Mr. Jay Williamson

Dear Mr. Williamson:

This letter responds to your comments, discussed in our telephone conversation on August 21, 2019, regarding the preliminary proxy statement on Schedule 14A filed by Neuberger Berman High Yield Strategies Fund Inc. (the “Fund”) with the U.S. Securities and Exchange Commission (the “SEC”) on August 12, 2019, and the Fund’s responses thereto.

Comment 1: Please respond to our comments in writing in a correspondence filing. Where a comment asks for revised disclosure or revisions are contemplated by your response, please provide draft disclosure to be included in your definitive with your response. Please resolve all material comments prior to printing and mailing.

Response: The Fund will transmit this comment response letter to the SEC as a correspondence filing. The Fund has included revised disclosure herein, as appropriate.

Comment 2: Saba Capital Management, L.P.’s (“Saba”) proxy statement suggests that you intend to invoke the Maryland Control Share Acquisition Act (the “MCSAA”) and that you are taking a position contrary to staff guidance contained in the Boulder Total Return Fund no-action letter (November 15, 2010). Please confirm if this is accurate and, if so, tell us your basis for doing so. Please note that we may have additional comments depending on your response.

Response: We note that the Fund’s proxy statement does not mention the MCSAA. The Fund is not commenting on the accuracy of Saba’s recollection of any discussions it may have had with the Fund’s investment adviser. The Fund is aware of the SEC staff’s guidance in the Boulder Total Return Fund no-action letter and aware of other circumstances, not listed in that letter, in which the SEC staff has permitted registered funds to structure voting rights in a manner other than one vote per share, such as dollar-based voting. See, e.g., SEC No-Action

Letter Sentinel Group Funds, Inc. (October 27, 1992). When a fund uses dollar-based voting each stockholder has one vote for each dollar of net asset value per share, resulting in varying numbers of votes per share both across series/portfolios in a trust and among classes in a single series/portfolio. The Fund is also aware of the Maryland case in which the U.S. District Court allowed a closed-end fund organized in Maryland to rely on the MCSAA. See Neuberger Berman Real Estate Income Fund Inc. v. Lola Brown Trust No. 1B, 342 F. Supp.2d 371 (D. Md. 2004). The Fund understands that the SEC staff is currently evaluating its position on the MCSAA and looks forward to any additional views the SEC staff has as a result of that process. The Fund will consider the guidance that is currently available and that may become available prior to its stockholder meeting and will make a determination on whether to rely on the MCSAA prior to its meeting.

Comment 3: Please confirm your understanding of Item 4(b) of Schedule 14A and, in particular, paragraph 6 as it relates to settlements between parties.

Response: The Fund confirms that it is aware of Item 4(b)(6) of Schedule 14A. If a there is a settlement to which Item 4(b)(6) applies before the Fund files its definitive proxy statement, the Fund will disclose the appropriate information.

Comment 4: On the cover page, please state the approximate date on which the proxy statement is first being sent to stockholders.

Response: The Fund will include the approximate date.

Comment 5: On page 28 under “Vote Required,” we note your statement that the Class II Directors must be voted on by the holders of a majority of outstanding shares. Please confirm if this is the correct standard for a contested election and, if so, clarify disclosure regarding what happens if no director receives that number of votes.

Response: The voting standard on page 28 under the heading “Vote Required” is the correct voting standard for a contested election. The Fund has added the following statement in that paragraph:

If no director nominee receives the required vote, each incumbent Class II Director will carry over and hold office until he or she receives the required vote or until his or her successor is elected and qualified.

Comment 6: On page 34 what does “improved by more than .93% than its Morningstar category mean”? Please revise to clarify.

Response: The Fund has revised the relevant paragraph as follows:

The Board and NBIA regularly review the Fund’s discount compared to other similar closed-end funds and notes that while the Fund did experience a significant widening of its discount at the end of 2018, as did many closed-end funds, the discount it has also narrowed substantially since that time. From December 21, 2018 through July 31, 2019, the Fund’s discount improved by 12.26% while the and has improved by 0.93% more than its Morningstar category average discount improved by 7.46%, through July 31, 2019.

Comment 7: On page 34, we note your statement regarding the cost of a search for a replacement adviser and that diligence would be significant and would be borne by the Fund. As there is a potential that a new adviser could reimburse these expenses in connection with the approval of a new agreement, please revise to include less definitive language.

Response: The Fund notes that it would be unusual for an adviser to reimburse expenses for a new advisory agreement absent a change of control of the adviser necessitating a stockholder vote on the new agreement or the fund being subject to an expense cap arrangement or for a new adviser to reimburse expenses for a new advisory agreement if it were not purchasing another adviser’s business. Nonetheless, the Fund has revised the relevant statement as follows:

The costs of the search for a replacement advisor, the required due diligence of any such potential replacement and the negotiation of a new advisory agreement would be significant and would very likely be borne by the Fund.

Comment 8: On page 36, we note your statement that Saba acquired 73% of its holdings in the six month period ended April 11, 2019. Please tell us when the other 27% was acquired and, if relevant, explain how these other holdings are not inconsistent with your statement that Saba is a short term investor.

Response: The Fund has limited information regarding the purchases and sales of its shares by individual stockholders and groups. Based on publicly available information, it appears that Saba, through the funds and accounts that it manages, has owned a small percentage of the Fund, in varying amounts, for several years. (Saba manages funds and accounts that invest in many closed-end funds and that appear to hold these positions while waiting for potential arbitrage opportunities.) However, as noted in the Fund’s proxy statement, a significant amount of Saba’s investment in the Fund was recently acquired. For example, Saba owned approximately 2.91% of the Fund’s shares as of June 30, 2018 and, less than one year later, owned 19.27% of the Fund’s shares on April 11, 2019.

Saba has a history of quickly acquiring large positions in closed-end funds and, shortly thereafter, submitting one or more self-serving proposal(s) seeking to achieve a short-term gain through some sort of liquidity event such as a tender offer. Shortly after a liquidity event or the proposal(s) passing, Saba typically sells all or most of its position (through the liquidity event or in the market during the lead up to or following the liquidity event). This accelerated accumulation of significant position in a fund followed by an accelerated sale of all or a large portion of that position allows Saba to achieve significant short-term gain to the detriment of the fund’s actual, long-term stockholders and is emblematic of an investor with a short-term investment horizon. For example, Saba recently submitted a shareholder proposal(s) and/or nominees and then later withdrew them after entering into a standstill agreement with nine closed-end funds managed by four separate investment advisers.

Comment 9: On page 36, please explain the basis for your statement that Saba is simply looking for a large, one-time liquidity event to realize profits for itself. In this respect it appears that any benefits accruing to Saba as a result of a self-tender would also be available to other investors.

Response: Please see the Fund’s response above to comment #8. Saba has a history of seeking large, one-time liquidity events to realize profits. Saba, through its ETF, private funds, and accounts, invests in closed-end funds and has a history of submitting proposals and/or nominations and later withdrawing them once funds agree to conduct one or more liquidity events such as tender offers, open-end fund conversions, and liquidations. The Fund believes that Saba does this to benefit its own clients, and not to benefit the stockholders of the closed-end funds it attacks. The Fund believes, including for the reasons described in its proxy statement, that Saba’s actions are harmful to long-term stockholders. Based on public information, Saba is currently the Fund’s largest stockholder and therefore would stand to gain the largest return or benefit from its self-interested proposals. In addition, because stockholders have purchased shares of the Fund at different times (both prior to and after Saba) and at different prices, they may not achieve the same benefits as Saba (for example, a potential tender offer price may not be accretive to all stockholders if some purchased shares at a price higher than the potential tender offer price). Given Saba’s pattern of selling its positions in closed-end funds that have conducted liquidity events, it is unlikely that it would remain in the Fund should the Fund implement the tender offer described in Saba’s proposal. As a result, it would not incur the ongoing higher expenses and other consequences of such a tender offer described in the proxy statement, unlike long-term stockholders.

As stated in the proxy statement, Saba is simply looking for a large, one-time liquidity event to realize profits for itself and has a history of attacking closed-end funds for its own short-term profit. For example, Saba owned 12.05% of Delaware Enhanced Global Dividend and Income Fund’s outstanding shares as of Saba’s latest Schedule 13D amendment filing on March 9, 2018 but did not hold any shares after that fund’s tender offer based on Saba’s Schedule 13F filing

covering the period ended June 30, 2019.1 The Fund is not the first to because aware of this trend. Please see, for example, page 7 of the definitive additional proxy materials filed by BlackRock Credit Allocation Income Trust on June 19, 2019, which includes a table that provides ten examples of when Saba has sold its entire position or significantly reduced its position in a closed-end fund after a liquidity event.2

Comment 10: On page 36, starting with your statement that Saba knowingly fails to comply with regulatory requirements, you make several assertions that Saba has failed to comply with the Investment Company Act of 1940 (the “1940 Act’) and certain SEC orders. We are not in a position to assess the reasonableness of your statement but supplementally request that you provide us with the underlying data you believe supports your position. This data might include, for example, comparisons of creation redemption baskets against fund holdings on particular dates. We further remind you that section b. of the note to Rule 14a-9 indicates that material that directly or indirectly charges improper, illegal or immoral conduct without sufficient foundation may be misleading for purposes of Rule 14a-9.

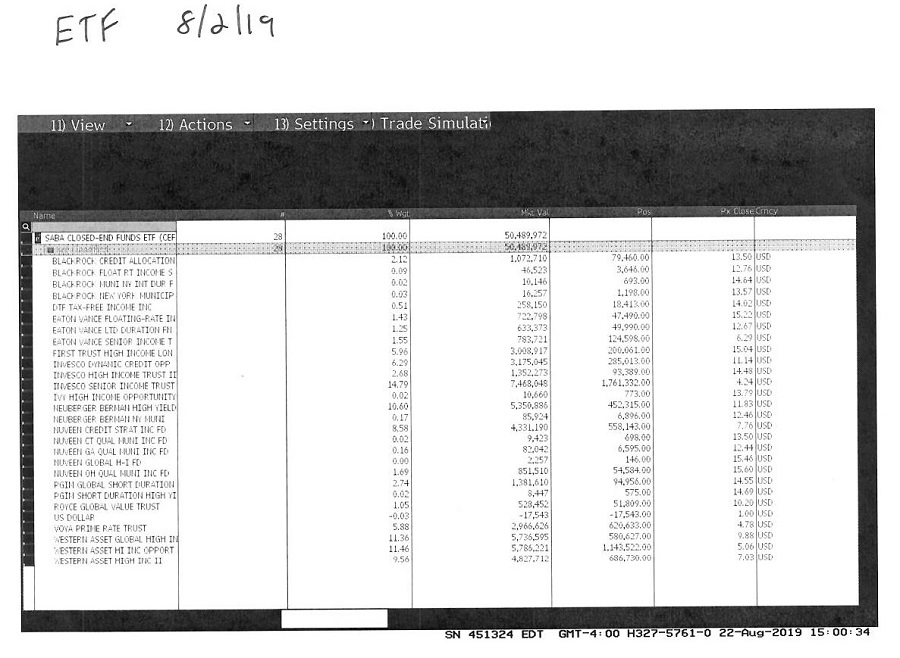

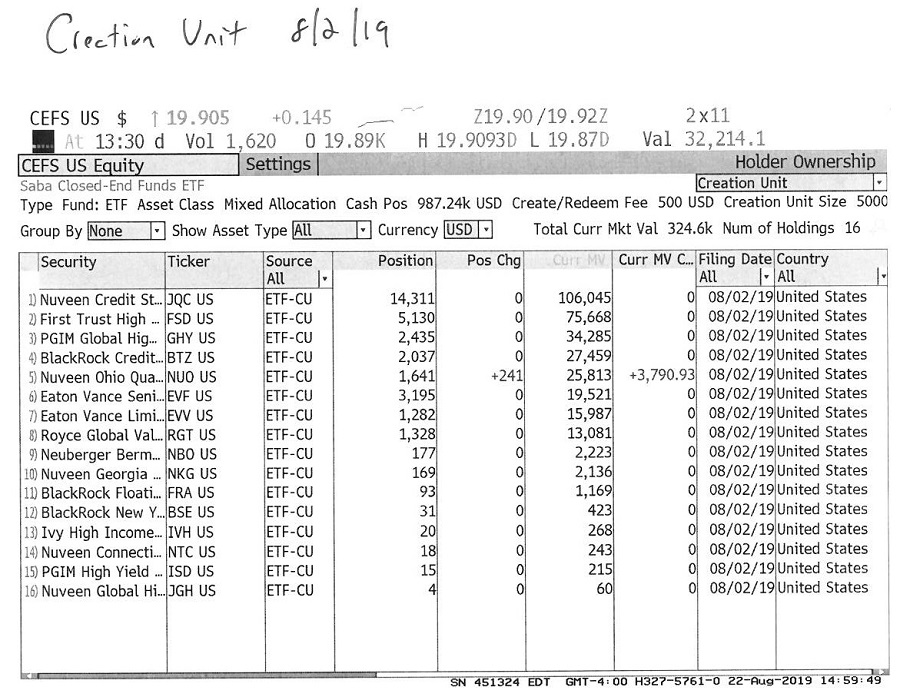

Response: Neuberger Berman Investment Advisers LLC, the Fund’s investment manager (“NBIA”), has observed certain practices related to Saba’s creation basket process for Saba Closed-End Funds ETF (BATS: CEFS) (the “ETF”), a series of an Exchange Traded Concepts LLC (“ETC”) sponsored “umbrella” trust Exchange Listed Funds Trust, that is sub-advised by Saba that appear to be impermissible under the exemptive application and order on which the ETF relies (the “Exemptive Order”) and in violation of the federal securities laws, including Section 17(d) of the Investment Company Act of 1940, as amended and Rule 17d-1 thereunder.3

The belief that Saba’s creation baskets are unlawful is based primarily on ETC’s Exemptive Order for its actively managed ETFs. The Exemptive Order, requires a relying ETF’s baskets to be a pro rata slice of the portfolio, subject to narrow exceptions that do not appear applicable here.4 In practice, CEFS creation baskets bear little resemblance to a pro rata slice of the ETF’s holdings. For example, Saba (i) excludes significant numbers of the ETFs holdings from the creation baskets; (ii) weights the positions that are selected for the creation basket in a manner that appears to be purely discretionary; and (iii) includes securities in the creation basket that are not in CEFS’ portfolio. Unlike index based ETFs, actively managed ETFs relying on the Exemptive Order do not have the flexibility to representatively sample their target index or

_________________________________

1Available at https://www.sec.gov/Archives/edgar/data/1396167/000106299318001139/sched13da.htm and https://www.sec.gov/Archives/edgar/data/1510281/000106299319003423/xslForm13F_X01/form13fInfoTable.xml.

2 Available at https://www.sec.gov/Archives/edgar/data/1379384/000119312519176581/d765756ddefa14a.htm.

3 Available at https://www.sec.gov/Archives/edgar/data/732126/000114420413013284/v337241_40appa.htm.

4 The permissible exceptions under the Exemptive Order are as follows: (a) in the case of bonds, for minor differences when it is impossible to break up bonds beyond certain minimum sizes needed for transfer and settlement; (b) for minor differences when rounding is necessary to eliminate fractional shares or lots that are not tradeable round lots; (or) TBA Transactions; short positions or other positions that cannot be transferred in-kind will be excluded from a creation basket.

include securities in the basket that are not in the index or portfolio. Attached as an Exhibit please find a side-by-side comparison showing CEFS’ portfolio holdings against the holdings of the creation basket for a sampling of days during March and April 2019, when CEFS was accumulating shares in the Fund, and a more recent day from earlier this month that highlight certain CEFS portfolio holdings that do not appear in the basket or that appear in a weighting that is not close to pro rata. We note that the Exhibit is only a representative sample of what NBIA has observed to be Saba’s typical creation basket construction practices, but it is illustrative of the deficiencies noted above.

NBIA and the Fund also believe that Saba’s activities on behalf of CEFS likely violate certain 1940 Act requirements relating to affiliated persons, including Section 17(d) of the 1940 Act and Rule 17d-1 thereunder. For example, Saba appears to use the creation basket process to acquire shares in closed-end funds in advance of launching an activist campaign on behalf of the ETF as well as one or more hedge funds and/or accounts advised by Saba. Once Saba acquires a position in a desired size, the position is often removed from the creation basket, which can preserve the voting power that Saba asserts to increase the likelihood of success of its activist campaign. NBIA and the Fund believe Saba’s practice presents an actual prohibited conflict of interest between the ETF investors, the investors in Saba’s hedge fund(s) and/or account(s) and, most notably, Saba itself. The conflict and opportunity for harm is particularly noteworthy because Saba’s investment of CEFS assets in portfolio companies that Saba is attempting to take over or force into liquidity events harms those entities’ long-term shareholders. Assuming Saba is successful in its efforts, a primary beneficiary would be Saba. Section 17(d) requires registrants to obtain exemptive relief from the SEC but neither Saba nor CEFS appears to have sought or obtained such relief.

Comment 11: The Fund’s N-CSR discloses $90 million in notes payable and $35 million in redeemable preferred shares. Please consider revising the disclosure under the heading “Reduction in Fund Size negatively impacts the Fund’s use of Leverage” on page 39 to address current leverage levels and ratios and provide more definitive disclosure about the actions the Fund would likely need to take if it engaged in the tender offer described by the proposal. In addition, due to the potential negative impact a repurchase may have on the preferred shares, please provide us with the analysis you performed supporting the conclusion that a separate vote would not be required under Section 18(a)(2) of the 1940 Act or any other documents defining the rights and privileges of preferred shares.

Response: The Fund has revised the relevant paragraph as follows:

The Fund has currently outstanding privately placed notes with an aggregate principal value of $90 million and mandatory redeemable preferred shares with an aggregate liquidation preference of $35 million. Saba’s proposal could negatively impact the Fund’s ability to maintain its current amount of leverage. As required by the 1940 Act and in accordance with the terms of the Fund’s leverage

arrangements, if the Fund’s assets were to drop below certain levels relative to the amount of its outstanding leverage, it would be required to reduce the amount of its leverage. Accordingly, if the Fund implemented the tender offer described in Saba’s proposal and a significant number of its shares were tendered, its assets would drop and the Fund would be required to redeem all or a portion of its outstanding preferred shares and/or notes. Doing so would require the Fund to sell more portfolio holdings to raise proceeds to repay notes and/or redeem the preferred shares, resulting in an additional drop in assets, additional transactional expenses and potential incurrence of taxable capital gains. The Fund would need to distribute any net realized capital gains under the tax code. A complete or partial de-lever by the Fund also would deprive the Fund of additional assets to invest in pursuit of its stated objective and may result in a reduction of the Fund’s earnings. The overall reduction in assets could also make it more difficult for the Fund to retain its current level of portfolio diversification.

The Fund believes that a separate vote would not be required under Section 18(a)(2) of the 1940 Act or any other documents defining the rights and privileges of preferred shares. Section 18(a)(2)(D) of the 1940 Act requires that provision be made to require a separate class vote of preferred shares regarding any reorganization or action requiring a vote of security holders pursuant to Section 13(a) of the 1940 Act. As the proposal at issue is precatory, the Fund does not believe it is covered by these categories.

Comment 12: Regarding the reference to the Morningstar US Closed-End High Yield Fund on page 40, please confirm whether this is a comparison the Fund typically makes or uses when it compares its performance internally and to investors.

Response: The Fund notes that Morningstar (and not the Fund) has determined to include the Fund as part of its Morningstar US Closed-End High Yield Fund category. which Morningstar describes as including all U.S. closed-end funds that that seek high current income through investing in non-investment grade debt instruments. The Fund has used this Morningstar category for internal purposes and in regular periodic reports to the Fund’s Board. The Fund also compared its average trading discount to this Morningstar category in the President’s letter accompanying its most recent stockholder report.

Comment 13: On page 43, the Fund’s existing disclosure under the heading “Quorum; Adjournment” suggests you may use your proxy authority to vote for adjournment to solicit more votes. An adjournment to solicit additional proxies is considered a separate proposal for which proxies must be separately solicited and for which discretion is not available. To the extent proxies are being solicited for adjournment of meeting please revise the proxy card accordingly.

Response: The Fund respectfully disagrees with the Staff’s analysis. Rule 14a-4(a)(3) requires the proxy statement to identify “each separate matter intended to be acted upon.” The

Fund submits that an adjournment of a stockholder meeting is not a “separate matter intended to be acted upon” at the meeting.

In Statement on Adjournment of Investment Company Shareholder Meetings and Withdrawal of Proposed Rule 20a-4 and Amendment to Rule 20a-1, Release No. IC-7659 (February 6, 1973) (the “Adjournment Release”), the SEC withdrew proposed Rule 20a-4, which would have prohibited any adjournment of a meeting of shareholders of a registered investment company that related to a proposal requiring shareholder approval if a quorum pursuant to state law were present at such meeting. In lieu of the proposed Rule, the SEC stated:

Investment company management must weigh carefully the decision whether to adjourn a shareholder meeting for the purpose of soliciting shareholders to obtain additional proxies in an effort to secure sufficient votes to pass a particular proposal or proposals. In any case where shareholders clearly express their disagreement and disinterest in a proposal through negative votes or abstentions, and thus fail to yield sufficient votes for passage, management must determine if an adjournment and additional solicitation is reasonable and in the interest of shareholders, or whether such procedures would constitute an abuse of management’s office. Where management embarks upon a course of adjournment and additional solicitation, the Commission will consider whether such conduct appears to constitute a breach of fiduciary duty under Section 36(a) of the Act.

The SEC has thus expressly authorized investment company management to decide whether to adjourn a shareholder meeting for the purpose of soliciting shareholders to obtain additional proxies, subject to management's fiduciary duty to shareholders. The Fund further notes that, had the question of adjournment required a separate proposal, the Adjournment Release and proposed Rule 20a-4 would have been unnecessary. The Adjournment Release therefore does not support the notion that such adjournments are a substantive proposal for which proxies must be independently solicited. Rather, matters relating to the adjournment of a stockholders meeting are governed by state law. Moreover, under Maryland law, the Chairman of the meeting would be authorized to adjourn the meeting to solicit additional proxies.

In addition, the proxy statement explicitly states that “the persons named as proxies may propose one or more adjournments of such Meeting to permit further solicitation of proxies.” As a result, stockholders who execute a proxy are aware that the persons named as proxies may propose an adjournment and will have authorized the named proxies to adjourn the meeting.

* * * * *

If you have any further questions regarding this filing, please contact me at 202-778-9286. Thank you for your attention to this matter.