- AL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Air Lease (AL) DEF 14ADefinitive proxy

Filed: 18 Mar 24, 4:06pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. |

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, California 90067

(310) 553-0555

March 18, 2024

Dear Fellow Stockholder:

Your officers and directors join me in inviting you to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) at 8:30 a.m. Pacific time, on Friday, May 3, 2024. The Annual Meeting will be held online in a virtual only meeting format via a live audio webcast at www.cesonlineservices.com/al24_vm. There will not be a physical location for the Annual Meeting. Stockholders may only participate online and must pre-register to attend.

If you plan to attend the virtual meeting, you will need to pre-register at www.cesonlineservices.com/al24_vm by 8:30 a.m. Pacific time on Thursday, May 2, 2024. To pre-register for the Annual Meeting, please follow the instructions provided under “Other Matters – General Information About the Annual Meeting – How do I pre-register to attend the Annual Meeting?” found in the accompanying Proxy Statement. Once registered, you will be able to attend the Annual Meeting, vote and submit your questions during the Annual Meeting via live online webcast by visiting www.cesonlineservices.com/al24_vm.

The expected items of business for the Annual Meeting are described in detail in the attached Notice of 2024 Annual Meeting of Stockholders and Proxy Statement.

We look forward to your participation on May 3rd. We encourage you to submit your vote as soon as possible, whether or not you expect to attend the Annual Meeting. Your vote is very important to us.

Sincerely,

Steven F. Udvar-Házy

Executive Chairman of the Board

Notice of 2024 Annual Meeting of Stockholders

|

| Time and Date: | 8:30 a.m., Pacific time, on Friday, May 3, 2024 | |||

| Location: | www.cesonlineservices.com/al24_vm | |||

| Agenda: | (1) | Elect nine directors, each to serve for a one-year term until the next annual meeting of stockholders, and until their respective successors are duly elected and qualified or until his or her resignation or removal; | ||

| (2) | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2024; | |||

| (3) | Advisory vote to approve named executive officer compensation; | |||

| (4) | Advisory vote on the frequency of future advisory votes to approve named executive officer compensation; and | |||

| (5) | Act upon such other matters as may properly come before the meeting or any postponement or adjournment. | |||

| Record Date: | You can vote at the meeting and at any postponement or adjournment of the meeting if you were a stockholder of record as of the close of business on March 4, 2024. A list of all stockholders entitled to vote at the meeting will be available for examination at our principal executive offices at 2000 Avenue of the Stars, Suite 1000N, Los Angeles, CA 90067, for 10 days before the meeting, and during the meeting, such list will be available to registered stockholders as a link on the meeting platform. | |||

| Voting: | Please vote as soon as possible, even if you plan to attend the meeting, to ensure that your shares will be represented. You do not need to attend the meeting to vote if you vote your shares before the meeting. If you are a record holder, you may vote your shares by mail, telephone or the Internet. If your shares are held by a broker, bank or other nominee, you must follow the instructions provided by your broker, bank or other nominee to vote your shares. To vote at the Annual Meeting, you must pre-register at www.cesonlineservices.com/al24_vm by 8:30 a.m. Pacific time on Thursday, May 2, 2024. See additional instructions in section “Other Matters – General Information About the Annual Meeting – How do I vote in the Annual Meeting webcast?” found in the accompanying Proxy Statement. | |||

| Annual Report: | Copies of our 2023 Annual Report to Stockholders (the “Annual Report”), including our 2023 Annual Report on Form 10-K, are being made available to stockholders concurrently with the accompanying Proxy Statement. We anticipate that these materials will first be made available to stockholders on or about March 21, 2024. You may also access our 2023 Annual Report on Form 10-K, which we have filed with the Securities and Exchange Commission (the “SEC”), on the investor section of our website at http://www.airleasecorp.com. The other information on our website does not constitute part of this Proxy Statement. | |||

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting

of Stockholders to be Held on May 3, 2024: Our Proxy Statement and Annual Report are available online at http://www.proxyvote.com.

By Order of the Board of Directors,

Carol H. Forsyte

Executive Vice President, General Counsel, Corporate

Secretary and Chief Compliance Officer

Los Angeles, California

March 18, 2024

Table of Contents

|

FORWARD-LOOKING STATEMENTS

Statements in this proxy statement that are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are based on our current intent, belief and expectations. We claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 for all forward-looking statements. Words such as “can,” “could,” “may,” “predicts,” “potential,” “will,” “projects,” “continuing,” “ongoing,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and “should,” and variations of these words and similar expressions, are used in many cases to identify these forward-looking statements. Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results, performance or achievements, or industry results to differ materially from those expressed in such statements. Our actual results, performance or achievements, or industry results could differ materially from those anticipated in such forward-looking statements as a result of the following factors, among others: our inability to obtain additional capital on favorable terms, or at all, to acquire aircraft, service our debt obligations and refinance maturing debt obligations; increases in our cost of borrowing, decreases in our credit ratings, or changes in interest rates; our inability to generate sufficient returns on our aircraft investments through strategic acquisition and profitable leasing; our failure to close our aircraft acquisition commitments; the failure of an aircraft or engine manufacturer to meet its contractual obligations to us, including or as a result of manufacturing flaws and technical or other difficulties with aircraft or engines before or after delivery; our ability to recover losses related to aircraft detained in Russia, including through insurance claims and related litigation; obsolescence of, or changes in overall demand for, our aircraft; changes in the value of, and lease rates for, our aircraft, including as a result of aircraft oversupply, manufacturer production levels, our lessees’ failure to maintain our aircraft, inflation, and other factors outside of our control; impaired financial condition and liquidity of our lessees, including due to lessee defaults and reorganizations, bankruptcies or similar proceedings; increased competition from other aircraft lessors; the failure by our lessees to adequately insure our aircraft or fulfill their contractual indemnity obligations to us or the failure of such insurers to fulfill their contractual obligations; increased tariffs and other restrictions on trade; changes in the regulatory environment, including changes in tax laws and environmental regulations; other events affecting our business or the business of our lessees and aircraft manufacturers or their suppliers that are beyond our or their control, such as the threat or realization of epidemic diseases, natural disasters, terrorist attacks, war or armed hostilities between countries or non-state actors; and any additional factors discussed under “Part I — Item 1A. Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2023 and other filings we make with the SEC, including future SEC filings.

All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from our expectations. You are therefore cautioned not to place undue reliance on such statements. Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout the documents incorporated by reference in this proxy statement. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect actual results or events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

Proxy Statement Summary

|

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement and our Annual Report on Form 10-K before voting. We anticipate that these materials will first be made available to stockholders on or about March 21, 2024.

References throughout this Proxy Statement to “Air Lease Corporation,” “we,” “us,” and “our” refer to Air Lease Corporation and its subsidiaries, unless the context indicates otherwise.

Proposals to be Voted On

| Proposal | Description | Board Recommendation |

More Information

| |||||

Proposal 1 |

Election of Nine Director Nominees |

FOR each nominee |

pages 18 to 27 | |||||

Matthew J. Hart Yvette Hollingsworth Clark Cheryl Gordon Krongard Marshall O. Larsen Susan McCaw

| Robert A. Milton John L. Plueger Ian M. Saines Steven F. Udvar-Házy | |||||||

Proposal 2 |

Ratification of Appointment of Independent Registered Public Accounting Firm

|

FOR |

page 28 | |||||

Proposal 3 |

Advisory Vote to Approve Named Executive Officer Compensation

|

FOR |

page 29 | |||||

Proposal 4 |

Advisory Vote on the Frequency of Future Advisory Votes to Approve Named Executive Officer Compensation

|

1 YEAR |

page 30 | |||||

2024 Proxy Statement | Air Lease Corporation | i

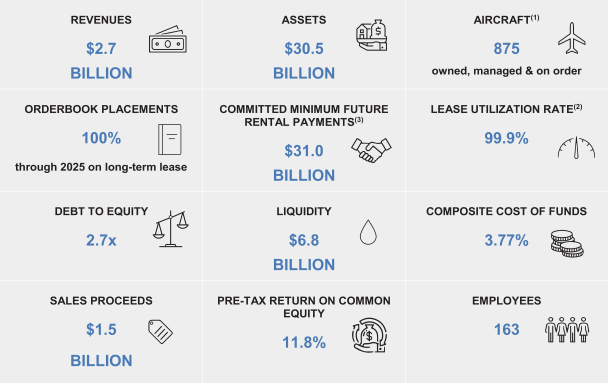

2023 Financial and Business Highlights

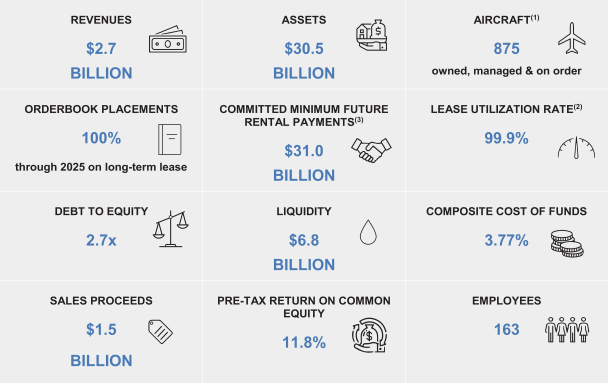

We delivered strong financial and operational results in 2023. Highlights for the year ended December 31, 2023 include:

(1) As of December 31, 2023, our owned fleet count included 14 aircraft classified as flight equipment held for sale and 12 aircraft classified as net investments in sales-type leases which were included in “other assets” on our consolidated balance sheet in our Annual Report on Form 10-K for 2023. |

(2) Lease utilization rate is calculated based on the number of days each aircraft was subject to a lease or letter of intent during the period, weighted by the net book value of the aircraft. |

(3) Consists of $16.4 billion in contracted minimum rental payments on the aircraft in our existing fleet and $14.6 billion in minimum future rental payments related to aircraft which will deliver between 2024 through 2027. |

Aircraft Activity. During the year ended December 31, 2023, we purchased and took delivery of 71 aircraft from our new order pipeline and sold 27 aircraft1, ending the year with a total of 463 aircraft in our owned fleet. The weighted average age of our fleet was 4.6 years, and the weighted average lease term remaining was 7.0 years as of December 31, 2023. The net book value of our fleet grew by 6.9%, to $26.2 billion as of December 31, 2023, compared to $24.5 billion as of December 31, 2022, and our lease utilization rate for 2023 was 99.9%. Our managed fleet was comprised of 78 aircraft as of December 31, 2023, as compared to 85 aircraft as of December 31, 2022.

| 1 | Aircraft sales include two sales-type lease transactions during the year ended December 31, 2023. |

ii | Air Lease Corporation | 2024 Proxy Statement

New Aircraft Pipeline. As of December 31, 2023, we had commitments to purchase 334 aircraft from Airbus and Boeing for delivery through 2028 with an estimated aggregate commitment of $21.7 billion. We have placed 100% of our committed orderbook on long-term leases for aircraft delivering through the end of 2025 and have placed 65% of our entire orderbook. We ended 2023 with $31.0 billion in committed minimum future rental payments, consisting of $16.4 billion in contracted minimum rental payments on the aircraft in our existing fleet and $14.6 billion in minimum future rental payments related to aircraft which will deliver between 2024 through 2027.

Financing. During 2023, we raised approximately $3.6 billion in committed debt financings, with floating interest rates ranging from SOFR plus 0.42% and SOFR plus 1.50% and fixed interest rates ranging from 5.30% to 5.94%, net of the effects of cross-currency hedging arrangements. Additionally, we ended 2023 with an aggregate borrowing capacity under our revolving credit facility of $6.3 billion and total liquidity of $6.8 billion. As of December 31, 2023, we had total debt outstanding of $19.4 billion, of which 84.7% was at a fixed rate and 98.4% of which was unsecured and, in the aggregate, our composite cost of funds was 3.77%.

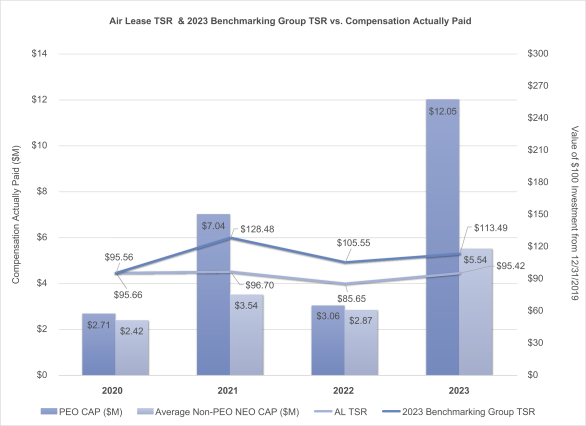

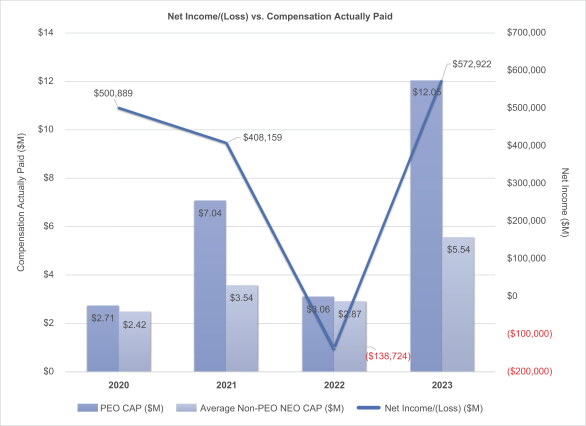

Financial Highlights. Our total revenues for the year ended December 31, 2023 increased by 15.9% to $2.7 billion as compared to 2022. The increase in total revenues was primarily driven by the continued growth in our fleet, an increase in sales activity, and higher end of lease revenue. Our net income attributable to common stockholders for the year ended December 31, 2023 was $572.9 million, or $5.14 per diluted share, as compared to a net loss attributable to common stockholders of $138.7 million, or $1.24 loss per diluted share, for the year ended December 31, 2022. The increase compared to the prior year was primarily due to the increase in revenues from the continued growth of our fleet, an increase in sales activity, and higher end of lease revenue described above, partially offset by higher interest expense, which resulted from an increase in our composite cost of funds. In addition, in 2023, we recognized a net benefit of approximately $67.0 million from the settlement of insurance claims under JSC Siberia Airline’s (“S7”, a Russian airline) insurance policies related to four aircraft previously included in our owned fleet and our equity interest in certain aircraft from our managed fleet that were previously on lease to S7, whereas in 2022, we recognized a net write-off of $771.5 million related to our Russian fleet. During the year ended December 31, 2023, our adjusted net income before income taxes2 was $733.6 million compared to $659.9 million for the year ended December 31, 2022. Our adjusted diluted earnings per share before income taxes for the full year 2023 was $6.58 compared to $5.89 for the full year 2022. The increase in our adjusted net income before income taxes and adjusted diluted earnings per share before income taxes primarily relates to the increase in revenues as discussed above, partially offset by higher interest expense. Our pre-tax return on common equity for the year ended December 31, 2023 increased to 11.8% as compared to (3.0)% in 2022 driven primarily by the increase in net income attributable to common stockholders discussed above.

Increased Return of Capital. On November 3, 2023, our Board of Directors approved an increase in our quarterly cash dividend on our Class A Common Stock by 5%, from $0.20 per share to $0.21 per share. This dividend, paid on January 10, 2024, marked our 44th consecutive dividend since we declared our first dividend in 2013 and our eleventh consecutive annual dividend increase over that time.

| 2 | Our adjusted net income before income taxes and adjusted diluted earnings per share before income taxes exclude the effects of certain non-cash items, one-time or non-recurring items that are not expected to continue in the future and certain other items, such net write-offs and recoveries related to our former Russian fleet. Adjusted net income before income taxes and adjusted diluted earnings per share before income taxes are measures of financial and operational performance that are not defined by U.S. Generally Accepted Accounting Principles (“GAAP”). See Appendix A for a discussion of adjusted net income before income taxes and adjusted diluted earnings per share before income taxes as non-GAAP measures and a reconciliation of these measures to net income attributable to common stockholders. |

2024 Proxy Statement | Air Lease Corporation | iii

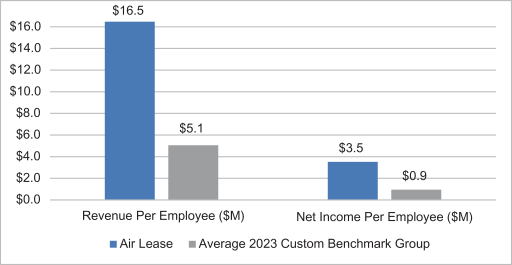

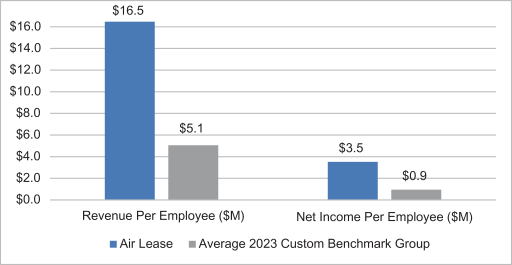

Workforce Productivity. As of December 31, 2023, we had 163 employees and $30.5 billion of total assets. Per employee, our total revenues, net income attributable to common stockholders, and adjusted net income before income taxes for the year ended December 31, 2023 were approximately $16.5 million, $3.5 million and $4.5 million, respectively.

For a comprehensive discussion of our financial results, please review our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on February 15, 2024 and is available at http://www.airleasecorp.com/investors.

iv | Air Lease Corporation | 2024 Proxy Statement

Board Matrix

Our nine director nominees are highly experienced and possess the necessary skills and balance of perspectives to oversee our unique business. Set forth below is a summary of each director nominee’s qualifications and experience, certain demographical information, as well as their committee membership. More detailed information is provided in each director nominee’s biographical information beginning on page 19.

|  |  |  |  |  |  |  |  | ||||||||||

| Udvar-Házy | Plueger | Milton | Hart | Krongard |

Hollingsworth | Larsen | McCaw | Saines | ||||||||||

Qualifications and Experience | ||||||||||||||||||

Executive Leadership Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

Airline Industry/Aviation Expertise | ● | ● | ● | ● | ● | ● | ||||||||||||

Financial/Capital Allocation Expertise | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

International Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

Risk Management and Oversight Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||

Other Public Company Board Experience | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

Committee Membership | ||||||||||||||||||

Audit | ● |  | ● | ● | ||||||||||||||

Nominating & Corporate Governance |  | ● | ● | ● | ||||||||||||||

Leadership Development & Compensation | ● |  | ● | ● | ||||||||||||||

Independent | ||||||||||||||||||

| ● | ● | ● | ● | ● | ● | ● | ||||||||||||

Board Tenure | ||||||||||||||||||

Years | 14 | 14 | 14 | 14 | 10 | 3 | 10 | 4 | 14 | |||||||||

Demographics | ||||||||||||||||||

Gender | ||||||||||||||||||

Female | ● | ● | ● | |||||||||||||||

Male | ● | ● | ● | ● | ● | ● | ||||||||||||

Race/Ethnicity | ||||||||||||||||||

African American or Black | ● | |||||||||||||||||

White | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

Age | ||||||||||||||||||

Years | 78 | 69 | 63 | 71 | 68 | 57 | 75 | 61 | 61 | |||||||||

| Committee Chair |

v | Air Lease Corporation | 2024 Proxy Statement

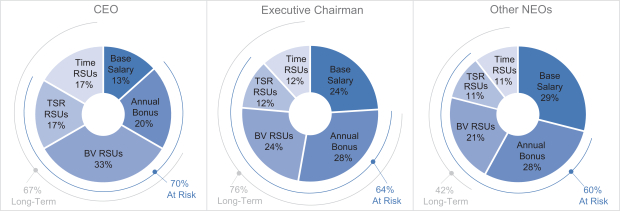

Executive Compensation Highlights

Compensation Philosophy

Our executive compensation program is designed to attract, retain and motivate the highest caliber executives in the aircraft leasing industry by offering a comprehensive compensation program that is attractive enough to entice and retain successful senior executives. We also believe it is important that our compensation program attracts the highly talented executive who is experienced and capable of managing our aircraft fleet with a very small team to help drive our profitability.

At the end of 2023, we had total revenues of $2.7 billion and 163 employees, with total compensation expense representing 4.0% of revenues.

We believe that our ratio of employees to total revenue and net income attributable to common stockholders compares favorably to other companies in capital-intensive businesses. The chart below shows our total revenues and net income attributable to common stockholders per employee as of December 31, 2023 as compared to the average of our 2023 custom benchmark group: |

COMPENSATION EXPENSE

4% 2023 total revenues |

Pay-for-Performance Philosophy

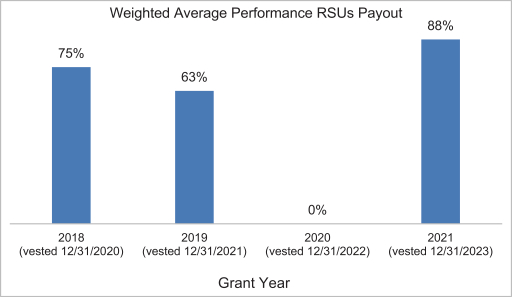

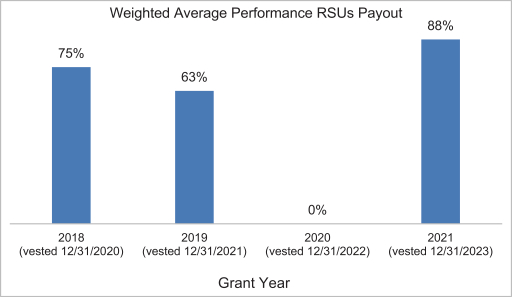

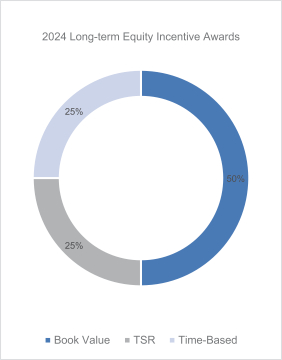

Our executive compensation program is also designed to reward our executives for contributing to the achievement of our annual and long-term objectives. We set performance metrics based on our 2023 financial plan, with the goal of aligning our performance-based compensation with the creation of long-term value for our stockholders. In 2023, we made changes to our compensation program, including increasing the weighting of the financial metrics in our annual bonus program from 60% to 70%, while simultaneously reducing the weighting of the strategic objectives from 40% to 30%. We had reduced the relative weighting of the financial metrics included in our annual bonus program during the COVID-19 pandemic and our industry’s recovery given the difficulty in forecasting our financial performance during that period. We also kept the substantial majority of our long-term incentive awards tied to performance-based objectives with the relative split between performance and time-based long-term incentive awards for 2023 consisting of 50% Book Value RSUs, 25% TSR RSUs and 25% time-based RSUs.

2024 Proxy Statement | Air Lease Corporation | vi

Our recent long-term incentive performance award payouts demonstrate the rigor of the long-term performance targets set by the leadership development and compensation committee:

We believe that our directors’ and employees’ ownership of our stock is critical to alignment with our stockholders. Our employees and independent directors collectively owned approximately 7% of the Company’s outstanding Class A Common Stock as of March 4, 2024.

vii | Air Lease Corporation | 2024 Proxy Statement

Compensation Governance

Our leadership development and compensation committee regularly reviews our compensation governance practices to ensure we are incentivizing hard work and high performance while also managing risk. Highlights of our executive compensation program include:

What We Do:

| ✓ | Pay for Performance |

| ✓ | Double-Trigger Change in Control Provisions |

| ✓ | Manage the use of equity incentives conservatively with a net equity burn rate of less than 1% in 2023 |

| ✓ | Tally Sheets |

| ✓ | Director Stock Ownership Guidelines (5X annual cash retainer) |

| ✓ | Executive Officer Stock Ownership Guidelines (6X for CEO and Executive Chairman and 2X for other executives; excludes unvested performance shares) |

| ✓ | Mitigate Undue Risk |

| ✓ | Independent Compensation Consultant |

| ✓ | Annual Compensation Analysis Against Custom Benchmark Group |

| ✓ | Clawback Policy in compliance with current NYSE Listing Standards |

| ✓ | Annual “Say-on-Pay” |

| ✓ | Robust Stockholder Engagement Program |

What We Don’t Do:

| x | Directors or Employee Hedging |

| x | Executive Officer or Director Pledging |

| x | Tax Gross-Ups (except in connection with foreign assignments) |

| x | Dividend or Dividend Equivalents on Unvested Equity Awards |

| x | Re-Price Stock Options |

| x | Pension Benefits (other than 401(k)) |

| x | Employment Agreements (except in connection with foreign assignments) |

| x | Equity awards with less than 1-year vesting |

| x | Uncapped payouts in our incentive plans |

| x | No liberal share recycling of stock options or stock appreciation rights |

| x | Stock Option Awards |

| x | Equity plan evergreen provisions |

| x | Guaranteed cash incentives, equity compensation or salary increases for NEOs (except upon death or disability) |

| x | Excessive perquisites or other benefits |

Extensive Stockholder Engagement and Demonstrated Responsiveness

To better understand our investors’ perspectives regarding our executive compensation program as well as a variety of corporate governance and sustainability topics, we engage with our investors throughout the year via individual or group meetings, at industry and bank conferences, as well as through our investor relations team. Following the 2023 annual stockholders meeting, in addition to our regular investor engagement efforts, the leadership development and compensation committee also oversaw dedicated stockholder outreach efforts in light of the results of our 2023 “say-on-pay” advisory vote. Engagement with our stockholders helps us better understand evolving priorities and perspectives, gives us an opportunity to elaborate upon our initiatives with relevant experts, and fosters constructive dialogue. We take feedback and insights from our engagement with investors into consideration as we review and evolve our business and governance practices and disclosures, and further share them with our Board of Directors and leadership development and compensation committee, as appropriate.

2024 Proxy Statement | Air Lease Corporation | viii

Following the 2023 annual stockholders meeting, we engaged with holders of over 70% of outstanding shares of our Class A Common Stock (none of whom were our employees or directors). A summary of what we heard during these engagement sessions, along with the changes we implemented in response, is below:

| What We Heard | How We Responded | |||

| Stockholders expressed concern over the goal rigor of metrics in our annual bonus program —specifically, that goals for some metrics were set below prior year actual results |  | We incorporated stockholder feedback on this topic in several ways:

First, the leadership development and compensation committee exercised its discretion to reduce the payouts under the 2023 annual bonus plan from 188% to 147%, which reflects what payouts would have been if the target adjusted pre-tax margin level for 2023 had been set at actual 2022 results. While the committee’s adjustment was primarily made to reflect the difficulties in forecasting 2023 results at the time our 2023 performance metrics were set in early 2023 given uncertainties surrounding interest rates, the timing and impact of capital expenditures and aircraft sales, as well as the variability around end of lease income, the leadership development and compensation committee considered stockholder feedback on this topic in making this adjustment

Second, we made significant changes to our annual bonus program for 2024:

(i) We set the target metrics in our 2024 annual bonus program above 2023 actual financial results;

(ii) We significantly increased the outperformance required to obtain above target payouts on all of the financial metrics included in our 2024 annual bonus program;

(iii) We updated the financial metrics in our annual bonus plan to replace adjusted pre-tax margin with adjusted net income before income taxes as we believe this is a better barometer in evaluating the performance of the business on an absolute basis and better reflects the growth and profitability of the business; and

(iv) We increased the weighting of our financial metrics to reflect a greater importance of these metrics relative to strategic goals. | ||

| Stockholders expressed concern over the goal rigor of the book value RSU awards included in our long-term incentive awards |  | We almost doubled the required growth for target payout of the book value RSU awards included in our 2024 long-term incentive awards | ||

ix | Air Lease Corporation | 2024 Proxy Statement

| What We Heard | How We Responded | |||

| Stockholders indicated support for our proposal to return our annual bonus program to pre-pandemic historical financial and strategic goal splits |  | For our 2024 annual bonus program, our leadership development and compensation committee increased the weighting of the financial metrics from 70% to 80%, while simultaneously reducing the weighting of the strategic objectives from 30% to 20%. This weighting is consistent with the weighting of the financial and strategic metrics in our annual bonus plan prior to the pandemic | ||

| Stockholders indicated a desire for more specific goals and target achievement levels for strategic metrics included in our annual bonus program |  | We updated the strategic metrics in our 2023 and 2024 annual bonus program to be entirely comprised of metrics that can be quantitatively assessed for achievement and have included disclosure of these goals in this Proxy Statement | ||

| Stockholders asked us to provide increased disclosure in our proxy statement regarding the role of our Executive Chairman |  | We have added increased disclosure in this Proxy Statement to help our stockholders better understand the important role of our Executive Chairman, including his significant engagement as a member of our executive team. See the section titled, “Compensation Discussion and Analysis—Our Named Executive Officers” in this Proxy Statement | ||

| Some stockholders expressed concern over the pay of our Executive Chaiman relative to our CEO |  | While some stockholders expressed concern over the close proximity of compensation of our Executive Chairman and CEO, many stockholders noted that they look at the quantum of overall executive compensation, and because our overall named executive officer compensation is generally in line with other similarly sized companies, most stockholders indicated our CEO and Executive Chairman compensation structure was not problematic. Additionally, many stockholders acknowledged that our CEO and Executive Chairman compensation structure was appropriate in light of our Executive Chairman’s importance in the management of customer and OEM relationships and active, full-time employment with the Company | ||

| Stockholders generally supported and requested the continued inclusion of a sustainability metric in our annual bonus program |  | Our 2023 and 2024 annual bonus program include a strategic metric based on the percentage of our fleet comprised of the newest generation aircraft | ||

| Some stockholders noted they would like to see increased scope emissions disclosure, including Scope 3 emissions disclosure |  | We have increased our scope emissions disclosures in recent years, with 2023 being our second year providing Scope 1 and Scope 2 emissions disclosure, and we plan to disclose all required scope emissions in compliance with all applicable corporate sustainability reporting directives as those are adopted or phase in | ||

2024 Proxy Statement | Air Lease Corporation | x

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, California 90067

(310) 553-0555

Proxy Statement for the 2024 Annual Meeting of Stockholders

|

Our Board of Directors

|

Members and Meetings of the Board of Directors

The Board of Directors (the “Board of Directors”) of Air Lease Corporation (“we,” “our,” “us,” or the “Company”) is currently composed of nine members: Matthew J. Hart, Yvette Hollingsworth Clark, Cheryl Gordon Krongard, Marshall O. Larsen, Susan McCaw, Robert A. Milton, John L. Plueger, Ian M. Saines, and Steven F. Udvar-Házy. Our directors serve for one-year terms until the next annual meeting of stockholders, and until their respective successors are duly elected and qualified or until his or her resignation or removal. Certain information regarding our directors is set forth below in Proposal 1: Election of Directors.

Our Board of Directors held six meetings in 2023. Each of the director nominees standing for election at the Annual Meeting attended 100% of the meetings of the Board of Directors and the committees of the Board of Directors on which he or she served in 2023 other than one director who attended 86% of the meetings of the Board of Directors and the committees of the Board of Directors on which they served in 2023. We expect, but do not require, our directors to attend the annual meeting of stockholders each year. Eight of our nine director nominees attended the 2023 annual meeting.

Director Independence

Under the corporate governance rules of the New York Stock Exchange (the “NYSE”), a majority of the members of the Board of Directors must satisfy the NYSE criteria for “independence.” No director qualifies as independent unless the Board of Directors affirmatively determines that he or she has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us. The Board of Directors has determined that seven of our nine current directors, Mr. Hart, Ms. Hollingsworth Clark, Ms. Krongard, Mr. Larsen, Ms. McCaw, Mr. Milton and Mr. Saines were independent in accordance with NYSE rules during the periods in 2023 and 2024 that such directors served on the Board of Directors. Messrs. Udvar-Házy and Plueger are not independent because they are employees of the Company.

2024 Proxy Statement | Air Lease Corporation | 1

Board of Directors’ Leadership

The Board of Directors currently has no firm policy as to whether the roles of Chairman of the Board of Directors and Chief Executive Officer should be combined or separate. Instead, our Board of Directors believes that our leadership structure should be considered in the context of our Company’s circumstances at any given time, including company culture, strategic objectives and any challenges we may be facing. Therefore, our Board of Directors evaluates its leadership structure annually to ensure that the most optimal structure is in place for our Company’s needs, which may evolve over time.

Our Corporate Governance Guidelines provide that if the Chairman of the Board of Directors is not an independent director, the nominating and corporate governance committee may designate an independent director to serve as “Lead Director,” who shall be approved by a majority of the independent directors. The Board of Directors believes having an independent Lead Director provides an appropriate balance between strong Company leadership and appropriate oversight by independent directors.

Mr. Udvar-Házy, our founder and former Chief Executive Officer, serves as the Executive Chairman of the Board of Directors, and in addition to his executive officer role, chairs the meetings of the Board of Directors and works closely with Robert A. Milton, our independent Lead Director. The role of the independent Lead Director helps ensure oversight by an active and involved independent Board of Directors, while Mr. Udvar-Házy’s continued engagement as Executive Chairman of the Board enables the Company and the Board of Directors to benefit from his deep knowledge, industry relationships, and operational experience. John L. Plueger, our Chief Executive Officer, also works closely with Mr. Milton in his role as independent Lead Director.

In this role, Mr. Milton has the following responsibilities as set forth in our Corporate Governance Guidelines and as requested by the Board of Directors:

| • | chair meetings of the non-management or independent directors; |

| • | call meetings of the non-management or independent directors, if deemed appropriate; |

| • | provide input on the selection of any new director; |

| • | lead the annual Board of Directors and committee self-evaluations; |

| • | meet with any director who is not adequately performing his or her duties as a member of the Board or any committee; |

| • | facilitate communications between other members of the Board and the Executive Chairman and/or Chief Executive Officer; |

| • | work with the Executive Chairman in the preparation of the agenda for each meeting; |

| • | work with the Executive Chairman in determining the need for special meetings; |

| • | otherwise consult with the Executive Chairman and/or the Chief Executive Officer on matters of governance and Board performance; |

| • | report the results of the annual performance evaluation of the Executive Chairman and the Chief Executive Officer, to each individual; and |

| • | be available, as appropriate, for consultations and direct communication with stockholders. |

Mr. Milton also serves on each committee of the Board. The Board of Directors believes that Mr. Milton’s extensive aviation industry experience, chief executive officer experience, as well as other board experience make him well suited to serve as its independent Lead Director.

2 | Air Lease Corporation | 2024 Proxy Statement

The Board of Directors believes that the leadership structure with a strong independent Lead Director on the one hand, and knowledgeable and experienced Executive Chairman of the Board of Directors on the other, provides balance and is in the best interest of the Company.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines (the “Guidelines”) to assist it in the exercise of its duties and responsibilities and to serve the best interests of the Company and our stockholders. The Guidelines describe (i) the Lead Director’s and the Board of Directors’ responsibilities, (ii) the qualification criteria for serving as a director, including diversity considerations and over-boarding limits, (iii) the requirement that a director must offer to resign if the Board has determined that an actual conflict of interest arises with respect to the director which is not waived by the Board or such director fails to receive a majority vote at an annual meeting (with any such resignation being subject to review and acceptance by the full Board of Directors), (iv) the requirement that directors are subject to the Company’s Code of Business Conduct described below in the section titled “The Board of Directors’ Role in Governance Oversight” and (v) the standards for the conduct of meetings and establishing and maintaining committees. In addition, the Guidelines (i) contain a “Rooney Rule” requirement to actively include women and minority candidates in the pool of qualified director candidates from which directors are to be selected, (ii) confirm that the directors will have full and free access to officers and employees of the Company and have authority to retain independent advisors as necessary and appropriate in carrying out their activities, (iii) establish frameworks for director compensation, director orientation and continuing education, and an annual evaluation of the Board and its committees and of the Guidelines, (iv) charge the leadership development and compensation committee with oversight of management evaluation and succession, and (v) detail the Company’s policies regarding confidentiality and communications between our Board of Directors and the press and media on matters pertaining to the Company and clarify our practices regarding communications to our Board of Directors by stockholders and other interested parties.

Our Board of Directors periodically reviews the Guidelines and makes amendments from time to time. The Guidelines are available on our website at www.airleasecorp.com.

Executive Sessions of Non-Employee Directors

As part of the Board of Directors’ regularly scheduled meetings, the non-employee directors meet in executive session. Any non-employee director can request additional executive sessions. Mr. Milton, as independent Lead Director, schedules and chairs the executive sessions.

Committees of the Board of Directors

Our Board of Directors has three standing committees: an audit committee, a leadership development and compensation committee and a nominating and corporate governance committee. Our Board of Directors has determined that each of these committees is composed solely of independent directors under the applicable NYSE rules. Our Board of Directors has adopted a charter for each committee that is available on our website at www.airleasecorp.com.

All of the independent members of the Board of Directors are invited to attend all committee meetings and it is the practice of the independent directors to attend the meetings of committees upon which they do not serve. The independent directors believe that their attendance at these meetings enhances their understanding of the business and permits them to more substantively contribute at the meetings of the full Board of Directors.

2024 Proxy Statement | Air Lease Corporation | 3

Below is a summary of our current committee membership information along with brief descriptions of each committee’s roles and responsibilities:

Audit Committee | ||

Members

Mr. Hart (Chair)

Ms. Hollingsworth Clark

Mr. Milton

Mr. Saines

All Independent/Financially Literate/Financial Experts(1)

|

2023 Meetings

• Held four meetings

• 100% attendance

| |

Responsibilities. The responsibilities of the audit committee include, but are not limited to, overseeing:

• the integrity of the financial statements of the Company;

• the independent registered public accounting firm’s qualifications and independence;

• the performance of our internal audit function and independent registered public accounting firm;

• our compliance with legal and regulatory requirements;

• our accounting and system of internal controls;

• our cybersecurity program; and

• our overall policies and practices with respect to risk assessment and risk management.

| ||

| (1) | Our Board of Directors has determined that each member of our audit committee is “financially literate” under applicable rules of the NYSE and is an “audit committee financial expert,” as defined under the rules and regulations of the Securities and Exchange Commission (“SEC”). In addition, each member of our audit committee also meets the enhanced independence requirements pursuant to Rule 10A-3(b)(i) of the Securities Exchange Act and NYSE rules for purposes of serving on an audit committee. |

Nominating and Corporate Governance Committee | ||

Members

Mr. Milton (Chair)

Mr. Hart

Ms. Krongard

Mr. Larsen

All Independent

|

2023 Meetings

• Held four meetings

• 100% attendance

| |

Responsibilities. Our nominating and corporate governance committee monitors the implementation of sound corporate governance principles, practices and risks and will, among other things:

• identify individuals qualified to become a member of our Board and recommend to the Board of Directors candidates to be appointed to fill vacancies and newly created directorships consistent with criteria approved by the Board and as further described under the section titled “Consideration of Director Candidates”;

• periodically review and recommend changes, as appropriate, to our corporate governance documents;

• review stockholder proposals submitted in accordance with our bylaws;

• annually oversee the evaluation of the Board of Directors and its committees; and

• review and approve all related person transactions in accordance with our Related Persons Transaction Policy.

| ||

4 | Air Lease Corporation | 2024 Proxy Statement

Leadership Development and Compensation Committee | ||

Members

Ms. Krongard (Chair)

Ms. McCaw

Mr. Larsen

Mr. Milton

All Independent(1)

|

2023 Meetings

• Held five meetings

• 100% attendance

| |

Responsibilities. The responsibilities of the leadership development and compensation committee include, but are not limited to:

• overseeing our overall compensation structure, policies and programs;

• reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer and Executive Chairman, reviewing the performance of each such individual in light of those goals and objectives and recommending to the independent directors of the Board the compensation level for each such individual based on this evaluation;

• reviewing and approving corporate goals and objectives relevant to the compensation of our other named executive officers, reviewing the performance of each such individual in light of those goals and objectives and determining the compensation level for each such individual based on this evaluation and the recommendation of our Chief Executive Officer and/or Executive Chairman;

• administering, and making recommendations to the Board of Directors with respect to our incentive-compensation and equity-based compensation plans that are subject to Board approval;

• reviewing and evaluating the Company’s programs and practices related to leadership development and human capital management, including periodically reviewing diversity and inclusion programs and practices and succession plans relating to positions held by executive officers and making recommendations to the Board regarding the selection of individuals to fill these positions;

• at least annually reviewing the compensation (both cash and equity-based compensation) of non-employee directors for service on the Board and its committees and recommending any changes to the Board for approval;

• broadly overseeing matters relating to the attraction, motivation, development and retention of employees; and

• reviewing the risk exposure related to the areas of its responsibility.

| ||

| (1) | Our Board of Directors has determined that each member of the leadership development and compensation committee satisfies the additional independence requirements specific to compensation committee membership under NYSE rules and qualifies as a “non-employee director” under SEC rules for purposes of serving on a compensation committee. In making this determination, the Board of Directors considered whether the director has a relationship with the Company that is material to the director’s ability to be independent from management in connection with the duties of a member of the leadership development and compensation committee. |

In fulfilling its responsibilities, the leadership development and compensation committee may delegate to management or to a subcommittee of the leadership development and compensation committee. The leadership development and compensation committee has delegated to the Company’s Executive Chairman and Chief Executive Officer, each of whom is a member of the Board of Directors, the authority to make RSU grants in 2023 and 2024 to employees (at or below the vice president level) on the same

2024 Proxy Statement | Air Lease Corporation | 5

terms as grants made by the leadership development and compensation committee to other officers on the same level, subject to a cap on both the aggregate number of RSUs approved for issuance by the leadership development and compensation committee and the dollar amount of any individual award.

The leadership development and compensation committee also oversees preparation of the compensation discussion and analysis to be included in our annual proxy statement, recommends to the Board of Directors whether to include the compensation discussion and analysis, and provides an accompanying report to be included in our annual proxy statement. The committee also considers the results of the most recent stockholder advisory vote on executive compensation and to the extent the committee determines it appropriate to do so, takes such results into consideration in connection with its review and approval of executive officer compensation.

In accordance with the leadership development and compensation committee’s charter, the leadership development and compensation committee may retain independent compensation advisors and other management consultants. In 2023, the leadership development and compensation committee retained Exequity LLP (“Exequity”), a nationally recognized independent compensation consultant, to provide advice with respect to compensation decisions for our executive officers and non-employee directors.

Compensation Committee Interlocks and Insider Participation

Each of Ms. Krongard, Ms. McCaw, Mr. Larsen and Mr. Milton served on the leadership development and compensation committee for all of 2023. None of the members of our leadership development and compensation committee has at any time been one of our officers or employees. None of our executive officers serves, or in the past year has served, as a member of the board of directors or the leadership development and compensation committee of any entity that has one or more executive officers who serve on our Board of Directors or leadership development and compensation committee.

The Board and Committee Annual Self-Evaluation

To ensure that the Board of Directors and each Board committee functions effectively, the nominating and corporate governance committee conducts an annual self-evaluation to identify and assess areas for improvement. The written assessment focuses on Board composition and its role, the operation of the Board, the Board’s processes relating to the Company’s strategy, financial position and corporate governance and the function and effectiveness of the Board committees. The independent Lead Director leads the evaluation process which includes collecting the assessment feedback and conducting a one-on-one conversation with each director.

In connection with the one-on-one conversation with each director, the Lead Director asked the directors to discuss several additional questions on critical topics impacting the Company in 2023, including the Board’s evaluation of the Company’s sales strategy in view of significant increases in aircraft sales, as well as the Company’s risk management strategy in light of ongoing geopolitical instability in certain regions.

The Lead Director discusses the results of the evaluations and feedback received with the non-employee directors in executive session at its February meeting each year, then shares the results with the employee directors and, as necessary, the Board implements resulting recommendations.

6 | Air Lease Corporation | 2024 Proxy Statement

Consideration of Director Candidates

Qualifications of Director Candidates

Our nominating and corporate governance committee is responsible for identifying and evaluating director candidates based on the perceived needs of the Board of Directors at the time. Our Board of Directors has established criteria for identifying and evaluating individuals qualified to become members of the Board of Directors, which it uses as a guideline in considering director nominations. The criteria, which are included in our Guidelines, include but are not limited to:

| • | The nominee’s reputation for integrity, honesty and adherence to high ethical standards. |

| • | The nominee’s judgment and independence of thought, financial literacy, leadership experience and a fit of abilities and personality that helps build an effective, collegial, and responsive Board of Directors. |

| • | The nominee’s demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company and willingness and ability to contribute positively to the decision-making process of the Company. |

| • | The nominee’s commitment to understand the Company and its industry, including its competitors. |

| • | The absence of conflicting time commitments and the nominee’s commitment to regularly attend and participate in meetings of the Board and its committees. |

| • | The nominee’s background, knowledge, education, experience, skills, age, and gender, ethnic and geographic diversity. The nominating and corporate governance committee will actively include, and will instruct any search firms utilized to include, women and racial and/or ethnic minority candidates in the pool of potential director candidates from which new directors are selected. |

| • | The nominee’s interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, creditors and the general public, and to faithfully represent the interests of all stockholders. |

| • | The impact of the nominee’s appointment on overall Board of Directors balance, breath of experience, collective knowledge, perspective and ability. |

The criteria established by the Board of Directors are not exhaustive and the nominating and corporate governance committee and the Board of Directors may consider other qualifications and attributes that they believe are appropriate in evaluating the ability of an individual to serve as a director. The nominating and corporate governance committee reviews and assesses the nomination criteria periodically.

The nominating and corporate governance committee does not have a formal policy specifying how diversity of background and personal experience should be applied in identifying or evaluating director candidates, and a candidate’s background and personal experience, while important, does not necessarily outweigh other attributes or factors the nominating and corporate governance committee considers in evaluating candidates. However, the Board of Directors is committed to identifying candidates with gender, racial and/or ethnic diversity and our Guidelines contain a “Rooney Rule” requirement to actively include women and minority candidates in the pool of qualified director candidates from which directors are to be selected.

Our nominating and corporate governance committee has not retained professional search firms to assist it in recruiting potential director candidates.

2024 Proxy Statement | Air Lease Corporation | 7

Stockholder-Recommended Director Candidates

Any stockholder may recommend a director candidate for our nominating and corporate governance committee to consider by submitting the candidate’s name and qualifications to us addressed to our Corporate Secretary (the “Secretary”) at the address for our principal executive office listed on the cover page of this Proxy Statement. Candidates recommended by a stockholder are evaluated in the same manner and using the same criteria as used for any other director candidate.

Stockholders of record seeking to nominate a candidate for election as a director at our annual meeting of stockholders (as opposed to making a recommendation to the nominating and corporate governance committee as described above) or to bring other business before our annual meeting of stockholders, may do so by providing timely notice of their intent in writing by the deadlines specified in our Fourth Amended and Restated Bylaws (the “Bylaws”). For more information, see the section below titled “Stockholder Proposals and Director Nominations for our 2025 Annual Meeting of Stockholders.”

Communications with the Board of Directors

Stockholders and any other interested parties who wish to communicate with the Board of Directors or an individual director, including our independent Lead Director or our independent directors as a group, or any Board committee or any chairperson of any Board committee, by either name or title, may send written communications to the Secretary at the address for our principal executive office listed on the cover page of this Proxy Statement. All such communications will be opened by the Secretary or his or her designee for the sole purpose of determining whether the contents represent a message to the Company’s directors. The Secretary will forward copies of all correspondence that, in the opinion of the Secretary, deals with the functions of the Board or its committees or that he or she otherwise determines requires the attention of any member, group or committee of the Board. The Secretary will not forward junk mail, job inquiries, business solicitations, offensive or otherwise inappropriate materials.

8 | Air Lease Corporation | 2024 Proxy Statement

Board of Directors’ Role in the Oversight of the Company’s

|

The Board of Directors’ Role in Risk Oversight

The Board of Directors has delegated to the audit committee primary responsibility for risk oversight. In accordance with its charter, the audit committee is responsible for monitoring the Company’s policies and practices with respect to risk assessment and risk management. This includes oversight of management’s implementation of the Company’s annual enterprise risk management assessment (the “ERM program”), which is an ongoing, enterprise-wide program designed to enable effective and efficient identification of, and management visibility into, critical enterprise risks over the short-, intermediate-, and long-term, and to facilitate the incorporation of risk considerations into decision making across the Company. In particular, the annual enterprise risk management assessment clearly defines risk management roles and responsibilities, brings together senior management and the Company’s external auditor to discuss risk, promotes visibility and constructive dialogue around risks relevant to the Company’s strategy and operations, and facilitates appropriate risk response strategies at the Board, committee, and management levels. Under the ERM program, management develops a holistic portfolio of the Company’s enterprise risks by performing targeted risk vulnerability assessments and incorporating information regarding specific categories of risk gathered from the Company’s technical, procurement, treasury, human resources, IT and legal teams, who provide input into this process and are responsible for the day-to-day monitoring, evaluating, reporting, and mitigating of their respective risk categories. The ERM program works in tandem with the Company’s accounting and financial reporting teams to align the risk identification and assessment with the Company’s existing disclosure controls and procedures. The audit committee also meets with representatives of the Company’s independent registered public accounting firm at least quarterly. As needed, the Chair of audit committee escalates issues relating to risk oversight to the full Board of Directors, in a continuous effort to keep the Board of Directors adequately informed of developments that could affect the Company’s risk profile or other aspects of its business. The Board of Directors also considers specific risk topics in connection with strategic planning and other matters.

The audit committee’s risk management oversight also includes oversight of the Company’s cybersecurity program. Throughout the year as needed and on an annual basis, the audit committee receives updates on the cybersecurity program, including in connection with program enhancements, audits of the program, and employee cybersecurity training. Additional risk management oversight by the audit committee includes oversight of the Company’s compliance program. The Company’s compliance program is led by the Company’s General Counsel, Secretary and Chief Compliance Officer, who reports directly to the Company’s Chief Executive Officer. The Company’s General Counsel, Secretary and Chief Compliance Officer meets at least quarterly with the audit committee and Board of Directors to report on key ethics and compliance risks facing the Company and provides an annual compliance program update to the audit committee.

The Board of Directors has delegated to the leadership development and compensation committee oversight with respect to risks that may arise from our compensation arrangements and policies. This is accomplished on an ongoing basis through the committee’s review and approval of specific arrangements and policies to ensure that they are consistent with our overall compensation philosophy and our business goals. The leadership development and compensation committee periodically discusses any compensation risk-related concerns with senior management and with its independent compensation consultant. The Chair of the committee reports to the full Board of Directors regarding any material risks as deemed appropriate. In view of this oversight and based on our ongoing assessment, we do not believe that our present employee compensation arrangements, plans, programs or policies are likely to have a material adverse effect on the Company.

2024 Proxy Statement | Air Lease Corporation | 9

The leadership development and compensation committee also provides oversight with respect to risks related to the Company’s leadership development and human capital management. This is accomplished through regular involvement by the committee with senior management in matters relating to the attraction, motivation, development and retention of employees.

The Board of Directors retains oversight of the risks related to corporate governance and sustainability practices that are not specifically delegated to the audit and leadership development and compensation committees, including environmental risks as discussed below. The Board of Directors has retained direct oversight of environmental risks in light of the Company’s core business strategy of focusing on the replacement market to assist airlines looking to replace aging aircraft with new, modern technology, fuel efficient jet aircraft.

The Board of Directors believes that its governance structure supports the Board’s role in risk oversight. With the exception of environmental risk oversight conducted by the full Board of Directors, independent directors chair each of the Board committees responsible for risk oversight and the Company’s independent Lead Director facilitates communication between senior management and directors.

The Board of Directors’ Role in Governance Oversight

The Board of Directors regularly reviews developing governance practices and, when appropriate, implements enhancements to our governance practices. Each year, the Board of Directors dedicates time to discuss the business and competitive environment and evaluate the Company’s strategic goals and direction. Thereafter, the Board of Directors has ongoing discussions of these topics at its regular meetings. We maintain governance practices that we believe establish meaningful accountability for our company and our Board, including:

| • | All Directors except Executive Chairman and Chief Executive Officer are Independent |

| • | All Standing Board Committees Comprised Entirely of Independent Directors |

| • | Independent Lead Director with Clearly Defined Role and Responsibilities |

| • | Commitment to Board Diversity with Three Female Directors, One of Whom is from an Underrepresented Community |

| • | Requirement to Actively Include Women and Individuals From Minority Groups in the Pool of Potential Director Candidates |

| • | Majority Vote Standard for Director Elections With Mandatory Director Resignation if Not Elected |

| • | All Directors Elected on an Annual Basis |

| • | Annual Board and Committee Evaluations |

| • | All Audit Committee Members are Financial Experts |

| • | Focus on Critical Risk Oversight Role |

| • | Ongoing Board Succession Planning - Management and Board Dialogue to Ensure Successful Oversight of Succession Planning |

| • | Active Board Oversight of the Company’s Governance |

| • | Robust Director and Executive Officer Stock Ownership Guidelines |

| • | Prohibition on Short Sales, Transactions in Derivatives and Hedging of Company Stock by Directors and all Employees |

| • | Prohibition on Pledging of Company Stock by Directors and Executive Officers |

| • | Clawback Policy for Executive Compensation in compliance with current NYSE Listing Standards |

| • | All Independent Directors are Invited to Attend Meetings of Committees they are not Members of and Regularly Attend those Meetings |

10 | Air Lease Corporation | 2024 Proxy Statement

Code of Business Conduct and Ethics

Our Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees. Among other things, the Code of Business Conduct and Ethics is intended to ensure fair and accurate financial reporting, to promote ethical conduct and compliance with applicable laws and regulations given our worldwide operations, to provide guidance with respect to the handling of ethical issues, to foster a culture of honesty and accountability and to deter wrongdoing. It also requires disclosure to us of any situation, transaction or relationship that may give rise to any actual or potential conflict of interest. Such conflicts must be avoided unless approved by our nominating and corporate governance committee. The Code of Business Conduct and Ethics prohibits our employees, officers and directors from taking, or directing a third party to take, a business opportunity that is discovered through the use of company resources. We encourage all employees to report concerns or wrongdoing. A copy of our Code of Business Conduct and Ethics is available on our website at www.airleasecorp.com.

The Board of Directors’ Role in Leadership Development and Succession Planning

The Company’s leadership is comprised of a small number of talented individuals, with extensive industry experience, capable of managing a capital-intensive business responsibly to drive our profitability and growth. At the end of 2023, we had total assets of $30.5 billion and 163 full-time employees. Our Board of Directors recognizes that human capital management is critical to our success and is actively engaged on overseeing it.

The leadership development and compensation committee is actively involved in reviewing and evaluating the Company’s programs and practices related to leadership development and human capital management, including reviewing succession plans relating to positions held by executive officers and making recommendations to the Board regarding the selection of individuals to fill these positions. In the most recent review of our succession planning in November 2023, all the independent directors participated.

Annually, our Chief Executive Officer and Executive Chairman report to the leadership development and compensation committee on succession planning for other senior executive positions. Our Board of Directors also maintains an emergency Chief Executive Officer succession plan which will become effective in the event our Chief Executive Officer becomes unable to perform his duties in order to minimize potential disruption to our business and operations.

The Board of Directors and the leadership development and compensation committee also regularly engage with senior management, including human resources, on a broad range of human capital management matters. Engagement is focused on our culture, succession planning, compensation (including pay equity), benefits, talent development and recruiting, employee retention, and diversity and inclusion. We strive to cultivate an environment where all our employees can succeed and seek out partners that uphold our ethical standards. We aim to support the communities in which we do business, as well as educational and charitable organizations within the aviation industry. Some of the highlights from our human capital and social initiatives include:

| • | We pride ourselves on our comprehensive benefits package, which is annually benchmarked in the 90th percentile of coverage for similarly sized companies. Our benefits package includes various employee assistance programs that provide wellness benefits. |

| • | We offer competitive compensation to our employees worldwide. All of our U.S. employees, and, to the extent permissible, those outside the U.S., are eligible to participate in our long-term stock-based incentive plan. |

2024 Proxy Statement | Air Lease Corporation | 11

| • | We are building a diverse organization that respects and encourages different backgrounds and experiences. As of December 31, 2023, 39% of our employees were multicultural and 52% were female. |

| • | We have codes and policies in place which outline expectations for our employees and the companies with which we do business, such as a Code of Business Conduct and Ethics, Supplier Code of Conduct, Anti-Corruption Policy, and Human Rights Policy. |

| • | We support and pay for training and education programs that provide continual improvement for our employees, including continuing education, leasing seminars, and conferences related to the employee’s role in the Company. |

| • | We require all employees to participate in our training programs, including anti-harassment, compliance and cybersecurity. From time to time, outside experts are brought in to provide supplemental training on topical subjects. |

| • | We require all employees to participate in training focused on promoting equity in the workplace. |

| • | We support various charitable causes with both financial and human resources to advance aviation, education and humanitarian assistance. In 2023, we increased our giving to these charitable causes from amounts given in 2022. |

The Board of Directors’ Role in Environmental Risk Oversight

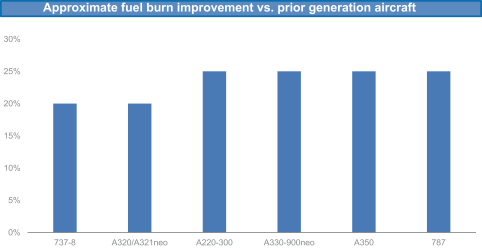

Since our inception, our strategy has been to invest in the most modern, fuel-efficient, new technology commercial aircraft. We believe focusing on these priorities aligns us with our airline customers’ need to replace ageing aircraft in their fleets with aircraft that offer reduced fuel consumption, emissions and noise.

| • | As of December 31, 2023, we had 463 aircraft in our owned fleet. Our flight equipment subject to operating lease had a weighted average age of 4.6 years, making it approximately 7 years younger than the average of the world’s fleet of commercial passenger aircraft. |

| • | As of December 31, 2023, our orderbook was comprised of 334 of the most environmentally friendly commercial aircraft available. |

| • | The new aircraft we have on order from the manufacturers are generally 20% to 25% more fuel-efficient than those they will replace, as shown in the chart below, and have a significantly smaller noise footprint. |

Source: Boeing & Airbus 2023. Aircraft comparisons: A220-300 compared to A319ceo. A320neo compared to A320ceo. A321neo compared to A321ceo. A330-900neo compared to B767-300ER. A350-900 compared to B777-200ER. A350-1000 compared to B777-300ER. 737-8 compared to 737NG (no winglet). 787 compared to 767-300ER. 737-8 is 20% lower and 737-9 is 21% lower. 787-9 and 787-10 are both 25% lower. A320neo is 20% lower, A321neo is 22% lower. A350-900 and A350-1000 are both 25% lower. | ||

12 | Air Lease Corporation | 2024 Proxy Statement

| • | Our headquarters in Los Angeles are located in a LEED GOLD certified building. |

Our CEO leads our environmental sustainability efforts and reports regularly to the Board of Directors on these matters. Working collaboratively with key functions within the Company and our Sustainability Committee, our CEO and other senior-level executives assess and manage our climate-related risks. They regularly engage with our customers on environmental sustainability topics and concerns as well as with our suppliers, including Airbus and Boeing and the major aircraft engine manufacturers, to develop the next generation aircraft that reduce fuel consumption, emissions and noise, which we believe are vital to helping our airline customers meet their sustainability goals over time. They also participate in industry events to highlight the importance of the aviation industry’s sustainability efforts and need for industry-wide improvement.

Environmental sustainability continues to be a focus of the investor community and our stakeholders. During 2023, we continued to discuss these matters with our stakeholders, including environmental topics and continued to include Scope 1 and Scope 2 emissions in our annual Sustainability Report.

In addition to engagement with our stakeholders, our Board of Directors actively oversees our climate-related risks and opportunities, which are included as an agenda item at every quarterly Board of Directors meeting, with a more focused environmental risk review at our annual Board of Directors strategy session. In addition, for 2023 and continuing in 2024, our Board of Directors has included a sustainability metric in our annual bonus plan related to the number of newest generation aircraft in our fleet.

Our Sustainability Committee is comprised of our CEO, who leads it, our chief financial officer, general counsel, a senior member of our marketing department, senior members of our finance department, and the heads of human resources and investor relations. The Sustainability Committee meets at least quarterly to guide our sustainability programs and related disclosures.

Certain Relationships and Related Person Transactions

Our Board of Directors has adopted a written Related Person Transaction Policy that is intended to comply with Item 404 of Regulation S-K. The purpose of the policy is to describe the procedures used to identify, review, approve and disclose, if necessary, any transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which (i) the Company (including any of its subsidiaries) was, is or will be a participant; (ii) the amount involved exceeds $120,000; and (iii) a related party had, has or will have a direct or indirect material interest (a “Related Person Transaction”). For purposes of the policy, a related party is any of our directors, director nominees, executive officers, beneficial owners of more than 5% of our Class A Common Stock, or any of their respective immediate family members.

Under our Related Person Transaction Policy, the nominating and corporate governance committee is responsible for reviewing and approving each Related Person Transaction. In determining whether to approve a Related Person Transaction, the nominating and corporate governance committee will consider the relevant facts and circumstances of the Related Person Transaction available to the nominating and corporate governance committee and to take into account, among other factors it deems appropriate, whether the Related Person Transaction is on terms comparable to those available to an unaffiliated third party or to employees generally under the same or similar circumstances and the extent of the related party’s interest in the transaction. If a Related Person Transaction falls within one of certain specified pre-approved transaction categories set forth in the policy, it does not require review by the nominating and corporate governance committee and shall be deemed to be pre-approved even if the amount involved exceeds $120,000.

2024 Proxy Statement | Air Lease Corporation | 13

No member of the nominating and corporate governance committee who is a related party is permitted to vote on the approval or ratification of their own Related Person Transaction, but may, if requested by other members of the nominating and corporate governance committee, participate in some or all of the nominating and corporate governance committee’s discussions of the Related Person Transaction. Out of an abundance of caution, the nominating and corporate governance committee will sometimes review and approve or ratify transactions with a related person or an entity affiliated with a related person, even if the related person does not have a direct or indirect material interest in the transaction. We did not have any Related Person Transactions (other than pre-approved transactions) during 2023.

14 | Air Lease Corporation | 2024 Proxy Statement

Board Compensation and Stock Ownership

|

Director Compensation

Our Board of Directors sets non-employee director compensation based on recommendations from the leadership development and compensation committee. The committee periodically reviews the cash and equity-based award compensation of non-employee directors serving on the Board and its committees. The leadership development and compensation committee’s independent compensation consultant, Exequity, assists in this review, including obtaining market information, annually benchmarking our director compensation and designing various aspects of our compensation program for directors. After its review, the committee recommends any changes to the Board of Directors for approval. Directors who are also employees of the Company (currently Messrs. Udvar-Házy and Plueger) do not receive any additional compensation for their service as a director.

Annual Cash Retainer and Other Cash Fees

Cash retainers under our non-employee director compensation program for 2023 consisted of:

| Retainer Type | Annual Cash Compensation | |

Annual Board Retainer | $ 80,000 | |

Committee Member Retainer | ||

• Audit | $ 15,000 | |

• Leadership Development and Compensation | $ 10,000 | |

• Nominating and Corporate Governance | $ 10,000 | |

Additional Retainer for Committee Chair | ||

• Audit | $ 20,000 | |

• Leadership Development and Compensation | $ 10,000 | |

• Nominating and Corporate Governance | $ 10,000 | |

Additional Retainer for Lead Independent Director | $ 50,000 | |