Exhibit 99.2

SMART Technologies Inc.

NOTICE OF ANNUAL GENERAL AND SPECIAL

MEETING TO BE HELD ON

AUGUST 7, 2014

AND

MANAGEMENT INFORMATION CIRCULAR

June 30, 2014

SMART Technologies Inc.

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF THE SHAREHOLDERS

TAKE NOTICE THAT an Annual General and Special Meeting (the “Meeting”) of the shareholders (“Shareholders”) of SMART Technologies Inc. (the “Corporation”) will be held at the offices of the Corporation located at 3636 Research Road NW, Calgary, Alberta T2L 1Y1, at 11:00 A.M. (MDT) on Thursday, August 7, 2014 for the following purposes:

| 1. | to receive and consider the financial statements of the Corporation as at and for the fiscal year ended March 31, 2014, together with the report of the auditors thereon; |

| 2. | to elect Neil Gaydon, Gary Hughes, Ian McKinnon, Michael J. Mueller and Robert C. Hagerty as the directors of the Corporation for the ensuing year; |

| 3. | to amend the articles of the Corporation to redesignate the class A subordinate voting shares of the Corporation as common shares and to cancel the class B shares of the Corporation as further described in the management information circular dated June 30, 2014 accompanying this notice (the “Information Circular”); |

| 4. | to appoint KPMG LLP, Chartered Accountants as the auditors of the Corporation for the ensuing year and to authorize the directors of the Corporation to determine the remuneration to be paid to the auditors; and |

| 5. | to transact such other business as may properly come before the Meeting. |

Information relating to matters to be acted upon by the Shareholders at the Meeting is set forth in the accompanying Information Circular.

A Shareholder may attend the Meeting in person or may be represented at the Meeting by proxy. Shareholders who are unable to attend the Meeting in person and wish to be represented by proxy are requested to date, sign and return the accompanying instrument of proxy, or other appropriate form of proxy, in accordance with the instructions set forth in the accompanying Information Circular and instrument of proxy. Shareholders who cannot attend the Meeting may vote by mail, by using the internet or by telephone. See the accompanying Information Circular for information on how to vote. An instrument of proxy will not be valid unless it is received by Computershare Trust Company of Canada (“Computershare”) not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the province of Alberta) before the time of the Meeting, or any adjournment thereof. A person appointed as proxy holder need not be a Shareholder of the Corporation.

Only Shareholders of record as at the close of business on June 20, 2014 are entitled to receive notice of the Meeting.

This year, as described in the notice and access notification mailed to beneficial Shareholders of the Corporation, the Corporation has decided to deliver the Information Circular to beneficial Shareholders by posting the Information Circular on the following website: http://materials.proxyvote.com/83172R. The use of this alternative means of delivery is more environmentally friendly as it will help reduce paper use and it will also reduce the Corporation’s printing and mailing costs. The Information Circular will also be available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. The Information Circular will be mailed to registered Shareholders.

SHAREHOLDERS ARE CAUTIONED THAT THE USE OF THE MAIL TO TRANSMIT PROXIES IS AT EACH SHAREHOLDER’S RISK.

DATED at Calgary, Alberta as of the 30th day of June, 2014.

BY ORDER OF THE BOARD OF DIRECTORS

(signed) “Michael J. Mueller”

Chairman

1

SMART Technologies Inc.

Management Information Circular

TABLE OF CONTENTS

2

3

SMART Technologies Inc.

Management Information Circular

Dated June 30, 2014

INFORMATION REGARDING PROXIES AND VOTING AT THE MEETING

Solicitation of Proxies

This management information circular (the “Information Circular”) is furnished in connection with the solicitation of proxiesby and on behalf of management of SMART Technologies Inc. (the “Corporation”) for use at the annual general and special meeting (the “Meeting”) of holders (“Shareholders”) of class A subordinate voting shares (the “Class A Shares”) of the Corporation to be held at the offices of the Corporation, 3636 Research Road N.W., Calgary, Alberta T2L 1Y1, at 11:00 A.M. (MDT) on Thursday, August 7, 2014 for the purposes set forth in the notice of annual general and special meeting (the “Notice”) accompanying this Information Circular. Solicitation of proxies will be primarily by mail, but may also be undertaken by way of telephone, facsimile or oral communication by one or more members of the board of directors (the “Board”), officers or regular employees of the Corporation, at no additional compensation. Costs associated with the solicitation of proxies will be borne by the Corporation.

Appointment of Proxy Holders

Accompanying this Information Circular is an instrument of proxy (“Instrument of Proxy”) for use at the Meeting. A Shareholder may vote by proxy in one of the following ways:

| | (i) | by mailing or delivering the signed form of proxy to Computershare Trust Company of Canada, Proxy Department at 100 University Avenue – 8th Floor, Toronto, ON M5J 2Y1; |

| | (ii) | by using the internet at www.investorvote.com; or |

| | (iii) | for shareholders in Canada and the United States, by calling the following toll-free number: 1-866-732-VOTE (8683). |

In order to be valid, Instruments of Proxy must be received by Computershare Trust Company of Canada not less than 48 hours (excluding Saturdays, Sundays and statutory holidays in the province of Alberta) prior to the time set for the Meeting or any adjournment thereof.

The persons designated in the Instrument of Proxy are officers and/or directors of the Corporation.A Shareholder has the right to appoint a person (who need not be a Shareholder) other than the persons designated in the accompanying Instrument of Proxy, to attend at and represent the Shareholder at the Meeting.To exercise this right, a Shareholder should insert the name of the designated representative in the blank space provided on the Instrument of Proxy and strike out the names of management’s nominees. Alternatively, a Shareholder may complete another appropriate Instrument of Proxy.

Signing of the Instrument of Proxy

The Instrument of Proxy must be signed by the Shareholder or the Shareholder’s duly appointed attorney authorized in writing or, if the Shareholder is a corporation, under its corporate seal or by a duly authorized officer or attorney of the Corporation. An Instrument of Proxy signed by a person acting as attorney or in some other representative capacity (including a representative of a corporate Shareholder) should indicate that person’s

4

capacity (following his or her signature) and should be accompanied by the appropriate instrument evidencing qualification and authority to act (unless such instrument has previously been filed with the Corporation).

Revocability of Proxies

A Shareholder who has submitted an Instrument of Proxy may revoke it at any time prior to the exercise thereof. In addition to any manner permitted by law, a proxy may be revoked by instrument in writing executed by the Shareholder or by his or her duly authorized attorney or, if the Shareholder is a corporation, under its corporate seal or executed by a duly authorized officer or attorney of the corporation and deposited either: (i) at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournments thereof, at which the Instrument of Proxy is to be used; or (ii) with the Chairman of the Meeting on the day of the Meeting, or any adjournment thereof. In addition, an Instrument of Proxy may be revoked: (i) by the Shareholder personally attending the Meeting and voting the securities represented thereby or, if the Shareholder is a corporation, by a duly authorized representative of the corporation attending at the Meeting and voting such securities; or (ii) in any other manner permitted by law.

Voting of Proxies and Exercise of Discretion by Proxy Holders

All Class A Shares represented at the Meeting by properly executed proxies will be voted on any ballot that may be called for and, where a choice with respect to any matter to be acted upon has been specified in the Instrument of Proxy, the Class A Shares represented by the Instrument of Proxy will be voted in accordance with such instructions. The management designees named in the accompanying Instrument of Proxy will vote or withhold from voting the Class A Shares in respect of which they are appointed in accordance with the direction of the Shareholder appointing him or her on any ballot that may be called for at the Meeting.In the absence of such direction, such Class A Shares will be voted “FOR” the proposed resolutions at the Meeting. The accompanying Instrument of Proxy confers discretionary authority upon the persons named therein with respect to amendments of or variations to the matters identified in the accompanying Notice and with respect to other matters that may properly be brought before the Meeting. In the event that amendments or variations to matters identified in the Notice are properly brought before the Meeting or any other business is properly brought before the Meeting, it is the intention of the management designees to vote in accordance with their best judgment on such matters or business. At the time of printing this Information Circular, the management of the Corporation knows of no such amendment, variation or other matter to come before the Meeting other than the matters referred to in the accompanying Notice.

General

All monetary sums set forth in this Information Circular are in U.S. dollars unless otherwise specified.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED ON

Except as disclosed in this Information Circular, none of the directors or executive officers of the Corporation at any time since the beginning of the Corporation’s last fiscal year, nor any proposed nominee for election as a director of the Corporation, nor any associate or affiliate of any of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise in any matter to be acted on, other than the election of directors.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

Voting Shares and Record Date

The authorized share capital of the Corporation consists of an unlimited number of Class A Shares, an unlimited number of class B shares (“Class B Shares”) and an unlimited number of preferred shares (the “Preferred

5

Shares”) issuable in series. The record date for the determination of Shareholders entitled to receive notice of and to vote at the Meeting is June 20, 2014 (the “Record Date”). As at the Record Date, there were 121,924,928 Class A Shares, no Class B Shares and no Preferred Shares issued and outstanding.

Class A Subordinate Voting Shares, Class B Shares and Preferred Shares

Except as otherwise described herein, the Class A Shares and Class B Shares are equal in all respects and will be treated as shares of a single class.

Each holder of Class B Shares and each holder of Class A Shares is entitled to receive notice of and attend all meetings of Shareholders, except meetings at which only holders of another particular class or series have the right to vote. At each such meeting, each Class B Share entitles its holder to 10 votes and each Class A Share entitles its holder to one vote, voting together as a single class.

In accordance with the provisions of the Corporation’s articles and share provisions, all of the outstanding Class B Shares automatically converted into single vote Class A Shares on April 17, 2014 commensurate with the resignations of David Martin and Nancy Knowlton from the Board. At the Meeting, Shareholders will be asked to consider and, if deemed appropriate, approve a special resolution amending the articles of the Corporation to redesignate the Class A Shares as common shares and to cancel the Class B Shares of the Corporation. See “Particulars of Matters to be Acted Upon – Amendments to the Articles”.

More information regarding the Class A Shares, Class B Shares and Preferred Shares is disclosed in the Annual Information Form of the Corporation for the fiscal year ended March 31, 2014 (“AIF”), which is incorporated by reference into this Information Circular and forms an integral part thereof. The AIF is available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and is also available on EDGAR at www.sec.gov (as an exhibit to the Form 40-F filed by the Corporation on May 15, 2014). Upon request, the Corporation will promptly provide a copy of the AIF free of charge to any Shareholder of the Corporation.

Voting of Shares – General

Only Shareholders whose names are entered in the Corporation’s register of shareholders at the close of business on the Record Date and holders of Class A Shares issued by the Corporation after the Record Date and prior to the Meeting will be entitled to receive notice of and to vote at the Meeting, provided that, to the extent that: (i) a registered Shareholder has transferred the ownership of any Class A Shares subsequent to the Record Date; and (ii) the transferee of those Class A Shares produces properly endorsed share certificates, or otherwise establishes that he or she owns the Class A Shares and demands, not later than ten days before the Meeting, that his or her name be included on the Shareholder list before the Meeting, in which case the transferee shall be entitled to vote his or her Class A Shares at the Meeting.

Voting of Class A Shares – Advice to Non-Registered Holders

Only registered holders of Class A Shares, or the persons they appoint as their proxies, are permitted to attend and vote at the Meeting. However, in many cases, Class A Shares beneficially owned by a holder (a “Non-Registered Holder”) are registered either:

| | (a) | in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the Class A Shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or |

| | (b) | in the name of a clearing agency (such as The Canadian Depository for Securities Limited). |

The Corporation is not forwarding its proxy-related materials directly to non-objecting beneficial holders. In accordance with the requirements of National Instrument 54-101 –Communication with Beneficial Owners of

6

Securities of a Reporting Issuer(“NI 54-101”), the Corporation intends to pay for Intermediaries to forward the proxy-related materials and the voting instruction form to objecting beneficial owners.

Applicable Canadian regulatory policies require Intermediaries to seek voting instructions from Non-Registered Holders in advance of shareholders’ meetings. Every Intermediary has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Non-Registered Holders in order to ensure that their Class A Shares are voted at the Meeting. Often, the voting instruction form supplied to a Non-Registered Holder by its Intermediary (or the agent of the Intermediary) is very similar or even identical to the Instrument of Proxy provided by the Corporation to registered shareholders. However, its purpose is limited to instructing the registered Shareholder (the Intermediary or agent of the Intermediary) how to vote on behalf of the Non-Registered Holder. In Canada, the majority of Intermediaries now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”). In most cases, Broadridge mails a scannable voting instruction form in lieu of the Instrument of Proxy provided by the Corporation and asks Non-Registered Holders to return the voting instruction form to Broadridge or otherwise communicate voting instructions to Broadridge (by way of telephone or the Internet, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Class A Shares to be represented at the Meeting.A Non-Registered Holder receiving a proxy or voting instruction form from Broadridge cannot use that form to vote Class A Shares directly at the Meeting, rather the form must be returned to Broadridge or, alternatively, instructions must be received by Broadridge well in advance of the Meeting in order to have the Class A Shares voted. If you have any questions respecting the voting of your Class A Shares held through an Intermediary, please contact that Intermediary for assistance.

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Class A Shares they beneficially own. Should a Non-Registered Holder wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should strike out the names of the persons named in the proxy and insert the Non-Registered Holder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediaries and their service companies.

Only registered Shareholders have the right to revoke a proxy. Non-Registered Holders who wish to change their vote must in sufficient time in advance of the Meeting, arrange for their respective Intermediaries to change their vote and if necessary revoke their proxy in accordance with the revocation procedures set out above.

Notice-and-Access

NI 54-101 and National Instrument 51-102 –Continuous Disclosure Obligationsallow for the use of a “notice-and-access” regime for the delivery of proxy-related materials.

Under the notice-and-access regime, reporting issuers are permitted to deliver proxy-related materials by posting them on SEDAR as well as a website other than SEDAR and sending shareholders a notice package that includes: (i) the voting instruction form; (ii) basic information about the meeting and the matters to be voted on; (iii) instructions on how to obtain a paper copy of the materials; and (iv) a plain-language explanation of how the new notice-and-access system operates and how the materials can be accessed online. Where prior consent has been obtained, a reporting issuer can send this notice package to shareholders electronically. This notice package must be mailed to shareholders from whom consent to electronic delivery has not been received.

The Corporation has elected to send its Information Circular to beneficial Shareholders using the notice-and-access regime. Accordingly, the Corporation will send the above-mentioned notice package to beneficial Shareholders which includes instructions on how to access the Corporation’s Information Circular online and how to request a paper copy of the Information Circular. Distribution of the Corporation’s Information Circular

7

pursuant to the notice-and-access regime has the potential to substantially reduce printing and mailing costs and reduce our impact on the environment.

Notwithstanding the notice-and-access regime, Alberta’sBusiness Corporations Act (“ABCA”) requires the Corporation to: (i) deliver a paper copy of its annual financial statements to a registered Shareholder unless such registered Shareholder informs the Corporation in writing that it does not want a copy of the annual financial statements or provides written consent to electronic delivery; and (ii) deliver a paper copy of the Information Circular to a registered Shareholder unless such Shareholder provides written consent to electronic delivery. In order to ensure compliance with the ABCA, registered Shareholders who have not yet consented to electronic delivery will be mailed a copy of the Information Circular.

Principal Holders of Shares

The following table sets forth, to the best of the knowledge of the directors and executive officers of the Corporation, as at June 20, 2014, the only persons, corporations or other entities (other than securities depositories) who beneficially own, directly or indirectly, or exercise control or discretion over voting securities carrying more than 10% of the voting rights attached to the Class A Shares of the Corporation.

| | | | | | | | | | | | | | |

Name and Address of Beneficial Owner | | Type of

Ownership | | Number of Class

A Shares(1) | | | Percentage of

Share Capital | | | Percentage of

Voting Power | |

Entities related to and Funds advised or managed by Apax Partners(2) | | Direct | | | 37,658,083 | | | | 30.9 | % | | | 30.9 | % |

Intel Corporation(3) | | Direct | | | 17,466,633 | | | | 14.3 | % | | | 14.3 | % |

David Martin(4) | | Direct and

Indirect | | | 27,876,704 | | | | 22.9 | % | | | 22.9 | % |

Nancy Knowlton(4) | | Direct and

Indirect | | | 27,875,704 | | | | 22.9 | % | | | 22.9 | % |

NOTES:

| (1) | In accordance with the provisions of the Corporation’s articles and share provisions, all of the issued and outstanding Class B Shares automatically converted into single vote Class A Shares, such conversion being effective commensurate with the resignations of David Martin and Nancy Knowlton from the Board on April 17, 2014. |

| (2) | Represents Class A Shares beneficially owned by PCV Belge SCS, which is advised by Apax Partners L.P. and Apax Europe V (a collective of 9 partnerships comprised of Apax Europe V – A, L.P., Apax Europe V – B, L.P., Apax Europe V C GmbH & Co. KG, Apax Europe V – D, L.P., Apax Europe V – E, L.P., Apax Europe V – F, C.V., Apax Europe V – G, C.V., Apax Europe V – 1, LP and Apax Europe V – 2, LP), which is managed by Apax Partners LLP. Apax US VII, L.P. and Apax Europe V (collectively, “Apax Partners”) each disclaim beneficial ownership of the Shares held by the other. The address of Apax Partners LLP is 33 Jermyn Street, London, UK, SW1Y 6DN. |

| (3) | The address of Intel Corporation (“Intel”) is 2200 Mission College Boulevard, Santa Clara, California. |

| (4) | 502,333 Class A Shares are held directly by Mr. Martin and 501,333 Class A Shares are held directly by Ms. Knowlton. 27,374,371 Class A Shares are owned by IFF Holdings Inc. (“IFF”), a corporation with respect to which David Martin and Nancy Knowlton own 100% of the securities directly or indirectly. Mr. Martin and Ms. Knowlton are married to each other and as such Mr. Martin and Ms. Knowlton may each be deemed to be beneficial owners or to have control and direction over all of the Class A Shares owned by IFF. The address for Mr. Martin, Ms. Knowlton and IFF is c/o Byye Management Inc., PO Box 21039 Dominion, Calgary, AB T2P 4H5 Canada. |

8

PARTICULARS OF MATTERS TO BE ACTED UPON

Financial Statements

The audited financial statements for the Corporation for the fiscal year ended March 31, 2014, together with the report of the auditors thereon will be presented to the Shareholders at the Meeting.

Election of Directors

Management proposes to nominate at the Meeting the persons whose names are set forth in the table below to serve as directors of the Corporation until the next meeting of Shareholders at which the election of directors is considered, or until their successors are elected or appointed.Unless directed otherwise, the persons named in the accompanying Instrument of Proxy intend to vote FOR the election of such persons at the Meeting. Management does not contemplate that any of the nominees will be unable to serve as a director of the Corporation.

The following table and the notes thereto state the names of all persons proposed by management to be nominated for election as directors of the Corporation at the Meeting, their principal occupation or employment within the five preceding years, the period during which they have been directors of the Corporation, and their shareholdings, including the number of voting securities of the Corporation beneficially owned, directly or indirectly, or over which control or direction is exercised by each of them.

In the event that a vacancy occurs because of death or for any reason prior to the Meeting, the proxy shall not be voted with respect to the filling of the vacancy.

| | | | | | |

Name and Residence | | Class A Shares | | Offices Held and Time as

Director | | Principal Occupation |

Gary Hughes Scotland, UK | | Nil(6) | | Director since December 2013 | | Operating Executive, APAX Partners LLP; Corporate Director. |

| | | |

Ian McKinnon(1)(2)(3)(4) Ontario, Canada | | Nil(7) | | Director since August 2013 | | Corporate Director. |

| | | |

Neil Gaydon Alberta, Canada | | 51,166 | | President and Chief Executive Officer Director since February 2013 | | Director and President and Chief Executive Officer of the Corporation; Director and Chief Executive Officer of Pace PLC. |

| | | |

Michael J. Mueller(1)(2)(3)(4)(5) Ontario, Canada | | 50,000(8) | | Director since July 2010 | | Corporate Director. |

| | | |

Robert C. Hagerty(1)(2)(3)(4)(5) California, U.S.A. | | Nil(9) | | Director since July 2010 | | Since September 2011, CEO and Director of iControl Networks, Inc. Served at Polycom, Inc. in various executive capacities and as an advisor from 1997 through 2011 including Chairman, Director, President and CEO. |

NOTES:

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Corporate Governance and Nominating Committee. |

| (5) | On April 17, 2014, following the resignations of David Martin and Nancy Knowlton from the Board, Mr. Hagerty was appointed by the Board as Acting Chairman of the Board. Effective May 15, 2014, Mr. Mueller was appointed Chairman of the Board. |

9

| (6) | 37,658,083 Class A Shares are beneficially owned by funds advised or managed by Apax Partners LLP and by PCV Belge SCS, an entity related to Apax Partners LLP. Mr. Hughes was appointed a director on December 1, 2013 and is an Operating Executive at Apax Partners LLP but disclaims beneficial ownership of these Class A Shares. |

| (7) | Mr. McKinnon became a director on August 26, 2013. He was awarded 21,250 deferred share units on November 7, 2013 and 14,742 deferred share units on May 15, 2014. |

| (8) | Mr. Mueller has voting and dispositive power over 50,000 Class A Shares. He has options to acquire 20,000 Class A Shares at an exercise price of $17.00 per Class A Share. He was awarded 10,000 deferred share units on June 22, 2011; 10,000 deferred share units on June 18, 2012; 21,250 deferred share units on November 7, 2013 and 14,742 deferred share units on May 15, 2014. |

| (9) | Mr. Hagerty has options to acquire 20,000 Class A Shares at an exercise price of $17.00 per Class A Share. He was awarded 10,000 deferred share units on June 22, 2011; 10,000 deferred share units on June 18, 2012; 21,250 deferred share units on November 7, 2013 and 14,742 deferred share units on May 15, 2014. |

| (10) | Information in the above table is as of June 20, 2014. On April 17, 2014, concurrent with the resignations of David Martin and Nancy Knowlton as directors of the Corporation, all Class B Shares converted on a one-to-one basis into Class A Shares. |

The information as to voting securities beneficially owned, directly or indirectly, is based upon information furnished by the respective nominees.

With the decision of Mr. Martin and Ms. Knowlton to resign from the Board effective April 17, 2014, the Board, after giving consideration to the experience and skillset of the remaining Board, the current business environment and strategic objectives of the Corporation and the desirability of having additional directors serve on the Board, determined that it intends to appoint one additional director. A search process overseen by the Corporate Governance & Nominating Committee has accordingly been recently commenced. To date, a list of qualified candidates is being generated and the Board will select the most suitable candidate and appoint such person as the additional director following the Meeting.

Other than disclosed herein, no proposed director is, as at the date of the Information Circular, or has been, within the last 10 years, a director or executive officer of any company (including the Corporation) that: (a) was the subject of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days (“Order”) that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; (b) was subject to an Order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or (c) within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

Mr. Hughes was a director of Gala Coral Group Limited from October 2008 to October 2011. In May 2010 Gala Coral Group Limited underwent a voluntary creditors’ approved liquidation in the United Kingdom.

Mr. McKinnon was a director of Empirical Inc., a TSX Venture Exchange listed company, from December 2007 until 2008. In January 2009, Empirical announced that it had entered into a standstill agreement with its creditors. The company’s assets were sold in February 2009, following which its shares were suspended from trading on the TSX Venture Exchange. Mr. McKinnon was a director and chair of the board of Adeptron Technologies Corporation, a TSX Venture listed company, from August 2011 to March 2012. In October 2011, Adeptron announced that it had entered into a business combination with Artaflex Inc. Following this announcement, the TSX Venture Exchange halted trading of Adeptron’s shares pending receipt and review of acceptable documentation from Adeptron in respect of the transaction. Trading of Adeptron’s shares resumed in February 2012.

10

No proposed director has within the last 10 years become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

The Corporation has not adopted a majority voting policy for the election of directors. To be elected, a majority of the votes cast must be in favor of the election of each nominee. The Board believes that a majority voting policy is unsuitable for the Corporation as it could put the Corporation at risk of losing directors with particular experience or expertise. The current process for the election of directors of the Corporation is compliant with corporate and securities laws, including the requirements of the Toronto Stock Exchange (the “TSX”).

Amendments to the Articles

In accordance with the provisions of the Corporation’s articles and share provisions, all of the issued and outstanding Class B Shares have automatically converted into single vote Class A Shares, such conversion being effective commensurate with the resignations of Mr. Martin and Ms. Knowlton from the Board on April 17, 2014. The Corporation no longer has any issued and outstanding Class B Shares that carry multiple voting privileges and under the Corporation’s articles and share provisions, no further Class B Shares are permitted to be issued by the Corporation.

At the Meeting, Shareholders will be asked to consider and, if deemed advisable, approve a special resolution (the “Special Resolution”) amending the articles (the “Articles”) of the Corporation (the “Article Amendment”) as follows:

| | • | | to redesignate the Class A Shares as common shares of the Corporation; and |

| | • | | to cancel the Class B Shares as a class so that the Corporation is no longer authorized to issue the Class B Shares; |

The resolution approving the Article Amendment must be approved by not less than 66 2⁄3% of the votes cast thereon by Shareholders represented in person or by proxy at the Meeting.Unless directed otherwise, the persons named in the accompanying Instrument of Proxy intend to vote FOR the approval of the Article Amendment. The text of the Special Resolution is set out below:

“BE IT RESOLVEDas a special resolution of the holders of shares of SMART Technologies Inc. (the “Corporation”) that:

| 1. | the articles of the Corporation (the “Articles”) be amended as follows: |

| | (a) | pursuant to Section 173(1)(e) of theBusiness Corporations Act(the “ABCA”), to redesignate the “Class A Subordinate Voting Shares” of the Corporation as “Common Shares” of the Corporation; and |

| | (b) | pursuant to Section 173(1)(h) of the ABCA, to cancel the “Class B Shares” of the Corporation as a class so that the Corporation is no longer authorized to issue Class B Shares; |

| 2. | the Articles, as amended, be restated pursuant to subsection 180(1) of the ABCA; |

| 3. | the Corporation is authorized to make all filings necessary for the issuance of certificates by the Registrar under the ABCA to give effect to this special resolution; |

| 4. | any director or officer of the Corporation is authorized and directed, for and in the name of and on behalf of the Corporation, to execute, or cause to be executed, whether under the corporate seal of the Corporation or otherwise, and to deliver or cause to be delivered all such other documents and instruments, and to do or cause to be done all such other acts and things as, in the opinion of such director or officer, may be necessary or desirable in order to carry out the intent of this special resolution, the execution of any such document or the doing of any such other act or thing being conclusive evidence of such determination; and |

11

| 5. | notwithstanding the foregoing, the directors of the Corporation are authorized to revoke this special resolution and not proceed with matters herein authorized, without further approval of the shareholders of the Corporation.” |

The text of the proposed amendment to the Articles and restated Articles will be available for review at the Meeting and upon request from the Corporation at (403) 245-0333.

Appointment of Auditors

Management is nominating KPMG LLP, Chartered Accountants, Calgary, Alberta, as auditors, to hold office until the next annual meeting and is requesting authorization for the directors to fix their remuneration. KPMG LLP has been the Corporation’s auditors since 1993 and has been the auditors of the Corporation since it became a public company in July 2010. The persons named in the accompanying Instrument of Proxy intend to vote for the appointment of KPMG LLP and the authorization for the directors to fix their remuneration at the Meeting, unless otherwise directed.

Other Business

Management knows of no amendment, variation or other matter to come before the Meeting other than the matters identified in the Notice of Meeting. However, if any other matter properly comes before the Meeting or any adjournment or postponement thereof, the Class A Shares subject to the Instrument of Proxy solicited hereunder will be voted on such matter in the discretion of and according to the best judgment of the proxyholder unless otherwise indicated on such Instrument of Proxy.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following discussion and analysis examines the compensation earned during the last financial year of the Corporation by the persons who acted as the Corporation’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) for any part of the fiscal year ended March 31, 2014 as well as each of the three other most highly compensated executive officers of the Corporation (collectively, the “NEOs”) earning more than $150,000 in total compensation for the fiscal year ended March 31, 2014.

Under the guidance of the Compensation Committee of the Board, the Corporation has taken a strategic approach in the design of its compensation program to ensure transparency and alignment with business objectives and performance. The Compensation Committee has adopted a philosophy of transparency in its compensation programs rewarding performance with competitive base salaries, annual performance and success-sharing bonuses and long-term incentive awards including the granting of stock options, restricted share units and retirement plans.

Executive Compensation Guiding Principles

The Corporation recognizes that its success is in large part dependent on the Corporation’s ability to attract and retain skilled employees. The Corporation endeavors to create and maintain compensation programs based on performance, teamwork and rapid progress and to align the interests of the executives and Shareholders. The principles and objectives of the compensation and benefits programs for employees generally, and for the NEOs specifically, are to:

| | • | | attract, motivate and retain highly-skilled individuals who have incentives to achieve the Corporation’s strategic goals; |

12

| | • | | closely align compensation with the Corporation’s business and financial objectives and the long-term interests of Shareholders; and |

| | • | | offer total compensation that is competitive and fair. |

Elements of Executive Compensation

The compensation of the NEOs consists of the following principal components:

| | • | | performance-based cash bonuses; and |

| | • | | participation in the Corporation’s amended and restated equity incentive plan (the “Equity Incentive Plan”). |

Each compensation element has a role in meeting the above objectives. The mix of compensation components is designed both to reward short-term results and to motivate long-term performance. The compensation level of the NEOs reflects to a significant degree the varying roles and responsibilities of the NEOs.

The appropriate level for overall NEOs compensation is determined by the Compensation Committee for all of the NEOs based on: (i) a review of certain available market data including a review of the compensation paid to other named executive officers by a comparison group of companies as set forth below; and (ii) internal equity, length of service, skill level and other factors deemed appropriate.

Compensation-Setting Process

The Corporation has relied on market survey data for similar positions in other companies to assist in determining compensation levels that are competitive and fair. In addition, the CEO (and with respect to the CEO, the Compensation Committee) reviews the performance of each NEO on an annual basis. Based on this review and the factors described above, such parties made recommendations to the Board as to the executive compensation package for each NEO. This review commences in the last quarter of the fiscal year to which the performance relates and is completed in the first quarter of the subsequent fiscal year.

Competitive Positioning and Compensation Advisors

The Compensation Committee is authorized to retain the services of external executive compensation specialists from time to time, as the committee sees fit, in connection with the establishment of cash and equity compensation and related policies. In January 2011, the Compensation Committee first retained the services of Mercer Canada Limited (“Mercer”), an executive compensation consultant, to assist in establishing and reviewing a comparator group to conduct an analysis to assist in establishing competitive total direct compensation and short-term and long-term incentive targets for the NEOs. For the fiscal year ended March 31, 2014, Mercer provided data and analysis with respect to compensation matters in respect of each NEO as well as providing general salary information that was used by the Corporation for assessing the compensation elements for the general employee population. Prior to January 2011, the Corporation did not engage the services of a compensation consultant.

Comparator Group Analysis

The Compensation Committee annually reviews the total compensation of the Corporation’s NEOs and compensation practices of the Corporation. The Corporation, with the assistance of Mercer, used a group of 5 Canadian and 15 U.S. companies (“Comparator Group”) to assist in the setting of compensation for the fiscal year ending March 31, 2014. The Comparator Group reflects the types of organizations with which the Corporation competes for talent for executives. The Compensation Committee collects data from the Comparator

13

Group targeting total direct compensation at the 50th percentile. The Comparator Group used for the fiscal year ended March 31, 2014 was comprised of the following companies:

| | | | |

• Aastra Technologies Limited | | • Netgear Inc. | | • Sierra Wireless, Inc. |

| | |

• Arris Group, Inc. | | • Novatel Wireless Inc. | | • STEC Inc. |

| | |

• Constellation Software Inc. | | • OCZ Technology Group Inc. | | • Super Micro Computer, Inc. |

| | |

• Cts Corp. | | • Open Text Corporation | | • Synaptics Inc. |

| | |

• Emulux Corp. | | • Polycom, Inc. | | • United On Line Inc. |

| | |

• Intermec Inc. | | • QLogic Corp. | | • ViaSat Inc. |

| | |

• Macdonald Dettwiler & Associates Ltd. | | • RealNetworks Inc. | | |

Note: U.S. companies are initalics.

The Corporation benchmarks each named executive position against similar positions in the Comparator Group. Competitive market data on the Comparator Group gives the Compensation Committee and the Board an initial reference point for determining executive compensation. The Comparator Group is used to assess the reasonableness of the Corporation’s compensation and to confirm that compensation is consistent with the Corporation’s desired philosophical positioning. In setting compensation of an executive, the Comparator Group is considered among other factors, including the individual’s contribution, experience, performance and internal equity. The Compensation Committee, in consultation with Mercer, reviews the Comparator Group annually to ensure that it continues to be appropriate. The Comparator Group was used to evaluate executive compensation for the fiscal year ended March 31, 2014. The criteria used for determining the companies included in the Comparator Group include that each company: (i) is autonomous and publicly-traded; (ii) has comparable revenues to that of the Corporation; (iii) is similarly sized considering assets, market capitalization and number of employees; and (iv) has robust compensation data available. The Comparator Group has been chosen by the Compensation Committee as appropriate because it represents a cross-section of companies from different sectors that are similar to the Corporation in terms of size of assets and revenues.

Compensation Risk

The Corporation believes it has effective risk management and regulatory compliance for its compensation policies. The Corporation has a Compensation Committee to assist the Board in discharging its duties relating to compensation of the Corporation’s directors and executive officers. The Compensation Committee and the Board have structured the executive compensation to ensure that executives are compensated fairly, and in a way that does not incur undue risk to the Corporation or encourage executives to take inappropriate risks. Risks related to compensation are taken into consideration as part of the general review and determination of executive compensation by the Compensation Committee and the Board, including: review of salaries of the Comparator Group, review and approval by the Compensation Committee and recommendation to the Board for approval. Director and executive compensation are reviewed annually, and benchmarked against the Comparator Group to assess competitiveness and fairness. Management will use Mercer to conduct a competitive compensation review for all executive positions as and when appropriate. This independent advice provides the Compensation Committee and the Board with a market reference point when they assess individual performance in the context of overall corporate performance.

Inappropriate and excessive risks by executives are mitigated by regular meetings of the Board, at which activity by the executives must be approved by the Board if such activity is outside or beyond previously Board-approved actions. Through the Audit Committee, the Board also receives regular reports concerning risk management activities as well as management’s compliance with company policies and procedures. Part of the Corporation’s executive compensation consists of grants under the Equity Incentive Plan. Such compensation is long term and, accordingly, is directly linked to the achievement of long term value creation and aligns executives’ interests with those of Shareholders. As the benefits of such compensation, if any, are not realized by the executive until a

14

significant period of time has passed, the ability of executives to take inappropriate or excessive risks that are beneficial to them from the standpoint of their compensation at the expense of the Corporation and its Shareholders is limited.

The other two elements of compensation, base salary and performance-based cash bonuses, represent the remaining portion of an executive’s total compensation. While neither salary nor bonus is long term, these components of compensation represent only a portion of total compensation and as a result it is unlikely that an executive would take inappropriate or excessive risks at the expense of the Corporation and its Shareholders that would be beneficial to them from the standpoint of their short term compensation when their long term compensation might be put at risk from their actions.

For the reasons set forth above, the Compensation Committee has concluded that there are minimal risks arising from the Corporation’s executive compensation policies and practices that are reasonably likely to have a material adverse effect on the Corporation.

Although the Corporation has not adopted a policy forbidding insiders from purchasing financial instruments relating to the Class A Shares, the Corporation is not aware of any insider having entered into this type of transaction.

Compensation Components

The compensation of the NEOs consists of the following principal components:

| | • | | performance-based cash bonuses; and |

| | • | | participation in the Equity Incentive Plan. |

The NEOs’ compensation packages provide a balanced set of elements consistent with the objectives of the Corporation’s compensation strategy. The fixed elements, assessed in their entirety, provide a competitive base of fixed compensation necessary to attract, retain and motivate executives. The variable elements, assessed in their entirety, are reviewed and approved by the Compensation Committee and are designed to balance short-term objectives with the long-term interests of the Corporation, motivate superior performance against both timeframes and reward the attainment of individual and business objectives. The combination of the fixed elements and variable incentive opportunities delivers a competitive compensation package as compared to the peer group used by the Corporation.

Below is a description of the total compensation elements of the Corporation as of March 31, 2014, forms of compensation, performance periods and how the amount is determined for each element.

| | | | | | |

Type of compensation | | Form | | Performance period | | How it is determined |

Base salary | | Cash | | One year | | Reflects consideration of sector market conditions, the role of the executive, individual competency, and attraction and retention considerations. Base salary was benchmarked to the 50th percentile for the selected Comparator Group of companies and adjusted to reflect the NEOs’ experience, responsibilities and performance. |

| | | |

Short-Term Incentive | | Performance-Based Cash Bonuses | | One year | | Focuses on specific annual objectives. Target award is based on market competitiveness. The actual award is based on Corporation performance in the case of the CEO, and on Corporation and individual performance in the case of the other NEOs. |

15

| | | | | | |

Type of compensation | | Form | | Performance period | | How it is determined |

| | | |

Long-Term Incentive | | Stock options | | Typically, three or four-year vesting and a five-year term | | Target award (using an option pricing model to estimate the value) is based on market competitiveness of the long-term incentive package. However, the final realized value is based on the appreciation of the price of the Class A Shares. |

| | | |

| | Restricted Stock Units | | Typically, equal annual vesting over a three year term | | Target award is determined by the Compensation Committee and based on market competitiveness of the aggregate value of all long-term incentives awarded in a particular year. |

| | | |

| | Performance Stock Units | | Typically, three year cliff vesting and a three year term | | Target award is determined by the Compensation Committee and is based on the market competitiveness of the aggregate value of all long-term incentives awarded in a particular year. |

| | | |

Benefits | | Medical and dental insurance | | Ongoing | | Based on historical practices of the Corporation. |

| | | |

Retirement Plans | | RRSP Contribution 401K Contribution | | Ongoing | | The Corporation matches an employee’s contribution to a maximum of 3.5% of the employee’s annual salary. With respect to 401K plans, an employee’s contribution to a maximum of 2.0% of the employee’s annual salary. |

Base Salaries

In general, base salaries for the NEOs are initially established through arm’s-length negotiation at the time of hire, taking into account such NEO’s qualifications, experience and prior salary and prevailing market compensation for similar roles in comparable companies. The initial base salaries of the NEOs are then reviewed annually by the Compensation Committee for the CEO and by the CEO and the Compensation Committee for all other NEOs, to determine whether any adjustment is warranted. Base salaries are also reviewed in the case of promotions or other significant changes in responsibility.

In considering a base salary adjustment, the Compensation Committee considers the Corporation’s overall performance, the scope of the NEO’s functional responsibilities, individual contribution, responsibilities and prior experience. The Compensation Committee may also take into account the NEO’s current salary, equity position both vested and unvested, and the amounts paid to the NEO’s peers inside the Corporation.

Performance-Based Cash Bonuses

Annual performance-based cash bonuses are intended to reward the NEOs for achieving short-term goals while making progress towards the Corporation’s longer-term objectives. The Fiscal 2014 Discretionary Bonus Plan (the “2014 Bonus Plan”) includes target bonus opportunities and target goals. The Compensation Committee determined the actual bonus awards for fiscal 2014 for each of the NEOs.

Each bonus under the 2014 Bonus Plan has two components as described in greater detail below: (i) a company performance bonus; and (ii) an individual performance bonus. These components are measured as follows:

| | • | | The company performance bonus is measured by reference to a key performance indicator: “adjusted EBITDA” as determined by internal management financial statements. The term “adjusted net EBITDA” is defined as net income before interest, income taxes, depreciation and amortization, as well as adjusting for the following items: foreign exchange gains or losses, net change in deferred revenue, |

16

| | stock-based compensation, costs of restructuring, impairment of goodwill, impairment of property and equipment, other income and gains or losses related to the sale of long-lived assets. The Corporation uses this method to assess business performance when evaluating results in comparison to budgets, forecasts, prior-year financial results and the performance of comparable companies. |

| | • | | Individual performance bonus is measured by reference to the following factors relating to an individual NEO’s performance: contribution to the Corporation’s strategy, contribution to key issues for the Corporation, attention to values, principles and policies and delivery against objectives set out in an individual NEO’s annual work plan and as otherwise communicated to such individual. |

Each NEO’s target bonus opportunity under the 2014 Bonus Plan was expressed as a percentage of his or her base salary, with individual target award opportunities being a range of 70% to 100% of base salary, with additional bonus opportunity for exceptional performance. There is an additional bonus opportunity as well for the NEO in the event the Corporation exceeds the company performance target(s). The weighting of the bonus for the NEO is a range of 80% to 100% for company performance and a range of 0% to 20% for individual performance. The bonus is weighted towards company performance reflecting the NEO’s ability to impact overall company performance. The company performance targets for payout under the 2014 Bonus Plan were set at amounts the Board reasonably believed to be attainable. If the company performance threshold is not achieved, the 2014 Bonus Plan contemplates that the individual performance bonus may not be paid. Under the 2014 Bonus Plan, the Board has the ability to exercise discretion to award compensation in the absence of attaining performance goals or can increase or decrease awards on a discretionary basis having regard, in each instance, to the general spirit and intent of the 2014 Bonus Plan. For the purposes of determining both the individual performance and company performance components of individual bonuses for the fiscal year ended March 31, 2014, the Board established the company performance factor to be 150%.

For NEOs whose short term incentive includes an individual performance component, the factors comprising such individual performance include: achieving established in-year objectives, continuing to build the capability, capacity and process improvement of the officer’s functional area(s) of responsibility and adhering to the established budget of the officer’s functional areas(s) of responsibility.

Long-Term Equity Incentives

The Corporation adopted the Equity Incentive Plan in connection with its IPO and has granted equity incentive awards to the NEOs pursuant to the Equity Incentive Plan. Such grants were made with consideration given to the overall compensation of the NEO as well as the number of Class A Shares already held.

Change in Control Benefits

The Corporation has entered into employment agreements with the NEOs that provide for the payment of certain severance benefits if the Corporation undergoes a change in control and the NEO is terminated in relation to such change in control or suffers a material change in the scope of his duties or responsibilities as a result of such change in control, within a specified period preceding or following the change in control. The Corporation believes that these arrangements, which require both a change in control and termination of employment or such material change before payment is owed, effectively allow the NEOs to objectively assess and pursue aggressively any corporate transactions that are in the best interests of Shareholders without undue concern over the impact of such a transaction on their own personal financial and employment situation.

Perquisites and Other Personal Benefits

The Corporation does not utilize perquisites or other benefits as a significant element of the compensation program currently provided to NEOs. All future practices regarding perquisites will be approved and subject to periodic review by the Compensation Committee.

17

Compensation Governance

The Corporation has a Compensation Committee that is currently composed of Messrs. Hagerty, Mueller and McKinnon, all of whom are independent within the meaning of National Instrument 58-101 – Disclosure of Corporate Governance Practices (“NI 58-101”).

All members of the Compensation Committee have direct experience in compensation matters as current or former chief executive officers of public companies or chief operating officers of large accounting firms. Collectively, this experience provides the Compensation Committee with the knowledge, skills, experience and background in executive compensation and human resources matters to make decisions on the suitability of the Corporation’s compensation policies and practices. In addition to the collective experience of the Compensation Committee in compensation matters, all of the members stay actively informed of trends and developments in compensation matters and the applicable legal and regulatory frameworks.

The Compensation Committee acts on behalf of the Board in all matters pertaining to the appointment, compensation, benefits and termination of members of the senior management team. The Compensation Committee reviews the goals and objectives relevant to the compensation of the senior management team, as well as the annual salary, bonus, pension, severance and termination arrangements and other benefits, direct and indirect, of the senior management team, and makes recommendations to the Board and/or management, as appropriate.

Specific responsibilities of the Compensation Committee include:

| | • | | reviewing management succession plans and processes of the CEO, the CFO, the Chief Technology Officer, the President of the Education Business Unit and the President of the Enterprise Business Unit and the other executives that report directly to the CEO as well as any other senior employees designated for this purpose by the committee from time to time and making recommendations to the Board and/or management as appropriate (no other senior employees have been so designated by the committee as of March 31, 2014); |

| | • | | reviewing the annual salary, bonus, pension, severance and termination arrangements and other benefits, direct and indirect, of the executive management team and making recommendations to the Board and/or management as appropriate; |

| | • | | reviewing and approving (or in the discretion of the Compensation Committee, making recommendation to the Board) recommendations concerning the operation of employee compensation plans, including the terms, eligible participants, vesting, price and incentive targets and the exercise of any discretion provided in these plans; |

| | • | | providing recommendations to the Board regarding the administering and granting of options, awards or rights pursuant to any stock option, purchase plan or incentive plan; and |

| | • | | reviewing any proposed disclosure relating to executive compensation. In particular, reviewing, commenting on and approving the statement of Executive Compensation (including the Compensation Discussion and Analysis and related tables) and recommending it to the Board for inclusion in this Information Circular prepared for the annual meeting of Shareholders. |

The Corporation retained Mercer to provide research, advice and recommendations with respect to the compensation of the directors and certain key employees of the Corporation. The services that Mercer has provided to the Corporation include advising on the design of overall compensation packages, reviewing the Corporation’s director compensation program, compiling comparative data with respect to the compensation programs of similar entities, analyzing the Corporation’s executive compensation packages and the individual elements thereof and comparing such compensation packages to those offered by other entities in the Comparator Group. Mercer did not provide any other services to the Corporation, or to any of its directors or members of management, other than or in addition to those compensation services referred to above.

18

The total compensation paid to Mercer for the fiscal year ending March 31, 2014 for the provision of these services was approximately $88,000 of which approximately $69,500 was related to consulting work related to compensation programs and approximately $18,500 was related to the Corporation’s participation in annual market surveys carried out by Mercer. There have been no fees paid to Mercer other than as provided for herein for the fiscal year ended March 31, 2014.

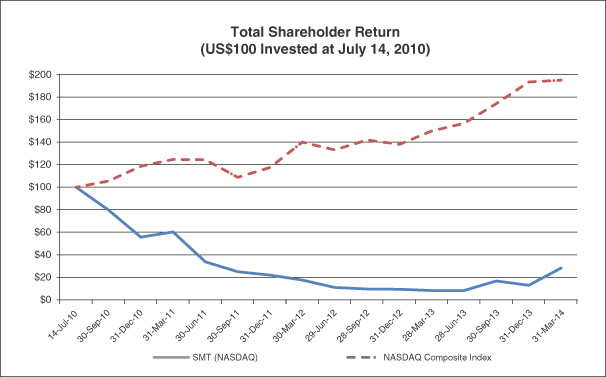

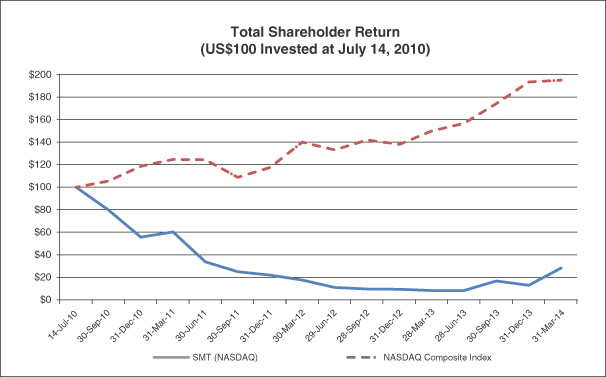

Performance Graph

The following chart illustrates the cumulative Total Shareholder Return of $100 invested in the Corporation’s Class A Shares on the NASDAQ Global Select Market (the “NASDAQ”) on July 14, 2010 (the Corporation’s first day of public trading) through March 31, 2014. This is compared to the equivalent cumulative value invested in the NASDAQ Composite Index for the same time period.

| | | | |

Date | | SMT (NASDAQ) | | NASDAQ

Composite

Index |

| 14-Jul-10 | | 100.00 | | 100.00 |

| 30-Sep-10 | | 79.71 | | 105.48 |

| 31-Dec-10 | | 55.53 | | 118.48 |

| 31-Mar-11 | | 60.06 | | 124.46 |

| 30-Jun-11 | | 33.53 | | 124.40 |

| 30-Sep-11 | | 24.71 | | 108.61 |

| 31-Dec-11 | | 21.71 | | 117.50 |

| 30-Mar-12 | | 17.47 | | 139.78 |

| 29-Jun-12 | | 10.71 | | 133.10 |

| 28-Sep-12 | | 9.59 | | 141.76 |

| 31-Dec-12 | | 9.29 | | 138.00 |

| 28-Mar-13 | | 8.18 | | 149.76 |

19

| | | | |

Date | | SMT (NASDAQ) | | NASDAQ

Composite

Index |

| 28-Jun-13 | | 8.00 | | 156.54 |

| 30-Sep-13 | | 16.53 | | 174.05 |

| 31-Dec-13 | | 12.88 | | 193.36 |

| 31-Mar-14 | | 28.12 | | 194.96 |

As at March 31, 2014, the share price of the Corporation’s Class A Shares was approximately 228% of its price one year earlier. Base salaries for the NEOs who were with the Corporation over the past fiscal year remained constant over this time period and the performance based cash bonuses earned in respect of performance for the fiscal year ended March 31, 2014 were significantly higher, reflecting in part the increase in share price over that period.

Summary Compensation Table

Executive Compensation is required to be disclosed for the NEOs. The following table sets forth information concerning the total compensation paid or earned by the NEOs for each of the years ended March 31, 2014, 2013 and 2012.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and

Principal Position | | Year | | | Salary($)(1) | | | Share-based

awards

($)(2) | | | Option-based

awards ($)(3) | | | Non-equity incentive plan

compensation ($) | | | Pension

Value

($) | | | All other

Compensation

($)(1) | | | Total

Compensation

($)(1) | |

| | | | | | Annual

incentive

plans(1)(4) | | | Long-term

incentive

plans | | | | |

Neil Gaydon President & CEO(5) | | | 2014 | | | | 735,643 | | | | 1,000,500 | | | | 81,426 | | | | 1,103,465 | | | | Nil | | | | Nil | | | | 30,514 | (10) | | | 2,951,548 | |

| | | 2013 | | | | 321,569 | | | | 258,000 | | | | 121,580 | | | | 336,456 | | | | Nil | | | | Nil | | | | 100,335 | | | | 1,137,940 | |

| | | 2012 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | |

| | | | | | | | | |

Kelly Schmitt Vice President, Finance & CFO(6) | | | 2014 | | | | 287,520 | | | | 404,000 | | | | Nil | | | | 294,219 | | | | Nil | | | | Nil | | | | 27,258 | (11) | | | 1,012,998 | |

| | | 2013 | | | | 200,625 | | | | 64,100 | | | | 60,790 | | | | 49,945 | | | | Nil | | | | Nil | | | | 26,900 | | | | 402,360 | |

| | | 2012 | | | | 175,876 | | | | Nil | | | | 26,429 | | | | 26,706 | | | | Nil | | | | Nil | | | | 2,955 | | | | 231,966 | |

| | | | | | | | | |

Warren Barkley Chief Technology Officer(7) | | | 2014 | | | | 380,819 | | | | 463,000 | | | | 54,284 | | | | 560,418 | | | | Nil | | | | Nil | | | | 60,165 | (12) | | | 1,518,685 | |

| | | 2013 | | | | 152,140 | | | | 64,500 | | | | 59,772 | | | | 152,140 | | | | Nil | | | | Nil | | | | 991 | (13) | | | 429,544 | |

| | | 2012 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | |

| | | | | | | | | |

Greg Estell President, Education(8) | | | 2014 | | | | 377,197 | | | | 408,000 | | | | 60,014 | | | | 355,950 | | | | Nil | | | | Nil | | | | 35,054 | (14) | | | 1,236,216 | |

| | | 2013 | | | | 15,625 | | | | Nil | | | | Nil | | | | 2,197 | | | | Nil | | | | Nil | | | | 25,000 | (15) | | | 42,822 | |

| | | 2012 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | |

| | | | | | | | | |

Scott Brown President, Enterprise(9) | | | 2014 | | | | 250,000 | | | | 396,000 | | | | 58,368 | | | | 187,250 | | | | Nil | | | | Nil | | | | 80,085 | (16) | | | 971,703 | |

| | | 2013 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | |

| | | 2012 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | |

NOTES:

| (1) | Cash compensation is paid in Canadian and U.S. currency. Canadian dollar compensation has been translated into U.S. dollars at the average exchange rate for the year based on exchange rates published by the Bank of America and Bank of Canada. Exchange rates used – for 2014: 1.00 CAD = 0.9492 USD; for 2013: 1.00 CAD = 0.9989 USD; and for 2012: 1.00 CAD = 1.0070 USD. |

| (2) | All share-based awards are priced in U.S. dollars. Share-based awards represent the fair value of RSUs and PSUs granted in the year. The fair value of the RSUs and PSUs is based on the closing market price of the Class A Shares as determined by NASDAQ on the effective date of grant multiplied by the number of RSUs and PSUs granted. |

20

| (3) | All option-based awards are priced in U.S. dollars. Option based awards represent the fair value of stock options granted in the year under the Equity Incentive Plan. The fair value of stock options granted is calculated using the Black-Scholes valuation model on the date of grant. Under this method, the weighted average fair value of stock options granted was $0.94 in 2014, $0.72 in 2013 and $2.00 in 2012. |

| | | | | | |

| | | 2014 | | 2013 | | 2012 |

Expected dividend yield | | Nil | | Nil | | Nil |

Expected stock price volatility | | 61.51% | | 63.00% | | 45.00% |

Expected risk-free interest rate | | 0.7% | | 0.54% | | 0.6-1.4% |

Expected life of options | | 3.5 years | | 4 years | | 4 years |

The assumed dividend yield reflects the Corporation’s current intention to not pay cash dividends in the foreseeable future. The assumed volatility for options granted for the years ended March 31, 2014 and 2013 was the Corporation’s historical volatility from the Corporation’s IPO on July 20, 2010 to the date of grant. The assumed volatility for options granted prior to April 1, 2012 was the Corporation’s estimate of the future volatility of the share price based on a review of the volatility of comparable public companies. The assumed risk-free interest rate is based on the yield of a U.S. government zero coupon Treasury bill issued at the date of grant with a remaining life approximately equal to the expected term of the option. The assumed expected life is the Corporation’s estimated exercise pattern of the options.

| (4) | Amounts earned pursuant to the 2014, 2013 and 2012 Bonus Plans. |

| (5) | Mr. Gaydon was appointed President & CEO of the Corporation on October 24, 2012. |

| (6) | Ms. Schmitt was appointed Vice President, Finance & CFO of the Corporation on November 30, 2012. |

| (7) | Mr. Barkley was appointed Chief Technology Officer of the Corporation on November 13, 2012. |

| (8) | Mr. Estell was appointed President, Education of SMART Technologies ULC, a wholly-owned, direct subsidiary of the Corporation on March 18, 2013. |

| (9) | Mr. Brown was appointed President, Enterprise of SMART Technologies ULC, a wholly-owned, direct subsidiary of the Corporation on June 3, 2013. |

| (10) | Includes $29,430 paid to Mr. Gaydon for relocation reimbursement and $1,084 for benefits. |

| (11) | Includes $15,312 paid as a special bonus; $10,063 in respect of company contributions to Ms. Schmitt’s RRSP; and $1,883 for benefits. |

| (12) | Includes $58,282 paid to Mr. Barkley for relocation reimbursement and $1,883 for benefits. |

| (13) | The $991 amount was for benefits. |

| (14) | Includes $6,294 in respect of company contributions to Mr. Estell’s 401K, $23,675 for relocation reimbursement and $5,085 for benefits. |

| (15) | $25,000 paid as a signing bonus pursuant to the terms of Mr. Estell’s employment agreement. |

| (16) | Includes $75,000 paid as a signing bonus pursuant to the terms of Mr. Brown’s employment agreement and $5,085 for benefits. |

Incentive Plan Awards – Equity Incentive Plan

Reservation and Issuance of Class A Shares

The Equity Incentive Plan provides for the grant of options, restricted share units, deferred share units and performance restricted share units to the directors, officers, employees, consultants and service providers of the Corporation and to directors, officers, employees, consultants and service providers of the Corporation’s subsidiaries and affiliates.

The Corporation has authorized for issuance Class A Shares representing 12% of the Corporation’s total outstanding Class A Shares. All equity based awards granted will be in compliance with the requirements of the TSX, the NASDAQ and all other applicable securities laws of both Canada and the United States of America (“Applicable Securities Laws”). The purchase price and vesting provisions (if any) for any optioned Class A Shares shall be fixed by the directors, subject to the limitations and restrictions of the TSX.

21

Class A Shares subject to award under the Equity Incentive Plan that lapse, expire, terminate or are forfeited or settled in cash will again become available for grants under the Equity Incentive Plan. Class A Shares used to satisfy awards under the Equity Incentive Plan will be authorized and unissued Class A Shares from treasury.

No more than 2.5% of the Class A Shares may be subject to the total awards granted under the Equity Incentive Plan to any individual participant in a given calendar year. The number of securities of the Corporation issuable to insiders at any time under the Equity Incentive Plan and all of the Corporation’s other security based compensation arrangements shall not exceed 12% of the Corporation’s issued and outstanding securities at any time and shall be limited to 5% of the Corporation’s issued and outstanding securities within any one year period. The Equity Incentive Plan limits the number of Class A Shares that may be issued to directors who are not officers or employees to 1% of the issued and outstanding Class A Shares.

The options granted pursuant to the Equity Incentive Plan to independent directors at the time of the IPO in July 2010 vest equally on the first, second, third and fourth anniversaries of the date of grant, subject to the discretion of the Compensation Committee. Options granted to employees prior to October 2011 generally vest equally on the second, third and fourth anniversaries of the date of grant. Options granted to employees subsequent to that time but prior to November 2012 generally vest equally on the first, second, third and fourth anniversaries of the date of the grant. Options granted in and subsequent to November 2012 vest equally on the first, second and third anniversaries of the date of the grant. Options granted in the fiscal year which will end March 31, 2015 now vest in their entirety on the third anniversary of the date of grant.

Administration of Awards

The Compensation Committee provides recommendations to the Board relative to the administration of the Equity Incentive Plan. The Compensation Committee provides recommendations to the Board with respect to the terms and conditions of the awards, including the individuals who will receive awards, the term of awards, the exercise price, the number of Class A Shares subject to each award, the limitations or restrictions on vesting and exercisability of awards, the acceleration of vesting or the waiver of forfeiture or other restrictions on awards, the form of consideration payable on exercise, whether awards will entitle the holder to receive dividend equivalents and the timing of grants. The Compensation Committee, in compliance with the provisions of the TSX, the NASDAQ and Applicable Securities Laws, also recommends to the Board any modifications, amendments or adjustments to the terms and conditions of outstanding awards provided such modifications, amendments or adjustments do not impair the rights of a holder of a previously granted award, to arrange for financing by broker-dealers (including payment by the Corporation of commissions), to establish award exercise procedures (including “cashless exercise”) and to establish procedures for payment of withholding tax obligations with cash or Class A Shares.

Stock Options

The Compensation Committee may recommend to the Board the exercise price of options granted under the Equity Incentive Plan, but the exercise price of an option may not be less than 100% of fair market value of the Class A Shares of a date specified at the time of the grant. No options may be granted for a term longer than ten years. Options may be exercised as provided in the applicable award agreement. Generally, when a participant is terminated for cause, or a participant voluntarily resigns, outstanding unvested options granted under the Equity Incentive Plan will be forfeited immediately. For other terminations of employment, vested options generally remain exercisable for 90 days after termination, except in the event of death, where they generally remain exercisable for six months. Specific provisions of a written employment agreement may provide for different treatment. However, an option granted under the Equity Incentive Plan is never exercisable after its term expires.

Restricted Share Units

Restricted share unit (“RSU”) awards may consist of grants of rights to receive, at the Corporation’s option, Class A Shares, the cash value of Class A Shares or a combination of both, which may vest in installments in

22

accordance with performance criteria specified by the Compensation Committee, or on a deferred basis. The Class A Shares underlying RSUs may be issued from treasury or purchased on the open market.

Deferred Share Units

Deferred share unit (“DSU”) awards are awards similar to awards of restricted share units except that such awards may not be redeemed for Class A Shares or for the value of Class A Shares until the participant has ceased to hold all offices, employment and directorships with the Corporation and its subsidiaries and affiliates. The Class A Shares underlying DSUs may be issued from treasury or purchased on the open market.

Performance Restricted Share Units

The Compensation Committee has the ability, at the time RSU awards are granted under the Plan, to designate all or a portion of such RSU awards as performance restricted share unit (“PSU”) awards and in the event that RSU awards are designated as PSU awards, such PSU awards shall vest based in whole or in part on the performance criteria set forth in the applicable award agreement.

Effect of a Significant Event

In the event of a “significant event”, as defined in the Equity Incentive Plan, and unless otherwise provided in an award agreement or a written employment contract between the Corporation and a plan participant, the Board may provide that the successor company will assume each award or replace it with a substitute award, or the awards will become exercisable or vested in whole or in part upon written notice, or the awards will be surrendered for a cash payment, or any combination of the foregoing will occur.

Under the Equity Incentive Plan and unless otherwise defined in an award agreement or a written employment agreement between the Corporation and a plan participant (and subject to certain exceptions described in the Equity Incentive Plan), a significant event means:

| | • | | a person or group of persons becomes the beneficial owner of securities constituting 50% or more of the voting power; |

| | • | | individuals who were proposed as nominees (but not including nominees under a Shareholder proposal) to the Board immediately prior to a meeting of Shareholders involving a contest for, or an item of business relating to, the election of directors, not constituting a majority of the directors following such election; |

| | • | | a merger, consolidation, amalgamation or arrangement (or a similar transaction) involving the Corporation occurs, unless after the event, 50% or more of the voting power of the combined company is beneficially owned by Shareholders who owned all of the Class A Shares immediately before the event; or |

| | • | | the Corporation’s Shareholders approve a plan of complete liquidation or winding-up of the Corporation, or the sale or disposition of all or substantially all its assets (other than a transfer to an affiliate). |

Transferability