Exhibit 99.1

August 2016 Update

Summary www.blackridgeoil.com 2 Closed debt restructuring agreement on June 21, 2016 Company focused on asset management business and partnering with investment sponsors to acquire oil and gas assets, energy loans and provide capital for oil and gas drilling / completion projects

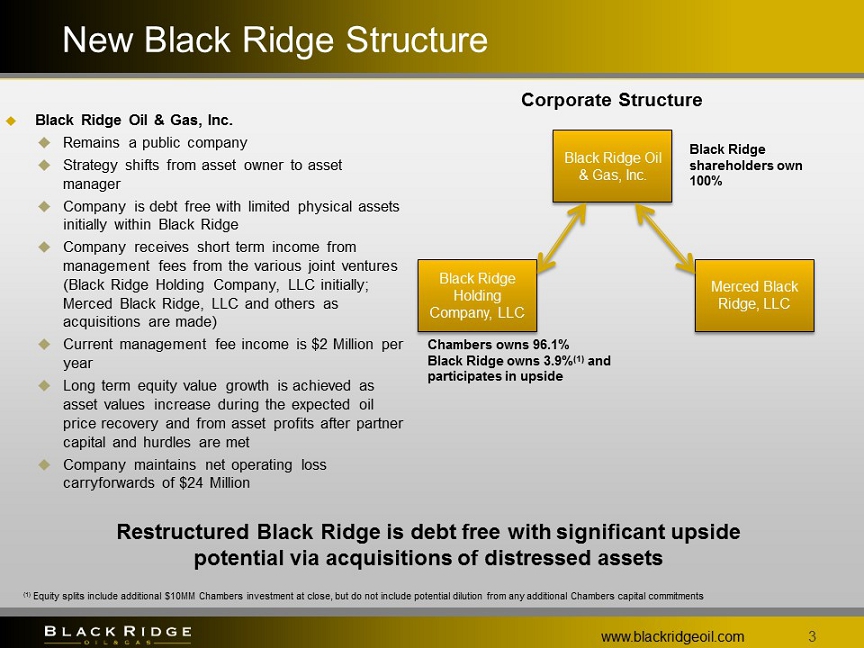

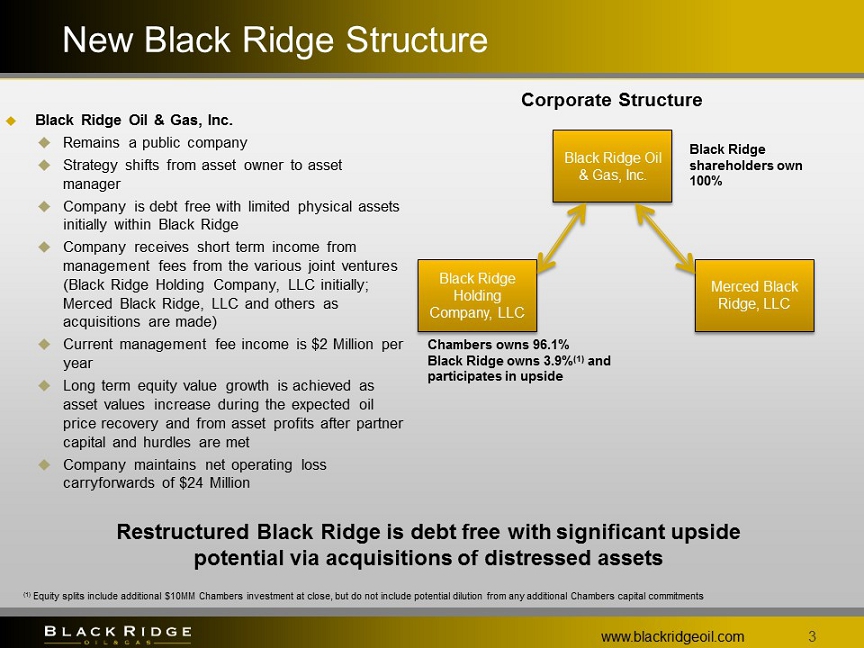

New Black Ridge Structure www.blackridgeoil.com 3 Corporate Structure Black Ridge Oil & Gas, Inc. Merced Black Ridge, LLC Black Ridge Holding Company, LLC Black Ridge Oil & Gas, Inc. Remains a public company Strategy shifts from asset owner to asset manager Company is debt free with limited physical assets initially within Black Ridge Company receives short term income from management fees from the various joint ventures (Black Ridge Holding Company, LLC initially; Merced Black Ridge, LLC and others as acquisitions are made) Current management fee income is $2 Million per year Long term equity value growth is achieved as asset values increase during the expected oil price recovery and from asset profits after partner capital and hurdles are met Company maintains net operating loss carryforwards of $24 Million Restructured Black Ridge is debt free with significant upside potential via acquisitions of distressed assets Black Ridge shareholders own 100% Chambers owns 96.1% Black Ridge owns 3.9% (1) and participates in upside (1) Equity splits include additional $10MM Chambers investment at close, but do not include potential dilution from any additional Chambers capital commitments

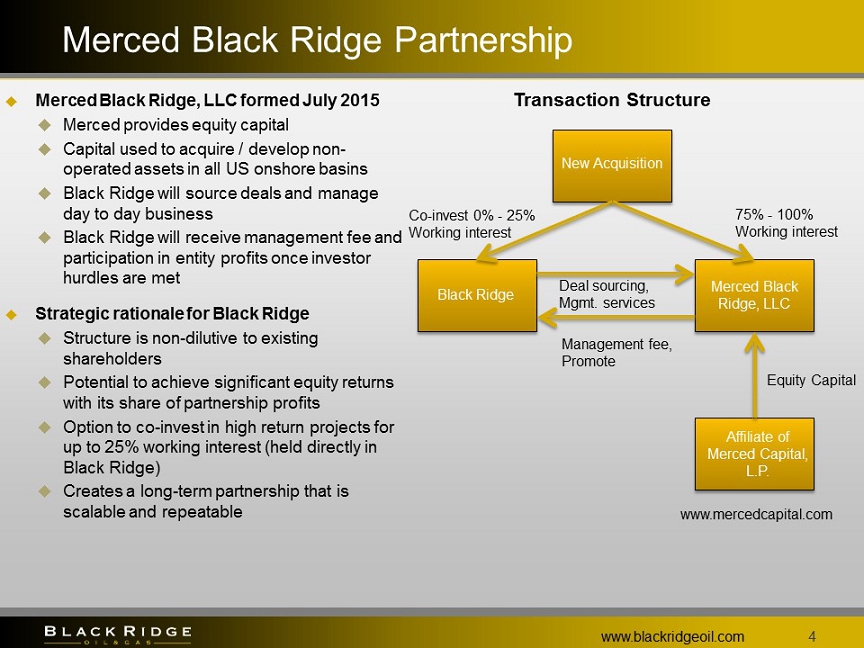

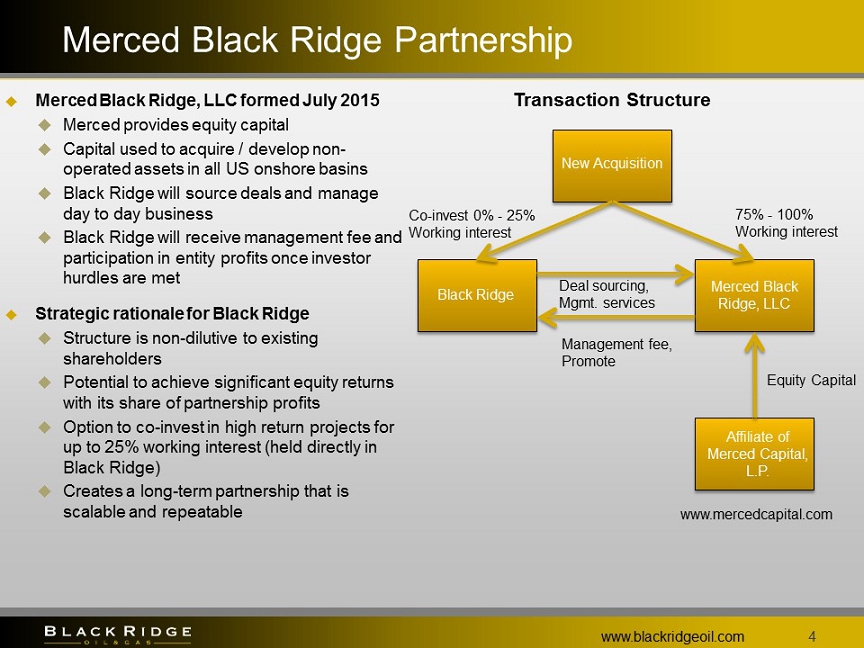

Merced Black Ridge Partnership www.blackridgeoil.com 4 Transaction Structure New Acquisition Merced Black Ridge, LLC Black Ridge Affiliate of Merced Capital, L.P. Equity Capital Deal sourcing, Mgmt. services Management fee, Promote Co - invest 0% - 25% Working interest 75% - 100% Working interest Merced Black Ridge, LLC formed July 2015 Merced provides equity capital Capital used to acquire / develop non - operated assets in all US onshore basins Black Ridge will source deals and manage day to day business Black Ridge will receive management fee and participation in entity profits once investor hurdles are met Strategic rationale for Black Ridge Structure is non - dilutive to existing shareholders Potential to achieve significant equity returns with its share of partnership profits Option to co - invest in high return projects for up to 25% working interest (held directly in Black Ridge) Creates a long - term partnership that is scalable and repeatable www.mercedcapital.com