Executing On Our Unique Higher Performing Banking Model Q1 2019 Investor Presentation Member FDIC April, 2019 NYSE: CUBI

Investment Proposition Highly Focused, Innovative, Relationship Banking Based Commercial Bank Business bank with a unique private banking service model; approximately $10 billion in assets Highly skilled teams targeting privately held businesses and high net worth families Strong Organic Growth, Well Capitalized, Branch Lite Bank in Attractive Markets Target market from Boston to Washington DC along Interstate 95, and Chicago Robust risk management driven business strategy Significantly Improving Profitability & Efficient Operations Operating efficiencies offset tighter margins and generate sustainable profitability Target approximately 1.25% ROAA and double digit ROTCE in 2-3 years Strong Credit Quality & Expanding Margin Unwavering underwriting standards Loan portfolio performance consistently better than industry and peers Attractive Valuation April 18, 2019 share price of $22.30, 8.6x the 2020 consensus estimate of $2.60 and 0.93x tangible book value of $23.92(1) March 31, 2019 tangible book value(1) of $23.92, which has grown at a CAGR of 10% over the last 5 years BankMobile We expect to retain BankMobile, our disruptive digital banking strategy, for the next 2-3 years and are excited about our first White Label partnership (1) A non-GAAP measure; refer to the reconciliation schedules at the end of this document 2

Customers Bank Business Banking 3

Customers’ Single Point of Contact Model Private Banking High Tech / Service High Touch Model Excellence in Branch Lite Service Experienced Strong Asset Leadership Quality Unique Private Customer Banking Model Superior Risk Centric Management Approach to Winning Model Relationship driven but never deviate from following critical success factors • Only focus on very strong credit quality niches • Very strong risk management culture • Operate at lower efficiency ratio than peers to deliver sustainable strong profitability and growth • Always attract and retain top quality talent • Culture of innovation and continuous improvement 4

Banking Strategy – Customers Bank Very Experienced Teams Exceptional Service Risk Based Incentive Compensation Business Banking Focus - ~95% of Customers Bank Business Banking Segment revenues are from commercial business units 5

Banking Strategy – Our Footprint Customers Bank Business Banking Branches and Loan Production Offices 6

BankMobile One of America’s Fastest Growing Digital Banks for Consumers 7

BankMobile – Critical Success Factors 1. Unique and exponentially better customer acquisition strategy 2. Customer engagement and customer for life profitability strategy Critical success factors 3. Unique technology, contractual relationships, and Durbin create barriers to entry 4. Long-term profitability better than traditional banks, with potential for ROA of approximately 1.50% within 2-3 years 8

BankMobile – Banking as a Service (BaaS) Besides student disbursements, our biggest focus over the last two years has been the development of “Banking as a Service” model • Developing own proprietary technology, some patented T-Mobile • 250 team members, with over 40% entirely focused on technology development and user experience design Partnership • Spent over $20 million in R&D, technology and product development for White Label • A very customer friendly product offering • T-Mobile partnership launched in beta stage in late 2018, with official “launch” April 18, 2019 9

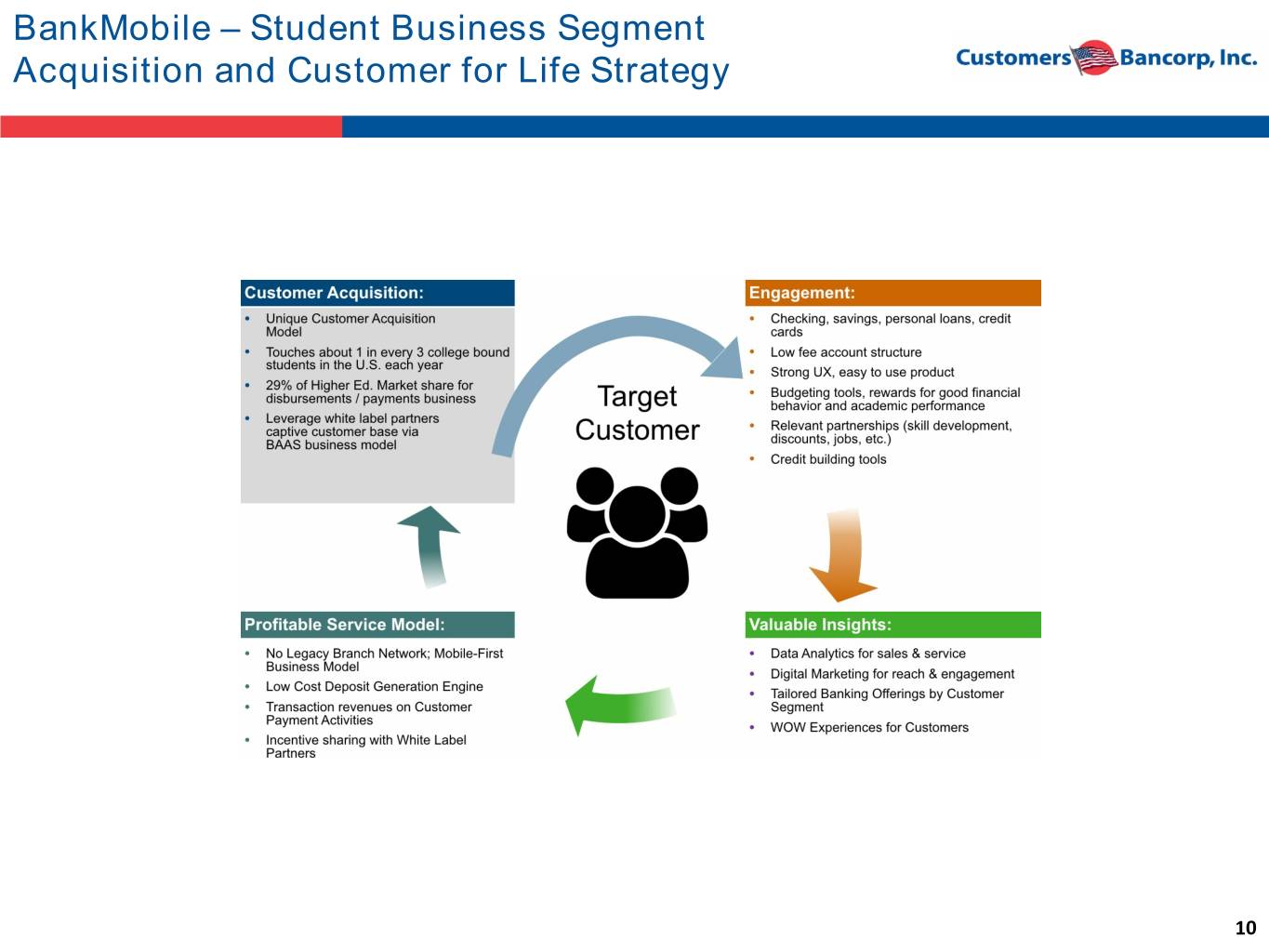

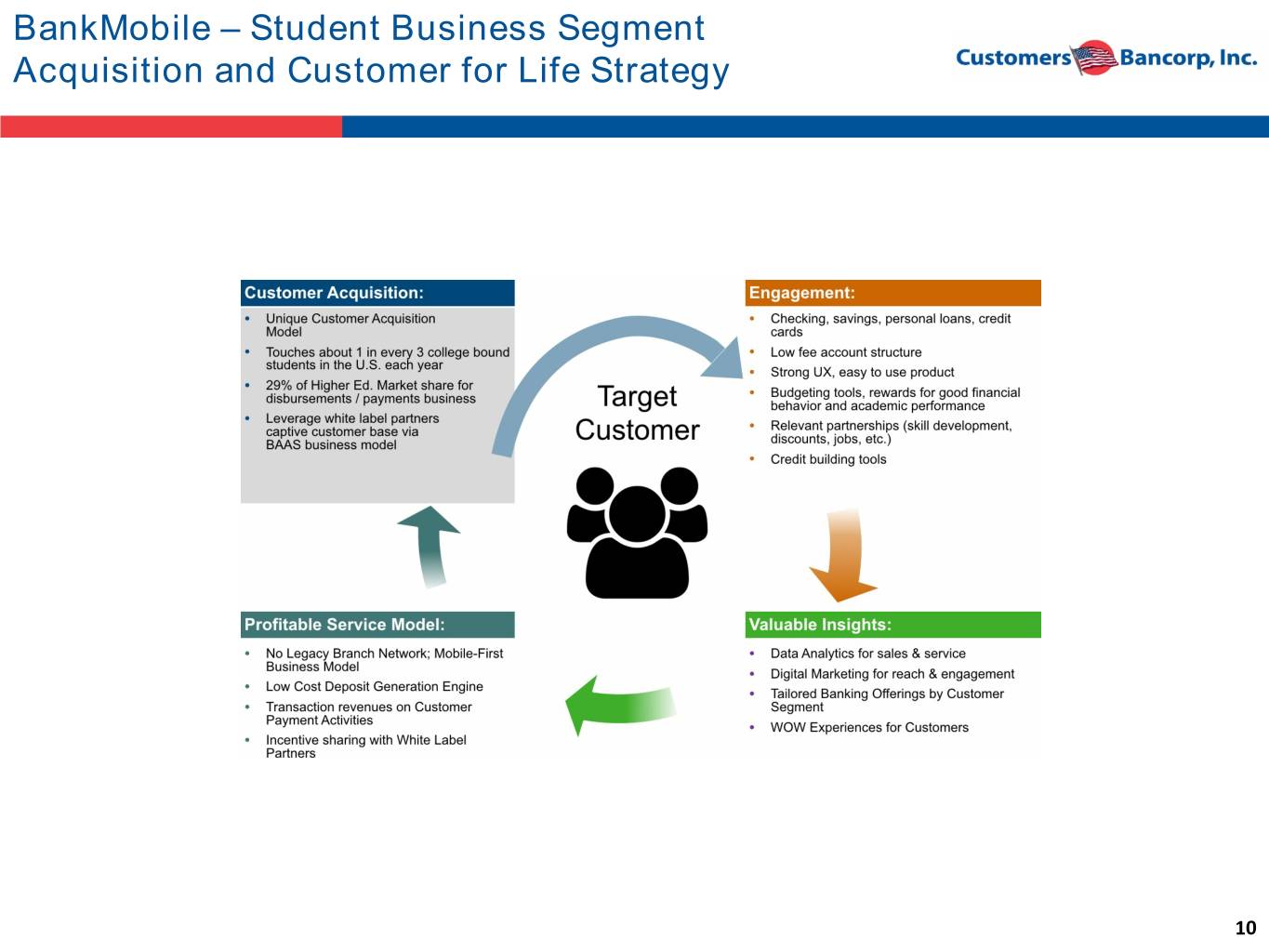

BankMobile – Student Business Segment Acquisition and Customer for Life Strategy 10

Customers Bancorp, Inc. Strategic Priorities 11

Strategic Priorities 1) Create shareholder value through improved profitability • We target an ROAA of approximately 1.25% in the next 2-3 years • We target a double digit ROTCE in the next 2-3 years • We target a NIM of 2.75%+ by year-end 2019 2) Focus and grow core banking operations • We expect to grow our core banking franchise (low cost deposits, C&I lending) through reductions in non-core areas (multi-family loans and high cost wholesale funding) • We expect to manage the size of the consolidated balance sheet to optimize capital and profitability while preserving full interchange income from debit cards 3) Grow BankMobile for 2-3 years before monetizing the investment • We expect to retain BankMobile for 2-3 years, but will regularly assess our alternatives • We expect BankMobile to generate a positive contribution to Customers’ earnings by the end of 2019 • We are excited about BankMobile’s new White Label partner, which we expect to generate significant low cost deposit growth 4) Strengthen our mix • We sold $495 million of lower yielding securities in Q3 2018 and $55 million of lower yielding multi-family loans in Q4 2018 which were funded with high cost borrowings • We purchased $133 million of residential mortgages and consumer loans in Q1 2019 • We expect to grow C&I lending and consumer lending and create space on the balance sheet with multi-family reductions • We expect to grow low cost deposits and run-off high cost funding 5) Deploy excess capital to benefit shareholders • We expect to continue to deploy excess capital, while maintaining a TCE ratio above our 7.0% target • Our board will evaluate the best options for excess capital, including share repurchases and calling preferred shares when they become callable, subject to regulatory approval 12

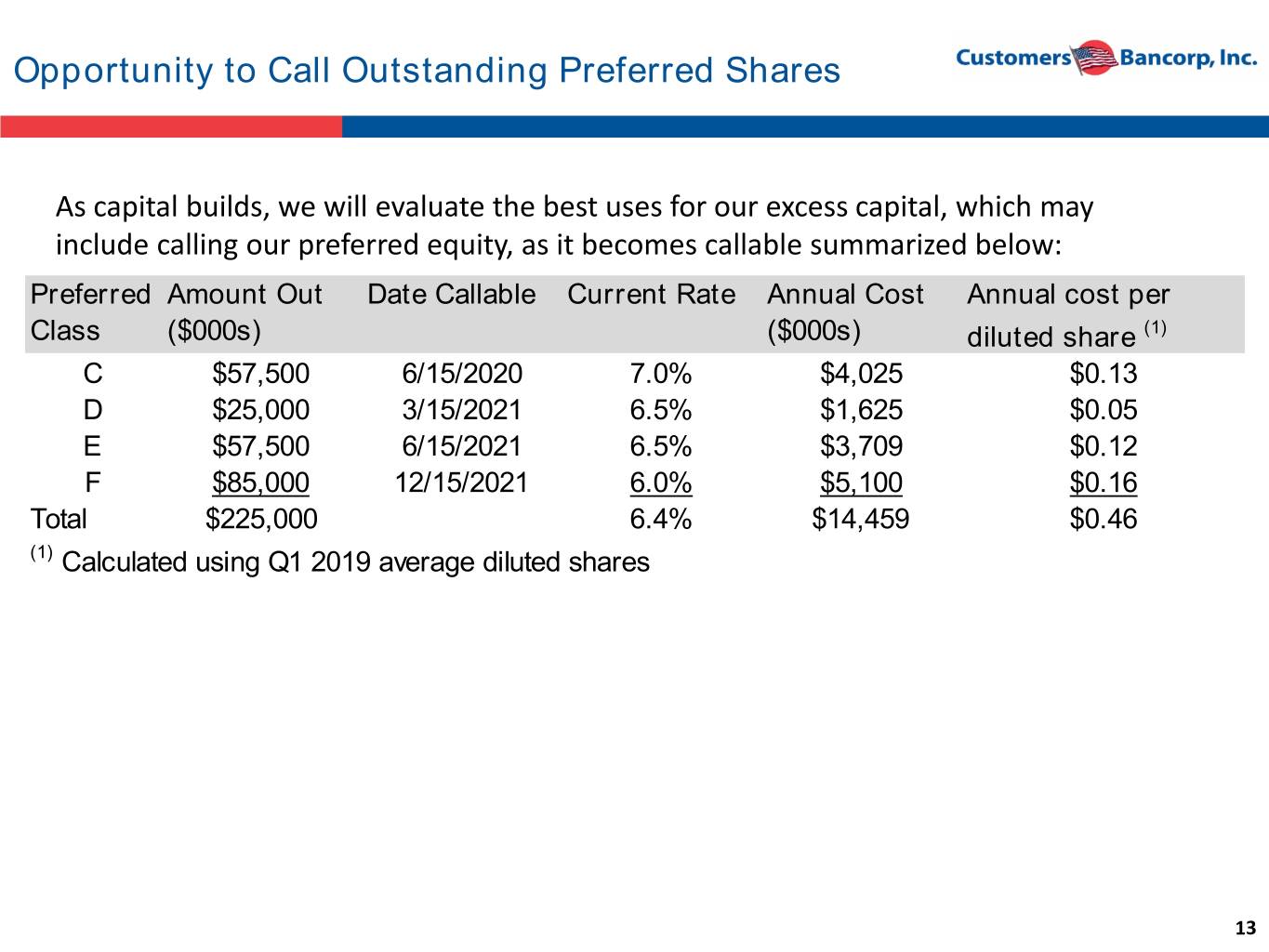

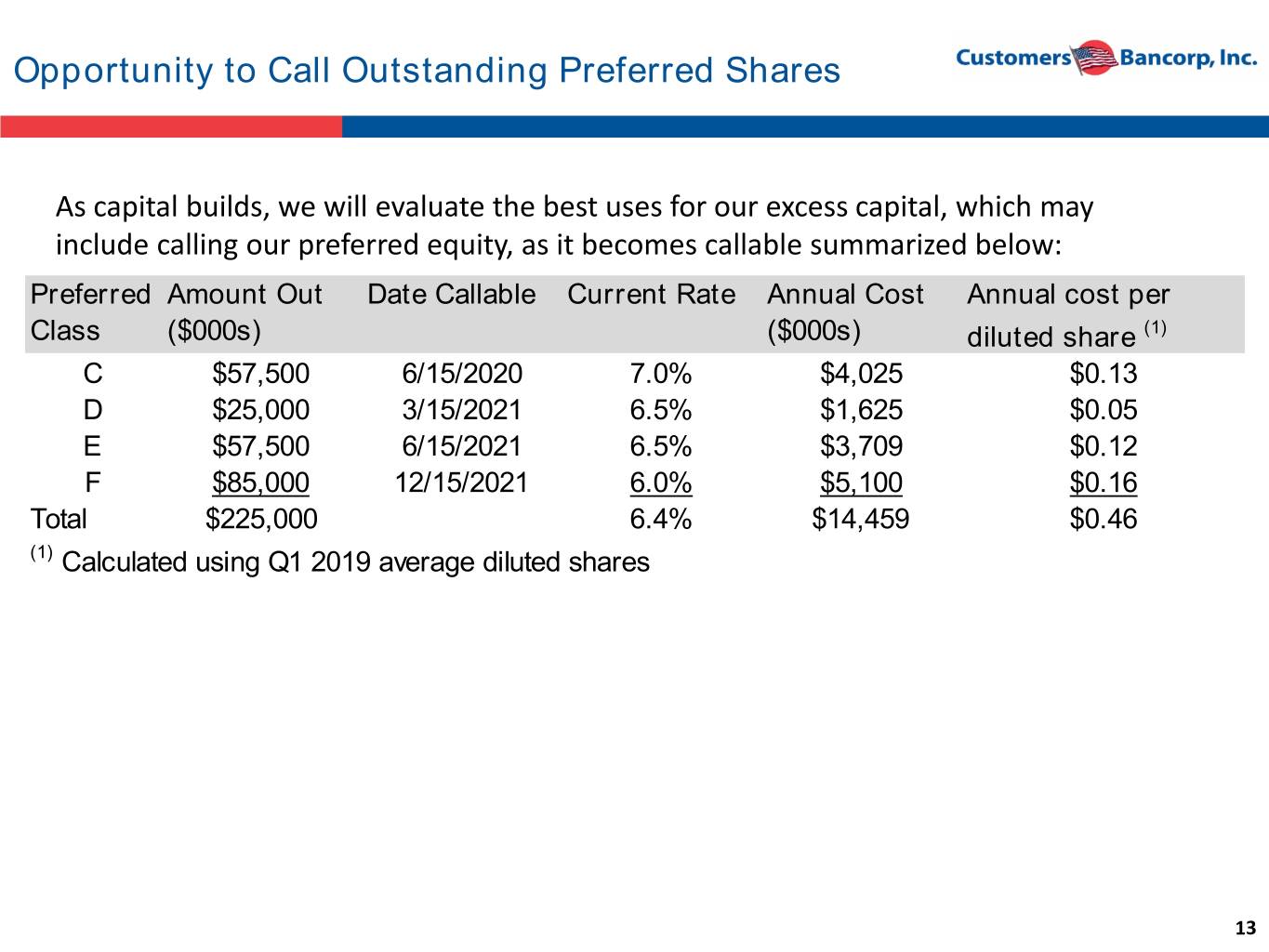

Opportunity to Call Outstanding Preferred Shares As capital builds, we will evaluate the best uses for our excess capital, which may include calling our preferred equity, as it becomes callable summarized below: Preferred Amount Out Date Callable Current Rate Annual Cost Annual cost per Class ($000s) ($000s) diluted share (1) C $57,500 6/15/2020 7.0% $4,025 $0.13 D $25,000 3/15/2021 6.5% $1,625 $0.05 E $57,500 6/15/2021 6.5% $3,709 $0.12 F $85,000 12/15/2021 6.0% $5,100 $0.16 Total $225,000 6.4% $14,459 $0.46 (1) Calculated using Q1 2019 average diluted shares 13

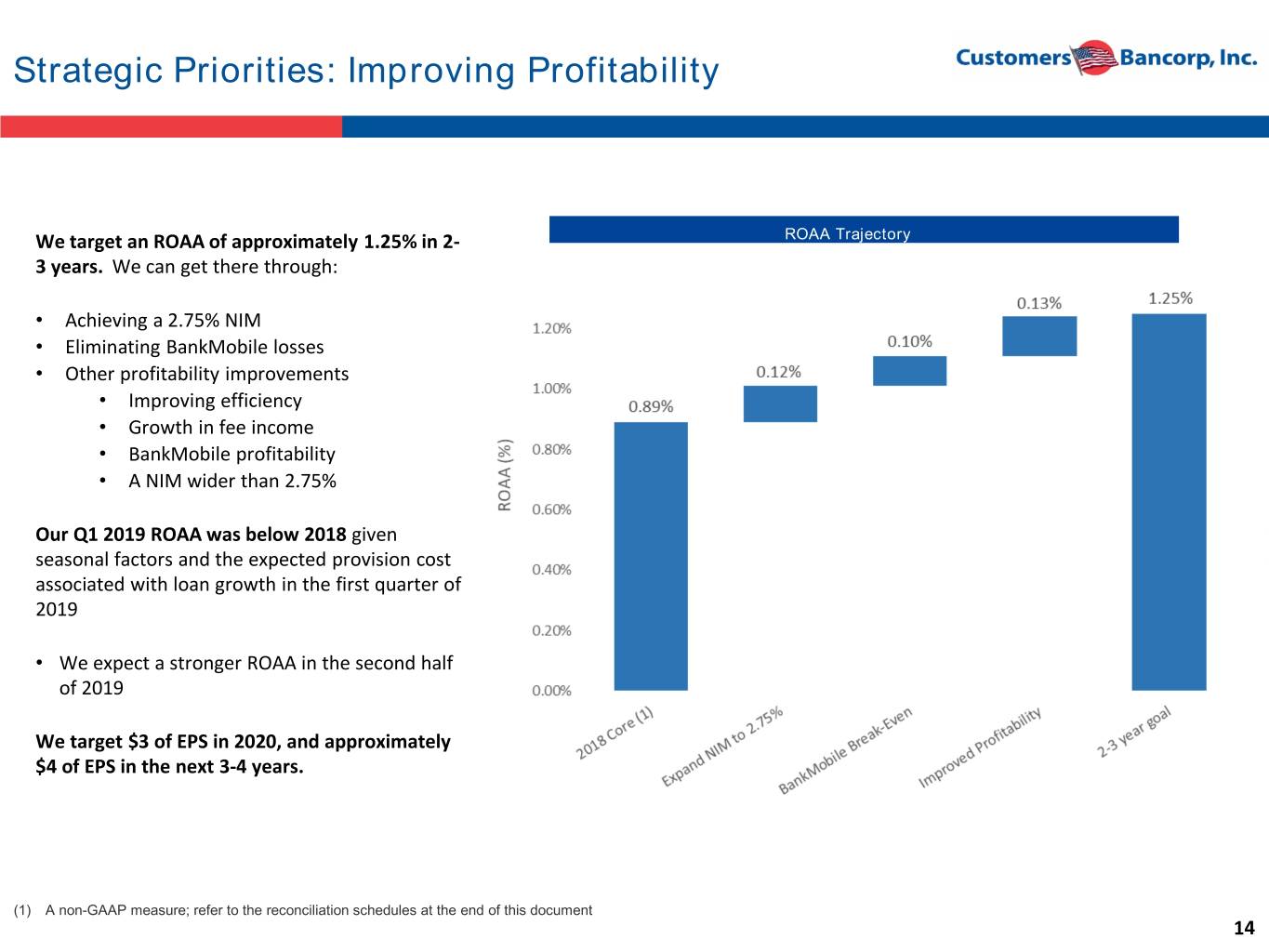

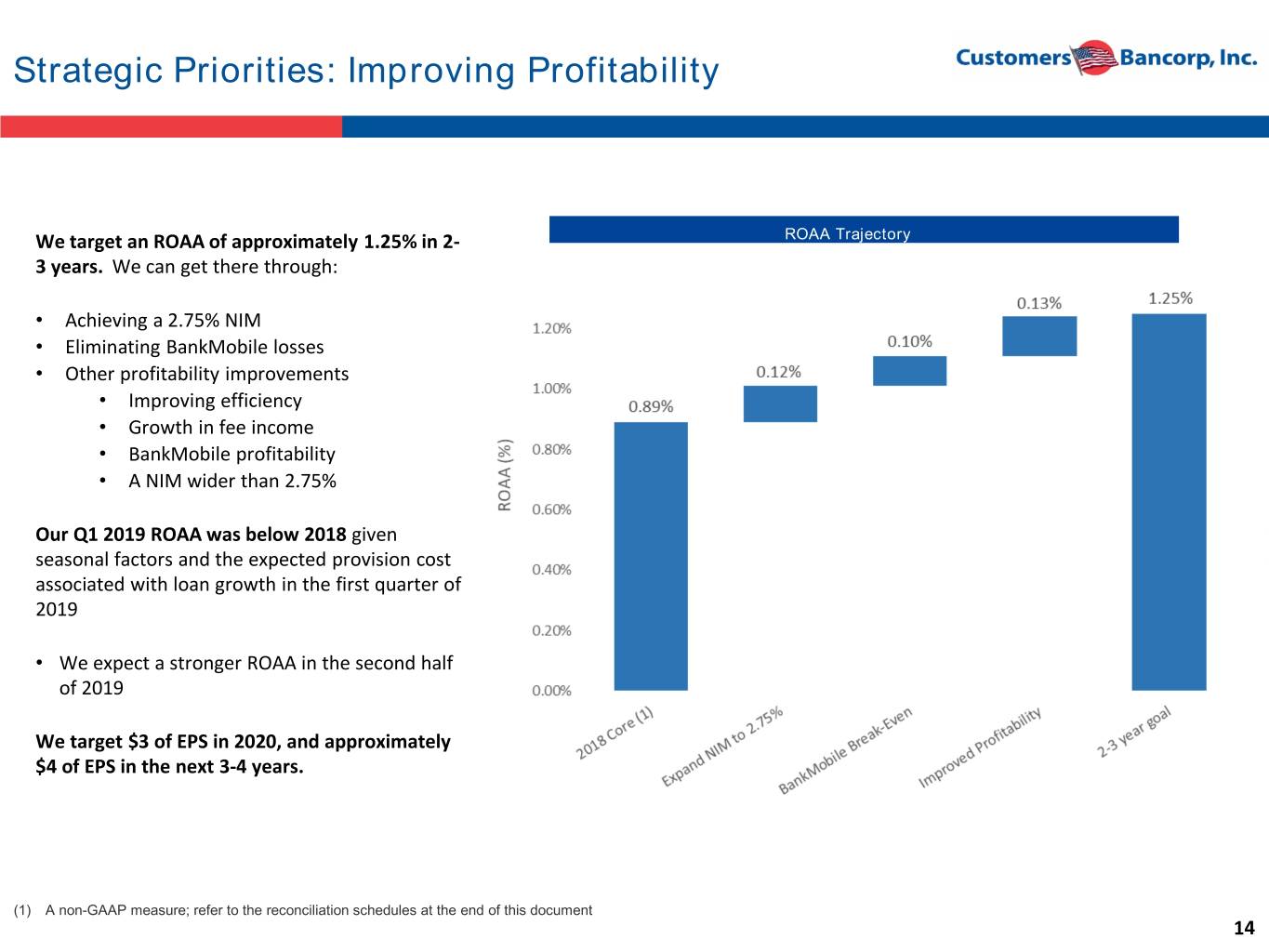

Strategic Priorities: Improving Profitability We target an ROAA of approximately 1.25% in 2- ROAA Trajectory 3 years. We can get there through: • Achieving a 2.75% NIM • Eliminating BankMobile losses • Other profitability improvements • Improving efficiency • Growth in fee income • BankMobile profitability • A NIM wider than 2.75% Our Q1 2019 ROAA was below 2018 given seasonal factors and the expected provision cost associated with loan growth in the first quarter of 2019 • We expect a stronger ROAA in the second half of 2019 We target $3 of EPS in 2020, and approximately $4 of EPS in the next 3-4 years. (1) A non-GAAP measure; refer to the reconciliation schedules at the end of this document 14

Strategic Priorities: Improving our Mix Projected Balance Sheet Mix Shifts 2019 YTD Ending Balance Sheet ($ in millions) Dec 2017 Dec 2018 Mar 2019 Change Targeted Balance Sheet Shifts From December 2018 through December 2019 Interest Earning Deposits 126 44 76 31 Investment Securities 471 665 678 13 Multi Family Loans 3,647 3,285 3,209 (77) ~$700 million to $1.2 billion reduction in Multifamily & CRE CRE Loans 1,304 1,181 1,162 (19) Warehouse 1,845 1,462 1,535 73 C&I Loans 1,583 1,895 1,982 87 $500 million of growth in C&I loans at 5.25%+ Mortgage & Home Equity 236 568 635 67 Manufactured Housing 90 80 79 (1) Other Consumer 3 74 144 70 $400 million of growth in Consumer Loans at 8% to 12% Loans 8,708 8,545 8,746 201 Allowance for Loan Losses (38) (40) (44) (4) Loans, Net of Allowance 8,670 8,505 8,703 198 Other Assets 573 619 687 68 Total Assets 9,840 9,833 10,144 310 De minimis asset growth in 2019, with mix shift towards higher yielding assets Non Interest Bearing Deposits 1,052 1,122 1,372 250 Interest Checking 524 804 811 8 Money Market 3,279 3,097 3,266 168 Savings 39 385 417 33 CDs 1,906 1,734 1,558 (176) Total Deposits 6,800 7,142 7,425 283 In 2019, we will continue to focus on growing core deposits, and running off higher cost Borrowings 2,062 1,668 1,647 (21) borrowings and deposits Other Liabilities 57 67 93 26 Total Liabilities 8,919 8,877 9,166 289 Equity 921 956 978 22 Total Liabilities and Equity 9,840 9,833 10,144 311 15

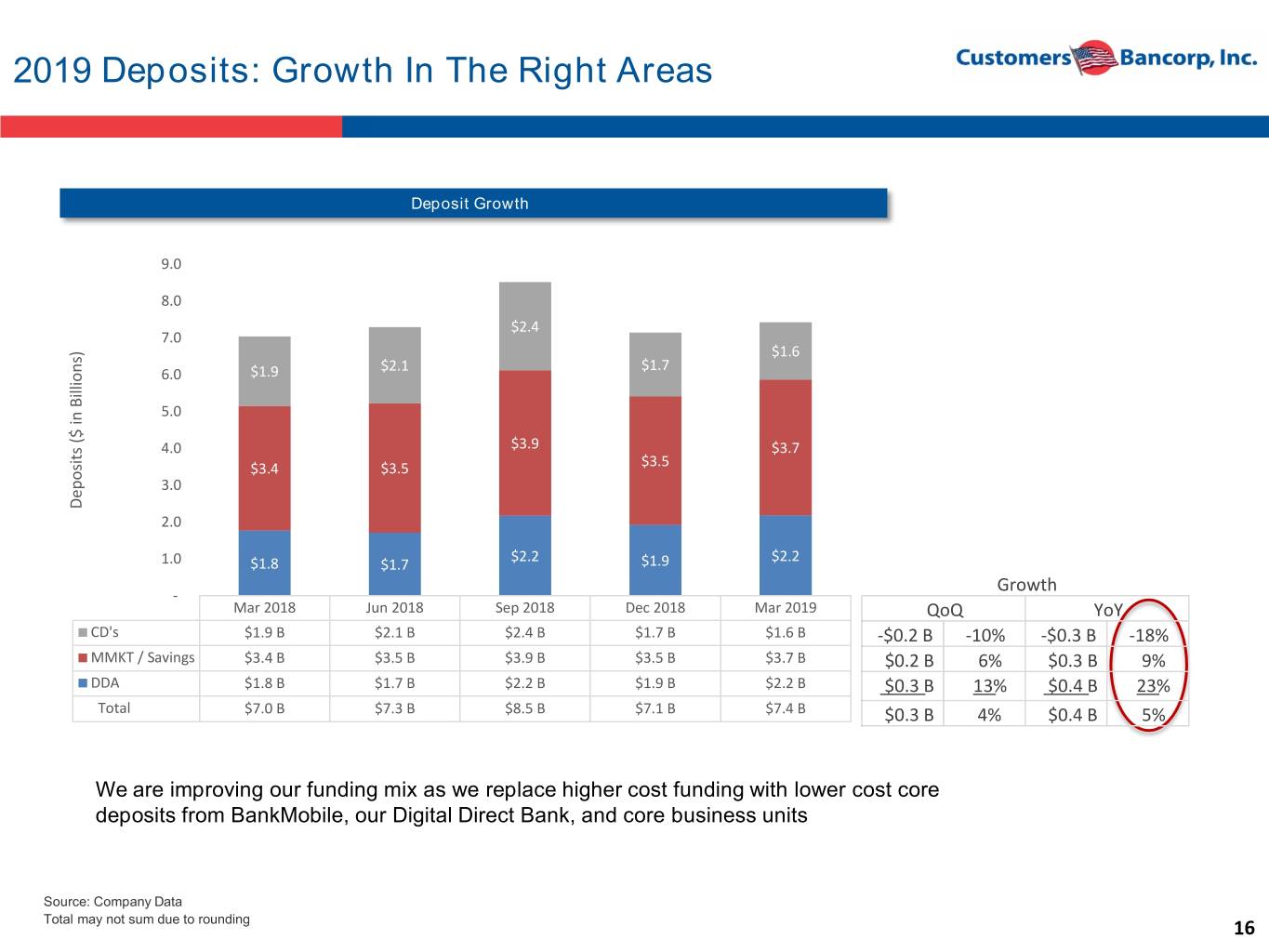

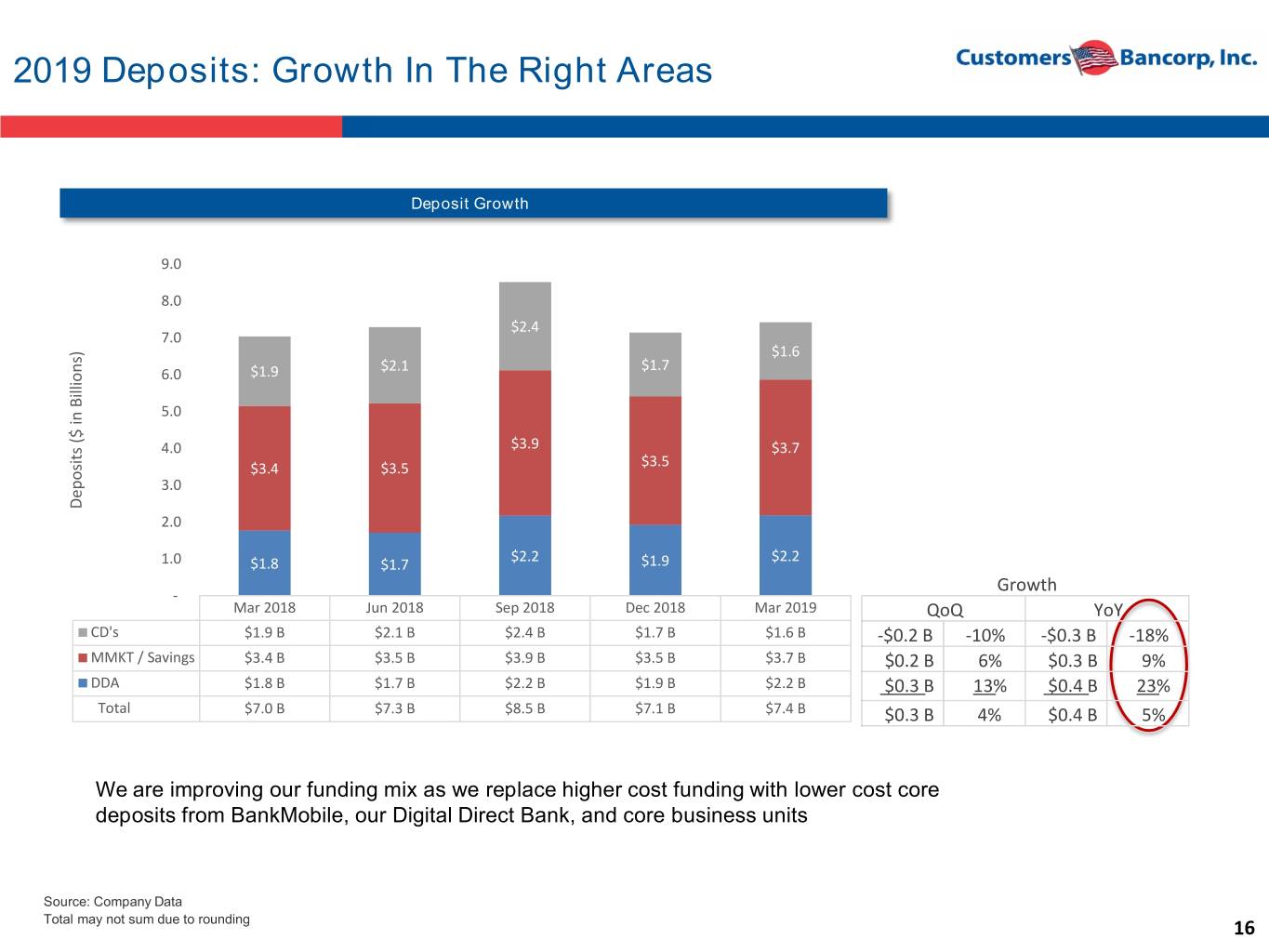

2019 Deposits: Growth In The Right Areas Deposit Growth 9.0 8.0 $2.4 7.0 $1.6 $2.1 $1.7 6.0 $1.9 5.0 4.0 $3.9 $3.7 $3.4 $3.5 $3.5 3.0 Deposits ($ in Billions)Deposits in ($ 2.0 $2.2 $2.2 1.0 $1.8 $1.7 $1.9 Growth - Mar 2018 Jun 2018 Sep 2018 Dec 2018 Mar 2019 QoQ YoY CD's $1.9 B $2.1 B $2.4 B $1.7 B $1.6 B -$0.2 B -10% -$0.3 B -18% MMKT / Savings $3.4 B $3.5 B $3.9 B $3.5 B $3.7 B $0.2 B 6% $0.3 B 9% DDA $1.8 B $1.7 B $2.2 B $1.9 B $2.2 B $0.3 B 13% $0.4 B 23% Total $7.0 B $7.3 B $8.5 B $7.1 B $7.4 B $0.3 B 4% $0.4 B 5% We are improving our funding mix as we replace higher cost funding with lower cost core deposits from BankMobile, our Digital Direct Bank, and core business units Source: Company Data Total may not sum due to rounding 16

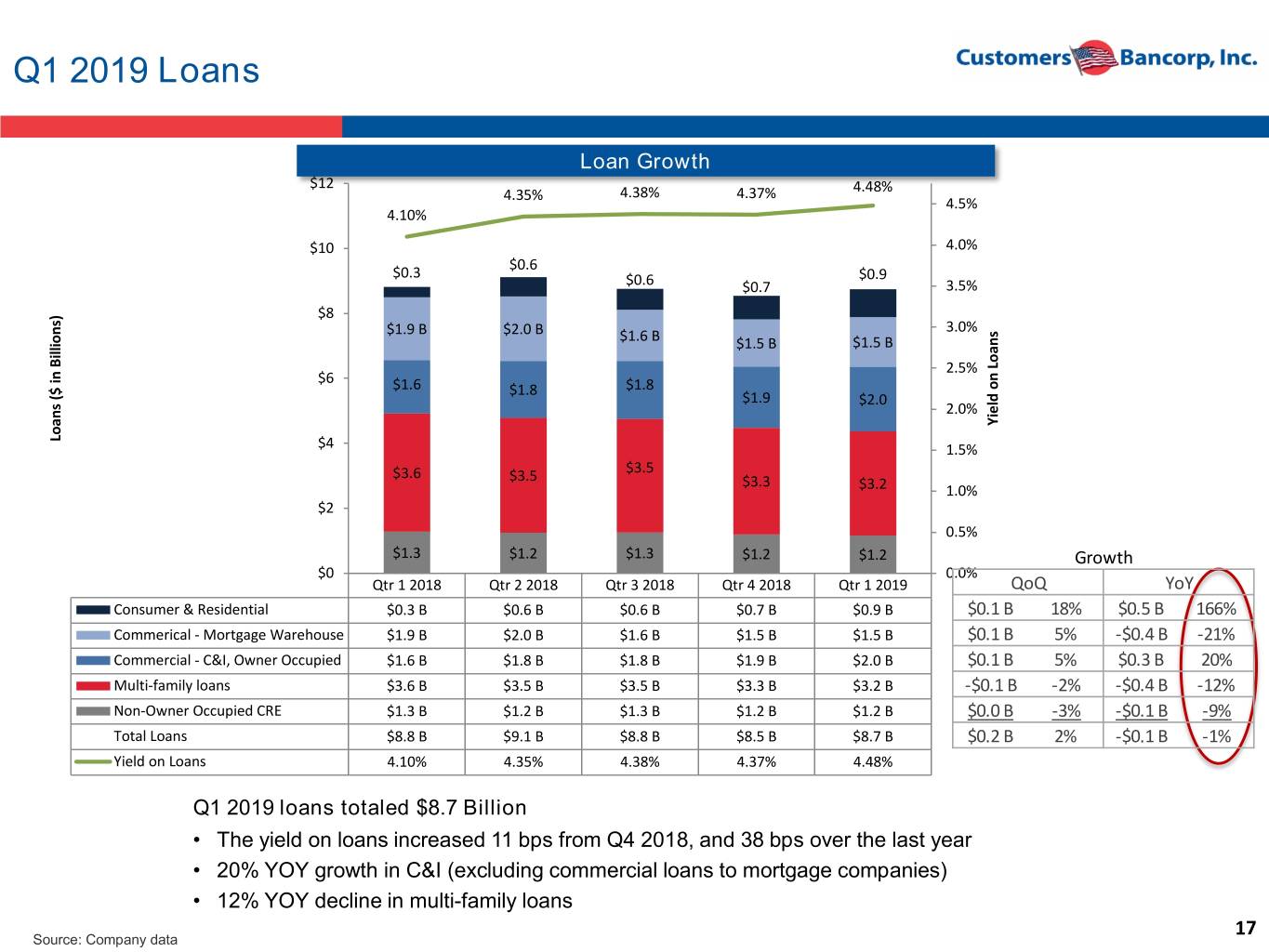

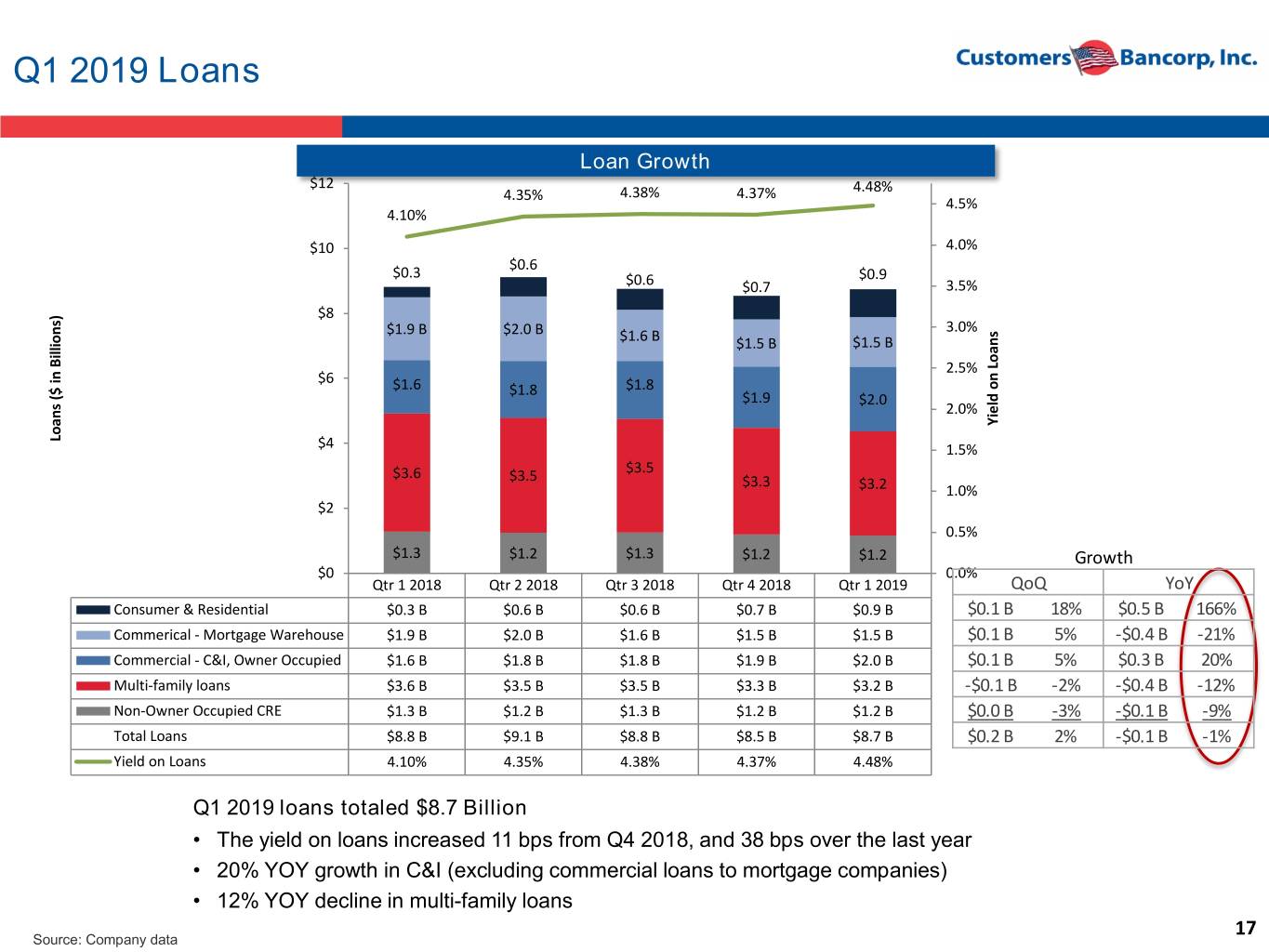

Q1 2019 Loans Loan Growth $12 4.48% 4.35% 4.38% 4.37% 4.5% 4.10% $10 4.0% $0.6 $0.3 $0.9 $0.6 $0.7 3.5% $8 $1.9 B $2.0 B 3.0% $1.6 B $1.5 B $1.5 B 2.5% $6 $1.6 $1.8 $1.8 $1.9 $2.0 2.0% Yield Loanson Loans ($ in Billions) $4 1.5% $3.6 $3.5 $3.5 $3.3 $3.2 1.0% $2 0.5% $1.3 $1.2 $1.3 $1.2 $1.2 Growth $0 0.0% Qtr 1 2018 Qtr 2 2018 Qtr 3 2018 Qtr 4 2018 Qtr 1 2019 QoQ YoY Consumer & Residential $0.3 B $0.6 B $0.6 B $0.7 B $0.9 B $0.1 B 18% $0.5 B 166% Commerical - Mortgage Warehouse $1.9 B $2.0 B $1.6 B $1.5 B $1.5 B $0.1 B 5% -$0.4 B -21% Commercial - C&I, Owner Occupied $1.6 B $1.8 B $1.8 B $1.9 B $2.0 B $0.1 B 5% $0.3 B 20% Multi-family loans $3.6 B $3.5 B $3.5 B $3.3 B $3.2 B -$0.1 B -2% -$0.4 B -12% Non-Owner Occupied CRE $1.3 B $1.2 B $1.3 B $1.2 B $1.2 B $0.0 B -3% -$0.1 B -9% Total Loans $8.8 B $9.1 B $8.8 B $8.5 B $8.7 B $0.2 B 2% -$0.1 B -1% Yield on Loans 4.10% 4.35% 4.38% 4.37% 4.48% Q1 2019 loans totaled $8.7 Billion • The yield on loans increased 11 bps from Q4 2018, and 38 bps over the last year • 20% YOY growth in C&I (excluding commercial loans to mortgage companies) • 12% YOY decline in multi-family loans 17 Source: Company data

Outstanding Credit Quality Credit metrics remain better than peers NPLs to Total Loans Net Charge Offs / Average Total Loans 2.06% 2.25% 0.48% 0.45% 0.47% 0.45% 0.50% 0.42% 1.70% 1.70% 1.75% 0.40% 1.30% 1.18% 1.25% 1.11% 0.30% 0.92% 0.85% 0.19% 0.80% 0.74% 0.20% 0.16% 0.15% 0.18% 0.75% 0.15% 0.30% 0.32% 0.10% 0.07% 0.20% 0.15% 0.22% 0.26% 0.04% 0.05% 0.25% 0.07% 0.19% 0.02% 0.00% -0.25% 2014 2015 2016 2017 2018 YTD 2014 2015 2016 2017 2018 YTD Industry Peer Customers Bancorp Industry Peer Customers Bancorp Note: Customers 2015 charge-offs includes 12 bps for a $9 million fraudulent loan Source: S&P Global, Company data. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with comparable asset size and predominantly commercial business focused loan portfolios as further described in our 2019 proxy. Industry data includes all commercial and savings banks. Peer and industry data as of December 31, 2018. Industry and peer data in the current YTD period is not yet available for all companies. 18

Superior Operating Efficiency and Costs Our Customers Bank Business Banking Segment operating costs(2), as a percentage of average assets, are at least 100 bps lower than peers and approximately 150 bps lower than the industry Total Operating Costs as a % of Average Assets (1) (1) Source: S&P Global and Company data. Data based on Customers Bank Business Banking Segment unless labeled Consolidated. Peer data consists of Northeast and Mid- Atlantic banks and thrifts with comparable asset size and predominantly commercial business focused loan portfolios as further described in our 2019 proxy. Industry data includes all commercial and savings banks. Peer and industry data as of December 31, 2018. Industry and peer data in the current YTD period is not yet available for all companies. (2) Operating costs consist of all non-interest expenses. 19

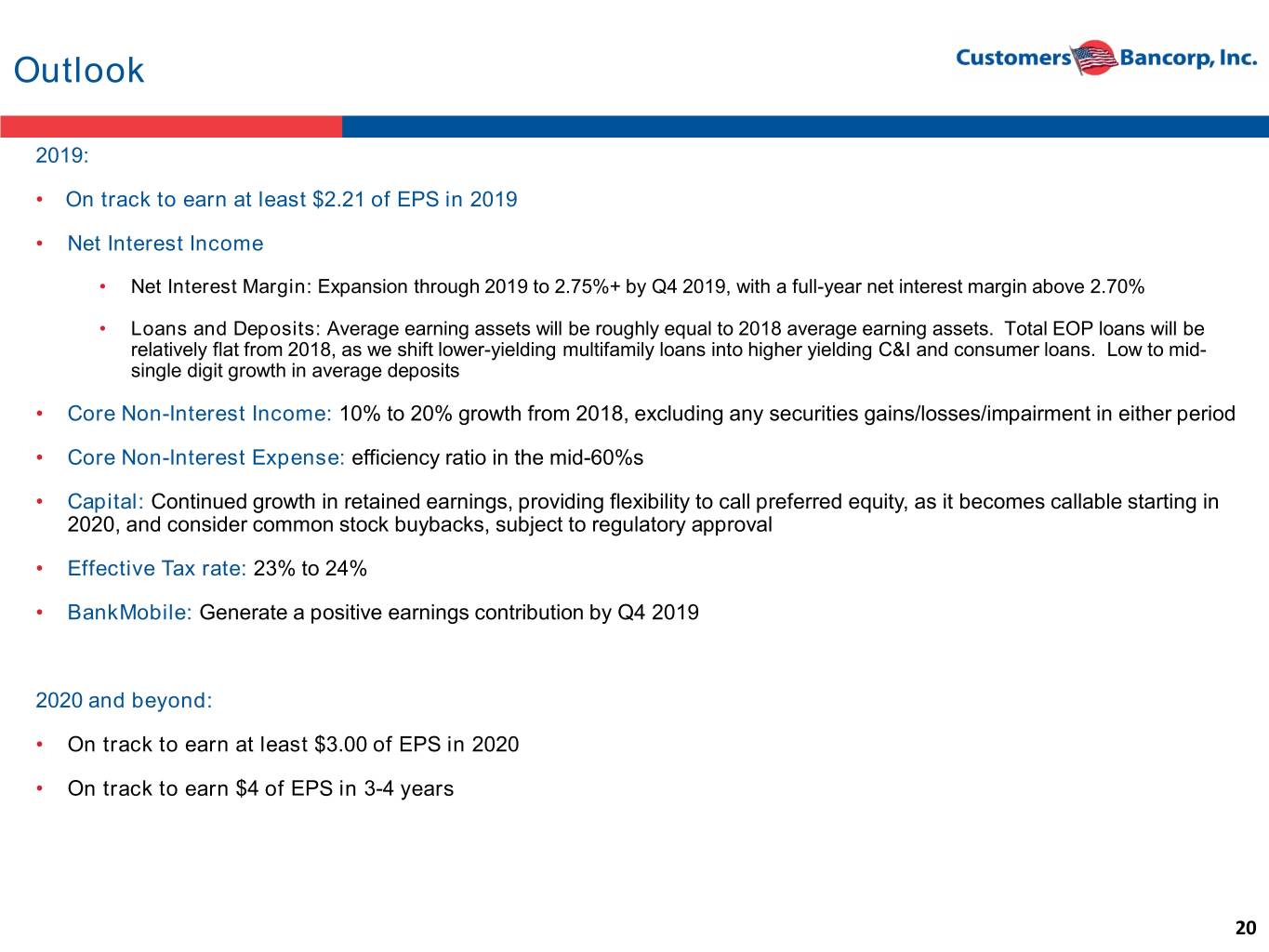

Outlook 2019: • On track to earn at least $2.21 of EPS in 2019 • Net Interest Income • Net Interest Margin: Expansion through 2019 to 2.75%+ by Q4 2019, with a full-year net interest margin above 2.70% • Loans and Deposits: Average earning assets will be roughly equal to 2018 average earning assets. Total EOP loans will be relatively flat from 2018, as we shift lower-yielding multifamily loans into higher yielding C&I and consumer loans. Low to mid- single digit growth in average deposits • Core Non-Interest Income: 10% to 20% growth from 2018, excluding any securities gains/losses/impairment in either period • Core Non-Interest Expense: efficiency ratio in the mid-60%s • Capital: Continued growth in retained earnings, providing flexibility to call preferred equity, as it becomes callable starting in 2020, and consider common stock buybacks, subject to regulatory approval • Effective Tax rate: 23% to 24% • BankMobile: Generate a positive earnings contribution by Q4 2019 2020 and beyond: • On track to earn at least $3.00 of EPS in 2020 • On track to earn $4 of EPS in 3-4 years 20

Contacts Company: Carla Leibold, CFO Tel: 484-923-8802 cleibold@customersbank.com Jay Sidhu Chairman & CEO Tel: 610-935-8693 jsidhu@customersbank.com Bob Ramsey Director of IR and Strategic Planning Tel: 484-926-7118 rramsey@customersbank.com 21

Customers Bancorp, Inc. Appendix A Q1 2019 Financial Highlights 22

Q1 2019 Key Financial Results Customers Bank Business Consolidated Banking Segment GAAP Diluted Earnings Per Share (EPS) $0.38 $0.38 YOY Change -100% -100% GAAP Net Income Available to Common ($ millions) $11.8 $12.0 Core Earnings ($ in millions)(1) $11.8 $12.0 Tangible Book Value (TBV)(1) $23.92 Return on Average Assets (ROAA) 0.64% 0.66% Return on Average Common Equity (ROACE) 6.38% 6.87% Efficiency 68% 60% Valuation (2) April 18 Price $22.30 P/E 2019 10.0x P/E 2020 8.6x P/TBV(2) 0.93x Q1 2019 Highlights • 2 basis point sequential expansion in Q1 2019 margin • 20% YOY growth in C&I lending (excluding loans to mortgage companies) • 12% YOY decline in Multi-family loans • 5% YOY growth in total deposits • Pristine credit quality (1) A non-GAAP measure; refer to the reconciliation schedules at the end of this document. (2) 2019 and 2020 consensus EPS estimates of $2.22 and $2.60, respectively, sourced from S&P Global. 23

Q1 2019 Consolidated Results GAAP vs. Core EPS(1) $0.70 Q1 2019 Net Income to Common Shareholders of $0.64 $0.64 $11.8 million, and Diluted Earnings Per Common $0.60 $0.64 $0.62 $0.62 Share of $0.38. $0.50 $0.53 • $0.38 of diluted EPS from the Customers Bank Business Banking segment $0.40 $0.44 $0.38 $0.38 • ($0.01) of diluted loss per share from the EPS $0.30 BankMobile Segment, which includes a 4.42% earnings rate on BankMobile’s excess low cost $0.20 deposits. $0.10 $0.07 $0.00 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 GAAP EPS Core EPS(1) Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 GAAP EPS $0.64 $0.62 $0.07 $0.44 $0.38 Notable Items: Executive severance $0.00 $0.00 $0.00 $0.04 $0.00 Losses on sale of multi-family loans $0.00 $0.00 $0.00 $0.03 $0.00 Merger and acquisition related expenses $0.00 $0.02 $0.07 $0.01 $0.00 Securities (gains) losses ($0.00) $0.00 $0.48 $0.00 ($0.00) Core EPS(1) $0.64 $0.64 $0.62 $0.53 $0.38 (1) A non-GAAP measure; refer to the reconciliation schedules at the end of this document 24

Q1 2019 Highlights: Customers Bank Business Banking Segment Customers Bank Business Banking Segment GAAP vs. Core EPS(1) Customers Bank Business Banking segment Q1 2019 profits of $12.0 million (or $0.38 per diluted share) Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Bank Segment GAAP $0.67 $0.72 $0.26 $0.55 $0.38 Notable Items: Executive severance $0.00 $0.00 $0.00 $0.04 $0.00 Losses on sale of multi-family loans $0.00 $0.00 $0.00 $0.03 $0.00 Securities (gains) losses $0.00 $0.00 $0.48 $0.00 $0.00 Bank Segment Core(1) $0.67 $0.73 $0.73 $0.62 $0.38 (1) A non-GAAP measure; refer to the reconciliation schedules at the end of this document 25

Q1 2019 Highlights: BankMobile Segment BankMobile Segment GAAP vs. Core EPS(1) $0.00 -$0.01-$0.01 -$0.02 -$0.03-$0.03 BankMobile segment loss of $163 thousand (or -$0.01 -$0.04 per diluted share) in Q1 2019 -$0.06 • BankMobile deposits averaged $635 million in Q1 2019 -$0.08 -$0.08 -$0.09 • BankMobile segment reporting reflects a 4.42% yield on -$0.10 -$0.10 -$0.10 excess deposits in Q1 2019 EPS -$0.11 -$0.12 -$0.14 $(0.0 -$0.16 -$0.18 -$0.18 -$0.20 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 BankMobile GAAP BankMobile Core (1) Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 BankMobile GAAP -$0.03 -$0.10 -$0.18 -$0.10 -$0.01 Notable Items: Merger and acquisition related expenses $0.00 $0.02 $0.07 $0.01 $0.00 BankMobile Core (1) -$0.03 -$0.08 -$0.11 -$0.09 -$0.01 (1) A non-GAAP measure; refer to the reconciliation schedules at the end of this document 26 Source: Company data

BankMobile Segment Appendix B Expanded Financials 27

BankMobile Segment Expanded Financials BankMobile Segment Income Statement ($ in 000s), Except Per Share Data Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Interest Income $0 $0 $0 $0 $0 $2 $1 $2 $1 $0 $2 $1,344 $2,590 Interest Expense $4 $5 $5 $6 $6 $11 $10 $6 $8 $125 $50 $179 $166 Fund Transfer Pricing Net Credit $1,723 $1,306 $1,381 $2,466 $4,247 $2,738 $2,693 $3,202 $4,401 $3,520 $3,875 $3,822 $5,614 Net interest income $1,718 $1,301 $1,376 $2,460 $4,242 $2,727 $2,684 $3,197 $4,394 $3,394 $3,827 $4,987 $8,038 Provision for loan losses -$1 $0 $250 $546 $0 $0 $478 $652 $243 $463 $422 $1,585 $1,791 Deposit Fees $1 $509 $3,916 $2,500 $2,803 $1,875 $2,338 $1,833 $1,805 $1,338 $1,691 $1,713 $1,910 Card Revenue $226 $1,730 $11,387 $10,719 $13,308 $8,521 $9,355 $9,542 $9,438 $6,199 $6,903 $7,362 $8,626 Other Fees $0 $164 $1,062 $991 $1,216 $1,024 $2,143 $165 $1,228 $1,125 $1,246 $1,450 $1,605 Total non-interest income $227 $2,403 $16,365 $14,210 $17,327 $11,420 $13,836 $11,540 $12,471 $8,662 $9,840 $10,525 $12,141 Compensation & Benefits $866 $1,708 $5,419 $5,595 $4,949 $6,965 $6,154 $5,909 $5,671 $5,918 $5,695 $5,850 $6,064 Occupancy $59 $67 $71 $70 $109 $104 $297 $321 $309 $321 $328 $308 $303 Technology $286 $1,448 $5,847 $6,585 $6,617 $6,386 $11,740 $9,796 $7,129 $7,172 $8,171 $8,248 $8,897 Outside services $251 $886 $4,264 $4,267 $4,519 $3,310 $3,871 $3,366 $2,899 $1,665 $2,205 $1,902 $2,284 Merger related expenses $176 $874 $144 $0 $0 $0 $0 $410 $106 $869 $2,945 $470 $0 Other non-interest expenses $397 $1,115 $4,178 $3,266 $3,025 $3,081 $4,988 $1,085 $1,835 $85 $1,645 $1,959 $1,053 Total Non-interest expense $2,034 $6,099 $19,922 $19,783 $19,219 $19,846 $27,050 $20,888 $17,949 $16,029 $20,989 $18,267 $18,600 Income (loss) before income tax expense -$88 -$2,394 -$2,432 -$3,659 $2,350 -$5,699 -$11,008 -$6,803 -$1,327 -$4,436 -$7,744 -$4,340 -$212 Income tax expense (benefit) -$33 -$910 -$924 -$1,390 $893 -$2,166 -$4,100 -$2,563 -$326 -$1,090 -$1,902 -$1,066 -$49 Net income (loss) available to common shareholders -$54 -$1,484 -$1,507 -$2,269 $1,457 -$3,533 -$6,908 -$4,239 -$1,001 -$3,346 -$5,842 -$3,274 -$163 EPS $0.00 -$0.05 -$0.05 -$0.07 $0.04 -$0.11 -$0.21 -$0.13 -$0.03 -$0.10 -$0.18 -$0.10 -$0.01 (1) Core EPS $0.00 -$0.03 -$0.05 -$0.07 $0.02 -$0.14 -$0.16 -$0.12 -$0.03 -$0.08 -$0.11 -$0.09 -$0.01 End of Period Deposits ($ in Millions) $337 $240 $533 $457 $708 $453 $781 $400 $624 $419 $732 $376 $627 Average Deposits ($ in Millions) $351 $286 $332 $548 $794 $532 $531 $558 $644 $468 $497 $532 $635 Average Loans ($ in Millions) $1 $1 $1 $5 $7 $2 $2 $2 $2 $2 $2 $59 $120 Average Excess Deposits ($ in Millions) $350 $285 $332 $543 $787 $530 $529 $556 $642 $466 $495 $474 $515 Yield Earned on Avg. Excess Deposits 1.99% 1.84% 1.65% 1.80% 2.19% 2.07% 2.02% 2.29% 2.78% 3.03% 3.11% 3.20% 4.42% (1) A Non-GAAP measure; refer to the reconciliation schedule at the end of this document 28

Customers Bancorp, Inc. Appendix C Reconciliation of Non-GAAP Measures 29

Reconciliation of Non-GAAP Measures - Unaudited Customers believes that the non-GAAP measurements disclosed within this document are useful for investors, regulators, management and others to evaluate our results of operations and financial condition relative to other financial institutions. Presentation of these non-GAAP financial measures is consistent with how Customers evaluates its performance internally and these non-GAAP financial measures are frequently used by securities analysts, investors, and other interest parties in the evaluation of companies in Customers' industry. These non- GAAP financial measures exclude from corresponding GAAP measures the impact of certain elements that we do not believe are representative of our financial results, which we believe enhance an overall understanding of our performance. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. Although non-GAAP financial measures are frequently used in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results of operations or financial condition as reported under GAAP. The following tables present reconciliations of GAAP to Non-GAAP measures disclosed within this document. 30

Reconciliation of Non-GAAP Measures - Unaudited Core Earnings - Customers Bancorp, Inc. Consolidated ($ in thousands, not including per share amounts) Q1 2019 Q4 2018 Q3 2018 Q2 2018 Q1 2018 US D Per Share US D Per Share US D Per Share US D Per Share US D Per Share GAAP net income to common shareholders $ 11,825 $ 0.38 $ 14,247 $ 0.44 $ 2,414 $ 0.07 $ 20,048 $ 0.62 $ 20,527 $ 0.64 Reconciling items (after tax): Executive severance expense - - 1,421 0.04 - - - - - - Merger and acquisition related expenses - - 355 0.01 2,222 0.07 655 0.02 80 - Losses on sale of multi-family loans - - 868 0.03 (Gains) losses on investment securities (2) - 101 - 15,417 0.48 138 - (10) - Core earnings $ 11,823 $ 0.38 $ 16,992 $ 0.53 $ 20,053 $ 0.62 $ 20,841 $ 0.64 $ 20,597 $ 0.64 Core Earnings - Customers Bank Business Banking Segment ($ in thousands, not including per share amounts) Q1 2019 Q4 2018 Q3 2018 Q2 2018 Q1 2018 US D Per Share US D Per Share US D Per Share US D Per Share US D Per Share GAAP net income to common shareholders $ 11,988 $ 0.38 $ 17,521 $ 0.55 $ 8,256 $ 0.26 $ 23,394 $ 0.72 $ 21,528 $ 0.67 Reconciling items (after tax): Executive severance expense - - 1,421 0.04 - - - - - - Losses on sale of multi-family loans - - 868 0.03 - - - - - - (Gains) losses on investment securities (2) - 101 - 15,417 0.48 138 - (10) - Core earnings $ 11,986 $ 0.38 $ 19,911 $ 0.62 $ 23,673 $ 0.73 $ 23,532 $ 0.73 $ 21,518 $ 0.67 31

Reconciliation of Non-GAAP Measures - Unaudited Core Loss - BankMobile Segment ($ in thousands, not including per share amounts) Q1 2019 US D Per Share GAAP net loss to common shareholders $ (163) $ (0.01) Reconciling items (after tax): Merger and acquisition related expenses - - Catch-up depreciation/amortization on BankMobile assets - - Core loss $ (163) $ (0.01) Core Loss - BankMobile Segment ($ in thousands, not including per share amounts) Q4 2018 Q3 2018 Q2 2018 Q1 2018 US D Per Share US D Per Share US D Per Share US D Per Share GAAP net loss to common shareholders $ (3,274) $ (0.10) $ (5,842) $ (0.18) $ (3,346) $ (0.10) $ (1,001) $ (0.03) Reconciling items (after tax): Merger and acquisition related expenses 355 0.01 2,222 0.07 655 0.02 80 - Catch-up depreciation/amortization on BankMobile assets - - - - - - - - Core loss $ (2,919) $ (0.09) $ (3,620) $ (0.11) $ (2,691) $ (0.08) $ (921) $ (0.03) Core Loss - BankMobile Segment ($ in thousands, not including per share amounts) - continued Q4 2017 Q3 2017 Q2 2017 Q1 2017 US D Per Share US D Per Share US D Per Share US D Per Share GAAP net income (loss) to common shareholders $ (4,240) $ (0.13) $ (6,908) $ (0.21) $ (3,533) $ (0.11) $ 1,457 $ 0.04 Reconciling items (after tax): Merger and acquisition related expenses 256 0.01 - - - - - - Catch-up depreciation/amortization on BankMobile assets - - 1,765 0.05 (883) (0.03) (882) (0.03) Core loss $ (3,984) $ (0.12) $ (5,143) $ (0.16) $ (4,416) $ (0.14) $ 575 $ 0.02 Core Loss - BankMobile Segment ($ in thousands, not including per share amounts) - continued Q4 2016 Q3 2016 Q2 2016 Q1 2016 US D Per Share US D Per Share US D Per Share US D Per Share GAAP net loss to common shareholders $ (2,269) $ (0.07) $ (1,507) $ (0.05) $ (1,484) $ (0.05) $ (54) $ - Reconciling items (after tax): Merger and acquisition related expenses - - 89 - 542 0.02 109 - Catch-up depreciation/amortization on BankMobile assets - - - - - - - - Core loss $ (2,269) $ (0.07) $ (1,418) $ (0.05) $ (942) $ (0.03) $ 55 $ - 32

Reconciliation of Non-GAAP Measures - Unaudited Tangible Book Value per Common Share - Customers Bancorp, Inc. Consolidated ($ in thousands, except per share data) Q1 2019 Q4 2018 Q4 2017 Q4 2016 Q4 2015 Q4 2014 Q4 2013 GAAP -Total Shareholders' Equity $ 978,373 $ 956,816 $ 920,964 $ 855,872 $ 553,902 $ 443,145 $ 386,623 Reconciling Items: Preferred Stock (217,471) (217,471) (217,471) (217,471) (55,569) - - Goodwill and Other Intangibles (16,173) (16,499) (16,295) (17,621) (3,651) (3,664) (3,676) Tangible Common Equity $ 744,729 $ 722,846 $ 687,198 $ 620,780 $ 494,682 $ 439,481 $ 382,947 Common shares outstanding 31,131,247 31,003,028 31,382,503 30,289,917 26,901,801 26,745,529 26,646,566 Tangible Book Value per Common Share $ 23.92 $ 23.32 $ 21.90 $ 20.49 $ 18.39 $ 16.43 $ 14.37 CA GR 10.19% Customers Bancorp, Inc. Consolidated - Net Interest Margin, tax equivalent ($ in thousands) Q1 2019 Q4 2018 Q3 2018 Q2 2018 Q1 2018 GAAP Net interest income $ 59,304 $ 61,524 $ 64,001 $ 67,322 $ 65,031 Tax-equivalent adjustment 181 171 172 171 171 Net interest income tax equivalent $ 59,485 $ 61,695 $ 64,173 $ 67,493 $ 65,202 Average total interest earning assets $ 9,278,413 $ 9,518,120 $ 10,318,943 $ 10,329,530 $ 9,881,220 Net interest margin, tax equivalent 2.59% 2.57% 2.47% 2.62% 2.67% 33

Reconciliation of Non-GAAP Measures - Unaudited Core Return on Average Assets - Core Return on Average Assets - Customers Bancorp, Inc. Consolidated ($ in thousands) Customers Bank Business Banking Segment ($ in thousands) Q1 2019 FY 2018 Q1 2019 GAAP net income $ 15,440 $ 71,695 GAAP net income $ 15,603 Reconciling items (after tax): Reconciling items (after tax): Executive severance expense - 1,421 (Gains) losses on investment securities (2) Merger and acquisition related expenses - 3,312 Core net income $ 15,601 Losses on sale of multi-family loans - 868 (Gains) losses on investment securities (2) 15,646 Average Total Assets $ 9,560,296 Core net income $ 15,438 $ 92,942 Core Return on Average Assets 0.66% Average Total Assets $ 9,759,529 $ 10,418,102 Core Return on Average Assets 0.64% 0.89% Core Return on Average Common Equity - Core Return on Average Common Equity - Customers Bancorp, Inc. Consolidated ($ in thousands) Customers Bank Business Banking Segment ($ in thousands) Q1 2019 Q1 2019 GAAP net income to common shareholders $ 11,825 GAAP net income to common shareholders $ 11,988 Reconciling items (after tax): Reconciling items (after tax): (Gains) losses on investment securities (2) (Gains) losses on investment securities (2) Core earnings $ 11,823 Core earnings $ 11,986 Average Total Common Shareholders' Equity $ 751,133 Average Total Common Shareholders' Equity $ 707,573 Core Return on Average Common Equity 6.38% Core Return on Average Common Equity 6.87% 34

Forward-Looking Statements This presentation, as well as other written or oral communications made from time to time by us, contains forward-looking information within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to future events or future predictions, including events or predictions relating to future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,” “plan,” “intend,” or “anticipate” or the negative thereof or comparable terminology. Forward- looking statements in this presentation include, among other matters, guidance for our financial performance, and our financial performance targets. Forward-looking statements reflect numerous assumptions, estimates and forecasts as to future events. No assurance can be given that the assumptions, estimates and forecasts underlying such forward-looking statements will accurately reflect future conditions, or that any guidance, goals, targets or projected results will be realized. The assumptions, estimates and forecasts underlying such forward-looking statements involve judgments with respect to, among other things, future economic, competitive, regulatory and financial market conditions and future business decisions, which may not be realized and which are inherently subject to significant business, economic, competitive and regulatory uncertainties and known and unknown risks, including the risks described under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018 and subsequent Quarterly Reports on Form 10-Q and current reports on Form 8-K, including any amendments thereto, as such factors may be updated from time to time in our filings with the SEC. Our actual results may differ materially from those reflected in the forward-looking statements. In addition to the risks described under “Risk Factors” in our filings with the SEC, important factors to consider and evaluate with respect to our forward-looking statements include: • changes in external competitive market factors that might impact our results of operations; • changes in laws and regulations, including without limitation changes in capital requirements under Basel III; • changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events; • our ability to identify potential candidates for, and consummate, acquisition or investment transactions; • the timing of acquisition, investment or disposition transactions; • constraints on our ability to consummate an attractive acquisition or investment transaction because of significant competition for these opportunities; • local, regional and national economic conditions and events and the impact they may have on us and our customers; • costs and effects of regulatory and legal developments, including the results of regulatory examinations and the outcome of regulatory or other governmental inquiries and proceedings, such as fines or restrictions on our business activities; • our ability to attract deposits and other sources of liquidity; • changes in the financial performance and/or condition of our borrowers; • changes in the level of non-performing and classified assets and charge-offs; • changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; • inflation, interest rate, securities market and monetary fluctuations; 35

Forward-Looking Statements (Cont.) • timely development and acceptance of new banking products and services and perceived overall value of these products and services by users, including the products and services being developed and introduced to the market by the BankMobile division of Customers Bank; • changes in consumer spending, borrowing and saving habits; • technological changes; • our ability to increase market share and control expenses; • continued volatility in the credit and equity markets and its effect on the general economy; • effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters; • the businesses of Customers Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being more difficult, time-consuming or costly than expected; • material differences in the actual financial results of merger and acquisition activities compared with our expectations, such as with respect to the full realization of anticipated cost savings and revenue enhancements within the expected time frame; • our ability to successfully implement our growth strategy, control expenses and maintain liquidity; • Customers Bank's ability to pay dividends to Customers Bancorp; • risks relating to BankMobile, including: • our ability to maintain interchange income with the small issuer exemption to the Durbin amendment; • the implementation of Customers Bancorp, Inc.'s strategy to retain BankMobile for 2-3 years, the possibility that the expected benefits of retaining BankMobile for 2-3 years may not be achieved, or the possible effects on Customers' results of operations if BankMobile is never divested could cause Customers Bancorp's actual results to differ from those in the forward- looking statements; • our ability to manage our balance sheet under $10 billion; • our ability to execute on our White Label strategy to grow demand deposits through strategic partnerships; • material variances in the adoption rate of BankMobile's services by new students • the usage rate of BankMobile's services by current student customers compared to our expectations; 36

Forward-Looking Statements (Cont.) • the levels of usage of other BankMobile student customers following graduation of additional product and service offerings of BankMobile or Customers Bank, including mortgages and consumer loans, and the mix of products and services used; • our ability to implement changes to BankMobile's product and service offerings under current and future regulations and governmental policies; • our ability to effectively manage revenue and expense fluctuations that may occur with respect to BankMobile's student-oriented business activities, which result from seasonal factors related to the higher-education academic year; and • BankMobile's ability to successfully implement its growth strategy and control expenses. • risks related to planned changes in our balance sheet, including: • our ability to reduce the size of our multi-family loan portfolio; • our ability to execute our digital distribution strategy; and • our ability to manage the risk of change in our loan mix to include a greater proportion of consumer loans. You are cautioned not to place undue reliance on any forward-looking statements we make, which speak only as of the date they are made. We do not undertake any obligation to release publicly or otherwise provide any revisions to any forward-looking statements we may make, including any forward-looking financial information, to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events, except as may be required under applicable law. This presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. 37