UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

(Amendment No. 2)

(Mark One)

[X] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended ________________________________

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to __________

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _______________

Commission file number ________________

BRIDGEPORT VENTURES INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Ontario

(Jurisdiction of incorporation or organization)

1000 - 36 Toronto Street, Toronto, Ontario M5C 2C5

(Address of principal executive offices)

Carmelo Marrelli, phone (416) 848-0106, fax (416) 361-0923, carm@marrellisupport.ca

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

1

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Common Shares, without par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. 32,553,000

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ___ No X

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ___ No ___

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ___ No X

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ___ No ___

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ___ | Accelerated filer ___ | Non-accelerated filer X |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ___ | International Financial Reporting Standards as Issued by the International Accounting Standards Board ___ | Other X |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 X Item 18 ___

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ___ No ___

2

BRIDGEPORT VENTURES INC.

FORM 20-F/A REGISTRATION STATEMENT

TABLE OF CONTENTS

| Part I | ||

| &nb sp; | Page | |

| Item 1. | Identity of Directors, Senior Management and Advisers | 8 |

| Item 2. | Offer Statistics and Expected Timetable | 8 |

| Item 3. | Key Information | 9 |

| Item 4. | Information on the Company | 20 |

| Item 4A. | Unresolved Staff Comments | 112 |

| Item 5. | Operating and Financial Review and Prospects | 112 |

| Item 6. | Directors, Senior Management and Employees | 124 |

| Item 7. | Major Shareholders and Related Party Transactions | 132 |

| Item 8. | Financial Information | 134 |

| Item 9. | The Offer and Listing | 135 |

| Item 10. | Additional Information | 136 |

| Item 11. | Quantitative and Qualitative Disclosures About Market Risk | 147 |

| Item 12. | Description of Securities Other than Equity Securities | 147 |

| Part II | ||

| Item 13. | Defaults, Dividend Arrearages and Delinquencies | 147 |

| Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 148 |

| Item 15. | Controls and Procedures | 148 |

| Item 16. | [Reserved] | 148 |

| Item 16A. | Audit Committee Financial Expert | 148 |

| Item 16B. | Code of Ethics | 148 |

| Item 16C. | Principal Accountant Fees and Services | 148 |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 148 |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 148 |

| Item 16F. | Changes in Registrant’s Certifying Accountant | 148 |

| Part III | ||

| Item 17. | Financial Statements | 148 |

| Item 18. | Financial Statements | 149 |

| Item 19. | Exhibits | 150 |

3

GLOSSARY OF TECHNICAL TERMS

Agrillite means a sedimentary rock composed of compacted mud and clay particles.

Assay means the quantitative test of minerals and ore by chemical and/or fire assay techniques.

Breccia means a coarse-grained clastic rock, composed of angular broken rock fragments held together by a mineral cement or in a fine-grained matrix.

Clastic means pertaining to a rock or sediment composed principally of broken fragments that are derived from pre-existing rocks or minerals and that have been transported some distance from their places of origin; also said of the texture of such a rock.

Conglomerates means a coarse-grained clastic sedimentary rock, composed of rounded to subangular fragments, set in a fine-graned matrix.

Cretaceous means a geological period between 66 and 135 million years ago and which identifies the formation date of strata.

Gangue means the valueless rock or mineral aggregates in an ore.

Hydrothermal Alteration means the chemical and mineralogical changes in rock brought about by the addition or removal of materials by hydrothermal fluids (for example, silicification).

Igneous means a rock or mineral that solidified from molten or partly molten material.

Intrusive means a rock formed by the process of emplacement of magma in pre-existing rock.

Lithology means the description of rocks on the basis of such characteristics as color, mineralogic composition, and grain size.

Magma means naturally occurring mobile rock material, generated within the earth and capable of intrusion and extrusion and from which igneous rocks are thought to have been derived through solidification and related processes.

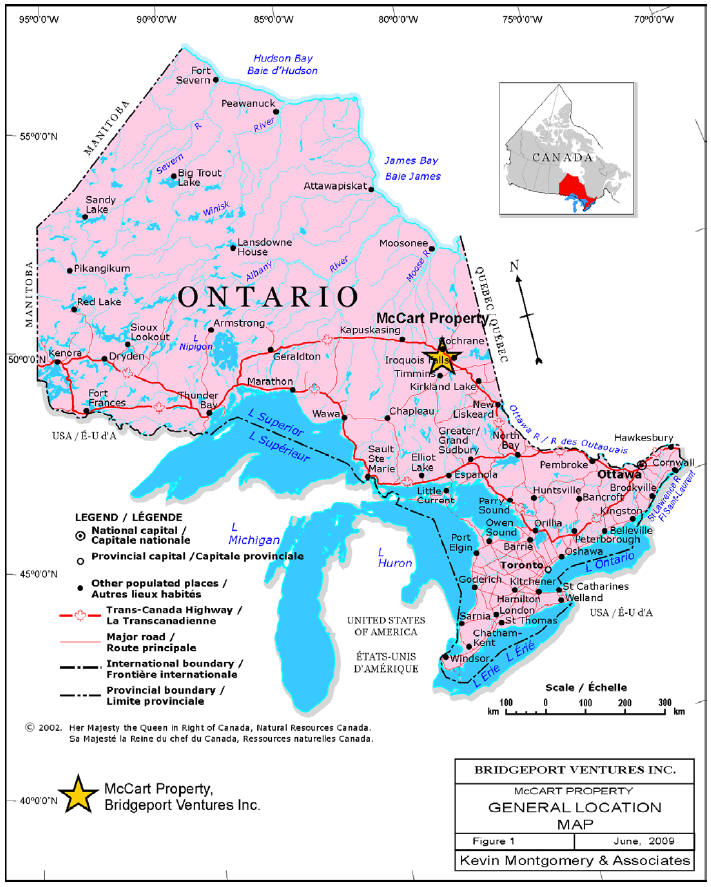

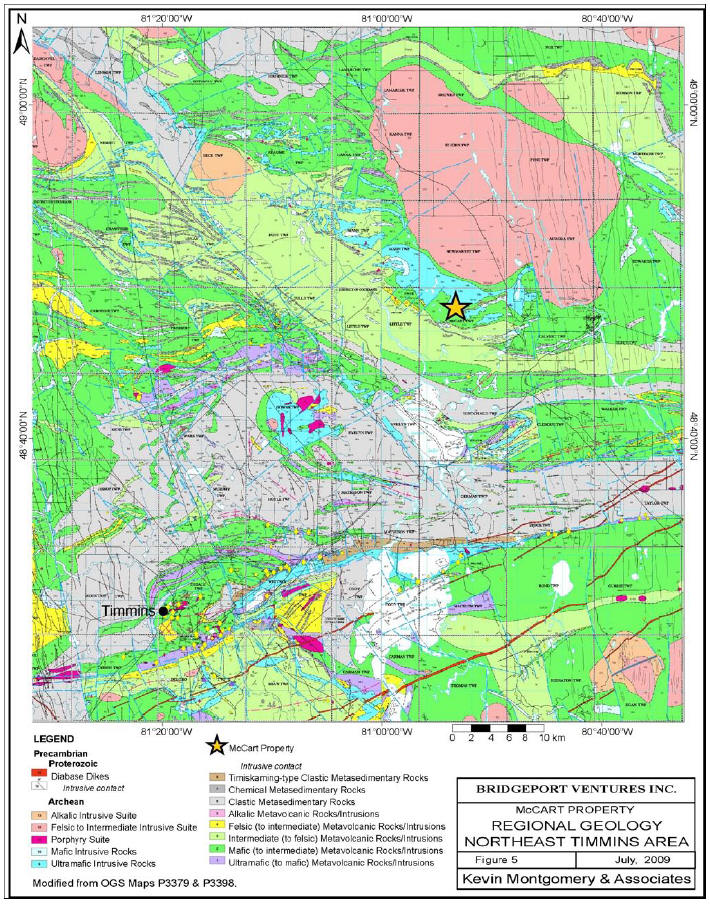

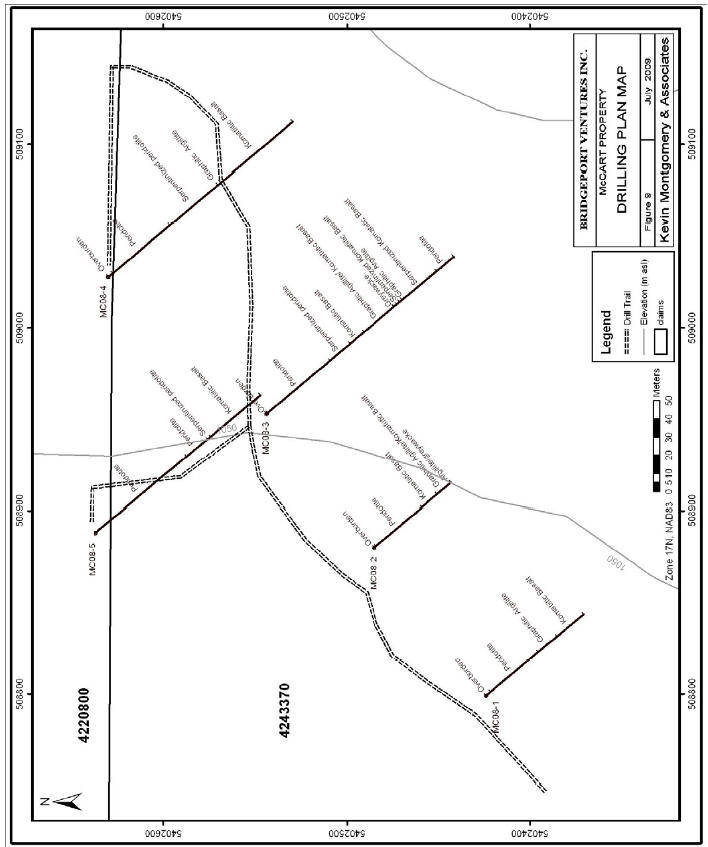

McCart Property means the property comprised of five mineral claims totalling approximately 534 hectares located in McCart Township, Porcupine Mining Division, Ontario known as the McCart Property, in which Bridgeport Ventures Inc. (the “Corporation”) holds a 100% interest, subject to a 2% NSR with respect to two such mineral claims and a 1% NSR with respect to three such mineral claims.

McCart Report means the technical report dated July 20, 2009 entitled “A Report to NI 43-101 Standards on the McCart Property, Ontario, Canada for Bridgeport Ventures Inc.” and prepared by Kevin Montgomery, M.Sc.(A), P. Geo., for the Corporation in respect of the McCart Property in compliance with NI 43-101.

Mineral Deposit means a deposit of mineralization which may or may not be ore, the determination of which requires a comprehensive feasibility study. A mineral deposit usually has been intersected by sufficient closely spaced drill holes and/or underground sampling to support sufficient tonnage and average grade of metal(s) tow arrant further exploration and development work.

Mineralized Material means a mineralized body which has been delineated by appropriately spaced drilling and/or underground sampling to support an estimate of size by tonnage and average grade of metals. Such a deposit does not qualify as “ore” or a reserve, which would require a comprehensive feasibility evaluation based upon unit cost, grade, recoveries, and other factors relating to engineering, legal, financial and economic feasibility.

Mineral Reserve means the economically mineable part of a Mineral Resource classified as “measured” or “indicated” demonstrated by at least a preliminary feasibility study. Mineral Reserves can be classified into “proven” and “probable” categories.

Mineral Resource means a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are subdivided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

4

Molybdenum means a hard, silvery metal used in steel and nickel alloys.

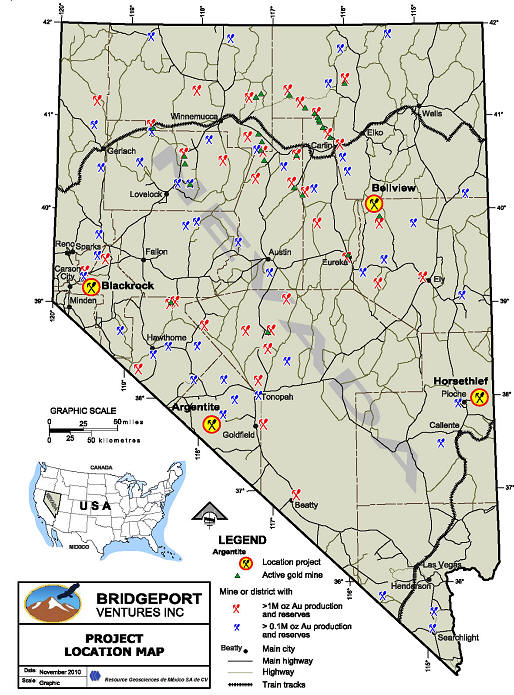

Nevada Report means the technical report dated November 26, 2010 entitled "Summary Report on the Nevada Gold Project Portfolio Comprising the Blackrock, Argentite, Bellview and Horsethief Gold Projects, Nevada, USA" prepared by Matthew Gray, Ph.D., C.P.G. for the Corporation in respect of the Nevada Portfolio properties (as hereinafter defined) in compliance with NI 43-101.

NI 43-101 means National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators.

NSR means net smelter return royalty.

Ore means a mineral or aggregate of minerals more or less mixed with gangue which can be profitably mined given economic circumstances at the time. The Corporation does not own any interest in properties where the mineralization has been determined to be ore.

Oxide means mineral from which sulphur has been partially or completely removed by the action of surface water and oxygen.

Plan means the stock option plan of the Corporation which received shareholder approval on December 18, 2007.

Porphyritic means pertaining to or resembling porphyry.

Porphyry means an igneous rock containing conspicuous crystals or phenocrysts in a fine-grained groundmass; type of mineral deposit in which ore minerals are widely disseminated, generally of low grade but large tonnage.

Pyrite means a very common iron sulphide mineral often associated with gold and other economic mineral deposits.

Pyroclastic means type of fragmented rock formed by volcanic explosion or aerial expulsion.

Pyrrhotite means an iron sulphide mineral, sometimes magnetic. Less widespread than pyrite, often associated with nickel and copper deposits.

Rhyolite means an extrusive igneous (volcanic) rock with phenocrysts of quartz and alkalic feldspar, commonly of porphyritic texture.

Rosario Property means the property comprised of 551 hectares known as the Rosario property located in Region III of Chile near the mining centre of Copiapo, in which Rio Condor holds the right to acquire a 100% interest subject to certain underlying royalties.

Rosario Report means the technical report dated November 27, 2009 as revised December 4, 2009 entitled “Summary Report on the Rosario Copper-Gold Project, Region III, Atacama, Chile” and prepared by Matthew Gray, Ph.D, C.P.G. for the Corporation in respect of the Rosario Property in compliance with NI 43-101.

Sedimentary means rock formed of sediment, as conglomerate, sandstone and shale, formed of fragments of other rock transported from their sources and deposited in water; rocks formed by precipitation from solution as rock salt or gypsum or non-organic secretions of organisms, e.g., most limestone.

Strata means a tabular or sheet-like body of sedimentary rock.

Sulphide means a group of minerals consisting of metals combined with sulphur; common metallic ores. (or “Sulfide”)

Vein means a tabular or sheet-like mineral deposit with identifiable walls, often filling a fracture or fissure

Wallrock means the rock forming the walls of a vein or other mineral deposit.

5

NOTE TO U.S. READERS – DIFFERENCES REGARDING THE DEFINITIONS OF RESOURCE AND

RESERVE ESTIMATES IN THE UNITED STATES AND CANADA

| Mineral Reserve | Under United States standards, a “mineral reserve” is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made, where: |

“reserve” means that part of a mineral deposit which can be economically and legally extracted or produced at the time of the reserve determination; | |

“economically” implies that profitable extraction or production has been established or analytically demonstrated to be viable and justifiable under reasonable investment and market assumptions; and | |

while “legally” does not imply that all permits needed for mining and processing have been obtained or that other legal issues have been completely resolved, for a reserve to exist, there should be a reasonable certainty based on applicable laws and regulations that issuance of permits or resolution of legal issues can be accomplished in a timely manner. | |

Mineral reserves are categorized as follows on the basis of the degree of confidence in the estimate of the quantity and grade of the deposit. Under United States standards, proven or measured reserves are defined as reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes, grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geographic character is so well defined that size, shape, depth and mineral content of reserves are well established. Under United States standards, probable reserves are defined as reserves for which quantity and grade and/or quality are computed from information similar to that of proven reserves (under United States standards), but the sites for inspection, sampling, and measurement are further apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven mineral reserves, is high enough to assume continuity between points of observation. | |

| Mineral Resource | While the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource,” and “inferred mineral resource” are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. As such, information contained in this report concerning descriptions of mineralization and resources under Canadian standards may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the Securities and Exchange Commission. “Indicated mineral resource” and “inferred mineral resource” have a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. |

6

FORWARD-LOOKING STATEMENTS

This Registration Statement contains certain forward-looking statements. Readers can identify these forward-looking statements by the use of words such as "expect", "anticipate", "estimate", "believe", "may", "potential", "intends", "plans" and other similar expressions or statements that an action, event or result "may", "could" or "should" be taken, occur or be achieved, or the negative thereof or other similar statements. These statements are only predictions and involve known and unknown risks, uncertainties and other factors which may cause the Corporation’s actual results, performance or achievements, or industry results, to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. Such statements include, but are not limited to: (i) the Corporation’s belief on the basis of the McCart Report that the McCart Property is prospective for nickel ("Ni"); (ii) the Corporation’s plan to target certain types of properties for acquisition and exploration, including properties which are prospective for gold ("Au") and Ni resources; the Corporation’s anticipation that, as its stable of properties grows, that there will be a greater emphasis placed on the exploration of such properties, with the long-term goal of developing the properties and achieving commercial production; (iii) the possibility that the Corporation may enter into partnerships in order to fully exploit the production potential of its exploration assets; (iv) the possibility that the Xstrata Kidd Metallurgical Site might be available to process potential Ni ore from the McCart Property thereby obviating the need of the Corporation to build a mill at such property; (v) the possibility that there is excess base metal capacity at the Xstrata Kidd Metallurgical Site that would be available to the Corporation should an economic base metals deposit be discovered on the McCart Property; (vi) management’s belief that the Corporation’s cash is sufficient to meet its general and administrative expenditures for fiscal 2010 at current operating levels; (vii) the Corporation’s intended use of cash for funding of its general and administrative expenditures and funding its investment activities; (viii) management’s belief that the Corporation has sufficient funds to finance operations with respect to the Rosario Property for the 12-month period ending April 30, 2011; (ix) the estimated costs of Phase 1 and Phase 2 with respect to the McCart Property; (x) the Corporation’s intent to enter into an option agreement to acquire a 100% interest in the Trillador property; (xi) the Corporation’s planned development of the mineral properties acquired from certain subsidiaries of Fronteer Gold Inc., including Fronteer Development (USA) Inc. and Nevada Eagle Resources LLC (collectively, "Fronteer") and (xii) the estimated costs of exploring and developing, if warranted, the Nevada properties acquired from Fronteer (the "Acquired Nevada Properties") and the additional 149 claims located in Nevada that the Corporation has staked (together with the Acquired Nevada Properties, the "Nevada Portfolio"). These other factors include, among others, the following: capital expenditures, operating costs, mineral resources, recovery rates, grades and prices; business strategies and measures to implement such strategies; competitive strengths; estimated goals; expansion and growth of the business and operations; plans and references to the Corporation’s future successes; the Corporation’s history of operating losses and uncertainty of future profitability; risks related to the Corporation’s ability to continue as a going concern; the Corporation’s status as an exploration stage corporation; the Corporation’s lack of mineral reserves; risks related to the Corporation’s ability to close its recently announced transaction with Fronteer to acquire certain mineral properties and to develop such mineral properties post-closing; the hazards associated with mining construction and production; compliance with environmental laws and regulations; risks associated with obtaining permits; risks associated with current variable economic conditions; the possible impact of future financings; the possibility for adverse results in potential litigation; uncertainties associated with changes in government policy and regulation; the effectiveness of the Corporation’s management and its strategic relationships; risks associated with the Corporation’s ability to attract and retain key personnel; risks related to the fact that the Corporation’s officers do not devote all of their time to the Corporation’s business; uncertainties regarding the Corporation’s need for additional capital; uncertainties relating to the Corporation’s status as a non-U.S. corporation; uncertainties related to the volatility of the Corporation’s share price and trading volumes; risk associated with the Corporation’s shares being adversely affected by the penny stock rules; ability to enforce civil liabilities under U.S. securities laws outside the United States; risks associated with the Corporation’s possible status as a "passive foreign investment corporation" under the applicable provisions of the U.S. Internal Revenue Code of 1986, as amended; risks related to the fact that the Corporation’s operations may require the approval of aboriginal peoples in the future, and other risks and uncertainties described under the heading "Risk Factors" of this Registration Statement.

METRIC EQUIVALENTS

For ease of reference, the following factors for converting metric measurements into imperial equivalents are provided:

| To Convert From Metric | To Imperial | Multiply By |

| hectares | acres | 2.471 |

| metres | feet | 3.281 |

| kilometres | miles | 0.621 |

| tonnes | tons (2000 pounds) | 1.102 |

7

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

1.A. Directors and Senior Management

The Corporation’s current directors and officers are listed below.

| Name | Business Address | Position with Company |

| Shastri Ramnath(1) | 36 Toronto Street, Suite 1000 Toronto, Ontario M5C 2C5 | President and Chief Executive Officer, Director |

| Hugh Snyder(2) | 36 Toronto Street, Suite 1000 Toronto, Ontario M5C 2C5 | Chairman |

| John McBride | 36 Toronto Street, Suite 1000 Toronto, Ontario M5C 2C5 | Director |

| Jon North | 36 Toronto Street, Suite 1000 Toronto, Ontario M5C 2C5 | Director |

| Wolf Seidler | 36 Toronto Street, Suite 1000 Toronto, Ontario M5C 2C5 | Director |

| Carmelo Marrelli | 500 – 360 Bay Street Toronto, Ontario M5H 2V6 | Chief Financial Officer |

(1) Ms. Ramnath was appointed President and Chief Executive Officer of the Corporation effective September 29, 2010 and appointed as a director on October 14, 2010.

(2) Mr. Snyder resigned as Chief Executive Officer of the Corporation effective September 29, 2010.

1.B. Advisers

Legal counsel – Cassels Brock & Blackwell LLP

2100 Scotia Plaza, 40 King Street West

Toronto, Ontario M5H 3C2

1.C. Auditors

McGovern, Hurley, Cunningham, LLP

300 - 2005 Sheppard Avenue East, Toronto, Ontario, M2J 5B4

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

8

ITEM 3. KEY INFORMATION

3.A. Selected Financial Data

The selected financial data below is presented in accordance with Canadian generally accepted accounting principles.

| As at April 30, 2010 (in Cdn$) (Audited) | As at April 30, 2009 (in Cdn$) (Audited) | As at April 30, 2008 (in Cdn$) (Audited) | |

| Total Current Assets | $11,267,724 | $113,189 | $295,619 |

| Interest in Mineral Property and Deferred Exploration Expenditures | $3,840,460 | $165,932 | $135,000 |

| Total Current Liabilities | $325,079 | $29,926 | $8,972 |

| Capital Stock | $11,798,967 | $367,100 | $367,100 |

| Total Shareholders’ Equity, 28,036,000, 7,895,000 and 7,895,000 common shares outstanding as of April 30, 2010, 2009 and 2008, respectively | $14,384,923 | $233,995 | $357,847 |

| Year Ended April 30, 2010 (in Cdn$) (Audited) | Year Ended April 30, 2009 (in Cdn$) (Audited) | Period from incorporation on May 10, 2007 to April 30, 2008 (in Cdn$) (Audited) | |

| Revenue | - | - | - |

| Net loss | $1,978,198 | $123,852 | $9,253 |

| Net loss per share, basic | $0.12 | $0.02 | $0.00 |

| As at July 31, 2010 (in Cdn$) (Unaudited) | As at July 31, 2009 (in Cdn$) (Unaudited) | |

| Total Current Assets | $10,043,785 | $94,830 |

| Interest in Mineral Property and Deferred Exploration Expenditures | $4,422,054 | $22,510 |

| Total Current Liabilities | $115,822 | $58,346 |

| Capital Stock | $11,801,733 | $397,100 |

| Total Shareholders’ Equity, 28,041,000 and 8,045,000 common shares outstanding as of July 31, 2010 and 2009, respectively | $13,969,426 | $256,934 |

| Three months ended July 31, 2010 (in Cdn$) (Unaudited) | Three months ended July 31, 2009 (in Cdn$) (Unaudited) | |

| Revenue | $- | $- |

| Net (loss) income | $(654,872) | $(7,061) |

| Net (loss) income per share, basic and diluted | $(0.02) | $(0.00) |

9

Exchange Rates

Unless otherwise indicated, all monetary references herein are denominated in Canadian Dollars. References to “$” or “Dollars” or “Cdn$” are to Canadian Dollars and references to “US$” or “U.S. Dollars” are to United States Dollars.

The following tables set forth, (i) for the three fiscal years ended April 30, 2008, 2009 and 2010 and the interim period from May 1, 2010 through July 31, 2010, the average rate of exchange for the Canadian dollar, expressed in U.S. dollars, calculated by using the average of the exchange rates on the last day for which data is available for each month during such periods; and (ii) the high and low exchange rate during the previous six months, in each case based on the Bank of Canada noon rate of exchange.

The average rate, calculated by using the average of the exchange rates on the last day of each month during the period, is set out for each of the periods indicated in the table below.

| Quarter Ended | Year Ended April 30, | |||

| July 31, 2010 | 2010 | 2009 | 2008 | |

| Average (US$) for Period | $0.9619 | $0.9358 | $0.8767 | $0.9841 |

The high and low exchange rates for each month during the previous six months are as follows:

| Month Ended | ||||||

| November 2010 | October 2010 | September 2010 | August 2010 | July 2010 | June 2010 | |

| High for Period (US$) | $0.9987 | $0.9970 | $0.9783 | $0.9844 | $0.9724 | $0.9805 |

| Low for Period (US$) | $0.9743 | $0.9690 | $0.9506 | $0.9397 | $0.9381 | $0.9429 |

As of April 30, 2010, the noon rate of exchange, as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was US$0.9885 (US$1.00 = Cdn$1.0116).

As of December 2, 2010, the noon rate of exchange, as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was US$0.9954 (US$1.00 = Cdn$1.0046).

The financial statements of the Corporation are prepared in accordance with Canadian generally accepted accounting principals ("Canadian GAAP").

3.B. Capitalization and Indebtedness

The table below sets forth the capitalization of the Corporation as of July 31, 2010. The Corporation does not have any outstanding long-term debt.

| Shareholders’ Equity: | |||

| Common Shares, no par value; | |||

| unlimited common shares authorized | |||

| 28,041,000 common shares issued and outstanding | $ | 11,801,733 | |

| (Deficit) | $ | (2,766,175 | ) |

| Net Shareholders’ Equity | $ | 13,969,426 | |

| TOTAL CAPITALIZATION | |||

| Stock Options Outstanding | 2,400,000 | ||

| Share Purchase Warrants Outstanding | 19,685,200 |

10

3.C. Reasons for the Offer and Use Of Proceeds

Not applicable.

3.D. Risk Factors

The Corporation operates in a dynamic and rapidly changing environment that involves numerous risks and uncertainties. The risks described below should be considered carefully when assessing an investment in the Corporation’s common shares. The occurrence of any of the following events could harm the Corporation. If these events occur, the trading price of the Corporation’s common shares could decline, and shareholders may lose part or even all of their investment.

The Corporation’s exploration and development activities are subject to certain operating risks.

Mining exploration and development operations generally involve a high degree of risk. The Corporation’s operations are subject to all the hazards and risks normally encountered in the exploration, development and production of Ni, copper (“Cu”), precious metals and other minerals, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas which may result in environmental pollution and consequent liability.

The Corporation may not discover or produce commercial quantities of minerals and may not achieve profitable operations in the future.

The exploration for and development of mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of a mineral-bearing structure may result in substantial rewards, few properties which are explored are ultimately developed into producing mines.

Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by the Corporation will result in a profitable commercial mining operation. Whether a Ni, Cu or other mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as quantity and quality of mineralization and proximity to infrastructure; mineral prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Corporation not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by the Corporation towards the search and evaluation of Ni, Cu or other minerals will result in discoveries of commercial quantities of Ni, Cu or other minerals.

Limited exploration has been conducted by the Corporation on these properties to date. No Mineral Resources or Mineral Reserves have been identified with respect to any of the Corporation’s property interests to date and there is no certainty that the expenditures made by the Corporation towards the search and evaluation of mineral occurrences will result in discoveries of commercial quantities of Ni, Cu or other minerals. The Corporation may expend substantial funds in exploring its properties only to abandon them and lose its entire expenditure on the properties if no commercial or economic quantities of minerals are found.

11

In addition, even in the event of the successful completion by the Corporation of initial exploration programs on its properties, there is no assurance that the results of such exploration will warrant the completion of further exploration of such properties and the properties might not be brought into a state of commercial production. The Corporation is an exploration stage company with no history of pre-tax profit and no income from its operations. There can be no assurance that the Corporation’s operations will be profitable in the future. Most exploration projects do not result in the discovery of commercially mineable deposits and no assurance can be given that any particular level of recovery of mineral reserves will in fact be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) mineral deposit that can be legally and economically exploited. There can be no assurance that minerals recovered in small-scale tests will be duplicated in large-scale tests under on-site conditions or in production.

In such circumstances, the Corporation may be required to acquire and focus its operations on one or more additional mineral properties. There can be no assurance that any such additional mineral properties will be available for acquisition by the Corporation or that, if available, the terms of acquisition will be favourable to the Corporation.

The Corporation does not own certain of its properties but is required to make payments to earn its interest.

If the Corporation is unable to make the required outlays, its entire investment could be lost. Certain of the Corporation’s properties, including the Rosario Property, are currently held under option. The Corporation has no ownership interest in these properties until it meets, where applicable, all required cash payments. If the Corporation is unable to fulfill the requirements of these option agreements, it is likely that it would be considered in default of the agreements and the option agreements could be terminated, resulting in the complete loss of all expenditures including the payments made on the properties to that date.

Ongoing exploration of properties currently held by the Corporation under option could result in a devaluation of such properties.

Certain of the Corporation’s properties, including the Rosario Property, are currently held under option. Until such time as the Corporation acquires an ownership in the properties, other companies have the right to explore and exploit certain of the Company’s properties. This ongoing exploration could result in a devaluation of the Company’s properties due to the potential removal of minerals from the properties by other companies. If such removal of minerals were to occur, it would likely ultimately negatively impact upon the estimated mineral resources and reserves, if any, related to such properties.

The Corporation has a history of losses and expects losses to continue for the foreseeable future. As a result, it will require additional equity financings, which will cause dilution to the interests of existing shareholders.

The Corporation has limited financial resources and has no operating cash flow. As of the quarter ended July 31, 2010, the Corporation had incurred accumulated losses totalling $2,766,175 under United States generally accepted accounting principles (“U.S. GAAP”). The continued exploration efforts will require additional capital to help maintain and expand exploration on the Corporation’s principal exploration properties. Additionally, if the Corporation decides to proceed with a feasibility study on any of its primary properties, substantial additional funds will be required to complete the study as well as to complete the acquisition of the projects held under option agreements. Late in fiscal year 2008, resulting from the on-going credit crisis centered in the United States, many economies including that of Canada went into a recession. This recession has impacted investor confidence and this has effectively reduced the availability of risk capital. The Corporation has traditionally been required to raise funds through the sale of its common shares and has no current plans to obtain financing through means other than equity financing. However, due to the current economic conditions, the Corporation may not be able to obtain additional equity financing on reasonable terms, if at all. If the Corporation is unable to obtain sufficient financing in the future, it might have to dramatically slow exploration efforts and/or lose control of its projects. If equity financing is required, then such financings could result in significant dilution to the interests of existing or prospective shareholders. These financings may be on terms less favourable to the Corporation than those obtained previously.

The Corporation’s ability to continue as a going concern is dependent on raising additional capital, which it may not be able to do on favorable terms, or at all.

The Corporation will need to raise additional capital to support its continuing operations. The Corporation can provide no assurance that additional funding will be available on a timely basis, on terms acceptable to the Corporation, or at all. If the Corporation is unsuccessful raising additional funding, its business may not continue as a going concern. Even if the Corporation does find additional funding sources, it may be required to issue securities with greater rights than those currently possessed by holders of its common shares. The Corporation may also be required to take other actions that may lessen the value of its common shares or dilute its common shareholders, including borrowing money on terms that are not favorable to the Corporation or issuing additional equity securities. If the Corporation experiences difficulties raising money in the future, its business and liquidity will be materially adversely affected.

12

The Corporation currently relies on a limited number of properties.

The principal property interests of the Corporation are currently its interest in the properties known as the McCart Property, the Rosario Property, and the Nevada Portfolio. As a result, unless the Corporation acquires additional property interests, any adverse developments affecting the McCart Property, the Rosario Property or the Nevada Portfolio could have a material adverse effect upon the Corporation and could materially and adversely affect the potential mineral resource production, profitability, financial performance and results of operations of the Corporation.

The Corporation is subject to certain uninsured risks which may result in losses and have a material adverse effect upon the financial performance and results of operations of the Corporation.

The Corporation’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labour disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods, fire and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to the Corporation’s properties or the properties of others, delays in mining, monetary losses and possible legal liability.

The Corporation currently maintains only general liability and director and officer insurance but no insurance against its properties or operations. Although the Corporation may in the future maintain additional insurance to protect against certain risks in such amounts as it considers to be reasonable, its insurance will not cover all the potential risks associated with a mining company’s operations. The Corporation may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to the Corporation or to other companies in the mining industry on acceptable terms. The Corporation might also become subject to liability for pollution or other hazards which may not be insured against or which the Corporation may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Corporation to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

The Corporation’s property interests may be subject to undetected title defects.

No assurances can be given that there are no title defects affecting either the McCart Property, the Rosario Property or the Nevada Portfolio. Title insurance generally is not available, and the Corporation’s ability to ensure that it has obtained secure claim to individual mineral properties or mining concessions may be severely constrained. Furthermore, the Corporation has not conducted surveys of the claims in which it holds an interest and, therefore, the precise area and location of such claims may be in doubt. Accordingly, the Corporation’s mineral properties may be subject to prior unregistered liens, agreements, transfers or claims, including native land claims, and title may be affected by, among other things, undetected defects. In addition, the Corporation may be unable to operate its properties as permitted or to enforce its rights with respect to its properties.

There are no guarantees that title to the Corporation’s properties will not be challenged in the future.

The possibility exists that the Corporation could lose title and ownership to the Rio Condor Resources S.A. (“Rio Condor”) properties even if the options it holds are validly exercised, which would have a negative effect on its operations and valuation. The Corporation’s Chilean legal counsel has reviewed documents pertaining to certain of the Rio Condor properties and has opined that title to these is current and that the agreements entered into between Rio Condor and the underlying vendors are appropriate. The Corporation has only completed a preliminary legal survey of the boundaries of some of its properties, and therefore, in accordance with the laws of the jurisdictions in which these properties are situated, their existence and area could be in doubt. There may be valid challenges to the title to the Corporation's mineral properties which, if successful, could impair the Corporation's ownership rights to such properties. Any disputes with respect to title may have to be defended through the courts. In the event of an adverse judgment, the Corporation could lose its property rights which could have a material adverse effect on the Corporation.

The unsuccessful resolution of litigation relating to the Simonetta mining concessions may result in the Corporation losing its interest in the Simonetta mining concessions.

A third party is disputing Rio Condor’s access and exploration rights at the Simonetta mining concessions. Rio Condor has initiated legal action to defend Rio Condor’s exploration rights.

If Rio Condor is not successful in either obtaining a favorable judgment or potentially reaching a settlement in connection with such litigation, Rio Condor will lose its interest in the Simonetta mining concessions with the result that it would be forced to abandon its efforts to continue exploration and, if warranted, development of the Simonetta mining concessions. In this event, the Corporation anticipates that the trading price of its common shares could decrease significantly and the Corporation may not be able to raise the additional financing that will be required to finance the Corporation to sustain its business operations. Further, the continued presence of this litigation may impair the ability of the Corporation to obtain additional financing for the further exploration and, if warranted, development of the Simonetta mining concessions. The inability to obtain financing would likely result in the Corporation’s inability to complete its exploration activities and, if warranted, development of the Simonetta mining concessions.

13

Amendments to certain government regulations applicable to mineral exploration and development activities may adversely impact the Corporation’s operations.

The development and mineral exploration activities of the Corporation are, and any future mining and processing activities will be, subject to various laws governing prospecting, development, production, taxes, labour standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. Although the Corporation’s exploration and development activities are currently, and any future mining and processing operations will be, carried out in accordance with all applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail production or development. Amendments to current laws and regulations governing operations and activities of mining and milling or more stringent implementation thereof could have a substantial adverse impact on the Corporation.

The Corporation relies upon a small number of key executives and directors and the loss of such individuals may adversely affect its business and operations.

The Corporation is dependent on the services of key executives, including the directors of the Corporation and a small number of highly skilled and experienced executives. Due to the relatively small size of the Corporation, the loss of these persons or the Corporation’s inability to attract and retain additional highly skilled personnel may adversely affect its business and future operations. The Corporation’s key executives include Shastri Ramnath, President, Chief Executive Officer and a director, Hugh Snyder, Chairman and Carmelo Marrelli, Chief Financial Officer; and the other directors of the Corporation, including John McBride, Jon North and Wolf Seidler. The Corporation maintains no "key man" life insurance on any members of its management or directors.

The Corporation’s results of operations depend on economic conditions in Chile.

The Corporation’s financial condition and results of operations depend significantly on economic conditions prevailing in Chile. According to data published by the Central Bank, the Chilean economy grew at a rate of 5.7% in 2005, 4.0% in 2006, 5.3% in 2007, 3.2% in 2008 and -1.5% in 2009. The Chilean government has exercised and continues to exercise substantial influence over many aspects of the private sector and has changed monetary, fiscal, tax and other policies to influence the Chilean economy. We have no control over and cannot predict how government intervention and policies will affect the Chilean economy or, directly and indirectly, our operations and revenues. Our operations and financial condition may be adversely affected by changes in policies involving labor laws, exchange controls, taxation, exportation and other matters. In addition, our operations and financial condition may be adversely affected by factors such as:

- fluctuations in exchange rates; base interest rate fluctuations; and

- other political, diplomatic, social and economic developments in or affecting Chile.

Mineral operations are subject to market forces outside of the Corporation’s control, which could negatively impact the Corporation’s operations.

The marketability of minerals is affected by numerous factors beyond the control of the entity involved in their mining and processing. These factors include market fluctuations, government regulations relating to prices, taxes, royalties, allowable production, import, exports and supply and demand. One or more of these risk elements could have an impact on costs of an operation and if significant enough, reduce the profitability of the operation and threaten its continuation.

The Corporation has a limited operating history and may not achieve a return on shareholders’ investment.

The Corporation has a very limited history of operations, is in the early stage of exploration and must be considered a start-up company. As such, the Corporation is subject to many risks common to such enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial and other resources and lack of revenues. There is no assurance that the Corporation will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered in light of its early stage of operations.

14

The Corporation operates in foreign countries and is subject to currency fluctuations which could have a negative effect on its operating results.

A substantial portion of the Corporation’s operations are located in Chile, which makes it subject to foreign currency fluctuations. The Corporation’s accounts are maintained in Canadian dollars while certain expenses are numerated in U.S. dollars and Chilean pesos. Such fluctuations may adversely affect the Corporation’s financial position and results of operations. Management may not take any steps to address foreign currency fluctuations that would eliminate all adverse effects and, accordingly, the Corporation may suffer losses due to adverse foreign currency fluctuations.

The Corporation may be unable to obtain sufficient capital for purposes of financing its operations.

The development and exploration of the Corporation’s properties will require substantial additional financing. Failure to obtain sufficient financing may result in the delay or indefinite postponement of exploration, development or production on any or all of the Corporation’s properties or even a loss of property interest. The Corporation may not have sufficient funds to finance such operations. The primary source of funding available to the Corporation consists of equity financing. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, the terms of such financing will be favourable to the Corporation.

Uncertain global economic conditions will affect the Corporation and its common share price.

Current conditions in the domestic and global economies are uncertain. There continues to be a high level of market instability and market volatility with unpredictable and uncertain financial market projections. Global financial problems and lack of confidence in the strength of global financial institutions have created many economic and political uncertainties that have impacted the global economy. As a result, it is difficult to estimate the level of growth for the world economy as a whole. It is even more difficult to estimate growth in various parts of the world economy, including the markets in which the Corporation participates. All components of the Corporation's budgeting and forecasting are dependent on commodity prices and their fluctuations as well as political acceptance and policy. The prevailing economic uncertainties render estimates of future expenditures difficult.

There are significant uncertainties regarding the price of Au, Ni, Cu and other minerals and the availability of equity financing for the purposes of mineral exploration and development. The prices of Au, Ni, Cu and other minerals have fallen substantially over the past several months and financial markets have deteriorated to the point where it has become extremely difficult for companies to raise new capital. The Corporation’s future performance is largely tied to the development of its current mineral properties and the overall financial markets. Current financial markets are likely to be volatile in Canada potentially into late 2010, reflecting ongoing concerns about the stability of the global economy and weakening global growth prospects. As well, concern about global growth has led to sustained drops in the commodity markets. Unprecedented uncertainty in the credit markets has also led to increased difficulties in borrowing and raising funds. Companies worldwide have been affected particularly negatively by these trends. As a result, the Corporation may have difficulties raising equity financing for the purposes of mineral exploration and development, particularly without excessively diluting present shareholders of the Corporation. These economic trends may limit the Corporation’s ability to develop and/or further explore its mineral property interests.

The Corporation is subject to environmental risks and hazards and a failure to comply with environmental regulations could have a material adverse effect on the Corporation’s results of operations.

All phases of the Corporation’s operations are subject to environmental regulation in the jurisdictions in which it operates. These regulations mandate, among other things, the maintenance of air, water and soil quality standards, land reclamation, and the protection of vegetation, wildlife and historical and cultural resources, if present. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Corporation’s operations. Environmental hazards may exist on the properties on which the Corporation holds interests which are unknown to the Corporation at present and which have been caused by previous or existing owners or operators of the properties.

15

In Chile, exploration activities require an environmental declaration, while mining activities require an environmental evaluation. These documents are presented to the government entity (i.e., Conama or Corena) before activities begin. As the Corporation is at the exploration stage, the disturbance of the environment is limited and the costs of complying with environmental regulations are minimal. However, if operations result in negative effects upon the environment, government agencies will usually require the Corporation to provide remedial actions to correct the negative effects.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations or in the exploration or development of mineral properties may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining and exploration companies, or more stringent implementation thereof, could have a material adverse impact on the Corporation and cause increases in exploration expenses, capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Permitting, licensing and approval processes are required for the Corporation’s operations and obtaining and maintaining these permits, licenses and approvals is subject to many conditions which the Corporation may be unable to achieve.

The Corporation’s exploration activities are subject to various federal, provincial and local laws governing land use, the protection of the environment, prospecting, development, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, and other matters. Many of the operations of the Corporation require licenses and permits from various governmental authorities. Exploration generally requires one form of permit while development and production operations require additional permits.

The Corporation believes it holds or is in the process of obtaining all necessary licenses and permits to carry on the activities which it is currently conducting under applicable laws and regulations. Such licenses and permits are subject to changes in regulations and changes in various operating circumstances. There can be no guarantee that the Corporation will be able to obtain all necessary licenses, permits and approvals that may be required to maintain its exploration and mining activities including constructing mines or milling facilities and commencing operations of any of its exploration properties. In addition, if the Corporation proceeds to production on any exploration property, it must obtain and comply with permits and licenses which may contain specific conditions concerning operating procedures, water use, the discharge of various materials into or on land, air or water, waste disposal, spills, environmental studies, abandonment and restoration plans and financial assurances. There can be no assurance that the Corporation will be able to obtain such permits and licenses or that it will be able to comply with any such conditions.

The Corporation’s operations depend upon the availability and maintenance of certain infrastructure that is necessary for purposes of mineral exploration and development activities.

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Corporation’s operations, financial condition and results of operations.

16

The Corporation faces competition from companies with greater financial resources and operational capabilities.

The mining industry is competitive in all of its phases. The Corporation faces strong competition from other mining companies in connection with the acquisition of properties producing, or capable of producing, precious and base metals. Many of these companies have greater financial resources, operational experience and technical capabilities than the Corporation. Other companies could outbid the Corporation for potential projects or produce minerals at lower costs, which would have a negative effect on the Corporation’s operations. As a result of this competition, the Corporation may be unable to maintain or acquire attractive mining properties on terms it considers acceptable or at all. Consequently, the Corporation’s revenues, operations and financial condition could be materially adversely affected.

Declining mineral prices may adversely impact the Corporation’s financial results and operations and the price of its common shares.

The price of the common shares of the Corporation, the Corporation’s financial results and exploration, development and mining activities may in the future be significantly adversely affected by declines in the price of Au, Ni, Cu or other minerals. The price of Au, Ni, Cu or other minerals fluctuates widely and is affected by numerous factors beyond the Corporation’s control such as the sale or purchase of commodities by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, the political and economic conditions of major mineral-producing countries throughout the world, and the cost of substitutes, inventory levels and carrying charges. Future serious price declines in the market value of Au, Ni, Cu or other minerals could cause continued development of and commercial production from the Corporation’s properties to be impracticable. Depending on the price of Au, Ni, Cu and other minerals, cash flow from mining operations may not be sufficient and the Corporation could be forced to discontinue production and may lose its interest in, or may be forced to sell, some of its properties. Future production from the Corporation’s mining properties is dependent upon the prices of Au, Ni, Cu and other minerals being adequate to make these properties economic.

In addition to adversely affecting the Corporation’s reserve estimates and its financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such a reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

The market price of the Corporation’s common shares may be subject to factors unrelated to the Corporation’s performance and such market price may not accurately reflect the long-term value of the common shares.

Securities of micro-cap and small-cap companies have experienced substantial volatility in the past, often based on factors unrelated to the financial performance or prospects of the companies involved. These factors include macroeconomic developments in North America and globally and market perceptions of the attractiveness of particular industries. The price of the securities of the Corporation is also likely to be significantly affected by short-term changes in Au, Ni, Cu or other mineral prices or in its financial condition or results of operations as reflected in its quarterly earnings reports. Other factors unrelated to the Corporation’s performance that may have an effect on the price of the Corporation’s securities include the following: the extent of analytical coverage available to investors concerning the Corporation’s business may be limited if investment banks with research capabilities do not follow the Corporation’s securities; lessening in trading volume and general market interest in the Corporation’s securities may affect an investor’s ability to trade significant numbers of securities; the size of Corporation’s public float may limit the ability of some institutions to invest in the Corporation’s securities; and a substantial decline in the price of the Corporation’s securities that persists for a significant period of time could cause the Corporation’s securities, if listed on an exchange, to be delisted from such exchange, further reducing market liquidity.

As a result of any of these factors, the market price of the securities of the Corporation at any given point in time may not accurately reflect the Corporation’s long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. The Corporation may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

17

The Corporation may not pay dividends on its common shares in the foreseeable future.

The Corporation has paid no dividends on its common shares since incorporation and does not anticipate paying dividends in the foreseeable future. Payment of any future dividends will be at the discretion of the Corporation’s board of directors after taking into account many factors, including the Corporation’s operating results, financial condition and current and anticipated cash needs.

Sales of common shares by existing shareholders may impair the Corporation’s ability to raise capital in the future.

Sales of a large number of common shares of the Corporation in the public markets, or the potential for such sales, could decrease the trading price of the common shares and could impair the Corporation’s ability to raise capital through future sales of common shares. At any given time, the Corporation may have previously issued common shares at an effective price per share which is lower than the then market price of the common shares as publicly traded. Accordingly, at any time a significant number of shareholders of the Corporation may have an investment profit in the common shares of the Corporation that they may seek to liquidate.

The Corporation’s directors and officers may have conflicts of interest in connection with other mineral exploration and development companies.

Certain of the directors and officers of the Corporation also serve as directors and/or officers and/or shareholders of other companies involved in natural resource exploration and development. Specifically, John McBride serves as a director for Brionor Resources Inc., Merc International Minerals Inc. and Anaconda Mining Inc.; Jon North serves as a director for New Dawn Mining Corp., Northquest Ltd. and Continental Nickel Limited; Wolf Seidler serves as a director for Inmet Mining Corporation; and Carmelo Marrelli serves as a director for Odyssey Resources Limited. Each of these companies is in either resource exploration or development, or mining. Consequently, it is possible that conflicts of interest may arise between these individuals’ duties as directors and officers of the Corporation and their duties as directors of other corporations. For example, certain corporate opportunities may come to the attention of such individuals where such opportunities would be attractive to both the Corporation and another corporation for which the individual serves as a director. Any decision made by any of such directors and officers involving the Corporation should be made in accordance with their duties and obligations to deal fairly and in good faith with a view to the best interests of the Corporation and its shareholders. In addition, each of the directors is required to declare and refrain from voting on any matter in which such directors may have a conflict of interest in accordance with the procedures set forth in the Business Corporations Act (Ontario) (the "Business Corporations Act") and other applicable laws.

The Corporation’s executive officers do not devote all of their time to the Corporation’s business, which may hinder its ability to operate successfully.

The Corporation’s executive officers are involved in other business activities, which may result in their spending less time than may be required to manage the Corporation's business successfully. This could have a material adverse effect on the Corporation’s business, financial condition and results of operations. In addition, the amount of time the Corporation’s officers will allocate among its business and other businesses could vary significantly from time to time depending on various circumstances and needs of the businesses, such as the relative levels of strategic activities of the businesses. There are no formal requirements or guidelines for the allocation of the Corporation’s officers' time between its business and other businesses.

The Corporation has no history of earnings and no foreseeable earnings.

None of the properties in which the Corporation has or may acquire an interest has been determined to be commercially feasible and hence none have any commercial production. The Corporation has no history of profits and has a substantial deficit. The Corporation receives no revenues, earnings or cash flow from production or otherwise and is entirely dependent on raising additional equity and loan financing.

While the Corporation may receive funds from the exercise of outstanding share purchase warrants and stock options there are no assurances that this will occur. While the Corporation may generate additional working capital through joint ventures or sale of its properties in whole or in part, there is no assurance that this will be possible.

18

U.S. investors may have difficulty enforcing U.S. judgments against the Corporation.

The Corporation is incorporated under the laws of Ontario, Canada and all of the Corporation’s directors and officers are residents of Canada. Consequently, it may be difficult for U.S. investors to effect service of process within the United States upon the Corporation or upon such persons who are not residents of the United States, or to realize in the United States upon judgments of U.S. courts predicated upon civil liabilities under U.S. securities laws. A judgment of a U.S. court predicated solely upon such civil liabilities may be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter. There is substantial doubt whether an original action could be brought successfully in Canada against any of such persons or the Corporation predicated solely upon such civil liabilities.

The Corporation may be a passive foreign investment company, which has certain adverse consequences for U.S. Holders (as defined herein).

A non-U.S. corporation generally will be considered a “passive foreign investment company” (a “PFIC”) as such term in defined in the U.S. Internal Revenue Code of 1986, as amended (the “Code”), for any taxable year if either (1) at least 75% of its gross income is passive income or (2) at least 50% of the value of its assets is attributable to assets that produce or are held for the production of passive income. If the Corporation were treated as a PFIC for any taxable year in which a U.S. Holder held the Corporation’s shares, certain adverse consequences could apply, including a material increase in the amount of tax that the U.S. Holder would owe, an imposition of tax earlier than would otherwise be imposed, interest charges and additional tax form filing requirements.

The determination of whether a corporation is a PFIC involves the application of complex tax rules. The Corporation has not made a conclusive determination as to whether it has been in prior tax years or is currently a PFIC. The Corporation could have qualified as a PFIC for past tax years and may qualify as a PFIC currently or in future tax years. However, no assurance can be given as to such status for prior tax years, for the current tax year or future tax years. U.S. Holders of Corporation’s shares are urged to consult their own tax advisors regarding the application of U.S. income tax rules. Each U.S. Holder of the Corporation is urged to consult a tax advisor with respect to how the PFIC rules affect their situation.

Shares of the Corporation may be adversely affected by the penny stock rules.

Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) impose sales practice and disclosure requirements on certain broker-dealers who engage in certain transactions involving “penny stocks.” Subject to certain exceptions, a penny stock generally includes any equity security not traded on an exchange that has a market price of less than US$5.00 per share. The Corporation’s shares are expected to be deemed penny stock for the purposes of the Exchange Act. The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in the Corporation’s shares, which could severely limit the market liquidity of the shares and impede the sale of the shares in the secondary market.

Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of US$1,000,000 or an annual income exceeding US$200,000, or US$300,000 together with his or her spouse in each of the two most recent fiscal years with a reasonable expectation of achieving such level in the current fiscal year) must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt. In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the Securities and Exchange Commission (the “Commission”) relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

19

Inflation in Chile may disrupt the Corporation’s business and have an adverse effect on its financial condition and results of operations.

Despite a decrease in 2009, Chile has experienced high rates of inflation in the past. The annual rates of inflation (as measured by changes in the consumer price index and as reported by the Chilean National Institute of Statistics) in 2007, 2008 and 2009 were 7.8%, 8.9% and -1.4%, respectively. High levels of inflation in Chile could adversely affect the Chilean economy and have a material adverse effect on the Corporation’s financial condition and results of operations. The Corporation cannot assure you that Chilean inflation will not continue to increase significantly. The Corporation cannot assure you that, under competitive pressure, it would be able to realize price increases, which could adversely impact its financial condition and results of operations.

The Chilean government could levy additional taxes on corporations operating in Chile.

In 2005, the Chilean Congress approved Law No. 20,026 (also known as the “Royalty Law”) establishing a royalty tax to be applied to mining activities developed in Chile. The Corporation cannot assure you that the way in which the Royalty Law is interpreted and applied will not change in the future. In addition, the Chilean Government may decide to levy additional taxes on mining companies or other corporations in Chile. Such changes could have a material adverse effect on the Corporation’s business, financial condition and results of operations.

Environmental laws and regulations in Chile could expose the Corporation to higher costs, liabilities, claims and failure to meet production targets in the future.

Chilean environmental regulations have become increasingly stringent in recent years, both with respect to the approval of new projects and in connection with the implementation and development of projects already approved. This trend is likely to continue. Furthermore, recently implemented environmental regulations have created uncertainty because rules and enforcement procedures for these regulations have not been fully developed. Given public interest in environmental enforcement matters, these regulations or their application may also be subject to political considerations that are beyond the Corporation’s control.

The Corporation’s operations may require the approval of aboriginal peoples in the future.

Notification to Canadian First Nations in order to conduct mineral exploration on Crown land (as described herein) is anticipated to be included in the upcoming revision of Ontario’s Mining Act. In the event that such provisions are enacted, prior to commencing any further exploration work, the Corporation will be required to contact three First Nations bands which have traditional interests covering the McCart Property. To the extent that the approval of aboriginal people of any of the Corporation’s operations is required, and such approvals are not obtained, the Corporation may be curtailed or prohibited from continuing its exploration or mining operations or from proceeding with planned exploration or development of mineral properties, which could have a material adverse impact on its operations and financial condition.

The Corporation may not be able to raise the funds necessary to develop the mineral properties acquired from Fronteer.

There is no assurance that the Corporation would be able to raise the requisite funds necessary to commence exploration and, if warranted, development of the Nevada Portfolio properties, including the Acquired Nevada Properties. The Corporation anticipates that it would need approximately $3,154,073 for completion of the phase I recommended program on the Blackrock, Argentite, Bellview and Horsethief properties comprising, in part, the Nevada Portfolio properties. If warranted based on the results of phase I, the Corporation anticipates that it would need approximately $3,538,096 for completion of the phase II recommended program on the Blackrock, Argentite, Bellview and Horsethief properties comprising, in part, the Nevada Portfolio properties. The Corporation anticipates that it would need approximately $3,057,300 for completion of the planned 2011 exploration program on the Hot Pot, Fri Gold, Columbia, Kobeh, Ashby and East Walker properties comprising, in part, the Nevada Portfolio properties. Such funds may not be available to the Corporation on terms acceptable to it, if at all. If such funds are not raised and/or the exploration and development of such mineral properties does not occur or is significantly curtailed, it would likely adversely affect the Corporation and the price of its common shares.

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

Bridgeport Ventures Inc. is a corporation which was incorporated under the laws of the Province of Ontario, Canada by articles of incorporation dated May 10, 2007. The registered office and the principal office of the Corporation are located at 36 Toronto Street, Suite 1000, Toronto, Ontario M5C 2C5, telephone number (416) 350-2173.

The Corporation completed its initial public offering in Canada on October 7, 2009, pursuant to which it issued an aggregate of 6,000,000 units at a price of $0.20 per unit to raise aggregate gross proceeds of $1,200,000. Each unit consists of one common share and one common share purchase warrant. Each warrant entitles the holder thereof to acquire one additional common share of the Corporation at an exercise price of $0.50 until October 7, 2014.