The Board currently consists of nine members. The Company’s Certificate of Incorporation and Amended and Restated Bylaws divide the Board into three classes. One class is elected each year for a term of three years. The following table sets forth the class that each director is a member of, the year in which he or she first became a director, and whether or not he or she is independent as defined under The NASDAQ Stock Market rules and regulations (the “NASDAQ rules”).

The terms of office of the Class I directors expire at the Annual Meeting. The Board, upon the recommendation of the Nominating and Corporate Governance Committee, has nominated Craig Carlock, Richard Noll and Michael Tucci, and recommended that each of them be elected to the Board as Class I directors, to hold office until the annual meeting of stockholders to be held in 2017 and until his successor has been duly elected and qualified or until his earlier death, resignation or removal.

The following paragraphs set forth information about each director nominee’s business background, as furnished to the Company by the nominee, and additional experience, qualifications, attributes or skills that led the Board to conclude that the nominee should serve on the Board.

Mr. Carlock’s qualifications to serve on the Board include his knowledge of the Company and the food retail industry and his extensive management experience at the Company.

positions with increasing responsibilities while employed by Sara Lee Branded Apparel. Mr. Noll received a Masters in Business Administration from Carnegie Mellon University and a B.S. in Business Administration from Pennsylvania State University.

Mr. Noll’s qualifications to serve on the Board include his executive management experience as Chief Executive Officer of a company that focuses on consumer products, his experience with strategic and branding initiatives and his prior experience in a food production business.

Michael Tucci. Mr. Tucci, age 53, has served as a member of the Board since December 2011. Since November 2013, Mr. Tucci has served as Managing Partner and as a member of the board of directors of Rag & Bone, a women’s and men’s apparel and accessories company. From February 2012 to August 2013, Mr. Tucci served as President, North American Group of Coach, Inc., a leading American marketer of fine accessories and gifts for women and men, where he previously served as President, North American Retail from 2003 until 2012. Prior to joining Coach, Mr. Tucci held senior executive positions at The Gap, Inc. and Macy’s, Inc. Mr. Tucci holds a B.A. in English from Trinity College.

Mr. Tucci’s qualifications to serve on the Board include his executive management, operations, including store operations, and merchandising experience with a high-growth retail company.

Each of Messrs. Carlock, Noll and Tucci is standing for re-election to the Board and has agreed to be named in this Proxy Statement and to serve if elected. Although the Company knows of no reason why any of the nominees would not be able to serve, if any nominee is unavailable for election, the proxy holders intend to vote your shares for any substitute nominee proposed by the Board. At the Annual Meeting, proxies cannot be voted for a greater number of individuals than the three nominees named in this Proxy Statement.

The Board unanimously recommends that you vote “FOR” the election of

the foregoing nominees to serve as members of Class I of the Board.

Unless a proxy is marked to give a different direction, the persons named in the proxy will vote“FOR” each of the foregoing nominees to serve as a member of Class I of the Board.

Set forth below is information about each continuing director’s business background and additional experience, qualifications, attributes or skills that qualify him or her to serve on the Board.

Ray Berry. Mr. Berry, age 73, is the founder of the Company, has served as Chairman of the Board since he founded the Company in 1981 and served as President and Chief Executive Officer of the Company from 1981 until 2007. Prior to starting the Company, Mr. Berry held positions at numerous grocery and retail companies, including Vice President of Stores at Southland Corporation (former parent of 7-Eleven, Inc.) where he was responsible for the operations of nearly 4,000 7-Eleven stores. Mr. Berry received a B.A. in Psychology from San Diego State University and also completed the Stanford Executive Program at the Stanford Graduate School of Business.

Mr. Berry’s qualifications to serve on the Board include his knowledge of the Company and the food retail industry and his years of leadership at the Company.

Jeffrey Naylor. Mr. Naylor, age 55, has served as a member of the Board since the Company’s initial public offering in November 2010. Mr. Naylor is currently the founder and Managing Director of Topaz Consulting, LLC, a financial consulting company. From 2004 until his retirement in April 2014, Mr. Naylor worked at The TJX Companies, Inc., the leading off-price apparel and home fashions retailer in the United States and worldwide. Most recently, from February 2013 until April 2014, he served as TJX’s Senior Corporate Advisor. Previously, Mr. Naylor served as TJX’s Senior Executive Vice President, Chief Administrative Officer from January 2012 to February 2013, Senior Executive Vice President, Chief Financial and Administrative Officer from February 2009 to January 2012, Senior Executive Vice President, Chief Administrative and Business Development Officer from June 2007 to February 2009, Chief Financial and Administrative Officer from September 2006 to June 2007, and Senior Executive Vice President, Chief Financial Officer from 2004 to September 2006. Mr. Naylor received a Masters in Management from the J.L.

10

Kellogg Graduate School of Management, Northwestern University and a B.A. in Economics and Political Science from Northwestern University.

Mr. Naylor’s qualifications to serve on the Board include his executive management experience, his financial and accounting expertise and his extensive experience in the retail industry.

David Rea. Mr. Rea, age 53, has served as a member of the Board since the Company’s initial public offering in November 2010. From January 2007 to March 2008, Mr. Rea served as Senior Vice President and Chief Financial Officer of Sally Beauty Holdings, Inc., an international specialty retailer and distributor of professional beauty supplies. From 2000 to 2006, Mr. Rea worked at La Quinta Corporation and La Quinta Properties, Inc., owners/operators of limited-service hotels, serving as President and Chief Operating Officer from February 2005 to January 2006 and Executive Vice President and Chief Financial Officer from June 2000 to February 2005. Prior to joining La Quinta, Mr. Rea held various finance related positions, including positions at T. Rowe Price Associates, Inc. Mr. Rea received a Masters in Business Administration from the Amos Tuck School of Business Administration, Dartmouth College and a B.A. from Colgate University.

Mr. Rea’s qualifications to serve on the Board include his executive management experience, his financial expertise and his extensive experience in real estate related businesses.

Bob Sasser. Mr. Sasser, age 62, has served as a member of the Board since March 2012. He has served since 2004 as Chief Executive Officer and a director of Dollar Tree, Inc., a leading operator of discount variety stores, where he also served as President from 2001 to 2013 and as Chief Operating Officer from 1999 to 2004. Previously, he held executive and management positions at Roses Stores, Inc. and Michael’s Stores, Inc. Mr. Sasser received a B.S. in Marketing from Florida State University.

Mr. Sasser’s qualifications to serve on the Board include his executive management experience as Chief Executive Officer of a retail company, his experience with a high-growth retailer, and his total of forty-one years of retail experience.

Steven Tanger. Mr. Tanger, age 65, has served as a member of the Board since June 2012. Mr. Tanger has served as the President and Chief Executive Officer of Tanger Factory Outlet Centers, Inc., one of the largest owners and operators of outlet centers in the United States and Canada, since January 2009 and as a director of Tanger Factory Outlet Centers, Inc. since 1993. He previously held executive positions with Tanger Factory Outlet Centers, Inc. as President and Chief Operating Officer from January 1995 to December 2008, and as Executive Vice President from 1986 to December 1994. He has over forty years of experience in commercial real estate. Mr. Tanger received a B.S. in Business Administration from the University of North Carolina.

Mr. Tanger’s qualifications to serve on the Board include his executive management experience with a publicly traded company and his substantial experience in real estate and real estate-related businesses.

Jane Thompson. Ms. Thompson, age 62, has served as a member of the Board since June 2012. Ms. Thompson is the founder and CEO of Jane J. Thompson Financial Services LLC, a management consulting firm. Ms. Thompson served as President of Wal-Mart Financial Services from May 2002 to June 2011. Previously, she led the Sears Credit, Sears Home Services, and Sears Online groups within Sears, Roebuck & Company, and was a partner with McKinsey & Company, Inc. advising consumer companies. She has served on the board of directors and Compensation Committee of VeriFone Systems, Inc., a provider of electronic payment solutions, since March 2014 and served on the board of directors and the Audit Committee of ConAgra Foods, Inc. from 1995 to 1999. Ms. Thompson received a Masters in Business Administration from Harvard Business School and a B.B.A. in Marketing from the University of Cincinnati.

Ms. Thompson’s qualifications to serve on the Board include her extensive management experience with large, publicly-traded retail businesses and her understanding of consumer marketing, branding and finance.

11

The Company is governed by the Board and its various committees. The Board and its committees have general oversight responsibility for the affairs of the Company. In exercising its fiduciary duties, the Board represents and acts on behalf of the Company’s stockholders. The Board has adopted written corporate governance policies, principles and guidelines, known as the Corporate Governance Guidelines. The Board also has adopted a Code of Business Conduct and Ethics for Directors applicable to the Company’s directors as well as a Code of Ethics for Financial and Executive Officers, which applies to the Company’s Chief Executive Officer, Chief Financial Officer, Corporate Controller and other senior professionals, and a Code of Conduct, which applies to all of the Company’s officers and employees. These codes include guidelines relating to the ethical handling of actual or potential conflicts of interest, compliance with laws, accurate financial reporting and other related topics.

All of the Company’s corporate governance materials, including the charters for the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, the Corporate Governance Guidelines, the Code of Business Conduct and Ethics for Directors, the Code of Ethics for Financial and Executive Officers and the Code of Conduct, are published on the investor relations portion of the Company’s website athttp://ir.thefreshmarket.com. These materials are also available in print free of charge to any stockholder upon request by contacting the Company at The Fresh Market, Inc., 628 Green Valley Road, Suite 500, Greensboro, North Carolina 27408, Attention: Investor Relations, or by telephone at (336) 272-1338. Any modifications to these corporate governance materials will be reflected, and the Company intends to post any amendments or waivers to the Code of Ethics for Financial and Executive Officers on the investor relations portion of the Company’s website. Except for the availability of this Proxy Statement and the Annual Report on Form 10-K for the fiscal year ended January 26, 2014, which are available for viewing, printing and downloading athttp://ir.thefreshmarket.com, the information on the Company’s website is not part of this Proxy Statement.

The Board believes that a majority of its members are independent under both the applicable NASDAQ rules and the applicable SEC rules. The NASDAQ rules provide that a director does not qualify as “independent” unless the board of directors affirmatively determines that the director has no relationship with the company that would interfere with his or her exercise of independent judgment in carrying out the responsibilities of a director. The Board has adopted Categorical Director Independence Standards, which incorporate the independence standards of the NASDAQ rules, to assist the Board in determining whether a director has a relationship with the Company that would impair his or her independence.

The Categorical Director Independence Standards take into consideration whether the director was an employee of the Company, or a family member of the director was an executive officer of the Company, or the director or family member received certain compensation from the Company, within the prior three years; whether the director is a partner or employee of the Company’s independent or internal audit firm, or a family member is a partner of such firm or an employee of such firm who works on the Company’s audit, or the director or family member is a former partner or employee of such firm who has personally worked on the Company’s audit within the last three years; whether the director is an executive officer at a company where an executive officer of the Company serves on that company’s compensation committee; or whether the director or a family member holds certain positions with a company or charitable organization that purchases from, sells to, is indebted to, holds indebtedness of, or receives contributions from the Company, in each case, in amounts that exceed a certain percentage of the revenues, receipts, or assets of that company or organization.

In March 2014, the Board, with the assistance of the Nominating and Corporate Governance Committee, conducted an evaluation of director independence based on the Categorical Director Independence Standards, the NASDAQ rules and the SEC rules. As a result of this evaluation, the Board affirmatively determined that

12

none of Messrs. Naylor, Noll, Rea, Sasser, Tanger or Tucci nor Ms. Thompson had a relationship with the Company other than in their capacity as directors and that each of them is an independent director under the Categorical Director Independence Standards, the NASDAQ rules and the SEC rules. The Board also determined that each member of the Audit, Compensation and Nominating and Corporate Governance Committees (see membership information below under “Board Committees”) is independent.

Board Leadership Structure The Company’s Corporate Governance Guidelines provide the Board with flexibility to select the appropriate leadership structure at a particular time based on the specific needs of the Company’s business and what is in the best interests of the Company’s stockholders. The Company’s Corporate Governance Guidelines provide that the Board has no established policy on whether the positions of Chairman of the Board and Chief Executive Officer, or CEO, should be held by the same or different persons.

The Company currently has separated the roles of Chairman and CEO. In certain circumstances, however, the Board may determine that it is in the best interests of the Company for the same person to hold the positions of Chairman and CEO. The Board believes that the Company’s present leadership structure is appropriate for the Company at the current time, as it provides an appropriate balance between the two roles. The CEO is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while the Chairman of the Board provides guidance to the CEO and sets the agenda for Board meetings and presides over meetings of the full Board. Thus, the Board believes that the current structure balances the need for the CEO to run the Company on a day-to-day basis with the benefit provided to the Company by involvement of an experienced member of the Board who has significant historical experience with the Company and its business, but no role in the day-to-day affairs of the Company.

The Company’s Corporate Governance Guidelines provide that in the event that the Chairman is not independent, as determined by the Board, the independent directors may determine that the Board should have a lead independent director, who would be appointed by a majority of the independent directors. In March 2014, the Board appointed Richard Noll to serve as the lead independent director of the Board. The Company’s Corporate Governance Guidelines provide that the lead independent director will: (i) assist the Chairman of the Board and the Board in assuring compliance with and implementation of the Company’s Corporate Governance Guidelines, (ii) coordinate the agenda for and moderate sessions of the Board’s non-management directors, and (iii) facilitate communications between the non-management directors and the other members of the Board and management. If a lead independent director is not designated, the foregoing functions will be performed by the Chair of the Board’s Nominating and Corporate Governance Committee.

The Board has a standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Committee members and committee chairs are appointed by the Board. The members of these committees are identified in the following table:

Director

| | | | Audit

Committee

| | Compensation

Committee

| | Nominating and

Corporate Governance

Committee

|

|---|

| | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | |

13

Each committee of the Board functions pursuant to a written charter adopted by the Board. The following table provides information about the operation and key functions of these committees:

Committee

| | | |

|

| Functions and Additional Information

| | Number of

Meetings in

Fiscal 2013

|

|---|

| | | | | | Oversees the Company’s accounting and financial reporting processes, internal controls and internal audit functions. | | |

| | | | | | Reviews and discusses with management and the independent registered public accounting firm the annual and quarterly financial statements and earnings press releases. | | |

| | | | | | Reviews and pre-approves all audit and non-audit services proposed to be performed by the independent registered public accounting firm. | | |

| | | | | | Reviews and approves or ratifies related person transactions. | | |

| | | | | | Oversees compliance with legal and regulatory requirements. | | |

| | | | | | The Board has determined that Mr. Naylor is an “audit committee financial expert” within the meaning of the SEC rules, that each of Messrs. Rea and Sasser meet the qualifications to be an “audit committee financial expert” within the meaning of the SEC rules, and that Messrs. Naylor, Rea and Sasser are “independent” as that term is defined under Rule 10A-3(b)(1) of the Exchange Act and the NASDAQ rules. | | |

| |

| | | | | | Oversees the administration of the executive compensation plans. | | |

| | | | | | Reviews and establishes the compensation of the executive officers. | | |

| | | | | | Reviews and recommend to the Board the form and amount of director compensation. | | |

| | | | | | Reviews and makes recommendations to the non-management directors on the Board with respect to any employment agreements, consulting arrangements, severance or retirement arrangements or change in control agreements and provisions covering any current or former executive officer of the Company. | | |

| | | | | | Oversees regulatory compliance regarding compensation matters. | | |

| | | | | | The Board has determined that each member of the Compensation Committee during fiscal 2013 was an “outside director” as defined under Section 162(m) of the Internal Revenue Code. | | |

| |

Nominating and Corporate

Governance Committee | | | | | | Determines qualifications for membership on the Board and recommends such qualifications to the Board for approval. | | |

| | | | | | Determines qualifications for membership on the committees of the Board and reviews such qualifications with the Board periodically. | | |

| | | | | | Makes recommendations to the Board concerning committee appointments. | | |

| | | | | | Makes recommendations to the Board with respect to determinations of director independence. | | |

| | | | | | Identifies, evaluates and recommends director candidates to the Board. | | |

| | | | | | Oversees annual evaluation of the Board and the committees of the Board. | | |

| | | | | | Considers and recommends to the Board other actions relating to corporate governance. | | |

14

The Board may also establish other committees from time to time as it deems necessary.

Director Meeting Attendance The Board held four meetings during fiscal 2013. Each incumbent director attended 75% or more of the aggregate number of meetings of the Board and committees of the Board on which the director served during fiscal 2013. It is the Board’s policy that the directors should attend the Company’s annual meeting of stockholders absent exceptional circumstances. All nine of the incumbent directors attended the 2013 Annual Meeting of Stockholders.

Pursuant to the Corporate Governance Guidelines, the independent directors meet in regularly scheduled executive sessions without management. Mr. Noll, as the lead independent director, presides over these executive sessions.

Director Nomination Process The Nominating and Corporate Governance Committee is responsible for identifying and evaluating individuals qualified to become members of the Board and for recommending to the Board the individuals for nomination as members. In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Nominating and Corporate Governance Committee considers such candidate’s independence, diversity, integrity, skills, expertise, breadth of experience, knowledge about the Company’s business or industry, ownership interest in the Company and willingness to devote adequate time and effort to Board responsibilities in the context of the existing composition and needs of the Board and its committees.

Neither the Nominating and Corporate Governance Committee nor the Board has a specific policy with regard to the consideration of diversity in identifying director nominees. However, both may consider the diversity of background and experience of a director nominee in the context of the overall composition of the Board at that time, such as diversity of knowledge, skills, experience, geographic location, age, gender, and ethnicity.

The Nominating and Corporate Governance Committee may, at its discretion, hire third parties to assist in the identification and evaluation of director nominees. Except for the Company’s founder, no director or nominee may stand for re-election or election to the Board after his or her 70th birthday.

Stockholder Recommendations of Director Candidates Recommendations by stockholders for director candidates to be considered for the 2015 Annual Meeting of Stockholders must be delivered to or mailed and received by the Company’s Secretary at The Fresh Market, Inc. c/o Secretary, 628 Green Valley Road, Suite 500, Greensboro, North Carolina 27408 not earlier than the close of business on February 3, 2015 and not later than the close of business on March 5, 2015. If the date of the annual meeting is advanced by more than 30 days or delayed by more than 90 days from June 3, 2015, notice by the stockholder to be timely must be so delivered or received not earlier than the close of business on the 120th day prior to the date of the 2015 Annual Meeting of Stockholders and not later than the close of business on the later of the 90th day prior to the date of the 2015 Annual Meeting of Stockholders or the 10th day following the day on which the Company first makes a public announcement of the date of such meeting. A public announcement of adjournment or postponement of an annual meeting shall not commence a new time period for the giving of notice.

Notice of a director nomination must be submitted in accordance with the requirements set forth in the Company’s Amended and Restated Bylaws (available athttp://ir.thefreshmarket.com or upon request from the Company), which include requirements to provide the name and address of the stockholder making the recommendation, a representation that the recommending stockholder is a record holder of Common Stock, all information regarding the nominee that would be required to be set forth in a proxy statement, the consent of the nominee to serve as a director and such other items required by the Amended and Restated Bylaws from time to time. Such information should be sent to Nominating and Corporate Governance Committee c/o Secretary, The Fresh Market, Inc., 628 Green Valley Road, Suite 500, Greensboro, North Carolina 27408. Recommended candidates will be subject to a comprehensive private investigation background check by a

15

qualified firm of the Company’s choosing. Appropriate submission of a recommendation by a stockholder does not guarantee the selection of the stockholder’s candidate or the inclusion of the candidate in the proxy statement; however, the Nominating and Corporate Governance Committee will consider any such candidate in accordance with the director nomination process described above.

Policy for Review of Related Person Transactions The Company reviews relationships and transactions in which the Company and its directors and executive officers or their immediate family members are participants to determine whether such related persons have a direct or indirect material interest in the relationship or transaction. The Company’s executive management is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related person transactions and for then determining, based on the facts and circumstances, whether a related person has a direct or indirect material interest in the transaction. As required under the SEC rules, transactions that are determined to be directly or indirectly material to a related person are disclosed in this Proxy Statement. In addition, the Audit Committee reviews and approves or ratifies any related person transaction that is required to be disclosed under the SEC rules. As set forth in the Audit Committee’s charter, which is available on the investor relations portion of the Company’s website athttp://ir.thefreshmarket.com, in the course of its review and approval or ratification of a disclosable related person transaction, the Audit Committee considers the relevant facts and circumstances, including the material terms of the transactions, risks, benefits, costs, availability of other comparable services or products and, if applicable, the impact on a director’s independence.

Related Person Transactions

In connection with the Company’s initial public offering, the Company entered into a registration rights agreement with its pre-IPO stockholders (“the Berry family”) pursuant to which the Company granted them registration rights with respect to the Common Stock owned by them. These rights include demand registration rights, shelf registration rights and “piggyback” registration rights, as well as customary indemnification. All fees, costs and expenses related to registrations will be borne by the Company, other than stock transfer taxes and underwriting discounts or commissions.

| • | | Demand registration rights. The registration rights agreement grants the Berry family demand registration rights. The Company will be required, upon the written request of any two or more of Ray Berry, Brett Berry and Amy Barry, to use its reasonable best efforts to effect registration of shares requested to be registered by the Berry family as soon as practicable after receipt of the request. The Company is not required to effect any such demand registration within 180 days after the effective date of a previous demand registration. The Company is not required to effect a demand registration on Form S-1 after it has effected three such demand registrations. The Company is not required to comply with any registration demand unless the anticipated aggregate offering amount equals or exceeds $75.0 million. |

| • | | Shelf registration rights. The registration rights agreement grants the Berry family shelf registration rights. Under the terms of the registration rights agreement, any two or more of Ray Berry, Brett Berry and Amy Barry may demand that the Company file a shelf registration statement with respect to those shares requested to be registered by the Berry family. Upon such demand, the Company is required to use its reasonable best efforts to effect such registration. |

| • | | “Piggyback” registration rights. The registration rights agreement grants the Berry family “piggyback” registration rights. If the Company registers any of its securities either for its own account or for the account of other security holders, the Berry family is entitled to include its shares in the registration. |

Tax Indemnification Agreements

In connection with its initial public offering, the Company entered into tax indemnification agreements with its stockholders prior to the offering. Pursuant to these agreements, the Company agreed that upon filing

16

any tax return (amended or otherwise), or in the event of any restatement of its taxable income, in each case for any period during which it was an S-corporation, the Company will make a payment to each stockholder on a pro rata basis in an amount sufficient so that the stockholder with the highest incremental estimated tax liability (calculated as if the stockholder would be taxable on its allocable share of the Company’s taxable income at the highest applicable federal, state and local tax rates and taking into account all amounts the Company previously distributed in respect of taxes for the relevant period) receives a payment equal to its incremental tax liability. The Company also agreed to indemnify the stockholders for any interest, penalties, losses, costs or expenses (including reasonable attorneys’ fees) arising out of any claim under the agreements.

Lease Agreement

The Company leases real estate for its Macon, Georgia store (the “Store”) from Coro Rivoli Ventures, LLC (“CRV”), a real estate company in which Michael Barry and Randy Kelley are principals and have combined beneficial ownership of approximately 50%. Mr. Barry is a former director and executive officer of the Company, beneficially owns approximately 6.4% of the Company’s outstanding Common Stock and is the son-in-law of Mr. Ray Berry, Chairman of the Board. Mr. Kelley resigned in March 2013 as the Company’s Senior Vice President — Real Estate and Development.

CRV became the landlord under the Store’s lease in July 2013 in connection with CRV’s purchase of a shopping center in which the Store is a tenant. The lease’s terms have not changed as a result of CRV becoming the landlord or since CRV became the landlord. During fiscal 2013, the Company made payments to CRV under the Store’s lease of approximately $138,109 (consisting of $132,450 in rent and $5,659 in pass-through common area maintenance escrow, taxes and insurance, each of which may be subject to adjustment in connection with periodic reconciliations conducted by or on behalf of the parties to the lease). Total payments due to CRV under the Store’s lease from the date of CRV becoming the landlord through the expiration of the existing term of the Store’s lease on August 31, 2019 are estimated, based upon current levels of expenditures, at approximately $1,843,208. The Audit Committee of the Board, which is comprised entirely of independent directors, ratified the Store’s lease following CRV becoming landlord thereunder after taking into consideration all of the material facts, including that (i) the lease was entered into originally with an unrelated landlord, (ii) the lease was acquired by CRV and CRV’s acquisition of the lease did not require or permit the Company’s consent, (iii) the lease did not provide the Company any rights to terminate or otherwise alter the lease as a result of CRV or any other person assuming the lease, and (iv) the lease’s terms have not changed as a result of CRV becoming the landlord or since CRV became the landlord.

The Board’s Role in Risk Oversight The Board oversees the Company’s risk profile and management’s processes for assessing and managing risk, both as a whole Board and through its committees. The full Board reviews strategic risks and opportunities facing the Company. Among other areas, the Board is involved in overseeing risks related to the Company’s overall strategy, business results, capital structure, capital allocation and budgeting and executive officer succession. Certain other important categories of risk are assigned to designated Board committees (which are compromised solely of independent directors) that report back to the full Board. In general, the committees oversee the following risks:

| • | | Audit Committee oversees risks related to internal financial and accounting controls, legal, regulatory and compliance risks, work performed by the Company’s independent registered public accounting firm and, if applicable, the Company’s internal audit function, related person transactions, and the overall risk management governance structure and risk management function; |

| • | | Compensation Committee oversees compensation programs and practices. For a detailed discussion of the Company’s efforts to manage compensation related risks, see “Risk Analysis of Compensation Programs” on page 48; and |

| • | | Nominating and Corporate Governance Committee oversees issues that may create governance risks, such as Board composition and structure, director selection, and director succession planning. |

The Board leadership structure supports the Company’s governance approach to risk oversight as the Chief Executive Officer is involved directly in risk management as a member of the Company’s management

17

team, while the Chairman of the Board, the lead independent director and the committee chairpersons, in their respective areas, maintain oversight roles as a non-management director (in the case of the Chairman of the Board) and independent directors (in the case of the lead independent director and committee chairpersons) of the Board.

Compensation Committee Advisors The Compensation Committee has sole authority under its charter to retain compensation consultants and other advisors and to approve such consultants’ and advisors’ fees and retention terms. In August 2011, the Compensation Committee retained Frederic W. Cook & Co., Inc. (“FWC”) to act as its independent advisor and to provide it with advice and support on executive compensation issues. The Compensation Committee has renewed this engagement each year since. Since its engagement, FWC has assisted with peer group identification and benchmarking, design of compensation programs, review of compensation-related disclosures and related services.

The independence of FWC, as compensation consultant, has been reviewed and confirmed by the Compensation Committee. Neither FWC nor any of its affiliates provide any services to the Company except for services provided to the Compensation Committee and the services provided prior to the Company’s initial public offering to its private company board of directors, which did not include any of the Company’s named executive officers, regarding benchmarking of executive compensation as part of the initial public offering planning process. In addition to FWC, the Compensation Committee has reviewed the independence of each other outside adviser in advance of receiving advice from such person.

Communications with the Board of Directors Stockholders and other interested parties can communicate directly with any of the Company’s directors, including its non-management directors, by sending a written communication to a director at The Fresh Market, Inc. c/o Secretary, 628 Green Valley Road, Suite 500, Greensboro, North Carolina 27408. In addition, any party who has concerns about the accounting, internal controls or auditing matters may contact the Audit Committee directly by sending a written communication to the Chair of the Audit Committee c/o General Counsel at the above address or by calling toll-free 1-866-276-3796. Such communications may be confidential or anonymous. All such communications are promptly reviewed before being forwarded to the addressee. Any concerns relating to accounting, internal controls, auditing matters or officer conduct are sent immediately to the Chair of the Audit Committee. The Company generally will not forward to directors a stockholder communication that it determines to be primarily commercial in nature, relates to an improper or irrelevant topic or requests general information about the Company.

The Company’s director compensation policy provides that each director who is considered “independent” within the meaning of the NASDAQ rules will receive compensation for service on the Board. Non-independent directors receive no compensation for their service as directors. In fiscal 2013, the Company’s non-independent directors were Messrs. Ray Berry, Brett Berry and Craig Carlock. Mr. Brett Berry retired from the Board on March 19, 2014.

The Compensation Committee reviews and approves compensation of the members of the Board. In approving director compensation, the Compensation Committee considers recommendations of its outside compensation consultant, including benchmarking of the director compensation against the compensation paid to directors of the companies that are members of the Company’s compensation peer group for purposes of executive compensation, and makes such modifications as it deems appropriate. The current compensation for the Company’s independent directors is as follows:

| • | | an annual retainer of $40,000 in cash; |

| • | | an annual retainer of $15,000 in cash to the Chairs of the Audit Committee and the Compensation Committee, $5,000 in cash to the Chair of the Nominating and Corporate Governance Committee and, beginning in June 2014, $15,000 in cash to the lead independent director; |

18

| • | | $1,000 in cash for in-person attendance at meetings and $500 in cash for telephonic attendance at meetings, for each Board or committee meeting in excess of six meetings per year, in each case, of the Board or the applicable committee, with the year being measured from annual meeting of stockholders to the next annual meeting of stockholders; and |

| • | | an annual equity grant of restricted shares of Common Stock in an amount approximately equal to $60,000 per annum. The restricted shares are granted at (i) the time of each annual meeting of stockholders, for continuing directors and (ii) the time of appointment, for directors appointed to the Board following the annual meeting of stockholders. The restricted shares vest at the earlier of one year from the date of grant and the next annual meeting of stockholders. The holders of the restricted shares are entitled to the rights of a stockholder in respect of such restricted shares, including the right to vote and receive dividends. |

Director compensation is prorated for partial year service. In lieu of the annual Board and committee chair cash retainers, directors may elect to receive deferred stock units (“DSUs”). In the event a director elects to receive DSUs, the DSUs will be distributed in shares of Common Stock, with the timing of distribution to be based on director elections in accordance with Internal Revenue Code Section 409A.

The following table shows the compensation paid to each independent director who served on the Board in fiscal 2013:

2013 Director Compensation Table

Name

| | | | Fees Earned or

Paid in Cash

($)(1)

| | Stock Awards

($)(2)

| | Total

($)

|

|---|

| | | | | 59,000 | | | | 60,000 | | | | 119,000 | |

| | | | | 45,500 | | | | 60,000 | | | | 105,500 | |

| | | | | 60,500 | | | | 60,000 | | | | 120,500 | |

| | | | | 4,000 | | | | 100,000 | | | | 104,000 | |

| | | | | 40,000 | | | | 60,000 | | | | 100,000 | |

| | | | | 41,500 | | | | 60,000 | | | | 101,500 | |

| | | | | 1,500 | | | | 100,000 | | | | 101,500 | |

| (1) | | The amounts shown in this column represent the aggregate amounts of all fees earned or paid in cash for services as a director in fiscal 2013 as discussed above. |

| (2) | | Represents the full grant date fair value of restricted stock or DSU awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“FASB ASC Topic 718”), subject to rounding as the actual number of shares of restricted stock or DSUs issued was determined by dividing $60,000 and $40,000, respectively, by the closing price ($49.07) of the Common Stock on June 4, 2013 and rounding down to the next whole share. Generally, the full grant date fair value is the amount that the Company would expense in the financial statements over the award’s vesting schedule. For additional information regarding the assumptions made in calculating these amounts, see the notes to the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended January 26, 2014. These amounts reflect the accounting expense and do not correspond to the actual value that will be recognized by the directors. |

| (3) | | Each of Messrs. Sasser and Tucci elected to receive DSUs in lieu of his annual retainer for service on the Board. |

19

The following table shows the number of shares of restricted stock and DSUs held by each independent director as of January 26, 2014:

Name

| | | | Restricted

Stock

(#)

| | Deferred

Stock Units

(#)

|

|---|

| | | | | 6,863 | | | | — | |

| | | | | 4,136 | | | | — | |

| | | | | 6,863 | | | | — | |

| | | | | 2,467 | | | | 815 | |

| | | | | 2,256 | | | | — | |

| | | | | 2,256 | | | | — | |

| | | | | 3,018 | | | | 815 | |

Stock Ownership and Retention Guidelines. The Board has adopted Stock Ownership and Retention Guidelines for the Company’s independent directors. The Guidelines require each independent director to (i) own shares of Common Stock (excluding unvested equity awards) having a market value equal to five times the annual cash retainer for independent directors or (ii) until clause (i) is met, retain 100% of his or her equity awards. The retention requirements are applicable to equity awards made after the Board’s adoption of the Stock Ownership and Retention Guidelines in March 2012.

Activities that May be Deemed Hedging or Pledging of Company Stock Prohibited. Directors are expressly prohibited from buying or selling puts, calls or other derivatives and are also prohibited from short-selling shares of Common Stock or pledging or margining shares of Common Stock.

Set forth below is a list of names and ages of the Company’s executive officers indicating all positions and offices held by each such person and each person’s principal occupations or employment during the past five years. Each officer is elected annually by the Board.

Craig Carlock. Mr. Carlock, age 47, is the President and Chief Executive Officer and a director of the Company. Mr. Carlock has been President and Chief Executive Officer since 2009 and a director since 2012. Additional information about Mr. Carlock can be found under “Proposal 1: Election of Directors — Nominees for Director” on page 9.

Jeffrey Ackerman. Mr. Ackerman, age 50, has served as Executive Vice President and Chief Financial Officer of the Company since June 2013. Previously, he served as Executive Vice President and Chief Financial Officer at Sealy Corporation, one of the largest bedding manufacturers in the world, from 2006 to 2013. From 1997 to 2006, Mr. Ackerman was Vice President, Finance with Dade Behring, Inc., a medical diagnostics company. From 1989 to 1997, he held a variety of finance roles at the Frito-Lay branded snack division of PepsiCo, Inc. Mr. Ackerman holds a Masters in Business Administration from the University of Texas at Austin and a B.S. in Industrial Management from Purdue University.

Sean Crane. Mr. Crane, age 46, has served as Executive Vice President and Chief Operations Officer of the Company since January 2012, and in addition, served as interim Chief Financial Officer of the Company from December 2012 to June 2013. Previously, Mr. Crane served as Senior Vice President — Store Operations of the Company from 2006 until 2012 and as Senior Vice President — Real Estate and Development of the Company from 2005 until 2006. He joined the Company in 2000 and previously served as Controller, Director of Real Estate, Vice President — Real Estate and Vice President — Real Estate and Development. Prior to joining the Company, Mr. Crane held various management positions in accounting and finance with Grand Union, Neiman Marcus, Inc. and Office Depot, Inc. Mr. Crane is a Certified Public Accountant and received a Masters in Business Administration from the University of North Carolina and a B.B.A. in Accounting from Florida Atlantic University.

Matt Argano. Mr. Argano, age 41, has served as Senior Vice President — Human Resources of the Company since May 2012. Before joining the Company, Mr. Argano served as Global Vice President, Human Resources of Maidenform Brands, Inc., a global intimate apparel company. Mr. Argano also held positions with increasing responsibility at two retailers, The Children’s Place Retail Stores, Inc. and Bed Bath & Beyond Inc. Mr. Argano earned a Ph.D. in Organizational Leadership from Tennessee Temple University, a

20

Master of Arts in Organizational Management from Beacon College & Graduate School, and a B.S. in H.R. Management from National University. He serves on the Membership Advisory Committee for the North Carolina Psychological Association and is an active member of the Society for Industrial Organizational Psychology.

Scott Duggan.Mr. Duggan, age 48, has served as Senior Vice President — General Counsel of the Company since September 2010. Prior to joining the Company, Mr. Duggan was a partner in the law firm of Goodwin Procter LLP where he practiced corporate law. He received a J.D. from Boston University School of Law and a B.S. in Business Administration from The University of Maine.

Marc Jones.Mr. Jones, age 42, has served as Senior Vice President — Marketing and Merchandising of the Company since December 2009. Mr. Jones served as Vice President — Marketing and Merchandising of the Company from February to December 2009. He joined the Company in 2006 and previously served as Director of Merchandising (Non-Perishables) and Vice President — Marketing (Non-Perishables). Prior to joining the Company, Mr. Jones was a Vice President at Daymon Worldwide, a full-service global retail branding and sourcing company. He received a Masters in Business Administration from Harvard Business School and a B.A. in Spanish and a B.A. (Honours) in Political Studies from Queen’s University.

Randy Young. Mr. Young, age 56, has served as Senior Vice President — Real Estate and Development of the Company since September 2013. He previously served as Vice President, Real Estate at Advance Auto Parts, Inc., a leading retailer of automotive parts and accessories, from September 2006 to September 2013. Prior to joining Advance Auto Parts, Mr. Young was Managing Vice President of Site Acquisition and Development at Cedarwood Development, Inc. from 2004 to 2006, served as President of Real Estate at Clear Channel Entertainment from 1999 to 2003, and held a variety of real estate and construction roles at McDonald’s Corporation from 1985 to 1998. Mr. Young holds a J.D. from Capital University in Columbus, Ohio and a B.S. in Civil Engineering from Ohio Northern University.

21

Compensation Discussion and Analysis Introduction

This Compensation Discussion and Analysis provides the Company’s stockholders with important information about the Company’s compensation philosophy and objectives and describes the material compensation decisions and elements for its named executive officers for fiscal 2013. This Compensation Discussion and Analysis should be read in conjunction with the compensation tables that follow. The Company’s named executive officers for fiscal 2013 are:

| | | | | | President and Chief Executive Officer |

| | | | | | Executive Vice President and Chief Financial Officer since June 3, 2013 |

| | | | | | Executive Vice President and Chief Operating Officer and, from December 7, 2012 to June 3, 2013, interim Chief Financial Officer |

| | | | | | Senior Vice President — Marketing and Merchandising |

| | | | | | Senior Vice President — General Counsel |

The Compensation Committee has the responsibility for establishing the Company’s compensation philosophy and assists the Board in discharging its responsibilities related to the compensation of all of the Company’s executive officers, including its named executive officers.

Executive Summary

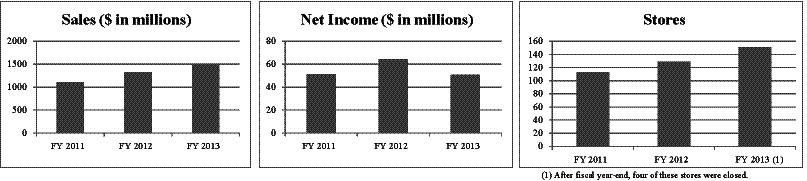

The Company’s core business continued to perform well in 2013. The Company opened 22 new stores, grew its top-line revenue to $1.51 billion (a 13.7% increase compared to fiscal 2012) and achieved an increase in comparable store sales of 3.1%. However, the Company’s overall performance as a high-growth specialty retailer was disappointing. Some of the Company’s stores in California and Texas did not meet the Company’s expectations despite increased spending on promotions at these stores. In the fourth quarter, the Company recognized an impairment charge of $27.6 million related to seven of its underperforming stores, and subsequently, the Company decided to close four of them.

Despite the disappointing overall performance, the Company did achieve solid performance in its core business. In addition to its top-line revenue growth, the Company:

| • | | Improved its gross profit by $63.7 million to $515.4 million; |

| • | | Improved its gross margin rate by 10 basis points as a percentage of sales; |

| • | | Generated operating income of $83.4 million; |

| • | | Generated net income, including the $27.6 million impairment charge, of $50.8 million or $1.05 per share on a fully diluted basis; |

| • | | Generated return on invested capital, excluding excess cash, of 16.5%; |

| • | | Generated $140.4 million in cash flow from operations; and |

| • | | Opened 22 new stores, or approximately 17% unit growth, including its first stores in Texas. |

22

The Company’s pay practices are intended to reward executive officers when strong financial results are achieved and to hold management accountable when those results are not achieved. The 2013 annual incentive compensation program required the Company to increase sales by 15.3% to $1.532 billion and operating income, on an excluded items basis, by 19.7% to $121.4 million for the named executive officers to earn their target annual incentive compensation. The program also included a return on invested capital (or ROIC) modifier that reduces any formulaic bonus under the program by 20% in the event the Company’s ROIC, on an excluded items basis, fell below 20%. The Company did not have any excluded items for purposes of calculating operating income or ROIC for fiscal 2013. Accordingly, references within this Compensation Discussion and Analysis to each financial measure when used to discuss actual performance in fiscal 2013 will refer to operating income and ROIC without reference to any exclusions. Appendix A includes information regarding the calculation of ROIC.

The Company’s overall financial results as described above were not as strong as management, the Compensation Committee and investors expected. While the Company increased sales by 13.7%, its operating income decreased and its ROIC fell below 20% due to the impairment charges recorded in the fourth quarter. Accordingly, the annual incentive compensation executive officers earned for 2013 was only 14.3% of their Target Annual Incentive Compensation.

The Company continues to maintain pay practices that reward executive officers for driving performance and are aligned with stockholders’ interests:

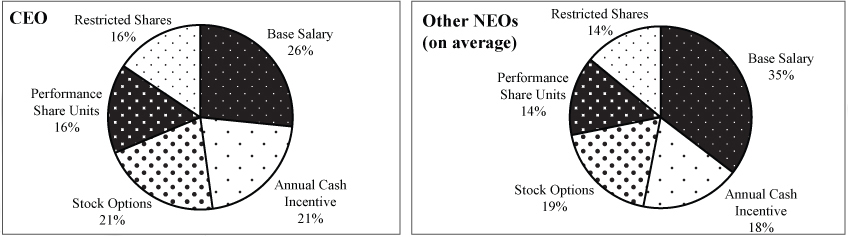

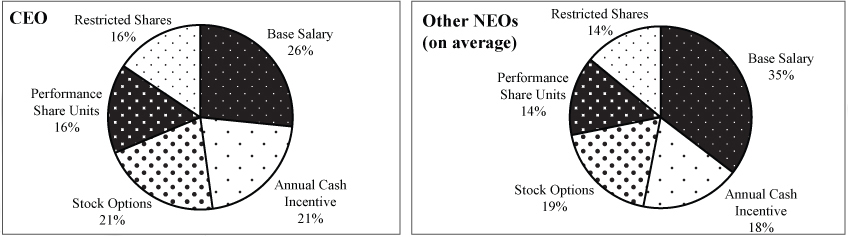

| • | | Pay-at-Risk. 58% of the Chief Executive Officer’s and 51% of the other named executive officers’ (on average, but excluding the Chief Financial Officer who was hired from outside of the Company in the second quarter of fiscal 2013) fiscal 2013 annual Target Total Direct Compensation (defined as base salaryplus Target Annual Incentive Compensationplus annual Target Long-Term Incentive Compensation (grant date value at target)) is at risk through the Company’s pay-for-performance cash incentive programs and long-term equity awards, consisting of performance share units and stock options, linked to the Company’s financial performance and increases in stockholder value. |

| • | | Pay-for-Performance. The Company’s 2013 annual incentive compensation program for its executive officers was linked entirely to the Company’s fiscal 2013 financial performance. |

| • | | Pay-for-Performance and Awards Tied to Increase in Stockholder Value. The Company’s long-term equity incentive program includes performance share units, options and restricted shares, thus linking long-term executive compensation with both the Company’s financial performance (performance share units) and stockholder value creation (performance share units, options and restricted shares). |

| • | | Special Equity Award Subject to Long-Term Cliff Vesting. During fiscal 2013, the named executive officers received a special equity award which supports the Company’s retention objectives and encourages additional executive stock ownership. This special equity award is subject to a three-year cliff vesting period and is subject to the Company’s Stock Ownership and Retention Guidelines. The Company did not make any similar equity award in connection with its annual fiscal 2014 compensation decisions. |

| • | | Benchmarking against the Company’s Peers. The Company periodically benchmarks its executive compensation levels and opportunities against the compensation of executive officers at companies included in a peer group that the Compensation Committee identified with assistance from the Committee’s independent compensation consultant. |

| • | | Stock Ownership Guidelines and Risk Mitigation. The Company’s Stock Ownership and Retention Guidelines require the Chief Executive Officer to own shares of Common Stock having a value of at least six times his annual base salary. The Chief Executive Officer satisfies this requirement. Two of the other named executive officers satisfy the ownership requirements of the Guidelines applicable to them and all of the named executive officers have complied with the retention requirements of the Guidelines applicable to them. The Company’s Compensation Recoupment Policy applies to incentive compensation as described more fully below. |

| • | | No Hedging or Pledging of Company Stock. The Company maintains anti-hedging and anti-pledging policies that apply to executive officers as well as the members of the Board. |

23

| • | | Double Trigger Change in Control Arrangement. The Company’s severance program includes a “double trigger” pursuant to which severance benefits are payable to the named executive officers and equity awards are accelerated following a change in control only upon involuntary terminations of employment or termination by the executive officer for “good reason.” |

| • | | Limited Perquisites. The Company maintains limited executive officer perquisites which are evaluated by the Compensation Committee periodically. During fiscal 2013, the Company eliminated the executive health insurance benefit program that reimbursed executives for deductibles and out-of-pocket medical expenses. |

| • | | No Excise Tax Gross-Up. The Company’s severance program does not provide tax gross-ups on severance compensation, including in the event of a change in control. |

Executive Compensation Philosophy and Objectives

The Compensation Committee believes that executive compensation arrangements should incorporate an appropriate balance of fixed versus variable compensation — as well as cash-based versus equity-based compensation — and reward performance that is measured against established goals that have been set after considering the Company’s short-term and long-term business plan and objectives and the competitive and economic environment in which the Company operates. The Compensation Committee has established a compensation philosophy and objectives that focus on:

| • | | Achieving strong, consistent business performance; |

| • | | Aligning executive officers’ interests with those of stockholders; |

| • | | Attracting and retaining valuable employees; and |

| • | | Fostering teamwork and cohesion. |

As the Company implements its compensation philosophy and pursues its objectives, the Compensation Committee considers various factors including (i) the Company’s past and projected performance, (ii) the impact of the Company’s compensation programs on its projected financial performance, (iii) executive officers’ performance, job responsibilities and duties, (iv) external data, including compensation data for a peer group of companies as described below, (v) input from the Chief Executive Officer (other than for himself) and (vi) other factors such as the ability to attract and retain executive officers in an intensely competitive environment for senior management talent.

Say-on-Pay Feedback from Stockholders

The Company has submitted its executive compensation program to an advisory vote of its stockholders at each annual meeting of stockholders in 2011 through 2013, and each time the Company received the support of more than 99% of the total votes cast on the proposal. The Compensation Committee reviews the result of each advisory vote and considers this feedback when it considered executive officers’ compensation for the current fiscal year. The Company expects the Compensation Committee to continue this practice when it considers fiscal 2014 compensation for executive officers.

24

Elements of the Company’s Executive Compensation Program

The following table summarizes the key elements of the Company’s executive compensation program:

Compensation Element

| | | | Objective

| | Form and Type of Compensation

|

|---|

| | | | To provide a minimum, fixed level of cash compensation for executive officers | | Annual cash compensation; not at risk |

| |

Annual Incentive Compensation | | | | To encourage and reward executive officers for achieving annual performance goals | | Annual performance compensation; entirely at risk |

| |

Long-Term Incentive Compensation | | | | To motivate and retain executive officers and align their interests with stockholders’ interests through: | | | | |

| |

| | | | •Performance-based stock unit awards based on long-term, cumulative financial goals, stock price performance and continued service | | Long-term performance compensation; entirely at risk |

| | | | | | | |

| | | | •Stock options based on continued service that deliver value only if stockholder value increases after the grant date | | Long-term stock appreciation-based compensation; time-based vesting, but value is at risk to extent stock price does not appreciate |

| |

| | | | •Restricted shares that deliver value only if the executive officer remains employed by the Company during the vesting period | | Long-term, time-based vesting which advances the Company’s goals of retaining talented executive officers and increasingly aligning their interests, through stock-based equity compensation, with those of stockholders |

Executive Compensation Process

Role of the Board and the Compensation Committee

For fiscal 2013, the Compensation Committee determined and recommended the named executive officers’ compensation to the Board and the Board approved the named executive officers’ compensation (excluding the Chief Executive Officer’s compensation, which was approved by the non-management members of the Board). Neither the Board nor the Compensation Committee delegated any authority with respect to the compensation of any executive officer for fiscal 2013 to any member of management or any third party.

The Compensation Committee determined each named executive officer’s compensation for fiscal 2013 taking into consideration the factors outlined above, including such executive officer’s performance and the financial impact of the Company’s compensation programs, as well as the objective data and compensation recommendations provided by Frederic W. Cook & Co., Inc., the Compensation Committee’s independent compensation consultant (FWC), input provided by the Chief Executive Officer, except with respect to his own compensation, and the historical information provided by management (see“Executive Compensation Philosophy and Objectives” above and“Role of Executive Officers in Compensation Decisions” below). Fiscal 2014 compensation for the named executive officers will be approved by the Compensation Committee and, in the case of the Chief Executive Officer’s compensation, the Compensation Committee will also recommend his compensation to the Board, excluding any member of management, for its consideration and ratification.

Role of Executive Officers in Compensation Decisions

The Compensation Committee utilized objective historical data regarding each named executive officer’s compensation compiled by management. The objective historical data regarding each named executive officer’s compensation compiled by management is provided to the Committee in the form of “tally sheets”

25

that set forth each element of compensation for the preceding three years, estimated payouts upon termination of employment, including in connection with a change in control, and information regarding equity ownership, including whether the executive officer satisfies the Company’s Stock Ownership and Retention Guidelines. The input provided by the Chief Executive Officer with respect to the other named executive officers includes his annual performance review of each other named executive officer.

Compensation Peer Group

Prior to fiscal 2012, FWC recommended, and the Compensation Committee approved, a peer group consisting of publicly-traded food and general specialty retail companies and restaurant companies. The Compensation Committee recognized at that time that there were few high-growth, publicly-traded specialty food retailers that were truly comparable to the Company. As a result, the Compensation Committee, with FWC’s assistance, considered factors in establishing the Company’s peer group such as whether the proposed peer group company is a high-growth retailer, has a food-based focus, is of a comparable size, is a multi-unit operator and has similar types of investors. The Company believes that its compensation peer group of 15 companies includes companies that are the types of companies that compete with it for talent, real estate locations and respective shares of consumers’ discretionary spending, investor interest and investment dollars. The Company’s revenues approximate the median of the peer companies and its market capitalization was between the median and 75th percentile of the peer companies when the Company’s executive officer compensation was last benchmarked against similarly situated executive officers at the peer companies listed below. The Compensation Committee made no changes in the compensation peer group companies for fiscal 2013 which consist of:

Company

|

|

| | High-Growth

Specialty

Retailer

| | Food

Retailers

| | Fast

Casual/Sit-

Down Casual

Restaurant

|

|---|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Harris Teeter Supermarkets, Inc. | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Red Robin Gourmet Burgers, Inc. | | | | | | | | |

| | | | | | | | |

Ulta Salon, Cosmetics & Fragrance, Inc. | | | | | | | | |

Village Super Market, Inc. | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

The Company expects that periodically the Compensation Committee will evaluate and, as appropriate, update the peer group as the Company continues to evolve, new companies enter the marketplace and existing peer group companies are acquired or otherwise change.

Executive Compensation Benchmarking

To achieve the objectives outlined above and as described more fully below, for fiscal 2013 the Compensation Committee has determined that annual Target Total Direct Compensation for the executive officers should be set at approximately the median range of similarly situated executive officers at the compensation peer group companies. Actual positioning of targeted compensation may be above or below the

26

median based on many factors, including the executive’s skill set, experience, responsibilities and tenure and may take some time to move to that positioning. In addition, executive officers who are hired from outside may receive compensation that is higher or lower than existing executive officers when comparing each executive officer’s compensation to the median range of similarly situated executive officers at the compensation peer group. The Compensation Committee periodically evaluates the manner, weighting and structure of the Company’s compensation programs as the Committee continues to aim for the executive officers’ annual Target Total Direct Compensation to be at the median range of similarly situated executive officers at the compensation peer group companies.

The Compensation Committee expects to achieve this Target Total Direct Compensation through a combination of (i) below median Target Total Annual Compensation (defined as base salaryplus Target Annual Incentive Compensation) and (ii) above median annual Target Long-Term Incentive Compensation. The Compensation Committee weighted Target Total Annual Compensation, which consists of short-term, cash-based elements, below the median and annual Target Long-Term Incentive Compensation, which consists of long-term, equity-based elements, above the median because heavier weighting of longer-term, equity-based compensation supports the Company’s retention and accountability objectives as the Company continues to build the equity-based compensation program that was established at the time of its initial public offering.

Setting Executive Compensation

Based on the compensation philosophy and objectives described above, the Compensation Committee has structured the Company’s executive compensation program primarily to motivate executive officers to achieve the business goals established by the Company and reward executive officers for meeting and exceeding these business goals. For fiscal 2013, the Company observed the following procedures and processes with respect to setting compensation for executive officers, which the Company defines for these purposes as Senior Vice Presidents, Executive Vice Presidents (includes the Chief Operating Officer and Chief Financial Officer) and President, who is also the Chief Executive Officer:

| • | | Following consideration of the increases in compensation for fiscal 2012, the Compensation Committee determined not to update the benchmarking conducted for fiscal 2012 compensation determinations as the Committee did not anticipate meaningful changes to the fiscal 2013 annual Target Total Direct Compensation payable to the executive officers. |

| • | | The Compensation Committee, with the assistance of FWC, established a framework for the fiscal 2013 compensation program for executive officers that was consistent with the fiscal 2012 compensation program. |

| • | | The Compensation Committee conducted the annual performance review for compensation purposes for each of the executive officers and considered, in the case of the executive officers other than the Chief Executive Officer, the annual performance review conducted by the Chief Executive Officer. |

| • | | The Compensation Committee considered the financial impact of the Company’s executive compensation program and proposed changes in the amount or nature of compensation on the Company’s future financial performance, including the fiscal year within which the compensation decisions were made. |

| • | | The Compensation Committee considered the results of the 2012 annual say-on-pay advisory vote, the performance reviews described above, historical compensation information set forth in the tally sheets described above, management’s fiscal 2013 annual plan and three-year plan, external estimates of the Company’s future financial performance, and the 2% Company-wide target for increases in base salaries. The Compensation Committee, after considering the matters described above: |

| o | | established the financial performance goals for the annual incentive compensation program and the long-term incentive compensation program, as well as the minimum, target and maximum levels of performance for each financial performance goal in these programs; |

27

| o | | established, for each executive officer: |

| — | | a 2% increase in base salary in order to align the executive officers’ increases for fiscal 2013 with the Company-wide target for increases for other salaried employees, which fosters company cohesion; |

| — | | the percentage of base salary to be used for the annual incentive compensation target, which did not change from those set for fiscal 2012; |

| — | | an annual long-term incentive compensation grant date value (at target), the amount of which did not change from that set for fiscal 2012; and |

| — | | a special long-term incentive compensation grant date value to be awarded in the form of restricted shares subject to three-year cliff vesting to encourage retention and further align each executive officer’s long-term interests with those of stockholders (see “Special Award of Three-Year Cliff Vest Restricted Shares”); |

| o | | recommended the foregoing to the Board, the majority of which were also independent directors; and |

| • | | After fiscal 2013, the Compensation Committee considered the Company’s financial performance to determine the payouts under the annual incentive compensation program. After Ernst & Young issued its audit report, the annual incentive compensation was paid to the executive officers. |

Fiscal 2013 Compensation

The Company’s fiscal 2013 compensation was comprised of base salary, annual incentive compensation and long-term equity incentive compensation, consisting of stock options, performance share unit awards and restricted stock awards. As described below, restricted shares were added to the annual long-term equity incentive compensation to support the retention objective of the Company’s compensation philosophy. Fifty-eight percent of the Chief Executive Officer’s and 51% of the other named executive officers’ (on average, but excluding the Chief Financial Officer who was hired from outside of the Company in the second quarter of fiscal 2013) annual Target Total Direct Compensation is at risk through pay-for-performance cash incentive programs and long-term equity awards, consisting of options and performance share units, linked to the Company’s financial performance and increases in stockholder value. The following charts summarize the proportion of each of the direct annual compensation elements (base salary, annual incentive compensation, stock options, performance share unit awards and annual restricted stock awards) provided to the Chief Executive Officer and the other named executive officers (on average, but excluding the Chief Financial Officer who was hired from outside of the Company in the second quarter of fiscal 2013) for fiscal 2013.