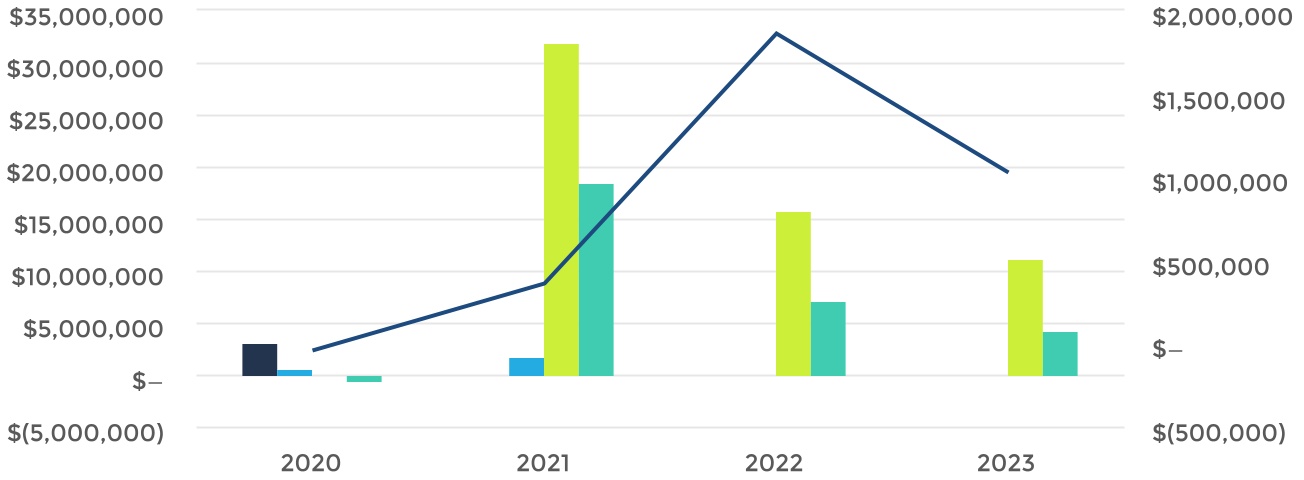

2023 Shareholder Return Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | $11.88 per share BASE PLUS VARIABLE CASH DIVIDEND FOR YEAR ENDED DECEMBER 31, 2023 | | $240.9MM COMMON STOCK REPURCHASED |

| | | | | | |

Sustainability

At Chord, we are dedicated to responsibly meeting the world’s energy demands while continuously enhancing our environmental, social, and governance ("ESG") performance. We strongly believe that oil and natural gas will remain essential for delivering affordable and reliable energy crucial for global quality of life and economic development for decades to come. We further believe that the U.S., with its abundant resources, established rule of law, and robust regulatory framework, is well-positioned to meet future oil and natural gas demand.

We understand that a commitment to sustainable business operations begins at the top and requires proper governance. Chord’s ESG Committee, comprising members of the Board, works with other Board committees and our senior leadership team, including the Vice President of Sustainability, to drive ESG initiatives, including those related to climate, and to evaluate progress and integration as we strive for continuous improvement in our ESG performance.

This commitment to sustainable operations is also reflected in the Company's compensation programs. All employees, including executives, participate in an annual incentive plan that rewards the achievement of quantitative and qualitative metrics and performance targets that are of primary importance to the Company during the coming year, including targets related to safety, spills, and emissions. We believe that

setting specific performance targets in advance helps establish important benchmarks, communicates our top priorities to our executives and employees, and motivates them to achieve and exceed those goals.

The Company continues to make progress in reducing Scope 1 greenhouse gas ("GHG") emissions, improving safety performance, and making advancements in community engagement, workforce diversity, and climate-related governance. These results are shared in more detail in our inaugural sustainability report, released in 2023, with select highlights presented in the ESG Performance Summary below.

Advancing our ESG performance is a journey of continuous improvement. We expect our stakeholders, and society at large, will remain focused on GHG emissions reductions as the world evolves towards a lower carbon economy, and at Chord we are committed to doing our part. We are voluntarily working to align with the World Bank’s Zero Routine Flaring initiative, and we are using and testing a variety of emissions monitoring solutions to more quickly identify, fix, and redesign equipment that may emit GHG emissions. Additional ESG priorities we are progressing can be seen in the Looking Forward box below.

Chord encourages you to visit the “Sustainability” page on our website to access our Sustainability Report and corporate policies to learn more about the Company’s commitment to sustainability.

ESG Performance Summary

Highlights from our Sustainability Report issued in 2023

| | | | | | | | | | | |

| Environmental |

| | | |

SCOPE 1 INTENSITY 53% Decrease in operated Scope 1 GHG emissions intensity in 2022 since 2019 | METHANE REDUCTION 47% Decrease in operated Scope 1 methane emissions intensity in 2022 since 2019 | SPILL MANAGEMENT 54% Reduction in secondary containment spill intensity in 2022 since 2019 | BIODIVERSITY

<1% Proved or probable reserves in or near protected habitat sites or identified endangered species |

| | | | | | | | | | | |

| Social |

| | | |

TURNOVER RATE 8% Voluntary turnover rate in 2022 | SAFETY PERFORMANCE 47% Year-over-year reduction in Total Recordable Incident Rate as compared to 2021 | DRIVING SAFETY 14% Year-over-year reduction in Preventable Vehicle Incident Rate as compared to 2021 | SOCIAL INVESTMENT ~$1MM Donated to education, community, and mental health organizations in 2022 |

ESG Priorities

Looking Forward

| | | | | | | | | | | | | | |

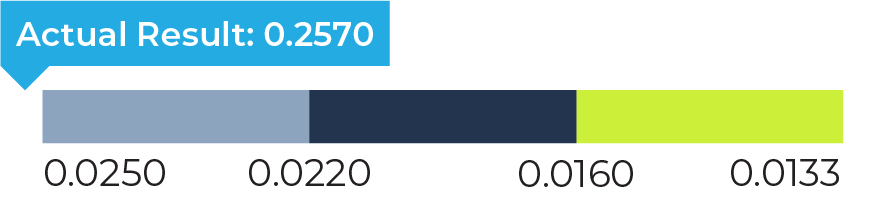

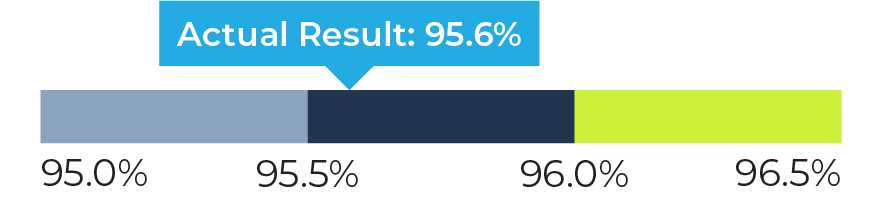

SAFETY Working with peers and contractors to enhance safety performance and best practices as part of our efforts for continual improvement | EMISSIONS Focusing on Scope 1 and 2 GHG emissions data quality and methodology across years | GAS CAPTURE Continued improvement in gas capture, with 2024 gas capture target set at 96.0%

| RISKS Enhancing disclosure regarding climate-related risks in line with the TCFD framework | DOCUMENTATION Documenting Scope 1 and 2 GHG emissions calculation processes and enhancing controls in preparation for compliance with new SEC and EPA disclosure rules |

Human Capital Management

Our mission is to responsibly produce hydrocarbons while exercising capital discipline, operating efficiently, improving continuously and providing a rewarding environment for our employees. We seek to foster a culture of innovation and are constantly looking for ways to strengthen our organizational agility and adaptability. Executing this strategy in our highly competitive industry depends on our attracting, developing and retaining a highly effective and talented workforce. As of March 7, 2024, we employed 516 full-time employees and we utilize independent contractors to perform various field and corporate services as needed. Our current hiring plans focus on advancing talent attraction in our primary operating locations of Houston, Texas and Williston, North Dakota.

We are committed to protecting the health and safety of our employees, contractors, and communities. To maintain our safety culture, we have developed a comprehensive safety management system and continue to monitor and update our safety policies and practices. In addition, safety training is provided regularly to all employees, and, in order to reinforce accountability, safety performance is integrated into our annual compensation program. We seek to partner only with contractors and vendors who share our commitment to safety.

| | | | | |

| COMPENSATION AND BENEFITS |

Our total rewards program includes base pay and short- and long-term incentive opportunities for eligible employees, and benefits including retirement plan dollar matching, health insurance, income protection and disability coverage, paid time off, flexible work schedules, and financial and mental health wellness resources and services. We strive to competitively compensate our employees so that they feel valued and to enable us to attract, motivate, and retain high-level talent, as well as to increase employee focus on key performance goals, deepen commitment to our collective success and improve employee well-being. Our intent is for the compensation and benefits provided as part of our total rewards program to be fair and equitable across positions and locations, market competitive, based on merit, consistent with our values and transparent to our employees.

| | | | | |

| TRAINING, DEVELOPMENT AND CAREER OPPORTUNITIES |

We are committed to the personal and professional development of our employees. Many of our employees work in disciplines that require highly specialized skills and subject-matter expertise, underpinning our ability to deliver on our strategic priorities. Employees are provided with training programs designed to develop skills in leadership, professional competencies, safety, and information and technology. Through these programs, employees develop skills to help them best perform in their current jobs as well as skills and experience that support long-term growth. Our robust approach to succession planning for key personnel includes assessing the competencies, experience, leadership capabilities and development opportunities of identified succession candidates. We will continue to build a pipeline of talent through our new graduate and intern hiring programs. We are also proud to sponsor and support various training, scholarship, and other charitable programs to support growth in our communities, including the Bakken Area Skills Center, Habitat for Humanity, OneGoal and Junior Achievement.

| | | | | |

| DIVERSITY, EQUITY AND INCLUSION |

We believe a diverse and inclusive workforce provides the best opportunity to obtain unique perspectives, experiences and ideas to help our business succeed, and we are committed to creating an environment where every employee is valued and heard. We are an equal opportunity employer and do not discriminate on the basis of any characteristic protected by applicable law. We embrace an approach to talent attraction and promotion that enables all individuals to be evaluated based on their merit. To sustain and promote a diverse, equitable and inclusive workforce, we maintain a robust compliance program supported by annual certification by all employees to our Code of Business Conduct and Ethics Policy, as well as training programs on equal employment opportunity. Approximately 45% of our employees are women or members of a traditionally underrepresented racial or ethnic group, and 63% of our independent directors are women.

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this proxy statement.

| | | | | | | | | | | |

| | | |

| PROPOSAL 1 | | |

| | | |

| |

| Election of Nine Directors |

| |

| |

| The Board recommends a vote FOR each director nominee. | |

| |

Director Nominees

The following provides summary information about each director nominee.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| = Chair | | = Member | $ = Financial Expert | | = Independent | AR = Audit and Reserves |

CHR = Compensation and Human Resources | ESG = Environmental, Social and Governance | NG = Nominating and Governance |

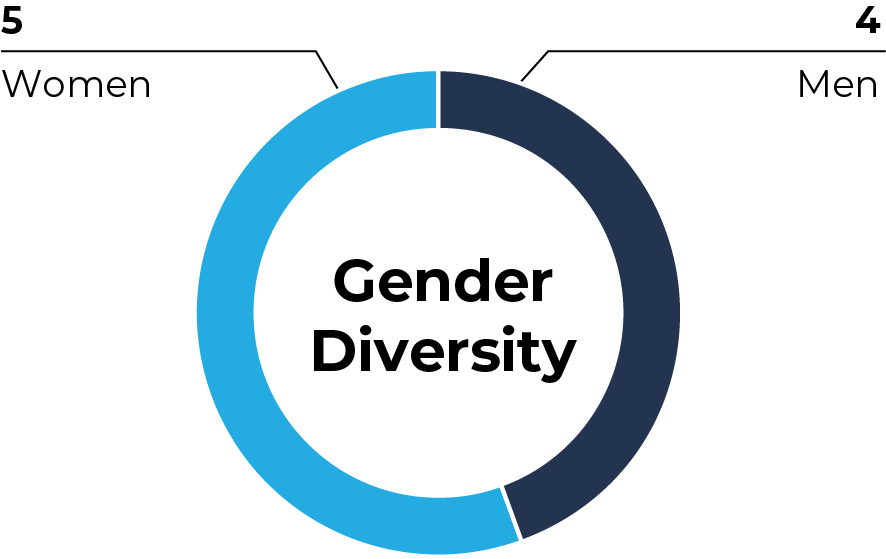

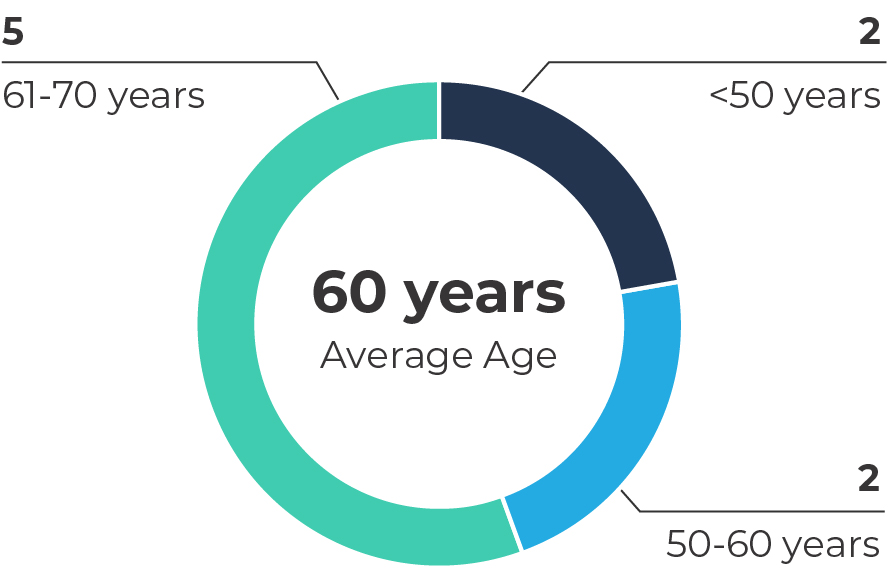

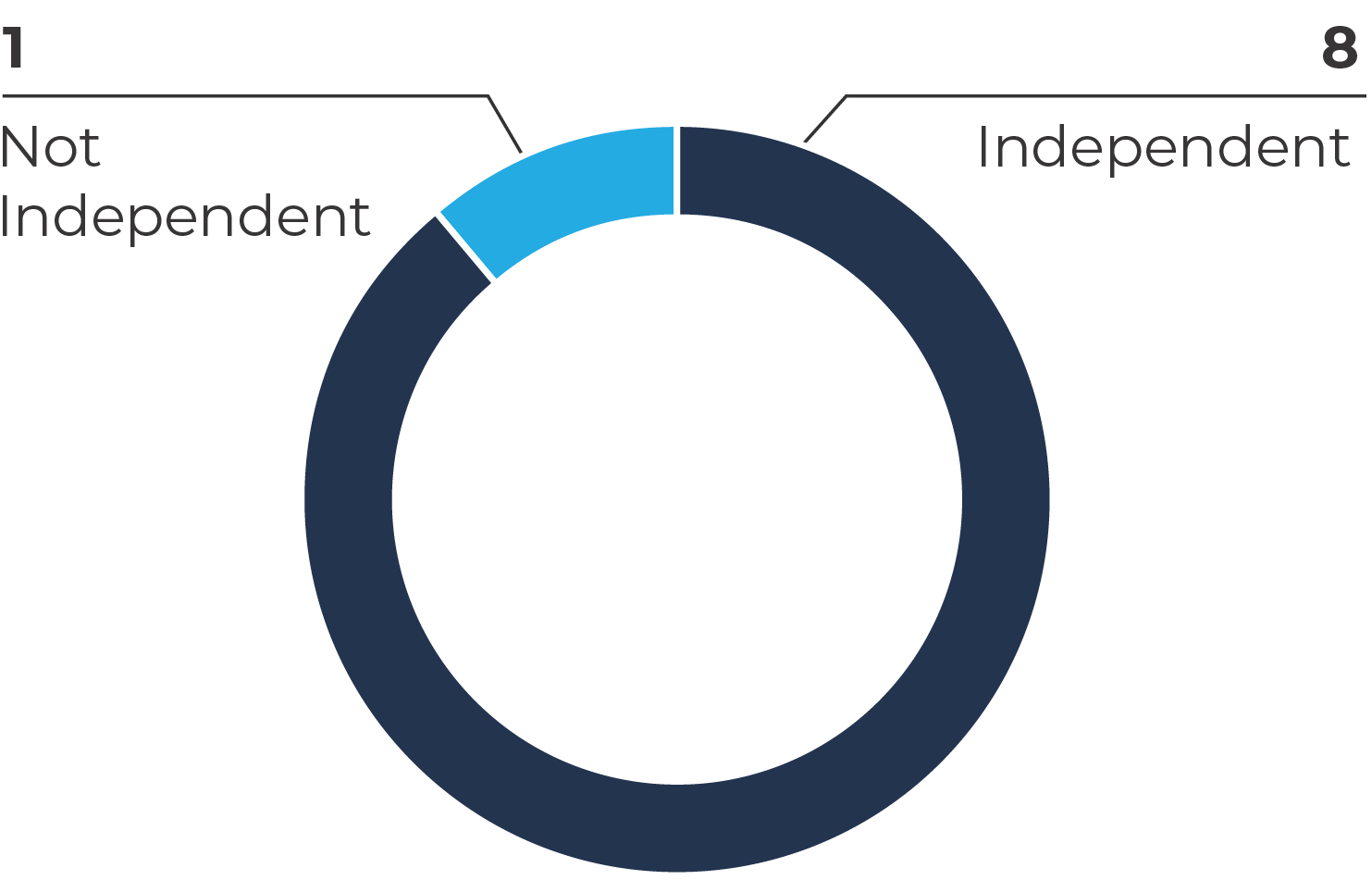

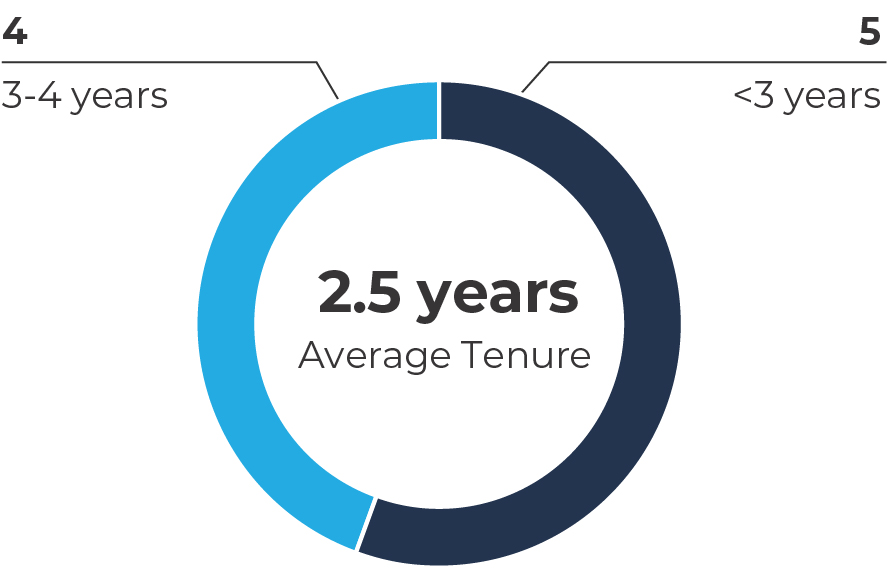

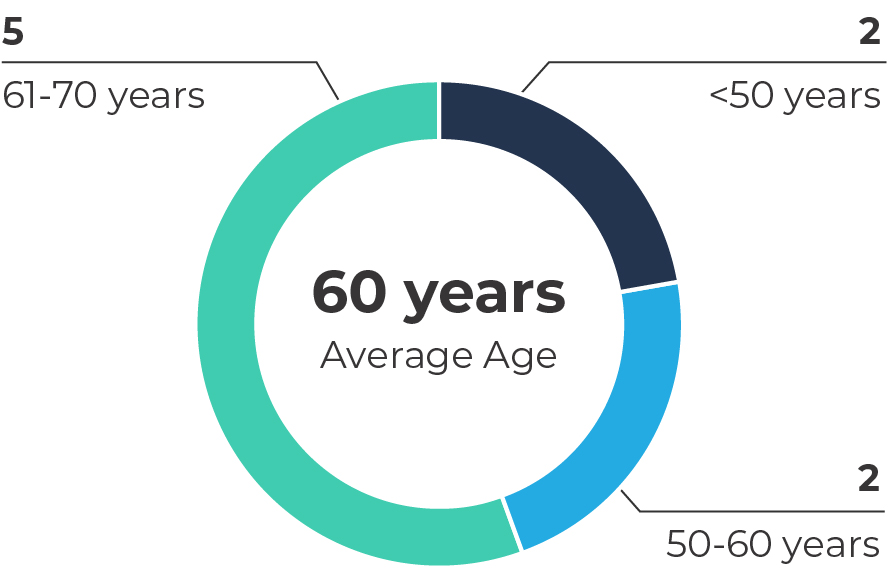

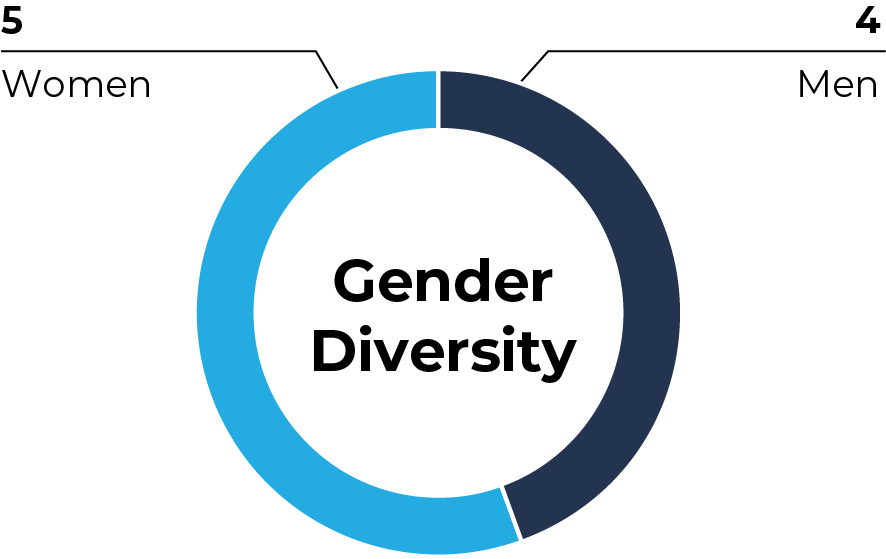

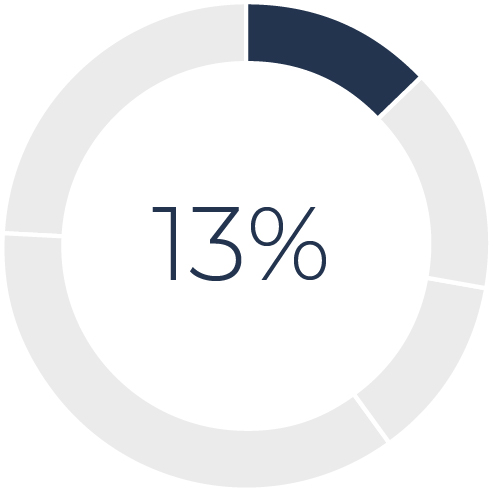

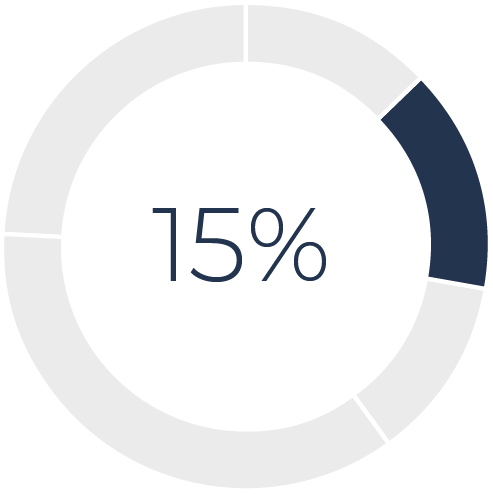

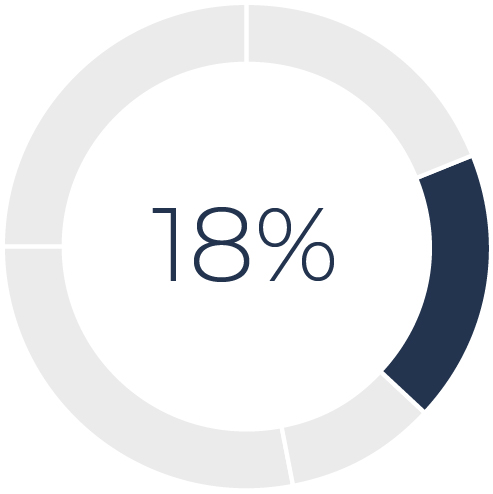

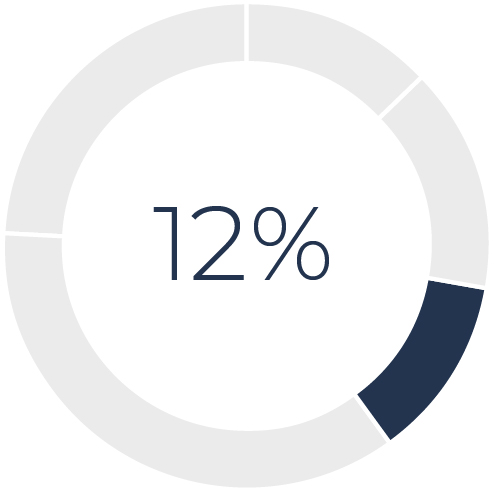

Board Snapshot

| | | | | | | | |

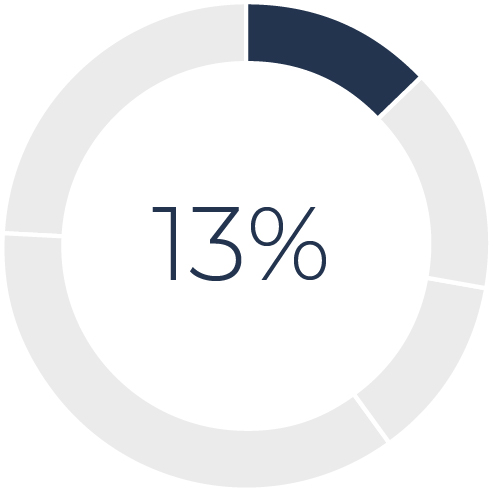

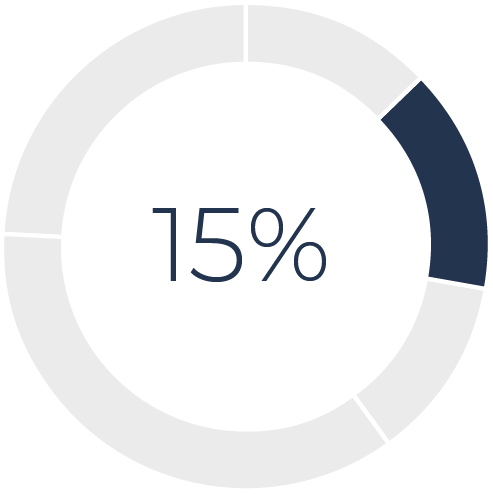

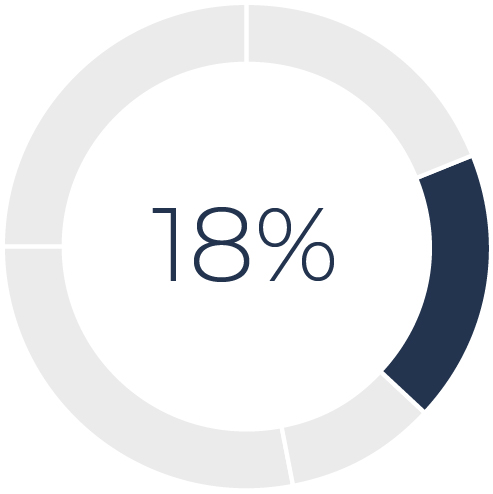

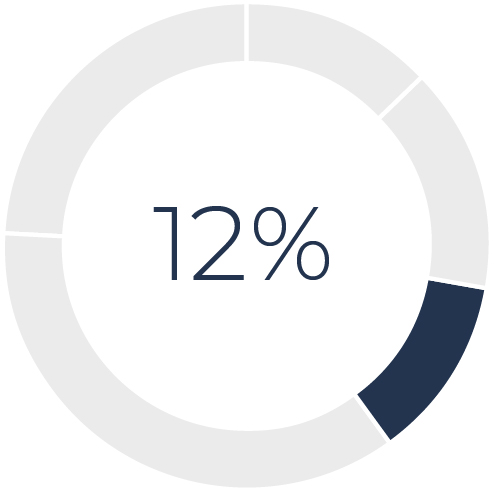

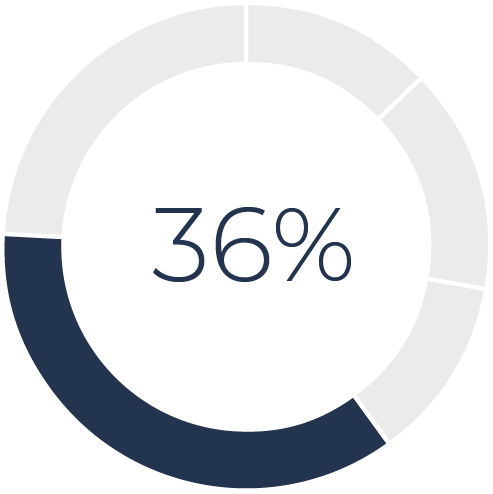

| Independence | Gender Diversity | Age |

| | |

| | | | | | | | |

| SKILLS & EXPERIENCE | TOTAL |

| | |

| | |

| Current or Past Public Company C-Suite Public company C-suite experience demonstrates a practical understanding of organizations, processes, strategy, risk, and risk management. | 7 |

| | |

| | |

| E&P Operations Industry experience provides valuable perspective on issues specific to our business within the E&P industry. | 8 |

| | |

| | |

| Capital Allocation/Investment The ability to allocate capital wisely is critical to the successful execution of our operational plans and to the protection of our shareholders' investment in us. | 8 |

| | |

| | |

| Financial Reporting & Accounting Financial reporting, audit knowledge, and experience in capital markets, both debt and equity, are critical to our business. | 7 |

| | |

| | |

| Environmental, Health and Safety Management EHS experience contributes to proper stewardship of our environmental and human resources, which are critical components of our success and license to operate. | 6 |

| | |

| | |

| Information Technology Experience in information technology, including cybersecurity risk, cloud computing, scalable data analytics, and big data technologies add exceptional value to our Board. | 3 |

| | |

| | |

| Business Development/M&A Business development skill and experience is highly valuable to the Company as we seek to execute our strategic vision and build scale accretively. | 8 |

| | |

| | |

| Compensation & Human Resources Human capital management experience is essential for effective oversight on matters such as culture, succession planning, talent development, and retention. | 5 |

| | |

| | |

| Risk Management/Sustainability Risk management/sustainability experience supports achievement of strategic business objectives and long-term value creation with a responsible, sustainable business model. | 7 |

| | |

| | |

| Corporate Governance Corporate governance experience supports our goals of strong board and management accountability, transparency, and protection of shareholder interests. | 8 |

| | |

| | |

| Legal & Regulatory Legal and regulatory experience offers valuable insight into the many regulations and governmental actions and decisions that affect our industry. | 3 |

| | |

Governance At-a-Glance

Following are highlights of our governance program.

| | | | | |

|

| Chord Governance |

|

| |

•Annual election of directors •Majority voting and Director Resignation Policy in contested elections •Shareholder right to call special meetings •Shareholder proxy access •Separate CEO and Board Chair •Director stock ownership guidelines equal to 5x annual Board cash retainer •No supermajority voting provisions •No "poison pill" in effect •Single class share capital structure •Hedging, pledging, short sales of Company stock prohibited •No restrictions on director access to management •Board oversight of strategy and risk management •Performance relative to strategic priorities impacts executive and employee compensation •Quantitative ESG metrics impact executive and employee compensation •Consistent shareholder engagement; demonstrated responsiveness to feedback | •Deep experience and diverse perspectives on the Board •Annual skills matrix completed, evaluated, disclosed •Robust annual Board and committee evaluation process with actionable follow-up •Regular assessment of emerging needs for Board refreshment and skills •Focus on diversity and directors with the right skills for the optimal enhancement of the current mix of talent and experience on the Board •Independent Committee Chairs •Regular executive sessions of independent directors at Board and committee meetings •55% of Board members are women •Women chair our Board and 100% of our Board committees •Regular Board trainings on corporate governance and sustainability-related issues and access to additional materials and seminars provided |

| |

| | | | | | | | | | | |

| | | |

| PROPOSAL 2 | | |

| | | |

| |

| Advisory Vote to Approve Executive Compensation |

| |

| |

| The Board recommends a vote FOR this proposal. | |

| |

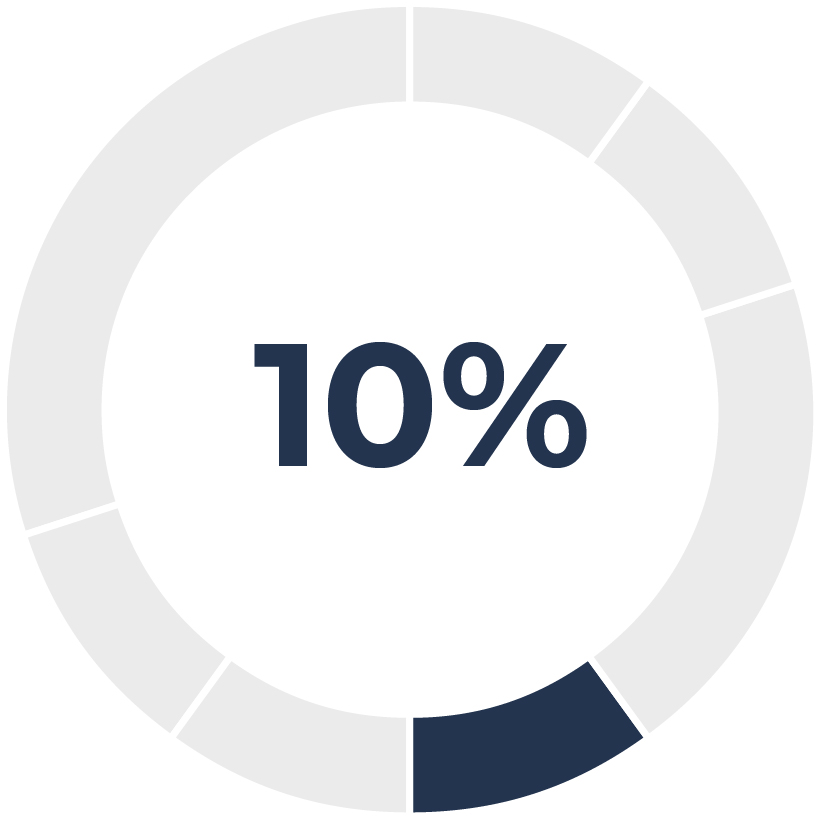

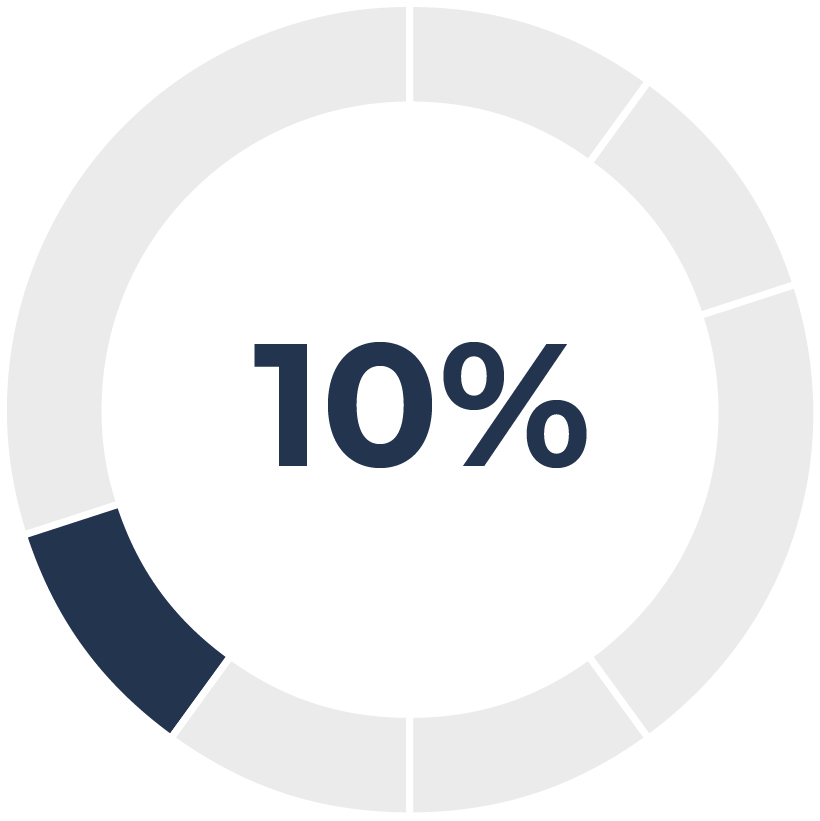

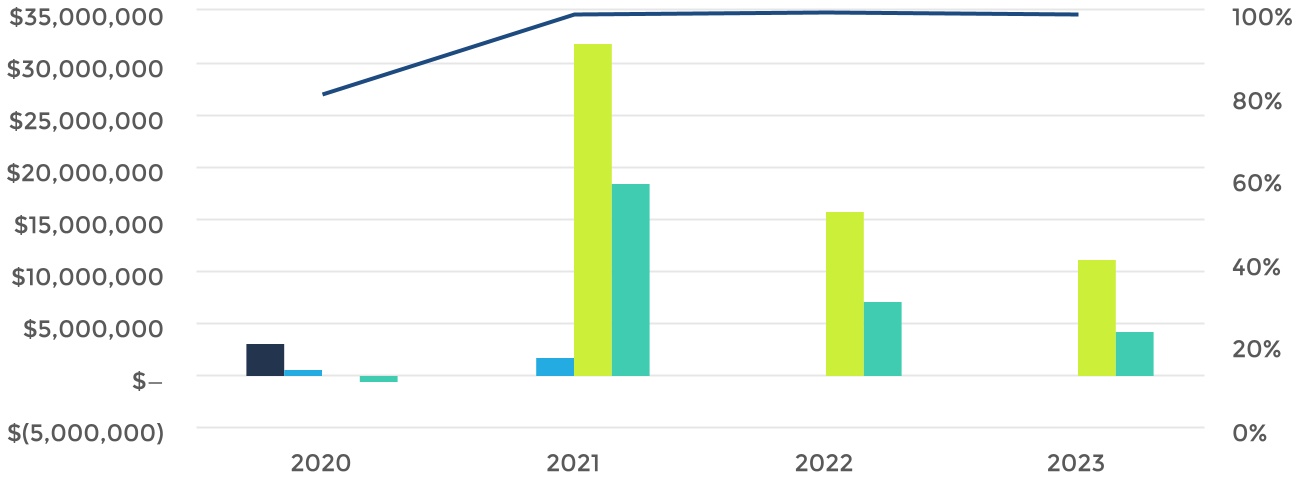

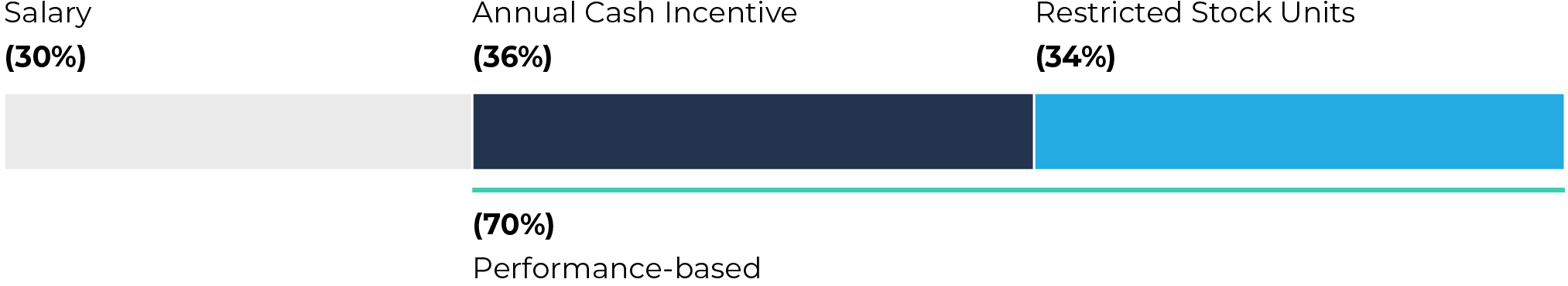

Elements of Compensation

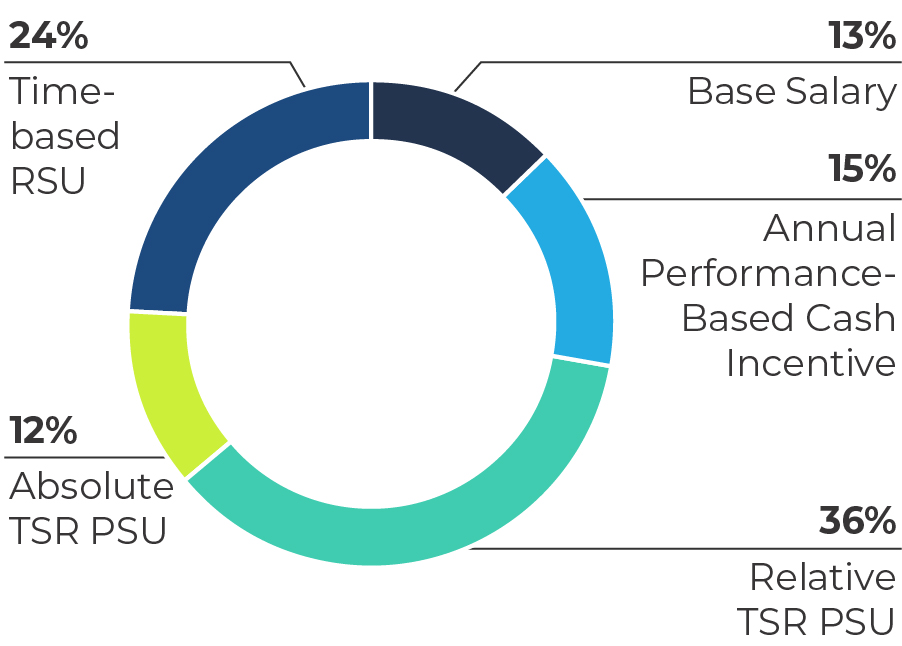

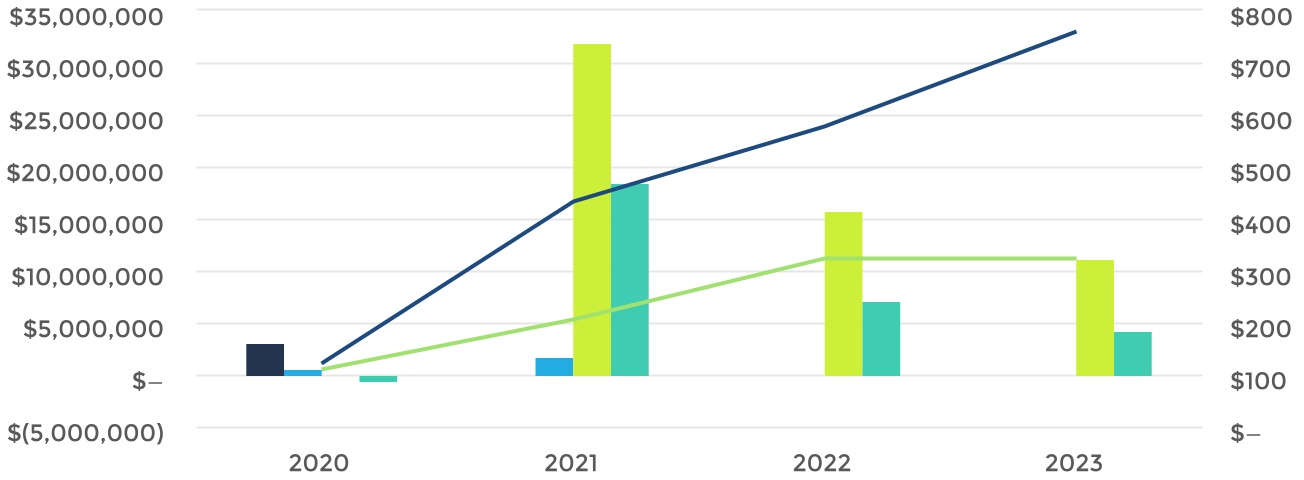

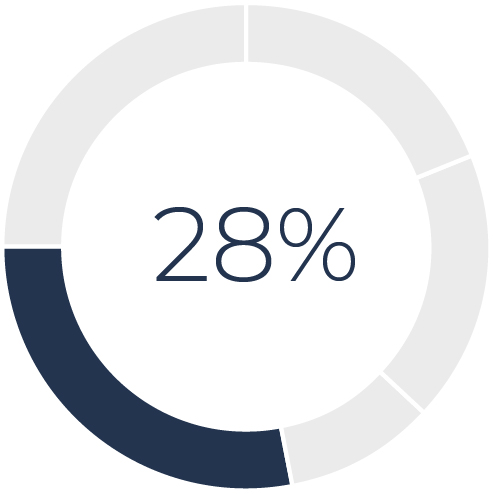

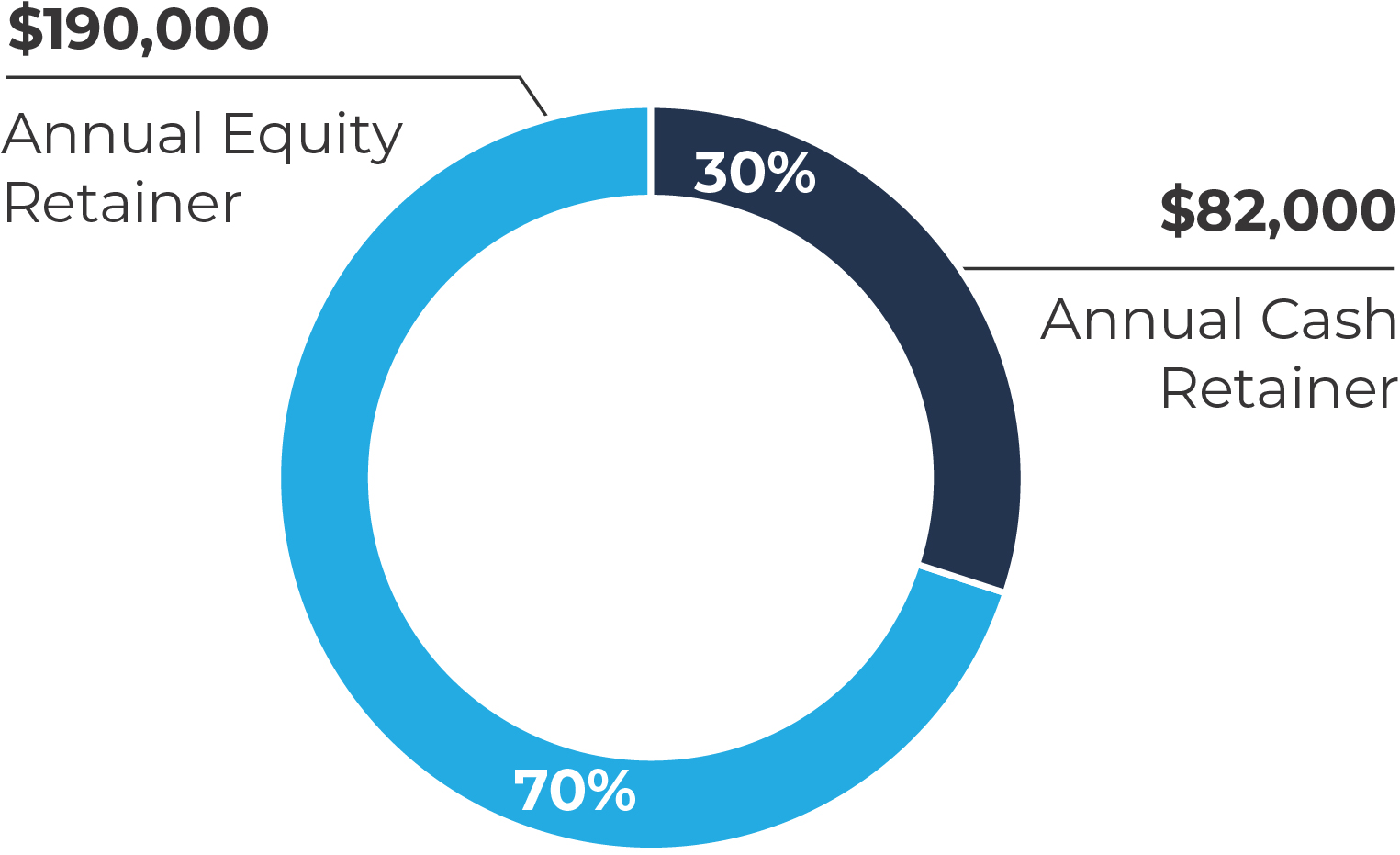

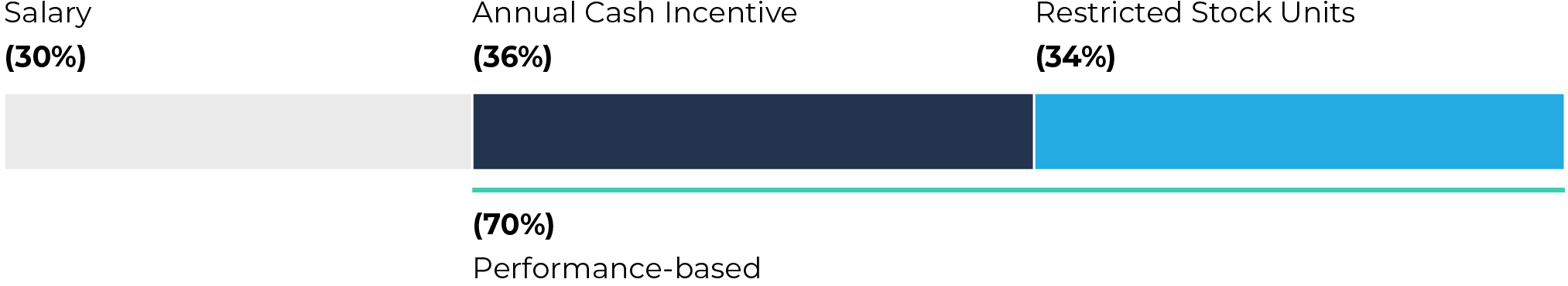

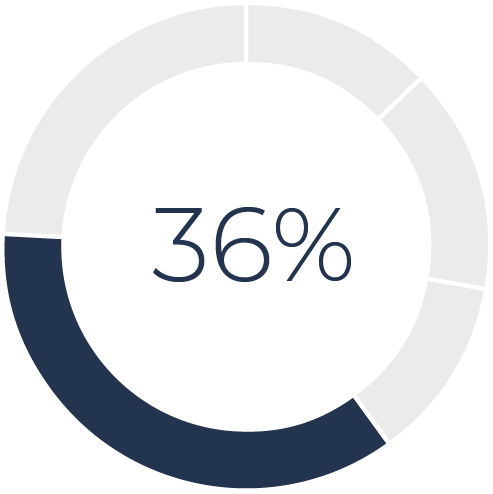

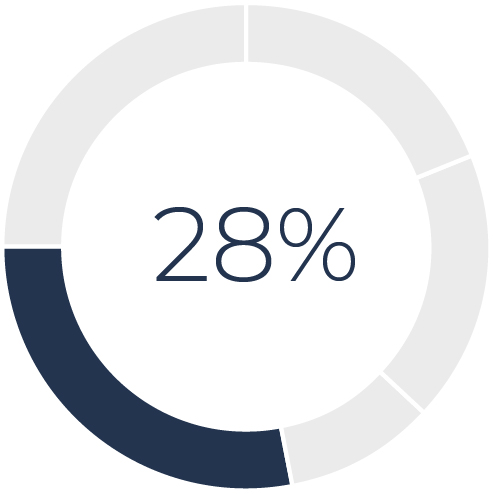

We view the various components of our compensation program as distinct but related, and we emphasize “pay for performance” by structuring our program so that a significant portion of our Executive Officers' total compensation is "at risk" and tied to the Company's long- and short-term financial, operational and strategic goals. The charts below reflect this allocation for our 2023 executive compensation program.

Historically, the Company has closely aligned executive compensation with Company performance by tying a majority of the value of our Named Executive Officers' compensation to the performance of the Company's common stock through grants of performance- and time-based RSU awards. Our annual cash incentive program is also performance-based.

While we did not employ a traditional long-term incentive compensation program in 2023, a majority of our 2023 Named Executive Officer compensation value was still tied to Company performance through our annual incentive program and grants of RSUs, as shown below.

2023 Compensation

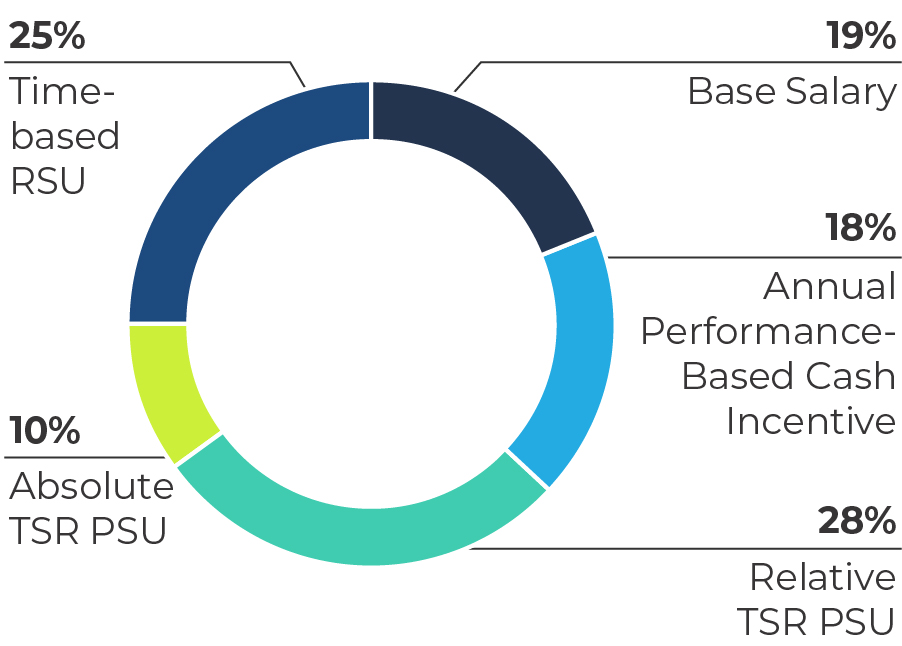

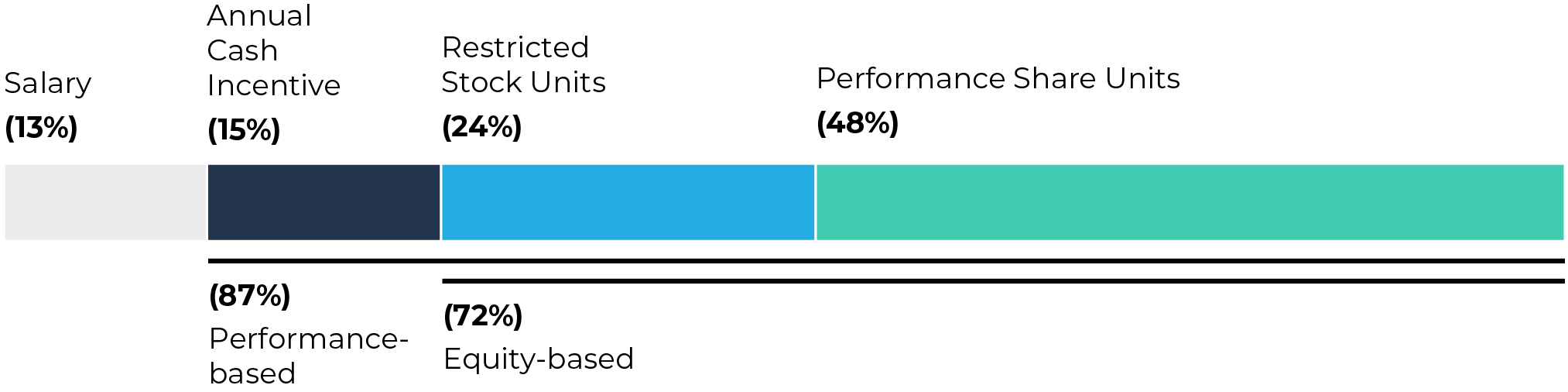

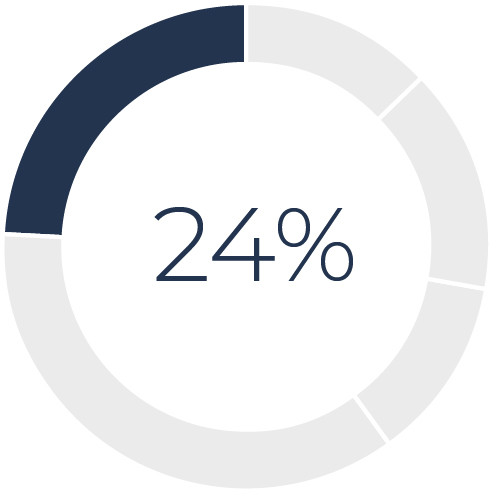

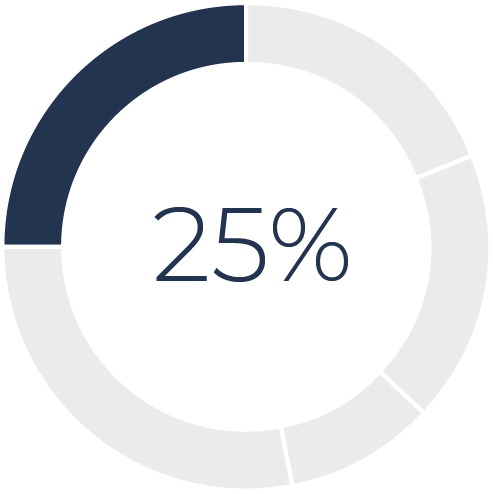

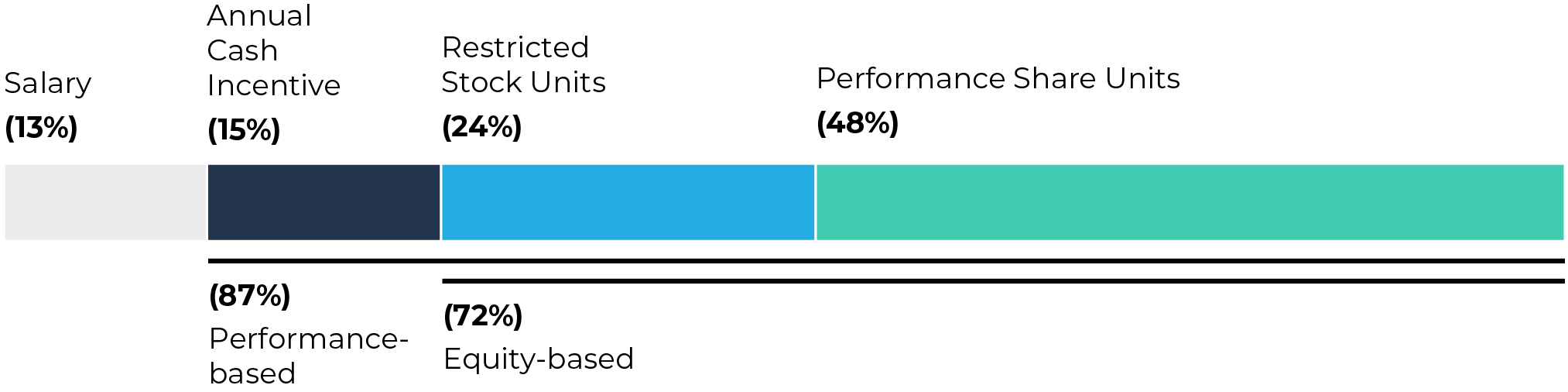

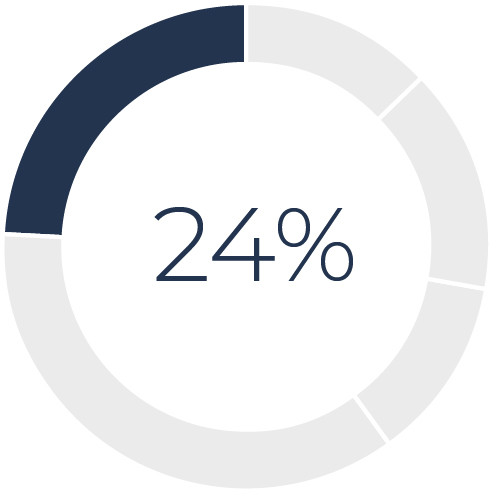

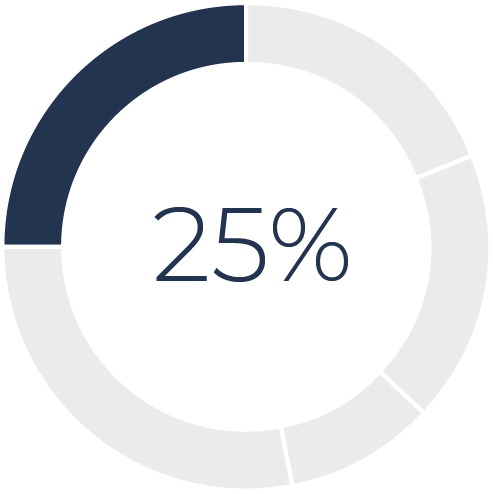

In 2024, 72% of our CEO's target total compensation will be equity-based, with 67% of his equity compensation comprised of absolute TSR and relative TSR PSUs. His annual cash incentive opportunity, which is also performance-based, accounts for another 15% of his target total compensation. For additional information, please see "—Elements of Compensation" and "—Actions Taken for the 2024 Fiscal Year."

2024 Compensation

The approximate allocation of the Company's direct compensation elements for the 2024 executive compensation program (consisting of base salary, annual performance-based cash incentives, performance share units ("PSUs") based on absolute and relative total shareholder return ("TSR") metrics, and time-based restricted stock units ("RSUs")) is shown below.

| | | | | | | | |

| COMPENSATION ELEMENTS |

| CEO | OTHER NEOs | DESCRIPTION |

| Base Salary |

| | |

| | •Fixed pay determined by position and level of responsibility •Competitively targeted within peer group |

| | |

| Annual Performance-Based Cash Incentive |

| | |

| | •Aligns employees’ interest with those of shareholders •Payment made based on achievement of specified Company performance goals •Final payout subject to Board discretion •Target payout is percentage of salary, which varies by position |

| | |

| Long-Term Equity-Based Compensation |

| Absolute TSR PSUs |

| | |

| | •Contingent shares may be earned over 3-year periods depending upon TSR performance measured against specific premium return objectives •Promote alignment with shareholder interests by rewarding the absolute increase in TSR •Number of PSUs earned ranges from 0-300% of target |

| | |

| Relative TSR PSUs |

| | |

| | •Contingent shares may be earned over 3-year periods depending upon relative TSR performance measured against a specified company peer group •Promote alignment with shareholder interests by rewarding shareholder returns compared to potential alternative investments •Number of PSUs earned ranges from 0-200% of target |

| | |

| Time-Based RSUs |

| | |

| | •Contingent shares vest ratably over three years to promote retention of key executives •Value at-risk based on stock price performance |

| | |

| | |

| Other Employee Benefits | •Benefits available to all employees, including medical, dental, short- and long-term disability, health club subsidy, parking and 401(k) plan with employer matching of first 6% eligible compensation contributed |

| | |

Committee Oversight

Chord has a robust annual cycle to plan, review and execute the executive compensation process and to oversee the Company's strategies relating to talent, leadership, and culture. Our competitive business requires attracting, developing and retaining a motivated team inspired by leadership, engaged in meaningful work, motivated by growth opportunities and thriving in a culture that embraces diversity and inclusion. As described above, the CHR Committee is responsible for overseeing Chord’s human resources strategies and prioritizing our efforts to attract and retain employees and leaders with the skills and experience needed to achieve our strategic objectives in dynamic market conditions. During 2023, the CHR Committee engaged with management on several issues impacting Chord’s human capital strategy, including: effective employee engagement; positive corporate culture, executive and employee succession, and recruiting and retention.

Best Practices in Our Compensation Program

The CHR Committee reviews on an ongoing basis the Company’s executive compensation program to evaluate whether it supports the Company’s executive compensation philosophies and objectives and is aligned with shareholder interests. Our 2023 executive compensation practices include the following, each of which the CHR Committee believes reinforces our executive compensation objectives:

| | | | | |

What We Do What We Do |  What We Do Not Do What We Do Not Do |

| |

Independent compensation consultant reports directly to the Committee Independent compensation consultant reports directly to the Committee Double-trigger change-in-control severance benefits Double-trigger change-in-control severance benefits Clawback Policy Clawback Policy Robust stock ownership guidelines Robust stock ownership guidelines Annual Say-on-Pay vote Annual Say-on-Pay vote Active Shareholder Engagement Active Shareholder Engagement Limited perquisites Limited perquisites Mitigation of undue risk Mitigation of undue risk |  No tax gross-ups No tax gross-ups No defined benefit pension plans or nonqualified deferred compensation plans No defined benefit pension plans or nonqualified deferred compensation plans No dividends on unearned performance-based awards under our LTIP No dividends on unearned performance-based awards under our LTIP LTIP does not allow repricing of underwater stock options without shareholder approval LTIP does not allow repricing of underwater stock options without shareholder approval No pledging, hedging, or short sales of our securities No pledging, hedging, or short sales of our securities |

Shareholder Outreach

| | | | | | | | | | | |

| | | |

In 2023, we invited shareholders representing over 50% of shares outstanding to meet with us regarding compensation and ESG matters and other topics of interest to shareholders. | | | Shareholders representing ~ 25% of shares outstanding elected to participate in discussions with the Company’s executive management and provided valuable feedback. |

| | | |

Participants were supportive of the Company’s compensation program, and in line with recommendations, and consistent with the Company’s commitment to increase transparency and improve ESG performance, the Company included quantitative sustainability metrics as performance goals in its 2023 performance-based cash incentive award program.

| | | | | | | | | | | |

| | | |

| PROPOSAL 3 | | |

| | | |

| |

| Ratification of Appointment of the Independent Registered Public Accounting Firm |

| |

|

|

| | | |

| |

| The Board recommends a vote FOR this proposal. | |

| |

The Audit and Reserves Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for 2024.

The Board of Directors is submitting the appointment of PricewaterhouseCoopers LLP for ratification at the Annual Meeting. Although the submission of this matter for approval by shareholders is not required, we value the opinions of our shareholders and believe that shareholder ratification of the appointment is a good corporate governance practice.

If the shareholders do not ratify the appointment of PricewaterhouseCoopers LLP, the Audit and Reserves Committee may reconsider the appointment of that firm as the Company’s independent registered public accounting firm.

| | | | | | | | |

| | |

| PROPOSAL 1 | |

| | |

| |

| Election of Directors |

| |

To the extent authorized by the proxies, the shares represented by the proxies will be voted in favor of the election of the nine nominees for director whose names are set forth herein. If for any reason any of these nominees is not a candidate when the election occurs, the shares represented by such proxies will be voted for the election of the other nominees named and may be voted for any substituted nominees or the Board may reduce its size. However, management of the Company does not expect this to occur. Vote Required Each of our directors will stand for election annually and must be elected by a majority of votes cast with respect to such director. |

| |

| |

| The board recommends a vote "FOR” each of the persons nominated. |

| |

Board Nominee Highlights

Our directors are diverse, industry-leading experts with an average of approximately 30 years of industry leadership experience across multiple disciplines.

Board Skills, Experience and Qualifications

The Board believes it is important for directors to possess a diverse array of backgrounds, skills, and achievements. When considering new candidates, the Nominating and Governance Committee (the “NG Committee”), with input from the Board, takes these factors into account as well as other appropriate characteristics, such as sound judgment, personal character and integrity. The Board’s commitment to diversity is reflected in the charter of the NG Committee, which states that the NG Committee will take into account in considering individual director candidates “diversity in professional experience, skills and background, and diversity in race, gender and other attributes, and the optimal enhancement of the current mix of talent and experience” on the Board. The Committee seeks to take reasonable steps to include diverse candidates in the pool of nominees and any search firm engaged by the Committee is instructed to seek diverse candidates.

To identify nominees, the NG Committee may, in its discretion, engage one or more search firms or solicit recommendations from existing directors and management. If existing directors or management are solicited, their recommendations would be considered by the NG Committee along with any recommendations that have been received from shareholders. The NG Committee Charter provides that the NG Committee must treat recommendations for directors that are received from the Company’s shareholders equally with recommendations received from any other source; provided, however, that in order for such shareholder recommendations to be considered, the recommendations must comply with the procedures outlined in the Company’s Bylaws and described in the Company’s proxy statement for its annual meeting of shareholders.

The Company's goal is to assemble and maintain a Board composed of individuals that not only bring a wealth of business and/or technical expertise, experience, and achievement, but that also demonstrate a commitment to ethics in carrying out the Board’s responsibilities with respect to oversight of the Company’s operations. We believe our current Board reflects these principles. With an average of over 30 years of industry experience, our directors have held leadership roles across the upstream, midstream, oil services, investing, banking, advising, and finance industries. Furthermore, 55% our directors are women, and they hold critical leadership positions of Board Chair, Audit and Reserves Committee Chair, Compensation and Human Resources Committee Chair, ESG Committee Chair, and NG Committee Chair.

A skill set chart follows that identifies the diversity of expertise, experience and characteristics that the Board believes contribute to an effective and well-functioning board. The lack of a check does not mean that the director does not possess that skill or experience. Rather, a check indicates that the item is a specific skill or experience that the director brings to the Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Skills & Experience | | | | | | | | | |

| Current or Past Public Company C-Suite | | | | | | | | | |

| E&P Operations | | | | | | | | | |

| Capital Allocation/ Investment | | | | | | | | | |

| Financial Reporting & Accounting | | | | | | | | | |

| Environmental, Health and Safety Management | | | | | | | | | |

| Information Technology | | | | | | | | | |

| Business Development/ M&A | | | | | | | | | |

| Compensation & Human Resources | | | | | | | | | |

| Risk Management/Sustainability | | | | | | | | | |

| Corporate Governance | | | | | | | | | |

| Legal & Regulatory | | | | | | | | | |

| Demographic Background | | | | | | | | | |

| Tenure | 3 years | 3 years | 1.5

years | 3 years | 1.5 years | 1.5 years | 1.5 years | 3 years | 2.5 years |

| Age | 65 | 48 | 68 | 55 | 67 | 64 | 68 | 47 | 58 |

| Gender | M | M | F | F | M | M | F | F | F |

| | | | | | | | |

| SKILLS & EXPERIENCE | TOTAL |

| | |

| | |

| Current or Past Public Company C-Suite Public company C-suite experience demonstrates a practical understanding of organizations, processes, strategy, risk, and risk management. | 7 |

| | |

| | |

| E&P Operations Industry experience provides valuable perspective on issues specific to our business within the E&P industry. | 8 |

| | |

| | |

| Capital Allocation/ Investment The ability to allocate capital wisely is critical to the successful execution of our operational plans and to the protection of our shareholders' investment in us. | 8 |

| | |

| | |

| Financial Reporting & Accounting Financial reporting, audit knowledge, and experience in capital markets, both debt and equity, are critical to our business. | 7 |

| | |

| | |

| Environmental, Health and Safety Management EHS experience contributes to proper stewardship of our environmental and human resources, which are critical components of our success and license to operate. | 6 |

| | |

| | |

| Information Technology Experience in information technology, including cybersecurity risk, cloud computing, scalable data analytics, and big data technologies add exceptional value to our Board. | 3 |

| | |

| | |

| Business Development/ M&A Business development skill and experience is highly valuable to the Company as we seek to execute our strategic vision and build scale accretively. | 8 |

| | |

| | |

| Compensation & Human Resources Human capital management experience is essential for effective oversight on matters such as culture, succession planning, talent development, and retention. | 5 |

| | |

| | |

| Risk Management/Sustainability Risk management/sustainability experience supports achievement of strategic business objectives and long-term value creation with a responsible, sustainable business model. | 7 |

| | |

| | |

| Corporate Governance Corporate governance experience supports our goals of strong board and management accountability, transparency, and protection of shareholder interests. | 8 |

| | |

| | |

| Legal & Regulatory Legal and regulatory experience offers valuable insight into the many regulations and governmental actions and decisions that affect our industry. | 3 |

| | |

Board Diversity

The following matrix sets forth our directors’ self-identified gender identity and demographic characteristics that were voluntarily provided. Each of the categories listed in the matrix below has the meaning as it is used in Nasdaq Rule 5605(f) and related instructions.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix |

| | | | As of March 19, 2024 |

| Total Number of Directors | | 9 |

| | | | | Female | Male | Non-Binary | Did Not

Disclose

Gender |

| Part I: Gender Identity | | | | | | | | |

| Directors | | | | | 5 | 4 | ─ | ─ |

| Part II: Demographic Background | | | | | | | | |

| African American or Black | | | | | ─ | ─ | ─ | ─ |

| Alaskan Native or Native American | | | | | ─ | ─ | ─ | ─ |

| Asian | | | | | ─ | ─ | ─ | ─ |

| Hispanic or Latinx | | | | | ─ | ─ | ─ | ─ |

| Native Hawaiian or Pacific Islander | | | | | ─ | ─ | ─ | ─ |

| White | | | | | 4 | 4 | ─ | ─ |

| Two or More Races or Ethnicities | | | | | 1 | ─ | ─ | ─ |

| | | | | | | | | | |

| LGBTQ+ | | — |

| Did Not Disclose Demographic Background | | — |

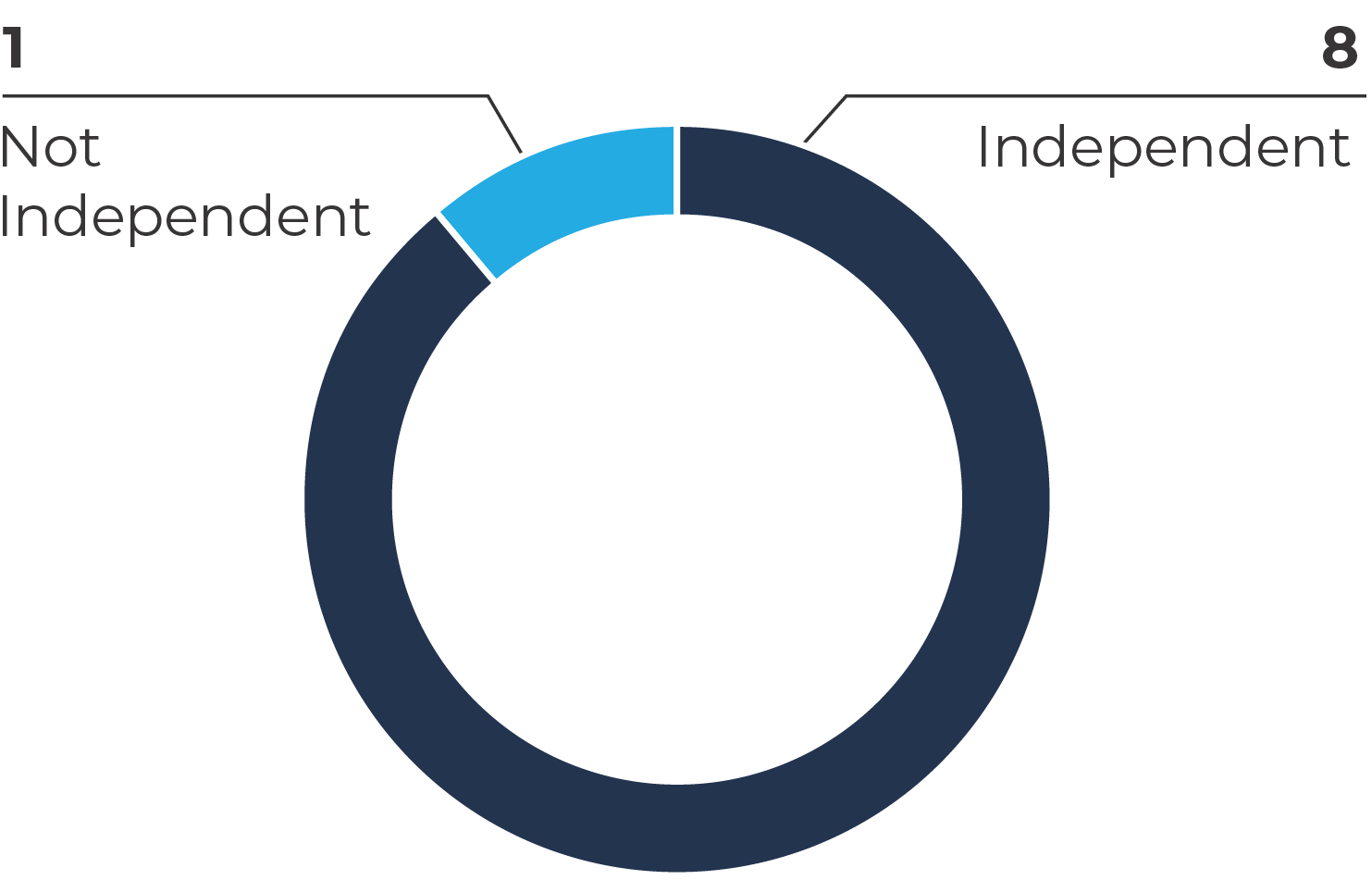

Director Independence

To maintain a strong and independent board, all directors of the Company, other than Mr. Brown, are independent. The Company’s Corporate Governance Guidelines require the assessment of directors’ independence each year. A director cannot be considered independent unless the Board affirmatively determines that he or she does not have any relationship with management or the Company that may interfere with the exercise of his or her independent judgment.

The Board has assessed the independence of each non-employee director nominee under the Company’s Corporate Governance Guidelines and the independence standards of the Nasdaq. The Board affirmatively determined that all eight non-employee directors (Mses. Cunningham, Holroyd, Taylor, Walker, and Woung-Chapman and Messrs. Brooks, Korus and McCarthy) are independent.

| | | | | |

| Proposal 1 - Election of Directors | |

Who We Are

Our directors are diverse, industry-leading experts with an average of approximately 30 years of industry leadership experience across multiple disciplines. Each of our directors will stand for election annually and must be elected by a majority of shares voted. Set forth below is biographical information about each of the Company’s directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | SUSAN M. CUNNINGHAM, 68 | | | | | | |

| | | | | | | | | |

| Director since: 2022 Houston, Texas | | Committees: Compensation and Human Resources Environmental, Social and Governance |

| |

| | | | | | | | | | |

| | | | | | | | | | |

EXPERIENCE •Advisor for Darcy Partners, a consulting firm (2017-2019) •EVP, EHSR and New Frontiers, Noble Energy, Inc. (2014-2017) •SVP, Gulf of Mexico, West Africa, and Frontier Ventures for Noble Energy, Inc. •Variety of positions at Texaco U.S.A., Statoil Energy, Inc. and Amoco Corporation

Ms. Cunningham has more than 35 years of oil and gas industry experience and brings strong leadership skills and extensive exploration and production experience and knowledge developed as a senior executive of Noble Energy, Inc. | | OTHER DIRECTORSHIPS •Whiting Petroleum - ESG (Chair) and Audit Committees (2020-2022) •Enbridge Inc. – Compensation Committee and Chair of the Sustainability Committee •Chair of the Advisory Board to the Dean of the Faculty Science at McMaster University (Canada) •Board of Directors of Oil Search (2018-2021) •Board of Directors of Cliffs Natural Resources/Cleveland Cliffs (2005-2014) EDUCATION •BA, Geology and Physical Geography – McMaster University, Ontario Canada •Advanced Management Program and Executive Coaching Certification – Rice University |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | | | | |

| Current or past public company C-Suite | | Financial Reporting & Accounting | | E&P Operations | | Environmental, health and safety management |

| Capital Allocation/ Investment | | Information Security | | Risk Management/Sustainability | | Legal & Regulatory |

| | | | | |

| Proposal 1 - Election of Directors |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | DANIEL E. BROWN, 48 | | | | | | | |

| | | | | | | | | |

| President and Chief Executive Officer of Chord Energy Director since: 2021 Houston, Texas | | Committees: None |

| | | |

| | | | | | | | | | |

| | | | | | | | | | |

EXPERIENCE •Executive Vice President, U.S. Onshore Operations, Anadarko Petroleum Corporation (2017-2019) •Vice President, Corporate Planning, Vice President, Operations, Senior Vice President, International and Deepwater Operations and Executive Vice President, International and Deepwater Operations, Anadarko (2013-2017)

Mr. Brown brings extensive experience from his 25 years in the oil and gas industry. His broad knowledge base developed during his career in U.S. onshore, Gulf of Mexico and international operations adds valuable perspective and enhances the Board’s expertise. Through his senior leadership positions at two large, well-respected, public energy companies, Mr. Brown has a deep knowledge of the strategic, financial, risk and compliance issues facing a publicly- traded company. | | OTHER DIRECTORSHIPS •Beacon Offshore Energy, LLC •Board Chair of OMP GP LLC, general partner of Oasis Midstream Partners LP* (2021-2022) •Western Midstream Partners, LP (2019) •Western Gas Equity Partners, LP and Western Gas Partners, LP (2017-2019) EDUCATION •BS, Mechanical Engineering - Texas A&M University •MBA, Rice University (Jones Scholar Award) |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | | | |

| Current or past public company C-Suite | | E&P Operations | | Capital Allocation/ Investment | | Environmental, health and safety management |

| Business Development/ M&A | | Compensation & Human Resources | | Risk Management/Sustainability | | Corporate Governance |

| | | | | |

| Proposal 1 - Election of Directors | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | DOUGLAS E. BROOKS, 65 | | | | | | |

| | | | | | | | | |

| Director since: 2020 Montgomery, Texas | | Committee: Environmental, Social and Governance |

| |

| | | | | | | | | | |

| | | | | | | | | | |

EXPERIENCE •Advisor, Covalence Investment Partners (2024-present) •Chord, Lead Independent Director (2022-2023) •CEO, Oasis Petroleum Inc. (2020-2021) •President, CEO and Director of Energy XXI Gulf Coast, Inc. until its sale to Cox Oil & Gas (2017-2018) •President, CEO and Director of Yates Petroleum Corporation, a private E&P company until its merger with EOG Resources (2015-2016) •CEO of Aurora Oil & Gas Limited until its acquisition by Baytex Energy (2012-2014) •Founder and CEO of Compass Resources, a private equity sponsored resource exploration company (2006-2012) •Marathon Oil Company for 24 years - Director, Western Hemisphere Business Development and Upstream M&A

Mr. Brooks provides extensive industry and executive and board leadership experience to the Board. Given his experience, he is well positioned to provide key insight into asset management, operations and strategy. Mr. Brooks was recognized by NACD among America's Top 100 Directors in 2022. | | OTHER DIRECTORSHIPS •California Resources Corporation, Nominating and Governance Committee and Finance Committee (2020-2023) •Board Chair of Oasis Petroleum Inc. (2020-2022) •Board Chair of OMP GP LLC, general partner of Oasis Midstream Partners LP (2020-2021) •Chaparral Energy, Inc. (2017-2020) •Madalena Energy Inc., a Canadian-based oil and gas company (now Centaurus Energy, Inc.) (2014-2020) EDUCATION •BS, Business Management - University of Wyoming, Casper •MBA, Our Lady of the Lake University |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | | | |

| Current or past public company C-Suite | | E&P Operations | | Capital Allocation/ Investment | | Financial Reporting & Accounting |

| Environmental, health and safety management | | Business Development/ M&A | | Compensation & Human Resources | | Risk Management/Sustainability |

| Corporate Governance | | Legal & Regulatory | | | | |

| | | | | |

| Proposal 1 - Election of Directors |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | SAMANTHA F. HOLROYD, 55 | | | | | | |

| | | | | | | | | |

| Director since: 2020 Houston, Texas | | Committees: Environmental, Social and Governance (Chair) Audit and Reserves, Audit Committee Financial Expert |

| |

| | | | | | | | | | |

| | | | | | | | | | |

EXPERIENCE •Golden Advisory Services, LLC: Founding Manager, Independent Corporate Advisor •Lead Independent Director, Oasis Petroleum (2020-2021) •Managing Director at Lantana Energy Advisors (2018-2020) •Managing Director at TPG Sixth Street Partners (2016-2018) •Technical Director at Denham Capital Management LP (2011-2016) •Global Reserves Audit Manager and Business Opportunity Manager at Royal Dutch Shell PLC •Vice President of EIG Global Energy Partners •Vice President of Ryder Scott Company

Ms. Holroyd is a Certified Corporate Director and is ESG Certified by the National Association of corporate Directors (NACD), FINRA Series 7 & 63 licenses and Registered as a Professional Engineer in the State of Texas. Through Golden, Ms. Holroyd advises executive managers, boards, and investors on emerging and green technologies supporting carbon reductions, climate change and sustainability. Ms. Holroyd’s operational, reserves, investment and strategic expertise are invaluable to Chord as a public company navigating a dynamic market environment. | | OTHER DIRECTORSHIPS •Amerant Bancorp, Risk Committee, Corporate Nominating, Governance & Sustainability Committee (2022-2024) •Crestwood Equity GP and Crestwood Equity Partners LP (2022) •Gulfport Energy, an independent natural gas company (2020-2021) EDUCATION •BS, Petroleum Engineering - Colorado School of Mines |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | | | |

| E&P Operations | | Capital Allocation/ Investment | | Financial Reporting & Accounting | | Business Development/ M&A |

| Risk Management/Sustainability | | Legal & Regulatory | | | | |

| | | | | |

| Proposal 1 - Election of Directors | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | PAUL J. KORUS, 67 | | | | | | | | | |

| | | | | | | | | | |

| Director since: 2022 Littleton, Colorado | | | Committees: Audit and Reserves, Audit Committee Financial Expert Environmental, Social and Governance |

| | |

| | | | | | | | | | | |

| | | | | | | | | | | |

EXPERIENCE •SVP and CFO, Cimarex Energy Co., (2002-2015) •SVP and CFO, Key Production Company (1999-2002) •Gas Research Analyst at an investment banking firm •Apache Corporation – various positions including corporate planning, information technology and investor relations

Mr. Korus has more than 35 years of oil and gas industry experience and brings strong financial and accounting expertise, having served as Chief Financial Officer of Cimarex Energy Co., as well as his experience having served as a CPA and a director of several other public energy companies. | | | OTHER DIRECTORSHIPS •PDC Energy, Inc. (2020-2023) •Crestwood Equity GP and Crestwood Equity Partners LP (2022) •Whiting Petroleum, Audit (Chair) and Nominating and Governance Committees (2020-2022) •SRC Energy Inc. (2016-2022) •Antero Midstream Partners LP (2019) •Antero Resources Corporation (2018-2021) EDUCATION •BS, Economics - University of North Dakota •MS, Accounting - University of North Dakota |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | | | |

| Current or past public company C-Suite | | E&P Operations | | Capital Allocation/ Investment | | Financial Reporting & Accounting |

| Environmental, health and safety management | | Information Security | | Business Development/ M&A | | Risk Management/Sustainability |

| Corporate Governance | | | | | | |

| | | | | |

| Proposal 1 - Election of Directors |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | KEVIN S. MCCARTHY, 64 | | | | | | |

| | | | | | | | | |

| Director since: 2022 Houston, Texas | | Committees: Compensation and Human Resources Nominating and Governance |

| |

| | | | | | | | | | |

| | | | | | | | | | |

EXPERIENCE •Vice Chairman, Kayne Anderson Capital Advisors, L.P. (2019-2023) •CEO Kayne Anderson’s closed-end funds (2004-2019) •Chairman of the Board for Kayne Anderson’s closed-end funds (2004-2020) •Range of leadership positions, including global head of energy investment banking at UBS Securities and similar positions at PaineWebber and Dean Witter

Mr. McCarthy has significant energy finance and investment experience with deep knowledge of oil and gas commodity markets and oil and gas companies both as an investment banker and from having served as Chairman and Chief Executive Officer at Kayne Anderson. | | OTHER DIRECTORSHIPS •Kinetik Holdings Inc., Compensation and Audit Committees •PAA GP Holdings LLC, Nominating and Governance and ESG Committees •Whiting Petroleum - Chairman of the Board, Compensation and Human Resources and Nominating and Governance Committee (2020-2022) •Kayne Anderson Public Funds (2004-2020) •ONEOK, Inc., Compensation and Nominating and Governance Committees (2015-2017) •Range Resources Corporation - Compensation Committee (2005-2018) EDUCATION •BA, Economics and Geology – Amherst College •MBA, Finance – Wharton School at the University of Pennsylvania |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | | | |

| Current or past public company C-Suite | | E&P Operations | | Capital Allocation/ Investment | | Financial Reporting & Accounting |

| Business Development/ M&A | | Compensation & Human Resources | | Corporate Governance | | |

| | | | | |

| Proposal 1 - Election of Directors | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | ANNE TAYLOR, 68 | | | | | | | | |

| | | | | | | | | |

| Director since: 2022 Houston, Texas | | Committees: Compensation and Human Resources (Chair) Nominating and Governance |

| |

| | | | | | | | | | |

| | | | | | | | | | |

EXPERIENCE •AT Strategies LLC, a private consulting firm •Deloitte (1987-2018) - Vice Chairman, Mid-America Regional Managing Partner, Houston Managing Partner; U.S. Chief Strategy Officer and Global Leader for e-business

Ms. Taylor brings to the Board significant and valuable experience in business strategy development and execution, technology, management and leadership, talent development and corporate governance, as well as energy industry and public company knowledge. | | OTHER DIRECTORSHIPS •Conway MacKenzie (2019-2022) •Deloitte (2001-2004) •Group 1 Automotive, Inc., Compensation & Human Resources (Chair) and Audit Committees •Memorial Hermann Hospital System, Children's (Chair), Compensation and HR Committees •Southwestern Energy Company - Compensation (Chair) and Audit Committees •Whiting Petroleum, Compensation and Human Resources (Chair) and ESG Committees (2020-2022) EDUCATION •BS and MS, Civil Engineering – University of Utah •Ph.D. Studies, Engineering - Princeton University |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | | | |

| Financial Reporting & Accounting | | Information Security | | Business Development/ M&A | | Compensation & Human Resources |

| Risk Management/Sustainability | | Corporate Governance | | | | |

| | | | | |

| Proposal 1 - Election of Directors |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | CYNTHIA L. WALKER, 47 | | | | | | |

| | | | | | | | | |

| Director since: 2020 Houston, Texas | | Committees: Audit and Reserves (Chair), Audit Committee Financial Expert Nominating and Governance |

| |

| | | | | | | | | | |

| | | | | | | | | | |

EXPERIENCE •CEO of TES-H2 and Chief Strategy Officer of TES-H2 Group (October 2022-present) •Occidental Petroleum (2012-2019) - Senior Vice President, Midstream and Marketing; Senior Vice President, Strategy and Development; Executive Vice President and Chief Financial Officer •Managing Director in the Global Natural Resources Group and Mergers & Acquisitions Group in the Investment Banking Division at Goldman, Sachs & Co.

Ms. Walker brings extensive financial expertise and executive management experience to the Board. Her investment banking experience provides insight into the investor perspective. | | OTHER DIRECTORSHIPS •Sempra, Audit Committee and Safety, Sustainability & Technology Committee (2018-2023) EDUCATION •BBA, The University of Texas at Austin |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | | | |

| Current or past public company C-Suite | | E&P Operations | | Capital Allocation/ Investment | | Financial Reporting & Accounting |

| Environmental, health and safety management | | Business Development/ M&A | | Risk Management/Sustainability | | Corporate Governance |

| | | | | |

| Proposal 1 - Election of Directors | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | MARGUERITE N. WOUNG-CHAPMAN, 58 | | | |

| | | | | | | | | | |

| Director since: 2021 Houston, Texas | | Committees: Nominating and Governance (Chair) Compensation and Human Resources

|

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

EXPERIENCE •Served as Senior Vice President, General Counsel and Corporate Secretary of Energy XXI Gulf Coast, Inc., an oil and natural gas company (2018) •General Counsel and Corporate Secretary at EP Energy Corporation, other roles included Senior Vice President, Land Administration (2012-2017) •Various roles at El Paso Corporation and its predecessors, including as Vice President, Legal Shared Services, Corporate Secretary and Chief Governance Officer (1991-2012)

Ms. Woung-Chapman brings extensive experience in management and strategic direction of publicly-traded energy companies. Her combination of corporate governance, regulatory, compliance, corporate and asset transactional, legal and business administration experience provides valuable perspective. | | OTHER DIRECTORSHIPS •Summit Midstream Partners, LP, Nominating, Governance and Sustainability Committee Chair, Compensation Committee •Texas Pacific Land Corporation, Audit Committee, Nominating and Governance Committee EDUCATION •BS, Linguistics - Georgetown University •J.D. - Georgetown University Law Center |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Skills and Qualifications | | | |

| Current or past public company C-Suite | | E&P Operations | | Capital Allocation/ Investment | | Environmental, health and safety management |

| Business Development/ M&A | | Compensation & Human Resources | | Corporate Governance | | Legal & Regulatory |

| | | | | |

| Proposal 1 - Election of Directors |

Director Nomination and Refreshment

| | | | | | | | | | | | | | | | | | | | |

| Identification | | Assessment | | Selection |

| | | | | | |

The NG Committee seeks to identify individuals qualified to be nominated for the Board. To identify nominees, the NG Committee may, in its discretion, engage one or more search firms or solicit recommendations from existing directors and management. | | | Prior to recommending the nomination of a person for election as a director of the Board, the NG Committee may consider, as applicable, each candidate’s: •Past Board and committee meeting attendance and performance •Individual director evaluations •Length of Board service •Personal and professional integrity, including commitment to the Company’s core values •Relevant experience, skills, qualifications and contributions •Independence under applicable standards •Diversity in experience, skills and background •Business judgment •Service on boards of directors of other companies and other time commitments •Openness and ability to work as part of a team •Willingness to commit the required time to serve as a Board member •Familiarity with the Company and its industry | | | The goal is to assemble and maintain a Board composed of individuals that not only bring a wealth of business and/or technical expertise, experience, and achievement, but that also demonstrate a commitment to ethics in carrying out the Board’s responsibilities with respect to oversight of the Company’s operations. |

| | | | | | |

Proxy Access Nominations by Shareholders

Eligible shareholders, or a group of up to 20 shareholders and beneficial owners who have owned an aggregate of at least 3% of the voting power of the Company’s outstanding common stock continuously for at least three years, may nominate a candidate for election to the Board for inclusion in the Company’s proxy materials in accordance with the proxy access provisions of Section 3.14 of the Company's Bylaws.

Governance At-a-Glance

The Board and management believe that one of their primary responsibilities is to promote a corporate culture of accountability, responsibility and ethical conduct throughout the Company. The Company is committed to maintaining high standards of business conduct and corporate governance, which we believe is essential to operating our business efficiently, maintaining our integrity in the marketplace and serving our shareholders.

Following are highlights of our governance program.

| | | | | |

|

| Chord Governance |

|

| |

•Annual election of directors •Majority voting and Director Resignation Policy in contested elections •Shareholder right to call special meetings •Shareholder proxy access •Separate CEO and Board Chair •Director stock ownership guidelines equal to 5x annual Board cash retainer •No supermajority voting provisions •No "poison pill" in effect •Single class share capital structure •Hedging, pledging, short sales of Company stock prohibited •No restrictions on director access to management •Board oversight of strategy and risk management •Performance relative to strategic priorities impacts executive and employee compensation •Quantitative ESG metrics impact executive and employee compensation •Consistent shareholder engagement; demonstrated responsiveness to feedback | •Deep experience and diverse perspectives •Annual skills matrix completed, evaluated, disclosed •Robust annual Board and committee evaluation process with actionable follow-up •Regular assessment of emerging needs for Board refreshment and skills •Focus on diversity and directors with the right skills for the optimal enhancement of the current mix of talent and experience on the Board •Independent Committee Chairs •Regular executive sessions of independent directors at Board and committee meetings •55% Board members are women •Women chair our Board and 100% of our Board committees •Regular Board trainings on corporate governance and sustainability-related issues and access to additional materials and seminars provided |

| |

Board Structure and Operations

The Board is responsible for the control and direction of the Company. The diversity and strength of the directors’ professional and leadership experience allows for open and robust dialog and decision-making ability, including with respect to the Board’s leadership structure.

Board Leadership Structure

The Company’s Corporate Governance Guidelines contain the Board’s policy that the offices of Board Chair and CEO should be held by two different individuals. However, our Bylaws do permit the same person to hold both positions, for there to be an Executive Chair, or for there to be a Board Chair that is not otherwise independent, so long as the Board appoints a Lead Independent Director for any period in which the Board Chair is not independent.

Factors that the Board considers in reviewing its leadership structure and making this determination include, but are not limited to, the current composition of the Board, the policies and practices in place to provide independent Board oversight of management, the Company’s circumstances and the views of our shareholders and other stakeholders. Changes in the Board’s leadership structure will be reflected on our website shortly after becoming effective and disclosed in compliance with applicable regulatory requirements.

| | | | | | | | |

| | |

| BOARD CHAIR | | PRESIDENT & CEO |

| | |

| | |

| | |

| | |

| | |

| Susan M. Cunningham | | Daniel E. Brown |

| | |

| | |

•Presides over Board meetings •Approves agenda for Board meetings with input from CEO •Provides advice and counsel to the CEO •Facilitates communications among the other members of the Board •Serves as the Board’s contact for employee and shareholder communications with the Board •Calls special meetings of the Board •Presides over shareholder meetings •Approves retention of advisors that report directly to the Board | | •Possesses extensive knowledge and deep understanding of the industry, business, and challenges we face •Prioritizes matters for the Board through his day-to-day insight into our challenges and opportunities •Leads execution of Company strategy to maximize shareholder value •Develops strong executive management team

|

| | |

The non-management directors of the Board regularly meet in executive session without the CEO or other members of management present. During 2023, while serving as Lead Independent Director, Mr. Brooks presided at these meetings and provided the Board’s guidance and feedback to the Company’s Executive Chair and management team, to which the Board has full access. Since the beginning of 2024, Ms. Cunningham, our independent Board Chair, has led these sessions.

Board Committees

The Board has four standing committees: the Audit and Reserves Committee, the Compensation and Human Resources Committee, the ESG Committee, and the Nominating and Governance Committee. Each of our standing committees has a charter that is publicly available on the Company’s website at

ir/chordenergy.com/corporate-governance.

| | | | | | | | |

| |

| AUDIT AND RESERVES COMMITTEE |

|

| |

| | |

CURRENT MEMBERS •Cynthia L. Walker (Chair) •Samantha F. Holroyd •Paul J. Korus QUALIFICATIONS •The Board has identified Cynthia Walker, Samantha Holroyd, and Paul Korus as qualified financial experts and has designated each of them as “Audit Committee Financial Experts” as defined by the SEC. •All members of the Audit and Reserves Committee are independent under the applicable rules of the Nasdaq, the SEC, and the Company’s independence standards. | KEY RESPONSIBILITIES •Directly responsible for the appointment, compensation, retention and oversight of the work of the Company’s independent registered public accounting firm, which reports directly to the committee, and each year, the committee reviews the independent registered public accounting firm’s qualifications, independence and performance. •Assists the Board with its oversight of the integrity of the Company’s consolidated financial statements, the appointment, compensation, and performance of the Company’s internal auditor, the integrity of the estimates of the Company’s oil, natural gas and natural gas liquid reserves, the independence, qualifications and performance of the Company’s independent reservoir engineers, compliance by the Company with legal and regulatory requirements and the Company’s monitoring of cybersecurity risk. The Audit and Reserves Committee meets regularly with representatives of the independent registered public accounting firm, the independent reservoir engineers, and with the internal auditor for these purposes. |

| | |

| | | | | | | | |

| |

| COMPENSATION AND HUMAN RESOURCES COMMITTEE |

|

| |

| | |

CURRENT MEMBERS •Anne Taylor (Chair) •Susan M. Cunningham •Kevin S. McCarthy •Marguerite N. Woung-Chapman QUALIFICATIONS •All of the members of the Compensation and Human Resources Committee are independent under the rules of the Nasdaq and the Company’s independence standards. | KEY RESPONSIBILITIES •Oversees the compensation of the Company’s directors and executive officers and the Company's agreements, plans, policies and programs to compensate the Company's employees other than executive officers. •Annually evaluates the performance of the Company’s CEO and other executive officers in light of the Company’s executive compensation goals and objectives, and reviews with management and recommends inclusion of the Compensation Discussion and Analysis (the “CD&A”) section in the proxy statement for the annual meeting of shareholders. The CD&A included in this proxy statement contains additional information about the Compensation and Human Resources Committee. In carrying out its duties, the committee has direct access to outside advisors, independent compensation consultants and others to assist them. The committee also oversees strategies and initiatives related to human capital management, including employee engagement and diversity, equity and inclusion. |

| | |

| | | | | | | | |

| |

| THE ENVIRONMENTAL, SOCIAL AND GOVERNANCE COMMITTEE |

|

| |

| | |

CURRENT MEMBERS •Samantha F. Holroyd (Chair) •Douglas E. Brooks •Susan M. Cunningham •Paul J. Korus QUALIFICATIONS •All of the members of the ESG Committee are independent under the rules of the Nasdaq and the Company’s independence standards. | KEY RESPONSIBILITIES •Oversees the Company’s general approach, strategies, and goals for addressing ESG matters relevant to the Company. The committee additionally monitors the Company’s policies, controls and systems for ESG matters and broader ESG trends, including climate change, economic policy, natural resource policy, environmental, and health and safety matters. •Oversees the publication of the Company’s sustainability-related disclosure and assists the Board with its oversight of the Company’s ESG-related policies and programs, including its commitment to protect the health and safety of the Company’s workers and the communities in which we operate, promote sustainability and minimize the Company’s adverse impact on the environment, and comply with environment-related laws. •Provides oversight and recommendations related to the Company’s commitment to socially responsible business conduct and the promotion of diversity, compliance with related laws, and the support of charitable organizations and community affairs. |

| | |

| | | | | | | | |

| |

| THE NOMINATING AND GOVERNANCE COMMITTEE |

|

| |

| | |

CURRENT MEMBERS •Marguerite N. Woung-Chapman (Chair) •Kevin S. McCarthy •Anne Taylor •Cynthia L. Walker QUALIFICATIONS •All of the members of the NG Committee are independent under the rules of the Nasdaq and the Company’s independence standards | KEY RESPONSIBILITIES •Identifies and recommends potential Board and committee members, oversees evaluation of the Board’s performance, assesses the Company’s Corporate Governance Guidelines and reviews the monitoring of the Company’s compliance programs and Corporate Code of Business Conduct and Ethics. •Reviews relationships between the Company and directors to determine satisfaction of applicable independence standards, advises the Board on the need for any changes in its size and composition, oversees succession planning of the CEO and makes recommendations to the Board on the selection of a Lead Independent Director if the Board Chair is not independent. •Reviews and recommends proposed changes to the Company’s Certificate of Incorporation and Bylaws to the Board, provides oversight of engagement with shareholder proposals and recommends Board responses to such proposals. |

| | |

Compensation Committee Interlocks and Insider Participation

Mses. Cunningham, Taylor and Woung-Chapman and Mr. McCarthy currently serve on the Compensation and Human Resources Committee. During 2023, none of the directors who served on the Compensation and Human Resources Committee (i) was an officer or employee of the Company, or (ii) had any relationship requiring disclosure by the Company under any paragraph of Item 404 of Regulation S-K; and none of the Company’s executive officers served as a director or member of the compensation committee (or other committee performing similar functions) of any other entity of which an executive officer served on the Board or the Compensation and Human Resources Committee.

Director Engagement

Meeting and Attendance

During 2023, the Company's Board and committee meetings were as follows:

| | | | | | | | |

15 meetings THE BOARD | 10 meetings COMPENSATION AND HUMAN RESOURCES COMMITTEE | 4 meetings ENVIRONMENTAL, SOCIAL AND GOVERNANCE COMMITTEE |

| |

5 meetings AUDIT AND RESERVES COMMITTEE | 5 meetings NOMINATING AND GOVERNANCE COMMITTEE |

| | |

| | | | | | | | | | | |

| | | |

Director attendance for Board and committee meetings averaged 99% of the total number of meetings of the Board and committees on which the Director served. | | | 100% of the directors attended the Chord 2023 annual meeting of shareholders. |

| | | |

As set forth in the Company’s Corporate Governance Guidelines, all directors are expected to attend each annual meeting of shareholders.

Board Education and Onboarding

The Board has an orientation and onboarding program for new directors and provides continuing education for all directors that is overseen by the Nominating and Governance Committee.

| | | | | |

| |

| New Director Orientation | The orientation program is tailored to the needs of each new director depending on his or her level of experience serving on other boards and knowledge of Chord and the oil and gas industry. Materials provided include information on Chord's strategic plans, financial matters, and governance practices. The onboarding process includes a series of meetings with members of senior management and their staff for briefings on our operations, financial strategies, and values. The orientation program may include a visit to our field sites. |

| |

| |

| Continuing Education | Continued Education is provided during Board and committee meetings and is focused on topics that are designed to assist directors in fulfilling their duties, including reviews of compliance and governance developments; learning opportunities through site visits; and briefings on topics that present special risks and opportunities to Chord. Education often takes the form of “white papers” covering timely subjects or topics. As part of the Board’s annual evaluation process, directors are asked to identify areas where they feel continuing education would be helpful. |

| |

| |