UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant £

Filed by a Party other than the Registrant S

Check the appropriate box:

£ Preliminary Proxy Statement

£ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

S Definitive Proxy Statement

£ Definitive Additional Materials

£ Soliciting Material Pursuant to §240.14a-12

GREEKTOWN SUPERHOLDINGS, INC.

(Name of Registrant as Specified in its Charter)

BRIGADE LEVERAGED CAPITAL STRUCTURES FUND LTD.

BRIGADE CAPITAL MANAGEMENT, LLC

DONALD E. MORGAN, III

NEAL P. GOLDMAN

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

S No fee required.

£ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | |

(1) | | Title of each class of securities to which transaction applies: |

| | |

|

(2) | | Aggregate number of securities to which transaction applies: |

| | |

|

(3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

|

(4) | | Proposed maximum aggregate value of transaction: |

| | |

|

(5) | | Total fee paid: |

| | |

£ Fee paid previously with preliminary materials.

£ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | |

(1) | | Amount Previously Paid: |

| | |

|

(2) | | Form, Schedule or Registration Statement No.: |

| | |

|

(3) | | Filing Party: |

| | |

|

(4) | | Date Filed: |

| | |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

BRIGADE LEVERAGED CAPITAL STRUCTURES FUND LTD.

April 6, 2012

Dear Fellow Shareholder:

Brigade Leveraged Capital Structures Fund Ltd. (“Brigade Fund”) and the other participants in this solicitation (collectively, “Brigade” or “we”) are the owners of an aggregate of 94,999 shares of Series A-1 Preferred Stock, $0.01 par value per share (the “Series A-1 Preferred Stock”) of Greektown Superholdings, Inc. (the “Company” or “Greektown”) and 121,676 shares of Series A-2 Preferred Stock, par value $0.01 per share (“Series A-2 Preferred Stock”). We do not own any shares of Series A-1 Common Stock, par value $0.01 per share (“Series A-1 Common Stock” and, together with the Series A-1 Preferred Stock and the Series A-2 Preferred Stock, collectively, the “Voting Stock”). We own approximately 6.57% of the Voting Stock of the Company. For the reasons set forth in the attached Proxy Statement, we are seeking representation on the Board of Directors of the Company. We are seeking your support at the annual meeting of shareholders scheduled to be held at the Company’s offices located at 555 East Lafayette, Detroit, Michigan 48226 on May 8, 2012 at 10:00 a.m., local time, including any adjournments or postponements thereof and any meeting which may be called in lieu thereof (the “Annual Meeting”), for the following:

|

1. | | | | To elect Brigade Fund’s nominee to the Board of Directors in opposition to one of the Company’s incumbent directors; and |

|

2. | | | | To transact such other business, if any, as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

We are seeking one seat on the Company’s Board of Directors (the “Board”) to ensure that the interests of the shareholders, the true owners of the Company, are appropriately represented in the boardroom. The Board is currently composed of seven directors, all of whom are up for election at the Annual Meeting. In the Company’s Proxy Statement for the Annual Meeting, the Company indicated its intention to increase the size of its Board of Directors to nine members in connection with the Annual Meeting.

Under the proxy rules, we may only solicit proxies for our nominee, which would result in limiting the ability of shareholders that would like to vote for the nominees to fully exercise their voting rights to vote for a full complement of nine directors. Alternatively, we may solicit proxies in support of our nominee and also seek authority to vote for all of the Greektown nominees other than the Greektown nominee we specify. This would enable a shareholder who desires to vote for up to a full complement of nine director nominees to use theWHITE proxy card to vote for our nominee as well as the Greektown nominees for whom we are seeking authority to vote for other than those nominees as to which the shareholder specifically withholds our authority to vote for. We have nominated one nominee, Neal P. Goldman, and are seeking authority to vote for up to all of the Greektown nominees other than John Bitove. As a result, should a shareholder so authorize us, on theWHITE proxy card, we would vote the stockholder’s share holdings for our nominee and up to eight Greektown nominees. Other than James A. Barrett, Jr. none of the Greektown nominees for whom we seek authority to vote have agreed to serve with our nominee, if elected.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosedWHITE proxy card today. The attached Proxy Statement and the enclosedWHITE proxy card are first being furnished to the shareholders on or about April 9, 2012.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated proxy.

If you have any questions or require any assistance with your vote, please contact Georgeson, Inc., which is assisting us, at their address and toll-free numbers listed below.

Thank you for your support.

Neal P. Goldman

Brigade Leveraged Capital Structures Fund Ltd.

If you have any questions, require assistance in voting yourWHITEproxy card, or need additional copies of Brigade’s proxy materials, please contact Georgeson at the phone number or email listed below.

Georgeson Inc.

199 Water Street

26th Floor

New York, NY 10037

Phone: (866) 295-3782

Email: brigade@georgeson.com

2012 ANNUAL MEETING OF SHAREHOLDERS

OF

GREEKTOWN SUPERHOLDINGS, INC.

PROXY STATEMENT

OF

BRIGADE LEVERAGED CAPITAL STRUCTURES FUND LTD.

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Brigade Leveraged Capital Structures Fund Ltd. (“Brigade Fund”), Brigade Capital Management LLC (“Brigade LLC”) and Donald E. Morgan, III (collectively, “Brigade” or “we”) are significant shareholders of Greektown Superholdings, Inc., a Delaware corporation (the “Company”), owning 94,999 shares of Series A-1 Preferred Stock, $0.01 par value per share (the “Series A-1 Preferred Stock”) and 121,676 shares of Series A-2 Preferred Stock, par value $0.01 per share (“Series A-2 Preferred Stock”). We do not own any shares of Series A-1 Common Stock, par value $0.01 per share (“Series A-1 Common Stock” and, together with the Series A-1 Preferred Stock and the Series A-2 Preferred Stock, collectively, the “Voting Stock”). We own approximately 6.57% of the Voting Stock of the Company. We are seeking representation on the Board of Directors of the Company (the “Board”) because we believe that the Board could be improved, and the Company would benefit from independent directors who have strong, relevant backgrounds and the operational expertise necessary to fully explore available opportunities to unlock shareholder value. We are seeking your support at the annual meeting of shareholders scheduled to be held at the Company’s offices located at 555 East Lafayette, Detroit, Michigan 48226 on May 8, 2012 at 10:00 a.m., local time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

|

1. | | | | To elect Brigade Fund’s director nominee, Neal P. Goldman (the “Nominee”), to serve as a director of the Company to hold office until the 2013 annual meeting of shareholders and until his successor has been duly elected and qualified, in opposition to one of the Company’s incumbent directors whose term expires at the Annual Meeting; and |

|

2. | | | | To transact any other business as may properly come before the Annual Meeting. |

The Company has set the close of business on March 23, 2012 as the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). Shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, 152,054 shares of Series A-1 Common Stock, 1,463,535 shares of Series A-1 Preferred Stock and 162,255 shares of Series A-2 Preferred Stock were outstanding. Each outstanding share of Series A-1 Common Stock is entitled to ten votes and each outstanding share of Series A-1 Preferred Stock is entitled to a number of votes equal to ten times the number of shares of Series A-1 Common Stock into which such share of Series A-1 Preferred Stock is convertible as of the Record Date. Each outstanding share of Series A-2 Preferred Stock is entitled to a number of votes equal to the number of shares of Series A-2 Common Stock into which such share of Series A-2 Preferred Stock is convertible as of the Record Date. As of the Record Date, after giving effect to accrued dividends and subject to certain conversion limitations included in the Company’s certificate of incorporation, each share of the Company’s Series A-1 Preferred Stock is convertible into 1.1297 shares of the Company’s Series A-1 Common Stock, and each share of the Company’s Series A-2 Preferred Stock is convertible into 1.1297 shares of the Company’s Series A-2 Common Stock, $0.01 par value per share (the “Series A-2 Common Stock”). No shares of the Series A-2 Common Stock of the Company were outstanding as of the Record Date. Shareholders do not have cumulative voting rights.

As of the date hereof, the members of Brigade and the Nominee own 94,999 shares of Series A-1 Preferred Stock and 121,676 shares of Series A-2 Preferred Stock. We intend to vote such Shares FOR the election of the Nominee.

THIS SOLICITATION IS BEING MADE BY BRIGADE AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH BRIGADE IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

BRIGADE URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEE.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE FOR THE PROPOSAL DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

2

IMPORTANT

Your vote is important, no matter how few shares of Voting Stock you own. Brigade urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of the Nominee.

|

• | | | | If your shares of Voting Stock are registered in your own name, please sign and date the enclosedWHITE proxy card and return it to Brigade, c/o Georgeson, Inc. (“Georgeson”) in the enclosed postage-paid envelope today. |

|

• | | | | If your shares of Voting Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Voting Stock, and these proxy materials, together with aWHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Voting Stock on your behalf without your instructions. |

|

• | | | | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our independent Nominee only on ourWHITE proxy card. So please make certain that the latest dated proxy card you return is theWHITE proxy card.

If you have any questions, require assistance in voting yourWHITEproxy card, or need additional copies of Brigade’s proxy materials, please contact Georgeson at the phone number or email listed below.

Georgeson Inc.

199 Water Street

26th Floor

New York, NY 10037

Phone: (866) 295-3782

Email: brigade@georgeson.com

3

REASONS FOR THE SOLICITATION

Brigade, a significant shareholder of the Company, strongly believes that the Company’s vast value potential is not being realized. We also lack confidence in the commitment of certain members of the Company’s Board to protect shareholder interests. We are therefore soliciting your proxy to vote at the 2012 Annual Meeting for the election of our director nominee who is committed to improving shareholder value and protecting the interests of all shareholders of the Company. We believe it is important for shareholders to finally have a choice with respect to who represents their interests in the Greektown boardroom.

Company performance on an earnings before income, taxes, depreciation, amortization and restructuring charges or, EBITDAR, basis has been presented by the Company in a misleading manner that is inconsistent with Wall Street research and the true economic reality.

The EBITDAR numbers that Greektown’s Chairman, George Boyer, chose to highlight in public presentations understated the Company’s EBITDAR decline as compared to independent Wall Street research. In particular, 2009 EBITDAR is 11% lower in the Company’s shareholder presentation and leaves out proper adjustments including the very material 5% tax rollback Greektown was awarded. The Company’s presentation implies a 4.5% EBITDAR decline since George Boyer commenced as Chairman when the real EBITDAR decline is a much higher 14.8%.

| | | | | | | | | | | | |

| | Greektown Presentations(1) | | Wall Street Research(2) |

| | 2009A | | 2010A | | 2011E | | 2009A | | 2010A | | 2011E |

| | (dollar amounts in millions) | | (dollar amounts in millions) |

EBITDAR | | | $ | | 79.2 | | | | $ | | 82.4 | | | | $ | | 75.6 | | | | $ | | 71.4 | | | | $ | | 82.5 | | | | $ | | 75.6 | |

Pro Forma 5% Tax Rollback(3) | | | $ | | 0.0 | | | | $ | | 0.0 | | | | $ | | 0.0 | | | | $ | | 17.3 | | | | $ | | 0.0 | | | | $ | | 0.0 | |

| | | | | | | | | | | | |

Pro Forma EBITDAR | | | $ | | 79.2 | | | | $ | | 82.4 | | | | $ | | 75.6 | | | | $ | | 88.7 | | | | $ | | 82.5 | | | | $ | | 75.6 | |

% Gain / (Decline) year over year | | | | | | 4.0 | % | | | | | (8.3 | %) | | | | | | | (7.0 | %) | | | | | (8.4 | %) | |

% Gain / (Decline) cumulative | | | | | | | | (4.5 | %) | | | | | | | | | (14.8 | %) | |

Note: 2011E EBITDAR number is based on company filings and uses the midpoint of the fourth quarter EBITDAR range that Greektown reported in a press release on January 18, 2012 and adds back $530,000 of estimated annual noncash stock compensation expense.

|

(1) | | | | 2009 and 2010 EBITDAR numbers are from the June 2011 shareholder presentation filed on a Form 8-K by Greektown on June 8, 2011. |

|

(2) | | | | 2009 and 2010 EBITDAR numbers are from an RBC Capital Markets high yield research report published on December 2, 2011. |

|

(3) | | | | Per Greektown’s 2010 Form 10-K, “On March 9, 2010, the Michigan Gaming Control Board certified that the casino was in compliance with the development agreement as of February 15, 2009 and as such was entitled to a tax adjustment retroactive to February 15, 2009.” The $17.3 million adjustment is an annualized tax adjustment of the 5% tax rollback multiplied by Greektown’s 2009 Gross Gaming Revenue as reported by the Michigan Gaming Control Board. There is no adjustment in 2010 or 2011 because as stated in Greektown’s 2010 Form 10-K, “As a result of the retroactive adjustment, the Company recorded a gaming tax refundable from the State of Michigan for approximately $15.0 million at March 8, 2010, which was utilized instead of making daily wagering tax payments through September 10, 2010. As of September 30, 2010, there was no refundable amount outstanding.” |

We are concerned by the erosion of the Company’s margins and market share.

In the midst of a recovery of the gaming industry in Detroit, the Greektown Casino has lost a cumulative 105 basis points of market share and 384 basis points of EBITDA margin in the two years since the Company emerged from bankruptcy and George Boyer started as Chairman of the Company.

4

Recent Performance

| | | | | | |

| | 2009 | | 2010 | | 2011 |

| | (dollar amounts in millions) |

Greektown Net Revenue | | | $ | | 331.6 | | | | $ | | 330.1 | | | | $ | | 330.0 | |

% Gain/(Decline) | | | | | | (0.5 | %) | | | | | (0.0 | %) | |

% Cumulative Gain/(Decline) | | | | | | | | (0.5 | %) | |

Detroit Gaming Revenue | | | $ | | 1,339.5 | | | | $ | | 1,377.9 | | | | $ | | 1,424.4 | |

% Gain/(Decline) | | | | | | 2.9 | % | | | | | 3.4 | % | |

% Cumulative Gain/(Decline) | | | | | | | | 6.3 | % | |

Greektown Market Share | | | | 25.8 | % | | | | | 25.4 | % | | | | | 24.8 | % | |

Basis Point Gain/(Decline) year over year | | | | | | (45 | ) | | | | | (60 | ) | |

Basis Point Gain/(Decline) cumulative | | | | | | | | (105 | ) | |

Greektown EBITDA Margin | | | | 26.7 | % | | | | | 25.0 | % | | | | | 22.9 | % | |

Basis Point Gain/(Decline) | | | | | | (175 | ) | | | | | (209 | ) | |

| | | | | | | | (384 | ) | |

Source: Public filings, market share derived from Greektown’s Gross Gaming Revenue as reported by the Michigan Gaming Control Board. 2011 EBITDA margin is estimated based on Company filings and uses the midpoint of the fourth quarter EBITDA range that Greektown reported in a press release on January 18, 2012 and adds back $530,000 of estimated non-cash stock compensation expense.

We believe the current management’s leadership has led to equity value destruction.

While the vast majority of all publicly-traded middle-market gaming companies have seen equity value grow considerably since George Boyer started running the Company on June 30, 2010, Greektown has seen its equity value decline almost 30% as implied by its equity valuation.

Shareholder valuation over time

| | | | | | | | | | | | |

| | 6/30/10(1) | | 12/31/2011 | | | | 6/30/10(1) | | 3/19/2012 | | %

Change |

| | (dollar amounts in millions) | | | | | | | | |

LTM EBITDA(2) | | | $ | | 92.0 | | | | $ | | 75.6 | | | Penn National Gaming, Inc. (PENN) | | | $ | | 23.10 | | | | $ | | 44.01 | | | | | 90.5 | % | |

Multiple(3) | | | | 7.5 | x | | | | | 7.5 | x | | | Pinnacle Entertainment, Inc. (PNK) | | | $ | | 9.46 | | | | $ | | 11.13 | | | | | 17.7 | % | |

| | | | | | | | | | | | |

Enterprise Value | | | $ | | 690.0 | | | | $ | | 567.0 | | | MTR Gaming Group, Inc. (MNTG) | | | $ | | 1.62 | | | | $ | | 4.17 | | | | | 157.4 | % | |

Less: Debt | | | $ | | 385.0 | | | | $ | | 385.0 | | | Ameristar Casinos, Inc. (ASCA) | | | $ | | 15.06 | | | | $ | | 20.75 | | | | | 37.8 | % | |

Plus: Cash | | | $ | | 13.6 | | | | $ | | 45.9 | | | Boyd Gaming Corporation (BYD) | | | $ | | 8.49 | | | | $ | | 8.30 | | | | | (2.2 | )% | |

| | | | | | | | | | | | |

Shareholder Value | | | $ | | 318.6 | | | | $ | | 227.9 | | | | | | | | | |

| | | | | | | | | | | | |

% Gain/(Decline) | | | | | | (28.5 | %) | | | | | Average | | | | 60.2 | % | |

|

(1) | | | | Greektown officially emerged from bankruptcy on June 30, 2010 which is the time when George Boyer became Chairman and Interim CEO. |

|

(2) | | | | June 30, 2010 LTM EBITDA (last twelve months earnings before interest, taxes, depreciation and amortization) amount from RBC Capital Markets high yield research report dated December 20, 2010. December 31, 2011 EBITDA amount is based on Company filings and uses the midpoint of the fourth quarter EBITDAR range that Greektown reported in a press release on January 18, 2012 and adds back $530,000 of estimated annual noncash stock compensation expense. |

|

(3) | | | | Analysis assumes a 7.5x EBITDA multiple for Greektown based on average current industry comparables. |

|

(4) | | | | Cash amount of $45.9 million is as of September 30, 2011 which is the latest date for which Greektown has reported its cash balance in its SEC filings. |

Source: Public filings, Bloomberg.

5

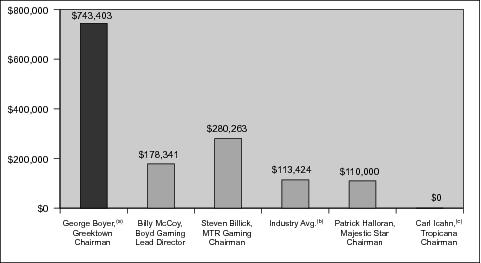

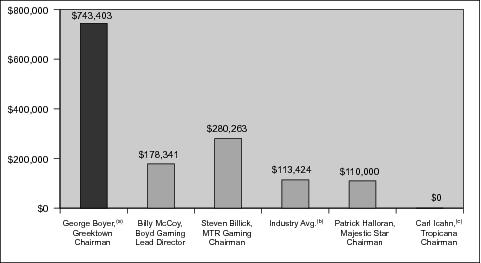

We believe that the Chairman of the Greektown board has been paid unjustifiably high compensation.

We believe George Boyer’s ability to properly address the issues facing the Company is compromised by the misalignment between his compensation and the Company’s performance. Despite being the only single asset company in this comparison, the Company compensates Mr. Boyer substantially more than the Chairman or Lead Director of other regional gaming companies. Mr. Boyer’s compensation is outrageous by any standard, but particularly for a Chairman who has destroyed equity value under his tenure.

2010 Director Total Compensation

|

(a) | | | | Includes expenses paid relating to life, accidental disbursement and disability, long term disability, medical, dental and vision insurance. |

|

(b) | | | | The 2011 BDO 600 Survey—Board of Directors Pay Study; $325 million-$650 million category. |

|

(c) | | | | Each independent director was entitled to $50,000. |

Source: Public filings and Majestic Star disclosure.

Our nominee has the experience and qualifications necessary to fully explore opportunities to enhance shareholder value.

Our Nominee has valuable and relevant business and financial experience that we believe will allow him to make informed, decisive decisions to explore and identify opportunities to enhance shareholder value. We believe it is time for change on the Greektown Board and that it would benefit from the fresh viewpoints and new energy that our Nominee would bring to the Greektown Board. With no prior decisions to justify, our Nominee will not hesitate to propose, if warranted, changes in the way that business and policies have been conducted in the past. Our Nominee will ask tough questions and work tirelessly with other members of the Greektown board to take steps to improve corporate governance and create shareholder value.

Neal P. Goldman is one of the founding partners of Brigade Capital Management, LLC which was formed in 2007. Brigade is an asset management firm specializing in high yield and distressed debt investing with over $9 billion of assets under management. Prior to this, Mr. Goldman was a Managing Director at MacKay Shields, LLC working in the high yield division from 2001-2006. Prior to joining MacKay Shields, Mr. Goldman was a Principal in the Special Situations Group at Banc of America Securities, where he specialized in distressed debt investing. Before Banc of America, Mr. Goldman worked at Salomon Brothers in the Merger and Acquisitions Group and as a Vice President in the High Yield Bond Department. Mr. Goldman has served on several boards including NII Holdings, Inc., a Nasdaq-listed company which provides wireless communication services under

6

the Nextel brand name to businesses and individuals in Mexico, Brazil, Argentina, Peru and Chile. While at NII Holdings, Mr. Goldman served on the company’s nominating and compensation committees and helped create hundreds of millions of dollars in shareholder value during his tenure. He has an MBA from the University of Illinois and a BA from the University of Michigan. Mr. Goldman’s relevant experience in turnaround management, his valuable financial expertise, familiarity with mergers and acquisitions, capital markets transactions and private equity and his substantial board experience and corporate governance knowledge well qualifies him to serve on the board.

7

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of seven directors whose terms expire at the Annual Meeting. In the Company’s proxy statement for the Annual Meeting, the Company indicated its intention to increase the size of its Board of Directors to nine members in connection with the Annual Meeting. Your vote to elect the Nominee will have the legal effect of replacing one of the Company’s incumbent directors with the Nominee. If elected, the Nominee will be a minority of the directors and will not alone be able to adopt resolutions. However, the Nominee expects to be able to actively engage other Board members in full discussion of the issues facing the Company and resolve them together. By utilizing his experience and working constructively with Board members, the Nominee believes he can effect positive change at the Company.

THE NOMINEE

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of the Nominee. The nomination was made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. This information has been furnished to us by the Nominee. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominee should serve as a director of the Company is set forth above in the section entitled “Reasons for The Solicitation”. The Nominee is a citizen of the United States of America.

Neal P. Goldman, age 42, is one of the founding partners of Brigade Capital Management, LLC which was formed in 2007. Brigade is an asset management firm specializing in high yield and distressed debt investing with over $9 billion of assets under management. Prior to this, Mr. Goldman was a Managing Director at MacKay Shields, LLC working in the high yield division from 2001-2006. Prior to joining MacKay Shields, Mr. Goldman was a Principal in the Special Situations Group at Banc of America Securities, where he specialized in distressed debt investing. Before Banc of America, Mr. Goldman worked at Salomon Brothers in the Merger and Acquisitions Group and as a Vice President in the High Yield Bond Department. Mr. Goldman has served on several boards including NII Holdings, Inc., a Nasdaq-listed company which provides wireless communication services under the Nextel brand name to businesses and individuals in Mexico, Brazil, Argentina, Peru and Chile. While at NII Holdings, Mr. Goldman served on the company’s nominating and compensation committees and helped create hundreds of millions of dollars in shareholder value during his tenure. He has an MBA from the University of Illinois and a BA from the University of Michigan. His business address is 399 Park Avenue, Suite 1600, New York, NY 10022.

As of the date hereof, Mr. Goldman does not directly own any securities of the Company. The Nominee may be deemed to be a member of the “group” for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and accordingly may be deemed to beneficially own the shares of Voting Stock owned directly by the other members of the group. The Nominee specifically disclaims beneficial ownership of such shares of Voting Stock that he does not directly own. For information regarding purchases and sales during the past two years by members of the group of securities of the Company that may be deemed to be beneficially owned by the Nominee, see Schedule I.

Other than as stated herein, there are no arrangements or understandings between members of Brigade and the Nominee or any other person or persons pursuant to which the nomination of the Nominee described herein is to be made, other than the consent by the Nominee to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. The Nominee is not a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

The Nominee presently is, and if elected as a director of the Company would be, an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to

8

board composition, including Rule 5605(a)(2), and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. The Nominee is not a member of the Company’s compensation, nominating or audit committee nor is he not independent under any such committee’s applicable independence standards.

WE STRONGLY URGE YOU TO VOTE FOR THE ELECTION OF NEAL P. GOLDMAN BY MARKING, SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE PAID ENVELOPE PROVIDED TO YOU WITH THIS PROXY STATEMENT OR BY USING THE WHITE PROXY CARD TO VOTE BY TELEPHONE OR INTERNET. IF YOU HAVE SIGNED THE WHITE PROXY CARD AND NO MARKING IS MADE, YOU WILL BE DEEMED TO HAVE GIVEN A DIRECTION TO VOTE ALL THE SHARES OF VOTING STOCK REPRESENTED BY THE WHITE CARD FOR THE ELECTION OF NEAL P. GOLDMAN AND THE GREEKTOWN NOMINEES OTHER THAN JOHN BITOVE.

VOTING AND PROXY PROCEDURES

Only shareholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Shareholders who sell their shares of Voting Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Voting Stock. Shareholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Voting Stock after the Record Date. Based on publicly available information, Brigade believes that the only outstanding classes of securities of the Company entitled to vote at the Annual Meeting are the Series A-1 Common Stock, the Series A-1 Preferred Stock and the Series A-2 Preferred Stock.

Shares of Voting Stock represented by properly executedWHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be votedFOR the election of the Nominee to the Board and the Greektown Nominees other than John Bitove and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate nine candidates for election as directors at the Annual Meeting. This Proxy Statement is soliciting proxies to elect our Nominee and the Greektown nominees other than John Bitove. The participants in this solicitation intend to vote all of their shares of Voting Stock in favor of the Nominee and the Greektown nominees other than John Bitove.

QUORUM AND VOTES REQUIRED TO ELECT DIRECTORS AND ADOPT PROPOSALS

A quorum is the minimum number of shares that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. The holders of a majority in voting power entitled to vote at the meeting must be represented in person or by proxy at the Annual Meeting for there to be a quorum and for the meeting to be held. Withheld votes, abstentions and broker non-votes will be counted as present for purposes of determining whether a quorum is present. If a quorum is present, the nine nominees receiving the highest number of affirmative votes will be elected as directors of the Company. A broker is not permitted to vote on a shareholder’s behalf with respect to the election of directors unless the shareholder has provided specific voting instructions to the broker. For your vote to be counted, you need to communicate your voting instructions to your broker, bank or other financial institution before the date of the meeting. Withheld votes and broker non-votes will not be counted as votes cast with respect to, and therefore will have no effect on, the election of the directors.

VOTES REQUIRED FOR APPROVAL

Election of Directors—According to the Company’s proxy statement, the directors elected at the meeting will be the nine directors receiving the highest number of votes. A shareholder who abstains with respect to this proposal will have no effect on the outcome of the vote for the election of directors.

9

REVOCATION OF PROXIES

Shareholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to Brigade in care of Georgeson at the address set forth on the back cover of this Proxy Statement or to the Company at 555 East Lafayette, Detroit, MI 48226 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to Brigade in care of Georgeson at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the voting power entitled to vote at the meeting. Additionally, Georgeson may use this information to contact shareholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominee.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEE TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED WHITE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

ATTENDING THE ANNUAL MEETING

According to the Company’s proxy statement, if you plan to attend the Annual Meeting and wish to vote your shares in person, you will be asked to present valid government-issued photo identification, such as a driver’s license. If you are a holder of record, you will need to bring with you your WHITE proxy card to gain admission to the Annual Meeting. If you require special assistance due to a disability or other reasons, please notify William Williams in writing at 555 East Lafayette Detroit, Michigan 48266 Attention: William Williams or by telephone at (313) 223-2999. If your shares are held by a broker, bank or other similar organization, bring with you to the Annual Meeting the WHITE proxy card, any voting instruction form that is sent to you, or your most recent brokerage statement or a letter from your broker, bank or other similar organization indicating that you beneficially owned the shares of Voting Stock as of the Record Date. The Company can use that to verify your beneficial ownership of Voting Stock and admit you to the Annual Meeting.If you intend to vote at the Annual Meeting, you also will need to bring to the Annual Meeting a legal proxy from your broker, bank or other similar organization that authorizes you to vote the shares that the record holder holds for you in its name.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by Brigade. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

Brigade Fund has entered into an agreement with Georgeson for solicitation and advisory services in connection with this solicitation, for which Georgeson will receive a fee not to exceed $15,000, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Georgeson will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Brigade Fund has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Voting Stock they hold of record. Brigade Fund will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Georgeson will employ approximately 25 persons to solicit shareholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by Brigade. Costs of this solicitation of proxies are currently estimated to be approximately $350,000. Brigade estimates that through the date hereof its expenses in connection with this solicitation are approximately $250,000. Brigade intends to seek reimbursement from the Company of all expenses it incurs in connection with this

10

solicitation. Brigade does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

The Nominee and the members of Brigade are participants in this solicitation. The principal business of Brigade Fund, a Cayman Islands exempted company, is serving as a private investment fund. Brigade Fund has been formed for the purpose of making equity investments and, on occasion, taking an active role in the management of portfolio companies in order to enhance shareholder value. Brigade LLC, a Delaware limited liability company, has been formed for the purpose of investing in securities and engaging in all related activities and transactions.

The address of the principal office of each of Brigade LLC and Donald E. Morgan, III is 399 Park Avenue, Suite 1600, New York, NY 10022. The address of the principal office of Brigade Leveraged Capital Structures Fund Ltd. is c/o Ogier Fiduciary Services (Cayman) Limited, 89 Nexus Way, Camana Bay, Grand Cayman, KY1-9007, Cayman Islands.

As of the date hereof, Brigade Fund owns 94,999 shares of Series A-1 Preferred Stock and 121,676 shares of Series A-2 Preferred Stock.

Each participant in this solicitation, as a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed to beneficially own 94,999 shares of Series A-1 Preferred Stock,178,284 shares of Series A-2 Preferred Stock, 107,331 shares of Series A-1 Common Stock and 201,509 shares of Series A-2 Common Stock. Each participant in this solicitation disclaims beneficial ownership of the Voting Stock he or it does not directly own. For information regarding purchases and sales of securities of the Company during the past two years by the participants in this solicitation, see Schedule I.

Brigade LLC has agreed to indemnify Mr. Goldman against claims arising from the solicitation of proxies from the Company shareholders in connection with the Annual Meeting and any related transactions.

The Voting Stock purchased by each of Brigade Fund and Brigade LLC were purchased with working capital.

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting.

11

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to the Nominee, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten years.

OTHER MATTERS AND ADDITIONAL INFORMATION

Brigade is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which Brigade is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosedWHITE proxy card will vote on such matters in their discretion.

SHAREHOLDER PROPOSALS

Under the Bylaws, any shareholder intending to present any proposal (other than a proposal made by, or at the direction of, the Board) at the Company’s 2013 Annual Meeting of Shareholders (the “2013 Annual Meeting”), must give written notice of that proposal (including certain information about any nominee or matter proposed and the proposing shareholder) to the Company’s Secretary not later than the close of business on the 90th day (February 7, 2013) nor earlier than the close of business on the 120th day (January 8, 2013) prior to the first anniversary of the preceding year’s annual meeting. However, in the event that the date of the 2013 Annual Meeting is advanced by more than 30 days before or delayed by more than 60 days after that anniversary date, the notice must be delivered not earlier than the close of business on the 120th day prior to the 2013 Annual Meeting and not later than the close of business on the later of the 90th day prior to the 2013 Annual Meeting or the 10th day following the day on which public announcement of the date of the 2013 Annual Meeting is first made.

The information set forth above regarding the procedures for submitting shareholder proposals for consideration at the 2013 Annual Meeting is based on information contained in the Company’s proxy statement. The incorporation of this information in this proxy statement should not be construed as an admission by Brigade that such procedures are legal, valid or binding.

INCORPORATION BY REFERENCE

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING. THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. THE COMPANY’S STOCKHOLDERS SHOULD REFER TO THE COMPANY’S 2012 PROXY STATEMENT IN ORDER TO REVIEW THIS DISCLOSURE. UPON REQUEST TO OUR PROXY SOLICITOR GEORGESON, WE WILL PROVIDE A COPY OF THESE DISCLOSURES WITHOUT CHARGE TO EACH PERSON TO WHOM OUR PROXY STATEMENT IS DELIVERED. GEORGESON’S CONTACT INFORMATION APPEARS ON PAGE 3 OF THIS PROXY STATEMENT. ALTHOUGH WE DO NOT HAVE ANY KNOWLEDGE INDICATING THAT ANY STATEMENT MADE BY IT THEREIN IS UNTRUE, WE DO NOT TAKE ANY RESPONSIBILITY FOR THE ACCURACY OR COMPLETENESS OF STATEMENTS TAKEN FROM PUBLIC DOCUMENTS AND RECORDS THAT WERE NOT PREPARED BY OR ON OUR BEHALF, OR FOR ANY FAILURE BY THE COMPANY TO DISCLOSE EVENTS THAT MAY AFFECT THE SIGNIFICANCE OR ACCURACY OF SUCH INFORMATION. SUCH INFORMATION WILL BE PROVIDED BY US TO YOU UPON REQUEST AS SOON AS IT IS AVAILABLE. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

12

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

|

BRIGADE LEVERAGED CAPITAL STRUCTURES FUND LTD. |

|

April 6, 2012 |

13

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

All purchases and sales were made in privately negotiated transactions.

| | | | | | |

Class of Security | | Securities

Purchased/(Sold) | | Price per share ($) | | Date of

Purchase (Sale) |

| | Brigade Leveraged Capital Structures Fund Ltd. |

Series A-2 Preferred | | | | 121,676 | | | | | 100 | | | | | 6/30/10 | |

Series A-1 Preferred | | | | 94,999 | | | | | 100 | | | | | 6/30/10 | |

Series A-1 Common | | | | 12,876 | | | | | — | | | | | 6/30/10 | |

Series A-1 Common | | | | (12,876 | ) | | | | | 70.50 | | | | | 6/3/11 | |

I-1

SCHEDULE II

The following table is reprinted from the Company’s preliminary proxy statement filed with the Securities and Exchange Commission on March 30, 2012.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of the Company’s Series A-1 Common Stock, the Series A-1 Preferred Stock and the Series A-2 Preferred Stock as of March 23, 2012 for (i) each person who is a member of the Board, (ii) each named executive officer and significant employee, (iii) each person known to the Company to be the beneficial owner of more than 5% of the Series A-1 Common Stock, the Series A-1 Preferred Stock and the Series A-2 Preferred Stock and (iv) the Board and the named executive officers of the Company as a group. Beneficial ownership is determined according to the rules of the SEC, and generally a person has beneficial ownership of a security if he or she possesses sole or shared voting or investment power of that security, and includes any securities that a person has the right to acquire beneficial ownership within 60 days. Except as indicated, all shares of Voting Stock were owned directly as of March 23, 2012, and the person or entity listed as the beneficial owner has sole voting and investment power. The address for each director and executive officer of the Company is c/o Greektown Superholdings, Inc., 555 East Lafayette, Detroit, Michigan 48226. In accordance with applicable SEC rules, the ownership and voting percentages included in this table (a) exclude shares issuable upon the exercise of warrants to purchase shares of our Voting Stock which are not exercisable within 60 days of March 23, 2012 and (b) do not give effect to the dividend accruals, which have the effect of increasing the number of Series A-1 Common Stock and Series A-2 Common Stock into which each share of Series A-1 Preferred Stock and Series A-2 Preferred Stock, respectively, is convertible.

| | | | | | | | | | | | | | | | | | |

Name, Position and

Address of

Beneficial Owner | | Series A-1

Common Stock | | Series A-1

Preferred Stock | | Series A-2

Preferred Stock | | Total | | Value |

| | Number

Beneficially

Owned | | % of

Total

Series A-1

Common

Stock | | Number

Beneficially

Owned | | % of

Total

Series A-1

Preferred

Stock | | Number

Beneficially

Owned | | % of

Total

Series A-2

Preferred

Stock | | Total

Number of

Capital

Stock

Beneficially

Owned | | % of

Total

Capital

Stock | | % of

Voting

Capital

Stock |

John Bitove,

Director(1) | | | | 1,388 | | | | | * | | | | | — | | | | | — | | | | | | | — | | | | | 1,388 | | | | | * | | | | | * | |

George Boyer,

Director(2) | | | | 4,471 | | | | | * | | | | | — | | | | | — | | | | | | | — | | | | | 4,471 | | | | | * | | | | | * | |

Michael E. Duggan,

Director(3) | | | | 1,388 | | | | | * | | | | | — | | | | | — | | | | | | | — | | | | | 1,388 | | | | | * | | | | | * | |

Benjamin Duster,

Director(4) | | | | 1,388 | | | | | * | | | | | — | | | | | — | | | | | | | — | | | | | 1,388 | | | | | * | | | | | * | |

Freman Hendrix,

Director(5) | | | | 2,031 | | | | | * | | | | | — | | | | | — | | | | | | | — | | | | | 2,031 | | | | | * | | | | | * | |

Yvette E, Landau,

Director(6) | | | | 1,388 | | | | | * | | | | | — | | | | | — | | | | | | | — | | | | | 1,388 | | | | | * | | | | | * | |

Michael Puggi,

President and CEO | | | | — | | | | | — | | | | | — | | | | | — | | | | | | | — | | | | | — | | | | | — | | | | | — | |

Glen Tomaszewski,

Senior Vice

President and CFO | | | | — | | | | | — | | | | | — | | | | | — | | | | | | | — | | | | | — | | | | | — | | | | | — | |

Clifford J. Vallier,

General Manager | | | | — | | | | | — | | | | | — | | | | | — | | | | | | | — | | | | | — | | | | | — | | | | | — | |

William M. Williams,

Vice President of Guest Services | | | | — | | | | | — | | | | | — | | | | | — | | | | | | | — | | | | | — | | | | | — | | | | | — | |

II-1

| | | | | | | | | | | | | | | | | | |

Name, Position and

Address of

Beneficial Owner | | Series A-1

Common Stock | | Series A-1

Preferred Stock | | Series A-2

Preferred Stock | | Total | | Value |

| | Number

Beneficially

Owned | | % of

Total

Series A-1

Common

Stock | | Number

Beneficially

Owned | | % of

Total

Series A-1

Preferred

Stock | | Number

Beneficially

Owned | | % of

Total

Series A-2

Preferred

Stock | | Total

Number of

Capital

Stock

Beneficially

Owned | | % of

Total

Capital

Stock | | % of

Voting

Capital

Stock |

All Board directors and named executive officers as a group | | | | 12,054 | | | | | 7.93 | % | | | | | — | | | | | — | | | | | | | — | | | | | 12,054 | | | | | * | | | | | * | |

John Hancock

Bond Fund(7) | | | | 885 | | | | | * | | | | | 17,280 | | | | | 1.18 | % | | | | | — | | | | | — | | | | | 18,165 | | | | | 1.02 | % | | | | | 1.11 | % | |

John Hancock

Income Securities Trust(7) | | | | 768 | | | | | * | | | | | 14,991 | | | | | 1.02 | % | | | | | — | | | | | — | | | | | 15,759 | | | | | * | | | | | * | |

John Hancock Investors Trust(7) | | | | 978 | | | | | * | | | | | 19,074 | | | | | 1.30 | % | | | | | — | | | | | — | | | | | 20,052 | | | | | 1.13 | % | | | | | 1.23 | % | |

John Hancock Funds III Leveraged | | | | | | * | | | | | | | | | | | | | | | * | | | | | * | |

Companies Fund(7) | | | | 92 | | | | | * | | | | | 1,563* | | | | | — | | | | | | | — | | | | | 1,655 | | | | | * | | | | | * | |

John Hancock Funds II Active Bond | | | | * | | | | | * | | | | | * | | | | | | | | | | | | | |

Fund(7) | | | | 166 | | | | | * | | | | | 3,249 | | | | | *— | | | | | — | | | | | 3,415 | | | | | * | | | | | * | | | |

John Hancock Funds Trust Active Bond | | | | | | * | | | | | | | | | | | | | | | * | | | | | * | |

Trust(7) | | | | 821 | | | | | * | | | | | 16,024 | | | | | 1.09 | % | | | | | — | | | | | — | | | | | 16,845 | | | | | * | | | | | 1.03 | % | |

Manulife Global Funds U.S. Bond Fund(7) | | | | 38 | | | | | * | | | | | 739 | | | | | *— | | | | | — | | | | | 777 | | | | | * | | | | | * | | | |

Manulife Global Fund US Special Bond Fund(7) | | | | 148 | | | | | * | | | | | 2,879 | | | | | *— | | | | | | | — | | | | | 3,027 | | | | | * | | | | | * | |

Manulife Global Fund Strategic Income(7) | | | | 64 | | | | | * | | | | | 1,146 | | | | | *— | | | | | | | | | 1,210 | | | | | * | | | | | * | |

John Hancock Trust Strategic Income Trust(7) | | | | 269 | | | | | * | | | | | 5,366 | | | | | * | | | | | — | | | | | — | | | | | 5,635 | | | | | * | | | | | * | |

John Hancock Funds II High Income Fund(7) | | | | 7,894 | | | | | 5.19 | % | | | | | 168,490 | | | | | 11.51 | % | | | | | — | | | | | — | | | | | 176,384 | | | | | 9.92 | % | | | | | 10.81 | % | |

John Hancock Funds II Strategic Income Fund(7) | | | | 3,049 | | | | | 2.01 | % | | | | | 55,025 | | | | | 3.76 | % | | | | | — | | | | | — | | | | | 58,074 | | | | | 3.27 | % | | | | | 3.56 | % | |

John Hancock High Yield Fund(7) | | | | 18,487 | | | | | 12.16 | % | | | | | 158,092(11 | ) | | | | | 10.80 | % | | | | | — | | | | | — | | | | | 176,579 | | | | | 9.93 | % | | | | | 10.82 | % | |

John Hancock Strategic Income Fund(7) | | | | 8,565 | | | | | 5.63 | % | | | | | 159,488 | | | | | 10.90 | % | | | | | — | | | | | — | | | | | 168,053 | | | | | 9.45 | % | | | | | 10.30 | % | |

Oppenheimer Global Strategic Income Fund(8) | | | | 8,267 | | | | | 5.44 | % | | | | | 109,250 | | | | | 7.46 | % | | | | | — | | | | | — | | | | | 117,517 | | | | | 6.61 | % | | | | | 7.20 | % | |

Oppenheimer Funds, Inc.(8) | | | | 15,741 | | | | | 10.35 | % | | | | | 208,030 | | | | | 14.21 | % | | | | | — | | | | | — | | | | | 223,771 | | | | | 12.59 | % | | | | | 13.71 | % | |

Brigade Leveraged Capital Structures Fund Ltd(9) | | | | — | | | | | — | | | | | 94,999 | | | | | 6.49 | % | | | | | 121,676(12 | ) | | | | | 74.99 | % | | | | | 216,675 | | | | | 12.19 | % | | | | | 6.57 | % | |

Donald Morgan(9) | | | | — | | | | | — | | | | | 94,999 | | | | | 6.49 | % | | | | | 121,676(12 | ) | | | | | 74.99 | % | | | | | 216,675 | | | | | 12.19 | % | | | | | 6.57 | % | |

II-2

| | | | | | | | | | | | | | | | | | |

Name, Position and

Address of

Beneficial Owner | | Series A-1

Common Stock | | Series A-1

Preferred Stock | | Series A-2

Preferred Stock | | Total | | Value |

| | Number

Beneficially

Owned | | % of

Total

Series A-1

Common

Stock | | Number

Beneficially

Owned | | % of

Total

Series A-1

Preferred

Stock | | Number

Beneficially

Owned | | % of

Total

Series A-2

Preferred

Stock | | Total

Number of

Capital

Stock

Beneficially

Owned | | % of

Total

Capital

Stock | | % of

Voting

Capital

Stock |

Brigade Capital Management, LLC(9) | | | | — | | | | | — | | | | | 94,999 | | | | | 6.49 | % | | | | | 121,676(12 | ) | | | | | 74.99 | % | | | | | 216,675 | | | | | 12.19 | % | | | | | 6.57 | % | |

Solus GP LLC(10) | | | | — | | | | | — | | | | | 291,000 | | | | | 19.88 | % | | | | | 40,579(13 | ) | | | | | 25.01 | % | | | | | 331,579 | | | | | 18.65 | % | | | | | 18.08 | % | |

Christopher Pucillo(10) | | | | — | | | | | — | | | | | 291,000 | | | | | 19.88 | % | | | | | 40,579(13 | ) | | | | | 25.01 | %) | | | | | 331,579 | | | | | 18.65 | % | | | | | 18.08 | % | |

Solus Alternative

Asset Management Fund LP(10) | | | | — | | | | | — | | | | | 291,000 | | | | | 19.88 | % | | | | | 40,579(13 | ) | | | | | 25.01 | % | | | | | 331,579 | | | | | 18.65 | % | | | | | 18.08 | % | |

Standard General Master Fund L.P.(14) | | | | 6,442 | | | | | 4.24 | % | | | | | 50,731 | | | | | 3.47 | % | | | | | — | | | | | — | | | | | 57,173 | | | | | 3.22 | % | | | | | 3.50 | % | |

Standard General OC Master Fund L.P.(14) | | | | 6,861 | | | | | 4.51 | % | | | | | 50,982 | | | | | 3.48 | % | | | | | — | | | | | — | | | | | 57,843 | | | | | 3.25 | % | | | | | 3.54 | % | |

Standard General Focus Fund L.P.(14) | | | | 110 | | | | | * | | | | | 2,226 | | | | | * | | | | | — | | | | | — | | | | | 2,336 | | | | | * | | | | | * | |

SGMF Holdco LLC(14) | | | | — | | | | | — | | | | | 38,940 | | | | | 2.66 | % | | | | | — | | | | | — | | | | | 38,940 | | | | | 2.19 | % | | | | | 2.39 | % | |

OCMF Holdco LLC(14) | | | | — | | | | | — | | | | | 32,545 | | | | | 2.22 | % | | | | | — | | | | | — | | | | | 32,545 | | | | | 1.83 | % | | | | | 1.99 | % | |

SGMF HC LLC(14) | | | | — | | | | | — | | | | | 38,408 | | | | | 2.62 | % | | | | | — | | | | | — | | | | | 38,408 | | | | | 2.16 | % | | | | | 2.35 | % | |

OCMF HC LLC(14) | | | | — | | | | | — | | | | | 32,268 | | | | | 2.20 | % | | | | | — | | | | | — | | | | | 32,268 | | | | | 1.82 | % | | | | | 1.98 | % | |

Soohyung Kim(14) | | | | 13,413 | | | | | 8.82 | % | | | | | 246,100 | | | | | 16.82 | % | | | | | — | | | | | — | | | | | 259,513 | | | | | 14.60 | % | | | | | 15.90 | % | |

Nicholas J. Singer(14) | | | | 13,413 | | | | | 8.82 | % | | | | | 246,100 | | | | | 16.82 | % | | | | | — | | | | | — | | | | | 259,513 | | | | | 14.60 | % | | | | | 15.90 | % | |

Standard General L.P.(14)(15) | | | | 13,413 | | | | | 8.82 | % | | | | | 246,100 | | | | | 16.82 | % | | | | | — | | | | | — | | | | | 259,513 | | | | | 14.60 | % | | | | | 15.90 | % | |

|

* | | | | Less than 1%. |

|

(1) | | | | Mr. Bitove has been granted 1,388 shares of restricted Series A-1 common stock of the Company, which will vest over three years, commencing as of July 1, 2010, in three equal annual installments with the first of such installments occurring on July 1, 2011. |

|

(2) | | | | Mr. Boyer has been granted (i) 1,500 shares of restricted Series A-1 common stock of the Company, vesting in quarterly increments over a one year period, commencing as of July 1, 2010 with the first quarterly vesting occurring on October 1, 2010 (due to Mr. Boyer’s resignation from the Compensation Committee and the Nominating, Governance and Regulatory Committee, 84 of such shares which would have otherwise vested on October 1, 2010 were forfeited, as they were applicable to his service on such committees) and (ii) 3,055 shares of restricted Series A-1 common stock of the Company, which will vest over three years, commencing as of July 1, 2010, in three equal annual installments with the first of such installments occurring on July 1, 2011. |

|

(3) | | | | Mr. Duggan has been granted 1,388 shares of restricted Series A-1 common stock of the Company, which will vest over three years, commencing as of April 1, 2011, in three equal annual installments with the first of such installments occurring on April 1, 2012. |

|

(4) | | | | Mr. Duster has been granted 1,388 shares of restricted Series A-1 common stock of the Company, which will vest over three years, commencing as of June 1, 2011, in three equal annual installments with the first of such installments occurring on June 1, 2012. |

|

(5) | | | | Mr. Hendrix has been granted (i) 277 shares of restricted Series A-1 common stock of the Company, vesting in quarterly increments over a one year period, commencing as of October 1, 2010, with the first quarterly vesting to occur on January 1, 2011, (ii) 88 shares of restricted Series A-1 common stock of the Company, vesting in quarterly increments over a one year period, commencing as of October 1, 2011, with the first quarterly vesting to occur on January |

II-3

| | | | 1, 2012 and (iii) 1,666 shares of restricted Series A-1 common stock of the Company, which will vest over three years, commencing as of October 1, 2010, in three equal annual installments with the first of such installments occurring on October 1, 2011 |

|

(6) | | | | Ms. Landau has been granted 1,388 shares of restricted Series A-1 common stock of the Company, which will vest over three years, commencing as of July 1, 2010, in three equal annual installments with the first of such installments occurring on July 1, 2011. |

|

(7) | | | | Address: 101 Huntington Avenue, H-7, Boston, MA 02199. |

|

(8) | | | | Oppenheimer Funds, Inc. is the beneficial owner of all the shares held by Oppenheimer Global Strategic Income Fund and shares 100% of the power to vote on the shares held by the Oppenheimer Global Strategic Income Fund with the Oppenheimer Global Strategic Income Fund. Address: 6803 S. Tucson Way, Centennial, CO 80112. The number of shares reported in the above table under the row of Oppenheimer Funds, Inc. includes, and reflects the aggregate number of, shares held by Oppenheimer Funds, Inc. and Oppenheimer Global Strategic Income Fund. |

|

(9) | | | | Brigade Capital Management, LLC is the beneficial owner of all the shares held by Brigade Leveraged Capital Structures Fund Ltd. The number of shares reported in the above table under the row of Brigade Capital Management, LLC includes the number of shares held by Brigade Leveraged Capital Structures Fund Ltd. Address: 399 Park Avenue, 16th Floor, New York, New York 10022. |

|

(10) | | | | Solus Alternative Asset Management LP, Solus GP LLC and Mr. Pucillo do not directly own any shares. By reason of the provisions of Rule 13d-3 of the Securities Exchange Act of 1934, each of Solus Alternative Asset Management LP, Solus GP LLC and Mr. Pucillo may be deemed to own beneficially 331,579 common and preferred shares. Each of Solus Alternative Asset Management LP, Solus GP LLC and Mr. Pucillo disclaim direct beneficial ownership of any of the securities. Address: 410 Park Avenue, 11th Floor, New York, NY 10022. |

|

(11) | | | | Excludes warrants to acquire 202,511 shares of Series A-1 Preferred Stock. |

|

(12) | | | | Excludes warrants to acquire 273,930 shares of Series A-2 Preferred Stock. |

|

(13) | | | | Excludes warrants to acquire 186,657 shares of Series A-2 Preferred Stock. |

|

(14) | | | | Each of Mr. Kim, Mr. Singer, Standard General L.P., Standard General Master Fund, L.P., SGMF Holdco LLC, SGMF HC LLC, Standard General OC Master Fund L.P., OCMF Holdco LLC, OCMF HC LLC, disclaim beneficial ownership of the shares except to the extent of its pecuniary interest in such shares. Address: 650 Madison Avenue, 23 rd Floor, New York, New York 10022. |

|

(15) | | | | The number of shares reported in the above table under the row of OCMF HC LLC includes the number of shares held by Standard General Master Fund L.P., Standard General OC Master Fund L.P., Standard General Focus Fund L.P., SGMF Holdco LLC, OCMJF Holdco LLC, SGMF HC LLC, and OCMF HC LLC. |

II-4

IMPORTANT

Tell your Board what you think! Your vote is important. No matter how many shares of Voting Stock you own, please give Georgeson your proxy FOR the election of the Nominee by taking three steps:

|

• | | | | SIGNING the enclosedWHITE proxy card, |

|

• | | | | DATING the enclosedWHITE proxy card, and |

|

• | | | | MAILING the enclosedWHITE proxy card TODAY in the envelope provided (no postage is required if mailed in the United States). |

If any of your shares of Voting Stock are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such shares of Voting Stock and only upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by toll- free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosedWHITE voting form.

If you have any questions or require any additional information concerning this Proxy Statement, please contact Georgeson at the address, telephone number or email set forth below.

Georgeson Inc.

199 Water Street

26th Floor

New York, NY 10037

Phone: (866) 295-3782

Email: brigade@georgeson.com

WHITE PROXY CARD

DATED April 6, 2012

GREEKTOWN SUPERHOLDINGS, INC.

2012 ANNUAL MEETING OF SHAREHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF

BRIGADE LEVERAGED CAPITAL STRUCTURES FUND LTD.

THE BOARD OF DIRECTORS OF GREEKTOWN SUPERHOLDINGS, INC.

IS NOT SOLICITING THIS PROXY

PROXY

The undersigned appoints Neal P. Goldman and Doug Pardon, and each of them, attorneys and agents with full power of substitution to vote all shares of stock of Greektown Superholdings, Inc. (the “Company”) which the undersigned would be entitled to vote if personally present at the 2012 Annual Meeting of Shareholders of the Company scheduled to be held at the Company’s offices at 555 East Lafayette, Detroit, Michigan 48226 on May 8, 2012 at 10:00 a.m., local time (including any adjournments or postponements thereof and any meeting called in lieu thereof, the “Annual Meeting”).

The undersigned hereby revokes any other proxy or proxies heretofore given to vote or act with respect to the shares of stock of the Company held by the undersigned, and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by virtue hereof. If properly executed, this Proxy will be voted as directed on the reverse and in the discretion of the herein named attorneys and proxies or their substitutes with respect to any other matters as may properly come before the Annual Meeting that are unknown to Brigade Leveraged Capital Structures Fund Ltd. (“Brigade”) a reasonable time before this solicitation.

IF NO DIRECTION IS INDICATED WITH RESPECT TO THE PROPOSALS ON THE REVERSE, THIS PROXY WILL BE VOTED “FOR” (I) NEAL P. GOLDMAN FOR DIRECTOR; (II) THE PERSONS WHO HAVE BEEN NOMINATED BY GREEKTOWN TO SERVE AS DIRECTORS, OTHER THAN JOHN BITOVE; AND (III) IN THE PROXY HOLDERS’ DISCRETION AS TO OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE ANNUAL MEETING.

This Proxy will be valid until the completion of the Annual Meeting. This Proxy will only be valid in connection with Brigade’s solicitation of proxies for the Annual Meeting.

IMPORTANT: PLEASE SIGN, DATE AND MAIL THIS PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

WHITE PROXY CARD

S Please mark vote as in this example

BRIGADE STRONGLY RECOMMENDS THAT SHAREHOLDERS VOTE IN FAVOR OF THE

NOMINEE LISTED BELOW IN PROPOSAL 1.

1. Brigade’s Proposal to elect Neal P. Goldman as a director of the Company.

| | | | |

Nominee: | | FOR | | WITHHOLD |

Neal P. Goldman | | [ ] | | [ ] |

PLUS the persons who have been nominated by Greektown to serve as directors, other than John Bitove. Brigade is NOT seeking authority to vote for and WILL NOT exercise any authority to vote for John Bitove. There is no assurance that Greektown’s nominees will serve as directors if our Nominee is elected to the Board. You should refer to the proxy statement and form of proxy distributed by Greektown for the names, background, qualifications and other information concerning Greektown nominees.

Note: YOU MAY WITHHOLD AUTHORITY TO VOTE FOR THE PERSONS WHO HAVE BEEN NOMINATED BY GREEKTOWN TO SERVE AS DIRECTORS (OTHER THAN JOHN BITOVE, AND TO WHOM THIS PROXY WILL NOT BE VOTED IN ANY CASE) BY WRITING THE NAMES OF SUCH NOMINEES BELOW. YOUR SHARES WILL THEN BE VOTED FOR THE REMAINING NOMINEE(S).

Dated

(Signature)

(Signature, if held jointly)

(Title)

WHEN SHARES ARE HELD JOINTLY, JOINT OWNERS SHOULD EACH SIGN. EXECUTORS, ADMINISTRATORS, TRUSTEES, ETC., SHOULD INDICATE THE CAPACITY IN WHICH SIGNING. PLEASE SIGN EXACTLY AS NAME APPEARS ON THIS PROXY.