Daniel K. Donahue

Tel 949.732.6557

Fax 949.732.6501

donahued@gtlaw.com

July 28, 2015

VIA EDGAR

Jennifer Gowetski, Esq.

Special Counsel

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Reven Housing REIT, Inc. |

| | Amendment No. 2 to Registration Statement on Form S-11 |

| | Filed June 12, 2015 |

| | File No. 333-196282 |

Dear Ms. Gowetski:

On behalf of Reven Housing REIT, Inc., a Maryland corporation (the “Company”), and pursuant to the applicable provisions of the Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations promulgated thereunder, please find enclosed for filing with the Securities and Exchange Commission (the “Commission”) via EDGAR a complete copy of Amendment No. 3 (“Amendment No. 3”) to the Company’s Registration Statement on Form S-11 (the “Registration Statement”).

This letter provides the Company’s responses to the comments received on July 9, 2015 from the staff of the Division of Corporation Finance of the Commission (the “Staff”) relating to Amendment No. 2 to the Registration Statement filed on June 12, 2015. Amendment No. 3 reflects revisions to the Registration Statement in response to the Staff’s comments.

General

| 1. | We note your response to our prior comment 1 and your disclosure on page 51 that you have negative estimated cash flow available for distributions. We continue to believe that you should provide a detailed analysis regarding your basis for a proposed distribution, including explaining how your negative estimated cash flow supports such distribution. Alternatively, consider removing your disclosure regarding the proposed distribution. We may have further comment. |

Response:The section “Distribution Policy” has been revised to delete all references to estimated distributions to shareholders. Please see page 50 of Amendment No. 3. Similar revisions have been made throughout the prospectus as appropriate.

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501

Jennifer Gowetski, Esq.

Division of Corporation Finance

July 28, 2015

Page 2

_____________________

Prospectus Summary

Historical and Pro Forma Financial Information

Unaudited Historical and Pro Forma Condensed Consolidated Balance Sheets, pages 14-15

| 2. | We note your adjustments (b) and (c), please revise to disclose the nature of the adjustment to Accumulated deficit. To the extent it does not relate to acquisition costs, please tell us how you determined it was not necessary to adjust Accumulated deficit for acquisition costs. |

Response:

The adjustments to the accumulated deficit relate entirely to the Company’s estimate of acquisition costs that will be incurred during the purchase of the two indicated portfolios. The Company has added footnote (e) to disclose estimated acquisition costs. Please see pages 15 and F-5 of Amendment No. 3.

| 3. | We note your adjustments (b) and (c). Please revise to disclose the allocation of the purchase price among land, building and improvements, and intangible assets. Further, please disclose how you determined the valuation of assets, and the accounting guidance you relied upon to determine the allocations. Please address the valuation method for each type of asset separately. |

Response:

The Company has expanded the pro forma balance sheet to show the estimated allocation of land, building and improvements, and lease origination costs based on their estimated fair values at the date of acquisition. Footnotes (b) and (c) have been expanded to further explain this allocation.Please see pages 14-15 and F-4 and F-5 of Amendment No. 3.

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501

Jennifer Gowetski, Esq.

Division of Corporation Finance

July 28, 2015

Page 3

_____________________

Unaudited Pro Forma Condensed Consolidated Statement of Operations, pages 15-17

| 4. | We note your response to our prior comment nine. Additionally, we note your disclosure on page 14 regarding the exclusion of interest, depreciation and amortization, and general and administrative costs. We also note your disclosure regarding the exclusion of certain revenues and expenses in adjustments (b) – (g) to the Pro Forma Consolidated Statement of Operations for the year ended December 31, 2014 and adjustments (c) and (d) for the three months ended March 31, 2015. Please clarify if the items noted on page 14 and in the adjustments noted above are the same items. To the extent they are not the same items, please tell us your basis for excluding these items. We further note that the adjustment amount for Property operating and maintenance in the Pro Formas exceeds the amount of the Rule 8-06 financial statements. Please tell us if the difference is entirely attributable to the property management costs. To the extent the difference is due to something else, please tell us your basis for the difference. |

Response:

The Company confirms that the items noted on page 14 and in the adjustments noted above are the same. The Company also confirms that the difference between the amounts for property operating and maintenance in the pro formas and in the Rule 8-06 financial statements is entirely attributable to the Company’s addition of its contractual property management costs as indicated.

| 5. | We note your adjustment (e) to the Pro Forma Consolidated Statement of Operations for the three months ended March 31, 2015. Please tell us how you calculated the interest expense for the three months ended March 31, 2015. To the extent that you have included amortization of loan fees, please revise your filing to disclose this item. To the extent you have not included amortization of loan fees, please revise your filing to include this item. |

Response:

The Company has revised its disclosure and calculation to include the amortization of loan fees.Please see pages 16 and F-7 of Amendment No. 3.

| 6. | We note your adjustment (h) to the Pro Forma Consolidated Statement of Operations for the year ended December 31, 2014. It appears that you have not included amortization of loan fees, please revise your filing to include this item. |

Response:

The Company has revised its disclosure and calculation to include the amortization of loan fees. Please see pages 18 and F-10 of Amendment No. 3.

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501

Jennifer Gowetski, Esq.

Division of Corporation Finance

July 28, 2015

Page 4

_____________________

Distribution Policy, page 50

| 7. | Notwithstanding our comment above, we note your response to our prior comment 7 and your revisions to the table on page 51. Please revise to provide more detail regarding how you estimated the amount per home based on past operating results. Your revision should include, but not necessarily be limited to, how many years or months of operating results you considered. |

Response:

The referenced table has been removed. Please see page 50 of Amendment No. 3.

| 8. | Notwithstanding our comment above, we note that most of your leases are expiring in the next 12 months, please revise to exclude rental income and expense for leases that you do not expect to renew. You may base your estimate on historical renewal rates. Within your revision to your filing, please disclose how you determined your historical renewal rates, we may have further comment. |

Response:

We have removed the referenced table. Please see page 50 of Amendment No. 3.

Capitalization, page 58

| 9. | Please revise your first paragraph to reference the purchase of the 240 homes. |

Response:

The Company has modified the capitalization section to include a reference to the purchase of the 240 homes. Please see page 52 of Amendment No. 3.

| 10. | Please revise your historical debt balance for consistency with your financial statements. |

Response:

The debt balance has been revised to conform to the Company’s balance sheet as of March 31, 2015. Please see page 52 of Amendment No. 3.

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501

Jennifer Gowetski, Esq.

Division of Corporation Finance

July 28, 2015

Page 5

_____________________

| 11. | Please revise the As Adjusted column for consistency with your Pro Forma financial information. |

Response:

The as adjusted amounts have been revised to reflect the balances in the Company’s pro forma financial information. Please see page 52 of Amendment No. 3.

Management’s Discussion and Analysis, page 60

| 12. | We note your response to our prior comment 12. Please revise to provide the delinquency rate and clarify the amount of time represented by any delinquency, as appropriate. In addition, please discuss your tenant retention rate and quantify your average turnover cost per home. To the extent you have experienced a growth rate or rate of decline associated with new or renewed rents, please also disclose. |

Response:

The Company has revised the first risk factor on page 29 of Amendment No. 3 to disclose the delinquency rate as of March 31, 2015. The Company has also revised its discussion of results of operations on pages 58 and 59 to provide appropriate disclosure concerning delinquency rates, tenant retention and average turnover cost per home. Please be advised that the Company is not aware of any trends with regard to these items.

Our Investment Process, page 101

| 13. | Please revise to discuss how you or the property managers monitor tenant quality. |

Response:

The requested disclosure has been provided on pages 100 and 102 of Amendment No. 3.

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501

Jennifer Gowetski, Esq.

Division of Corporation Finance

July 28, 2015

Page 6

_____________________

Property Management, page 108

| 14. | We note that all of your properties are managed by third party property managers. Please revise to quantify the number of third party property managers with whom you have agreements and clarify whether these third party property managers managed the properties prior to your acquisition of such properties. |

Response:

The Company currently utilizes four different third-party property managers, one in each general location where the properties are located. Approximately 70% of the Company’s properties are managed by the parties who managed the properties prior to their acquisition by the Company. The Company has revised the Property Management section to reflect its current number of third-party property managers and the 70% figure.Please see page 102 of Amendment No. 3.

| 15. | We note on page 29 you state that 15% of your properties are located within HOAs. Please revise to disclose how HOA fees are paid. |

Response:

The majority of the HOA fees due on the Company’s properties are billed annually. The fees are paid when due by the Company’s property managers and are included in the Company’s property and operating expenses. Please see page 29 of Amendment No. 3.

Principal Stockholders, page 126

| 16. | Please advise as to why Mr. Chad Carpenter, Mr. Xiaofan Bai, and King Apex Group have not filed amendments to their Schedule 13Ds to reflect the material changes in their beneficial ownership information, or file the amended Schedule 13Ds. Refer to Rule 13d-2(a). In this regard, please note the reverse stock split in November 2014 or another change in the aggregate number of shares outstanding would not relieve them of their obligation to file an amended Schedule 13D. Refer to Question 103.08, Sections 13(d) and 13(g) and Regulation 13D-G Beneficial Ownership Reporting in the Division’s Compliance and Disclosure Interpretations. |

Response:

The Schedules 13D have been amended as requested.

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501

Jennifer Gowetski, Esq.

Division of Corporation Finance

July 28, 2015

Page 7

_____________________

Financial Statements

General

| 17. | We note you have filed Rule 8-06 financial statements for the Houston 150 that closed on October 31, 2013 in a Form 8-K/A filed on May 7, 2015. Please tell us how you determined it was not necessary to include these Rule 8-06 financial statements in this registration statement. Please refer to Rule 8-06 of Regulation S-X. |

Response:

The Rule 8-06 financial statements for the Houston 150 portfolio are now included in Amendment No. 3. Please see pages F-40 through F-43 of Amendment No. 3.

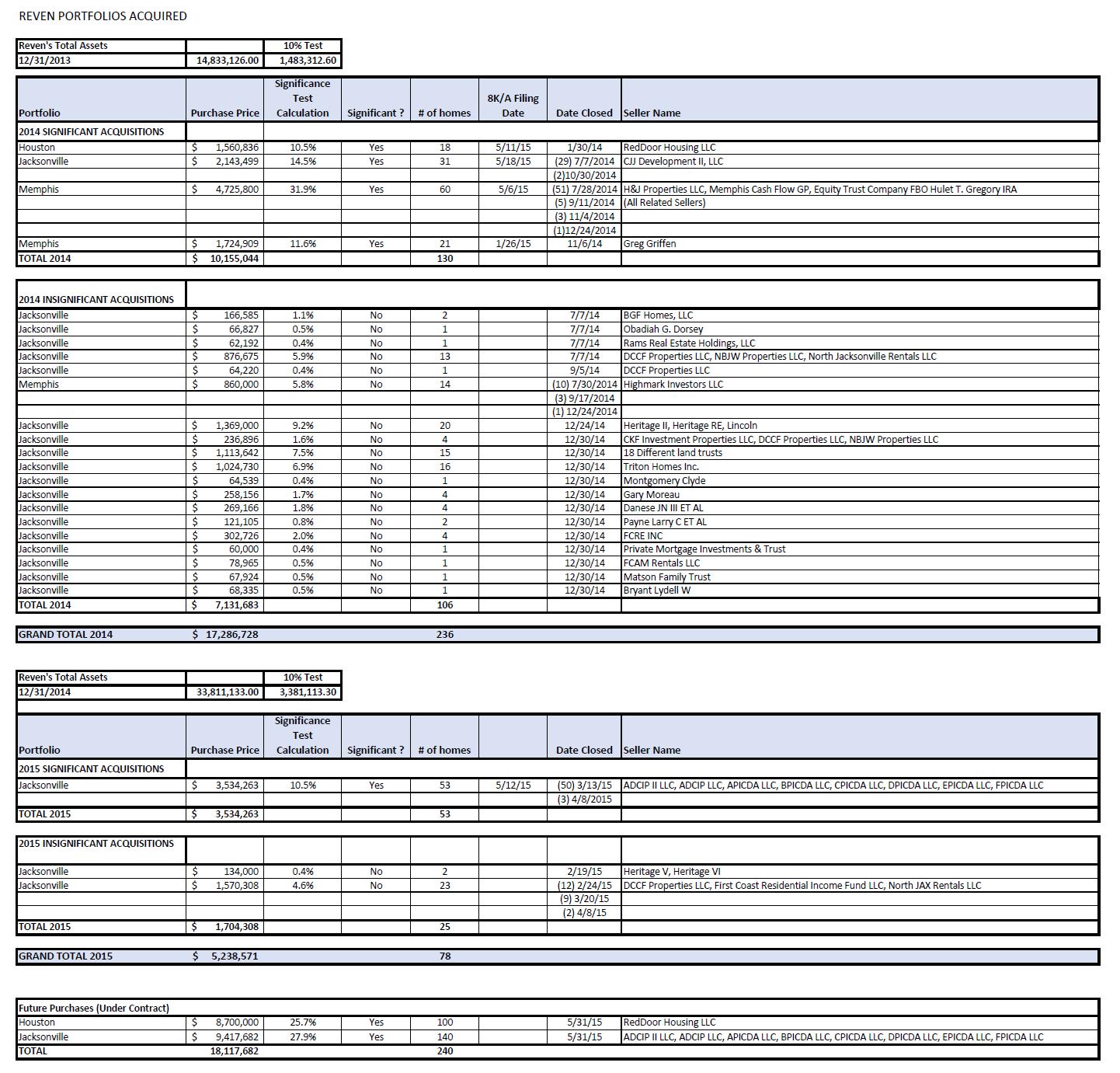

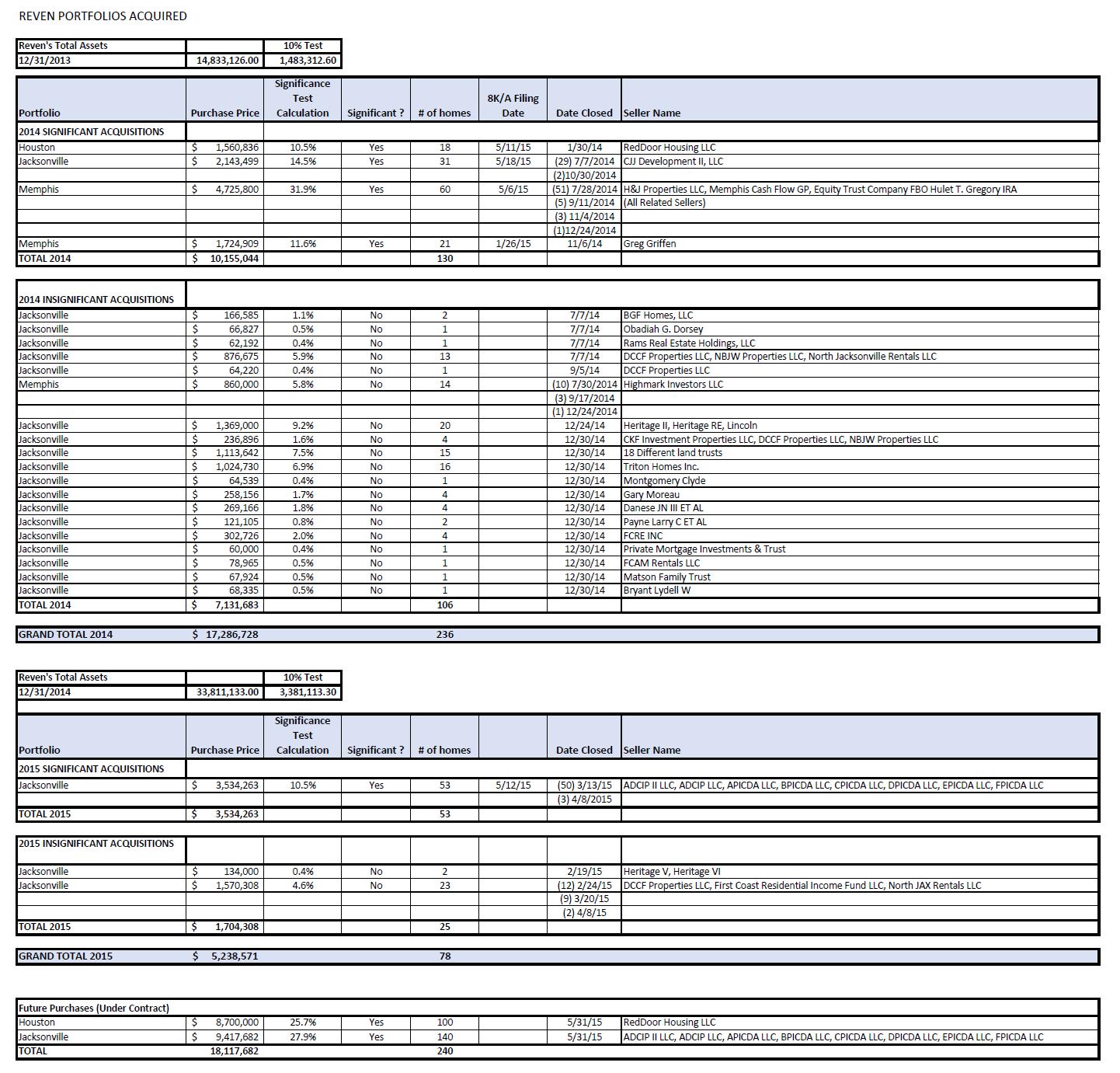

| 18. | We note your response to our prior comment 3 and that you have provided financial statements in accordance with Rule 8-06 of Regulation S-X for certain acquisitions during 2014, 2015, and probable acquisitions. Please provide us with a detail of your Rule 8-06 significance test calculations for all of your 2014 and 2015 and probable acquisitions of residential homes. Your significance test calculation should be for each group of related properties. Additionally, your 2015 and probable acquisitions significant test calculation should address significance in the aggregate. Further, please tell us if you have any additional contracts for properties that have not yet closed. To the extent you have any such contracts, please include them within your significance test calculations, or advise. |

Response:

We are enclosing with this letter on a supplemental basis a schedule of all acquisitions and proposed acquisitions of SFRs by the Company during 2014 and 2015, including the Company’s analysis of the significance test calculations under Rule 8-06 of Regulation S-X. The column captioned “8-K/A Filing Date” includes the filing date of the Form 8-K/A that includes the Rule 8-06 financial statements for the related significant acquisition. This will confirm that the Company grouped all related properties in conducting the significant acquisition calculations. This will also confirm that the only property portfolios currently under contract by the Company are the Jacksonville 140 and Houston 100 portfolios.

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501

Jennifer Gowetski, Esq.

Division of Corporation Finance

July 28, 2015

Page 8

_____________________

Consolidated Financial Statements for the year ended December 31, 2014, page F-11

Notes to Consolidated Financial Statements, page F-17

Note 2. Basis of Presentation and Significant Accounting Policies, page F-18

Investments in Real Estate, page F-18

| 19. | We note your response to our prior comment 15 and your revision to your filing. Your response indicates that you have restated your financial statements to reflect lost revenue and carrying costs during vacancy periods. Your revision indicates that in-place leases represents the costs you would have incurred to lease the property at the date of acquisition. Please reconcile these two statements. Please refer to ASC 805-20. |

Response:

The Company estimates the fair value of acquired in-place leases as the expected costs the Company would have incurred to lease the property at the date of acquisition. This is reflected in its disclosure on page F-18 of Amendment No. 3. We had intended to convey the foregoing to the Staff by way of our letter to the Staff dated June 12, 2015.

Note 3. Investments in Real Estate, page F-22

| 20. | Please revise your filing to include the disclosures required by paragraph 2h of ASC 805-10-50 or advise. |

Response:

The Company has added the disclosures required under ASC 805-10-50. Please see pages F-22 and F-23 of Amendment No. 3.

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501

Jennifer Gowetski, Esq.

Division of Corporation Finance

July 28, 2015

Page 9

_____________________

Condensed Consolidated Financial Statements for the three months ended March 31, 2015, page F-29

| 21. | We note your responses to our prior comments 14 and 15. It does not appear that you have restated any amounts for the three month ended March 31, 2014. Specifically, we noted that your depreciation and amortization expense and net loss for the three months ended March 31, 2014 are unchanged. Please tell us why these amounts are unchanged. Further, it appears you have reallocated costs to acquisition costs; please tell us if you had previously capitalized acquisition cost for the three months ended March 31, 2014. |

Response:

The Company evaluated the financial information provided for the quarter ended March 31, 2014 and determined that any adjustments were immaterial and thus did not require the restatement of the first quarter financial statements. The Company purchased 18 homes during the quarter ended March 31, 2014 and incurred acquisition costs of approximately $23,500. It was determined that revising the financial statements to reclassify this amount, and any corresponding changes to depreciation and amortization, would be immaterial. The Company did incorporate this change along with the other revisions it made during the quarter ended September 30, 2014 in order that the Company’s statements at September 30, 2014 and December 31, 2014 included all modifications.

Part II. Information Not Required in Prospectus

Item 31. Other Expenses of Issuance and Distribution, page II-1

| 22. | Please describe the nature of the fees comprising miscellaneous expenses. |

Response:

The estimated issuance and distribution expenses have been updated and revised to more accurately reflect our current expense estimates.

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501

Jennifer Gowetski, Esq.

Division of Corporation Finance

July 28, 2015

Page 10

_____________________

The Company has endeavored to respond fully to each of the Staff’s comments. If you should have any questions about this letter or require any further information, please contact me at (949) 732-6557.

| | Sincerely, |

| | |

| | |

| | /s/ Daniel K. Donahue |

| | Daniel K. Donahue, Esq. |

| cc: | Reven Housing REIT, Inc. |

| | PKF Certified Public Accountants, A Professional Corporation |

| | Squar, Milner, Peterson, Miranda & Williamson, LLP |

| | Ellenoff Grossman & Schole LLP |

| | Joseph A. Herz, Esq., Greenberg Traurig, LLP |

Greenberg Traurig, LLPn Attorneys at Lawn WWW.GTLAW.COM

3161 Michelson Drive, Suite 1000nIrvine, California 92612nTel 949.732.6500nFax 949.732.6501