Annual Meeting December 2, 2015

2 Agenda • Welcome • Items for Shareholder Vote: 1. Election of Board of Directors 2. Ratify appointment of Cherry Bekaert LLP as Public Accountants 3. Approve compensation of executives on advisory basis 4. Approve frequency of executive compensation on advisory basis • Company Presentation • Vote Tally • Meeting Adjourns

3 Safe Harbor This presentation contains forward - looking statements that are based on the beliefs of Scio Diamond’s management and reflect Scio’s current expectations and projections about future results, performance, prospects and opportunities . Scio has tried to identify these statements by using words such as “anticipate,” believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “potential,” “should,” “will,” “will be,” “would” and similar expressions, but this is not an exclusive way of identifying such statements . Investors are cautioned that all forward - looking statements contained herein speak only as of the date of this presentation and involve risks and uncertainties that could cause Scio’s actual results, performance and achievements to differ materially from those expressed in these forward - looking statements, including, without limitation, the impact of the current challenging global economic conditions and recent financial crisis ; the development of the market for cultured diamonds ; competition ; Scio’s ability to raise the capital required for research, product development, operations and marketing ; anticipated dependence on material customers and material suppliers . For a detailed discussion of factors that could affect Scio’s future operating results, investors should see disclosures under “Risk Factors” in the company’s applicable filings with the US Securities and Exchange Commission . These factors should be considered carefully and investors should not rely on any forward-looking statements contained herein, or that may be made elsewhere from time to time by Scio or on Scio’s behalf . Scio undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law .

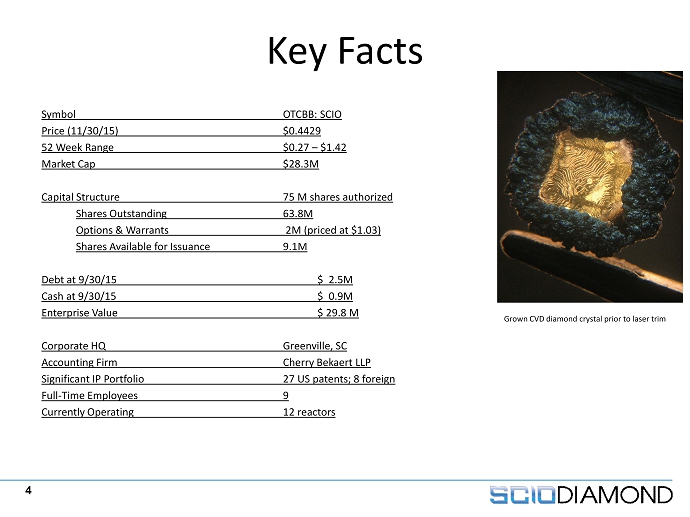

4 Key Facts Symbol OTCBB : SCIO Price (11/30/15) $0.4429 52 Week Range $ 0.27 – $1.42 Market Cap $28.3M Capital Structure 75 M shares authorized Shares Outstanding 63.8M Options & Warrants 2 M ( priced at $1.03) Shares Available for Issuance 9.1M Debt at 9 /30/15 $ 2.5M Cash at 9/30/15 $ 0.9M Enterprise Value $ 29.8 M Corporate HQ Greenville, SC Accounting Firm Cherry Bekaert LLP Significant IP Portfolio 27 US patents; 8 foreign Full - Time Employees 9 Currently Operating 12 reactors Grown CVD diamond crystal prior to laser trim

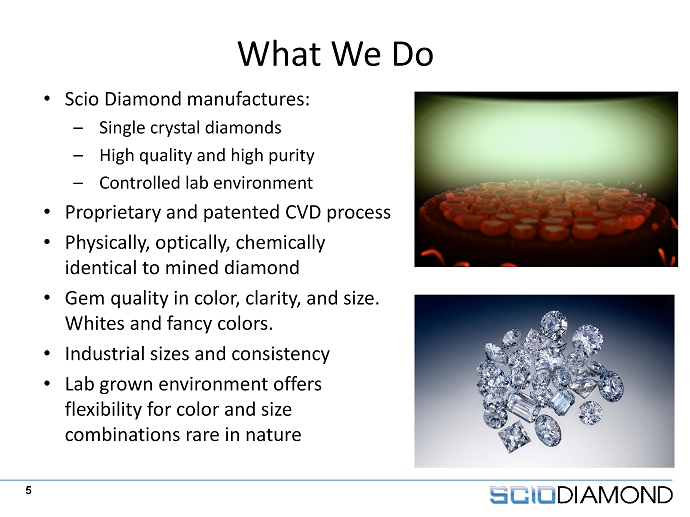

5 What We Do • Scio Diamond manufactures: – Single crystal diamonds – High quality and high purity – Controlled lab environment • Proprietary and patented CVD process • Physically , optically, chemically identical to mined diamond • Gem quality in color, clarity, and size. Whites and fancy colors. • Industrial sizes and consistency • Lab grown environment offers flexibility for color and size combinations rare in nature

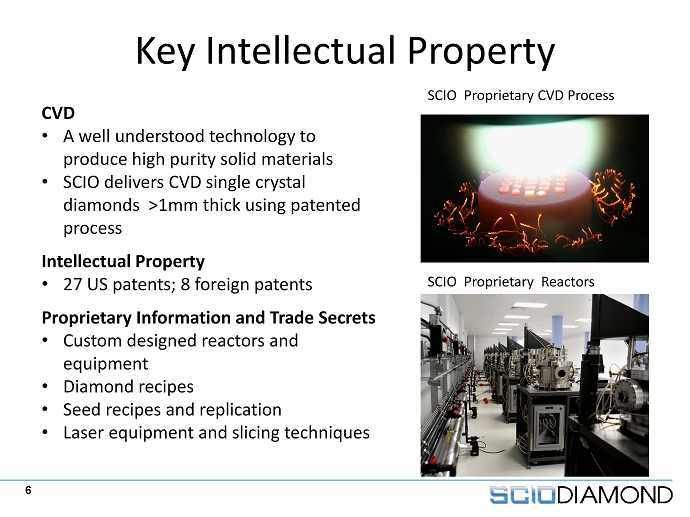

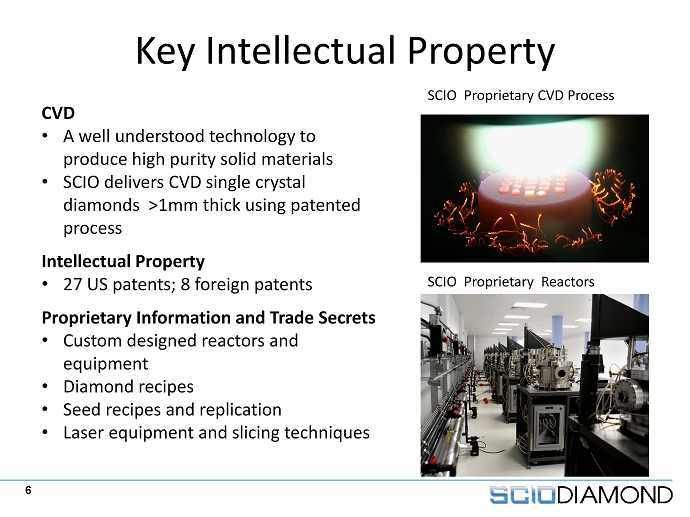

6 Key Intellectual Property SCIO Proprietary CVD Process SCIO Proprietary Reactors CVD • A well understood technology to produce high purity solid materials • SCIO delivers CVD single crystal diamonds >1mm thick using patented process Intellectual Property • 27 US patents; 8 foreign patents Proprietary Information and Trade Secrets • Custom designed reactors and equipment • Diamond recipes • Seed recipes and replication • Laser equipment and slicing techniques

7 Significant Progress over the Year Overcoming historical challenges … • Established Board Governance – Committees formed, Governance documents in place – Eliminated material weakness in financial reporting • Restructured debt, reducing cost of borrowing by over 10 percentage points • Expanded Factory – New technology more than doubled capacity – Agreements in place for further expansion • Product – Developed, launched high - quality pink created diamonds with JV, with Helzberg as lead customer. The market has taken longer to develop than expected. – Developed and improved colorless diamonds to GHI color range – began shipping limited quantities in September . – Ramping production now. Working to transition from startup mode to a profitable enterprise. – Projecting a cash flow breakeven operating month prior to fiscal year end • Channels – Executed JV agreement for fancy pink diamonds – Shipping colorless diamonds to many customers including JV – Developing channels for industrial material • Revamped Web site

8

9

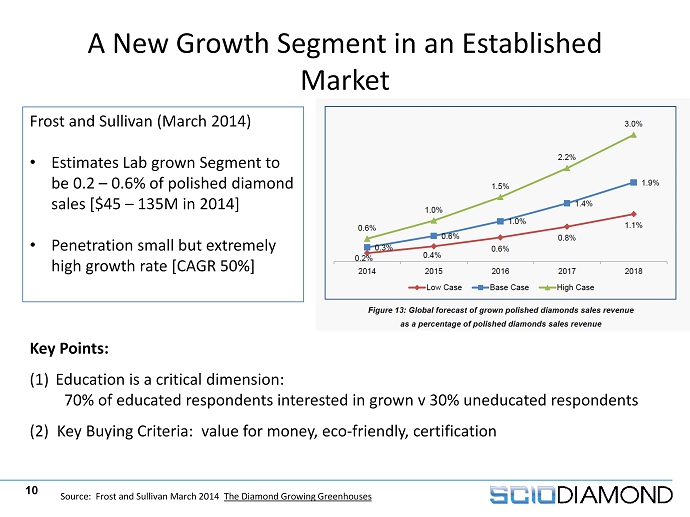

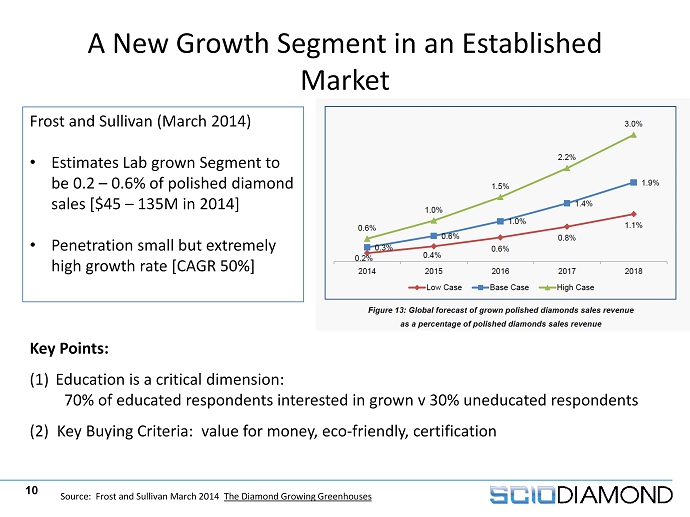

10 A New Growth Segment in an Established Market Frost and Sullivan (March 2014) • Estimates Lab grown Segment to be 0.2 – 0.6% of polished diamond sales [$45 – 135M in 2014] • Penetration small but extremely high growth rate [CAGR 50%] Key Points: (1) Education is a critical dimension: 70% of educated respondents interested in grown v 30% uneducated respondents (2) Key Buying Criteria: value for money, eco - friendly, certification Source: Frost and Sullivan March 2014 The Diamond Growing Greenhouses

11 The Opportunity • Rapidly expanding segment in $80+ Billion market place • Disruptive and proprietary CVD process give best economics • Technology well suited for “sweet - spot” sizes and colors of diamond • Readily scalable economically