EXHIBIT 99.3

Higher One Holdings, Inc. Q1'13 Earnings Results May 7, 2013

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Forward-Looking Statements This presentation includes forward-looking statements, as defined by the Securities and Exchange Commission. Management's projections and expectations are subject to a number of risks and uncertainties that could cause actual performance to differ materially from that predicted or implied. These statements speak only as of the date they are made, and the company does not intend to update or otherwise revise the forward-looking information to reflect actual results of operations, changes in financial condition, changes in estimates, expectations or assumptions, changes in general economic or industry conditions or other circumstances arising and/or existing since the preparation of this presentation or to reflect the occurrence of any unanticipated events. The forward-looking statements in this presentation do not include the potential impact of any acquisitions or divestitures that may be announced and/or completed after the date hereof. Information about the factors that could affect future performance can be found in our recent SEC filings, available on our website at http://ir.higherone.com/. This presentation includes certain metrics presented on a non-GAAP basis, including non-GAAP adjusted EBITDA, non-GAAP adjusted EBITDA margin, non-GAAP adjusted net income, non-GAAP adjusted diluted EPS, and non-GAAP Free Cash Flow. We believe that these non-GAAP measures, which exclude amortization of intangibles, stock-based compensation, and certain non-recurring or non-cash impacts to our results, all net of taxes, provide useful information regarding normalized trends relating to the company's financial condition and results of operations. Reconciliations of these non-GAAP measures to their closest comparable GAAP measure are included in the appendix of this presentation.

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Higher One's Core Goals Lower the cost of education by improving administrative efficiencies and reducing fraud and waste Provide financial literacy and low-cost financial services to college students Help schools improve student success by providing better data to efficiently allocate resources

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Campus Solutions Acquisition – Rationale Campus Solutions is a division of Sallie Mae that provides a suite of services to more than 450 college and university business offices across the country Campus Solutions product suite: Tuition Payment Plans NetPay Refund disbursement Why this makes sense: Opportunity to significantly grow refund and payment client base Further diversify revenue Provide future opportunities to work with Sallie Mae on other products and initiatives Increase total SSE exposure to over 13.2 million students Solidifies competitive market leading position

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Campus Solutions Acquisition – Financial Impact Purchase price: ~$46 million in cash Dilutive after acquisition related expenses ~$24 million annual revenue in 2012 Expected cross selling opportunity Will convert existing Campus Solutions Refund clients to OneDisburse, generating additional revenue in 2014 Expenses: Short-term: Cost synergies from elimination of duplication of corporate and allocated expense, reduction of client facing costs Near-term: Further synergies expected once client facing operations are fully integrated Long-term: Data processing and technology costs – plan for 12 to 24 month transition

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Sales Update Product Development Regulatory & Compliance Today's Additional Topics

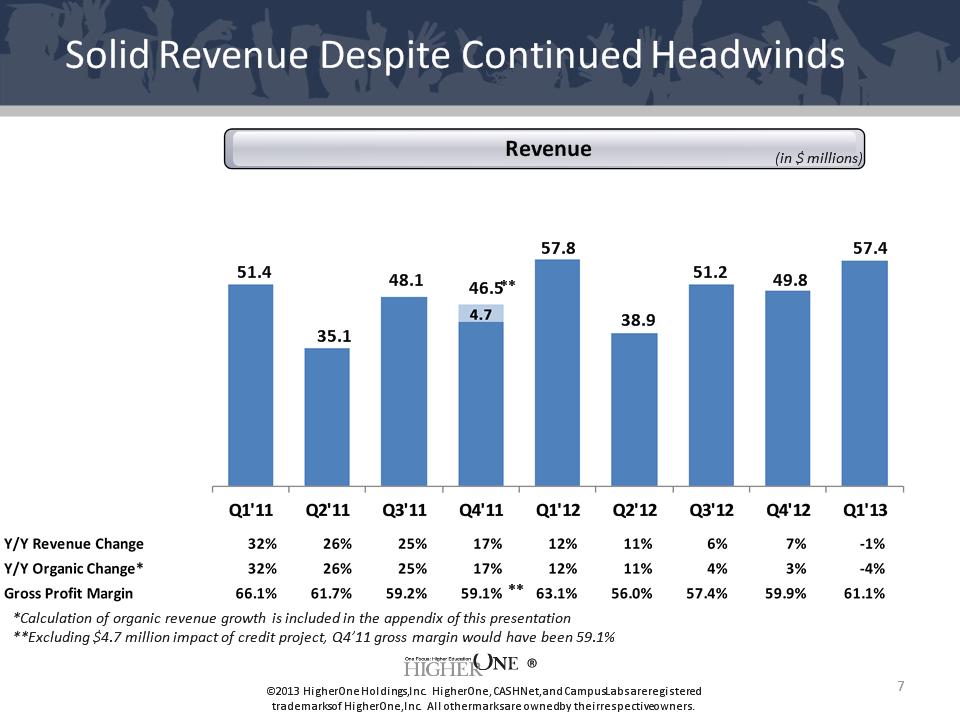

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * (in $ millions) Solid Revenue Despite Continued Headwinds 49.8 51.4 35.1 48.1 46.5 ** ** 57.8 38.9 *Calculation of organic revenue growth is included in the appendix of this presentation **Excluding $4.7 million impact of credit project, Q4'11 gross margin would have been 59.1% 51.2 57.4

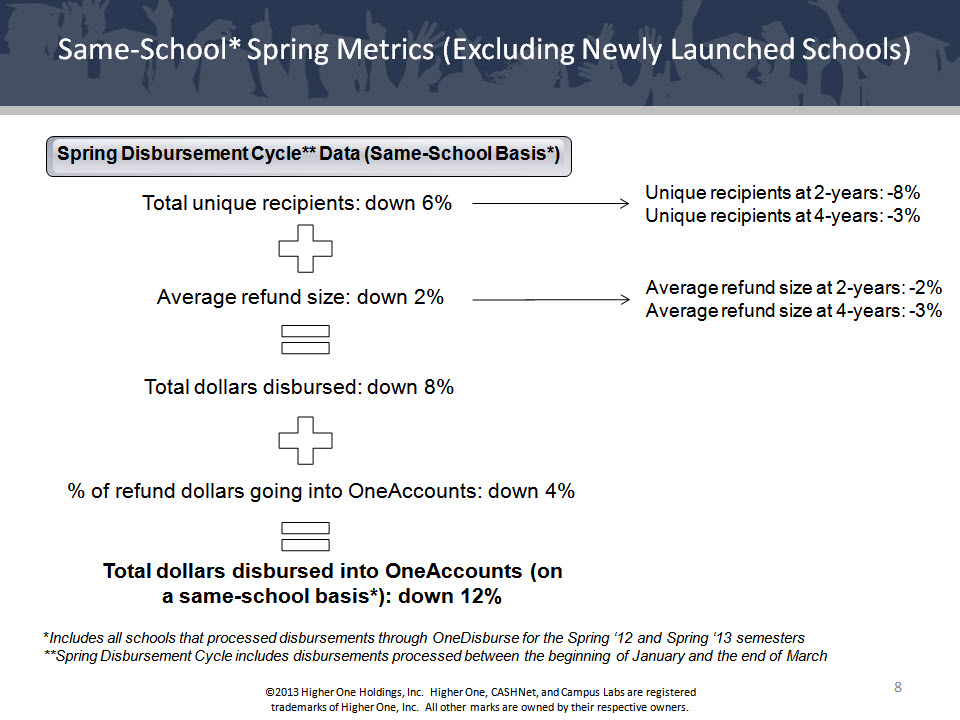

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Same-School* Spring Metrics (Excluding Newly Launched Schools) Total unique recipients: down 6% Average refund size: down 2% Total dollars disbursed: down 8% % of refund dollars going into OneAccounts: down 4% Total dollars disbursed into OneAccounts (on a same-school basis*): down 12% Spring Disbursement Cycle** Data (Same-School Basis*) Unique recipients at 2-years: -8% Unique recipients at 4-years: -3% Average refund size at 2-years: -2% Average refund size at 4-years: -3% *Includes all schools that processed disbursements through OneDisburse for the Spring '12 and Spring '13 semesters **Spring Disbursement Cycle includes disbursements processed between the beginning of January and the end of March

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Aggregate Spring Metrics (Including Newly Launched Schools) Launched SSE: up 17% Total refund dollars disbursed: up 4.7% % of total dollars disbursed going into OneAccounts: down 8% Dollars disbursed into OneAccounts: down 4% When factoring in non-refund deposits, total deposits are down 2%

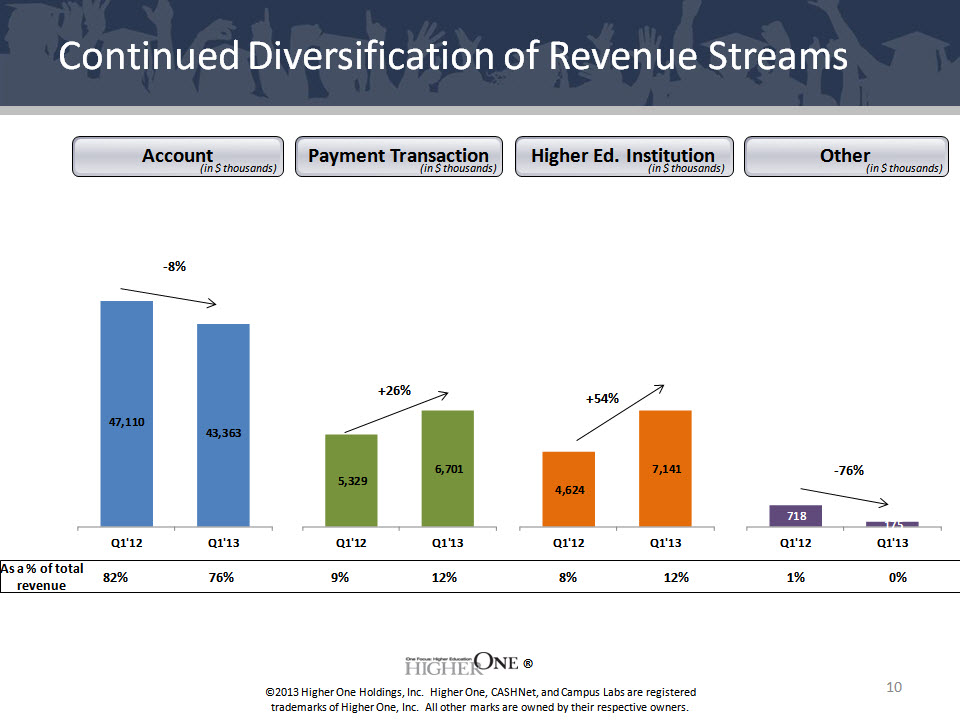

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Continued Diversification of Revenue Streams As a % of total revenue (in $ thousands) (in $ thousands) (in $ thousands) (in $ thousands) 82% 76% 9% 12% 8% 12% 1% 0% -8% +26% +54% -76%

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Increases in G&A, PD and Marketing Spend Professional fees higher in quarter Increase in depreciation, mainly due to IT infrastructure Includes a full quarter of Campus Labs Increased costs related to Campus Labs acquisition, including personnel and amortization (as a % of rev) (as a % of rev ) (as a % of rev) 5.6%

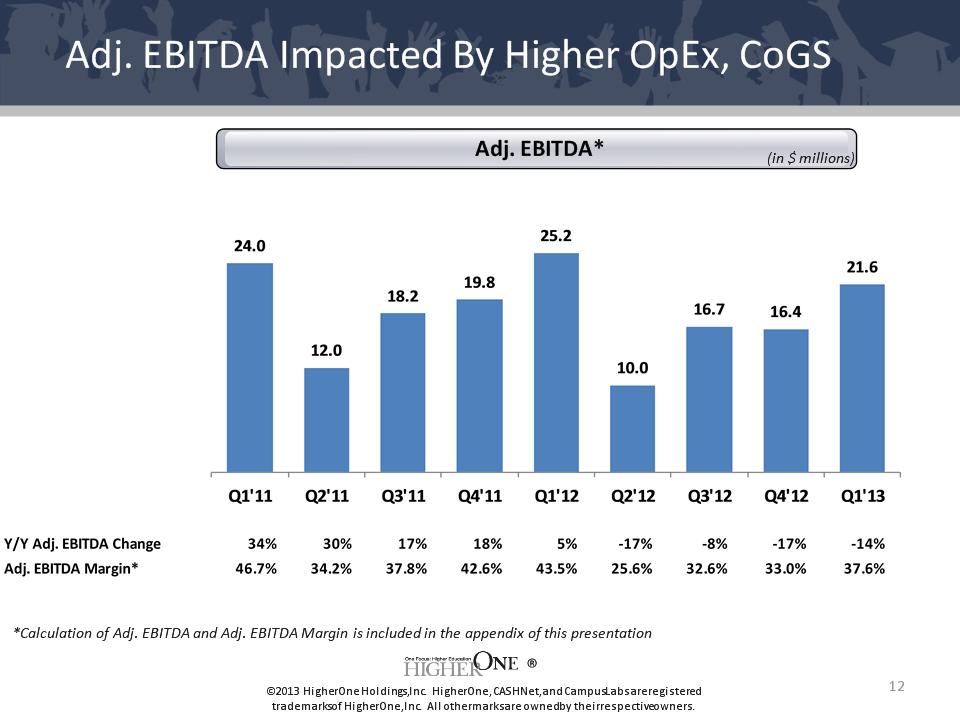

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Adj. EBITDA Impacted By Higher OpEx, CoGS *Calculation of Adj. EBITDA and Adj. EBITDA Margin is included in the appendix of this presentation (in $ millions)

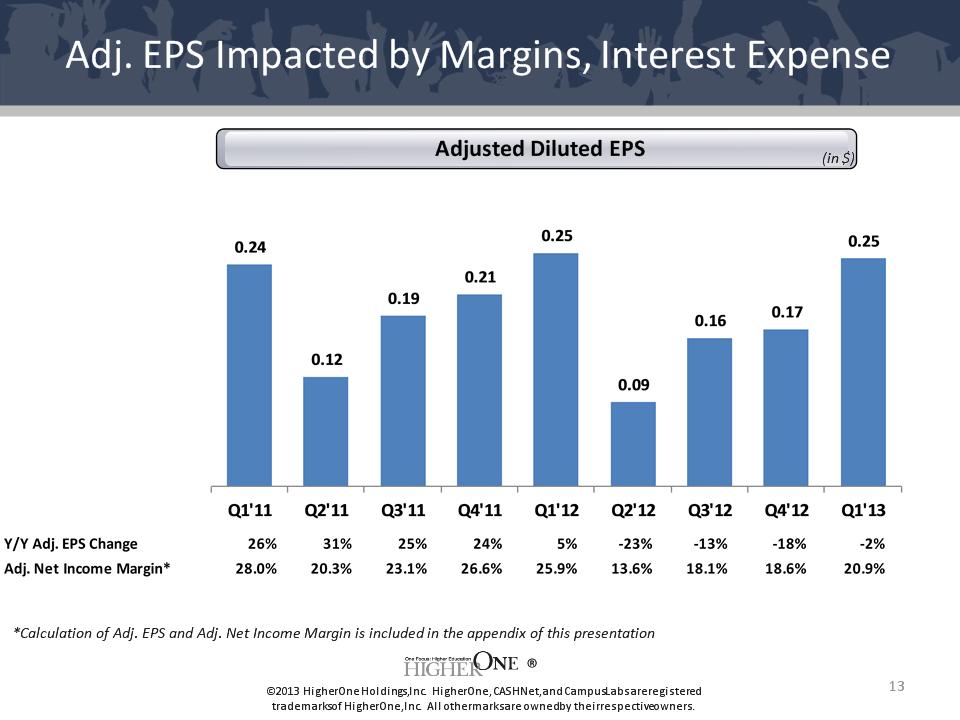

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Adj. EPS Impacted by Margins, Interest Expense *Calculation of Adj. EPS and Adj. Net Income Margin is included in the appendix of this presentation (in $)

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * FCF Benefitting from Lower CapEx *Calculation of Free Cash Flow is included in the appendix of this presentation (in $ millions)

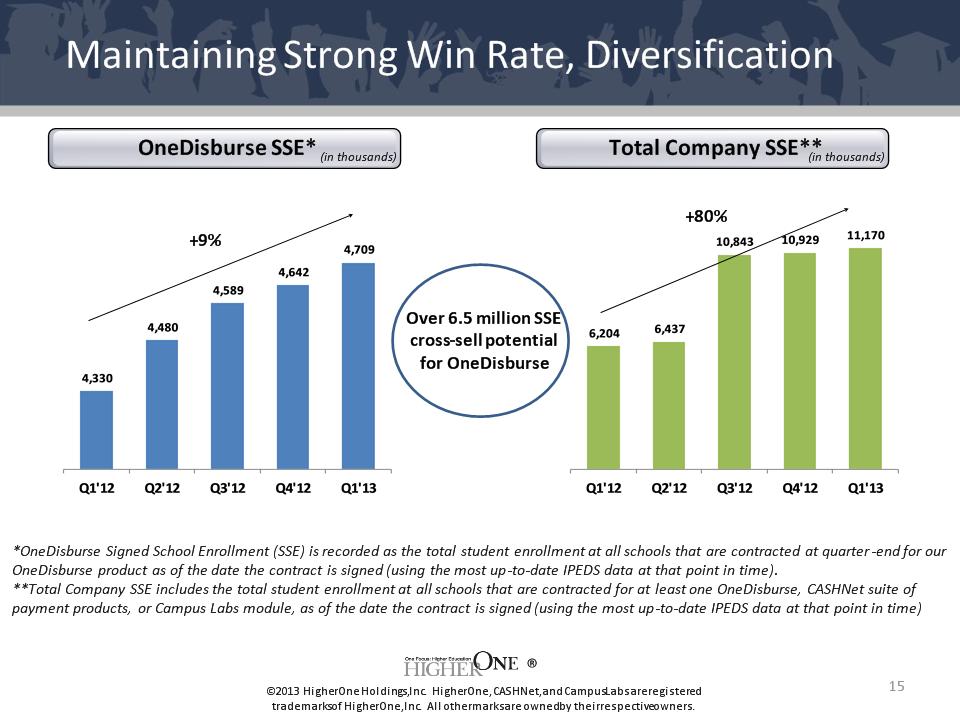

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Maintaining Strong Win Rate, Diversification *OneDisburse Signed School Enrollment (SSE) is recorded as the total student enrollment at all schools that are contracted at quarter-end for our OneDisburse product as of the date the contract is signed (using the most up-to-date IPEDS data at that point in time). **Total Company SSE includes the total student enrollment at all schools that are contracted for at least one OneDisburse, CASHNet suite of payment products, or Campus Labs module, as of the date the contract is signed (using the most up-to-date IPEDS data at that point in time) OneDisburse SSE* +9% (in thousands) Total Company SSE** (in thousands) +80% Over 6.5 million SSE cross-sell potential for OneDisburse

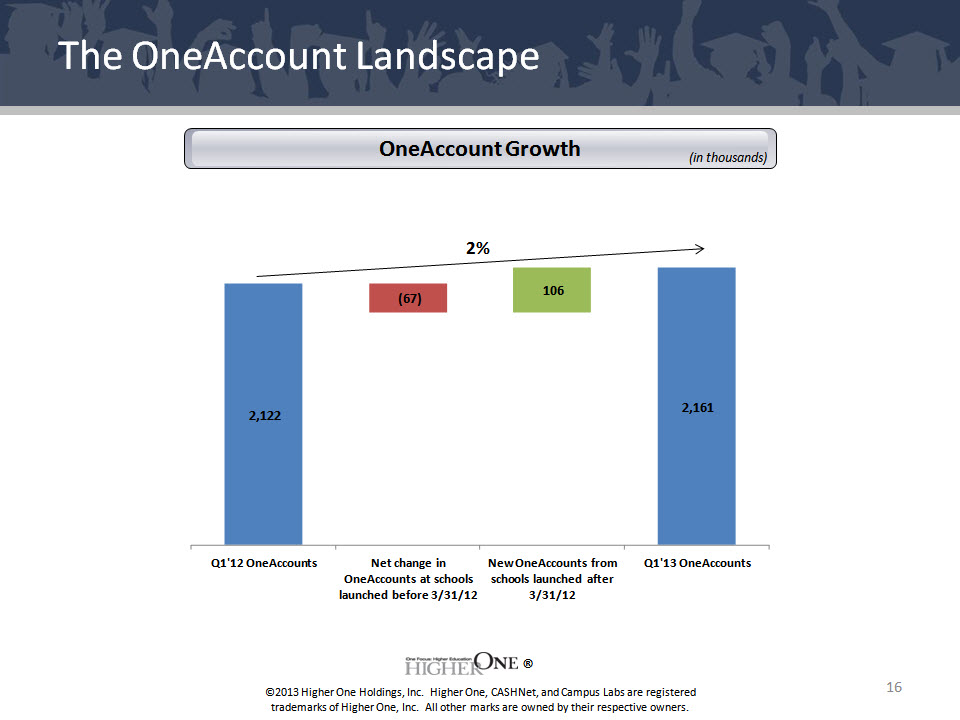

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * The OneAccount Landscape OneAccount Growth 2% (in thousands)

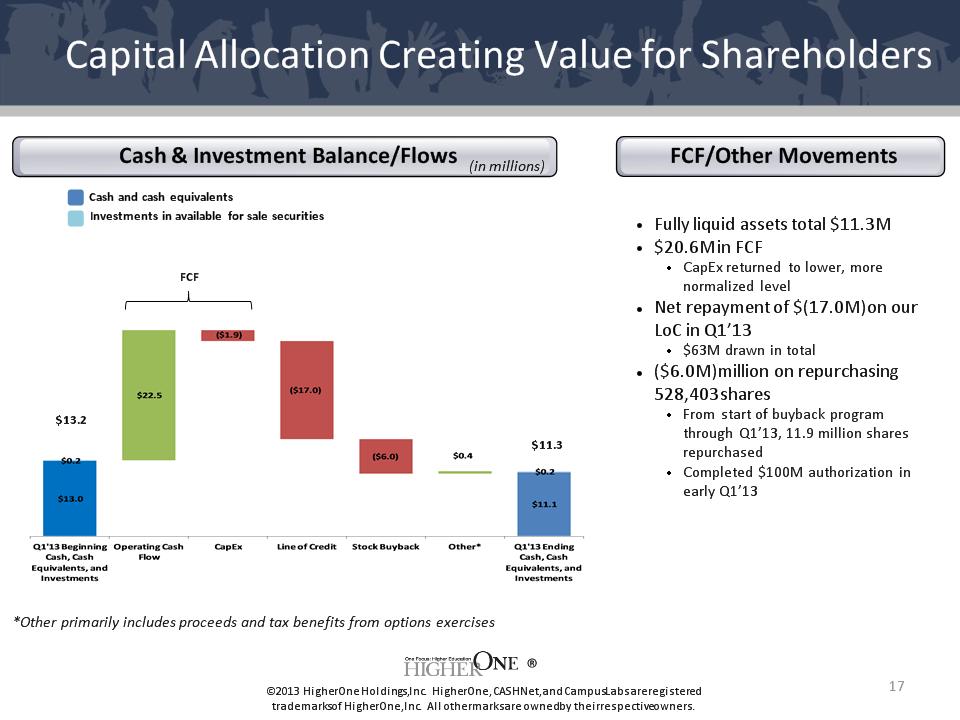

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Capital Allocation Creating Value for Shareholders *Other primarily includes proceeds and tax benefits from options exercises Cash & Investment Balance/Flows (in millions) FCF/Other Movements $13.2 FCF Cash and cash equivalents Investments in available for sale securities $11.3 Fully liquid assets total $11.3M $20.6M in FCF CapEx returned to lower, more normalized level Net repayment of $(17.0M) on our LoC in Q1'13 $63M drawn in total ($6.0M) million on repurchasing 528,403 shares From start of buyback program through Q1'13, 11.9 million shares repurchased Completed $100M authorization in early Q1'13

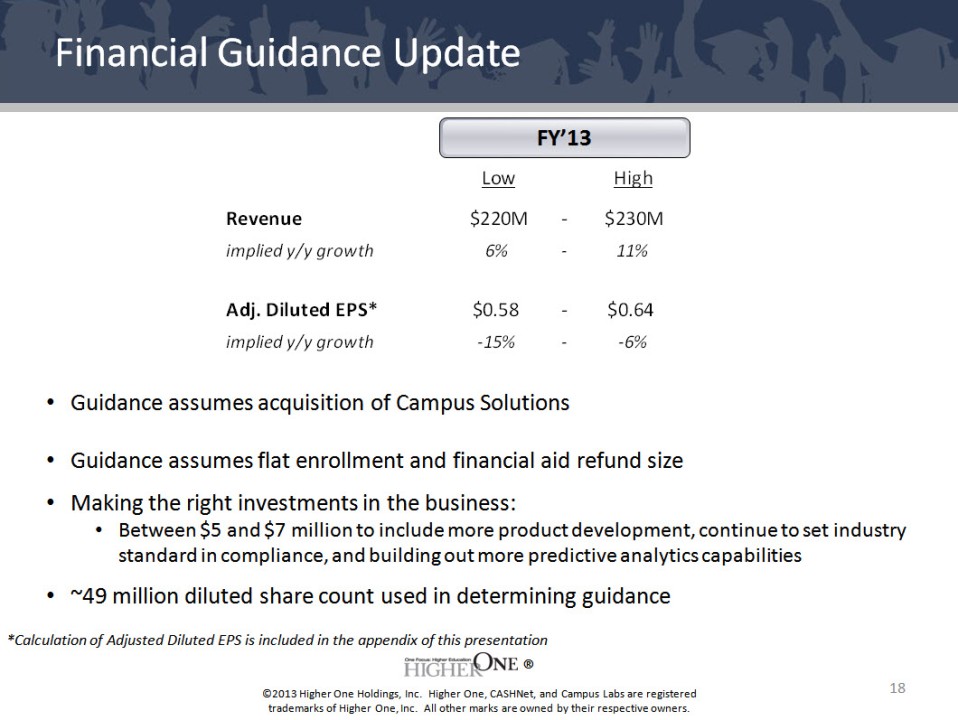

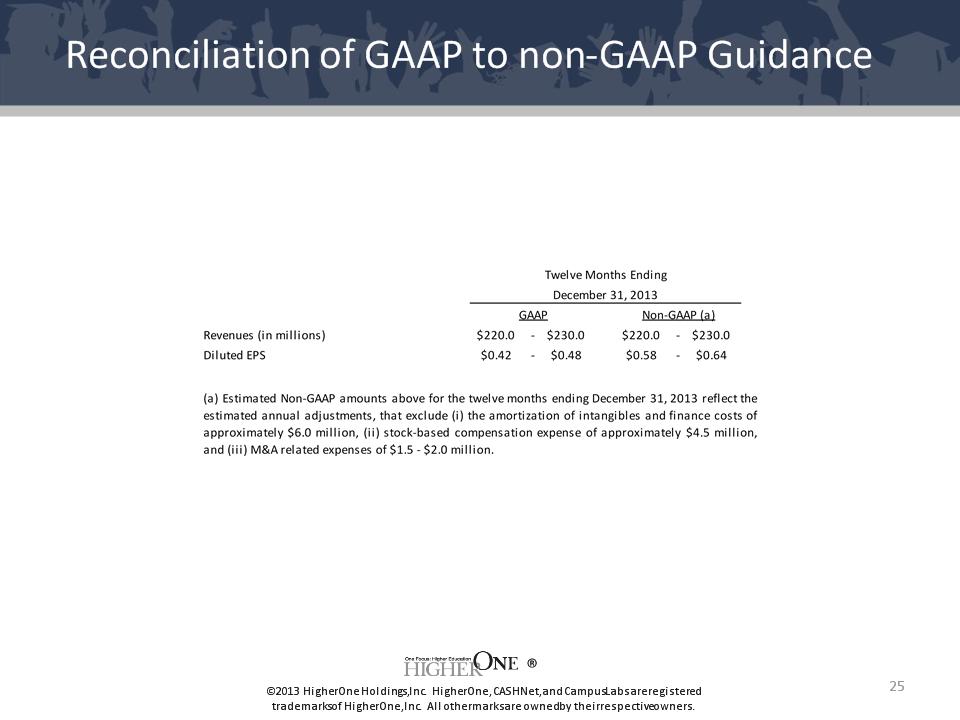

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Financial Guidance Update *Calculation of Adjusted Diluted EPS is included in the appendix of this presentation FY'13 Guidance assumes acquisition of Campus Solutions Guidance assumes flat enrollment and financial aid refund size Making the right investments in the business: Between $5 and $7 million to include more product development, continue to set industry standard in compliance, and building out more predictive analytics capabilities ~50 million diluted share count used in determining guidance

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Q & A

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Appendix

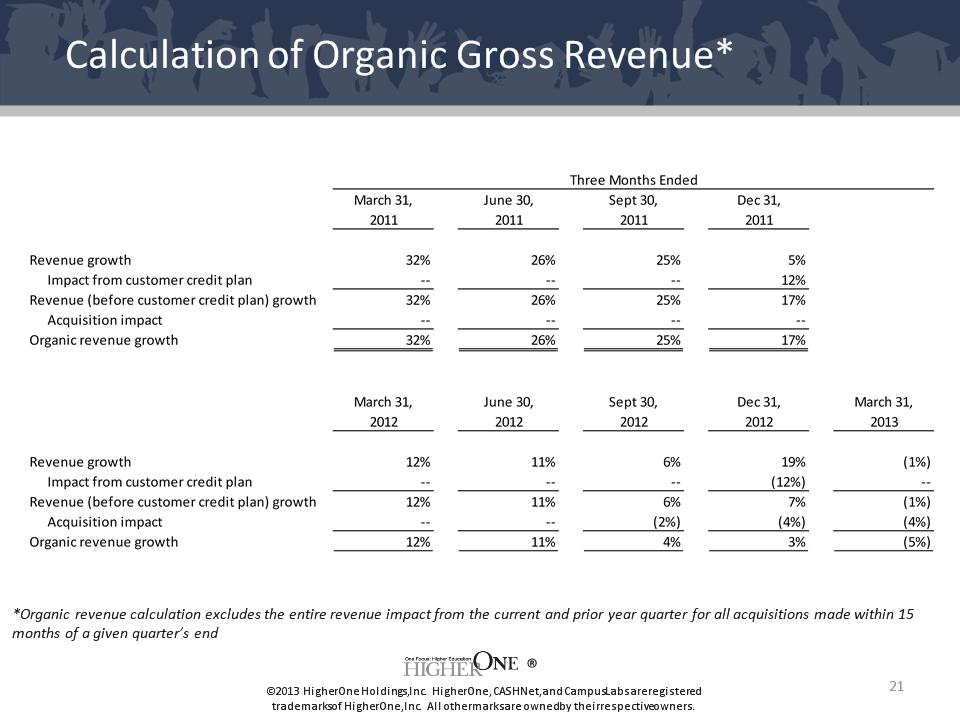

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Calculation of Organic Gross Revenue* *Organic revenue calculation excludes the entire revenue impact from the current and prior year quarter for all acquisitions made within 15 months of a given quarter's end

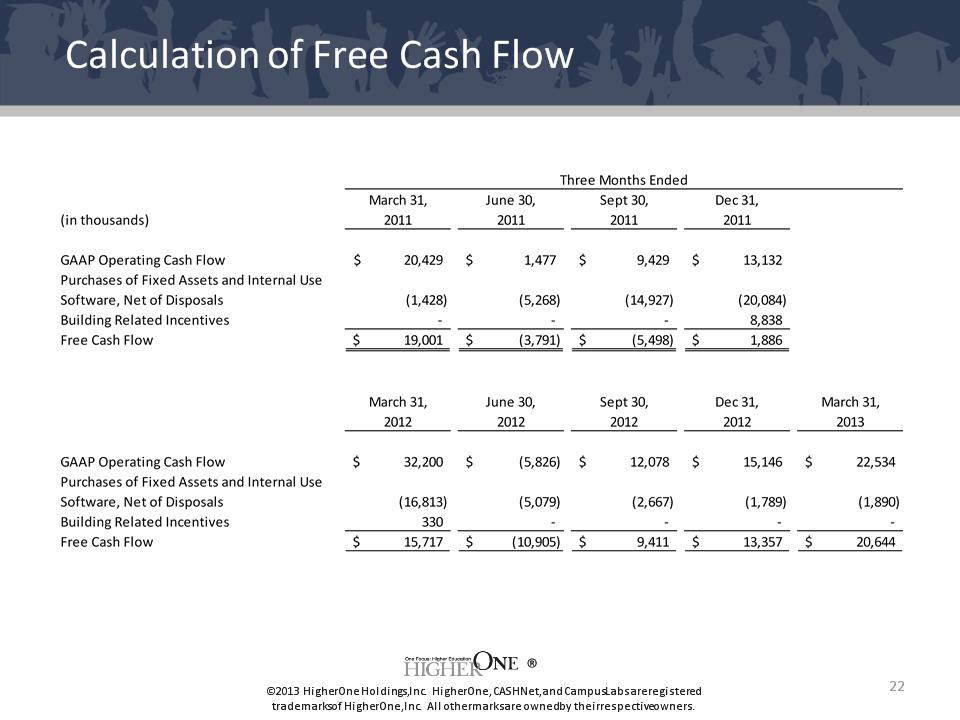

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Calculation of Free Cash Flow

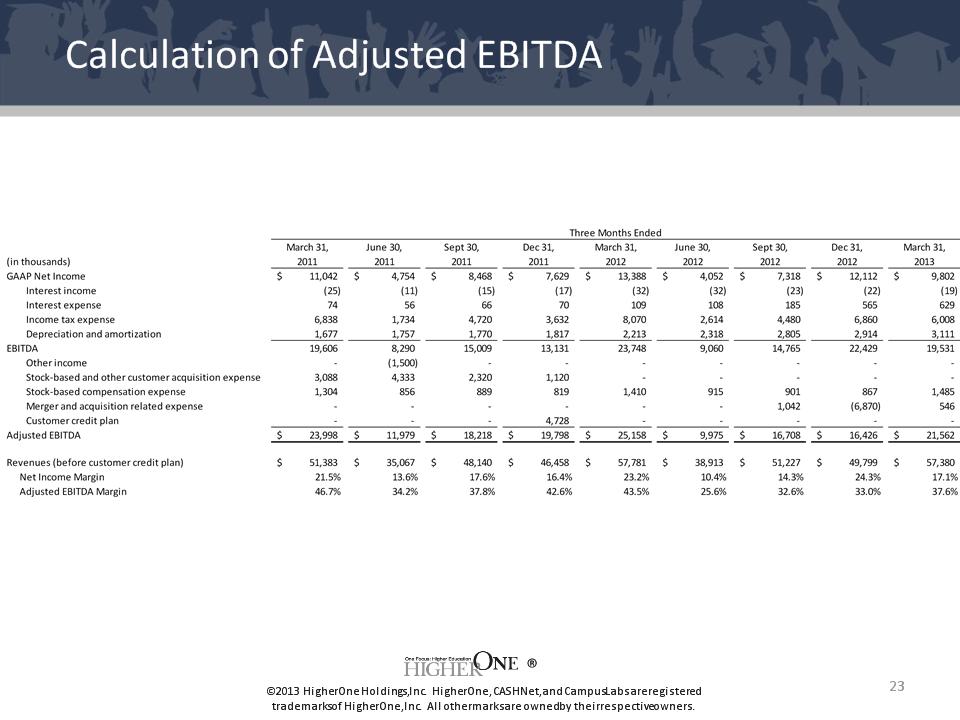

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Calculation of Adjusted EBITDA

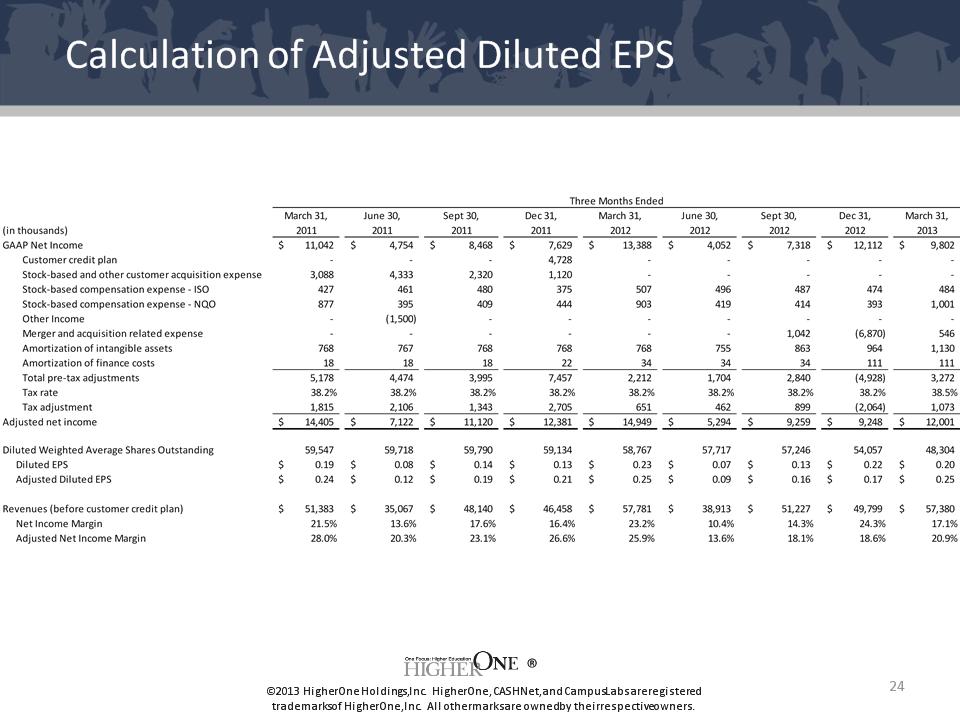

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Calculation of Adjusted Diluted EPS

® ©2013 Higher One Holdings, Inc. Higher One, CASHNet, and Campus Labs are registered trademarks of Higher One, Inc. All other marks are owned by their respective owners. * Reconciliation of GAAP to non-GAAP Guidance