| | Paul D. Chestovich Direct Dial: (612) 672-8305 Direct Fax: (612) 642-8305 paul.chestovich@maslon.com |

May 7, 2014

Via EDGAR and Federal Express

Assistant Director Division of Corporation Finance Securities and Exchange Commission 100 F Street, N.E. Washington, DC 20549 | |

| | | Cachet Financial Solutions, Inc. (the “Company”) Draft Registration Statement on Form S-1 Submitted April 8, 2014 File No. 377-00558 |

This letter responds on behalf of the Company to your comment letter dated April 29, 2014 with respect to above-referenced document submitted by the Company to the Commission. To facilitate your review, we have included in this letter your original comments (in bold) followed by our responses.

General

| 1. | As soon as practicable, please furnish us with a statement as to whether the amount of compensation to be allowed or paid to the underwriters has been cleared with FINRA. Prior to the effectiveness of this registration statement, please provide us with a copy of the letter or a call from FINRA informing us that FINRA has no additional concerns. |

RESPONSE: We have not yet obtained clearance from FINRA with respect to the compensation to be paid to the underwriters for our offering. As requested, we will provide you with FINRA’s written clearance or arrange for a call at the appropriate time.

Mr. Larry Spirgel Assistant Director Division of Corporation Finance Securities and Exchange Commission May 7, 2014 | |

| 2. | Please supplementally provide us with copies of all written communications, as defined in Rule 405 under the Securities Act, that you, or anyone authorized to do so on your behalf, present to potential investors in reliance on Section 5(d) of the Securities Act, whether or not they retain copies of the communications. Similarly, please supplementally provide us with any research reports about you that are published or distributed in reliance upon Section 2(a)(3) of the Securities Act of 1933 added by Section 105(a) of the Jumpstart Our Business Startups Act by any broker or dealer that is participating or will participate in your offering. |

RESPONSE: At this time, we have not presented any written communications, as defined in Rule 405, pursuant to Section 5(d) of the Securities Act of 1933, nor are we aware of any research reports about our company that have been published or distributed by any offering participant in reliance in reliance on Section 2(a)(3) of the Securities Act of 1933.

| 3. | We note references to third-party information throughout the prospectus, including information from reports prepared by Markets & Markets and Celent. Please provide us with copies of any materials that support third-party statements, clearly cross-referencing a statement with the underlying factual support. Confirm for us that these documents are publicly available. |

RESPONSE: With this letter we are providing you with copies of materials supporting the third-party statements contained in our prospectus. In the hard copies of these materials that we send to you, the supporting statements are highlighted in some fashion to facilitate your review of the same. All documents listed below are publicly available either in full or in summary. Please note that we have yet to fully corroborate the statements relating to Attachments 3.3 and 3.4. As such, we will provide them to you in a supplemental response or, if we are unable to fully corroborate those statements, we will revise the prospectus appropriately.

| Statement in Prospectus | | Supporting Material Reference (Internet address at which publicly available) | | Attach-ment |

| “According to a Markets & Markets study ….” (page [35], paragraph 1) | | http://www.marketsandmarkets.com/Market-Reports/merchant-remote-deposit-capture-180.html | | 3.1 |

| “According to a recent Celent report …” (page [35], paragraph 1) | | http://www.celent.com/reports/state-remote-deposit-capture-2012-replacement-market-emerges | | 3.2 |

| “According to Celent, this growth has resulted ….” (page [35], paragraph 1) | | http://www.celent.com/reports/state-remote-deposit-capture-2012-replacement-market-emerges | | 3.2 |

| “In a February 2008 publication, Architecture/Infrastructure has taken the position ….” (page [35], paragraph 3) | | http://www.banktech.com/architecture-infrastructure/remote-deposit-capture-poised-for-explos/206900270 | | 3.3 |

Mr. Larry Spirgel Assistant Director Division of Corporation Finance Securities and Exchange Commission May 7, 2014 | |

| “According to AlixPartners, mobile deposit is the number one mobile feature sought ….” (page [35], paragraph 4) | | http://www.alixpartners.com/en/MediaCenter/PressReleases/tabid/821/articleType/

ArticleView/articleId/203/Smartphones-Rapidly-Transforming-Mobile-Banking-From-New-Concept-to-Tablestakes-According-to-AlixPartners-Study.aspx#sthash.PsKkllSn.dpbs | | 3.4 |

| “In addition, the Aite Group projects ….” (page [35], paragraph 4) | | http://www.americanbanker.com/issues/177_243/mobile-banking-will-grow-300-percent-over-

the-next-four-years-aite-1055318-1.html | | 3.5 |

| “In response to high and growing consumer demand, the percentage of the largest financial institutions offering mobile RDC has nearly tripled over the past two years. In fact, according to Javelin Strategy & Research, ….” (page [35], paragraph 5) | | https://www.javelinstrategy.com/news/1393/92/Mobile-Imaging-Moves-Beyond-Mobile-RDC-

to-Bridge-the-Transaction-Gap/d,pressRoomDetail | | 3.6 |

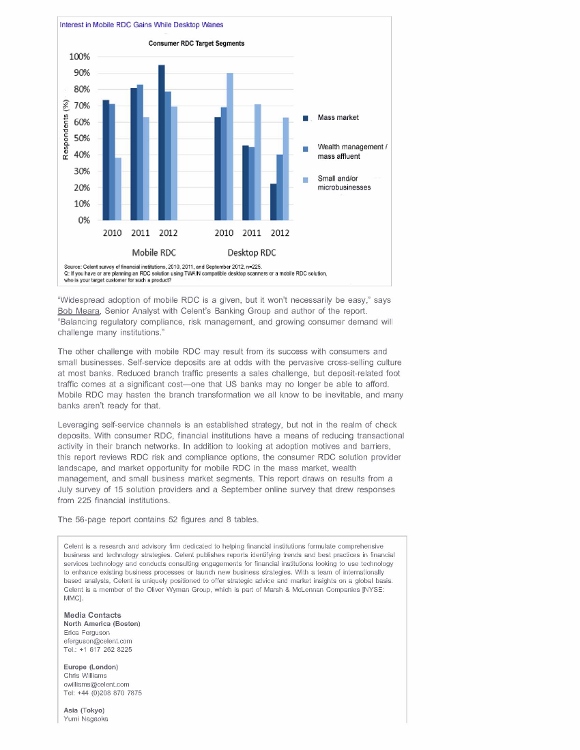

| “A 2012 Celent survey (“State of Consumer RDC 2012) reports that 80% of United States financial institutions ….” (page [35], paragraph 5) | | http://www.celent.com/reports/state-consumer-rdc-2012-death-desktop-0 | | 3.7 |

| “Mitek reports that major banks report saving ….” (page [35], paragraph 6) | | http://globenewswire.com/news-release/2013/03/18/531292/10025445/en/Mitek-s-Mobile-Deposit-R-Enables-Consumers-to-Snap-Their-Way-to-More-Than-40-Billion-in-Deposits.html?print=1 | | 3.8 |

Mr. Larry Spirgel Assistant Director Division of Corporation Finance Securities and Exchange Commission May 7, 2014 | |

| 4. | Please prominently disclose that the company was a shell company. Also, revise your disclosure throughout your prospectus, including in your risk factors, to account for the implications of being designated a shell company and to discuss the conditions that must be met under Rule 144(i). |

RESPONSE: We note that our prospectus already contains disclosure relating to the status of the Company as a shell company. Please see pp. 45 (Plan of Distribution—Shares Eligible for Future Sale) and 60 (Market for Common Equity and Related Stockholder Matters—Rule 144(i)). Nonetheless, we have inserted summary disclosure (together with a cross reference to the fuller discussions contained in the Plan of Distribution and Market for Common Equity and Related Stockholder Matters sections of the prospectus at pp. 46 and 60, respectively. In this regard, please see p. 5 of the prospectus.

Prospectus Summary, page 1

| 5. | Please provide a concise summary, in non-technical terms, of the services you provide to your customers. For example, on page 2, we note your statement that your mobile application is analogous to banking with JP Morgan Chase. Please explain in plain English the products and services you provide to your customers. |

RESPONSE: In our prospectus, we have revised our description of the services we provide to eliminate, as much as possible, the use of technical jargon and explain the services in plain English. Please see “—Our Solutions” at p. 2 of the prospectus.

| 6. | Revise your summary to discuss management’s reasons for becoming a public company at this time in the company’s development and with little time and attention from management. Discuss the pros and cons of doing so, including management’s estimate of the increased expenses of publicly reporting. |

RESPONSE: As you have suggested, our revised prospectus contains a summary description of the business rationale for becoming a public reporting company, including the benefits and burdens of that status and our estimate of the direct costs we will incur as a public reporting company.

| 7. | We note that you have engaged in several significant acquisitions over the last several years. Please expand your history to discuss these acquisitions. |

RESPONSE: The only recent acquisition of which we are aware is our March 2014 acquisition of the Select Mobile Money assets from DeviceFidelity, Inc. That acquisition is discussed at pp. 5 and 32 of the prospectus. If we have misunderstood your comment, please advise. When we speak of the “acquisition” of the business of Cachet Financial Solutions Inc., we are speaking of the reverse merger transaction that resulted in our Company taking control of the public reporting company formerly known as DE Acquisition 2, Inc. We already discuss this transaction in several sections of the prospectus, including the Summary, Risk Factors, Business and elsewhere.

Mr. Larry Spirgel Assistant Director Division of Corporation Finance Securities and Exchange Commission May 7, 2014 | |

| 8. | Please highlight here, in the Risk Factors and under the Plan of Distribution the impact of the concurrent selling shareholder offering on the company’s ability to sell its shares. |

RESPONSE: Our revised prospectus contains added disclosure relating to the effect on our offering that may result from the concurrent offering of our shares by our selling shareholders. In reviewing the structure of the Summary section, we thought it best and in keeping with the flow of the narrative to include this disclosure at page 4. Please see also pp. 20 (Risk Factors) and 45 (Plan of Distribution) of the prospectus.

| 9. | We note your discussion on page 1 of the unbanked or the underbanked market. Please revise this disclosure to clarify how your products service this market and what portion of this market you believe is addressable by your products. |

RESPONSE: In our prospectus, we have attempted to explain how our products serve the unbanked and underbanked markets, and the extent to which those products may address the needs of those markets. Please see the third full paragraph of “—Our Solutions” at page 2 of the prospectus.

| 10. | Please revise to disclose here that your auditor has expressed a substantial doubt as to your ability to continue as a going concern. |

RESPONSE: We have added prominent disclosure of the going concern opinion of our independent registered public accounting firm. Please see page 4 of the prospectus as well as a risk factor added at page 9.

Our Competitive Strengths, page 2

| 11. | We note your disclosure regarding your innovative products. Please revise your disclosure to clarify the importance of these technologies to your operations. For example, we note your disclosure on page 38 that none of these functions are “critical to our overall ability to provide RDC services.” |

RESPONSE: We have reviewed your comment. After consideration, we have revised our later-occurring disclosure in the “Business—Intellectual Property” section of the prospectus to clarify that our ultimate receipt of the letters patent discussed there is what we believe to not be “critical to our overall ability to provide RDC services.” The functionality that is the subject of those patent applications, however, is critical to our business and ability to compete in the RDC marketplace.

Mr. Larry Spirgel Assistant Director Division of Corporation Finance Securities and Exchange Commission May 7, 2014 | |

Recent Developments, page 4

| 12. | Please revise the first sentence of the final paragraph in this section to delete the portion of the sentence indicating that the summary of Merger Agreement is qualified in its entirety by reference to the actual Merger Agreement. It is your responsibility to summarize accurately the material portions of the Merger Agreement. |

RESPONSE: We have deleted the sentence referred to in your comment.

Risk Factors, page 9

We have a significant number of shares of our common stock issuable…, page 9

| 13. | We note your discussion of your Loan and Security Agreement with Michael J. Hanson. Please update to reflect whether the loan was repaid prior to April 4, 2014. In addition, please provide an estimate of the number of shares that will be issued to Mr. Hanson based on $2.40 per share. |

RESPONSE: We have updated the risk factor to disclose the current status of our obligations to Mr. Hanson under the Loan and Security Agreement, and to disclose our current estimate of the number of shares issuable to Mr. Hanson at the rate of $2.40 per share. In particular, we did not repay the loan from Mr. Hanson on April 4, 2014. As a result, the Company issued 19,531 shares of common stock (representing 3.125% of the original principal amount of the $1.5 million loan, at a rate of $2.40 per share, pursuant to Section 1.6(b) of the agreement), in addition to the 78,125 shares of common stock issued as additional consideration (representing 12.5% of the original principal amount of the $1.5 million loan, at a rate of $2.40 per share, pursuant to Section 1.6(a) of the agreement) . We are required to issue an additional 19,531 shares each fifth successive business day after April 4, 2014, for so long as any portion of the loan remains unpaid. Through the date of this letter, Mr. Hanson has received or will receive an aggregate of 175,780 shares of common stock on account of this loan. Please see page 10 of the prospectus.

We have a significant amount of secured and unsecured debt…, page 10

| 14. | Please revise to include accrued but unpaid interest in this discussion. |

RESPONSE: We have updated this risk factor include disclosure of the amounts of accrued but unpaid interest on the various obligations that we discuss. Please see page 10 of the prospectus.

Under our current business model, we rely upon third parties to provide software…, page 12

| 15. | Please clarify that you do not currently own proprietary software for your RDC solutions. |

RESPONSE: We have revised the risk factor to emphatically state that we do not own any software for our RDC products. Please see page 12 of the prospectus.

Mr. Larry Spirgel Assistant Director Division of Corporation Finance Securities and Exchange Commission May 7, 2014 | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 23

| 16. | Please enhance the overview of your management’s discussion and analysis to discuss the likely impact of known trends, demands, commitments, events or uncertainties that are reasonably likely to have material effects on your financial condition or results of operations. Your overview should provide a general overview of the trends in the RDC and mobile wallet market, including technological trends. For more information, refer to the Commission Guidance Regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations (Release Nos. 33-8350, dated December 29, 2003), and Section III of the Interpretive Rule on Management’s Discussion and Analysis (Release Nos. 33-6835, 34-26831, dated May 18, 1989). |

RESPONSE: We have revised the overview portion of our MD&A discussion to provide more information relating to trends in our business and the RDC market in general. Please see page 24 of the prospectus (under the subcaption “—Business and Development of Business”).

Business, page 31

Outsourced Functions, page 37

| 17. | Please revise your disclosure to clarify the current status of your RDC software platform, including whether you have entered into a new license agreement with a third party. In addition, please tell us whether the cancellation of this agreement poses a risk to your operations or business. |

RESPONSE: We have added disclosure to the prospectus that clarifies the current status of our RDC software platform and our plans for platform software development. We do not believe that the cancellation of the agreement poses a risk to our operations or business, and we have revised the prospectus to so state. Please see page 40 of the prospectus.

Mr. Larry Spirgel Assistant Director Division of Corporation Finance Securities and Exchange Commission May 7, 2014 | |

New Products & Product Enhancements, page 37

| 18. | Please revise this disclosure to provide a more detailed description of your plans to develop these new products. This discussion should include specific information regarding each material event or step required to develop these products, including costs and time. |

RESPONSE: We have revised these bullet points to add details about expected release dates and our estimated internal development costs. In addition, we have deleted several bullet points. The bullet point for “alternate platforms” was deleted since our internal RDC software platform development (see your comment 17 and our related response above) includes these enhancements; the bullet point for “partner integration” was deleted because upon review it appears duplicative with the “core integration” bullet point; and the “expansion of supported mobile technology” bullet point was deleted since was have already accomplished iOS and Android functionality enhancements and our additional planned enhancement have been incorporated into our internal RDC software platform development (see your comment 17 and our related response above).

Should you have any further questions or comments, or wish to discuss these matters with us, we ask that you please contact us. I can be reached using the contact information above. If I am unavailable, please feel free to contact Mr. Darin McAreavey, Chief Financial Officer of the Company, at (952) 698-5214. On behalf of the Company, we greatly appreciate your prompt attention to this letter.

| | Very truly yours, |

| | |

| | /s/ Paul Chestovich | |

| | Paul D. Chestovich |

| cc: | Darin McAreavey Jeffrey C. Mack Howard Wilensky |