1 Merger with LegacyTexas Group, Inc. Creation of Preferred Bank for Dallas Businesses and Families EXHIBIT 99.2

2 Safe Harbor Statement When used in this presentation, in filings by ViewPoint Financial Group, Inc. (“ViewPoint”) with the Securities and Exchange Commission (the “SEC”) in ViewPoint’s press releases or other public or shareholder communications, and in oral statements made with the approval of an authorized executive officer, the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “intends” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical earnings and those presently anticipated or projected, including, among other things, the expected cost savings, synergies and other financial benefits from the ViewPoint-LegacyTexas merger might not be realized within the expected time frames or at all and costs or difficulties relating to integration matters might be greater than expected, the requisite regulatory approvals and the approval of the shareholders of LegacyTexas might not be obtained or other conditions to completion of the merger set forth in the merger agreement might not be satisfied or waived, changes in economic conditions, legislative changes, changes in policies by regulatory agencies, fluctuations in interest rates, the risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses, ViewPoint’s ability to access cost-effective funding, fluctuations in real estate values and both residential and commercial real estate market conditions, demand for loans and deposits in ViewPoint’s market area, the industry-wide decline in mortgage production, competition, changes in management’s business strategies and other factors set forth in ViewPoint’s filings with the SEC. ViewPoint does not undertake – and specifically declines any obligation – to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. ViewPoint will be filing with the SEC a registration statement on Form S-4 concerning the merger. The registration statement will include a proxy statement/prospectus, which will be sent to the shareholders of LegacyTexas. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain these documents free of charge at the SEC’s website (www.sec.gov). In addition, documents filed with the SEC by ViewPoint will be available free of charge by accessing ViewPoint’s website (www.viewpointfinancialgroup.com, under “SEC Filings”) or by contacting Casey Farrell at (972) 801-5871. The directors, executive officers and certain other members of management and employees of ViewPoint may be deemed to be participants in the solicitation of proxies in favor of the merger from the shareholders of LegacyTexas. Information about the directors and executive officers of ViewPoint is included in the proxy statement for its 2013 annual meeting of shareholders, which was filed with the SEC on April 10, 2013. The directors, executive officers and certain other members of management and employees of LegacyTexas may also be deemed to be participants in the solicitation of proxies in favor of the merger from the shareholders of LegacyTexas. Information about the directors and executive officers of LegacyTexas will be included in the proxy statement/prospectus for the merger.

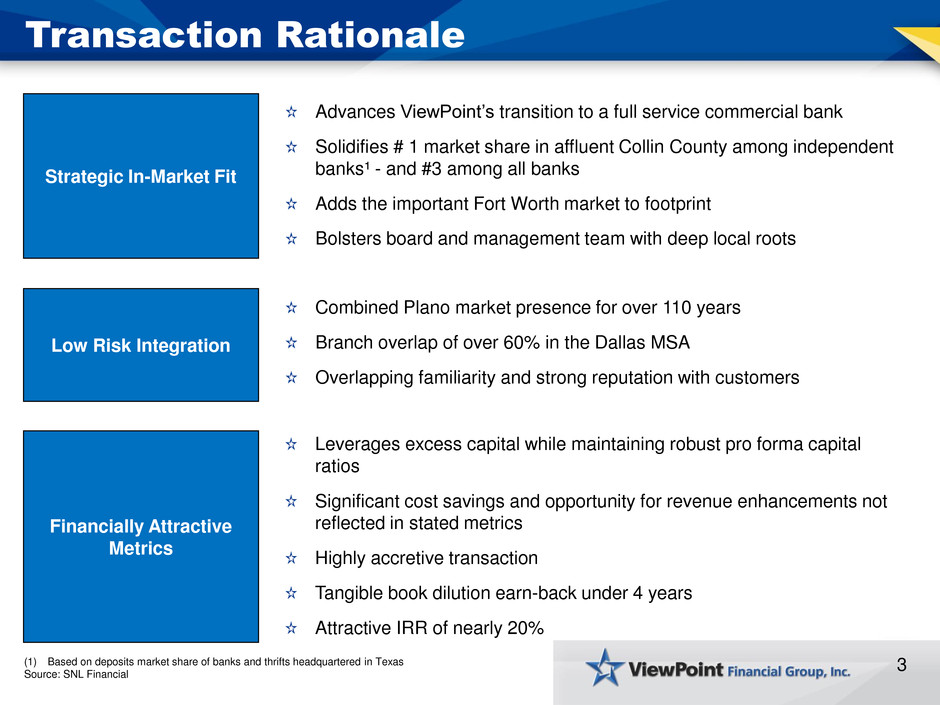

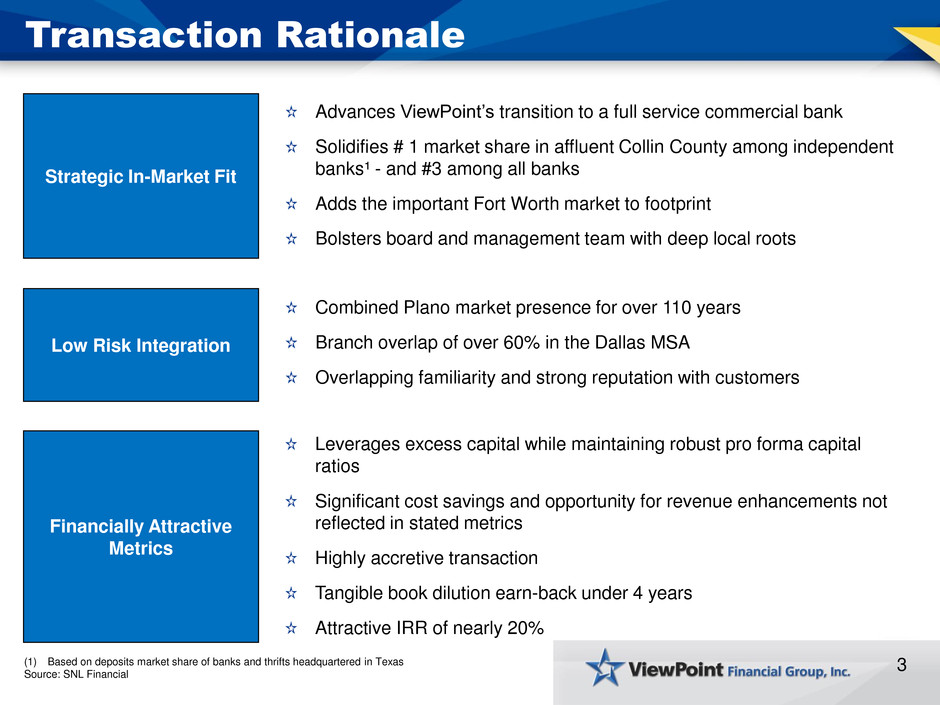

3 Transaction Rationale Advances ViewPoint’s transition to a full service commercial bank Solidifies # 1 market share in affluent Collin County among independent banks¹ - and #3 among all banks Adds the important Fort Worth market to footprint Bolsters board and management team with deep local roots (1) Based on deposits market share of banks and thrifts headquartered in Texas Source: SNL Financial Strategic In-Market Fit Financially Attractive Metrics Leverages excess capital while maintaining robust pro forma capital ratios Significant cost savings and opportunity for revenue enhancements not reflected in stated metrics Highly accretive transaction Tangible book dilution earn-back under 4 years Attractive IRR of nearly 20% Low Risk Integration Combined Plano market presence for over 110 years Branch overlap of over 60% in the Dallas MSA Overlapping familiarity and strong reputation with customers

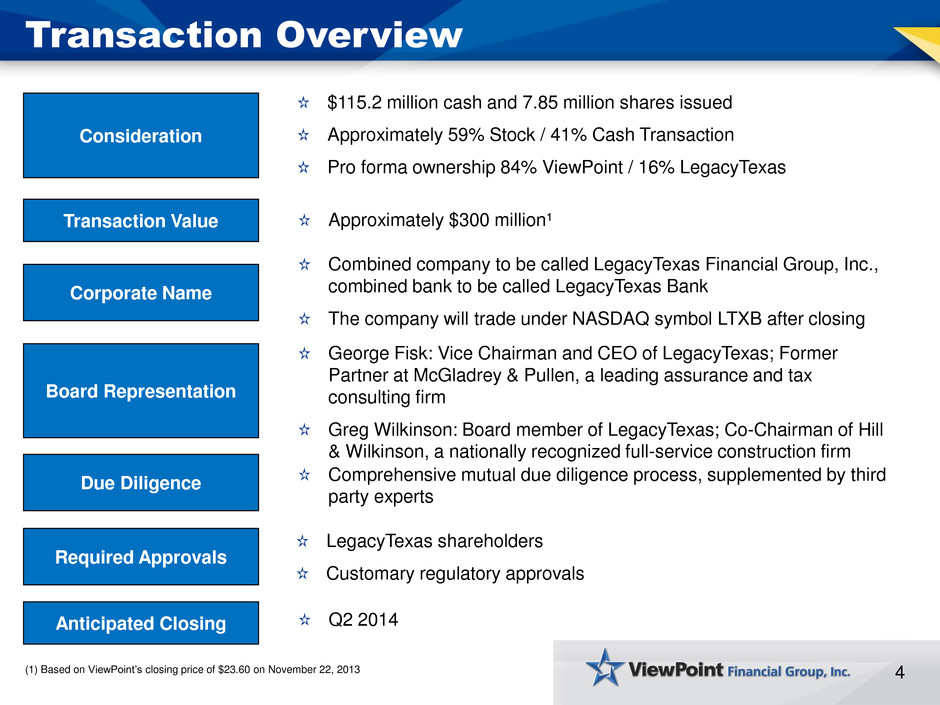

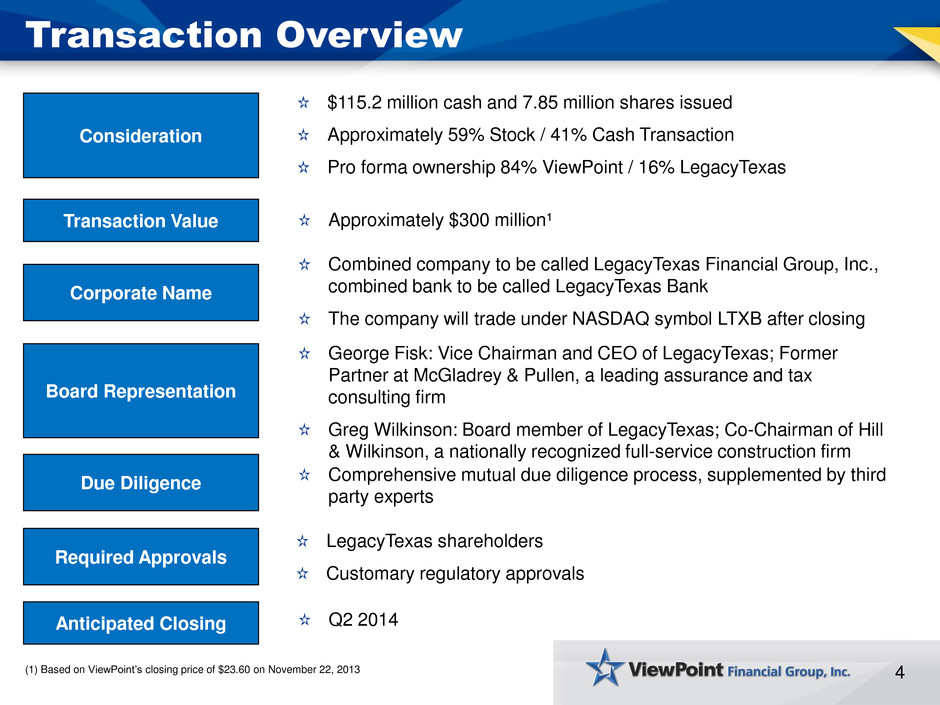

Transaction Overview $115.2 million cash and 7.85 million shares issued Approximately 59% Stock / 41% Cash Transaction Pro forma ownership 84% ViewPoint / 16% LegacyTexas Consideration Transaction Value Due Diligence Required Approvals Anticipated Closing Approximately $300 million¹ Comprehensive mutual due diligence process, supplemented by third party experts LegacyTexas shareholders Customary regulatory approvals Q2 2014 Corporate Name Combined company to be called LegacyTexas Financial Group, Inc., combined bank to be called LegacyTexas Bank The company will trade under NASDAQ symbol LTXB after closing Board Representation George Fisk: Vice Chairman and CEO of LegacyTexas; Former Partner at McGladrey & Pullen, a leading assurance and tax consulting firm Greg Wilkinson: Board member of LegacyTexas; Co-Chairman of Hill & Wilkinson, a nationally recognized full-service construction firm 4 (1) Based on ViewPoint’s closing price of $23.60 on November 22, 2013

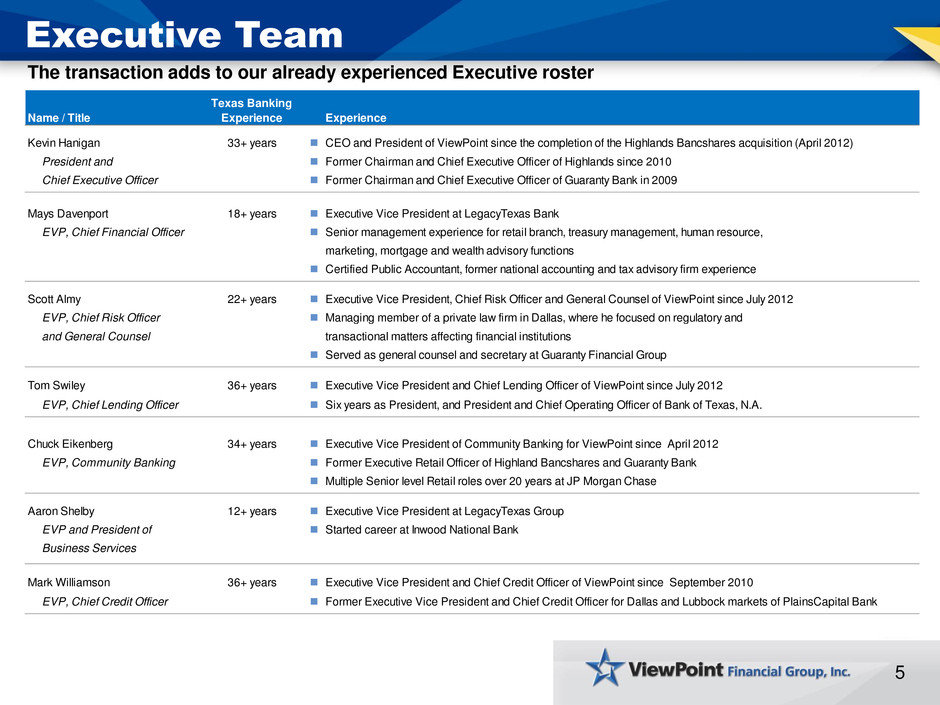

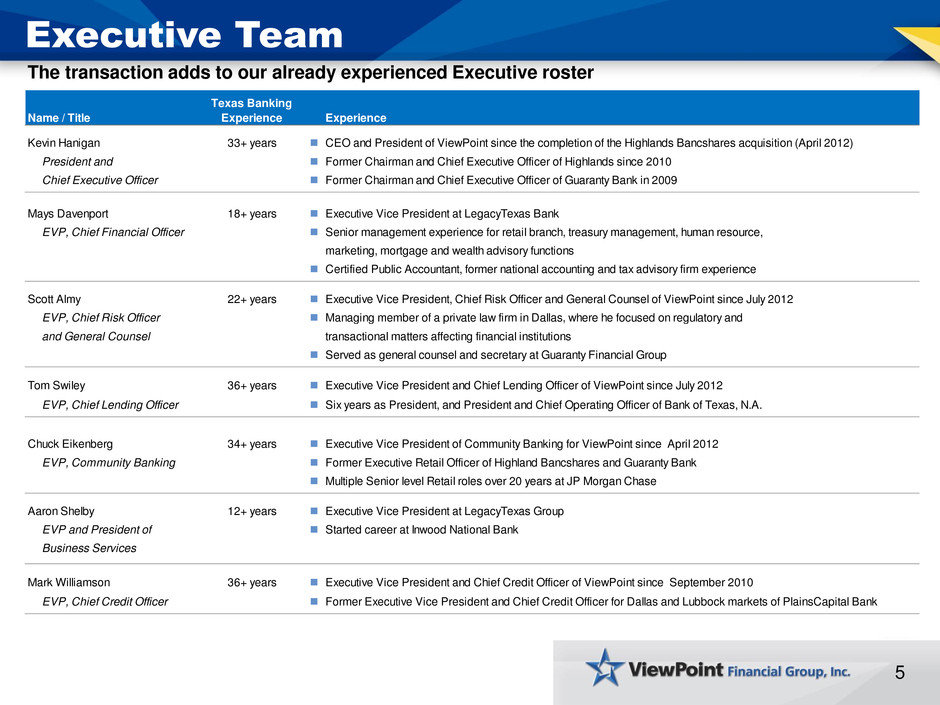

5 Name / Title Texas Banking Experience Experience Kevin Hanigan 33+ years n CEO and President of ViewPoint since the completion of the Highlands Bancshares acquisition (April 2012) President and n Former Chairman and Chief Executive Officer of Highlands since 2010 Chief Executive Officer n Former Chairman and Chief Executive Officer of Guaranty Bank in 2009 Mays Davenport 18+ years n Executive Vice President at LegacyTexas Bank EVP, Chief Financial Officer n Senior management experience for retail branch, treasury management, human resource, marketing, mortgage and wealth advisory functions n Certified Public Accountant, former national accounting and tax advisory firm experience Scott Almy 22+ years n Executive Vice President, Chief Risk Officer and General Counsel of ViewPoint since July 2012 EVP, Chief Risk Officer n Managing member of a private law firm in Dallas, where he focused on regulatory and and General Counsel transactional matters affecting financial institutions n Served as general counsel and secretary at Guaranty Financial Group Tom Swiley 36+ years n Executive Vice President and Chief Lending Officer of ViewPoint since July 2012 EVP, Chief Lending Officer n Six years as President, and President and Chief Operating Officer of Bank of Texas, N.A. Chuck Eikenberg 34+ years n Executive Vice President of Community Banking for ViewPoint since April 2012 EVP, Community Banking n Former Executive Retail Officer of Highland Bancshares and Guaranty Bank n Multiple Senior level Retail roles over 20 years at JP Morgan Chase Aaron Shelby 12+ years n Executive Vice President at LegacyTexas Group EVP and President of n Started career at Inwood National Bank Business Services Mark Williamson 36+ years n Executive Vice President and Chief Credit Officer of ViewPoint since September 2010 EVP, Chief Credit Officer n Former Executive Vice President and Chief Credit Officer for Dallas and Lubbock markets of PlainsCapital Bank Executive Team The transaction adds to our already experienced Executive roster

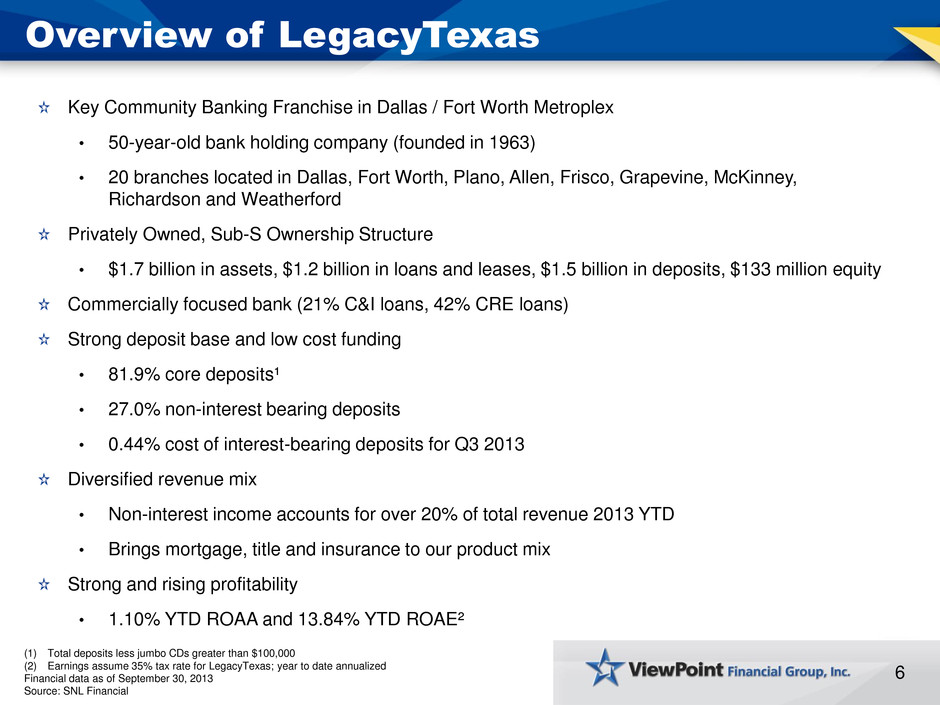

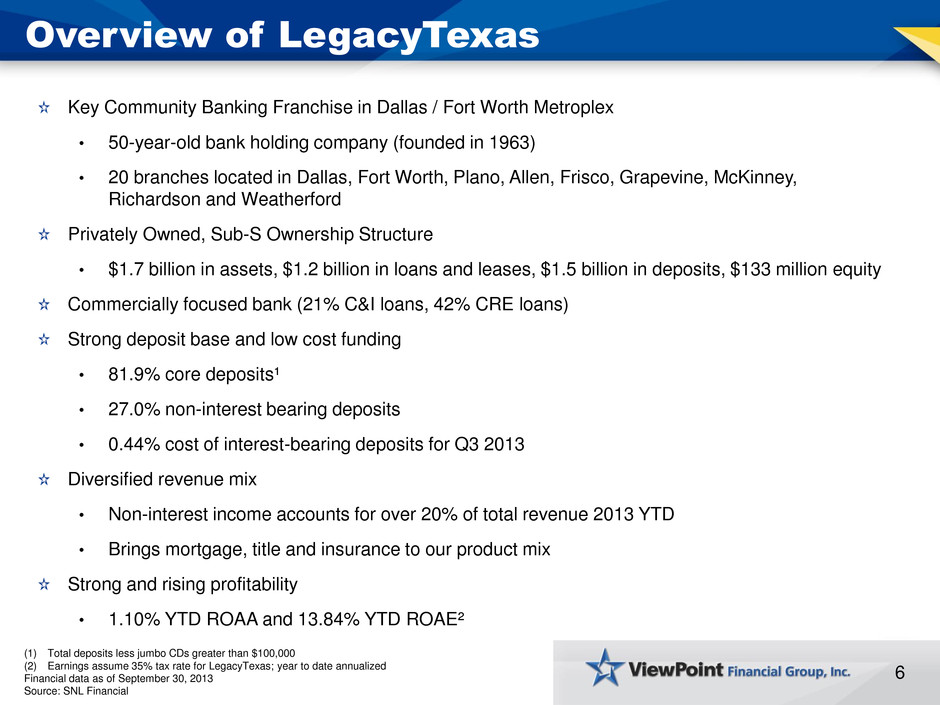

6 Overview of LegacyTexas Key Community Banking Franchise in Dallas / Fort Worth Metroplex • 50-year-old bank holding company (founded in 1963) • 20 branches located in Dallas, Fort Worth, Plano, Allen, Frisco, Grapevine, McKinney, Richardson and Weatherford Privately Owned, Sub-S Ownership Structure • $1.7 billion in assets, $1.2 billion in loans and leases, $1.5 billion in deposits, $133 million equity Commercially focused bank (21% C&I loans, 42% CRE loans) Strong deposit base and low cost funding • 81.9% core deposits¹ • 27.0% non-interest bearing deposits • 0.44% cost of interest-bearing deposits for Q3 2013 Diversified revenue mix • Non-interest income accounts for over 20% of total revenue 2013 YTD • Brings mortgage, title and insurance to our product mix Strong and rising profitability • 1.10% YTD ROAA and 13.84% YTD ROAE² (1) Total deposits less jumbo CDs greater than $100,000 (2) Earnings assume 35% tax rate for LegacyTexas; year to date annualized Financial data as of September 30, 2013 Source: SNL Financial

7 Branch Map Source: SNL Financial Texas Franchise LegacyTexas (20 branches total) ViewPoint (31 branches total) Dallas Fort Worth MSA Franchise

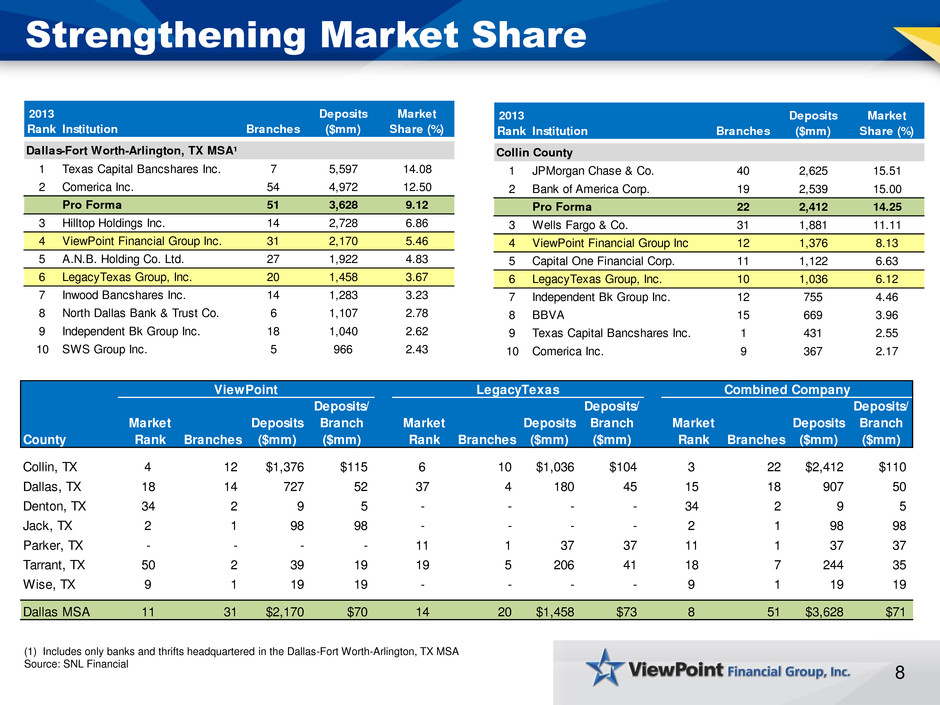

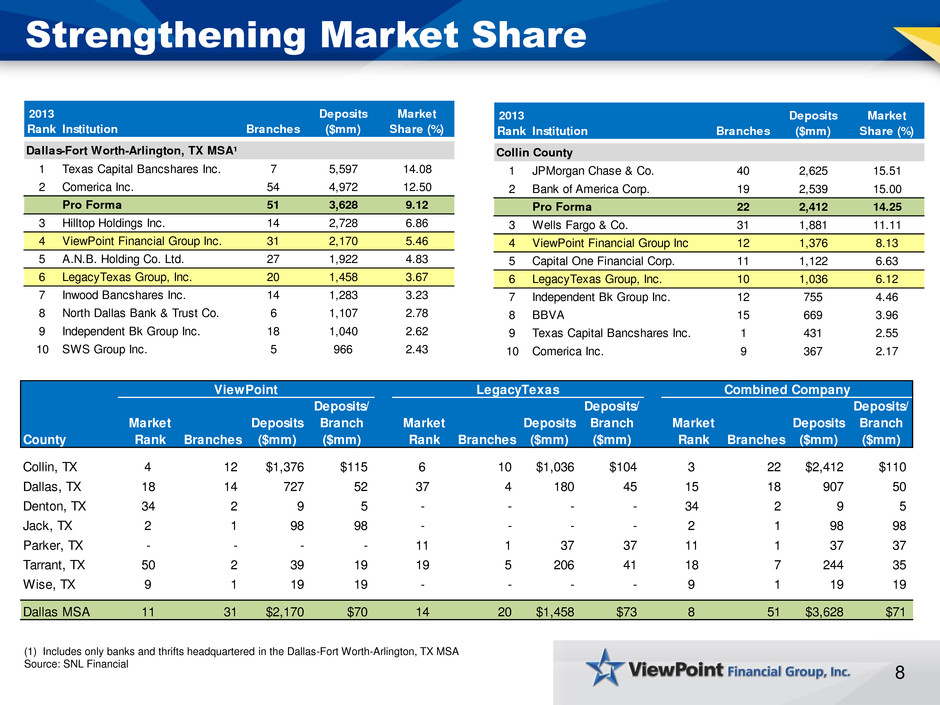

8 Strengthening Market Share (1) Includes only banks and thrifts headquartered in the Dallas-Fort Worth-Arlington, TX MSA Source: SNL Financial 2013 Rank Institution Branches Deposits ($mm) Market Share (%) Dallas-Fort Worth-Arlington, TX MSA¹ 1 Texas Capital Bancshares Inc. 7 5,597 14.08 2 Comerica Inc. 54 4,972 12.50 Pro Forma 51 3,628 9.12 3 Hilltop Holdings Inc. 14 2,728 6.86 4 ViewPoint Financial Group Inc. 31 2,170 5.46 5 A.N.B. Holding Co. Ltd. 27 1,922 4.83 6 LegacyTexas Group, Inc. 20 1,458 3.67 7 Inwood Bancshares Inc. 14 1,283 3.23 8 North Dallas Bank & Trust Co. 6 1,107 2.78 9 Independent Bk Group Inc. 18 1,040 2.62 10 SWS Group Inc. 5 966 2.43 2013 Rank Institution Branches Deposits ($mm) Market Share (%) Colli C unty 1 JPMorgan Chase & Co. 40 2,625 15.51 2 Bank of America Corp. 19 2,539 15.00 Pro Forma 22 ,412 14.25 3 Wells Fargo & Co. 31 1,881 11.11 4 ViewPoint Financial Group Inc 12 1,376 8.13 5 Capital One Financial Corp. 11 1,122 6.63 6 Lega yTexas Group, Inc. 10 1,036 6.12 7 Independent Bk Group Inc. 12 755 4.46 8 BBVA 15 669 3.96 9 Texas Capital Bancshares Inc. 1 431 2.55 10 Comerica Inc. 9 367 2.17 ViewPoint LegacyTexas Combined Company County Market Rank Branches Deposits ($mm) Deposits/ Branch ($mm) Market Rank Branches Deposits ($mm) Deposits/ Branch ($mm) Market Rank Branches Deposits ($mm) Deposits/ Branch ($mm) Collin, TX 4 12 $1,376 $115 6 10 $1,036 $104 3 22 $2,412 $110 Dallas, TX 18 1 727 52 37 4 180 45 15 18 907 50 Denton, TX 34 2 9 5 - - - - 34 2 9 5 Jack, TX 2 1 98 98 - - - - 2 1 98 98 Parker, TX - - - - 11 1 37 37 11 1 37 37 Tarrant, TX 50 2 39 19 19 5 206 41 18 7 244 35 Wise, TX 9 1 19 19 - - - - 9 1 19 19 Dallas MSA 11 31 $2,170 $70 14 20 $1,458 $73 8 51 $3,628 $71

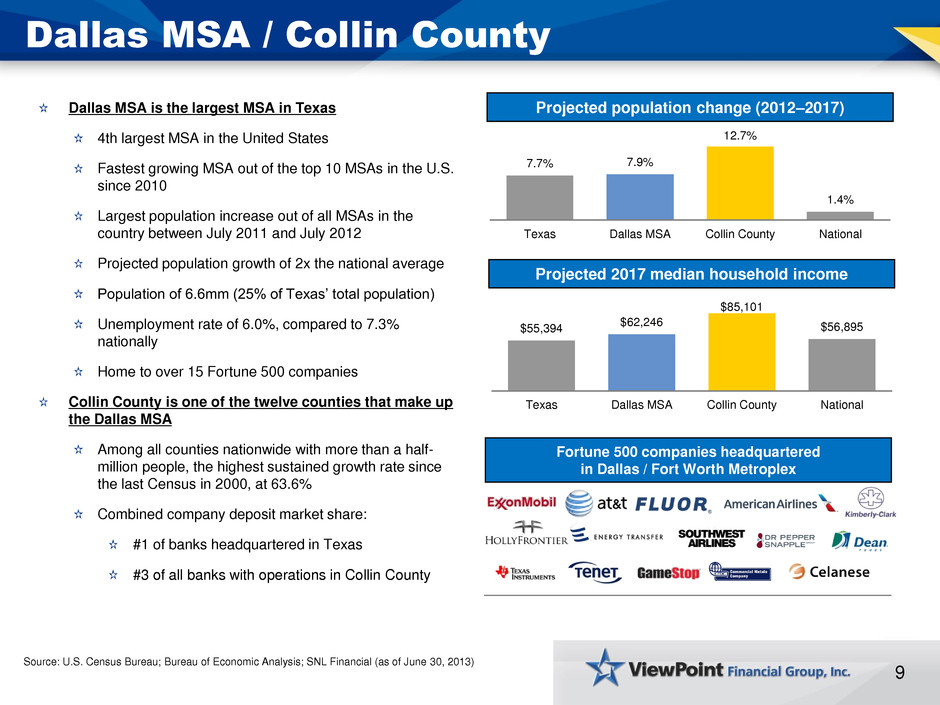

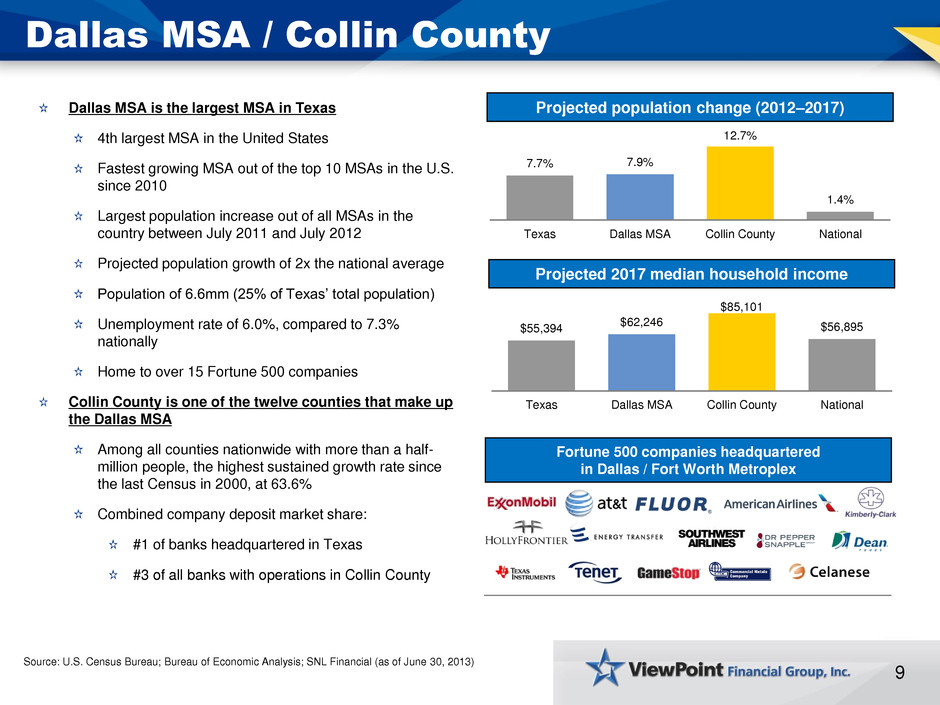

9 Dallas MSA / Collin County Dallas MSA is the largest MSA in Texas 4th largest MSA in the United States Fastest growing MSA out of the top 10 MSAs in the U.S. since 2010 Largest population increase out of all MSAs in the country between July 2011 and July 2012 Projected population growth of 2x the national average Population of 6.6mm (25% of Texas’ total population) Unemployment rate of 6.0%, compared to 7.3% nationally Home to over 15 Fortune 500 companies Collin County is one of the twelve counties that make up the Dallas MSA Among all counties nationwide with more than a half- million people, the highest sustained growth rate since the last Census in 2000, at 63.6% Combined company deposit market share: #1 of banks headquartered in Texas #3 of all banks with operations in Collin County 7.7% 7.9% 12.7% 1.4% Texas Dallas MSA Collin County National $55,394 $62,246 $85,101 $56,895 Texas Dallas MSA Collin County National Projected population change (2012–2017) Projected 2017 median household income Fortune 500 companies headquartered in Dallas / Fort Worth Metroplex Source: U.S. Census Bureau; Bureau of Economic Analysis; SNL Financial (as of June 30, 2013)

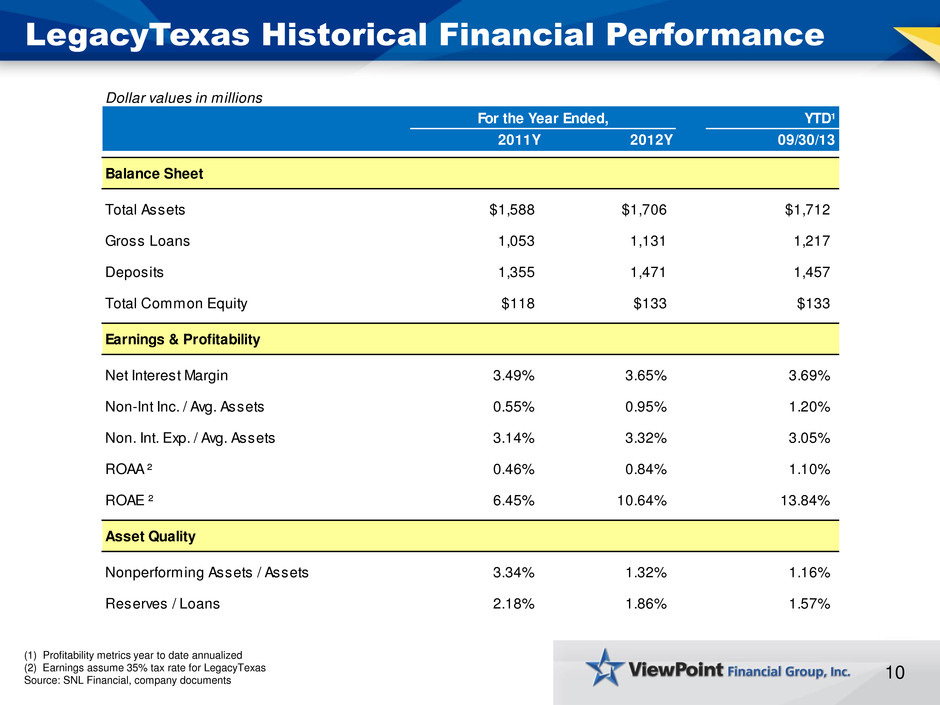

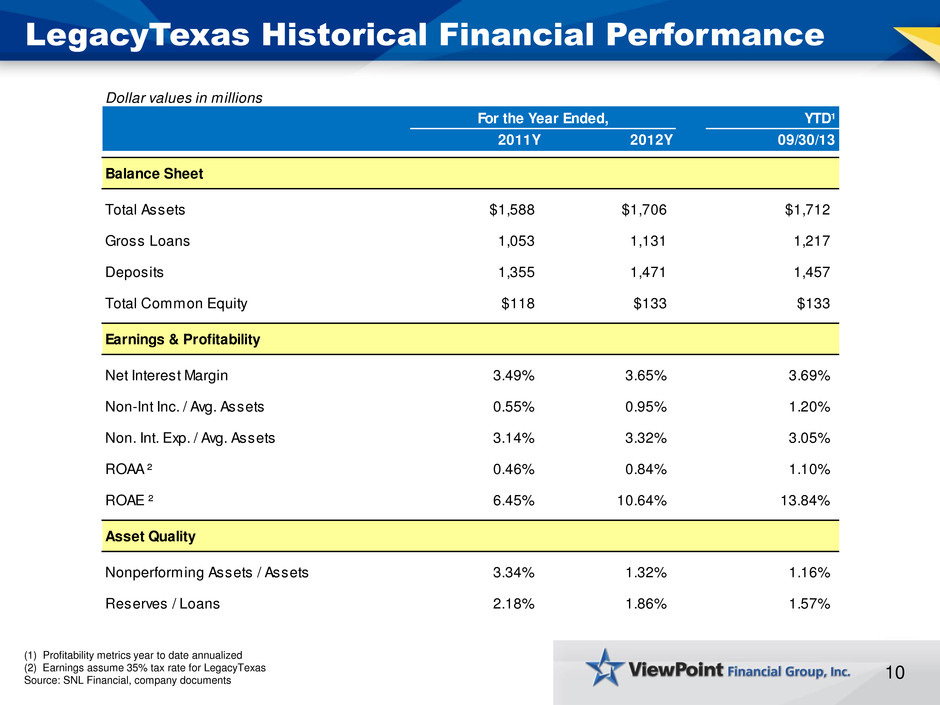

10 LegacyTexas Historical Financial Performance (1) Profitability metrics year to date annualized (2) Earnings assume 35% tax rate for LegacyTexas Source: SNL Financial, company documents Dollar values in millions For the Year Ended, YTD¹ 2011Y 2012Y 09/30/13 Balance Sheet Total Assets $1,588 $1,706 $1,712 Gross Loans 1,053 1,131 1,217 Deposits 1,355 1,471 1,457 Total Common Equity $118 $133 $133 Earnings & Profitability Net Interest Margin 3.49% 3.65% 3.69% Non-Int Inc. / Avg. Assets 0.55% 0.95% 1.20% Non. Int. Exp. / Avg. Assets 3.14% 3.32% 3.05% ROAA ² 0.46% 0.84% 1.10% ROAE ² 6.45% 10.64% 13.84% Asset Quality Nonperforming Assets / Assets 3.34% 1.32% 1.16% Reserves / Loans 2.18% 1.86% 1.57%

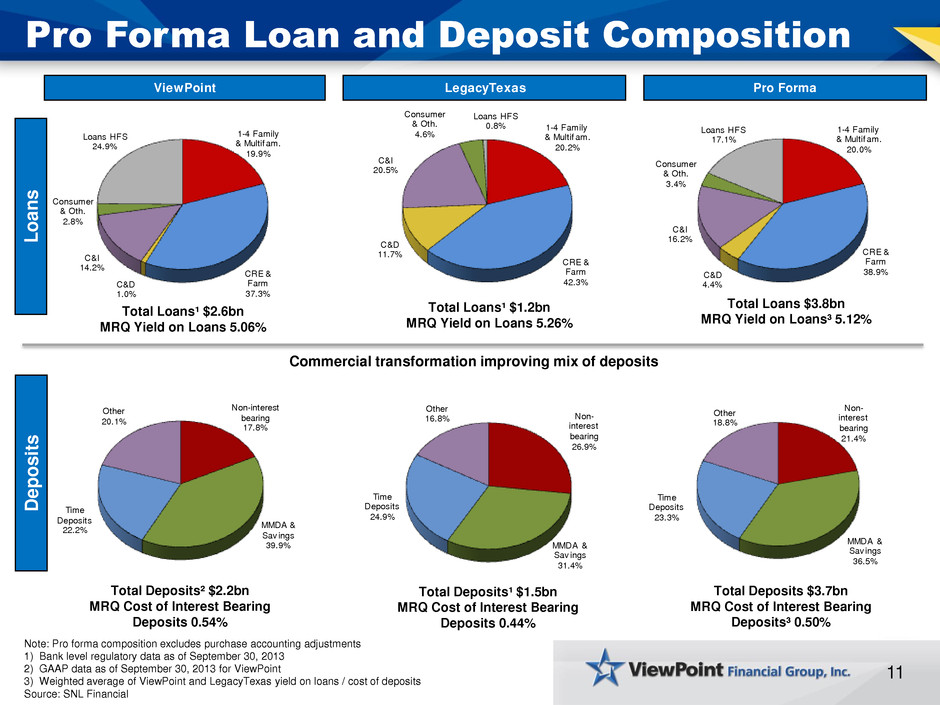

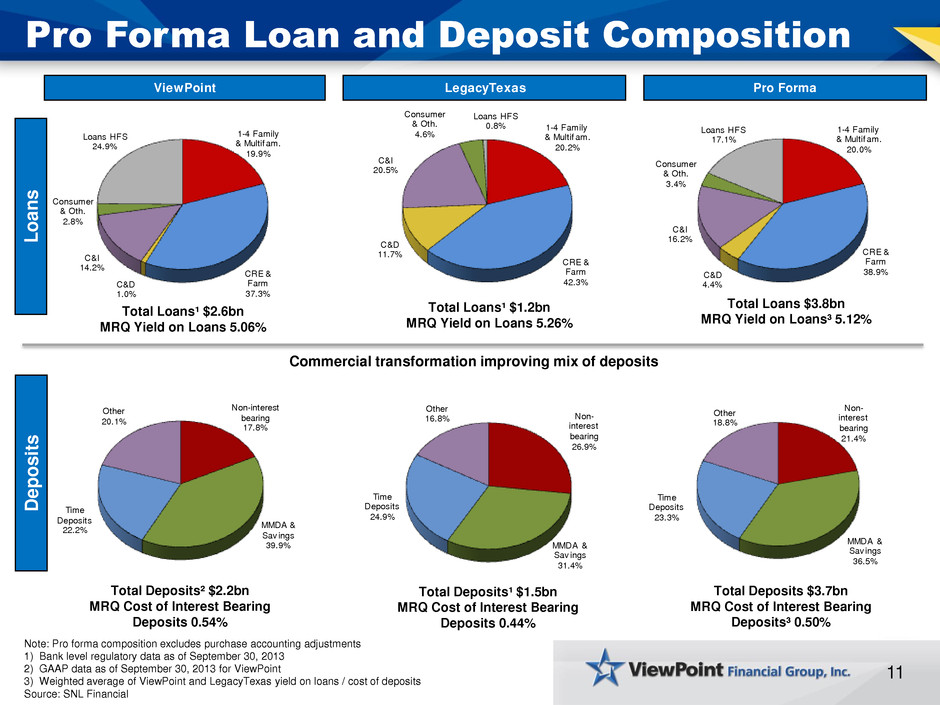

ViewPoint LegacyTexas Pro Forma 1-4 Family & Multif am. 19.9% CRE & Farm 37.3% C&D 1.0% C&I 14.2% Consumer & Oth. 2.8% Loans HFS 24.9% 1-4 Family & Multif am. 20.2% CRE & Farm 42.3% C&D 11.7% C&I 20.5% Consumer & Oth. 4.6% Loans HFS 0.8% 1-4 Family & Multif am. 20.0% CRE & Farm 38.9%C&D 4.4% C&I 16.2% Consumer & Oth. 3.4% Loans HFS 17.1% 11 Pro Forma Loan and Deposit Composition Note: Pro forma composition excludes purchase accounting adjustments 1) Bank level regulatory data as of September 30, 2013 2) GAAP data as of September 30, 2013 for ViewPoint 3) Weighted average of ViewPoint and LegacyTexas yield on loans / cost of deposits Source: SNL Financial L o a n s D e p o s it s Total Deposits² $2.2bn MRQ Cost of Interest Bearing Deposits 0.54% Total Deposits¹ $1.5bn MRQ Cost of Interest Bearing Deposits 0.44% Total Deposits $3.7bn MRQ Cost of Interest Bearing Deposits³ 0.50% Total Loans¹ $2.6bn MRQ Yield on Loans 5.06% Total Loans¹ $1.2bn MRQ Yield on Loans 5.26% Total Loans $3.8bn MRQ Yield on Loans³ 5.12% Commercial transformation improving mix of deposits Non-interest bearing 17.8% MMDA & Sav ings 39.9% Time Deposits 22.2% Other 20.1% Non- interest bearing 26.9% MMDA & Sav ings 31.4% Time Deposits 24.9% Other 16.8% Non- interest bearing 21.4% MMDA & Sav ings 36.5% Time Deposits 23.3% Other 18.8%

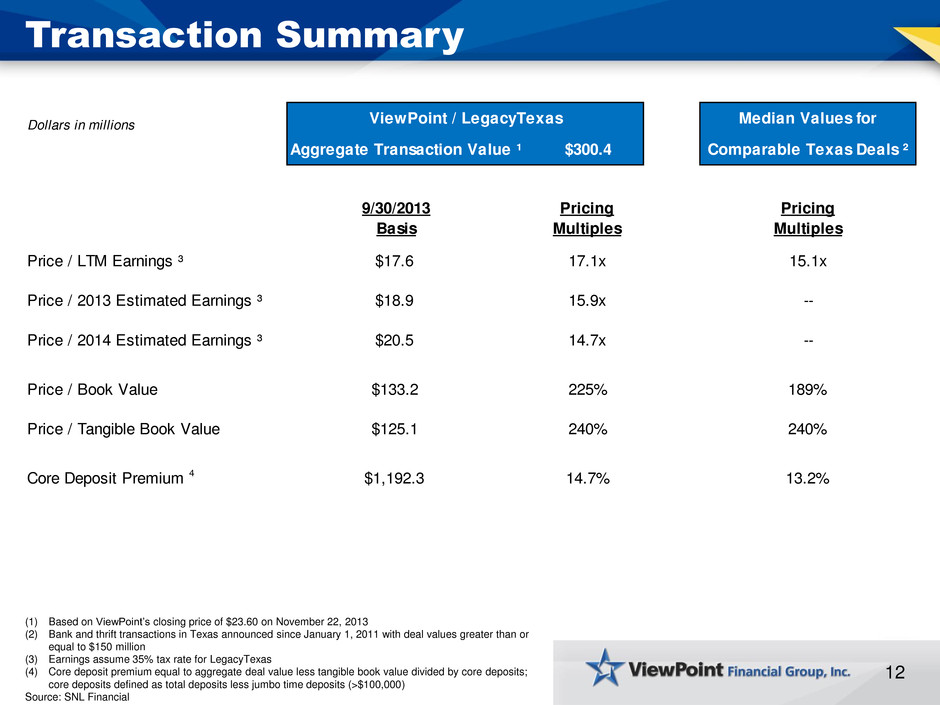

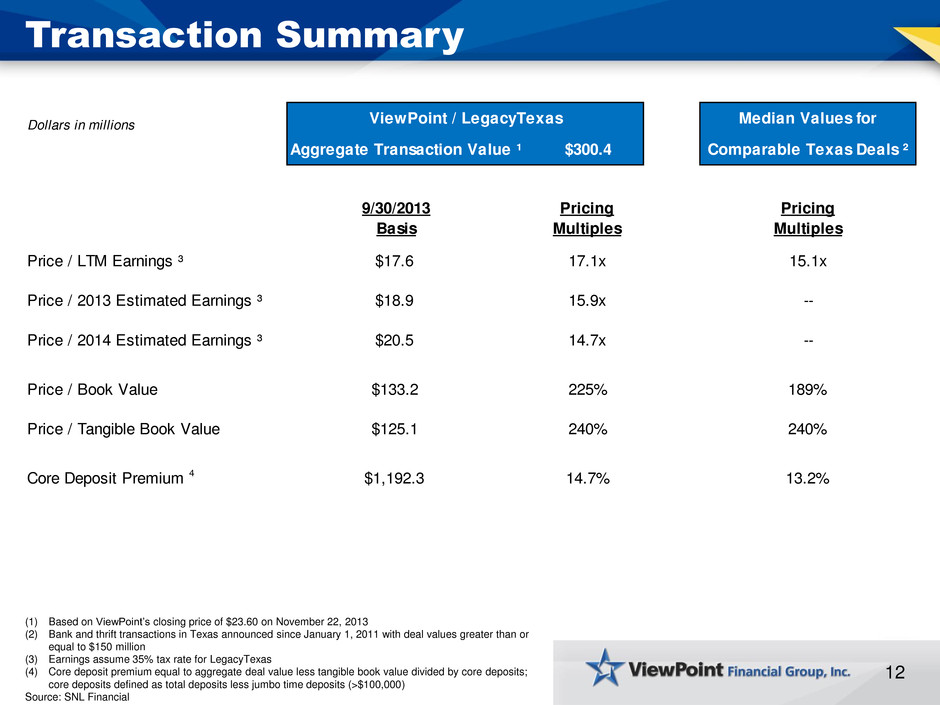

Dollars in millions ViewPoint / LegacyTexas Median Values for Aggregate Transaction Value ¹ $300.4 Comparable Texas Deals ² 9/30/2013 Basis Pricing Multiples Pricing Multiples Price / LTM Earnings ³ $17.6 17.1x 15.1x Price / 2013 Estimated Earnings ³ $18.9 15.9x -- Price / 2014 Estimated Earnings ³ $20.5 14.7x -- Price / Book Value $133.2 225% 189% Price / Tangible Book Value $125.1 240% 240% Core Deposit Premium 4 $1,192.3 14.7% 13.2% 12 Transaction Summary (1) Based on ViewPoint’s closing price of $23.60 on November 22, 2013 (2) Bank and thrift transactions in Texas announced since January 1, 2011 with deal values greater than or equal to $150 million (3) Earnings assume 35% tax rate for LegacyTexas (4) Core deposit premium equal to aggregate deal value less tangible book value divided by core deposits; core deposits defined as total deposits less jumbo time deposits (>$100,000) Source: SNL Financial

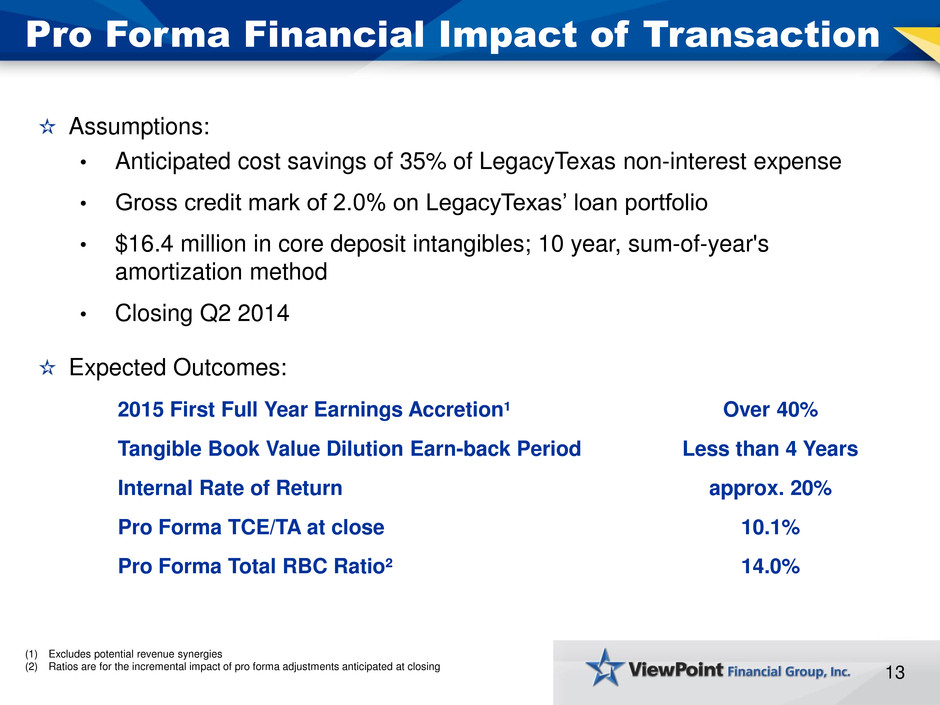

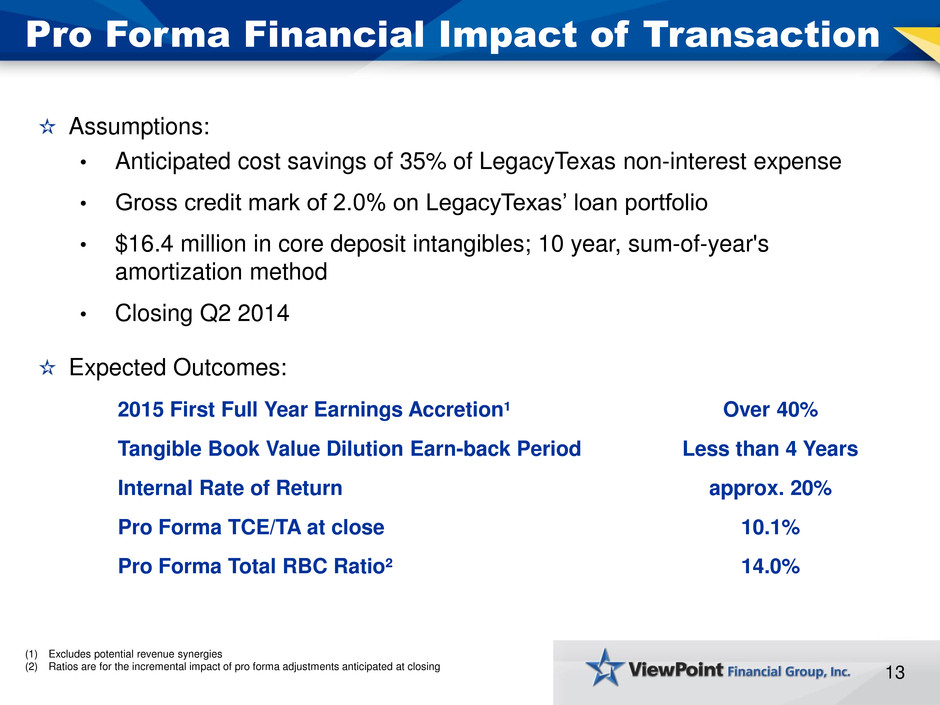

13 Pro Forma Financial Impact of Transaction Assumptions: • Anticipated cost savings of 35% of LegacyTexas non-interest expense • Gross credit mark of 2.0% on LegacyTexas’ loan portfolio • $16.4 million in core deposit intangibles; 10 year, sum-of-year's amortization method • Closing Q2 2014 Expected Outcomes: 2015 First Full Year Earnings Accretion¹ Over 40% Tangible Book Value Dilution Earn-back Period Less than 4 Years Internal Rate of Return approx. 20% Pro Forma TCE/TA at close 10.1% Pro Forma Total RBC Ratio² 14.0% (1) Excludes potential revenue synergies (2) Ratios are for the incremental impact of pro forma adjustments anticipated at closing

14 Summary of Transaction Acquisition of one of select community banking jewels of Dallas / Fort Worth Metroplex Continues ViewPoint’s transition to fully commercial community bank in key North Texas communities Leverages ViewPoint’s excess capital in a financially attractive transaction Expands established LegacyTexas brand Combined management team with strong local roots Further diversifies sources of fee income and creates additional cross-sell opportunities Attractive financial returns for shareholders Capital position allows for continued growth

15