UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2011

Commission File No. 333-166076

ODENZA CORP.

(Exact name of registrant as specified in its charter)

| Nevada | | None |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

126 Station Street

Newtown, NSW 2042, Australia

(Address of principal executive offices, zip code)

+61 (422) 70-84-44

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year,

if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

| | | (Do not check if a smaller | |

| | | reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

At April 30, 2010, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was approximately $186,000. At January 27, 2011, there were 3,360,000 shares of the Registrant’s common stock, $0.001 par value per share, outstanding. At January 31, 2011, the end of the Registrant’s most recently completed fiscal year, there were 3,360,000 shares of the Registrant’s common stock, par value $0.001 per share, outstanding.

ODENZA CORP.

TABLE OF CONTENTS

| | | | Page No. |

| | | | |

| | | PART I | |

| | | | |

| Item 1. | | Business | 3 |

| Item 1A. | | Risk Factors | 13 |

| Item 1B. | | Unresolved Staff Comments | |

| Item 2. | | Properties | |

| Item 3. | | Legal Proceedings | |

| Item 4. | | (Removed and Reserved) | |

| | | | |

| | | PART II | |

| | | | |

| Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 14 |

| Item 6. | | Selected Financial Data | 15 |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 15 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | 17 |

| Item 8. | | Financial Statements and Supplementary Data | 18 |

| Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 28 |

| Item 9A. | | Controls and Procedures | 28 |

| Item 9B. | | Other Information | 29 |

| | | | |

| | | Part III | |

| | | | |

| Item 10. | | Directors, Executive Officers and Corporate Governance | 30 |

| Item 11. | | Executive Compensation | 32 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 33 |

| | Certain Relationships and Related Transactions, and Director Independence | 34 |

| Item 14. | | Principal Accounting Fees and Services | 34 |

| | | | |

| | | Part IV | |

| | | | |

| Item 15. | | Exhibits and Financial Statement Schedules | 35 |

| | | Signatures | 36 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K of Odenza Corp., a Nevada corporation, contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of such terms and other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include, among other things: the volatility of minerals prices, the possibility that exploration efforts will not yield economically recoverable quantities of minerals, accidents and other risks associated with mineral exploration and development operations, the risk that the Company will encounter unanticipated geological factors, the Company’s need for and ability to obtain additional financing, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company’s exploration and development plans, the exercise of the approximately 68.3% control the Company’s sole officer and director holds of the Company’s voting securities, other factors over which we have little or no control; and other factors discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”).

Our management has included projections and estimates in this Form 10-K, which are based primarily on management’s experience in the industry, assessments of our results of operations, discussions and negotiations with third parties and a review of information filed by our competitors with the SEC or otherwise publicly available. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

All references in this Form 10-K to the “Company”, “Odenza”, “we”, “us,” or “our” are to Odenza Corp.

PART I

ITEM 1. BUSINESS

ORGANIZATION WITHIN THE LAST FIVE YEARS

On July 16, 2010, the Company was incorporated under the laws of the State of Nevada. We are engaged in the business of acquisition, exploration and development of natural resource properties.

William O’Neill has served as our President and Chief Executive Officer, Secretary and Treasurer, from July 16, 2010, until the current date. Our board of directors is comprised of one person: William O’Neill.

We are authorized to issue 75,000,000 shares of common stock, par value $.001 per share. In November 2010, we issued 2,500,000 shares of common stock to our director. Said issuance was paid at a purchase price of the par value per share or a total of $2,500. We hold our cash in bank accounts located in Australia.

On September 25, 2010 we entered into a Mineral Property Option Agreement whereby we have the right to acquire a 100% interest in an anticipated- to-be-granted Prospecting License P21/709, located in the Murchison Mineral-filed in Western Australia and known as the Island Project Lake Austin. The option agreement requires us to make an initial cash payment of AUD$4,000 (US$3,680), which we paid on September 25, 2010. The option agreement has an exercise price of approximately fifty thousand AUD$50,000 (US$46,000) cash to be paid if exercised by the Company. We retained a consulting geologist to prepare an evaluation report on the prospects. We intend to conduct exploratory activities on the claim and if feasible, develop the prospects.

IN GENERAL

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We currently hold an option to acquire for AUS$50,000 (US$46,000) a 100% undivided interest Prospecting License P21/709 located in the Murchison Mineral-filed in Western Australia and known as the Island Project Lake Austin. We are currently conducting mineral exploration activities on the Island Project Lake Austin in order to assess whether it contains any commercially exploitable mineral reserves. Currently there are no known mineral reserves on the Island Project Lake Austin.

We have not earned any revenues to date. Our independent auditor has issued an audit opinion which includes a statement expressing substantial doubt as to our ability to continue as a going concern. The source of information contained in this discussion is our geology report prepared Gregory Curnow, B. SC (Geology), M AusIMM, dated November 12, 1099.

There is the likelihood of our mineral claim containing little or no economic mineralization or reserves of gold and other minerals. We are presently in the exploration stage of our business and we can provide no assurance that any commercially viable mineral deposits exist on our mineral claims, that we will discover commercially exploitable levels of mineral resources on our property, or, if such deposits are discovered, that we will enter into further substantial exploration programs. Further exploration is required before a final determination can be made as to whether our mineral claims possess commercially exploitable mineral deposits. If our claim does not contain any reserves all funds that we spend on exploration will be lost.

We have no current plans, proposals or arrangements, written or otherwise, to seek a business combination with another entity in the near future.

POTENTIAL ACQUISITION OF THE ISLAND PROJECT LAKE AUSTIN

In September 25, 2010, we purchased an option to acquire a 100% undivided interest in a mineral claim known as Prospecting License P21/709 located in the Murchison Mineral-filed in Western Australia and known as the Island Project Lake Austin, for a price of AUD$4,000 (US$3,600). The mineral claim underlying the option was granted by the Department of Mines and Petroleum, Western Australia, on July 16, 2010.

We engaged Gregory Curnow, B. SC (Geology). M AusIMM, to prepare a geological evaluation report on the Island Project Lake Austin. Mr. Curnow is a consulting professional geologist and Member of the Australasian Institute of Mining & Metallurgy. Mr. Curnow attended Monash University, Melbourne, Australia and graduated in 1986 with Bachelor of Science degree in geology.

The work completed by Mr. Curnow in preparing the geological report consisted of a review of geological data from previous exploration within the region. The acquisition of this data involved the research and investigation of historical files to locate and retrieve data information acquired by previous exploration companies in the area of the mineral claims.

DESCRIPTION OF PROPERTY

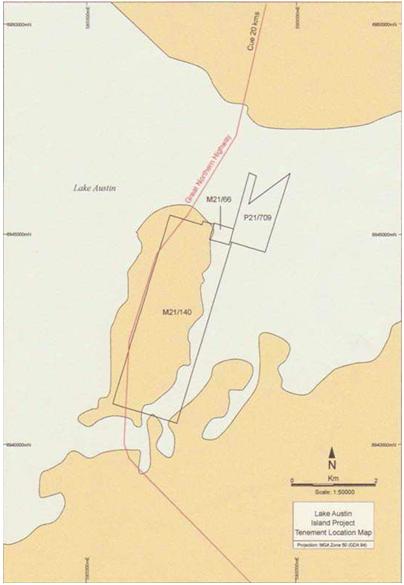

The property on which the Company has an option is the Lake Austin prospect which is comprised of one located mineral claim, Prospecting License 21/709. The Lake Austin prospect is in the Day Dawn district of the Murchison Mineral Fields approximately 550 kilometers north north-east of Perth. The nearest towns are the mining centers of Cue 25 kilometers to the north and Mt Magnet 50 kilometers to the south.

The license occurs in the central part of Lake Austin adjacent to an area known as the Island. The Island covers an area of about eight square kilometers and is approximately five kilometers from north to south and two kilometers across its widest point. The highest ridge on the Island rises approximately 50 meters

above the lake floor.

The Great Northern Highway crosses Lake Austin via the Island and a causeway connects the Island to the mainland. A graded track leads from the highway to Mining Lease M 21/66 from which access to Prospecting License P 21/709 is obtained.

The license was applied for by Victor Caruso on July 12, 2010 and covers approximately 140 hectares of salt lake ground at Lake Austin. Mr. Caruso is the third party with whom we have entered into our Mineral Property Option Agreement.

[remainder of page intentionally left blank]

PHYSIOGRAPHY, CLIMATE, VEGETATION & WATER

The Lake Austin prospect is situated in the state of Western Australia, Australia, at the southern end of the Sheep Mountain Range, a north-south trending range of mountains with peaks reaching an elevation of 4,184 feet. The western portion of the claim covers a plateau-like area with the northeastern portion of descending elevations to a local valley and road. Elevations within the confines of the Claim are within the range of 300 feet.

The area is of a typically desert climate and relatively high temperature and low precipitation. Vegetation consists mainly of desert shrubs and cactus. Sources of water would be available from valley wells.

PROPERTY HISTORY

There is no prior mining exploration activity for the property to which our Mineral Property Option Agreement relates.

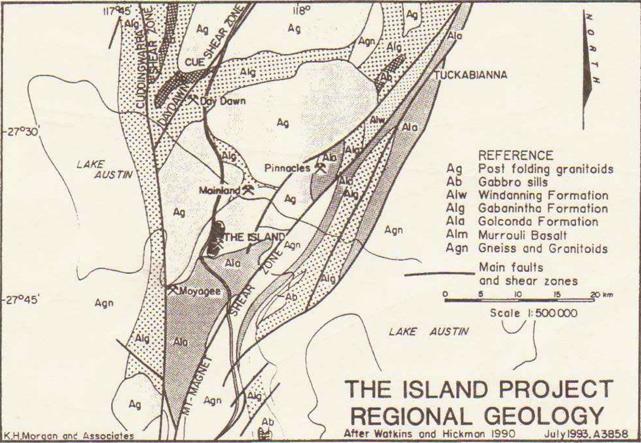

REGIONAL GEOLOGY

The portion of the Golconda Formation exposed in the property to which our Mineral Property Option relates (the “Project Area”) forms part of a steep westerly dipping limb of a north trending and north plunging anticline. Geologically the Island consists of two contrasting halves with the eastern side, where all the old workings are located, consisting of a series of ridges that run the full length of the Island.

The stratigraphic succession is reasonably well known. In contrast, the western side of the Island has no outcrop and, until recently received little attention. A series of rotary air-blast holes along widely spaced traverses encountered ultramafic rocks that displayed signs of shearing. This program was followed by 15 angled reverse circulation air core drill holes. Most of the drilling was west of the Project Area but they also encountered ultramafics. The Golconda Formation on the eastern side of the Island has been divided into five lithostratigraphic units.

Quartz veining is common in the BIF and mafic volcanics. Some geologists suggest that the veins represent axial plane fracture filling of various fold structures generally trending north. However, auriferous quartz veins with other orientations occur on the Island.

One geologist notes the existence of irregular quartz reefs which adopt “a somewhat tortuous course” Yet another geologist reports the presence of an east striking quartz reef at the Chicago workings and indicates that it was very rich in gold where it intersected a large north striking reef.

Three sets of faults are present locally and include a set of strike slip faults and two sets of cross faults; one set trending east- northeast and the other trending west- northwest. The strike slip faults are most commonly developed in the mafic volcanics and are potential sites for gold mineralization.

Figure 2: Project Area Geology

| Unit | | Description | | Associated Mine |

| Camp Dolerite | | Coarse grained dolerite and gabbro intruding most stratigraphic formation | | |

| Austin Trigg series | | Mafic volcanic/sediments, banded iron formation(carbonate facies) Mafic volcanic/sediments with dolerite BIF (carbonate facies) | | |

| Eureka Series | | Mafic volcanic /sediments with dolerite Mafic volcanic BIF sequence(sulphide-carbonate facies Mafic volcanic /sediments with dolerite BIF (oxide facies) | | Eureka, Golconda Hevrons, Baxters |

| Miners Hut series | | Mafic volcanic banded iron formation ( carbonate facies) Mafic volcanic /sediments with dolerite BIF (silicate-sulphide-carbonate facies) Mafic volcanic /sediment. Banded iron formation with dolerite BIF (oxide-sulphide facies) | | Golconda Golconda, Scottish Chief Evening Star |

| Ironclad series | | Mafic volcanic /sediments with dolerite BIF ( sulphide-carbonate facies) Mafic volcanic sediment with dolerite BIF/chert (oxide-silicate facies and mafic volcanic black shale) BIF/chert (oxide silicate facies) Rhyolite. Mafic volcanic /sediment with dolerite | | Ironclad, Chicago Shamrock, Orient |

| Lake Basalt | | Pyroclastics and basalt | | |

Table 2: Subdivision of the Golconda Formation

Mineralization

Gold mineralization on the Island is associated with the Archaean basement, though there is alluvial mineralization associated with the overlaying Cainozoic sediments. The basement mineralization can be broken up into three types.

• Vein Gold Deposits

Most past production has been based on gold mineralization associated with quartz veins. These occupy narrow shear zones, faults and tension fractures in the inter-bedded mafic metavolcanics and banded iron formation.

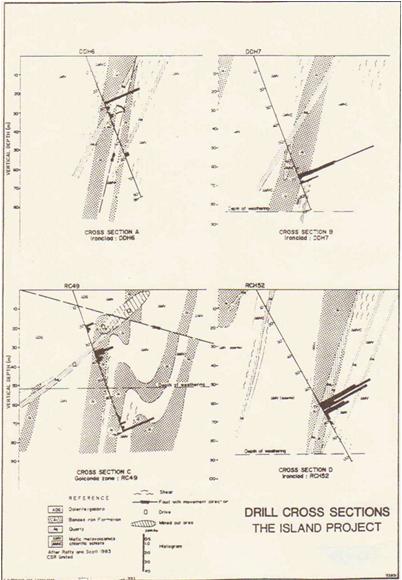

The quartz veins are generally parallel to the banded iron formation but dip at a slightly flatter angle (see Fig 3a, 3b, and 3c).

In the case of the Golconda mine, past drilling indicates that there is a flattening of the dip of the quartz vein at depth (Fig 3c). The gold mineralization increases where the quartz veins are close to, or in contact with, the banded iron formation.

• Mafic Hosted Shear Zones

This type of mineralization was intersected in CSR’s drillhole RC49, which bottomed out in a shear zone consisting of chlorite schist and contained 3.38 g/t Au over the last meter (Fig 3c).

As far as is known, this is the only known occurrence of this type of mineralization.

• Banded Iron Formation

Generally, gold mineralization in banded iron formation is associated with quartz veining. Surface sampling of BIF by BHP Minerals failed to detect gold bearing horizons (Williams 1980).

However, Rafty Scott (1983) report disseminated gold mineralization in a sulphide-carbonate facies of BIF in a diamond drill hole just north of the Ironclad mine (Fig 3b).

This occurrence is in the oxidized zone and the highest value recorded was 8.74 g/t Au over 0.5 meter.

EXPLORATION POTENTIAL

The exploration potential of project area is based on the substantial past production and known, widespread occurrence of gold on the Island itself (Lake Austin Gold Mining Centre). It is highlighted by similar widespread mineralization at the adjacent Mainland and Moyagee Gold Mining Centres, as well as the major production of the whole mining district (Day Dawn Mining District).

In spite of the high potential, the project area is under explored and this is reflected in the lack of specific knowledge of mineralization controls. It is expected that such control will be partly structural and partly ithologic/stratigraphic. Therefore the Company has adopted six conceptual targets as follows:

• Ultramafic

On the basis of the regional geology a major shear zone around the western perimeter of the Golconda Formation can be postulated. This zone would roughly parallel the Mt Magnet and Day Dawn Shear Zones and would be consistent with the linear distribution of gold parallel to the western margin of the Golconda Formation in this area. The recent discovery of gold in ultramafics along the Austin Line (Perilya Mines NL) further to the south at Moyagee highlights the gold potential.

• Banded Iron Formation Suite

The exploration work on the BIF by two geologists shows gold mineralization in five separate stratigraphic horizons, through the entire structure (Table 2).

Although a gold resource has been identified in the BIF at the New Orient mine, factors controlling gold mineralization within the BIF horizons are not yet totally understood. BIF horizons should be traced along the Island into the Licence and its gold potential fully explored.

• Shear Zones within the Mafic Volcanics

The drilling program completed by CSR Limited indicated that strike faults are relatively common within the mafic volcanics and that the shear zones associated with them are potentially auriferous.

Drillhole RC49 bottomed in one such shear auriferous shear zone with the bottom meter containing 3.38 g/t Au (Fig 3c). Mafic volcanics are predominate in the section on the eastern side of the Island, but are poorly exposed and as a result have not been extensively explored.

• Gold Mineralization Associated with Cross Faults

At this stage it is not known what role, if any, the cross faults play in gold mineralization on the Island and in the Project Area.

Two geologists have already observed that most production from BIF on the Island has come from structurally complex areas bounded by northeasterly and west-north westerly striking faults and mafic intrusions.

Nine such unexplored fault zones are prominent on the Island and should be explored over their full length, including the projected area where they would intersect the ultramafics.

• Fault Zones

The richest ore shoots in the banded iron formation were associated with tight folds, possibly drag folds, which parallel the plunge of the main fold, to the north.

Mapping by two geologists shows a series of folds extending in a south- southeast direction from the Golconda mine. The identification of fold zones should be explored for in the Project Area.

• Placer Deposits

The onshore auriferous alluvials were shown to extend beneath the lake sediments by the early prospectors. These should be pursued, particularly in the shallower areas, for detrital and re-precipitated gold. The pursuit of gravel-filled channels beneath the lake clays further from the shore should also be regarded as a prime exploration target. A great deal of new information is now available on the deposition of hydrochemical gold in sediments (Morgan, 1992). Palaeoalluvial deposits have been significant producers in Western Australia, such as at Ora Banda and Higginsville.

[remainder of page intentionally left blank]

Figure 3: Drilling Cross-Sections

CONDITIONS TO RETAIN TITLE TO THE CLAIM

State and local regulations will require a yearly maintenance fee to keep the claim to Island Project Lake Austin in good standing. Yearly maintenance fees of AUD$15,000 (US$13,800) payable to the Department of Mines and Petroleum Western Australia, and AUD$1,500 (US$1,380) payable to the Shire of Ashburton, are payable prior to the anniversary of the claim to keep the claim in good standing for an additional year.

COMPETITIVE CONDITIONS

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are a very early stage mineral exploration company and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other companies like ours for financing and joint venture partners. Additionally, we compete for resources such as professional geologists, camp staff, helicopters and mineral exploration supplies.

GOVERNMENT APPROVALS AND RECOMMENDATIONS

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Australia, the state of Western Australia and the Shire of Ashburton.

COSTS AND EFFECTS OF COMPLIANCE WITH ENVIRONMENTAL LAWS

We currently have no costs to comply with environmental laws concerning our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended three phases described in the chart below. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

| Proposed Work | | Amount | | Cost ($AUD) | |

| Phase 1 | | | | | |

| Data Collection | | | | $ | 5,000.00 | |

| Re-Interpretation of Geophysical Data | | | | $ | 10,000.00 | |

| Field Mapping | | 5 days @ $500 | | $ | 2,500.00 | |

| Sampling | | 50 samples @ $30 | | $ | 1,500.00 | |

| Travel & Accommodation | | 5 days @ $300 | | $ | 1,500.00 | |

| Report | | 1.5 days @ $1,000 | | $ | 1,500.00 | |

| Administration | | 15 % of costs | | $ | 3,300.00 | |

| | | | | | | |

| | | | | $ | 25,300.00 | |

| Phase 2 | | | | | | |

| Soil Sampling | | 5 days @ $750 | | $ | 3,750.00 | |

| Assaying | | 150 samples @ $20 | | $ | 3,000.00 | |

| Ground Geophysics | | | | $ | 65,000.00 | |

| Report | | 1.5 days @ $1,000 | | $ | 1,500.00 | |

| Administration | | 15 % of costs | | $ | 10,987.50 | |

| | | | | | | |

| | | | | $ | 84,237.50 | |

| Phase 2 | | | | | | |

| Drilling | | 1,000 metres @ $50 | | $ | 50,000.00 | |

| Assaying | | 1,000 metres @ $30 | | $ | 30,000.00 | |

| Supervision | | 7 days @ $600 | | $ | 4,200.00 | |

| Travel & Accommodation | | 7 days @ $300 | | $ | 2,100.00 | |

| Report | | 1.5 days @ $1,000 | | $ | 1,500.00 | |

| Administration | | 15 % of costs | | $ | 13,170.00 | |

| | | | | | | |

| | | | | $ | 100,970.00 | |

| | | | | | | |

| Total | | | | $ | 210,507.50 | |

EMPLOYEES

We currently have no employees other than our directors. We intend to retain the services of geologists, prospectors and consultants on a contract basis to conduct the exploration programs on our mineral claims and to assist with regulatory compliance and preparation of financial statements.

ITEM 1A. RISK FACTORS

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our current business address is 126 Station Street, Newtown, NSW 2042, Australia. Our telephone number is +61 (422) 70-84-44.

We believe that this space is adequate for our current needs.

ITEM 3. LEGAL PROCEEDINGS

We are not currently involved in any legal proceedings and we are not aware of any pending or potential legal actions.

ITEM 4. (REMOVED AND RESERVED).

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS MARKET INFORMATION

Our shares of common stock do not trade on an exchange or on any over-the-counter market.

We intend to have our common stock be quoted on the OTC Bulletin Board. If our securities are not quoted on the OTC Bulletin Board, a security holder may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our securities. The OTC Bulletin Board differs from national and regional stock exchanges in that it:

(1) is not situated in a single location but operates through communication of bids, offers and confirmations between broker-dealers, and

(2) securities admitted to quotation are offered by one or more Broker-dealers rather than the “specialist” common to stock exchanges.

To qualify for quotation on the OTC Bulletin Board, an equity security must have one registered broker-dealer, known as the market maker, willing to list bid or sale quotations and to sponsor the company listing. We do not yet have an agreement with a registered broker-dealer, as the market maker, willing to list bid or sale quotations and to sponsor the Company listing. If the Company meets the qualifications for trading securities on the OTC Bulletin Board our securities will trade on the OTC Bulletin Board until a future time, if at all, that we apply and qualify for admission to quotation on the NASDAQ Capital Market. We may not now and it may never qualify for quotation on the OTC Bulletin Board or be accepted for listing of our securities on the NASDAQ Capital Market.

TRANSFER AGENT

Our transfer agent is Signature Stock Transfer of Plano, Texas. Their address is 2220 Coit Road, Ste. 480, PMB 317, Plano, Texas 75075 and their telephone number is (972) 612-4120.

HOLDERS

As of May 13, 2011, the Company had 3,360,000 shares of our common stock issued and outstanding held by 30 holders of record.

Historically, we have not paid any dividends to the holders of our common stock and we do not expect to pay any such dividends in the foreseeable future as we expect to retain our future earnings for use in the operation and expansion of our business.

RECENT SALES OF UNREGISTERED SECURITIES

None.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

We have not established any compensation plans under which equity securities are authorized for issuance.

PURCHASES OF EQUITY SECURITIES BY THE REGISTRANT AND AFFILIATED PURCHASERS

We did not purchase any of our shares of common stock or other securities during the year ended January 31, 2011.

ITEM 6. SELECTED FINANCIAL DATA

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS

We have generated no revenues since inception and have incurred $33,433 in operating expenses from inception through January 31, 2011. These expenses were comprised of $24,108 in professional fees, $4,735 in office and general costs. We incurred net loss of $25,375 and $8,058 for the years ended January 31, 2011 and 2010, respectively. Our net loss since inception (September 25, 2007) through October 31, 2010 was $33,433. The following table provides selected financial data about our company for the years ended January 31, 2011 and 2010. | Balance Sheet Data | | January 31, 2011 | | | January 31, 2010 | |

| Cash and Cash Equivalents | | $ | 18,309 | | | $ | 31,284 | |

| Total Assets | | $ | 18,309 | | | $ | 31,284 | |

| Total Liabilities | | $ | 20,242 | | | $ | 7,842 | |

| Shareholders’ Equity | | $ | (1,933) | ) | | $ | 23,422 | |

GOING CONCERN

Odenza Corp. is an exploration stage company and currently has no operations. Our independent auditor has issued an audit opinion for Odenza Corp. which includes a statement raising substantial doubt as to our ability to continue as a going concern.

LIQUIDITY AND CAPITAL RESOURCES

Our cash balance at January 31, 2011 was $18,309 with $20,242 in outstanding liabilities. Total expenditures over the next 12 months are expected to be approximately $35,000. If we experience a shortage of funds prior to generating revenues from operations we may utilize funds from our directors, who have informally agreed to advance funds to allow us to pay for operating costs, however they have no formal commitment, arrangement or legal obligation to advance or loan funds to us. Management believes our current cash balance will not be sufficient to fund our operations for the next six months.

PLAN OF OPERATION

Our plan of operation for the twelve months is to complete the first and second phases of the three phased exploration program on our claim. In addition to the $19,000 we anticipate spending for the first two phases of the exploration program as outlined below, we anticipate spending an additional $16,000 on general and administration expenses including fees payable in connection with complying with reporting obligations, and general administrative costs. Total expenditures over the next 12 months are therefore expected to be approximately $35,000. If we experience a shortage of funds prior to funding we may utilize funds from our directors, however they have no formal commitment, arrangement or legal obligation to advance or loan funds to the company.

Phase 1: Localized soil surveys, trenching and sampling over known and indicated mineralized zones.

Phase 2: VLF-EM and magnetometer surveys.

Phase 3: Positive areas will need to be diamond drill tested. The amount of drilling will depend on the success of phase 1 and 2.

BUDGET

| | | $ | |

| Phase 1 | | | 7,000 | |

| Phase 2 | | | 12,000 | |

| Phase 3 | | | 75,000 | |

| Total | | | 94,000 | |

We plan to commence Phase 1 of the exploration program on the claim in summer 2011. We expect this phase to take two weeks to complete and an additional one to two months for the geologist to prepare his report.

The above program costs are management’s estimates based upon the recommendations of the professional geologist’s report and the actual project costs may exceed our estimates. To date, we have not commenced exploration.

Following phase one of the exploration program, if it proves successful in identifying mineral deposits, we intend to proceed with phase two of our exploration program. Subject to the results of phase 1, we anticipate commencing with phase 2 in fall 2011. We will require additional funding to proceed with phase 3 work on the claim; we have no current plans on how to raise the additional funding. We cannot provide any assurance that we will be able to raise sufficient funds to proceed with any work after the first two phases of the exploration program.

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

ITEM 8. FINANCIAL STATEMENTS

ODENZA CORP.

(An Exploration Stage Company)

FINANCIAL STATEMENTS

Chang G. Park, CPA, Ph. D. t 4725 MERCURY STREET SUITE 210 t SAN DIEGO t CALIFORNIA 92111t t TELEPHONE (858)722-5953 t FAX (858) 761-0341 t FAX (858) 764-5480 t E-MAIL changgpark@gmail.comt |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Odenza Corp.

(An Exploration Stage Company)

We have audited the accompanying balance sheets of Odenza Corp. (An Exploration Stage “Company”) as of January 31, 2011 and 2010 and the related statement of operation, changes in shareholders’ equity and cash flow for the year ended January 31, 2011, the period from July 16, 2009 (inception) to January 31, 2010 and the period from July 16, 2009 (inception) through January 31, 2011. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Odenza Corp. as of January 31, 2011 and 2010, and the result of its operation and its cash flow for the year ended January 31, 2011, the period from July 16, 2009 (inception) to January 31, 2010 and the period from July 16, 2009 (inception) through January 31, 2011 in conformity with U.S. generally accepted accounting principles.

The financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company’s losses from operations and no operation raise substantial doubt about its ability to continue as a going concern. Management's plans regarding those matters also are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/Chang Park

____________________

CHANG G. PARK, CPA

May 16, 2011

San Diego, CA. 92111

ODENZA CORP.

(An Exploration Stage Company)

BALANCE SHEETS

| | | January 31, 2011 - $ - | | | January 31, 2010 - $ - | |

| | | | | | | |

| ASSETS | | | | | | |

| Current assets | | | | | | |

| Cash | | | 18,309 | | | | 31,284 | |

| Total assets | | | 18,309 | | | | 31,284 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| | | | | | | | | |

| Current liabilities | | | | | | | | |

| Accounts payable | | | - | | | | 807 | |

| Due to related party | | | 20,242 | | | | 7,035 | |

| Total current liabilities | | | 20,242 | | | | 7,842 | |

| Total liabilities | | | 20,242 | | | | 7,842 | |

| STOCKHOLDERS’ EQUITY | | | | | | | | |

| Common stock | | | | | | | | |

| Authorized: | | | | | | | | |

| 75,000,000 common shares with a par value of $0.001 | | | | | | | | |

| Issued and outstanding: | | | | | | | | |

| 3,660,000 common shares | | | 3,660 | | | | 3,660 | |

| Additional paid in capital | | | 27,840 | | | | 27,840 | |

| Deficit accumulated during the exploration stage | | | (33,433 | ) | | | (8,058 | ) |

| Total stockholders’ equity | | | (1,933 | ) | | | 23,442 | |

| Total liabilities and stockholders’ equity | | | 18,309 | | | | 31,284 | |

The accompanying notes are an integral part of these financial statements

ODENZA CORP.

(An Exploration Stage Company)

STATEMENTS OF OPERATIONS

| | | Year ending January 31, 2011 - $ - | | | Period from July 16, 2009 (Inception) to January 31, 2010 - $ - | | | Period from July 16, 2009 (Inception) to January 31, 2011 - $ - | |

| | | | | | | | | | |

| Office and general | | | 4,125 | | | | 610 | | | | 4,735 | |

| Professional fees | | | 21,250 | | | | 2,858 | | | | 24,108 | |

| Mining costs | | | - | | | | 4,590 | | | | 4,590 | |

| Net loss | | | 25,375 | | | | 8,058 | | | | 33,433 | |

| Basic and diluted net loss per share | | | (0.00 | ) | | | (0.00 | ) | | | | |

| Weighted average number of shares outstanding | | | 3,660,000 | | | | 3,660,000 | | | | | |

The accompanying notes are an integral part of these financial statements

ODENZA CORP.

(An Exploration Stage Company)

STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE PERIOD FROM July 16, 2009 (INCEPTION) TO JANUARY 31, 2011

| | | Common Stock | | | Additional Paid-in Capital | | | Deficit Accumulated During Development Stage | | | Total | |

| | | Number | | | | -$ - | | | | - $- | | | | - $- | | | | - $- | |

| Balance, July 16, 2009 (Inception) | | | - | | | | - | | | | - | | | | - | | | | - | |

| Common stock issued for cash at $0.001 per share | | | 2,500,000 | | | | 2,500 | | | | - | | | | - | | | | 2,500 | |

| Common stock issued for cash at $0.025 per share – July 16, 2009 to January 31, 2010 | | | 1,160,000 | | | | 1,160 | | | | 27,840 | | | | - | | | | 29,000 | |

| Net loss | | | - | | | | - | | | | - | | | | (8,058 | ) | | | (8,058 | ) |

| Balance, January 31, 2010 (Audited) | | | 3,660,000 | | | | 3,660 | | | | 27,840 | | | | (8,058 | ) | | | 23,442 | |

| Net loss | | | - | | | | - | | | | - | | | | (25,375 | ) | | | (25,375 | ) |

| Balance, January 31, 2011 (Audited) | | | 7,900,000 | | | | 3,660 | | | | 27,840 | | | | (33,433 | ) | | | (1,933 | ) |

The accompanying notes are an integral part of these financial statements

ODENZA CORP.

(An Exploration Stage Company)

STATEMENTS OF CASH FLOWS

| | | Year ending January 31, 2011 - $ - | | | Period from July 16, 2009 (Inception) to January 31, 2010 - $ - | | | Period from July 16, 2009 (Inception) to January 31, 2011 - $ - | |

| | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Net loss | | | (25,375 | ) | | | (8,058 | ) | | | (33,433 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | | | | | |

| Changes in: | | | | | | | | | | | | |

| Accounts payable | | | (807 | ) | | | 807 | | | | - | |

| | | | | | | | | | | | | |

| NET CASH USED IN OPERATING ACTIVITIES | | | (26,182 | ) | | | (7,251 | ) | | | (33,433 | ) |

| | | | | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | | | | |

| Due to related party | | | 13,207 | | | | 7,035 | | | | 20,242 | |

| Proceeds from sale of common stock | | | - | | | | 31,500 | | | | 31,500 | |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 13,207 | | | | 38,535 | | | | 51,742 | |

NET INCREASE (DECREASE) IN CASH | | | (12,975 | ) | | | 31,284 | | | | 18,309 | |

| | | | | | | | | | | | | |

| CASH, BEGINNING OF PERIOD | | | 31,284 | | | | - | | | | - | |

| CASH, END OF PERIOD | | | 18,309 | | | | 31,284 | | | | 18,309 | |

| | | | | | | | | | | | | |

| Supplemental cash flow information: | | | | | | | | | | | | |

| Interest paid | | | - | | | | - | | | | - | |

| Income taxes paid | | | - | | | | - | | | | - | |

The accompanying notes are an integral part of these financial statements

ODENZA CORP.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

| 1. | NATURE OF OPERATIONS |

| | |

| | The Company was incorporated in the State of Nevada on July 16, 2009 and its year-end is January 31. The Company is an exploration stage company and is currently seeking new business opportunities.

Going concern These financial statements have been prepared on a going concern basis. The Company has incurred losses since inception resulting in an accumulated deficit of $33,433 at January 31, 2011 and further losses are anticipated in the development of its business raising substantial doubt about the Company’s ability to continue as a going concern. Its ability to continue as a going concern is dependent upon the ability of the Company to generate profitable operations in the future and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has plans to seek additional capital through a private placement of its common stock or further director loans as needed. These financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue. |

| | |

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

| | |

| | Basis of presentation

These financial statements are presented in United States dollars and have been prepared in accordance with United States generally accepted accounting principles. Use of estimates and assumptions The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are readily apparent from other sources. The actual results experienced by the Company may differ materially from the Company’s estimates. To the extent there are material differences, future results may be affected. Estimates used in preparing these financial statements include the carrying value of the equipment, deferred income tax amounts, rates and timing of the reversal of income tax differences.

Mineral property costs The Company has been in the exploration stage since its formation on July 16, 2009 and has not yet realized any revenues from its planned operations. It is primarily engaged in the acquisition and exploration of mining properties. Mineral property acquisition and exploration costs are charged to operations as incurred. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property, are capitalized. Such costs will be amortized using the units-of-production method over the estimated life of the probable reserve. Loss per common share Basic earnings per share includes no dilution and is computed by dividing income available to common stockholders by the weighted average number of common shares outstanding for the period. Dilutive earnings per share reflect the potential dilution of securities that could share in the earnings of the Company. Because the Company does not have any potentially dilutive securities, diluted loss per share is equal to the basic loss per share. |

ODENZA CORP.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

| | Comprehensive Loss For all periods presented, the Company has no items that represent a comprehensive loss and, therefore, has not included a statement of comprehensive loss in these financial statements. Financial instruments The fair value of the Company’s financial instruments consisting of cash, accounts payable, and amounts due to related party approximate their carrying values due to the immediate or short-term maturity of these financial instruments. The Company operates in Australia and therefore is exposed to foreign exchange risk. It is management's opinion that the Company is not exposed to significant interest or credit risks arising from these financial instruments. Income taxes Deferred income taxes are provided for tax effects of temporary differences between the tax basis of asset and liabilities and their reported amounts in the financial statements. The Company uses the liability method to account for income taxes, which requires deferred taxes to be recorded at the statutory rate expected to being in effect when the taxes are paid. Valuation allowances are provided for a deferred tax asset when it is more likely than not that such asset will not be realized.

Management evaluates tax positions taken or expected to be taken in a tax return. The evaluation of a tax position includes a determination of whether a tax position should be recognized in the financial statements, and such a position should only be recognized if the Company determines that it is more likely than not that the tax position will be sustained upon examination by the tax authorities, based upon the technical merits of the position. For those tax positions that should be recognized, the measurement of a tax position is determined as being the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement.

Stock-based compensation The Company has not adopted a stock option plan and therefore has not granted any stock options. Accordingly, no stock-based compensation has been recorded to date.

Foreign Currency Translation Foreign denominated monetary assets and liabilities are translated to their United States dollar equivalents using foreign exchange rates which prevailed at the balance sheet date. Expenses are translated at average rates of exchange during the period. Related translation adjustments are reported as a separate component of stockholders' equity, whereas gains or losses resulting from foreign currency transactions are included in results of operations.

Recent Accounting Pronouncements

In February 2010, the FASB issued Accounting Standards Update (“ASU”) No. 2010-09, “Amendments to Certain Recognition and Disclosure Requirements” (“ASU 2010-09”), which is included in the FASB Accounting Standards CodificationTM ( the “ASC”) Topic 855 (Subsequent Events). ASU 2010-09 clarifies that an SEC filer is required to evaluate subsequent events through the date that the financial statements are issued. ASU 2010-09 is effective upon the issuance of the final update and did not have a significant impact on the Company’s consolidated financial statements. |

ODENZA CORP.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

| | In June 2009, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 168, FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles, a replacement of SFAS No. 162 (“Statement 168”). Statement 168 establishes the FASB Accounting Standards Codification as the source of authoritative accounting principles recognized by the FASB to be applied in the preparation of financial statements in conformity with generally accepted accounting principles. Statement 168 explicitly recognizes rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under federal securities laws as authoritative GAAP for SEC registrants. Statement 168 is effective for financial statements issued for fiscal years and interim periods ending after September 15, 2009. The Company has adopted Statement 168 for the year ended January 31, 2010.

Other pronouncements issued by the FASB or other authoritative accounting standards groups with future effective dates are either not applicable or are not expected to be significant to the financial statements of the Company. |

| | |

| 3. | MINERAL PROPERTY |

| | |

| | On September 25, 2009 the Company entered into an Option Agreement to acquire a 100% undivided legal, beneficial and register-able interest in Prospecting License P21/709 of approximately 140 hectares located in the Murchison Mineral field in Western Australia and known as the Island Project Lake Austin. The option period is for two years from effective date. The exercise price of the option is AU$ 50,000 (equivalent amounts of USD 50,322 as of January 31, 2011) cash.

At January 31, 2011, accumulated costs totalled $4,590. These costs were expensed in the prior year. |

| | |

| 4. | RELATED PARTY TRANSACTIONS |

| | |

| | During the period, the Company issued 2,500,000 common shares at $0.001 per share to the Company's President for cash proceeds of $2,500.

At January 31, 2011, the Company owed $20,242 to the president and the director of the Company for funds advanced. This amount is unsecured, bears no interest and is payable on demand.

Related party transactions are measured at the exchange amount which is the amount agreed upon by the related parties. |

ODENZA CORP.

(An Exploration Stage Company)

NOTES TO THE FINANCIAL STATEMENTS

| 5. | INCOME TAXES |

| | |

| | As of January 31, 2011, the Company has estimated tax loss carry forwards for tax purpose of approximately $33,433, which expire by 2031. These amounts may be applied against future taxable income. Future tax benefits which may arise as a result of these losses have not been recognized in these financial statements, as their realization has not been determined to be more likely than not to occur.

The actual income tax provisions differ from the expected amounts calculated by applying the statutory income tax rate to the Company’s loss before income taxes. The components of these differences are as follows: |

| | | 2011 | | | 2010 | |

| Loss before income tax | | $ | 25,375 | | | $ | 8,058 | |

| Statutory tax rate | | | 34 | % | | | 34 | % |

| Expected recovery of income taxes at standard rates | | | 8,627 | | | | 2,740 | |

| Change in valuation allowance | | | (8,627 | ) | | | (2,740 | ) |

| | | | | | | | | |

| Income tax provision | | $ | - | | | $ | - | |

| Components of deferred tax asset: | | | | | | |

| Non-capital tax loss carry forwards | | $ | 11,367 | | | $ | 2,740 | |

| Less: valuation allowance | | | (11,367 | ) | | | (2,740 | ) |

| | | | | | | | | |

| Net deferred tax asset | | $ | - | | | $ | - | |

| | The Company has not filed income tax returns since inception in the United States. Both taxing authorities prescribe penalties for failing to file certain tax returns and supplemental disclosure. Upon filing there could be penalties an interest assessed. Such penalties vary by jurisdiction and by assessing practices and authorities. As the Company has incurred losses since inception there would be no known or anticipated exposure to penalties for income tax liability. However, certain jurisdictions may assess penalties for failing to file returns and other disclosures and for failing to file other supplemental information associated with foreign ownership, debt and equity position. Inherent uncertainties arise over tax positions taken with respect to transfer pricing, related party transactions, tax credits, tax based incentives and stock based transactions. Management has considered the likelihood and significance of possible penalties associated with its current and intended filing positions and has determined, based on their assessment, that such penalties, if any, would not be expected to be material. |

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

DISCLOSURE CONTROLS AND PROCEDURES

Under the supervision and with the participation of our management, including our principal executive officer and the principal financial officer, we are responsible for conducting an evaluation of the effectiveness of the design and operation of our internal controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as of the end of the fiscal year covered by this report. Disclosure controls and procedures means that the material information required to be included in our Securities and Exchange Commission (“SEC”) reports is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms relating to our company, including any consolidating subsidiaries, and was made known to us by others within those entities, particularly during the period when this report was being prepared. Based on this evaluation, our principal executive officer and principal financial officer concluded as of the evaluation date that our disclosure controls and procedures were effective as of January 31, 2011.

MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

As of January 31, 2011, management assessed the effectiveness of our internal control over financial reporting. The Company's management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. Internal control over financial reporting is defined in Rule 13a-15(f) or 15d-15(f) promulgated under the Securities Exchange Act of 1934, as amended, as a process designed by, or under the supervision of, the Company’s Chief Executive Officer and Chief Financial Officer and effected by the Company’s Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with GAAP in the United States of America and includes those policies and procedures that:

· Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect our transactions and dispositions of our assets;

· Provide reasonable assurance our transactions are recorded as necessary to permit preparation of our financial statements in accordance with GAAP, and that receipts and expenditures are being made only in accordance with authorizations of our management and directors; and

· Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statement.

In evaluating the effectiveness of our internal control over financial reporting, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control – Integrated Framework. Based on that evaluation, completed only by William O’Neill, our President, Chief Executive Officer, Treasurer and Director, who also serves as our principal financial officer and principal accounting officer, Mr. O’Neill concluded that, during the period covered by this report, such internal controls and procedures were not effective to detect the inappropriate application of US GAAP rules as more fully described below.

This was due to deficiencies that existed in the design or operation of our internal controls over financial reporting that adversely affected our internal controls and that may be considered to be material weaknesses.

The matters involving internal controls and procedures that our management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (i) lack of a functioning audit committee due to a lack of a majority of independent members and a lack of a majority of outside directors on our board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (ii) inadequate segregation of duties consistent with control objectives; and (iii) ineffective controls over period end financial disclosure and reporting processes. The aforementioned material weaknesses were identified by our President, Chief Executive Officer, Secretary, Treasurer and Director, who also serves as our principal financial officer and principal accounting officer, in connection with the review of our financial statements as of January 31, 2011.

Management believes that the lack of a functioning audit committee and the lack of a majority of outside directors on our board of directors results in ineffective oversight in the establishment and monitoring of required internal controls and procedures, which could result in a material misstatement in our financial statements in future periods.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING.

There were no changes in the Company’s internal control over financial reporting that occurred during the fourth quarter of the year ended January 31, 2011 that have materially affected, or that are reasonably likely to materially affect, the Company’s internal control over financial reporting.

ITEM 9B. OTHER INFORMATION.

None.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Our executive officer’s and director’s and their respective age’s as of January 31, 2011 are as follows:

| | Age | | Positions and Offices |

| | | | | |

| Mr. William O’Neill | | 49 | | President, Chief Executive Officer, Treasurer and Director |

The directors named above will serve until the next annual meeting of the stockholders or until their respective resignation or removal from office. Thereafter, directors are anticipated to be elected for one-year terms at the annual stockholders’ meeting. Officers will hold their positions at the pleasure of the Board of Directors, absent any employment agreement, of which none currently exists or is contemplated.

Set forth below is a brief description of the background and business experience of our executive officers and directors for the past five years.

WILLIAM O’NEILL

Mr. O’Neill has served as our President, Chief Executive Officer, Secretary and a Director since July 16, 2009. Since January 2005, Mr. O’Neill has owned and operated an IT consultancy business, focusing primarily on website development services. Prior to 2005, Mr. O’Neill was an employee of Qantas Airlines for 13 years and an employee of British Airways for 3 years, holding a variety of positions, including programming, systems delivery and sales. Mr. O’Neill obtained his Bachelor of Business in 1981 from the Western Australia Institute of Technology, now named Curtin University of Technology, located in Perth, Australia.

TERM OF OFFICE

All directors hold office until the next annual meeting of the stockholders of the Company and until their successors have been duly elected and qualified. The Company’s Bylaws provide that the Board of Directors will consist of no less than three members. Officers are elected by and serve at the discretion of the Board of Directors.

DIRECTOR INDEPENDENCE

Our board of directors is currently composed of one member, whom does not qualify as an independent director in accordance with the published listing requirements of the NASDAQ Global Market (the Company has no plans to list on the NASDAQ Global Market). The NASDAQ independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director, nor any of his family members has engaged in various types of business dealings with us. In addition, our board of directors has not made a subjective determination as to our director that no relationships exist which, in the opinion of our board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, though such subjective determination is required by the NASDAQ rules. Had our board of directors made these determinations, our board of directors would have reviewed and discussed information provided by our director and us with regard to our director’s business and personal activities and relationships as they may relate to us and our management.

CERTAIN LEGAL PROCEEDINGS

No director, nominee for director, or executive officer of the Company has appeared as a party in any legal proceeding material to an evaluation of his ability or integrity during the past five years.

SIGNIFICANT EMPLOYEES AND CONSULTANTS

Other than our officers and directors, we currently have no other significant employees. AUDIT COMMITTEE AND CONFLICTS OF INTEREST

Since we do not have an audit or compensation committee comprised of independent directors, the functions that would have been performed by such committees are performed by our directors. The Board of Directors has not established an audit committee and does not have an audit committee financial expert, nor has the Board of Directors established a nominating committee. The Board is of the opinion that such committees are not necessary since the Company is an early exploration stage company and has only two directors, and to date, such directors have been performing the functions of such committees. Thus, there is a potential conflict of interest in that our directors and officers have the authority to determine issues concerning management compensation, nominations, and audit issues that may affect management decisions.

There are no family relationships among our directors or officers. Other than as described above, we are not aware of any other conflicts of interest with any of our executive officers or directors.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who own more than ten percent of a registered class of our equity securities, file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater-than-ten percent stockholders are required by SEC regulations to furnish us with all Section 16(a) forms they file. Based on our review of filings made on the SEC website, and the fact of us not receiving certain forms or written representations from certain reporting persons that they have complied with the relevant filing requirements, we believe that, during the year ended January 31, 2011, none of our executive officers, directors and greater-than-ten percent stockholders complied with all Section 16(a) filing requirements.

CODE OF ETHICS

The Company has not adopted a code of ethics that applies to its principal executive officers, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Company has not adopted a code of ethics because it has only commenced operations.

ITEM 11. EXECUTIVE COMPENSATION

The following tables set forth certain information about compensation paid, earned or accrued for services by our Chief Executive Officer and all other executive officers (collectively, the “Named Executive Officers”) in the fiscal years ended January 31, 2011 and 2010:

SUMMARY COMPENSATION TABLE

The table below summarizes all compensation awarded to, earned by, or paid to our Officers for all services rendered in all capacities to us as of the year ended January 31, for the fiscal year ended as indicated.

| | | | | | | | | | | | | | | | | | Non-Equity | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Incentive | | | Nonqualified | | | | | | | |

| Name and | | | | | | | | | | | Stock | | | Option | | | Plan | | | Deferred | | | All Other | | | | |

| | Year | | | Salary ($) | | | Bonus ($) | | | Awards ($) | | | Awards ($) | | | Compensation($) | | | Compensation($) | | | Compensation($) | | | Total ($) | |

| William O’Neill (1) | | 2011 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| | | 2010 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

_________

(1) President and Chief Executive Officer, Secretary, Treasurer and Director.

None of our directors have received monetary compensation since our inception to the date of this prospectus. We currently do not pay any compensation to our directors serving on our board of directors.

We have not granted any stock options to the executive officers since our inception. Upon the further development of our business, we will likely grant options to directors and officers consistent with industry standards for junior mineral exploration companies.

EMPLOYMENT AGREEMENTS

The Company is not a party to any employment agreement and has no compensation agreement with its sole officer and director, William O’Neill.

DIRECTOR COMPENSATION

The following table sets forth director compensation as of January 31, 2011:

| | | Fees | | | | | | | | | Non-Equity | | | Nonqualified | | | | | | | |

| | | Earned | | | | | | | | | Incentive | | | Deferred | | | | | | | |

| | | Paid in | | | Stock | | | Option | | | Plan | | | Compensation | | | All Other | | | | |

| Name | | Cash ($) | | | Awards( $) | | | Awards ($) | | | Compensation ($) | | | Earnings ($) | | | Compensation ($) | | | Total ($) | |

| William O’Neill | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table lists, as of January 31, 2011, the number of shares of common stock of our Company that are beneficially owned by (i) each person or entity known to our Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each officer and director of our Company; and (iii) all officers and directors as a group. Information relating to beneficial ownership of common stock by our principal shareholders and management is based upon information furnished by each person using “beneficial ownership” concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

The percentages below are calculated based on 3,360,000 shares of our common stock issued and outstanding as of January 31, 2011. We do not have any outstanding warrant, options or other securities exercisable for or convertible into shares of our common stock.

| | | Name and Address | | Number of Shares | | | Percent of | |

| Title of Class | | of Beneficial Owner (1) | | Owned Beneficially | | | Class Owned | |

| | | | | | | | | |

| Common Stock: | | Mr. William O’Neill, President, President, Chief Executive Officer, Treasurer and Director | | | 2,500,000 | | | | 68.3 | % |

| | | | | | | | | | | |

| All executive officers and directors as a group (1 person) | | | | | 2,500,000 | | | | 68.3 | % |

_______

(1) Unless otherwise noted, the address of each person or entity listed is, c/o Odenza Corp., 126 Station Street, Newtown, NSW 2042, Australia.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

None.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

For the year ended January 31, 2011 the total fees charged to the company for audit services, including quarterly reviews were $8,750, for audit-related services were $0 and for tax services and other services were $0 and $0, respectively.

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULE

(a) The following Exhibits, as required by Item 601 of Regulation SK, are attached or incorporated by reference, as stated below.

| Number | | Description |

| | | |

| 3.1 | | Articles of Incorporation* |

| 3.2 | | Bylaws* |

| 31.1 | | Certification of Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 31.2 | | Certification of Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 32.1 | | Certification of Principal Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

_________

* Incorporated by reference to the Registrant’s Form S-1 (File No. 333-166076), filed with the Commission on April 15, 2010.

SIGNATURES

In accordance with Section 13 or 15(d) of the Securities Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ODENZA CORP. |

| | (Name of Registrant) |

| | | |

| Date: May 17, 2011 | By: | /s/ William O’Neill |

| | | William O’Neill |

| | | President, Chief Executive Officer, Treasurer (and principal financial officer and principal accounting officer) |

EXHIBIT INDEX

| Number | | Description |

| | | |

| 3.1 | | Articles of Incorporation* |

| 3.2 | | Bylaws* |

| 31.1 | | Certification of Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 31.2 | | Certification of Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 32.1 | | Certification of Principal Executive Officer and Principal Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

__________

* Incorporated by reference to the Registrant’s Form S-1 (file no. 333-166076), filed with the Commission on April 15, 2010.