(cc) “Saturn Requisite Stockholder Approvals” means (i) the Saturn Stockholder Approval, (ii) the Unaffiliated Saturn Stockholder Approval and (iii) the Charter Saturn Stockholder Approval;

(dd) “Saturn Stockholder Approval” means the affirmative vote of the holders of a majority of the outstanding shares of Saturn Common Stock adopting this Agreement;

(ee) “Saturn Stockholders Meeting” means a meeting of the stockholders of Saturn to be called to consider approving and adopting this Agreement and the transactions contemplated hereby, including the Merger;

(ff) “Saturn VWAP” means the volume-weighted average price of a share of Saturn Common Stock for the twenty (20) trading day period starting with the opening of trading on the twenty-first (21st) trading day prior to the Closing Date and ending at the closing of trading on the second to last trading day prior to the Closing Date, as reported by Bloomberg;

(gg) “SEC” means the U.S. Securities and Exchange Commission;

(hh) “Share Issuance” means the issuance of shares of Halley Common Stock pursuant to the First Merger as contemplated by this Agreement or in respect of Saturn Equity Awards after the Effective Time;

(ii) “Subsidiary” means, with respect to any Person, any corporation, partnership, joint venture or other legal entity of which such Person (either above or through or together with any other subsidiary), owns, directly or indirectly, more than fifty percent (50%) of the stock or other equity interests, the holders of which are generally entitled to vote for the election of the board of directors or other governing body of such corporation or other legal entity;provided,however that neither Saturn nor its Subsidiaries will be deemed a Subsidiary of Halley for any purpose hereunder, unless otherwise expressly stated;

(jj) “Tax” (including “Taxes”) means all federal, state, local, foreign and other income, gross receipts, sales, use, ad valorem, transfer, franchise, profits, license, lease, service, service use, withholding, payroll, employment, excise, severance, stamp, occupation, premium, property, windfall profits, registration, value added, capital stock, environmental, alternative minimum, unclaimed property, estimated, social security (or similar), unemployment, escheat, customs, duties or other taxes, fees, assessments or charges of any kind whatsoever payable to a Governmental Entity, together with any interest and any penalties, additions to tax or additional amounts with respect thereto;

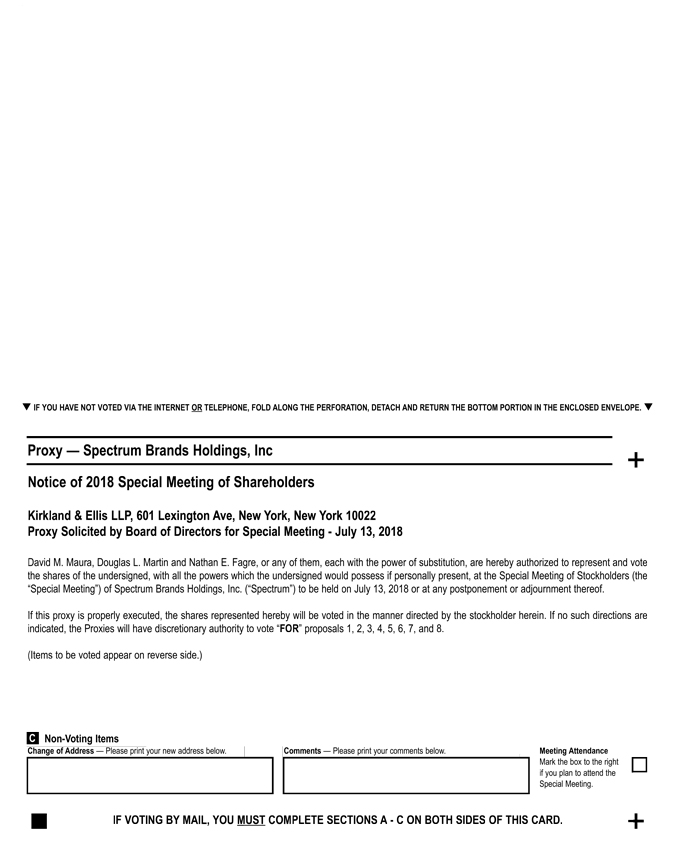

(kk) “Tax Counsel” means any of (i) Kirkland & Ellis LLP, (ii) Davis Polk & Wardwell LLP and (iii) such other nationally recognized Tax counsel as is reasonably satisfactory to Halley and Saturn;

(ll) “Tax Return” means any return, declaration, report, statement, notice, certificate, election, information statement or other document filed or required to be filed with respect any Tax, including any claims for refunds of Taxes and any amendments, supplements, schedules or attachments to any of the foregoing;

(mm) “Taxing Authority” means any government or subdivision, agency, commission or authority thereof, or any quasi-governmental or private body having jurisdiction over the assessment, determination, collection or other imposition of Taxes;

(nn) “Unadjusted Saturn Shares Held by Halley” means the number of shares of Saturn Common Stock held by Halley and its Subsidiaries as of immediately prior to the Effective Time; and

(oo) “Unaffiliated Saturn Stockholder Approval” means the affirmative vote of the holders of a majority of the outstanding shares of Saturn Common Stock beneficially owned, directly or indirectly, by Unaffiliated Saturn Stockholders, adopting this Agreement.

A-53