Exhibit 99.1

N° MI 8473789

Lárez, Mendez y Asociados

Public Accountants

J-40016904-6

INDEPENDENT AUDITORS' REPORT

To the shareholders of

Etelix.com USA LLC

We have reviewed the accompanying balance sheet of Etelix.com USA LLC at December 31, 2016, and the income statement, statement of changes in equity and cash flow, statement for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to issue a report on these financial statements based on our review.

We conducted our review in accordance with the International Standard on Review Engagements 2400. This Standard requires that we plan and perform the review to Obtain moderate assurance as to whether the financial statements are free of material misstatement. A review is limited primarily to inquiries of company personnel and analytical procedures applied to financial data and thus provides less assurance than an audit. We have not performed an audit and, accordingly, we do not express an audit opinion.

Based on our review, nothing has come to our attention that causes us to believe that the accompanying financial statements do not give a true and fair view (or are not presented fairly, in all material respects) in accordance with InternationalAccounting Standards for Small and Medium-sized Entities.

/s/ Mariaexandra Lárez

Lic. Mariaexandra Lárez

Lárez Mendez y Asoc.

Certified Public Accountants

CCP. MI 20300

April 27, 2017

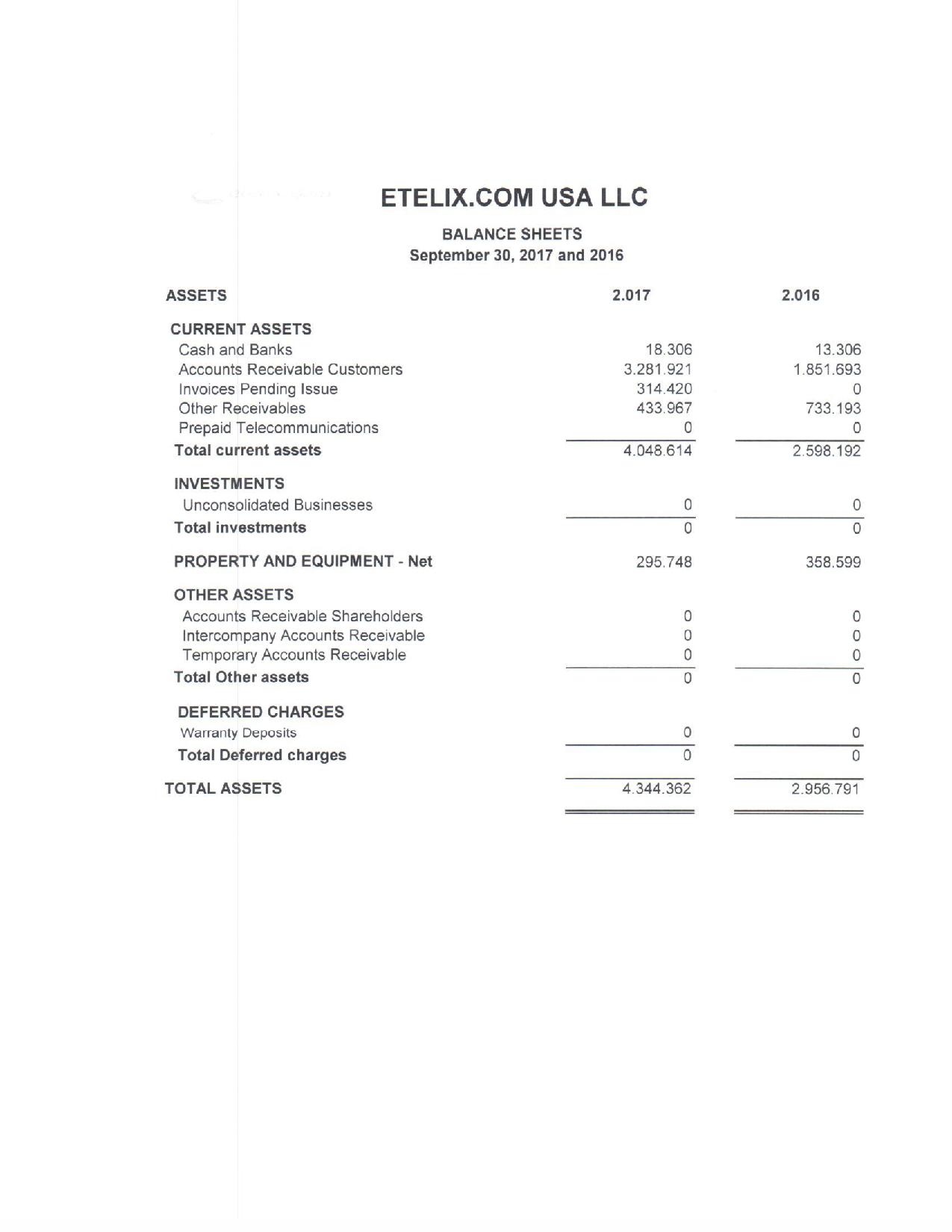

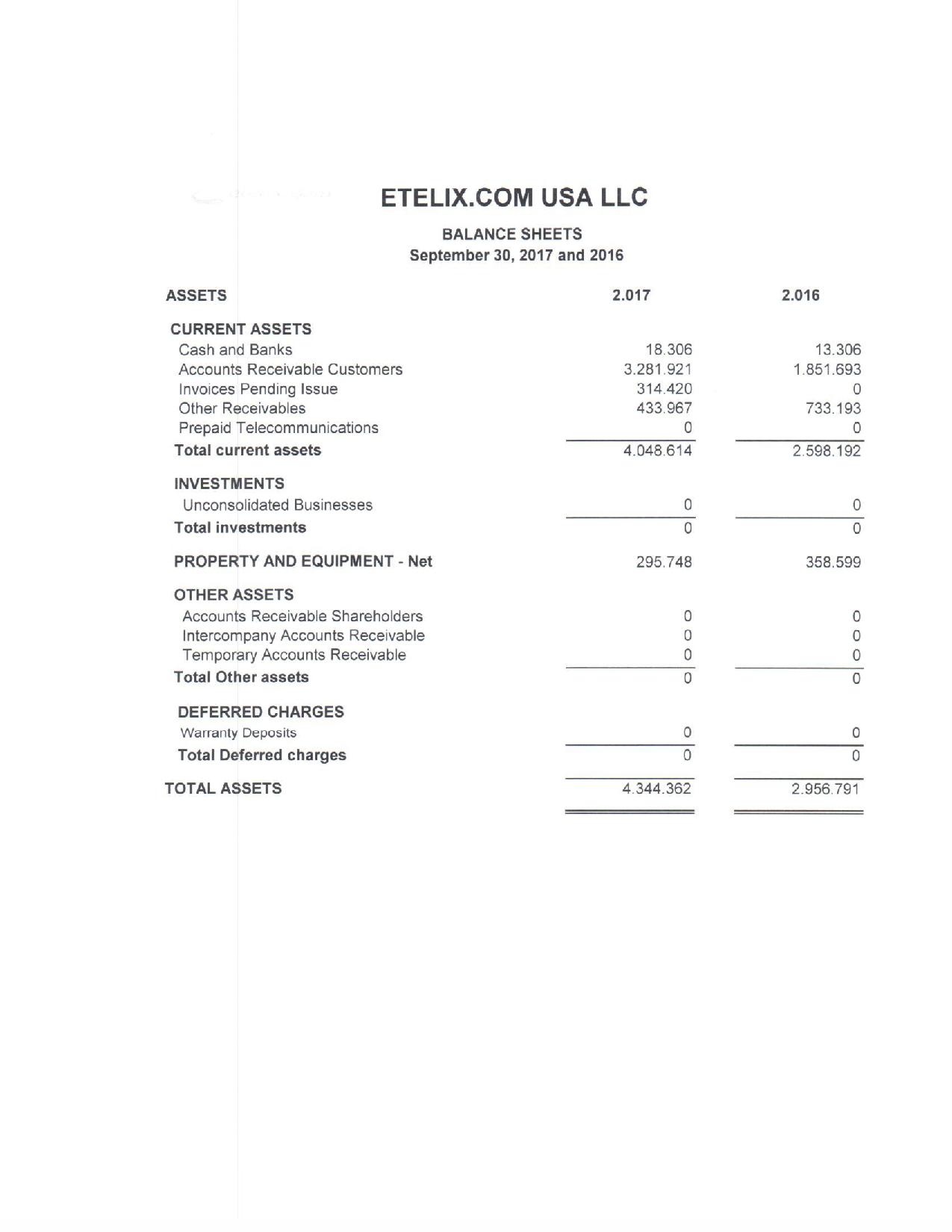

ETELIX.COM USA LLC

BALANCE SHEETS

AS OF DECEMBER 31,2016

| ASSETS | | |

| | | |

| CURRENT ASSETS | | | | |

| Cash and Banks | | | 17,885 | |

| Accounts Receivable Customers | | | 2,909,771 | |

| Other Receivables | | | 750,044 | |

| Total current assets | | | 3,677,700 | |

| | | | | |

| PROPERTY AND EQUIPMENT - Net | | | 352,332 | |

| | | | | |

| TOTAL ASSETS | | | 4,030,032 | |

| | | | | |

| | | | | |

| | | | | |

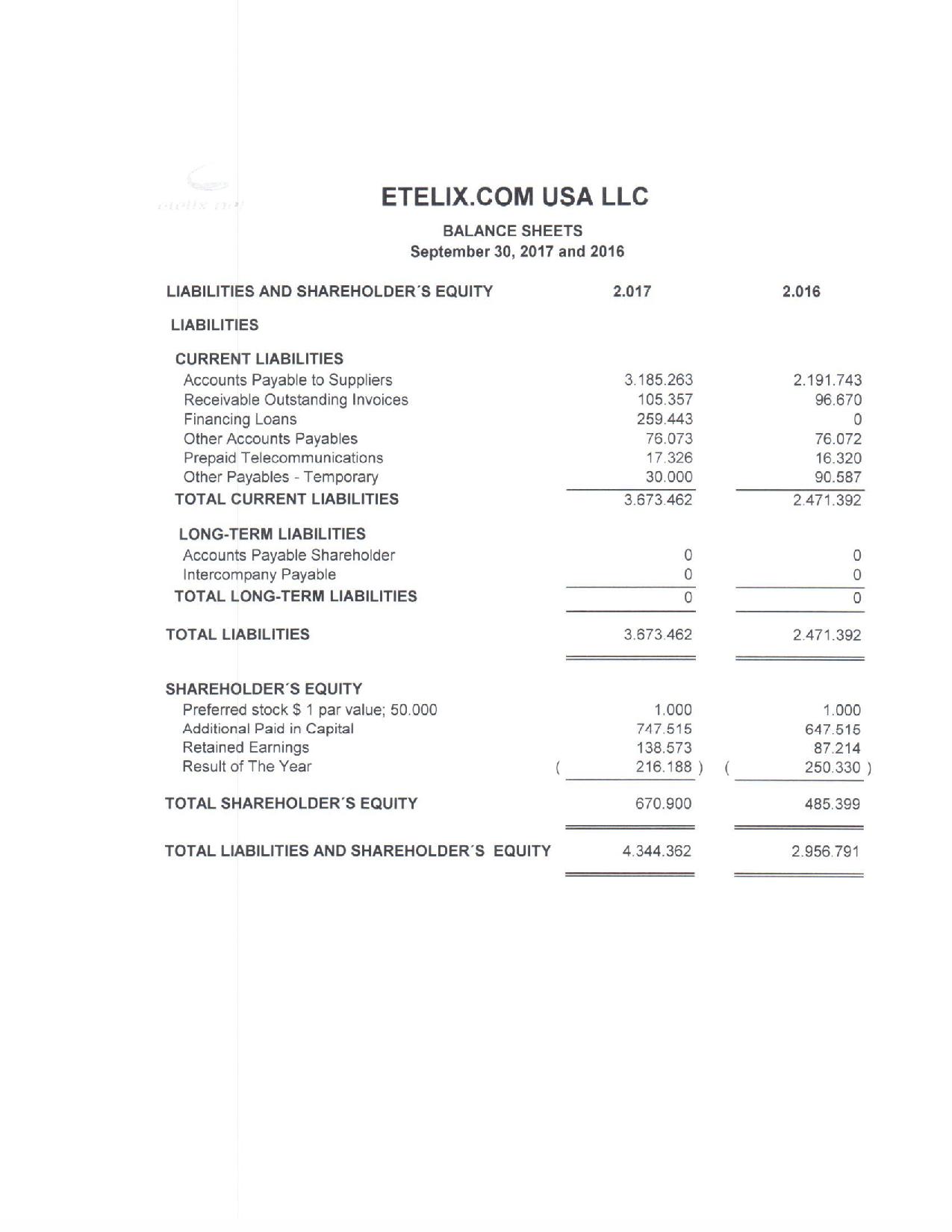

| LIABILITIES AND SHAREHOLDER´S EQUITY | | | | |

| | | | | |

| LIABILITIES | | | | |

| | | | | |

| CURRENT LIABILITIES | | | | |

| Accounts Payable | | | 2,727,348 | |

| Receivable Outstanding Invoices | | | 322,455 | |

| Other Accounts Payables | | | 200 | |

| Prepaid Telecommunications | | | 8,576 | |

| Other Payables - Temporary | | | 84,365 | |

| TOTAL CURRENT LIABILITIES | | | 3,142,944 | |

| | | | | |

| TOTAL LIABILITIES | | | 3,142,944 | |

| | | | | |

| | | | | |

| SHAREHOLDER´S EQUITY | | | | |

| Capital Stock | | | 1,000 | |

| Additional Paid in Capital | | | 747,515 | |

| Retained Earnings | | | 82,529 | |

| Net Income | | | 56,044 | |

| | | | | |

| TOTAL SHAREHOLDER´S EQUITY | | | 887,088 | |

| | | | | |

| | | | | |

| TOTAL LIABILITIES AND SHAREHOLDER´S EQUITY | | | 4,030,032 | |

ETELIX.COM USA LLC

STATEMENTS OF INCOME

AS OF DECEMBER 31,2016

| INCOME SALES | | | 4,067,807 | |

| | | | | |

| COST OF SERVICES | | | 3,484,471 | |

| | | | | |

| | | | | |

| | | | | |

| GROSS PROFIT | | | 583,336 | |

| | | | | |

| | | | | |

| OPERATING EXPENSES | | | | |

| | | | | |

| Salaries and wages | | | 134,299 | |

| Depreciation Expense | | | 36,123 | |

| Sales commission | | | 67,824 | |

| Amortizacion expense | | | 26,727 | |

| Bank service Changes | | | 18,517 | |

| Financial Interest expenses | | | 12,334 | |

| Professional fees | | | 46,349 | |

| Regulatory fees | | | 829 | |

| Technology Expense | | | 156,453 | |

| Trade insurance | | | 15,314 | |

| Travel expenses | | | 16,661 | |

| Other expenses | | | 13,200 | |

| | | | | |

| TOTAL OPERATING EXPENSES | | | 544,630 | |

| | | | | |

| | | | | |

| OTHER INCOME AND EXPENDES | | | | |

| | | | | |

| Other income | | | 17,338 | |

| Federal Tax prior year | | | 4,686 | |

| | | | | |

| TOTAL OTHER INCOME AND EXPENDES | | | (12,652 | ) |

| | | | | |

| | | | | |

| | | | | |

| NET INCOME | | | 51,358 | |

| | | | | |

| | | | | |

| Federal Tax prior year | | | 4,686.00 | |

| | | | | |

| NET INCOME 2016 | | | 56,044 | |

ETELIX.COM USA LLC

STATEMENTS OF CASH FLOW

AS OF DECEMBER 31,2016

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| | | | | |

| NET INCOME | | | 56,045 | |

| | | | | |

| Adjustments to reconcile net income to net cash provided by | | | | |

| operating activities: | | | | |

| | | | | |

| Depreciation and Amortization | | | 62,850 | |

| | | | | |

| Changes in working capital: | | | | |

| | | | | |

| Accounts receivable | | | (1,967,835 | ) |

| Accounts Receivable Employees | | | 0 | |

| Other accounts receivable | | | (707,735 | ) |

| Invoices pending issue | | | 0 | |

| Prepaid Telecommunications | | | 0 | |

| Accounts Receivable Shareholders | | | 0 | |

| Intercompany Accounts Receivable | | | 0 | |

| Sales Tax | | | | |

| Accounts payable to suppliers | | | 1,958,257 | |

| Receivable Outstanding Invoices | | | 0 | |

| Other payables | | | 68,667 | |

| Receivable Outstanding Invoices | | | 322,455 | |

| Prepaid Telecommunications | | | 8,576 | |

| Intercompany payable | | | 0 | |

| Accounts payable Shareholder | | | 200 | |

| Net cash provided by operating activities | | | (254,566 | ) |

| | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

| | | | | |

| Additional Paid in Capital | | | 197,000 | |

| Net Fixed Assets | | | (6,113 | ) |

| Capital Stock | | | 0 | |

| Net Effect of Investment | | | 0 | |

| Net cash used in investing activities | | | 190,887 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITY: | | | | |

| | | | | |

| Income Tax 2015 | | | (4,686 | ) |

| | | | | |

| Net cash used in financing activity | | |

(4,686 | ) |

| | | | | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | (12,320 | ) |

| | | | | |

| Cash and cash equivalents - Beginning of period | | | 30,204 | |

| | | | | |

| Cash and cash equivalents - end of period | | | 17,884 | |

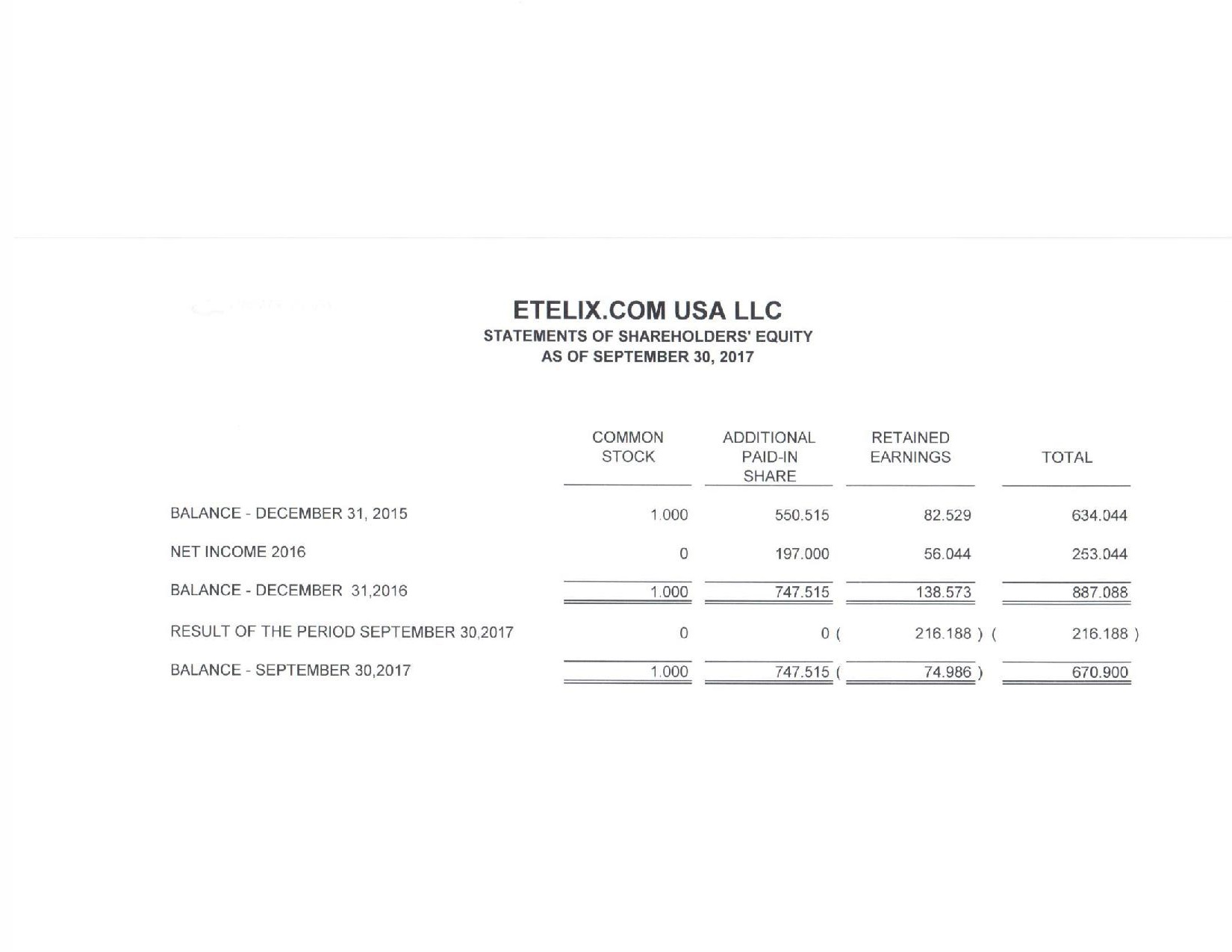

ETELIX.COM USA LLC

STATEMENTS OF SHAREHOLDERS' EQUITY

AS OF DECEMBER 31, 2016

| | | COMMON | | ADDITIONAL | | RETAINED | | |

| | | STOCK | | PAID-IN | | EARNINGS | | TOTAL |

| | | | | SHARE | | | | |

| | | | | | | | | |

| BALANCE - DECEMBER 31, 2015 | | $ | 1,000 | | | $ | 550,515 | | | $ | 82,529 | | | $ | 634,044 | |

| | | | | | | | | | | | | | | | | |

| NET INCOME 2016 | | $ | 0 | | | $ | 197,000 | | | $ | 56,044 | | | $ | 253,044 | |

| | | | | | | | | | | | | | | | | |

| BALANCE - DECEMBER 31,2016 | | $ | 1,000 | | | $ | 747,515 | | | $ | 138,573 | | | $ | 887,088 | |

Etelix.com USA LLC

NOTES TO THE FINANCIAL STATEMENTS

AS OF DECEMBER 31, 2016

1-. CONSTITUTION AND OPERATIONS:

The company was registered on September 30, 2008, at the Florida Department of State in the Division of Corporations. Under the registration number Nº 08000092741. It is a Limited Liability Company. The purpose for which this limited liability company is organized is any and all lawful business.

2-. PRESENTATION OF THE FINANCIAL STATEMENTS:

The accompanying financial statements have been prepared in historical values, based on the Original Financial Statements in US dollars.

3-. SUMMARY, MEANING AND POLICY OF THE ACCOUNTS:

Cash and Cash Equivalents:Refers to available and demand deposits at banks; That is, any item that allows the entity, at any time, to deposit or withdraw funds.

Accounts Receivable Clients: The company recognizes as accounts receivable all transactions invoices that have actually been individually reviewed and issued within the established periods and crossed with the counterparts of service provision.

Other accounts receivable: The Company recognizes in this item Telecom Prepaid for provisions to be made that will be converted into invoices and Short Term Loan Operations of New Life Omega Service and Caribbean Telecom as an investment in fixed assets to be realized.

Tangible and intangible Fixed Assets: These are recorded at cost from the date of purchase. Depreciation and amortization is calculated based on the straight-line method over the estimated useful life of the asset and the use of the asset. Depreciation and amortization expenses for the period are those corresponding to a normal period, based on the value of the asset divided by the estimated useful life.

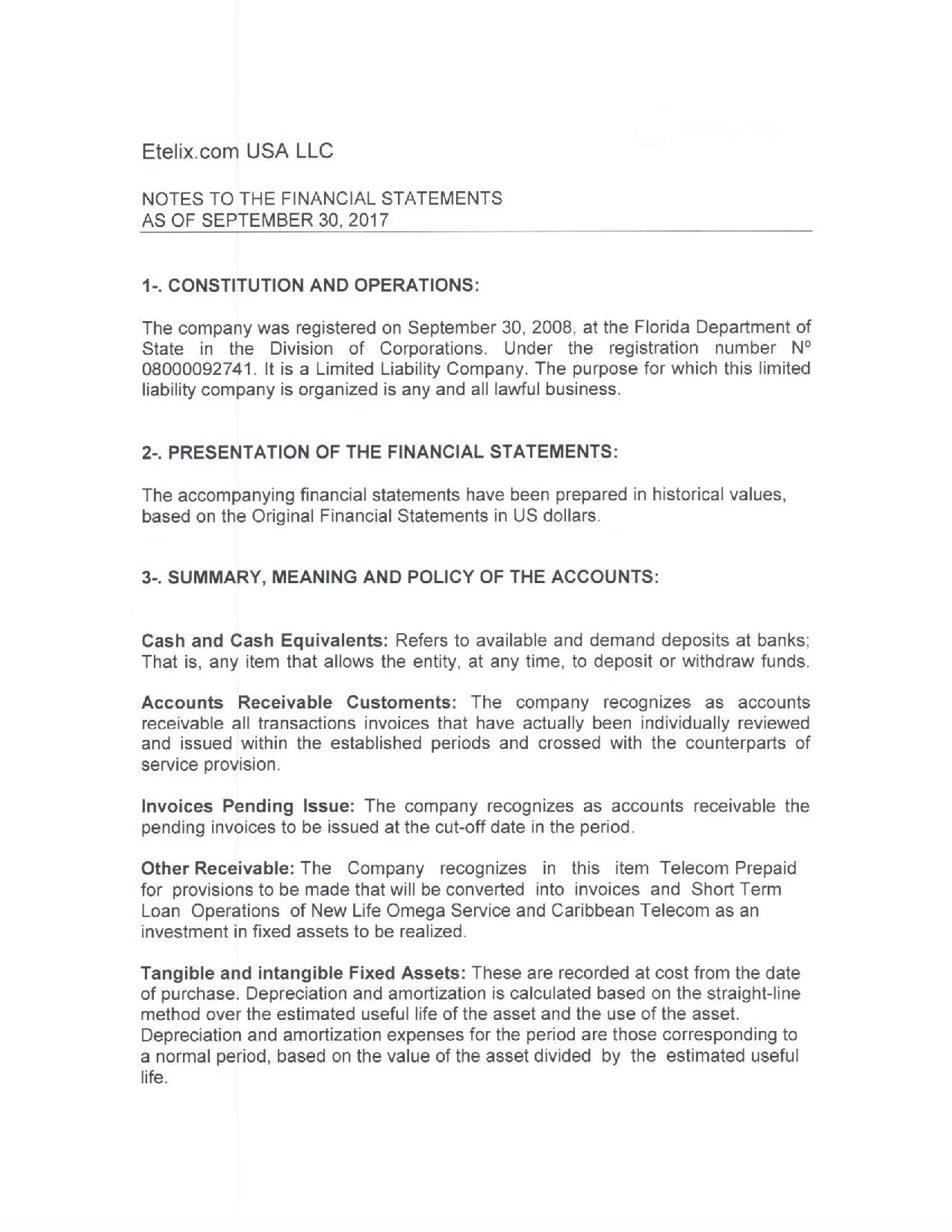

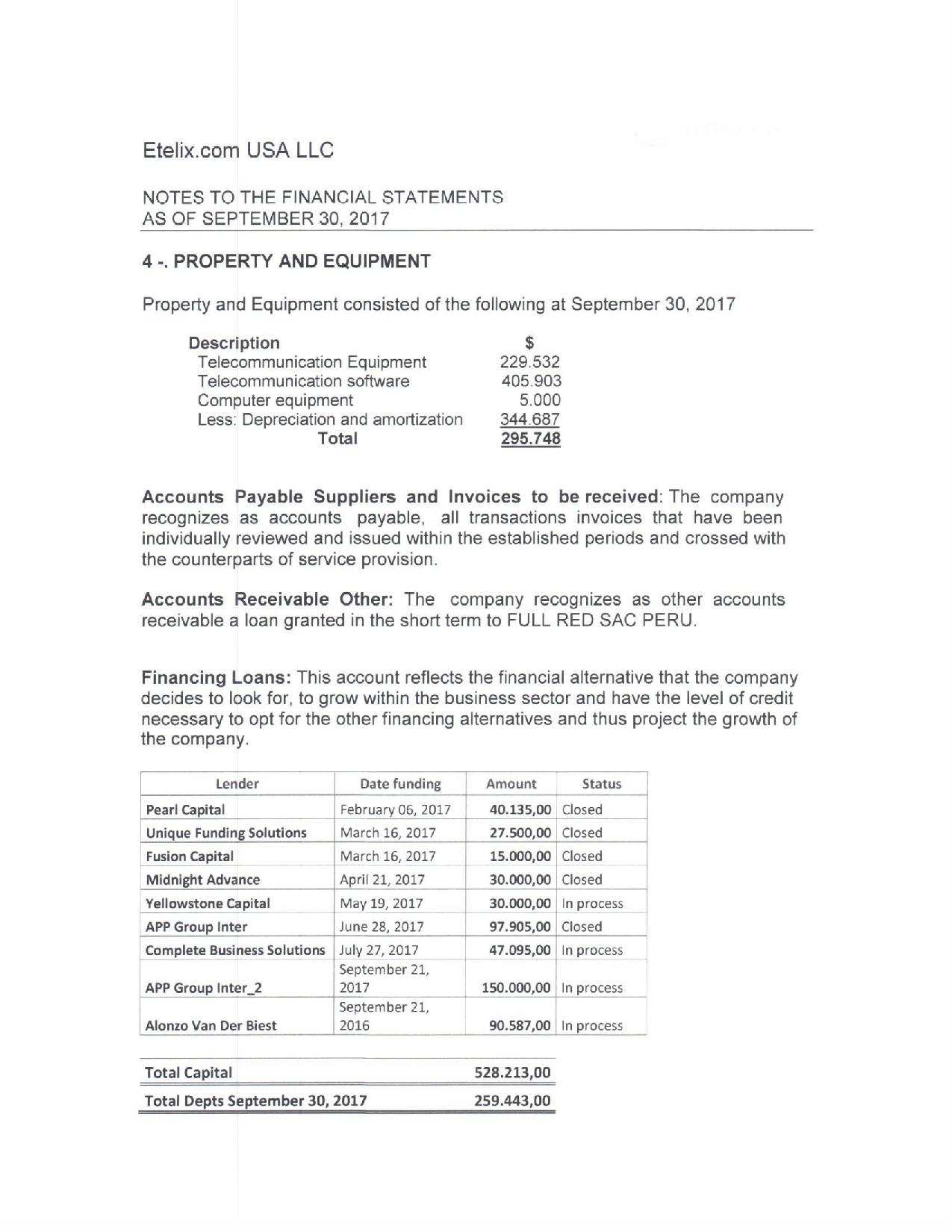

4 -. PROPERTY AND EQUIPMENT

Property and Equipment consisted of the following at December 31, 2016

| Description | | $ |

| Telecommunication Equipment | | | 229.532 | |

| Telecommunication software | | | 405.903 | |

| Computer equipment | | | 5.728 | |

| Less: Depreciation and amortization | | | 288.831 | |

| Total | | | 352.332 | |

Accounts Payable Suppliers and Invoices to be received: The company recognizes as accounts payable, all transactions invoices that have been individually reviewed and issued within the established periods and crossed with the counterparts of service provision.

Accounts Receivable Other: The company recognizes as other accounts receivable a loan granted in the short term to FULL RED SAC PERU.

Income from services: The revenues of the company are the product of the sale of minutes for long-distance telecommunications, network utilization and fund administration for ETELIX.Net and Etelix.UK collections and payments.

Cost of the Service: The service costs represent the purchase of minutes to the different operators with whom the activity is handled and the exchange of the service rendering is performed.

5-. COMMITMENTS - SHAREHOLDER´S EQUITY

The result of the company at the close of 2016 $ 56.044 was 2015 $ 22.987 and 2014 $ 50.153 and 2013 $ 14.074. Social capital consists of $ 1.000and unrealized capital of $ 747.515, by acquisition of assets.

6-. INCOME TAX:

The company from the moment it decides to start operations in 2013, has submitted all the corresponding declarations to the ISR for each period 2013, 2014 and 2015, with legal extensions, as established in the IRS, by the year 2016 already stabilizes With the timely fulfillment of their fiscal commitments.