UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the RegistrantS

Filed by a Party other than the Registranto

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| £ | Definitive Proxy Statement |

| S | Definitive Additional Materials |

| o | Soliciting Material Pursuant to § 240.14a-12 |

Greektown Superholdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| S | No fee required. | |

| | | | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| | | | |

| | (1) | Title of each class of securities to which transaction applies: | |

| | | | |

| | (2) | Aggregate number of securities to which transaction applies: | |

| | | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | | | |

| | (4) | Proposed maximum aggregate value of transaction: | |

| | | | |

| | (5) | Total fee paid: | |

| | | | |

| o | Fee paid previously with preliminary materials. | |

| | | |

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| | | | |

| | (1) | Amount Previously Paid: | |

| | | | |

| | (2) | Form, Schedule or Registration Statement No.: | |

| | | | |

| | (3) | Filing Party: | |

| | | | |

| | (4) | Date Filed: | |

| | | | |

| | | | |

Greektown Superholdings, Inc. Presentation to Institutional Shareholder Services Inc. April 23, 2012 Freman Hendrix, Vice Chairman, Board of Directors, Chairman of the Nominating Committee Michael Puggi, President and CEO Glen Tomaszewski, Senior Vice President and CFO 1

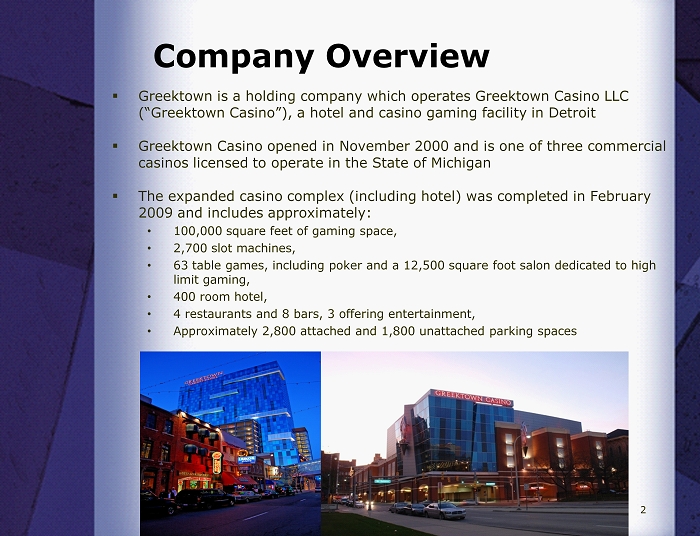

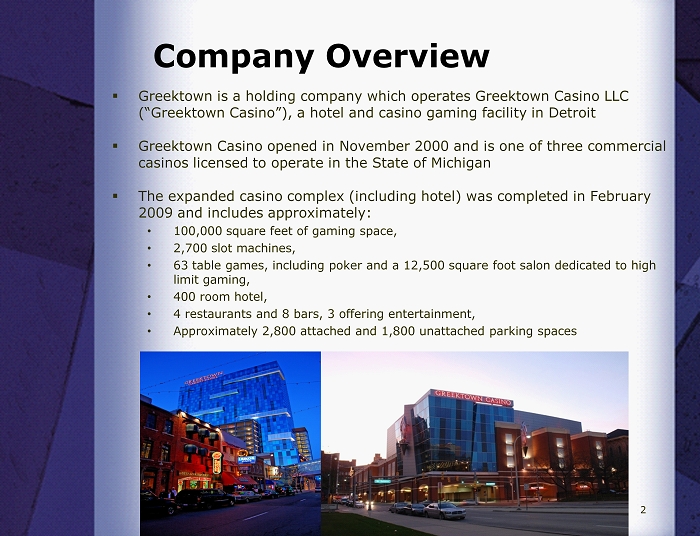

Company Overview ▪ Greektown is a holding company which operates Greektown Casino LLC (“Greektown Casino”), a hotel and casino gaming facility in Detroit ▪ Greektown Casino opened in November 2000 and is one of three commercial casinos licensed to operate in the State of Michigan ▪ The expanded casino complex (including hotel) was completed in February 2009 and includes approximately: • 100,000 square feet of gaming space, • 2,700 slot machines, • 63 table games, including poker and a 12,500 square foot salon dedicated to high limit gaming, • 400 room hotel, • 4 restaurants and 8 bars, 3 offering entertainment, • Approximately 2,800 attached and 1,800 unattached parking spaces 2

History ▪ As an operator of a casino gaming facility, Greektown is subject to regulation by the Michigan Gaming Control Board (“MGCB”) under the Michigan Gaming Control Act ▪ Prior to its bankruptcy, Greektown Casino was owned by Greektown Holdings, L.L.C. (“Greektown Holdings”) which was in turn owned by the Sault Ste. Marie Tribe of Chippewa Indians ▪ On May 29, 2008, Greektown Holdings, together with its subsidiaries and certain affiliates, filed voluntary petitions under Chapter 11 of the U.S. Bankruptcy Code ▪ Among the reasons for Greektown Holdings bankruptcy filing include: − Greektown Holdings was unable to maintain compliance with its financial covenants under its credit facility and under an applicable order from the MGCB − Greektown Holdings was unable to obtain sufficient debt or equity financing to complete an expansion of the casino, incuding the construction of its hotel facility, which would have caused a default under its Development Agreement with the City of Detroit − Greektown Holdings was affected by the downturn in the economy, including its effect on the Detroit economy 3

History ▪ Greektown Casino emerged from bankruptcy in June 2010 ▪ In connection with the plan of reorganization (the “Plan”) of Greektown Casino and its affiliates, the four largest noteholders of Greektown Casino (Hancock, Solus , Oppenheimer and Brigade) as the proponents of the Plan (the “Plan Proponents”), who today own approximately 80% of the outstanding voting stock of Greektown, designated in the Plan an initial board of directors consisting of seven initial members, whose appointment was subject to applicable Michigan Gaming Control Board approvals ▪ Six of those members were subsequently approved by the MGCB and are currently on Greektown’s Board of Directors. The other designee withdrew his name from consideration. A seventh member was named by the board to replace the withdrawing member. 4

History ▪ Greektown was originally to be managed by a management company, named in the Plan ▪ The designated management company withdrew immediately prior to Greektown’s emergence from bankruptcy ▪ The Plan Proponents, representing a majority of the would be equity stake in the Company, urged George Boyer to act as interim CEO, and left it up to the Board of Directors to decide whether Greektown should be self - managed or managed by a management company ▪ Mr. Boyer agreed to act as Interim CEO 5

History ▪ Following emergence from bankruptcy, the Board decided self - management was preferred because: − Better track record of equity performance by self - managed companies − Lower cost of self - management − Management companies considered to be too focused on short term gains only − Self - management considered to be better suited to build long - term customer loyalty and employee morale 6

Management Team ▪ Michael Puggi was hired as CEO in June 2011, following an extensive search and receipt of regulatory approvals. Mr. Puggi has been in the gaming industry for more than 30 years. His experience includes providing executive management consulting services to the gaming and hospitality industry, acting as regional vice president and general manager, Southern Nevada for Herbst Gaming Inc. where he was responsible for seven of the Herbst’s fifteen casinos and president and COO for Primm Valley Resorts, the parent company of which was MGM Mirage, where he was responsible for eight Southern Nevada casinos. ▪ The Board determined to have Mr. Boyer remain as Executive Chairman on an interim basis through 12/31/2012 ▪ Since Mr. Puggi’s hiring, the Company has hired a CFO, Glen Tomaszewski, and has taken steps to reorganize and strengthen the management team. Mr. Tomaszewski was previously Vice President, Chief Accounting Officer, Controller and Treasurer of Borders Group, Inc. ▪ Mr. Boyer role as Executive Chairman will end at end of 2012 and it is planned that he will continue as Chairman of the Board with reduced compensation 7

Progress Since Emerging From Bankruptcy ▪ During the Company’s bankruptcy proceedings, which lasted for more than two years, the Company’s property went through a period of neglect while its competitors were making significant capital improvements to their properties ▪ Under the direction of Mr. Boyer and Mr. Puggi, Greektown has taken many steps to improve the casino property and the performance of the Company, including: 8

Recent and Future Initiatives 2011 Accomplishments • New management team in place • Michael Puggi (President and CEO, 6/15/11) • Glen Tomaszewski (Senior Vice President and CFO, 10/11/11) • Numerous other executive changes • Significant renovations throughout the casino, including: • Asteria , a new bar/lounge and entertainment venue • Super Pit table games area • The Fringe bar • New promotions area, cage, and club booth 2012 Initiatives* • New valet garage scheduled for opening Q1 2013 • 850 car capacity, linked via elevated walkway to the casino • Continued renovation throughout the casino, including: • Eclipz lounge • Trapper’s terrace • High limit gaming area • Restrooms • New slot machines/slot system upgrade *Subject to MCGB approval 9

Improvements in Results ▪ The initiatives taken by the Board and the management team are beginning to show results Our market share has increased year - over - year during the past two quarters • Significant portions of the casino floor were renovated during the second and third quarters of 2011, adversely impacting financial results • Since completion of construction, operating performance has significantly improved (1) – The Company measures market share as its percentage of the total adjusted revenues, as reported by the Michigan Gaming Control Board; of the three casinos in Michigan: Greektown Casino, MGM Grand Detroit and MotorCity Casino. 10

Gaming Board Regulation ▪ Greektown is subject to regulation by the MGCB under the Michigan Gaming Control Act ▪ Regulations include approval by the MGCB of all directors and officers of Greektown ▪ Greektown was initially limited to three directors, John Bitove, George Boyer and Yvette Landau, as those were the only directors approved by the MGCB ▪ The Board has since grown to seven members as the MGCB approved additional members and the Company has proposed to increase the Board to nine members in connection with the 2012 annual meeting 11

Brigade Nominations ▪ Brigade owns convertible preferred shares which represent approximately 6.6% of the voting power of the Company (representing approximately 15% of the outstanding capital stock of Greektown on an as - converted basis)* ▪ On March 2, 2012, Brigade sent notice to the Board nominating two directors: Neal Goldman and James Barrett ▪ Also on March 2, 2012, George Boyer sent notice to the Board nominating himself and three directors: Soohyung Kim (a representative of Standard General, which owns approximately 16% of Greektown’s outstanding voting stock), Charles Moore (a consultant with gaming experience and a CPA) and Michael Puggi (the Company’s CEO) ▪ The Nominating Committee met and carefully vetted all five nominees of Brigade and Mr. Boyer and recommended to Board, and the Board determined, that the Board should be expanded from seven members to nine members to expand its talent pool and strengthen the gaming industry background on the Board 12 *Excludes certain warrants held by Brigade, which may not be exercised without MGCB approval and which Brigade does not report in its beneficial ownership filings with the SEC. The company has two classes of preferred stock, Series A - 1 preferred stock, which has ten votes per share and Series A - 2 preferred stock which has one vote per share. Brigade's ownership consists mostly of the Series A - 2 preferred stock.

Greektown’s Slate of Nominees ▪ The Nominating Committee recommended and the Board unanimously approved a slate of nine directors, including one of Brigade’s nominees (Mr. Barrett), two of Mr. Boyer’s nominees (Mr. Kim and Mr. Moore) and six incumbents (John Bitove , George Boyer, Darrell Burks, Michael E. Duggan, Freman Hendrix and Yvette Landau) ▪ The Nominating Committee and Board determined that one representative of Brigade, rather than two members, out of a nine member Board was appropriate given that one member out of nine more than exceeded Brigade’s 6.6% voting control of the Company, and selected Mr. Barrett from Brigade’s slate based on his strong background in the gaming industry and his accounting background as a CPA ▪ The Board has determined that six of its nine nominees are independent within the NASDAQ definition ▪ The Board believes its slate is comprised of highly qualified, proven business leaders with deep experience in the gaming industry and a broad range of complementary experience in hospitality, financial, risk management and other areas essential to Greektown’s business 13

Greektown’s Slate of Nominees ▪ The Board’s nominees consist of: − James Barrett : Mr. Barrett served for over 25 years as the senior financial executive and board member of Marnell Companies, a Nevada - based privately held firm involved in various business units, including Marnell Corrao Associates, the nation’s oldest and largest hotel casino design/build firm with a portfolio of properties that includes Las Vegas’ Bellagio, Caesars Palace, the M Resort and Atlantic City’s Borgata. − John Bitove : Mr. Bitove is Chairman of DAVE Wireless Inc. and has been Chairman of a number of public companies including Canadian Satellite Radio Holdings (CSR) Inc. and Scott’s Real Estate Investment Trust and was the founder of the Toronto Raptors of the NBA. − George Boyer : Mr. Boyer was interim CEO from August 10, 2010 to June 15, 2011 and is currently the Executive Chairman. Mr. Boyer’s vast experience in the gaming industry includes President and COO of the MGM Grand Detroit from 2002 to 2008 and other leadership positions in casinos in Las Vegas. 14

Greektown’s Slate of Nominees − Darrell Burks : Mr. Burks has been a partner at PricewaterhouseCoopers LLP since 1992 and has experience providing audit and consulting services to companies in all aspects of the casino gaming industry including casino - hotels, card clubs, Native American Casinos, and debt offerings. − Michael E. Duggan : Mr. Duggan has been President and Chief Executive Officer of Detroit Medical Center since January 2004, overseeing eight hospitals and 12,000 employees, and was previously a member of the eleven member Governor’s Blue Ribbon Commission on Casino Gaming in Michigan. − Freman Hendrix : Mr. Hendrix has been President and principal owner of Advanced Security & Investigative Solutions, a uniformed security guard company, since 2006. Mr. Hendrix formerly served as Chief of Staff and Deputy Mayor of City of Detroit, overseeing 43 departments and 17,000 employees. Mr. Hendrix sits on the Board as the designee of the City of Detroit. A Detroit designee is required by the terms of a prior settlement agreement with the City of Detroit. 15

Greektown’s Slate of Nominees − Soohyung Kim : Mr. Kim has more than 15 years of investment management experience. He is the Chief Investment Officer of Standard General, which owns approximately 16% of Greektown’s outstanding voting stock, and is also the CEO and a member of the board of directors of ALST Holdco, which owns the Aliante Casino in Las Vegas, Nevada. − Yvette E. Landau : Ms. Landau has been a co - owner of W.A. Richardson Builders, LLC, which provides casino advisory, general contracting, construction management and purchasing services to casino resorts since April 2005, and was Vice President, General Counsel and Secretary of Mandalay Resort Group, a formerly NYSE listed company that owned various casino resort properties, from 1996 to April 2005 when it was acquired by MGM Resorts International. − Charles Moore : Mr. Moore has been employed by Conway MacKenzie, Inc., a restructuring and financial advisory firm since 2001, where he is a Senior Managing Director and Shareholder. Mr. Moore was a consultant to the Company during its bankruptcy and following its emergence and has expertise in restructuring and reorganizing companies, as well as extensive financial and accounting expertise. 16

Forward - Looking Statements Disclosure Regarding Forward - Looking Statements This presentation contains statements that we believe are, or may be considered to be, “forward - looking statements.” All statements other than statements of historical fact included in this presentation regarding the prospects of our industry or our prospects, plans, financial position or business strategy may constitute forward - looking statements. In addition, forward - looking statements generally can be identified by the use of forward - looking words such as “may,” “will,” “expect,” “intend,” “estimate,” “foresee,” “project,” “anticipate,” “believe,” “plan,” “forecast,” “continue” or “could” or the negative of these terms or variations of them or similar terms. Furthermore, forward - looking statements may be included in various filings that we make with the SEC or press releases or oral statements made by or with the approval of one of our authorized executive officers. Although we believe that the expectations reflected in these forward - looking statements are reasonable, we cannot assure you that these expectations will prove to be correct. These forward - looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward - looking statements. Readers are cautioned not to place undue reliance on any forward - looking statements contained in this presentation, which reflect management’s opinions only as of the date hereof. Except as required by law, we undertake no obligation to revise or publicly release the results of any revision to any forward - looking statements. You are advised, however, to consult any additional disclosures we make in our reports to the SEC. All subsequent written and oral forward - looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this presentation. 17