[Translated from Hebrew]

Spring Health Solutions Ltd.

Goodwill impairment assessment, 30 September 2012

| November 2012 | Third draft for discussion |

22 November 2012

To:

D Medical Industries Ltd.

Re: Operation value assessment for goodwill impairment assessment

Background

We were requested by D Medical Industries Ltd. (“D Medical” and/or “Parent company”) to assess the value of Spring Health Solutions (hereinafter: “Spring” and/or “The company”) as of 30 September2012 (hereinafter: “Valuation date”) in order to apply the requirements of International Accounting Standard no. 36 –Impairment of Assets (hereinafter: “IAS 36”).

Objective

The objective of D Medical’s engagement with Laor was to assess the value of Spring’s operation in order to assess whether there has been a decline in its value, as compared to its book value in D Medical’s accounts. All this according to relevant accounting standards, subject to the reservations specified above and below and for this purpose only. This assessment does not take into account considerations that may affect the value estimation for a specific investor.

Except for the auditors, for auditing purposes, no third party may make any use of it or rely on it for any purpose without prior written permission from us.

For our work, we used Spring’s audited and unaudited financial statements, financial and operational information, internal administrative reports and additional information received from D Medical's management, provided at its best knowledge and experience. Additionally, we used public information published by others.

We used sources of information that seem reliable, whole, precise and updated to us, however, we did not carry out any auditing procedures, as defined in law and rulings, nor did we make an independent check or examination of the information we received and we do not have any opinion of the appropriateness of the data used in our work. However, we did carry out several tests regarding the reasonability of the data and forecasts. These test included, inter alia, analysis of financial statements and historical financial information about the company.

Scope of examination

The work was carried out according to the provisions of International Accounting Regulation no. 36 – impairment of assets (hereinafter: “IAS 36”) by comparing the carrying amount of the property in the books to its recoverable amount, requiring the recognition of impairment whenever the recoverable amount is lower than its carrying amount.

Sources of information

In carrying out the work we relied on the following information, among other things:

* Financial statements for the years 2009-2011

* Financial statement draft for 30 September 30, 2012

* Other financial and operation data received from D Medical management

* Company's budget for 2012 , approved by the Board of Directors of the Company;

* Company budget versus performance in 2012.

* Multi-annual business plan draft (yet to be approved by company board of directors)

* Valuation of goodwill for impairment assessment as at 31 December 2011

* Conversations and clarifications with D Medical management, and

* Financial and general information from various open sources.

Procedures used by us

The procedures we used include the following, among others:

* Conversations with D Medical's management regarding data and information we received.

* Independent checks by Spring, financial and operation history, analysis of business environment and company’s competitive positioning on the market; and

* Valuation of Spring’s operations.

Please note individual calculations that were used in the work process are not presented in the paper, since calculations were made on an electronic spreadsheet, difference due to rounding up numbers may have occurred.

We hereby declare we have no personal interest in D Medical and/or Spring shares, shareholders or any related parties, as specified by law or ruling, and we have no dependency or affiliation to them or parties related to them as specified in the Companies Law.

Payment for our services had no influence whatsoever on our examination results.

We are aware our findings will be used by D Medical management for the financial reporting required by the accounting principles accepted in Israel. We agree this opinion be included and/or mentioned within D Medical’s financial statements for 30 September 2012 and its reports to the Securities Authority, if so required.

Summary

According to our Valuation, based on our calculations, subject to the reservations noted above and below, the value of Spring’s operations estimated on the date of the assessment is approximately NIS 74 thousand. This value is lower than the net carrying amount attributed to the company, of NIS 2,308 thousand on 30 September2012. Therefore, and in view of the above, we have found said goodwill value impaired. The determining date for this opinion is 22 November2012. Our opinion is specified below.

Sincerely,

Laor – Consulting and Investments Ltd.

| Chapter | Subject | Page |

| 1 | | 5 |

| 2 | | 9 |

| 3 | | 22 |

| 4 | | 25 |

| 5 | | 35 |

| | | 45 |

| | | 47 |

| | | 48 |

| | | 49 |

| | | 50 |

Company Description

General

Springs Health Solutions Ltd. (formerly Nilimedics Ltd.) was established in 2002 as part of the Technion Enterprise Incubator Ltd., and currently operates under D Medical Industries Ltd., traded on the Tel Aviv Stock Exchange.* The company operates, together with Spring Set and Spring Inc, in the field of manufacturing and marketing infusion sets, under the trade name of Spring TM Universal Infusion Set., with products based on the Continuous Glucose Monitoring (CGM) drug delivery technology.

Company headquarters are situated in Granot, Israel.

Products and Technology

The company has developed two major product lines:

| * | Spring Zone insulin pump. IntellispringTM technology is the core of the Spring Zone insulin delivery system. The pocket pump operates on a pressure metering system that derives insulin delivery energy from the pressure generated when insulin is loaded on the unique infusion set and the spring mechanism in the pump is depressed. This sophisticated mechanism, backed by the Total Line ControlTM safety system, enables safe operation and extraordinary reliability for constant control and monitoring of insulin supply. Intellispring exploits the spring's energy as power for moving the insulin. Omitting the use of a mechanism powered by a motor and gear provides a significant advantage in performance and costs, increases the system's life expectancy and reliability and enables significant decrease and miniaturization of the pump. Additional key properties of the Spring Zone insulin pump include better identification of blockage and disconnection from the body, better adaptation and constant monitoring of the insulin supply dosage. |

The Spring Zone substance delivery system has several innovative solutions:

- Sophisticated mechanism that regulates and stops substance provision

- Control mechanism that coordinates substance provision temperature and pressure

- Substance delivery dosage control mechanism.

Intellispring exploits the spring's energy as power for moving the insulin. Omitting the use of a mechanism powered by a motor and gear provides a significant advantage in performance and costs increases the system's life expectancy and reliability and enables significant decrease and miniaturization of the pump. Additional key properties of the Spring Zone insulin pump include better identification of blockage and disconnection from the body, better adaptation and constant monitoring of the insulin supply dosage.

Key properties of the technology:

| | - | Hybrid system – the innovative Intellispring technology integrated into the company's traditional Adi pump was converted and turned into the world's first pump based on a hybrid system for constant insulin delivery. |

| | - | Continuous monitoring – the continuous safety and monitoring system on the pipe enables safe operation and high reliability for continuous control and monitoring over insulin delivery. |

| | - | Lightweight and convenient – the pump is particularly lightweight and easy to use. |

----------------

* In 2006 D Medical bought 72.99% of Spring's shares for $1.5 million. Over the years it bought additional shares eventually reaching 100% of Spring's issued share capital

| | - | Tiny dimensions – the pump is tiny, free of background noises when operating, retaining patients' privacy |

| | - | Simplicity – the entire system is in one unit, without being cumbersome and using multiple parts (cartridge, pipes, and connections) |

| | - | Durability – the system is made of magnesium and damage proof |

| | - | Reliability – the system is assembled from disposable parts ensuring operation malfunctions are prevented compared to multiple use systems. |

| | - | Saving – system dimensions and materials from which it is made enable low production cost compared to competing products. |

| | - | Support services – instruction, service and support processed based on network of certified distributors. |

| * | Spring hybrid dressing pump. The innovative Intellispring technology integrated into the company's traditional Adi pump underwent conversion into the world's first pump that is a hybrid continuous insulin delivery system. The system is hybrid because it may be worn as a dressing pump directly on the body or traditionally by connection to the body with an IV set. The system is tiny and can give warning in any possible case of blockage and the unique device that discovers air bubbles in the system. The Spring Hybrid Dressing Pump presents a new level of environmental friendliness – the pump is made of a multiple use control system with long life expectancy combined with a disposable medication receptacle. No electric component, metal materials and batteries are disposed, the only garbage is a tiny plastic container. The motor-less energy saving system can operate for approximately 30 days on standard AAA batteries. |

Marketing and sales

The SpringTM insulin pump received CE approval and is now ready for commercial sale in Europe. However, D Medical management believes that in order to begin the commercialization process the company should raise money. D Medical management expects the company to begin selling the product in Europe in the fourth quarter of 2014.

The initial version of the Spring hybrid dressing pump, semi-disposable, received CE approval. Company management expects it to be able to complete the commercial deployment process and design of the Spring hybrid dressing pump by the third quarter of 2015, begin preparations for the product's production and marketing stages and even obtain all required regulatory permissions for the commercial design from the EU. By the third quarter of 2015 it is also expected to obtain the permit required for the American market. Moreover, D Medical management claims that when it has excess inventory it will begin selling the Spring hybrid dressing pump to BRIC countries (Brasil, Russia, India and China).

The company currently holds some10 active distributor agreements covering product distribution in the following countries: Canada, Czech Republic, Greece, Netherlands, Poland and Sweden, and five distribution agreements for the American market.

Additionally, the company has signed 3 inactive distribution agreements, covering company product distribution in the following countries: China, India and Mexico.

Subject to the above mentioned distribution agreements, sale of company products will be made at the company plant, except for the United States, in which sale will take place on the customer's premises. Additionally, company pumps are covered by a four-year warranty.

Business Strategy

D Medical management intends to raise financial resources from external investors to enable continued development activities until sales of its products currently under development or intangible assets. At the same time, Spring wants to obtain a significant section of the global insulin pump market and Biodegradable accessories, particularly in BRIC countries, Mexico and Europe. To achieve this goal, the company plans to apply the following strategies:

| * | Leverage the saving characterizing the company's spring-based design to enter BRIC countries and Mexican markets. |

| * | Increase its profit margin by using distributors and refraining from the costs that accompany management of a direct sales force and customer support system. |

| * | Initial launch of company products in Europe. |

| * | Streamlining and improving company production processes to decrease product cost to the end consumer. |

| * | Create presence of company products in the United States. |

| * | Leverage company proprietary technology to integrate it in additional drug administration devices. |

| * | On March 22, 2012, D Medical declared it had initiated a strategic restructuring process designed to focus its business on maximization and realization of the value of the company's innovative technology and intellectual property, by licensing and/or sale of this technology (or part of it) to third parties. Our Valuation is based on company strategy that intends to promote sale of its products through marketers. |

Market Review

General Review

About Diabetes

Diabetes is a life-threatening chronic disease with no known cure. Diabetes is caused by the body's inability to produce the insulin hormone or use it efficiently, preventing the body from proper regulation of blood sugar levels.

Glucose is the cells' major energy source and it must remain at a certain concentration level in the blood to enable the cells to function at their best. Usually, the pancreas controls blood glucose level by secreting the insulin hormone that lowers glucose levels when they get too high.

In case of diabetics, the pancreas does not produce enough insulin, or the body does not utilize insulin efficiently, thus causing abnormal increase in glucose levels.

This state, called hyperglycemia, may cause long-range chronic complications including heart conditions, limb amputation, damage to kidney function or blindness.

To prevent high blood glucose levels, diabetics often use insulin to regulate glucose levels. Insulin injections may cause blood glucose levels to impairment dangerously, leading to hypoglycemia. In cases of severe hypoglycemia, diabetics are at risk of grave complications, including losing consciousness and even death. In view of the drastic implications of the severe complications involved in hypoglycemia, many diabetics are afraid of lowering blood glucose levels. As a result, these patients often remain in a state of hyperglycemia, exposing themselves to the long-range chronic complications specified above.

According to the American Diabetic Engagement:

| * | Diabetes was the seventh leading cause of death, apparent from death certificates issued for adults in the USA in 2006; |

| * | Adults suffering from diabetes are exposed to a much higher risk of stroke or heart disease compared to non-diabetic adults. |

| * | Diabetes is among the leading causes of new cases of blindness discovered in adults aged 20 to 74, and finally, it is the major cause of kidney failure; |

| * | Some 60-70% of diabetics suffer medium to severe malfunction of the nervous system; and |

| * | Over 60% of non-traumatic amputations of lower limbs are performed on diabetics. |

Diabetes is usually divided into two categories: type 1 diabetes (formerly called diabetes mellitus, insulin dependent, or juvenile diabetes) and type 2 diabetes (formerly called diabetes mellitus, non-insulin dependent or adult diabetes). Their rate of prevalence is 5-10% and 90-95%, respectively, of the total cases of diabetes diagnosed in the US. Patients suffering from diabetes type 1 must take insulin on a daily basis, while diabetes type 2 patients need a diet, exercise, orally administered medication and/or insulin to regulate blood glucose levels. Due to the progressive character of diabetes, a large number of patients suffering from diabetes type 2 needs to use insulin to regulate their blood glucose levels.

According to the National Diabetes Information Clearing House (NDICH), a unit of the National Health Institute, diabetes type 1:

* Cannot be prevented, currently

| * | Develops when the body's immune system destroys beta cells in the pancreas, the only cells in the body that produce insulin. |

| * | Usually appears in children and young adults (although diabetes may be discovered at any age). |

| * | May be caused by autoimmune, generic or environmental factors, including viruses. |

| * | According to the NDICH, diabetes type 2: |

| * | Usually begins as resistance to insulin, an ailment in which (i) the cells do not use insulin properly and require larger than usual amounts of insulin for normal function, while (ii) the pancreas gradually loses its ability to produce insulin, and |

| * | Is usually related to older age, obesity, family history of diabetes, history of gestational diabetes, defective glucose metabolism, lack of physical activity and ethnic origin. |

Over the past two decades, type 2 diabetes has turned into a significant problem that increases in severity, among children and adolescents in the US. One of the possible causes of the increased frequency of diabetes type 2 during childhood and adolescence is exposure to diabetes in the womb. The problem is related to low physical activity and obesity which we see around the world. Usually, children diagnosed with diabetes type 2 are 10-19 years of age, have a family history of diabetes and suffer from insulin resistance.

Global frequency of diabetes*

Most diabetics live in the lesser economically developed regions of the world. In regions where the disease is less frequent (Africa) assessment has is that 280,000 cases of death in 2011 are elated to diabetes. Although over 80% of the total diabetics reside in countries with low or medium income, only 20% of all global health expenses have been channeled to these regions – data that reflects huge differences.

Diabetes and prevalence of Impaired Glucose Tolerance (IGT)

The largest number of diabetics has been recorded in the western-Pacific region and includes 132 million people, while the lowest number in 2011 was 14.7 million in Africa. However, the Middle East and North Africa were characterized by the highest prevalence of adult diabetes in 2011 – 11%, with North America and the Caribbeans in second place with 10.7% prevalence. The region with the second lowest prevalence after Africa is Europe, with 6.7% diabetics.

The following table displays regional estimates on diabetes (ages 20-79) for the years 2011 and 2030:

| | | 2011 | | | 2030 | | | | |

| Region | | Population | | | No. of diabetics (millions) | | | Diabetic prevalence (%) | | | Population | | | No. of diabetics (millions) | | | Diabetic prevalence (%) | | | Rate of change in diabetics (%) | |

| Africa | | | 387 | | | | 14.7 | | | | 4.5 | | | | 658 | | | | 28 | | | | 5 | | | | 90 | |

| Europe | | | 653 | | | | 52.8 | | | | 6.7 | | | | 673 | | | | 64 | | | | 7 | | | | 22 | |

| Middle East and North Africa | | | 356 | | | | 32.6 | | | | 11.0 | | | | 539 | | | | 60 | | | | 11 | | | | 83 | |

| North America and Caribbean | | | 322 | | | | 37.7 | | | | 10.7 | | | | 386 | | | | 51 | | | | 11 | | | | 36 | |

| Southern and central Europe | | | 289 | | | | 25.1 | | | | 9.2 | | | | 376 | | | | 40 | | | | 9 | | | | 59 | |

| South-East Asia | | | 858 | | | | 71.4 | | | | 9.2 | | | | 1,188 | | | | 121 | | | | 10 | | | | 69 | |

| Western Pacific | | | 1,544 | | | | 131.9 | | | | 8.3 | | | | 1,766 | | | | 188 | | | | 9 | | | | 42 | |

| Global | | | 4,407 | | | | 366 | | | | 9 | | | | 5,586 | | | | 552 | | | | 9 | | | | 51 | |

Source: International Diabetes Federation

Data for IGT is similar. According to estimates, the Pacific-West region has the highest number of diabetics, 85 million in 2011, although the highest comparative prevalence of IGT was recorded in the North America & Caribbean region (10.75). In total, IGT prevalence was generally lower than diabetes, except in Europe, North America & Caribbean regions where its prevalence is higher.

Mortality

The mortality rate due to diabetes is 6.1% of all deaths in people aged 20-79 in Africa, to over 15% in the Pacific-West region. In ages over 49 and in all regions, diabetes is responsible for a higher percentage of total deaths among women, compared to men, totaling over 20% in certain regions and particular age groups.

These assessments show diabetes poses a significant death threat and investment in decreasing it are justified and necessary.

Medical treatment costs

The current differences between regions are quite prominent when it comes to health expenditure related to diabetes. In 2011, North American & Caribbean region spent some $223 billion, or 48% of global medical expenses on diabetes. The European region spent half that amount, $130 billion. In 2011, both regions together recorded the highest diabetes related expenses. On the other hand, the Pacific-Western region spent $72 billion only on treating diabetes, despite the fact it has the highest number of diabetics. South and Central America as well as the Middle East and North Africa spent less than 5% of their total health budget on diabetes related items, while South-East Asia and Africa spent less than 1% in 2011.

Diabetes treatment market

Market data

The diabetes treatment market includes medicinal components and medical device components. The pharmaceutical aspect is divided into insulin and orally administered anti-diabetes drugs. The device sector is composed of diagnosis and monitoring devices for Biodegradable substances they accompany, and a variety of insulin providing devices. Some of these devices contain pre-loaded insulin doses, and they can be treated both as medical devices and pharmaceutical products. The leading sectors on the diabetes products market are: insulin, blood sugar meters and related Biodegradable materials (e.g. needles, test strips), insulin pumps, insulin delivery devices (e.g. syringes, pens) and anti-diabetes drugs.

The global diabetes product market in 2010* (in $ millions) is described below:

In 2010, the global diabetes management market totaled $40 billion and is expected to reach a total of $114 billion soon, following an annual growth rate (CAGR) of 13.5%. Insulin, test strips and anti-diabetes drugs are the products that generate the highest revenue in this market.

Of the two major sectors of the global diabetes market, the anti-diabetes drug market constitutes a $28 billion sector, with oral drugs covering 38% and injected drugs contributing over 55%. The additional major sector of the global diabetes market – the device sector – was responsible for $16 billion in 2010.**

The value of the global insulin pump market was an estimated $724.3 million in 2010 and is expected to have an annual growth rate (CAGR) of 7.9%, reaching $1.2 billion in 2017***. According to market statements and studies, the market is expected to be powered by high increase in diabetes prevalence, available monetary refund, positive clinical results for studies on insulin pumps and the advantages provided by insulin pumps for "niche" groups of patients. The USA continues to be the largest insulin pump market, propelled by a higher infiltration rate of pumps and available monetary refunds.

In 2010, the value of the American insulin pump market was an estimated $518.5 and is expected to have an 8.5% CAGR, reaching a value of $915.4 million by 2017. Market growth should be propelled by several factors, including increase in prevalence of diabetes among people of all ages, higher introduction of insulin pumps onto the market and available monetary refunds.****

--------------------

* Diabetes Therapies & Diagnostics: Global Markets", Bharat Book bureau, June 2010.

** Life Science Market Research Statements, "Global Diabetes Devices Market & Diabetes Drugs Market (2011-2016)", February 27, 2012.

*** Bio Spectrum, "Global insulin pumps market to reach $1.2 billion by 2017" December 30, 2011.

**** See previous footnote

Diabetes treatment market (continued)

Quite frequently, coping with diabetes is frustrating and difficult on patients since blood glucose levels are influenced by hydrocarbon content of meals, physical activity, pressure, existing or developing diseases, hormonal fluctuations, insulin absorption fluctuations and changes in the influence of insulin on the body. Diabetics with insulin dependent diabetes, and particularly those with diabetes type 1, require:

| * | Constant monitoring and daily intake of insulin, as well as increased carbohydrate intake during the day to retain normal blood glucose levels, and |

| * | Constant insulin supply, known as basal insulin, to provide a response for background metabolic needs. |

In addition to basal insulin, insulin-dependent diabetics require addition insulin dosage known as "bolus" to compensate for carbohydrates conamounted during meals, as snacks or in order to offset high doses of glucose in the blood. Diabetics who try to closely control blood glucose levels to prevent long-term complications related to the fluctuations in these levels are at high risk of "over correction" that sometimes causes hypoglycemia. Therefore, the time dedicated to diabetes management, blood glucose level fluctuations and fear of hypoglycemia all contribute to the huge burden carried by patients and their relatives.

Insulin treatment

There are three major types of insulin treatments:

| * | Traditional treatment that includes use of insulin injection devices to inject long-term and regular insulin, once or twice a day by the patient. |

| * | Multiple Daily Injections (MDI) treatment, includes the use of insulin self-injection systems by the patient that inject long term or regular insulin or a mixture of the two types, once or twice daily, as well as additional injection of fast-acting insulin before any meal or snack, if required. And, |

| * | Treatment using an insulin pump, composed of the use of insulin pumps by patients that inject fast acting basal insulin continuously through a subcutaneous infusion (i.e. below the skin). This includes the ability to inject fast acting "bolus" insulin before meals and snacks, if necessary. |

Traditional treatment and MDI treatment use insulin injection systems, including multiple-use injection pens prepared in advance, insulin syringes and needle kits, as well as jet insulin syringes.

| * | Injection pens are pre-filled devices containing several insulin doses, or multiple-use devices using insulin cartridges replaced every few days. Insulin injection pens use short, thin needles and a spring to deliver the drug. |

| * | Insulin syringe and needle kits are specially designed needles connected to small hollow, barrel shaped, devices equipped with a moving crank, designed for single use. Most syringe and needle kits are packed in a ready to use form, with the needle connected to the receptacle. |

| * | Insulin jet syringes are designed for subcutaneous insulin delivery enabled by releasing a high pressure jet through a tiny hole in the bottom part of the injection device. |

Diabetes treatment market (continued)

Insulin pumps

There are two types of insulin pumps on the market presently, multiple-use and disposable.

Multiple use insulin pumps are small mechanical devices a bit larger than a pager. The multiple use pump is externally installed, usually on the belt or in a pocket, and provides insulin subcutaneously through a disposable infusion kit. The infusion kit contains two pipes: a tiny, flexible plastic pipe known as "canola", inserted under the skin, usually on the stomach, arms or legs, as well as a thin plastic pipe that connects the canola to the insulin pump. Usually, infusion kits are replaced every two-three days. Insulin passes through the infusion kit, using a reservoir cartridge located in the insulin pump and usually containing 200-300 insulin units. The reservoir cartridge connects to the infusion pipe through an adapter within the pump.

Disposable insulin pumps are small, lightweight, adhesive devices currently provided by Insulet alone. The pump is placed directly onto the skin under the patient's clothes, for three days maximum, and is then replaced. Insulin is injected into the reservoir cartridge within the pump, containing 200 units of insulin, and is delivered through a canola (similar to the multiple use pump canola) inserted into the skin using an automatic process. The disposable insulin pump is equipped with a manual wireless device similar in size and appearance to a PDA, used to program and control the insulin pump.

The Centre for Evidence-Based Purchasing, NHS Purchasing and Supply Agency, CEP 08004, February 2008 buying guide assesses direct costs of treatment based on insulin pumps are three times higher than MDI treatment. They include the cost of equipment (insulin pumps and disposable accessories) and the cost of insulin.

Advantages of treatment using an insulin pump

MDI treatments and insulin pump treatments are intense insulin management therapies that according to many health professionals lead to more efficient monitoring of blood glucose levels. Although traditional treatment is easier to apply and relatively inexpensive, it is not as efficient as the other forms of treatment and in the long range leads to the highest rate of complications.

It has been proven that compared to MDI treatments, insulin pump treatment provides a variety of advantages for insulin-dependent diabetics, including:

| * | Improved glycemic control. Several studies have proven the advantages of treatment using insulin pumps compared to MDI treatments, including improved glycemic control, lower glycemic fluctuations and number of hypoglycemic incidents. Additionally, insulin pump treatment provides higher consistency compared to MDI treatment with regard to basal insulin absorption, due to the use of fast acting insulin compared to long range insulin, as well as bolus treatments, added at higher frequency through the insulin infusion without need for additional injections. |

| * | Improved lifestyle flexibility. Treatment with an insulin pump provides patients with increased flexibility with regard to nutrition, ability to carry out physical activities and sleeping habits. |

Diabetes treatment market (continued)

| * | In case of MDI treatment, patients may have to eat whether they are hungry or not to compensate for peak insulin levels, low blood glucose levels or physical activity. When treated with an insulin pump, the insulin rise phenomenon decreases and patients can generally tolerate the decline in blood glucose levels or carry out physical activities during insulin pump treatment. The insulin peak phenomenon decreases and patients can usually tolerate decline in blood glucose levels or carry out physical activities without being required to eat, buy temporary slowing down basal insulin infusion rate. Furthermore, insulin pump treatment helps patients avoid the need for frequent, painful injections. |

Challenges characterizing insulin pump treatment

Although insulin pump treatment is considered the best clinical treatment for diabetes type 1 and diabetes type 2 patients who depend on insulin, the treatment integration process was limited by its very essence.

The company believes, limited integration of treatment with insulin pumps may be related to the high cost it involves as well as performance and design of current insulin pumps that are below optimal. Additionally, the company believes some of these factors are related to the motor and gear system delivery method that characterizes their competitors' pumps.

The motor and gear systems require sophisticated, expensive production processes. The company believes the high costs related to motor and gear based insulin pumps greatly restricted integration of these pumps, particularly in developing countries.

Due to the high production costs of motor and gear based insulin pumps, the prices of multiple use insulin pumps are between $4,000 and $6,000. These costs, come in addition to the ongoing annual expense involved in using infusion kits, batteries and the expensive insulin type required to operate the pump.

To the company's best knowledge, multiple use insulin pumps on the market are usually designed for use over a four-year period, the standard warranty period for such devices. The price of the only commercially marketed disposable insulin pump – Insulet Omnipod – may be lower at only $700. However, following initial purchase of the system, Omnipod uses are required to buy at least 10 disposable insulin pumps a month, each sold for $34. Assuming the system is used over a four year period (the Omnipod system remote control is also covered by a four-year warranty) and taking into consideration the Biodegradable materials required for disposable insulin pumps (valued at $1,500 annually, without insulin), the total price of the disposable insulin pump is actually higher than the multiple use insulin pumps. The total price of the Omnipod may reach the price of a multiple use insulin pump after two years of use only. However, the cost advantage of the disposable pump remains due to the pay-as-you-go pricing model used for it.

In the USA and other developed countries, the cost of insulin pumps are covered, at least partially, but third party factors, however joint payments and deductibles can still be quite significant. For example, in the USA, joint payments total 20% of the insulin pump cost, meaning the patient has to invest between

Diabetes treatment market (continued)

$800 and $1,200 in the insulin pump as well as $300 annually for infusion kits, in addition to the cost of insulin.

Usually, diabetes type 2 patients have to handle higher costs, since some of them don't receive any monetary refund.

The company believes an additional obstacle facing widespread integration of insulin pump treatment is derived from the lack of willingness of external payment factors to cover the high prior cost of multiple use insulin pumps, due to the relatively short length of time patients remain in a particular health framework and the fear they may stop using the insulin pump treatment.

Competitors

A description of several companies in the business:

| * | Insulet Corporation (hereinafter: "Insulet") – Insulet is a medical device supplier that develops, manufactures and markets insulin infusion systems for insulin dependent diabetics. Insulet's insulin management system, OmniPod (OmniPod system), includes the OmniPod disposable infusion device as well as mobile diabetes manager that operates on wireless. The FDA approved the sale of the OmniPod system in the USA. |

| * | Medtronic Inc. (hereinafter: "Medtronic") – Medtronic is a global company operating in the medical technology arena. It operates through seven divisions that manufacture and sell medical treatments based on devices: heart rhythm management, spine, cardiovascular, neuro-modulation, surgical technologies and physio-control. Through its seven divisions, Medtronic develops, manufactures and markets its medical devices in over 120 countries. Its major products include solutions for cardiac arrhythmia, cardiovascular diseases, neurological problems, spinal problems, skeletal and muscular system traumas, urological problems and gastric problems, diabetes as well as nose, ear and throat disorders. The Medtronic sugar division produces external insulin pumps, continuous glucose monitoring devices, Carelink treatment management software and blood sugar meters. |

| * | Animas Corporation (hereinafter: "Animas") – Animas develops pager-sized automated insulin pumps, "worn" by diabetic patients, providing the body with continuous fast acting insulin. The infusion pumps, connected to a pipe with a needle inserted under the skin, replace the use of periodic insulin injections. Additionally, Animas sells diabetes management software and various pump accessories. It markets its products around the world through a combination of direct sales representatives and distributors. Animas is a Johnson & Johnson subsidiary, subordinated to its LifeScan division. |

| * | I-Flow Corporation (hereinafter: "I-Flow") – I-Flow designs, develops and markets drug delivery systems and surgical products for alleviating post surgical pains and treatment of the operated area. I-Flow products are used in hospitals, independent surgical centers, homes etc. The group deals mainly in design, development, production and marketing of advanced, cost-effective ambulatory infusion systems. It operates through a single operation channel. I-Flow has identified two product lines: local anesthetics and intravenous infusion treatment. It produces compact, mobile infusion pumps, catheters and pain kits that enable delivery of local anesthetics, cheparentapy, nutritious additives and other medications. Group customers include hospitals and alternative sites. It markets its products through distributors in the United States, Canada, Europe, Asia, Mexico, Brazil, Australia, New Zealand and the Middle East. |

Competition (continued)

The competitors' share of the global insulin pump market (based on revenue):

Medtronic is the leading supplier, hodling 58% of the market in 2009. Medtronic's MiniMed Paradigm product sells well: it is the first insulin pump integrated with the company's continuous sugar monitoring system (CGM), providing closer monitoring of glucose levels along with higher quality of living.

Roche, with a 12% market share, is the second leading supplier. The company's Accucheck insulin pump is characterized by steady growth due to properties including three operating menus, four bolus options, five basal profiles and smaller dimensions.

MiniMed (Medtronics) and Disetronic Medical Systems (Roche) were market leaders in this sector until 2000, when the market began to split flowing the entrance of companies such as Animas Corporation with is R1000 insulin pump, and Eltec with its Cozmo insulin pump. The acquisition of MiniMed, considered the leading insulin pump manufacturer in the USA, by Medtronic and acquisition of Disetronic, one of Europe's leading insulin pump manufacturers, by Roche helped these companies regain market shares and obtain control of the insulin pump global market.

Currently, Animas holds a 11% global market share and is in constant Competitors with Insulet, who has a 10% market share. Since at the moment, Insulet is the only company that supplies disposable insulin pumps, it has managed to increase its market share quickly since entering the arena in 2005.

Major Risk and Uncertainty Factors

An economic valuation should reasonably and fairly reflect a given situation for a particular time, based on known facts and defined risk factors, relating to the basic assumptions and forecasts based on this information. The starting point of our forecasts is the unaudited financial statements on 30 September 2011. According to company data presented to us, the major risk and uncertainty factors related and stemming from its line of business are:

| * | Financing problems. Company operation was stopped several months ago due to lack of financing. Delay and/or difficulty in raising the finance needed to renew its product development operation may cause the company to terminate its operation altogether. Furthermore, any delay in the company work schedule, for any reason, due to the extensive costs involved, may cause the company to incur additional expenses that could prevent completion of product development due to lack of the required financing sources. |

| * | Market recession. The recession in the Israeli and global financial markets and crisis such as the latest economic crisis that hit the global markets, may make it difficult for the company to raise the required financing sources and may make the financing terms obtained by the company, if any, more expensive. |

| * | Technological changes. Company operation results depend on its ability to finish developing its products and market them commercially. There are no assurances that R&D activity that begins in over a year's time will bear fruit, enabling successful Competitors with competing products. |

| * | Advanced medical instruments developed and manufactured by Competitors. Development of advanced medical devices by the company's competitors providing apt and/or more advanced alternatives to its products, may make future introduction to its destination markets more difficult. |

| * | Commercial production and marketing of company products. The company has not yet experienced production for commercial marketing. When the company transitions to production for commercial purposes, difficulties may arise that delay or even prevent expected sale of products and company development and growth. Successful marketing of company products is based on the company's ability to establish an efficient marketing and sales mechanism in cooperation with external parties. Inability to establish the required marketing and sales system may damage or even prevent commercial marketing of the products. |

| * | Completion of development of company products. The company is taking measures to complete development of its products. There is no certainty that development activities will conclude successfully, and the products are found efficient and safe for use. The company's development schedule may change, subject to existence of various factors. Failure to uphold the planned schedule may cause the company addition expense related to product development or even prevent completion of their development. Furthermore, costs related to the product development process may change and the company may incur additional product development expenses that may even prevent completion of the development without the required financing sources. |

Financial Analysis

Profit and Loss Statement

The following table displays the reviewed profit and loss statement for Spring in the first nine months of 2012 and audited statements for the years 2010-2011 (in NIS thousands):

| NIS in thousands | | December 31, 2009 | | | December 31, 2010 | | | December 31, 2011 | | | September 30, 2011 | | | September 30, 2012 | |

| Income | | | 368 | | | | 1,264 | | | | 1,506 | | | | 1,224 | | | | 609 | |

| Cost of sales | | | 437 | | | | 4,778 | | | | 4,580 | | | | 5,130 | | | | 1,006 | |

| Gross profit | | | (69 | ) | | | (3,514 | ) | | | (3,074 | ) | | | (3,906 | ) | | | (397 | ) |

| R&D expenses | | | 6,314 | | | | 9,336 | | | | 11,773 | | | | 10,223 | | | | 1,375 | |

| Sales and marketing expenses | | | 611 | | | | 2,274 | | | | 2,099 | | | | 1,627 | | | | 1,208 | |

| General and Administrative expenses | | | 1,221 | | | | 2,733 | | | | 2,629 | | | | 1,945 | | | | 1,865 | |

| Operating Profit (loss) | | | (8,215 | ) | | | (17,857 | ) | | | (19,575 | ) | | | (17,700 | ) | | | (4,845 | ) |

General

In view of the company's business situation and lack of available financing sources, on 21 March 2012 a decision was made to apply a strategic reorganization plan aimed a significant decrease in operational expenses, including cutting down on manpower and a pay cut for position holders. At the Valuation date, the company had stopped its R&D operations.

Operational revenue and profitability

Company revenue over the first nine months of the year totaled NIS 610 thousand, compared to NIS 1,225 thousand in the parallel period last year, mainly from sale of pump sets. The decrease in sale and the decrease in operational performance is derived mainly from lack of the resources required to support the company's ongoing operation and work in a diminished format from last March.

Balance sheet

The following table displays Spring's balance sheet draft for 30 September 2012 and audited balance for 31 December2011 (in NIS thousands):

| NIS in thousands | | December 31, 2010 | | | December 31, 2011 | | | September 30, 2012 | |

| Current assets | | | | | | | | | |

| Cash and cash equivalent | | | 9,777 | | | | 796 | | | | 1,198 | |

| Short term deposits | | | 210 | | | | 303 | | | | 301 | |

| Trade receivables | | | 322 | | | | 251 | | | | 13 | |

| Other accounts receivable | | | 1,787 | | | | 3,155 | | | | 115 | |

| Fixed assets held for sale | | | - | | | | - | | | | 204 | |

| Inventory | | | 1,279 | | | | 808 | | | | 1,785 | |

| Total current assets | | | 13,375 | | | | 5,313 | | | | 3,615 | |

| | | | | | | | | | | | | |

Non-current assets | | | | | | | | | | | | |

| Long term deposits | | | 151 | | | | 74 | | | | 7 | |

| Fixed assets, net | | | 1,250 | | | | 1,114 | | | | 1,827 | |

| Intangible assets | | | 133 | | | | 165 | | | | 89 | |

Total non-current assets | | | 1,534 | | | | 1,353 | | | | 1,923 | |

| Total assets | | | 14,909 | | | | 6,665 | | | | 5,539 | |

| | | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | | |

| Trade payables and service providers | | | 3,125 | | | | 296 | | | | 195 | |

| Other accounts payable | | | 1,615 | | | | 3,204 | | | | 2,528 | |

| Loans from parent company | | | 22,126 | | | | 27,657 | | | | 35,229 | |

| Total current liabilities | | | 26,866 | | | | 31,157 | | | | 37,952 | |

| | | | | | | | | | | | | |

Non-current liabilities | | | | | | | | | | | | |

| Provision for chief scientist's royalties | | | 5,236 | | | | 6,691 | | | | 4,488 | |

| Obligations for capital lease and rent | | | - | | | | - | | | | 65 | |

| Liabilities for employee severance Benefits | | | 55 | | | | 37 | | | | - | |

| Total noncurrent obligations | | | 5,291 | | | | 6,728 | | | | 4,553 | |

| Equity | | | (17,248 | ) | | | (31,220 | ) | | | (36,966 | ) |

| Total liabilities and equity | | | 14,909 | | | | 6,665 | | | | 5,539 | |

Major assets in company balance for 30.9.2012 are fixed assets (approximately 33%), inventory (approximately 32%), cash and cash equivalent (approximately 27%).

Company liquidity is "weak" characterized by high reliance on parent company loans. The company's cash on 30.9.12 was only NIS 1,500 thousands. Should the company fail to raise external financing sources, its continued R&D operation is seriously threatened.

Methodology and relevant accounting standards

Relevant Accounting Standards

The International Accounting Standard 36 (amended) (hereinafter: “standard” or “IAS 36”) is looking to ensure that the amount presented for an entity’s assets is is not bigger than their recoverable amount. An asset is presented by an amount that is bigger than its recoverable amount when the carrying amount of the asset is higher than the amount to be received from the use or sale of the asset. If this is the case, the asset is considered impaired and the standard requires the entity to recognize loss due to the decline in value of the asset.

The standard applies to all assets (except some exceptios specified in the standard) including fixed assets, intangible assets and goodwill acquired in a business combination. Goodwill acquired in a business combination represents payment made by the buyer, in anticipation of future financial benefits from assets that cannot be identified or recognized separately. Goodwill does not produce cash flows that are independent from other assets or groups of assets, and often contributes to the cash flow of several cash-generating units.

Cash generating unit is the smallest identified group of assets that generate positive cash flows, which are substantively independent of positive cash flows from other assets or groups of assets.

Determining impairment of depreciable assets. The standard defines several stages to identify, acknowledge and measure impairment of an asset that is systematically depreciated or amortized , including fixed assets. Only when one stage is realized, it passes on to the following stage.

Stage A – identifying an asset that may be impaired

An entity shall assess at the end of each reporting period whether there is any indication that an asset may be impaired. If any such indication exists, the process of evaluation should continue. Examination of the indications will be carried out on the date of each balance. The standard provides a list of examples for indications of impairment:

External sources of information

| * | During the period, as asset's market value has declined significantly more than would be expected as a result of the passage of time or normal use; |

| * | Significant changes with an adverse effect on the entity have taken place during the period, or will take place in the near future, in the technological, market, economic or legal environment in which the entity operates or in the market to which an asset is dedicated; |

| * | market interest rates or other market rates of return on investments have increased during the period, and those increases are likely to affect the discount rate used in calculating an asset's value in use and decrease the asset's recoverable amount materially; |

| * | The carrying amount of the entity’s net assets is more than the entity’s market capitalization. |

| Internal sources of information |

| * | There is available evidence of obsolescence or physical damage of an asset. |

| * | Significant changes with an adverse effect on the entity have taken place during the period or are expected to take place in the near future, in the extent to which, or the manner in which the asset is used or expected to be used. |

Relevant Accounting Standards (continued) |

| * | There is evidence showing the asset’s economic performance is, or will be, worse than expected. |

Should signs of impairment in value be found, one should examine whether impairment has occurred in view of the above signs and others. For that, the recoverable amount should be measured. Should the recoverable amount of the asset be lower than its carrying amount, the asset should be written down accordingly. In addition, the standard requires an annual impairment test to be conducted for indefinite life intangible assets, intangible assets that are not yet ready for use and goodwill acquired in a business combination; the annual test is required regardless the existence, or lack of existence, of impairment indications.

Stage B – measuring the recoverable amount

The recoverable amount of an asset or cash generating unit is the higher of its fair value less costs to selle and its value in use. The recoverable amount will be determined for a single property or the cash generating unit to which it belongs.

Fair value less costs to sell, is the amount that may be obtained from the sale of an asset or cash generating unit in a transaction not influenced by special relationships between the parties, between a willing buyer and willing seller, operating in an intelligent manner, less the costs of disposal.

Value in use, is the present value of the future cash flows expected from the asset or cash-generating unit.

The standard determines it is not always necessary to determine both the fair value less costs to sell and its value in use, this is for example the situation when the value under one of these components is higher than the book carrying amount of the asset. Furthermore, the standard notes it is sometimes impossible to establish the fair value of the asset less costs to sell, particularly when the asset is not traded in an active market. In this situation, the standard notes that the entity may use the assets’s value in use, as its recoverable amount.

According to the standard, the value in use of an asset (or cash generating unit) includes positive and negative cash flows from ongoing use of the asset (including operational overhead and cost of “maintaining the existing state”). The standard emphasizes cash flows from the asset are not to include negative flows from financing activities and payments or income tax returns.

The standard further emphasizes, the capitalization rate in which the asset’s (or cash generating unit’s) cash flows should be capitalized is the pre-tax discount rate , reflecting the market assessments of the time value of money and specific risks of the asset (or cash generating unit) for which the asset’s cash flows were not adjusted.

Relevant accounting standards (continued)

Stage C – recognition and measurement of loss due to impairment

As mentioned above, the recoverable amount is the highest of the assets’s fair value and/or asset’s value in use. The asset’s carrying amount must be reduced to its recoverable amount only if the asset’s recoverable amount is lower than its carrying account.

Carrying amount is defined as the amount presented in the books after deducting the accumulated depreciation and accumulated impairment losses.

This deduction constitutes loss from impairment. Additionally, the standard requires that loss due to impairment will be recognized immediately in the profit and loss statement, when the impairment of a cash generating unit will first be allocated to goodwill, if any, and then to the remaining noncurrent assets in proportion to their carrying amount.

The standard also determines a limit for allocation of loss from impairment to an asset belonging to a cash generating unit so that the asset, in the second stage, is not written down beyond the higher of its fair value less costs tosell or value in use, or zero.

Common Valuation Approaches

There are several commonly used methods of evaluating the financial value of businesses and companies:

* Net asset value method (NAV)

* Comparison to similar transactions

* Multiplier method, and

* Discounted cash flow (DCF) method

Net asset value (NAV) method

The net asset value (NAV) method is suited mainly for business with multiple tangible assets, such as companies holding real-estate properties. This method is based on the cost of the property held by the business minus its obligations, reflected in its balance sheet. Additionally, NAV is used to evaluate the worth of holding companies.

The approach is also suitable for valuation of the establishment costs of a similar business, but not necessarily to assess potential profit expected from the business' assets. The major drawback of the method is in the fact it overlooks existing profit potential of the business beyond the assets recorded in the books.

Comparison with similar transactions

Comparison with similar transactions uses the actual price of the sales transaction of the evaluated business or of similar businesses, providing this transaction was carried out a reasonable time before the Valuation. In order to compare with transactions in similar businesses, transactions that are similar in their line of business, operational properties, tradability rate and financial data should be located.

The Valuation stages in comparing with similar transactions are:

* Locate transactions in businesses with operational properties similar to the evaluated business.

| * | Find an appropriate base to compare the relative size of the similar businesses with the evaluated business. |

| * | Calculate a mean multiplier of the similar transactions and evaluate the business by using this multiplier. |

The advantages of this method is by properly reflecting, through prices actually determined between willing buyers and sellers, all parameters that influence value and prevents the need to base the valuation on forecasts that may be questionable. Furthermore, using transactions that were realized close to the Valuation date ensures the value produced using this method is based on similar financial reality and business environment, truly reflected by the market price.

The major drawback of this method is the difficulty, usually encountered when trying to trace similar transactions from which the value of the evaluated business may be derived.

Common Valuation Approaches (continued)

Multiplier method

The multiplier method resembles the comparison to similar transactions but is based on the share prices of public companies in the evaluated business' sector.

Using the multiplier method, the business is evaluated based on the mean ratio in the field in which it operates, between data based on market values and a selected accounting parameter. The acceptable parameters include net profit, operational profit, sales and equity. Sometimes operational parameters are used, including number of subscribers, sales area etc. The mean ratio in the line of business between market value and that parameter.

It is particularly worthy for obtaining an initial general assessment of the value of the business, but does not provide precise value. The advantage of the method is its simplicity and speed compared to other methods. The major disadvantage is in the fact it does not include a series of factors that may influence the specific value of the business, unlike "similar" businesses in the same field, e.g.: different growth rate, capital structure etc. Another drawback is that in most cases there is a wide range of multipliers and the average does not necessarily bring the correct result.

Discounted Cash Flow method

The discounted cash flow method is based on assessment of the ability of the business to produce cash. Accordingly, the value of the business is assessed through discounted cash flow it is expected to produce. Future cash flows are discounted at the capital rate that reflects the risk involved in the business operations and expresses the gain an investor would expect to make from a business with similar risk.

The discounted cash flow method is the most acceptable method with the soundest theoretical base. To use this method a financial model should be constructed to forecast sales, sales growth, management and selling expenses, taxes and investments, from which the expected cash flow is derived.

The major advantage of the method comes from its adaptation to a specific business and attention to unique factors within the evaluated business. This characteristic creates relatively high precision. The method's disadvantages are the difficulty in forecasting relevant future revenue, expenses and investment and determining the appropriate capital price.

Scenario analysis

In certain cases, the discounted cash flow method is applied to a series of alternative scenarios for the business and the field it operates in. Usually, this is done when the business and/or field are under significant uncertainty. In this framework, several clearly different scenarios are examined, reflecting the business operation results under different assumption on the business and field development. For each scenario an individual DCF analysis is generated. The realization probability of each scenario is calculated. The value of the business is based on the weighted average of the different scenarios.

Goodwill impairment examination method

Examination of goodwill impairment was carried out as of September 30, 2012, t in view of indications of impairment, as assessed by D medical management, during the reported period.

Since goodwill cannot be assessed separately from Spring's operation, the accepted method of examining impairment in goodwill value is assessing the recoverable value of each cash generating unit to which the acquired goodwill or part of it has been related.

Since Spring was identified as the smallest cash generating unit to which goodwill may be allocated, and since the company is not traded, there is no basis for reliable assessment of the expected return from its sale in an arm's lengths transaction between a willing buyer and seller, behaving rationally. Therefore, the net selling price of Spring cannot be determined and its recoverable amount will be based on its value in use.

The measurement of the recoverable amount is therefore based on the company's value in use. The value in use is assessed using the DCF method of the revenue expected from company operation, applying the scenario method, based on company management assessments, data and documents received from the company and our assumptions specified below.

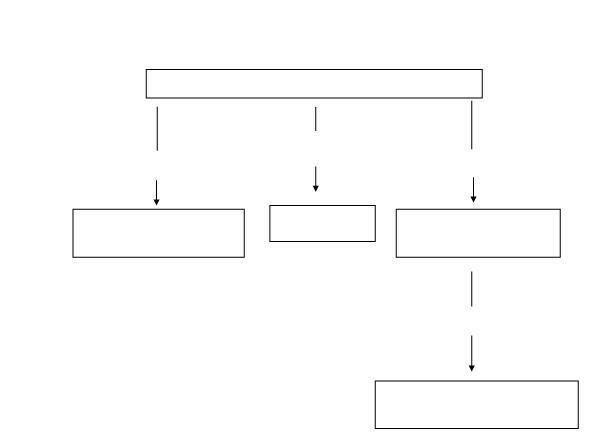

Possible scenarios:

| * | Pessimistic scenario (assessed by D Medical management at 80% probability). This scenario assume the company will be terminated due to lack of external financing sources and/or failure in introducing its products to destination markets. Since the company does not have substantial tangible assets, in this case its value is zero. |

| * | Base scenario (20% probability). The company raises the financial resources required to continue its ongoing operation and markets its products according to the multi-annual business plan. |

The company's value in use composed of the scheme for the two above mentioned scenarios will, as mentioned above, constitute the recoverable amount. This amount will be compared to the company's book value (based on the 30 September 2012 financial statement).

Discount rate

In order to assess asset value using the revenue approach, annual cash flows from the asset must be discounted to the present value by the discount rate that enfolds the risks included in the cash flow and realization of expected cash flow.

In determining the discount rate, one must take into account that the discount rate is relative to the risk included in the specific investment. An investor compares alternative investments and chooses the one that brings him the highest return on his investment, under given risk levels. When determining the discount level, one should relate to the mean return on capital of the company in general. This discount rate is the weighted average cost of external capital and return on the shareholders' capital.

The discount rate is calculated using the WACC model, Weighted Average Cost of Capital, including cost of external capital and return on shareholders' capital, specified below.

WACC = Kd * (d%) + Ke * (e%)

In which:

Kd – debt return rate

d% = percentage of debt from total assets

Ke = percentage of return on equity

e% = percentage of equity from total assets

Debt return rate – the price of normative debt paid by the company, we value it at 0%.

Spring's capital structure – to assess the ratio of debt compared to Spring's total assets the weight of equity was assessed at 100%.

Equity return rate – determined using the CAPM (Capital Asset Pricing Model). According to this model, the return rate on equity is derived from riskless interest on the date of purchase in addition to market risk premium multiplied by the company's risk level compared to the market portfolio standard deviation (β).

Ke=Rf+b *(Rm-Rf)

In which:

Riskless Israeli interest (Rf) - is determined based on average return of State of Israel "Galilee" type long range bonds valued at 2.28%*.

Market risk premium (Rm-Rf) – was calculated according to the company's destination market risk premium valued at 8.08**.

------------------

* Source: Bank of Israel

** Source: Stern Business School, Damodaran online

Capitalization rate (continued)

Spring's beta (β) – the company's relative risk factor compared to market premium. This factor reflects relative risk involved in any investment, based on the correlation between investment return to general market capital return. When this factor is greater than 1, the business is highly sensitive to market fluctuations. I.e., in case of recession the field will be worse hit than others and in case of flourishing, the field will be influenced positively more than other fields. When this factor is smaller than one, the value of the business is sensitive below average to market fluctuations.

For Valuation purposes, we used the average beta of the comparison companies (specified in Appendix A). This beta is an estimated 0.81.

Small company risk premium (SFP) – another return rate related to company shares and reflecting specific risks, including additional premium demanded in case of lack of tradability and liquidity (hereinafter: "tradability premium"). Empirical data and various studies show investors in the capital market usually demand additional risk premiums for investment in companies, expressing the different parameters of their investment. The appropriate discount rate for company capital was composed in this study from the Specific Premium Size rate assessed at the date of our study at 11.77%*. And additional risk premium relating to private companies and negative operational parameters assessed in our paper at 5% (similar to previous Valuation) on interim results of the calculated Ke. Accordingly, the return rate on equity is 25.58%.

According to these parameters the capital price determined for the company is 25.58%, detailed in the table below:

WACC

| Risk-less interest rate in Israel (Rf) | 2.28% |

| Market premium (Rm-Rf) | 8.08% |

Beta (β) | 0.81 |

| Additional risk premium (Rs) | 16.77% |

| Price of capital (Re) | 25.58% |

| Weight of equity | 100.0% |

| Price of debt (Kd) | 0% |

| Percentage of tax | 25% |

| Representative debt price, before tax | 0% |

| Weight of debt | 0% |

| WACC, rounded | 25.58% |

International standard 36 requires to assess pre-tax cash flows at the pre-tax discount rate. However, post-tax cash flow discounted at the discount rate after tax, as calculated by us, will give an almost identical result. In view of this, and for completeness reasons, we decided to present the pre-tax cash flow and use the pre-tax discount rate, that is estimated at 30.8%.

-----------------

* The company in re is a private company operating in Israel while the compared company sample relates to public companies traded on leading global stock exchanges with substantially higher operation volumes than the company's. Furthermore, they have more varied operations and in most cases higher gross profit margins than the company's. Therefore, based on differences in returns between small and large American companies, a specific risk premium was selected. Valuation Edition Yearbook [2012], Boston Associates Inc.

Key Working assumptions

Profit and Loss Statements

Spring's valuation was carried out, as mentioned, using the income approach through discounted cash flows (DCF) expected to derive from company, while applying the scenario analysis approach. Based on the company's historical performance, multi-annual business forecast, company budget compared to execution in 2012 and public information, forecast cash flows for the forecasted period was determined.

Pessimistic scenario. As specified in the previous section, the pessimistic scenario assume the company will not manage to raise financing resources for its continued operation and/or will not manage to enter destination markets. Since the company does not have substantial tangible assets, company value in this scenario is zero.

Base scenario. In this case, since the company is a startup company due to begin sales only in 2014 and reach "relative" stability in sales growth in 2018, a six-year forecast period was used. The cash flow was discounted by the appropriate return rate for the company's development stage.

The following table presents expected profit and loss statements for Spring in the base scenario (NIS thousands):

| NIS k | | | 2009A | | | | 2010A | | | | 2011A | | | | 2012A 9m | | | 2012E Q4 | | | | 2013E | | | | 2014E | | | | 2015E | | | | 2016E | | | | 2017E | | | | 2018E | | | Repre- sentative | |

| Sales | | | 368 | | | | 1,264 | | | | 1506 | | | | 609 | | | | - | | | | - | | | | 565 | | | | 8,059 | | | | 27,024 | | | | 73,817 | | | | 132,707 | | | | 139,342 | |

| Cost of Sales | | | 437 | | | | 4,778 | | | | 4,580 | | | | 1,006 | | | | - | | | | - | | | | 648 | | | | 7,405 | | | | 15,821 | | | | 42,676 | | | | 74,316 | | | | 78,032 | |

| Gross profit | | | (69 | ) | | | (3,514 | ) | | | (3,074 | ) | | | (397 | ) | | | - | | | | - | | | | (83 | ) | | | 654 | | | | 11,203 | | | | 31,140 | | | | 58,391 | | | | 61,311 | |

| Gross profit % | | | (18.8 | )% | | | (278 | )% | | | (204.1 | )% | | | (65.2 | )% | | | | | | | | | | | (14.7 | )% | | | 8.1 | % | | | 41.5 | % | | | 42.2 | % | | | 44. | % | | | 44.0 | % |

| R&D costs | | | 6,314 | | | | 9,336 | | | | 11,773 | | | | 1,375 | | | | - | | | | - | | | | 2,471 | | | | 2,901 | | | | 3,243 | | | | 7,382 | | | | 10,617 | | | | 11,147 | |

| Sales and marketing costs | | | 611 | | | | 2,274 | | | | 2,099 | | | | 1,208 | | | | - | | | | - | | | | 2,259 | | | | 3,980 | | | | 7,490 | | | | 12,351 | | | | 16,044 | | | | 16,847 | |

| Management and administrative costs | | | 1,221 | | | | 2,733 | | | | 2,629 | | | | 1,865 | | | | 419 | | | | 1,896 | | | | 2,305 | | | | 2,801 | | | | 3,405 | | | | 4,139 | | | 5,031 | | | | 5,282 | |

Total operating expenses | | | 8,146 | | | | 14,343 | | | | 16,501 | | | | 4,448 | | | | 419 | | | | 1,896 | | | | 7,034 | | | | 9,638 | | | | 14,138 | | | | 23,872 | | | | 31,692 | | | | 33,276 | |

Operating profit (loss) rate | | | (8,215 | ) | | | (17,857 | ) | | | (19,575 | ) | | | (4,845 | ) | | | (419 | ) | | | (1,896 | ) | | | (7,117 | ) | | | (9,029 | ) | | | (2,935 | ) | | | 7,269 | | | | 26,699 | | | | 28,034 | |

| Profit (loss) % on regular operation | | | (2232 | )% | | | (1413 | )% | | | (1300 | )% | | | (796 | )% | | | - | | | | - | | | | (1259.5 | )% | | | (112.0 | )% | | | (10.9 | )% | | | 9.8 | % | | | 20.1 | % | | | 20.1 | % |

Key working assumptions (continued)

Expected revenue

The following table shows the expected revenue according to the different products in the base scenario (NIS in thousands)

| NIS k | | | Q4 2012E | | | | 2013E | | | | 2014E | | | | 2015E | | | | 2016E | | | | 2017E | | | | 2018E | | | Representative | |

Springtm Zone pump | | | - | | | | - | | | | 528 | | | | 5,468 | | | | 8,220 | | | | 9,852 | | | | 8,161 | | | | 8,569 | |

Dedicated IV set for Springtm Zone pump | | | - | | | | - | | | | 37 | | | | 984 | | | | 2,753 | | | | 4,778 | | | | 6,438 | | | | 6,760 | |

Hybrid dressing pump Springtm Zone | | | - | | | | - | | | | - | | | | 1,168 | | | | 9,400 | | | | 30,006 | | | | 47,013 | | | | 49,364 | |

| Dedicated IV set for hybrid pump | | | - | | | | - | | | | - | | | | 439 | | | | 6,651 | | | | 29,180 | | | | 71,095 | | | | 74,649 | |

| Total revenue | | | - | | | | - | | | | 565 | | | | 8,059 | | | | 27,024 | | | | 73,817 | | | | 132,707 | | | | 139,342 | |

| Growth rate | | | | | | | | | | | | | | | 1326 | % | | | 235 | % | | | 173 | % | | | 80 | % | | | 5 | % |

Spring's revenue forecast is founded on the company's multi-annual business plan, examining its reasonability according to public information on the market in which it operates, and discussions with D Medical management.

The company's forecast revenue is based on its expected sales in the following product lines:

* SpringTM Zone pump

* Dedicated IV set for SpringTM Zone pump

* Hybrid dressing pump SpringTM Zone

* Dedicated IV set for the hybrid pump

Details below:

SpringTM Zone pump

The multi-use insulin pump SpringTM Zone is used as the improved next generation for the company's Adi pump; part of the universal IV set Medex that the company began marketing as a pilot from 2010 to late 2011, due to its weak business situation. As far as the company is aware, SpringTM Zone pump is the only insulin pump that applies the IntellispringTM insulin delivery technology. This technology, backed by a continuous monitoring safety system Total Line ControlTM (TLC), enables a new innovative dimension in continuous monitoring and control of insulin delivery (for more information see Section 1).

Early this year, the company obtained CE permission to market the insulin pump in Europe. However, due to lack of financing, commercialization operations were put on hold. D Medical management believes the product will be launched to distributors in the fourth quarter of 2014.

Key Working assumptions (continued)

Here are the major working assumptions used to examine company revenue forecast for the product:

| * | Global market potential of insulin pumps (in quantitative terms): based on global market potential for insulin and scope of global population we calculated the number of insulin pumps in relation to the population. This ratio was multiplied by the European population estimate* (as mentioned, the company intends to begin marketing in Europe in the fourth quarter of 2014). Market potential considered the insulin pump's life expectancy, an estimated 4 years according to public information. |

| * | 7.9% annual growth in the number of insulin pump users.** |

| * | Gradual infiltration rate of 3% into the European market. |

| * | 25% annual wear and tear rate in the number of multiple-use pumps replaced with the hybrid pumps. |

| * | Sales prices were based on D Medical management forecast. Prices were compared to competing products and found reasonable. |

| * | Based on the body of working assumptions specified above, the expected revenues from SpringTM Zone pump sales, between NIS 530 thousands in 2014 to approximately NIS 8,160 thousands in 2018, was found to be reasonable. Additionally, a permanent growth rate of 5% was assumed. |

Dedicated IV set for SpringTM Zone pump |

Along with the SpringTM Zone pump sales, the company intends to sell its distributors the dedicated disposable IV set developed for the pump.

The major working assumptions used to examine the reasonability of the company's revenue forecast for the product are specified below:

* Amount of sales forecast for SpringTM Zone pump, assessed above.

* Annual ratio of 120 sets per pump (replacement every three days).

| * | Sales prices were based on D Medical management forecast. Prices were compared to competing products and found reasonable. |

| * | Based on the body of working assumptions specified above, the expected revenues from SpringTM Zone pump IV set sales, between NIS 40 thousand in 2014 to approximately NIS 6,440 thousands in 2018, was found to be reasonable. Additionally, a permanent growth rate of 5% was assumed. |

SpringTM Zone hybrid dressing pump |

At the date of the assessment, the company is in final stages of developing the SpringTM Zone hybrid dressing pump. The system is hybrid since it can be worn as a dressing pump directly on the body or traditionally by connecting it to the body with an IV set (for more information, see Section 1). The hybrid pump offers, in addition to small dimensions, a price that is cheaper than similar products. The company intends to exploit this advantage for future infiltration into developing markets, e.g. BRIC countries, with a low rate of medical insurance and sensitivity for product prices.

-------------------

* United Nations, Department of Economic and Social Affairs, Population Division.

** Bio Spectrum, "Global insulin pumps market to reach $1.2 billion by 2017" December 30, 2011.

The first version of the pump received SE approval. Company management expects to finish development and design of the pump, including regulatory permission in Europe and the USA towards the end of 2014. Company forecast does not include sale of the pump to BRIC countries due to the high uncertainty involved in entering these developing markets.

Major working assumptions that served to examine reasonability of company revenue forecast for the product are specified below:

| * | Global market potential of insulin pumps (in quantitative terms): based on global market potential for insulin and scope of global population we calculated the number of insulin pumps in relation to the population. This ratio was multiplied by the European and American population estimate* (as mentioned, the company intends to begin marketing in Europe and the USA in the fourth quarter of 2014). |

| * | 7.9% annual growth in the number of insulin pump users. |

| * | Gradual infiltration rate of 3% into the European and American markets over 6 years. |

| * | 25% annual wear and tear rate in the number of multiple-use pumps replaced by the hybrid pumps. |

| * | Sales prices were based on D Medical management forecast. Prices were compared to competing products and found reasonable. |

| * | Based on the body of working assumptions specified above, the expected revenues from SpringTM Zone hybrid dressing pump sales, between NIS 1,170 thousands in 2015 to approximately NIS 47,000 thousands in 2018, was found to be reasonable. Additionally, a permanent growth rate of 5% was assumed. |

Dedicated IV set for SpringTM Zone hybrid dressing pump |

Along with the SpringTM Zone hybrid dressing pump sales, the company intends to sell its distributors the dedicated IV set developed for the pump.

The major working assumptions used to examine the reasonability of the company's revenue forecast for the product are specified below:

* Amount of sales forecast for SpringTM Zone hybrid dressing pump, assessed above.

* Annual ratio of 120 sets per pump.

| * | Sales prices were based on D Medical management forecast. Prices were compared to competing products and found reasonable. |

| * | Based on the body of working assumptions specified above, the expected revenues from SpringTM Zone pump IV set sales, between NIS 440 thousand in 2015 to approximately NIS 71,100 thousands in 2018, was found to be reasonable. Additionally, a permanent growth rate of 5% was assumed. |

-------------------

* United Nations, Department of Economic and Social Affairs, Population Division.

Key working assumptions (continued)

Cost of sales and gross profitability