- LYB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

LyondellBasell Industries (LYB) 8-KLyondellBasell Reports Record 2012 Earnings

Filed: 1 Feb 13, 12:00am

Jim Gallogly, Chief Executive Officer Karyn Ovelmen, Chief Financial Officer Doug Pike, VP - Investor Relations February 1, 2013 Fourth-Quarter 2012 Earnings Exhibit 99.2 Sergey Vasnetsov, SVP - Strategic Planning and Transactions |

lyondellbasell.com Cautionary Statement 2 The information in this presentation includes forward-looking statements. These statements relate to future events, such as anticipated revenues, earnings, business strategies, competitive position or other aspects of our operations or operating results. Actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Factors that could cause actual results to differ from forward-looking statements include, but are not limited to, availability, cost and price volatility of raw materials and utilities; supply/demand balances; industry production capacities and operating rates; uncertainties associated with worldwide economies; legal, tax and environmental proceedings; cyclical nature of the chemical and refining industries; operating interruptions; current and potential governmental regulatory actions; terrorist acts; international political unrest; competitive products and pricing; technological developments; the ability to comply with the terms of our credit facilities and other financing arrangements; the ability to implement business strategies; and other factors affecting our business generally as set forth in the “Risk Factors” section of our Form 10-K for the year ended December 31, 2011, which can be found at www.lyondellbasell.com on the Investor Relations page and on the Securities and Exchange Commission’s website at www.sec.gov. This presentation contains time sensitive information that is accurate only as of the date hereof. Information contained in this presentation is unaudited and is subject to change. We undertake no obligation to update the information presented herein except as required by law. |

Information Related to Financial Measures 3 We have included EBITDA in this presentation, which is a non-GAAP measure, as we believe that EBITDA is a measure commonly used by investors. However, EBITDA, as presented herein, may not be comparable to a similarly titled measure reported by other companies due to differences in the way the measure is calculated. For purposes of this presentation, EBITDA means net income before net interest expense, income taxes, depreciation and amortization, reorganization items, income from equity investments, income(loss) attributable to non-controlling interests, net income (loss) from discontinued operations, plus joint venture dividends, as adjusted for other items management does not believe are indicative of the Company’s underlying results of operations such as impairment charges, asset retirement obligations and the effect of mark-to-market accounting on our warrants. The specific items for which EBITDA is adjusted in each applicable reporting period may only be relevant in certain periods and are disclosed in the reconciliation of non-GAAP financial measures. EBITDA should not be considered an alternative to profit or operating profit for any period as an indicator of our performance, or as an alternative to operating cash flows as a measure of our liquidity. See Table 9 of our accompanying earnings release for reconciliations of EBITDA to net income. While we also believe that free cash flow (FCF) measure is commonly used by investors, free cash flow, as presented herein, may not be comparable to similarly titled measures reported by other companies due to differences in the way the measure is calculated. For purposes of this presentation, free cash flow means net cash provided by operating activities minus capital expenditures. lyondellbasell.com |

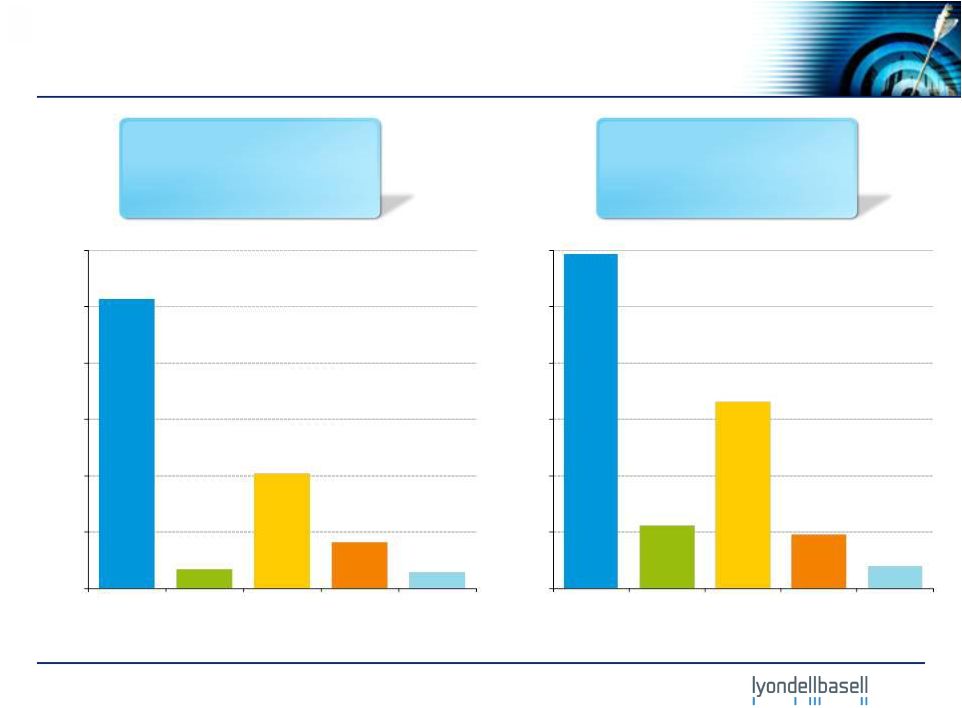

lyondellbasell.com Highlights EBITDA (1) 1Q’11 – 4Q’12 FY 2012 Record Earnings – 16% growth in Income from Continuing Operations vs. 2011 ($ in millions) 4 500 1,000 1,500 $2,000 1Q'11 2Q'11 3Q'11 4Q'11 1Q'12 2Q'12 3Q'12 4Q'12 Income from Continuing Operations 750 1,500 2,250 $3,000 2011 2012 16% ($ in millions, except per share data) 4Q'12 3Q'12 4Q'11 FY 2012 FY 2011 EBITDA (1) $1,289 $1,565 $766 $5,856 $5,585 Income from Continuing Operations $645 $851 $27 $2,858 $2,472 Diluted Earnings ($ / share) from Continuing Operations $1.13 $1.47 $0.05 $4.96 $4.32 (1) (1) 1) The third quarter 2012 includes a $71 million market price recovery that offset second quarter 2012 lower of cost or market adjustment (LCM). |

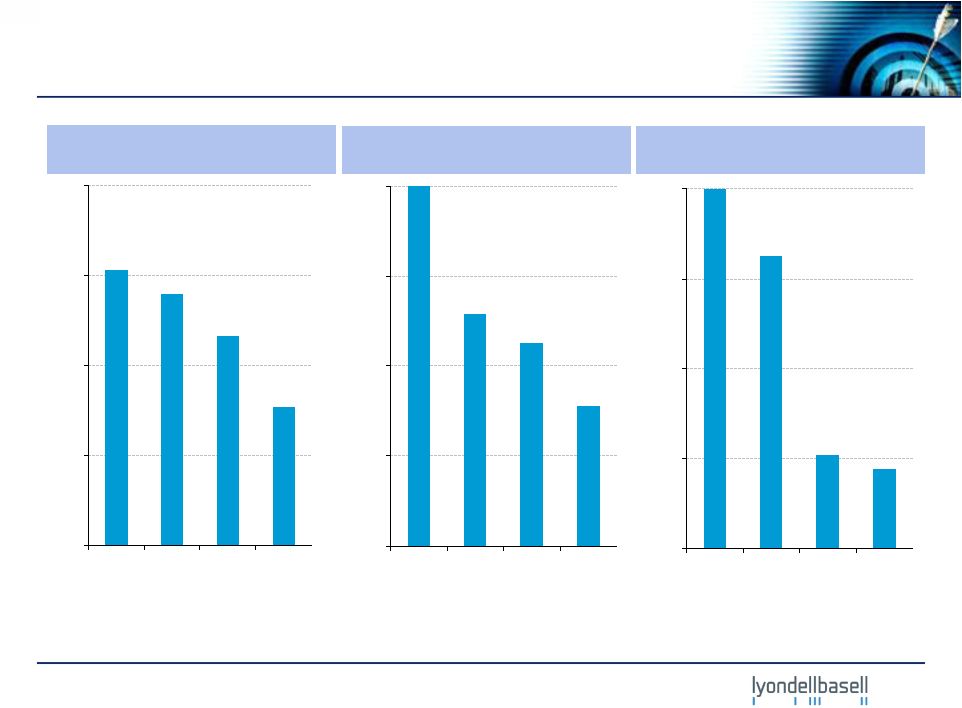

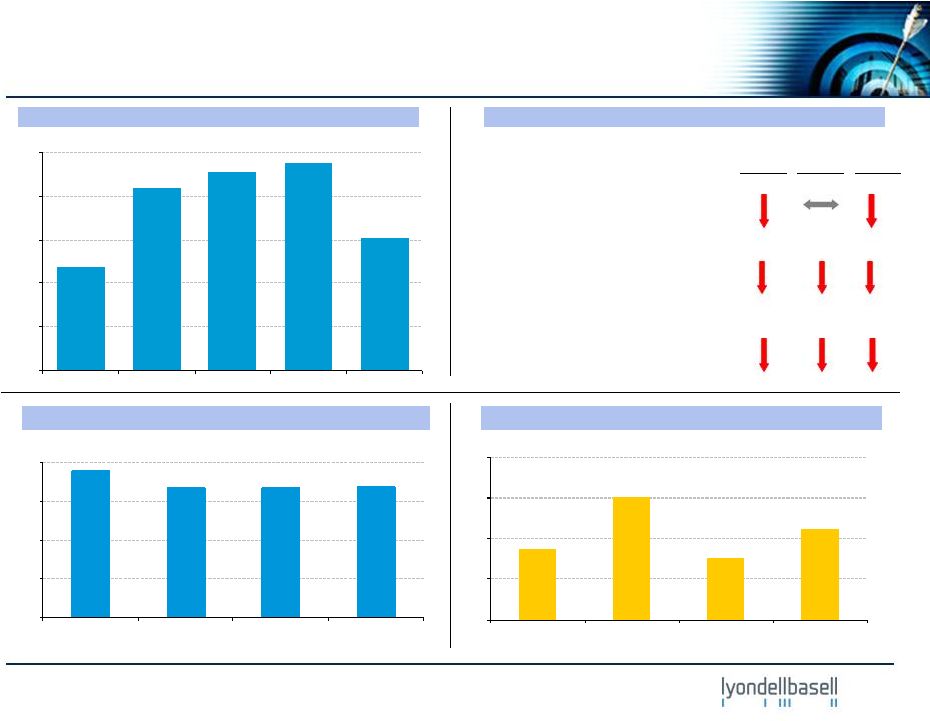

lyondellbasell.com Record Health, Safety and Environmental Performance 1) Includes employees and contractors. Injuries per 200,000 Hours Worked (1) Indexed Environmental Incidents Indexed Process Incidents 5 0.00 0.15 0.30 0.45 0.60 2009 2010 2011 2012 0% 25% 50% 75% 100% 2009 2010 2011 2012 0% 25% 50% 75% 100% 2009 2010 2011 2012 |

lyondellbasell.com Finance • Generated $4.8 billion cash from operations • Paid $2.4 billion in dividends, equivalent to ~ 7% dividend yield (2) • Increased quarterly interim dividend to $0.40 per share • Reduced net annual interest expense by $367 million • Received $147 million in JV dividends • S&P 500 index inclusion 2012 Accomplishments Manufacturing • Increased NGL cracking by 10% to 85% of North American ethylene production • Second half of the year, North American ethylene production exceeded nameplate capacity • Completed two key maintenance turnarounds at two of our largest sites • Manufacturing achieved multiple production records Commercial • All major expansion projects on schedule • Defined next phase of ethylene expansions • Advanced European restructuring and optimization • Signed China Propylene Oxide joint venture MOU Record Results, continued progress made across the company ($ in millions) Overall • Record earnings • 89% total return vs. 13% for S&P 500 (1) • Outstanding HSE performance • Normalized fixed costs managed flat since 2009 • Ceased operations at the Berre refinery 1) Based on CapIQ dividend adjusted beginning and closing prices for 2012. 2) Dividend Yield data means the total 2012 dividends divided by the company market capitalization. The market cap is calculated based on December 31, 2012 closing stock price and approximately 577 million outstanding shares. 6 Segment EBITDA 2011 EBITDA 2012 EBITDA Y-o-Y Change Y-o-Y Change, % Olefins & Polyolefins - Americas $2,140 $2,963 $823 38% Olefins & Polyolefins - EAI 894 561 (333) -37% Intermediates & Derivatives 1,392 1,653 261 19% Refining 977 481 (496) -51% Technology 214 197 (17) -8% Total $5,585 $5,856 $271 5% |

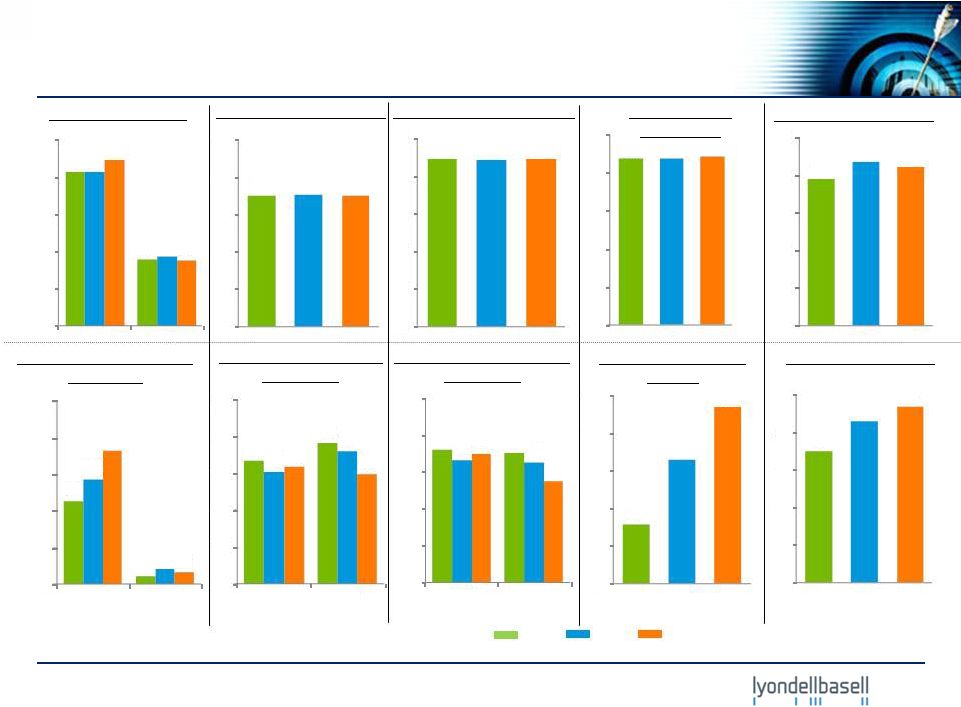

lyondellbasell.com Key Volumes and Margins: 2010 - 2012 HRO Crude Oil Rates Polyethylene Volumes Polypropylene Volumes Maya 2-1-1 Spreads Indexed Polyethylene Spreads (3) Indexed Polypropylene Spreads (3) Ethylene Volumes Indexed Ethylene Cash Margins (2) 2010 2011 I&D Chemical Volumes (1) MTBE Raw Material Margin MBPD ($/bbl) billion lbs billion lbs billion lbs billion lbs (Cents/gal) 7 2012 1) I&D volumes exclude oxyfuels 2) EU ethylene cash margins normalized to 2009 US margins. 2009 indexed margin is equal to 1.0 3) Polyethylene and Polypropylene spreads indexed to 2009; 2009 indexed margins are equal to 1.0 10.6 10.5 10.7 0 2 5 7 10 12 236 263 255 0 60 120 180 240 300 9.0 8.9 9.0 0 2 4 6 8 10 10.5 10.6 10.6 0 3 6 9 12 15 8.4 3.6 8.4 3.7 9.0 3.5 0 2 4 6 8 10 US EU 2.3 0.2 2.9 0.5 3.7 0.3 0 1 2 3 4 5 US EU 1.0 1.2 0.9 1.1 1.0 0.9 0.0 0.3 0.6 0.9 1.2 1.5 US EU 1.1 1.1 1.0 1.0 1.1 0.8 0.0 0.3 0.6 0.9 1.2 1.5 US EU 40 83 118 0 25 50 75 100 125 18 22 24 0 5 10 15 20 25 |

lyondellbasell.com FY 2012 EBITDA Fourth-Quarter 2012 and FY 2012 Segment EBITDA Fourth-Quarter 2012 EBITDA ($ in millions) ($ in millions) 8 Q4’12 EBITDA $1,289 million Q4’12 Operating Income $959 million FY 2012 EBITDA $5,856 million FY 2012 Operating Income $4,676 million 150 300 450 600 750 $900 Olefins & Polyolefins - Americas Olefins & Polyolefins - EAI Intermediates & Derivatives Refining Technology 500 1,000 1,500 2,000 2,500 $3,000 Olefins & Polyolefins - Americas Olefins & Polyolefins - EAI Intermediates & Derivatives Refining Technology |

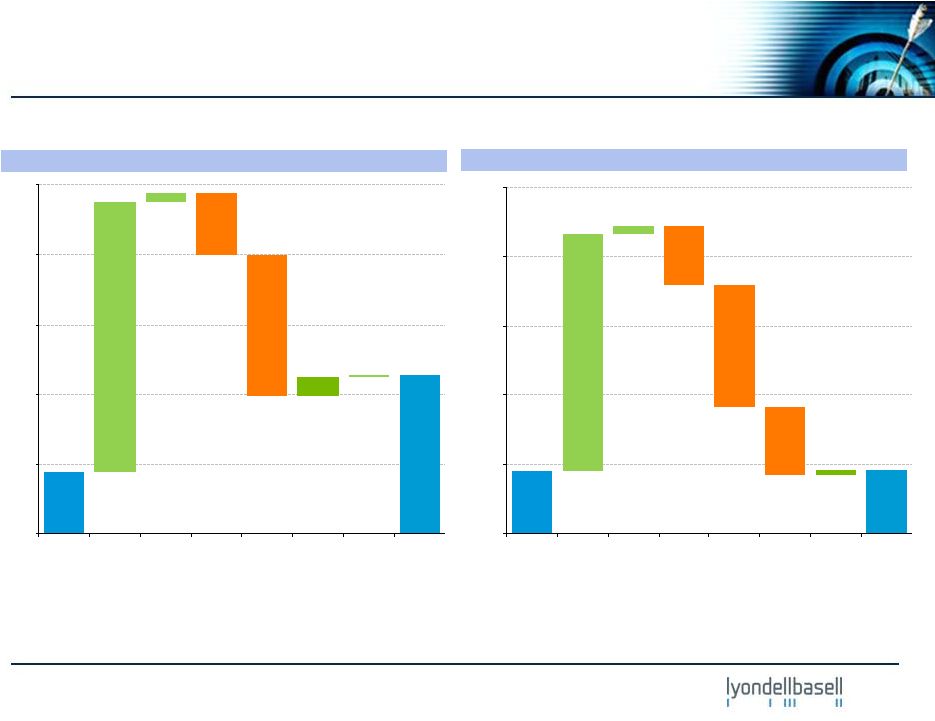

lyondellbasell.com $2,711 $2,732 0 3,000 6,000 9,000 12,000 $15,000 May 2010 Begin. Cash Balance CF from Operations excl. Working Capital Working Capital Changes Capex Dividends Net Debt Repayment Other 2012 Ending Cash Balance $1,065 $2,732 0 1,200 2,400 3,600 4,800 $6,000 2012 Beginning Cash Balance CF from Operations excl. Working Capital Working Capital Changes Capex Dividends Net Debt Repayment Other 2012 Ending Cash Balance 1) Beginning and ending cash balance includes cash and cash equivalents; 2) Includes inventories, accounts payable and accounts receivable; 3) Includes capital and maintenance turnaround spending. (3) (2) (1) ($ in millions) (2) (1) FY 2012 May 2010 – December 2012 (3) (1) 9 (1) Cash Flow |

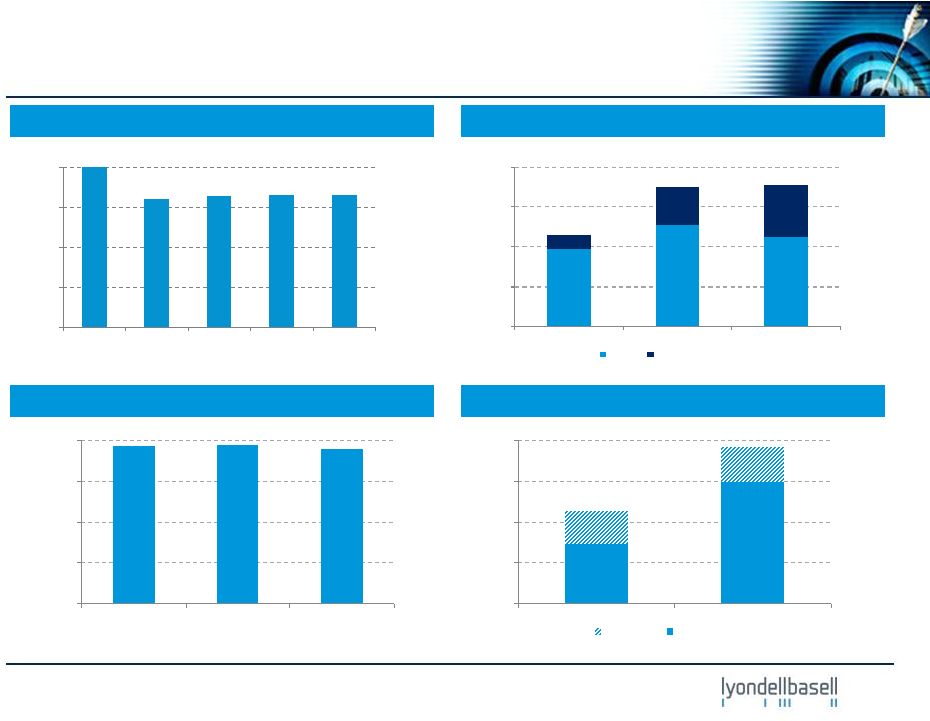

lyondellbasell.com 0 300 600 900 $1,200 2010 2011 2012 Base Growth 10 Indexed Cash Fixed Cost (1) Working Capital (2) Capital Expenditures Free Cash Flow (3) Working Capital and Key Financial Statistics 0 1,500 3,000 4,500 $6,000 2010 2011 2012 ($ in millions) ($ in millions) ($ in millions) 0 1,250 2,500 3,750 $5,000 2011 2012 Capex Free Cash Flow 1) Cash fixed costs include costs related to compensation, travel, insurance, third party services, maintenance, marketing, selling, and administration; 2) Figures depicted represent end of year balances; 3) Free Cash Flow = net cash provided by operating activities – capex 0% 25% 50% 75% 100% 2008 2009 2010 2011 2012 (2008 index = 100%) |

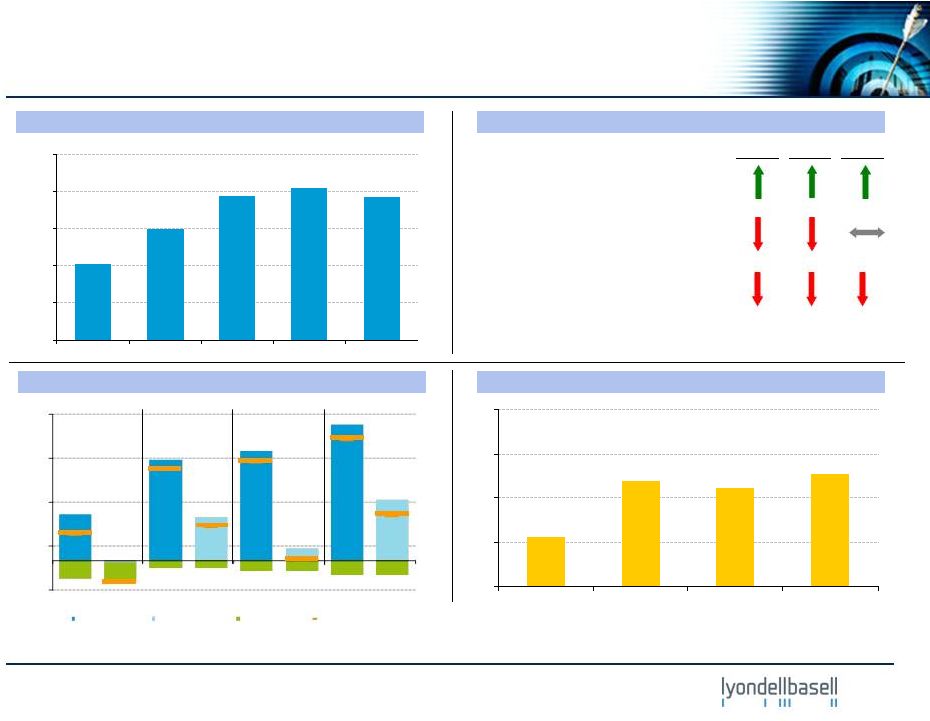

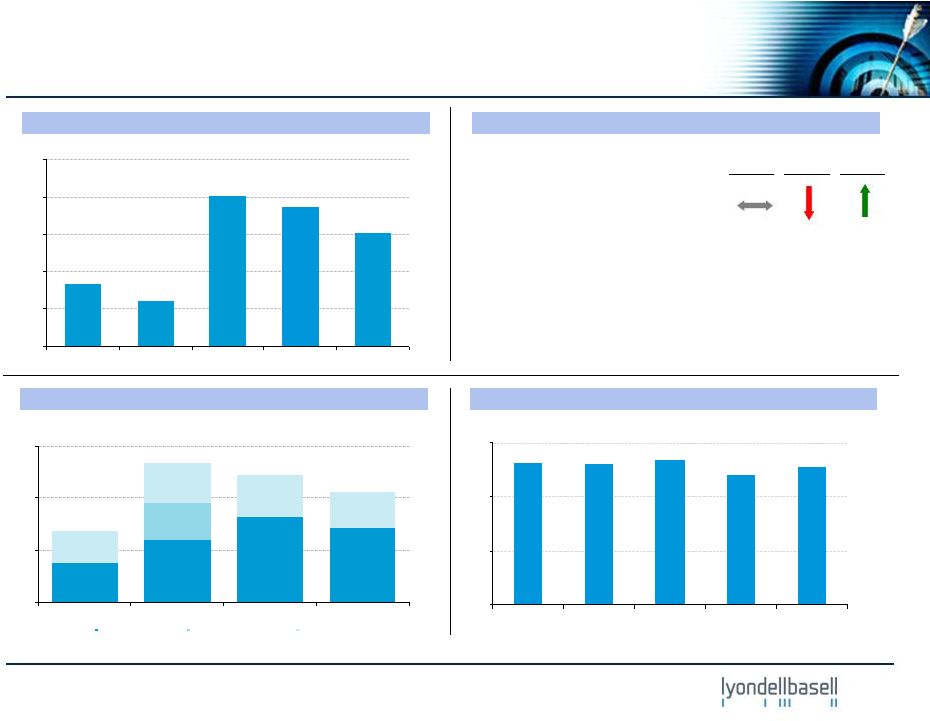

lyondellbasell.com Olefins & Polyolefins - Americas Highlights and Business Drivers - 4Q’12 U.S. Olefins • 100% capacity utilization • Margin up driven by higher ethylene price Polyethylene • Volumes relatively steady • Spread down 1¢/lb Polypropylene (includes Catalloy) • Volumes down ~ 6% • Spread down 1¢/lb Ethylene Chain Margins (per IHS) EBITDA (1) Performance vs. 3Q’12 Polypropylene Margins (per IHS) EBITDA Margin Volume ($ in millions) (cents / lb) (cents / lb) 11 1) Q3’12 EBITDA includes a $71 million non-cash LCM reversal of Q2’12 LCM inventory valuation adjustment. Q2’12 results include $29 million proceeds from hurricane insurance settlement. Q1’12 and Q3’12 include $10 million each in dividends from Indelpro joint venture. (1) 0 1 2 3 4 4Q'11 3Q'12 4Q'12 Jan'13 0 200 400 600 800 $1,000 4Q'11 1Q'12 2Q'12 3Q'12 4Q'12 (10) 5 20 35 50 4Q’11 3Q’12 4Q’12 Jan’13 Ethane Margin Naphtha Margin HDPE Margin Ethylene/HDPE Chain |

lyondellbasell.com EBITDA Margin Volume 100 200 300 $400 4Q'11 1Q'12 2Q'12 3Q'12 4Q'12 Olefins & Polyolefins - Europe, Asia, International Highlights and Business Drivers - 4Q’12 EU Olefins • Margin near breakeven • Completed Wesseling turnaround Polyethylene • Volumes relatively unchanged Polypropylene (includes Catalloy) • Volumes down ~ 4% JV dividends • Equity income relatively unchanged • $50 million in dividends received European Ethylene Chain Margins (per IHS) EBITDA Performance vs. 3Q’12 European Polypropylene Margins (per IHS) ($ in millions) (cents / lb) (cents / lb) 12 (6) (4) (2) 0 2 4Q'11 3Q'12 4Q'12 Jan'13 (10) 5 20 35 50 4Q'11 3Q'12 4Q'12 Jan'13 HDPE Margin Naphtha Margin Ethylene/HDPE Chain |

lyondellbasell.com 0 11 22 33 44 4Q11 3Q12 4Q12 1Q13 E Intermediates & Derivatives Highlights and Business Drivers - 4Q’12 EBITDA Propylene Oxide and Derivatives • Seasonal impact on volumes • Slow aircraft deicer sales Intermediates • Seasonal impact on volumes and C4 chemical margins Oxyfuels EBITDA Margin Volume Performance vs. 3Q’12 ($ in millions) 13 EU MTBE Raw Material Margins (per Platts) (cents / gallon) P-Glycol Raw Material Margins (per Chemdata) (cents / lb) 0 50 100 150 200 4Q'11 3Q'12 4Q'12 Jan'13 100 200 300 400 $500 4Q'11 1Q'12 2Q'12 3Q'12 4Q'12 • Seasonal impact on volumes and gasoline to butane spread |

lyondellbasell.com 0 100 200 300 4Q'11 1Q'12 2Q'12 3Q'12 4Q'12 0 10 20 30 4Q'11 3Q'12 4Q'12 Jan'13 Lt-Hvy Lt-Gasoline Lt-Heating Oil 40 80 120 160 $200 4Q'11 1Q'12 2Q'12 3Q'12 4Q'12 Refining Highlights and Business Drivers - 4Q’12 Houston Refinery • Underlying EBITDA is relatively unchanged • Q4 crude throughput: 255 MBPD; refinery operational limitations • Maya 2-1-1: $24.36 per bbl Refining Spreads (per Platts) (2) EBITDA (1) Performance vs. 3Q’12 EBITDA Margin Volume ($ in millions) ($ / bbl) 1) Q3’12 includes $24 million of restitution while Q2’12 includes $53 million of hurricane insurance settlement; Underlying EBITDA is relatively unchanged exclusive of these items. 2) Light Louisiana Sweet (LLS) is the referenced light crude. 14 HRO Operating Rate (MBPD) (1) |

lyondellbasell.com – Benefitting from low ethane and propane costs, increasing co-product values – Positive momentum building in: • U.S. ethylene, propylene, and polyethylene – European olefins chain remains weak – Houston refinery and I&D turnarounds in the first quarter – Growth projects remain on schedule 15 Fourth-Quarter Summary and Outlook – Strong U.S. Olefins results • Continued U.S. NGL advantage – Business declines driven by seasonal effects such as: • Lower oxyfuels margins • Lower polyolefin and I&D volumes – Minimal EBITDA generated in: • European olefins and commodity polyolefins – Dividends • Paid $2.75 per share special dividend in addition to interim dividend of $0.40 per share Fourth-Quarter Summary Near-term Outlook |

lyondellbasell.com Save the Date 16 Save the Date! We cordially invite you to attend LyondellBasell's Investor Day on March 13, 2013, in New York. At this half-day session, you will have an opportunity to interact with members of our leadership team and get an update on current results, near-term outlook and long-term plans for profitable growth. We hope you can join us to learn more about how we are seizing the moment to secure our future success. LOCATION New York Marriott Marquis Astor Ballroom 1535 Broadway, New York, NY 10036 Invitation and additional information to follow. |