UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the fiscal year ended November 30, 2016.

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

Commission File Number 0-54744

CHINA GEWANG BIOTECHNOLOGY, INC.

(Name of Registrant as Specified in its Charter)

| Nevada | | 42-1769584 |

(State of Other Jurisdiction of incorporation or organization) | | (I.R.S.) Employer

I.D. No.) |

Floor 29 No. 334, Huanshi East Road, Yuexiu District

Guangzhou City, Guangdong Province, P.R. China 510623

(Address of Principal Executive Offices)

Registrant's Telephone Number: 86-024-2397-4663

Securities Registered Pursuant to Section 12(b) of the Act: None

Securities Registered Pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 406 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One)

Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐ Smaller reporting company ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 31, 2016 (the last business day of the most recently completed second fiscal quarter) the aggregate market value of the common stock held by non-affiliates was approximately $129,148,425, based on the closing market price on that date.

As of February 10, 2017, there were 75,000,000 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

CHINA GEWANG BIOTECHNOLOGY, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED NOVEMBER 30, 2016

TABLE OF CONTENTS

| Part I | | Page No |

| | | |

| Item 1 | Business | 1 |

| Item 1A | Risk Factors | 12 |

| Item 1B | Unresolved Staff Comments | 24 |

| Item 2 | Description of Properties | 24 |

| Item 3 | Legal Proceedings | 24 |

| Item 4 | Mine Safety Disclosure | 24 |

| | | |

| Part II | | |

| | | |

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchase of Equity Securities | 25 |

| Item 6 | Selected Financial Data | 27 |

| Item 7 | Management’s Discussion and Analysis | 28 |

| Item 7A | Quantitative and Qualitative Disclosure about Market Risk | 35 |

| Item 8 | Financial Statements and Supplementary Schedules | 36 |

| Item 9 | Changes and Disagreements with Accountants on Accounting and Financial Disclosure | 37 |

| Item 9A | Controls and Procedures | 37 |

| Item 9B | Other Information | 38 |

| | | |

| Part III | | |

| | | |

| Item 10 | Directors, Executive Officers and Corporate Governance | 39 |

| Item 11 | Executive Compensation | 41 |

| Item 12 | Security Ownership of Certain Beneficial Owners, and Management and Related Stockholder Matters | 42 |

| Item 13 | Certain Relationships and Related Transactions and Director Independence | 44 |

| Item 14 | Principal Accountant Fees and Services | 45 |

| | | |

| Part IV | | |

| | | |

| Item 15 | Exhibits and Financial Statement Schedules | 46 |

| | | |

| | Signatures | 47 |

FORWARD-LOOKING STATEMENTS: NO ASSURANCES INTENDED

In addition to historical information, this Annual Report contains forward-looking statements, which are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans to,” “estimates,” “projects,” or similar expressions. These forward-looking statements represent Management’s belief as to the future of China Gewang Biotechnology, Inc. Whether those beliefs become reality will depend on many factors that are not under Management’s control. Many risks and uncertainties exist that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in Section 1A of this Report, entitled “Risk Factors.” Readers are cautioned not to place undue reliance on these forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements.

PART I

Item 1. Business

Guangdong Gewang was founded in June 2010 in Guangzhou City, with registered capital of RMB 10 million (US$1,561,000). Guangdong Gewang is engaged in the sale of selenium supplements within the PRC. It is a standing member of the Chinese Selenium Supplements Association.

Guangdong Gewang initiated its business by cooperating with the Academy of Agricultural Sciences of Shandong Province (the Academy) in the development of formulas for three selenium supplements: a selenium capsule, a capsule combining selenium with glossy ganoderma (a therapeutic mushroom), and a selenium powder. The Academy has given Guangdong Gewang an exclusive license to manufacture and market the three products. As a result of our relationship with the Academy, Guangdong Gewang has required no investment in research and development within the past three years other than payments directly to the Academy.

The Academy also assisted Guangdong Gewang in identifying manufacturing companies possessing the advanced nanometer processing technology and production processes needed to produce the products. Guangdong Gewang now outsources the manufacturing of the products, then sells them under the trademarked brand “Jindanli”. We currently have three separate trademarks in China on aspects of the Jindanli brand, which expire in 2022, 2023 and 2025, at which time Guangdong Gewang can apply for renewal. The Jindanli brand is important to our efforts to distinguish our products from other manufacturers.

Guangdong Gewang entered into a Licensing Agreement and a License Agreement Supplement Agreement (together, the “Licensing Agreements”) with the Academy which have been in effect since December 30, 2015. The Licensing Agreements have a term of five years and allow Guangdong Gewang the exclusive right to use the Academy-developed selenium formulas in its trademarked Jindanli branded products. The selenium formulas belong to the Academy but Guangdong Gewang has a license to use the formulas as it sees fit, including by contracting with third-party manufacturers to produce the products. The formulas are trade secrets, and Guangdong Gewang is contractually obligated to ensure the confidentiality of the formulas pursuant to the Licensing Agreements. The Academy must notify Guangdong Gewang of any improvements or upgrades to the selenium formulas, whereupon Guangdong Gewang has the option to choose to use the new formulas in its products. The Licensing Agreements require Guangdong Gewang to pay an annual fee of 600,000 RMB ($87,000).

In September 2016 Guangdong Gewang entered into an additional agreement with the Academy, under which the Academy granted Guangdong Gewang an exclusive right of first refusal to use any research related to advanced selenium enrichment techniques and technology developed by the Academy relating to selenium research techniques. The agreement calls for annual payments of 4,000,000 RMB ($580,000) payable quarterly. Additional payments will be required for use of any techniques or technology developed by the Academy.

Initially, for the convenience of management, Guangdong Gewang marketed exclusively on a wholesale basis to chain stores that retail health care products. Early in 2014, as the Registrant developed the necessary infrastructure, Guangdong Gewang commenced direct marketing to consumers from its executive “home office.” Subsequently we have opened three more physical stores dedicated to the sale of the three Jindanli products.

In March 2016, Guangdong Gewang entered into cooperation agreements with 6 selenium enriched food product manufacturers for Guangdong Gewang to distribute their selenium enriched food products to chain stores and to sell these products in Guangdong Gewang’s retail stores. Guangdong Gewang pays promotion fees to chain stores to ensure optimal product placement and widespread distribution of these products. Guangdong Gewang has worked with the Academy to ensure that each of these selenium enriched food product manufacturers meets its standards. Guangdong Gewang has also begun to sell these selenium enriched food products in its flagship retail store alongside its Jindanli branded selenium products. The wholesale and retail sales of selenium enriched food products has broadened Guangdong Gewang’s reach in China and helped to further expand the Registrant’s market share in selenium products beyond selenium supplements.

Selenium

Background on Selenium

Selenium is one of the “essential” nutrients for humans, meaning that our bodies cannot produce it, and so we have to get it from our diet. Selenium deficiency can cause health problems including Keshan’s disease, and the World Health Organization has found that between 50 and 250 micrograms of selenium constitute a healthy daily intake.

Selenium was discovered as an element in 1817 by the Swedish chemist Jöns Jacob Berzelius, who determined the atomic weights of many elements and developed a system of chemical symbols. It was first thought to be a toxin, but scientists determined that selenium was an essential mineral in the 1950s. By the 1960s doctors began researching selenium’s possible tumor fighting properties in animals, according to the American Cancer Society.

Scientists now know selenium is necessary in the body’s production of selenoproteins, a family of proteins that contain selenium in the form of an amino acid. So far, 25 different selenoproteins in the body have been isolated, but only half of their functions have been identified. Selenium is one of several nutrients known to have antioxidant properties, meaning selenium plays a part in chemical reactions that stop free radicals from damaging cells and DNA. Free radicals are unstable molecules from environmental toxins, or from byproducts of the human body’s metabolism. In 1973, a paper published by JT Rotruk et al. showed that selenium is the basic component of erythrocyte glutathione peroxidase (GSH-PX), an enzyme that removes harmful substances produced by cell respiration. Further research into the antioxidant functions of selenium have shown that six other enzymes (glycine reductase, formate dehydrogenase, nicotinic acid hydroxylase, sulfur dehydrogenase and xanthine solution enzyme) are activated only in the presence of selenium.

Human and animal research has found selenoproteins are involved in embryo development, thyroid hormone metabolism, antioxidant defense, sperm production, muscle function and the immune system’s response to vaccinations. Antioxidant supplements, including selenium, are often touted to help prevent heart disease, cancer and vision loss.

According to the Chinese Selenium Supplements Association, selenium is purported to help people with asthma, and reduce the risk of rheumatoid arthritis and cardiovascular disease. Selenium levels drop with age, so some have claimed selenium can slow the aging process, cognitive decline and dementia. Low selenium levels are also implicated in depression, male infertility, weak immune systems and thyroid problems.

Plants grown in soil containing selenium convert it into a form that is usable by humans or animals. Soil around the world varies in its selenium concentration. The higher the concentration of selenium is in soil, the higher the concentration of selenium is in crops. Soil in Nebraska, South and North Dakota, for example, is especially rich in selenium, and people living in these areas typically have the highest dietary intake of selenium in the United States.

Soil in some areas of China and Russia is naturally low in selenium. Selenium deficiencies in the Keshan region in northeast China were severe enough to spur a form of heart disease called cardiomyopathy, now called Keshan’s disease. Chinese government programs to supplement people’s diets with selenium in the 1970s greatly reduced cases of Keshan disease, according to the National Institutes of Health’s Office of Dietary Supplements. Low selenium levels in China, Tibet and Siberia may also play a role in a type of osteoarthritis called Kashin-Beck disease.

Seventy-two percent (72%) of the land in China is selenium-poor. In the area from the three provinces in Northeast China to the Yunnan Guizhou plateau, two-thirds of the arable land is recognized as having a selenium deficiency, where the selenium content of the principal crops is less than 0.05ppm.

Selenium Toxicity

The human body only needs a trace amount of selenium, so it is possible to overdose with selenium supplements. For example, in 2008, a liquid dietary supplement that was 200 times more concentrated than advertised led to selenium poisoning in more than 200 people in the U.S. The most common effects were diarrhea, fatigue, hair loss, joint pain, brittle nails and nausea. A third of the people affected continued to experience symptoms 90 days after taking the mislabeled supplements.

Taking too much selenium over time can lead to selenosis, which can cause hair loss, nail loss, nausea, irritability, fatigue and some nerve damage. Other symptoms of chronic selenium overdose are a metallic taste in the mouth, and a garlic scent on the breath. A selenium overdose can cause skin lesions and nervous system abnormalities. In severe cases, selenium toxicity can cause tremors, kidney failure, cardiac failure, respiratory distress or even death.

The Institute of Medicine’s Food and Nutrition Board caps the safe daily intake of selenium at 45 micrograms for infants, 60 to 90 micrograms in toddlers, 150 to 280 micrograms in prepubescent children and 400 micrograms in adults.

Selenium may increase the risk of bleeding if it is combined with blood thinners such as clopidogrel (Plavix), coumadin, heparin or aspirin, according to the University of Maryland Medical Center. Animal studies show selenium supplements may also extend the effects of sedatives. Antioxidant supplements that included selenium have been shown to interfere with cholesterol-lowering treatments.

For these reasons, our marketing program combines both information about the need for adequate selenium intake with advice and warnings about the risk of excess ingestion of selenium.

The Opportunity in China

We believe that the importance of selenium to human health and the fact of selenium deficiency in large parts of China create a vast market potential for development. Selenium has been studied extensively in China. These efforts have resulted in confirming that selenium is an important element for human health and that there are areas within China that are significantly deficient in the soil and water. In the past decade, Chinese government policy has helped to enhance the potential of the selenium market.

Since 2008, the government has assisted Ankang City in developing selenium-rich products as a pillar industry. Government officials reviewed the experience of selenium supplements at home and abroad, and solicited the opinions of experts on selenium supplement research. Based on that review, the government developed the first provincial “selenium content standards” for Shaanxi Province, completed a census of selenium-rich resources in Ankang prefecture, drew an atlas of soil rich in selenium, established a selenium-rich food label system, selenium research and development institutions, cultivated selenium-rich food enterprises, organized a food industry association, and established a sound selenium-rich food industry development framework and system. These activities evidence the government’s support of the selenium industry.

The selenium industry is still in its infancy. It is currently fragmented with no dominant players. According to the Chinese Selenium Supplements Association, over three hundred, mostly small, enterprises are engaged in producing selenium products. Production costs are high because the products have not yet achieved economic scale. In addition, because the industry is new, the quality of selenium-rich health products is uneven, in part due to the lack of a nationwide standard for selenium products in China. In spite of these challenges, the selenium industry as a whole grew to 26.6 billion RMB (US$4.6 billion) in 2015 with a historical annual growth rate of 9.3% to 13.1%, and we believe the industry will experience rapid growth in the future.

Our Products

Through a partnership with the Academy of Agricultural Sciences of Shangdong Province, a highly regarded research institute in China, we have licensed the exclusive right to contract for the manufacture and marketing of products using three selenium formulas developed and owned by the Academy. In compensation for the license, we pay the Academy a fee of 50,000 RMB ($8,104) per month.

Currently Guangong Gewang distributes 89 distinct products which include processed foods such as selenium enriched porridge, ready to eat foods such as selenium-enriched peanuts and ingredients such as selenium enriched flower. Guangong Gewang is actively engaged in marketing healthy selenium rich foods including Selenium-Rich Maize Residue, Selenium-Rich Brown Rice. Selenium Enriched Black Beans, Selenium-Enriched Buckwheat Kernel and Selenium-Enriched Ormosia. These foods compliment the Registrant’s Jindanli branded products by raising awareness of the need for selenium in the diets of our target consumer market.

We currently offer the following products for sale under the brand “Jindanli”:

| ● | Selenium Capsules. 12% of our sales in fiscal year 2016 were sales of our selenium capsules. The selenium capsules are sold in a box of 300 capsules, with a recommended dosage of one capsule twice daily. A box of selenium capsules (i.e. a five month supply) retails for 1,380 RMB ($215) with a wholesale price of 650 RMB ($101). |

| ● | Selenium - Glossy Ganoderma Capsules. 8% of our sales in fiscal year 2016 were sales of our selenium - glossy ganoderma capsules. Glossy ganoderma is an edible fungus, known as the “magical oriental mushroom” in traditional Chinese medicine. Glossy ganoderma is believed to boost energy, control blood pressure, and strengthen the immune system. Guangdong Gewang offers glossy ganoderma combined with selenium because the anti-oxidant effects of the selenium help prevent oxidation of the glossy ganoderma spore powder, thereby maximizing the effectiveness of the glossy ganoderma. A box of 300 selenium - glossy ganoderma capsules (i.e. a five month supply) retails for 1,380 RMB ($215) with a wholesale price of 650 RMB ($101). |

| ● | Organic Selenium Powder. 6% of our sales in fiscal year 2016 were sales of our selenium powder. We offer the selenium powder in a box of 90 bags, with a recommended dosage of one or two bags daily. A box (i.e. a 1½ to three month supply) retails for 1,380 RMB ($215) with a wholesale price of 650 RMB ($101). |

The only significant raw material needed for our selenium capsules and selenium powder is selenium. Selenium is readily available, as it has numerous industrial uses. For our selenium - glossy ganoderma capsules, we also need glossy ganoderma. Historically, the reisha mushroom, which is the source of glossy ganoderma, was rare in the wild. Recently, however, farmers have been successful in domesticating the reisha mushroom, which has resulted in an abundance of the reisha mushroom and of its derivative glossy ganoderma. As a result, sourcing our raw materials has not been a matter of concern, nor are we subject to significant effects from changes in the prices of our raw materials.

Our Manufacturing

Currently, we outsource our manufacturing to three production companies:

| ● | Yantai Yisheng Pharmaceutical Co., Ltd., which produces our selenium capsules; |

| ● | Taian Zhishengtang Ganoderma Lucidum Co., Ltd., which produces our selenium - glossy ganoderma capsules; and |

| ● | Beijing Technology Development Company of CAAS, which produces our organic selenium powder. |

The inventory held by Guangdong Gewang consists only of inventory in our retail stores. Generally, upon receipt of an order from our customer, we place a corresponding order with the appropriate manufacturer. Guangdong Gewang and our colleagues at the Academy strictly supervise the production process, and we inspect and accept the finished product. When the products are ready for shipment, either our logistics team or the manufacturer (depending on our agreement with the manufacturer) engages a delivery service to pick up the product from the manufacturer’s site and deliver it to the customer.

We have signed with each manufacturer, as well as with the Academy, a Product Manufacture and Purchase Agreement. Each agreement has a five year term, and mandates that the products be manufactured to our specification, with the manufacturer bearing responsibility for any product defects. The agreement gives Guangdong Gewang the authority to supervise the manufacturing process. We have also signed with each manufacturer a Non-Disclosure Agreement, which requires the manufacturer to protect the product formula and trade secrets, and prevents the manufacturer from entering into any venture in competition with us.

Our Marketing

Selenium deficiency is harmful to all humans. It is of particular concern, however, to the elderly and to lactating women. As we deliver information to the populations of areas with selenium-poor soil, those two groups are our target market. Nevertheless, our staff is committed to raising awareness of selenium issues throughout China, particularly in the eastern regions with large populations and selenium-poor soil. Our marketing staff makes personal appearances throughout our prime markets, both to raise awareness of the problem of selenium deficiency and to educate consumers about the proper use of selenium supplements and the risks of excess selenium ingestion. Additionally, we plan to develop a media advertising program in the future.

At present, Guangdong Gewang has distribution agreements with sixteen major wholesale customers, including eight well-established customers that retail health care products and eight distributors that sell selenium-enriched food in China. Each wholesale customer is assigned an exclusive market and barred by contract from selling in other markets. The sixteen wholesale customers, their designated markets and the expiration of the respective contracts are:

| Customers and Distributors | | | Market | | | | Expiration | |

| Dongguan Renzheng Pharmaceuticals and Trading Co., Ltd. | | | Dongguan | | | | March 5, 2017 | |

| Shenzhen Youmeikang Biotechnology Co., Ltd. | | | Shenzhen | | | | March 7, 2017 | |

| Foshan Kangchen Biotechnology Co., Ltd. | | | Foshan | | | | March 25, 2017 | |

| Fujian Beier Pharmaceuticals Co., Ltd. | | | Fujian | | | | April 14, 2017 | |

| Guangdong Sinopharm Pharmaceuticals Co., Ltd. | | | Guangdong | | | | May 9, 2017 | |

| Huizhou Liqi Pharmaceuticals Co., Ltd. | | | Huizhou | | | | May 9, 2017 | |

| Heyuan City Corning Pharmaceutical Biotechnology Co., Ltd | | | Heyuan | | | | October 23, 2018 | |

| Anhui Huishanghongfu Chain Supermarket LLC | | | Anhui | | | | February 28, 2017 | |

| Zhejiang Supply &Sales Supermarket Co., Ltd. | | | Zhejiang | | | | March 1, 2017 | |

| Tianjin Quanbao Supermarket Limited Liability Company | | | Tianjin | | | | March 29, 2017 | |

| Shanghai Liangyou Jinban Convenience Chain Co., Ltd. | | | Shanghai | | | | June 2, 2017 | |

| Shanxi Taiyuan Tangjiu Supermarket Co., Ltd. | | | Shanxi | | | | July 26, 2017 | |

| Guangzhou Huayuda Commerce and Trade Co., Ltd. | | | Guangzhou | | | | March 30, 2017 | |

| Shanwei City Urban Area Dongsheng Health Products Co., Ltd. | | | Shanwei | | | | August 16, 2019 | |

| Hubei Fudi Industrial Inc. | | | Hubei | | | | August 31, 2017 | |

| Guangdong Tianmei Selenium Enrichment Beverage Chain Corporation | | | Guangdong | | | | March 31, 2017 | |

Our distribution agreements fix the payment terms, which vary among customers. In each distribution agreement, Guangdong Gewang warrants that the products will conform to all the requirements set forth in the New National Pharmacopeia of the National Food and Drug Supervision and Management Bureau, and that all products will have a remaining viable period of no less than 12 months when delivered.

Our distribution agreements with the wholesale customers do not prevent them from selling competitor’s selenium products. Rather we assure ourselves of their loyalty by providing focused advertising of our brand in the chain stores’ markets, thereby making sale of the Jindanli products an attractive, low-effort proposition for our wholesale customers.

Our Competition

There are a limited number of name brands of selenium supplements in China, as the industry is in its early development period. In the markets where we do face competition, we emphasize the high quality of the Jindanli products such as the following:

| | ● | The Jindanli Selenium Capsule is designed using carageenan capsules to offer rapid absorption and high quality, yielding a product useful for all persons in need of added selenium in their diet. |

| | | |

| | ● | The Jindanli Selenium - Glossy Ganoderma Capsules offer an attractive combination of contemporary biotechnology with traditional healing. We source pure ganoderma spore powder from Mount Taishan wood, combine it with Jindanli selenium and package it in a carageenan capsule. |

| | | |

| | ● | The Jindanli Organic Selenium Powder provides the benefits of selenium to infants and the infirm, for whom swallowing capsules is difficult. |

While the industry has grown significantly, we believe the market is still in its early stages which is why we believe the market is fragmented and lacking a nationally recognized brand of selenium supplements.

Due to the fragmented market comprised of small players, many potential customers’ initial experiences with selenium supplements are with what we believe to be inferior products, many of which make unsupportable health claims. According to the Chinese Selenium Supplements Association, this has led to a lack of confidence in the selenium supplements among the Chinese people. Therefore, our marketing strategy must include education and strong prudent promotion, coupled with publicity to build confidence in the industry and our brands.

We believe that the quality of our products, along with our association with top quality manufacturers and chain stores, will enable us to compete effectively and gain market share, as the selenium supplement industry grows.

Our Growth Strategy

Through our wholesale and retail operations, we are currently selling selenium products in Guangdong Province, Fujian Province, Zhejiang Province, Anhui Province, Hunan Province, Shanxi Province, Hubei Province and the cities of Tianjin, Shanghai and Shenzhen. We also have current plans to expand our sales through a combination of retail stores and wholesale chain stores to Jiangsu Province, Jiangxi Province, Chongqing Province and Sichuan Province. We have begun our efforts to establish a nationwide reach through the wholesale and retail operations carried on at our home office, and our immediate plan is to bring intense marketing to regions where the need for selenium supplements is most pronounced, by locating dedicated corporate stores in these key markets. The stores will feature the Jindanli products, allowing us, by our pronounced presence, to bring attention to the issue of selenium deficiency, attract new customers, and provide customers with the information about the proper use of selenium supplements. The stores will also function as promoters of the Jindanli brand, and we believe this will enable us to build our brand as a high quality choice and become a dominant player in the market.

We currently have four stores, strategically located near our large chain customers. We opened our first store, in Chancheng, in September 2014, and opened two more stores, in Xiamen and Changsha, during fiscal year 2015. In June 2016, we opened our flagship store in Guangzhou. Also in June 2016, our Chancheng store moved to Foshan, our Xianmen store moved to Longyan and our Changshai store moved to Zhuzhou. Our goal is to open up to 26 new stores in the fiscal year 2017. Each store requires an investment of 300,000 to 400,000 RMB ($47,000 to $62,000) along with working capital of 100,000 to 200,000 RMB ($16,000 to $31,000).

The stores do not carry any products that compete against the Jindanli brand products. However, the stores do carry other quality selenium products and related health food and other products allowing us to bring attention to the issue of selenium deficiency, attract new customers, provide them the information about the proper use of selenium supplements and offering a full array of quality selenium products and other health food and related products to allow customers to increase their understanding of selenium and one location for their health food and related products. The stores will also function as a training center for the employees of our large chain customers to support our education and marketing strategy throughout their respective stores with a focus on the Jindanli brand, allowing us to fill the void in the selenium industry that lacks any well-known brand.

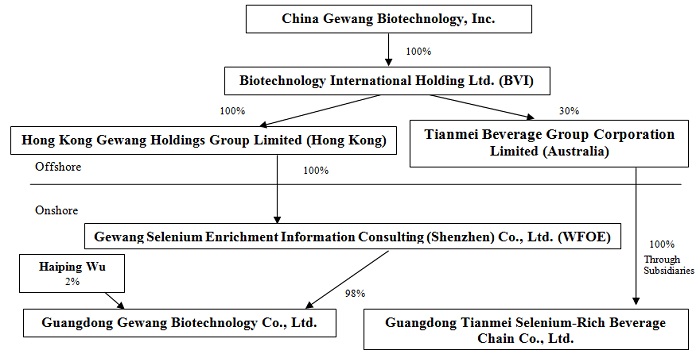

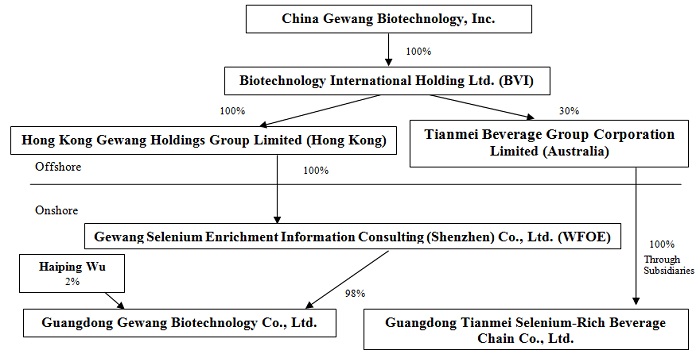

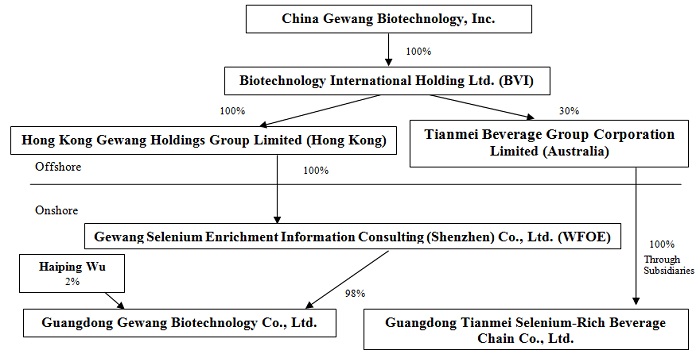

Corporate Structure

China Gewang Biotechnology, Inc., our U.S. parent company (the “Registrant” or the “U.S. Company”) was incorporated on May 29, 2009 in the State of Nevada under the name Rich Star Development Corporation. On January 8, 2015 the U.S. Company’s corporate name was changed to “China Gewang Biotechnology, Inc.” The name change was effected as an amendment to its Articles of Incorporation pursuant to Nevada Revised Statutes Section 92A.200.

The U.S. Company was originally formed for the purpose of sourcing and distributing food products, paper products, janitorial products, restaurant utensils and equipment to the food service industry in the PRC. Due to lack of financing, the U.S. Company never initiated operations. On December 1, 2014, control of the U.S. Company was transferred by its management and its primary shareholders to Mr. Shili Zhang. Mr. Zhang immediately abandoned the U.S. Company’s prior business plan and set about causing the U.S. Company to acquire control of Guangdong Gewang.

Organization and Acquisition of Biotechnology International and Guangdong Gewang

The corporate structure of the U.S. Company and its subsidiaries and affiliates was developed through the following steps:

| ● | In June 2010 three individuals (Shili Zhang, Yun Zeng, Wei Xu) organized Guangdong Gewang as a limited liability company in China under the name “Guangzhou Qinxiyuan Food Co., Ltd.” The registered equity was allocated among the founders thus: Shili Zhang - 54%, Yun Zeng - 28%, Wei Xu - 18%. On December 27, 2011, the limited liability company changed its name to Guangzhou Qinxiyuan Biotechnology Co., Ltd. Subsequently on July 17, 2013, the name was changed to Guangdong Gewang Biotechnology Co., Ltd. Since the time of its organization, Guangdong Gewang has been engaged in the wholesale marketing of selenium supplements. Since January 2014 it has also engaged in retail marketing of selenium supplements. |

| ● | On June 3, 2014, Bing Hua Wu, a resident of the PRC, organized Hong Kong Gewang in Hong Kong. Bing Hua Wu organized Hong Kong Gewang at the behest of Shili Zhang, as the first step in Mr. Zhang’s plan to place Guangdong Gewang under foreign control. The registered capital of Hong Kong Gewang was 10,000 Hong Kong Dollars. Mr. Zhang established Hong Kong Gewang to take advantage of tax advantages offered by the government of China to WFOEs whose equity-owners are Hong Kong residents. On August 29, 2014, Bing Hua Wu transferred the capital stock of Hong Kong Gewang to Shili Zhang, who in turn transferred it to Bin Wang on October 17, 2014. On January 20, 2015, Bin Wang transferred the shares to Gao Yishi Yang, a resident of Beijing. |

| ● | On March 10, 2015, Hong Kong Gewang received a Certificate of Approval from the local government of the PRC approving the establishment of Gewang Selenium as a WFOE wholly owned by Hong Kong Gewang. |

| ● | On March 17, 2015, Shili Zhang organized Biotechnology International under the BVI Business Companies Act, 2004 in the British Virgin Islands. Mr. Zhang was appointed Director of Biotechnology International, and held 25% of the outstanding shares. The remaining 50,000 shares were purchased for US$1.00 each by nineteen of Mr. Zhang’s business associates, none of whom acquired more than 4.9% of the outstanding shares. Mr. Zhang organized a British Virgin Islands holding company because the tax policies as well as the flexible corporation laws of the British Virgin Islands are advantageous to residents of the PRC requiring an offshore holding company. |

| ● | On April 2, 2015, Gao Yishi Yang transferred to Biotechnology International all of the outstanding shares of Hong Kong Gewang in exchange for 10,000 Hong Kong Dollars. |

| ● | On April 6, 2015, Gewang Selenium, Guangdong Gewang and the equity owners in Guangdong Gewang entered into the Variable Interest Entity Agreements (the “VIE Agreements”), as a result of which Guangdong Gewang became a controlled affiliate (variable interest entity) of Gewang Selenium. |

| ● | On April 20, 2015, the U.S. Company acquired all of the capital stock of Biotechnology International through the Share Exchange with the shareholders of Biotechnology International. |

| ● | On July 13, 2016, the U.S. Company's wholly owned subsidiary, Gewang Selenium, exercised its option to purchase all of the registered equity of Guangdong Gewang. The purchase price paid for the equity was RMB10,000 (approximately $1,500). The equity was purchased from Shili Zhang, Yun Zeng and Wei Xu. Shili Zhang was the U.S. Company's CEO until April 8, 2016 and is the father of Mengdi Zhang, who owned 12.7% of the U.S. Company’s outstanding common stock at the time of the sale on July 13, 2016. The other two sellers were not affiliated with the U.S. Company. Upon application to the provincial government for registration of the transfer of equity, the U.S. Company was informed that Gewang Selenium would not be permitted to own 100% of Guangdong Gewang. Therefore the parties modified the exercise of the option to provide that Gewang Selenium would purchase 98% of the registered equity of Guangdong Gewang. The remaining 2% of the registered equity was then sold by Yun Zeng to Haiping Wu for a price of RMB200,000 (approximately $30,000), which equaled 2% of the registered equity of Guangdong Gewang. The acquisition, as modified, was then approved by the provincial government on August 8, 2016. Prior to the acquisition, Gewang Selenium controlled Guangdong Gewang through a series of contractual agreements, which made Guangdong Gewang a variable interest entity, the effect of which was to cause the balance sheet and operating results of Guangdong Gewang to be consolidated with those of Gewang Selenium in the U.S. Company's financial statements. As a result of the acquisition by Gewang Selenium of registered ownership of Guangdong Gewang, the balance sheet and operating results of Guangdong Gewang will hereafter continue to be consolidated with those of Gewang Selenium as its majority owned subsidiary and the VIE Agreements are no longer in effect. The previous non-controlling interest has been reclassified to additional paid-in-capital. |

Acquisition of Tianmei Australia and Guangdong Tianmei

| | ● | On April 28, 2016, the Registrant's wholly-owned subsidiary, Biotechnology International, entered into an investment agreement with Guangdong Tianmei. The investment agreement provided that Biotechnology International would pay US$1,000,000 to acquire a 30% interest in an Australian corporation to be formed, which would indirectly own all of the equity in Guangdong Tianmei. On May 6, 2016, Biotechnology International participated in the organization of Tianmei Beverage Group Corporation Limited ("Tianmei Australia"). |

| ● | On May 16, 2016, Tianmei Australia purchased all of the outstanding shares of Tianmei BVI. The purchase price paid by Tianmei Australia was US$50,000. The seller was not affiliated with the Registrant or its subsidiaries. Tianmei BVI, through its wholly owned subsidiary, a Hong Kong holding company, owns all of the equity of a wholly foreign-owned subsidiary organized in the PRC, which wholly owns Guangdong Tianmei. Guangdong Tianmei was organized in May 2015, and is engaged in the business of distributing selenium-rich bottled water and also functions as a placement agent for a variety of products from various manufacturers, all within the PRC. |

Corporate Structure Chart

Our organizational structure is as follows:

Employees

Guangdong Gewang has 130 full time employees: 5 in human resources, 6 in administration, 7 in accounting, 11 in the purchase department, 4 in logistics, 6 in technology quality control, 10 in brand management, 8 in the customer center, 7 in the Chairman’s office and 66 in external collaboration, which includes our store sales, training and regional management employees.

PRC Government Regulations

Because our operating subsidiary, Guangdong Gewang, is located in the PRC, our business is regulated by the national and local laws of the PRC. We believe our conduct of business complies with existing PRC laws, rules and regulations.

General Regulation of Businesses

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time.

According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees. We are required to pay no less than local minimum wages to our employees. We are also required to provide employees with labor safety and sanitation conditions meeting PRC government laws and regulations and carry out regular health examinations of our employees engaged in hazardous occupations.

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these Rules, the RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a subsidiary in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loans and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

Dividend Distributions

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10% of its after-tax profit based on PRC accounting standards each year as as general reserve until the cumulative amount of such reserves reach 50% of its registered capital. These reserves are not distributable as cash dividends.

The Enterprise Income Tax Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises’ shareholder has a tax treaty with China that provides for a different withholding arrangement. Gewang Selenium is considered a FIE and is directly held by our subsidiary in Hong Kong, Hong Kong Gewang. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to a company in Hong Kong that directly holds at least 25% of the equity interest in the FIE will be subject to a withholding tax of no more than 5%. We expect that such 5% withholding tax will apply to dividends paid to Hong Kong Gewang by Gewang Selenium, but this treatment will depend on our status as a non-resident enterprise.

Item 1A. Risk Factors

Investing in our common stock involves risk. You should carefully consider the risks described below together with all of the other information contained in this Report, including the financial statements and the related notes, before deciding whether to purchase any shares of our common stock. If any of the following risks is realized, our business, financial condition or operating results could materially suffer. In that event, the trading price of our common stock could decline and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

Our management has limited experience in managing and operating a public company. Any failure to comply with federal securities laws, rules or regulations could subject us to fines or regulatory actions, which may materially adversely affect our business, results of operations, financial condition and the market price of our stock.

Our management personnel have no prior experience managing and operating a public company. They will rely in many instances on the professional experience and advice of third parties, including our attorneys and accountants. None of the members of our management staff were educated and trained in U.S. business systems, and we may have difficulty hiring new employees in the PRC with such training. As a result, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet U.S. standards. This may result in significant deficiencies or material weaknesses in our internal controls, which could impact the reliability of our financial statements and prevent us from complying with the SEC rules and regulations. Failure to comply with any laws, rules, or regulations applicable to our business may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition and could result in delays in development of an active and liquid trading market for our common stock. To the extent that the market place perceives that we do not have a strong financial staff and financial controls, the market for, and price of, our stock may be impaired.

During the past two fiscal years, management has identified material weaknesses in our internal controls, including:

| ● | The relatively small number of employees who are responsible for accounting functions prevents us from segregating duties within our internal control system; |

| | | |

| ● | Our internal financial staff lack expertise in identifying and addressing complex accounting issues under U.S. Generally Accepted Accounting Principles; |

| | | |

| ● | Our executive officers are not familiar with the accounting and reporting requirements of a U.S. public company; and |

| | | |

| ● | We have not developed sufficient documentation concerning our existing financial processes, risk assessment and internal controls. |

We plan to continue to address these deficiencies by nominating independent directors including a “financial expert” highly experienced in internal control systems and creating an Audit Committee to address these material weaknesses. Pursuant to an Audit Committee Charter, which we plan to adopt, the members of the Audit Committee will recommend to management concrete actions to address each material weakness and review the impact of such actions to remedy the deficiencies in our internal controls.

We depend on our partnership with the Academy for the development and conduct of our business. Any interference with that partnership could jeopardize our ability to conduct our business.

The formulas for our proprietary selenium products have been developed by the Academy of Agricultural Sciences of Shandong Province, which licenses to us the right to market and sell these products. The Academy also identifies the manufacturers of our products and provides technical expertise to those manufacturers. If we are unable to maintain the current arrangement with the Academy, we could lose the right to sell our products and our relationships with our contract manufacturers as well as our general reputation could suffer. If the Academy provides the formula or otherwise cooperates with any of our competitors, we could lose the competitive advantage inherent in our current arrangements with the Academy. Also, if the Academy decides to discontinue its work further developing selenium formulas, our potential for further growth could suffer.

We rely on a single manufacturer to manufacture each of our three products. Events that interfere with any manufacturer’s ability to fill our orders could damage our business.

We currently depend on three contracted manufacturers, one to manufacture each of the three products that we sell. If any significant problems occur at the production facility of one of our third-party manufacturers, our ability to deliver that manufacturer’s products could be adversely affected. If any of our contract manufacturers are unable to maintain adequate manufacturing and shipping capacity, timely delivery of products of acceptable quality could become problematic. Our inability to meet our customers’ demand for our products could have a material adverse impact on our business, financial condition and results of operations. Additionally, if the prices charged by any of our contractors increase for reasons such as increases in labor costs, our cost of manufacturing would increase, adversely affecting our operations. We require our contract manufacturers to meet our standards in terms of product quality and other matters. A failure by any of our contract manufacturers to meet these standards, to adhere to labor or other laws or to diverge from our mandated practices, and the potential negative publicity relating to any of these events, could harm our business and reputation.

The lack of expertise in U.S. GAAP among the staff of our finance department could result in errors in our filings.

The books and records of Guangdong Gewang, our operating entity, are maintained in accordance with bookkeeping practices that are customary in China. The financial statements of Guangdong Gewang and Gewang Selenium are prepared in accordance with accounting principles generally accepted in China. The staff of our finance department, which prepares those financial statements, has experience with Chinese GAAP, but very limited experience with U.S. GAAP. Therefore, in order to file with the SEC consolidated financial statements prepared in accordance with U.S. GAAP, we have engaged an independent consultant who makes the adjustments to the financial statements of Guangdong Gewang and Gewang Selenium necessary to achieve compliance with U.S. GAAP, and performs the consolidation required to produce the consolidated financial statements of China Gewang. Because that consultant, who is not present in our executive offices, is the only participant in the preparation of our financial statements possessing a familiarity with U.S. GAAP, there is a risk that the persons responsible for the initial classifications of the elements of our financial results will err in making those classifications, which will cause our reported financial statements to be erroneous. Any such errors, besides being misleading to investors, could result in subsequent restatements, which could have an adverse effect on the perception of the U.S. Company among investors.

We may not be able to meet the internal control reporting requirements imposed by the SEC resulting in a possible decline in the price of our common stock and our inability to obtain future equity or debt financing.

As directed by Section 404 of the Sarbanes-Oxley Act, the SEC adopted rules requiring each public company to include a report of management on its internal controls over financial reporting in its annual reports. Although the Dodd-Frank Wall Street Reform and Consumer Protection Act exempts emerging growth companies from the requirement that our independent registered public accounting firm attest to our financial controls, this exemption does not affect the requirement that we include a report of management on our internal control over financial reporting and does not affect the requirement to include the independent registered public accounting firm’s attestation when we cease to be an emerging growth company. For the fiscal year ending November 30, 2016, we were not subject to the requirement that we include an attestation report, as we are an emerging growth company.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. Regardless of whether we are required to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, if we are unable to do so, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

In addition, in the event that our independent registered public accounting firm is unable to rely on our internal controls in connection with its audit of our financial statements, and in the further event that it is unable to devise alternative procedures in order to satisfy itself as to the material accuracy of our financial statements and related disclosures, it is possible that we would be unable to file our Annual Report on Form 10-K with the SEC, which could also adversely affect the market for and the market price of our common stock and our ability to secure additional equity or debt financing as needed.

The residents of China have only recently begun to use supplements to offset selenium deficiency in their diets. We cannot, therefore, predict the potential market for our products. If the market fails to develop adequately, our financial results will be insufficient to produce a profitable return for our investors.

Selenium deficiency has been a problem in eastern China for centuries, and the relationship of selenium deficiencies to Keshan Disease has long been known. Until recently, efforts to alleviate selenium deficiency have been limited to changes in diet, the introduction of selenium-rich foods, where available. The use of selenium supplements, such as those sold by Guangdong Gewang is relatively recent. For that reason, we cannot know the extent to which we will be able to develop a sizeable market for our supplements. As food production and transportation rapidly increases in China, selenium-rich foods will become available to more of the residents of eastern China, where the problem of selenium deficiency is most acute. If Chinese people prefer to alter their diets to include imported selenium-rich foods, the demand for our selenium supplements will be reduced. In addition, concerns among the population about the possibility of harm from ingestion of excessive selenium could reduce demand for our products. If we are not able to persuade a sizeable market that use of selenium supplements is a safe, cost-effective method of avoiding selenium deficiency, our company will not grow.

The loss of the services of our key employees, particularly the services rendered by Li Wang, our Chief Executive Officer, could harm our business.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Li Wang, our chief executive officer. We currently do not have key employee insurance for our officers and directors. The loss of any these key employees, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

We require highly qualified personnel and, if we are unable to hire or retain qualified personnel, we may not be able to grow effectively.

Our future success also depends upon our ability to attract and retain highly qualified personnel. Expansion of our business and the proposed growth of our business will require additional managers and employees with industry experience, and our success will be highly dependent on our ability to attract and retain skilled management personnel and other employees. We may not be able to attract or retain highly qualified personnel. Competition for skilled marketing and administrative personnel is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees.

Product liability claims could materially impact operating results and profitability.

Excessive ingestion of selenium can have serious harmful effects on an individual. We intend to use our best efforts to educate our customers regarding the proper amount of selenium to add to their diets. If, however, an individual intentionally or inadvertently ingests too much selenium and is injured, we may be subject to a lawsuit for damages. Such lawsuits could drain our financial resources, particularly as we do not presently carry any product liability insurance or business interruption insurance. Lawsuits by customers may also distract the time and attention of our management. In addition, a product liability claim, regardless of merit or eventual outcome, could result in damage to our reputation, decreased demand for our products, product recalls and loss of revenue.

Government regulation or other influences may cause us to disclose the formulas for our products, which could assist our competitors in producing copies of our products.

We have a significant competitive advantage in the Jindanli brand, which represents a group of products available only from Guangdong Gewang. The exclusive quality of our products, which is comprised of the formula for each, is known only to Guangdong Gewang, our manufacturers, and our colleagues at the Academy of Agricultural Sciences of Shandong Province. However, because excess ingestion of selenium is known to be harmful, it may occur that one or more government bodies will mandate that the selenium content of our products must be disclosed. In addition, disclosure of the selenium content of our products may occur as a result of malfeasance by employees, accidental disclosure, or litigation. If the formula for our products becomes known in our industry, we will lose the competitive advantage that comes with being the exclusive source for the Jindanli products.

Our inability to protect our trademarks and license rights may prevent us from successfully marketing our products and competing effectively.

Failure to protect our intellectual property could harm our brands and our reputation, and adversely affect our ability to compete effectively. Further, enforcing or defending our intellectual property rights, including our trademarks, trade secrets, and our exclusive rights with the Academy to our product formulas could result in the expenditure of significant financial and managerial resources. We produce, market and sell our products under the brand “Jindanli”. We regard our intellectual property, particularly our trademarks and license rights, to be of considerable value and importance to our business and our success. There can be no assurance that the steps taken by us to protect these proprietary rights will be adequate or that third parties will not infringe or misappropriate our trademarks or the formulas for our products.

RISKS RELATED TO DOING BUSINESS IN CHINA

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiary and affiliate in the PRC. Our operating subsidiary is generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

The Registrant is a Nevada holding company and most of our assets are located outside of the United States. All of our current business operations are conducted in the PRC through Guangdong Gewang. In addition, all of our directors and officers are nationals and residents of the PRC, and the assets of these persons are located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States

Restrictions on currency exchange may limit our ability to receive and use our funds effectively.

All our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account,” which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, our PRC operating subsidiary may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC government authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in RMB, any existing and future restrictions on currency exchange may limit our ability to utilize funds denominated in RMB to fund any future business activities outside China or to utilize foreign currencies should the need to do so arise.

Foreign exchange transactions by our PRC operating subsidiary under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if our PRC operating subsidiary borrows foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiary by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local counterparts. These limitations could affect their ability to obtain foreign exchange through debt or equity financing.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between U.S. dollars and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without there being any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

In August 2015, the PRC government devaluated the RMB by approximately 3.5%, and from January 2016 through November 2016 the PRC government devalued its currency by an additional 7.5%. Additional devaluation could occur in the future and affect our results.

Since July 2005, the RMB is no longer pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC subsidiary’s ability to make dividend and other distributions could materially and adversely affect our ability to grow, make investments or complete acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

Substantially all of our revenues are earned by our PRC subsidiary. However, PRC regulations restrict the ability of our PRC subsidiary to make dividend and other payments to its offshore parent company. PRC legal restrictions permit payments of dividend by our PRC subsidiary only out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiary is also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to the statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiary to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Under the Enterprise Income Tax (the “EIT”) Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

Under the New Income Tax Law, enterprises established outside the PRC whose “de facto management bodies” are located in the PRC are considered “resident enterprises” and their global income will generally be subject to the uniform 25% enterprise income tax rate. On December 6, 2007, the PRC State Council promulgated the Implementation Regulations on the New Income Tax Law, which define “de facto management bodies” as bodies that have material and overall management control over the business, personnel, accounts and properties of an enterprise. In addition, a circular issued by the State Administration of Taxation on April 22, 2009 provides that a foreign enterprise controlled by a PRC company or a PRC company group will be classified as a “resident enterprise” with its “de facto management bodies” located within the PRC if the following requirements are satisfied:

| i. | the senior management and core management departments in charge of its daily operations function mainly in the PRC; |

| ii. | its financial and human resources decisions are subject to determination or approval by persons or bodies in the PRC; |

| iii. | its major assets, accounting books, company seals, and minutes and files of its board and shareholders’ meetings are located or kept in the PRC; and |

| iv. | more than half of the enterprise’s directors or senior management with voting rights reside in the PRC. |

Because the EIT Law, its implementing rules and the recent circular are relatively new, no official interpretation or application of this new “resident enterprise” classification is available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of potentially unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on any worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the EIT Law and its implementing rules dividends paid to us from our PRC subsidiary would qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 5% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares.

If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against our U.S. tax.

If the China Securities Regulatory Commission (“CSRC”) or another PRC regulatory agency determines that CSRC approval was required in connection with the reverse acquisition of Biotechnology International, the reverse acquisition may be unwound, or we may become subject to penalties.

On August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rule”), which became effective on September 8, 2006. The M&A Rule, among other things, requires that an offshore company controlled by PRC companies or individuals that have acquired a PRC domestic company for the purpose of listing the PRC domestic company’s equity interest on an overseas stock exchange must obtain the approval of the CSRC prior to the listing and trading of such offshore company’s securities on an overseas stock exchange. In addition, when an offshore company acquires a PRC domestic company, the offshore company is generally required to pay the acquisition consideration within three months after the issuance of the foreign-invested company license unless certain ratification from the relevant PRC regulatory agency is obtained. On September 21, 2006, the CSRC, pursuant to the M&A Rule, published on its official web site procedures specifying documents and materials required to be submitted to it by offshore companies seeking CSRC approval of their overseas listings.

We believe the M&A Rule mandating CSRC approval for acquisition of a PRC domestic company by an offshore company controlled by PRC companies or individuals should not apply to our reverse acquisition of Biotechnology International because none of Biotechnology International, Hong Kong Gewang or Gewang Selenium was a “Special Purpose Vehicle” or an “offshore company controlled by PRC companies or individuals” at the moment of acquisition. Because we believe the M&A Rule does not apply, we have not sought approval from the CSRC or any other agency, including MOFCOM for the reverse acquisition of Biotechnology International. However, if the PRC regulatory authorities take the view that the reverse acquisition of Biotechnology International constituted a “round-trip investment” without MOFCOM approval, they could invalidate our acquisition and ownership of Biotechnology International. We cannot make any assurance in such a case that we would be able to obtain the approval required from MOFCOM.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiary, limit our PRC subsidiary’s and affiliate’s ability to distribute profits to us or otherwise materially adversely affect us.

On July 4, 2014, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange for Overseas Investment and Financing and Reverse Investment by Domestic Residents via Special Purpose Vehicles, or Circular 37, which replaced the Notice on Issues Relating to the Administration of Foreign Exchange for the Financing and Reverse Investment by Domestic Residents via Offshore Special Purpose Vehicles issued by SAFE in October 2005, or Circular 75. Pursuant to Circular 37, any PRC residents, including both PRC institutions and individual residents, are required to register with the local SAFE branch before making any contribution to a company set up or controlled by the PRC residents outside of the PRC for the purpose of overseas investment or financing with their legally owned domestic or offshore assets or interests, referred to in this circular as a "special purpose vehicle." Under Circular 37, the term "PRC institutions" refers to entities with legal person status or other economic organizations established within the territory of the PRC. The term "PRC individual residents" includes all PRC citizens (also including PRC citizens abroad) and foreigners who habitually reside in the PRC for economic benefits. A registered special purpose vehicle is required to amend its SAFE registration in the event of any change of basic information including PRC individual resident shareholder, name, term of operation, or PRC individual resident's increase or decrease of capital, transfer or exchange of shares, merger, division or other material changes. In addition, if a non-listed special purpose vehicle grants any equity incentives to directors, supervisors or employees of domestic companies under its direct or indirect control, the relevant PRC individual residents could register with the local SAFE branch before exercising such options. The SAFE simultaneously issued a series of guidances to its local branches with respect to the implementation of Circular 37. Circular 37 modified certain defined terms under Circular 75 to clarify the SAFE registration scope. For example, Circular 37 broadened the definition of special purpose vehicle to offshore entities that were (i) established for the purpose of overseas investments by PRC residents (in addition to for the purpose of financing as defined under Circular 75) and (ii) established by PRC residents with their legally owned offshore assets or interests (in addition to domestic assets or interests as defined under Circular 75); and it also broadened the definition of reverse investment to include establishing new foreign invested entities or projects as a way of domestic direct investment by PRC residents, directly or indirectly, through a special purpose vehicle, which was excluded by Circular 75. Furthermore, Circular 37 modified certain SAFE registration procedures and requirements for special purpose vehicles and clarified the SAFE registration procedures for equity incentive awards granted by non-listed special purpose vehicles to directors, supervisors or employees of their controlled domestic companies.

We have advised our shareholders who are PRC residents, as defined in Circular 37 , to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiary and affiliate. However, as SAFE registration is a personal obligation of each shareholder, we cannot provide any assurances that their existing registrations have fully complied with, and they have made all necessary amendments to their registration to fully comply with, all applicable registrations or approvals required by Circular 37. Moreover, because of uncertainty over how Circular 37 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 37 by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 37. We also have little control over either our present or prospective direct or indirect shareholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident shareholders to comply with Circular 37, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.