UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) or (g) of THE SECURITIES EXCHANGE ACT OF 1934

USA SYNTHETIC FUEL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

DELAWARE (State or Other Jurisdiction of Incorporation or Organization) | | 13-3995258 (IRS Employer Identification Number) |

4925

(Primary Standard Industrial Classification Code Number)

312 Walnut Street

Cincinnati, Ohio 45202

(513) 621-0077

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive office)

Securities to be registered pursuant to Section 12(b) of the Act: None

Title of each class to be registered | | Name of each exchange on which each class is to be registered |

Securities to be registered pursuant to Section 12(g) of the Act:

75,000,000 shares, Common Stock, $0.0001 par value

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

Table of Contents

| SUMMARY | 3 |

| EXPLANATORY NOTE | 7 |

| Special note regarding forward-looking statements | 8 |

| Item 1. | Business | 9 |

| Item 1A. | Risk Factors | 33 |

| Item 2. | Financial Information | 42 |

| Item 4. | Security Ownership of Certain Beneficial Owners | 49 |

| Item 5. | Directors and Executive Officers | 50 |

| Item 6. | Executive and director compensation | 54 |

| Item 7. | Certain Relationships and Related Transactions, and Director Independence | 56 |

| Item 8. | Legal Proceedings | 56 |

| Item 9. | Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters | 56 |

| Item 10. | Recent Sales of Unregistered Securities | 58 |

| Item 11. | Description of Registrant’s Securities to be Registered | 58 |

| Item 12. | Indemnification of Directors and Officers | 60 |

| Item 13. | Financial Statements and Supplementary Data | 61 |

| Item 14. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 61 |

| Item 15. | Financial Statements and Exhibits | 61 |

| SIGNATURES | | 62 |

| EXHIBIT INDEX | | 63 |

| GLOSSARY | | 65 |

A glossary of certain terms used in this registration statement appears beginning on page 65 hereof.

SUMMARY

Our Company

USA Synthetic Fuel Corporation (“USASF” or the “Company”) is an environmentally focused alternative energy company pursuing clean energy solutions based on gasification and other proven Btu conversion technologies. We intend to develop, finance, construct, own and operate gasification, synthetic natural gas, and Fisher Tropsch liquid production facilities, to convert low-value, solid hydrocarbon feed sources into higher value, environmentally cleaner energy sources. We believe that we are a leading gasification and alternative energy company in the United States.The Company will leverage its existing intellectual property and experience to develop its project s in the United States and to market cost-competitive products such as synthetic natural gas, “green electricity,” hydrogen, diesel, and related products. The Company expects to secure profitable off-take agreements and to operate its projects such that its product sales will produce attractive returns and cash flows, thereby creating shareholder value. USASF has entered into agreements to acquire major project and solid hydrocarbon energy assets to launch its integrated business strategy. These projects are being developed to produce up to 36.6 million Barrels of Oil Equivalent (“BOE”) of synthetic natural gas annually, as well as up to 516 megawatt of “green electric” power. Our strategy is to be an integral part of United States energy policy aimed at energy independence while, at the same time, providing for the ethical stewardship of the earth and its resources and creating shareholder value. We were among the first in the gasification and energy industries to advocate for, commit to, and des ign for virtually 100 percent carbon capture and storage of carbon dioxide at our facilities. We intend to bring pre-combustion carbon capture and storage technology to our projects in the United States. Our projects include: |

| |

· | Lima Energy Project: In June 2010, the Company entered into an agreement to acquire from Global Energy, Inc. (“GEI”), a related party, all of the outstanding stock of Lima Energy Company, the project company for the Lima Energy Project. In exchange for Lima Energy stock, the Company will pay Global Energy $6,439,429.00 which represents the book value of construction-in-progress to date, and Global Energy will retain a 50% ownership interest in Gas 1, the first phase of the Lima Energy Project. . Payment of this consideration was made with a senior secured note to Global Energy with 7% per annum accrued interest, which is payable at the first to occur of $400 million in Lima Energy financing, an equity offering by the Company of $75 mil lion or more, or March 31, 2011. The Lima Energy Project will be developed in three phases: Gas 1, Gas 2 and Combined Cycle Gas Turbine, as described in more detail below. The Lima Energy Project was fully permitted and the initial contracts awarded for certain site preparation work and foundation work which began in 2004 and 2005. We expect to commence commercial operation of Gas 1 within the next four years and possibly sooner for the Combined Cycle Gas Turbine due to growing electricity demand by 2012. Successfully financing these two phases will enable us to resume field work on both while facilitating financing for Gas 2. |

| | |

| · | Cleantech Energy Project: This project is being developed by our subsidiary, Cleantech Energy Company, will be located in Wyoming, and we plan to use the energy asset of approximately 1.02 billion Barrels of Oil Equivalent of solid hydrocarbons which Cleantech Energy Company entered into an agreement to acquire in June 2010 from Interfuel E&P Ltd. This solid hydrocarbon energy asset is supported by an equivalent energy asset located adjacent to the Cleantech Energy Project in Wyoming. In exchange for this approximately 1.02 billion Barrels of Oil Equivalent energy asset, Cleantech Energy Company issued to Interfuel E&P Ltd. preferred stock valued at approximately $714 million ($0.70/BOE). The Cleantech Energy Project is being designed to produce 182 billion cubic feet per year of pipeline quality synthetic natural gas and to capture and fully utilize the carbon dioxide produced during the synthetic natural gas manufacture. Engineering, technology licensing, and permit planning for this facility are progressing. |

The Technologies

Gasification, synthetic natural gas, Fisher Tropsch liquids, and Integrated Gasification Combined Cycle production processes are proven technologies. Gasification has been in world-wide commercial use for more than 50 years, and world gasification capacity has grown to 56,238 megawatt thermal of synthetic gas output. In its 2004 Survey, the Department of Energy stated, “the reason for this long-term and continuing growth is clear: modern, high temperature slagging gasifiers have the ability to convert low value feedstocks into higher value products - chemicals, fuels and electricity - while meeting the most demanding environmental standards for air emissions, solids, water use and CO2 removal from the product gas.”

By converting low cost, solid hydrocarbon feeds into higher value products, these technologies have distinct cost advantages and pricing stability over traditionally sourced liquid or gas fuels, such as petroleum derived fuels or natural gas. According to the International Energy Outlook’s 2010 Annual Energy Outlook, the average price of United States coal is expected to decline slowly from $1.55 per million British thermal units in 2008 to $1.44 per million British thermal units in 2035, for an average decline of 0.3 percent per year over the entire period. During the same period, the price of Western United States coal is expected to increase slowly by approximately 0.5 percent per year from $0.80 per million British thermal units in 2008 to approxim ately $1.00 per million British thermal units in 2025. According to New York Mercantile Exchange projections, the market price of natural gas is expected to range between $5.81 and $7.27 per million British thermal units from 2012 to 2018, a range higher than the projected cost to produce synthetic natural gas via our gasification and synthetic natural gas production technologies.

Gasification products represent an economic alternative to the historically high and volatile costs of liquid and gas-based fuel sources, particularly natural gas. These technologies are flexible and have been able to convert different low value solid hydrocarbon fuel sources with relatively stable price structures into various higher value products, which are environmentally superior energy sources compared to the original fuels. We believe that the most significant application of gasification is the conversion of coal and petroleum coke into alternate energy sources at costs that compare favorably to current market prices for natural gas.

Of equal importance is our belief that gasification projects address the environmental concerns associated with traditional carbon-based fuel sources, particularly coal. The environmental benefits result from the capability to produce energy with extremely low sulfur oxides, nitrogen oxides, and particulate emissions compared to burning coal and other solid fuels in conventional boilers. Gasification also addresses concerns over the atmospheric buildup of carbon dioxide. Through gasification and downstream gas cleanup processes, we believe that carbon dioxide can be captured more cost-efficiently than in conventional coal power systems. The carbon dioxide then can be compressed and injected into deep saline aquifers or other secure geologic formations or used for Enhanced Oil Rec overy projects.

Due to the abundant domestic supply of solid hydrocarbons such as coal, these technologies represent a potentially large scale alternative to conventional natural gas and power generation. The United States Energy Information Administration estimates, as of January 2008, that recoverable coal reserves in the United States are 262.7 billion tons. Based on current annual production of nearly 1.1 billion tons, the United States has at least an approximate 250-year supply of coal. Renewable feedstock, such as biomass and municipal waste, are readily available in the United States as well. We believe that development of these domestic resources in an environmentally responsible format is an essential element of our national energy goal of reducing dependence on foreign sour ces of energy.

Our Markets

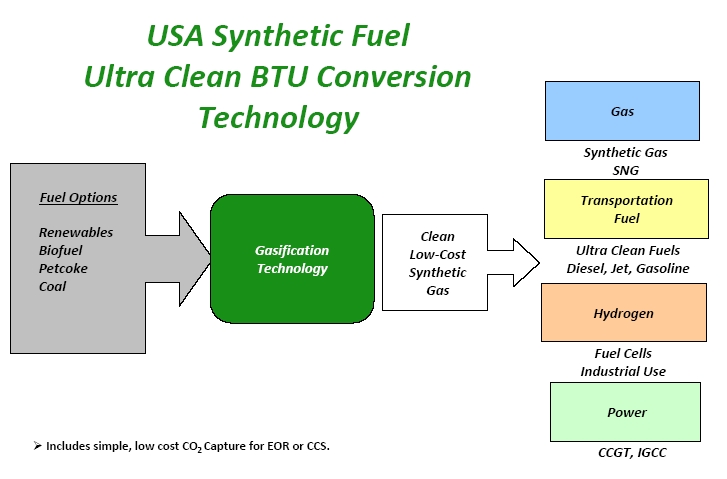

We intend to sell pipeline quality synthetic natural gas into the domestic natural gas market. We believe the production of hydrogen from the gasification of solid hydrocarbon will have ready acceptance in the emerging automotive and fuel cell markets. Prospectively, we intend to produce and sell ultra clean Fisher Tropsch liquids (i.e. diesel, gasoline and jet) into the transportation fuels markets, especially targeting the Department of Defense supply requests. Additionally, we intend to sell electricity, derived from co-production of these energy products, into power markets. Natural gas is an abundant, clean-burning fuel used primarily as a fuel for residential use (heating, air conditioning, cooking, etc), to produce chemicals, to generate electricity , and to heat buildings. |

| Our Business Strategy

Our goal is to be the leader in the development, construction, ownership and profitable operation of environmentally responsible gasification and synthetic natural gas production and integrated gasification combined cycle facilities in the United States. We believe that development of domestic solid hydrocarbon resources in an environmentally responsible format is an essential part of our national energy goal of reducing dependence on foreign sources of energy. In order to achieve this goal, we intend to: |

· | Finance and complete our near-term major gasification projects. |

· | Operate our facilities to maximize the environmental benefits of the gasification process. |

· | Implement effective carbon capture and storage systems. |

· | Enter into long-term off-take agreements and commercial merchant opportunities. |

· | Leverage the expertise of our management team to bring our projects to commercial operation. |

· | Leverage our fuel sourcing capabilities to efficiently capitalize on the feedstock flexibility of our projects. |

· | Expand our commercial product offerings over time to capitalize on the conversion flexibility of our gasification facilities. |

· | Develop, construct, own and operate additional gasification and synthetic gas production projects, including large scale gasification facilities to produce synthetic natural gas, electricity and other products. |

| |

Competitive Strengths

We believe the gasification and synthetic natural gas production technologies the Company intends to utilize together with our operational experience and technical expertise give us several potential competitive strengths in the natural gas and electricity markets, including the following: |

| |

· | Our management team has significant expertise in the operation and ownership of gasification facilities, has been instrumental in the advancement of gasification and synthetic natural gas production technologies and has over 300 years of combined experience in the development, construction, ownership and operation of gasification and other energy facilities. |

· | We have an advanced portfolio of gasification and synthetic natural gas production projects. The Lima Energy Project represents one of the earliest projects to receive the permits necessary to begin construction work on a gasification facility. |

· | Our projects will use proven technologies. |

· | Our projects are being equipped to capture the carbon dioxide produced in the pre-combustion stage, while being designed to allow us to implement technology to separate and isolate carbon dioxide in the post-combustion stage from combustion exhaust steams. |

· | Our projects are being designed to produce synthetic natural gas that we believe will provide cost advantages over traditionally sourced natural gas. |

· | Our projects are being designed to produce environmentally superior fuels compared to the combustion of coal, while our facilities will be designed to significantly reduce emissions of pollutants. |

· | Our projects are being designed to flexibly convert a broad and dynamic range of energy sources, including renewables, into a variety of different fuel outputs. |

· | Our projects are able to run on a variety of abundant domestic resources, such as coal, petroleum coke and renewables. |

· | We have entered into an agreement to acquire a 1.02 billion BOE energy asset which we plan to use for our projects. |

Risk Factors

In operating our business, we will face significant challenges. Our ability to successfully operate our business, and execute our development and construction plan, is subject to numerous risks, as discussed more fully in the section entitled “Risk Factors”. Among the risks and uncertainties that face our business are the following: |

| | |

· | We have no current operating revenues. |

· | We anticipate that we will incur operating losses and negative cash flows for the foreseeable future. |

· | Our ability to become profitable is uncertain. |

· | We anticipate undergoing a period of rapid growth and activity, and our failure to manage this growth could harm our business. |

· | Our development and construction plan requires substantial capital, and we may be unable to raise capital when needed which could force us to delay, reduce or eliminate some or all of our plans. |

· | We may be unable to complete the development and construction of our projects on our planned schedule or within our project budget. |

· | Our dependence on third-party service providers and suppliers may cause delays in our projects. |

· | We may be subject to additional construction risk as a result of Gasification Engineering Corp. acting as the main contractor for the Lima Energy Project. |

· | We use specialized technology and equipment at our projects which may cause delays or increased costs in connection with their completion and delivery. |

· | We may be unable to obtain or maintain the regulatory permits, approvals and consents required to commence operations at our projects. |

· | We do not currently operate a gasification facility, and we have a limited history of operations. |

· | We may be unable to meet the debt service requirements of the financing arrangements required by our development and construction plans. |

· | We may be unable to obtain feedstock for our projects at acceptable prices. |

· | We may not be able to implement an effective system for the management of carbon dioxide. |

· | We may be subject to third-party infringement claims with respect to proprietary rights. |

· | We may be unable to sell our end-products at favorable prices or at all due to fluctuations in energy commodity prices or if market acceptance of gasification and synthetic natural gas production technologies does not continue to increase. |

| |

Any of the above risks, as well as others discussed in more detail elsewhere in this registration statement, could have a material adverse effect on our business, financial condition, prospects and results of operations.

Our Corporate Information

We are incorporated in Delaware. Our principal executive offices are located at 312 Walnut Street, Cincinnati, Ohio, 45202, and our telephone number is (513) 621-0077. Our website address is www.usasfc.com. The information on, or that may be accessed through, our website is not incorporated by reference into this registration statement and should not be considered a part hereof. |

EXPLANATORY NOTE

USA Synthetic Fuel Corporation (“USASF” or the “Company”) is the successor company to BigStar Entertainment Inc. (“BGST”), having been created in December 2009 through a reverse merger undertaken pursuant to an Exchange Agreement dated as of December 4, 2009 between USASF and BGST. Upon completion of the transactions under the Exchange Agreement as described in more detail below, BGST’s name was changed to USA Synthetic Fuel Corporation, and the ownership of the issued and outstanding shares of the Company’s common stock is now controlled by those individuals and other entities described in more detail in Items 4 and 11 hereof. The merger became effective upon the filing of an amendment to BGST’s certificate of incorporation in Delaware on December 31, 2009.

BGST was incorporated in March 1998 under Delaware law and was engaged in the business of online retailing of filmed entertainment products and providing entertainment industry information and other website services as part of its e-commerce platform. BGST operated as a private business until August 1999 when its initial public offering became effective and the company’s stock began trading on the NASDAQ National Market system under the symbol “BGST”. The company’s core business never proved successful, and BGST was delisted from the NASDAQ National Market in January 2001 and, thereafter, traded on the OTC Bulletin Board. As a result of continuing unfavorable business conditions, on March 17, 2003 BGST filed SEC Form 15-12G with the Securities and Exchange Commission (“SECR 21;) to voluntarily de-register its stock and exempt the company from SEC reporting requirements. BGST has not engaged in any material business activities since that date and has been inactive while maintaining its corporate existence. The company’s stock was thinly traded on the Pink OTC Markets from March 2003 under the symbol “BGST”, until February 23, 2010, when it began trading on the Pink OTC Markets under the symbol “USFC”.

USASF was incorporated in Delaware in November 2009 by Global Energy, Inc. (“GEI”) as the acquisition shell company for acquiring BGST through a reverse merger. Under the Exchange Agreement, all of the outstanding shares of USASF common stock (100 shares), which were owned by GEI, were exchanged for 97% (72,750,000 shares) of newly authorized and issued common shares of USASF, after giving effect to certain surrenders, conversions and a reverse split of the then outstanding shares of BGST common stock. The remaining 3% (2,250,000 shares) of the Company’s authorized and issued common stock consists of 2,090,900 newly issued shares, which are owned by the former holder of BGST’s preferred shares, and 159,100 of registered shares, which are owned by those shareholders owning BGST common shares im mediately prior to the reverse merger. The 159,100 shares constitute the “public float”. With the filing in Delaware of a certificate of amendment to its charter on December 31, 2009, BGST’s corporate name was officially changed to that of the Company, which name change was accomplished by USASF changing its name to Cleantech Corporation immediately prior to the filing of that certificate of amendment.

Our Company’s Board of Directors has made a determination to file this registration statement on Form 10 to re-register under the Exchange Act of 1934. It is the Company’s intention to resume filing all periodic reports required under the Exchange Act of 1934. As described above, our shares currently trade on the Pink OTC Markets. The Company expects to seek to have our shares listed on the National Association of Securities Dealers Automated Quotations (“NASDAQ”) National Market System and shortly will file a Listing Application and related documents with NASDAQ in furtherance of this goal, although we can give no assurances that such application will be approved. Our Board of Directors is taking these actions as part of our ongoing efforts to access the public capital markets for development of the Company’s projects forecasted to earn positive cash flows and to achieve our goal of maximizing value for our shareholders.

References to “we”, “us”, “USASF”, “USFC”, “the Company”, and “our Company” all refer to USA Synthetic Fuel Corporation and its subsidiaries unless the context otherwise requires.

Special note regarding forward-looking statements

Statements in this Form 10 or in the documents incorporated by reference herein that are not descriptions of historical facts are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Reference is made in particular to the descriptions of our plans to, and objectives for, future operations, assumptions underlying such plans and objectives and other forward-looking terminology such as “may”, “expects”, “believes”, “anticipates”, “intends”, “projects”, or similar terms, variations of such terms or the negative of such terms. Forward-looking statements are based on management’s current expectations. Actual results could differ materially fro m those currently anticipated due to a number of factors, including those set forth under “Risk Factors” including, in particular, risks relating to:

| | · | Construction and Technology. |

| | · | Maintaining our Contract and Intellectual Property Rights. |

We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any changes in our expectations or any changes in events, conditions or circumstances on which any such statement is based.

Registration Statement

We are voluntarily filing this registration statement on Form 10 in order to make information concerning USA Synthetic Fuel Corporation more readily available to the public. We believe that being a reporting company under the Securities Exchange Act of 1934, as amended, will enable us to make an application to have our common stock traded on the NASDAQ, although we can give no assurances that such application will be approved. Also, being a reporting company will make information concerning USASF accessible to its stockholders, prospective stockholders, and the public trading market. This registration statement will automatically become effective upon filing with the United States Securities and Exchange Commission unless voluntarily withdrawn by the Company prior to that time. Upon the effectiv eness of this registration statement, we will be obligated to file with the SEC certain interim and periodic reports including an annual report containing audited financial statements. We will also be obligated to report significant current events and changes in stock ownership of our officers, directors, and affiliates.

Item 1. Business

Our Company

USA Synthetic Fuel Corporation (“USASF” or the “Company”) was created to address and satisfy America’s growth market for ultra clean energy products for improved efficiency and reduction of harmful emissions including greenhouse gases. The Company will leverage its existing intellectual property and operating experience to develop its ultra clean Btu conversion business in the United States of America to market cost-competitive products such as ultra clean synthetic natural gas (“SNG”), “green electricity,” hydrogen (“H2”), ultra clean diesel, gasoline and jet fuels, and related products. The Company is expected to secure profitable off-take agreements and sales for its product line and realize attrac tive returns and cash flows to create shareholder value. America and the world are re-tooling the energy business to be cleaner and greener, and USASF is well positioned to profit from this significant growth opportunity.

We are an environmentally focused alternative energy company pursuing clean energy solutions based on gasification and other proven ultra clean Btu conversion technologies. We intend to develop, construct, own and operate gasification facilities, certain of which will employ SNG gas and Fisher Tropsch liquid production technologies. Gasification facilities cost-effectively convert low-value, solid hydrocarbon feed sources into higher value, environmentally cleaner energy sources such as SNG, which is virtually identical to natural gas, SG or Fisher Tropsch liquids such as gasoline, jet and diesel fuel. Gasification and associated technologies represent emerging segments of the energy market. Based on our team’s previous experience of owning and operating gasification facilities and our portfolio of active development proj ects, we believe that we are a leading gasification and alternative energy company in the United States.

Btu conversion technologies represent a series of processes which, collectively, convert low-value, solid hydrocarbons such as renewables, petroleum coke, or coal into value added, ultra clean energy products. The solid hydrocarbon feed initially is converted to synthetic gas, which is a mixture of carbon monoxide (“CO”) and H2, using gasification technology – the core Btu conversion technology process. Next, the synthetic gas is cleaned by downstream processes to remove materials of concern commonly associated with the solid hydrocarbons such as particulates, sulfur compounds, and mercury. The purified synthetic gas may be used as a fuel for the generation of electric power at an Integrated Gasification Combined Cycle (“IGCC”) power plant such as the Wabash River facility which has been called the cleanest coal-based power plant in the world by the United States Department of Energy. Additional Btu conversion technologies allow the synthetic gas to be converted further into other ultra clean, high value, energy products such as synthetic natural gas, Fischer Tropsch liquid fuels such as ultra-low sulfur diesel and jet fuels, and hydrogen gas, to name a few. A key component of Btu conversion technology is that virtually 100 percent of the carbon dioxide (“CO2”) produced during the manufacture of these ultra clean energy products is separated, captured and made available for Enhanced Oil Recovery operations or for long term carbon capture and storage options, thereby significantly limiting the emissions of this greenhouse gas to the environment.

The Company’s senior management and technology staff have, on a combined basis, 300 man-years of relevant industrial experience with gasification and related Btu conversion technologies. The ownership and operational experiences of our management team at the Wabash Gasification Facility in West Terre Haute, Indiana and the Westfield Development Centre in Fife, Scotland provide the Company with an owner/operator experience that is unique within the industry. Btu conversion technology offers the United States the way to convert its abundant energy reserves of solid hydrocarbons such as coal into the more environmentally responsible realm of liquid and gaseous fuels, limiting our energy and economic dependence on foreign energy sources.

Our corporate philosophy emphasizes the ethical stewardship of the earth and its resources. The Company believes in the significant environmental benefits of its ultra clean Btu conversion technologies. We are committed to wisely managing the impact our facilities and resources have on the planet. As a result, our management and technical team members were among the first in the gasification and energy industries to advocate for, commit to, and design for virtually 100 percent carbon capture and storage (“CCS”) of CO2 at our facilities. We intend to bring pre-combustion CCS technology to our projects in the United States via Carbon Management Technologies, LLC, a joint venture between Global Energy, Inc. and HTC Purenergy , Inc. of Canada. With Carbon Management Technologies and its founding joint venture partners, we also have in excess of 250 man-years of CCS and related experience from which to draw in the CCS arena.

USASF will launch its integrated business strategy with the following major assets:

| · | Lima Energy Company and the Lima Energy Project: In June 2010, the Company entered into an agreement to acquire from Global Energy, Inc., a related party, all of the outstanding stock of Lima Energy Company, now a subsidiary of the Company and the project company for the Lima Energy Project. The Lima Energy Project is being developed in three phases: Gas 1, Gas 2, which combined are being designed to produce 47 billion cubic feet per year (“BCF per year”) of pipeline quality SNG, and Combined Cycle Gas Turbine which is being designed to produce 516 megawatt (“MW”) of electric power, as described in more detail below. Global Energy will retain a 50% ownership interest in Gas 1, the first phase of the Lima Energy Project. |

| · | Cleantech Energy Company and the Cleantech Energy Project: The Cleantech Energy Project is being developed by our subsidiary, Cleantech Energy Company. The project will be located in Wyoming and it is our intent to use our energy asset of approximately 1.02 billion BOE of solid hydrocarbons which is described in more detail below. The Cleantech Energy Project is being designed to produce 182 BCF per year of pipeline quality SNG and to capture and utilize CO2 produced during the SNG manufacture in EOR and CCS applications. |

| · | Solid hydrocarbon energy asset: In June 2010, Cleantech Energy Company entered into an agreement to acquire an approximately 1.02 billion BOE of solid hydrocarbon energy asset from Interfuel E&P Ltd., which is described in more detail below. This energy asset, which previously was owned by Mobil Mining and Minerals Company, is supported by an equivalent energy asset located in Wyoming adjacent to our planned Cleantech Energy Project. This approximately 1.02 billion BOE of solid hydrocarbons represents a 25 year, low cost feedstock supply for the Cleantech Energy Project. Additionally, because the Cleantech Energy Project is adjacent to the solid hydrocarbon energy asset, transportation expenses would be minimized for this project, resulting in an additional economic advantage for the project. |

These projects are being developed to produce up to 5.6 million BOE and 31 million BOE of SNG annually, for the Lima Energy and Cleantech Energy Projects, respectively. The Lima Energy Project also will produce up to 516 MW of “green electric” power. USASF has a continuing commitment to focus on developing its proven environmental technologies to produce low cost, clean energy products. We believe we will lead the way toward energy independence for the United States, while providing for the ethical stewardship of the earth and its resources, and satisfying and balancing its stakeholders’ interests.

The Company is in active development of the Lima Energy Project, which will be developed in three phases: Gas 1, Gas 2 and Combined Cycle Gas Turbine (“CCGT”), and is in the process of obtaining construction and permanent financing for Gas 1 and CCGT. The Lima Energy Project was fully permitted and the initial contracts awarded for certain site preparation work and foundation work which began in 2004 and 2005. We expect to commence commercial operation of Gas 1 within the next four years and possibly sooner for CCGT. The prospect of growing electricity demand, particularly by 2012 and beyond, may warrant our acceleration of the CCGT Project into the Gas 1 construction window. A unique aspect of the Company’s intellectual property is that we can stage development to accelerate revenues and earnings such as bringing electricity to market through the CCGT prior to production of SNG. The CCGT may enter the marketplace consuming pipeline natural gas (“NG”) then switch to SNG when Gas 1 is operational. Successfully financing Gas 1 and CCGT will enable us to resume field work on Gas 1 and CCGT and facilitate financing for Gas 2. The Company also is developing our major facility in Wyoming, with plans to use the approximately 1.02 billion BOE of solid hydrocarbon energy asset that our subsidiary, Cleantech Energy Company, has acquired from Interfuel E&P Ltd. Enginee ring, technology licensing, and permit planning for this facility are progressing.

The Company has a 10 year off-take agreement, discussed more fully elsewhere in this registration statement, for SNG from Gas 1 with Procter & Gamble Paper Products Company (“P&G”), a major industrial customer based in Ohio. The Company may sell remaining SNG Capacity to either industrial customers or into the wholesale market. The Company’s integrated strategy is to control its solid hydrocarbon feed supply and costs, with flexibility in sourcing, to ensure continued low-cost production to satisfy sales commitments and create acceptable margins from its operations. We believe USASF’s integrated strategy differentiates the Company and creates a competitive advantage for us.

The Company will require substantial additional capital resources to complete our development and construction plan and grow our business. Over the next four years, we expect to need $497.0 million for Gas 1, $1.02 billion for Gas 2, $627.3 million for CCGT, and $2.3 billion for the Cleantech Energy Project, as well as additional funds for the development and construction of our longer term projects. We intend to finance a significant amount of the costs of these projects through a mix of equity and debt, which will consist primarily of project-specific non-recourse debt financing using the assets of each project to secure such debt combined with profitable off-take agreements. Lima Energy is currently seeking financing for Gas 1 and CCGT.

Our Markets

We intend to sell pipeline quality synthetic natural gas into the domestic natural gas market. We believe the production of hydrogen from the gasification of solid hydrocarbon will have ready acceptance in the emerging automotive and fuel cell markets. Prospectively, we intend to produce and sell ultra clean Fisher Tropsch liquids (i.e. diesel, gasoline and jet) into the transportation fuels markets, especially targeting the Department of Defense supply requests. Additionally, we intend to sell electricity, derived from co-production of these energy products, into power markets. Natural gas is an abundant, clean-burning fuel used primarily as a fuel for residential use (heating, air conditioning, cooking, etc), to produce chemicals, to generate electricity, and to heat buildings.

Natural Gas Industry Background

Current United States Energy Information Administration projections of natural gas demand show steadily increasing requirements for the next two decades in the United States and even stronger demand globally due primarily to strong demand growth in developing markets, such as China. According to the United States Energy Information Administration’s 2010 Annual Energy Outlook (“2010 Annual Energy Outlook”), total United States natural gas production is anticipated to be approximately 20.6 trillion cubic feet (“tcf”) in 2010 and about 23.9 tcf in 2030 and demand is anticipated to increase from approximately 23.1 tcf per year in 2010 to 25.6 tcf per year in 2030, yielding an average shortfall in natural gas production in the range of about 1.7 – 2.5 tcf per year. During this same time period, the percentag e of natural gas contributed by shale gas (mostly) and coalbed methane is forecast to increase from 17% to 34% of the total United States Production of natural gas. The Company believes that the lifting costs of NG from these sources will be significantly greater than from the conventional gas sources they will be replacing. Compounding this, according to the United States Energy Information Administration’s International Energy Outlook 2010 Highlights, worldwide energy consumption is projected to increase by approximately 50% from 2007 to 2035.

New, unconventional sources such as shale gas and imported natural gas in the form of liquefied natural gas (“LNG”) are suggested to fill this gap. We believe these new, unconventional sources are more expensive to produce and subject the market to higher price pressures. Companies in the United States are expanding their ability to receive LNG. The effect of increased reliance on LNG to meet natural gas consumption demands subjects the United States market to greater price sensitivity and uncertainty. However, the existence of significant shale gas initiatives may make such United States LNG terminals less cost effective, resulting in LNG favoring other international ports.

We believe that the anticipated growth in demand for natural gas in the United States can be met, in part, by significant investment in cost-effective SNG facilities. We believe the growth in China and Asia Pacific will result in diversion of LNG deliveries to international ports, thereby benefitting domestic production of SNG. Increased demand for natural gas or SNG for secure, clean, cost-effective power generation and alternative energy also will likely result from the pressures from clean air legislation, environmental regulations and concerns about rising levels of greenhouse gas emissions.

We also believe that consumption of natural gas will increase on a going-forward basis as a result of more stringent CO2 emission reduction requirements, thus increasing the projected gap between consumption and production beyond that anticipated by 2010 Annual Energy Outlook. The United States Congress is expected to address climate change legislation, but that notwithstanding, various states such as California have already enacted CO2 emission restrictions that favor natural gas as a fuel for power generation on a CO2 emission per kilowatt generation basis. In addition, we believe that, long term, the price of natural gas will remain sufficiently high as more costly unconventional production becomes increasingly used to satisfy consumer demand that will favor low cost SNG production.

Natural gas futures contracts traded on the New York Mercantile Exchange represent current market clearing prices. Although these prices do not extend beyond 2018, we believe they provide a reasonable perspective on price expectations for natural gas into the future. New York Mercantile Exchange closing prices for natural gas in the United States as of June 10, 2010 were as follows:

| Year | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| | | | | | | | |

| Natural Gas (1) | $5.81 | $5.98 | 6.16 | $6.39 | $6.65 | $6.95 | $7.27 |

| | | | | | | | |

(1) Natural gas prices are Henry Hub market prices in United States dollars per million British thermal units . |

These future prices are at projected levels that are above USASF’s expected costs to produce SNG under its integrated strategy.

Gasification, SNG, Fisher Tropsch liquids, and IGCC Production Technologies

Proven technology. Gasification and SNG production are well-established technologies that represent emerging alternative technologies for the natural gas and transportation fuels markets. Gasification has been in commercial use for more than 50 years around the world. Commercial coal gasification operations began in South Africa in 1955. According to the United States Department of Energy (“DOE”), during the 1990s, worldwide gasification capacity grew by 50% as 43 new plants were put into service. The 2007 World Gasification Survey, the most current study conducted by the DOE in conjunction with the Gasification Technologies Council, shows that existing world gasification capacity has grown to 56, 238 MWth of SG output. This includes 144 operating plants with a total of 427 gasifiers, both operating and spare. In its 2004 World Gasification Survey, the DOE stated, “the reason for this long-term and continuing growth is clear: modern, high temperature slagging gasifiers have the ability to convert low value feedstocks into higher value products—chemicals, fuels and electricity—while meeting the most demanding environmental standards for air emissions, solids, water use and CO2 removal from the product gas.”

The operational and economic viability of IGCC plants has been demonstrated in the United States by the operation of the Wabash River facility, which commenced operations in 1995, and by the IGCC facility operated by Tampa Electric Company at the Polk Power Station since 1997. In addition, according to the Environmental Protection Agency, a coal gasification plant producing SNG and other chemicals has been operating in North Dakota since 1984. This plant also engages in commercial CCS activity.

Cost advantages. Gasification and SNG production technologies (by virtue of converting low cost, solid hydrocarbon feeds, such as coal, petcoke or renewables such as biomass into higher value products such as SNG and Fisher Tropsch liquids) have distinct cost advantages over traditionally sourced liquid or gas fuels, such as petroleum derived fuels or natural gas. According to the 2010 Annual Energy Outlook, the average price of United States coal is expected to decline slowly from $1.55 per million British thermal units in 2008 to $1.44 per million British thermal units in 2035, for an average decline of 0.3 percent per year over the entire period. During the same period, the price of W estern United States coal is expected to increase slowly by approximately 0.5 percent per year from $0.80 per million British thermal units in 2008 to approximately $1.00 per million British thermal units in 2025. By comparison, as set forth in the table under “—Industry Background—” above, according to New York Mercantile Exchange projections, the market price of natural gas is expected to range between $5.81 and $7.27 per MMBtu from 2012 to 2018, a range higher than the projected cost to produce SNG via our gasification and SNG production technologies.

We believe that gasification products, such as SG and SNG, represent an environmentally attractive, economic alternative to the historically high and volatile costs of liquid and gas-based fuel sources, particularly natural gas. Gasification technology is flexible and consistently has been able to convert different low value solid hydrocarbon fuel sources with relatively stable price structures, such as coal, petcoke and renewables, into various higher value products including SG, SNG, Fisher Tropsch liquids, and H2, which are environmentally superior energy sources compared to the original solid hydrocarbon fuels. We believe that the most significant application of gasification is the conversion of coal and petcoke into SG or SNG at costs that compare fa vorably to current market prices for natural gas. The prices of solid hydrocarbons such as coal, on a Btu basis, historically have been considerably lower and less volatile than the price of natural gas. We also believe that the conversion of coal into SG and SNG to produce electricity provides cost advantages over natural gas and is cost competitive with traditionally sourced coal-based power generation, especially low-sulfur coal.

Clean energy source. In addition to this economic advantage, we believe that SG and SNG are alternative energy sources that are capable of addressing the current environmental concerns associated with traditional carbon-based fuel sources, particularly coal. The environmental benefits of gasification result from the capability to produce energy with extremely low sulfur oxides (“SOx”), nitrogen oxides (“NOx“) and particulate emissions compared to burning coal and other solid fuels in conventional boilers. For example, according to a report issued by the DOE in September 2000, the atmospheric emissions from the Wabash River facility after the introduction of the IGCC technology were significantly lower than the emissions from the coal-fired boiler that the IGCC system replaced. Specifically, according to the DOE:

| · | SOx emissions were reduced by 96% from 38.2 lb/megawatt hours (“MWh”) to 1.35 lb/MWh. |

| · | NOx emissions were reduced by 88% from 9.3 lb/MWh to 1.09 lb/MWh. |

| · | Particulate emissions were reduced by close to 100% from 0.85 lb/MWh to a non-detectable level. |

We believe that the emissions of CO2 at the Wabash River facility were reduced by approximately 18%, on a MWh basis as a result of the improvement in net plant efficiency.

We believe that, in addition to the reduction in CO2 emissions resulting from improvements in efficiency as demonstrated pursuant to installation of IGCC technology at the Wabash River facility, gasification offers a further environmental advantage in addressing concerns over the atmospheric buildup of greenhouse gases such as CO2. Through the utilization of gasification together with downstream gas cleanup processes, we believe that CO2 can be captured more cost-efficiently than in conventional coal powe r systems. Once captured, CO2 can be compressed and injected into deep saline aquifers or other secure geologic horizons, or used for Enhanced Oil Recovery (“EOR”) projects. If follow up monitoring shows carbon is prevented from escaping into the atmosphere, it may be considered sequestered.

A SNG-fueled CCGT has an essentially identical emissions profile, including CO2 release, as a CCGT using natural gas, the currently preferred fossil fuel. In addition, it has significantly better environmental performance than a traditional coal-based power plant, with criteria pollutants such as SOx and NOx at a tenfold reduction and CO2 at a 50% reduction. Therefore, solid hydrocarbon-derived SNG is both a superior use of solid fuels and can be adapted readily to post-combustion capture when that technology is perfected. We believe that a significant part of the expense associated with overall CCS from combust ion exhaust is capturing the CO2. Gasification and SNG production technologies make it possible to capture carbon prior to combustion by converting CO produced during gasification into H2 and CO2 where the CO2 can be isolated using traditional gas conditioning process systems. These systems operate at high pressure which reduces the volume of gas requiring treatment. Capturing CO2 from a post-combustion exhaust stack, such as coal-fired power plants are faced with, i s a more difficult and costly task. There, stack gases are at atmospheric pressure where the volume of exhaust gas is much greater and the concentration of CO2 is much lower due to dilution by the large quantity of combustion air in the boiler. We believe that removing a concentrated CO2 stream in the pre-combustion phase as part of the gasification and methanation processes currently is easier, more cost-effective and removes more CO2 than a post-combustion step located at a conventional coal-fired power plant. We currently intend to implement significant pre-combustion CO2 capture at our facilities. We will explore the adoption of post-combustion carbon capture from combustion exhausts at such time as that technology becomes more mature. As a result, our projects are being equipped to capture CO2 produced in the pre-combustion stage, while also being designed to allow us to implement technology to separate and isolate CO2 in the post-combustion stage from combustion exhaust streams in the future. CO2 captured in the pre-or post-combustion stage can be used in EOR projects or CO2 sequestration. We intend to explore and undertake sequestration and EOR methods of CO2 management, within the framework of any additional costs required by the creation of an infrastructure for such methods, as well as the incremental oil revenue economics associated with EOR. In the future, we may benefit economically from carbon credits which we may earn from CO2 that we are deemed to have permanently sequestered. When EOR has been applied, the industry experience has been favorable in that additional value is captured because the cost of producing a barrel of oil via EOR is well below the prevailing prices of crude oil production/supply.

Abundant supply. Due to the abundant worldwide supply of solid hydrocarbon fuels such as coal, gasification, SNG production, and IGCC technologies represent a potentially large scale alternative to conventional natural gas and power generation. According to the latest United States Energy Information Administration estimates, recoverable coal reserves worldwide are estimated (as of January 2006) at 929 billion tons. Coal is the most abundant fossil fuel resource in the United States , where recoverable coal reserves are estimated (as of January 2008) at 262.7 billion tons, also according to the United States Energy Information Administration. These coal resources are widely distributed throughout the United States with recoverable reserves located in 33 states. Based on current annual production of nearly 1.1 billion tons, the United States has at least an approximate 250-year supply of coal. In addition, renewable feedstock for gasification and SNG production facilities, such as biomass and municipal waste, are readily available in the United States.

The Cleantech Energy Company’s BOE energy asset currently is not classified as “reserves”, and the Company has no plans to classify it as reserve as there is no reason to do so in the ultra clean, Btu conversion mode in which the Company operates. Btu is converted into BOE at the ratio of 5.8 million Btu to one BOE. BOE conversion ratios are on an energy equivalence conversion method and do not represent a value equivalence.

We believe that due to gasification’s broad and dynamic matrix of potential inputs and outputs, reliance on globally abundant feedstocks, potential environmental benefits compared to other energy production methods and status as a proven and established process, we will be provided with a wide range of business opportunities and the flexibility to maximize value in an environment of high and volatile commodity prices.

The Gasification Process

Introduction

Gasification is a process that converts carbon-containing materials into SG composed primarily of CO and H2, the proportions of which can vary depending upon the conditions in the gasifier and the type of feedstock. Gasification occurs when a carbon-containing feedstock is exposed to steam at elevated temperatures and pressures in the presence of controlled amounts of oxygen. SG can be used as a fuel to generate electricity or steam or as a basic chemical building block in the petrochemical and refining industries.

The following diagram illustrates the major building blocks of the gasification process:

Gasifier

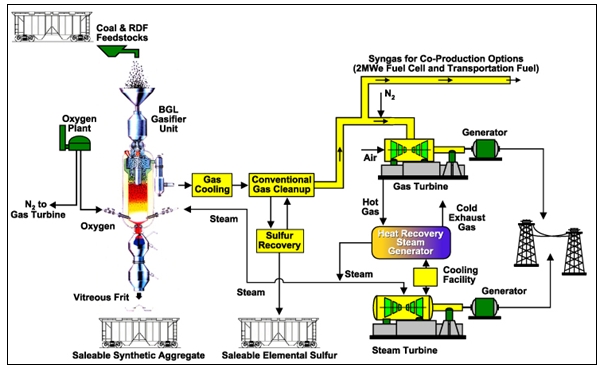

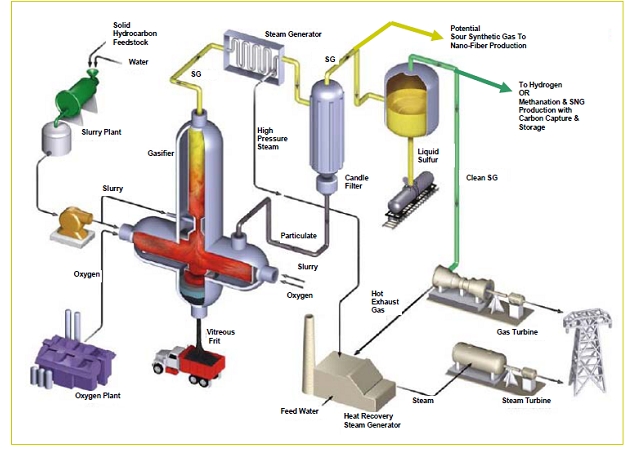

The heart of a gasification-based system is the gasifier. There are two basic types of gasifiers: fixed bed and entrained flow. Fixed bed gasification differs from entrained flow gasification primarily with regard to the method by which the system accepts feedstock, which in turn affects the size and types of incoming feedstock. Entrained flow gasifiers typically accept feedstock of less than one-quarter inch in size and use a pulverizing system to crush solid feedstock, such as coal or petcoke. Fixed bed gasifiers typically accept feedstock of one-quarter inch to three inches in size. As a result, in addition to coal and petcoke, fixed bed gasifiers can use renewable feedstock containing carbon, such as wood, refuse derived fuel and sludge powder which have been processed into pellets or cubes. The gasification technologies that we curre ntly use and plan to use in future projects also are referred to as slagging gasification technologies because they operate at a temperature high enough to melt the mineral components of the feedstock into a vitrified frit or glass-like material that is non-leachable. Synthetic aggregate is a marketable material with a variety of uses in the construction and building industries, such as road base and sea wall construction. Slagging gasification is a closed process that has minimal air emissions and does not produce ash. Gasification technologies differ in many aspects but share certain general production characteristics.

Feedstock

Coal is the most common feedstock used in the gasification process. As described below, virtually all types of coal can be processed in slagging gasifiers. Unlike conventional power plants, which typically avoid high-ash and high-sulfur coal due to regulatory emission compliance constraints, gasification facilities can readily process such types of coal. In addition, other feedstock such as petcoke, refuse derived fuel and renewables may be used in gasification systems. Gasification facilities remove the sulfur from the SG prior to use, thereby avoiding challenging regulatory limitations on sulfur emissions and broadening both the potential sources of feedstock supply and siting opportunities. While the specific type of feedstock used in any particular circumstances depends upon desired energy output, desired efficiency and other economic considerations, gasification technologies are versatile and flexible. As a result, we are able to build plants which will use technology appropriate to the type of feedstock expected to be available to us in the long term at a particular location. In addition, once our plants are constructed as designed, we will be able to efficiently switch among different types of feedstock as necessary. We expect that coal, including high-sulfur coal, and petcoke will be the primary feedstocks used with both the fixed bed and entrained flow gasification technologies which we plan to use in our projects. Refuse derived fuel and renewables are better suited to fixed bed designs.

Feedstock handling and storage

Feedstock handling is an important facet of the gasification process as most gasifiers can only process feedstock in a certain form that may require pre-treatment. Feedstock requires storage to ensure that periods of reduction in feedstock transport do not affect the flow to the gasifier. The feedstock must then be prepared and transported to the gasifier.

Gas clean-up

Sulfur impurities in the feedstock form hydrogen sulfide and, to a lesser extent, carbonyl sulfide, which can be removed from the SG stream using commercially available technology and converted to liquid elemental sulfur to be sold for agricultural use. Depending upon the overall facility configuration, minor amounts of CO2 which are formed during gasification and also may be formed in downstream processes can be separated into a concentrated stream and removed using commercially available physical solvents.

Gasification has the capability to produce relatively low SOx, NOx and particulate emissions compared to conventional coal-fired generating plants. NOx emissions from an IGCC plant, even without selective catalytic reduction, as well as SOx emissions, are typically significantly below those of the current New Source Performance Standard for conventional coal-fired generating plants. For example, the proposed IGCC component of the Lima Energy Project currently is permitted for approximately 0.08 lb of NOx per MMBtu compared with the New Source Performance Standard for a conv entional coal plant of 0.15 lb of NOx per MMBtu. Conventional coal-fired boilers use scrubbing technologies on the exhaust gas, which leave a significant solid waste residual commonly called fly ash, or simply ash, that must be disposed of in landfills or ash-settling ponds. Conversely, gasification technology results in the sulfur content of the carbon-based feedstock being largely removed in liquid form as molten sulfur as a saleable product and the ash content of the feedstock is melted to form a glassy or vitrified frit. Nitrogen oxides are a by-product of both coal and gas-fired power production that must be treated in conventional power plants with special control facilities, such as catalytic converters and “low-NOx” burners. Gasification plants, in contrast, dilute the SG stream with nitrogen or steam before it is used in the combustion turbine. This dilution minimizes the formation of NOx by causing the fuel to burn at a significantly lower temperature.

It is important to note that with SNG, the gasification and SNG production processes are collectively a closed system. Plant emissions will generally only be associated with fugitive emissions from feedstock handling, wet cooling towers and the flare, used for start-up, shut-down, and contingency conditions related to equipment malfunctions, for example. Power generation associated with SNG production is by steam turbine generator and not combustion turbines and, therefore, does not have combustion related emissions.

As designed, our gasification facilities will have two additional byproducts: sulfur and vitrified frit. Sulfur is converted to elemental sulfur which has commercial value in the chemical and agricultural markets. Vitrified frit is not leachable and, as a result, has commercial value as a synthetic aggregate and is not considered to be a waste stream. Unlike traditional coal-fired power plants, the gasification process does not produce ash material. In addition, process waters from the various plant operations at a gasification facility will be recycled where possible or sent to a special “zero liquid discharge” unit. In this unit, nearly pure water is produced from the process waters along with a solid salt residue stream which is sent to a properly permitted disposal facility. Mercury in coal used as a feedstock is a hazardo us constituent and must be handled properly. About 50% of the mercury from coal (petcoke generally does not contain mercury) ends up in the vitrified frit, where it is prevented from leaching by the inert characteristics of the material. The remaining mercury exits with the SG stream, where it is removed by downstream cleanup processes. These steps are expected to reduce the remaining mercury in the SG stream to levels below any current or anticipated regulatory limits. The permit limit for mercury at our Lima Energy Project is below current regulatory limits for coal-based combustion.

Although CO2 is not presently regulated by the United States government, it is considered a greenhouse gas and a significant contributor to global warming. Development efforts by third parties, including HTC Purenergy, a company focused on providing CO2 management services, are currently underway to evaluate the use of various techniques to separate and capture CO2 in the post-combustion stage for use in EOR projects or carbon sequestration. Carbo n Management Technologies (“CMT”), a joint venture between GEI and HTC Purenergy, will provide pre-combustion CO2 management and EOR solutions for the Lima Energy Project, the Cleantech Energy Project, and other projects based upon technologies developed by HTC Purenergy.

Conversion process and products

The principal product generated from the gasification process is SG, which can be converted into one or more end-products that have commercial applications. Some gasification facilities can be configured to produce more than one commercial end-product at the same facility in a process called co-production.

Synthetic gas. The principal product from the gasification process is SG (principally CO and H2), which can be sold on its own or converted into a variety of end-products, including SNG, “green electricity” Fisher Tropsch liquids (including low-sulfur diesel and jet fuel), H2 and other liquids such as methanol and chemicals.

SNG. SG produced in the gasification process is frequently converted into SNG which can be used either locally or compressed into a high pressure interstate natural gas pipeline system where it can be delivered nationwide and used as an alternative to traditional natural gas. An interconnect agreement with the respective pipeline transportation company typically reflects instrumentation necessary to measure SNG composition and quality, includes the relevant tariff specification for that company and describes the physical requirements of the interconnection itself.

Electricity. Gasification technology is frequently applied to the production of electricity in an IGCC configuration. An IGCC facility is composed of a gas island and a power island. The SG, or alternatively SNG, produced by the gas island is piped to the power island for use as a fuel in the combustion turbine. The power island of an IGCC facility consists of three primary components: a combustion turbine generator, a heat-recovery steam generator, which captures the hot exhaust heat of the gas turbine or other latent heat to produce high-pressure steam, and a steam turbine generator that produces additional electricity from the steam created by the heat-recovery steam generator. Currently, gasifi cation-based power generation systems can operate at approximately 40% or higher efficiency for the generation of power. By contrast, a conventional coal-based power plant employs only a steam turbine-generator, which we believe is typically limited to 34% to 36% efficiency. Higher efficiency means that less fuel is used to generate the rated power, resulting in better economics and the formation of less greenhouse gases. For SNG manufacture, heat (in the form of steam) from the gasification and methanation reactions is used to drive a steam turbine generator for the production of electric power.

Transportation fuel and other liquids. SG can be sent through a Fischer-Tropsch synthesis reactor and other downstream processes to produce Fisher Tropsch liquids such as ultra-low sulfur diesel, jet fuel, kerosene and naphtha.

Hydrogen. H2 in the SG can be isolated and then used for various manufacturing processes in petroleum refining and for the removal of sulfur from liquid fuels such as diesel and gasoline during their manufacture in refineries. Additional H2 may be produced from the SG by allowing the CO to react with water in a catalytic process to produce H2 and CO2.

Other liquids and chemicals. SG can also provide the basic building blocks for a broad range of chemicals (for example, fertilizer and plastics) using processes that are well established in today’s chemical industry.

The following diagram illustrates the fixed bed gasification process as applied to a process designed to produce power:

The following diagram illustrates the entrained flow gasification process as applied to a process designed to produce power:

Source: Gasification Technologies Council

Our Business Strategy

Our goal is to be the leader in the development, construction, ownership and operation of environmentally responsible gasification and SNG production, and where appropriate, IGCC facilities in the United States. In order to achieve this goal, we are pursuing the following business strategies:

Complete near-term major gasification projects. Our primary focus will be commencing operations at our two major gasification projects, currently under development, which we intend to begin operating within the next four years. This will include focus on completing Gas 1 in the second half of 2013, possibly accelerating the completion of CCGT, and completing the Cleantech Energy Project in the second half of 2014.

Operate our facilities in an environmentally responsible manner. We intend to operate our facilities to maximize the environmental benefits of the gasification process. We intend to develop, construct, own and operate projects which convert low value feedstock into higher value products while meeting the most demanding environmental standards for air emissions, solids, water use and CO2 removal.

Secure and maximize non-recourse project finance debt. We plan to finance our projects by maximizing the use of project-specific non-recourse debt financing secured by the assets of each individual project. Furthermore, we intend to maximize the level of project finance debt while maintaining a sustainable capital structure.

Balance long-term off-take agreements and commercial merchant opportunities. We plan to enter into long-term off-take agreements for a sufficient portion of the output from each project to support project debt while selling the remainder of the output, if any, in wholesale markets to take advantage of prevailing energy commodity prices.

Leverage the energy facility expertise of our management team to efficiently bring our projects to commercial operation. Our development team has substantial experience with designing, developing, and building energy, gas processing, chemical, power generation and other energy facilities. We intend to control the cost of building our new facilities by directly managing the engineering, procurement and construction (“EPC”) services for many of our projects. We will directly hire and supervise the contractors who will build our projects. As a result, we believe that our costs will be substantially less than costs associated with conventional EPC arrangements

Leverage our fuel sourcing capabilities to efficiently capitalize on the feed flexibility of our projects. We intend to continue to capitalize on our flexibility to utilize different types of feedstock, including different types of solid hydrocarbons based on sulfur and ash content, for our facilities depending upon the particular gasification technology to be used. Our subsidiary, Cleantech Energy Company, has entered into an agreement to acquire an approximately 1.02 billion BOE solid hydrocarbon energy asset. The Compay intends to use this energy asset in certain of our contemplated projects. Construction of such projects will depend, in part, upon future delivery of the solid hydrocarbon energy asse t to support the development and operation of the project. If we are not able to receive a sufficient quantity o f solid hydrocarbons from th is energy asset to justify construction of such a project, we may decide to redesign, relocate, develop alternate feedstock supplies, delay or not proceed on the development of such project. Where economically advantageous, aside from this energy asset, we intend to secure long-term contract agreements with owners of coal deposits, acquire deposits that are attractively priced or buy coal or petcoke in the open market.

Expand our commercial product offerings over time to capitalize on the conversion flexibility of our gasification facilities. In addition to producing SNG, our planned facilities are being designed to have the ability to produce electric power as well as convert SG into Fisher Tropsch liquids and H2, two important and increasingly expensive products for many industries, including airlines, chemical companies and the United States government.

Develop, construct, own and operate additional gasification and SNG production projects, including large scale gasification facilities to produce SNG, electricity and other products. With our prior owner/operator experience combined with the experience gained as our development projects are constructed and begin commercial operation, we believe that we will be well positioned to be the leader in the development of gasification technology projects in the United States that achieve regulatory compliance and are environmentally superior to competing alternatives. In the long term, we intend to develop, construct, own and operate additional facilities to produce SNG, electricity and other products.

Competition

We compete with other suppliers, including utility companies, in each of our anticipated product areas of SNG, electric power, transportation fuels and H2.

Natural gas suppliers. Competition from suppliers of natural gas include exploration and production companies which are increasing their drilling activity in areas anticipated to produce unconventional shale gas. In addition, some potential competitor companies are expanding LNG import operations in the United States, although we believe that these efforts face high costs, particularly in connection with the import of LNG, these companies may become competitors of ours.

Utilities, independent power producers and competing power technologies. We intend to focus our business on the sale of SNG and not materially compete with large utilities and independent power producers which sell power in our anticipated target markets. A number of utility companies that own and operate large coal-fired generating facilities have announced that they intend to consider installation of natural gas combined cycle power generation facilities rather than continue to seek regulatory approvals for conventional coal fired power stations. We intend to market SNG to these facilities as an alternative to natural gas. In addition, some large utilities have publicly discussed the environmental advantages of utilizing IGCC facilities for power production and have proposed the construction of IGCC facilities. These projects are in various stages of development, and we believe that Duke Energy’s project in Edwardsport, Indiana is the farthest advanced of these utility projects. Although such companies are currently focused on their own needs within their own service territories, they may become competitors in the independent power generation market.

Other independent IGCC companies. There are a number of gasification projects under consideration by companies other than the major utility and industrial companies discussed above which have proposed to construct IGCC facilities in the USA. These projects are in various stages of development. Additional independent companies may enter the business in the future, especially as the technology and operating performance of gasification facilities become more widely proven. Some of these companies may compete with us in the future for power off-takers, sites, and government funding.

Gasification technology licensors. We compete with a number of gasification technology licensors. For example, General Electric Company, Shell US Clean Coal Energy, Inc. and ConocoPhillips own the major commercial gasification technologies in the United States and may decide to develop or invest in IGCC or other gasification facilities in the future. General Electric Company and Bechtel Corporation announced an alliance to develop a standard commercial offering for IGCC projects in North America. Similar alliances have been announced by Black and Veatch Corporation and Uhde GmbH relating to Shell US Clean Coal Energy, Inc.’s gasification technology. While these alliances are reported to be targeted initially at turnkey projects to major utility companies, these companies have substantial resources should they decide to develop and own projects for their own account in the future. In addition, they may compete with us by offering gasification plants on a turnkey basis to host facilities that we may also target. Peabody Energy Corporation, the world’s largest coal producer, has announced its desire to promote the use of coal gasification as a means to increase its production rates. This may include the development, construction, ownership, and operation of gasification facilities dedicated to the production of products in a manner similar to ours.

Transportation fuel and H2 competitors. Oil production and petrochemical firms have proposed a number of new plants that have the capability to produce transportation fuel, H2 and a wide range of other products. Some companies have discussed the possibility of using gasification to produce power, steam and H2 as required to support their production of oil from Canadian tar sands. Although these firms are focused on their own needs, they could reduce the available market for the products that can be produced in our gasification facilities. Some companies have publicly discussed the fact that they own and license proprietary and patented processes that convert coal into liquid fuel.

Competitive Strengths

USASF was created to focus on ultra clean Btu conversion technology applied to solid hydrocarbons, and to develop commercially viable project opportunities in the USA market. Our foundation is GEI’s 22 years of experience pursuing clean energy solutions based upon ultra clean Btu conversion technologies. Since its incorporation in 1988, GEI has been actively acquiring and investigating ultra clean Btu conversion technologies including the technology, know-how, and operational bases from several multi-billion dollar public and private sector initiatives in the United States and the United Kingdom. A majority of our management and technical staff come to the Company from GEI and, as such, have operational and technical expertise relating to and including:

| · | Fixed bed gasification technologies, briquetting technologies to incorporate biofeed materials, the Dow Chemical entrained flow gasification technologies (now called E-GAS™ technology), and catalytic methanation technologies. |

| · | The Westfield Development Centre in Scotland previously operated on behalf of British Gas, and which GEI purchased in 1992 and began construction and operations of a General Electric 6FA CCGT project in 1998 at Fife Energy. |

| · | The operation of the Wabash River facility, and the E-Gas™ technology, were optimized by members of our management and technical team during the period of GEI’s ownership. This facility is one of only two IGCC facilities in the United States according to the DOE. The Wabash River facility was solely owned and operated by GEI from January 2000 through January 2005, at which point a joint venture (SG Solutions LLC) was formed between GEI and Wabash Valley Power Association. Joint ownership and operation of the Wabash River facility continued from 2005 until 2008, after which GEI sold its interest in order to focus on the Lima Energy Project. During this period, members of our management and technical team demonstrated an ability to reduce operating costs, produce clean SG at competitive costs compared to prevailing market prices for natural gas and increas e reliability at the Wabash River facility. |

| · | The Lima Energy Project received an air permit in 2002, began construction in 2005, and is currently in the process of obtaining construction financing. We believe the Lima Project is one of the most fully developed gasification projects in the United States. |

The Company is developing a major facility in Wyoming, known as the Cleantech Energy Project, which will use the approximately 1.02 billion BOE energy asset our subsidiary, Cleantech Energy Company, has entered into an agreement to acquire. This project is consistent with USASF’s integrated strategy to control, as much as possible, its solid hydrocarbon feedstock source effectively to lock in a low-cost feedstock that then is processed through our ultra clean Btu conversion technology for delivery of products to customers with off-take agreements. Engineering, technology licensing, and permit planning for this facility are progressing.

As noted above, a majority of our management and technical staff come over to us from GEI. We believe that our team’s previous operational experience at the Westfield and Wabash River facilities together with their development experience relating to the Lima Energy and Cleantech Energy projects (as well as development experience with energy-related projects generally), gives us the expertise required for developing, constructing, owning and operating gasification facilities. The Wabash River facility remains our reference plant for Gas 1 and the other two phases of the Lima Energy Project.

We believe the gasification and SNG production technologies the Company intends to utilize, together with our operational experience, technical expertise and strategic alliances give us several potential competitive strengths in the natural gas and electricity markets, including the following: