Filed Pursuant to Rule 424(b)(5)

Registration Nos. 333-166079

and 333-166079-01 through 333-166079-21

CALCULATION OF REGISTRATION FEE

| | Title of each class of securities to be registered | | Amount to be registered | | Proposed maximum offering price per security | | Proposed maximum aggregate offering price | | Amount of registration fee(1) | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 6.875% Senior Notes due 2018 | $800,000,000 | 100% | $800,000,000 | $57,040 | |||||||||||||||

| 7.125% Senior Notes due 2020 | $800,000,000 | 100% | $800,000,000 | $57,040 | |||||||||||||||

| Guarantees of 6.875% Senior Notes due 2018(2) | — | — | — | — | |||||||||||||||

| Guarantees of 7.125% Senior Notes due 2020(2) | — | — | — | — | |||||||||||||||

| Total | $1,600,000,000 | — | $1,600,000,000 | $114,080(3) | |||||||||||||||

- (1)

- Calculated in accordance with Rule 457(r) under the Securities Act of 1933, as amended (the "Securities Act"), and relates to the Registration Statement on Form S-3 (File Nos. 333-166079 and 333-166079-01 through 333-166079-21) filed by the registrants. Calculated as the product of the proposed maximum aggregate offering price and 0.00007130.

- (2)

- Pursuant to Rule 457(n) under the Securities Act, no separate registration fee is payable in respect of the registration of the guarantees.

- (3)

- Pursuant to Rule 457(p) under the Securities Act, the registrants hereby offset the registration fee required in connection with this offering of securities by $94,900.57, representing the amount of the registration fee associated with the Registration Statement on Form S-4 (File No. 333-157462) filed with the Securities and Exchange Commission by CF Industries Holdings, Inc. on February 23, 2009, which was withdrawn. Accordingly, a registration fee of $19,179.43 is being paid in connection with this offering of securities.

1

| PROSPECTUS SUPPLEMENT (To Prospectus dated April 15, 2010) |

$1,600,000,000

![]()

CF Industries, Inc.

$800,000,000 6.875% SENIOR NOTES DUE 2018

$800,000,000 7.125% SENIOR NOTES DUE 2020

fully and unconditionally guaranteed by

CF Industries Holdings, Inc.

and certain subsidiaries of CF Industries Holdings, Inc.

Interest payable on May 1 and November 1

CF Industries, Inc., a wholly-owned subsidiary of CF Industries Holdings, Inc., is offering 6.875% Senior Notes due 2018, or the 2018 notes, and 7.125% Senior Notes due 2020, or the 2020 notes. The 2018 notes will mature on May 1, 2018, and the 2020 notes will mature on May 1, 2020. Both series of notes offered hereby are referred to in this prospectus supplement collectively as the notes.

The issuer may redeem the notes, in whole at any time or in part from time to time, at a make-whole price calculated as described in this prospectus supplement, plus accrued and unpaid interest, if any, to, but not including, the applicable date of redemption. If we experience a change of control repurchase event with respect to a series of notes, as described in this prospectus supplement, unless the issuer has exercised its right to redeem those notes, the issuer will be required to offer to repurchase those notes from holders at the price described in this prospectus supplement.

The notes will be guaranteed by CF Industries Holdings, Inc. and each of CF Industries Holdings, Inc.'s current and future subsidiaries other than the issuer that from time to time is a borrower or guarantor under specified credit facilities of ours. The notes will be unsecured obligations of the issuer, ranking senior in right of payment to all of the issuer's future debt that is subordinated in right of payment to the notes and ranking equally in right of payment with all of the issuer's existing and future debt that is not subordinated in right of payment to the notes. Each guarantor's guarantee of the notes will be an unsecured obligation of that guarantor, ranking senior in right of payment to all of that guarantor's future debt that is subordinated in right of payment to that guarantee and ranking equally in right of payment with all of that guarantor's existing and future debt that is not subordinated in right of payment to that guarantee. The notes will be effectively junior to all liabilities of CF Industries Holdings, Inc.'s subsidiaries other than the issuer that are not guarantors of the notes and all secured debt of CF Industries Holdings, Inc. and its subsidiaries (including the issuer and subsidiaries of CF Industries Holdings, Inc. that guarantee the notes) to the extent of the value of the collateral securing that debt.

For a more detailed description of the notes, see "Description of the Notes" beginning on page S-88.

The notes are a new issue of securities for which there currently is no market. We do not intend to apply for listing of the notes on any national securities exchange.

Investing in the notes involves risks. See "Risk Factors" beginning on page S-24 of this prospectus supplement.

| | Per 2018 Note | Total | Per 2020 Note | Total | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Public offering price(1) | 100.000 | % | $ | 800,000,000 | 100.000 | % | $ | 800,000,000 | |||||

| Underwriting discount | 2.750 | % | $ | 22,000,000 | 2.750 | % | $ | 22,000,000 | |||||

| Proceeds, before expenses, to the issuer | 97.250 | % | $ | 778,000,000 | 97.250 | % | $ | 778,000,000 | |||||

- (1)

- Plus accrued interest, if any, from April 23, 2010.

The underwriters are offering the notes as set forth under "Underwriting (Conflicts of Interest)."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Morgan Stanley & Co. Incorporated expects to deliver the notes to purchasers on or about April 23, 2010.

Sole Book-Running Manager

MORGAN STANLEY

Senior Co-Manager

MITSUBISHI UFJ SECURITIES

| BMO Capital Markets | Natixis Bleichroeder LLC | Wells Fargo Securities |

April 20, 2010

| Prospectus Supplement | ||||

|---|---|---|---|---|

| | Page | |||

About This Prospectus Supplement | S-ii | |||

Market and Industry Data and Forecasts | S-ii | |||

Summary | S-1 | |||

Risk Factors | S-24 | |||

Forward-Looking Statements | S-45 | |||

Use of Proceeds | S-47 | |||

Capitalization | S-48 | |||

Selected Historical Consolidated Financial Data of CF Industries | S-51 | |||

Selected Historical Consolidated Financial Data of Terra | S-54 | |||

Unaudited Pro Forma Condensed Combined Consolidated Financial Statements | S-56 | |||

Overview of Financial Condition, Liquidity and Capital Resources | S-71 | |||

Industry Overview | S-74 | |||

Management | S-78 | |||

Description of Certain Other Indebtedness | S-82 | |||

Description of the Notes | S-88 | |||

Material U.S. Federal Income Tax Considerations to Non-U.S. Holders | S-112 | |||

Underwriting (Conflicts of Interest) | S-115 | |||

Legal Matters | S-120 | |||

Experts | S-120 | |||

Where You Can Find More Information | S-120 | |||

| Prospectus | ||||

| | Page | |||

Certain Terms Used in This Prospectus | i | |||

About This Prospectus | ii | |||

About Us | 1 | |||

Risk Factors | 1 | |||

Forward-Looking Statements | 2 | |||

Use of Proceeds | 3 | |||

Ratio of Earnings to Fixed Charges | 3 | |||

Description of Debt Securities | 4 | |||

Description of Guarantees of Debt Securities | 7 | |||

Plan of Distribution | 7 | |||

Legal Matters | 7 | |||

Experts | 8 | |||

Where You Can Find More Information | 8 | |||

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any related free writing prospectus issued by us. We have not authorized anyone to provide you with different information. We are not making an offer to sell or soliciting an offer to purchase these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus and any related free writing prospectus issued by us or any document incorporated by reference is accurate as of any date other than the date on the front cover of the applicable document. Neither the delivery of this prospectus supplement or the accompanying prospectus or other offering material (including any free writing prospectus) nor any distribution of securities pursuant to such documents shall, under any circumstances, create any implication that there has been no change in the information set forth in this prospectus supplement or the accompanying prospectus or other offering material or in our and our subsidiaries' affairs since the date of this prospectus supplement or the accompanying prospectus or other offering material.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of notes of CF Industries, Inc., referred to in this prospectus supplement as CFI or the issuer, and guarantees thereof by CF Industries Holdings, Inc., referred to in this prospectus supplement as CF Holdings, and certain subsidiaries of CF Holdings, and certain other matters relating to us and our business, financial condition and results of operations. The second part, the accompanying prospectus, contains more general information about debt securities the issuer may offer from time to time, some of which does not apply to this offering.

This prospectus supplement and the accompanying prospectus also incorporate by reference important information about us, Terra Industries Inc. and other information you should know before investing. You should read both this prospectus supplement and the accompanying prospectus as well as additional information described under "Where You Can Find More Information" in this prospectus supplement.

The information contained in this prospectus supplement may add, update or change information contained in the accompanying prospectus or in documents which we file or have filed with the Securities and Exchange Commission, or SEC, on or before the date of this prospectus supplement and which documents are incorporated by reference in this prospectus supplement and the accompanying prospectus. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or such documents incorporated by reference, the information in this prospectus supplement will supersede such information.

The distribution of this prospectus supplement and the accompanying prospectus and the offering of the notes and the guarantees in certain jurisdictions may be restricted by law. Persons into whose possession this prospectus supplement and the accompanying prospectus come should inform themselves about and observe any such restrictions. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation. See "Underwriting (Conflicts of Interest)."

We are also offering approximately $1.15 billion of CF Holdings common stock concurrently with this offering of notes. This offering of CF Holdings common stock, referred to in this prospectus supplement as the CF Holdings common stock offering, is being conducted pursuant to a separate prospectus supplement and registration statement. This prospectus supplement shall not be deemed an offer to sell or a solicitation of an offer to buy any of the CF Holdings common stock. There can be no assurance that the CF Holdings common stock offering can be consummated on terms acceptable to us or at all or that, if consummated, it will be for the amount contemplated. This offering of notes is not conditioned on the consummation of the CF Holdings common stock offering.

All references to dollars, or $, in this prospectus supplement refer to U.S. dollars, unless otherwise indicated.

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus supplement includes market share and industry data and forecasts that we have developed from independent consultant reports, reports from government agencies, publicly available information, various industry publications, other published industry sources and our internal data and estimates. Our internal data, estimates and forecasts are based upon information obtained from our customers, suppliers, trade and business organizations and other contacts in the markets in which we operate and our management's understanding of industry conditions. Some of the sources from which we have obtained information are FERTECON Fertilizer Economic Market Analysis & Consultancy, or

S-ii

Fertecon; the International Fertilizer Industry Association, or IFA; The Fertilizer Institute; the United States Department of Agriculture, or USDA; the Association of American Plant Food Control Officials; and the Organisation for Economic Co-operation and Development and the Food and Agriculture Organisation of the United Nations, or OECD-FAO. Although we believe all of our sources are reliable, the information relied on and referred to in this prospectus supplement has not been verified by any independent sources, and we do not guarantee the accuracy and completeness of such information.

Unless otherwise indicated, all financial information and operating data in this prospectus supplement pertaining to CF Holdings and its subsidiaries, including tons of product produced and sold, include information for Canadian Fertilizers Limited, our consolidated Canadian joint venture in which we own a 66% economic interest; and all such information and data pertaining to Terra Industries Inc. and its subsidiaries, including tons of product produced and sold, include information for Terra Nitrogen Company, L.P., a publicly-traded limited partnership of which we are the sole general partner and hold 75% of the limited partnership interests.

S-iii

This summary highlights certain information contained elsewhere or incorporated by reference in this prospectus supplement. Because this is only a summary, it does not contain all the information that may be important to you. You should read the entire prospectus supplement and the accompanying prospectus and the documents incorporated herein and therein by reference, including the financial statements included elsewhere or incorporated by reference in the prospectus supplement and the accompanying prospectus. You should also carefully consider the matters discussed under "Risk Factors."

The acquisition by CF Industries Holdings, Inc. of Terra Industries Inc. and its subsidiaries is referred to in this prospectus supplement as the Terra acquisition. As used in this prospectus supplement, the term "Terra" refers to Terra Industries Inc. and its subsidiaries; except as stated otherwise or the context requires otherwise, the terms "CF Industries," "we," "us" and "our" refer to CF Industries Holdings, Inc. and its subsidiaries, excluding Terra for periods prior to completion of the Terra acquisition and including Terra for periods following completion of the Terra acquisition; the terms "issuer" and "CFI" refer to CF Industries, Inc., the issuer of the notes, and not any of its subsidiaries; and the term "CF Holdings" refers to CF Industries Holdings, Inc. and not any of its subsidiaries.

We are one of the largest manufacturers and distributors of nitrogen and phosphate fertilizer products in the world. Our operations are organized into two business segments—the nitrogen segment and the phosphate segment. Our principal products in the nitrogen segment are ammonia, urea, urea ammonium nitrate solution, or UAN, and ammonium nitrate, or AN. Our other nitrogen products include diesel exhaust fluid, or DEF, and aqua ammonia, which are sold primarily to our environmental and industrial customers. Our principal products in the phosphate segment are diammonium phosphate, or DAP, and monoammonium phosphate, or MAP.

Our core market and distribution facilities are concentrated in the Midwestern U.S. grain-producing states and other major agricultural areas of the United States and Canada. We also serve global markets from our joint-venture production facilities in Trinidad and the United Kingdom, as well as through exports of nitrogen fertilizer products from our Donaldsonville manufacturing facilities and phosphate fertilizer products from our Florida phosphate operations through our Tampa port facility.

The principal customers for both our nitrogen and phosphate fertilizers are cooperatives and independent fertilizer distributors. Sales are initiated by our internal marketing and sales force and some export sales are initiated by KEYTRADE AG, or Keytrade, a global fertilizer trading company in which we own a 50% interest.

For the year ended December 31, 2009, on a pro forma basis giving effect to the Terra acquisition, we sold 11.8 million tons of nitrogen fertilizers and related products and 2.1 million tons of phosphate fertilizers and generated net sales of $4.2 billion.

Prior to the Terra acquisition, our principal assets included:

- •

- the largest nitrogen fertilizer complex in North America, located in Donaldsonville, Louisiana and referred to in this prospectus supplement as the CF Industries Donaldsonville facility;

- •

- a 66% economic interest in the largest nitrogen fertilizer complex in Canada, which we operate in Medicine Hat, Alberta, through Canadian Fertilizers Limited, or CFL (a consolidated variable interest entity);

- •

- one of the largest integrated phosphate fertilizer complexes in the United States, located in Plant City, Florida;

S-1

- •

- the most-recently constructed phosphate rock mine and associated beneficiation plant in the United States, located in Hardee County, Florida;

- •

- an extensive system of terminals, warehouses and associated transportation equipment located primarily in the Midwestern United States; and

- •

- a 50% interest in Keytrade, a global fertilizer trading company headquartered near Zurich, Switzerland.

As a result of the Terra acquisition, we acquired a number of new assets, including:

- •

- five nitrogen fertilizer manufacturing facilities located in Port Neal, Iowa; Courtright, Ontario; Yazoo City, Mississippi; Woodward, Oklahoma; and Donaldsonville, Louisiana, adjacent to the CF Industries Donaldsonville facility, referred to in this prospectus supplement as the Terra Donaldsonville facility;

- •

- a 75% interest in Terra Nitrogen Company, L.P., or TNCLP, a publicly traded limited partnership of which we are the sole general partner and the majority limited partner and which, through its subsidiary Terra Nitrogen, Limited Partnership, or TNLP, operates a nitrogen fertilizer manufacturing facility in Verdigris, Oklahoma;

- •

- a 50% interest in Point Lisas Nitrogen Limited, or Point Lisas, an ammonia production joint venture located in Trinidad serving international nitrogen markets; and

- •

- a 50% interest in GrowHow UK Limited, or GrowHow, a nitrogen products production joint venture located in the United Kingdom and serving the British agricultural and industrial markets.

The following table sets forth the production capacities at each of our nitrogen fertilizer production facilities:

| | Annual Capacity | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Location | Ammonia(1) | UAN(2) | AN | Urea(3) | Fertilizer Compounds | ||||||||||||

| | (thousands of tons) | ||||||||||||||||

Donaldsonville, Louisiana | |||||||||||||||||

CF Industries Donaldsonville facility(4) | 2,300 | 2,415 | — | 1,680 | — | ||||||||||||

Terra Donaldsonville facility | 500 | — | — | — | — | ||||||||||||

Medicine Hat, Alberta | 1,250 | — | — | 810 | — | ||||||||||||

Port Neal, Iowa | 370 | 735 | — | 60 | — | ||||||||||||

Verdigris, Oklahoma | 1,050 | 1,925 | — | — | — | ||||||||||||

Woodward, Oklahoma(5) | 440 | 298 | — | 25 | — | ||||||||||||

Yazoo City, Mississippi(6) | 500 | 525 | 775 | 20 | — | ||||||||||||

Courtright, Ontario | 480 | 350 | — | 175 | — | ||||||||||||

Ince, U.K.(7) | 201 | — | 343 | — | 340 | ||||||||||||

Billingham, U.K.(7) | 287 | — | 319 | — | — | ||||||||||||

Point Lisas, Trinidad(7) | 360 | — | — | — | — | ||||||||||||

Total | 7,738 | 6,248 | 1,437 | 2,770 | 340 | ||||||||||||

- (1)

- Represents gross annual production capacity, some of which is used to produce upgraded products.

- (2)

- Measured in tons of UAN containing 32% nitrogen by weight.

- (3)

- Urea is sold as granular urea from the CF Industries Donaldsonville facility and Medicine Hat facility, as urea liquor from the Port Neal, Woodward and Yazoo City facilities and as either granular urea or urea liquor from the Courtright facility.

S-2

- (4)

- The CF Industries Donaldsonville facility's production capacity depends on product mix. With the UAN plants operating at capacity, approximately 1.7 million tons of granular urea can be produced. Granular urea production can be increased to 2 million tons if UAN production is reduced.

- (5)

- The Woodward facility's production capacity depends on product mix (ammonia/methanol). The Woodward facility's UAN capacity does not include the effects of the upgrade project scheduled for completion in 2010. UAN capacity is expected to increase to 798,000 tons when the project is completed.

- (6)

- Our full AN capacity at Yazoo City is approximately 835,000 tons; however, such production would limit Yazoo City's UAN production to approximately 450,000 tons and increase urea production to approximately 45,000 tons.

- (7)

- Represents our 50% interest in capacity of each of these facilities.

The following table sets forth the production capacities at each of our phosphate production facilities:

| | Annual Capacity | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Location | Phosphate Rock | Phosphoric Acid as P2O5(1) | Sulfuric Acid | DAP/MAP | |||||||||

| | (thousands of tons) | ||||||||||||

Hardee Phosphate Rock Mine | 3,500 | — | — | — | |||||||||

Plant City Phosphate Fertilizer Complex | — | 1,055 | 2,800 | 2,165 | |||||||||

- (1)

- P2O5 is the basic measure of the nutrient content in phosphate fertilizer products.

We believe that the Terra acquisition offers numerous strategic benefits, including:

- •

- making us a global leader in fertilizers;

- •

- significantly increasing our scale and capital markets presence;

- •

- providing cost synergies estimated at $105–$135 million on an annualized basis;

- •

- further diversifying our asset base and our mix of products and customers; and

- •

- increasing our geographic reach and operational efficiency.

We believe that these strategic benefits significantly enhance our competitive profile and will drive increased profitability.

S-3

- •

- Global Leader. We are a leading global producer of nitrogen and phosphate fertilizers with world-scale manufacturing facilities.

- –

- Second Largest Public Nitrogen Producer Globally. As a result of the Terra acquisition, we are the second largest producer of nitrogen fertilizers globally among publicly traded companies, with 13.5 million product tons of capacity. Our combined nitrogen manufacturing capacity on a nutrient basis is 6.3 million tons. We are the largest nitrogen producer in North America and the leading producer of our key products—ammonia, urea and UAN.

- –

- Large Integrated U.S. Phosphate Producer. We operate a 2.2 million product ton phosphate facility in Central Florida, where we have reliable and economical access to raw materials and access to domestic and international markets through our Tampa port facility. Our Hardee phosphate rock mine supplies all of our facility's phosphate rock needs and benefits from 23 years of recoverable reserves, 13 of which are fully permitted. Our Hardee facility is the most recently constructed mine and processing plant of its type in the United States.

- •

- Cost Advantages Serving Principal Markets. Many of our North American manufacturing facilities enjoy a cost advantage in their principal markets.

- –

- Over 50% of the U.S. supply of nitrogen fertilizer is from imports. Natural gas is the primary raw material used in the production of nitrogen fertilizer products, accounting for up to 90% of the cash cost of producing ammonia. The cost of natural gas in North America is lower than for export oriented nitrogen production in the Ukraine and Eastern Europe. Factoring in the cost of freight to transport nitrogen products to the United States, North American producers enjoy a significant cost advantage over producers in these countries and are competitive with the cost of exports from Russia, another significant exporting country.

- –

- In addition to the relative attractiveness of North American natural gas compared to the gas cost for some of the major exporters, our nitrogen facilities in Oklahoma, Iowa and Medicine Hat, Alberta enjoy a natural gas price basis that historically has been below the price at Henry Hub, the major gas pricing basis in North America.

- –

- The proximity of several of our production sites to the Midwestern Corn Belt provides us with a transportation cost advantage relative to imports and other domestic competitors. In addition, access to the major agricultural markets for ammonia from our Donaldsonville facilities through our strategically located ammonia terminals, which are served by barge and pipeline transportation, provides us with a cost advantage in certain markets.

- –

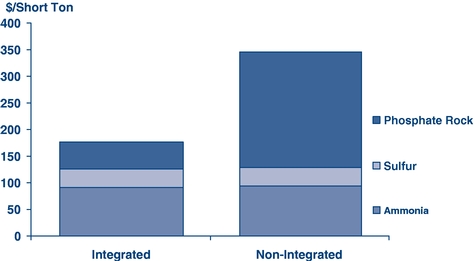

- Our Florida phosphate operation enjoys a cost advantage relative to non-integrated phosphate producers that do not have a captive supply of phosphate rock and smaller phosphate producers that do not realize the economies of scale available to a world-scale production facility such as our Plant City phosphate complex. As a result of our attractive costs for phosphate rock from our

We own the largest nitrogen fertilizer facility in North America and have a majority interest in the second largest nitrogen fertilizer facility in North America. The Donaldsonville complex, including the CF Industries and Terra Donaldsonville facilities, is the largest and, we believe, most versatile nitrogen fertilizer operation in North America. The Donaldsonville facilities have the capacity to produce 2.8 million tons of ammonia and upgrade most of their ammonia into higher value urea and UAN. These facilities are strategically located near the mouth of the Mississippi River, with access to river, rail and pipeline transportation and have the ability to import and export ammonia, urea and UAN. We operate and hold a two-thirds economic interest in the second-largest nitrogen facility in North America located in Medicine Hat, Alberta, which is the largest such facility in Canada.

S-4

- •

- Extensive, Flexible Distribution System. Our distribution system is ideally located in the area of highest fertilizer consumption in North America, the Corn Belt. We ship our products directly to customers from our manufacturing plants and through our extensive system of terminals and warehouses. Our distribution system includes 29 owned locations, of which 27 are in-market, in addition to the storage at our manufacturing plants and at more than 60 other locations. Our owned in-market locations house 20 ammonia terminals, 11 UAN terminals (including nine sites that accommodate both ammonia and UAN) and five dry product warehouses. These terminals and warehouses are located principally in the major fertilizer-consuming states, which typically account for 40% to 50% of the nitrogen and phosphate fertilizer used by commercial farmers in the United States. Storage at our Donaldsonville nitrogen facilities and its deep-water dock provide us with significant flexibility to import and export nitrogen products. We also own an ammonia terminal in Tampa, Florida, which is used primarily to import ammonia for use in the production of ammonium phosphate fertilizers at our Plant City, Florida facility.

- •

- Terra Environmental Technologies. Through Terra Environmental Technologies Inc., or TET, we have a leading position in supplying nitrogen products to the stationary and mobile emissions control markets.

- •

- Strong Management Team and Stable, Experienced Workforce. Our seasoned senior management team has a blend of related industry experience and extensive service with us. Our management team successfully transformed us from a cooperative to a public company in 2005. Following the Terra acquisition, our workforce consists of over 2,400 full-time and 100 part-time employees.

integrated Hardee mine and access to the highly competitive markets in Tampa for ammonia and sulfur, we believe our Plant City phosphate operations are very competitive with those of other large-scale, U.S. based integrated phosphate producers.

S-5

The Terra acquisition approximately doubled the size of CF Industries and provides us with a larger global platform, substantial synergy opportunities and broader access to capital. We intend to capitalize on this opportunity to create value for our stockholders by pursuing targeted strategies that generate growth and enhance profitability.

- •

- Integrate the Operations of CF Industries and Terra. We intend to integrate Terra's operations with those of CF Industries by executing a detailed integration plan over the next 24 months. By integrating the operations, processes and work forces of CF Industries and Terra, we will seek to position our combined enterprise to take advantage of our leadership position as the world's second largest nitrogen producer and the third largest phosphate producer among public companies.

- •

- Deliver Targeted Cost Synergies. We have identified substantial synergy value that we expect will generate $105-135 million in annual cost synergies, through headquarters consolidation, optimizing transportation and distribution networks and generating greater economies of scale in procurement and purchasing. We expect to realize these synergies within two years after the closing of the Terra acquisition at an expected one-time cost of $40-60 million. We also expect to achieve a one-time cash benefit of approximately $30-60 million from a reduced inventory requirement.

- •

- Realize Our Operational Potential. We intend to continue focusing on our core business of manufacturing and distributing fertilizer products to both agricultural and selected industrial and environmental customers. We will focus our marketing efforts on maximizing margins by assessing our mix of business and using tools such as our Forward Pricing Program, or FPP, to manage margins and associated risks. Flexibility in production points and an expanded array of distribution options resulting from the Terra acquisition provide us with more tools with which to optimize our marketing strategies. We will continue to pursue improvements in staffing, operating procedures and environmental, health and safety procedures to achieve the optimal return on our investment. We will also continue to invest selectively in upgrading and expanding existing operations.

- •

- Attain and Maintain an Optimal Capital Structure. We have a history of a conservative approach to capital structure and returning capital to stockholders. In the near-term, we are targeting a leverage range of 1.0-1.5x EBITDA, and believe that level is appropriate as a steady-state target debt level. This structure balances the value of having ready access to financial resources with the objective of minimizing the cost of capital. It also provides us with the financial strength to execute strategic initiatives.

- •

- Leverage Terra Environmental Technologies. Our position as a major urea producer complements TET's needs for additional urea feedstock for its DEF product line, which serves the rapidly growing mobile market. That synergy opportunity is expected to eliminate the need that Terra had for an approximately $200 million investment in urea capacity and replace it with more modest investments at our Donaldsonville and/or Medicine Hat facilities.

- •

- Pursue Global Strategic Opportunities. By successfully executing the strategies described above, we believe we will be positioned to exploit our global leadership through organic growth and/or acquisitions. Our strong position in North America and our partnership with Keytrade provide us with a base from which to expand and pursue global opportunities.

S-6

Terra Acquisition and Related Financing Transactions

On March 12, 2010, CF Holdings and Terra Industries Inc. entered into an agreement and plan of merger, referred to in this prospectus supplement as the merger agreement, providing for the Terra acquisition to be effected in two steps: (1) an exchange offer, completed on April 14, 2010, in which an indirect wholly-owned subsidiary of CF Holdings, or the acquisition subsidiary, offered to exchange 0.0953 shares of CF Holdings common stock and $37.15 in cash, referred to in this prospectus supplement as the merger consideration, for each outstanding share of Terra Industries Inc. common stock, followed by (2) the merger of the acquisition subsidiary into Terra Industries Inc., referred to in this prospectus supplement as the second-step merger, completed on April 15, 2010, with Terra Industries Inc. as the surviving corporation in the second-step merger. In the second-step merger, each outstanding share of Terra Industries Inc. common stock not acquired by the acquisition subsidiary in the exchange offer was extinguished in exchange for the merger consideration.

In the Terra acquisition, CF Holdings issued an aggregate of 9.5 million shares of its common stock and paid an aggregate of $3.7 billion in cash.

We estimate our cash requirements in connection with the Terra acquisition to be approximately $4.95 billion, consisting primarily of the cash consideration for the Terra Industries Inc. common stock and stock-based awards. This amount also includes a termination fee of $123 million, referred to in this prospectus supplement as the Yara termination fee, which we paid on behalf of Terra Industries Inc. in connection with the termination by Terra Industries Inc. of a separate agreement that it had made with Yara International ASA, or Yara, under which Terra Industries Inc. would have been acquired by Yara. It also includes $763.4 million on account of the redemption of the outstanding 7.75% senior notes due 2019 of Terra Industries Inc.'s subsidiary Terra Capital, Inc., or the Terra notes, in connection with the second-step merger, and estimated transaction costs, including fees and expenses relating to the exchange offer, the second-step merger and the financing arrangements.

The following table sets forth the sources and uses of funds in connection with the Terra acquisition. The table does not give effect to this offering of notes or the CF Holdings common stock offering.

| Source of Funds | Amount (in millions) | Use of Funds | Amount (in millions) | ||||||

|---|---|---|---|---|---|---|---|---|---|

Cash and cash equivalents | $ | 1,199.4 | Terra Industries Inc. equity | ||||||

Revolving credit facility(1) | — | purchased(4) | $ | 4,647.1 | |||||

Bridge facility(2) | 1,750.0 | Redemption of the | |||||||

Term loan facility(2) | 2,000.0 | Terra notes(5) | 763.4 | ||||||

CF Holdings common stock(3) | 882.1 | Estimated transaction costs(6) | 421.0 | ||||||

Total sources | $ | 5,831.5 | Total uses | $ | 5,831.5 | ||||

- (1)

- Consists of a five-year first lien senior secured revolving credit facility, referred to in this prospectus supplement as the revolving credit facility. The revolving credit facility initially provided for up to $300 million of borrowings outstanding at any time. On April 15, 2010, we and the lead arrangers agreed to increase the amount available under the revolving credit facility to $500 million. The revolving credit facility is to be used primarily for working capital requirements and for general corporate purposes, but up to $100 million of borrowings under the facility may be applied to the same purposes for which borrowings are permitted under the term loan facility and the bridge facility described below in footnote (2).

- (2)

- Consists of a five-year $2 billion (multiple draw) secured term loan facility before original issue discount, referred to in this prospectus supplement as the term loan facility, and a one-year $1.75 billion secured bridge facility, referred to in this prospectus supplement as the bridge facility. Borrowings under the term loan facility and the bridge facility were used to fund the cash portion of the consideration paid to Terra Industries Inc. stockholders pursuant to the exchange offer and the second-step merger, to pay transaction costs and to fund the redemption of the Terra notes.

S-7

- (3)

- Reflects the fair value of CF Holdings common stock issued to Terra Industries Inc. stockholders as a result of the Terra acquisition, calculated by using the closing price of CF Holdings common stock on the New York Stock Exchange, or NYSE, on April 1, 2010 multiplied by the estimated number of shares of CF Holdings stock issued to Terra Industries Inc. stockholders.

- (4)

- Based on the closing price of CF Holdings common stock on the NYSE on April 1, 2010, the estimated number of shares of Terra Industries Inc. acquired in the Terra acquisition and the cash consideration paid in the Terra acquisition.

- (5)

- Includes accrued interest and redemption premium in addition to $600 million principal amount payable upon the redemption of the Terra notes in connection with the second-step merger.

- (6)

- Includes original issue discount related to the credit facilities referred to in footnotes (1) and (2) above, consisting of original issue discount related to the term loan facility of $30 million based on pre-syndication assumptions (syndication of the credit facilities resulted in an actual amount of original issue discount of approximately $13 million); the Yara termination fee; financing fees; and advisory fees for CF Industries and Terra.

The Terra acquisition and related transactions, including the redemption of the Terra notes; the payment of the Yara termination fee; our entry into the revolving credit facility, the bridge facility and the term loan facility, referred to in this prospectus supplement collectively as the credit facilities; our borrowings under the credit facilities in connection with the Terra acquisition; and the payment of transaction costs with respect to the foregoing are referred to in this prospectus supplement collectively as the transactions.

Assuming the consummation of the CF Holdings common stock offering in an aggregate amount of $1.15 billion, and assuming that all of the net proceeds of this offering of notes will have been applied to repay outstanding borrowings under the bridge facility, borrowings under the bridge facility will be fully repaid and borrowings under the term loan facility will be reduced to approximately $1.07 billion. There can be no assurance that the CF Holdings common stock offering can be consummated on terms acceptable to us or at all or that, if consummated, it will be for the amount contemplated. This offering of notes is not conditioned on the consummation of the CF Holdings common stock offering.

S-8

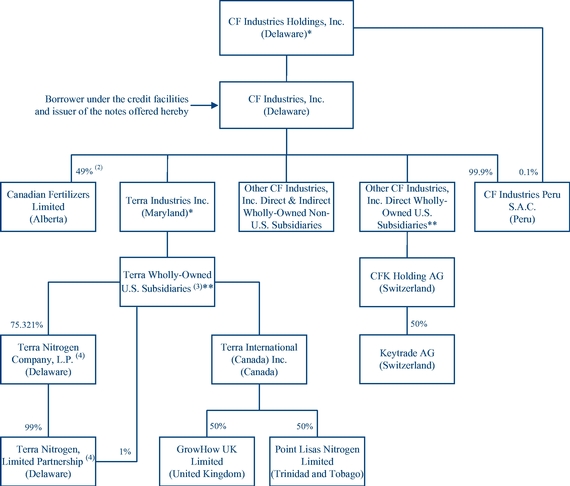

Summary Corporate Structure(1)

- *

- Guarantor of the notes and the issuer's borrowings under the revolving credit facility, the bridge facility and the term loan facility.

- **

- Guarantors of the notes and the issuer's borrowings under the revolving credit facility, the bridge facility and the term loan facility, subject to specified exceptions.

- (1)

- Jurisdiction of incorporation or organization shown in parentheses.

- (2)

- CF Industries, Inc. owns 49% of the voting common stock and 66% of the non-voting preferred stock of Canadian Fertilizers Limited. CF Industries, Inc. has a 66% economic interest in Canadian Fertilizers Limited pursuant to agreements to purchase approximately 66% of its facility's ammonia and urea production.

- (3)

- 16.65% of the units of Terra Industries Inc.'s indirect subsidiary Terra Investment Fund II LLC consist of preferred units held by third parties.

- (4)

- Separate $50.0 million revolving credit facility. See "Description of Certain Other Indebtedness—TNLP Facility."

S-9

Although our financial statements for the quarter ended March 31, 2010 are not yet complete, certain preliminary financial information and operating data underlying our results of operations are available. The following financial information and operating data is not a comprehensive statement of the financial results for CF Industries or Terra for the quarter ended March 31, 2010 and has not been reviewed or audited by CF Industries' and Terra's respective independent registered public accounting firms. The final financial results for the quarter ended March 31, 2010 may vary from our expectations and may be materially different from the preliminary financial information and operating data provided below as the quarterly financial statement close process is not complete and additional developments and adjustments may arise between now and the time the financial results for this period are finalized. Accordingly, you should not place undue reliance on the following financial information and operating data.

CF Industries

Management currently expects CF Industries' 2010 first quarter net sales to be approximately $502 million, or approximately 26% lower than CF Industries' 2009 first quarter net sales of $681 million. Sales volume in the first quarter of 2010 is expected to be 1.7 million tons, or a decline of 6% as compared to the 1.8 million tons sold in the first quarter of 2009. The decline in both net sales and sales volume is due to declines in both the nitrogen and phosphate segments.

Financial results for the first quarter of 2010 will be impacted by merger related costs, including the $123 million Yara termination fee that was paid on behalf of Terra Industries Inc., a $28 million gain on the sale of CF Holdings' investment in shares of Terra Industries Inc. common stock and fees for professionals and advisors relating to the Terra acquisition.

Nitrogen Segment

In the nitrogen segment, net sales are expected to be approximately $327 million, or 28% lower than the $456 million in the first quarter of 2009. Sales volume in the nitrogen segment is expected to decline by 5% to 1.2 million tons compared to the 1.3 million tons in the first quarter of 2009. Sales volume in the first quarter of 2010 declined as urea shipments fell, partially offset by increases in ammonia and UAN shipments. Pre-planting season sales volumes were impacted by cold and wet weather conditions in the first quarter. Average selling prices for all three nitrogen products are expected to be lower in the first quarter of 2010 compared to the first quarter of 2009, as the prior year period benefited from substantial sales volume that had been contracted under our FPP at earlier dates and higher prices. Average selling prices for all products in the first quarter of 2010 are expected to be higher than average selling prices in the fourth quarter of 2009. The weighted average cost of natural gas in the first quarter of 2010 declined by approximately 30% compared to the first quarter of 2009 from $7.33 per MMBtu in 2009 to $5.13 per

S-10

MMBtu in 2010. Set forth below is summary operating data for CF Industries' nitrogen segment based on management's current expectations for the quarters ended March 31, 2010 and 2009:

| | Three Months Ended March 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2010 v. 2009 | ||||||||

| | (in millions, except as noted) | ||||||||||

Net sales | $ | 327 | $ | 456 | $ | (129 | ) | ||||

Tons of product sold (000s) | 1,198 | 1,265 | (67 | ) | |||||||

Sales volume by product (000s) | |||||||||||

Ammonia | 189 | 133 | 56 | ||||||||

Urea | 598 | 733 | (135 | ) | |||||||

UAN(1) | 404 | 397 | 7 | ||||||||

Other nitrogen products | 7 | 2 | 5 | ||||||||

Average selling price per ton by product | |||||||||||

Ammonia | $ | 321 | $ | 527 | $ | (206 | ) | ||||

Urea | 306 | 365 | (59 | ) | |||||||

UAN(1) | 205 | 298 | (93 | ) | |||||||

Cost of natural gas (per MMBtu)(2) | |||||||||||

Donaldsonville | $ | 5.31 | $ | 8.09 | $ | (2.78 | ) | ||||

Medicine Hat | 4.70 | 5.99 | (1.29 | ) | |||||||

- (1)

- Measured in product tons.

- (2)

- Includes gas purchases and realized gains and losses on gas derivatives.

Phosphate Segment

In the phosphate segment, net sales are expected to be approximately $175 million, or 22% lower than the $224 million in the first quarter of 2009. Sales volumes in the phosphate segment are expected to have declined by 9% to 480,000 tons compared to 527,000 tons in the first quarter of 2009 as declines in DAP were only partially offset by increases in MAP shipments. Average selling prices for DAP and MAP are expected to be lower in the first quarter of 2010 versus the first quarter of 2009. Average selling prices in the first quarter of 2010 are expected to be higher than average selling prices in the fourth quarter of 2009. Set forth below is summary operating data for CF Industries' phosphate segment based on management's current expectations for the quarters ended March 31, 2010 and March 31, 2009:

| | Three Months Ended March 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2010 v. 2009 | ||||||||

| | (in millions, except as noted) | ||||||||||

Net sales | $ | 175 | $ | 224 | $ | (49 | ) | ||||

Tons of product sold (000s) | 480 | 527 | (47 | ) | |||||||

Sales volume by product (000s) | |||||||||||

DAP | 374 | 445 | (71 | ) | |||||||

MAP | 106 | 82 | 24 | ||||||||

Average selling price per ton by product | |||||||||||

DAP | $ | 361 | $ | 418 | $ | (57 | ) | ||||

MAP | 379 | 466 | (87 | ) | |||||||

Terra Industries

Management currently expects Terra's 2010 first quarter revenues to be approximately $409 million, approximately 3% lower than Terra's 2009 first quarter revenues of $420 million. This decline is primarily due to lower selling prices for ammonia, UAN and AN. The prior year first quarter selling price benefited from the orders that were previously committed to under higher prices during 2008. The decline in selling

S-11

prices was partially offset by an increase in UAN and AN sales volume of 34% and 76%, respectively. For the first quarter, natural gas unit costs, net of forward pricing gains and losses, decreased by approximately 27% from $7.37 per MMBtu in 2009 to $5.39 per MMBtu in 2010.

Set forth below is summary operating data for Terra based on management's current expectations for the quarters ended March 31, 2010 and 2009:

| | Three Months Ended March 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2010 v. 2009 | ||||||||

| | (in millions, except as noted) | ||||||||||

Total revenues | $ | 409 | $ | 420 | $ | (11 | ) | ||||

Tons of product sold (000s) | 1,589 | 1,251 | 338 | ||||||||

Sales volume by product (000s) | |||||||||||

Ammonia | 374 | 381 | (7 | ) | |||||||

Urea | 82 | 77 | 5 | ||||||||

UAN(1) | 837 | 625 | 212 | ||||||||

Other nitrogen products | 296 | 168 | 128 | ||||||||

Average selling price per ton by product(2) | |||||||||||

Ammonia | $ | 314 | $ | 336 | $ | (22 | ) | ||||

Urea | 325 | 322 | 3 | ||||||||

UAN(1) | 184 | 282 | (98 | ) | |||||||

Other nitrogen products | 193 | 267 | (74 | ) | |||||||

Cost of natural gas (per MMBtu)(3) | $ | 5.39 | $ | 7.37 | $ | (1.98 | ) | ||||

- (1)

- Measured in tons of UAN containing 32% nitrogen by weight.

- (2)

- After deducting outbound freight costs.

- (3)

- Includes all transportation and other logistical costs and any gains or losses on financial derivatives related to North American natural gas purchases.

CF Holdings is a Delaware corporation with principal executive offices at 4 Parkway North, Suite 400, Deerfield, Illinois 60015. The telephone number of CF Holdings' executive offices is (847) 405-2400. Our Internet website address ishttp://www.cfindustries.com. The content of our website is not incorporated by reference in this prospectus supplement, and you should not consider it a part of this prospectus supplement.

S-12

| Issuer | CF Industries, Inc. | |

Notes offered | $800,000,000 aggregate principal amount of 6.875% Senior Notes due 2018; | |

$800,000,000 aggregate principal amount of 7.125% Senior Notes due 2020. | ||

Maturity | 2018 Notes: May 1, 2018; | |

2020 Notes: May 1, 2020. | ||

Interest payment dates | Interest on the notes will accrue from April 23, 2010 and will be payable semiannually on May 1 and November 1 of each year, beginning on November 1, 2010. | |

Guarantees | The notes will be guaranteed by the issuer's parent, CF Holdings, and each of CF Holdings' current and future subsidiaries other than the issuer that from time to time is a borrower or guarantor under the term loan facility. See "Description of the Notes—The Note Guarantees." | |

Ranking | The notes will be unsecured obligations of the issuer, ranking senior in right of payment to all of the issuer's future debt that is subordinated in right of payment to the notes and ranking equally in right of payment with all of the issuer's existing and future debt that is not subordinated in right of payment to the notes. | |

Each guarantor's guarantee of the notes will be an unsecured obligation of that guarantor, ranking senior in right of payment to all of that guarantor's future debt that is subordinated in right of payment to that guarantee and ranking equally in right of payment with all of that guarantor's existing and future debt that is not subordinated in right of payment to that guarantee. | ||

The notes will be effectively junior to all liabilities of CF Holdings' subsidiaries other than the issuer that are not guarantors of the notes and all secured debt of CF Holdings and its Subsidiaries (including the issuer and subsidiaries of CF Holdings that guarantee the notes) to the extent of the value of the collateral securing that debt. |

S-13

| As of December 31, 2009, on a pro forma basis giving effect to the transactions, as adjusted to give effect to the offering of the notes and the application of net proceeds therefrom as described in "Use of Proceeds" (and without giving effect to the CF Holdings common stock offering), CF Holdings would have had approximately $3.77 billion of senior secured indebtedness on a consolidated basis, consisting primarily of indebtedness under the credit facilities, and additional senior secured borrowing availability of $500 million (reflecting no outstanding letters of credit), under the revolving credit facility. The revolving credit facility initially provided for up to $300 million of borrowings outstanding at any time. On April 15, 2010, we and the lead arrangers agreed to increase the amount available under the revolving credit facility to $500 million. | ||

For the twelve months ended December 31, 2009, the subsidiaries of CF Holdings other than the issuer that are not guaranteeing the notes had net sales of $815.7 million. As of December 31, 2009, these non-guarantor subsidiaries held $1.21 billion of the consolidated total assets of CF Holdings and had $208.8 million of total liabilities (including trade payables and liabilities attributable to noncontrolling interests). | ||

Optional redemption | The notes of a series will be redeemable, in whole at any time or in part from time to time, at the issuer's option, at a make-whole price calculated as described in this prospectus supplement under "Description of the Notes—Optional Redemption," plus accrued and unpaid interest, if any, to, but not including, the applicable date of redemption. | |

Change of control | Upon the occurrence of a change of control repurchase event with respect to any series of notes, unless the issuer has exercised its right to redeem those notes, the issuer will be required to offer to repurchase each holder's notes of such series at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest, if any, to, but not including, the date of repurchase. For more details, see "Description of the Notes—Change of Control." | |

Covenants | The indenture governing the notes will contain covenants that limit, among other things, the ability of CF Holdings and its subsidiaries, including the issuer, to: | |

• incur liens on certain properties to secure debt; | ||

• engage in sale and leaseback transactions; and | ||

• merge or consolidate with another entity or sell, lease or transfer all or substantially all of our assets to another entity. | ||

These covenants are subject to a number of important qualifications and exceptions. See "Description of the Notes—Certain Covenants." |

S-14

| Conflicts of interest | Affiliates of Morgan Stanley & Co. Incorporated and Mitsubishi UFJ Securities (USA), Inc. are lenders under the term loan facility and bridge facility and will receive their pro rata portion of the net proceeds from this offering through the repayment of the borrowings they have extended under the term loan facility and bridge facility. Because the portion of the net proceeds that may be so paid to affiliates of each of Morgan Stanley & Co. Incorporated and Mitsubishi UFJ Securities (USA), Inc. may be at least five percent of the net offering proceeds, not including underwriting compensation, this offering will be made in accordance with NASD Rule 2720 of the Financial Industry Regulatory Authority, Inc., or FINRA, which requires that a qualified independent underwriter, or QIU, participate in the preparation of this prospectus supplement and perform the usual standards of due diligence with respect thereto. BMO Capital Markets Corp. is assuming the responsibilities of acting as QIU in connection with this offering. We have agreed to indemnify BMO Capital Markets Corp. against certain liabilities incurred in connection with it acting as QIU in this offering, including liabilities under the Securities Act of 1933, as amended, or the Securities Act. For more information, see "Underwriting (Conflicts of Interest)." | |

Risk factors | You should carefully consider the information set forth in the "Risk Factors" section of this prospectus supplement, as well as all other information included in or incorporated by reference in this prospectus supplement and the accompanying prospectus, before deciding whether to invest in the notes. | |

Use of proceeds | We estimate the net proceeds from the issuance and sale of the notes, after deducting underwriting discounts and estimated offering expenses, will be approximately $1.55 billion. We intend to use the net proceeds from this offering to repay amounts outstanding under the bridge facility and, to the extent of any net proceeds in excess of the amount required to discharge the obligations under the bridge facility, to repay outstanding borrowings under the term loan facility. See "Use of Proceeds." | |

The CF Holdings common stock offering is being conducted concurrently with this offering of notes. We intend to use the net proceeds from the CF Holdings common stock offering to repay amounts outstanding under the bridge facility. There can be no assurance that the CF Holdings common stock offering can be consummated on terms acceptable to us or at all or that, if consummated, it will be for the amount contemplated. This offering of notes is not conditioned on the consummation of the CF Holdings common stock offering. |

S-15

Summary Consolidated Historical Financial Data of CF Industries

The following summary consolidated historical financial data as of December 31, 2009 and 2008 and for the years ended December 31, 2009, 2008 and 2007 have been derived from the audited consolidated financial statements of CF Industries incorporated by reference herein. The following summary consolidated historical financial data as of December 31, 2007 have been derived from the audited consolidated financial statements of CF Industries not included or incorporated by reference herein. The historical results presented below are not necessarily indicative of results that can be expected for any future period. The table should be read in conjunction with "Use of Proceeds," "Capitalization," "Overview of Financial Condition, Liquidity and Capital Resources," "Unaudited Pro Forma Condensed Combined Consolidated Financial Statements" and "Selected Historical Consolidated Financial Data of CF Industries," included elsewhere in this prospectus supplement, "Management's Discussion and Analysis of Financial Condition and Results of Operations," appearing in Item 7 of CF Holdings' Annual Report on Form 10-K for the fiscal year ended December 31, 2009 and incorporated by reference herein, and CF Industries' consolidated financial statements and accompanying notes appearing in CF Holdings' Current Report on Form 8-K filed on April 15, 2010 and incorporated by reference herein. See "Where You Can Find More Information."

| | Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2009 | 2008 | 2007 | |||||||

| | (in millions, except ratios) | |||||||||

Statement of Operations Data: | ||||||||||

Net sales | $ | 2,608.4 | $ | 3,921.1 | $ | 2,756.7 | ||||

Gross margin | 839.4 | 1,222.7 | 670.0 | |||||||

Earnings before income taxes, equity in earnings (loss) of unconsolidated affiliates and cumulative effect of a change in accounting principle | 695.6 | 1,175.4 | 625.9 | |||||||

Net earnings attributable to common stockholders | 365.6 | 684.6 | 372.7 | |||||||

Balance Sheet Data (at end of period): | ||||||||||

Total current assets | $ | 1,283.1 | $ | 1,433.2 | $ | 1,279.1 | ||||

Total assets | 2,494.9 | 2,387.6 | 2,012.5 | |||||||

Total current liabilities | 479.8 | 818.1 | 629.3 | |||||||

Total debt | 4.7 | 4.1 | 4.9 | |||||||

Stockholders' equity | 1,728.9 | 1,338.1 | 1,187.0 | |||||||

Other Financial Data: | ||||||||||

Ratio of earnings to fixed charges(1) | 105.3x | 171.9x | 104.1x | |||||||

EBITDA(2) | $ | 708.5 | $ | 1,138.5 | $ | 634.1 | ||||

- (1)

- The ratio of earnings to fixed charges for the years ended December 31, 2006 and 2005 is 13.9x and 7.5x, respectively.

- (2)

- We report our financial results in accordance with U.S. generally accepted accounting principles, or GAAP. Our management believes that certain non-GAAP financial measures provide additional meaningful information regarding our performance. The non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported results prepared in accordance with GAAP. In addition, because not all companies use identical calculations, the non-GAAP financial measures included in this prospectus supplement may not be comparable to similarly titled measures of other companies.

EBITDA, as presented in this prospectus supplement, is a supplemental measure of our performance. EBITDA is defined as net earnings attributable to common stockholders plus interest income—net, income tax provision and depreciation, depletion and amortization. We have presented EBITDA because management uses the measure to track performance and believes that it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. EBITDA is not required by, or presented in accordance

S-16

with, GAAP. EBITDA is not a measure of our financial performance or financial position under GAAP and should not be considered as an alternative to revenue, net income or any other performance measures derived in accordance with GAAP.

The table below provides an unaudited reconciliation of net earnings to EBITDA:

| | Year ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2009 | 2008 | 2007 | |||||||

| | (in millions) | |||||||||

Net earnings attributable to common stockholders | $ | 365.6 | $ | 684.6 | $ | 372.7 | ||||

Interest expense (income)—net | (3.0 | ) | (24.5 | ) | (22.7 | ) | ||||

Income taxes | 245.4 | 378.1 | 200.2 | |||||||

Depreciation, depletion and amortization | 101.0 | 100.8 | 84.5 | |||||||

Less: Loan fee amortization(A) | (0.5 | ) | (0.5 | ) | (0.6 | ) | ||||

EBITDA | $ | 708.5 | $ | 1,138.5 | $ | 634.1 | ||||

- (A)

- To adjust for amounts included in both interest and amortization.

S-17

Summary Consolidated Historical Financial Data of Terra

The following summary consolidated historical financial data as of December 31, 2009 and 2008 and for the years ended December 31, 2009, 2008 and 2007 have been derived from the audited consolidated financial statements of Terra incorporated by reference herein. The following summary consolidated historical financial data as of December 31, 2007 have been derived from the audited consolidated financial statements of Terra not included or incorporated by reference herein. The historical results presented below are not necessarily indicative of results that can be expected for any future period. The table should be read in conjunction with "Use of Proceeds," "Capitalization," "Overview of Financial Condition, Liquidity and Capital Resources," "Unaudited Pro Forma Condensed Combined Consolidated Financial Statements" and "Selected Historical Consolidated Financial Data of Terra," included elsewhere in this prospectus supplement, "Management's Discussion and Analysis of Financial Condition and Results of Operations," appearing in Item 7 of Terra Industries Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2009 appearing in CF Holdings' Current Report on Form 8-K/A filed on April 12, 2010 and incorporated by reference herein, and Terra's consolidated financial statements and accompanying notes appearing in CF Holdings' Current Report on Form 8-K filed on April 15, 2010 and incorporated by reference herein. See "Where You Can Find More Information."

| | Year Ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2009(1) | 2008(2) | 2007(3) | |||||||

| | (in millions, except ratios) | |||||||||

Statement of Operations Data: | ||||||||||

Total revenues | $ | 1,581.4 | $ | 2,891.5 | $ | 2,342.9 | ||||

Gross profit | 386.2 | 863.2 | 527.5 | |||||||

Income from continuing operations | 151.5 | 632.8 | 220.8 | |||||||

Income (loss) from discontinued operations | 1.1 | 8.3 | (18.9 | ) | ||||||

Net income attributable to Terra Industries Inc. | 152.6 | 641.0 | 201.9 | |||||||

Balance Sheet Data (at end of period): | ||||||||||

Total current assets | $ | 826.3 | $ | 1,392.5 | $ | 1,029.9 | ||||

Total assets | 1,599.7 | 2,113.0 | 1,888.3 | |||||||

Total current liabilities | 206.2 | 465.2 | 517.7 | |||||||

Long-term debt and capital leases | 602.4 | 330.0 | 330.0 | |||||||

Stockholders' equity | 490.7 | 1,063.0 | 621.5 | |||||||

Other Financial Data: | ||||||||||

Ratio of earnings to fixed charges and preferred dividends | 3.6x | 8.3x | 5.8x | |||||||

Adjusted EBITDA(4) | $ | 401.7 | $ | 964.3 | $ | 500.4 | ||||

- (1)

- The 2009 selected financial data includes (i) the effects of a special cash dividend of $7.50 per share (or $748.7 million) declared on October 29, 2009 and paid on December 11, 2009; (ii) $42.8 million, net of tax ($0.43 per diluted share) for the early repatriation of funds to the U.S.; (iii) $32.4 million, net of tax ($0.32 per diluted share) for the early retirement of debt; and (iv) $11.2 million, net of tax ($0.11 per diluted share) of other operating expenses related to CF Industries' unsolicited acquisition offers.

- (2)

- The 2008 selected financial data includes (i) the effects of the 4.25% Cumulative Convertible Perpetual Series A Preferred Shares, or Series A Preferred Shares, inducement converting a total of 118,400 Series A Preferred Shares to 11,887,550 shares of Terra Industries Inc. common stock; (ii) the effects of instituting a cash dividend per common share of $0.10 per quarter starting in May 2008; and (iii) the full year equity earnings effect of the GrowHow joint venture of $95.6 million.

- (3)

- The 2007 selected financial data includes (i) the effects of contributing the Terra Nitrogen U.K. operations into the GrowHow joint venture on September 14, 2007; (ii) a $39.0 million impairment

S-18

charge for the Beaumont, Texas assets; and (iii) a $38.8 million loss on the early retirement of debt associated with the debt refinancing that was completed during 2007.

- (4)

- Terra's financial results are reported in accordance with GAAP. Our management believes that certain non-GAAP financial measures provide additional meaningful information regarding Terra's performance. The non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Terra's reported results prepared in accordance with GAAP. In addition, because not all companies use identical calculations, the non-GAAP financial measures included in this prospectus supplement may not be comparable to similarly titled measures of other companies.

Adjusted EBITDA, as presented in this prospectus supplement, is a supplemental measure of Terra's performance. Adjusted EBITDA is defined as net income from continuing operations less interest income plus interest expense plus income tax provision plus depreciation, depletion and amortization and charges related to loss on early retirement of debt, which is a non-cash item. We have presented adjusted EBITDA because management uses the measure to track performance and believes that it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Adjusted EBITDA is not required by, or presented in accordance with, GAAP. Adjusted EBITDA is not a measure of Terra's financial performance or financial position under GAAP and should not be considered as an alternative to revenue, net income or any other performance measures derived in accordance with GAAP.

The table below provides an unaudited reconciliation of net income to adjusted EBITDA:

| | Year ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | 2009 | 2008 | 2007 | |||||||

| | (in millions) | |||||||||

Income from continuing operations | $ | 151.5 | $ | 632.8 | $ | 220.8 | ||||

Interest income | (4.1 | ) | (23.4 | ) | (17.3 | ) | ||||

Interest expense | 31.9 | 27.4 | 29.1 | |||||||

Income tax provision | 74.3 | 239.9 | 127.3 | |||||||

Depreciation and amortization | 94.6 | 87.6 | 101.7 | |||||||

EBITDA | $ | 348.2 | $ | 964.3 | $ | 461.6 | ||||

Loss on early retirement of debt | 53.5 | — | 38.8 | |||||||

Adjusted EBITDA | $ | 401.7 | 964.3 | $ | 500.4 | |||||

S-19

Summary Unaudited Pro Forma

Condensed Combined Consolidated Financial and Operating Information

The following table sets forth summary unaudited pro forma condensed combined consolidated financial information of CF Industries. The pro forma information has been derived from, and should be read in conjunction with, "Unaudited Pro Forma Condensed Combined Consolidated Financial Statements" and related notes, which appear elsewhere in this prospectus supplement. The pro forma information should also be read in conjunction with "Summary—Terra Acquisition and Related Financing Transactions," "Selected Historical Consolidated Financial Data of CF Industries," "Selected Historical Consolidated Financial Data of Terra," "Overview of Financial Condition, Liquidity and Capital Resources," "Description of the Notes" and "Description of Certain Other Indebtedness," included elsewhere in this prospectus supplement, "Management's Discussion and Analysis of Financial Condition and Results of Operations," appearing in Item 7 of CF Holdings' and Terra Industries Inc.'s Annual Reports on Form 10-K for the fiscal year ended December 31, 2009, respectively, both of which are incorporated by reference herein (with Terra Industries Inc.'s Form 10-K appearing on CF Holdings' Current Report on Form 8-K/A filed on April 12, 2010 and incorporated by reference herein), CF Industries' consolidated financial statements and accompanying notes, appearing in CF Holdings' Current Report on Form 8-K filed on April 15, 2010 and incorporated by reference herein, and Terra's consolidated financial statements and accompanying notes appearing in CF Holdings' Current Report on Form 8-K filed on April 15, 2010 and incorporated by reference herein. See "Where You Can Find More Information."

The summary unaudited pro forma condensed combined consolidated balance sheet information gives effect to the transactions on a pro forma basis as if the transactions had occurred on December 31, 2009. The summary unaudited pro forma condensed combined consolidated statements of income information gives effect to the transactions on a pro forma basis as if the transactions had occurred on January 1, 2009. The summary unaudited pro forma condensed combined consolidated financial information is provided for illustrative purposes only and does not purport to represent what the actual consolidated results of operations or the consolidated financial position of CF Industries would have been had the transactions occurred on the dates assumed, nor are they necessarily indicative of future consolidated results of operations or consolidated financial position.

The receipt and application of the proceeds from this offering of notes and the CF Holdings common stock offering are not reflected in the summary unaudited pro forma condensed combined consolidated

S-20

financial information. See "Capitalization" for certain information regarding potential effects of the CF Holdings common stock offering.

| | Pro Forma Year Ended December 31, 2009 | |||

|---|---|---|---|---|

| | (in millions) | |||

Statement of Operations Data: | ||||

Net sales | $ | 4,189.8 | ||

Cost of sales | 2,964.2 | |||

Gross margin | 1,225.6 | |||

Selling, general and administrative | 130.0 | |||

Equity in earnings of unconsolidated affiliates | (17.7 | ) | ||

Other operating—net | 114.7 | |||

Operating earnings | 998.6 | |||

Interest expense | 347.3 | |||

Interest income | (2.8 | ) | ||

Other non-operating—net | (12.8 | ) | ||

Earnings before income taxes and equity in earnings of unconsolidated affiliates | 666.9 | |||

Income tax provision | 213.9 | |||

Equity in earnings of unconsolidated affiliates—net of taxes | 13.1 | |||

Net earnings from continuing operations | 466.1 | |||

Less: Net earnings attributable to the non-controlling interest | 108.9 | |||

Net earnings attributable to common stockholders | $ | 357.2 | ||

S-21

| | Pro Forma December 31, 2009 | |||

|---|---|---|---|---|

| | (in millions, except per share amounts) | |||

Balance Sheet Data: | ||||

Cash and cash equivalents | $ | 339.9 | ||

Total assets | 7,610.7 | |||

Customer advances | 198.7 | |||

Total debt | 3,737.2 | |||

Stockholders' equity | 2,238.6 | |||

Total equity | 2,620.6 | |||

Book value per share(1) | $ | 38.60 | ||

| | Pro Forma Year Ended December 31, 2009 | ||||

|---|---|---|---|---|---|

| | (in millions, except as noted) | ||||

Other Financial Data: | |||||

EBITDA(2) | $ | 1,110.2 | |||

Operating Data (tons in thousands): | |||||

Combined sales volume:(3) | |||||

Net ammonia | 2,690 | ||||

Urea | 2,888 | ||||

UAN | 5,316 | ||||

AN | 879 | ||||

DAP and MAP | 2,085 | ||||

Combined production volume:(3) | |||||

Gross ammonia | 6,143 | ||||

Urea | 3,153 | ||||

UAN | 5,320 | ||||

AN | 995 | ||||

DAP and MAP | 1,830 | ||||

See notes to unaudited pro forma condensed combined consolidated financial statements under

"Unaudited Pro Forma Condensed Combined Consolidated Financial Statements."

- (1)

- Book value per share is equal to stockholders' equity divided by basic weighted average common shares outstanding.

- (2)

- We report our financial results in accordance with GAAP. Our management believes that certain non-GAAP financial measures provide additional meaningful information regarding our performance. The non-GAAP financial measures should be viewed in addition to, and not as an alternative for, our reported results prepared in accordance with GAAP. In addition, because not all companies use identical calculations, the non-GAAP financial measures included in this prospectus supplement may not be comparable to similarly titled measures of other companies.

Pro forma EBITDA, as presented in this prospectus supplement, is a supplemental measure of our performance on a pro forma combined basis. Pro forma EBITDA is defined as net earnings attributable to common stockholders less interest income, plus interest expense, income taxes and depreciation, depletion and amortization, in each case on a pro forma basis. We have presented pro forma EBITDA because management uses EBITDA to track performance and believes EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. EBITDA is not required by, or presented in accordance with, GAAP. EBITDA is not a measure of our financial performance or financial position under GAAP and should not be considered as an alternative to revenue, net income or any other performance measures derived in accordance with GAAP.

S-22

The table below provides an unaudited reconciliation of net earnings to EBITDA:

| | Pro Forma Year Ended December 31, 2009 | |||

|---|---|---|---|---|

| | (in millions) | |||

Net earnings attributable to common stockholders | $ | 357.2 | ||

Interest income | (2.8 | ) | ||

Interest expense | 347.3 | |||

Income taxes | 213.4 | |||

Depreciation, depletion and amortization | 195.6 | |||

Less: Loan fee amortization(A) | (0.5 | ) | ||

EBITDA | $ | 1,110.2 | ||

- (A)

- To adjust for amounts included in both interest and amortization.

- (3)

- For the years ended December 31, 2009, 2008 and 2007, CF Industries' and Terra's total sales and production volumes were as follows:

| | Year ended December 31, | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2009 | 2008 | 2007 | ||||||||

| | (tons in thousands) | ||||||||||

CF Industries total sales volume: | |||||||||||

Net ammonia | 1,083 | 1,079 | 1,434 | ||||||||

Urea | 2,604 | 2,617 | 2,701 | ||||||||

UAN(A) | 2,090 | 2,386 | 2,729 | ||||||||

DAP and MAP | 2,085 | 1,787 | 1,994 | ||||||||

Terra total sales volume: | |||||||||||

Net ammonia | 1,607 | 1,670 | 1,765 | ||||||||

Urea | 284 | 249 | 247 | ||||||||

UAN | 3,226 | 3,917 | 4,072 | ||||||||

AN | 879 | 990 | 968 | ||||||||

CF Industries total production volume: | |||||||||||

Gross ammonia | 3,098 | 3,249 | 3,289 | ||||||||

Urea | 2,350 | 2,355 | 2,358 | ||||||||

UAN(A) | 2,023 | 2,277 | 2,285 | ||||||||

DAP and MAP | 1,830 | 1,980 | 1,948 | ||||||||

Terra total production volume: | |||||||||||

Gross ammonia(B) | 3,045 | 3,171 | 3,521 | ||||||||

Urea | 803 | 250 | 921 | ||||||||

UAN | 3,297 | 3,703 | 4,131 | ||||||||

AN(B) | 995 | 986 | 2,268 | ||||||||

- (A)

- UAN volumes previously reported in CF Holdings' Annual Reports on Form 10-K have been converted to UAN containing 32% nitrogen by weight.

- (B)

- Terra's 2007 production volumes for ammonia and AN include U.K. production of 540,000 and 610,000 tons, respectively, since U.K. operations were reported on a consolidated basis prior to the formation of GrowHow in September 2007.

S-23

Our business is subject to a number of risks. If any of the events contemplated by the following risks actually occur, then our business, financial condition or results of operations could be materially adversely affected. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition and results of operations.

Risks Related to Our Business

Uncertainties exist in integrating the business and operations of CF Industries and Terra.