Exhibit 99.3

Changing the way the world works and learns.

That’s a big statement. But it actually comes from the people who use our products.

Students. Teachers. Businesspeople.

Over and over again, we hear customers say that SMART solutions have brought change to their lives. Significant change. We hear that an autistic student has read his first sentence in a SMART-enabled classroom. We hear how SMART solutions have helped construction teams slash building costs. Teachers tell us they can’t imagine working without a SMART Board® interactive whiteboard. Health care workers say they are more productive. And groups of IT specialists have revolutionized the way they talk to their customers.

The stories are consistent and pervasive. We are improving the way people work and learn.

That fact motivates us to keep innovating. It fuels our determination to create solutions that help students achieve and teams work together more effectively.

We’d like to thank our customers for choosing SMART solutions twice as often as other brands. For inspiring us. And for helping us change the way the world works and learns.

This document contains forward-looking statements within the meaning of applicable Canadian and U.S. securities laws, including statements relating to SMART’s plans and expectations for fiscal 2013. Many factors could cause SMART’s actual results, performance or achievements, or industry conditions to differ materially from those expressed or implied by the forward-looking statements as described within the 2012 Annual Report under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

Letter to Shareholders

Dear Shareholders,

The past year was challenging on many fronts, as education funding shortages in the United States persisted and Europe faced similar austerity measures and contended with debt reduction. These macroeconomic challenges had an impact on our business, resulting in year-over-year revenue decline. Though our revenues were marginally down, we maintained our position as the interactive display category leader both globally and in the United States. Our products remain a high priority purchase for educators worldwide, and we have generated promising momentum in the business segment as an increasing number of organizations integrate SMART products into their meeting rooms and other collaboration workspaces.

Almost two months have passed since the Board of Directors asked me to take on the role of interim President and CEO, and I have pushed forward with a full mandate and the Board’s support. A strategy review is underway, and we are examining all facets of the organization and our market opportunities. A myriad of options are being considered with an emphasis on refining our focus and maximizing our long-term growth potential. I expect to share more detail on the outcome of the strategy review in the third quarter of fiscal 2013.

Year in Review

Throughout our fiscal year, the economic downturn continued to adversely affect funding for school districts in the United States, resulting in some deterioration in demand for our classroom technology. With our large customer base, which includes many school districts that have standardized on SMART products, and the widespread use of our software and content, we are well positioned to increase classroom penetration and attachment sales when education funding returns to normalized levels. We will also continue to strategically target international markets and businesses to support our growth, where penetration levels are much lower.

While the education market continues to be a key part of our business, we have shifted some of our resources to the development of our opportunities in the business market. We are working closely with our customers to ensure we are maximizing the value our products add to organizations. More than 200 Fortune 1000 companies have trialed our products, and many of these trials are moving to broader adoptions. We continue to fuel this momentum with ongoing investments in our sales and marketing infrastructure, product development and channel relationships. During the year we forged alliances with leading technology companies, including Cisco® and Microsoft®. These alliances will provide SMART with additional avenues to showcase our products in business environments and ensure interoperability between our products and those of unified communications and collaboration (UC&C) market leaders.

Establishing a foothold in our key international education markets

Tom Hodson, Interim President and Chief Executive Officer

has been one of our top priorities over the past year. These efforts have produced successful results in several countries, including Russia and India. In other emerging markets, we have also developed a pipeline of promising opportunities on which we are ready to capitalize. In the second half of our fiscal year, we surpassed 100 SMART Showcase Schools in Europe, the Middle East and Africa (EMEA) with each school acting as a conduit that enables educators to display our brand and demonstrate the value of our products.

As the year progressed, we began to experience increased pricing pressure in certain education market geographies. We selectively and strategically participated in international tenders where we anticipated large future growth potential, and some margin erosion resulted. To address markets with higher sensitivity to price, we have launched our new LightRaise™ 40wi interactive projector, which is a more affordable interactive solution for classrooms.

As we position ourselves for more growth in price-sensitive markets, we continue to employ additional cost-down strategies to augment our new product offerings. In the latter half of the fiscal year, we transitioned our assembly operation in Ottawa to a contract manufacturer in Mexico. We have an internal team focused on continuous cost-down initiatives through product design and manufacturing efficiencies. A contract manufacturing location in China has also been established and production commenced there in August 2011.

New competitors have emerged in our space, and we have also seen the rise of tablets, which have revolutionized many industries and have made their way into the classroom. Though we do not view tablets as a substitute for SMART’s core products, we compete for the same education budget dollars. Currently, our approach is to enhance our education solutions to ensure that they continue to deepen student engagement and improve learning outcomes, so that they remain a priority purchase. Recently we have announced our new SMART Notebook™ app for iPad, which will enable students to access SMART Notebook lessons individually on the iPad and collaboratively in class on the SMART Board® interactive whiteboard. We believe SMART products will coexist with other technologies, including tablets, and we are working to ensure our products will interoperate well with them.

3

Financial Overview

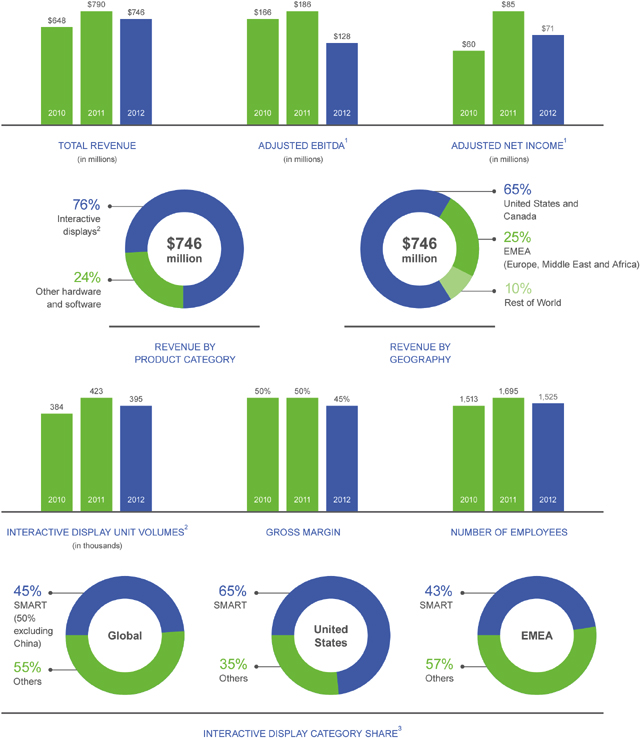

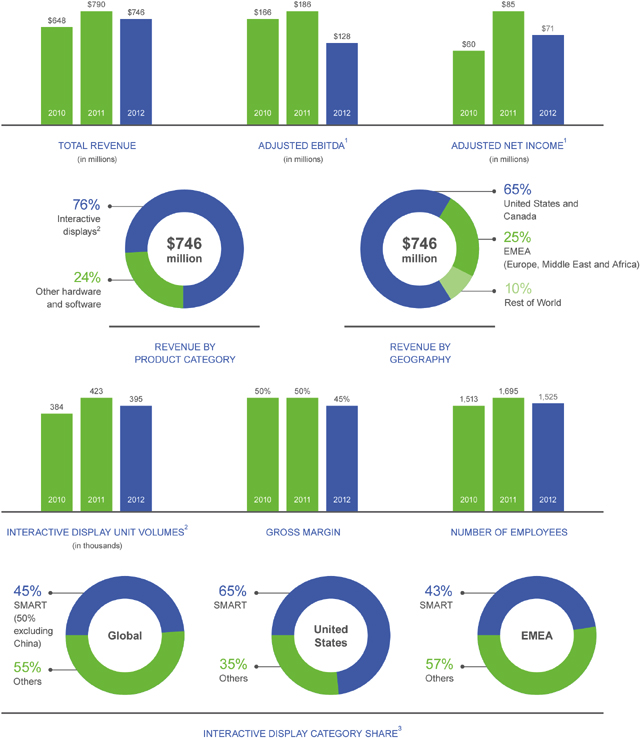

In fiscal 2012, SMART generated $746 million in revenue, which was a decrease of 6% over fiscal 2011. North America accounted for 65% of revenue, and EMEA and Rest of World (ROW) comprised 25% and 10%, respectively. North American revenues declined by 13% over the year, partially offset by 5% growth in EMEA and 33% growth in ROW. Gross margin for the year was 45%, a decline of 5 points over last year.

We finished the year with adjusted EBITDA of $128 million and adjusted net income of $71 million, decreases of 31% and 16% respectively. We generated $58 million in cash from operations, ending fiscal 2012 with a cash balance of $96 million.

We continue to take a conservative balance sheet approach and have repaid $48 million in debt over the past year while maintaining a solid cash position. In August 2011, our Board of Directors approved a share repurchase program under which we were authorized to repurchase up to four million Class A Subordinate Voting Shares for cancellation over the following year. Under the plan, we repurchased over 2.3 million shares in fiscal 2012.

Innovation

We are driven to create products that improve learning and collaboration. We provide educators with tools that facilitate the improvement of student outcomes, and we provide businesses with solutions that generate a tangible return on investment. Our product development team is focused on new products that help increase the efficiency and effectiveness of our customers. This team is continually enhancing our existing portfolio of products, making them easier to use and adding functionality. We have recently announced a number of new products and product upgrades that strengthen our technology and product leadership position.

Freestorm™ visual collaboration solutions – A set of comprehensive business products that combines industry-leading interactive displays, powerful collaboration software and dispersed collaboration options. They include the new SMART Board 8055i interactive flat panel with presence detection, SMART Meeting Pro™ 3.0 software with new SMART Ink™ and Bridgit® 4.5 conferencing software.

LightRaise 40wi interactive projector – A pen-enabled, ultra-short-throw projector that can turn nearly any surface into an interactive learning space. This projector provides a viable option for customers who are more price-sensitive but still desire the quality of SMART education solutions.

SMART Notebook 11 collaborative learning software – Software that has been enhanced with additional features that make collaboration with online resources more interactive and

comprehensive. New features include an embedded web browser for integrating online resources into SMART Notebook files and new widgets that enable even more learning resources to be included within SMART Notebook software.

SMART Notebook app for iPad – An app that allows students to use SMART Notebook software on their personal or school-owned iPad. The application enables a seamless transition between whole-class, small-group and personalized learning, allowing students and teachers with iPads to enjoy the engaging lesson materials of SMART Notebook software.

Looking Ahead

Despite the challenges we faced this year, I believe there is large market potential for our products in both education and business. Interactive display classroom penetration rates are only about 12% globally, and business adoption is accelerating. Even as parts of the world face economic challenges, governments continue to appreciate the importance of investment in education, and businesses continue to seek efficiency and effectiveness. At the heart of our strategy is a vision of innovation that helps our customers achieve these goals.

Through our strategy review process, we will strengthen the foundation that has brought us past success and will make key decisions that shape our future. The upcoming year will be one of transformation, as we reassess our competitive strategy and look to increase our operational effectiveness to ensure we have the right platform for future growth. Through this transformative process, we will remain driven to create products that make a difference to our customers. We are confident that customers will continue to experience the value of our solutions in businesses and classrooms as we change the way the world works and learns.

I would like to express my excitement and optimism regarding the future of SMART. Over my past five years with the company, I have developed confidence in the creativity and capability of my fellow employees. I have experienced firsthand the enthusiasm and commitment of our customers and resellers. As we begin this new chapter, I would like to extend my sincere appreciation to our staff, customers, resellers, suppliers and shareholders for their ongoing support of the company.

Sincerely,

Tom Hodson

Interim President and Chief Executive Officer

4

Financial Highlights

Challenging market dynamics in the education sector contributed to a decline in our revenue and key financial metrics in fiscal 2012. We continue to make investments to maintain our category-leading position in education and drive growth in the business sector.

| 1 - | Adjusted EBITDA and Adjusted Net Income are non-GAAP measures and are not substitutes for GAAP equivalents. For a full reconciliation of Adjusted EBITDA and Adjusted Net Income to their most comparable GAAP measures, please refer to Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended March 31, 2012 in this annual report. |

| 2 - | Interactive displays include SMART Board interactive whiteboard systems and associated projectors, SMART Board interactive flat panels, appliance-based interactive displays, SMART Board interactive overlays, SMART PodiumTM interactive pen displays and SMART TableTM interactive learning centers. |

| 3 - | Futuresource Consulting Ltd., May 2012 (trailing 12-month data to March 31, 2012). Interactive displays include interactive whiteboards and interactive flat panels. |

5

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following annual management’s discussion and analysis (“MD&A”) should be read in conjunction with our audited consolidated financial statements and the accompanying notes of SMART Technologies Inc. (the “Company”) for the fiscal year ended March 31, 2012. The consolidated financial statements have been presented in United States (“U.S.”) dollars and have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Unless the context otherwise requires, any reference to the “Company”, “SMART Technologies”, “SMART®”, “we”, “our”, “us” or similar terms refers to SMART Technologies Inc. and its subsidiaries. Because our fiscal year ends on March 31, references to a fiscal year refer to the fiscal year ended March 31 of the same calendar year. For example, when we refer to fiscal 2012, we mean our fiscal year ended March 31, 2012. Unless otherwise indicated, all references to “$” and “dollars” in this discussion and analysis mean U.S. dollars. The following table sets forth the period end and period average exchange rates for U.S. dollars expressed in Canadian dollars that are used in the preparation of our audited consolidated financial statements and this MD&A. These rates are based on the closing rates published by the Bank of Canada.

| | | | | | | | |

| | | Period End Rate | | | Period Average Rate | |

Year ended March 31, 2012 | | | 0.9975 | | | | 0.9930 | |

Year ended March 31, 2011 | | | 0.9696 | | | | 1.0167 | |

Year ended March 31, 2010 | | | 1.0158 | | | | 1.0906 | |

This MD&A includes forward-looking statements which reflect our current views with respect to future events and financial performance. These statements include forward-looking statements both with respect to us specifically and the technology product industry and business, demographic and other matters in general. Statements which include the words “expanding”, “expect”, “increase”, “intend”, “plan”, “believe”, “project”, “estimate”, “anticipate”, “may”, “will”, “continue”, “further”, “seek” and similar words or statements of a future or forward-looking nature identify forward-looking statements for purposes of the applicable securities laws or otherwise. In particular and without limitation, this MD&A contains forward-looking statements pertaining to general market conditions, our strategy and prospects, including expectations of the education, business and government markets for our products, our plans and objectives for future operations, productivity enhancements and cost savings, our future financial performance and financial condition, the addition of new products to our portfolio and enhancements to current products, our industry, opportunities in the business and government markets and licensing opportunities, working capital requirements, our acquisition strategy, regulation, exchange rates and income tax considerations.

All forward-looking statements address matters that involve risks, uncertainties and assumptions. Accordingly, there are or will be important factors and assumptions that could cause our actual results and other circumstances and events to differ materially from those indicated in these statements, as discussed more fully in the sections “Risks Related to Our Business” and “Capital Structure Risks”. These risk factors and assumptions include, but are not limited to, the following:

| | • | | competition in our industry; |

| | • | | reduced spending by our customers due to changes in the spending policies or budget priorities for government funding; |

| | • | | our ability to successfully execute our strategy to grow in the business and government markets; |

| | • | | our ability to grow our sales in foreign markets; |

| | • | | our ability to enhance current products and develop and introduce new products; |

| | • | | the development of the market for interactive learning and collaboration products; |

| | • | | possible changes in the demand for our products; |

| | • | | our ability to maintain sales in developed markets that are more saturated; |

| | • | | the potential negative impact of product defects; |

| | • | | our ability to successfully obtain patents or registration for other intellectual property rights or protect, maintain and enforce such rights; |

| | • | | third-party claims of infringement or violation of, or other conflicts with, intellectual property rights by us; |

| | • | | our ability to manage our business operations to create and sustain future growth effectively; |

| | • | | our ability to protect our brand; |

| | • | | our ability to obtain components and products from suppliers on a timely basis and on favorable terms; |

| | • | | the reliability of component supply and product assembly and logistical services provided by third parties; |

| | • | | our ability to establish new relationships and to build on our existing relationships with our dealers and distributors; |

6

| | • | | our ability to manage risks inherent in foreign operations; |

| | • | | the potential of increased costs related to future restructuring and related charges; |

| | • | | our ability to integrate the operations of the various businesses we acquire; |

| | • | | the potential negative impact of system failures or cyber security attacks; |

| | • | | our ability to manage, defend and settle litigation; and |

| | • | | our ability to manage cash flow, foreign exchange risk and working capital. |

Overview

SMART Technologies Inc. is a leading provider of collaboration solutions that change the way the world works and learns. As the global leader in interactive displays, our focus is on developing a variety of easy-to-use, integrated solutions that free people from their desks and computer screens, making collaboration and learning with digital resources more natural. Our products have transformed teaching and learning in more than 1.9 million classrooms worldwide, reaching over 40 million students and their teachers. In business, our Freestorm™ visual collaboration solutions improve the way that people work and collaborate, enabling them to be more productive and reduce costs.

At the core of SMART’s solution is the interactive display with solutions specifically designed for both education and business. SMART’s solutions for education combine collaboration software with a comprehensive line of interactive displays and other complementary hardware, accessories and services which enhance learning in a variety of ways. SMART’s Freestorm visual collaboration solutions for business include a set of comprehensive business products that combine industry leading interactive displays, intuitive collaboration software and remote collaboration tools.

We generate our revenue from the sale of these interactive technology products and integrated solutions, including hardware, software and services. Our global expansion has led to our products being used in more than 175 countries worldwide through our distributor and dealer network to the education, business and government markets. Although we do not sell to them directly, we consider these end-users to be our customers. We estimate that approximately 85% of our sales are to customers in the education market and the other 15% to customers in the business and government markets.

Our company operates in a fast-paced global environment where technology changes rapidly and the list of new competitors and competitor products is growing. As we focus on expanding our markets and further developing our portfolio of collaboration solutions, we plan to continue building on our position as the global leader in the interactive display product category. With educational funding constraints in North America and the ongoing economic debt crisis in Europe, we are focused on balancing our investment between education and our growing business segment.

The company is investing heavily in the business and government markets with plans to aggressively drive demand for our products. We are leveraging new and existing dealers and distributors and other strategic relationships to penetrate these markets. Our commitment to this segment is encompassed in our new Freestorm visual collaboration solutions which focus on the simplicity and ease of use of our products, while fully integrating them with critical business processes and products for a superior collaborative business solution. We have expanded our research and development, sales and marketing teams to develop and sell solutions for these markets and SMART has also recently partnered with other unified communication and collaboration companies to deliver enhanced interactive collaboration solutions.

In the education market, we believe that significant opportunities exist beyond the traditional markets we have penetrated. Our strategy includes acquiring new customers in emerging markets we are developing that have seen recent growth. We focus on selective investment in profitable emerging markets and have expanded operations in continental Europe, Asia and in other countries where we believe average penetration rates are currently lower than in the United Kingdom, U.S. and Canada. We have broadened our geographical focus to support our distribution channel by opening offices in additional countries, by continuing to hire additional personnel in our current global locations and by increasing our global distribution network. We have also varied our sales approach regionally with a focus on deeper product penetration in mature markets, like North America, while marketing and selling our complete solution to new customers in developing global markets.

We have been successful at penetrating our different target markets by providing fully integrated solutions including hardware, software and support services that enhance the interactive display experience with improved collaboration. We have also increased the depth and quality of the digital content offered by us and third parties for use on our interactive displays. We have supported our focus of expanding globally and further penetrating the education, business and government markets by developing different series of collaboration solutions designed to meet the specific requirements of our target markets.

Our portfolio of products has expanded to include several new products. We have recently launched four new models of collaboration systems for business which incorporate the SMART appliance and the SMART Board® 400 Series

7

interactive overlay which can be added to numerous types of flat-panel displays to enable touch and ink interactivity. We have recently announced our Freestorm visual collaboration solutions including the SMART Board 8055i interactive flat panel, our first large-format interactive display with presence detection, and the LightRaise™ 40wi interactive projector, intended to provide an affordable way of integrating interactive technology product into the classroom. We will also be launching SMART Notebook™ 11 software which has a number of new features that offer even more opportunities for collaboration and increased interaction.

Highlights

Economic challenges in our main markets and restrictions on government spending have continued to impact our results compared to prior periods. Restrained North American education spending on technology investments has resulted in a significant decline in North American education revenue in fiscal 2012, which was partially offset by growth in Europe, the Middle East and Africa (“EMEA”), the rest of world and the business market. Key highlights in fiscal 2012 are as follows:

| | • | | Revenue decreased by $44.3 million, or 5.6% in fiscal 2012 compared to fiscal 2011 and our interactive display unit sales declined 6.7% year over year. Gross margin at 45.0% was lower than the prior year primarily due to decreased revenue and the impact of allocating fixed overhead costs over this lower revenue. There were a number of other contributing factors including costs related to the move of our Ottawa assembly facility to contract manufacturers, delays in product cost reduction initiatives triggering lower than targeted margins on a number of new products and competitive pricing in certain markets. We also recorded a fourth quarter warranty charge of $5.2 million primarily related to repairs and replacements of our SMART UF55 line of projectors. This charge is in addition to warranty provisions previously disclosed for this product in the fourth quarter of fiscal 2011. The SMART UF55 projector was discontinued in fiscal 2011 and this issue is not expected to impact our current product lines. We are focused on improving our margins through cost reduction initiatives designed to reduce the cost of sales for both products sold in emerging markets and new products we introduce to maintain our market leadership position. |

| | • | | We are continuing our focus on cost management and investing strategically while striving to gain efficiencies in our base structure. We announced in August that we would move our remaining assembly operations to contract manufacturers and discontinue our own product assembly in Ottawa, Canada. In fiscal 2012, we incurred total costs of approximately $14.6 million related to this transition, of which $13.4 million was recorded as restructuring costs in operating expenses with the remainder in cost of sales. In December 2011, we ceased using the assembly and warehouse space at the Ottawa facility. As a result, we recorded lease obligation costs of $8.1 million in the third quarter of fiscal 2012 based on future lease expenditures and estimated future sublease rentals for the remainder of the lease term which are included in the $14.6 million of restructuring costs discussed above. |

| | • | | In August 2011, our Board of Directors approved a share repurchase program and normal course issuer bid for the purchase and cancellation of up to 4,000,000 of the Company’s Class A Subordinate Voting Shares. By March 31, 2012, we had repurchased for cancellation 2,327,486 Class A Subordinate Voting Shares at an average price of $4.19 per share for a total purchase price of $9.8 million. |

| | • | | During fiscal 2012, the remaining balance of $45.0 million of the Second lien facility was repaid. |

Sources of Revenue and Expenses

Revenue

We generate our revenue from the sale of interactive technology products and solutions, including hardware, software and services. Our distribution and sales channel includes dealers in North America and distributors in the EMEA, Caribbean, Latin America and Asia Pacific regions. We complement and support our sales channel with sales and support staff who work either directly with prospective customers or in coordination with our sales channel to promote and provide products and solutions that address the needs of the end-user. Revenue is recognized at the time we transfer the risks and rewards to our sales channel according to contractual terms. Our current practice usually involves multiple elements including post-contract technical support, software upgrades and updates, although we are not contractually required to do so. Revenue from product sales is allocated to each element based on relative fair values with any discount allocated proportionately. Revenue attributable to undelivered elements is deferred and recognized ratably over the estimated term of provision of these elements.

In the past, one of our key revenue metrics was the volume and average selling price of interactive whiteboards sold. Interactive technology products have evolved significantly and now encompass a far wider array of products. As a result, beginning in the fourth quarter of fiscal 2012, we are now reporting the volume and average selling price of interactive displays, a new broader category, and have stated these numbers retroactively throughout the MD&A. Interactive displays include SMART Board interactive whiteboard systems and associated projectors, SMART Board interactive flat panels, appliance-based interactive displays, SMART Board interactive overlays, SMART Podium™ interactive pen displays and SMART Table® interactive learning centers.

8

Cost of Sales

Our cost of sales have been primarily comprised of the cost of materials and components purchased from our suppliers, assembly labor and overhead costs, inventory provisions and write offs, warranty costs, product transportation costs and other supply chain management costs. With the transition of all product assembly to contract manufacturers in the last half of the fiscal year, assembly labor and certain overhead costs are now incorporated in the cost from contract manufacturers. Standard warranty periods on interactive displays extend up to five years and on other hardware products from one to three years. At the time product revenue is recognized, an accrual for estimated warranty costs is recorded as a component of cost of sales based on estimates for similar product experience. This is adjusted over time as actual claims experience data is obtained. In instances where specific product issues are determined outside of the normal warranty estimates, additional provisions are recorded to address the specific item. Depreciation of assembly equipment is included in cost of sales. To the extent that our sales increase, we also expect our cost of sales to increase in absolute dollars.

Selling, Marketing and Administration Expenses

Our selling and marketing expenses consist primarily of costs relating to our sales and marketing activities, including salaries and related expenses, customer order management activities, customer support, advertising, trade shows and other promotional activities. We offer various cooperative marketing programs to assist our sales channel to market and sell our products which are included as part of selling and marketing expenses. Our administration expenses consist of costs relating to people services, information systems, legal and finance functions, professional fees, insurance, stock-based compensation and other corporate expenses. We expect these expenses to increase slightly compared to prior years as a percentage of revenue.

Research and Development Expenses

Research and development expenses consist primarily of salaries and related expenses for software and hardware engineering and technical personnel as well as materials and consumables used in product development. We incur most of our research and development expenses in Canada and New Zealand, and are eligible to receive Scientific Research and Experimental Development (“SR&ED”) investment tax credits for certain eligible expenditures. Investment tax credits are netted against our provision for income taxes for financial statement presentation purposes. We expect research and development expenses to increase slightly compared to prior years as a percentage of revenue as we focus on enhancing and expanding our product offerings.

Interest Expense

We incur interest expense on our outstanding long-term debt and credit facility. Interest expense declined significantly in fiscal 2011 as a result of the 2010 Reorganization which resulted in the conversion of the shareholder note payable and cumulative preferred shares into equity during the first quarter of fiscal 2011. Interest expense also declined in fiscal 2012 due to the significant debt repayments made in the last three quarters of fiscal 2011 and first two quarters of fiscal 2012.

Foreign Exchange Gains & Losses

We report our financial results in U.S. dollars allowing us to assess our business performance in comparison to the financial results of other companies in the technology industry. Our Canadian operations and marketing support subsidiaries around the world have the Canadian dollar as their functional currency. Our U.S. and New Zealand operating subsidiaries have the U.S. dollar as their functional currency and our Japanese operating subsidiary has the Japanese Yen as its functional currency. The financial results of these operating subsidiaries are converted to Canadian dollars for consolidation purposes and then the Canadian consolidated financial results are converted from Canadian dollars to U.S. dollars for reporting purposes.

Our foreign exchange exposure is primarily between the Canadian dollar and both the U.S. dollar and the Euro. This exposure relates to our U.S. dollar-denominated assets and liabilities, including our external debt, the sale of our products to customers globally and purchases of goods and services in foreign currencies. Gains and losses on our U.S. dollar-denominated debt prior to its maturity or redemption are non-cash in nature.

9

Results of Operations

The following table sets forth certain consolidated statements of operations data and other data for the periods indicated in millions of dollars, except for percentages, shares, per share amounts, units and average selling prices.

| | | | | | | | | | | | |

| | | Fiscal Year Ended March 31, | |

| | | 2012 | | | 2011 | | | 2010 | |

Consolidated Statements of Operations | | | | | | | | | | | | |

Revenue | | $ | 745.8 | | | $ | 790.1 | | | $ | 648.0 | |

Cost of sales | | | 410.2 | | | | 399.2 | | | | 326.5 | |

| | | | | | | | | | | | |

Gross margin | | | 335.6 | | | | 390.9 | | | | 321.5 | |

Operating expenses | | | | | | | | | | | | |

Selling, marketing and administration | | | 178.3 | | | | 180.1 | | | | 138.8 | |

Research and development | | | 51.8 | | | | 53.7 | | | | 33.6 | |

Depreciation and amortization | | | 30.8 | | | | 31.8 | | | | 15.9 | |

Restructuring costs | | | 13.4 | | | | — | | | | — | |

| | | | | | | | | | | | |

Operating income | | | 61.3 | | | | 125.3 | | | | 133.2 | |

Non-operating expenses | | | | | | | | | | | | |

Other income, net | | | (0.5 | ) | | | (0.5 | ) | | | (0.2 | ) |

Interest | | | 14.6 | | | | 31.6 | | | | 64.9 | |

Foreign exchange loss (gain) | | | 8.5 | | | | (10.5 | ) | | | (91.8 | ) |

| | | | | | | | | | | | |

Income before income taxes | | | 38.7 | | | | 104.7 | | | | 160.3 | |

Income tax expense | | | 6.9 | | | | 35.3 | | | | 18.3 | |

| | | | | | | | | | | | |

Net income | | $ | 31.8 | | | $ | 69.4 | | | $ | 142.0 | |

| | | | | | | | | | | | |

Earnings per share | | | | | | | | | | | | |

Basic | | $ | 0.26 | | | $ | 0.53 | | | $ | 0.81 | |

Diluted | | $ | 0.26 | | | $ | 0.53 | | | $ | 0.81 | |

Weighted-average number of shares outstanding | | | | | | | | | | | | |

Basic | | | 122,726,275 | | | | 130,775,288 | | | | 176,322,584 | |

Diluted | | | 123,370,043 | | | | 130,775,288 | | | | 176,322,584 | |

Period end number of shares outstanding | | | 121,445,305 | | | | 123,772,791 | | | | 181,053,688 | |

| | | |

Selected Data | | | | | | | | | | | | |

Revenue by geographic location | | | | | | | | | | | | |

North America | | $ | 486.9 | | | $ | 558.4 | | | $ | 457.3 | |

Europe, Middle East and Africa | | | 183.9 | | | | 175.5 | | | | 149.9 | |

Rest of World | | | 75.0 | | | | 56.2 | | | | 40.8 | |

| | | | | | | | | | | | |

| | $ | 745.8 | | | $ | 790.1 | | | $ | 648.0 | |

| | | | | | | | | | | | |

| | | |

Revenue change(1) | | | (5.6 | )% | | | 21.9 | % | | | 38.4 | % |

As a percent of revenue | | | | | | | | | | | | |

Gross margin | | | 45.0 | % | | | 49.5 | % | | | 49.6 | % |

Selling, marketing and administration | | | 23.9 | % | | | 22.8 | % | | | 21.4 | % |

Research and development | | | 6.9 | % | | | 6.8 | % | | | 5.2 | % |

| | | |

Adjusted EBITDA(2) | | $ | 127.5 | | | $ | 185.8 | | | $ | 166.3 | |

Adjusted EBITDA as a percent of revenue(2)(3) | | | 16.9 | % | | | 23.1 | % | | | 25.1 | % |

| | | |

Adjusted Net Income(4) | | $ | 70.6 | | | $ | 85.5 | | | $ | 59.5 | |

Adjusted Net Income per share(4)(5) | | $ | 0.57 | | | $ | 0.65 | | | $ | 0.34 | |

| | | |

Total number of interactive displays sold(6) | | | 395,101 | | | | 423,390 | | | | 384,082 | |

Average selling price of interactive displays sold(7) | | $ | 1,426 | | | $ | 1,422 | | | $ | 1,513 | |

| | | |

Total assets | | $ | 539.6 | | | $ | 546.2 | | | $ | 528.1 | |

Total long-term liabilities | | $ | 393.6 | | | $ | 435.9 | | | $ | 978.0 | |

Certain reclassifications have been made to prior periods’ figures to conform to the current period’s presentation.

| (1) | Revenue change is calculated as a percentage by comparing the change in revenue in the period to revenue during the same period in the immediately preceding fiscal year. |

| (2) | Adjusted EBITDA is a non-GAAP measure that is described and reconciled to net income in the next section and is not a substitute for the GAAP equivalent. |

| (3) | Adjusted EBITDA as a percentage of revenue is calculated by dividing Adjusted EBITDA by revenue after adding back the net change in deferred revenue. |

| (4) | Adjusted Net Income is a non-GAAP measure that is described and reconciled to net income in the next section and is not a substitute for the GAAP equivalent. |

| (5) | Adjusted Net Income per share is calculated by dividing Adjusted Net Income by the average number of basic shares outstanding during the period. |

| (6) | Interactive displays include SMART Board interactive whiteboard systems and associated projectors, SMART Board interactive flat panels, appliance-based interactive displays, SMART Board interactive overlays, SMART Podium interactive pen displays and SMART Table interactive learning centers. |

| (7) | Average selling price of interactive displays is calculated by dividing the total revenue from the sale of interactive displays by the total number of units sold. |

10

Non-GAAP measures

We define Adjusted EBITDA as net income before interest, income taxes, depreciation and amortization, as well as adjusting for the following items: foreign exchange gains or losses, net change in deferred revenue, stock-based compensation, acquisition costs, costs of restructuring and other income. We define Adjusted Net Income as net income before stock-based compensation, acquisition costs, costs of restructuring, foreign exchange gains or losses, net change in deferred revenue and amortization of intangible assets, all net of tax.

Adjusted EBITDA and Adjusted Net Income are non-GAAP measures and should not be considered as an alternative to net income or any other measure of financial performance calculated and presented in accordance with GAAP. Adjusted EBITDA, Adjusted Net Income and other non-GAAP measures have inherent limitations and therefore, you should not place undue reliance on them.

We use Adjusted EBITDA as a key measure to assess the core operating performance of our business removing the effects of our leveraged capital structure and the volatility associated with the foreign exchange on our U.S. dollar-denominated debt. We also use Adjusted Net Income to assess the performance of the business removing the after-tax impact of stock-based compensation, acquisition costs, costs of restructuring, foreign exchange gains and losses, revenue deferral and amortization of intangible assets. We use both of these measures to assess business performance when we evaluate our results in comparison to budgets, forecasts, prior-year financial results and other companies in our industry. Many of these companies use similar non-GAAP measures to supplement their GAAP disclosures but such measures may not be directly comparable. In addition to its use by management in the assessment of business performance, Adjusted EBITDA is used by our Board of Directors and by our lenders in assessing management’s performance. Adjusted Net Income is used by our Board of Directors in assessing management’s performance and is a key metric in the determination of incentive plan payments. We believe Adjusted EBITDA and Adjusted Net Income may be useful to investors in evaluating our operating performance because securities analysts use metrics similar to Adjusted EBITDA and Adjusted Net Income as supplemental measures to evaluate the overall operating performance of companies.

Some of the limitations of Adjusted EBITDA are that it does not reflect:

| | • | | depreciation and amortization; |

| | • | | foreign exchange gains or losses; |

| | • | | changes in deferred revenue which, in accordance with our revenue recognition policy described under “Critical Accounting Policies and Estimates – Revenue Recognition” below, represents the portion of our sales that we do not recognize in the period less amounts recognized from prior periods; |

| | • | | stock-based compensation expense; |

| | • | | costs of restructuring; and |

| | • | | other income, including interest income and gains or losses related to the sale of property and equipment. |

Adjusted Net Income has the same limitations as Adjusted EBITDA discussed above, with the exception that it does reflect income taxes, depreciation and amortization of property and equipment, interest expense and other income.

We compensate for the inherent limitations associated with using Adjusted EBITDA and Adjusted Net Income through disclosure of such limitations, presentation of our financial statements in accordance with GAAP and reconciliation of Adjusted EBITDA and Adjusted Net Income to the most directly comparable GAAP measure, net income.

11

The following table sets forth the reconciliation of net income to Adjusted EBITDA in millions of dollars.

| | | | | | | | | | | | |

| | | Fiscal Year Ended March 31, | |

| | | 2012 | | | 2011 | | | 2010 | |

Adjusted EBITDA | | | | | | | | | | | | |

Net income | | $ | 31.8 | | | $ | 69.4 | | | $ | 142.0 | |

Income tax expense | | | 6.9 | | | | 35.3 | | | | 18.3 | |

Depreciation in cost of sales | | | 3.8 | | | | 4.1 | | | | 2.0 | |

Depreciation and amortization | | | 30.8 | | | | 31.8 | | | | 15.9 | |

Interest expense | | | 14.6 | | | | 31.6 | | | | 64.9 | |

Foreign exchange loss (gain) | | | 8.5 | | | | (10.5 | ) | | | (91.8 | ) |

Change in deferred revenue(1) | | | 8.6 | | | | 14.8 | | | | 13.4 | |

Stock-based compensation | | | 8.4 | | | | 8.7 | | | | — | |

Acquisition costs | | | — | | | | 1.1 | | | | 1.8 | |

Costs of restructuring(2) | | | 14.6 | | | | — | | | | — | |

Other income, net | | | (0.5 | ) | | | (0.5 | ) | | | (0.2 | ) |

| | | | | | | | | | | | |

Adjusted EBITDA | | $ | 127.5 | | | $ | 185.8 | | | $ | 166.3 | |

| | | | | | | | | | | | |

| (1) | Change in deferred revenue is calculated as the difference between deferred revenue and deferred revenue recognized. In accordance with our revenue recognition policy, deferred revenue represents the portion of our sales that we do not recognize in the period. Deferred revenue recognized represents the portion of our revenue deferred in a prior period that we recognized in the current period. We deferred revenue of $42.7 million, $44.2 million and $36.9 million in the years ended March 31, 2012, 2011 and 2010, respectively. |

| (2) | Includes restructuring costs of $13.4 million disclosed in the Company’s consolidated statements of operations in fiscal 2012 and $1.2 million in raw materials inventory write-offs in fiscal 2012 related to product lines that were discontinued at the Ottawa facility in connection with the restructuring activities. |

The following table sets forth the reconciliation of net income to Adjusted Net Income and basic and diluted earnings per share to Adjusted Net Income per share in millions of dollars, except per share amounts.

| | | | | | | | | | | | |

| | | Fiscal Year Ended March 31, | |

| | | 2012 | | | 2011 | | | 2010 | |

Adjusted Net Income | | | | | | | | | | | | |

Net income | | $ | 31.8 | | | $ | 69.4 | | | $ | 142.0 | |

Adjustments to net income | | | | | | | | | | | | |

Amortization of intangible assets | | | 9.6 | | | | 9.0 | | | | — | |

Foreign exchange loss (gain) | | | 8.5 | | | | (10.5 | ) | | | (91.8 | ) |

Change in deferred revenue(1) | | | 8.6 | | | | 14.8 | | | | 13.4 | |

Stock-based compensation | | | 8.4 | | | | 8.7 | | | | — | |

Acquisition costs | | | — | | | | 1.1 | | | | 1.8 | |

Costs of restructuring(2) | | | 14.6 | | | | — | | | | — | |

| | | | | | | | | | | | |

| | | 49.7 | | | | 23.1 | | | | (76.6 | ) |

Tax impact on adjustments(3) | | | 10.9 | | | | 7.0 | | | | 5.9 | |

| | | | | | | | | | | | |

Adjustments to net income, net of tax | | | 38.8 | | | | 16.1 | | | | (82.5 | ) |

| | | | | | | | | | | | |

Adjusted Net Income | | $ | 70.6 | | | $ | 85.5 | | | $ | 59.5 | |

| | | | | | | | | | | | |

Adjusted Net Income per share | | | | | | | | | | | | |

Earnings per share – basic and diluted | | $ | 0.26 | | | $ | 0.53 | | | $ | 0.81 | |

Adjustments to net income, net of tax, per share | | | 0.31 | | | | 0.12 | | | | (0.47 | ) |

| | | | | | | | | | | | |

Adjusted Net Income per share | | $ | 0.57 | | | $ | 0.65 | | | $ | 0.34 | |

| | | | | | | | | | | | |

| (1) | Change in deferred revenue is calculated as the difference between deferred revenue and deferred revenue recognized. In accordance with our revenue recognition policy, deferred revenue represents the portion of our sales that we do not recognize in the period. Deferred revenue recognized represents the portion of our revenue deferred in a prior period that we recognized in the current period. |

| (2) | Includes restructuring costs of $13.4 million disclosed in the Company’s consolidated statements of operations in fiscal 2012 and $1.2 million in raw materials inventory write-offs in fiscal 2012 related to product lines that were discontinued at the Ottawa facility in connection with the restructuring activities. |

| (3) | Reflects the tax impact on the adjustments to net income. A key driver of our foreign exchange loss (gain) is the conversion of our U.S. dollar-denominated debt that was originally incurred at an average rate of 1.05. When the unrealized foreign exchange amount on U.S. dollar-denominated debt is in a net gain position as measured against the original exchange rate, the gain is tax-effected at current rates. When the unrealized foreign exchange amount on the U.S. dollar-denominated debt is in a net loss position as measured against the original exchange rate, a valuation allowance is taken against it and as a result no net tax effect is recorded. |

Results of Operations – Fiscal 2012 Compared to Fiscal 2011

Revenue

Revenue decreased by $44.3 million, or 5.6%, from $790.1 million in fiscal 2011 to $745.8 million in fiscal 2012. Sales volumes for SMART’s interactive displays in fiscal 2012 were 395,101 units, a decrease of 28,289 units, or 6.7%, from 423,390 units in fiscal 2011. Although product penetration levels as well as budget and funding constraints in the U.S. education market have resulted in a decline in North American revenue, we have seen revenue growth in other areas in which we have invested, such as EMEA and the business market. For fiscal 2012 compared to fiscal 2011, the decline in North American revenue outweighed the impact of global expansion as U.S. federal, state and local education budgets faced pressure due to current economic conditions which resulted in a pullback in spending by school districts in all areas from salaries to technology purchases. The decrease in revenue related to lower North American spending was partially mitigated by the weakening of the U.S. dollar against the Euro, Canadian dollar and British pound sterling which positively impacted revenue by approximately $6.9 million in fiscal 2012 compared to fiscal 2011.

12

Gross Margin

Gross margin decreased by $55.3 million from $390.9 million in fiscal 2011 to $335.6 million in fiscal 2012. The gross margin percentage in fiscal 2012 declined to 45.0% compared to 49.5% in fiscal 2011. Lower revenue was the key driver of the absolute gross margin decline which was compounded by the impact of allocating fixed overhead costs over this lower revenue. Previously fixed overhead costs were included in inventory standard costs and spread over the year. Other factors contributing to the lower year-over-year gross margin percentages included costs relating to the transition from our assembly facility in Ottawa to contract manufacturers including inventory write-downs associated with the move and related cleanup and under absorbed overhead costs incurred during the period of transition. Warehousing and freight costs increased with our introduction of new and expanded product lines and our warranty provision increased by $6.0 million during the year largely due to a fourth quarter warranty charge of $5.2 million primarily related to repairs and replacements of our SMART UF55 line of projectors. We also launched a new line of projectors in fiscal 2012 for which the combination of introductory pricing and higher initial costs narrowed our margins. We expect to improve our margins going forward with lower cost, localized contract manufacturing and other cost-down initiatives. The decrease in gross margin related to the decline in revenue in fiscal 2012 compared to fiscal 2011 was partially offset by positive foreign exchange impacts of approximately $4.3 million primarily due to the year-over-year weakening of the U.S. dollar relative to the Euro, Canadian dollar and British pound sterling, which positively impacted our revenue and negatively impacted our cost of sales.

Operating Expenses

Selling, Marketing and Administration Expenses

Selling, marketing and administration expenses decreased by $1.8 million, or 1.0%, from $180.1 million in fiscal 2011 to $178.3 million in fiscal 2012. Removing the impact of foreign exchange, selling, marketing and administration decreased by $5.9 million in fiscal 2012 compared to fiscal 2011. This decrease reflects our focus on cost containment in light of continued uncertainty surrounding education funding. The negative foreign exchange impact of $4.1 million was due to the weakening in the value of the U.S. dollar relative to the Canadian dollar, Euro and New Zealand dollar.

Research and Development Expenses

Our research and development expenses decreased by $1.9 million, or 3.5%, from $53.7 million in fiscal 2011 to $51.8 million in fiscal 2012. Removing the impact of foreign exchange, research and development expenses decreased by $3.4 million. Reduced salary costs related to staff turnover and delays in resourcing certain projects contributed to the decline. Approximately $0.9 million of the decrease was related to technology development grant funding received from the New Zealand government in fiscal 2012. The negative foreign exchange impact of $1.5 million was due to the year-over-year weakening in the value of the U.S. dollar compared to the Canadian dollar and New Zealand dollar.

Depreciation and Amortization

Depreciation and amortization of property and equipment decreased by $1.6 million from $22.8 million in fiscal 2011 to $21.2 million in fiscal 2012.

Amortization of intangible assets reflects amortization of $9.6 million in fiscal 2012 compared to $9.0 million in fiscal 2011 on $50.1 million of intangible assets recorded upon the acquisition of NextWindow on April 21, 2010. The weighted-average amortization period for the intangible assets is 5.6 years.

Costs of Restructuring

In August 2011, we announced the transfer of the remainder of our interactive display assembly operations from our leased assembly facility in Ottawa, Canada to our existing contract manufacturers. This decision reflected our continued focus on cost management and the transition was completed by March 31, 2012. Although certain product development, procurement and logistics functions will remain in the Ottawa facility, staffing levels have been significantly reduced as a result of this decision. We incurred approximately $14.6 million related to this restructuring in fiscal 2012. These costs consisted of employee termination benefits and the associated costs of outplacement services of $3.7 million, $1.2 million in raw materials inventory write-offs related to product lines that were discontinued at the Ottawa facility as part of the transition to contract manufacturers and $1.6 million in labor and other costs related to the shutdown of the facility. In December 2011, we ceased using the assembly and warehouse space at the Ottawa facility. As a result, we recorded lease obligation costs of $8.1 million in the third quarter of fiscal 2012, based on future lease expenditures and estimated future sublease rentals for the remainder of the lease term.

13

Non-Operating Expenses

Interest Expense

Interest expense decreased by $17.0 million, or 53.8%, from $31.6 million in fiscal 2011 to $14.6 million in fiscal 2012. Interest expense decreased as a result of the 2010 Reorganization which resulted in the conversion of the shareholder note payable and cumulative preferred shares into equity during the first quarter of fiscal 2011, as well as the debt repayments made in the last three quarters of fiscal 2011 and first two quarters of fiscal 2012 totaling $232.8 million. Using interest rates and the debt level at March 31, 2012, we expect that future interest expense will be approximately $11.5 million annually.

Foreign Exchange Loss (Gain)

Foreign exchange loss (gain) changed by $19.0 million, from a gain of $10.5 million in fiscal 2011 to a loss of $8.5 million in fiscal 2012. This year-over-year change primarily related to the conversion of our U.S. dollar-denominated debt into our functional currency of Canadian dollars slightly offset by the revaluation of the higher U.S. dollar-denominated cash and accounts receivables in fiscal 2012 compared to fiscal 2011. The period end exchange rates moved from CDN$0.9696 at March 31, 2011 to CDN$0.9975 at March 31, 2012, representing a 2.9% strengthening of the U.S. dollar against the Canadian dollar compared to a weakening of the U.S. dollar of 4.5% against the Canadian dollar in fiscal 2011.

Provision for Income Taxes

Income tax expense decreased by $28.4 million from $35.3 million in fiscal 2011 to $6.9 million in fiscal 2012. Our tax provision is weighted towards Canadian income tax rates as substantially all our taxable income is Canadian-based. In calculating the tax provision, we adjust income before income taxes by the unrealized foreign exchange loss (gain) from the revaluation of the U.S. dollar-denominated debt. This is treated as a capital item for income tax purposes. We take a valuation allowance if the conversion of external U.S. dollar-denominated debt is in a net foreign exchange loss position due to the uncertainty that we will be able to utilize the capital loss in the future. The decrease in tax expense in fiscal 2012 compared to fiscal 2011 was primarily due to the reduction in net income and the recognition of additional SR&ED credits upon filing our June 7, 2010 and March 31, 2011 Canadian SR&ED claims. The tax provision also includes investment tax credits recorded in fiscal 2012 and fiscal 2011 of $9.2 million and $4.4 million, respectively.

Net Income

Net income decreased by $37.6 million from $69.4 million in fiscal 2011 to $31.8 million in fiscal 2012. The decrease was primarily due to the decrease in gross margin of $55.3 million, the increase in restructuring costs of $13.4 million included in operating expenses and the impact of the volatility of the U.S. dollar relative to the Canadian dollar, which resulted in a $19.0 million increase in year-over-year foreign exchange losses. This was offset by decreases in operating expenses excluding restructuring costs of $4.7 million and interest and income tax expenses of $17.0 million and $28.4 million, respectively.

Adjusted EBITDA

Adjusted EBITDA decreased by $58.3 million, or 31.4%, from $185.8 million in fiscal 2011 to $127.5 million in fiscal 2012. The change was primarily due to the decrease in gross margin partially offset by lower deferred revenue related to lower sales and decreases in selling, marketing and administration expenses and research and development expenses.

Adjusted Net Income

Adjusted Net Income decreased by $14.9 million, or 17.4%, from $85.5 million in the fiscal 2011 to $70.6 million in fiscal 2012. The decrease in gross margin was partially offset by lower deferred revenue related to lower sales, decreases in selling, marketing and administration expenses and research and development expenses and reduced interest expense and income taxes.

Stock-based Compensation

The Company has an Equity Incentive Plan which provides for the grant of options, restricted share units (“RSUs”) and deferred share units (“DSUs”) to directors, officers, employees and service providers of the Company and its subsidiaries. During fiscal 2012, we granted 2,172,828 stock options to purchase an equivalent number of the Company’s Class A Subordinate Voting Shares at a weighted-average exercise price of $5.54 which vest over 48 months. The Company had a total of 3,000,657 options outstanding at March 31, 2012 with a weighted-average exercise price of $9.11. During fiscal 2012, we also issued 30,000 DSUs to independent directors and 250,850 time-based RSUs and 404,250 performance-based RSUs to Company executives.

Including these new issuances, we expect total stock-based compensation in selling, marketing and administration and research and development expenses to be approximately $4.4 million in fiscal 2013.

14

Results of Operations – Fiscal 2011 Compared to Fiscal 2010

Revenue

Revenue increased by $142.1 million, or 21.9%, from $648.0 million in fiscal 2010 to $790.1 million in fiscal 2011. Sales volumes for SMART’s interactive displays for fiscal 2011 were 423,390 units, an increase of 39,308 units, or 9.3%, from 384,082 units in fiscal 2010. The majority of this growth was driven by market demand in the education sector in both North America and EMEA. In North America, revenue increased by $101.1 million as a result of continued adoption of interactive displays in the education market, and increased sales of related attachment products. In EMEA, revenue increased by $25.6 million as a result of our expansion in this region during fiscal 2011.

Gross Margin

Gross margin increased by $69.4 million from $321.5 million in fiscal 2010 to $390.9 million in fiscal 2011. The gross margin percentage in fiscal 2011 was 49.5% compared to 49.6% in fiscal 2010. Although we continue to focus on lowering assembly costs of certain key components in our product offering as well as logistics and transportation costs, improvements were offset by higher warranty provisions on certain attachment and extension products. The increase in gross margin was partially offset by a negative foreign exchange impact of approximately $6.1 million as a result of the year-over-year weakening of the Euro relative to the U.S. dollar, which impacted our revenue, and the strengthening of the Canadian dollar relative to the U.S. dollar, which impacted our cost of sales.

Operating Expenses

Selling, Marketing and Administration Expenses

Selling, marketing and administration expenses increased by $41.3 million, or 29.8%, from $138.8 million in fiscal 2010 to $180.1 million in fiscal 2011. Approximately $9.0 million of the increase was related to growth in North American employee levels and $8.1 million was related to stock-based compensation expense from the Participant Equity Loan Plan and the Equity Incentive Plan. Approximately $7.4 million of the increase related to increased consulting fees and other costs primarily related to our information systems, the acquisition of NextWindow and the additional costs related to being a public company. Internationally, our expansion in Europe, as part of our global strategy, accounted for approximately $4.3 million of the increase and selling, marketing and administration expenses of NextWindow accounted for approximately $5.7 million of the increase. Lastly, the strengthening in the value of the Canadian dollar compared to the U.S. dollar contributed approximately $8.8 million of the increase.

Research and Development Expenses

Our research and development expenses increased by $20.1 million, or 59.8%, from $33.6 million in fiscal 2010 to $53.7 million in fiscal 2011. These increases reflect our continued commitment to innovation and investment in product development for the education and business markets, including an increase in the number of software developers, engineers and technicians required to support this development, as well as the acquisition of NextWindow. Also, the strengthening in the value of the Canadian dollar compared to the U.S. dollar contributed approximately $3.1 million of the increase.

Depreciation and Amortization

Depreciation and amortization of property and equipment increased by $6.9 million from $15.9 million in fiscal 2010 to $22.8 million in fiscal 2011. This reflects higher depreciation from our continued investment in systems to support our business growth.

Amortization of intangible assets reflects amortization of $9.0 million on $50.1 million of intangible assets recorded upon the acquisition of NextWindow on April 21, 2010. The weighted average amortization period for the intangible assets is 5.6 years.

Non-Operating Expenses

Interest Expense

Interest expense declined by $33.3 million, or 51.3%, from $64.9 million in fiscal 2010 to $31.6 million in fiscal 2011. Interest expense declined as a result of the 2010 Reorganization which resulted in the conversion of the shareholder note payable and cumulative preferred shares into equity during the first quarter of fiscal 2011, as well as the debt repayments made in the last three quarters of fiscal 2011.

Foreign Exchange Gain

Foreign exchange gains decreased by $81.3 million, from $91.8 million in fiscal 2010 to $10.5 million in fiscal 2011. Foreign exchange gains and losses have primarily resulted from the conversion of our U.S. dollar-denominated long-term debt into our functional currency of Canadian dollars. From March 31, 2010 to March 31, 2011, the U.S. dollar weakened

15

by approximately 4.5% against the Canadian dollar from CDN$1.0158 to CDN$0.9696, resulting in an unrealized foreign exchange gain on our U.S. dollar-denominated debt of $10.4 million in the year. This compares to a $105.7 million gain reported in fiscal 2010 when the U.S. dollar weakened by approximately 19.5% compared to the Canadian dollar. Although U.S. dollar-denominated debt continued to be a key driver of foreign exchange gains and losses, the debt repayments in fiscal 2011 and the year-over-year increase in U.S. dollar-denominated cash and accounts receivable significantly offset the impact of the revaluation of U.S. dollar-denominated debt.

Provision for Income Taxes

Income tax expense increased by $17.0 million from $18.3 million in fiscal 2010 to $35.3 million in fiscal 2011. Our tax provision is weighted towards Canadian income tax rates as substantially all our taxable income is Canadian-based. In calculating the tax provision we adjust income before income taxes by the unrealized foreign exchange loss (gain) from the revaluation of the U.S. dollar-denominated debt. This is treated as a capital item for income tax purposes. We take a valuation allowance if the conversion of external U.S. dollar-denominated debt is in a net foreign exchange loss position due to the uncertainty that we will be able to utilize the capital loss in the future. The increase in income tax expense in fiscal 2011 compared to fiscal 2010 was due to a reduction in the valuation allowance against unrealized capital losses on U.S. dollar-denominated debt and utilization of non-capital losses occurring in fiscal 2010. The tax provision also includes investment tax credits for fiscal 2011 and fiscal 2010 of $4.4 million and $4.6 million, respectively.

Net Income

Net income decreased by $72.6 million from $142.0 million in fiscal 2010 to $69.4 million in fiscal 2011. This change was due to the increase in gross margin of $69.4 million and decrease in interest expense of $33.3 million, offset by an increase in operating expenses of $77.3 million, income taxes of $17.0 million and the impact of the volatility of the U.S. dollar relative to the Canadian dollar on our U.S. dollar-denominated debt, which resulted in an $81.3 million decrease in year-over-year foreign exchange gains.

Adjusted EBITDA

Adjusted EBITDA increased by $19.5 million, or 11.7%, from $166.3 million in fiscal 2010 to $185.8 million in fiscal 2011 due to continued revenue growth in the adoption of interactive displays and related attachment products. This was offset by a negative foreign exchange impact of approximately $17.7 million as a result of the year-over-year strengthening of the Canadian dollar relative to the U.S. dollar.

Stock-based Compensation

In June 2010, we implemented an Equity Incentive Plan which provides for the grant of options, restricted share units and deferred share units to directors, officers, employees, consultants and service providers of the Company and its subsidiaries. During fiscal 2011, we granted 1,444,500 stock options to purchase an equivalent number of the Company’s Class A Subordinate Voting Shares at a weighted average exercise price of $16.22. Of these options, 1,140,000 were granted on July 15, 2010, in conjunction with our IPO, at an exercise price of $17.00. These options will vest over various periods ranging between three and four years.

In August 2010, the Board of Directors approved a change to the Participant Equity Loan Plan (the “Plan”) whereby 40% of performance-based Class A Subordinate Voting Shares that did not become unrestricted as part of the IPO transaction on July 20, 2010, representing 24% of total shares under the Plan, which become unrestricted in two equal installments on each of the next two anniversary dates of the IPO. This was treated as a change in the Plan for accounting purposes.

16

Selected Quarterly Financial Data

The following tables set forth the Company’s unaudited quarterly consolidated statements of operations, reconciliation of net (loss) income to Adjusted EBITDA and reconciliation to Adjusted Net Income for each of the eight most recent quarters. The information in the table below has been derived from our unaudited interim consolidated financial statements. Our quarterly operating results have varied substantially in the past and may vary substantially in the future. Accordingly, the information below is not necessarily indicative of future results. Data for the periods are indicated in millions of dollars, except for shares, per share amounts, units and average selling prices.

| | | 000000 | | | | 000000 | | | | 000000 | | | | 000000 | | | | 000000 | | | | 000000 | | | | 000000 | | | | 000000 | |

| | | Fiscal Year 2012 | | | Fiscal Year 2011 | |

| | | Fourth

Quarter | | | Third

Quarter | | | Second

Quarter | | | First

Quarter | | | Fourth

Quarter | | | Third

Quarter | | | Second

Quarter | | | First

Quarter | |

Consolidated Statements of Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 148.0 | | | $ | 185.1 | | | $ | 210.3 | | | $ | 202.4 | | | $ | 167.3 | | | $ | 180.9 | | | $ | 222.7 | | | $ | 219.2 | |

Cost of sales | | | 89.2 | | | | 105.6 | | | | 113.3 | | | | 102.1 | | | | 89.6 | | | | 94.5 | | | | 106.6 | | | | 108.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross margin | | | 58.8 | | | | 79.5 | | | | 97.0 | | | | 100.3 | | | | 77.7 | | | | 86.4 | | | | 116.1 | | | | 110.7 | |

Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Selling, marketing and administration | | | 46.0 | | | | 43.7 | | | | 42.6 | | | | 46.0 | | | | 51.6 | | | | 45.4 | | | | 41.4 | | | | 41.7 | |

Research and development | | | 13.2 | | | | 12.7 | | | | 12.4 | | | | 13.5 | | | | 15.2 | | | | 13.9 | | | | 12.7 | | | | 11.9 | |

Depreciation and amortization | | | 7.9 | | | | 7.6 | | | | 7.7 | | | | 7.6 | | | | 7.9 | | | | 7.2 | | | | 8.1 | | | | 8.6 | |

Restructuring costs | | | 0.2 | | | | 8.7 | | | | 4.5 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (8.5 | ) | | | 6.8 | | | | 29.8 | | | | 33.2 | | | | 3.0 | | | | 19.9 | | | | 53.9 | | | | 48.5 | |

Non-operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other income, net | | | (0.1 | ) | | | (0.2 | ) | | | (0.1 | ) | | | (0.1 | ) | | | (0.1 | ) | | | (0.1 | ) | | | (0.1 | ) | | | (0.2 | ) |

Interest expense | | | 3.5 | | | | 2.9 | | | | 4.1 | | | | 4.1 | | | | 4.8 | | | | 5.3 | | | | 8.0 | | | | 13.5 | |

Foreign exchange (gain) loss | | | (5.6 | ) | | | (7.3 | ) | | | 22.7 | | | | (1.3 | ) | | | (13.6 | ) | | | (3.2 | ) | | | (14.7 | ) | | | 21.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income before income taxes | | | (6.3 | ) | | | 11.4 | | | | 3.1 | | | | 30.5 | | | | 11.9 | | | | 17.9 | | | | 60.7 | | | | 14.2 | |

Income tax (recovery) expense | | | (3.6 | ) | | | 0.5 | | | | 2.5 | | | | 7.5 | | | | 4.3 | | | | 5.4 | | | | 16.4 | | | | 9.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (2.7 | ) | | $ | 10.9 | | | $ | 0.6 | | | $ | 23.0 | | | $ | 7.6 | | | $ | 12.5 | | | $ | 44.3 | | | $ | 5.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Certain reclassifications have been made to prior periods’ figures to conform to the current period’s presentation. | |

| | |

| | | Fiscal Year 2012 | | | Fiscal Year 2011 | |

| | | Fourth

Quarter | | | Third

Quarter | | | Second

Quarter | | | First

Quarter | | | Fourth

Quarter | | | Third

Quarter | | | Second

Quarter | | | First

Quarter | |

Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (2.7 | ) | | $ | 10.9 | | | $ | 0.6 | | | $ | 23.0 | | | $ | 7.6 | | | $ | 12.5 | | | $ | 44.3 | | | $ | 5.0 | |

Income tax (recovery) expense | | | (3.6 | ) | | | 0.5 | | | | 2.5 | | | | 7.5 | | | | 4.3 | | | | 5.4 | | | | 16.4 | | | | 9.2 | |

Depreciation in cost of sales | | | 1.0 | | | | 1.0 | | | | 0.9 | | | | 0.9 | | | | 0.9 | | | | 0.9 | | | | 0.5 | | | | 1.8 | |

Depreciation and amortization | | | 7.9 | | | | 7.6 | | | | 7.7 | | | | 7.6 | | | | 7.9 | | | | 7.2 | | | | 8.1 | | | | 8.6 | |

Interest expense | | | 3.5 | | | | 2.9 | | | | 4.1 | | | | 4.1 | | | | 4.8 | | | | 5.3 | | | | 8.0 | | | | 13.5 | |

Foreign exchange (gain) loss | | | (5.6 | ) | | | (7.3 | ) | | | 22.7 | | | | (1.3 | ) | | | (13.6 | ) | | | (3.2 | ) | | | (14.7 | ) | | | 21.0 | |

Change in deferred revenue(1) | | | 0.3 | | | | 2.9 | | | | 3.4 | | | | 2.0 | | | | 1.5 | | | | 2.2 | | | | 5.4 | | | | 5.7 | |

Stock-based compensation | | | 1.0 | | | | 1.8 | | | | 2.1 | | | | 3.5 | | | | 3.1 | | | | 3.8 | | | | 1.8 | | | | — | |

Acquisition costs | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0.1 | | | | 1.0 | |

Costs of restructuring(2) | | | — | | | | 9.0 | | | | 5.6 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Other income, net | | | (0.1 | ) | | | (0.2 | ) | | | (0.1 | ) | | | (0.1 | ) | | | (0.1 | ) | | | (0.1 | ) | | | (0.1 | ) | | | (0.2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA(3) | | $ | 1.7 | | | $ | 29.1 | | | $ | 49.5 | | | $ | 47.2 | | | $ | 16.4 | | | $ | 34.0 | | | $ | 69.8 | | | $ | 65.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Change in deferred revenue is calculated as the difference between deferred revenue and deferred revenue recognized. In accordance with our revenue recognition policy, deferred revenue represents the portion of our sales that we do not recognize in the period. Deferred revenue recognized represents the portion of our revenue deferred in a prior period that we recognized in the current period. |

| (2) | Includes restructuring costs of $13.4 million disclosed in the Company’s consolidated statements of operations in fiscal 2012 and $1.2 million in raw materials inventory write-offs in fiscal 2012 related to product lines that were discontinued at the Ottawa facility in connection with the restructuring activities. |

| (3) | Adjusted EBITDA is a non-GAAP measure and is not a substitute for the GAAP equivalent. |

17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year 2012 | | | Fiscal Year 2011 | |

| | | Fourth

Quarter | | | Third

Quarter | | | Second

Quarter | | | First

Quarter | | | Fourth

Quarter | | | Third

Quarter | | | Second

Quarter | | | First

Quarter | |

Adjusted Net (Loss) Income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (2.7 | ) | | $ | 10.9 | | | $ | 0.6 | | | $ | 23.0 | | | $ | 7.6 | | | $ | 12.5 | | | $ | 44.3 | | | $ | 5.0 | |

Adjustments to net (loss) income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amortization of intangible assets | | | 2.4 | | | | 2.4 | | | | 2.4 | | | | 2.4 | | | | 2.4 | | | | 2.4 | | | | 2.4 | | | | 1.8 | |

Foreign exchange (gain) loss | | | (5.6 | ) | | | (7.3 | ) | | | 22.7 | | | | (1.3 | ) | | | (13.6 | ) | | | (3.2 | ) | | | (14.7 | ) | | | 21.0 | |

Change in deferred revenue(1) | | | 0.3 | | | | 2.9 | | | | 3.4 | | | | 2.0 | | | | 1.5 | | | | 2.2 | | | | 5.4 | | | | 5.7 | |

Stock-based compensation | | | 1.0 | | | | 1.8 | | | | 2.1 | | | | 3.5 | | | | 3.1 | | | | 3.8 | | | | 1.8 | | | | — | |

Acquisition costs | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0.1 | | | | 1.0 | |

Costs of restructuring(2) | | | — | | | | 9.0 | | | | 5.6 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (1.9 | ) | | | 8.8 | | | | 36.2 | | | | 6.6 | | | | (6.6 | ) | | | 5.2 | | | | (5.0 | ) | | | 29.5 | |

Tax impact on adjustments(3) | | | 0.5 | | | | 3.0 | | | | 5.6 | | | | 1.8 | | | | 0.2 | | | | 1.8 | | | | 0.6 | | | | 4.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjustments to net (loss) income, net of tax | | | (2.4 | ) | | | 5.8 | | | | 30.6 | | | | 4.8 | | | | (6.8 | ) | | | 3.4 | | | | (5.6 | ) | | | 25.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Net (Loss) Income(4) | | $ | (5.1 | ) | | $ | 16.7 | | | $ | 31.2 | | | $ | 27.8 | | | $ | 0.8 | | | $ | 15.9 | | | $ | 38.7 | | | $ | 30.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Adjusted Net (Loss) Income per share | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted-average number of shares outstanding (000’s) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 121,445 | | | | 122,033 | | | | 123,652 | | | | 123,773 | | | | 123,773 | | | | 123,773 | | | | 116,545 | | | | 159,167 | |

Diluted | | | 121,445 | | | | 122,693 | | | | 124,331 | | | | 124,452 | | | | 123,773 | | | | 123,773 | | | | 116,545 | | | | 159,167 | |

| | | | | | | | |

(Loss) earnings per share – basic and diluted | | $ | (0.02 | ) | | $ | 0.09 | | | $ | 0.00 | | | $ | 0.19 | | | $ | 0.06 | | | $ | 0.10 | | | $ | 0.38 | | | $ | 0.03 | |

Adjustments to net (loss) income, net of tax, per share | | | (0.02 | ) | | | 0.05 | | | | 0.25 | | | | 0.03 | | | | (0.05 | ) | | | 0.03 | | | | (0.05 | ) | | | 0.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Net (Loss) Income per share | | $ | (0.04 | ) | | $ | 0.14 | | | $ | 0.25 | | | $ | 0.22 | | | $ | 0.01 | | | $ | 0.13 | | | $ | 0.33 | | | $ | 0.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Total number of interactive displays sold(5) | | | 81,716 | | | | 100,898 | | | | 111,008 | | | | 101,479 | | | | 86,717 | | | | 93,362 | | | | 122,400 | | | | 120,911 | |

Average selling price of interactive displays sold(6) | | $ | 1,322 | | | $ | 1,400 | | | $ | 1,430 | | | $ | 1,532 | | | $ | 1,432 | | | $ | 1,465 | | | $ | 1,403 | | | $ | 1,402 | |

| (1) | Change in deferred revenue is calculated as the difference between deferred revenue and deferred revenue recognized. In accordance with our revenue recognition policy, deferred revenue represents the portion of our sales that we do not recognize in the period. Deferred revenue recognized represents the portion of our revenue deferred in a prior period that we recognized in the current period. |