As filed with the Securities and Exchange Commission on September 23, 2013

Registration No. 333-187604

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SINO AGRO FOOD, INC.

(Exact Name of Registrant as Specified in its Charter)

| Nevada | | 2020 | | 33-1219070 |

| | | | | |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification Number) |

Sino Agro Food, Inc.

Room 3801, Block A, China Shine Plaza

No. 9 Lin He Xi Road

Tianhe District, Guangzhou City, P.R.C. 510610

(860) 20 22057860

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Solomon Lee

Chief Executive Officer

Sino Agro Food, Inc.

Room 3801, Block A, China Shine Plaza

No. 9 Lin He Xi Road

Tianhe District, Guangzhou City, P.R.C. 510610

(860) 20 22057860

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Marc Ross, Esq.

Henry Nisser, Esq.

Sichenzia Ross Friedman Ference, LLP

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462 (c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting companyx |

CALCULATION OF REGISTRATION FEE

Title of Each Class of

Securities to Be Registered | | Amount to Be

Registered (1) | | | Proposed Maximum

Offering Price Per Share | | | Proposed Maximum

Aggregate Offering

Price | | | Amount Of Registration

Fee | |

| | | | | | | | | | | | | |

| Common stock, par value $0.001 per share (2) | | | 26,250,000 | | | $ | 1.00 | (3) | | $ | 26,250,000.00 | | | $ | 3,580.50 | |

| | | | | | | | | | | | | | | | | |

| Total | | | 26,250,000 | | | $ | 1.00 | | | $ | 26,250,000.00 | | | $ | 3,580.50 | (4) |

(1) In the event of a stock split, stock dividend, or similar transaction involving the common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416.

(2) Represents shares of the Registrant’s common stock being offered pursuant to the Registrant’s public offering.

(3) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(a) of the Securities Act of 1933, as amended.

(4) Previously paid.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED SEPTEMBER 23, 2013

SINO AGRO FOOD, INC.

Up to 26,250,000 Shares of Common Stock

This prospectus related to a direct public offering by Sino Agro Food, Inc. of a maximum of 26,250,000 shares of our common stock at a price of $1.00 per share for maximum aggregate gross proceeds of $26,250,000. The shares offered by us will be offered at a fixed price of $1.00 per share for a period not to exceed 180 days from the date of this prospectus. This price represents approximately 250% of the market price of the shares of our common stock as of September 20, 2013. There is no minimum number of shares that must be sold in the offering nor do we intend to establish an escrow or similar account. We will retain the proceeds from the sale of any of the offered shares, and funds will not be returned to investors. As a result, it is possible that no proceeds will be received by us or that if any proceeds are received, that such proceeds will not be sufficient to cover the costs of the offering. The shares are offered directly through our officers and directors. No commission or other compensation related to the sale of the shares will be paid to our officers and directors. Our officers and directors will not register as a broker-dealer with the Securities and Exchange Commission in reliance on Rule 3a4-1 of the Securities Exchange Act of 1934, as amended. The intended methods of communication include, without limitation, telephone and personal contact. For more information, see the section titled “Plan of Distribution” herein. Our officers, directors, control persons and affiliates of same do not intend to purchase any shares in this offering.

The direct public offering will terminate on the earlier of (i) the date when the sale of all 26,250,000 shares is completed or (ii) 180 days from the date of this prospectus. In addition, if we abandon the offering for any reason prior to 180 days from the date of this prospectus, we will terminate the offering.

Our common stock is eligible for quotation on the Over-the-Counter Bulletin Board under the symbol “SIAF.” On September 20, 2013, the last reported price of our common stock was $0.405 per share.

No underwriter or person has been engaged to facilitate the sale of shares of our common stock in this offering. There are no underwriting commissions involved in this offering. We have agreed to pay all the costs of this offering other than customary brokerage and sales commissions.

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” beginning on page 4 of this prospectus before making a decision to purchase our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _____, 2013

TABLE OF CONTENTS

| | Page |

| PROSPECTUS SUMMARY | 1 |

| | |

| RISK FACTORS | 4 |

| | |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 20 |

| | |

| USE OF PROCEEDS | 21 |

| | |

| DILUTION | 22 |

| | |

| MARKET FOR OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS | 23 |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS | 24 |

| | |

| BUSINESS | 61 |

| | |

| DIRECTORS AND EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 95 |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 98 |

| | |

| PLAN OF DISTRIBUTION | 99 |

| | |

| TERMS OF THE OFFERING | 100 |

| | |

| PROCEDURES FOR AND REQUIREMENTS FOR SUBSCRIBING | 100 |

| | |

| DESCRIPTION OF SECURITIES | 100 |

| | |

| EXPERTS | 1 02 |

| | |

| LEGAL MATTERS | 1 02 |

| | |

| WHERE YOU CAN FIND MORE INFORMATION | 1 02 |

| | |

| INDEX TO FINANCIAL STATEMENTS | F-1 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. It may not contain all the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis or Plan of Operations,” and our historical financial statements and related notes included elsewhere in this prospectus.

In this prospectus, unless the context requires otherwise, references to the “Company,” “Sino Agro” “we,” “our company,” “our” and “us,” refer to Sino Agro Food, Inc., a Nevada corporation together with its subsidiaries.

Business Overview

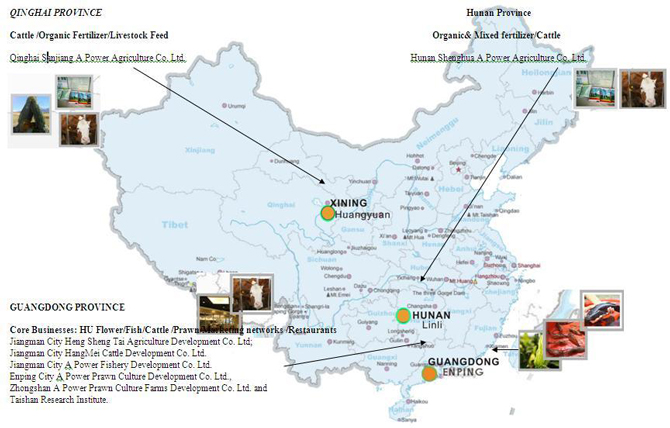

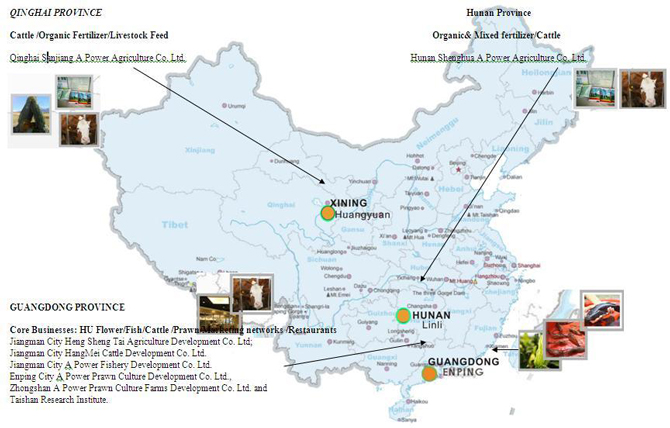

We are a consulting, engineering and technology based company operating in the agriculture and aquaculture sectors with a vertically integrated business model as a developer, producer and distributor of organic agriculture and aquaculture produce and products through our operating subsidiaries in China.

Activities in 2011 concentrated on the building out of primary production activities in our feedstock, fertilizer fishery and cattle farm businesses leading into the initiation of basic infrastructure developed for our pre-wholesale and wholesale operations.

2012 was characterized by a marked expansion and continuation of our primary production activities and the development of wholesale operations, many delivering product sales, and by the build-out of the distribution network including import-export, as well as the start of retail operations.

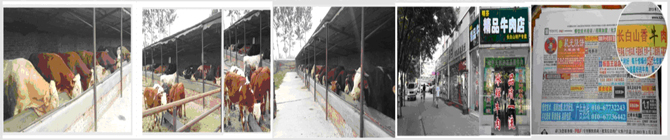

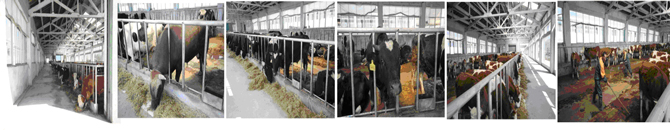

We divide our operations into five standalone business divisions or units but in this section we will cover it as four divisions as follows: (1) fishery, (2) beef cattle, (3) fertilizer, enzymes and livestock feed, (4) Dragon Fruit (“HU”) flower plantation and (5) Corporate. The commonality between the divisions is that each operates in a comparatively slow growth consolidating market; our strategy is targeting niches of these markets with our products.

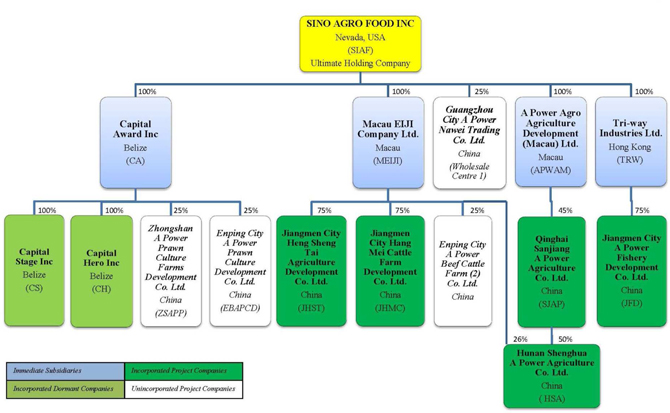

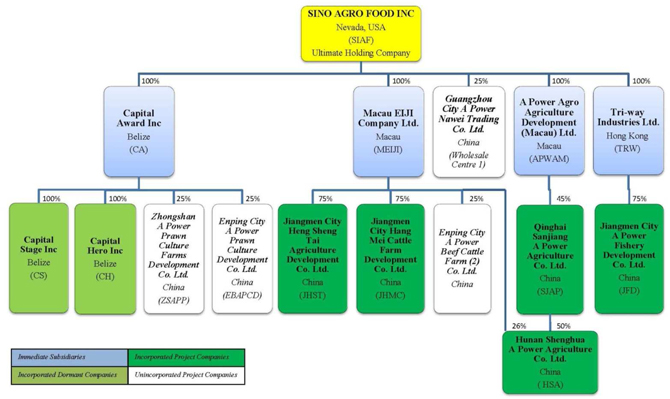

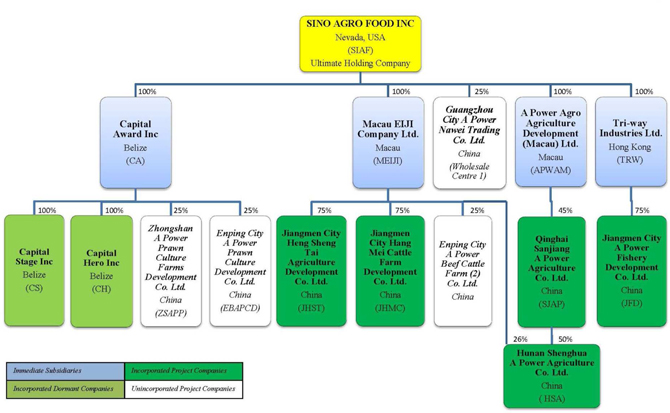

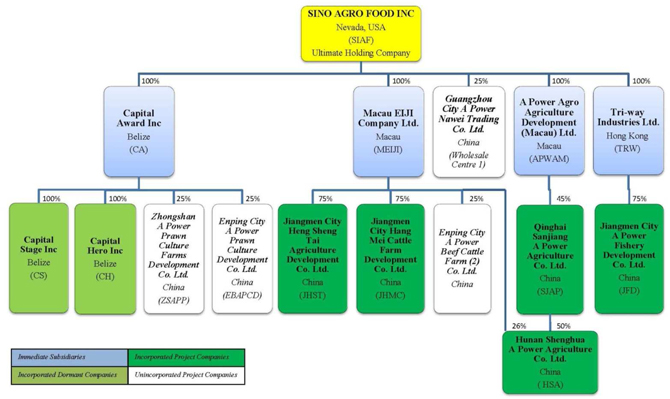

Corporate Structure

The table below shows our corporate structure:

Company History

Our company, which was formerly known as Volcanic Gold, Inc. and A Power Agro Agriculture Development, Inc., was incorporated on October 1, 1974 in the State of Nevada. We were engaged in the mining and exploration business but ceased our mining and exploring business on October 14, 2005. On August 24, 2007, we entered into a Merger and Acquisition Agreement with Capital Award Inc., a Belize corporation and its subsidiaries Capital Stage Inc. and Capital Hero Inc. Effective the same date, Capital Award completed a reverse merger transaction with us. We acquired all the outstanding common stock of Capital Award from Capital Adventure, a shareholder of Capital Award, for 32,000,000 shares of our common stock.

On August 24, 2007 we changed our name from Volcanic Gold, Inc. to A Power Agro Agriculture Development, Inc. On December 8, 2007, we changed our name to Sino Agro Food, Inc. Our principal executive office is located at Room 3801, 38th Floor, Block A, China Shine Plaza, No. 9 Lin He Xi Road, Tianhe District, Guangzhou City, Guangdong Province, PRC, 510610.

Cross-Listing on First North

We have taken steps to have our shares of common stock quoted (no new shares will be issued) on NASDAQ OMX First North in Stockholm, Sweden (“First North”). First North is an alternative market, operated by the different exchanges within NASDAQ OMX (the “Exchange”). It does not have the legal status as an EU-regulated market. Companies trading on First North are subject to the rules of First North and not the legal requirements for admission to trading on a regulated market. The risk in such an investment may be higher than on the main market.

Before trading in our shares of common stock can commence, an application must be submitted to the Exchange for approval. We have engaged Erik Penser Bankaktiebolag (“EPB”) to act as our financial adviser in connection with our efforts to have our shares of common stock quoted on First North. EPB, a privately held independent bank based in Stockholm, is assisting us in the application process. Trading on First North is subject to a number of conditions including affiliation of our shares to Euroclear Sweden, sufficient shareholder distribution in Sweden and the approval of NASDAQ OMX. Our shares are currently eligible for quotation on the OTC BB in the United States and we expect them to continue to be traded on the OTC BB. There can be no assurance that our shares of common stock will trade on First North.

Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completions of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeded $700.0 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act” and references herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| • | only two years of audited consolidated financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” disclosure; |

| • | reduced disclosure about our executive compensation arrangements; |

| • | no requirement that we hold non-binding advisory notes on executive compensation or golden parachute arrangements; and |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We have taken advantage of some of these reduced burdens, and thus the information we provide stockholders may be different from what you might receive from other public companies in which you hold shares.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

THE OFFERING

| Securities Being Offered: | | 26,250,000 shares of common stock, par value $0.001 per share. |

| | | |

| Offering Price per Share: | | $1.00 |

| | | |

| Offering Period: | | The shares are being offered for a period not to exceed 180 days. |

| | | |

| Gross Proceeds to our Company: | | $0 if no shares are sold, $6,562,500 if 25% of the maximum number of shares are sold, $13,125,000 if 50% of the maximum number of shares are sold, $19,687,500 if 75% of the maximum number of shares are sold and $26,250,000 if the maximum number of shares are sold. |

| | | |

| Use of Proceeds*: | | General working capital and capital for development purposes. |

| | | |

| Number of Shares Outstanding Before the Offering: | | 127,713,766 as of the date of this prospectus. |

| | | |

| Stock Symbol: | | SIAF |

| | | |

| Number of Shares Outstanding After the Offering**: | | 127,713,766, if no shares are sold, 134,276,266 if 25% of the maximum number of shares is sold, 140,838,766 if 50% of the maximum number of shares is sold, 147,401,266 if 75% of the maximum number of shares is sold and 153,963,966 if 100% if the maximum number of shares are sold. |

| | | |

| Risk Factors: | | An investment in our common stock involves a high degree of risk. You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 4 of this prospectus before deciding whether or not to invest in shares of our common stock. |

* We will retain the proceeds from the sale of any of the offered shares, and funds will not be returned to investors. It is possible that no proceeds will be received by the Company or that if any proceeds are received, that such proceeds will not be sufficient to cover the costs of the offering. See “Use of Proceeds” below for further information.

** There is no minimum number of shares that must be sold in the offering and the issue is not underwritten. Assumes no shares are issued between the date of this prospectus and the consummation of the offering.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Potential investors should consider carefully the risks and uncertainties described below together with all other information contained in this prospectus before making investment decisions with respect to our common stock. If any of the following risks actually occur, our business, financial condition, results of operations and our future growth prospects would be materially and adversely affected. Under these circumstances, the trading price and value of our common stock could decline resulting in a loss of all or part of your investment. The risks and uncertainties described in this prospectus are the only material risks and uncertainties that we presently know to be facing our company.

This prospectus contains forward-looking statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. These statements are only predictions. The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties and other factors that may cause our customers’ or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements, to differ. ”Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” as well as other sections in this prospectus, discuss the important factors that could contribute to these differences.

The forward-looking statements made in this prospectus relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

This prospectus also contains market data related to our business and industry. This market data includes projections that are based on a number of assumptions. If these assumptions turn out to be incorrect, actual results may differ from the projections based on these assumptions. As a result, our markets may not grow at the rates projected by these data, or at all. The failure of these markets to grow at these projected rates may have a material adverse effect on our business, results of operations, financial condition and the market price of our common stock.

Our current business operations are conducted in the PRC. Because China’s economy and its laws, regulations and policies are different from those typically found in the West and are continually changing, we face certain risks, which are summarized below.

Risks Related to Our Company

The current global economic and credit environment could have an adverse effect on demand for certain of our products and services, which would in turn have a negative impact on our results of operations, our cash flows, our financial condition, our ability to borrow and our stock price.

Since 2008, global market and economic conditions have been disrupted and volatile. Concerns over increased energy costs, geopolitical issues, the availability and cost of credit, the U.S. mortgage market sub-prime collapse and a declining residential real estate market in the U.S. have contributed to this increased volatility and diminished expectations for the economy and the markets going forward. These factors, combined with volatile oil prices, declining business and consumer confidence and increased unemployment, have precipitated a global recession. It is difficult to predict how long the current economic conditions will persist, whether they will deteriorate further, and which of our products, if not all of them, will be adversely affected. These conditions, if they continue, could cause a material decrease in our sales, net income and an increase in the prices we pay for raw materials used in producing our primary produce and products and our development cost and, thus, materially affect our operating results and financial condition.

We may be unable to maintain an effective system of internal control over financial reporting, and as a result we may be unable to accurately report our financial results.

Our reporting obligations as a public company place a significant strain on our management, operational and financial resources and systems. If we fail to maintain an effective system of internal control over financial reporting, we could experience delays or inaccuracies in our reporting of financial information, or non-compliance with the SEC, reporting and other regulatory requirements. This could subject us to regulatory scrutiny and result in a loss of public confidence in our management, which could, among other things, cause our stock price to drop.

Because we will require additional financing to expand our vertically integrated operation in accordance with our business plan and growing strategy, our failure to obtain necessary financing will impair our growth strategy; in addition, the risk of vertical integration is significant.

As of June 30, 2013, we had working capital of $145,332,475, including cash and cash equivalents of $9,391,449. Our capital requirements in connection with our planned vertically integrated development and growth plan of our business are significant.

In most of the developed countries, risks of agriculture operations are shared to a certain degree by different sectors in the industry, for example the following:

| • | Research and development are at times initiated and supported by government departments; |

| • | The primary producers are mainly concerned with the growing risks of the produce; |

| • | There are marketing companies that assume the risks of marketing the produce; |

| • | There are trading houses conduct the sales of the produce and assume the credit risks of the sales; and |

| • | There are logistic companies that assume the risks of transporting the produce. |

However, as a vertically integrated operator, we shall have to cover all the mentioned risks. China is a developing country and currently its agriculture industry has not been fully developed similarly to other developed nations. As a result, management believes that it is essentially important for us to be able to develop our business operation in a vertically integrated manner in order to be able to achieve reasonable profit margins for our products. Although we also believe that the multiple layers of profits generated through the multiple operations may compensate to some degree for the variety of risks that we face through the multiple operations, nevertheless, the overall risks are much greater. At the same time, the full module of our vertically integrated developments has not been completed and these vertically integrated developments may require significant capital expenditures and management resources. Failure to implement these vertically integrated developments could hurt our ability to manage our growth and our financial position.

The estimated costs for this and other projects that are part of our growth strategy in the future will cost us an estimated $500 million in the aggregate and will be undertaken in phases of our 5 year-plan that was initiated in March of 2010, depending on the funds available to us including internal capital and external capital. We intend to use a significant part of the net proceeds from this offering to fund part of the estimated costs of its final phase. However, we will need approximately $118 million in 2013 to accomplish our longer term objectives, including but not limited to the approximately $26 million in gross proceeds intended to be raised from this offering. See “Use of Proceeds” on page 21 for more information.

As of June 30, 2013, the Company believed itself to be approximately $16.5 million short of its requirements, assuming the full $26 million in net proceeds of this offering is raised. As a result, it has commenced a bond offering in order to make up the shortfall in which it hopes to raise an additional amount of approximately $16.9 million; however, there can be no assurance that this amount, or any amount, will be raised in the bond offering. The Company has expended $79.5 million of the $118 million and has cash on hand of approximately $9 million as well as working capital as of June 30, 2013 of approximately $145 million.

We may at a certain point in time determine to use some or even all of remaining net proceeds of this offering, which we presently expect to allocate to working capital, to begin implementing these longer term objectives. However, even if we did so we would only have available a small portion of what we would need.

To accomplish the objectives discussed above and to execute our business strategy, we need access to capital on appropriate terms. We currently have no commitments with any third party to obtain such additional financing and we cannot assure you that we will be able to obtain the requisite additional financing on any terms and, if we are able to raise additional funds, it may be necessary for us to sell our securities at a price which is at a significant discount from the market price and on other terms which may be disadvantageous to us. In connection with any such financing, we may be required to provide registration rights to the investors and pay damages to the investors in the event that the registration statement is not filed or declared effective by specified dates. The price and terms of any financing which would be available to us could result in both the issuance of a significant number of shares and significant downward pressure on our stock price. We cannot assure you that our business objectives, particularly over the longer term, will be met on a timely basis, if at all. Consequently, we may be unable to meet fixed obligations and expenses that will be generated in the operation of our business, whether as presently in existence or as proposed. Any failure to obtain requisite financing on acceptable terms could have material and adverse effect on our business, financial condition and future prospects.

No assurance of successful expansion of operations.

Our significant increase in the scope and the scale of our product launch, including the hiring of additional personnel, has resulted in significantly higher operating expenses. As a result, we anticipate that our operating expenses will continue to increase. Expansion of our operations may also cause a significant demand on our management, finances and other resources. Our ability to manage the anticipated future growth, should it occur, will depend upon a significant expansion of our accounting and other internal management systems and the implementation and subsequent improvement of a variety of systems, procedures and controls. There can be no assurance that significant problems in these areas will not occur. Any failure to expand these areas and implement and improve such systems, procedures and controls in an efficient manner at a pace consistent with our business could have a material adverse effect on our business, financial condition and results of operations. There can be no assurance that our attempts to expand our marketing, sales, manufacturing and customer support efforts will be successful or will result in additional sales or profitability in any future period. As a result of the expansion of our operations and the anticipated increase in our operating expenses, as well as the difficulty in forecasting revenue levels, we expect to continue to experience significant fluctuations in its results of operations.

We may be unable to successfully expand our production capacity, which could result in material delays, quality issues, increased costs and loss of business opportunities, which may negatively impact our product margins and profitability.

Part of our future growth strategy is to increase our production capacity to meet increasing demand for our existing goods. Assuming we obtain sufficient funding to increase our production capacity, any projects that we undertake to increase such capacity may not be constructed on the anticipated timetable or within budget. We may also experience quality control issues as we implement these production upgrades. Any material delay in completing these projects, or any substantial increase in costs or quality issues in connection with these projects, could materially delay our ability to bring our products to market and adversely affect our business, reduce our revenue, income and available cash, all of which could result in harming our financial condition.

Our business and operations are experiencing rapid growth. If we fail to effectively manage our growth, our business and operating results could be harmed.

We have experienced, and may continue to experience, rapid growth in our operations, which has placed, and may continue to place, significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, the quality of our products and services could suffer, which could negatively affect our operating results. To effectively manage this growth, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. These systems enhancements and improvements may require significant capital expenditures and management resources. Failure to implement these improvements could hurt our ability to manage our growth and our financial position.

If the Chinese government were to change its presently favorable policy toward the agriculture industry, we would no longer enjoy our present tax-related privileges, which would materially and adversely impact our sales performance, margins, and net profit and our costs structure.

As producers active in the agriculture industry, our subsidiaries are presently exempt from income tax and enjoy various incentive grants and subsidies given by the China Government. If the Chinese government were to change its presently favorable policy toward the agriculture industry, we would no longer enjoy our present tax-related privileges, which would materially and adversely impact our sales performance, margins, and net profit and our costs structure. We have experienced, and may continue to experience, quick changes of policies by the Chinese government. If we do not effectively and efficiently manage our growth on time due to lack of capital, we could suffer adversely from the consequences of any such policy changes.

Our intellectual property rights are valuable, and any inability to adequately protect, or uncertainty regarding validity, enforceability or scope of them could undermine our competitive position and reduce the value of our products, services and brand, and litigation to protect our intellectual property rights may be costly.

We attempt to strengthen and differentiate our product portfolio by developing new and innovative products and product improvements. As a result, our patents, trademarks, trade secrets, copyrights and other intellectual property rights are important assets to us. Various events outside of our control pose a threat to our intellectual property rights as well as to our products and services. For example, effective intellectual property protection may not be available in China and other countries in which our products are sold. Also, although we have registered our trademark in China, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete and adversely affect our results of operation. Also, protecting our intellectual property rights is costly and time consuming. Policing the unauthorized use of our proprietary technology can be difficult and expensive. Litigation might be necessary to protect our intellectual property rights. But due to the relative unpredictability of the Chinese legal system and potential difficulties of enforcing a court’s judgment in China, there is no guarantee that litigation would result in an outcome favorable to us. Furthermore, any such litigation may be costly and may divert our management’s attention away from our core business. An adverse determination in any lawsuit involving our intellectual property is likely to jeopardize our business prospects and reputation. Although currently we are not aware of any of such litigation, we have no insurance coverage against the litigation costs so we would be forced to bear all litigation costs if we cannot recover them from other parties in the future. All of the foregoing factors could harm our business, financial condition and results of operations. Any increase in the unauthorized use of our intellectual property in the future could make it more expensive for us to do business and harm our operating results.

We may be exposed to infringement or misappropriation claims by third parties, which, if determined adversely against us, could adversely affect our business and subject us to significant liability to third parties.

Our success mainly depends on our ability to use and develop our technology and product designs without infringing upon the intellectual property rights of third parties. We may be subject to litigation involving claims of patent infringement or violations of other intellectual property rights of third parties. The holders of patents and other intellectual property rights potentially relevant to our product offerings may be unknown to us, which may make it difficult for us to acquire a license on commercially acceptable terms. There may also be technologies licensed to us and that we rely upon that are subject to infringement or other corresponding allegations or claims by third parties which may damage our ability to rely on such technologies. In addition, although we endeavor to ensure that companies that work with us possess appropriate intellectual property rights or licenses, we cannot fully avoid the risks of intellectual property rights infringement created by suppliers of components used in our products or by companies we work with in cooperative research and development activities. Our current or potential competitors may have obtained or may obtain patents that will prevent, limit or interfere with our ability to make, use or sell our products. The defense of intellectual property claims, including patent infringement suits, and related legal and administrative proceedings can be both costly and time consuming, and may significantly divert the efforts and resources of our technical personnel and management. These factors could effectively prevent us from pursuing some or all of our business operations and result in our customers or potential customers deferring, canceling or limiting their purchase or use of our products, which may have a material adverse effect on our business, financial condition and results of operations.

We rely on highly skilled personnel and the continuing efforts of our executive officers and, if we are unable to retain, motivate or hire qualified personnel, our business may be severely disrupted.

Our performance largely depends on the talents, knowledge, skills and know-how and efforts of highly skilled individuals and in particular, the expertise held by our chief executive officer, Solomon Lee. His absence, were it to occur, could impact the development and implementation of the projects and businesses. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly skilled personnel for all areas of our organization. Our continued ability to compete effectively depends on our ability to attract new technology developers and to retain and motivate our existing contractors. If one or more of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain new officers. In addition, if any of our executives joins a competitor or forms a competing company, we may lose some of our customers.

Our financial and operating performance may be adversely affected by epidemics, adverse weather conditions, natural disasters and other catastrophes.

Our financial and operating performance may be adversely affected by epidemics, adverse weather conditions, natural disasters and other catastrophes. For example, in early 2003, several economies in Asia, including China, were affected by the outbreak of severe acute respiratory syndrome, or SARS. During May and June of 2003, many businesses in China were closed by the PRC government to prevent transmission of SARS. Our business could be materially and adversely affected by the effects of H1N1 flu (swine flu), avian flu, severe acute respiratory syndrome or other epidemics or outbreaks. In April 2009, an outbreak of H1N1 flu first occurred in Mexico and quickly spread to other countries, including the U.S. and China. In the last decade, China has suffered health epidemics related to the outbreak of avian influenza and severe acute respiratory syndrome. Any prolonged occurrence or recurrence of H1N1 flu (swine flu), avian flu, SARS or other adverse public health developments in China may have a material adverse effect on our business and operations. These health epidemics could result in severe travel restrictions and closures that would restrict our ability to ship our products. Potential outbreaks could also lead to temporary closure of our manufacturing facilities, our suppliers’ facilities and/or our end-user customers’ facilities, leading to reduced production, delayed or cancelled orders, and decrease in demand for our products. Any future health epidemic or outbreaks that could disrupt our operations and/or restrict our shipping abilities may have a material adverse effect on our business and results of operations.

Insofar as we do not encounter any epidemic in our aquaculture fishery farms in districts of the Guangdong Province or cattle farms in Huangyuan District of the Qinghai Province, however in the event of epidemics, we expect that our marine animals and our cattle will be quarantined until such time as a sanitary certificate for clean bill of health will be obtained before any of our products will be sold. Alternatively, in an extreme situation where our products would fail to obtain the sanitary certificate, they will be destroyed subject to the direction of the Inspection Authorities of the Agriculture Department of China. There is compensation granted by the Chinese Government for the destruction of our products but only for a fraction of our cost of production; as such the Company will bear virtually all losses under such circumstances.

Furthermore, the 2008 Sichuan earthquake also had a negative impact on many businesses in the region. Losses caused by epidemics, adverse weather conditions, natural disasters and other catastrophes, including SARS, avian flu, swine flu, earthquakes or typhoons, will adversely affect our operations.

If we make any acquisitions, they may disrupt or have a negative impact on our business.

Although we have no present plans for any specific acquisitions, in the event that we make acquisitions, we could have difficulty integrating the acquired companies’ personnel and operations with our own. In addition, the key personnel of the acquired business may not be willing to work for us. We cannot predict the effect expansion may have on our core business. Regardless of whether we are successful in making an acquisition, the negotiations could disrupt our ongoing business, distract our management and employees and increase our expenses. In addition to the risks described above, acquisitions are accompanied by a number of inherent risks, including, without limitation, the following:

| • | the difficulty of integrating acquired products, services or operations; |

| • | the potential disruption of the ongoing businesses and distraction of our management and the management of acquired companies; |

| • | the difficulty of incorporating acquired rights or products into our existing business; |

| • | difficulties in disposing of the excess or idle facilities of an acquired company or business and expenses in maintaining such facilities; |

| • | difficulties in maintaining uniform standards, controls, procedures and policies; |

| • | the potential impairment of relationships with employees and customers as a result of any integration of new management personnel; |

| • | the potential inability or failure to achieve additional sales and enhance our customer base through cross-marketing of the products to new and existing customers; |

| • | the effect of any government regulations which relate to the business acquired; |

| • | potential unknown liabilities associated with acquired businesses or product lines, or the need to spend significant amounts to retool, reposition or modify the marketing and sales of acquired products or the defense of any litigation, whether or not successful, resulting from actions of the acquired company prior to our acquisition. |

Our business could be severely impaired if and to the extent that we are unable to succeed in addressing any of these risks or other problems encountered in connection with these acquisitions, many of which cannot be presently identified, these risks and problems could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our results of operations.

We face significant competition, including changes in pricing.

The markets for our products are both competitive and price sensitive. Many of our competitors have significant financial, operations, sales and marketing resources and experience in research and development and compete with us by offering lower prices. Competitors could develop new technologies that compete with our products on achieving a lower unit price. If a competitor develops superior technology or cost-effective alternatives to our products and services, our business could be seriously harmed as they may achieve a lower price for the same quality.

The markets for some of our products are also subject to specific competitive risks because these markets are highly price competitive. Our competitors have competed in the past by lowering prices on certain products. If they do so again, we may be forced to respond by lowering our prices. This would reduce sales revenues and increase losses. Failure to anticipate and respond to price competition may also impact sales and aggravate losses.

Many of our competitors are larger and have greater financial and other resources than we do.

Our products compete and will compete with similar if not identical products produced by our competitors. These competitive products could be marketed by well-established, successful companies that possess greater financial, marketing, distributional, personnel and other resources than we possess. Using these resources, these companies can implement extensive advertising and promotional campaigns, both generally and in response to specific marketing efforts by competitors, and enter into new markets more rapidly to introduce new products. In certain instances, competitors with greater financial resources also may be able to enter a market in direct competition with us, offering attractive marketing tools to encourage the sale of products that compete with our products or present cost features that consumers may find attractive.

Risks Related to our Industry

Our agricultural assets are situated in three provinces in China and crop disease, severe weather, natural disasters and other conditions affecting the environment, including the effects of climate change, could result in substantial losses and weaken our financial condition.

Our agricultural operations are situated in Qinghai Province, Hunan and Guangdong Province. Qinghai Province in particular is subject to occasional periods of drought. Crops require water in different quantities at different times during the growth cycle. The limited water resource at any given point can adversely impact production. In Qinghai our cropping and pasture land presently comprises over 5,000 acres, an area too big and too costly to afford drip irrigation systems for our crops. In Hunan, the district of Linli where we have over 300 acres of crop and pasture land may from time to time be subject to flooding that could affect our agriculture production. In Enping, Guangdong, our HU Plants are very susceptible to dry and wet seasonal variation that could also affect our agriculture production.

Crop disease, severe weather conditions, such as floods, droughts, windstorms and hurricanes, and natural disasters, may adversely affect our supply of one or more products, reduce our sales volumes, increase our unit production costs or prevent or impair our ability to ship products as planned. Since a significant portion of our costs are fixed and contracted in advance of each operating year, volume declines due to production interruptions or other factors could result in increases in unit production costs, which could result in substantial losses and weaken our financial condition. We may experience crop disease, insect infestation, severe weather and other adverse environmental conditions from time to time. Severe weather conditions may occur with higher frequency or may be less predictable in the future due to the effects of climate change.

An occurrence of such an event might result in material disruptions to our operations, to the operations of our customers or suppliers, resulting in a decline in the agriculture industry. There can be no assurance that our facilities or products will not be affected by any such occurrence in the future, which occurrence may lead to adverse conditions to our operations and financial results.

Prices of agricultural products are subject to supply and demand, a market condition of which is not predictable.

Because our agricultural products are commodities, we are not able to predict with certainty what price we will receive for our products. Additionally, the growth cycle of such products in many instances dictates when such products must be marketed to achieve the maximum profitability. Excessive supplies tend to cause severe price competition and lower prices throughout the industry affected. Conversely, shortages may drive the prices higher. Shortages often result from adverse growing conditions which can reduce the availability of the agricultural products affected. Since multiple variables can affect supply and demand, we cannot accurately predict or control from year to year what prices, either favorable or unfavorable, it will receive from the market.

In addition, general public perceptions regarding the quality, safety or health risks associated with particular food products could reduce demand and prices for some of our products. To the extent that consumer preferences evolve away from products that we produce for health or other reasons, and we are unable to modify our products or to develop products that satisfy new consumer preferences, there will be a decreased demand for our products. However, even if market prices are unfavorable, some of our agricultural products which are ready to be, or have been, harvested must be brought to market promptly. A decrease in the selling price received for our products due to the factors described above could have a material adverse effect on our business, results of operations and financial condition.

We could realize losses and suffer liquidity problems due to declines in sales prices for our agriculture products.

Sales prices for agricultural products are difficult to predict. It is possible that sales prices for our products will decline in the future, and sales prices for other agricultural products may also decline. In recent years, there has been increasing consolidation among food retailers, wholesalers and distributors. A significant portion of our costs is fixed, so that fluctuations in the sales prices have an immediate impact on our profitability. Our profitability is also affected by our production costs, which may increase due to factors beyond our control.

We are subject to the risk of product contamination and product liability claims.

The sales of our products may involve the risk of injury to consumers. Such injuries may result from tampering by unauthorized personnel, product contamination or spoilage, including the presence of foreign objects, substances, chemicals, or residues introduced during the growing, packing, storage, handling or transportation phases. While we are subject to governmental inspection and regulations and believe our facilities comply in all material respects with all applicable laws and regulations, including internal product safety policies, we cannot be sure that consumption of our products will not cause a health-related illness in the future or that we will not be subject to claims or lawsuits relating to such matters. Even if a product liability claim is unsuccessful, the negative publicity surrounding any assertion that our products caused illness or injury could adversely affect our reputation with existing and potential customers and our brand image. We do not maintain product liability insurance.

We may not be successful in the implementation of our new technologies and new products, and our new products may be not widely accepted.

Our new technologies such as our drip irrigation system for precision agriculture or the introduction, testing and promotion of new agricultural varieties, must be able to adapt to local conditions. The term “drip irrigation” refers to a system whereby the exact amount of water is supplied to the plants’ roots at the correct moment. On the one hand, there exists the failure risk due to not being suitable for the local environment and market conditions; on the other hand, there are risks of loss of competitive advantages due to the rising of producing similar products enterprises and other enterprises that follow to produce the similar products.

We are a holding company whose subsidiaries are given certain degree of independency and our failure to integrate our subsidiaries may adversely affect our financial condition.

According to the specific characteristics of agricultural production in China, we have given our subsidiary companies and their farms a certain degree of independency in decision-making. On one hand, this independency increases the sense of ownership at all levels, on the other hand it has also increased the difficulty of the integration of operation and management, which has resulted in increased difficulty of management integration. In the event we are not able to successfully manage our subsidiaries this will result in operating difficulties and have a negative impact on our business.

One or more of our distributors could engage in activities that are harmful to our brand and to our business.

Our products are sold primarily through distributors, and those distributors are responsible for ensuring that our products have the appropriate licenses to be sold to farmers in their provinces and be kept at the right temperature to be fresh and meet shelf life terms. If those distributors do not obtain the appropriate licenses, their sales of our products in those provinces may be illegal, and we may be subject to government sanctions, including confiscation of illegal revenues and a fine of between two and three times the amount of such illegal revenues. Unlicensed sales in a province may also cause a delay for our other distributors in receiving a license from the authorities for their provinces, which could further adversely impact our sales. In addition, distributors may sell our products under another brand licensed in a particular province if our product is not licensed there. If our products are sold under another brand, the purchasers will not be aware of our brand name, and we will be unable to cross-market other seed varieties or other products as effectively to these purchasers. Moreover, our ability to provide appropriate customer service to these purchasers will be negatively affected, and we may be unable to develop our local knowledge of the needs of these purchasers and their environment. Furthermore, if any of our distributors sell inferior seeds produced by other companies under our brand name, our brand and reputation could be harmed, which could make marketing of our branded seeds more difficult. As of the date of this prospectus, we are not aware of the occurrence of any of the potential violations by our distributors described above.

The PRC agricultural market is highly competitive and our growth and results of operations may be adversely affected if we are unable to compete effectively.

The agricultural market in China is highly fragmented, largely regional and highly competitive, and we expect competition to increase and intensify within the sector. We face significant competition in our lines of business. Many of our competitors have greater financial, research and development and other resources than we have. Competition may also develop from consolidation within our industry in China or the privatization of producers that are currently operated by local governments in China. Our competitors may be better positioned to take advantage of industry consolidation and acquisition opportunities than we are. The reform and restructuring of state-owned equity in enterprises involved primarily in producing sectors will likely lead to the reallocation of market share in the agriculture industry, and our competitors may increase their market share by participating in the restructuring of state-owned agriculture companies. Such privatization would likely result in increased numbers of market participants with more efficient and commercially viable business models. As competition intensifies, our margins may be compressed by more competitive pricing and we may lose our market share and experience a reduction in our revenues and profit.

We may not possess all of the licenses required to operate our business, or we may fail to maintain the licenses we currently hold. This could subject us to fines and other penalties, which could materially adversely affect our results of operations.

We are required to hold a variety of permits and licenses to conduct business in China. We may not possess all of the permits and licenses required for each of our business segments. In addition, the approvals, permits or licenses required by governmental agencies may change without substantial advance notice, and we could fail to obtain the approvals, permits or licenses required to expand our business. If we fail to obtain or to maintain such permits or licenses, or if renewals are granted with onerous conditions, we could be subject to fines and other penalties and be limited in the number or the quality of the products that we could offer. As a result, our business, results of operations and financial condition could be materially and adversely affected.

Risks Related to Doing Business in China

Under PRC law, we are required to obtain and retain permits and business licenses, and our failure to do so would adversely impact our ability to conduct business in China.

We hold various permits, business licenses, and approvals authorizing our operations and activities, which are subject to periodic review and reassessment by the Chinese authorities. Standards of compliance necessary to pass such reviews change from time to time and differ from jurisdiction to jurisdiction, leading to a degree of uncertainty. If renewals, or new permits, business licenses or approvals required in connection with existing or new facilities or activities, are not granted or are delayed, or if existing permits, business licenses or approvals are revoked or substantially modified, we may not be able to continue to operate our facilities which would have a material adverse effect on our operations. If new standards are applied to renewals or new applications, it could prove costly for us to meet these new standards.

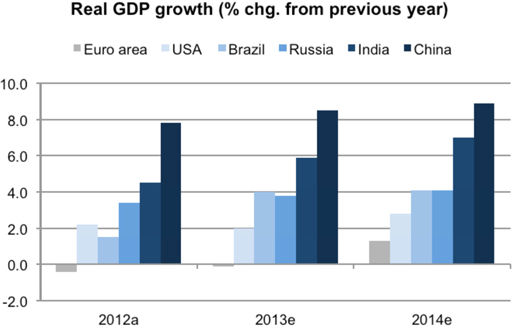

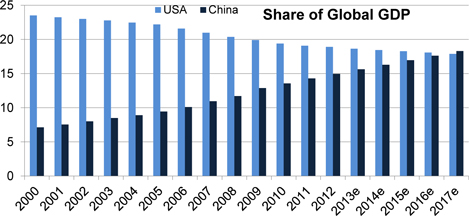

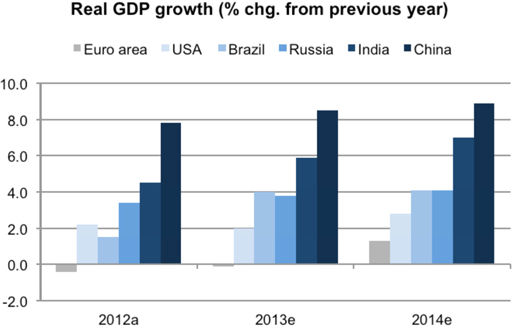

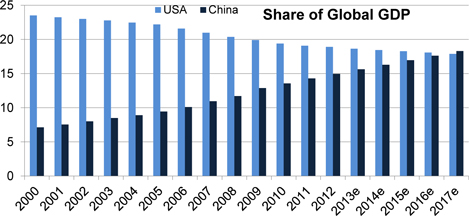

The PRC economic cycle may negatively impact our operating results.

We believe that the rapid growth of the PRC economy before 2008 generally led to higher levels of inflation. We believe that the PRC economy has more recently experienced a decrease in its growth rate. We believe that a number of factors have contributed to this deceleration, including appreciation of the RMB, the currency of China, which has adversely affected China’s exports. In addition, we believe the deceleration has been exacerbated by the recent global crisis in the financial services and credit markets, which has resulted in significant volatility and dislocation in the global capital markets. It is uncertain how long the global crisis in the financial services and credit markets will continue and the significance of the adverse impact it may have on the global economy in general or the Chinese economy in particular. Slowing economic growth in China could result in weakening growth and demand for our products which could reduce our revenues and income. In the event of a recovery in the PRC, renewed high growth levels may again lead to inflation. The government’s attempts to control inflation may adversely affect the business climate and growth of private enterprise. In addition, our profitability may be adversely affected if prices for our products rise at a rate that is insufficient to compensate for the rise in inflation.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert Chinese Renminbi, or RMB, into foreign currencies and, if the RMB were to decline in value, reducing our revenue in U.S. dollar terms.

The exchange rate of the RMB is currently managed by the Chinese government. On July 21, 2005, the People's Bank of China, or the People's Bank, with the authorization of the State Council of the PRC, announced that the RMB exchange rate would no longer be pegged to the U.S. Dollar and would float based on market supply and demand with reference to a basket of currencies. According to public reports, the governor of the People's Bank has stated that the basket is composed mainly of the U.S. Dollar, the European Union Euro, the Japanese Yen and the South Korean Won. Also considered, but playing smaller roles, are the currencies of Singapore, the United Kingdom, Malaysia, Russia, Australia, Canada and Thailand. The weight of each currency within the basket has not been announced.

The initial adjustment of the RMB exchange rate was an approximate 2% revaluation from an exchange rate of 8.28 RMB per U.S. Dollar to 8.11 RMB per U.S. Dollar. The People's Bank also announced that the daily trading price of the U.S. Dollar against the RMB in the inter-bank foreign exchange market would be allowed to float within a band of 0.3% around the central parity published by the People's Bank, while the trading prices of the non-U.S. Dollar currencies against the RMB would be allowed to move within a certain band announced by the People's Bank. The People's Bank has stated that it will make adjustments of the RMB exchange rate band when necessary according to market developments as well as the economic and financial situation. In a later announcement published on May 18, 2007, the band was extended to 0.5%. Since July 2008, the RMB has traded at 6.83 RMB per U.S. Dollar. Recent reports indicate an upward revaluation in the value of the RMB against the U.S. Dollar may be allowed. The People's Bank announced on June 19, 2010 its intention to allow the RMB to move more freely against the basket of currencies, which increases the possibility of sharp fluctuations in the value of the RMB in the near future and thus the unpredictability associated with the RMB exchange rate.

Despite this change in its exchange rate regime, the Chinese government continues to manage the valuation of the RMB. The value of our common stock will be indirectly affected by the foreign exchange rate between the U.S. dollar and the RMB. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars, as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

The income statements of our operations are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currencies denominated transactions results in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions results in increased revenue, operating expenses and net income for our international operations. We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries into U.S. dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into U.S. dollars will lead to a translation gain or loss, which is recorded as a component of other comprehensive income. In addition, we have certain assets and liabilities that are denominated in currencies other than the relevant entity’s functional currency. Changes in the functional currency value of these assets and liabilities create fluctuations that will lead to a transaction gain or loss.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Uncertainties with respect to the PRC legal system could adversely affect us and we may have limited legal recourse under PRC law if disputes arise under our contracts with third parties.

Since 1979, we believe PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, sometimes we may not be aware of our violation of these policies and rules until sometime after violation.

The Chinese government has enacted some laws and regulations dealing with matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, their experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes is unpredictable. The resolution of these matters may be subject to the exercise of considerable discretion by agencies of the Chinese government, and forces unrelated to the legal merits of a particular matter or dispute may influence their determination. Any rights we may have to specific performance, or to seek an injunction under PRC law, in either of these cases, are severely limited, and without a means of recourse by virtue of the Chinese legal system, we may be unable to prevent these situations from occurring. The occurrence of any such events could have a material adverse effect on our business, financial condition and results of operations.

Under the PRC EIT Law, we may be classified as a “resident enterprise” of the PRC. Such classification could result in tax consequences to us and our non-PRC resident shareholders.

On March 16, 2007, the National People’s Congress approved and promulgated a new tax law, the PRC Enterprise Income Tax Law, or “EIT Law,” which took effect on January 1, 2008. Under the EIT Law, enterprises are classified as resident enterprises and non-resident enterprises. An enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define “de facto management bodies” as a managing body that in practice exercises “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise; however, it remains unclear whether the PRC tax authorities would deem our managing body as being located within China. Due to the short history of the EIT Law and lack of applicable legal precedents, the PRC tax authorities determine the PRC tax resident treatment of a foreign company on a case-by-case basis.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of PRC tax consequences could follow. First, we could be subject to the enterprise income tax at a rate of 25 percent on our worldwide taxable income, as well as PRC enterprise income tax reporting obligations. Second, under the EIT Law and its implementing rules, dividends paid between “qualified resident enterprises” are exempt from enterprise income tax. As a result, if we are treated as a PRC “qualified resident enterprise,” all dividends paid from our Chinese subsidiaries to us would be exempt from PRC tax.

Finally, the new “resident enterprise” classification could result in a situation in which a 10% PRC tax is imposed on dividends we pay to our non-PRC stockholders that are not PRC tax “resident enterprises” and gains derived by hem from transferring our common stock, if such income is considered PRC-sourced income by the relevant PRC authorities. In such event, we may be required to withhold a 10% PRC tax on any dividends paid to non-PRC resident stockholders. Our non-PRC resident stockholders also may be responsible for paying PRC tax at a rate of 10% on any gain realized from the sale or transfer of our common stock in certain circumstances. We would not, however, have an obligation to withhold PRC tax with respect to such gain.

Moreover, the State Administration of Taxation (“SAT”) released Circular Guoshuihan No. 698 (“Circular 698”) on December 15, 2009 that reinforces the taxation of non-listed equity transfers by non-resident enterprises through overseas holding vehicles. Circular 698 addresses indirect share transfers as well as other issues. Circular 698 is retroactively effective from January 1, 2008. According to Circular 698, where a foreigner (non-PRC resident) who indirectly holds shares in a PRC resident enterprise through a non-PRC offshore holding company indirectly transfers equity interests in a PRC resident enterprise by selling the shares of the offshore holding company, and the latter is located in a country or jurisdiction where the effective tax burden is less than 12.5 percent or where the offshore income of his, her, or its residents is not taxable, the foreign investor is required to provide the PRC tax authority in charge of that PRC resident enterprise with certain relevant information within 30 days of the transfer. The tax authorities in charge will evaluate the offshore transaction for tax purposes. In the event that the tax authorities determine that such transfer is abusing forms of business organization and a reasonable commercial purpose for the offshore holding company other than the avoidance of PRC income tax liability is lacking, the PRC tax authorities will have the power to re-assess the nature of the equity transfer under the doctrine of substance over form. A reasonable commercial purpose may be established when the overall international (including U.S.) offshore structure is set up to comply with the requirements of supervising authorities of international (including U.S.) capital markets. If the SAT’s challenge of a transfer is successful, it may deny the existence of the offshore holding company that is used for tax planning purposes and subject the seller to PRC tax on the capital gain from such transfer. Since Circular 698 has a relatively short history, there is uncertainty as to its application. We (or a foreign investor) may become at risk of being taxed under Circular 698 and may be required to expend valuable resources to comply with Circular 698 or to establish that we (or such foreign investor) should not be taxed under Circular 698, which could have a material adverse effect on our financial condition and results of operations (or such foreign investor’s investment in us).

If any such PRC taxes apply, a non-PRC resident stockholder may be entitled to a reduced rate of PRC taxes under an applicable income tax treaty and/or a foreign tax credit against such stockholder’s domestic income tax liability (subject to applicable conditions and limitations). Prospective investors are encouraged to consult with their own tax advisors regarding the applicability of any such taxes, the effects of any applicable income tax treaties, and any available foreign tax credits.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may materially adversely affect us.

In October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents inside China, generally referred to as Circular 75. The policy announced in this notice required PRC residents to register with the relevant SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China on the strength of domestic PRC assets originally held by those residents. Failure to comply with the requirements of Circular 75 and any of its internal implementing guidelines as applied by SAFE in accordance with Notice 106 may result in fines and other penalties under PRC laws for evasion of applicable foreign exchange restrictions. Any such failure could also result in the SPV’s affiliates being impeded or prevented from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV, or from engaging in other transfers of funds into or out of China.

We have requested our shareholders who are PRC residents to make the necessary applications, filings and amendments as required under Circular 75 and other related rules. We attempt to comply, and attempt to ensure that our shareholders who are subject to these rules comply, with the relevant requirements. However, we cannot provide any assurances that our shareholders who are PRC residents will comply with our request to make any applicable registrations, and nor can we provide any assurances that our shareholders who are PRC residents will be able to obtain such applicable registration or comply with other requirements required by Circular 75 or other related rules or that, if challenged by government agencies, the structure of our organization fully complies with all applicable registrations or approvals required by Circular 75. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. A failure by such PRC resident shareholders or future PRC resident shareholders to comply with Circular 75 or other related rules, if SAFE requires it, could subject these PRC resident shareholders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

Adverse changes in political and economic policies of the Chinese government could have a material adverse effect on the overall economic growth of China, which could reduce the demand for our products and materially and adversely affect our competitive position.

Our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The Chinese economy differs from the economies of most developed countries in many respects, including:

| • | the amount of government involvement; |

| • | the level of development; |

| • | the control of foreign exchange; and |

| • | the allocation of resources. |

While the Chinese economy has grown significantly in the past 20 years, we believe the growth has been uneven, both geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. We believe some of these measures benefit the overall Chinese economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us.

The Chinese economy has been transitioning from a planned economy to a more market-oriented economy. Although in recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of the productive assets in China is still owned by the Chinese government. The Chinese government also exercises significant control over Chinese economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies.

Contract drafting, interpretation and enforcement in China involve significant uncertainty.