“A Digital-Forward Super-Community Bank“ Investor Presentation: Q3 2022 Let’s take on tomorrow. October 2022

2 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED In addition to historical information, this presentation may contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements with respect to Customers Bancorp, Inc.’s strategies, goals, beliefs, expectations, estimates, intentions, capital raising efforts, financial condition and results of operations, future performance and business. Statements preceded by, followed by, or that include the words “may,” “could,” “should,” “pro forma,” “looking forward,” “would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “project”, or similar expressions generally indicate a forward-looking statement. These forward-looking statements involve risks and uncertainties that are subject to change based on various important factors (some of which, in whole or in part, are beyond Customers Bancorp, Inc.’s control). Numerous competitive, economic, regulatory, legal and technological events and factors, among others, could cause Customers Bancorp, Inc.’s financial performance to differ materially from the goals, plans, objectives, intentions and expectations expressed in such forward-looking statements, including: The impact of the ongoing pandemic on the U.S. economy and customer behavior, the impact that changes in economy have on the performance of our loan and lease portfolio, the market value of our investment securities, the demand for our products and services and the availability of sources of funding, the continued success and acceptance of our blockchain payments system; the effects of actions by the federal government, including the Board of Governors of the Federal Reserve System and other government agencies, that effect market interest rates and the money supply; the actions that we and our customers take in response to these developments and the effects such actions have on our operations, products, services and customer relationships, higher inflation and its impacts, and the effects of changes in accounting standards or policies. Customers Bancorp, Inc. cautions that the foregoing factors are not exclusive, and neither such factors nor any such forward-looking statement takes into account the impact of any future events. All forward-looking statements and information set forth herein are based on management’s current beliefs and assumptions as of the date hereof and speak only as of the date they are made. For a more complete discussion of the assumptions, risks and uncertainties related to our business, you are encouraged to review Customers Bancorp, Inc.’s filings with the Securities and Exchange Commission, including its most recent annual report on Form 10-K for the year ended December 31, 2021, subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K, including any amendments thereto, that update or provide information in addition to the information included in the Form 10-K and Form 10-Q filings, if any. Customers Bancorp, Inc. does not undertake to update any forward-looking statement whether written or oral, that may be made from time to time by Customers Bancorp, Inc. or by or on behalf of Customers Bank, except as may be required under applicable law. This does not constitute an offer to sell, or a solicitation of an offer to buy, any security in any state or jurisdiction in which such offer, solicitation or sale would be unlawful. Forward-Looking Statements

3 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Community Banking Corporate & Specialty Banking Digital Banking o C&I o CRE o Multi-Family o SBA o SMB Lending o Residential Mortgage o Lender Finance o Fund Finance o Financial Institutions Group o Real Estate Specialty Finance o Loans to Mortgage Companies o Equipment Finance o Tech and Venture Banking o Healthcare Lending Consumer o Checking & Savings o Personal Loan o Student Loan o Credit Card BaaS o MPL Program Commercial o Digital Asset Banking o SMB Bundle o Credit Card Transaction Banking o Treasury Services o Payments Customers Bancorp Snapshot Customers Bancorp, Inc. NYSE: CUBI Headquarters West Reading, PA Offices1 39 FTE Employees 672 Market Capitalization As of 10/21/2022 $1.0B Total Assets $20.4B Tangible Book Value2 $38.35 Share price As of 10/21/2022 $31.17 Data as of 09/30/2022, unless otherwise noted. (1) Offices includes branches, executive offices, Private Banking Offices and Loan Production Offices. (2) Non-GAAP Measure, refer to Appendix for reconciliation. Lines of Business A Digital-Forward Super-Community Bank

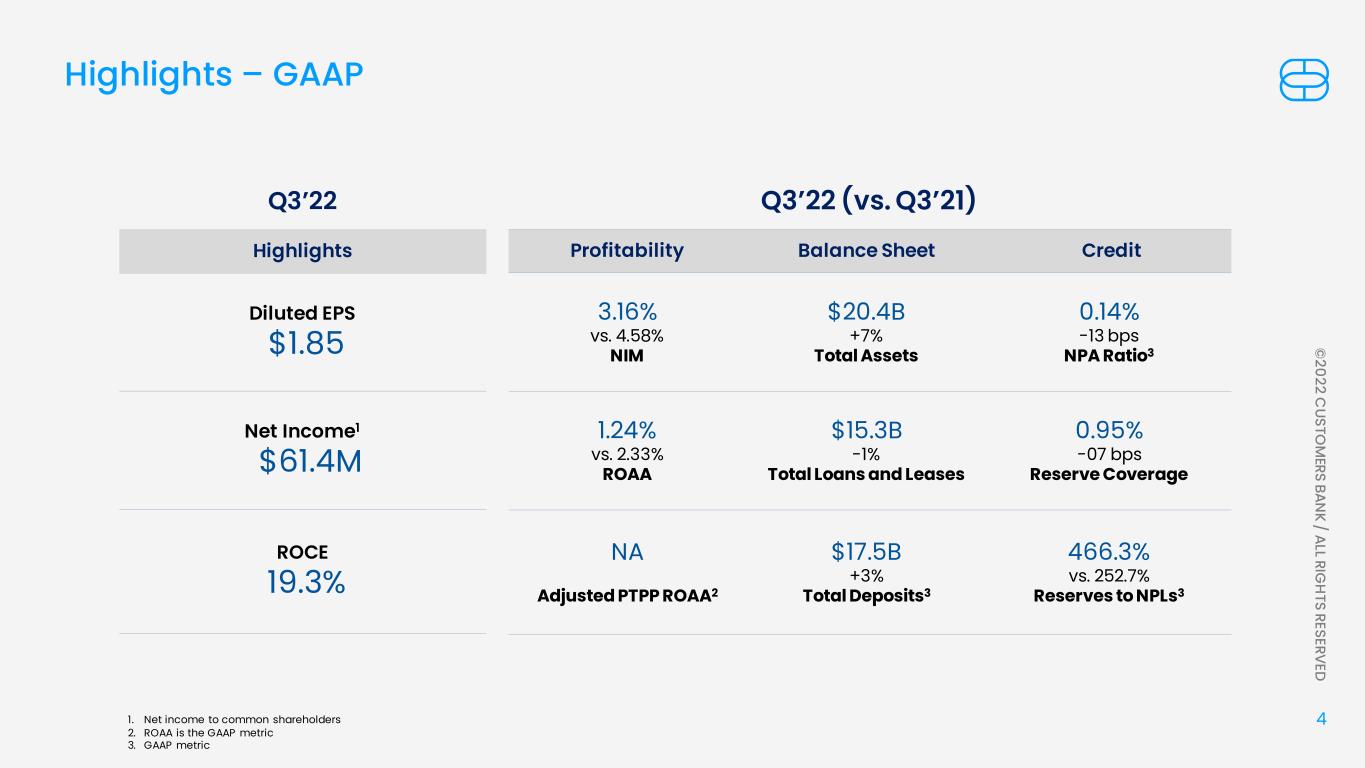

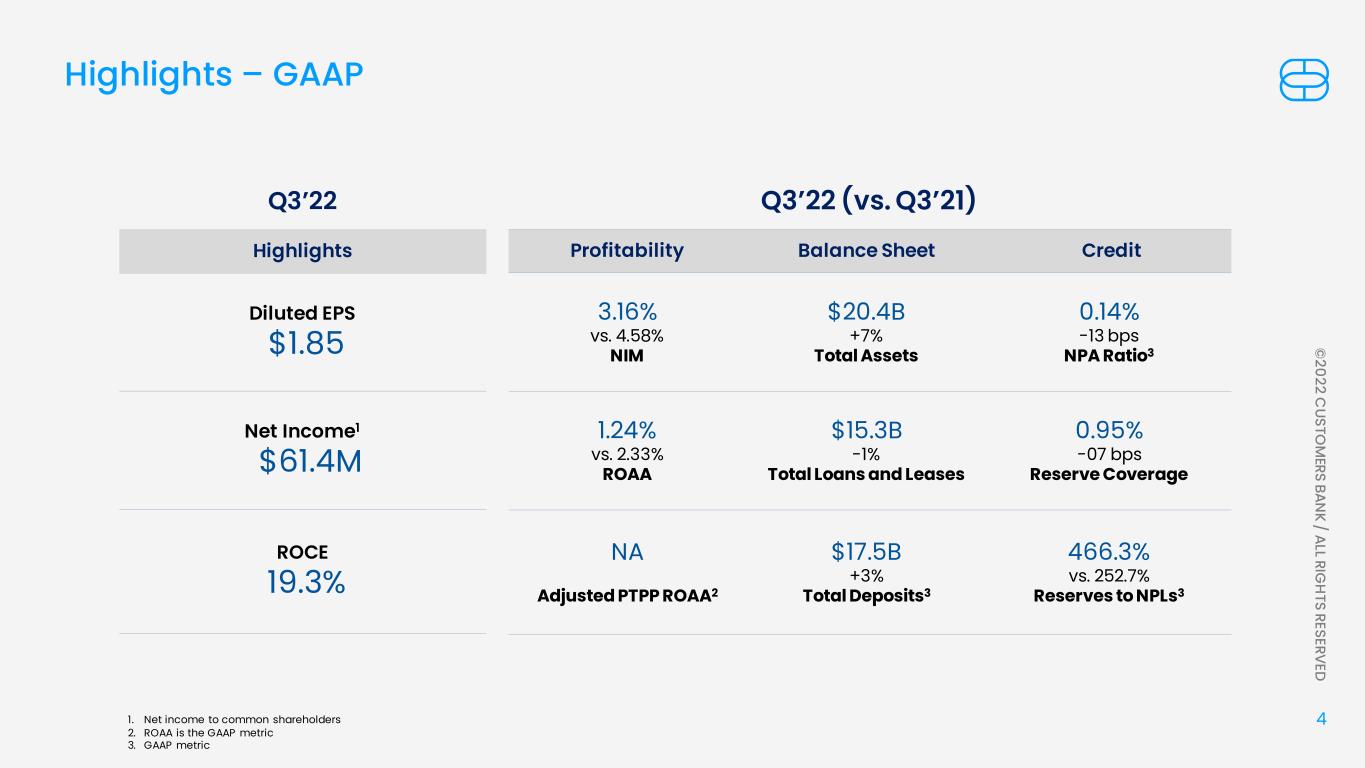

4 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Q3’22 (vs. Q3’21) Profitability Balance Sheet Credit 3.16% vs. 4.58% NIM $20.4B +7% Total Assets 0.14% -13 bps NPA Ratio3 1.24% vs. 2.33% ROAA $15.3B -1% Total Loans and Leases 0.95% -07 bps Reserve Coverage NA Adjusted PTPP ROAA2 $17.5B +3% Total Deposits3 466.3% vs. 252.7% Reserves to NPLs3 Highlights – GAAP 1. Net income to common shareholders 2. ROAA is the GAAP metric 3. GAAP metric Highlights Diluted EPS $1.85 Net Income1 $61.4M ROCE 19.3% Q3’22

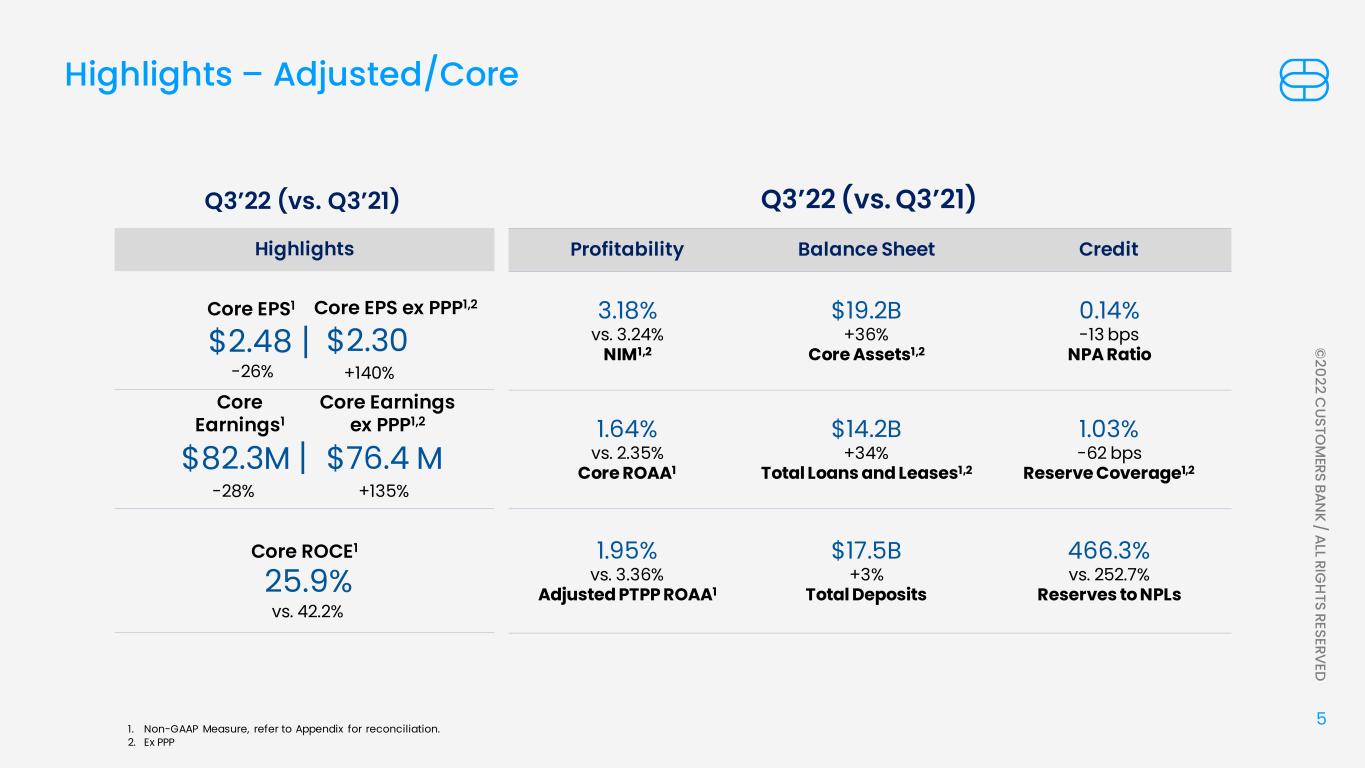

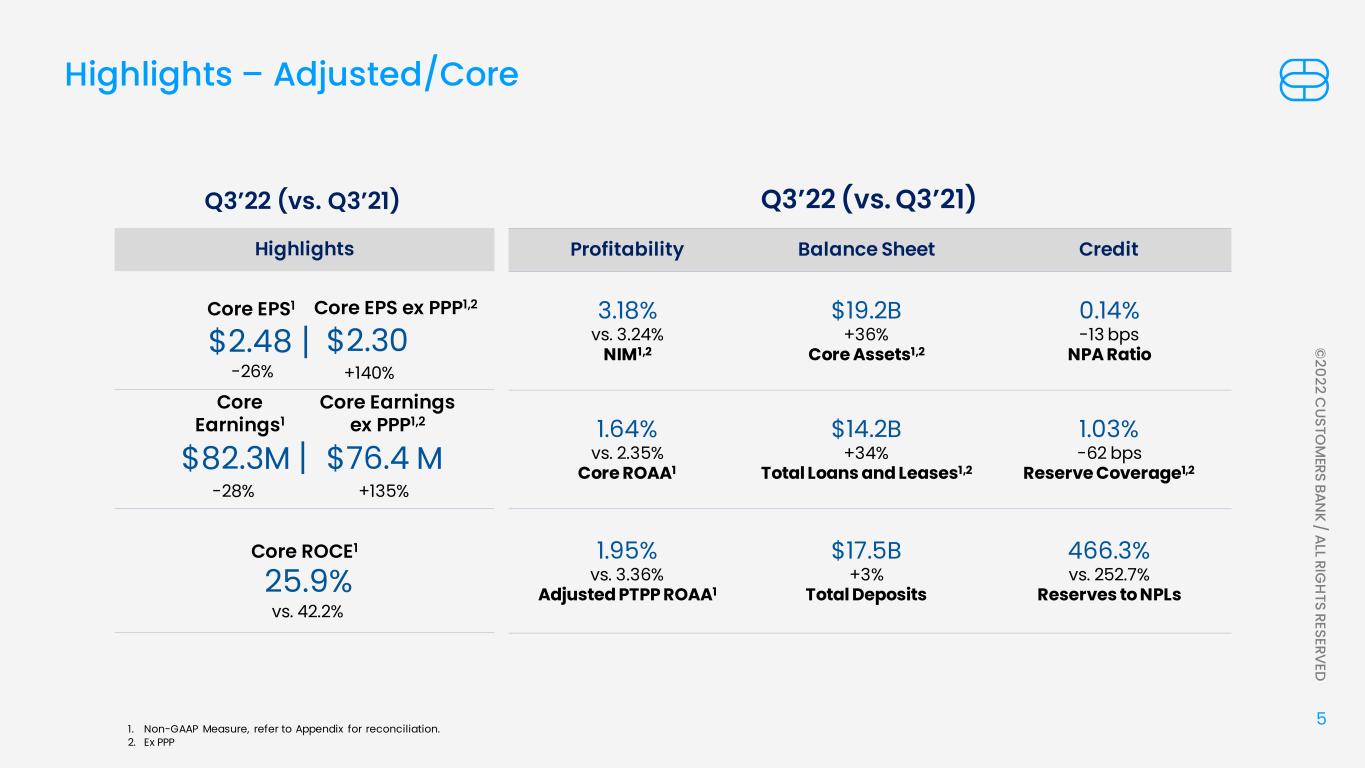

5 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Q3’22 (vs. Q3’21) Profitability Balance Sheet Credit 3.18% vs. 3.24% NIM1,2 $19.2B +36% Core Assets1,2 0.14% -13 bps NPA Ratio 1.64% vs. 2.35% Core ROAA1 $14.2B +34% Total Loans and Leases1,2 1.03% -62 bps Reserve Coverage1,2 1.95% vs. 3.36% Adjusted PTPP ROAA1 $17.5B +3% Total Deposits 466.3% vs. 252.7% Reserves to NPLs Highlights – Adjusted/Core Highlights Core ROCE1 25.9% Q3’22 (vs. Q3’21) -26% 1. Non-GAAP Measure, refer to Appendix for reconciliation. 2. Ex PPP vs. 42.2% +140% $2.30$2.48 Core EPS1 Core EPS ex PPP1,2 -28% +135% $76.4 M$82.3M Core Earnings1 Core Earnings ex PPP1,2

6 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED o Growth focused in variable rate specialty lending1 verticals with extremely low credit risk. o Portfolio mix2 shift to low risk verticals YoY − Specialty Lending C&I1: 19% to 37% − Consumer installment portfolio: 15% to 10% o $2.7B of the $3.6B loan growth ex PPP YoY in specialty lending1 is from low to no loss verticals Lender Finance-$1.6B, Fund Finance-$1.0B and FIG -$0.1B o Enhanced loan level stress-testing activities and proprietary technology enabled portfolio monitoring to proactively manage and take action, if needed Strategic initiatives we have implemented to best position us for the current and future external environment CREDIT & PORTFOLIO MIX o Managing balance sheet size by slowing outsized total asset growth: ~0.1B,+1% QoQ and $1.3B,+7% YoY o Sale of $500 million of consumer installment loans resulting in lower portfolio credit risk and capital boost o Transfer of $500 million of AFS securities to HTM in Q2’22 avoided further potential material unrealized loss in AOCI o Earnings growth consistently benefitting capital despite AOCI headwinds CAPITAL o Loan portfolio remix expected to be complete in Q4 2022 supporting NIM expansion in 2023 o Disciplined risk-adjusted pricing with targeted 3%+ spread over projected funding cost o Strategic sales from lower yielding AFS book redeployed in higher beta earning assets o Declining proportion of lower yielding PPP loans from 26% to 6% YoY as percentage of total assets leaves additional room for NIM expansion MARGIN o Liquidity almost doubled YoY to ~$10B while proactively paying down $4.8B in PPPLF balances. o Significant core deposit opportunities by onboarding teams and new product development through transaction banking product and services o Significant Liquidity and strong deposit pipeline to fund future core loan growth and transition of the BMTX DSA o Deposit growth of $2.5B from FIG group since Q3’20 LIQUIDITY & FUNDING o Organizational and leadership changes streamlined our structure while enhancing our ability to achieve our strategic business priorities o Despite significant growth, operating expenses did not increase over the prior quarter and a year ago quarter o Realigned the scope and areas of responsibility to simplify the organization structure o Better positioned to serve our clients while maintaining industry leading efficiency ratio of ~43%3 o Onboarded 300+ CBIT customers to-date bringing in over $1.9 billion in deposits o Launch our initial MPL Banking-as-a-Service program pilot in Q4’22 and target $10M+ in annual revenue o Launched Transaction Banking platform to enable continued low cost deposit generation beginning in 2023 o Build out of proprietary front-end digital platform to service the SMB Vendor/Dealer Market to add to SMB bundle offering with expected launch by Q1’23 TECHNOLOGY ORGANIZATIONAL EFFICIENCY 1. Includes owner occupied CRE ($0.2B) for Q3’22 2. Excludes the impact of PPP forgiveness 3. Core efficiency ratio for Q3’22. Non-GAAP measure. Refer to appendix for reconciliation

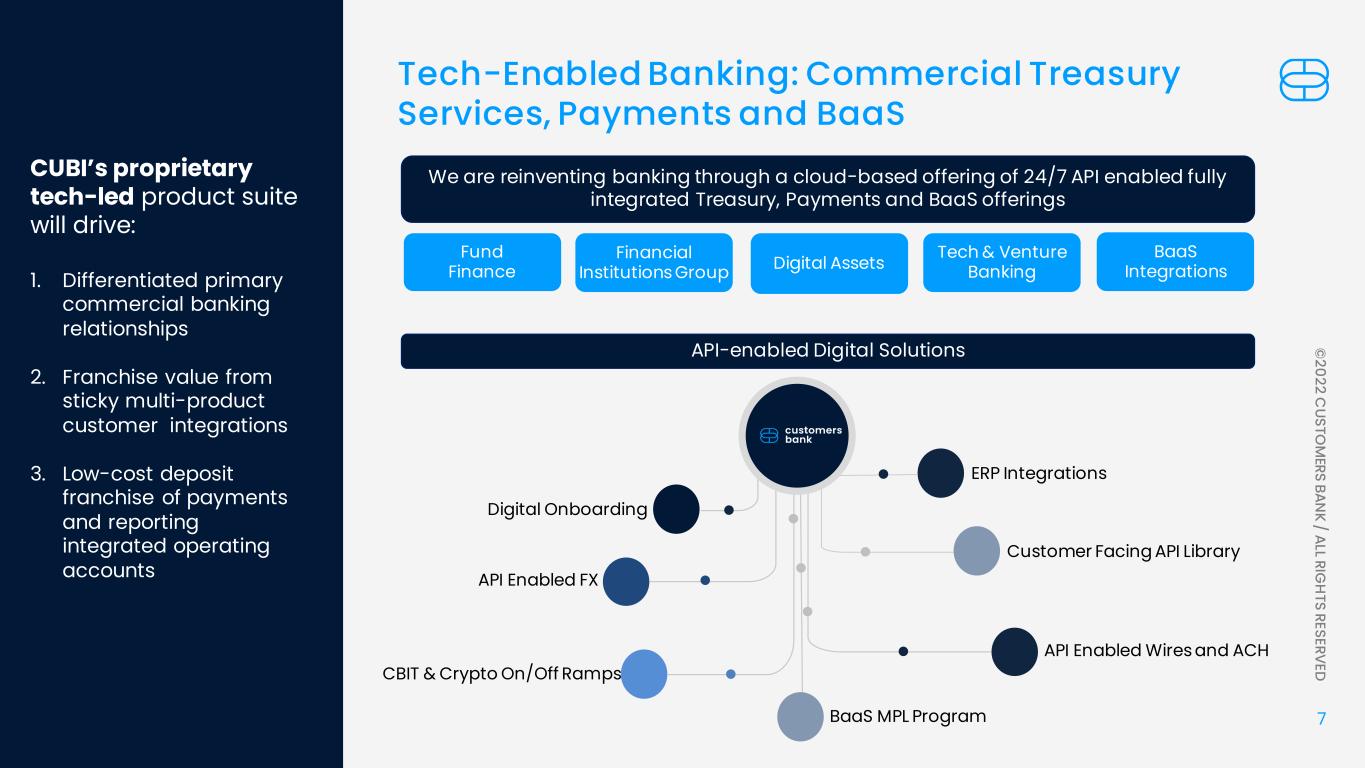

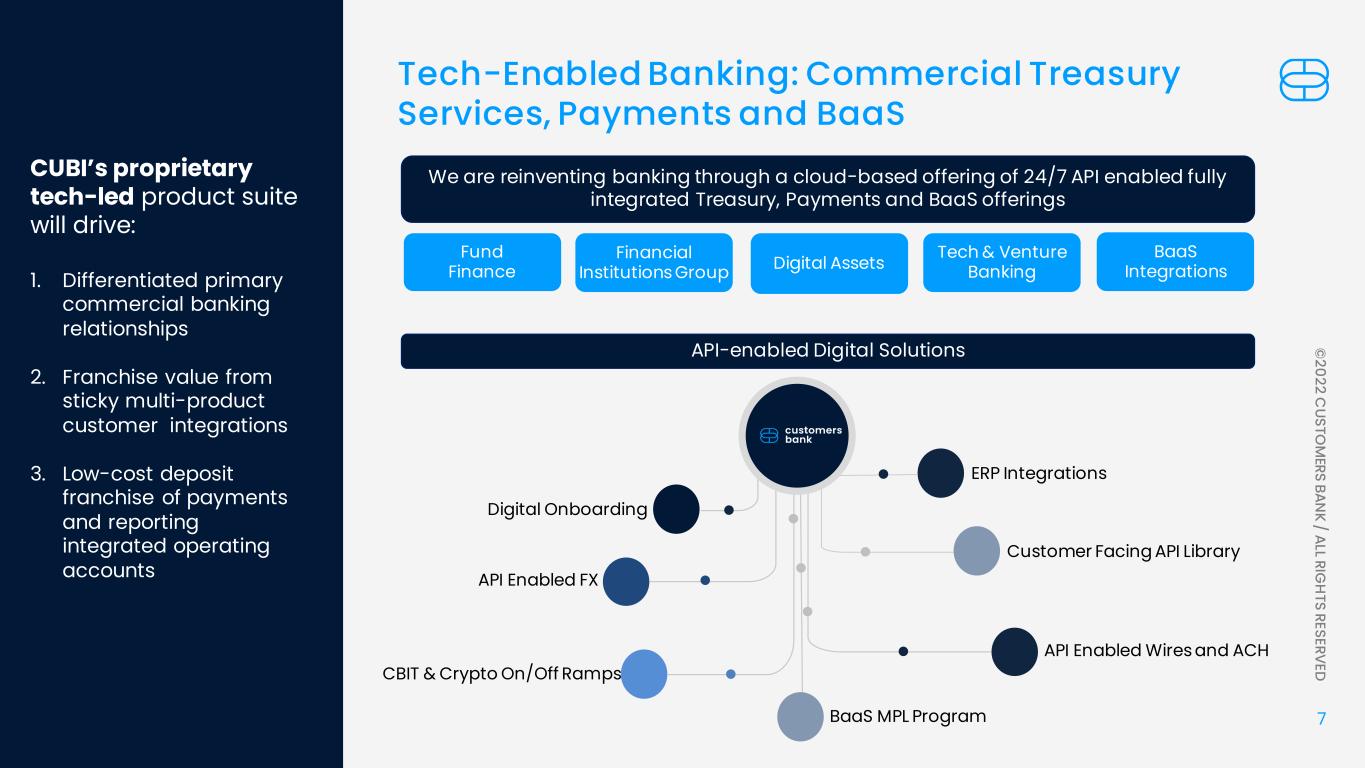

7 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED We are reinventing banking through a cloud-based offering of 24/7 API enabled fully integrated Treasury, Payments and BaaS offerings Digital AssetsFund Finance Tech & Venture Banking Financial Institutions Group API-enabled Digital Solutions Digital Onboarding API Enabled FX CBIT & Crypto On/Off Ramps ERP Integrations Customer Facing API Library Tech-Enabled Banking: Commercial Treasury Services, Payments and BaaS CUBI’s proprietary tech-led product suite will drive: 1. Differentiated primary commercial banking relationships 2. Franchise value from sticky multi-product customer integrations 3. Low-cost deposit franchise of payments and reporting integrated operating accounts BaaS MPL Program API Enabled Wires and ACH BaaS Integrations

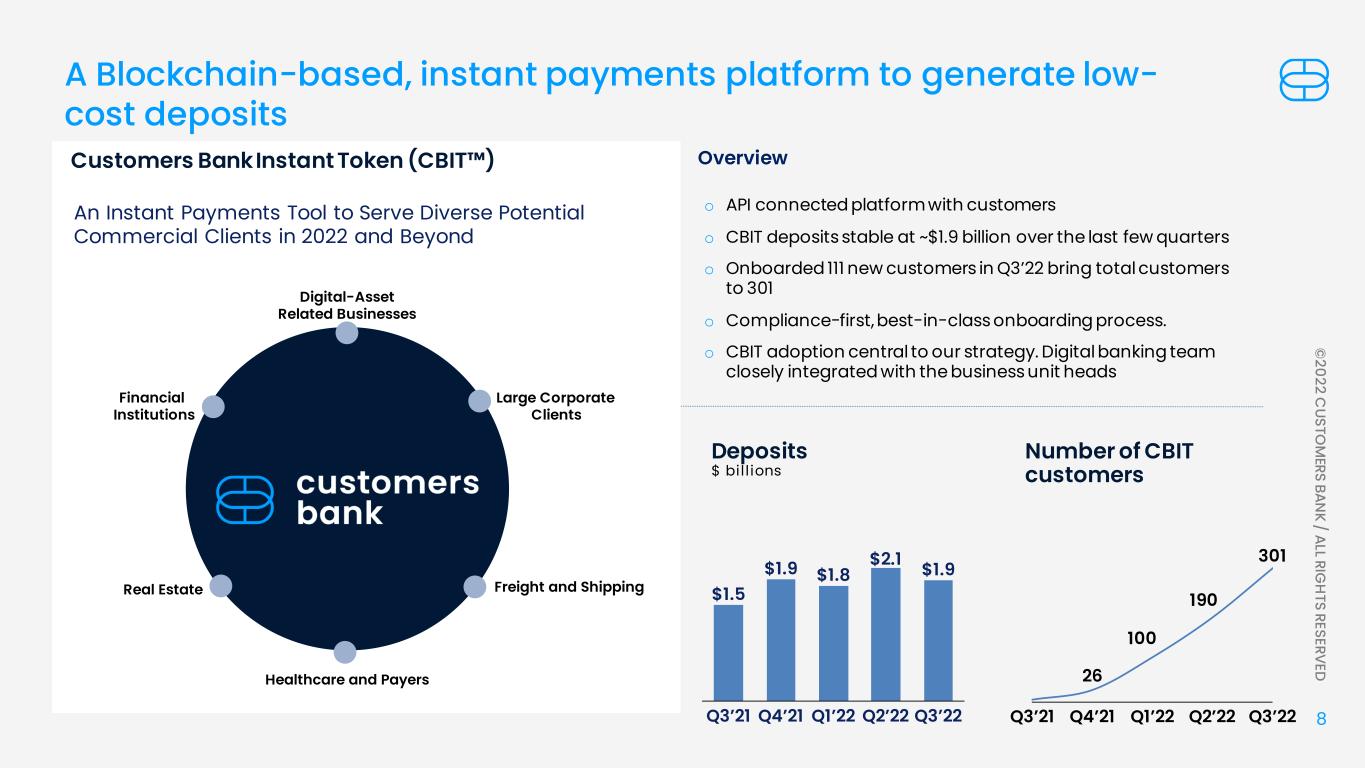

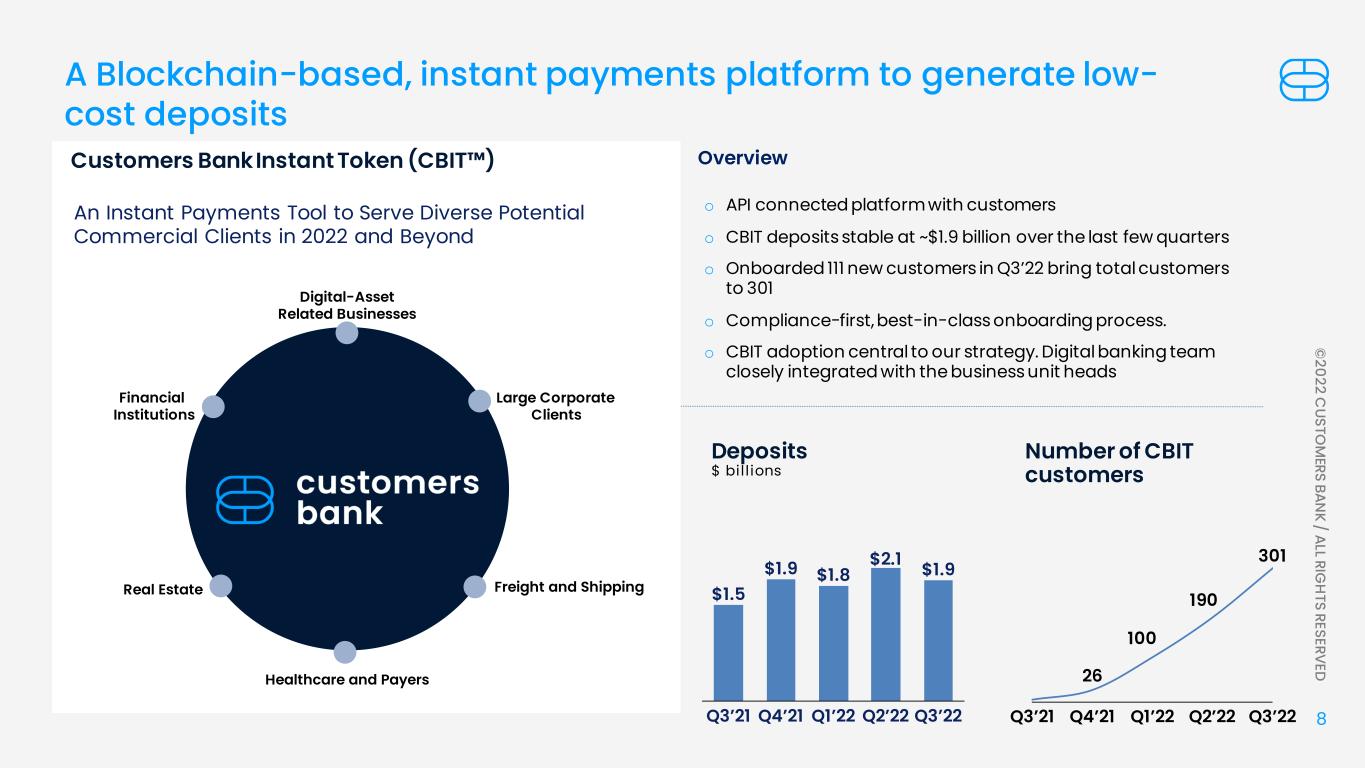

8 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED A Blockchain-based, instant payments platform to generate low- cost deposits Overview o API connected platform with customers o CBIT deposits stable at ~$1.9 billion over the last few quarters o Onboarded 111 new customers in Q3’22 bring total customers to 301 o Compliance-first, best-in-class onboarding process. o CBIT adoption central to our strategy. Digital banking team closely integrated with the business unit heads Customers Bank Instant Token (CBIT™) An Instant Payments Tool to Serve Diverse Potential Commercial Clients in 2022 and Beyond Freight and Shipping Large Corporate Clients Digital-Asset Related Businesses Healthcare and Payers Real Estate Financial Institutions $1.5 $1.9 $1.8 $2.1 $1.9 Q3’21 Q4’21 Q1’22 Q3’22Q2’22 Deposits $ bil l ions Number of CBIT customers 26 100 190 301 Q4’21Q3’21 Q1’22 Q3’22Q2’22

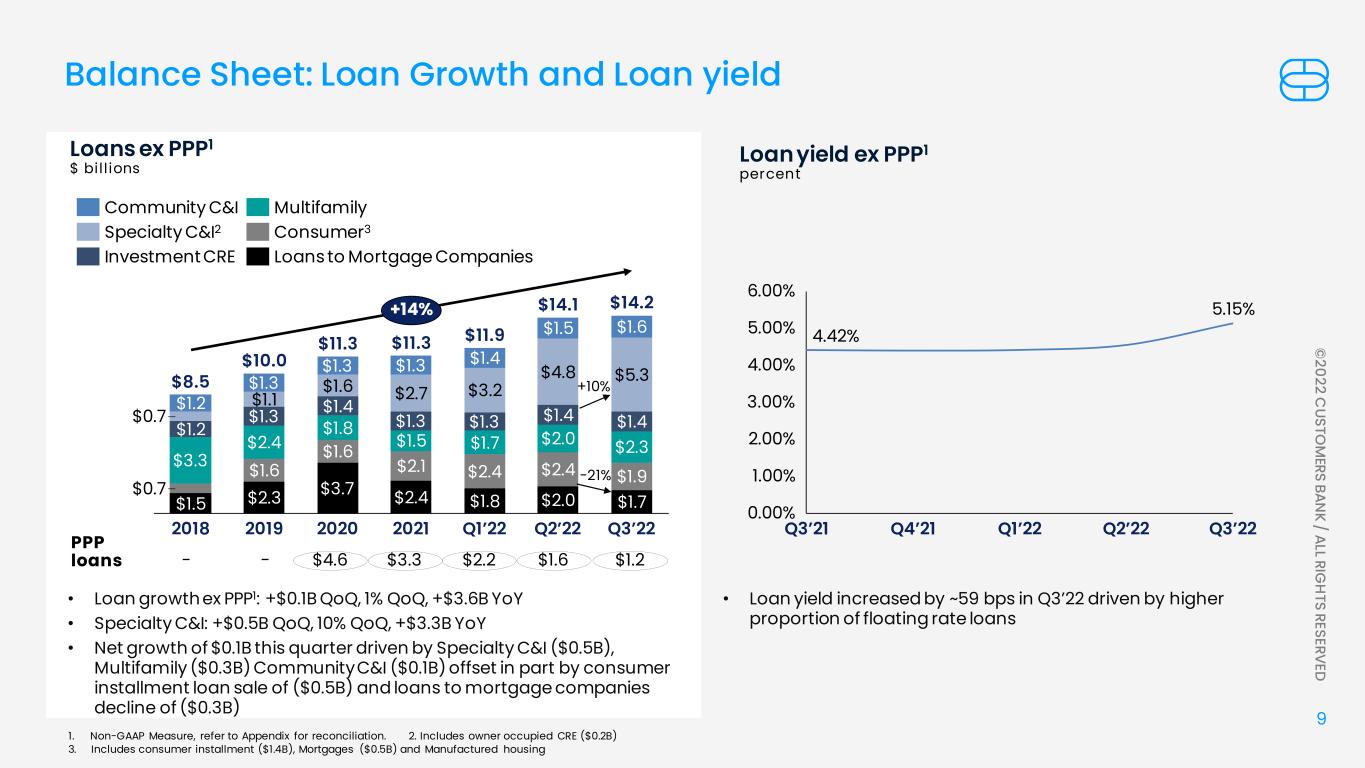

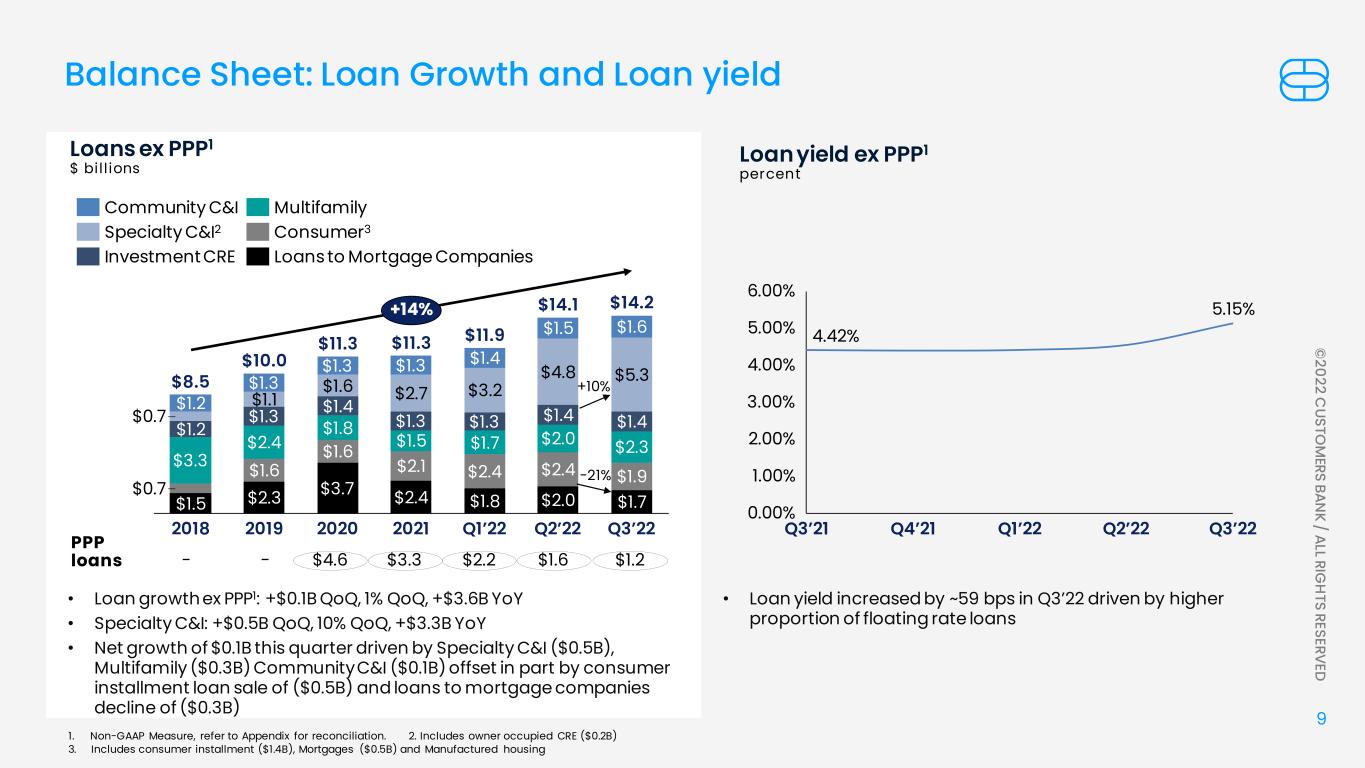

9 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Loans ex PPP1 $ bil l ions • Loan growth ex PPP1: +$0.1B QoQ, 1% QoQ, +$3.6B YoY • Specialty C&I: +$0.5B QoQ, 10% QoQ, +$3.3B YoY • Net growth of $0.1B this quarter driven by Specialty C&I ($0.5B), Multifamily ($0.3B) Community C&I ($0.1B) offset in part by consumer installment loan sale of ($0.5B) and loans to mortgage companies decline of ($0.3B) PPP loans Balance Sheet: Loan Growth and Loan yield $1.5 $2.3 $3.7 $2.4 $1.8 $2.0 $1.7 $0.7 $1.6 $1.6 $2.1 $2.4 $2.4 $1.9 $3.3 $2.4 $1.8 $1.5 $1.7 $2.0 $2.3 $1.2 $1.3 $1.4 $1.3 $1.3 $1.4 $1.4$0.7 $1.1 $1.6 $2.7 $3.2 $4.8 $5.3 $1.2 $1.3 $1.3 $1.3 $1.4 $1.5 $1.6 $11.3 20202019 $11.9 2018 2021 Q1’22 Q2’22 Q3’22 $8.5 $10.0 $11.3 $14.1 $14.2+14% Community C&I Consumer3Specialty C&I2 Multifamily Investment CRE Loans to Mortgage Companies 1. Non-GAAP Measure, refer to Appendix for reconciliation. 2. Includes owner occupied CRE ($0.2B) 3. Includes consumer installment ($1.4B), Mortgages ($0.5B) and Manufactured housing -- +10% -21% $1.2$4.6 $3.3 $2.2 $1.6 4.42% 5.15% 5.00% 4.00% 0.00% 1.00% 2.00% 3.00% 6.00% Q2’22Q3’21 Q4’21 Q1’22 Q3’22 Loan yield ex PPP1 percent • Loan yield increased by ~59 bps in Q3’22 driven by higher proportion of floating rate loans

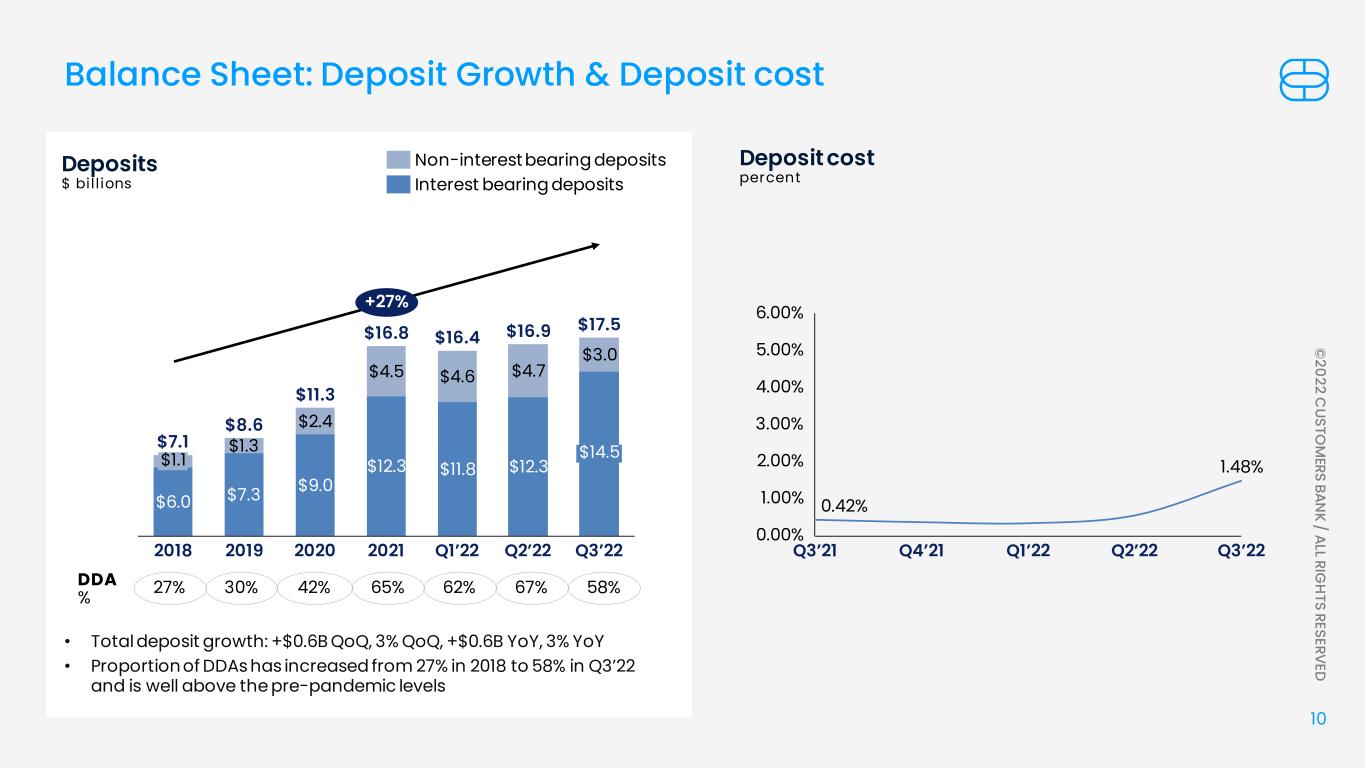

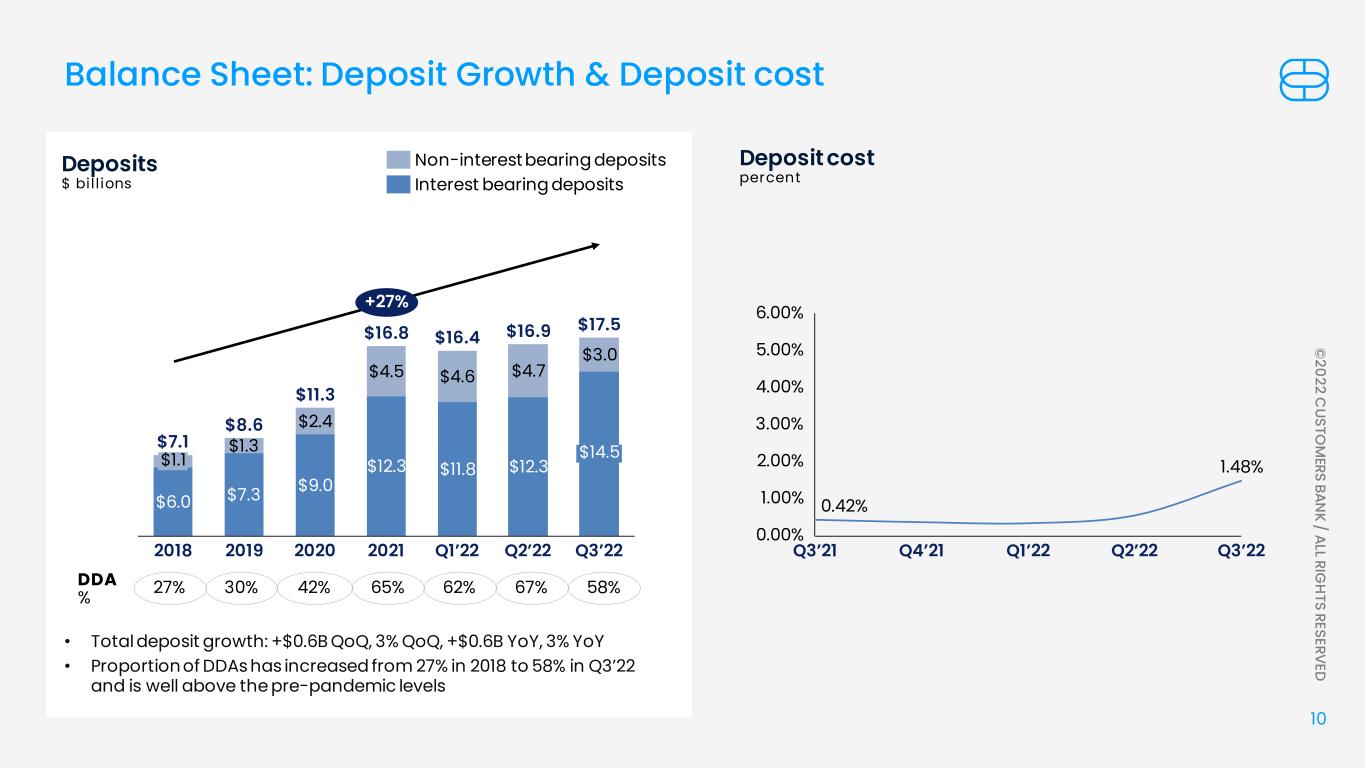

10 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Balance Sheet: Deposit Growth & Deposit cost $6.0 $7.3 $9.0 $12.3 $11.8 $12.3 $1.3 $2.4 $4.5 $4.6 $4.7 $3.0 Q3’22Q2’222018 $1.1 2020 $14.5 2019 $16.8 2021 Q1’22 $7.1 $8.6 $11.3 $16.9$16.4 $17.5 +27% Non-interest bearing deposits Interest bearing deposits Deposits $ bil l ions • Total deposit growth: +$0.6B QoQ, 3% QoQ, +$0.6B YoY, 3% YoY • Proportion of DDAs has increased from 27% in 2018 to 58% in Q3’22 and is well above the pre-pandemic levels 58%DDA % 30% 42% 65% 62% 67%27% 0.42% 1.48% 0.00% 5.00% 3.00% 1.00% 2.00% 4.00% 6.00% Q3’21 Q4’21 Q1’22 Q2’22 Q3’22 Deposit cost percent

11 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Interest earning assets mix1 Q3’22, percent Interest Rate Sensitive Earning Asset Mix • ~62% of interest earning assets are market sensitive which is greater than the proportion of market sensitive liabilities 51% 8% 25% 13% 2% Fixed LoansFloating Loans Floating Securities Cash Fixed Securities 1. Floating rate loans and securities are defined as assets with resets less than one year and include fixed loans maturing within one year (including PPP loans). 2. Non-GAAP Measure, refer to Appendix for reconciliation. 3. Includes owner occupied CRE ($0.2B) 4. Includes consumer installment ($1.4B), Mortgages ($0.5B) and Manufactured housing 5. Includes Mortgages and Home Equity loans 11% 37% 10% 16% 13% 12% Loan mix ex PPP2 percent • Significant improvement in loan mix with greater proportion of lower credit risk verticals • Pipeline remains strong especially in C&I • Loan mix ex PPP2: Consumer installment (~10% declined from 15% YoY), Consumer mortgages5 (~4%) Community C&I Specialty C&I3 Investment CRE Multifamily Consumer4 Loans to Mortgage Companies As of Q3’22 86 % Commercial Loans

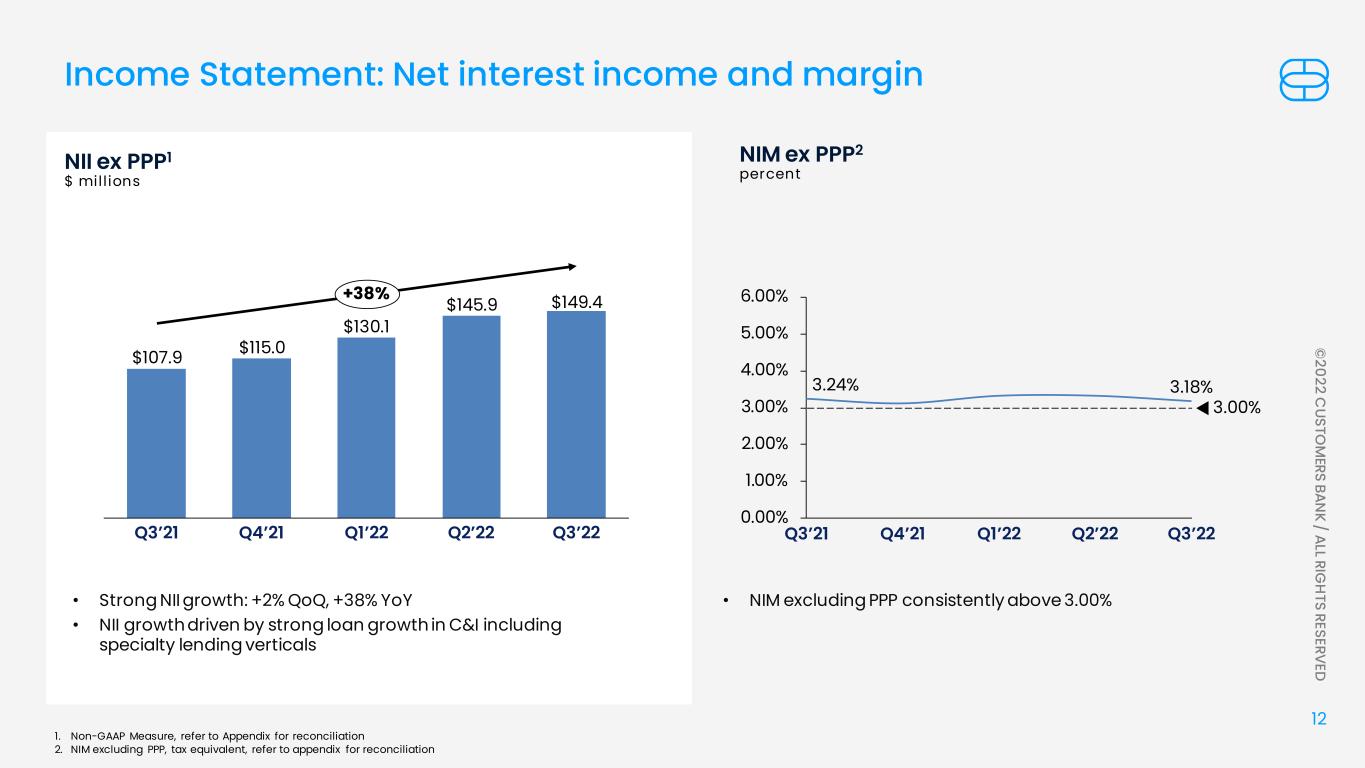

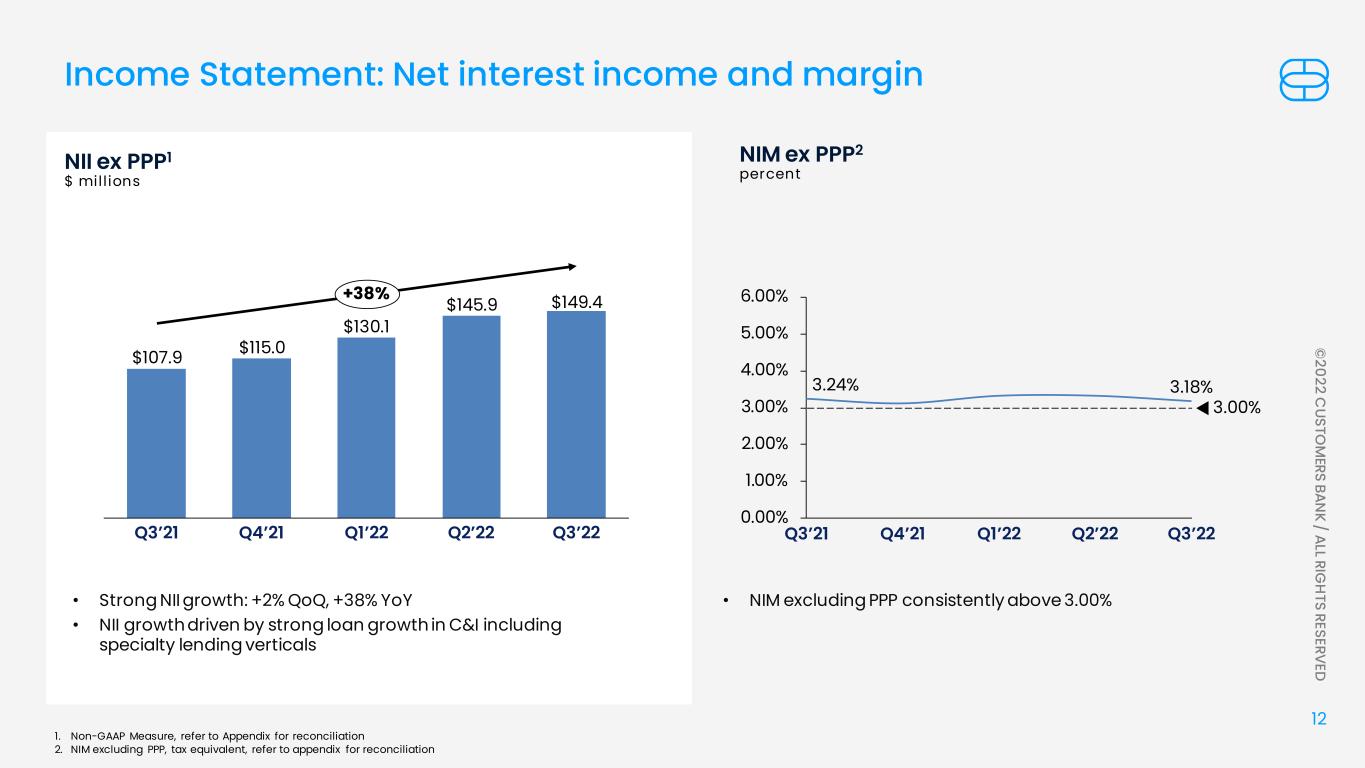

12 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Income Statement: Net interest income and margin 3.24% 3.18% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Q3’22Q4’21Q3’21 3.00% Q1’22 Q2’22 NIM ex PPP2 percent • NIM excluding PPP consistently above 3.00% $107.9 $115.0 $130.1 $145.9 $149.4 Q3’22Q2’22Q4’21Q3’21 Q1’22 +38% NII ex PPP1 $ mill ions 1. Non-GAAP Measure, refer to Appendix for reconciliation 2. NIM excluding PPP, tax equivalent, refer to appendix for reconciliation • Strong NII growth: +2% QoQ, +38% YoY • NII growth driven by strong loan growth in C&I including specialty lending verticals

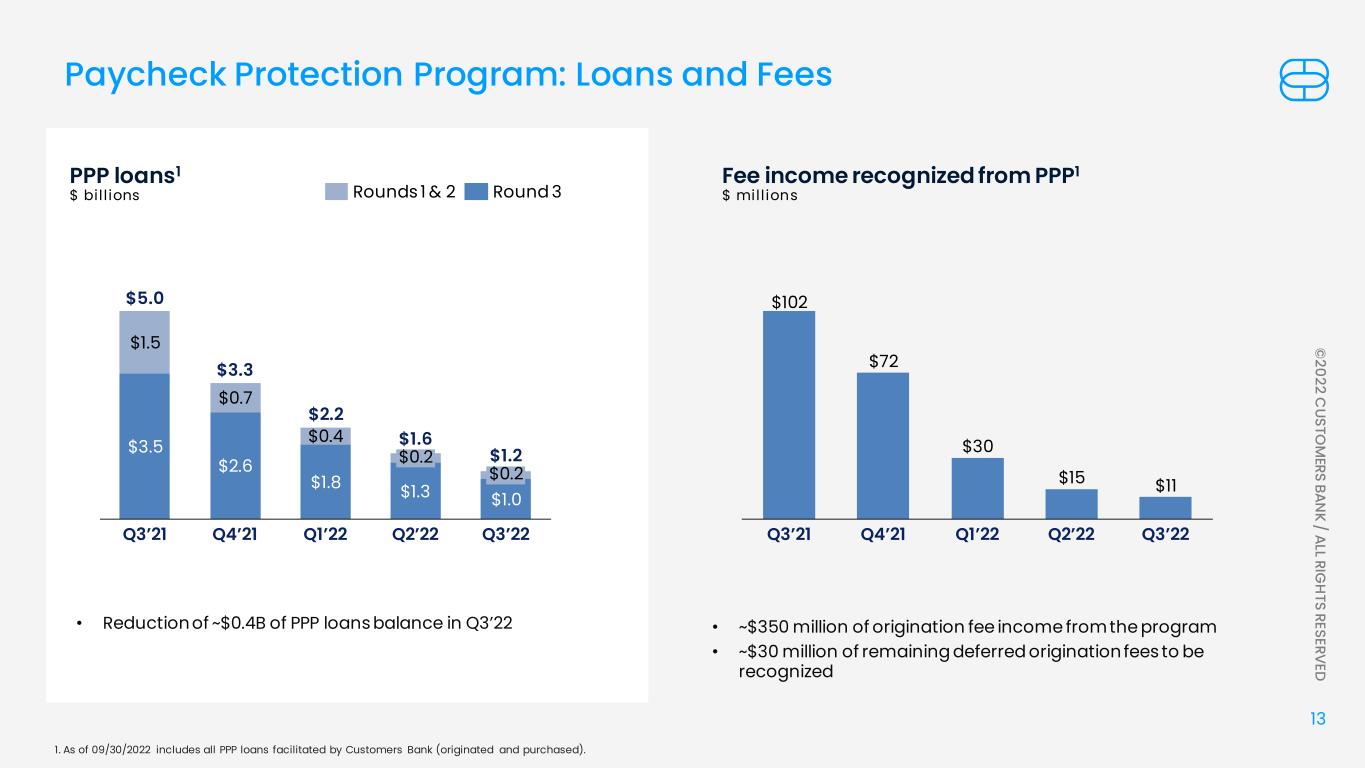

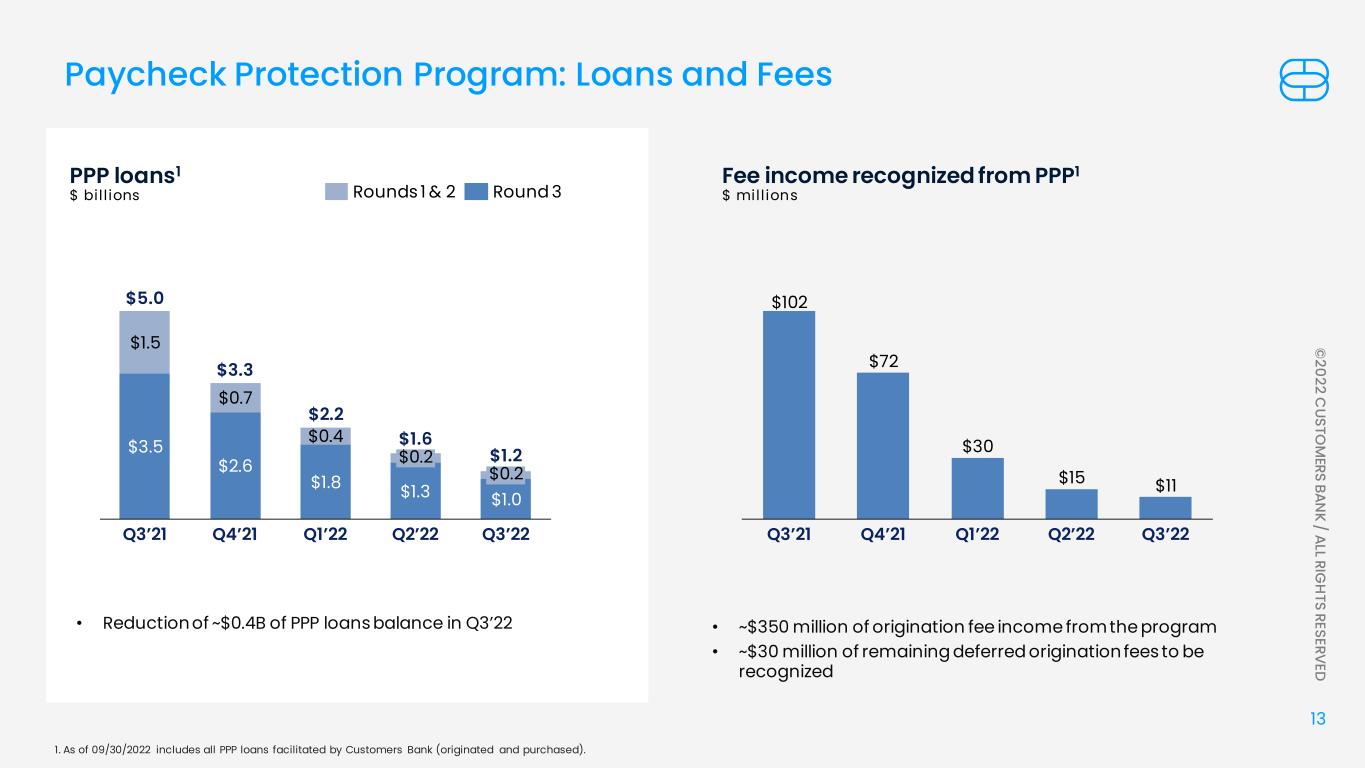

13 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED $3.5 $2.6 $1.8 $1.3 $1.0 $1.5 $0.7 $0.4 $0.2 Q3’21 Q2’22 Q3’22Q4’21 $0.2 Q1’22 $5.0 $3.3 $2.2 $1.6 $1.2 Rounds 1 & 2 Round 3 PPP loans1 $ bil l ions Fee income recognized from PPP1 $ mill ions • ~$350 million of origination fee income from the program • ~$30 million of remaining deferred origination fees to be recognized 1. As of 09/30/2022 includes all PPP loans facilitated by Customers Bank (originated and purchased). Paycheck Protection Program: Loans and Fees • Reduction of ~$0.4B of PPP loans balance in Q3’22 $102 $72 $30 $15 $11 Q3’22Q1’22Q4’21Q3’21 Q2’22

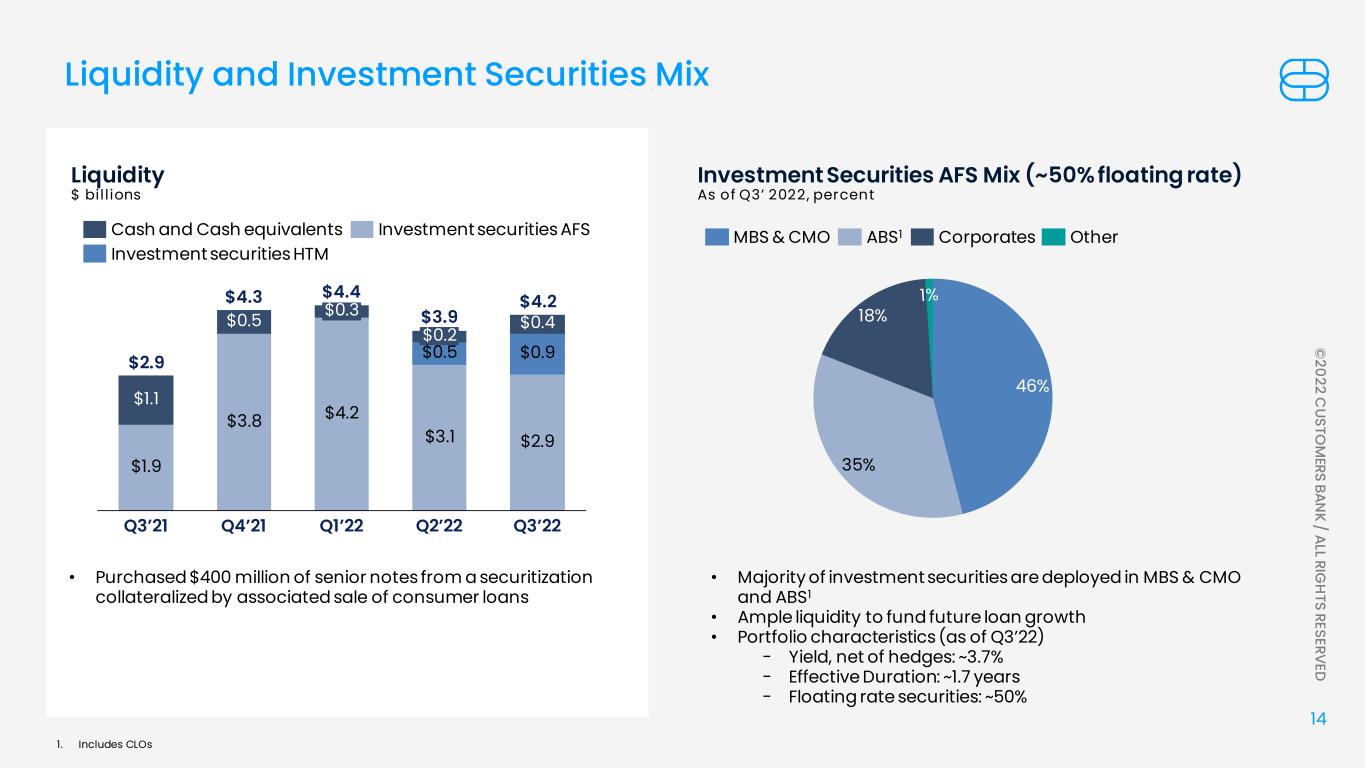

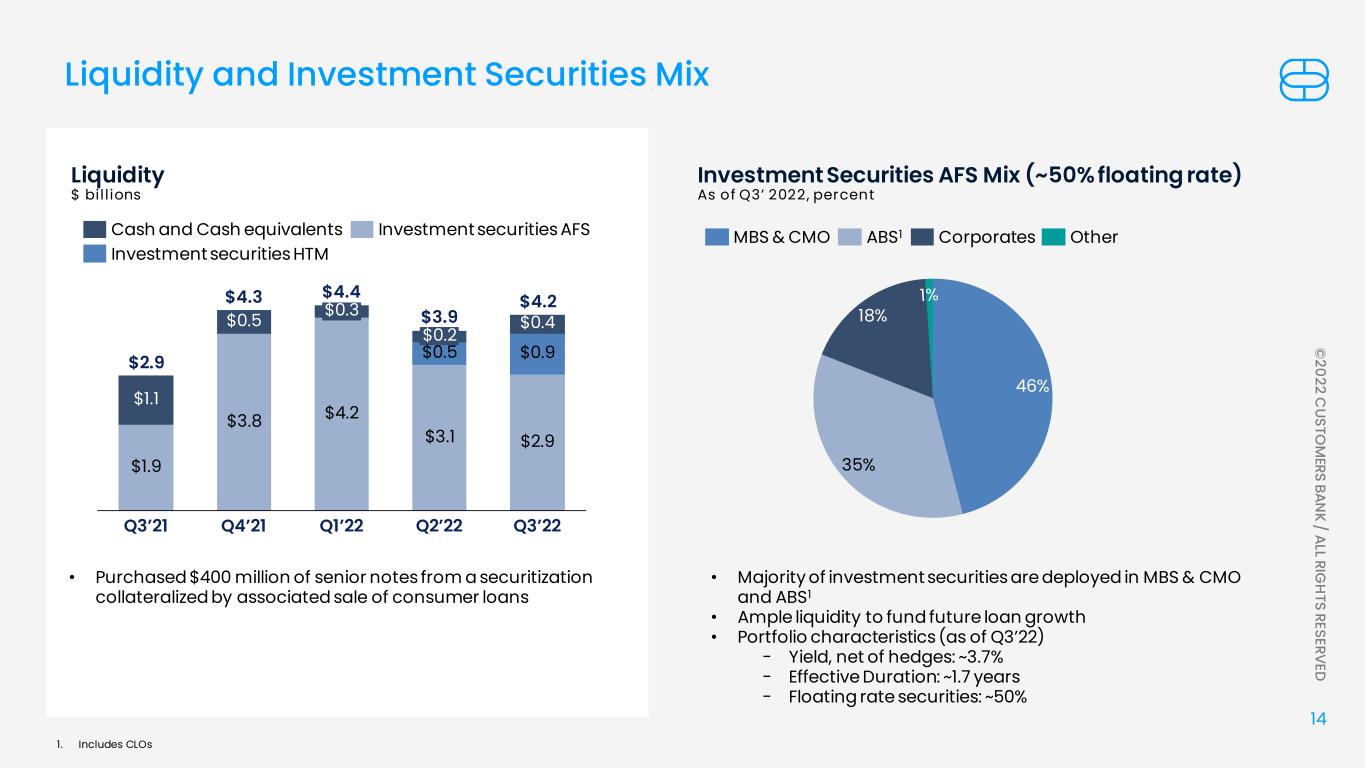

14 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED $1.1 $1.9 $0.3 $3.1 Q4’21Q3’21 $0.5 $3.8 $4.2 Q1’22 $0.2 $0.5 Q2’22 $0.4$3.9 $0.9 $2.9 Q3’22 $2.9 $4.3 $4.4 $4.2 Cash and Cash equivalents Investment securities HTM Investment securities AFS Liquidity $ bil l ions Investment Securities AFS Mix (~50% floating rate) As of Q3’ 2022, percent • Purchased $400 million of senior notes from a securitization collateralized by associated sale of consumer loans • Majority of investment securities are deployed in MBS & CMO and ABS1 • Ample liquidity to fund future loan growth • Portfolio characteristics (as of Q3’22) − Yield, net of hedges: ~3.7% − Effective Duration: ~1.7 years − Floating rate securities: ~50% Liquidity and Investment Securities Mix 46% 35% 18% MBS & CMO ABS1 Corporates Other 1. Includes CLOs

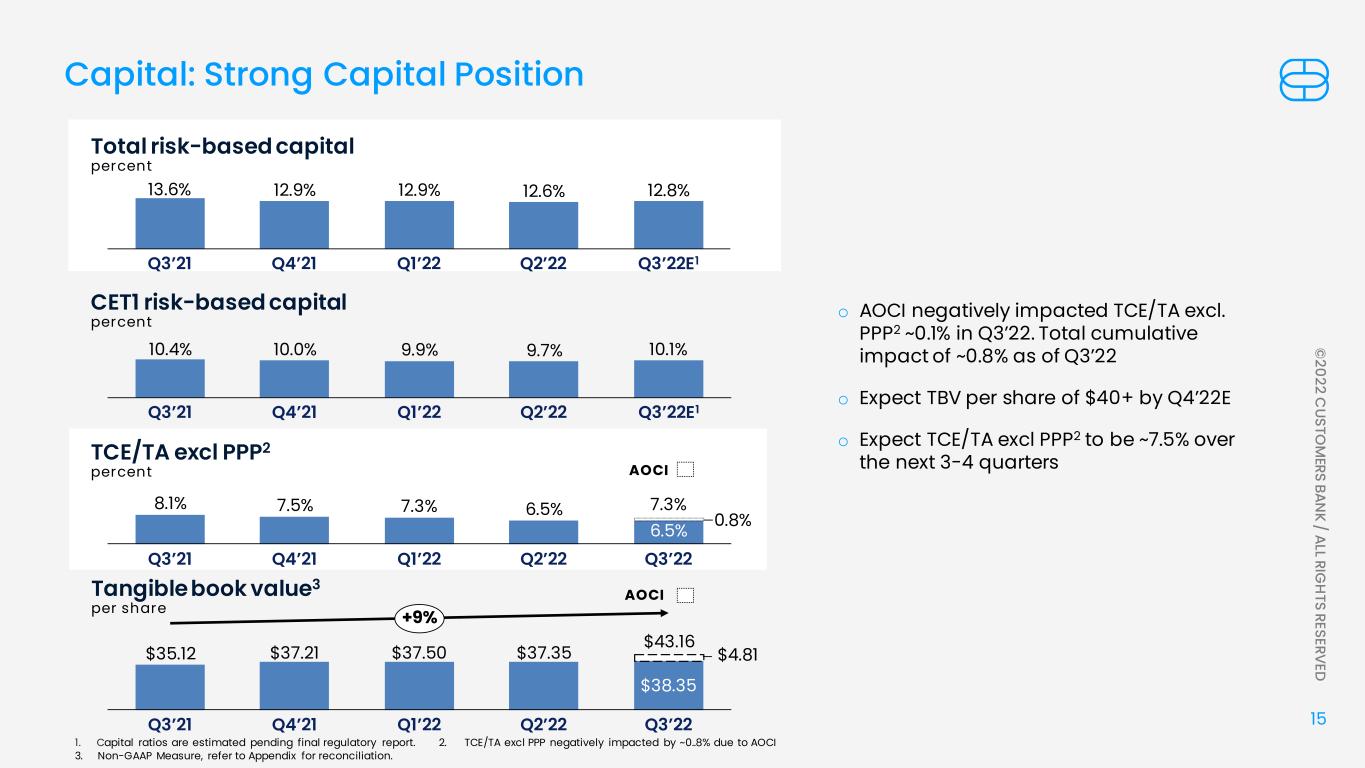

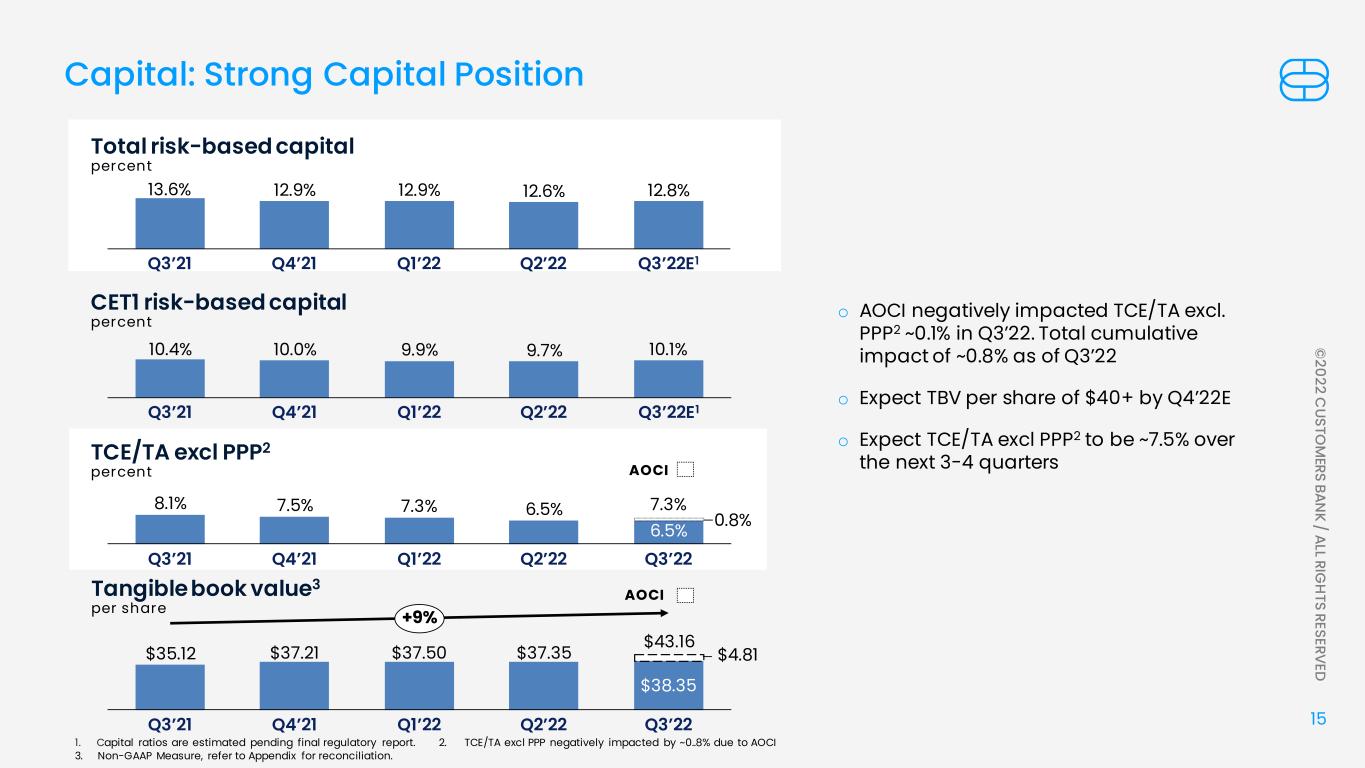

15 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED 13.6% 12.9% 12.9% 12.6% 12.8% Q2’22Q3’21 Q3’22E1Q4’21 Q1’22 Total risk-based capital percent 8.1% 7.5% 7.3% 6.5% Q2’22Q3’21 6.5% Q4’21 Q1’22 Q3’22 7.3% TCE/TA excl PPP2 percent $35.12 $37.21 $37.50 $37.35 $38.35 Q3’21 Q2’22Q4’21 Q1’22 Q3’22 $43.16 +9% Tangible book value3 per share o AOCI negatively impacted TCE/TA excl. PPP2 ~0.1% in Q3’22. Total cumulative impact of ~0.8% as of Q3’22 o Expect TBV per share of $40+ by Q4’22E o Expect TCE/TA excl PPP2 to be ~7.5% over the next 3-4 quarters 1. Capital ratios are estimated pending final regulatory report. 2. TCE/TA excl PPP negatively impacted by ~0..8% due to AOCI 3. Non-GAAP Measure, refer to Appendix for reconciliation. Capital: Strong Capital Position AOCI AOCI 0.8% $4.81 10.4% 10.0% 9.9% 9.7% 10.1% Q4’21Q3’21 Q2’22Q1’22 Q3’22E1 CET1 risk-based capital percent

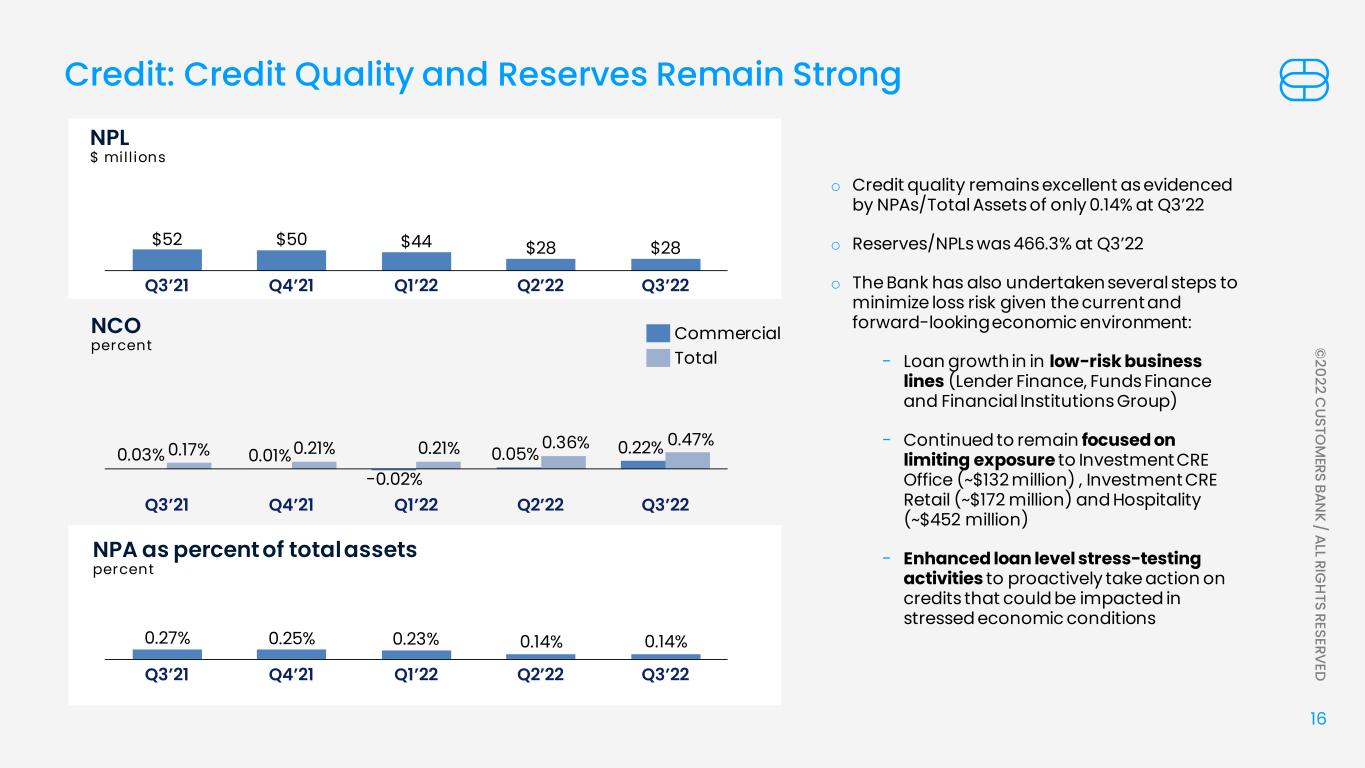

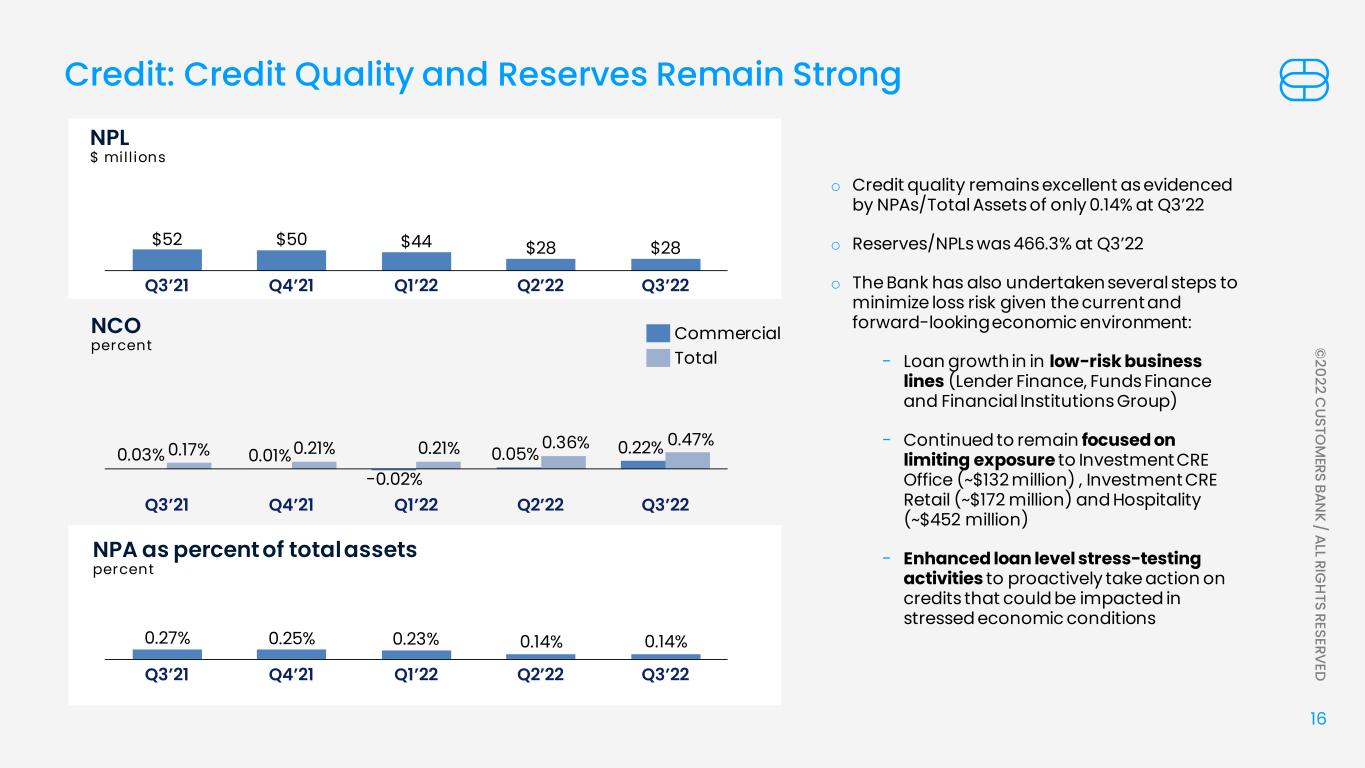

16 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED $52 $50 $44 $28 $28 Q2’22Q3’21 Q4’21 Q3’22Q1’22 NPL $ mill ions NCO percent 0.27% 0.25% 0.23% 0.14% 0.14% Q4’21Q3’21 Q1’22 Q3’22Q2’22 NPA as percent of total assets percent o Credit quality remains excellent as evidenced by NPAs/Total Assets of only 0.14% at Q3’22 o Reserves/NPLs was 466.3% at Q3’22 o The Bank has also undertaken several steps to minimize loss risk given the current and forward-looking economic environment: − Loan growth in in low-risk business lines (Lender Finance, Funds Finance and Financial Institutions Group) − Continued to remain focused on limiting exposure to Investment CRE Office (~$132 million) , Investment CRE Retail (~$172 million) and Hospitality (~$452 million) − Enhanced loan level stress-testing activities to proactively take action on credits that could be impacted in stressed economic conditions Credit: Credit Quality and Reserves Remain Strong 0.03% 0.01% -0.02% 0.05% 0.22%0.17% 0.21% 0.21% 0.36% 0.47% Q1’22 Q2’22Q3’21 Q4’21 Q3’22 Commercial Total

17 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Industry leading core loan growth and deposit growth supported by best-in-class digital banking Moderating growth in this environment to maintain/expand margin, improve capital ratios while maintaining profitability. On track for $6.00 or higher Core EPS in 2023. Exceptional credit quality Customer centric culture built around service and experience Demonstrated industry leading proprietary technological capabilities as a high-tech, high- touch bank Attractive valuation - Trading at ~0.8X1 tangible book value and ~5X1 2023E consensus. We will consider buying back common stock at below tangible book Let’s take on tomorrow. Key Investment Highlights 1. Based on share price as of October 21, 2022 (~$31.17)

ANALYST COVERAGE D.A. Davidson Companies Peter Winter Hovde Group David Bishop Jefferies Group LLC Casey Haire Keefe, Bruyette & Woods Inc. Michael Perito Maxim Group Inc. Michael Diana Piper Sandler Companies Frank Schiraldi Stephens Inc. Matt Breese Wedbush Securities Inc. David Chiaverini B. Riley Financial, Inc.

19 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Appendix

20 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Seasoned teams led by SPOC RM’s Exceptional service through omnichannel expansion Full service Private Business Banking Instant B2B payments platform Digital bank with over 500K customers API integrations support customer growth Streamlined digital u/w & onboarding HIGH TOUCH HIGH TECH The customer is at the center of everything we do • Single Point of Contact for customers (SPOC) • Technology led customer experience • Customer retention & referrals at an all time high • Industry leading employee retention

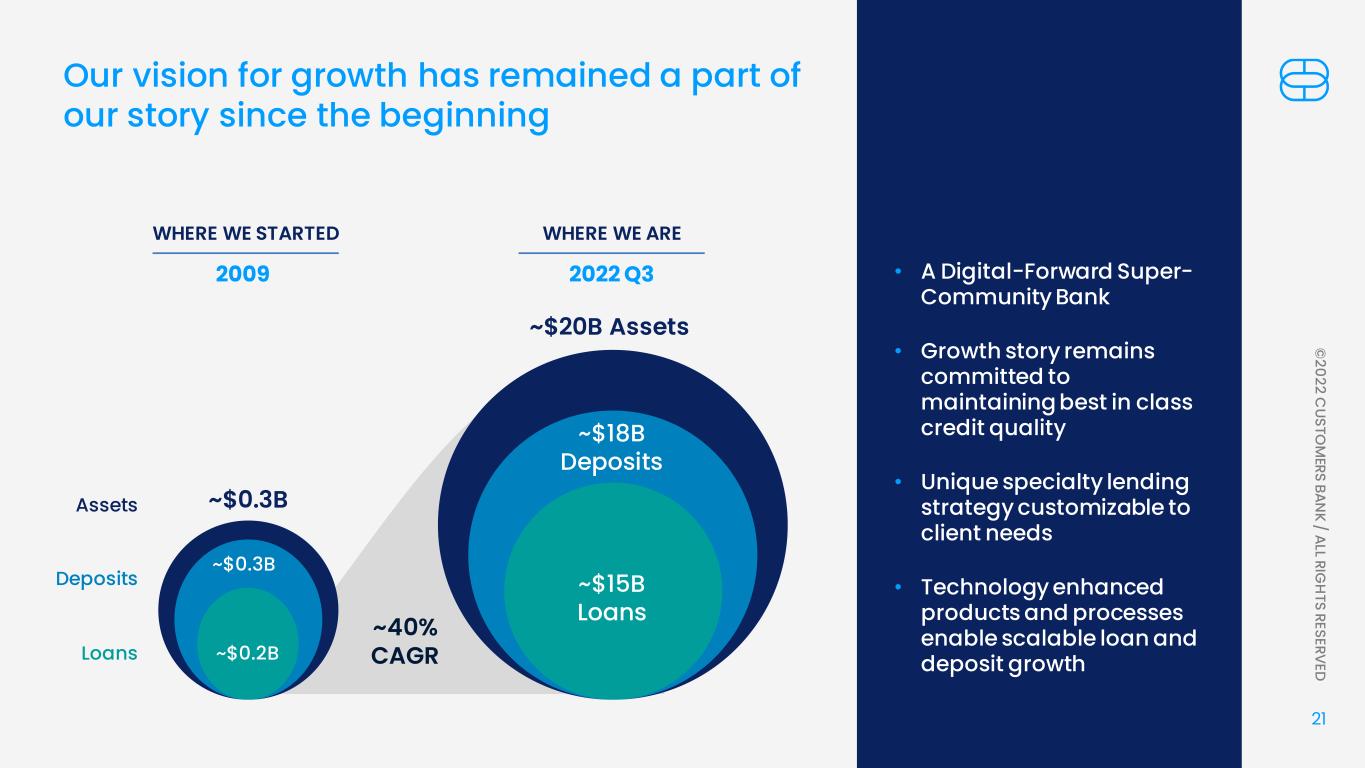

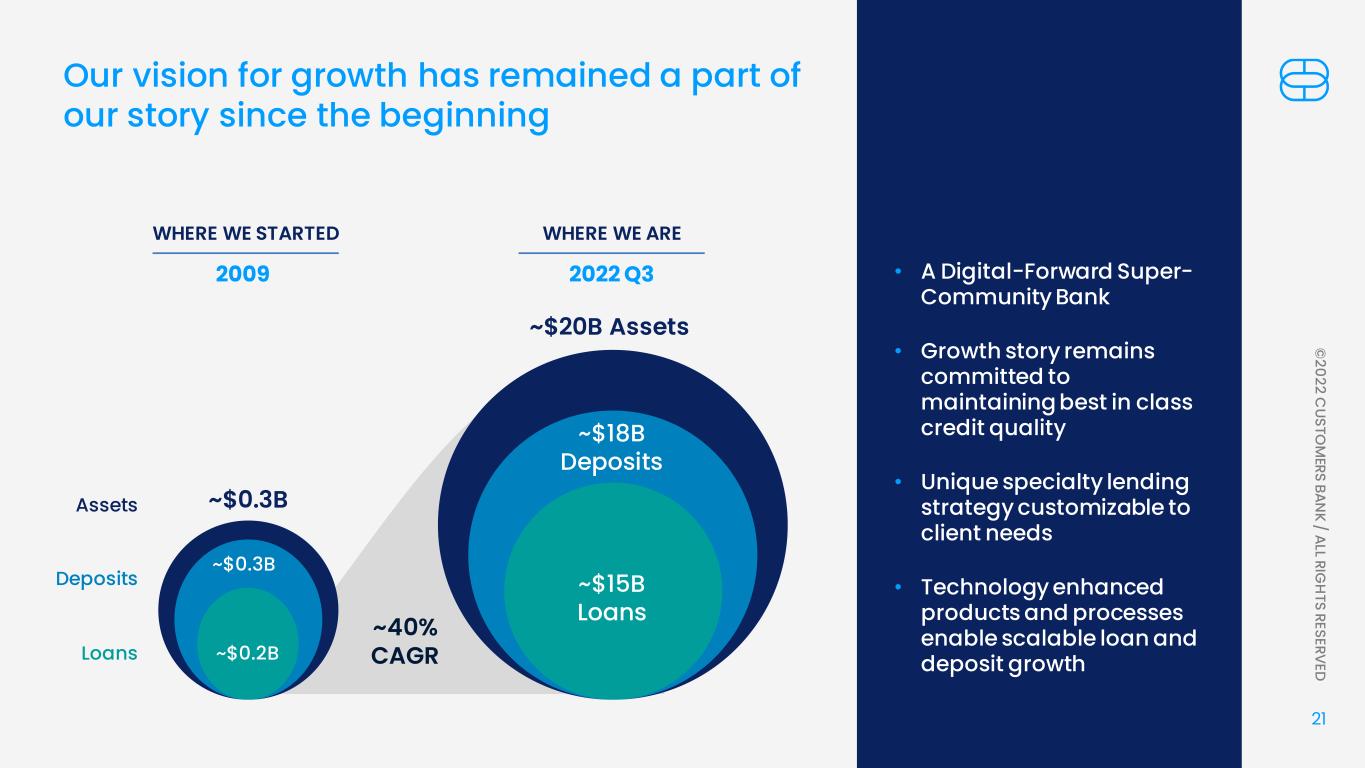

21 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED ~$20B Assets ~$18B Deposits ~$15B Loans • A Digital-Forward Super- Community Bank • Growth story remains committed to maintaining best in class credit quality • Unique specialty lending strategy customizable to client needs • Technology enhanced products and processes enable scalable loan and deposit growth ~$0.3B ~$0.3B ~$0.2B Assets Deposits Loans WHERE WE STARTED 2009 Our vision for growth has remained a part of our story since the beginning WHERE WE ARE 2022 Q3 ~40% CAGR

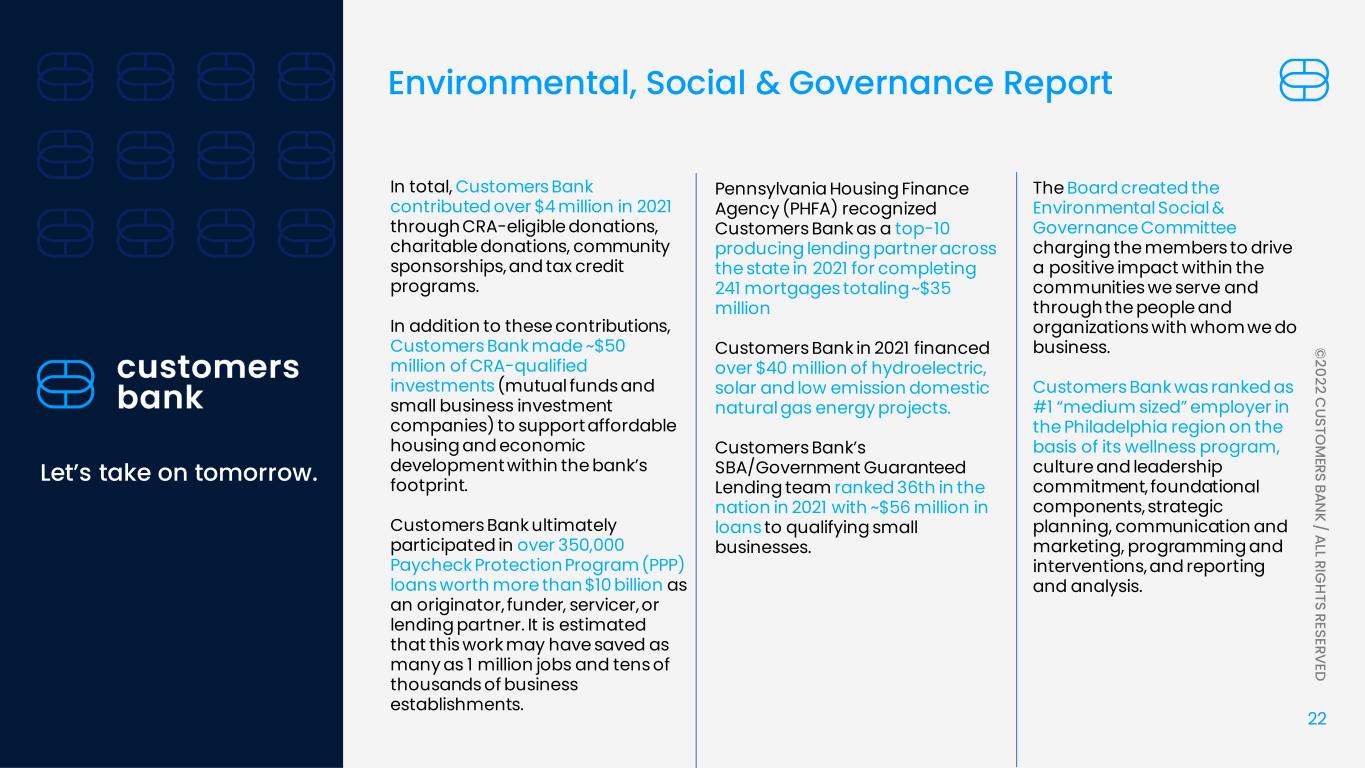

22 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Let’s take on tomorrow. Environmental, Social & Governance Report Pennsylvania Housing Finance Agency (PHFA) recognized Customers Bank as a top-10 producing lending partner across the state in 2021 for completing 241 mortgages totaling ~$35 million Customers Bank in 2021 financed over $40 million of hydroelectric, solar and low emission domestic natural gas energy projects. Customers Bank’s SBA/Government Guaranteed Lending team ranked 36th in the nation in 2021 with ~$56 million in loans to qualifying small businesses. In total, Customers Bank contributed over $4 million in 2021 through CRA-eligible donations, charitable donations, community sponsorships, and tax credit programs. In addition to these contributions, Customers Bank made ~$50 million of CRA-qualified investments (mutual funds and small business investment companies) to support affordable housing and economic development within the bank’s footprint. Customers Bank ultimately participated in over 350,000 Paycheck Protection Program (PPP) loans worth more than $10 billion as an originator, funder, servicer, or lending partner. It is estimated that this work may have saved as many as 1 million jobs and tens of thousands of business establishments. The Board created the Environmental Social & Governance Committee charging the members to drive a positive impact within the communities we serve and through the people and organizations with whom we do business. Customers Bank was ranked as #1 “medium sized” employer in the Philadelphia region on the basis of its wellness program, culture and leadership commitment, foundational components, strategic planning, communication and marketing, programming and interventions, and reporting and analysis.

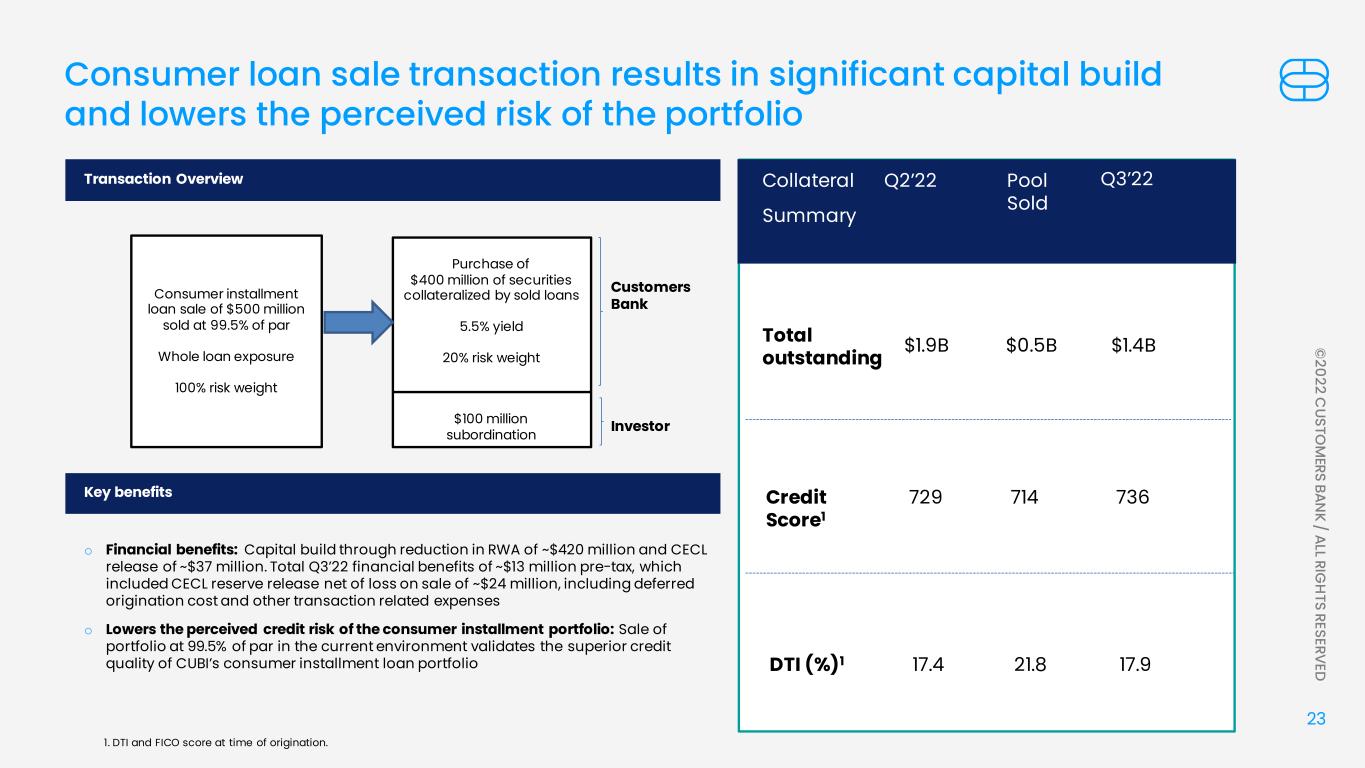

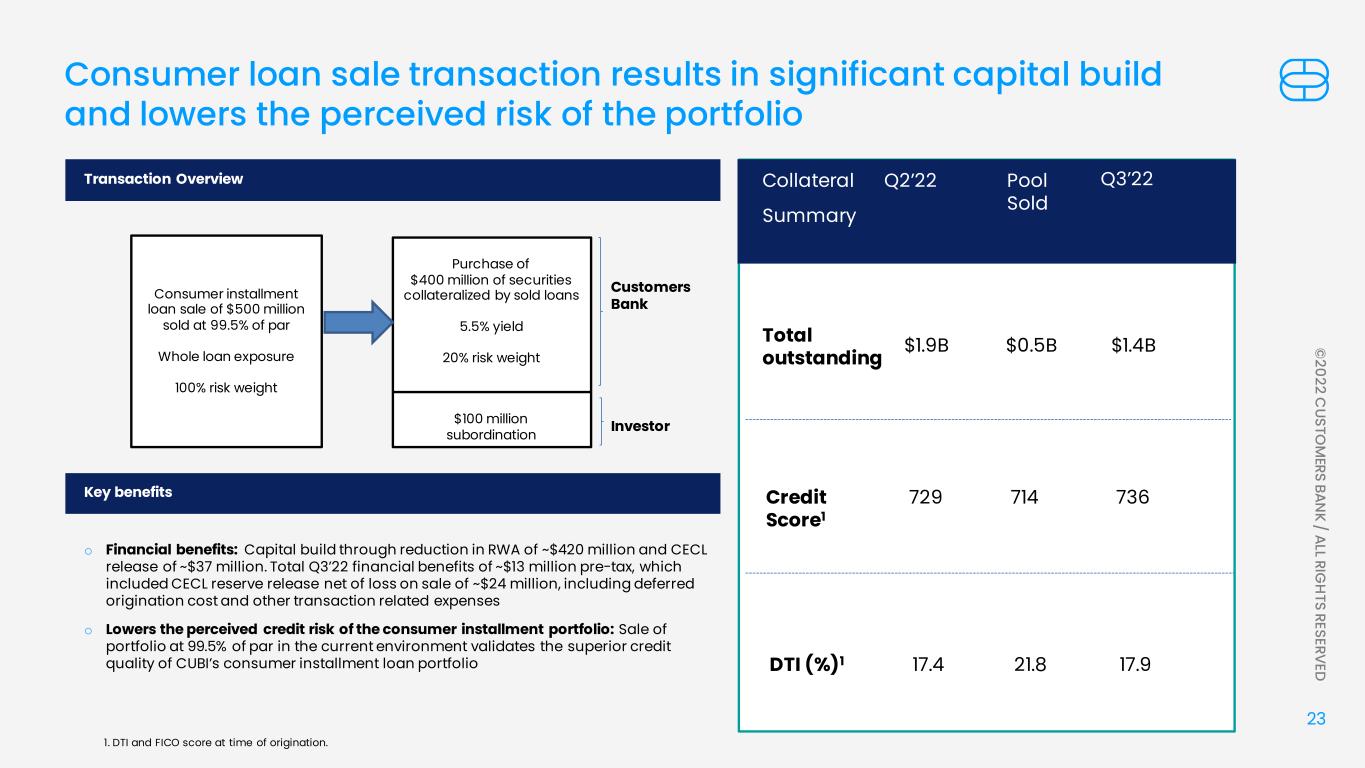

23 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Consumer loan sale transaction results in significant capital build and lowers the perceived risk of the portfolio s Credit Score1 729 714 736 Collateral Summary Q2’22 Pool Sold Q3’22 DTI (%)1 17.4 21.8 17.9 Total outstanding $1.9B $0.5B $1.4B Transaction Overview Key benefits Consumer installment loan sale of $500 million sold at 99.5% of par Whole loan exposure 100% risk weight Purchase of $400 million of securities collateralized by sold loans 5.5% yield 20% risk weight $100 million subordination Customers Bank Investor o Financial benefits: Capital build through reduction in RWA of ~$420 million and CECL release of ~$37 million. Total Q3’22 financial benefits of ~$13 million pre-tax, which included CECL reserve release net of loss on sale of ~$24 million, including deferred origination cost and other transaction related expenses o Lowers the perceived credit risk of the consumer installment portfolio: Sale of portfolio at 99.5% of par in the current environment validates the superior credit quality of CUBI’s consumer installment loan portfolio 1. DTI and FICO score at time of origination.

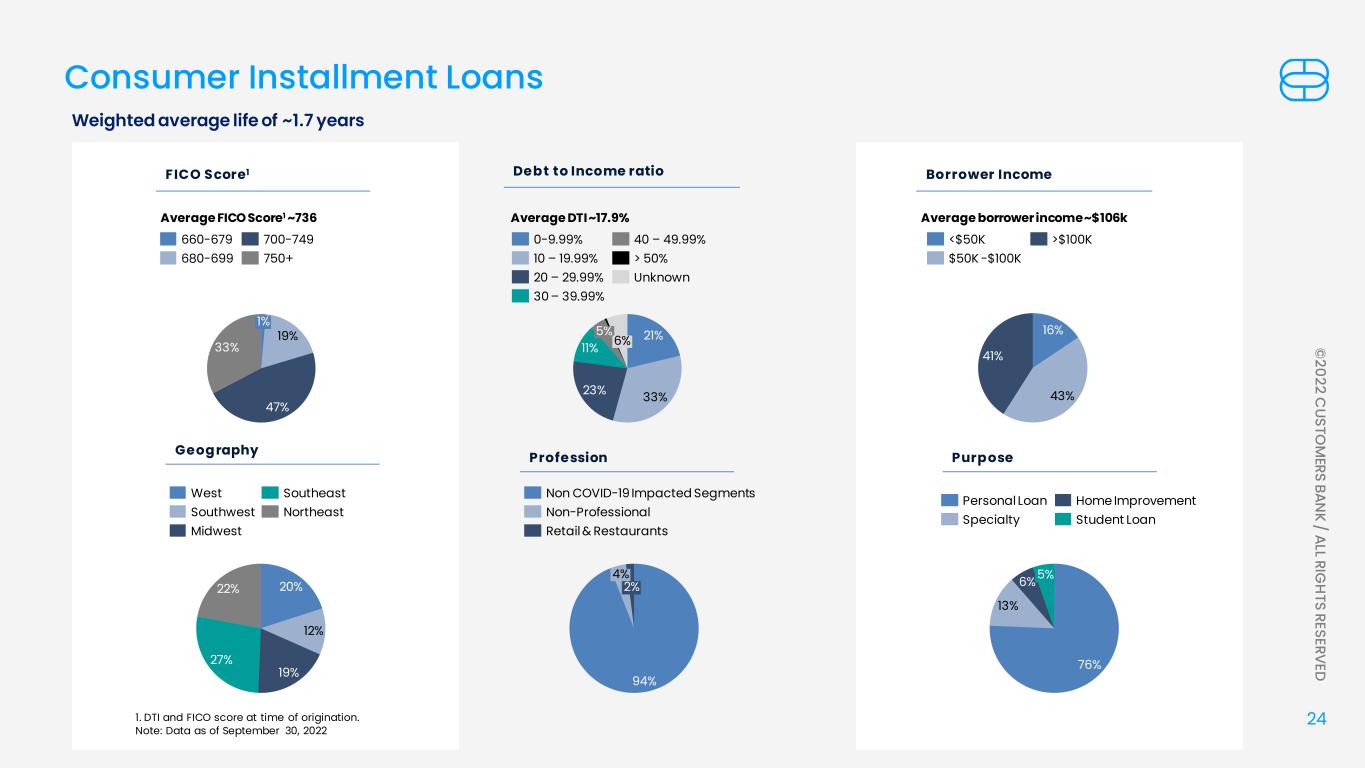

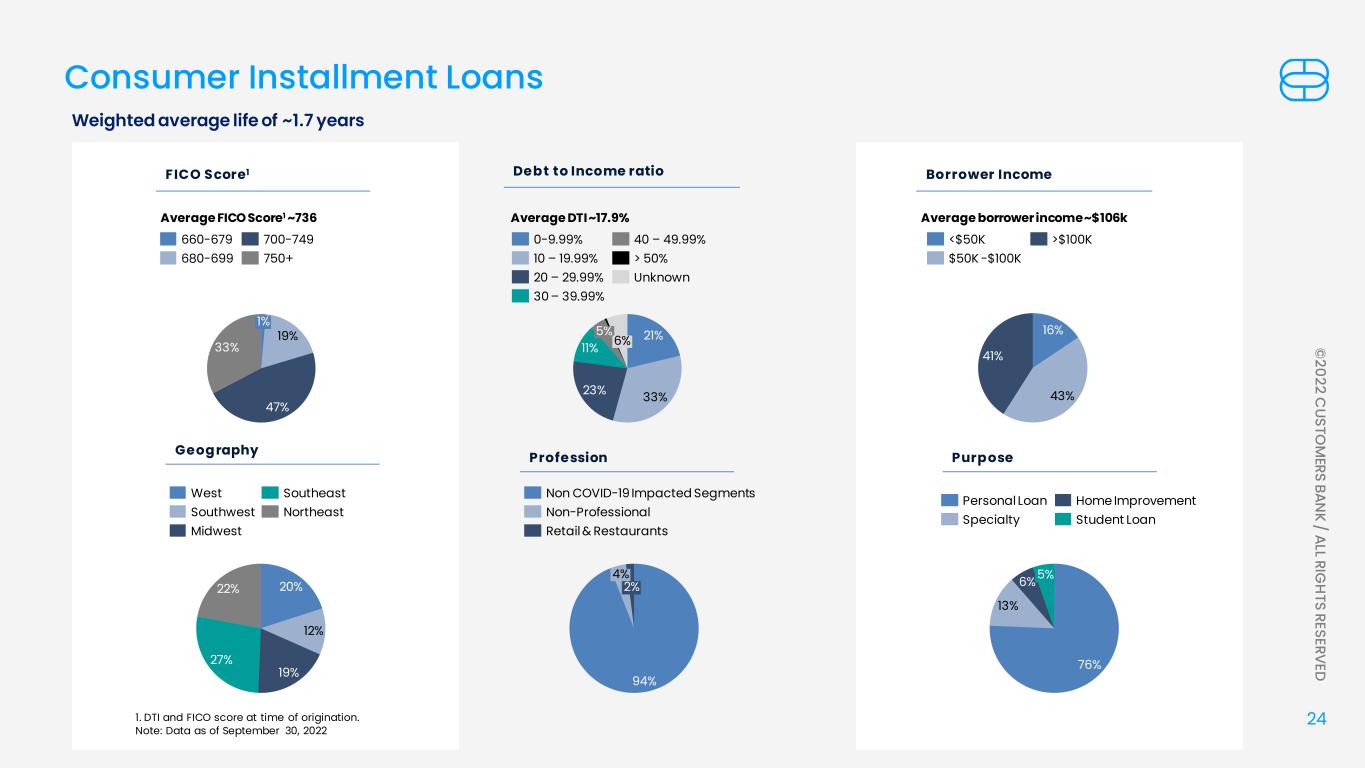

24 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED 1. DTI and FICO score at time of origination. Note: Data as of September 30, 2022 19% 47% 33% 1% FICO Score1 660-679 750+680-699 700-749 21% 33%23% 11% 5% 6% > 50% 20 – 29.99% 0-9.99% 10 – 19.99% 30 – 39.99% 40 – 49.99% Unknown Geog raphy Profession Deb t to Income ratio Borrower Income 16% 43% 41% $50K -$100K <$50K >$100K 20% 12% 19% 27% 22% West Southwest Midwest Southeast Northeast Consumer Installment Loans Purp ose 76% 13% 6%5% Personal Loan Specialty Home Improvement Student Loan 94% 4% 2% Non COVID-19 Impacted Segments Non-Professional Retail & Restaurants Average FICO Score1 ~736 Average DTI ~17.9% Average borrower income ~$106k Weighted average life of ~1.7 years

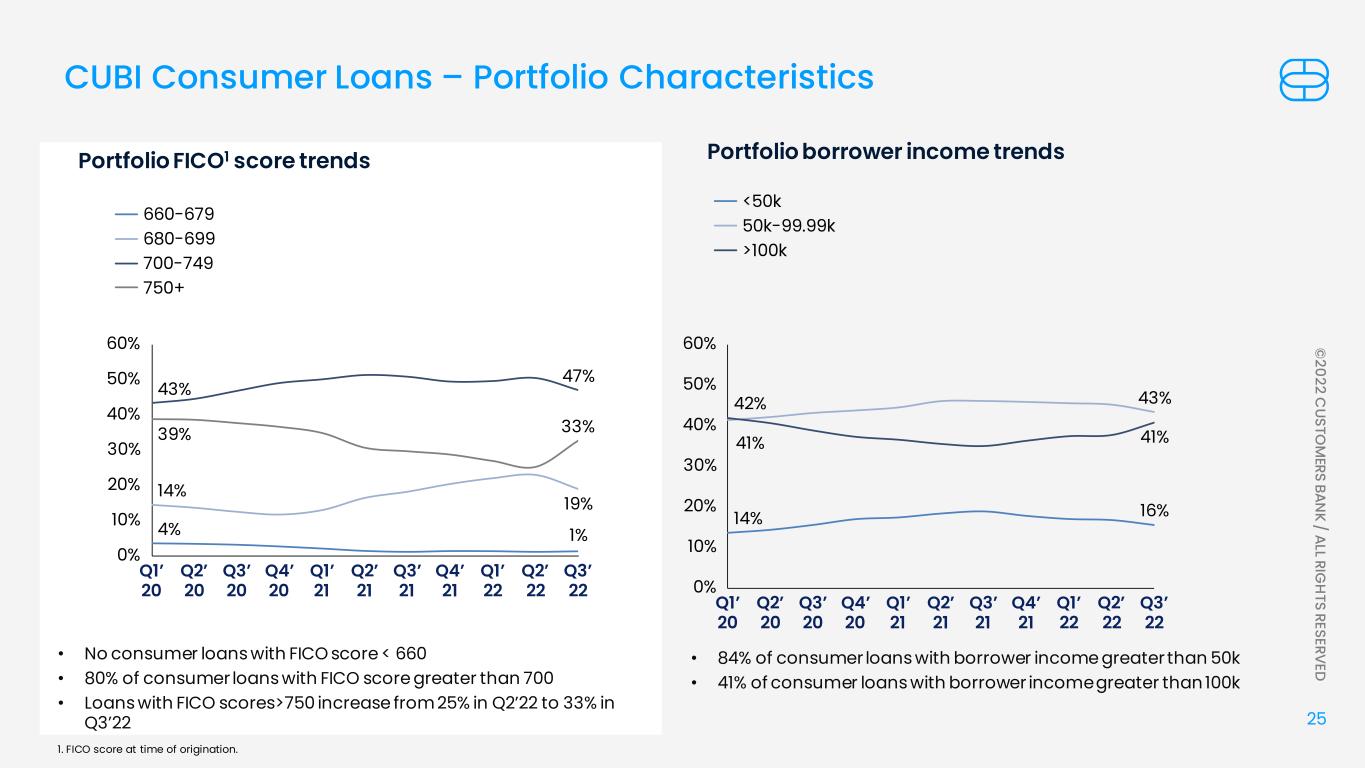

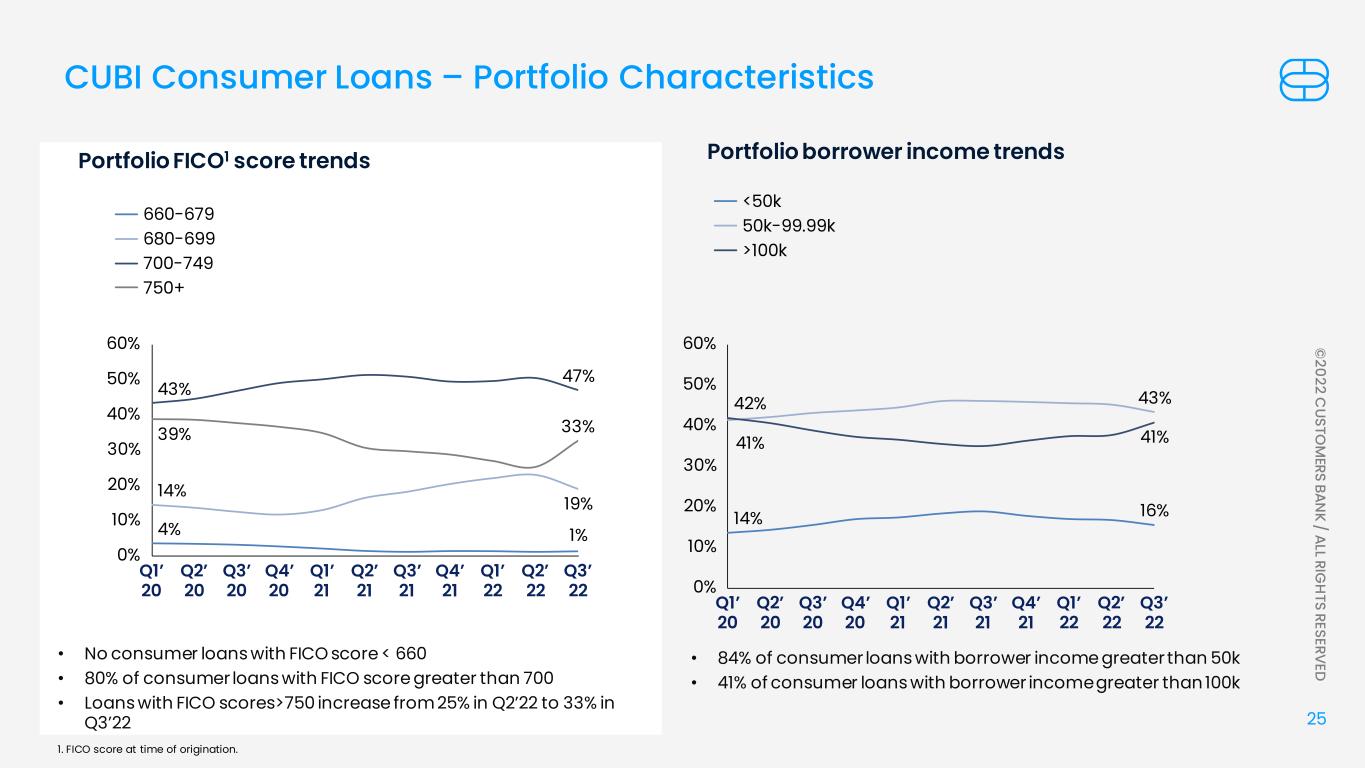

25 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED CUBI Consumer Loans – Portfolio Characteristics Portfolio borrower income trends • 84% of consumer loans with borrower income greater than 50k • 41% of consumer loans with borrower income greater than 100k 4% 1% 14% 19% 43% 47% 39% 33% 0% 30% 10% 20% 50% 40% 60% Q1’ 22 Q3’ 21 Q1’ 20 Q4’ 20 Q4’ 21 Q2’ 22 Q2’ 20 Q3’ 20 Q1’ 21 Q2’ 21 Q3’ 22 Portfolio FICO1 score trends 660-679 700-749 680-699 750+ • No consumer loans with FICO score < 660 • 80% of consumer loans with FICO score greater than 700 • Loans with FICO scores>750 increase from 25% in Q2’22 to 33% in Q3’22 14% 16% 41% 43%42% 41% 50% 0% 10% 20% 60% 30% 40% Q3’ 22 Q1’ 20 Q2’ 20 Q3’ 20 Q4’ 20 Q1’ 21 Q2’ 21 Q2’ 22 Q3’ 21 Q4’ 21 Q1’ 22 <50k 50k-99.99k >100k 1. FICO score at time of origination.

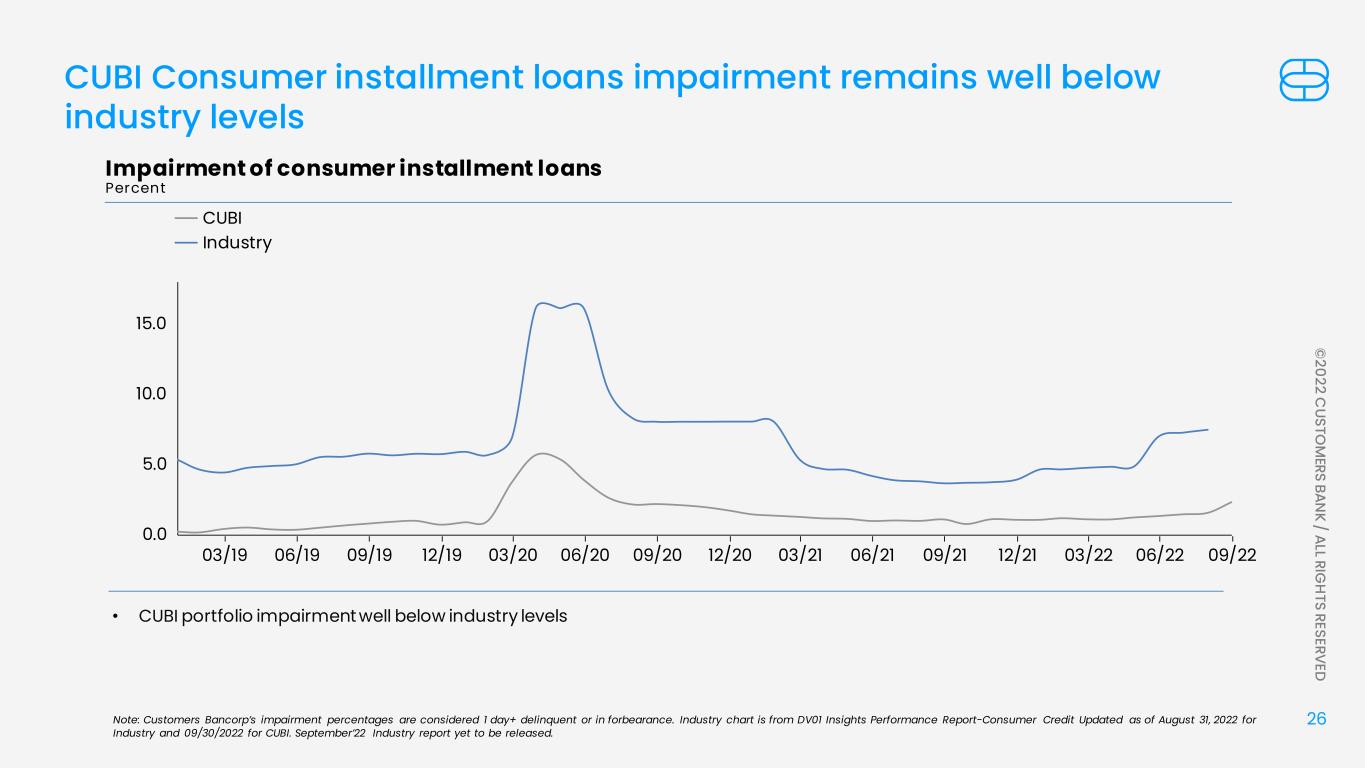

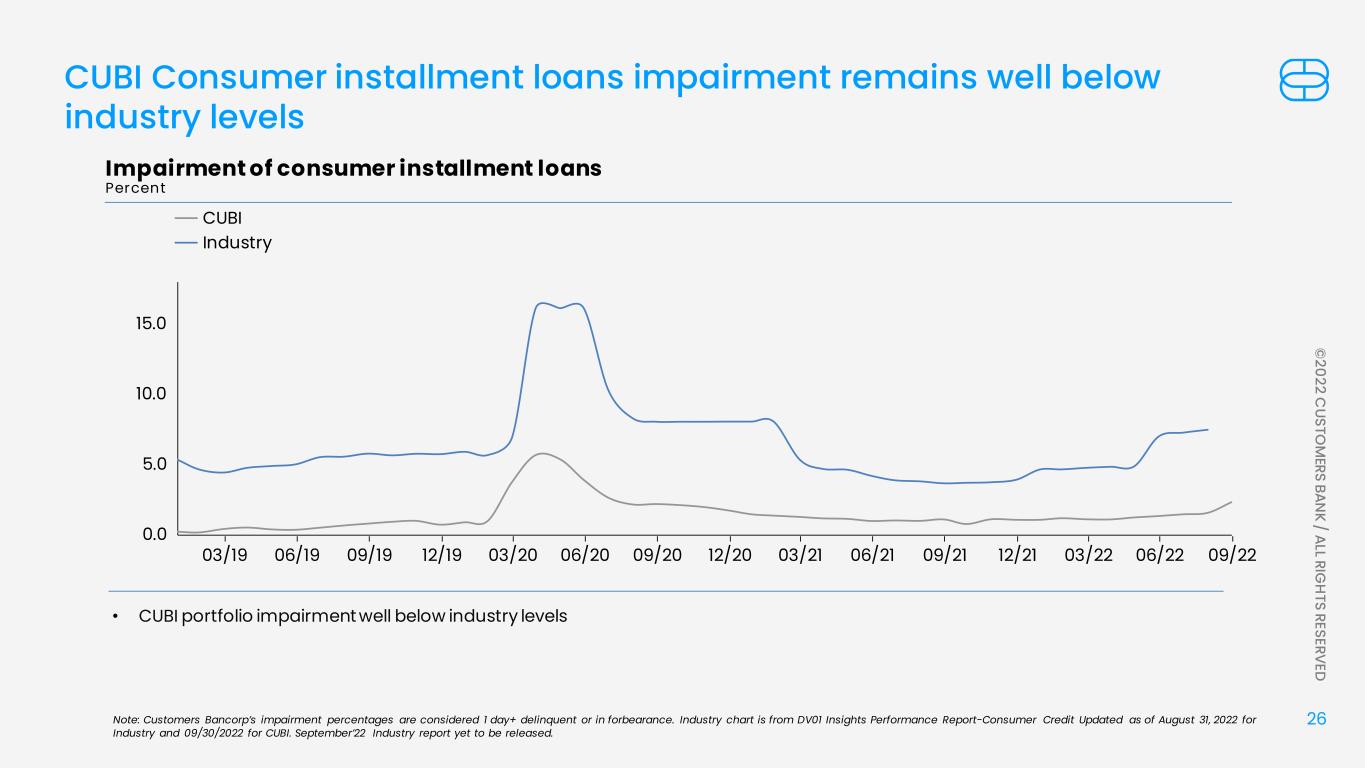

26 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Note: Customers Bancorp’s impairment percentages are considered 1 day+ delinquent or in forbearance. Industry chart is from DV01 Insights Performance Report-Consumer Credit Updated as of August 31, 2022 for Industry and 09/30/2022 for CUBI. September’22 Industry report yet to be released. Impairment of consumer installment loans Percent 09/1903/19 12/1906/19 15.0 03/20 06/20 09/20 12/20 09/2106/21 12/2103/21 06/2203/22 09/22 0.0 5.0 10.0 Industry CUBI CUBI Consumer installment loans impairment remains well below industry levels • CUBI portfolio impairment well below industry levels

27 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED (1) Utilized Moody’s September 2022 S1+S3 forecast with qualitative adjustments for Q2 2022 provision. (2) Excludes loans to mortgage companies reported at fair value, loans held for sale and PPP Loans. Credit: Allowance for Credit Losses for Loans and Leases September 30, 2022 ($ in thousands) Amortized Cost Allowance for Credit Losses Lifetime Loss Rate Loans and Leases Receivable: Commercial: Multi-Family 2,263,268 14,244 0.63% Commercial and Industrial 6,307,803 15,131 0.24% Commercial Real Estate Owner Occupied 726,670 6,220 0.86% Commercial Real Estate Non-Owner Occupied 1,263,211 11,332 0.90% Construction 136,133 1,614 1.19% Total Commercial Loans and Leases Receivable $ 10,697,085 $ 48,541 0.45% Consumer: Residential real estate $ 465,772 $ 5,453 1.17% Manufactured housing 46,990 4,482 9.54% Installment 1,397,895 71,721 5.13% Total Consumer Loans Receivable $ 1,910,657 $ 81,656 4.27% Total Loans and Leases $ 12,607,742 $ 130,197 1.03%

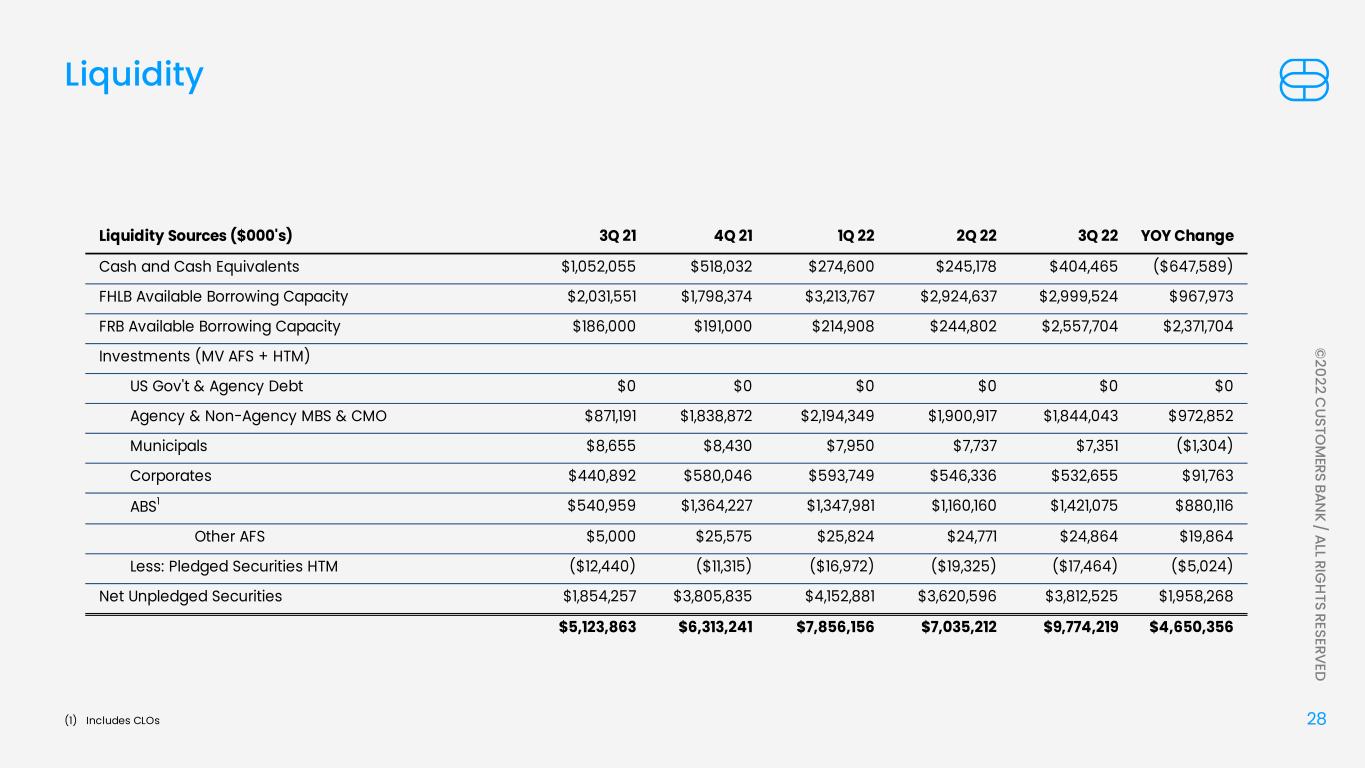

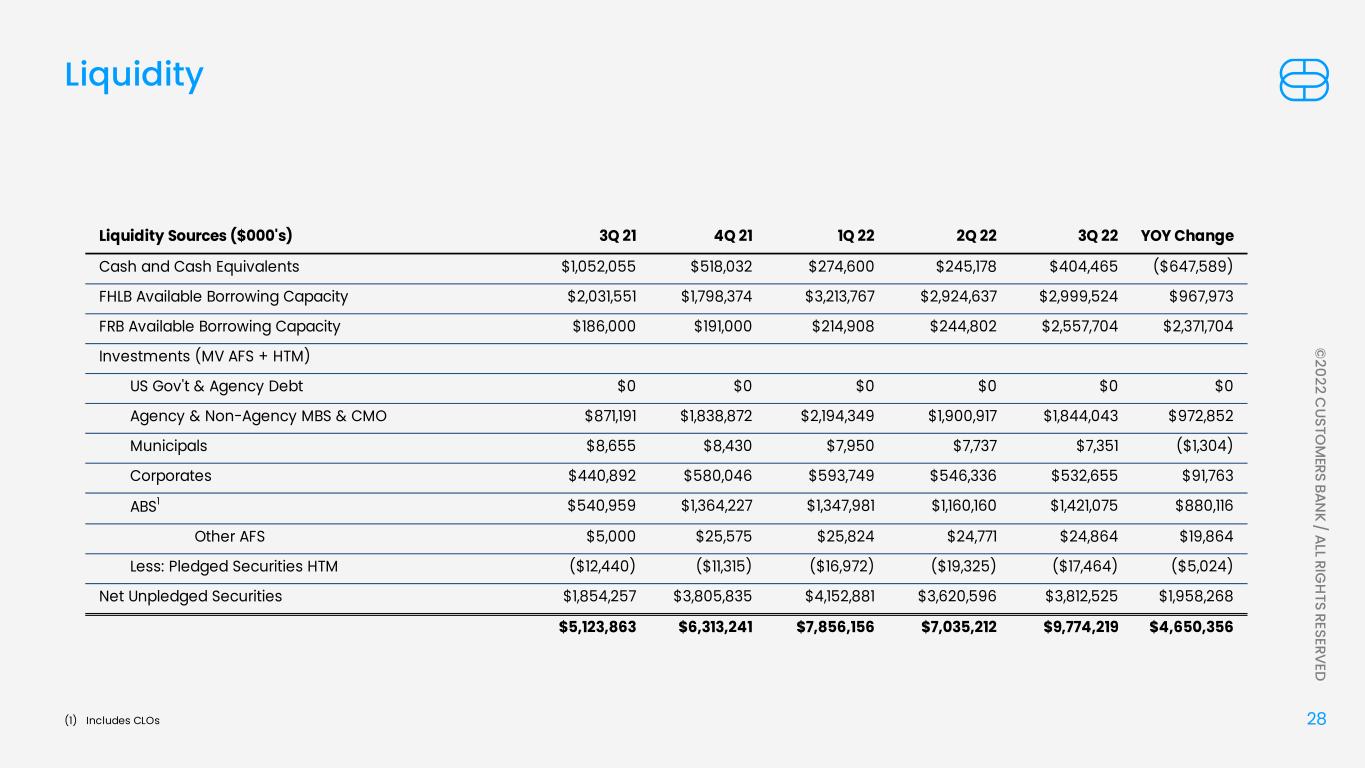

28 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Liquidity (1) Includes CLOs Liquidity Sources ($000's) 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 YOY Change Cash and Cash Equivalents $1,052,055 $518,032 $274,600 $245,178 $404,465 ($647,589) FHLB Available Borrowing Capacity $2,031,551 $1,798,374 $3,213,767 $2,924,637 $2,999,524 $967,973 FRB Available Borrowing Capacity $186,000 $191,000 $214,908 $244,802 $2,557,704 $2,371,704 Investments (MV AFS + HTM) US Gov't & Agency Debt $0 $0 $0 $0 $0 $0 Agency & Non-Agency MBS & CMO $871,191 $1,838,872 $2,194,349 $1,900,917 $1,844,043 $972,852 Municipals $8,655 $8,430 $7,950 $7,737 $7,351 ($1,304) Corporates $440,892 $580,046 $593,749 $546,336 $532,655 $91,763 ABS1 $540,959 $1,364,227 $1,347,981 $1,160,160 $1,421,075 $880,116 Other AFS $5,000 $25,575 $25,824 $24,771 $24,864 $19,864 Less: Pledged Securities HTM ($12,440) ($11,315) ($16,972) ($19,325) ($17,464) ($5,024) Net Unpledged Securities $1,854,257 $3,805,835 $4,152,881 $3,620,596 $3,812,525 $1,958,268 $5,123,863 $6,313,241 $7,856,156 $7,035,212 $9,774,219 $4,650,356

29 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Customers believes that the non-GAAP measurements disclosed within this document are useful for investors, regulators, management and others to evaluate our core results of operations and financial condition relative to other financial institutions. These non-GAAP financial measures are frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in Customers' industry. These non-GAAP financial measures exclude from corresponding GAAP measures the impact of certain elements that we do not believe are representative of our ongoing financial results, which we believe enhance an overall understanding of our performance and increases comparability of our period to period results. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. The non-GAAP measures presented are not necessarily comparable to non-GAAP measures that may be presented by other financial institutions. Although non-GAAP financial measures are frequently used in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results of operations or financial condition as reported under GAAP. The following tables present reconciliations of GAAP to non-GAAP measures disclosed within this document. Reconciliation of Non-GAAP Measures - Unaudited

30 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Core Earnings - Customers Bancorp ($ in thousands, except per share data) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 USD Per Share USD Per Share USD Per Share USD Per Share USD Per Share GAAP net income to common shareholders $ 61,364 $ 1.85 $ 56,519 $ 1.68 $ 74,896 $ 2.18 $ 98,647 $ 2.87 $ 110,241 $ 3.25 Reconciling items (after tax): Net loss from discontinued operations - - - - - - 1,585 0.05 - - Severance expense 1,058 0.03 - - - - - - - - Impairments on fixed assets and leases 126 0.00 705 0.02 220 0.01 1,118 0.03 - - Loss on sale of consumer installment loans 18,221 0.55 - - - - - - - - Legal reserves - - - - - - - - 897 0.03 (Gains) losses on investment securities 1,859 0.06 2,494 0.07 1,030 0.03 43 0.00 (4,591) (0.14) Derivative credit valuation adjustment (358) (0.01) (351) (0.01) (736) (0.02) (180) (0.01) (198) (0.01) Deposit relationship adjustment fees - - - - - - - - 4,707 0.14 Loss on redemption of preferred stock - - - - - - - - 2,820 0.08 Core earnings $ 82,270 $ 2.48 $ 59,367 $ 1.77 $ 75,410 $ 2.20 $ 101,213 $ 2.95 $ 113,876 $ 3.36 Reconciliation of Non-GAAP Measures – Unaudited (Contd.)

31 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Core Earnings, Excluding PPP - Customers Bancorp ($ in thousands, not including per share amounts) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 USD Per Share USD Per Share USD Per Share USD Per Share USD Per Share GAAP net income to common shareholders $ 61,364 $ 1.85 $ 56,519 $ 1.68 $ 74,896 $ 2.18 $ 98,647 $ 2.87 $ 110,241 $ 3.25 Less: PPP net income (after tax) 5,846 0.25 13,066 0.39 24,713 0.72 64,323 1.87 81,337 2.40 Net income to common shareholders, excluding PPP 55,518 1.59 43,453 1.29 50,183 1.46 34,324 1.00 28,904 0.85 Reconciling items (after tax): Net loss from discontinued operations - - - - - - 1,585 0.05 - - Severance expense 1,058 0.03 - - - - - - - - Impairments on fixed assets and leases 126 0.00 705 0.02 220 0.01 1,118 0.03 - - Loss on sale of consumer installment loans 18,221 0.55 - - - - - - - - Legal reserves - - - - - - - - 897 0.03 (Gains) losses on investment securities 1,859 0.06 2,494 0.07 1,030 0.03 43 0.00 (4,591) (0.14) Derivative credit valuation adjustment (358) (0.01) (351) (0.01) (736) (0.02) (180) (0.01) (198) (0.01) Deposit relationship adjustment fees - - - - - - - - 4,707 0.14 Loss on redemption of preferred stock - - - - - - - - 2,820 0.08 Core earnings, excluding PPP $ 76,424 $ 2.30 $ 46,301 $ 1.38 $ 50,697 $ 1.48 $ 36,890 $ 1.07 $ 32,539 $ 0.96

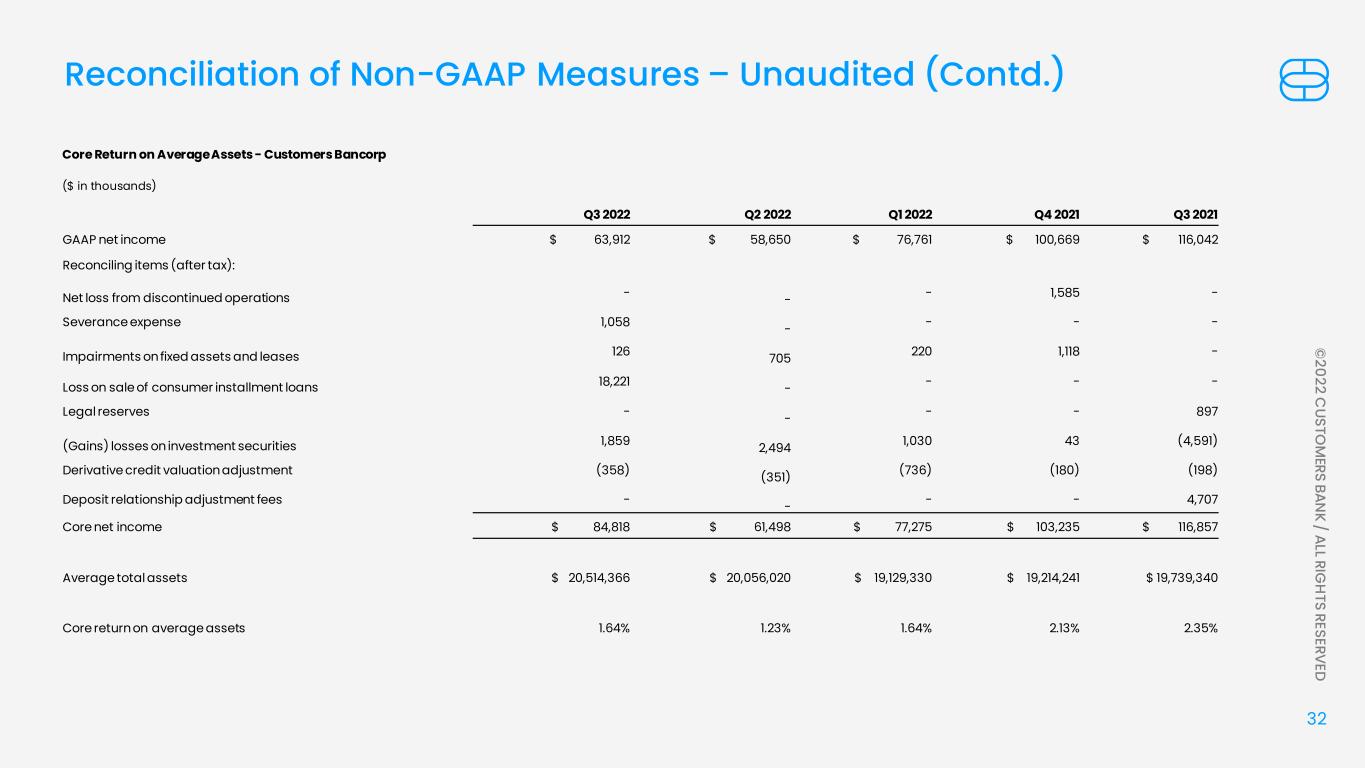

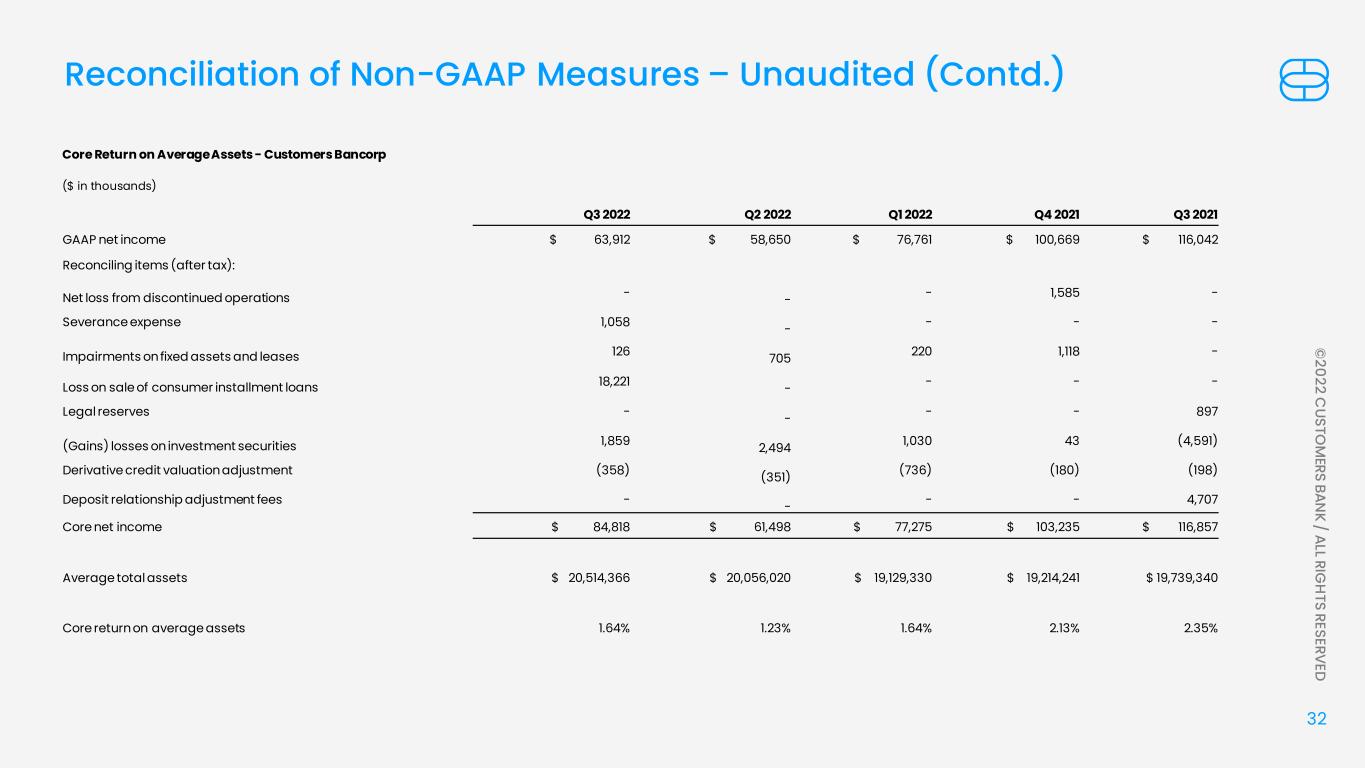

32 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Core Return on Average Assets - Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP net income $ 63,912 $ 58,650 $ 76,761 $ 100,669 $ 116,042 Reconciling items (after tax): Net loss from discontinued operations - - - 1,585 - Severance expense 1,058 - - - - Impairments on fixed assets and leases 126 705 220 1,118 - Loss on sale of consumer installment loans 18,221 - - - - Legal reserves - - - - 897 (Gains) losses on investment securities 1,859 2,494 1,030 43 (4,591) Derivative credit valuation adjustment (358) (351) (736) (180) (198) Deposit relationship adjustment fees - - - - 4,707 Core net income $ 84,818 $ 61,498 $ 77,275 $ 103,235 $ 116,857 Average total assets $ 20,514,366 $ 20,056,020 $ 19,129,330 $ 19,214,241 $ 19,739,340 Core return on average assets 1.64% 1.23% 1.64% 2.13% 2.35% Reconciliation of Non-GAAP Measures – Unaudited (Contd.)

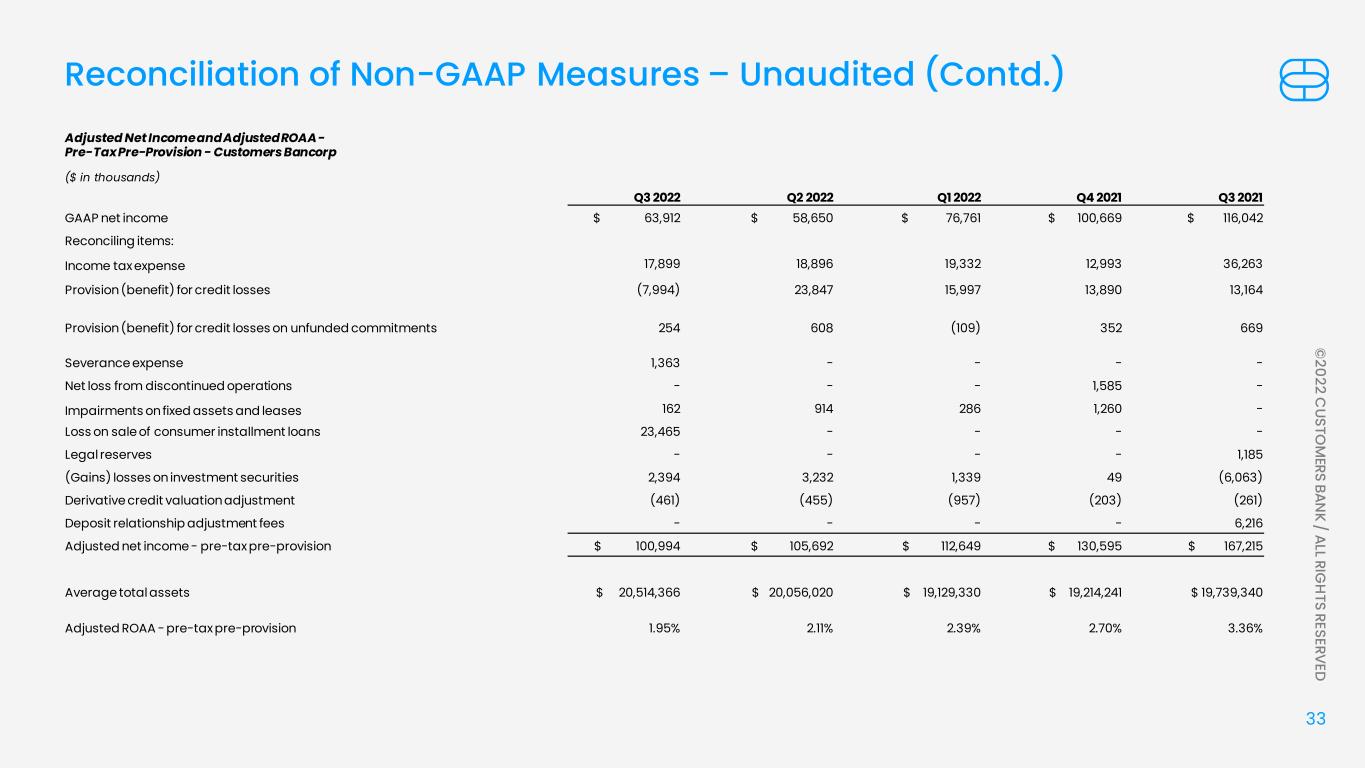

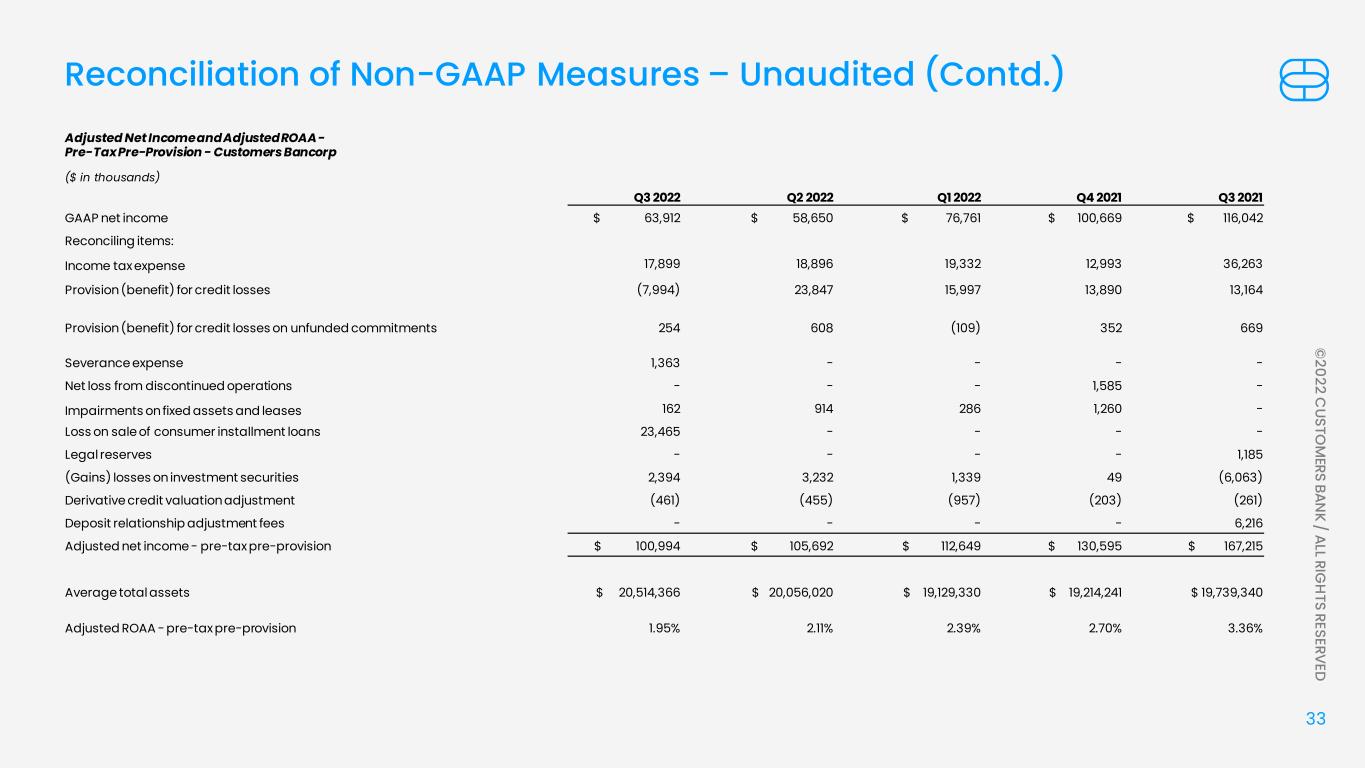

33 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Adjusted Net Income and Adjusted ROAA - Pre-Tax Pre-Provision - Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP net income $ 63,912 $ 58,650 $ 76,761 $ 100,669 $ 116,042 Reconciling items: Income tax expense 17,899 18,896 19,332 12,993 36,263 Provision (benefit) for credit losses (7,994) 23,847 15,997 13,890 13,164 Provision (benefit) for credit losses on unfunded commitments 254 608 (109) 352 669 Severance expense 1,363 - - - - Net loss from discontinued operations - - - 1,585 - Impairments on fixed assets and leases 162 914 286 1,260 - Loss on sale of consumer installment loans 23,465 - - - - Legal reserves - - - - 1,185 (Gains) losses on investment securities 2,394 3,232 1,339 49 (6,063) Derivative credit valuation adjustment (461) (455) (957) (203) (261) Deposit relationship adjustment fees - - - - 6,216 Adjusted net income - pre-tax pre-provision $ 100,994 $ 105,692 $ 112,649 $ 130,595 $ 167,215 Average total assets $ 20,514,366 $ 20,056,020 $ 19,129,330 $ 19,214,241 $ 19,739,340 Adjusted ROAA - pre-tax pre-provision 1.95% 2.11% 2.39% 2.70% 3.36% Reconciliation of Non-GAAP Measures – Unaudited (Contd.)

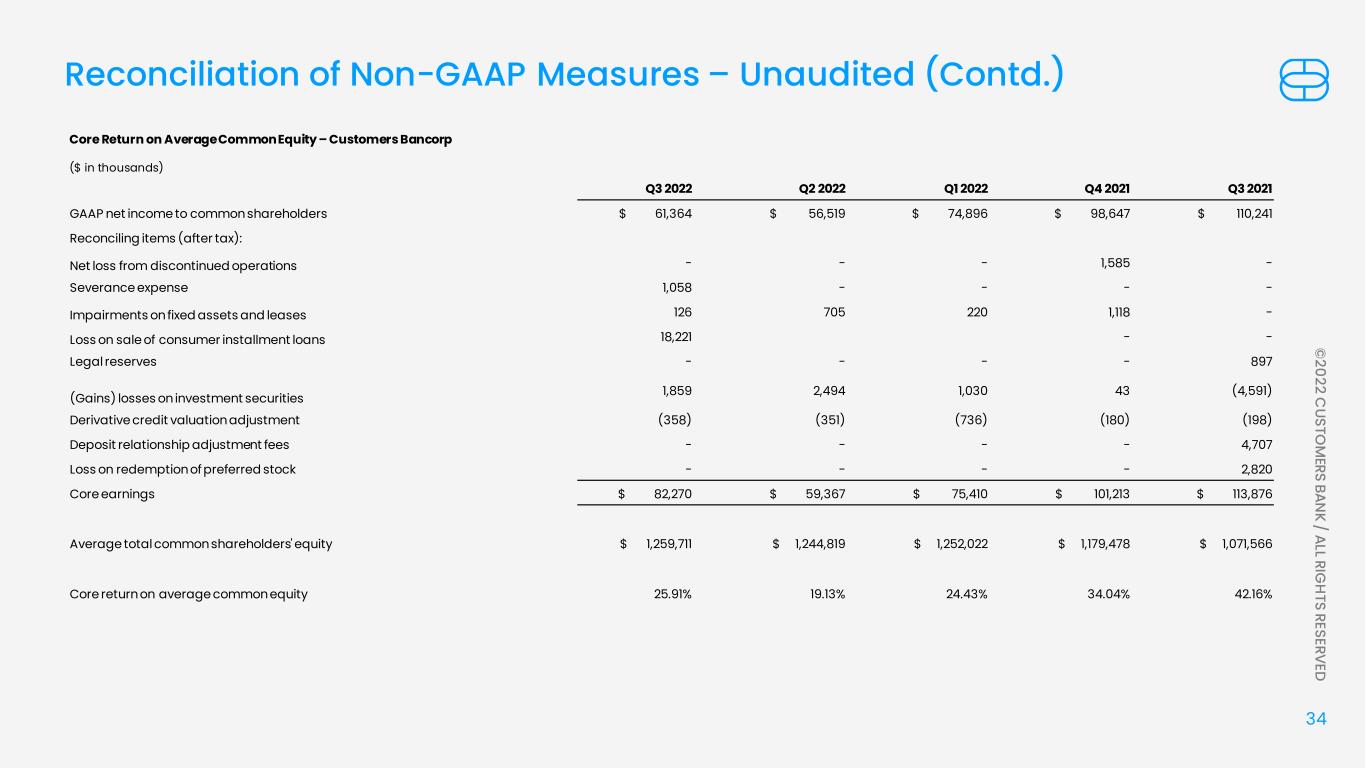

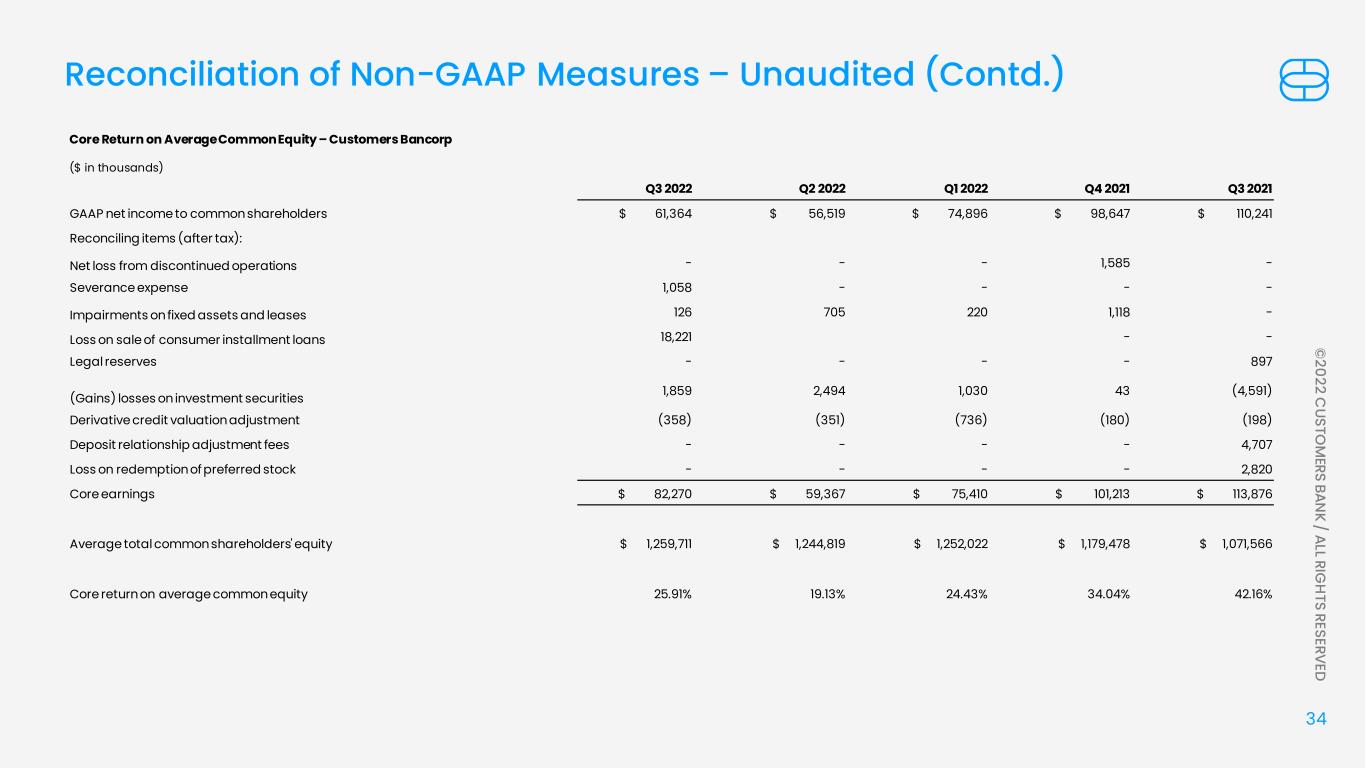

34 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Core Return on Average Common Equity – Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP net income to common shareholders $ 61,364 $ 56,519 $ 74,896 $ 98,647 $ 110,241 Reconciling items (after tax): Net loss from discontinued operations - - - 1,585 - Severance expense 1,058 - - - - Impairments on fixed assets and leases 126 705 220 1,118 - Loss on sale of consumer installment loans 18,221 - - Legal reserves - - - - 897 (Gains) losses on investment securities 1,859 2,494 1,030 43 (4,591) Derivative credit valuation adjustment (358) (351) (736) (180) (198) Deposit relationship adjustment fees - - - - 4,707 Loss on redemption of preferred stock - - - - 2,820 Core earnings $ 82,270 $ 59,367 $ 75,410 $ 101,213 $ 113,876 Average total common shareholders' equity $ 1,259,711 $ 1,244,819 $ 1,252,022 $ 1,179,478 $ 1,071,566 Core return on average common equity 25.91% 19.13% 24.43% 34.04% 42.16% Reconciliation of Non-GAAP Measures – Unaudited (Contd.)

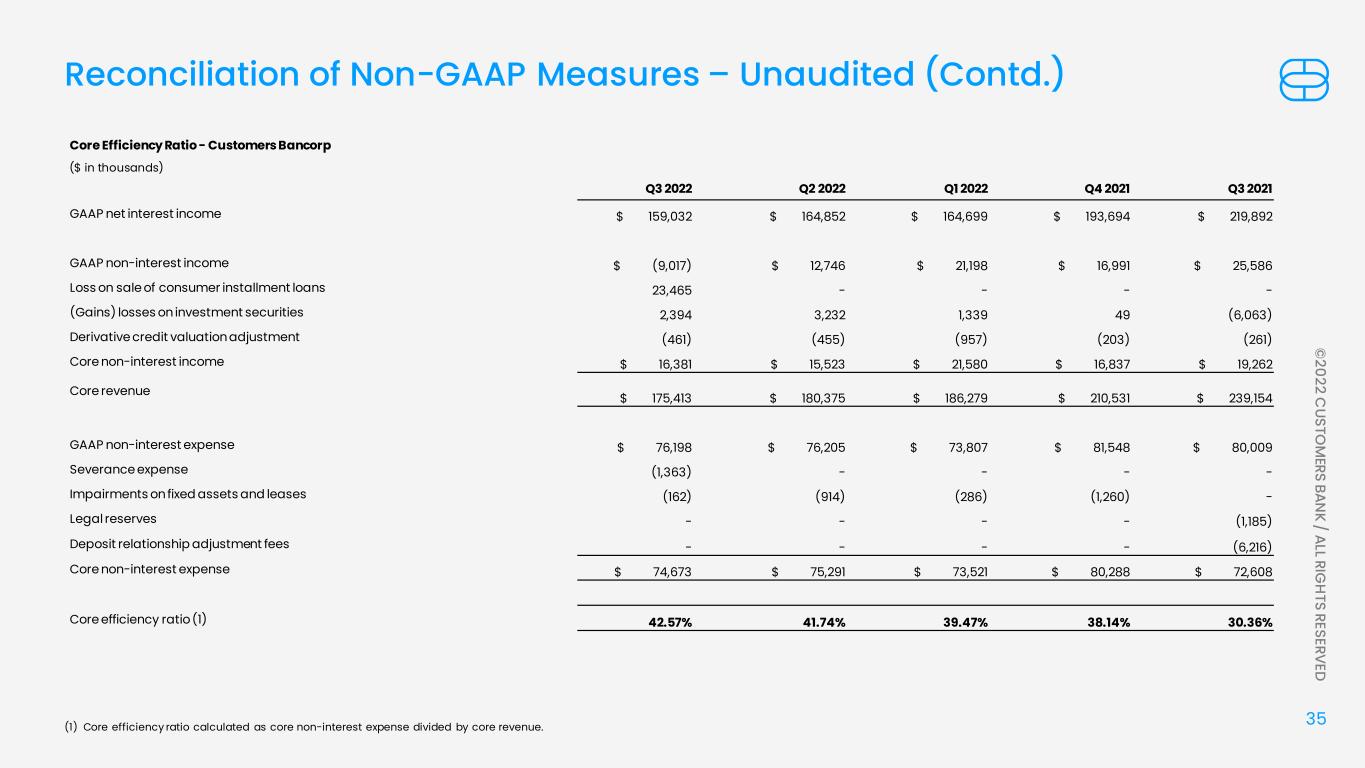

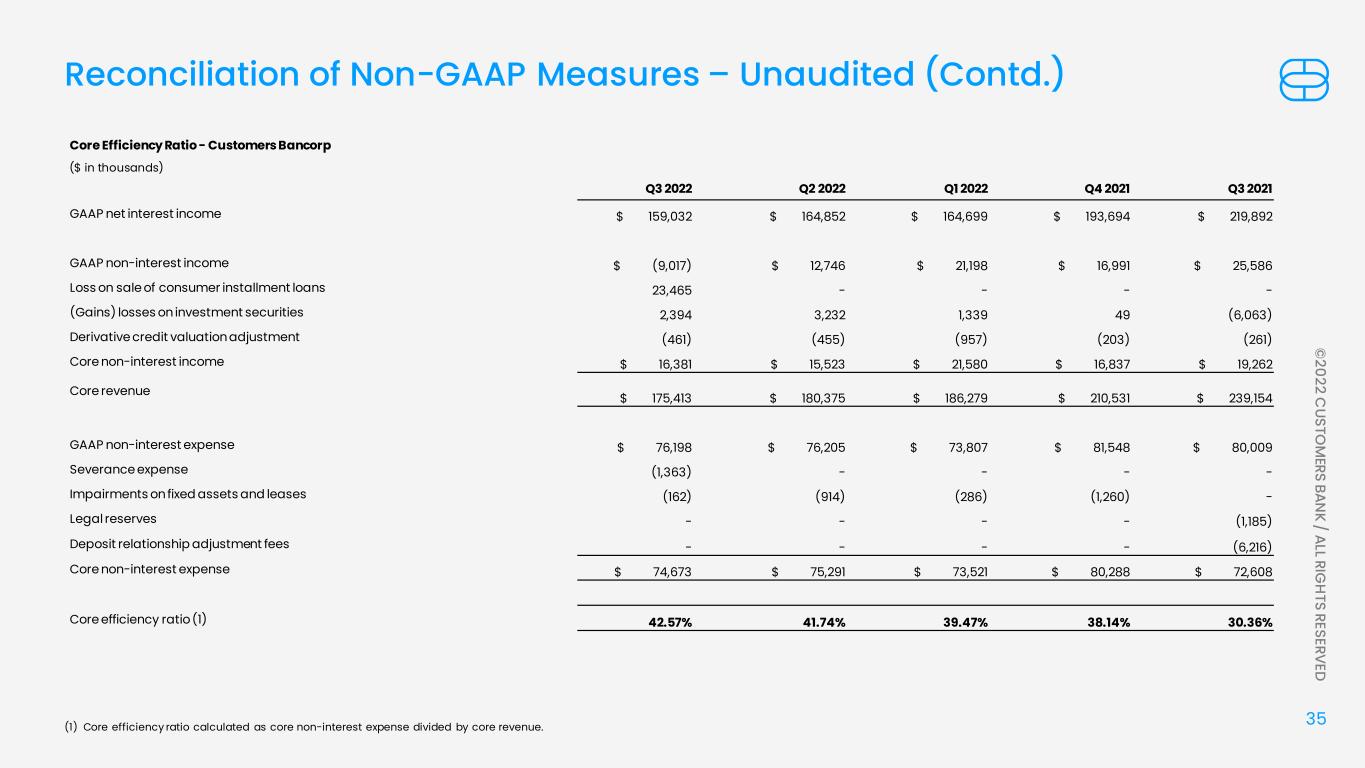

35 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Core Efficiency Ratio - Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP net interest income $ 159,032 $ 164,852 $ 164,699 $ 193,694 $ 219,892 GAAP non-interest income $ (9,017) $ 12,746 $ 21,198 $ 16,991 $ 25,586 Loss on sale of consumer installment loans 23,465 - - - - (Gains) losses on investment securities 2,394 3,232 1,339 49 (6,063) Derivative credit valuation adjustment (461) (455) (957) (203) (261) Core non-interest income $ 16,381 $ 15,523 $ 21,580 $ 16,837 $ 19,262 Core revenue $ 175,413 $ 180,375 $ 186,279 $ 210,531 $ 239,154 GAAP non-interest expense $ 76,198 $ 76,205 $ 73,807 $ 81,548 $ 80,009 Severance expense (1,363) - - - - Impairments on fixed assets and leases (162) (914) (286) (1,260) - Legal reserves - - - - (1,185) Deposit relationship adjustment fees - - - - (6,216) Core non-interest expense $ 74,673 $ 75,291 $ 73,521 $ 80,288 $ 72,608 Core efficiency ratio (1) 42.57% 41.74% 39.47% 38.14% 30.36% Reconciliation of Non-GAAP Measures – Unaudited (Contd.) (1) Core efficiency ratio calculated as core non-interest expense divided by core revenue.

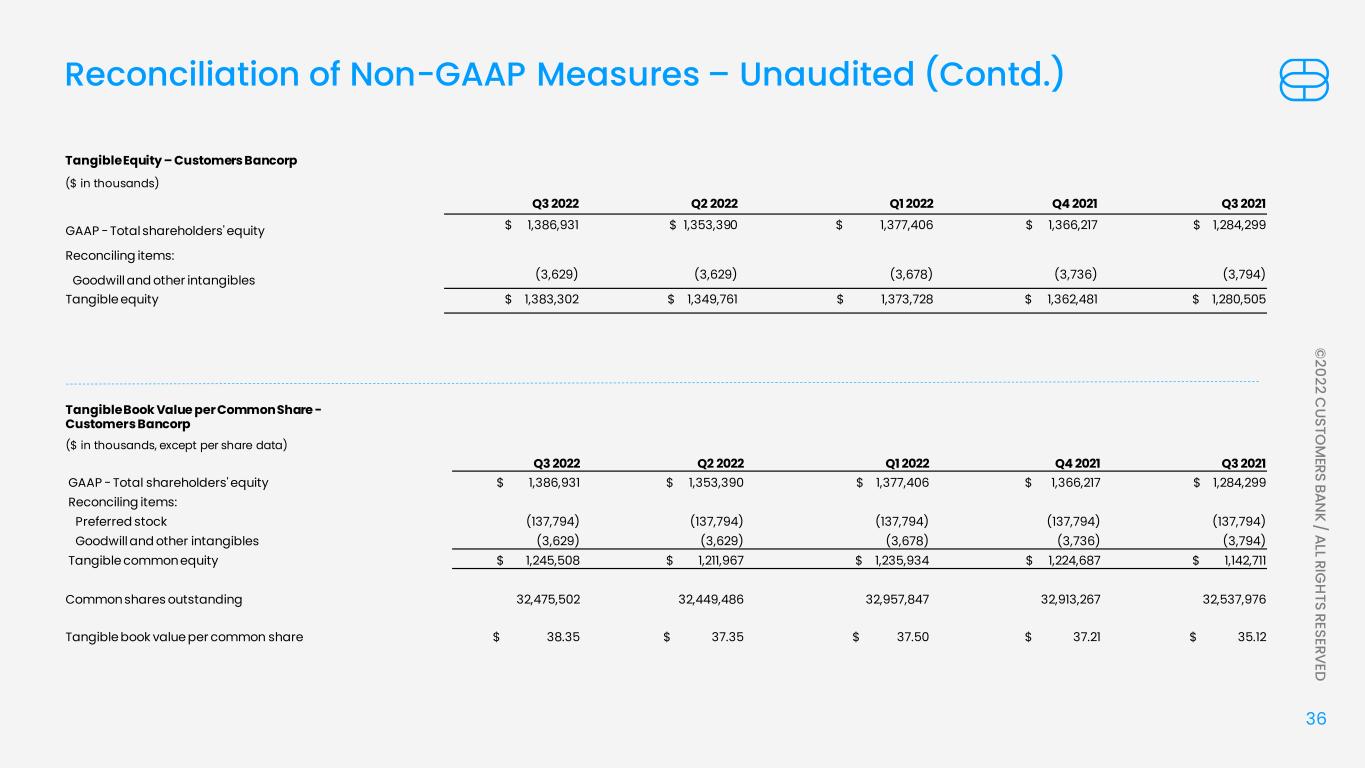

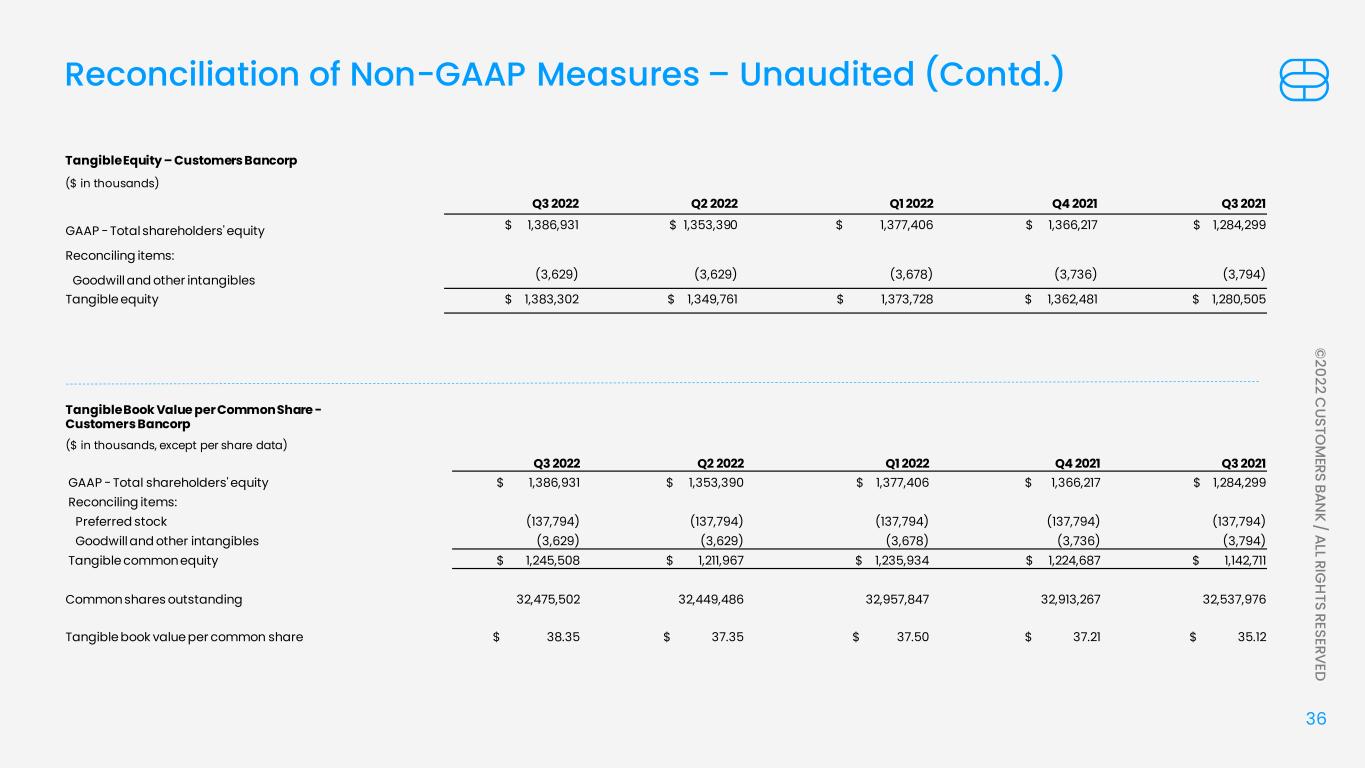

36 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Tangible Equity – Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP - Total shareholders' equity $ 1,386,931 $ 1,353,390 $ 1,377,406 $ 1,366,217 $ 1,284,299 Reconciling items: Goodwill and other intangibles (3,629) (3,629) (3,678) (3,736) (3,794) Tangible equity $ 1,383,302 $ 1,349,761 $ 1,373,728 $ 1,362,481 $ 1,280,505 Tangible Book Value per Common Share - Customers Bancorp ($ in thousands, except per share data) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP - Total shareholders' equity $ 1,386,931 $ 1,353,390 $ 1,377,406 $ 1,366,217 $ 1,284,299 Reconciling items: Preferred stock (137,794) (137,794) (137,794) (137,794) (137,794) Goodwill and other intangibles (3,629) (3,629) (3,678) (3,736) (3,794) Tangible common equity $ 1,245,508 $ 1,211,967 $ 1,235,934 $ 1,224,687 $ 1,142,711 Common shares outstanding 32,475,502 32,449,486 32,957,847 32,913,267 32,537,976 Tangible book value per common share $ 38.35 $ 37.35 $ 37.50 $ 37.21 $ 35.12

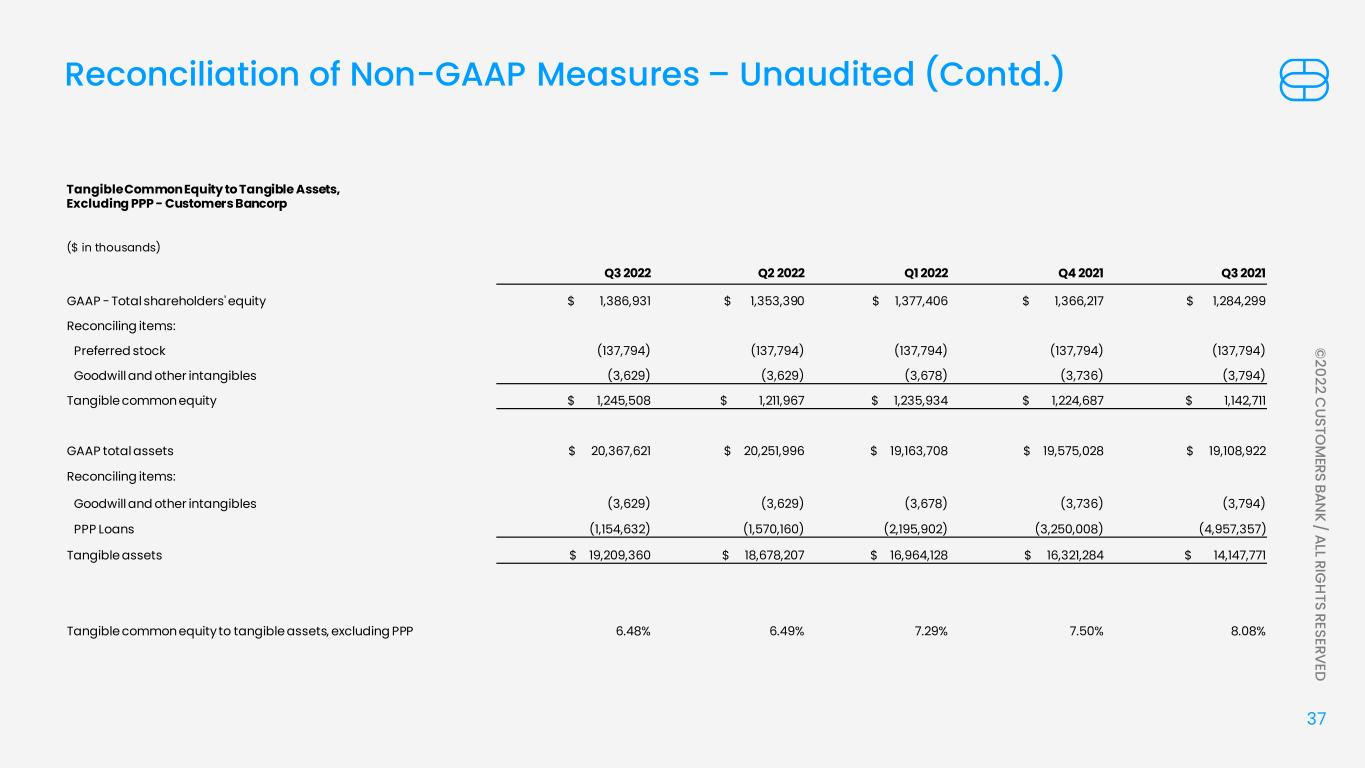

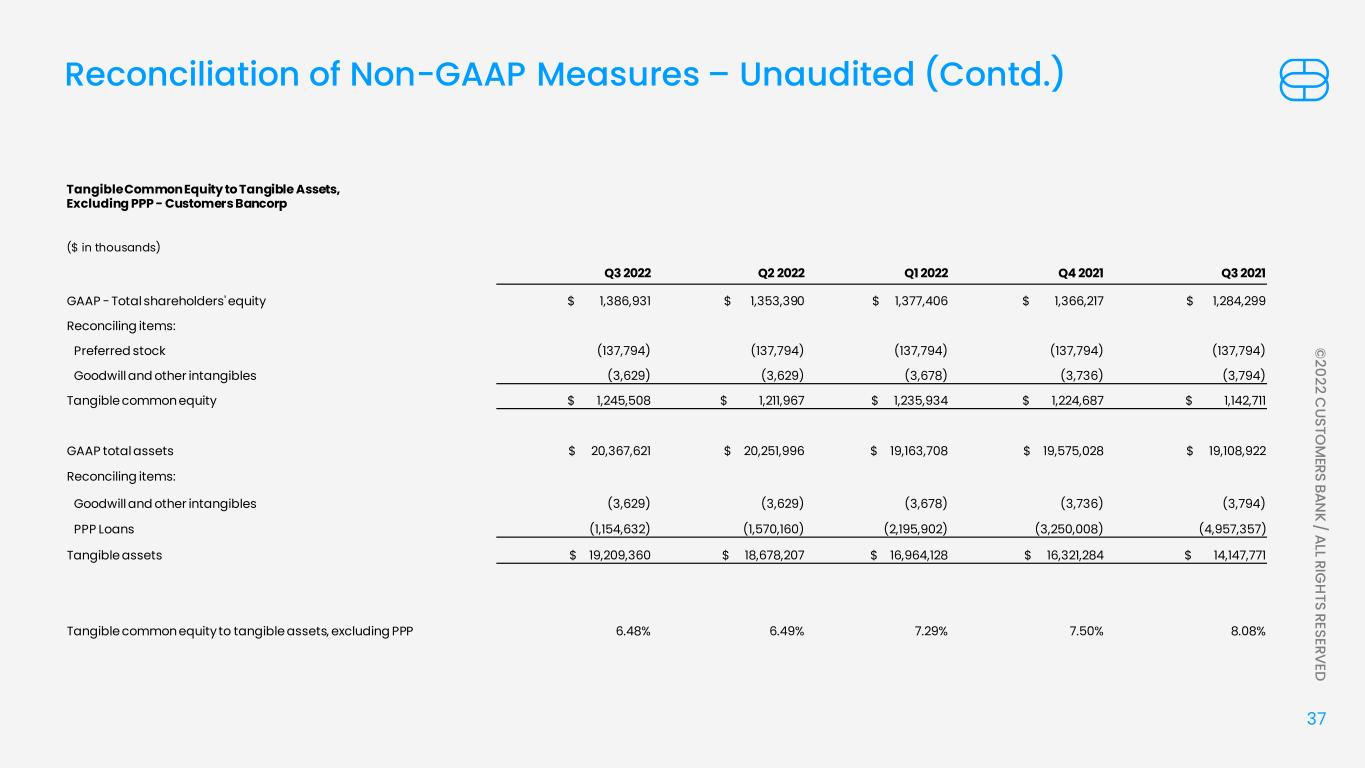

37 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Tangible Common Equity to Tangible Assets, Excluding PPP - Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP - Total shareholders' equity $ 1,386,931 $ 1,353,390 $ 1,377,406 $ 1,366,217 $ 1,284,299 Reconciling items: Preferred stock (137,794) (137,794) (137,794) (137,794) (137,794) Goodwill and other intangibles (3,629) (3,629) (3,678) (3,736) (3,794) Tangible common equity $ 1,245,508 $ 1,211,967 $ 1,235,934 $ 1,224,687 $ 1,142,711 GAAP total assets $ 20,367,621 $ 20,251,996 $ 19,163,708 $ 19,575,028 $ 19,108,922 Reconciling items: Goodwill and other intangibles (3,629) (3,629) (3,678) (3,736) (3,794) PPP Loans (1,154,632) (1,570,160) (2,195,902) (3,250,008) (4,957,357) Tangible assets $ 19,209,360 $ 18,678,207 $ 16,964,128 $ 16,321,284 $ 14,147,771 Tangible common equity to tangible assets, excluding PPP 6.48% 6.49% 7.29% 7.50% 8.08%

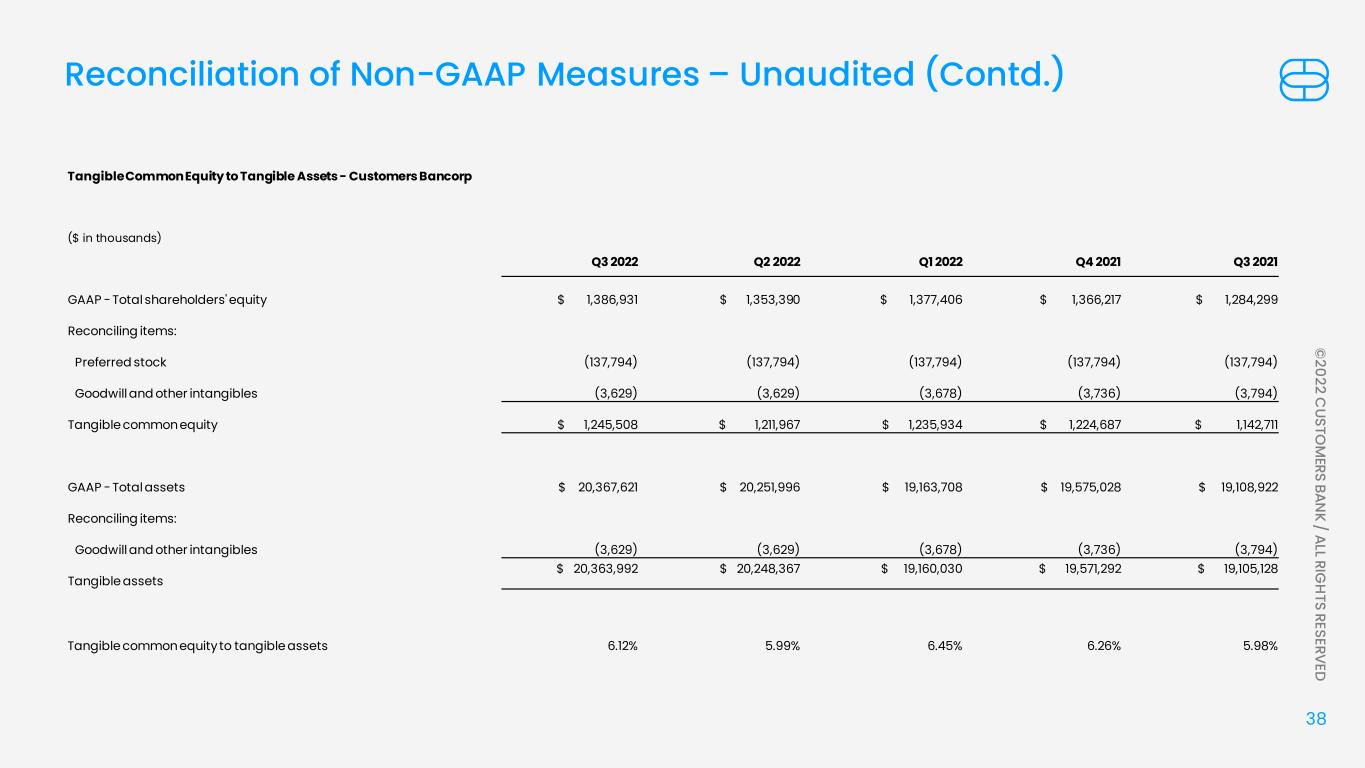

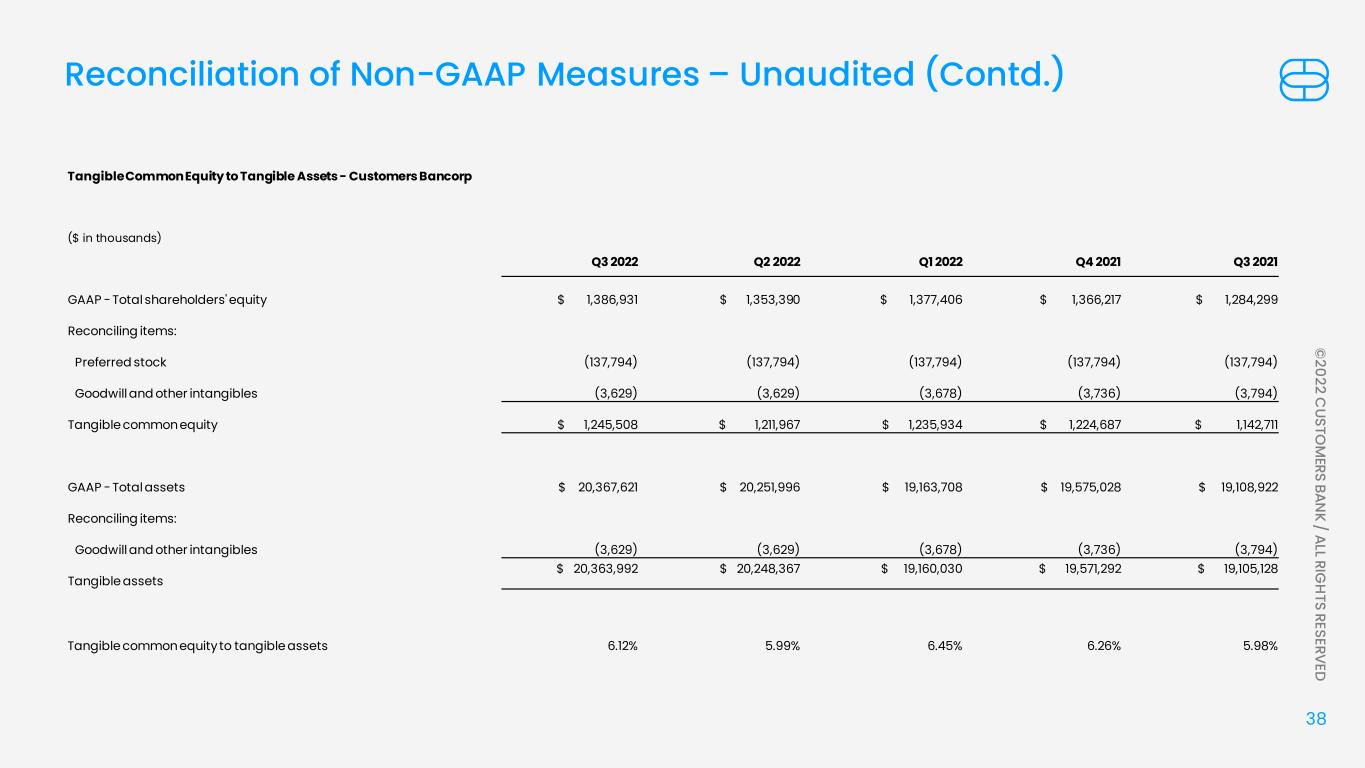

38 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Tangible Common Equity to Tangible Assets - Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP - Total shareholders' equity $ 1,386,931 $ 1,353,390 $ 1,377,406 $ 1,366,217 $ 1,284,299 Reconciling items: Preferred stock (137,794) (137,794) (137,794) (137,794) (137,794) Goodwill and other intangibles (3,629) (3,629) (3,678) (3,736) (3,794) Tangible common equity $ 1,245,508 $ 1,211,967 $ 1,235,934 $ 1,224,687 $ 1,142,711 GAAP - Total assets $ 20,367,621 $ 20,251,996 $ 19,163,708 $ 19,575,028 $ 19,108,922 Reconciling items: Goodwill and other intangibles (3,629) (3,629) (3,678) (3,736) (3,794) Tangible assets $ 20,363,992 $ 20,248,367 $ 19,160,030 $ 19,571,292 $ 19,105,128 Tangible common equity to tangible assets 6.12% 5.99% 6.45% 6.26% 5.98%

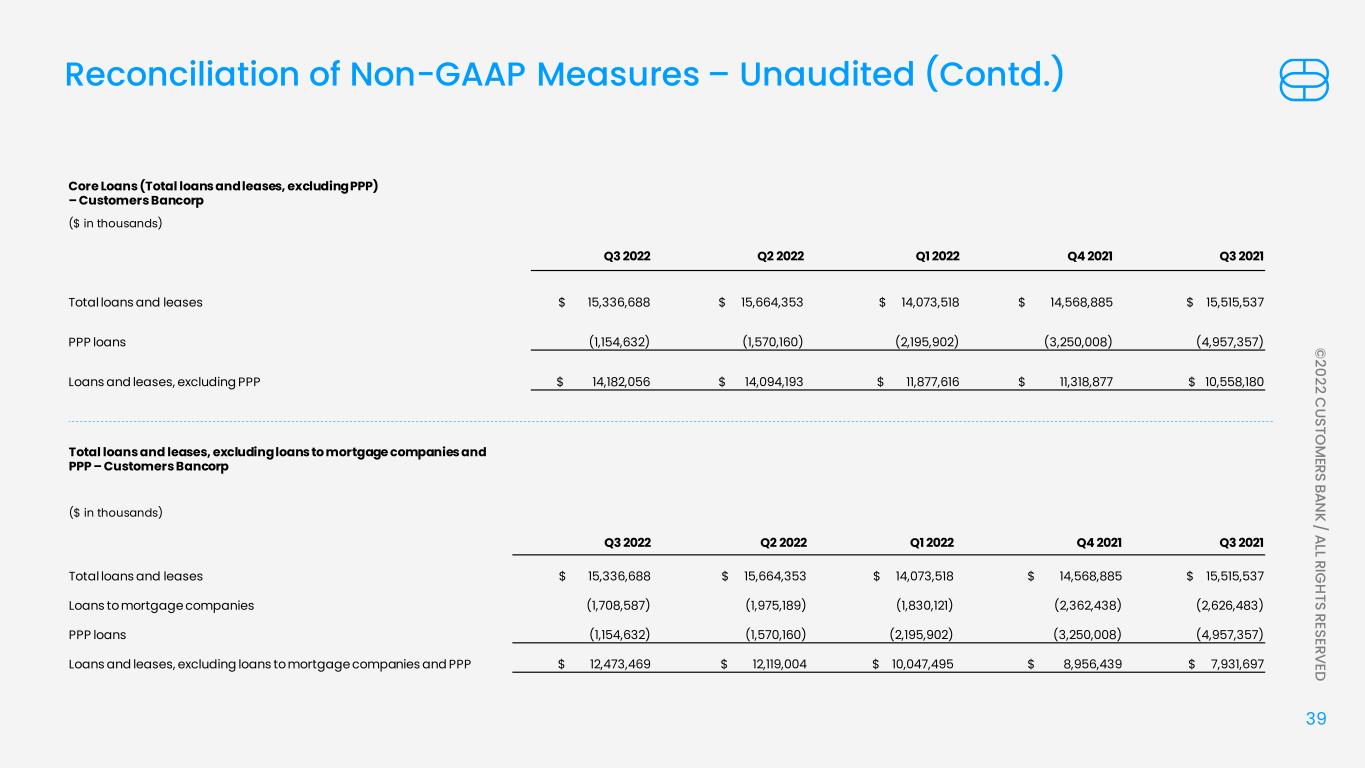

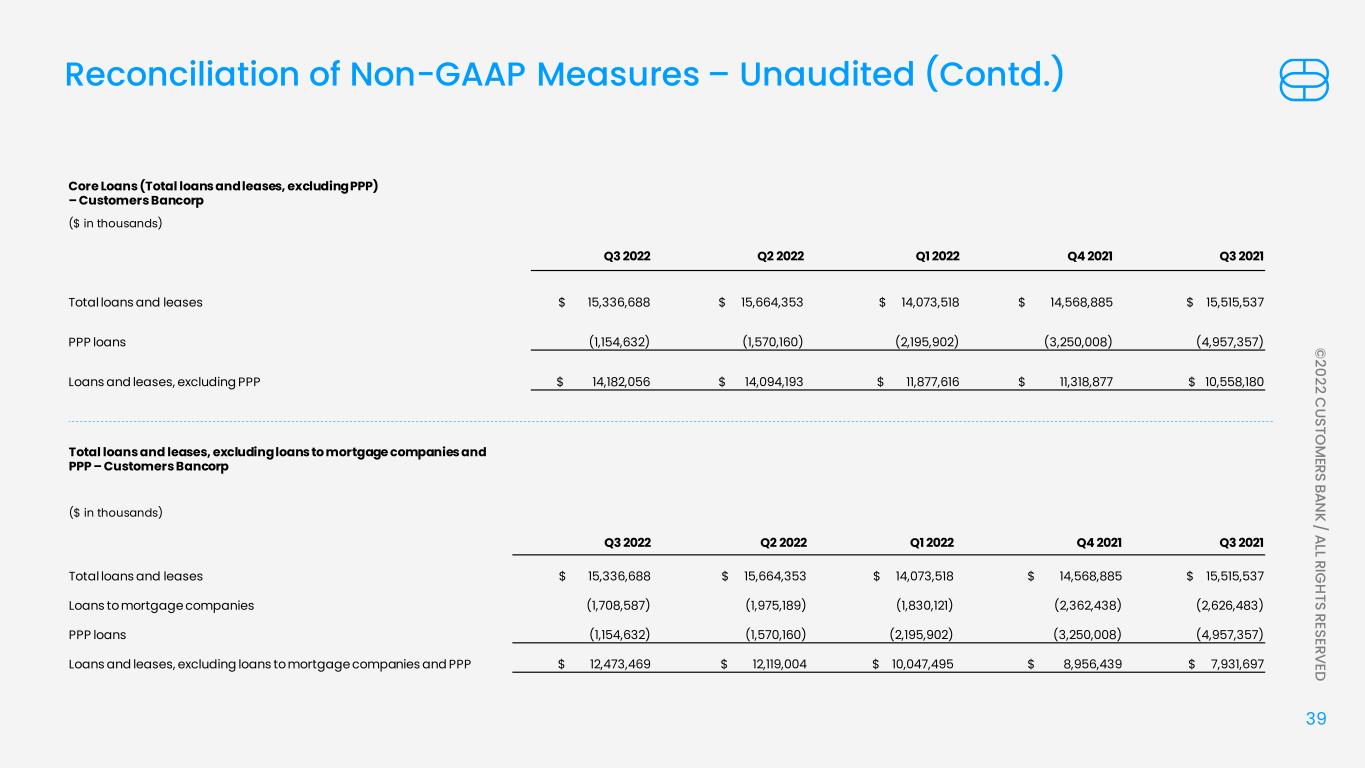

39 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Core Loans (Total loans and leases, excluding PPP) – Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Total loans and leases $ 15,336,688 $ 15,664,353 $ 14,073,518 $ 14,568,885 $ 15,515,537 PPP loans (1,154,632) (1,570,160) (2,195,902) (3,250,008) (4,957,357) Loans and leases, excluding PPP $ 14,182,056 $ 14,094,193 $ 11,877,616 $ 11,318,877 $ 10,558,180 Total loans and leases, excluding loans to mortgage companies and PPP – Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Total loans and leases $ 15,336,688 $ 15,664,353 $ 14,073,518 $ 14,568,885 $ 15,515,537 Loans to mortgage companies (1,708,587) (1,975,189) (1,830,121) (2,362,438) (2,626,483) PPP loans (1,154,632) (1,570,160) (2,195,902) (3,250,008) (4,957,357) Loans and leases, excluding loans to mortgage companies and PPP $ 12,473,469 $ 12,119,004 $ 10,047,495 $ 8,956,439 $ 7,931,697

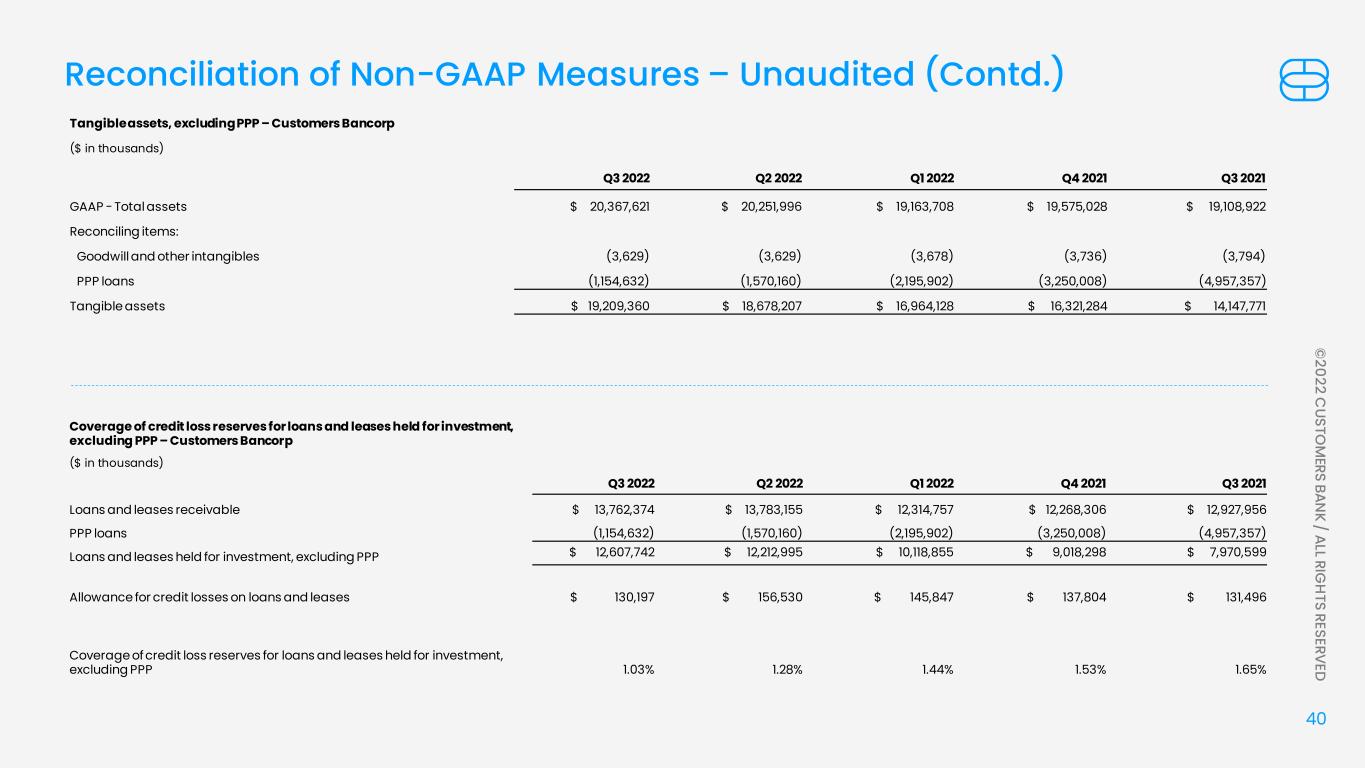

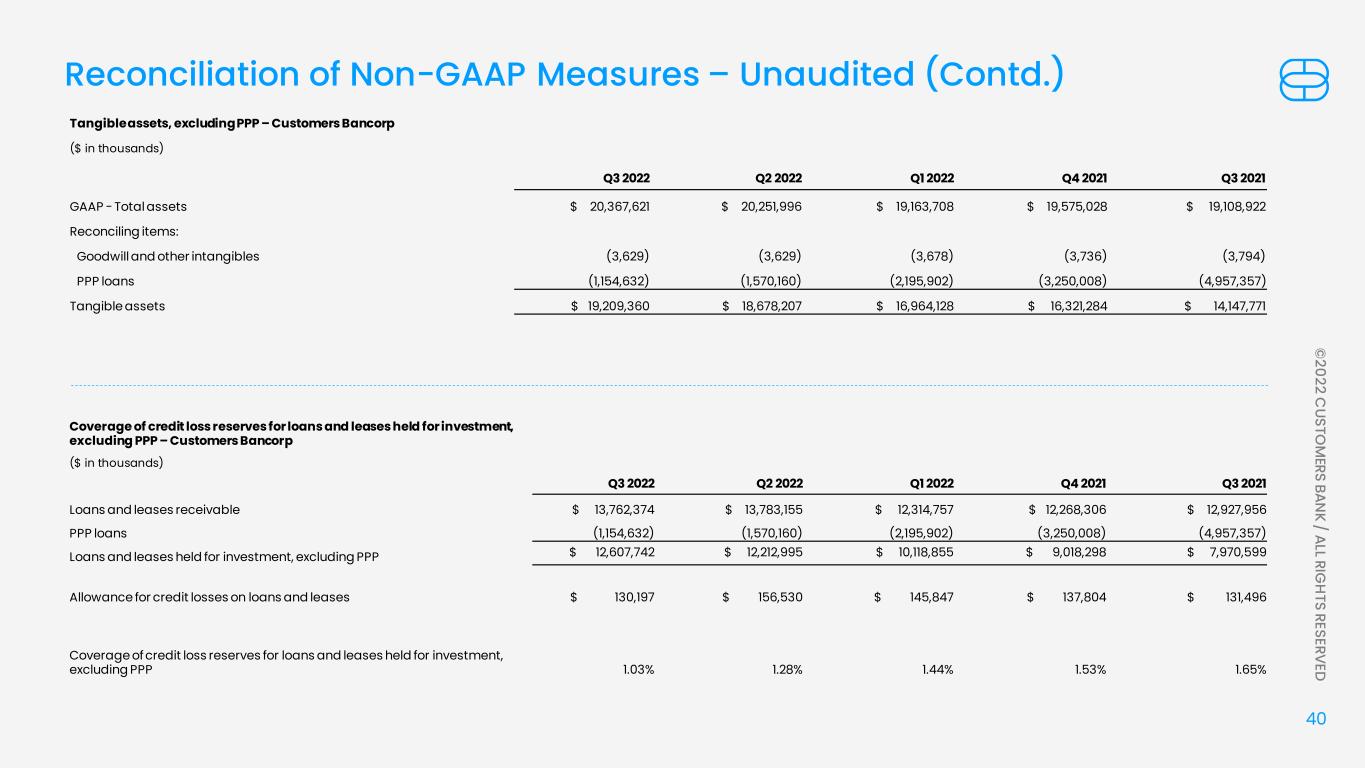

40 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Coverage of credit loss reserves for loans and leases held for investment, excluding PPP – Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Loans and leases receivable $ 13,762,374 $ 13,783,155 $ 12,314,757 $ 12,268,306 $ 12,927,956 PPP loans (1,154,632) (1,570,160) (2,195,902) (3,250,008) (4,957,357) Loans and leases held for investment, excluding PPP $ 12,607,742 $ 12,212,995 $ 10,118,855 $ 9,018,298 $ 7,970,599 Allowance for credit losses on loans and leases $ 130,197 $ 156,530 $ 145,847 $ 137,804 $ 131,496 Coverage of credit loss reserves for loans and leases held for investment, excluding PPP 1.03% 1.28% 1.44% 1.53% 1.65% Tangible assets, excluding PPP – Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP - Total assets $ 20,367,621 $ 20,251,996 $ 19,163,708 $ 19,575,028 $ 19,108,922 Reconciling items: Goodwill and other intangibles (3,629) (3,629) (3,678) (3,736) (3,794) PPP loans (1,154,632) (1,570,160) (2,195,902) (3,250,008) (4,957,357) Tangible assets $ 19,209,360 $ 18,678,207 $ 16,964,128 $ 16,321,284 $ 14,147,771

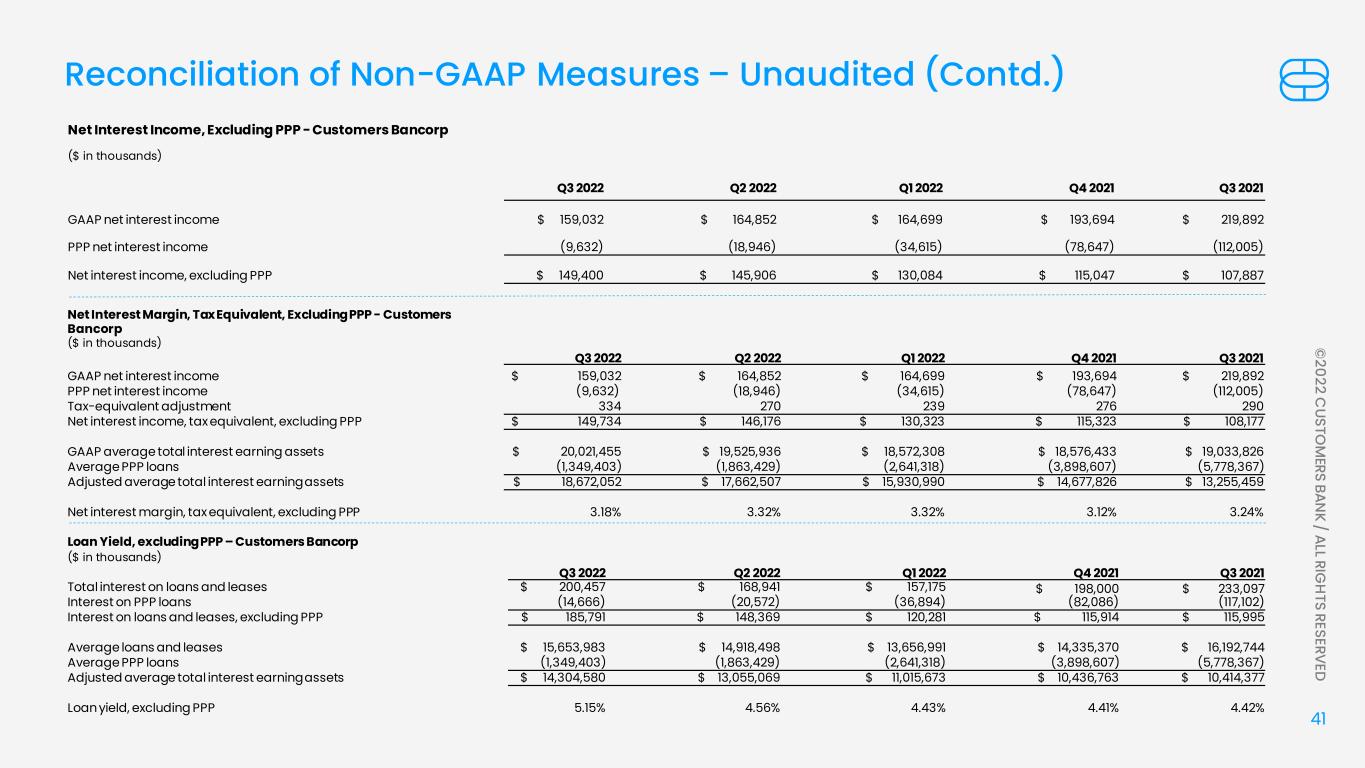

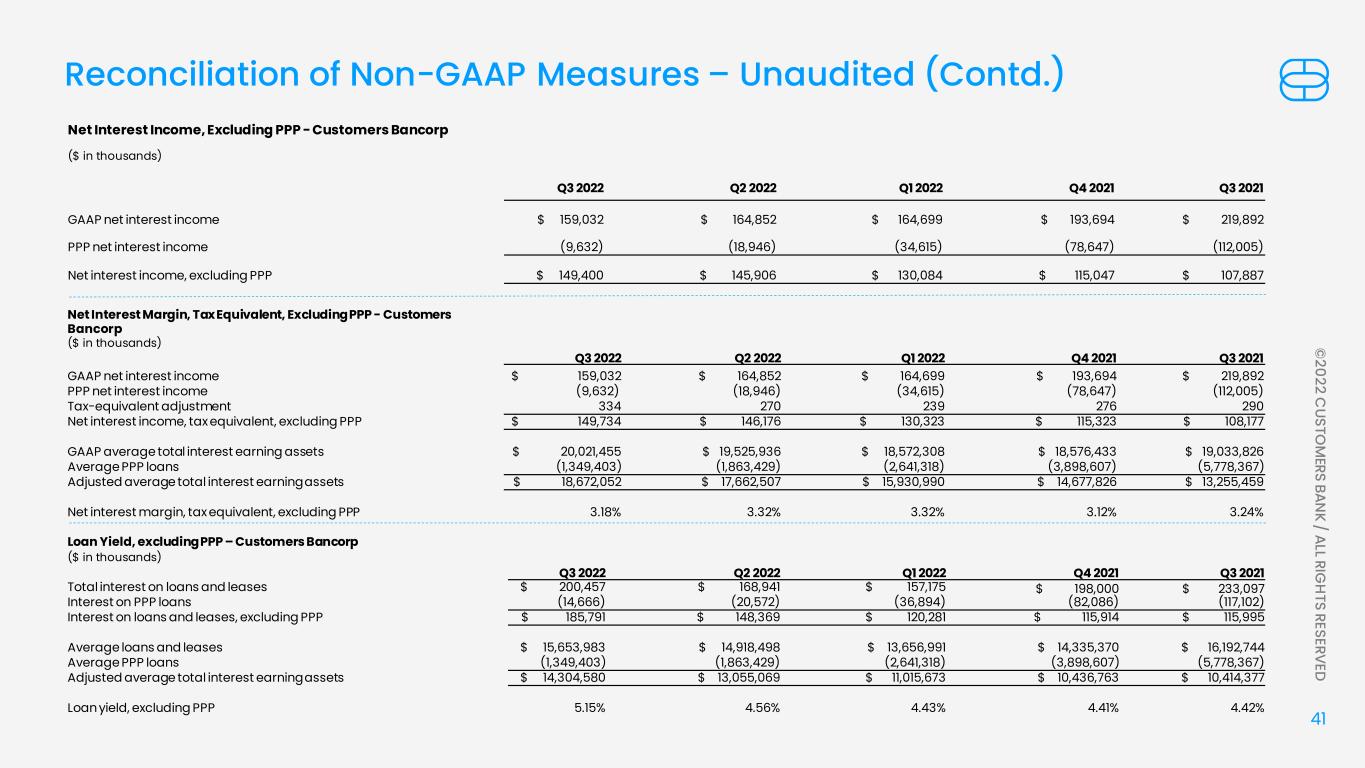

41 © 2022 C USTO M ERS BAN K / ALL RIG H TS RESERVED Reconciliation of Non-GAAP Measures – Unaudited (Contd.) Net Interest Margin, Tax Equivalent, Excluding PPP - Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP net interest income $ 159,032 $ 164,852 $ 164,699 $ 193,694 $ 219,892 PPP net interest income (9,632) (18,946) (34,615) (78,647) (112,005) Tax-equivalent adjustment 334 270 239 276 290 Net interest income, tax equivalent, excluding PPP $ 149,734 $ 146,176 $ 130,323 $ 115,323 $ 108,177 GAAP average total interest earning assets $ 20,021,455 $ 19,525,936 $ 18,572,308 $ 18,576,433 $ 19,033,826 Average PPP loans (1,349,403) (1,863,429) (2,641,318) (3,898,607) (5,778,367) Adjusted average total interest earning assets $ 18,672,052 $ 17,662,507 $ 15,930,990 $ 14,677,826 $ 13,255,459 Net interest margin, tax equivalent, excluding PPP 3.18% 3.32% 3.32% 3.12% 3.24% Loan Yield, excluding PPP – Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Total interest on loans and leases $ 200,457 $ 168,941 $ 157,175 $ 198,000 $ 233,097 Interest on PPP loans (14,666) (20,572) (36,894) (82,086) (117,102) Interest on loans and leases, excluding PPP $ 185,791 $ 148,369 $ 120,281 $ 115,914 $ 115,995 Average loans and leases $ 15,653,983 $ 14,918,498 $ 13,656,991 $ 14,335,370 $ 16,192,744 Average PPP loans (1,349,403) (1,863,429) (2,641,318) (3,898,607) (5,778,367) Adjusted average total interest earning assets $ 14,304,580 $ 13,055,069 $ 11,015,673 $ 10,436,763 $ 10,414,377 Loan yield, excluding PPP 5.15% 4.56% 4.43% 4.41% 4.42% Net Interest Income, Excluding PPP - Customers Bancorp ($ in thousands) Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 GAAP net interest income $ 159,032 $ 164,852 $ 164,699 $ 193,694 $ 219,892 PPP net interest income (9,632) (18,946) (34,615) (78,647) (112,005) Net interest income, excluding PPP $ 149,400 $ 145,906 $ 130,084 $ 115,047 $ 107,887