CRAIG-HALLUM ALPHA SELECT CONFERENCE SEPTEMBER 18, 2014

DISCLAIMER This presentation may contain forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical fact, such as statements regarding our growth opportunities, our potential acquisitions, our future operations, financial position and revenues, other financial guidance, and our other prospects, plans and management objectives, are forward-looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. There are a number of important factors that could cause our actual results to differ materially from those indicated by these forward-looking statements. We disclose many of these risk factors in our annual report on Form 10-K for our fiscal year ended December 31, 2013 and our most recent quarterly report on Form 10-Q and our the registration statement we filed with the Securities and Exchange Commission. All of the information provided in this presentation is as of today’s date and we undertake no duty to update this information.

• Over 29 years of experience in the aerospace industry • Leadership roles at major aerospace companies including Bombardier Aerospace, Delta Air Lines, Bell Helicopter, Textron, and American Airlines Udo Rieder CEO, President and Director TODAY’S PRESENTER 2

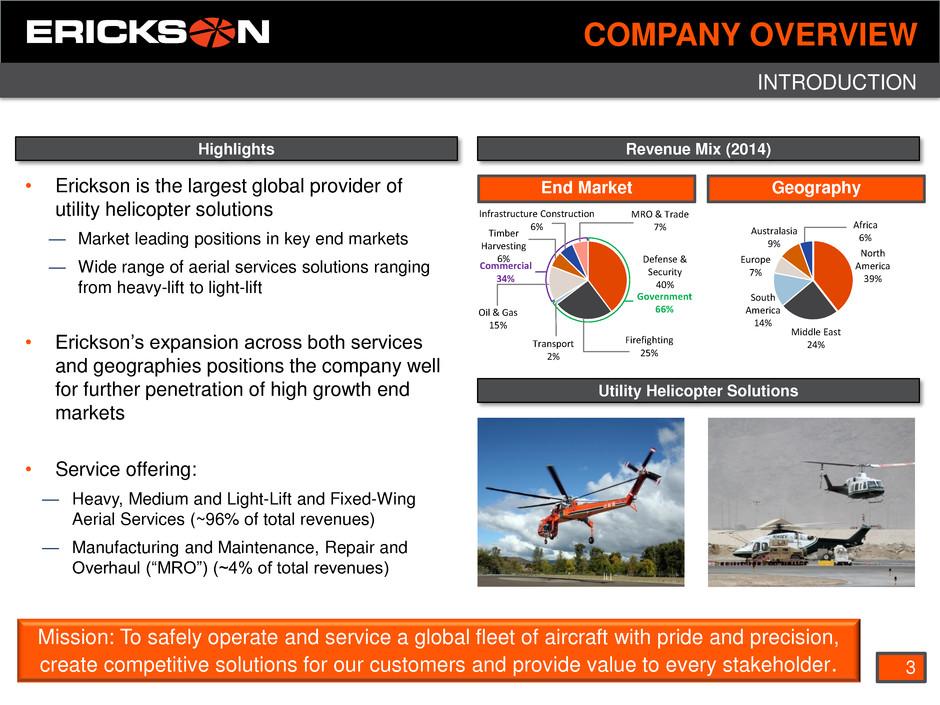

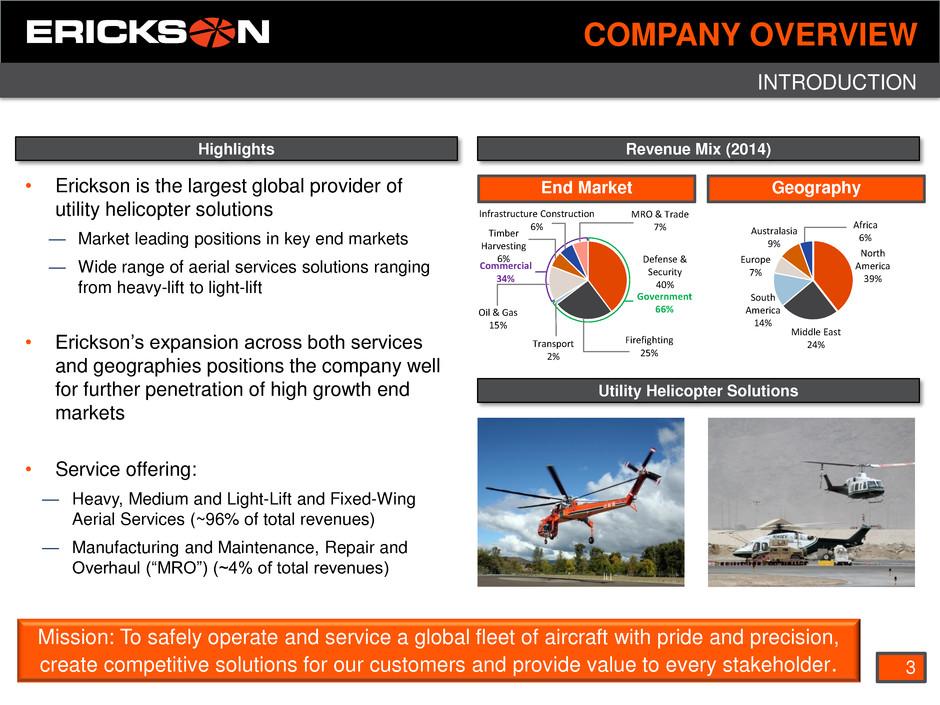

3 COMPANY OVERVIEW • Erickson is the largest global provider of utility helicopter solutions — Market leading positions in key end markets — Wide range of aerial services solutions ranging from heavy-lift to light-lift • Erickson’s expansion across both services and geographies positions the company well for further penetration of high growth end markets • Service offering: — Heavy, Medium and Light-Lift and Fixed-Wing Aerial Services (~96% of total revenues) — Manufacturing and Maintenance, Repair and Overhaul (“MRO”) (~4% of total revenues) Utility Helicopter Solutions Mission: To safely operate and service a global fleet of aircraft with pride and precision, create competitive solutions for our customers and provide value to every stakeholder. End Market Geography Revenue Mix (2014) Defense & Security 40% Firefighting 25% Transport 2% Oil & Gas 15% Timber Harvesting 6% Infrastructure Construction 6% MRO & Trade 7% Commercial 34% Government 66% North America 39% Middle East 24% South America 14% Europe 7% Australasia 9% Africa 6%Highlights INTRODUCTION

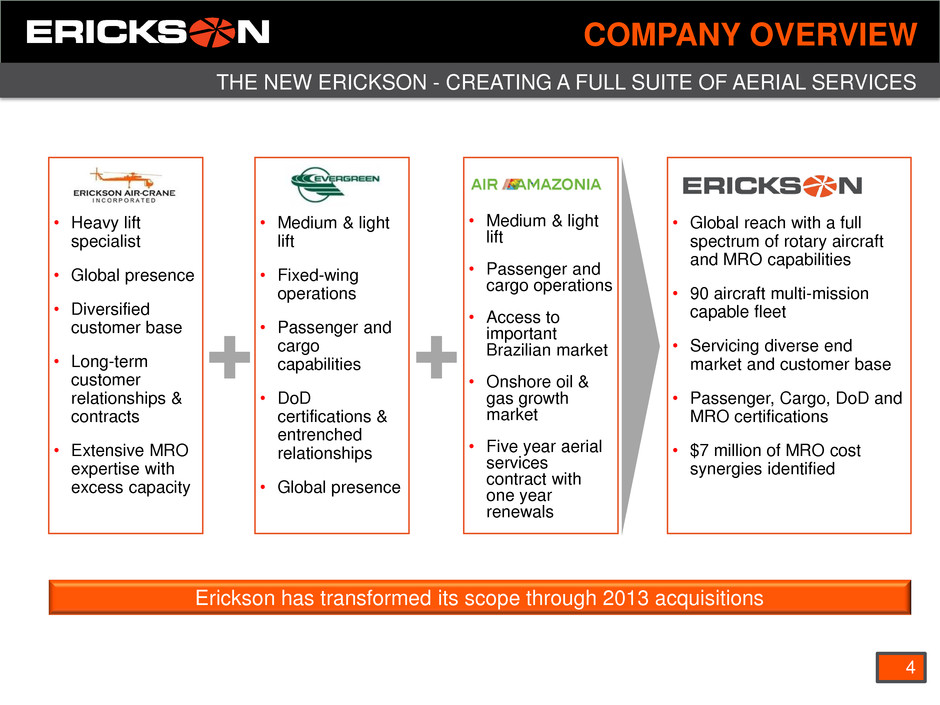

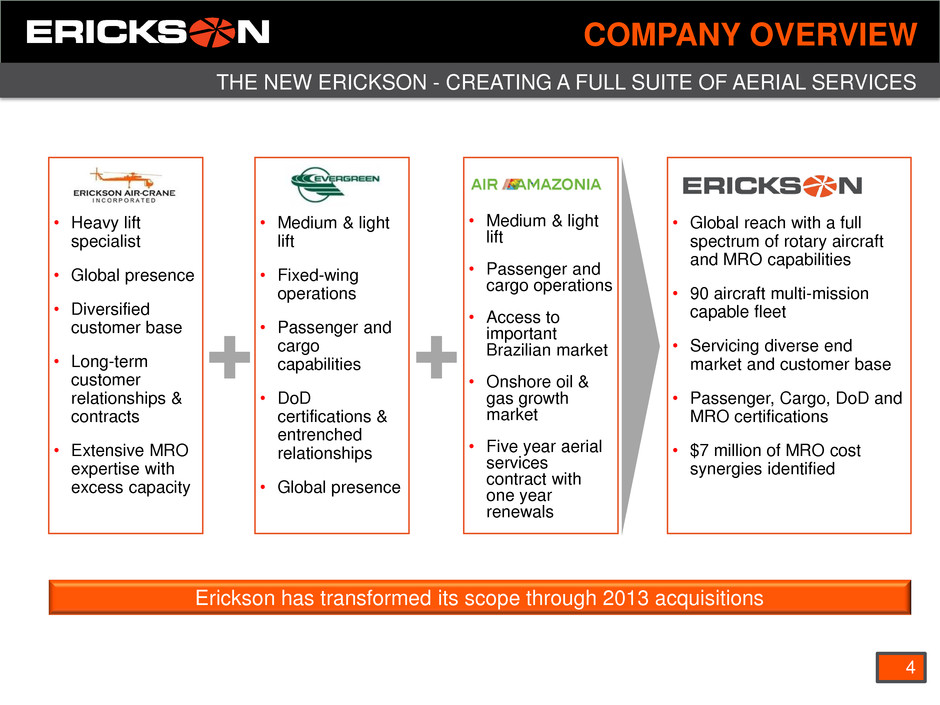

THE NEW ERICKSON - CREATING A FULL SUITE OF AERIAL SERVICES COMPANY OVERVIEW 4 • Heavy lift specialist • Global presence • Diversified customer base • Long-term customer relationships & contracts • Extensive MRO expertise with excess capacity • Medium & light lift • Fixed-wing operations • Passenger and cargo capabilities • DoD certifications & entrenched relationships • Global presence • Medium & light lift • Passenger and cargo operations • Access to important Brazilian market • Onshore oil & gas growth market • Five year aerial services contract with one year renewals • Global reach with a full spectrum of rotary aircraft and MRO capabilities • 90 aircraft multi-mission capable fleet • Servicing diverse end market and customer base • Passenger, Cargo, DoD and MRO certifications • $7 million of MRO cost synergies identified Erickson has transformed its scope through 2013 acquisitions

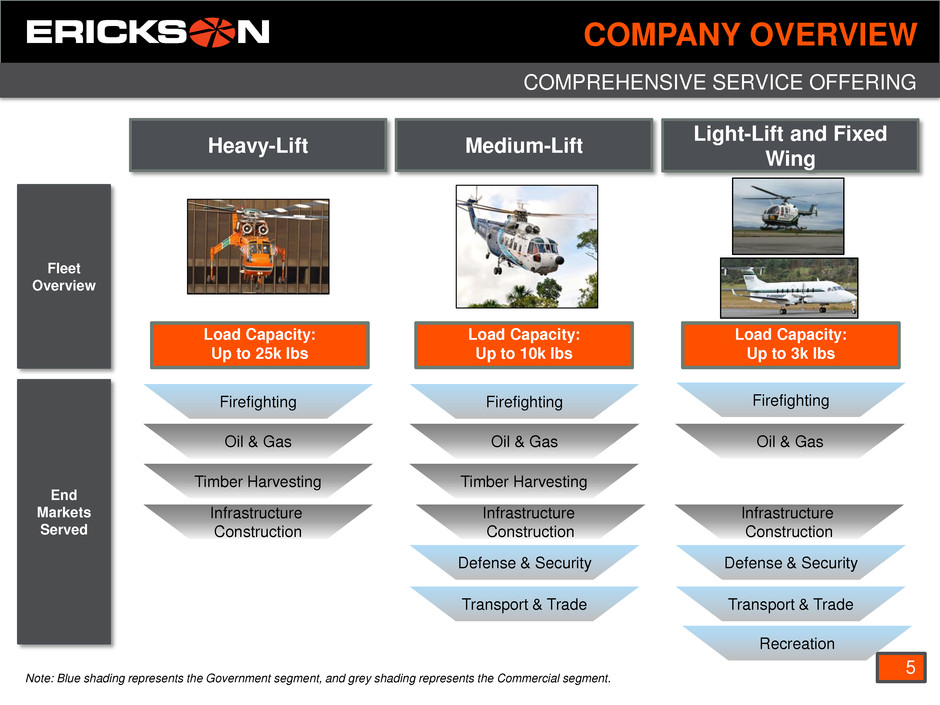

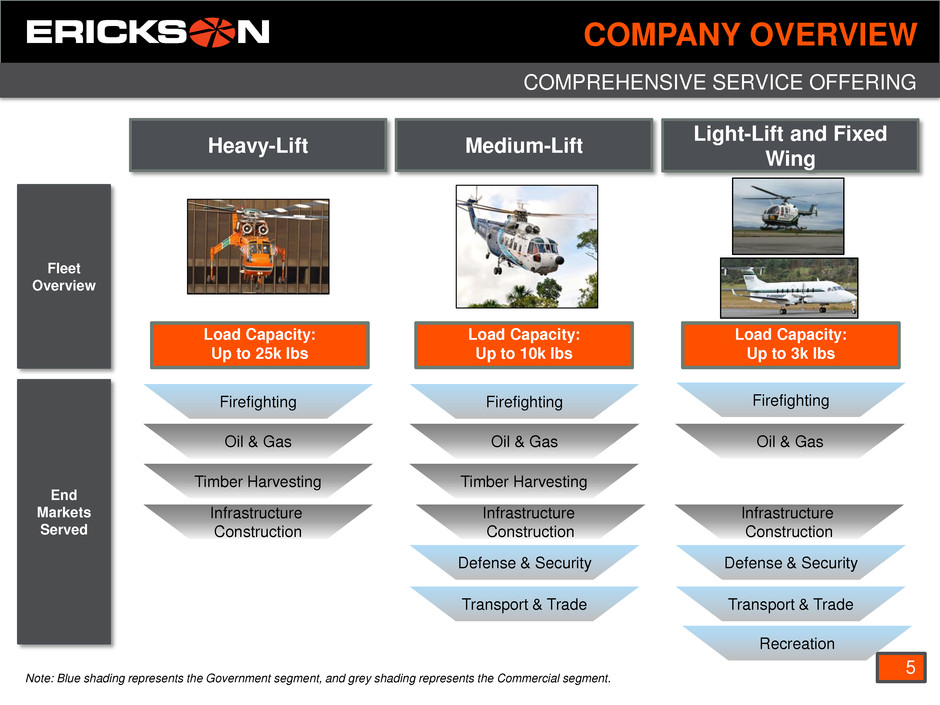

COMPREHENSIVE SERVICE OFFERING COMPANY OVERVIEW 5 Note: Blue shading represents the Government segment, and grey shading represents the Commercial segment. Heavy-Lift Medium-Lift Fleet Overview End Markets Served Firefighting Defense & Security Transport & Trade Timber Harvesting Infrastructure Construction Oil & Gas Oil & Gas Firefighting Transport & Trade Oil & Gas Load Capacity: Up to 25k lbs Load Capacity: Up to 10k lbs Load Capacity: Up to 3k lbs Light-Lift and Fixed Wing Recreation Defense & Security Timber Harvesting Infrastructure Construction Firefighting Infrastructure Construction

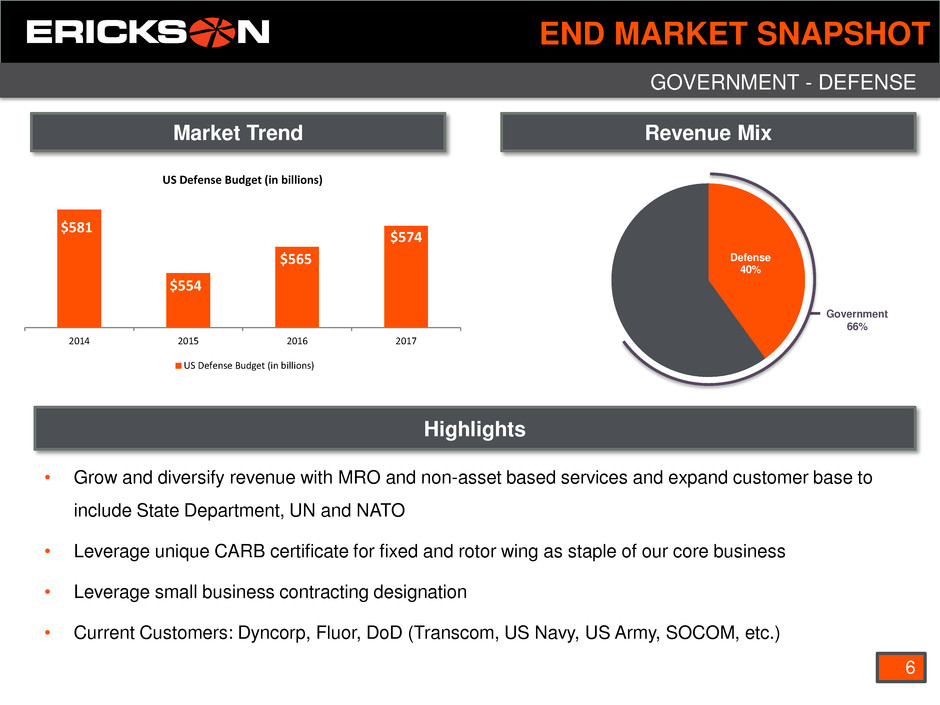

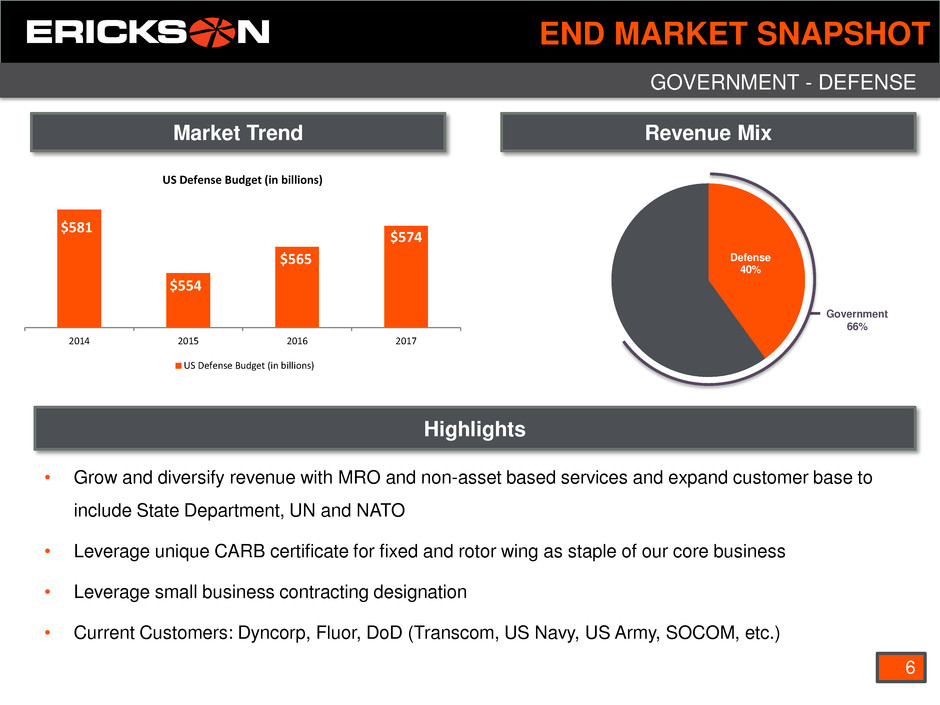

Market Trend Highlights GOVERNMENT - DEFENSE Revenue Mix 6 END MARKET SNAPSHOT • Grow and diversify revenue with MRO and non-asset based services and expand customer base to include State Department, UN and NATO • Leverage unique CARB certificate for fixed and rotor wing as staple of our core business • Leverage small business contracting designation • Current Customers: Dyncorp, Fluor, DoD (Transcom, US Navy, US Army, SOCOM, etc.) Defense 40% $581 $554 $565 $574 2014 2015 2016 2017 US Defense Budget (in billions) US Defense Budget (in billions) Government 66%

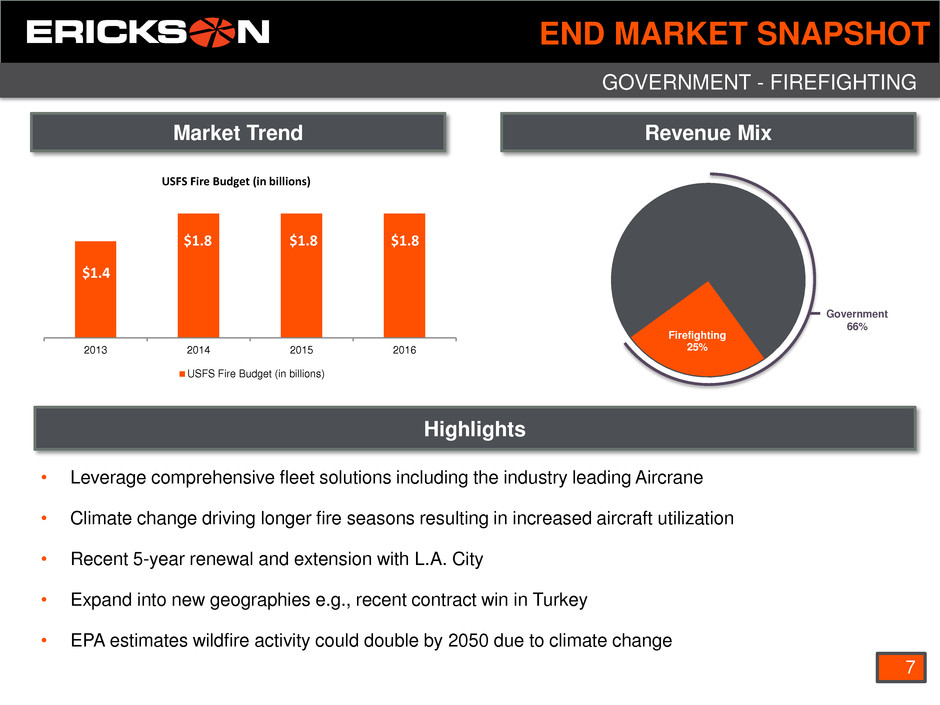

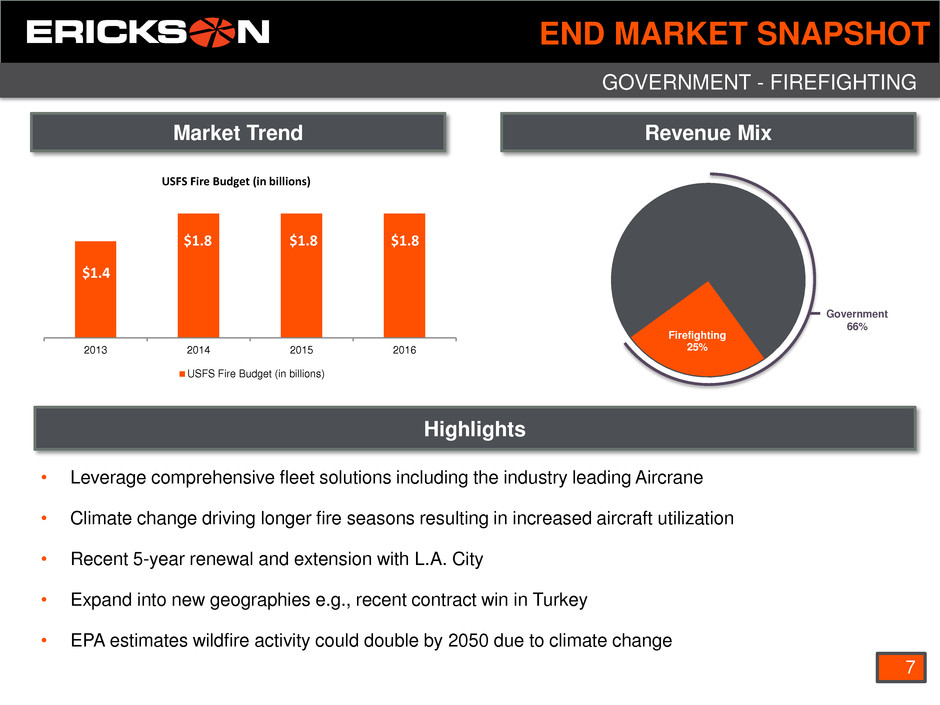

Firefighting 25% Market Trend Highlights GOVERNMENT - FIREFIGHTING Revenue Mix 7 END MARKET SNAPSHOT Government 66% • Leverage comprehensive fleet solutions including the industry leading Aircrane • Climate change driving longer fire seasons resulting in increased aircraft utilization • Recent 5-year renewal and extension with L.A. City • Expand into new geographies e.g., recent contract win in Turkey • EPA estimates wildfire activity could double by 2050 due to climate change $1.4 $1.8 $1.8 $1.8 2013 2014 2015 2016 USFS Fire Budget (in billions) USFS Fire Budget (in billions)

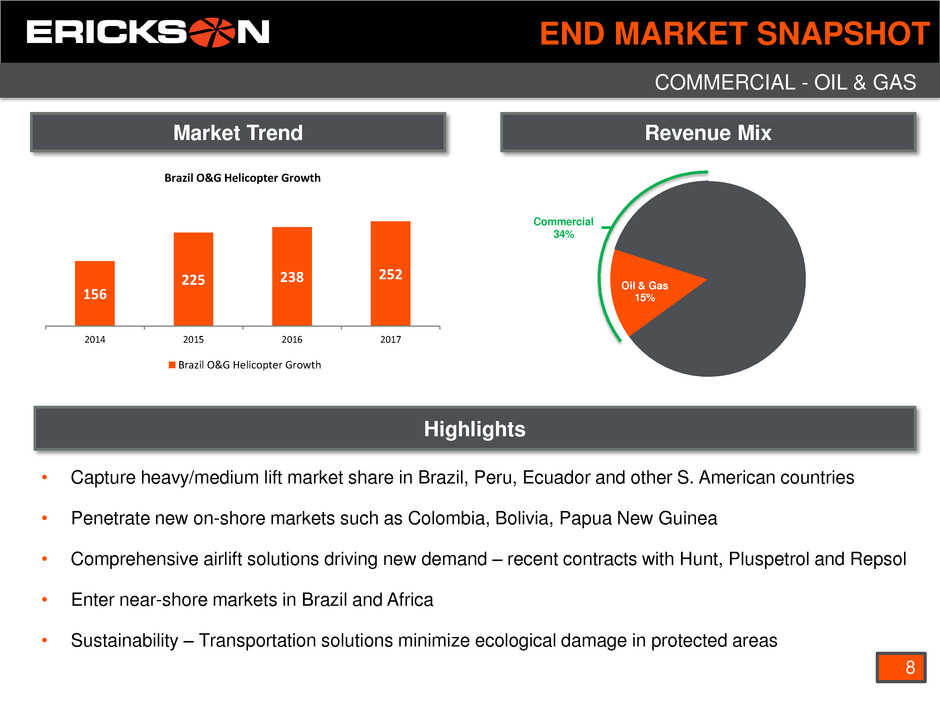

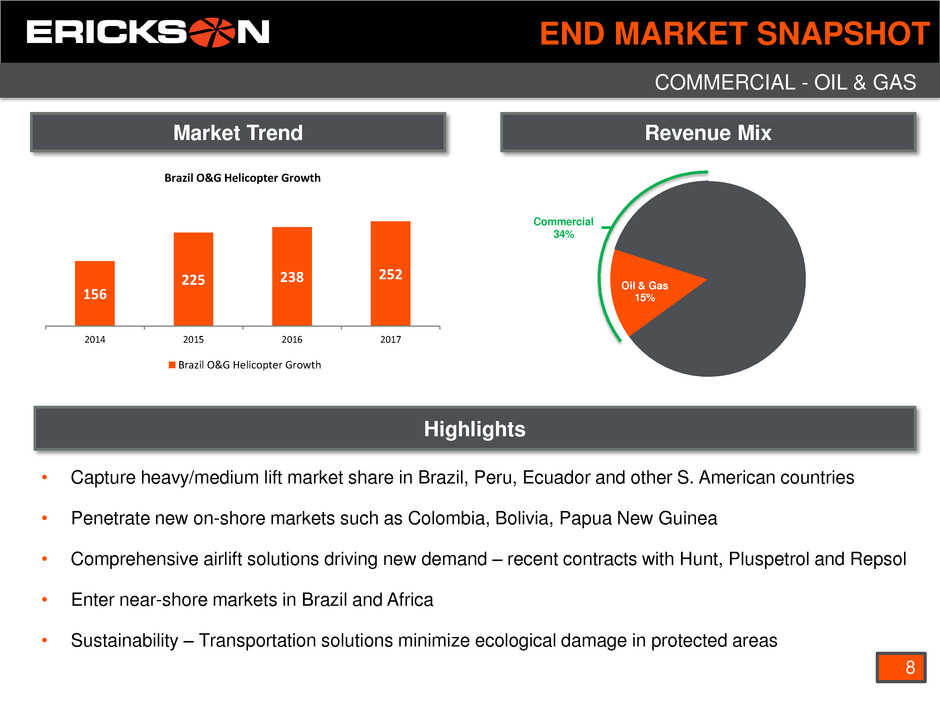

Oil & Gas 15% Market Trend Highlights COMMERCIAL - OIL & GAS Revenue Mix 8 END MARKET SNAPSHOT 156 225 238 252 2014 2015 2016 2017 Brazil O&G Helicopter Growth Brazil O&G Helicopter Growth Commercial 34% • Capture heavy/medium lift market share in Brazil, Peru, Ecuador and other S. American countries • Penetrate new on-shore markets such as Colombia, Bolivia, Papua New Guinea • Comprehensive airlift solutions driving new demand – recent contracts with Hunt, Pluspetrol and Repsol • Enter near-shore markets in Brazil and Africa • Sustainability – Transportation solutions minimize ecological damage in protected areas

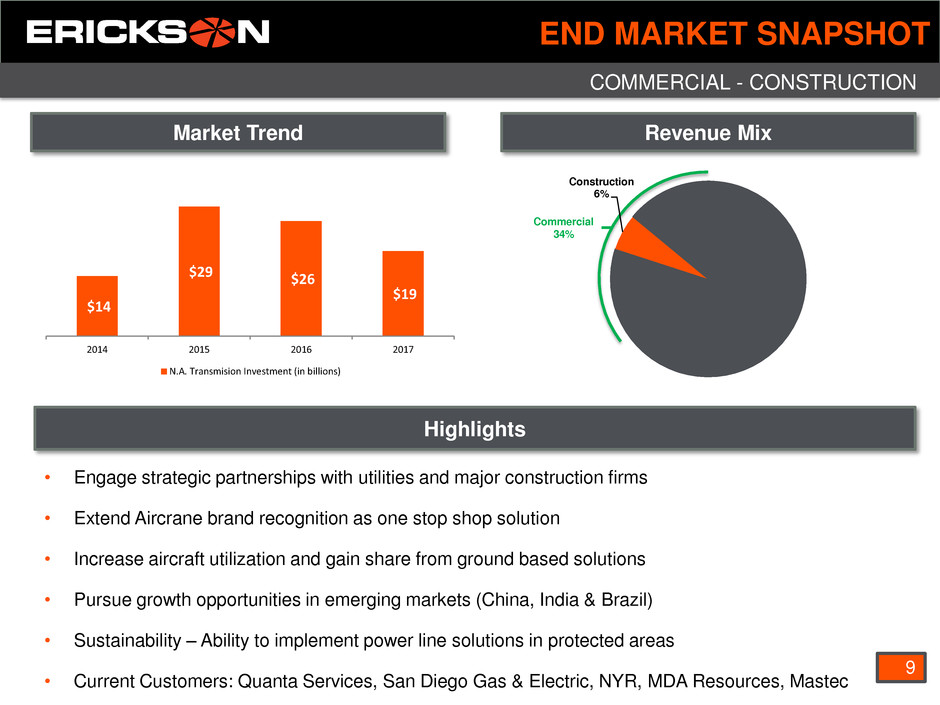

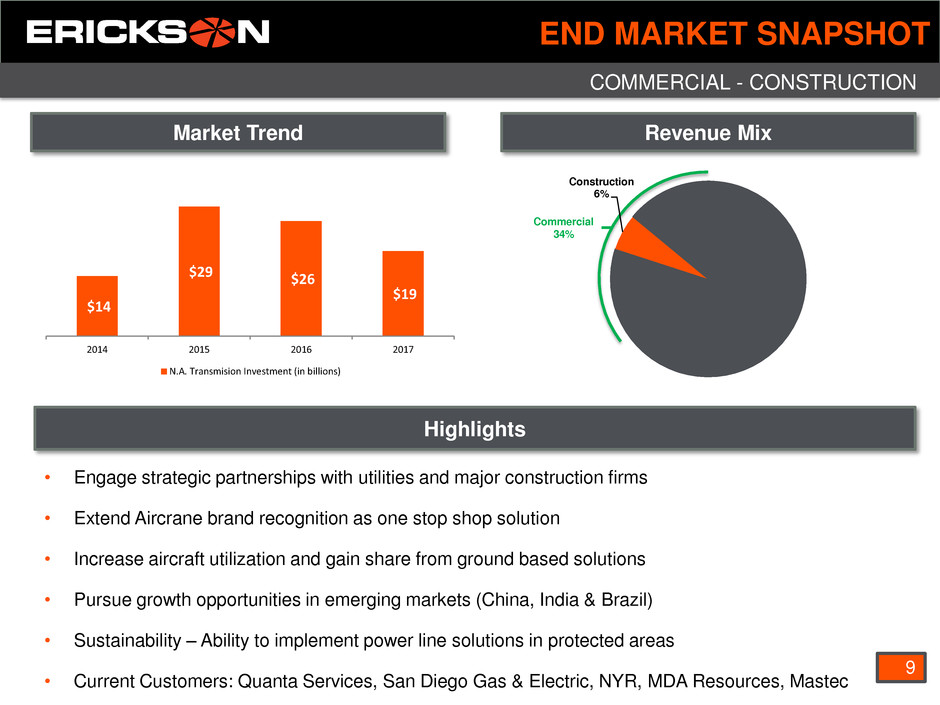

Construction 6% Market Trend Highlights COMMERCIAL - CONSTRUCTION Revenue Mix 9 END MARKET SNAPSHOT $14 $29 $26 $19 2014 2015 2016 2017 N.A. Transmision Investment (in billions) Commercial 34% • Engage strategic partnerships with utilities and major construction firms • Extend Aircrane brand recognition as one stop shop solution • Increase aircraft utilization and gain share from ground based solutions • Pursue growth opportunities in emerging markets (China, India & Brazil) • Sustainability – Ability to implement power line solutions in protected areas • Current Customers: Quanta Services, San Diego Gas & Electric, NYR, MDA Resources, Mastec

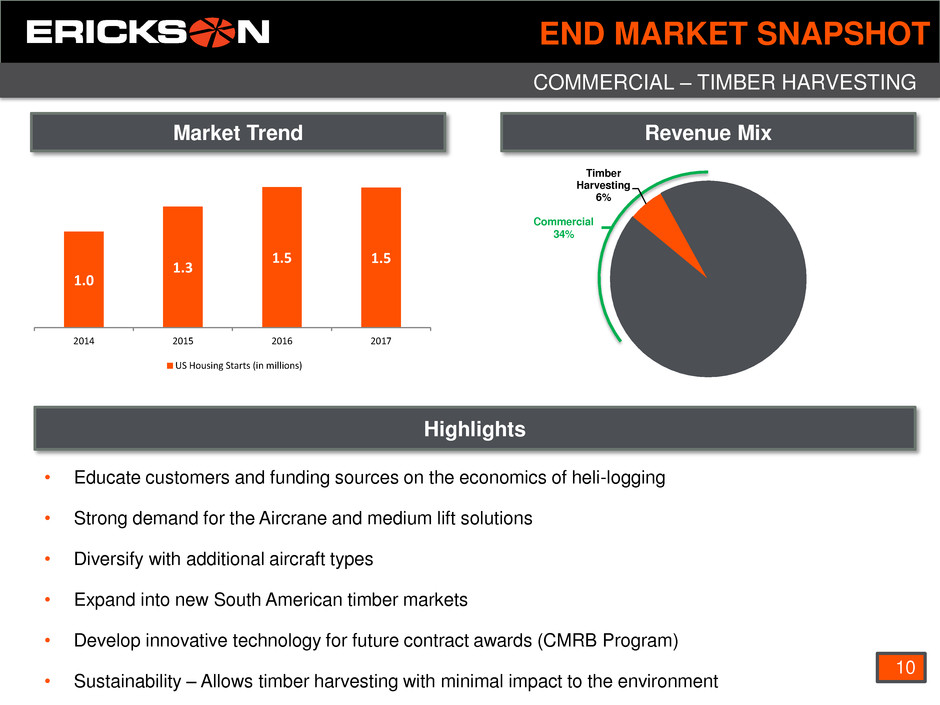

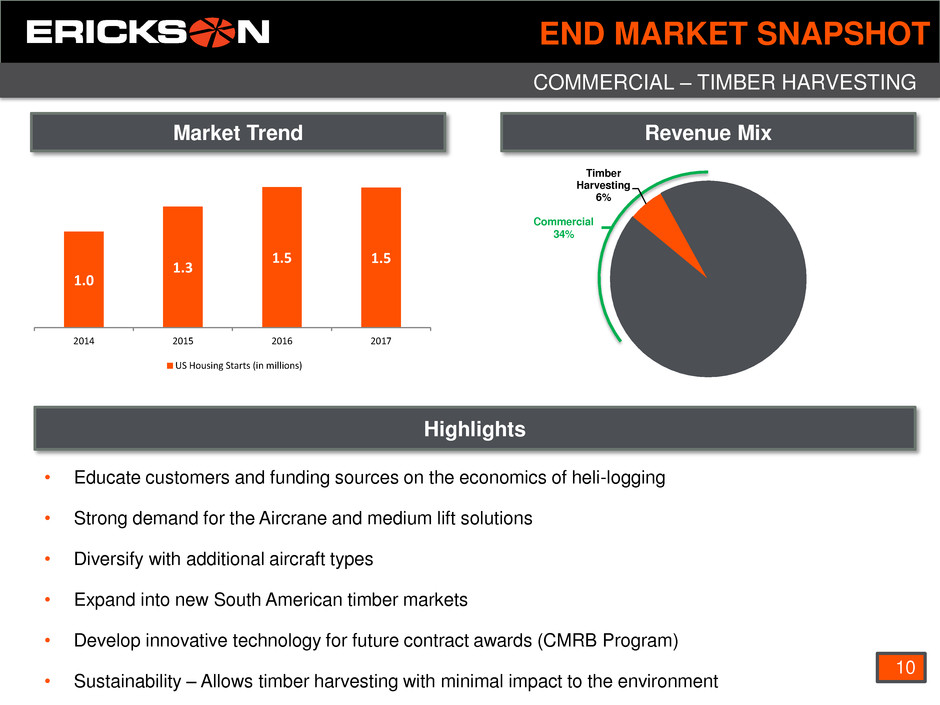

Market Trend Highlights COMMERCIAL – TIMBER HARVESTING Revenue Mix 10 END MARKET SNAPSHOT • Educate customers and funding sources on the economics of heli-logging • Strong demand for the Aircrane and medium lift solutions • Diversify with additional aircraft types • Expand into new South American timber markets • Develop innovative technology for future contract awards (CMRB Program) • Sustainability – Allows timber harvesting with minimal impact to the environment 1.0 1.3 1.5 1.5 2014 2015 2016 2017 US Housing Starts (in millions) Timber Harvesting 6% Commercial 34%

Market Trend Highlights CHINA Heavy Lift Demand 11 EMERGING MARKET GROWTH $130 $149 $171 $197 2014 2015 2016 2017 China Heavy Lift Market (in millions) China Heavy Lift Market (in millions) • Contract with government affiliated Aviation Industry Corporation of China (AVIC) to represent Erickson in China • In the final stages of certification of the Aircrane in China • Market our strong reputation in the precision heavy lift market • Airspace is opening for general aviation • Near term demand in transmission line construction and firefighting • Power Pylon Construction • Power Pylon Construction • Power Pylon Construction • Forest Firefighting • Forest Firefighting • Forest Firefighting

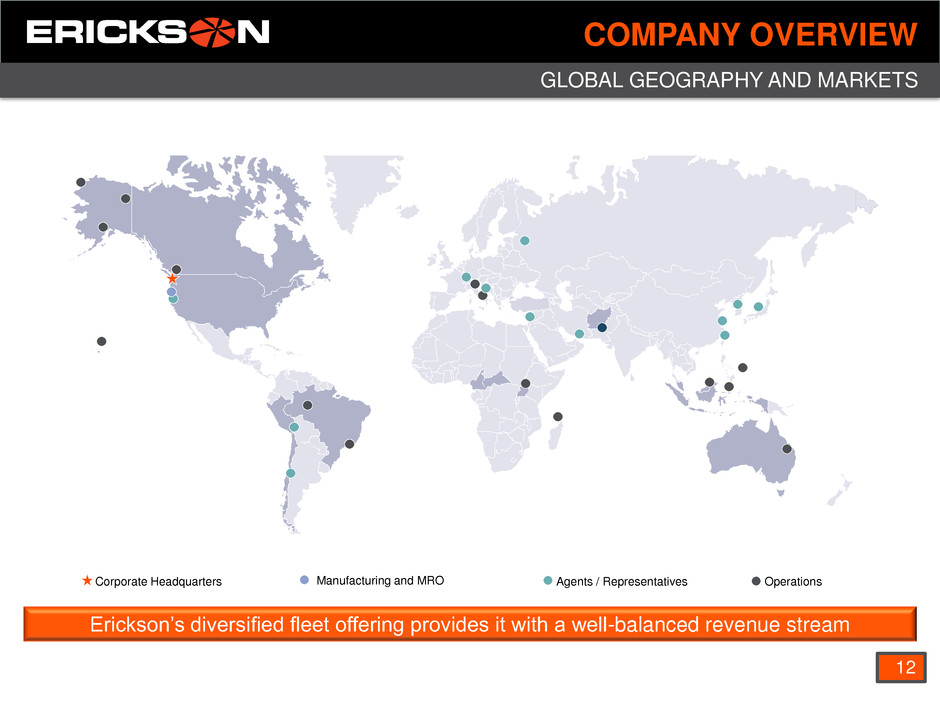

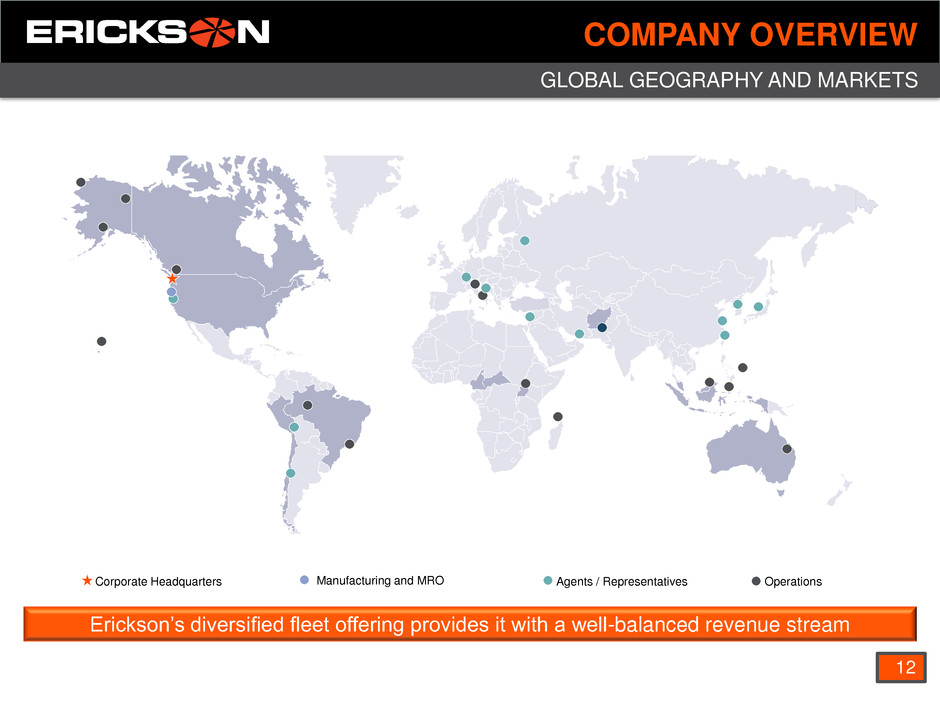

12 COMPANY OVERVIEW Erickson’s diversified fleet offering provides it with a well-balanced revenue stream GLOBAL GEOGRAPHY AND MARKETS Agents / Representatives Operations Manufacturing and MRO Corporate Headquarters

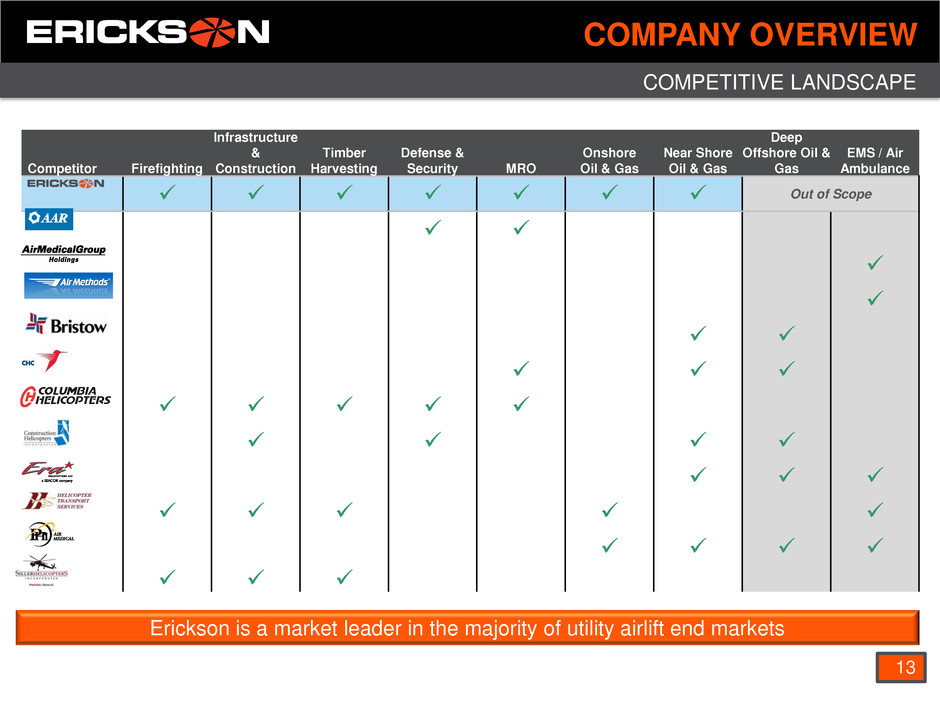

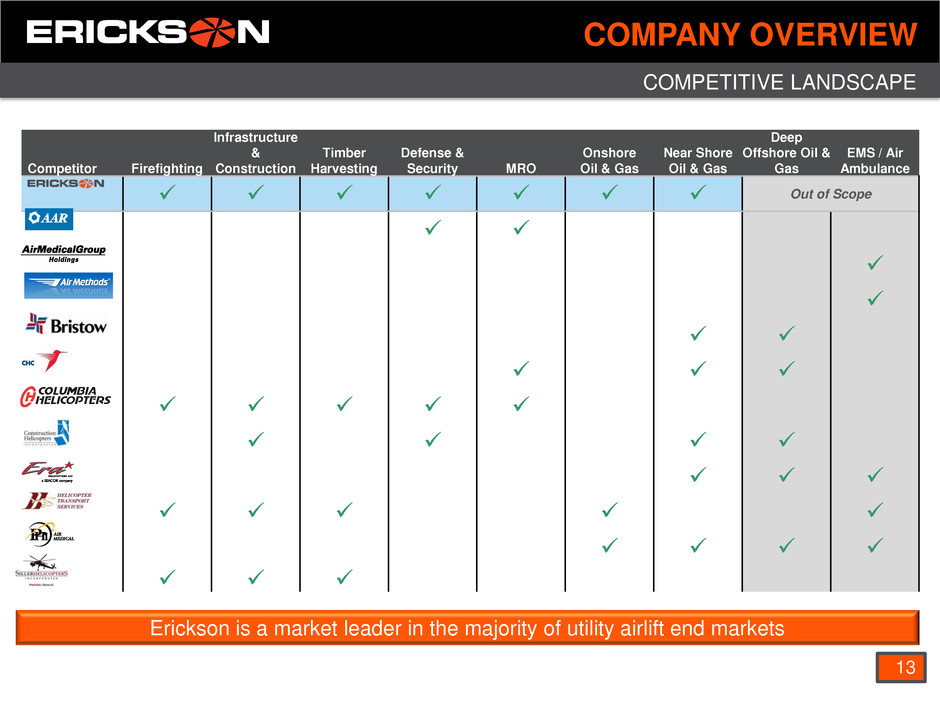

COMPETITIVE LANDSCAPE COMPANY OVERVIEW 13 Competitor Firefighting Infrastructure & Construction Timber Harvesting Defense & Security MRO Onshore Oil & Gas Near Shore Oil & Gas Deep Offshore Oil & Gas EMS / Air Ambulance Out of Scope Erickson is a market leader in the majority of utility airlift end markets

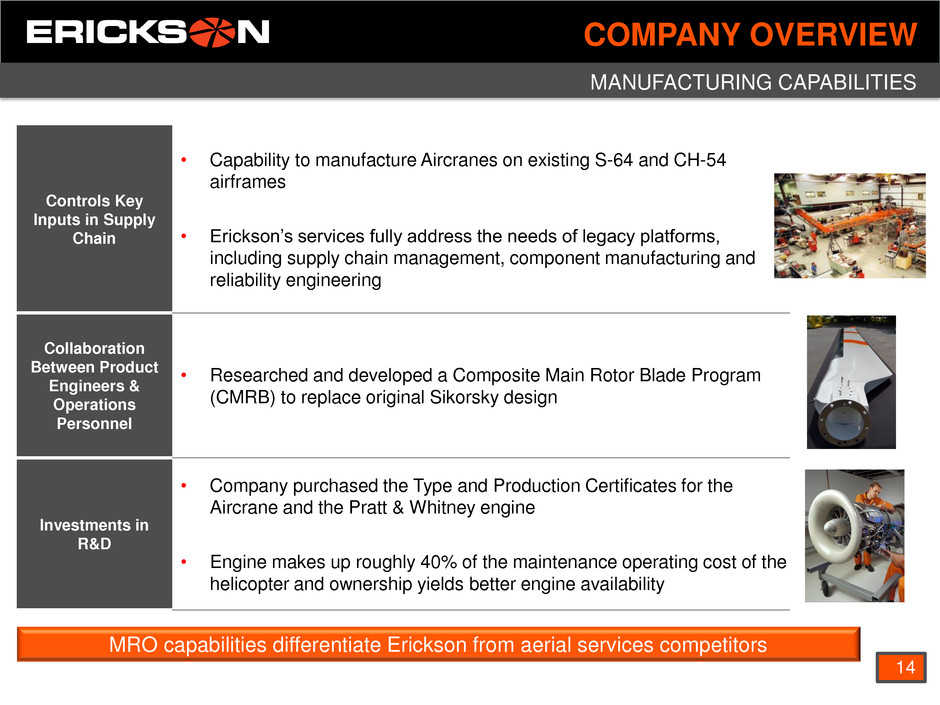

Controls Key Inputs in Supply Chain • Capability to manufacture Aircranes on existing S-64 and CH-54 airframes • Erickson’s services fully address the needs of legacy platforms, including supply chain management, component manufacturing and reliability engineering Collaboration Between Product Engineers & Operations Personnel • Researched and developed a Composite Main Rotor Blade Program (CMRB) to replace original Sikorsky design Investments in R&D • Company purchased the Type and Production Certificates for the Aircrane and the Pratt & Whitney engine • Engine makes up roughly 40% of the maintenance operating cost of the helicopter and ownership yields better engine availability MRO capabilities differentiate Erickson from aerial services competitors MANUFACTURING CAPABILITIES COMPANY OVERVIEW 14

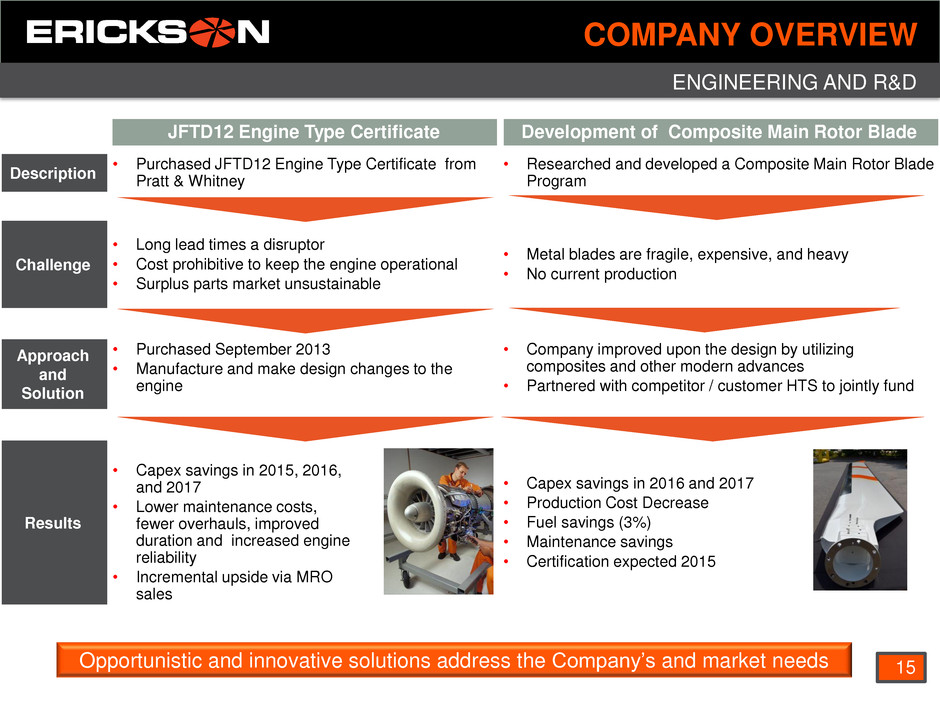

15 COMPANY OVERVIEW ENGINEERING AND R&D JFTD12 Engine Type Certificate Development of Composite Main Rotor Blade Description • Purchased JFTD12 Engine Type Certificate from Pratt & Whitney • Researched and developed a Composite Main Rotor Blade Program Challenge • Long lead times a disruptor • Cost prohibitive to keep the engine operational • Surplus parts market unsustainable • Metal blades are fragile, expensive, and heavy • No current production Approach and Solution • Purchased September 2013 • Manufacture and make design changes to the engine • Company improved upon the design by utilizing composites and other modern advances • Partnered with competitor / customer HTS to jointly fund Results • Capex savings in 2015, 2016, and 2017 • Lower maintenance costs, fewer overhauls, improved duration and increased engine reliability • Incremental upside via MRO sales • Capex savings in 2016 and 2017 • Production Cost Decrease • Fuel savings (3%) • Maintenance savings • Certification expected 2015 Opportunistic and innovative solutions address the Company’s and market needs

Deep aviation experience across the management team EXPERIENCED MANAGEMENT TEAM COMPANY OVERVIEW 16 Years of Experience Name / Position Selected Background Background 29 Udo Rieder CEO, President and Director • CEO / President since March 2008 • BS Mechanical Engineering Texas A&M University 20 Eric Struik CFO • CFO since September 2013 • BA in Economics University of Michigan; MBA Indiana University 20 Santiago Crespo VP of Global Sales & Marketing • VP of Global Sales since July 2013 • Undergraduate degree in Finance, Catholic University of Ecuador; MBA University of Portland 38 Brian Clegg VP of Global Aerial Operations • VP and Head of Aerial Operations since February 2014 • Spent 29 years with CHC 16 Ed Rizzuti VP, General Counsel and Corporate Secretary • VP, General Counsel and Corporate Secretary since 2011 • JD from NYU School of Law; BS in Civil Engineering from Rutgers 25 Glenn Splieth VP of Global Human Resources • Former Vice President of Human Resources for RadiSys Corporation • Focus in the areas of change management and organizational development 20 Kerry Jarandson VP, Manufacturing and MRO • General Manager of the Central Point Manufacturing/MRO Operation since 2012. Promoted to VP in 2014. • Over 20 years of experience in Aviation

17 FINANCIAL SUMMARY

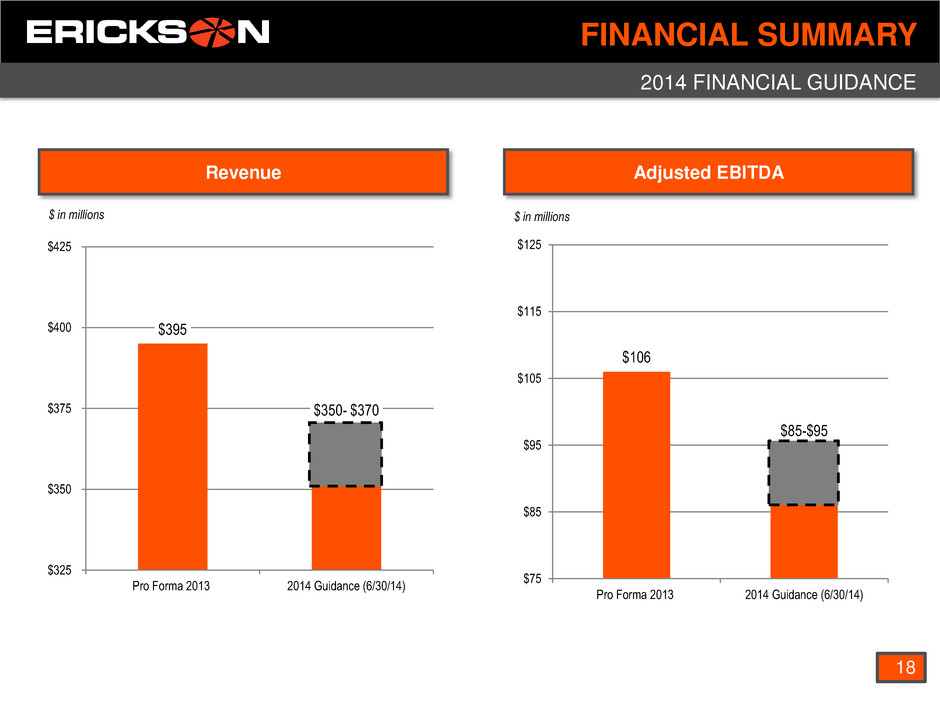

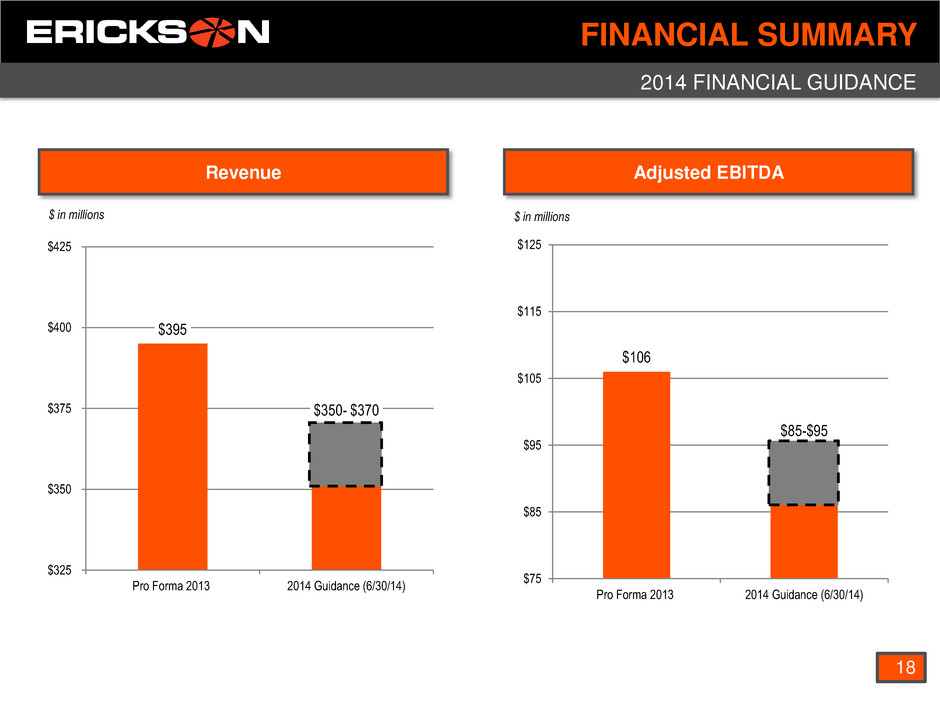

18 $106 $85-$95 $75 $85 $95 $105 $115 $125 Pro Forma 2013 2014 Guidance (6/30/14) $395 $350- $370 $325 $350 $375 $400 $425 Pro Forma 2013 2014 Guidance (6/30/14) Revenue Adjusted EBITDA $ in millions $ in millions FINANCIAL SUMMARY 2014 FINANCIAL GUIDANCE

19 NET ASSET VALUE ANALYSIS LTM NAV CALCULATION Stock has been trading below Net Asset Value per Share in Q2 5.00 7.00 9.00 11.00 13.00 15.00 17.00 19.00 21.00 23.00 25.00 Stock Price Book Value per Share NAV per Share

APPENDIX

Current Equity Snapshot Symbol (NASDAQ) EAC Price (9/12/14 close) $13.65 Share Count 13.8 million Market Cap (9/12/14) $188.6 million Enterprise Value (9/12/14) $659.7 million Implied EV/EBITDA 7.6x KEY PERFORMANCE MEASURES 21 Financial Performance 2014 Q2 Revenue $80.9 million 2014 Q2 Adj. EBITDA $13.8 million 2013 Q2 Revenue $68.6 million 2013 Q2 Adj. EBITDA $17.2 million LTM PF Revenue $371.9 million LTM PF Adj EBITDA $87.0 million

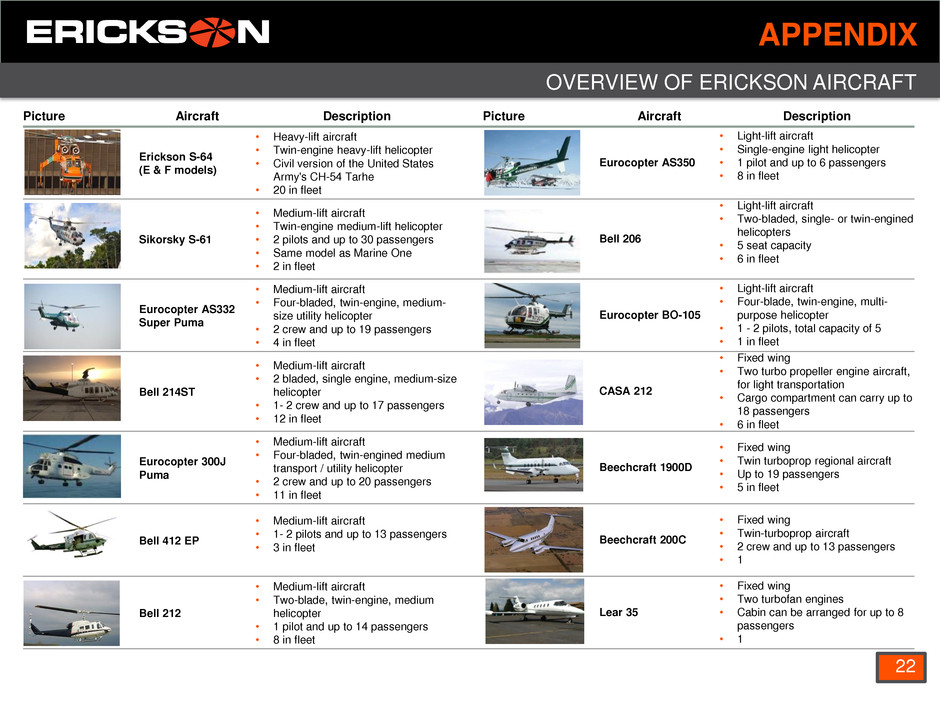

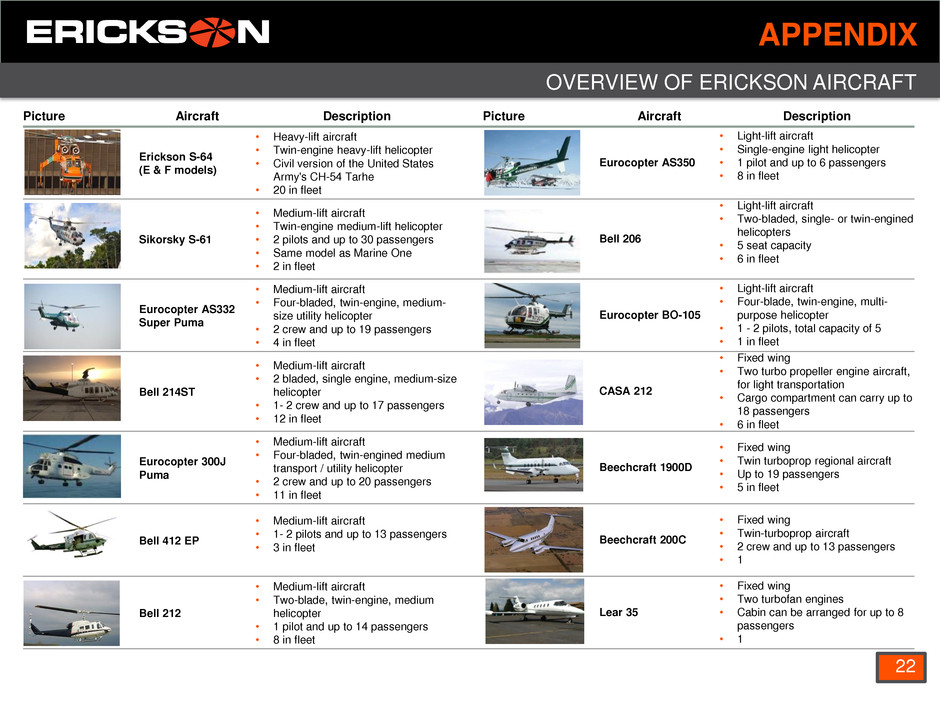

OVERVIEW OF ERICKSON AIRCRAFT APPENDIX 22 Picture Aircraft Description Picture Aircraft Description Erickson S-64 (E & F models) • Heavy-lift aircraft • Twin-engine heavy-lift helicopter • Civil version of the United States Army's CH-54 Tarhe • 20 in fleet Eurocopter AS350 • Light-lift aircraft • Single-engine light helicopter • 1 pilot and up to 6 passengers • 8 in fleet Sikorsky S-61 • Medium-lift aircraft • Twin-engine medium-lift helicopter • 2 pilots and up to 30 passengers • Same model as Marine One • 2 in fleet Bell 206 • Light-lift aircraft • Two-bladed, single- or twin-engined helicopters • 5 seat capacity • 6 in fleet Eurocopter AS332 Super Puma • Medium-lift aircraft • Four-bladed, twin-engine, medium- size utility helicopter • 2 crew and up to 19 passengers • 4 in fleet Eurocopter BO-105 • Light-lift aircraft • Four-blade, twin-engine, multi- purpose helicopter • 1 - 2 pilots, total capacity of 5 • 1 in fleet Bell 214ST • Medium-lift aircraft • 2 bladed, single engine, medium-size helicopter • 1- 2 crew and up to 17 passengers • 12 in fleet CASA 212 • Fixed wing • Two turbo propeller engine aircraft, for light transportation • Cargo compartment can carry up to 18 passengers • 6 in fleet Eurocopter 300J Puma • Medium-lift aircraft • Four-bladed, twin-engined medium transport / utility helicopter • 2 crew and up to 20 passengers • 11 in fleet Beechcraft 1900D • Fixed wing • Twin turboprop regional aircraft • Up to 19 passengers • 5 in fleet Bell 412 EP • Medium-lift aircraft • 1- 2 pilots and up to 13 passengers • 3 in fleet Beechcraft 200C • Fixed wing • Twin-turboprop aircraft • 2 crew and up to 13 passengers • 1 Bell 212 • Medium-lift aircraft • Two-blade, twin-engine, medium helicopter • 1 pilot and up to 14 passengers • 8 in fleet Lear 35 • Fixed wing • Two turbofan engines • Cabin can be arranged for up to 8 passengers • 1