UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22685

FEG DIRECTIONAL ACCESS FUND LLC

(Exact name of registrant as specified in charter)

201 EAST FIFTH STREET, SUITE 1600

CINCINNATI, OHIO 45202

(Address of principal executive offices) (Zip code)

RYAN WHEELER

201 EAST FIFTH STREET, SUITE 1600

CINCINNATI, OHIO 45202

(Name and address of agent for service)

Registrant's telephone number, including area code: 888-268-0333

Date of fiscal year end: MARCH 31

Date of reporting period: SEPTEMBER 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Financial Statements

FEG Directional Access Fund LLC

Six Months Ended September 30, 2013

(Unaudited)

FEG Directional Access Fund LLC

Financial Statements

Six Months Ended September 30, 2013

(unaudited)

Contents

| Statement of Assets, Liabilities and Member’s Capital | | | 1 | |

| Schedule of Investments | | | 2 | |

| Statement of Operations | | | 4 | |

| Statements of Changes in Members’ Capital | | | 5 | |

| Statement of Cash Flows | | | 6 | |

| Notes to Financial Statements | | | 7 | |

| Other Information | | | 20 | |

FEG Directional Access Fund LLC

Statement of Assets, Liabilities and Members' Capital

September 30, 2013

(unaudited)

| Assets | | | |

| Cash held with Fifth Third Bank | | $ | 75,000 | |

| Short-term investments (cost $328,680) | | | 328,680 | |

| Investments in Portfolio Funds, at fair value (cost $72,490,373) | | | 82,980,907 | |

| Portfolio Funds purchased in advance | | | 1,500,000 | |

| Receivable for Portfolio Funds sold | | | 1,090,123 | |

| Other assets | | | 4 | |

| Total assets | | $ | 85,974,714 | |

| | | | | |

| Liabilities and members’ capital | | | | |

| Capital withdrawals payable | | $ | 83,837 | |

| Captital contributions received in advance | | | 1,315,000 | |

| Management fee payable | | | 113,896 | |

| Professional fees payable | | | 33,544 | |

| Accounting and administration fees payable | | | 36,025 | |

| Other liabilities | | | 80,377 | |

| Total liabilities | | | 1,662,679 | |

| Members’ capital | | | 84,312,035 | |

| Total liabilities and members’ capital | | $ | 85,974,714 | |

| | | | | |

| Components of members’ capital | | | | |

| Capital contributions (net) | | $ | 76,845,398 | |

| Accumulated net investment loss | | | (2,844,491 | ) |

| Accumulated net realized loss on investments | | | (179,406 | ) |

| Accumulated net unrealized appreciation on investments | | | 10,490,534 | |

| Members' capital | | $ | 84,312,035 | |

| | | | | |

| Units of limited liability company interests | | | 77,397 | |

| Net Asset Value per unit | | $ | 1,089.35 | |

See accompanying notes.

FEG Directional Access Fund LLC

Schedule of Investments

September 30, 2013

(unaudited)

| | | | | | | | | Percentage | | | |

| | | | | | Fair | | | of Members’ | | | Withdrawals |

| Investment Name | | Cost | | | Value | | | Capital | | | Permitted |

| | | | | | | | | | | | |

Investments in Portfolio Funds:(1) | | | | | | | | | | | |

| United States: | | | | | | | | | | | |

| Hedged Equity: | | | | | | | | | | | |

| Asian Century Quest Fund (QP), L.P. | | $ | 3,732,903 | | | $ | 3,682,200 | | | | 4.4 | % | | Quarterly |

| Brenner West Capital Qualified Partners, LP | | | 4,500,000 | | | | 4,641,639 | | | | 5.5 | | | Quarterly(2) |

| Broadway Gate Onshore Fund, L.P. | | | 2,000,000 | | | | 2,149,455 | | | | 2.5 | | | Quarterly(2) |

| Conatus Capital Partners, L.P. | | | 5,325,790 | | | | 6,272,732 | | | | 7.4 | | | Quarterly(2) |

| Discovery Equity Partners, L.P. | | | 4,410,893 | | | | 4,050,010 | | | | 4.8 | | | Quarterly(3) |

| ESG Cross Border Equity Fund, L.P. | | | 5,000,000 | | | | 5,718,317 | | | | 6.8 | | | Quarterly |

| Fine Partners I, L.P. | | | 5,250,000 | | | | 6,409,167 | | | | 7.6 | | | Annually(4) |

| Hoplite Partners, L.P. | | | 5,500,000 | | | | 6,401,969 | | | | 7.6 | | | Annually(3) |

| Indus Asia Pacific Fund, L.P. | | | 4,554,095 | | | | 4,909,602 | | | | 5.8 | | | Quarterly(2) |

| Marble Arch Investments, L.P. | | | 5,000,000 | | | | 5,880,883 | | | | 7.0 | | | Semi-Annually(2) |

| Moon Capital Global Equity Fund, L.P. | | | 3,750,000 | | | | 4,106,930 | | | | 4.9 | | | Quarterly (5) |

| Palo Alto Healthcare Fund II, L.P. | | | 3,750,000 | | | | 5,128,316 | | | | 6.1 | | | Semi-Annually(3) |

| PFM Diversified Fund, L.P. | | | 6,500,000 | | | | 7,687,680 | | | | 9.1 | | | Quarterly(4) |

| Scout Capital Partners II, L.P. | | | 6,000,000 | | | | 7,725,608 | | | | 9.2 | | | Quarterly(2) |

| Tiger Consumer Partners, L.P. | | | 1,716,692 | | | | 1,954,519 | | | | 2.3 | | | Quarterly |

| Tybourne Equity (US) Fund | | | 5,500,000 | | | | 6,261,880 | | | | 7.4 | | | Quarterly(4) |

| Total Investments in Portfolio Funds | | $ | 72,490,373 | | | $ | 82,980,907 | | | | 98.4 | % | | |

See accompanying notes.

FEG Directional Access Fund LLC

Schedule of Investments (continued)

September 30, 2013

(unaudited)

| Short-Term Investments: | | | | | | | | | |

| Money Market Fund: | | | | | | | | | |

Federated Government Obligations Fund #5, 0.01% (6) | | $ | 328,680 | | | $ | 328,680 | | | | 0.4 | % |

| Total Investments in Portfolio Funds and | | | | | | | | | | | | |

| Short-Term Investments | | $ | 72,819,053 | | | $ | 83,309,587 | | | | 98.8 | % |

| | | | | | | | | | | | | |

| Other assets less liabilities | | | | | | | 1,002,448 | | | | 1.2 | % |

| | | | | | | | | | | | | |

| Members' Capital | | | | | | $ | 84,312,035 | | | | 100.0 | % |

| | (1) | Non-income producing. | | | | | | | | | |

| | (2) | Withdrawals from these portfolio funds are permitted after a one year lock-up period from the date of the initial investment. |

| | (3) | Withdrawals from these portfolio funds are permitted after a two year lock-up period from the date of the initial investment. |

| | (4) | Withdrawals from these portfolio funds are permitted after a three year lock-up period from the date of the initial investment. |

| | (5) | Withdrawals from these portfolio funds are permitted after a three year lock-up period from the date of the initial investment, with 1/12 of the total investment becoming eligible for redemption each quarter. |

| | (6) | The rate shown is the annualized 7-day yield as of September 30, 2013. | | | | | | | | |

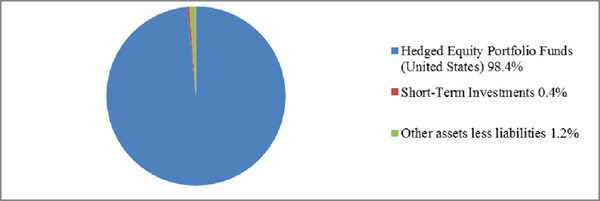

Type of Investment as a Percentage Total Members' Capital (unaudited):

See accompanying notes.

FEG Directional Access Fund LLC

Statement of Operations

Six Months Ended September 30, 2013

(unaudited)

| Investment income | | | | | | |

| Dividend income | | $ | 198 | | | | |

| | | | | | | | |

| Expenses | | | | | | | |

| Management fees | | | 362,651 | | | | |

| Professional fees | | | 70,833 | | | | |

| Accounting and administration fees | | | 69,544 | | | | |

| Insurance | | | 11,667 | | | | |

| Directors fees | | | 10,000 | | | | |

| Custodian fees | | | 6,639 | | | | |

| Compliance fees | | | 4,500 | | | | |

| Other fees | | | 18,000 | | | | |

| Total expenses | | | 553,834 | | | | |

| Net investment loss | | | | | | $ | (553,636 | ) |

| | | | | | | | | |

| Net realized and unrealized gain on investments | | | | | | | | |

| Net realized gain on investments | | | 1,007,377 | | | | | |

| Net change in unrealized appreciation/(depreciation) on investments | | | 2,821,041 | | | | | |

| Net realized and unrealized gain on investments | | | | | | | 3,828,418 | |

| Net increase in members' capital resulting from operations | | | | | | $ | 3,274,782 | |

FEG Directional Access Fund LLC

Statements of Changes in Members’ Capital

For the Six Months Ended September 30, 2013 (unaudited) and

the Year Ended March 31, 2013

| | | Members’ | |

| | | Capital | |

| Members’ capital at March 31, 2012 | | $ | 86,873,608 | |

| Capital contributions | | | 3,970,003 | |

| Capital withdrawals | | | (7,696,228 | ) |

| Net investment loss | | | (1,190,918 | ) |

| Net realized gain on investments | | | 127,386 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | 4,576,307 | |

| Members’ capital at March 31, 2013 | | $ | 86,660,158 | |

| Capital contributions | | | 3,866,142 | |

| Capital withdrawals | | | (9,489,047 | ) |

| Net investment loss | | | (553,636 | ) |

| Net realized gain on investments | | | 1,007,377 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | 2,821,041 | |

| Members’ capital at September 30, 2013 | | $ | 84,312,035 | |

| | | | | |

| Units outstanding at April 1, 2013* | | | 82,740 | |

| Units sold | | | 3,638 | |

| Units redeemed | | | (8,981 | ) |

| Units outstanding at September 30, 2013 | | | 77,397 | |

| * The Fund unitized on April 1, 2013 at a price of $1,047.37 per unit. | | | | |

See accompanying notes.

FEG Directional Access Fund LLC

Statement of Cash Flows

For the Six Months Ended September 30, 2013

(unaudited)

| Operating activities | | | |

| Net increase in members' capital resulting from operations | | $ | 3,274,782 | |

| Adjustments to reconcile net increase in members' capital resulting from | | | | |

| operations to net cash provided by operating activities: | | | | |

| Purchases of investments in Portfolio Funds | | | (7,000,000 | ) |

| Proceeds from sales of investments in Portfolio Funds | | | 9,896,578 | |

| Net realized gain on investments in Portfolio Funds | | | (1,007,377 | ) |

| Net change in unrealized (appreciation)/depreciation on investments | | | | |

| in Portfolio Funds | | | (2,821,041 | ) |

| Changes in operating assets and liabilities: | | | | |

| Short-term investments | | | 1,941,914 | |

| Other assets | | | 15 | |

| Management fee payable | | | 54,842 | |

| Professional fees payable | | | (33,186 | ) |

| Accounting and administration fees payable | | | 4,057 | |

| Other liabilities | | | (11,404 | ) |

| Net cash provided by operating activities | | | 4,299,180 | |

| | | | | |

| Financing activities | | | | |

| Proceeds from capital contributions | | | 5,181,142 | |

| Payments for capital withdrawals | | | (9,625,011 | ) |

| Net cash used in financing activities | | | (4,443,869 | ) |

| | | | | |

| Net change in cash | | | (144,689 | ) |

| Cash at beginning of period | | | 219,689 | |

| Cash at end of period | | $ | 75,000 | |

See accompanying notes.

FEG Directional Access Fund LLC

Notes to Financial Statements

September 30, 2013

(unaudited)

1. Organization

FEG Directional Access Fund LLC (the Fund) was formed on February 3, 2010, and is a Delaware limited liability company that commenced operations on April 1, 2010. The Fund registered with the U.S. Securities and Exchange Commission (the SEC) on April 2, 2012, under the Investment Company Act of 1940, as amended (the 1940 Act), as a non-diversified, closed-end management investment company. The Fund’s Board of Directors (the Board) has overall responsibility for the management and supervision of the Fund’s operations. To the extent permitted by applicable law, the Board may delegate any of its respective rights, powers and authority to, among others, the officers of the Fund, any committee of the Board, or the Investment Manager. Under the supervision of the Board and pursuant to an investment management agreement, FEG Investors, LLC serves as the investment manager (the Investment Manager) to the Fund. The Investment Manager is a registered investment adviser with the SEC under the Investment Advisers Act of 1940, as amended (the Advisers Act).

Pursuant to a sub-advisory agreement with the Investment Manager and the Fund, InterOcean Capital, LLC, an investment adviser registered under the Advisers Act, serves as the Fund’s sub-adviser (in such capacity, the Sub-Adviser). The Sub-Adviser participates by appointing a member of the Investment Manager’s investment policy committee, thereby assisting in oversight of the Fund’s investments, making Portfolio Fund Manager selection and termination recommendations and approving significant and strategic asset allocation changes.

The Fund’s primary investment objective is to meet or exceed the return of the broad equity markets over a full market cycle with less volatility than the equity markets as measured by the S&P 500 Index, although there can be no assurance that the Fund will achieve this objective. The Fund was formed to capitalize on the experience of the Investment Manager’s principals by creating a fund-of-funds product, which offers professional portfolio fund manager due diligence, selection and monitoring, consolidated reporting, risk monitoring, and access to portfolio fund managers for a smaller minimum investment than would be required for direct investment. The Investment Manager manages the Fund by allocating its capital among a number of independent general partners or investment managers (the Portfolio Fund Managers) acting through pooled investment vehicles and/or managed accounts (collectively, the Portfolio Funds).

Units of limited liability company interest (Units) of the Fund are offered only to investors (Members) that represent that they are an “accredited investor” within the meaning of Rule 501 under the Securities Act of 1933, as amended.

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

1. Organization (continued)

JD Clark and Company, a division of UMB Fund Services, Inc. and a subsidiary of UMB Financial Corporation, serves as the Fund’s administrator (the Administrator). The Fund has entered into an agreement with the Administrator to perform general administrative tasks for the Fund, including but not limited to maintenance of books and records of the Fund and the capital accounts of the Members of the Fund.

2. Significant Accounting Policies

The financial statements have been prepared in accordance with U.S. generally accepted accounting principles (U.S. GAAP). The preparation of these financial statements requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes.

Short-term investments represent an investment in a money market fund. Short-term investments are recorded at fair value. Dividend income is recorded on the ex-dividend date.

Investments in Portfolio Funds

The Fund values its investments in Portfolio Funds at fair value, which generally represents the Fund’s pro rata interest in the Members’ capital of the Portfolio Funds, net of management fees and incentive allocations payable to the Portfolio Funds’ Portfolio Fund Managers. The underlying investments held by the Portfolio Funds are generally valued at fair value in accordance with the policies established by the Portfolio Funds, as described in their respective financial statements and agreements. Due to the inherent uncertainty of less liquid investments, the value of certain investments held by the Portfolio Funds may differ from the values that would have been used if a ready market existed. The Portfolio Funds may hold investments for which market quotations are not readily available and are thus valued at their fair value, as determined in good faith by their respective Portfolio Fund Managers. Net realized and unrealized gains and losses from investments in Portfolio Funds are reflected in the Statement of Operations. Realized gains and losses from Portfolio Funds are recorded on the average cost basis.

For the period April 1, 2013 through September 30, 2013, the aggregate cost of purchases and proceeds from sales/withdrawals of investments were $5,500,000 and $9,896,578, respectively.

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

2. Significant Accounting Policies (continued)

Fair Value of Financial Instruments

In accordance with Accounting Standards Codification (ASC) 820, Fair Value Measurements and Disclosures, fair value is defined as the price that the Fund would receive to sell an investment or pay to transfer a liability in a timely transaction with an independent buyer in the principal market, or in the absence of a principal market, the most advantageous market for the investment or liability. ASC 820 establishes a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions that market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs), and (2) inputs that reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the fair value of the Fund’s investments.

The inputs are summarized in the three broad levels listed below:

Level 1 – Quoted prices in active markets for identical investments.

Level 2 – Other significant observable inputs (including quoted prices for similar investments).

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

The units of account that are valued by the Fund are its interests in the Portfolio Funds and not the underlying holdings of such Portfolio Funds. Thus, the inputs used by the Fund to value its investments in each of the Portfolio Funds may differ from the inputs used to value the underlying holdings of such Portfolio Funds.

Investments in Portfolio Funds are classified within Level 2 of the fair value hierarchy if the Fund has the ability to redeem the investments at the measurement dates or if the investments are redeemable in the near term in accordance with the normal operating protocols in the Portfolio Funds’ agreements. Investments in Portfolio Funds are classified within Level 3 of the fair value

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

2. Significant Accounting Policies (continued)

hierarchy if the Fund does not know when it will have the ability to redeem its investments or the investments are not redeemable within one year under the normal operating protocols of the Portfolio Funds’ agreements.

The following table represents the investments carried at fair value on the Statement of Assets, Liabilities and Members’ Capital by level within the valuation hierarchy as of September 30, 2013:

| Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Portfolio Funds | | $ | - | | | $ | 74,053,992 | | | $ | 8,926,915 | | | $ | 82,980,907 | |

| Short-Term Investments | | | 328,680 | | | | - | | | | - | | | | 328,680 | |

| Total | | $ | 328,680 | | | $ | 74,053,992 | | | $ | 8,926,915 | | | $ | 83,309,587 | |

The Schedule of Investments categorizes the aggregate fair value of the Fund’s investments in the Portfolio Funds by domicile, investment strategy, and liquidity.

The Fund discloses transfers between levels based on valuations at the end of the reporting period. There were no transfers between Levels 1 or 2 as of September 30, 2013. Investments are transferred between Level 2 and Level 3 when the investment can be liquidated within one year:

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

2. Significant Accounting Policies (continued)

| | | Investments in | |

| | | Portfolio Funds | |

| Balance as of March 31, 2013 | | $ | 11,317,709 | |

| Realized gain (loss) | | | - | |

| Net change in unrealized appreciation/depreciation | | | 567,270 | |

| Purchases | | | - | |

| Sales | | | - | |

| Net transfers in to Level 3 | | | - | |

| Net transfers out of Level 3 | | | (2,958,064 | ) |

| Balance as of September 30, 2013 | | $ | 8,926,915 | |

Investment transactions are recorded on a trade-date basis. Dividend income is accrued as it is earned.

The Fund is treated as a partnership for federal income tax purposes and therefore is not subject to U.S. federal income tax. For income tax purposes, the individual Members will be taxed upon their distributive shares of each item of the Fund’s profit and loss. The only taxes payable by the Fund are withholding taxes applicable to certain investment income.

Management has analyzed the Fund’s tax positions for all open tax years, which include the years ended December 31, 2010 through December 31, 2012, and has concluded that as of September 30, 2013, no provision for income taxes is required in the financial statements. Therefore, no additional tax expense, including any interest and penalties, was recorded in the current year and no adjustments were made to prior periods. To the extent the Fund recognizes interest and penalties, they are included in net change in unrealized appreciation (depreciation) on investments in Portfolio Funds in the Statement of Operations.

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

2. Significant Accounting Policies (continued)

Capital Contributions Received in Advance and Capital Withdrawals Payable

Capital contributions received in advance are comprised of cash received on or prior to September 30, 2013 for which Members’ interests were effective October 1, 2013. Capital contributions received in advance do not participate in the earnings of the Fund until such interests are effective. There was a total of $1,315,000 capital contributions received in advance as of September 30, 2013. Capital withdrawals are comprised of requests for withdrawals that were effective on September 30, 2013 but were paid subsequent to fiscal year-end.

Disclosures about Offsetting Assets and Liabilities

In January 2013, The Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2013-01, “Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities.” This update gives additional clarification to the FASB ASU 2011-11, “Disclosures about Offsetting Assets and Liabilities.” The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The guidance requires retrospective application for all comparative periods presented. Management has evaluated the impact on the financial statement disclosures and determined that there is no effect.

Recent Accounting Pronouncements

In June 2013, the FASB issued ASU 2013-08, “Financial Services – Investment Companies (Topic 946): Amendments to the Scope, measurement and Disclosure Requirements” (ASU 2013-08). ASU 2013-08 creates a two-tiered approach to assess whether an entity is an investment company. The guidance will also require an investment company to measure noncontrolling ownership interests in other investment companies at fair value and will require additional disclosures relating to investment company status, any changes thereto and information about financial support provided or contractually required to be provided to any of the investment company’s investees. The guidance is effective for financial statements with fiscal years beginning after December 15, 2013 and interim periods within those fiscal years. Management is evaluating the impact of this guidance on the Fund’s financial statement disclosures.

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

3. Investments in Portfolio Funds

The Investment Manager utilizes due diligence processes with respect to the Portfolio Funds and their Portfolio Fund Managers, which are intended to assist management in determining that financial information provided by the underlying Portfolio Fund Managers is reasonably reliable.

The Fund has the ability to liquidate its investments in Portfolio Funds periodically in accordance with the provisions of the respective Portfolio Fund’s agreement; however, these withdrawal requests may be subject to certain lockup periods such as gates, suspensions, and other delays, fees, or restrictions in accordance with the provisions of the respective Portfolio Fund’s agreement.

The Portfolio Funds in which the Fund has investments may utilize a variety of financial instruments in their trading strategies, including equity and debt securities of both U.S. and foreign issuers, options and futures, forwards, and swap contracts. These financial instruments contain various degrees of off-balance-sheet risk, including both market and credit risk. Market risk is the risk of potentially adverse changes to the value of the financial instruments and their derivatives because of the changes in market conditions, such as interest and currency rate movements and volatility in commodity or security prices. Credit risk is the risk of the potential inability of counterparties to perform the terms of the contracts, which may be in excess of the amounts recorded in the Portfolio Funds’ respective statements of financial condition. In addition, several of the Portfolio Funds sell securities sold, not yet purchased, whereby a liability is created for the repurchase of the security at prevailing prices. Such Portfolio Funds’ ultimate obligations to satisfy the sales of securities sold, not yet purchased may exceed the amount recognized on their respective statements of financial condition. However, due to the nature of the Fund’s interest in these investment entities, the Fund’s risk with respect to such transactions is limited to its investment in each Portfolio Fund.

The Fund is also subject to liquidity risks, including the risk that the Fund may encounter difficulty in generating cash to meet obligations associated with tender requests. Liquidity risk may result from an inability of the Fund to sell an interest in a Portfolio Fund on a timely basis at an amount that approximates its fair value. The Portfolio Funds require advance notice for withdrawal requests, generally only permit withdrawals at specified times, and have the right in certain circumstances to limit or delay withdrawals.

The Portfolio Funds provide for compensation to the respective Portfolio Fund Managers in the form of management fees generally ranging from 1.0% to 3.0% annually of Members’ capital, and incentive allocations typically range between 10% and 30% of profits, subject to loss carry forward provisions, as defined in the respective Portfolio Funds’ agreements.

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

4. Management Fee and Related Party Transactions

The Investment Manager receives from the Fund a monthly management fee (the Management Fee) equal to 1/12 of 0.85% of the Fund’s month-end Members’ capital balance, prior to reduction for the Management Fee then being calculated (a 0.85% annual rate). The Management Fee is paid monthly in arrears and is prorated with respect to investments in the Fund made other than at the beginning of a month. The Management Fee totaled $362,651 for the six months period ended September 30, 2013, of which $113,896 was payable at September 30, 2013.

The Investment Manager, not the Fund, pays the Sub-Adviser a monthly fee equal to 10% of the Management Fee received by the Investment Manager from the Fund pursuant to the Investment Management Agreement as of the end of each calendar month.

Each member of the Board who is not an “interested person” of the Fund (the Independent Directors), as defined by the 1940 Act, receives a fee of $2,500 per quarter. In addition, all Independent Directors are reimbursed by the Fund for all reasonable out-of-pocket expenses incurred by them in performing their duties. The Independent Director fees totaled $10,000 for the six months period ended September 30, 2013, of which $3,333 was payable at September 30, 2013.

At September 30, 2013, FEG Equity Access Fund Ltd., an affiliated investment fund advised by the Investment Manager, had ownership interests in the Fund of 81.78%, with a value of $68,946,282.

In accordance with the Fund’s Limited Liability Company Operating Agreement (the Operating Agreement), net profits or net losses are allocated to the Members in proportion to their respective capital accounts.

Members may be admitted when permitted by the Board. Generally, Members will only be admitted as of the beginning of a calendar month but may be admitted at any other time at the discretion of the Board. The minimum initial investment is $50,000, and additional contributions from existing Members may be made in a minimum amount of $25,000, although the Board may waive such minimums in certain cases.

No Member will have the right to require the Fund to redeem its Units. Rather, the Board may, from time to time and in its complete and absolute discretion, cause the Fund to offer to repurchase Units from Members pursuant to written requests by Members on such terms and

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

5. Members’ Capital (continued)

conditions as it may determine. In determining whether the Fund should offer to repurchase Units from Members pursuant to written requests, the Board will consider, among other things, the recommendation of the Investment Manager. The Investment Manager expects that it will recommend such repurchase offers twice a year, effective as of June 30th and December 31st each year. The repurchase amount will be determined by the Board in its complete and absolute discretion, but is expected to be no more than approximately 25% of the Fund’s outstanding Units. The Board also will consider the following factors, among others, in making such determination: (i) whether any Members have requested that the Fund repurchase Units; (ii) the liquidity of the Fund’s assets; (iii) the investment plans and working capital requirements of the Fund; (iv) the relative economies of scale with respect to the size of the Fund; (v) the history of the Fund in repurchasing Units; (vi) the conditions in the securities markets and economic conditions generally; and (vii) the anticipated tax consequences of any proposed repurchases of Units.

The Fund’s Operating Agreement provides that the Fund will be dissolved if any Member that has submitted a written request, in accordance with the terms of the Operating Agreement, to tender all of such Member’s Units for repurchase by the Fund has not been given the opportunity to so tender within a period of two (2) years after the request (whether in a single repurchase offer or multiple consecutive offers within the two-year period).

When the Board determines that the Fund will offer to repurchase Units (or portions of Units), written notice will be provided to Members that describes the commencement date of the repurchase offer, and specifies the date on which repurchase requests must be received by the Fund (the Repurchase Request Deadline).

For Members tendering all of their Units in the Fund, Units will be valued for purposes of determining their repurchase price as of a date approximately 65 days after the Repurchase Request Deadline (the Full Repurchase Valuation Date). The amount that a Member who is tendering all of its Units in the Fund may expect to receive on the repurchase of such Member’s Units will be the value of the Member’s capital account determined on the Full Repurchase Valuation Date, and the Fund will generally not make any adjustments for final valuations based on adjustments received from the Portfolio Funds, and the withdrawing Member (if such valuations are adjusted upwards) or the remaining Members (if such valuations are adjusted downwards) will bear the risk of change of any such valuations.

Members who tender a portion of their Units in the Fund (defined as a specific dollar value in their repurchase request), and which portion is accepted for repurchase by the Fund, will receive

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

5. Members’ Capital (continued)

such specified dollar amount. For Members tendering all of their Units in the Fund, the value of such Units being repurchased will be determined on the Full Repurchase Valuation Date. Within five days of the Repurchase Request Deadline, each Member whose Units have been accepted for repurchase will be given a non-interest bearing, non-transferable promissory note by the Fund entitling the Member to be paid an amount equal to 100% of the unaudited net asset value such Member’s capital account (or portion thereof) being repurchased, determined as of the Full Repurchase Valuation Date (after giving effect to all allocations to be made as of that date to such Member’s capital account). The note will entitle the Member to be paid within 30 days after the Full Repurchase Valuation Date, or ten business days after the Fund has received at least 90% of the aggregate amount withdrawn by the Fund from the Portfolio Funds, whichever is later (either such date, a Payment Date). Notwithstanding the foregoing, if a Member has requested the repurchase of 90% or more of the Units held by such Member, such Member shall receive (i) a non-interest bearing, non-transferable promissory note, which need not bear interest, in an amount equal to 90% of the estimated unaudited net asset value of such Member’s capital account (or portion thereof) being repurchased, determined as of the Full Repurchase Valuation Date (after giving effect to all allocations to be made as of that date to such Member’s capital account) (the Initial Payment), which will be paid on or prior to the Payment Date; and (ii) a promissory note entitling the holder thereof to the balance of the proceeds, to be paid within 30 days following the completion of the Fund’s next annual audit, which is expected to be completed within 60 days after the end of the Fund’s fiscal year.

In the event that a Member requests a repurchase of a capital account amount that had been contributed to the Fund within 18 months of the date of the most recent repurchase offer, the Board may require payment of a repurchase fee payable to the Fund in an amount equal to 2.00% of the repurchase price, which fee is intended to compensate the Fund for expenses related to such repurchase. Contributions shall be treated on a “first-in, first-out basis.” Otherwise, the Fund does not intend to impose any charges on the repurchase of Units.

If Members request that the Fund repurchase a greater number of Units than the repurchase offer amount as of the Repurchase Request Deadline, as determined by the Board in its complete and absolute discretion, the Fund shall repurchase the Units pursuant to repurchase requests on a pro rata basis, disregarding fractions, according to the portion of the Units requested by each Member to be repurchased as of the Repurchase Request Deadline.

A Member who tenders some but not all of the Member’s Units for repurchase will be required to maintain a minimum capital account balance of $50,000. The Fund reserves the right to reduce the amount to be repurchased from a Member so that the required capital account balance is maintained.

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

6. Indemnifications

The Fund enters into contracts that contain a variety of indemnifications. The Fund’s maximum exposure under these arrangements is not known. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

The below table represents the per Unit data throughout the period:

| Unit Value, April 1, 2013* | | $ | 1,047.37 | |

| Income from investment operations: | | | | |

| Net investment loss | | | (9.06 | ) |

| Net realized and unrealized gain on investment transactions | | | 51.04 | |

| Total from investment operations | | | 41.98 | |

| Unit Value, September 30, 2013 | | $ | 1,089.35 | |

* Unit value per unit information presented as unitization on April 1, 2013.

The following represents the ratios to average Members’ capital and total return information for the six months ended September 30, 2013 and the years ended March 31, 2013, 2012 and 2011:

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

7. Financial Highlights (continued)

| | | For the Six Months Ended September 30, | | | Year Ended March 31, | |

| | | 2013 | | | 2013 | | | 2012 | | | 2011 | |

| Ratios to average members’ capital: | | | | | | | | | | | | |

| Expenses | | | 1.30 | %(1) | | | 1.40 | % | | | 0.91 | % | | | 0.82 | % |

| Net investment loss | | | (1.30 | %)(1) | | | (1.40 | %) | | | (0.91 | %) | | | (0.81 | %) |

| Total Return | | | 4.01 | %(2) | | | 4.18 | % | | | (1.63 | %) | | | 2.27 | % |

| Portfolio turnover | | | 6.69 | %(2) | | | 12.69 | % | | | 4.37 | % | | | 7.12 | % |

| Members' Capital end of year (000's) | | $ | 84,312 | | | $ | 86,660 | | | $ | 86,874 | | | $ | 74,811 | |

The financial highlights are calculated for all the Members taken as a whole. An individual Member’s return may vary from these returns based on the timing of capital transactions. The ratios do not include investment income or expenses of the Portfolio Funds in which the Fund invests.

8. Credit Facility

Effective September 30, 2013, the Fund has entered into a $10 million credit facility administered by Fifth Third Bank, N.A. The Fund anticipates that this credit facility will be used for cash management purposes, such as providing liquidity for investments and repurchases. The Fund will incur additional interest and other expenses with respect to the use of this and other future credit facilities. Collateral for the new facility will be held by UMB Bank, N.A. as custodian. There was $75,000 held in cash at Fifth Third Bank to pay for any expenses associated with the line of credit.

FEG Directional Access Fund LLC

Notes to Financial Statements (continued)

(unaudited)

9. Subsequent Events

Management evaluated subsequent events through the date the financial statements were issued, and determined that, other than the events noted above, there were no subsequent events that required disclosure in or adjustment to the Fund’s financial statements.

FEG Directional Access Fund LLC

Other Information

Information on Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-888-268-0333. It is also available on the SEC’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling 1-888-268-0333, and on the SEC's website at http://www.sec.gov.

Availability of Quarterly Report Schedule

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

ITEM 2. CODE OF ETHICS.

Not applicable to semi-annual reports.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable to semi-annual reports.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable to semi-annual reports.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to semi-annual reports.

ITEM 6. SCHEDULE OF INVESTMENTS.

| | (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1 of this form. |

| | (b) | The registrant did not need to divest itself of securities in accordance with Section 13(c) of the Investment Company Act of 1940, as amended (the “1940 Act”), following the filing of its last report on Form N-CSR and before filing of the current report. |

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable to semi-annual reports.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable to semi-annual reports.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the registrant's board of directors, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407 (c)(2)(iv) of Regulation S-K, or this Item.

ITEM 11. CONTROLS AND PROCEDURES.

(a) The registrant's principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the 1940 Act (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the registrant's second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) Not applicable.

(a)(2) Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto.

(a)(3) Not applicable.

(b) Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (registrant) | FEG DIRECTIONAL ACCESS FUND LLC | |

| | | |

| By (Signature and Title)* | /s/ Christopher M. Meyer | |

| | Christopher M. Meyer, President | |

| | (principal executive officer) | |

| | | |

| Date: | DECEMBER 9, 2013 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ Christopher M. Meyer | |

| | Christopher M. Meyer, President | |

| | (principal executive officer) | |

| | | |

| Date: | DECEMBER 9, 2013 | |

| | | |

| By (Signature and Title)* | /s/ Mary T. Bascom | |

| | Mary T. Bascom, Treasurer | |

| | (principal financial officer) | |

| | | |

| Date: | DECEMBER 9, 2013 | |

* Print the name and title of each signing officer under his or her signature.