Exhibit 99.2

| 1 Investor Presentation Electromed, Inc. Investor Presentation February 11, 2025 NYSE American: ELMD Innovation Leader in Airway Clearance Technologies

| 2 Investor Presentation Forward Looking Statements Certain statements in this press release constitute forward - looking statements as defined in the US Private Securities Litigation Reform Act of 1995 . Forward - looking statements can generally be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will,” and similar expressions, including the negative of these terms, but they are not the exclusive means of identifying such statements . Forward - looking statements cannot be guaranteed, and actual results may vary materially due to the uncertainties and risks, known or unknown associated with such statements . Examples of risks and uncertainties for the Company include, but are not limited to the competitive nature of our market ; changes to Medicare, Medicaid, or private insurance reimbursement policies ; changes to state and federal health care laws ; changes affecting the medical device industry ; our ability to develop new sales channels for our products such as the homecare distributor channel ; our need to maintain regulatory compliance and to gain future regulatory approvals and clearances ; new drug or pharmaceutical discoveries ; general economic and business conditions ; our ability to renew our line of credit or obtain additional credit as necessary ; our ability to protect and expand our intellectual property portfolio ; the risks associated with expansion into international markets, as well as other factors we may describe from time to time in the Company’s reports filed with the Securities and Exchange Commission (including the Company’s most recent Annual Report on Form 10 - K, as amended from time to time, and subsequent Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) . Investors should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties or potentially inaccurate assumptions investors should take into account when making investment decisions . Shareholders and other readers should not place undue reliance on “forward - looking statements,” as such statements speak only as of the date of this press release . We undertake no obligation to update them in light of new information or future events .

| 3 Investor Presentation Electromed – Who We Are Electromed, Inc. is a growing medical device company focused on airway management to help people around the world breathe better, stay healthier, and lead active and fulfilling lives. As of and for 12 months ended 9/30/2024 Key Stats : Headquarters: New Prague, MN Ticker: ELMD Established: 1992 Annual Revenue: $59.7M Market Cap: $250M Share Count: 8.5M 174 Employees Manufacturing in Minnesota HFCWO Market Focus

| 4 Investor Presentation Electromed Highlights » Growing and profitable medical technology company » A leader in the large and expanding airway clearance market » The SmartVest ® Airway Clearance System’s H igh F requency C hest W all Oscillation (“HFCWO”) technology supported by clinical outcomes data with strong reimbursement. » Attractive direct - to - patient and provider model » Strong financial profile with attractive gross margins and well - capitalized balance sheet $35.8 $41.7 $48.1 $54.7 $59.7 $2.4 $2.3 $3.2 $5.2 $6.8 FY'21 FY'22 FY'23 FY'24 TTM 12/31/2024 Revenue Net Income 29% Net Income CAGR* *FY ‘21 through FY ‘24

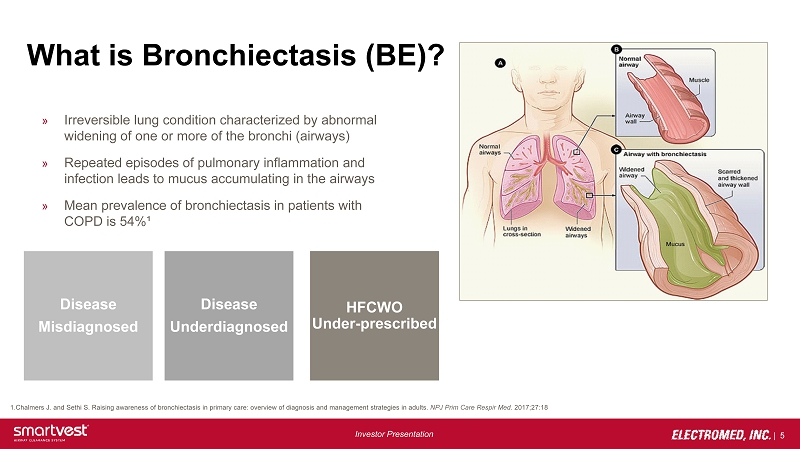

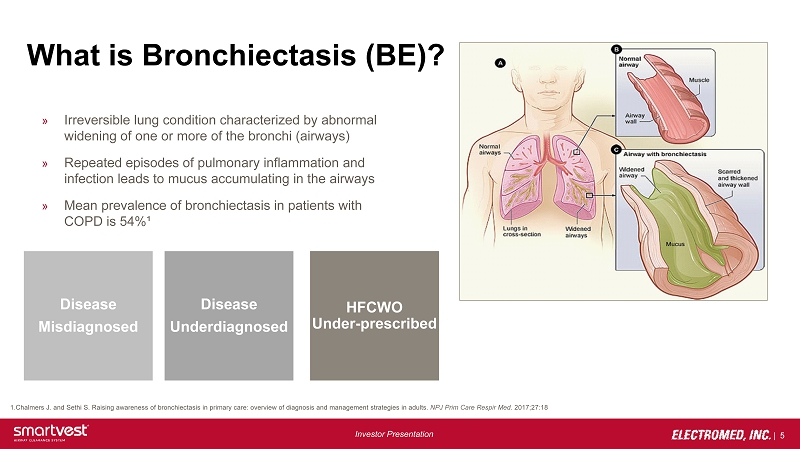

| 5 Investor Presentation What is Bronchiectasis (BE)? » Irreversible lung condition characterized by abnormal widening of one or more of the bronchi (airways) » Repeated episodes of pulmonary inflammation and infection leads to mucus accumulating in the airways » Mean prevalence of bronchiectasis in patients with COPD is 54%¹ 1.Chalmers J. and Sethi S. Raising awareness of bronchiectasis in primary care: overview of diagnosis and management strategi es in adults. NPJ Prim Care Respir Med . 2017;27:18 HFCWO Under - prescribed Disease Underdiagnosed Disease Misdiagnosed

| 6 Investor Presentation U.S. Market: Large, Growing, Underpenetrated 1. Derived from GUIDEHOUSE 2023 NASM claims database 2. Derived from GUIDEHOUSE 2023 literature review and 2023 CDC NHANES data Bronchiectasis HFCWO penetration ~15% 1 Diagnosed BE population growing at ~12% annually 1 Estimated Net Bronchiectasis prevalence, DIAGNOSED 1 Estimated bronchiectasis prevalence, UNDIAGNOSED with COPD/BE overla p 2 Estimated HFCWO bronchiectasis penetration, treated population 1 ~824K U.S. BE Diagnosed 1 4.1 million U.S. Undiagnosed 2 ~127K HFCWO ADOPTED 1

| 7 Investor Presentation How is Bronchiectasis Treated? Antibiotics, Anti - Inflammatories, Airway Clearance

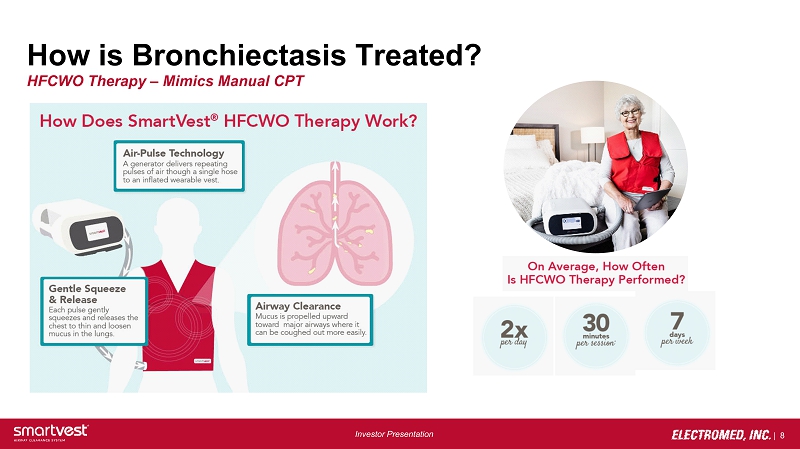

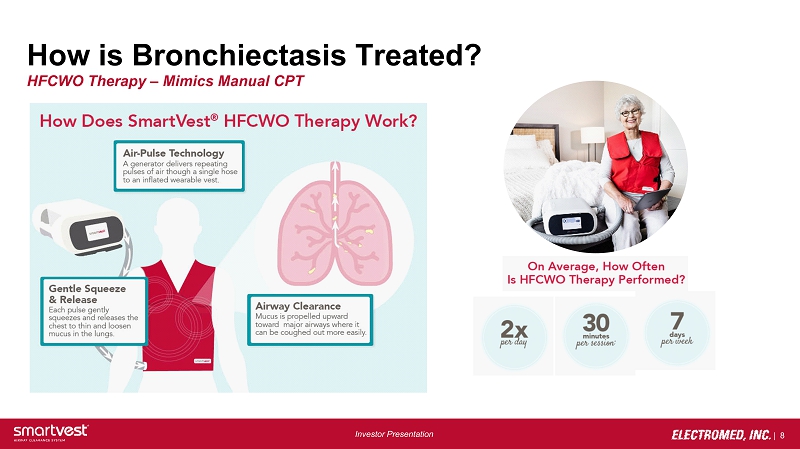

| 8 Investor Presentation How is Bronchiectasis Treated? HFCWO Therapy – Mimics Manual CPT

| 9 Investor Presentation Sleek and light weight generator Intuitive user interface for better patient adherence More portable and easier for travel SmartVest Clearway ® HFCWO Designed with the Patient in Mind An Enhanced Patient Experience SmartVest ® has a well - established reimbursement code from CMS – E0483; Electromed has over 275M contracted lives in the US

| 10 Investor Presentation SmartNotes™ Patient Progress Report SmartNotes combine patient Quality of Life and Therapy Utilization data to provide physicians with extended views into disease management » TeleRespiratory Services : A team of Respiratory Therapists stay connected with patients and support their therapy utilization. » Outcomes Management : Easy - to - read report provides physicians with a comprehensive view of disease progression and therapy impact. Patient Outcomes and Treatment Progress to Physicians

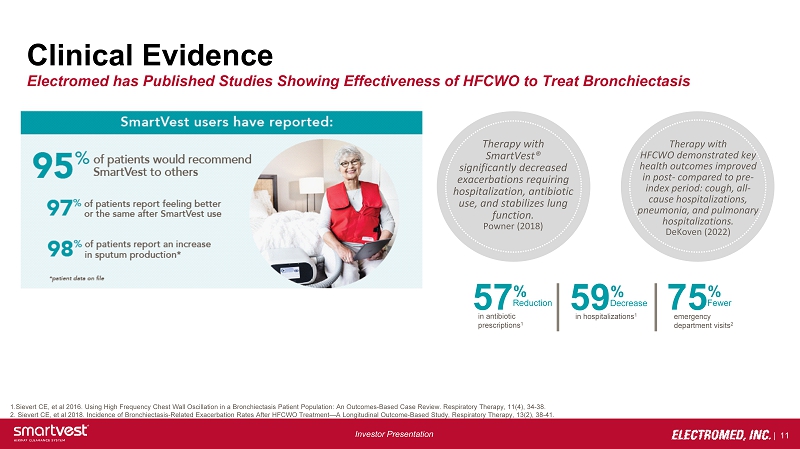

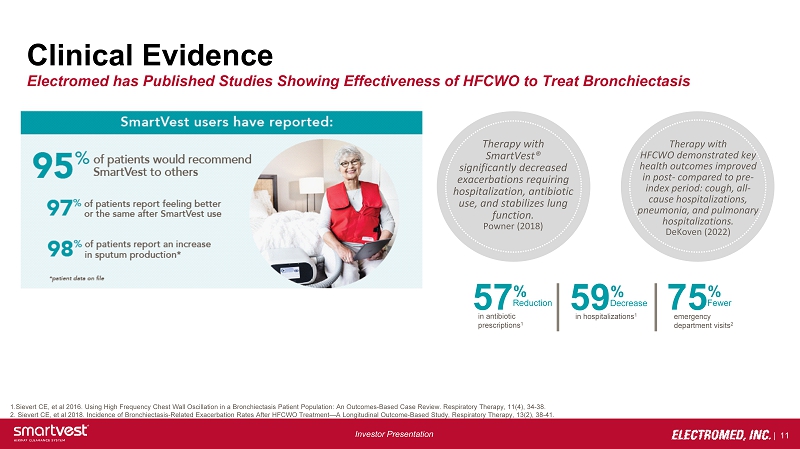

| 11 Investor Presentation Clinical Evidence Electromed has Published Studies Showing Effectiveness of HFCWO to Treat Bronchiectasis 1.Sievert CE, et al 2016. Using High Frequency Chest Wall Oscillation in a Bronchiectasis Patient Population: An Outcomes - Based Case Review. Respiratory Therapy, 11(4), 34 - 38. 2. Sievert CE, et al 2018. Incidence of Bronchiectasis - Related Exacerbation Rates After HFCWO Treatment — A Longitudinal Outcome - B ased Study, Respiratory Therapy, 13(2), 38 - 41. 57 % Reduction in antibiotic prescriptions 1 59 % Decrease in hospitalizations 1 75 % Fewer emergency department visits 2 Therapy with SmartVest® significantly decreased exacerbations requiring hospitalization, antibiotic use, and stabilizes lung function. Powner (2018) Therapy with HFCWO demonstrated key health outcomes improved in post - compared to pre - index period: cough, all - cause hospitalizations, pneumonia, and pulmonary hospitalizations. DeKoven (2022)

| 12 Investor Presentation Direct - to - Patient Model Drives Attractive Margin Profile Manufacturer DME Patient $ $ vs. Electromed Patient $$ Traditional Medical Equipment Channel Direct - to - Patient Distribution (Electromed) ELMD expects gross margins in the mid - 70s and improving with the SmartVest ® Clearway ®

| 13 Investor Presentation Net Revenue Breakdown - $59.7M (TTM ended 12/31/2024) 1% [PE RCE NTA GE] 94% By Setting Homecare By Payer Homecare Qualified Referral Volume 73% 3% 22% 2% 47% 51% 2% Home Care 1 Hospitals Other Medicare Commercial/Other 2 Medicaid Bronchiectasis Cystic Fibrosis Neuromuscular Other 1.Includes $2.4 million from home care distributor revenue 2.Includes Managed Medicare and Managed Medicaid

| 14 Investor Presentation Growth Strategy How will Electromed Increase Market Share? Continued sales force expansion along with complementary infrastructure investments Increase brand awareness and revenue with direct - to - consumer and physician marketing Market development to improve diagnosis rates and evidence to support the adoption of the SmartVest system for patients SmartAdvantage ™ best - in - class customer care and support Expand e - prescribing capability

| 15 Investor Presentation Long - Term Objectives Electromed is committed to delivering long - term profitable growth Double - digit Revenue Growth Operating Margin Improvement Increase market share Deeper penetration of current SmartVest prescribers Operating leverage as revenue increases

| 16 Investor Presentation Why Invest? Large, expanding chronic lung diseases market Clinically proven technology Broad payor coverage Consistent double - digit organic revenue growth High gross margins , robust cash flow and expanding operating leverage

| 17 Investor Presentation Management Incentives Aligned w/Investors CEO Incentive Management’s Incentive Compensation Reward based on increasing total shareholder return . Focused solely on delivering financial results .

| 18 Investor Presentation Attractive Valuation (TTM and as of 12/31/2024 Results) Metric ELMD RUS ME Sales Growth 15.5% > 2.5% Gross Margin 76.8% > 55.6% Operating Margin 14.5% > (1.3%)

| 19 Investor Presentation Mike Cavanaugh ( 617) 877 - 8641 m ike.cavanaugh@westwicke.com Maren Czura (332) 242 - 4365 maren.czura@westwicke.com Jim Cunniff , President & CEO (952) 758 - 9299 jcunniff @Electromed.com Brad Nagel, CFO (952) 758 - 9299 bnagel@Electromed.com

| 20 Investor Presentation APPENDIX

| 21 Investor Presentation Financial Highlights Financial Summary Three months ended Year Ended ( in $ millions, except shares amounts) Dec 31, 2023 (unaudited) Dec 31, 2024 (unaudited) June 30, 2023 June 30, 2024 TTM Dec 31, 2024 (unaudited) Revenues $13.7 $16.3 $48.1 $54.7 $59.7 Gross Profit $10.5 $12.6 $36.5 $41.7 $45.8 Gross margin 77% 78% 76% 76% 77% Operating income $2.3 $2.5 $4.0 $6.6 $8.7 Operating margin 17% 16% 8% 12% 15% Net income $1.7 $2.0 $3.2 $5.2 $6.8 Diluted EPS $0.19 $0.22 $0.36 $0.58 $0.76 Diluted Shares 8,800,172 8,953,349 8,700,833 8,864,585 8,953,349 Cash provided by operations $3.5 $3.2 $1.3 $9.1 $11.3