GenMark Diagnostics Reports Final

Fourth Quarter and Fiscal Year 2011 Results

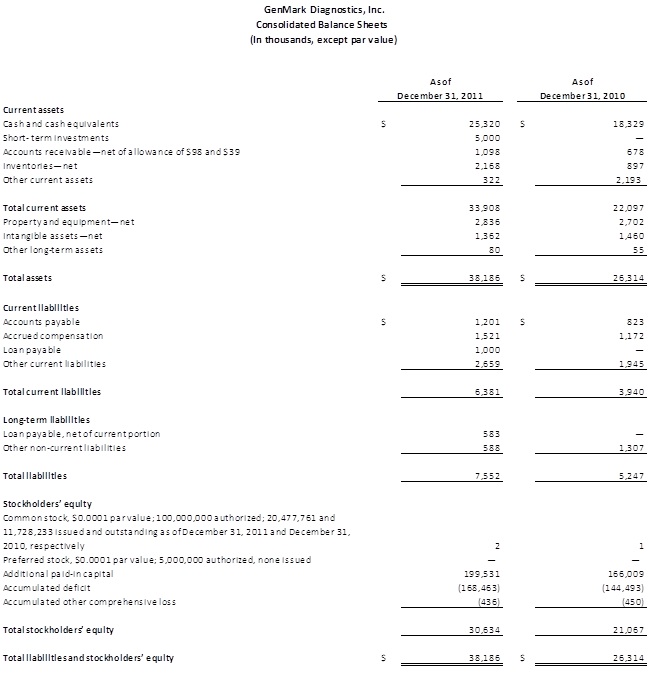

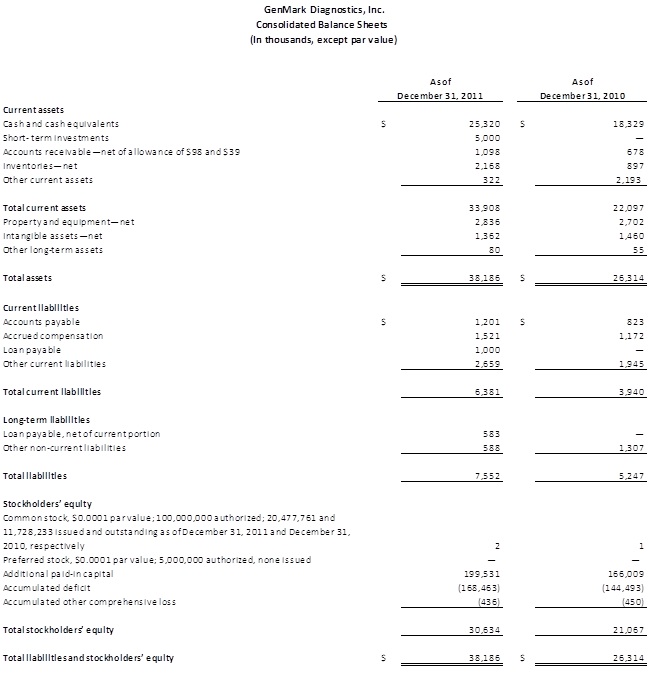

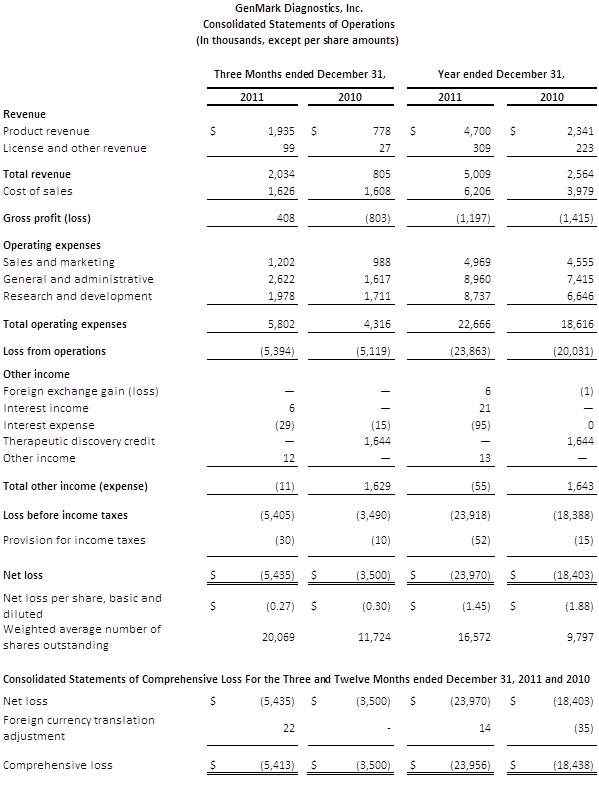

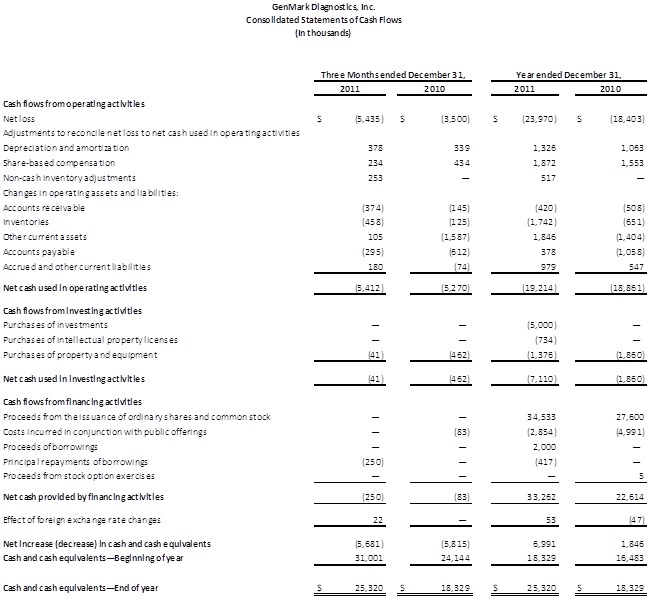

CARLSBAD, Calif., March 15, 2012 (BUSINESS WIRE) --GenMark Diagnostics, Inc. (Nasdaq:GNMK) today reported additional financial information for the fourth quarter ended December 31, 2011 that was unavailable at the time it released preliminary financial results on March 8, 2012. The additional information includes the Company's gross profit margin of 20%, loss per share of $0.27 and fully audited financial statements.

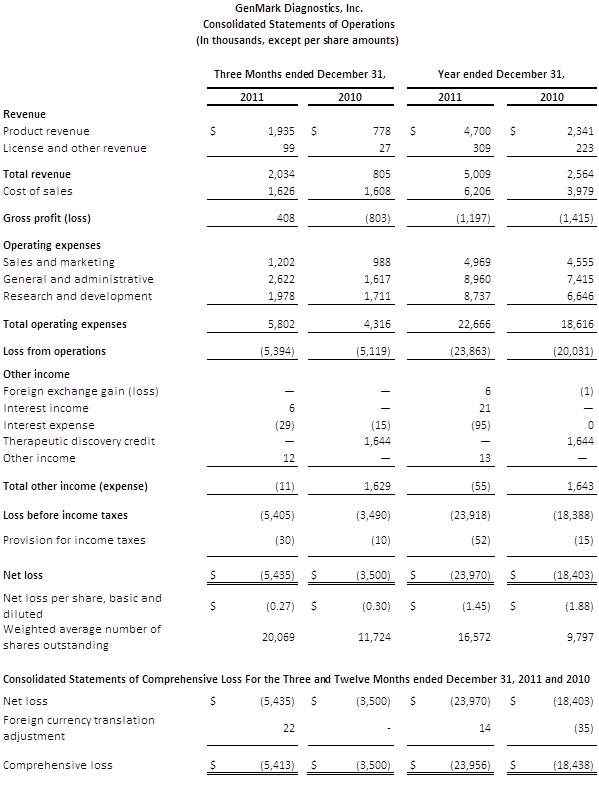

Revenues for the quarter ending December 31, 2011 were $2.0 million compared with $805,000 during the fourth quarter of 2010. The 148% year-over-year increase in total revenue reflects an increase in the number of systems in the field, growth in test menu and a significant increase in the number of tests sold. Reagent revenues for the fourth quarter grew 159% year over year to $1.8 million from $695,000. Instrument and other revenues increased by 104% year over year to $224,000 from $110,000 due mainly to capital sales of instruments. The Company placed 26 net analyzers during the quarter, bringing the installed base to 167, all in end-user laboratories within the U.S. market.

Gross profit for the quarter ending December 31, 2011 was 20% of sales, compared with a gross loss of $0.8 million and negative 100% for the same period in 2010. The improvement to positive gross profit was largely driven by three factors. First, the significant increase in volume allowed for the absorption of fixed manufacturing overhead costs. Second, a number of previously disclosed manufacturing inefficiencies were resolved and this resulted in significantly better and sustainable yields. Third, capital sales of several depreciated instruments improved the gross margin mix. Excluding the favorable gross margin mix, the gross profit during the fourth quarter would have been 15% of revenue.

Operating expenses increased $1.5 million to $5.8 million during the fourth quarter of 2011 compared with the fourth quarter of 2010. The increase in operating expenses was across all areas of the Company and reflected the higher volumes, increased headcount, infrastructure spending, and higher research and product development costs, including costs related to the Company's Respiratory Viral Panel (RVP) which was submitted to the FDA during the quarter for 510(k) clearance.

Loss per share was $0.27 for the fourth quarter of 2011, compared with a loss per share of $0.30 in the fourth quarter of 2010.

For the fiscal year ending December 31, 2011, revenues increased 92%, from $2.6 million in 2010 to $5.0 million in 2011, and gross margin turned from negative to positive during the latter half of the year. Two new assays were introduced during the year: a Hepatitis C Virus genotyping RUO test and a multiplexed Respiratory Viral Panel, the latter of which has been submitted to the FDA for 510(k) clearance. The Company placed 85 net analyzers during the year, bringing the total installed base to 167, and reagent annuity per analyzer increased from $30,000 to $50,000.

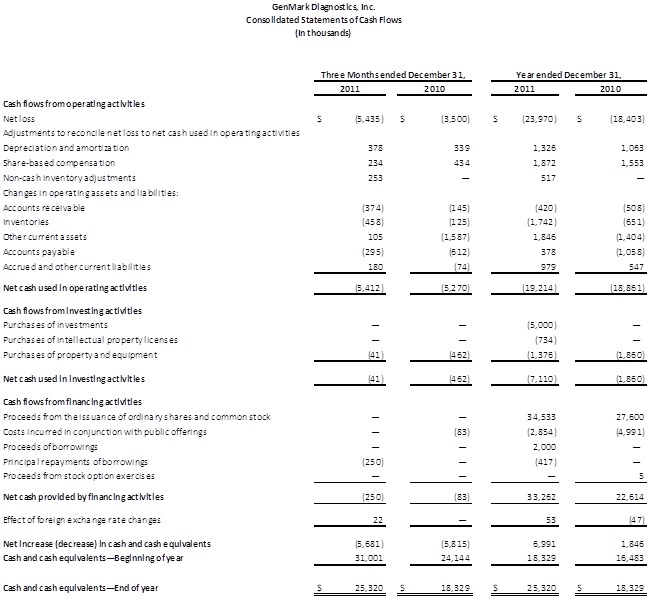

The Company ended 2011 with $30.3 million in cash and short-term investments, reflecting the cash proceeds from the follow-on offering completed during the year. The Company intends to continue utilizing its cash balances to invest in new product and menu development, including the development of its NexGen platform, and for infrastructure improvements and general corporate purposes.

For 2012, the Company expects revenue to grow by more than 100% over 2011 levels to greater than $10 million, with a disproportionate amount of the revenue occurring in the back end of the year due to the seasonality of the flu season. In addition, the Company expects to significantly grow the installed base in 2012 by placing in excess of 100 analyzers in customer laboratories. Gross margin is expected to remain positive throughout 2012 with improvements commensurate with anticipated volume growth. Lastly, the Company plans to introduce two to three new assays in 2012 and will continue to invest heavily in its NexGen platform development.

ABOUT GENMARK

GenMark Diagnostics is a leading provider of automated, multiplex molecular diagnostic testing systems that detect and measure DNA and RNA targets to diagnose disease and optimize patient treatment. Utilizing GenMark's proprietary eSensor® detection technology, GenMark's eSensor® XT-8 system is designed to support a broad range of molecular diagnostic tests with a compact, easy-to-use workstation and self-contained, disposable test cartridges. GenMark currently markets three tests that are FDA cleared for IVD use: Cystic Fibrosis Genotyping Test, Warfarin Sensitivity Test, and Thrombophilia Risk Test. A Respiratory Viral Panel (RVP) has been submitted to the FDA for 510(k) clearance. A number of other tests, including HCV Genotyping and 2C19, versions of which are available for research use only, and KRAS, are in development for IVD use. For more information, visit www.genmarkdx.com.

SAFE HARBOR STATEMENT

This press release includes forward-looking statements regarding events, trends and business prospects, which may affect our future operating results and financial position. Such statements, including, but not limited to, those regarding continued growth in sales of our diagnostic tests, the expansion of our diagnostic test menu, the development and functionality of our products and the continued development of our technology, are all subject to risks and uncertainties that could cause our actual performance, operating results and financial position to differ materially. Some of these risks and uncertainties include, but are not limited to, risks related to our history of operating losses, our ability to successfully commercialize our products, the need for further financing and our ability to access the necessary additional capital for our business, inherent risk and uncertainty in the protection intellectual property rights, ability to maintain gross margins, regulatory uncertainties regarding approval or clearance for our products, as well as other risks and uncertainties described under the "Risk Factors" in our public filings with the Securities and Exchange Commission. We assume no responsibility to update or revise any forward-looking statements to reflect events, trends or circumstances after the date they are made.

SOURCE:GenMark Diagnostics, Inc.

GenMark Diagnostics, Inc.

Paul Ross

Chief Financial Officer

760-448-4318